EXHIBIT 99.1

Annual Information Form February 23, 2017 |

| |

| 1 |

| 1 |

| 6 |

| 8 |

| 8 |

| 9 |

| 11 |

| 11 |

| 11 |

| 11 |

| 12 |

| 13 |

| 13 |

| 14 |

| 14 |

| 15 |

| 16 |

| 17 |

| 17 |

| 29 |

| 36 |

| 41 |

| 44 |

| 44 |

| 45 |

| 55 |

| 62 |

| 66 |

| 66 |

| 67 |

| 67 |

| 68 |

| 69 |

| 84 |

| 85 |

| 85 |

| 90 |

| 93 |

| 93 |

| 94 |

| 94 |

| 96 |

| 98 |

| 98 |

| 99 |

| 100 |

| 100 |

| 101 |

| 103 |

| 103 |

| 103 |

| 104 |

| 104 |

| A-1 |

| B-1 |

| C-1 |

| D-1 |

In this Annual Information Form, unless the context otherwise dictates, “we”, “Teck” or the “Company” refers to Teck Resources Limited and its subsidiaries.

Cautionary Statement on Forward-Looking Information

This Annual Information Form contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to as “forward-looking statements”). These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “should”, “believe” and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These statements speak only as of the date of this Annual Information Form. These forward-looking statements include but are not limited to, statements concerning:

| n | forecast operating costs and capital costs; |

| n | our strategies and objectives; |

| n | future prices and price volatility for coal, copper, zinc and other products and commodities that we produce and sell as well as oil, natural gas and petroleum products; |

| n | the demand for and supply of copper, coal, zinc and other products and commodities that we produce and sell; |

| n | expected receipt of regulatory approvals, and the expected timing thereof; |

| n | expected receipt of pre-feasibility studies, feasibility studies and other studies and the expected timing thereof; |

| n | proposed or expected changes in regulatory frameworks; |

| n | our interest and other expenses; |

| n | our tax position and the tax rates applicable to us; |

| n | the costs of construction at our Fort Hills oil sands project and timing of production; |

| n | decisions regarding the timing and costs of construction and production with respect to, and the issuance of the necessary permits and other authorizations required for, certain of our other development and expansion projects, including, among others, the Frontier project, the Quebrada Blanca Phase 2 project and the NuevaUnión copper project; |

| n | expected mine lives and possible extensions to mine lives, including but not limited to the Antamina mine life; |

| n | our estimates of the quantity and quality of our mineral and oil reserves and resources; |

| n | the production capacity of our operations, our planned production levels and future production; |

| n | availability of transportation for our products from our operations; |

| n | availability of any of our credit facilities; |

| n | financial assurance requirements related to our projects and related agreements; |

| n | potential impact of transportation and other potential production disruptions; |

| n | our planned capital expenditures and our estimates of reclamation and other costs related to environmental protection; |

| n | our future capital and mine production costs, including the costs and potential impact of complying with existing and proposed environmental laws and regulations in the operation and closure of various operations; |

| n | the costs and potential impact of managing water quality at our coal operations; |

| n | our financial and operating objectives; |

| n | our exploration, environmental, health and safety initiatives; |

| n | the outcome of legal proceedings and other disputes in which we are involved; |

| n | the outcome of our coal sales negotiations and negotiations with metals and concentrate customers concerning treatment charges, price adjustments and premiums; |

| n | the timing of completion of pre-feasibility or feasibility studies on our properties; |

| n | the estimated mine lives of our operations; |

| n | our dividend policy; and |

| n | general business and economic conditions. |

Canadian disclosure rules require us to present projected capital and projected operating costs for each of our material mining operations. The amounts presented for each operation are estimates, based on current mine plans and assumptions believed to be reasonable, including assumptions with respect to energy and labour costs and the Canadian/US dollar exchange rate. Future capital expenditures are based on management’s best estimate of expected future capital requirements, which are generally for the extraction and processing of existing reserves and resources. Cash operating costs are not a measure recognized under International Financial Reporting Standards in Canada or generally accepted accounting principles in the United States. Various factors will cause actual results to vary from the projected operating and capital costs set out below. Our disclosed cash operating costs do not include transportation costs or royalties, and may not be comparable to similar measures reported by other issuers.

Inherent in forward-looking statements are risks and uncertainties beyond our ability to predict or control, including risks that may affect our operating or capital plans; risks generally encountered in the permitting and development of mineral and oil and gas properties such as unusual or unexpected geological formations, unanticipated metallurgical difficulties, delays associated with permit appeals or other regulatory processes, ground control problems, adverse weather conditions, process upsets and equipment malfunctions; risks associated with the Canadian

Corruption of Foreign Public Officials Act and similar worldwide bribery laws; risks associated with labour disturbances and availability of skilled labour; risks associated with fluctuations in the market prices of our principal commodities, which are cyclical and subject to substantial price fluctuations; risks created through competition for mining and oil and gas properties; risks associated with lack of access to markets; risks associated with mineral and oil and gas reserve estimates; risks posed by fluctuations in exchange rates and interest rates, as well as general economic conditions; risks associated with access to capital; risks associated with our material financing arrangements and our covenants thereunder; risks associated with climate change, environmental compliance, changes in environmental legislation and regulation and changes to our reclamation objectives; risks associated with our dependence on third parties for the provision of transportation and other critical services; risks associated with non-performance by contractual counterparties; risks associated with potential disputes with partners and co-owners; risks associated with aboriginal title claims and other title risks; social and political risks associated with operations in foreign countries; risks associated with the preparation of our financial statements; risks related to trade barriers or import restrictions; risks of changes in tax laws or their interpretation; and risks associated with tax reassessments and legal proceedings. See “Risk Factors” for more detail on the risks and uncertainty we face.

Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this Annual Information Form. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about:

| n | general business and economic conditions; |

| n | changes in commodity and power prices; |

| n | acts of foreign or domestic governments and the outcome of legal proceedings; |

| n | the supply and demand for, deliveries of, and the level and volatility of prices of copper, coal and zinc and our other metals and minerals as well as oil, natural gas and other petroleum products; |

| n | the timing of the receipt of permits and other regulatory and governmental approvals for our development projects and other operations, including mine extensions; |

| n | our costs of production and our production and productivity levels, as well as those of our competitors; |

| n | our ability to secure adequate transportation for our products; |

| n | changes in credit market conditions and conditions in financial markets generally; |

| n | the availability of funding to refinance our borrowings as they become due or to finance our development projects on reasonable terms; |

| n | our ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; |

| n | the availability of qualified employees and contractors for our operations, including our new developments; |

| n | our ability to attract and retain skilled staff; |

| n | the satisfactory negotiation of collective agreements with unionized employees; |

| n | the impact of changes in Canadian-U.S. dollar and other foreign exchange rates on our costs and results; |

| n | engineering and construction timetables and capital costs for our development and expansion projects; |

| n | costs of closure, and environmental compliance costs generally, of operations; |

| n | the accuracy of our reserve and resource estimates (including, with respect to size, grade and recoverability) and the geological, operational and price assumptions on which these are based; |

| n | premiums realized over London Metal Exchange cash and other benchmark prices; |

| n | tax benefits and tax rates; |

| n | the outcome of our coal price and volume negotiations with customers; |

| n | the outcome of our copper, zinc and lead concentrate treatment and refining charge negotiations with customers; |

| n | the resolution of environmental and other proceedings or disputes; |

| n | the future supply of low cost power to the Trail smelting and refining complex; |

| n | our ability to obtain, comply with and renew permits in a timely manner; and |

| n | our ongoing relations with our employees and with our business partners and joint venturers. |

We caution you that the foregoing list of important factors and assumptions is not exhaustive. Other events or circumstances could cause our actual results to differ materially from those estimated or projected and expressed in, or implied by, our forward-looking statements. You should also carefully consider the matters discussed under “Risk Factors” in this Annual Information Form. Except as required by law, we undertake no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise.

Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources and Oil and Gas Reserves

This Annual Information Form has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws.

In this Annual Information Form we use the term “mineral resources” and its subcategories “measured”, “indicated” and “inferred” mineral resources. Readers are advised that while such terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission (“SEC”) does not recognize them and does not permit U.S. mining companies in their filings with the SEC to disclose estimates of mineral resources. Investors are cautioned not to assume that any part or all of the mineral resources in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, issuers must not make any disclosure of results of an economic evaluation that includes inferred mineral resources, except in very limited cases. Investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is, or will be economically or legally mineable.

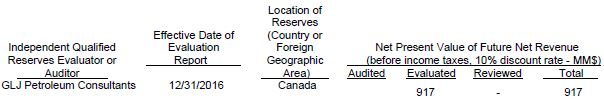

Canadian standards of oil and gas disclosure also differ significantly from the requirements of the SEC, and oil and gas reserve and resource information contained in this Annual Information Form may not be comparable to similar information disclosed by U.S. companies. The oil and gas reserves estimates in this Annual Information Form have been prepared in accordance with National Instrument 51-101 — Standards of Disclosure for Oil and Gas Activities ("NI 51-101"), which has been adopted by securities regulatory authorities in Canada and imposes oil and gas disclosure standards for Canadian public issuers engaged in oil and gas activities and differs from the oil and gas disclosure standards of the SEC under Subpart 1200 of Regulation S-K. The SEC definitions of proved and probable reserves are different than the definitions contained in NI 51-101. Therefore, proved and probable reserves disclosed in, or in the documents incorporated by reference into, this Annual Information Form in compliance with NI 51-101 may not be comparable to those disclosed by U.S. companies.

Glossary of Technical Terms

bitumen: a naturally occurring heavy viscous crude oil.

cathode: an electrode in an electrolytic cell which receives electrons and which represents the final product of an electrolytic metal refining process.

clean coal: coal that has been processed to separate impurities and is in a form suitable for sale.

coking coal: coals possessing physical and chemical characteristics that facilitate the conversion into coke, which is used in the steelmaking process. Coking coal may also be referred to as metallurgical coal.

concentrate: a product containing valuable minerals from which most of the waste rock in the ore has been eliminated in a mill or concentrator.

crude oil: unrefined liquid hydrocarbons, excluding natural gas liquids.

dump leach: a process that involves dissolving and recovering minerals from typically lower grade uncrushed ore from a mine dump.

flotation: a method of mineral separation in which a froth created in water by a variety of reagents floats certain finely-crushed minerals, while other minerals sink, so that the valuable minerals are concentrated and separated from the waste.

grade: the classification of an ore according to its content of economically valuable material, expressed as grams per tonne for precious metals and as a percentage for most other metals.

hard coking coal: a type of coking coal used primarily for making high strength coke for use in integrated steel mills.

heap leach: a process whereby metals are leached from a heap of crushed ore by leaching solutions seeping through the heap into a container or liner beneath the heap.

hypogene: primary sulphide ore located beneath shallow zones of ore affected by weathering processes.

LME: London Metals Exchange.

mill: a plant in which ore is ground and undergoes physical or chemical treatment to extract and produce a concentrate of the valuable minerals.

MMbbl: million barrels.

oil sands: sand and rock material that contains bitumen.

ore: naturally occurring material from which minerals of economic value can be extracted at a reasonable profit.

orebody: a contiguous, well defined mass of material of sufficient ore content to make extraction economically feasible.

PCI coal: coal that is pulverized and injected into a blast furnace. Those grades of coal used in the PCI process are generally non-coking. PCI grade coal is used primarily as a heat source in the steelmaking process in partial replacement for high quality coking coals which are typically more expensive.

semi-autogenous grinding (SAG): a method of grinding rock into fine particles in which the rock itself performs some of the function of a grinding medium, such as steel balls.

slag: a substance formed by way of chemical action and fusion at furnace operating temperatures; a by‑product of the smelting process.

smelter: a plant in which concentrates are processed into an upgraded product by application of heat.

steelmaking coal: the various grades of coal that are used in the steelmaking process including both coals to produce coke and coals that are pulverized for injection into the blast furnace as a fuel.

sulphide: a mineral compound containing sulphur but no oxygen.

supergene: near-surface ore that has been subject to secondary enrichment by weathering.

SX-EW: an abbreviation for Solvent Extraction–Electrowinning, a hydrometallurgical process to produce cathode copper from leached copper ores.

tailings: the effluent that remains after recoverable metals have been removed from the ore during processing.

thermal coal: coal that is used primarily for its heating value. Thermal coals tend not to have the carbonization properties possessed by coking coals. Most thermal coal is used to produce electricity in thermal power plants.

treatment and refining charges: the charge a mine pays to a smelter as a fee for conversion of concentrates into refined metal.

Name, Address and Incorporation

Teck Resources Limited was continued under the Canada Business Corporations Act in 1978. It is the continuing company resulting from the merger in 1963 of the interests of The Teck-Hughes Gold Mines Ltd., Lamaque Gold Mines Limited and Canadian Devonian Petroleum Ltd., companies incorporated in 1913, 1937 and 1951 respectively. Over the years, several other reorganizations have been undertaken. These include our merger with Brameda Resources Limited and The Yukon Consolidated Gold Corporation in 1979, the merger with Highmont Mining Corporation and Iso Mines Limited in 1979, the consolidation with Afton Mines Ltd. in 1981, the merger with Copperfields Mining Corporation in 1983, and the acquisition of 100% of Cominco Ltd. in 2001. On July 23, 2001, Cominco Ltd. changed its name to Teck Cominco Metals Ltd. and on September 12, 2001, we changed our name to Teck Cominco Limited. On January 1, 2008, we amalgamated with our wholly-owned subsidiary, Aur Resources Inc., by way of vertical short form amalgamation under the name Teck Cominco Limited. On April 23, 2009, we changed our name to Teck Resources Limited from Teck Cominco Limited. On June 1, 2009 Teck Cominco Metals Ltd. changed its name to Teck Metals Ltd.

Since 1978, the Articles of Teck have been amended on several occasions to provide for various series of preferred shares and for other corporate purposes. On January 19, 1988, our Articles were amended to provide for the subdivision of our Class A common shares and Class B subordinate voting shares on a two-for-one basis. On September 12, 2001, the Articles were amended to effect the name change to Teck Cominco Limited and to convert each outstanding Class A common share into one new Class A common share and 0.2 Class B subordinate voting shares and to enact “coattail” provisions for the benefit of the Class B subordinate voting shares. Effective May 7, 2007, our Articles were amended to subdivide our Class A common shares and Class B subordinate voting shares on a two-for-one basis. See “Description of Capital Structure” below for a description of the attributes of the Class A common shares and Class B subordinate voting shares. On April 23, 2009, our Articles were amended to effect the name change to Teck Resources Limited as described above.

The registered and principal offices of Teck are located at Suite 3300, 550 Burrard Street, Vancouver, British Columbia, V6C 0B3.

Intercorporate Relationships

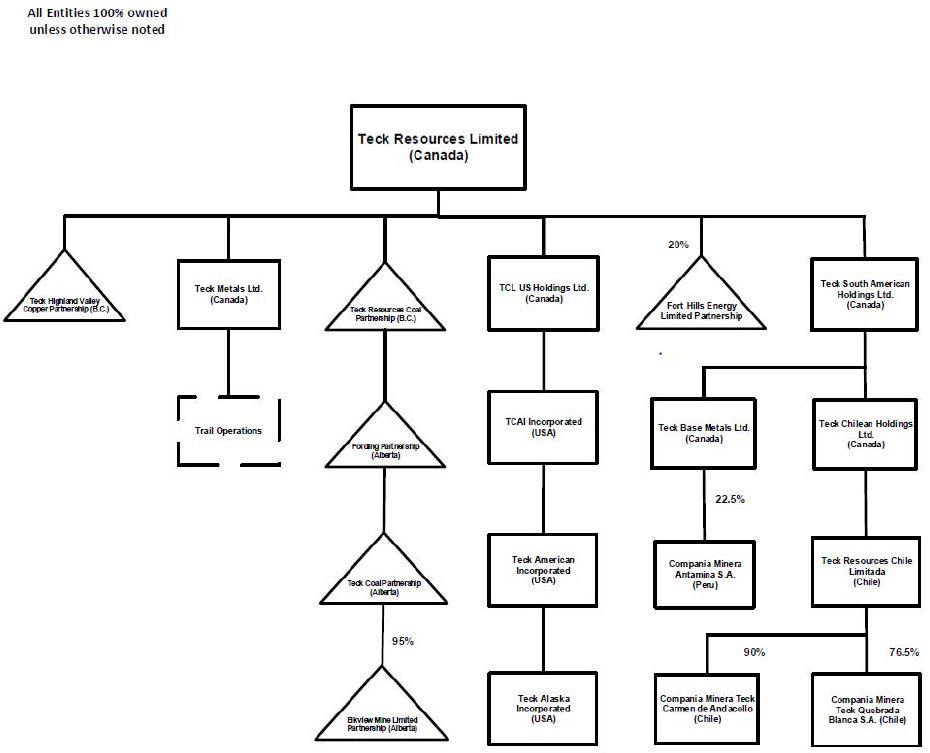

Our financial statements consolidate the accounts of all of our subsidiaries. Our material subsidiaries as at December 31, 2016 are listed below. Unless otherwise indicated all subsidiaries listed below are wholly-owned by Teck. Indentation indicates that the majority of the voting securities of the relevant subsidiary are held by the subsidiary listed immediately above.

| Company Name | Jurisdiction of Organization or Formation |

Teck South American Holdings Ltd.(1) | Canada |

Teck Chilean Holdings Ltd.(2) | Canada |

| Teck Resources Chile Limitada | Chile |

| Teck Base Metals Ltd. | Canada |

| Teck Metals Ltd. | Canada |

| Teck Resources Coal Partnership | British Columbia |

| Fording Partnership | Alberta |

| Teck Coal Partnership | Alberta |

Elkview Limited Partnership(3) | Alberta |

| Teck Highland Valley Copper Partnership | British Columbia |

| TCL U.S. Holdings Ltd. | Canada |

| TCAI Incorporated | Washington, U.S.A. |

| Teck American Incorporated | Washington, U.S.A. |

| Teck Alaska Incorporated | Alaska, U.S.A. |

(1) Formerly Teck Financial Corporation Ltd.

(2) Formerly Aur QB Ltd.

(3) 95% held, directly or indirectly, by Teck

In addition to the subsidiaries listed above, we own, directly or indirectly:

| — | a 20% limited partnership interest in Fort Hills Energy Limited Partnership; |

| — | a 76.5% share interest in Compañia Minera Teck Quebrada Blanca S.A.; |

| — | a 90% share interest in Compañía Minera Teck Carmen de Andacollo S.A.; and |

| — | a 22.5% indirect share interest in Compañía Minera de Antamina S.A., which owns the Antamina copper and zinc mine in Peru. |

The following chart sets out the relationships among our material subsidiaries as at December 31, 2016. Certain aspects of the ownership structure have been simplified.

General Development of the Business

In 2014, average annual prices for our principal products, other than zinc, decreased compared to 2013. Annual average prices for copper and zinc were US$3.11 and US$0.98 per pound, respectively, compared with US$3.32 and US$0.87 per pound in 2013. Realized coal prices decreased from US$149 per tonne in 2013 to US$115 per tonne in 2014.

Work on a number of projects was completed or continued through 2014. Construction of our Fort Hills oils sands project advanced on schedule through the year. The mill optimization project at the Highland Valley Copper operation was completed at the end of the first quarter of the year. In addition, our Pend Oreille zinc operation resumed production in December 2014 after being held on care and maintenance for a number of years. However, we deferred the restart of our Quintette coal project based on the near-term outlook for the coal market.

Our Elk Valley Water Quality Plan was approved by the B.C. Ministry of the Environment in 2014.

We did not engage in any financing activity in 2014, although we did increase the size of our committed revolving credit facility from US$2.0 billion to US$3.0 billion. In June we announced the renewal of our normal course issuer bid for up to 20 million of our Class B subordinate voting shares. In the year ended December 31, 2014, we purchased 200,000 Class B subordinate voting shares for cancellation.

We continued to implement our cost reduction program through 2014.

Our cash and cash equivalents as at December 31, 2014 were $2.0 billion against total debt of $8.4 billion, with the increase in our reported total debt mainly resulting from a strengthening U.S. dollar.

In 2015, average annual prices for our principal products decreased compared to 2014. Annual average prices in 2015 for copper and zinc were US$2.49 and US$0.87 per pound, respectively, compared with US$3.11 and US$0.98 per pound in 2014. Realized coal prices decreased from US$115 per tonne in 2014 to US$93 per tonne in 2015.

We undertook a number of transactions in 2015 that supported our liquidity and cash balance. In June, we established a new US$1.2 billion revolving credit facility maturing in 2017, which supplements the undrawn US$3 billion revolving credit facility maturing in 2020. Our subsidiary, Compañia Minera Carmen de Andacollo S.A., entered into a long-term gold streaming arrangement with a subsidiary of Royal Gold Inc., and also terminated the existing royalty agreement with a separate subsidiary of Royal Gold. We entered into a silver streaming transaction with a subsidiary of Franco Nevada Corporation, relating to our 22.5% interest in the Antamina mine. We also sold a number of non-core assets, including sales of royalties held in our exploration portfolio.

We significantly enhanced our copper development project portfolio through the combination of our Relincho project with Goldcorp Inc.’s La Fortuna (formerly El Morro) project, forming a 50/50 joint venture referred to as NuevaUnión.

As commodity prices continued to decline, we continued to implement our cost reduction program and announced several new cost reduction initiatives in 2015. As a result of the low commodity prices, we recorded non-cash asset and goodwill impairment charges totalling $3.6 billion on a pre-tax basis and $2.7 billion on an after-tax basis.

Our cash and cash equivalents as at December 31, 2015 were $1.9 billion against total debt of $9.6 billion, with the increase in our reported total debt mainly resulting from a strengthening U.S. dollar, partially offset by the payment of a US$300 million note that was due in October 2015.

In 2016, average annual prices for our principal products increased compared to 2015, except for copper. Annual average prices in 2016 for copper and zinc were US$2.21 and US$0.95 per pound, respectively, compared with US$2.49 and US$0.87 per pound in 2015. Average realized coal prices increased from US$93 per tonne in 2015 to US$115 per tonne in 2016, due primarily to dramatic price increases in the second half of the year.

Work advanced on a number of projects through 2016. Construction of our Fort Hills oils sands project advanced through the year and was approximately 76% complete by year end. See “Description of the Business ― Energy” for a discussion of the project. We submitted a Social and Environmental Impact Assessment for our Quebrada Blanca Phase 2 Project in September 2016 and the updated feasibility study for the project was completed in the first quarter of 2017. We also announced an agreement to increase our interest in the Zafranal project in November, through the public acquisition of AQM Copper Inc., one of our partners on the project. This acquisition was completed in January 2017.

During the year we undertook a number of transactions that supported our liquidity and strengthened our financial position. In June, we issued US$1.25 billion in aggregate principal amount of senior unsecured notes maturing in 2021 and 2024, and used the proceeds to repurchase, under a tender offer, notes maturing in 2017, 2018 and 2019, reducing near-term maturities. In September and early October we repurchased an additional US$759 million face value of debt in market transactions. We also extended the maturity of US$1.14 billion of our US$1.2 billion revolving credit facility from June 2017 to June 2019. See “General Description of Capital Structure - Credit Facilities and Debt Securities” for further details of our credit facilities and debt securities.

Notwithstanding improving commodity prices, we continued to implement our cost reduction program through 2016 and were generally able to maintain or increase production across our operations and achieve significant reductions of cash unit costs across our operations during the year. Our cash and cash equivalents as at December 31, 2016 were $1.4 billion against total debt of $8.3 billion, with the decrease in our reported total debt mainly resulting from the repurchases described above.

Description of the Business

Teck’s business is exploring for, developing and producing natural resources. Our activities are organized into business units focused on copper, steelmaking coal, zinc and energy.

We have interests in the following principal operations:

| | Type of Operation | Jurisdiction |

| Highland Valley | Copper/Molybdenum Mine | British Columbia, Canada |

| Antamina | Copper/Zinc Mine | Ancash, Peru |

| Quebrada Blanca | Copper Mine | Region I, Chile |

| Carmen de Andacollo | Copper Mine | Region IV, Chile |

| Elkview | Steelmaking Coal Mine | British Columbia, Canada |

| Fording River | Steelmaking Coal Mine | British Columbia, Canada |

| Greenhills | Steelmaking Coal Mine | British Columbia, Canada |

| Coal Mountain | Steelmaking Coal Mine | British Columbia, Canada |

| Line Creek | Steelmaking Coal Mine | British Columbia, Canada |

| Cardinal River | Steelmaking Coal Mine | Alberta, Canada |

| Trail Operations | Zinc/Lead Refinery | British Columbia, Canada |

| Red Dog | Zinc/Lead Mine | Alaska, U.S.A. |

| Pend Oreille | Zinc Mine | Washington, U.S.A. |

| Fort Hills | Oil Sands Mine Project | Alberta, Canada |

Our principal products are steelmaking coal, copper and zinc. Lead, molybdenum, silver and various specialty and other metals, chemicals and fertilizers are also produced at our operations. In addition, we own a 20% interest in the Fort Hills oil sands project, a 100% interest in the Frontier oil sands project and a 50% interest in Lease 421 in the Athabasca region of Alberta. We also actively explore for copper, zinc and gold.

The following table sets out our revenue by product for each of our last two financial years:

Revenue by product

| | 2016

$(Billions) | % | 2015

$(Billions) | % |

| Copper | 1.820 | 20 | 2.212 | 27 |

| Coal | 4.144 | 44 | 3.049 | 37 |

| Zinc | 1.787 | 19 | 1.612 | 19 |

Other(1) | 1.549 | 17 | 1.386 | 17 |

| Total | 9.300 | 100 | 8.259 | 100 |

| | (1) | Other revenues include sales of silver, lead, gold, molybdenum, various specialty metals, chemicals, energy and fertilizer. |

We produce both copper concentrates and copper cathode. Our principal market for copper concentrates is Asia, with a lesser amount sold in Europe. Copper concentrates produced at the Highland Valley Copper mine are distributed to customers in Asia by rail to a port in Vancouver, British Columbia, and from there by ship. Copper concentrates produced at Antamina are transported by a slurry pipeline to a port at Huarmey, Peru and from there by ship to customers in Asia and Europe. Copper concentrates produced at Carmen de Andacollo are trucked to the port of Coquimbo, Chile and from there by ship to customers in Asia and Europe. Copper concentrates are sold primarily under long term contracts, with treatment and refining charges negotiated on an annual basis. Copper cathode from our Quebrada Blanca and Carmen de Andacollo mines is trucked from the mines and sold primarily under annual contracts to customers in Asia, Europe and North America.

The copper business is cyclical. Treatment charges rise and fall depending upon the supply of copper concentrates in the market and the demand for custom copper concentrates by the copper smelting and refining industry. Prices for copper cathode also rise and fall as a result of changes in demand for, and supply of, refined copper metal. The major use of refined copper is in electrical and electronic applications, with prices and premiums highly dependent on the demand for electrical wire in construction, communications and automotive applications.

Global demand for copper metal grew by 2.0% in 2016 to reach an estimated 22.3 million tonnes. Copper consumption growth was lower than initially projected, but at 2.0% was higher than the 1.3% growth rate in 2015. Stronger than expected construction and automotive growth offset declines in manufacturing. The availability of copper scrap remains constrained, with imports of scrap into China down an estimated 8% in 2016.

All of our revenues from sales of copper concentrates and cathode copper were derived from sales to third parties.

Teck is the second-largest seaborne exporter of steelmaking coal in the world. Our hard coking coal, a type of steelmaking coal, is used primarily for making coke by integrated steel mills in Asia, Europe and the Americas. In 2016, sales to Asia accounted for approximately 75% of our annual coal sales volume, higher than 2015 mainly due to increased sales to Asian customers outside of China. Substantially all of the coal we produce is high quality hard coking coal. We also produce lesser quality semi-hard coking coal, semi-soft coking coal, PCI and thermal coal products, which in aggregate accounted for less than 25% of our annual sales volume in 2016.

Coal is processed at our mine sites. Processed coal is primarily shipped westbound from our mines by rail to terminals along the coast of British Columbia and from there by vessel to overseas customers. In 2016, approximately 5% of our processed coal was shipped eastbound directly by rail, or by rail and ship via Thunder Bay, to customers in North America.

Globally, we compete in the steelmaking coal market primarily with producers based in Australia and the United States. For sales to China, we also compete with Mongolian and Chinese domestic coal producers. Coal pricing is generally established in U.S. dollars and the competitive positioning among producers can be significantly affected by exchange rates. Our competitive position in the coal market continues to be determined primarily by the quality of our various coal products and our reputation as a reliable supplier, as well as by our production and transportation costs compared to other producers throughout the world.

The high quality seaborne steelmaking coal markets are cyclical, being driven by a combination of demand, production and export capacity. In difficult steel markets, steelmakers can use a higher proportion of semi-soft and PCI coal products in their production process, which can result in reduced pricing premiums for higher quality hard coking coals.

We have experienced significant fluctuations in coal prices and sales volumes in the past and have seen a significant decline in realized coal prices over the past few years. In late 2016, there was a dramatic increase in steelmaking coal prices due to tightness in supply. This was the result of numerous factors, including: the implementation of production curtailments that began in 2014 that have depleted global production capacity and inventories; a reduction in Chinese domestic production resulting from the implementation of a 276-day operating policy for steelmaking coal mines; production disruptions at key Australian mines; and increased seaborne demand from most market areas.

The benchmark price for our highest-quality products increased from US$81 per tonne in early 2016 to US$285 per tonne for the first quarter of 2017. Spot price assessments trended up for most of 2016, starting after the Lunar New Year holiday in China. After a short correction in May, price assessments resumed their upward progression from June and exceeded US$200 per tonne in mid-September, crossing US$300 per tonne in early November and then declining to approximately US$155 per tonne as of mid-February. Market expectations are that global steel production and demand for steelmaking coal will continue to increase in 2017.

In the past few years, a number of our customers reduced the proportion of coal purchased through quarterly-priced agreements and requested pricing for a portion of contract volumes on a spot basis in an effort to control costs in an environment of low steel prices. Our overall ratio of

sales priced on shorter than quarterly basis was around 60% in 2016, which was similar to 2015. While a significant portion of our coal sales volumes continue to be made under annual or multi-year arrangements, we expect that substantially all of our 2017 coal sales under these arrangements will be priced on a term basis of up to one year, including on a quarterly and per-vessel or spot basis.

Substantially all of our revenues from sales of coal products were derived from sales to third parties.

We produce refined zinc through our metallurgical operations at Trail and zinc concentrates through our mining operations. Our principal markets for refined zinc are North America and Asia. Refined zinc produced at our metallurgical operations at Trail, British Columbia is distributed to customers in North America by rail and/or truck and to customers in Asia by ship.

Our principal markets for zinc concentrates are Asia and Europe. In addition, in 2016, approximately 30% of Red Dog’s zinc concentrate production was sold to our metallurgical operations at Trail for treatment and refining. All of the production from our Pend Oreille zinc mine is sold to Trail.

All of our revenues in 2016 from sales of refined zinc and zinc concentrates (other than zinc concentrates produced at Red Dog or Pend Oreille that are sold to Trail) were derived from sales to third parties. We strive to differentiate our refined metal products by producing the alloys, sizes and shapes best suited to our customers’ needs.

We have substantial long-term frame contracts for the sale of zinc concentrates from the Red Dog mine to customers in Asia and Europe.

Trail’s supply of zinc and lead concentrates, other than those sourced from Red Dog or Pend Oreille, is provided primarily through long-term contracts with mine producers in North America, South America and Australia.

The zinc business is cyclical. Treatment and refining charges rise and fall depending upon the supply of zinc concentrates in the market and the demand for custom zinc concentrates by the zinc smelting and refining industry. Refined zinc is used primarily for galvanizing steel, and prices and premiums are highly dependent on the demand for steel products.

Copper Operations

Highland Valley Copper Mine, Canada (Copper)

We hold a 100% interest in the Highland Valley Copper mine located near Kamloops, British Columbia through our wholly-owned subsidiary Teck Highland Valley Copper Partnership (“HVC”), having acquired the remaining 2.5% interest previously held by third parties in the third quarter of 2016.

Highland Valley’s primary product is copper concentrate and it also produces molybdenum in concentrate. The property comprising the Highland Valley Copper mine consists of mineral leases, mineral claims and Crown grants. The mine property covers a surface area of approximately 34,000 hectares and HVC holds the mineral rights to that area pursuant to various leases, claims and licenses.

The Highland Valley mine is located adjacent to Highway 97C connecting Merritt, Logan Lake, and Ashcroft, British Columbia. Access to the mine is from a 1 kilometre access road from Highway 97C. The mine is approximately 50 kilometres southwest of Kamloops, and approximately 200 kilometres northeast of Vancouver. The mine operates throughout the year. Power is supplied by BC Hydro through a 138kV line which terminates at the Trans-Canada Highway west of Spuzzum in the Thompson Valley. Mine personnel live in nearby areas, primarily Logan Lake, Kamloops, Ashcroft, Cache Creek, and Merritt.

The mine is an open-pit operation. The processing plant, which uses autogenous and semi-autogenous grinding and flotation to produce metal in concentrate from the ore, has the capacity to process up to 145,000 tonnes of ore per day depending on ore hardness. Water from mill operations is collected and contained in a tailings impoundment area. Mill process water is reclaimed from the tailings pond. The operation is subject to water and air permits issued by the Province of British Columbia and is in material compliance with those permits. The operation holds all of the permits that are material to its current operations.

Ore is currently mined from the Valley, Lornex and Highmont pits. The crusher relocation project for the Valley pit was completed in 2015, providing access to over 30 million tonnes of reserves as part of Highland Valley Copper’s current life of mine plan. The Valley pit was the main feed source to the mill in 2015 and also provided our highest grade material through 2016. The transition to mining more of the lower grade Lornex ore progressed during the final quarter of 2016 as the current high-grade phase of the Valley pit was exhausted. The Lornex pit will be an important feed source through the remainder of mine life. In 2015, additional drilling and engineering studies were conducted to define resources near the existing Valley, Lornex and Highmont pits and to examine other options to optimize and extend production past the current mine life. Further expansion work was conducted in 2016, with additional studies and drilling planned for 2017 focused on evaluating the viability of a substantial expansion of the Valley and Highmont pits.

The pits are located in the Guichon batholith which hosts all of the ore bodies located in the area. The Lornex orebody occurs in skeena quartz diorite host rock, intruded by younger pre-mineral quartz porphyry and aplite dykes. The skeena quartz diorite is an intermediate phase of the Guichon batholith and is generally a medium-to-coarse grained equigranular rock distinguished by interstitial quartz and moderate ferromagnesian minerals. The sulphide ore is primarily fracture fillings of chalcopyrite, bornite and molybdenite with minor pyrite, magnetite, sphalerite and galena.

The host rocks of the Valley deposit are mainly porphyritic quartz monzonites and granodiorites of the Bethsaida phase of the batholith. These rocks are medium-to-coarse-grained with large phenocrysts of quartz and biotite. The rocks of the deposit were subjected to hydrothermal alteration followed by extensive quartz veining, quartz-sericite veining, and silicification. Bornite, chalcopyrite and molybdenum were introduced with the quartz and quartz-sericite veins and typically fill angular openings in them. Accessory minerals consist of hornblende, magnetite, hematite, sphene, apatite and zircon. Pre‑mineral porphyry and aplite dykes intrude the host rocks of the deposit.

Concentrates from the operation are transported first by truck to Ashcroft and then by rail to a port in Vancouver for export overseas, with the majority being sold under long-term sales contracts to smelters in Asia. The price of copper concentrate under these long-term sales agreements is based on LME prices during quotational periods determined with reference to the time of delivery, with treatment and refining charges negotiated annually. The balance is sold on the spot market. Molybdenum concentrates are sold to third party refiners on market terms.

In 2016, 27 diamond drill holes, totalling approximately 4,300 metres were drilled in the Valley, Lornex and Highmont pit areas. In addition, one hole, totalling 600 metres, was drilled in the surrounding district. Twelve reverse circulation holes, totalling 1,600 metres, were drilled within the Valley and Lornex pits. Quick logs of these holes indicate no material impacts on the quantity or grade of reserves and resources. Diamond drill core is split in halves using core saws and sampled in three metre intervals (NQ diameter core) and two metre intervals (HQ diameter core), respectively. The sample interval for reverse circulation drilling is 1.5 metres. One half is sent to an independent, off-site laboratory for analysis and the other is retained for future reference. Field duplicates and external umpire checks of approximately five percent of pulp samples are elements of the Highland Valley quality assurance-quality control program procedures.

Highland Valley Copper’s 2016 copper production was 119,300 tonnes of copper in concentrate, compared to 151,400 tonnes in 2015. The decrease was primarily due to lower copper grades and lower recoveries, partially offset by higher mill throughput. Molybdenum production was 59% higher in 2016 at 5.4 million pounds, compared to 3.4 million pounds in 2015, primarily due to higher grades.

As anticipated in the mine plan, production at Highland Valley Copper will vary significantly over the next few years due to significant fluctuations in ore grades and hardness in the three active pits. The production plan relies primarily on Lornex ore in 2017, supplemented by the similarly low-grade Highmont pit and lower grade sources in the Valley pit, which is in a heavier stripping phase over the next three to four years. Copper production in 2017 is anticipated to be between 95,000 and 100,000 tonnes, with lower production in the first half of the year before gradually

recovering in 2018 and 2019. Annual copper production from 2018 to 2020 is expected to be between 115,000 and 135,000 tonnes per year. Copper production is anticipated to return to above life of mine average levels of 140,000 tonnes per year after 2020 through to the end of the current mine plan in 2026. Molybdenum production in 2017 is expected to be approximately 9.0 to 9.5 million pounds contained in concentrate, before declining to more normal levels of approximately 7.0 million pounds contained in concentrate annually from 2018 to 2020.

See “—Mineral Reserves and Resources” for information about the mineral reserve and resource estimates for Highland Valley, including metal price and exchange rate assumptions.

The Highland Valley copper mine is subject to British Columbia mineral taxes. The B.C. mineral tax is a two-tier tax with a minimum rate of 2% and a maximum rate of 13%. A minimum tax of 2% applies to operating cash flows, as defined by the regulations. A maximum tax rate of 13% applies to cash flows after taking available deductions for capital expenditures and other permitted deductions.

Our labour agreement at Highland Valley Copper expired at the end of the third quarter of 2016, and negotiations are ongoing.

2017 projected capital costs for Highland Valley are approximately $32 million. The major components of the projected capital costs are:

Component | Approximate projected cost ($/million) |

| Sustaining | 18 |

| Major Enhancement | 14 |

2017 projected aggregate cash operating costs for Highland Valley are approximately $505 million. The major components of the projected cash operating costs are:

Component | Approximate projected cost ($/million) |

| Labour | 226 |

| Supplies | 200 |

| Energy | 103 |

| Other (including general & administrative, inventory changes) | 40 |

| Less amounts associated with projected capitalized stripping | (64) |

| Total | 505 |

The cash operating costs presented above do not include transportation or royalties.

Antamina Mine, Peru (Copper, Zinc)

We own indirectly 22.5% of the Antamina copper/zinc mine in Peru, with the balance held indirectly by BHP Billiton plc (33.75%), Glencore plc (33.75%) and Mitsubishi Corporation (10%). The participants’ interests are represented by shares of Compañía Minera Antamina S.A. (“CMA”), the Peruvian company that owns and operates the project. Our interest is subject to a net profits royalty of 1.667% on CMA’s free cash flow.

The Antamina property consists of numerous mining concessions and mining claims (including surface rights) covering an area of approximately 14,000 hectares. These rights concessions and claims can be held indefinitely, contingent upon the payment of annual license fees and provision of certain production and investment information. CMA also owns a port facility located at Huarmey and an electrical substation located at Huallanca. In addition, CMA holds title to all easements and rights of way for the 302 kilometre concentrate pipeline from the mine to CMA’s port at Huarmey.

The deposit is located at an average elevation of 4,200 metres, 385 kilometres by road and 270 kilometres by air north of Lima, Peru. Antamina lies on the eastern side of the Western Cordillera in the upper part of the Rio Marañon basin. Mine personnel live in a camp facility while at work and commute from both local communities and larger population centres, including Lima.

The mine is an open-pit, truck/shovel operation. The ore is crushed within the pit and conveyed through a 2.7 kilometre tunnel to a coarse ore stockpile at the mill. It is then processed utilizing two SAG mills, followed by ball mill grinding and flotation to produce separate copper, zinc, molybdenum and lead/bismuth concentrates. A 302 kilometre-long slurry concentrate pipeline, approximately 22 centimetres in diameter with a single pump station at the mine site, transports copper and zinc concentrates to the port where they are dewatered and stored prior to loading onto vessels for shipment to smelters and refineries world-wide.

The mine is accessible via an access road maintained by CMA. Power for the mine is taken from the Peru national energy grid through an electrical substation constructed at Huallanca. Fresh water requirements are sourced from a dam-created reservoir upstream from the tailings impoundment facility. The tailings impoundment facility is located next to the mill. Water reclaimed from the tailings impoundment is used as process water in the mill operation. The operation is subject to water and air permits issued by the Government of Peru and is in material compliance with those permits. The operation holds all of the permits that are material to its current operations.

The Antamina polymetallic deposit is skarn-hosted. It is unusual in its persistent mineralization and predictable zonation, and has a SW-NE strike length of more than 2,500 metres and a width of up to 1,000 metres. The skarn is well-zoned symmetrically on either side of the central intrusion with the zoning used as the basis for four major subdivisions being a brown garnet skarn, green garnet skarn, wollastonite/diopside/green garnet skarn and a marbleized limestone with veins or mantos of wollastonite. Other types of skarn, including the massive sulphides, massive magnetite, and chlorite skarn, represent the remainder of the skarn and are randomly distributed throughout the deposit. The variability of ore types can result in significant changes in the relative proportions of copper and zinc produced in any given year.

In 2016, 86 diamond drill holes were completed within the Antamina pit, for a total of approximately 31,000 metres. In addition, 2 reverse circulation holes with a total length of approximately 500 metres were also drilled in the pit. For diamond core, three-metre samples of half core (HQ or NQ) are taken and crushed for assay at an external laboratory. The remaining half of the core is retained for future reference. The assay program includes approximately 15% of quality-assurance/quality-control samples, comprising reference materials, duplicates and blanks. The reference materials consist of matrix-matched material from Antamina, homogenized and certified in accordance with industry practice.

Antamina’s copper production (100% basis) in 2016 was 431,100 tonnes, compared to 390,600 tonnes in 2015, with the increase primarily as a result of higher grades and recovery. Zinc production decreased by 16% to 198,000 tonnes in 2016, primarily due to a lower portion of copper-zinc ore processed, partially offset by higher zinc grades and recoveries. Molybdenum production totalled 10.3 million pounds, which was 134% higher than in 2015, due to higher grades.

Our 22.5% share of Antamina’s 2017 production is expected to be in the range of 88,000 to 92,000 tonnes of copper, 75,000 to 80,000 tonnes of zinc and approximately 2.0 million pounds of molybdenum in concentrate. Our share of copper production is expected to be between 90,000 and 100,000 tonnes from 2018 to 2020. Zinc production is expected to remain strong as the mine enters a phase with high zinc grades and a higher proportion of copper-zinc ore. Our share of zinc production is anticipated to average 80,000 tonnes per year during the same 2018 to 2020 period; however, annual production will fluctuate due to feed grades and the amount of copper-zinc ore processed, as anticipated in the mine plan. Our share of annual molybdenum production is expected to be between 2.5 and 3.0 million pounds between 2018 and 2020.

Antamina has entered into long-term off-take agreements with affiliates of the Antamina shareholders on market terms. Molybdenum concentrates are sold to third party refiners on market terms.

In Peru, the mining tax regime includes the Special Mining Tax and the Modified Mining Royalty which apply to CMA’s operating margin based on a progressive sliding scale ranging from 3% to 20.4%. CMA is also subject to Peruvian income tax.

Based on current tailings capacity, the mine life is expected to continue until 2028. CMA is currently considering options for storing additional tailings and alternative mine plans that could result in significant mine life extensions.

Our 22.5% share of 2017 projected capital costs for Antamina is approximately US$60 million. The major components of the projected capital costs are:

Component | Approximate projected cost (US$/million) |

| Sustaining | 59 |

| Major Enhancement | 1 |

Our 22.5% share of 2017 projected cash operating costs for Antamina is approximately US$156 million. The major components of the projected cash operating costs are:

Component | Approximate projected cost (US$/million) |

| Labour | 65 |

| Supplies | 91 |

| Energy | 41 |

| Other (including general & administrative, inventory changes) | 14 |

| Less amounts associated with projected capitalized stripping | (55) |

| Total | 156 |

The cash operating costs presented above do not include transportation or royalties.

Under a long-term streaming agreement with FN Holdings ULC (“FNH”), a subsidiary of Franco-Nevada Corporation, Teck has agreed to deliver silver to FNH equivalent to 22.5% of the payable silver sold by Compañia Minera Antamina S.A. using a silver payability factor of 90%. FNH made a payment of US$610 million on closing of the arrangement in 2015 and will pay 5% of the spot price at the time of delivery for each ounce of silver delivered under the agreement. After 86 million ounces of silver have been delivered under the agreement, the stream will be reduced by one-third. The streaming agreement restricts distributions from Teck Base Metals, our subsidiary that holds our 22.5% interest in CMA, to the extent of unpaid amounts under the agreement if there is an event of default under the streaming agreement or an insolvency of Teck. Compañia Minera Antamina S.A., which owns and operates Antamina, is not a party to the agreement and operations will not be affected.

In January 2016, a new labour agreement was ratified that will expire in the third quarter of 2018.

Quebrada Blanca Mine, Chile (Copper)

The Quebrada Blanca mine is owned by a Chilean private company, Compañía Minera Teck Quebrada Blanca S.A. (“CMTQB”). We own 90% of the Series A shares of CMTQB. Inversiones Mineras S.A. (“IMSA”), a Chilean private company, owns 10% of the Series A shares and 100% of the Series C shares of CMTQB. Empresa Nacional de Minería (“ENAMI”), a Chilean government entity, owns 100% of the Series B shares of CMTQB. When combined with the Series B and Series C shares of CMTQB, our 90% holding of the Series A shares equates to a 76.5% interest in CMTQB’s total share equity. IMSA’s and ENAMI’s shareholdings equate to a 13.5% and 10% interest in CMTQB’s total share equity, respectively. ENAMI’s interest is a carried interest and as a result ENAMI is generally not required to contribute further funding to CMTQB.

CMTQB owns the exploitation and/or exploration rights in the immediate area of the Quebrada Blanca deposit pursuant to various mining concessions and other rights. In addition, CMTQB

owns surface rights covering the mine site and other areas aggregating approximately 3,150 hectares as well as certain other exploration rights in the surrounding area and certain water rights.

The Quebrada Blanca mine is located in the Tarapacá Region of northern Chile approximately 240 kilometres southeast of the port city of Iquique and 1,500 kilometres north of the city of Santiago, the capital of Chile. The Quebrada Blanca property is located at approximately 4,400 metres elevation above sea level. The local topography is represented by rounded hills disrupted by steep gulches. Vegetation cover consists of sparse tufts of grass and small shrubs. Access to the mine site is via road from Iquique. Mine personnel are based in a camp facility and the majority commute from large population centres, including Iquique and Santiago.

Quebrada Blanca is an open-pit mine which produces ore for both heap leach and lower grade dump leach production. Copper-bearing solutions are collected from the heap and dump leach pads for processing in an SX-EW plant which produces copper cathode. Copper cathode is trucked to Iquique for shipment to purchasers.

The Quebrada Blanca orebody is a porphyry copper deposit located in a 30-40 kilometre wide belt of volcanic and sedimentary rocks which contains a number of the world’s largest copper mines including Collahuasi (10 kilometres to the east) and Chuquicamata (190 kilometres to the south). All of these deposits are spatially related to a major north-south fault, the West Fissure Fault, or to splays off this fault.

The Quebrada Blanca orebody occurs within a 2 kilometre by 5 kilometre quartz monzonite intrusive stock. Supergene enrichment processes have dissolved and redeposited primary (hypogene) chalcopyrite as a blanket of supergene copper sulphides, the most important being chalcocite and covellite, with lesser copper oxides/silicates such as chrysocolla in the oxide zone. Irregular transition zones, with (locally) faulted contacts separate the higher and lower grade supergene/dump leach ores from the leached cap and hypogene zones.

The majority of copper cathode produced at Quebrada Blanca is sold under annual contracts to metal consumers and metal trading companies. The remaining copper cathode is sold on the spot market. The price of copper cathodes is based on LME prices plus a premium based on market conditions.

At its peak, annual production of the SX-EW plant was approximately 85,000 tonnes of copper cathode per year. Following unexpected ground movement in June 2015, we decommissioned the north portion of the SX-EW plant. We continue to operate the south side of the SX-EW plant which has sufficient production capacity for the available ore sources over the remainder of the mine life. Current capacity is estimated at approximately 40,000 tonnes of copper cathode per year.

In 2016, Quebrada Blanca produced 34,700 tonnes of copper cathode, compared to 39,100 tonnes in 2015, with the reduction primarily as a result of ore availability and declining ore grades as the supergene deposit is depleted.

During the third quarter of 2016, we received our updated environmental permits for the existing facilities. During the first quarter of 2017, the agglomeration circuit will be halted with all

remaining supergene ore sent to the dump leach circuit, further reducing operating costs. Opportunities to recover additional copper from previously processed material continue to be evaluated.

We expect production of approximately 20,000 to 24,000 tonnes of copper cathode in 2017. Future production plans will depend on copper prices and further cost reduction efforts, although we currently anticipate cathode production to continue until mid-2019 at reduced cathode production rates as the supergene deposit is exhausted. Based on current economic conditions, there are sufficient reserves in the mine plan to support production through early 2018.

In early 2017, we completed an updated feasibility study on our Quebrada Blanca Phase 2 project, which incorporates recent project optimization and certain scope changes, including a revised tailings facility located closer to the mine. As previously outlined, the proposed Quebrada Blanca Phase 2 would extend the life of the existing mine as a large scale concentrate producing operation. The project is currently undergoing environmental permitting, with permit approval anticipated in early 2018.

The updated study estimates a capital cost for the development of the project on a 100% basis of US$4.7 billion (in first quarter 2016 dollars, not including working capital or interest during construction). This updates the capital cost estimate of US$5.6 billion (in January 2012 dollars) contained in the 2012 feasibility study.

The study is based on an initial mine life of 25 years, consistent with the capacity of the new tailings facility. The mine plan includes 1.26 billion tonnes of proven and probable mineral reserves grading 0.51% copper and 0.019% molybdenum The project scope includes the construction of a 140,000-tonne-per-day concentrator and related facilities connected to a new port facility and desalination plant by 165-kilometre long concentrate and desalinated water pipelines.

As part of the regulatory process for Quebrada Blanca Phase 2, we submitted a Social and Environmental Impact Assessment to the Region of Tarapacá Environmental Authority in the third quarter of 2016. A decision to proceed with development will be contingent upon regulatory approvals and market conditions, among other considerations. Given the timeline of the regulatory process, such a decision is not expected before mid-2018.

Certain commitments have been made by CMTQB in connection with the development of Quebrada Blanca Phase 2, including with respect to certain long-lead equipment and power purchase contracts. There are three primary power purchase agreements for Quebrada Blanca Phase 2, with staggered supply dates. Each of these agreements imposes a take-or-pay obligation on CMTQB, under which CMTQB is required to pay for the contracted power regardless of whether it is required in the operations. Supply from the first contract commenced in the fourth quarter of 2016 and the other supply dates are expected to commence in early 2018. CMTQB’s obligations under the power purchase agreements are guaranteed by Teck until Quebrada Blanca Phase 2 enters production. So long as Teck’s unsecured unsubordinated debt does not carry an investment grade credit rating from Moody’s, Standard & Poor’s or Fitch ratings agencies (or any two of these agencies if Teck is rated by more than one of them), we are required to deliver letters of credit to support these guarantees. There are currently US$672

million of letters of credit outstanding to support the guarantees. The aggregate fixed commitment of the three primary power supply agreements is approximately US$6.5 million per month, determined as of December 31, 2016. CMTQB is taking steps to manage its exposure in connection with these commitments in light of the permitting timeline discussed above, and may sell power at spot market rates or under contract to offset its exposure under these take or pay contracts until power is required for the QB2 project.

Taxes payable in Chile that affect the operation include a mining tax of 4% of net sales revenue under a tax stability agreement until 2018. From 2018 the Chilean Specific Mining Tax will apply to operating margin based on a progressive sliding scale from 5% to 14%. CMTQB is also subject to federal income tax in Chile.

Carmen de Andacollo Mine, Chile (Copper)

The Carmen de Andacollo property is owned by a Chilean private company, Compañía Minera Teck Carmen de Andacollo (“CDA”). We own 100% of the Series A shares of CDA while ENAMI owns 100% of the Series B shares of CDA. Our Series A shares of CDA equate to 90% of CDA’s total share equity and ENAMI’s Series B shares comprise the remaining 10% of total share equity. ENAMI’s interest is a carried interest and as a result ENAMI is not required to contribute further funding to CDA.

CDA owns the exploitation and/or exploration rights over an area of approximately 206 square kilometres in the area of the Carmen de Andacollo supergene and hypogene deposits pursuant to various mining concessions and other rights. In addition, CDA owns the surface rights covering the mine site and other areas aggregating approximately 21 square kilometres as well as certain water rights. CDA has, since 1996, been conducting mining operations on the supergene deposit on the Carmen de Andacollo property which overlies the hypogene deposit and since 2010 has been processing hypogene ore through a concentrator on the site.

The Carmen de Andacollo property is located in Coquimbo Province in central Chile. The site is adjacent to the town of Carmen de Andacollo, approximately 55 kilometres southeast of the city of La Serena and 350 kilometres north of Santiago. Access to the Carmen de Andacollo mine is by paved roads from La Serena. The mine is located near the southern limit of the Atacama Desert at an elevation of approximately 1,000 metres. The climate around Carmen de Andacollo is transitional between the desert climate of northern Chile and the Mediterranean climate of the Santiago area. The majority of mine personnel live in the town of Carmen de Andacollo, immediately adjacent to the mine or in the nearby cities of Coquimbo and La Serena.

The Carmen de Andacollo orebody is a porphyry copper deposit consisting of disseminated and fracture-controlled copper mineralization contained within a gently dipping sequence of andesitic to trachytic volcanic rocks and sub-volcanic intrusions. The mineralization is spatially related to a feldspar porphyry intrusion and a series of deeply-rooted fault structures. A primary copper-gold sulphide deposit (the “hypogene deposit”) containing principally disseminated and quartz vein-hosted chalcopyrite mineralization lies beneath the supergene deposit. The hypogene deposit was subjected to surface weathering processes resulting in the formation of a barren leached zone 10 to 60 metres thick. The original copper sulphides leached from this zone were re-

deposited below the barren leached zone as a copper-rich zone comprised of copper silicates (chrysocolla) and supergene copper sulphides (chalcocite with lesser covellite).

The Carmen de Andacollo mine is an open-pit mine. Copper concentrate is produced by processing hypogene ore through a flotation plant. Some supergene ore is also mined, which is transported to heap leach pads. Copper-bearing solutions are processed in an SX-EW plant to produce grade A copper cathode.

The majority of copper cathode produced at Carmen de Andacollo is sold under annual contracts with metal trading companies. The remaining Carmen de Andacollo copper cathode production is sold in the spot market. The price of copper cathodes is based on LME prices plus a premium based on market conditions. Copper concentrates are sold under long-term contracts to smelters in Asia and Europe using the LME price as the basis for copper pricing and with treatment and refining charges negotiated on an annual basis.

During 2016, 24 diamond drill holes, totaling approximately 3,800 metres were drilled in the Carmen de Andacollo mine. Sixteen of these drill holes were for geological logging purposes. The geological logging of these drill holes confirms the geological features identified in the deposit and only local changes of geological boundaries were recognized. Diamond drill core is split in halves and sampled in 2.5 metre intervals. One half is sent to the lab at the site for analysis and the other is retained for future reference. For this drilling campaign, one in five samples was submitted to metallurgical testing and subsequently these samples returned to the mechanical preparation process. Coarse blank, field duplicated (prior to shipment to the laboratory), crushing duplicated, fine coarse blank, pulp duplicated and standards were used as part of the quality assurance-quality control program.

Carmen de Andacollo produced 69,500 tonnes of copper contained in concentrate in 2016, similar to the amount produced in 2015. Copper cathode production was 3,700 tonnes in 2016, compared with 4,700 tonnes in 2015. Gold production, on a 100% basis, of 53,300 ounces was 12% higher than production of 47,600 ounces in 2015. One hundred percent of the gold produced at Carmen de Andacollo is for the account of RGLD Gold AG (RGLDAG), a wholly-owned subsidiary of Royal Gold, Inc., pursuant to a long term purchase agreement made in 2015. Under the agreement, RGLDAG pays a cash price of 15% of the monthly average gold price at the time of each delivery.

Consistent with the mine plan, copper grades are expected to continue to gradually decline in 2017 and in future years, which we expect to largely offset planned throughput improvements in the mill. Carmen de Andacollo’s production in 2017 is expected to be similar to 2016 and in the range of 68,000 to 72,000 tonnes of copper in concentrate and 3,000 to 4,000 tonnes of copper cathode. Copper in concentrate production is expected to be in the range of 65,000 to 70,000 tonnes for the subsequent three year period, with cathode production rates uncertain past 2017, although, there is potential to extend.

The current life of mine for Carmen de Andacollo is expected to continue until 2034. Additional permitting or amendments will be required to execute the life of mine plan.

Taxes payable in Chile that affect the operation include a mining tax of 5% of net sales revenue under a tax stability agreement until 2018. From 2018 the Chilean Specific Mining Tax applies to

operating margin based on a progressive sliding scale from 5% to 14%. CDA is also subject to federal income tax in Chile.

Duck Pond Mine, Canada (Copper/Zinc)

We hold a 100% interest in the Duck Pond copper-zinc property. The Duck Pond property is located in central Newfoundland approximately 100 kilometres southwest of the city of Grand Falls-Windsor. The property covers approximately 12,800 hectares and is held under various mining and surface leases, mineral licenses and contractual mining rights.

The mine permanently closed at the end of June 2015 as planned due to exhaustion of reserves. Mine closure and site restoration activities are progressing as expected.

Copper Projects

NuevaUnión (formerly Project Corridor), Chile

In November 2015 we combined Goldcorp’s La Fortuna (formerly El Morro) project and Teck’s Relincho project, located approximately 40 kilometres apart in the Huasco Province in the Atacama region of Chile, into a single copper-gold-molybdenum project.

In October 2016, work began on a pre-feasibility study concurrently with early and ongoing engagement with Indigenous Peoples and non-Indigenous communities to gather feedback and help inform project design. In addition, the first environmental baseline campaign was completed in December 2016. Planned 2017 activities include technical drilling on the Relincho and La Fortuna deposits in support of the studies. We expect to complete the pre-feasibility study at the end of the third quarter of 2017.

San Nicolás, Mexico

The San Nicolás property, located in Zacatecas State, one of the oldest mining regions in Mexico, is a significant copper, zinc, gold and silver massive sulphide deposit. The property is held by Minas de San Nicolás S.A. de C.V., which is owned 40% by Teck and 60% by Minera Tama S.A. de C.V. (“Tama”). Tama is owned 65% by Teck and 35% by Minera Faja de Plata, S.A. de C.V. resulting in Teck holding a 79% interest in the property. Our interest may vary depending on certain financing elections the parties may make under the agreements governing the project.

Additional drilling and metallurgical test work on the property was conducted in 2015 and an advanced scoping study was completed in 2016. A pre-feasibility study is planned to start in 2017 along with preliminary permitting work including baseline environmental and community studies.

Zafranal, Peru

The Zafranal property, located in southern Peru within the Provinces of Castilla and Caylloma, is a mid-sized copper-gold sulphide porphyry deposit. The project is held by Compañía Minera Zafranal S.A.C., in which we are a 50% direct shareholder. The other 50% shareholding is held by Minera A.Q.M. Copper Peru S.A.C, which is owned 60% by AQM Copper Inc. and 40% by Mitsubishi Materials Corporation. In January 2017, we completed an acquisition of all of the

outstanding shares of AQM Copper Inc. not already owned by us, increasing our ownership of the project to 80%.

A pre-feasibility study was completed on the Zafranal project in 2016. Additional drilling and a feasibility study are planned to start in 2017 along with community engagement activities, environmental studies, archeological studies and permitting work necessary to prepare and submit an Environmental Impact Assessment.

Mesaba, United States

The Mesaba project, located in northeastern Minnesota, is part of a potentially significant new copper-nickel mining district. Known ore deposits in the district, including Mesaba, consist of metallurgically complex disseminated copper-nickel sulphides that require a range of mineral processing to make saleable concentrate or metal products and appropriate considerations to meet State and Federal requirements to protect the environment. The mineral resources and related properties forming the Mesaba project are owned 100% by Teck.

Several drilling campaigns and engineering studies have been completed on the Mesaba project, including an updated scoping study in 2016, which included re-evaluation of the design basis which will inform next stages of study and potential future development of the project. Desktop studies and minor field programs, predominantly with an environmental focus, are planned for 2017.

Galore Creek, Canada

The Galore Creek project, located in the traditional territory of the Tahltan Nation in northwestern British Columbia, is a major copper-gold porphyry deposit. The project is owned by Galore Creek Partnership, a 50/50 partnership between Teck and NovaGold Canada Inc., and is managed by the Galore Creek Mining Corporation, a wholly-owned subsidiary of the Galore Creek Partnership.

The Galore Creek project has undergone several engineering studies since the 2012 Advanced Engineering Study and significant diamond drilling was also carried out in 2013 and 2014. A high level re-assessment of key design features of the project was completed in 2016. Although the project remains on care and maintenance, an updated engineering study is planned for 2017 as well as modest field programs focused on drill core management and preservation. In addition, during 2017 we will work with the Tahltan Central Government to renew the 10 year Participation Agreement entered into in 2007.

Schaft Creek, Canada

The Schaft Creek property, located in the traditional territory of the Tahltan Nation in northwestern British Columbia, approximately 26 kilometres northeast of the Galore Creek property, is a large low-grade copper-molybdenum-gold porphyry deposit. The project is a 75/25 joint venture between Teck and Copper Fox Metals Inc., with Teck as the operator.

The project is at an advanced stage of exploration. A feasibility study was updated in 2013. Ongoing environmental monitoring and engineering studies continued through 2016. Resource

modeling, trade-off and value-add conceptual studies are planned for 2017 along with a continuation of care and maintenance activities.

CESL Limited (CESL)

In 2016, our CESL hydrometallurgical facility, located in Richmond, B.C., continued to advance the commercialization of our proprietary copper, nickel and copper-arsenic process technologies on internal and external opportunities.

Our coal mineral holdings consist of a mix of fee simple lands owned by us and Crown leases and licenses, which are subject to licensing and leasing fees. In the past, renewals of these licenses and leases have generally been granted although there can be no assurance that this will continue in the future.

Five of Teck’s six operating coal mines are in British Columbia and are therefore subject to mineral taxes. British Columbia mineral tax is a two-tier tax with a minimum rate of 2% and a maximum rate of 13%. A minimum tax of 2% applies to operating cash flows, as defined by the regulations. A maximum tax rate of 13% applies to cash flows after taking available deductions for capital expenditures and other permitted deductions. Alberta Crown royalties are assessed on a similar basis, at rates of 1% and 13%, and apply to the Cardinal River mine.

All of Teck’s coal mines are conventional open-pit operations and are designed to operate on a continuous basis, 24 hours per day, 365 days per year. Operating schedules can be varied depending on market conditions and are subject to shutdowns for maintenance activities. Capacity may be restricted for a variety of reasons and actual production will depend on sales volumes. All of the mines are accessed by two-lane all-weather roads which connect to public highways. All the mines operate under permits granted by Provincial and/or Federal regulatory authorities. Each of the mines will require additional permits as they progress through their long-term mine plans. All permits necessary for the current operations of the mines are in hand and in good standing. Annual in-fill drilling programs are conducted to confirm and update the geological models used to develop the yearly mine plans.

Following mining, the coal is washed in coal preparation plants using a variety of conventional techniques and conveyed to coal or gas fired dryers for drying. Processed coal is conveyed to clean coal silos or other storage facilities for storage and load-out to railcars.

New five-year collective labour agreements were reached in 2016 at our Fording River and Elkview operations, and a four-year agreement was ratified at our Coal Mountain operations.

Elk Valley Water Management