Notice to LSE 2024 Full year results presentation 19 February 2025 Rio Tinto’s 2024 full year results presentation will be given at 8.00pm (19 February GMT) / 7.00am (20 February AEDT) by our Chief Executive, Jakob Stausholm and Chief Financial Officer, Peter Cunningham. The presentation slides are available at riotinto.com/results. The live webcast will be available at riotinto.com/results. Exhibit 99.2

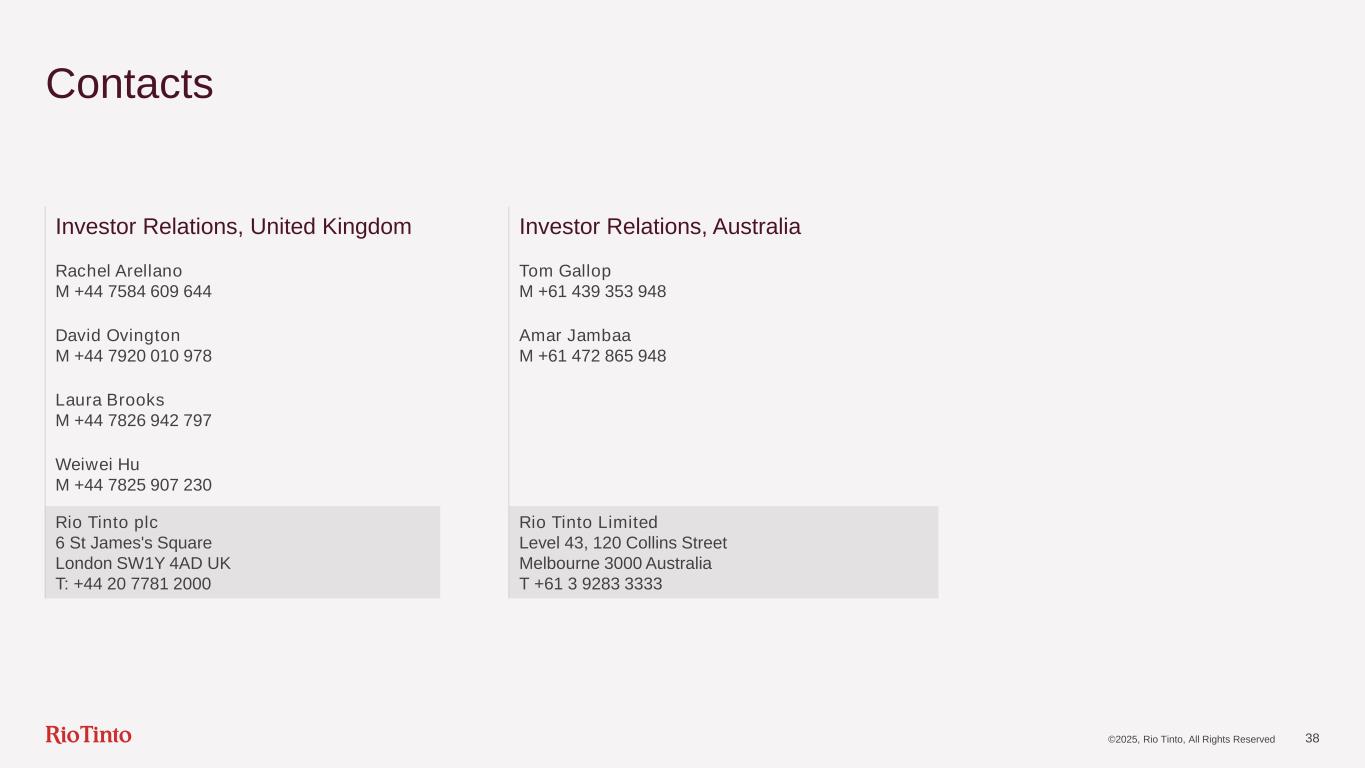

Notice to LSE Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Michelle Lee M +61 458 609 322 Rachel Pupazzoni M +61 438 875 469 Media Relations, Canada Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Vanessa Damha M +1 514 715 2152 Media Relations, US Jesse Riseborough M +1 202 394 9480 Investor Relations, United Kingdom Rachel Arellano M: +44 7584 609 644 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Weiwei Hu M +44 7825 907 230 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Andy Hodges, Rio Tinto’s Group Company Secretary. riotinto.com

2024 Full Year Results 19 February 2025 Oyu Tolgoi, Mongolia©2025, Rio Tinto, All Rights Reserved

©2025, Rio Tinto, All Rights Reserved 2 Cautionary and supporting statements This presentation has been prepared by Rio Tinto plc and Rio Tinto Limited (together with their subsidiaries,“Rio Tinto”). By accessing/attending this presentation you acknowledge that you have read and understood the following statements. Forward-looking statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included in this report, including, without limitation, those regarding Rio Tinto’s financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives relating to Rio Tinto’s products, production forecasts and reserve and resource positions), are forward-looking statements. The words “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, “target”, “set to” or similar expressions, commonly identify such forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Rio Tinto, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, particularly in light of the current economic climate and the significant volatility, uncertainty and disruption arising in connection with the Ukraine conflict. Such forward-looking statements are based on numerous assumptions regarding Rio Tinto’s present and future business strategies and the environment in which Rio Tinto will operate in the future. Among the important factors that could cause Rio Tinto’s actual results, performance or achievements to differ materially from those in the forward- looking statements include, but are not limited to: an inability to live up to Rio Tinto’s values and any resultant damage to its reputation; the impacts of geopolitics on trade and investment; the impacts of climate change and the transition to a low- carbon future; an inability to successfully execute and/or realise value from acquisitions and divestments; the level of new ore resources, including the results of exploration programmes and/or acquisitions; disruption to strategic partnerships that play a material role in delivering growth, production, cash or market positioning; damage to Rio Tinto’s relationships with communities and governments; an inability to attract and retain requisite skilled people; declines in commodity prices and adverse exchange rate movements; an inability to raise sufficient funds for capital investment; inadequate estimates of ore resources and reserves; delays or overruns of large and complex projects; changes in tax regulation; safety incidents or major hazard events; cyber breaches; physical impacts from climate change; the impacts of water scarcity; natural disasters; an inability to successfully manage the closure, reclamation and rehabilitation of sites; the impacts of civil unrest; the impacts of the Ukraine conflict; breaches of Rio Tinto’s policies, standard and procedures, laws or regulations; trade tensions between the world’s major economies; increasing societal and investor expectations, in particular with regard to environmental, social and governance considerations; the impacts of technological advancements; and such other risks identified in Rio Tinto’s most recent Annual Report and accounts in Australia and the United Kingdom and the most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (the “SEC”) or Form 6-Ks furnished to, or filed with, the SEC. Forward-looking statements should, therefore, be construed in light of such risk factors and undue reliance should not be placed on forward-looking statements. These forward-looking statements speak only as of the date of this report. Rio Tinto expressly disclaims any obligation or undertaking (except as required by applicable law, the UK Listing Rules, the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority and the Listing Rules of the Australian Securities Exchange) to release publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in Rio Tinto’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Nothing in this presentation should be interpreted to mean that future earnings per share of Rio Tinto plc or Rio Tinto Limited will necessarily match or exceed its historical published earnings per share. Past performance cannot be relied on as a guide to future performance. Disclaimer Neither this presentation, nor the question and answer session, nor any part thereof, may be recorded, transcribed, distributed, published or reproduced in any form, except as permitted by Rio Tinto. By accessing/ attending this presentation, you agree with the foregoing and, upon request, you will promptly return any records or transcripts at the presentation without retaining any copies. This presentation contains a number of non-IFRS financial measures. Rio Tinto management considers these to be key financial performance indicators of the business and they are defined and/or reconciled in Rio Tinto’s annual results press release, Annual Report and accounts in Australia and the United Kingdom and/or the most recent Annual Report on Form 20-F filed with the SEC or Form 6-Ks furnished to, or filed with, the SEC. Reference to consensus figures are not based on Rio Tinto’s own opinions, estimates or forecasts and are compiled and published without comment from, or endorsement or verification by, Rio Tinto. The consensus figures do not necessarily reflect guidance provided from time to time by Rio Tinto where given in relation to equivalent metrics, which to the extent available can be found on the Rio Tinto website. By referencing consensus figures, Rio Tinto does not imply that it endorses, confirms or expresses a view on the consensus figures. The consensus figures are provided for informational purposes only and are not intended to, nor do they, constitute investment advice or any solicitation to buy, hold or sell securities or other financial instruments. No warranty or representation, either express or implied, is made by Rio Tinto or its affiliates, or their respective directors, officers and employees, in relation to the accuracy, completeness or achievability of the consensus figures and, to the fullest extent permitted by law, no responsibility or liability is accepted by any of those persons in respect of those matters. Rio Tinto assumes no obligation to update, revise or supplement the consensus figures to reflect circumstances existing after the date hereof. Production Targets Simandou: The estimated annualised capacity of approximately 60 million dry tonnes per annum (27 million dry tonnes Rio Tinto Share) iron ore for the Simandou life of mine schedule referenced in slide 19 was previously reported in a release to the Australian Securities Exchange (ASX) dated 6 December 2023 titled “Simandou iron ore project update”. Rio Tinto confirms that all material assumptions underpinning that production target continue to apply and have not materially changed. Oyu Tolgoi: The 500ktpa copper production target (stated as recoverable metal) for the Oyu Tolgoi underground and open pit mines for the years 2028 to 2036 referenced in slide 13 and 19 were previously reported in a release to the ASX dated 11 July 2023 “Investor site visit to Oyu Tolgoi copper mine, Mongolia”. All material assumptions underpinning that production target continue to apply and have not materially changed. Rincon: The production target of approximately 53kt of battery grade lithium carbonate per year for a period of 40 years referenced in slide 18 was previously reported in a release to the ASX dated 4 December 2024 titled “Rincon Project Mineral Resources and Ore Reserves: Table 1”. Rio Tinto confirms that all material assumptions underpinning that production target continue to apply and have not materially changed. Plans are in place to build for a capacity of 60 kt of battery grade lithium carbonate per year with debottlenecking and improvement programs scheduled to unlock this additional throughput.

Jakob Stausholm Chief Executive We continue to build on our momentum, with another set of strong operational and financial results. Simandou, Guinea 3©2025, Rio Tinto, All Rights Reserved

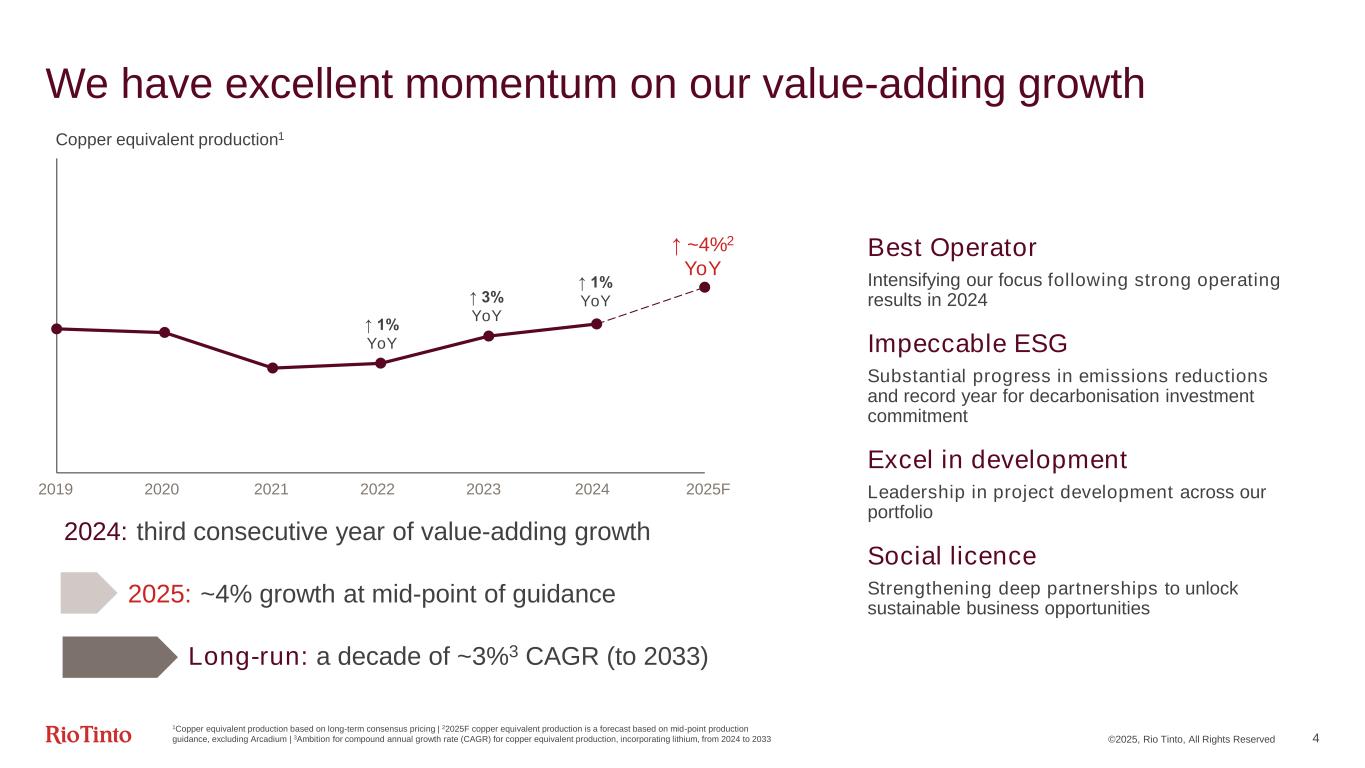

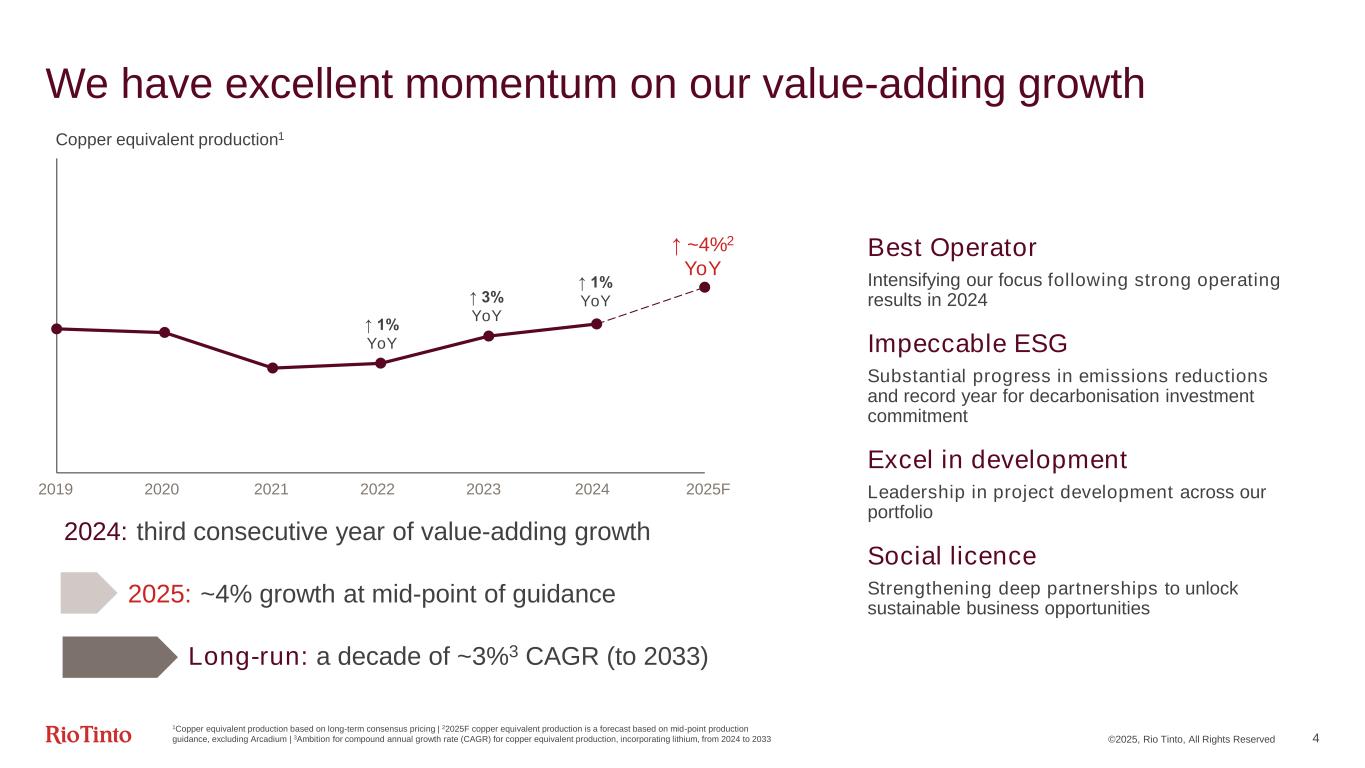

We have excellent momentum on our value-adding growth Simandou rail loop, Guinea 2019 2020 2021 2022 2023 2024 2025F ↑ 1% YoY ↑ 3% YoY ↑ 1% YoY ↑ ~4%2 YoY 2024: third consecutive year of value-adding growth ©2025, Rio Tinto, All Rights Reserved 1Copper equivalent production based on long-term consensus pricing | 22025F copper equivalent production is a forecast based on mid-point production guidance, excluding Arcadium | 3Ambition for compound annual growth rate (CAGR) for copper equivalent production, incorporating lithium, from 2024 to 2033 Long-run: a decade of ~3%3 CAGR (to 2033) 2025: ~4% growth at mid-point of guidance 4 Copper equivalent production1 Best Operator Intensifying our focus following strong operating results in 2024 Impeccable ESG Substantial progress in emissions reductions and record year for decarbonisation investment commitment Excel in development Leadership in project development across our portfolio Social licence Strengthening deep partnerships to unlock sustainable business opportunities

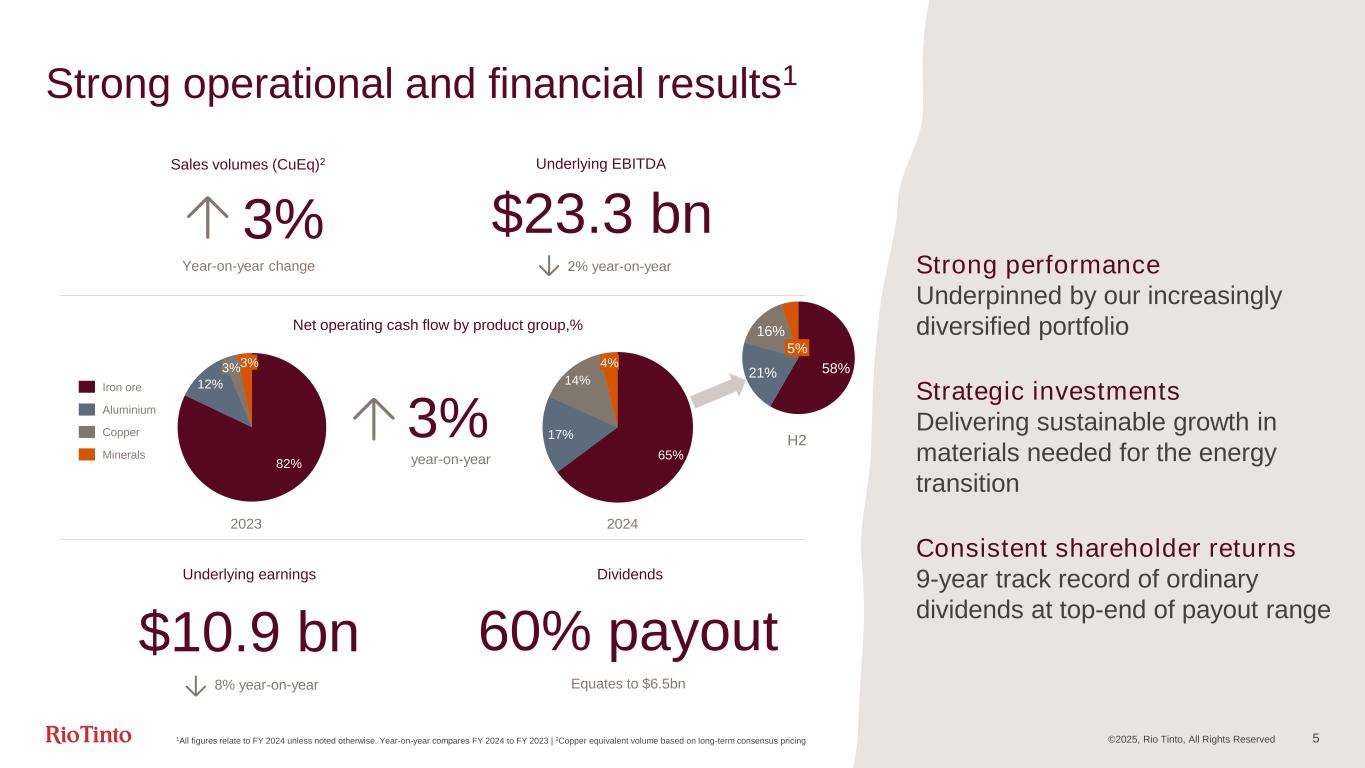

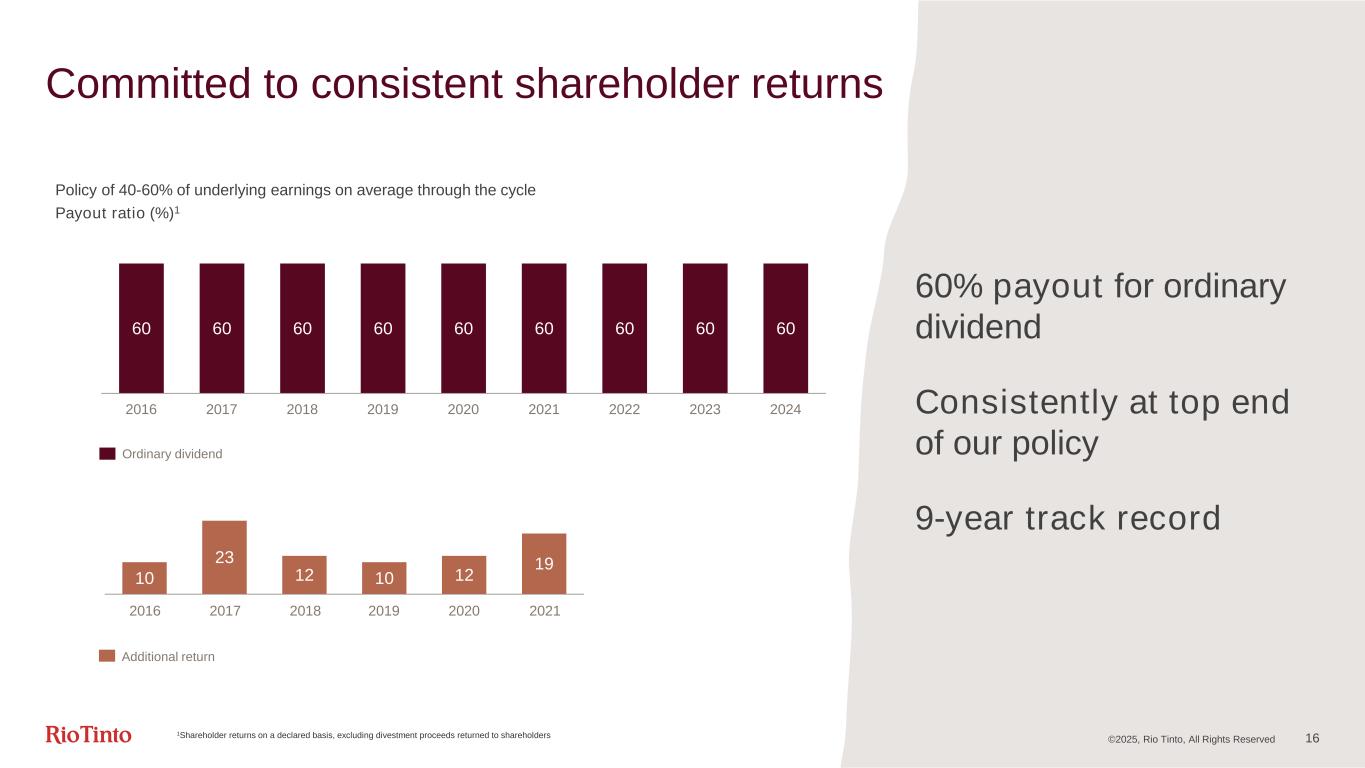

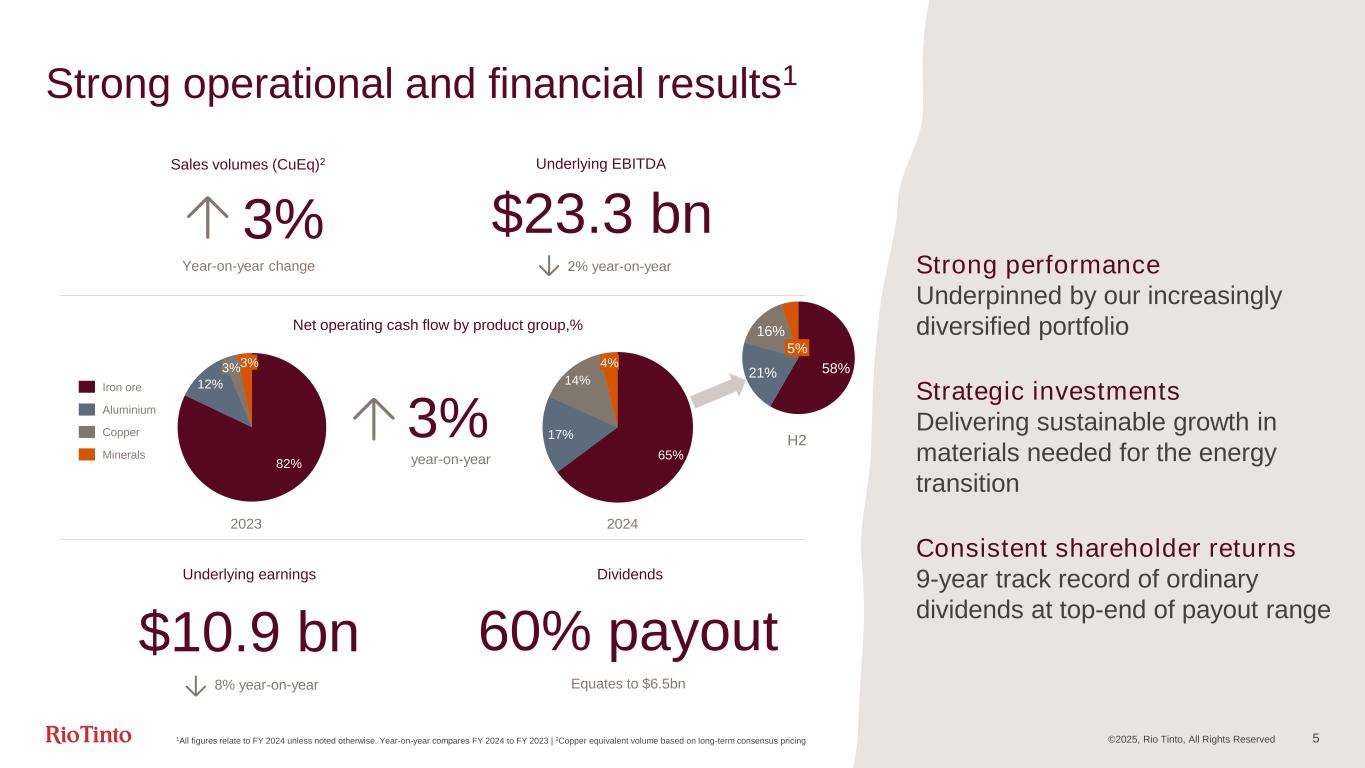

©2025, Rio Tinto, All Rights Reserved 5 Strong operational and financial results1 1All figures relate to FY 2024 unless noted otherwise. Year-on-year compares FY 2024 to FY 2023 | 2Copper equivalent volume based on long-term consensus pricing 3% Year-on-year change Strong performance Underpinned by our increasingly diversified portfolio Strategic investments Delivering sustainable growth in materials needed for the energy transition Consistent shareholder returns 9-year track record of ordinary dividends at top-end of payout range Sales volumes (CuEq)2 Underlying EBITDA Underlying earnings $10.9 bn 8% year-on-year Dividends 60% payout Equates to $6.5bn $23.3 bn 2% year-on-year Net operating cash flow by product group,% 65% 17% 14% 4% 82% 12% 3%3% 2023 2024 3% year-on-year Iron ore Aluminium Copper Minerals 58%21% 16% 5% H2

Peter Cunningham Chief Financial Officer Gove, Australia 6©2025, Rio Tinto, All Rights Reserved

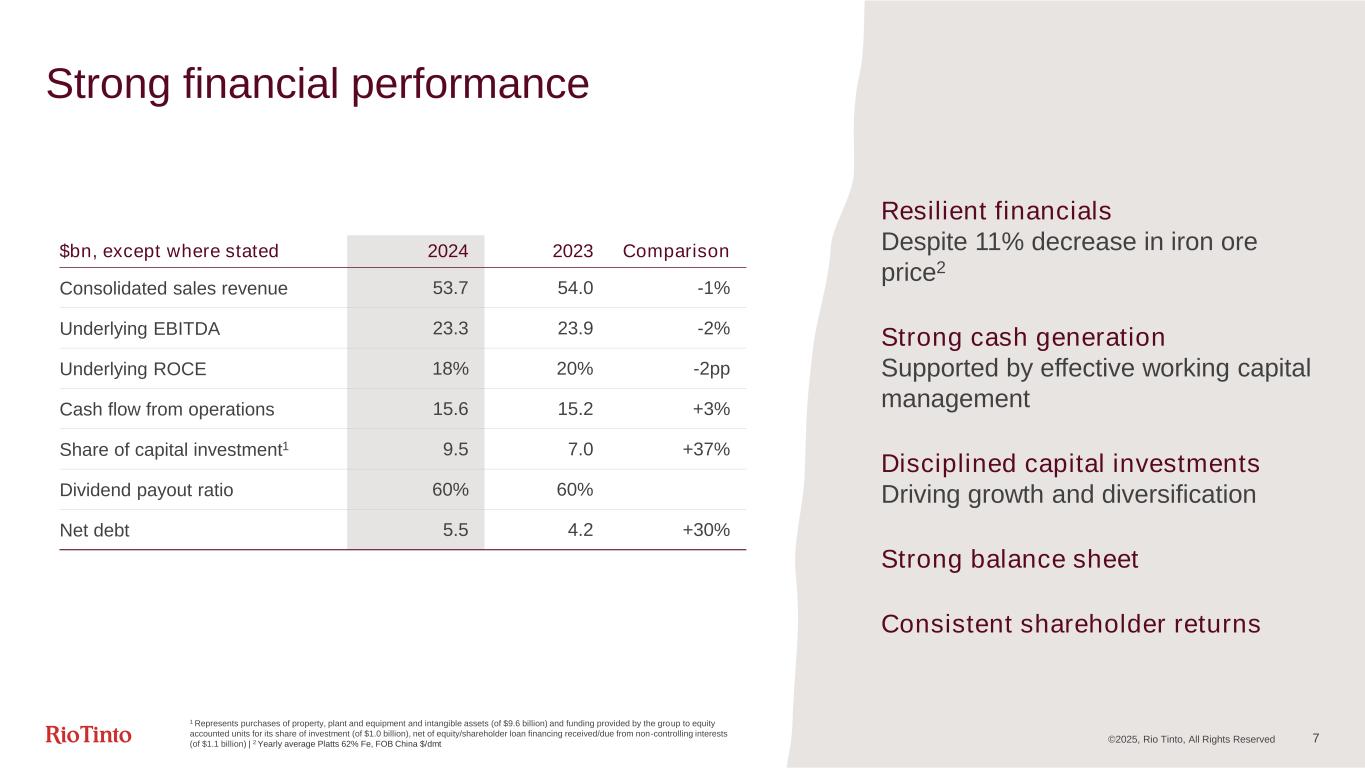

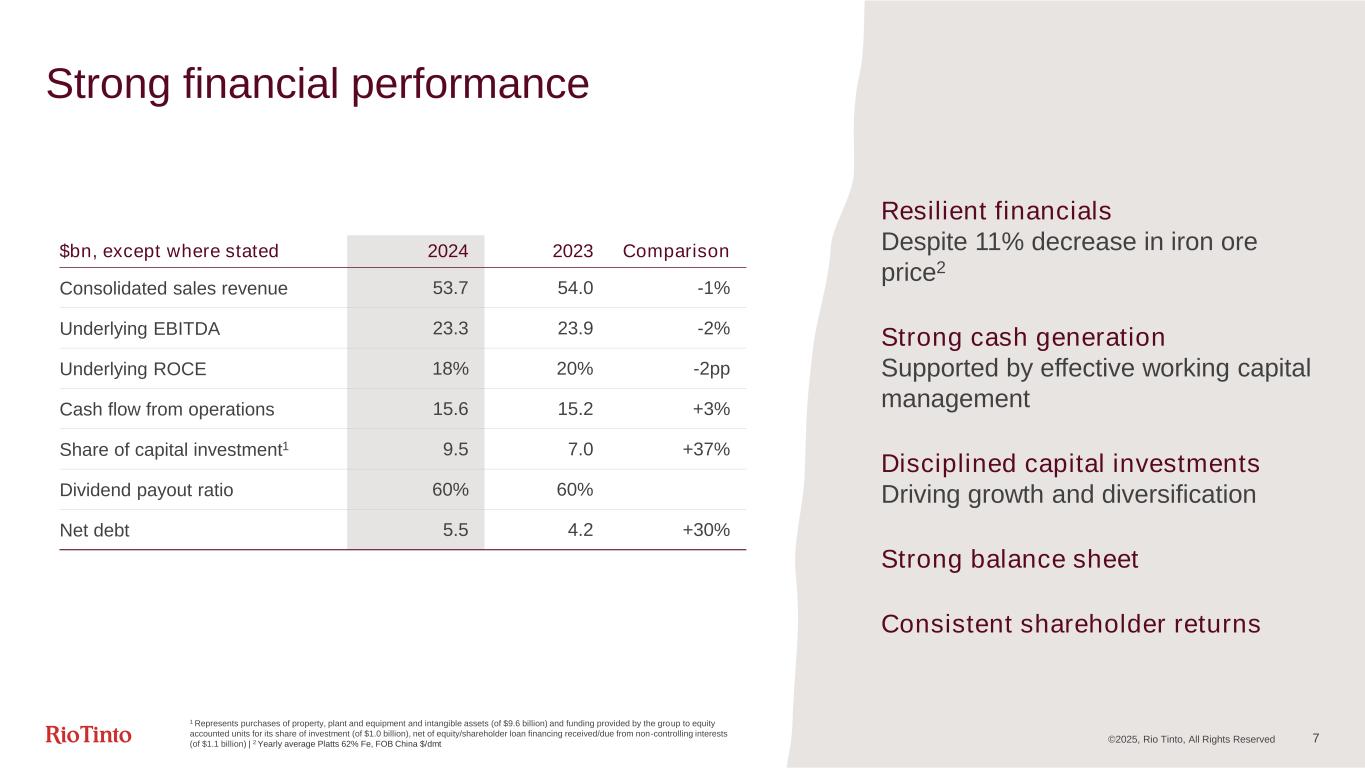

©2025, Rio Tinto, All Rights Reserved 7 Strong financial performance $bn, except where stated 2024 2023 Comparison Consolidated sales revenue 53.7 54.0 -1% Underlying EBITDA 23.3 23.9 -2% Underlying ROCE 18% 20% -2pp Cash flow from operations 15.6 15.2 +3% Share of capital investment1 9.5 7.0 +37% Dividend payout ratio 60% 60% Net debt 5.5 4.2 +30% 1 Represents purchases of property, plant and equipment and intangible assets (of $9.6 billion) and funding provided by the group to equity accounted units for its share of investment (of $1.0 billion), net of equity/shareholder loan financing received/due from non-controlling interests (of $1.1 billion) | 2 Yearly average Platts 62% Fe, FOB China $/dmt Resilient financials Despite 11% decrease in iron ore price2 Strong cash generation Supported by effective working capital management Disciplined capital investments Driving growth and diversification Strong balance sheet Consistent shareholder returns

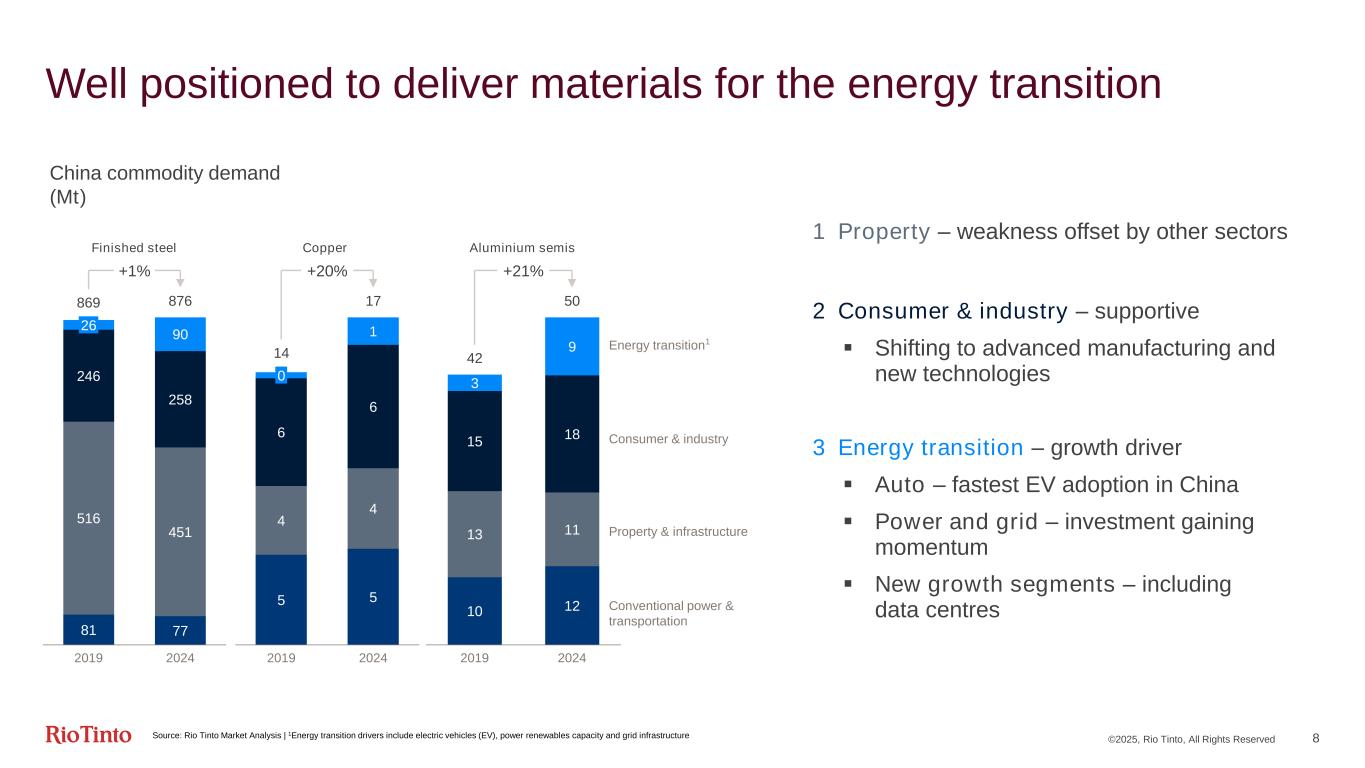

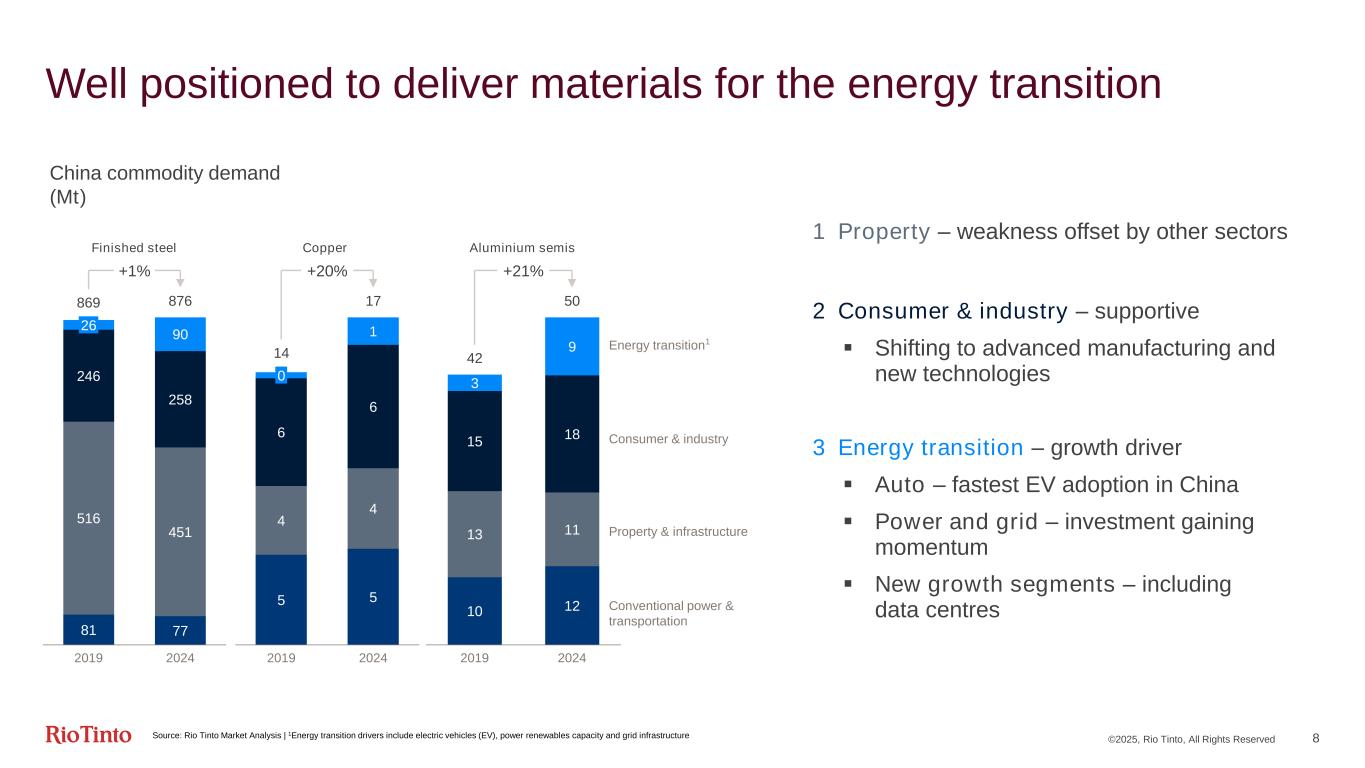

8 Well positioned to deliver materials for the energy transition 5 5 4 4 6 6 1 0 2019 2024 14 17 +20% 10 12 13 11 15 18 3 9 2019 2024 42 50 +21% 81 77 516 451 246 258 90 26 2019 2024 869 876 +1% Aluminium semisFinished steel Copper China commodity demand (Mt) Source: Rio Tinto Market Analysis | 1Energy transition drivers include electric vehicles (EV), power renewables capacity and grid infrastructure 1 Property – weakness offset by other sectors 2 Consumer & industry – supportive ▪ Shifting to advanced manufacturing and new technologies 3 Energy transition – growth driver ▪ Auto – fastest EV adoption in China ▪ Power and grid – investment gaining momentum ▪ New growth segments – including data centres Energy transition1 ©2025, Rio Tinto, All Rights Reserved Property & infrastructure Consumer & industry Conventional power & transportation

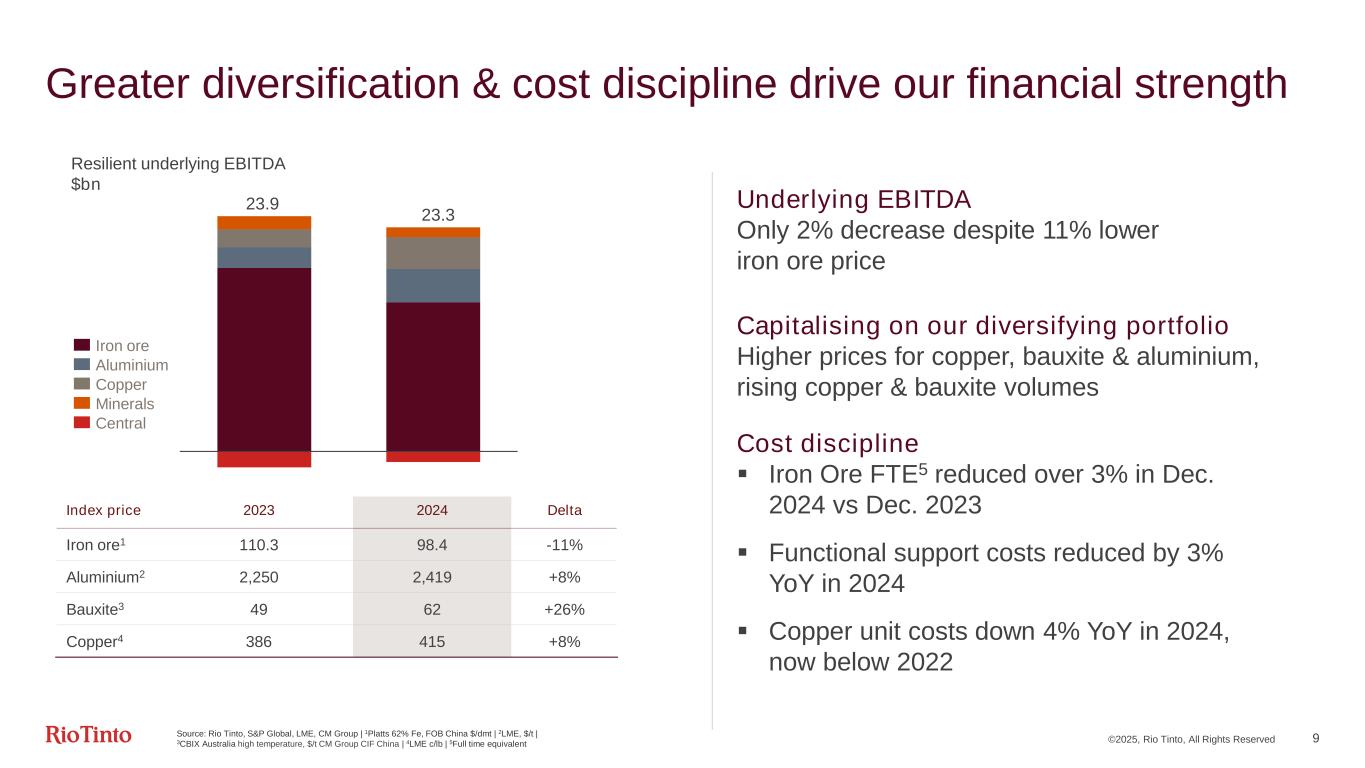

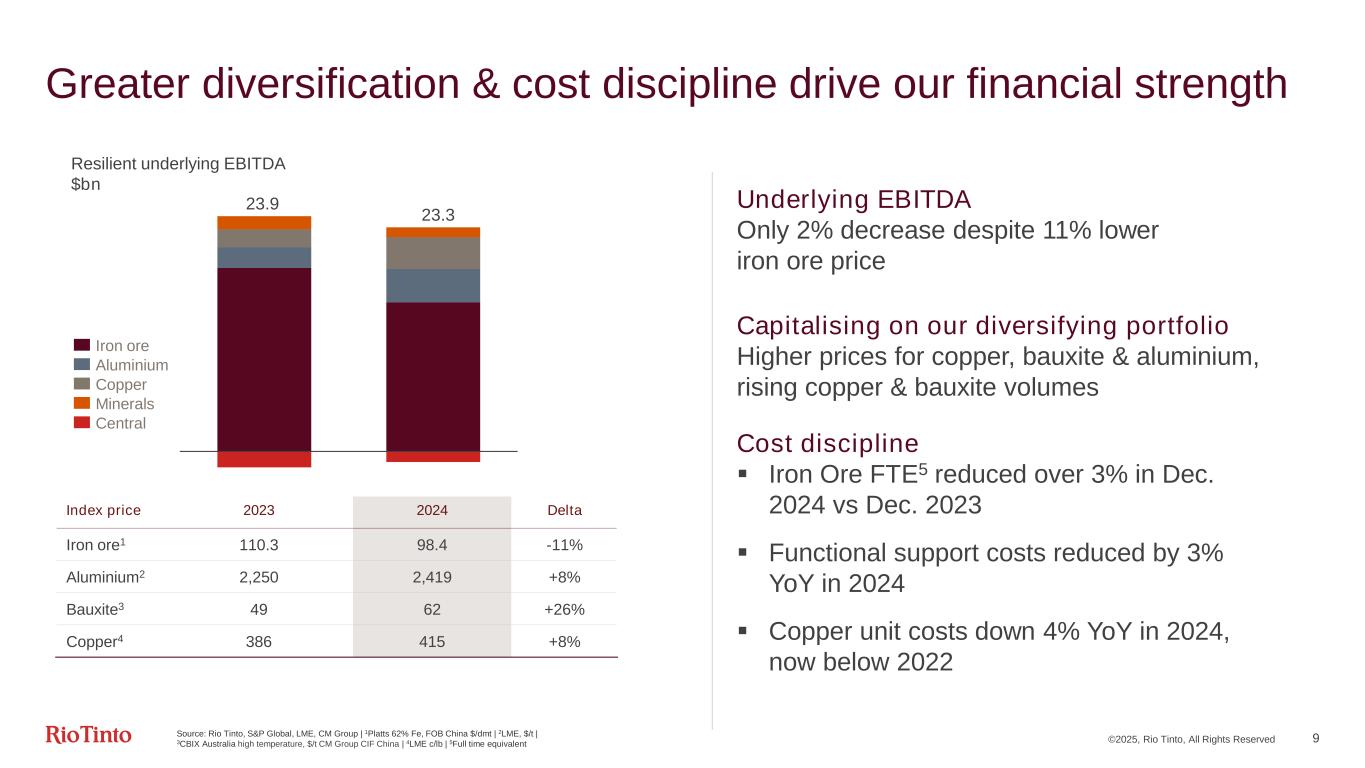

©2025, Rio Tinto, All Rights Reserved 9 Greater diversification & cost discipline drive our financial strength Source: Rio Tinto, S&P Global, LME, CM Group | 1Platts 62% Fe, FOB China $/dmt | 2LME, $/t | 3CBIX Australia high temperature, $/t CM Group CIF China | 4LME c/lb | 5Full time equivalent 23.9 23.3 Underlying EBITDA Only 2% decrease despite 11% lower iron ore price Capitalising on our diversifying portfolio Higher prices for copper, bauxite & aluminium, rising copper & bauxite volumes Cost discipline ▪ Iron Ore FTE5 reduced over 3% in Dec. 2024 vs Dec. 2023 ▪ Functional support costs reduced by 3% YoY in 2024 ▪ Copper unit costs down 4% YoY in 2024, now below 2022 Resilient underlying EBITDA $bn Index price 2023 2024 Delta Iron ore1 110.3 98.4 -11% Aluminium2 2,250 2,419 +8% Bauxite3 49 62 +26% Copper4 386 415 +8% Iron ore Aluminium Copper Minerals Central

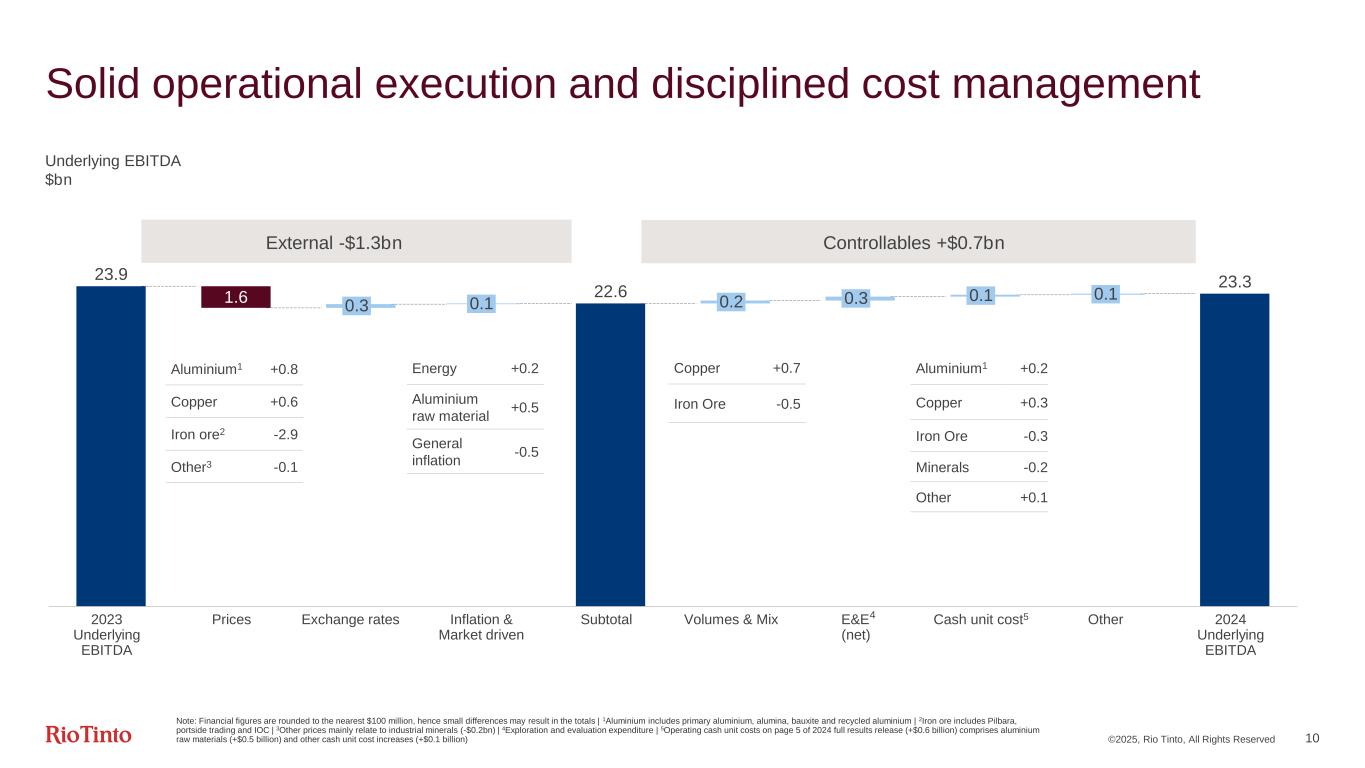

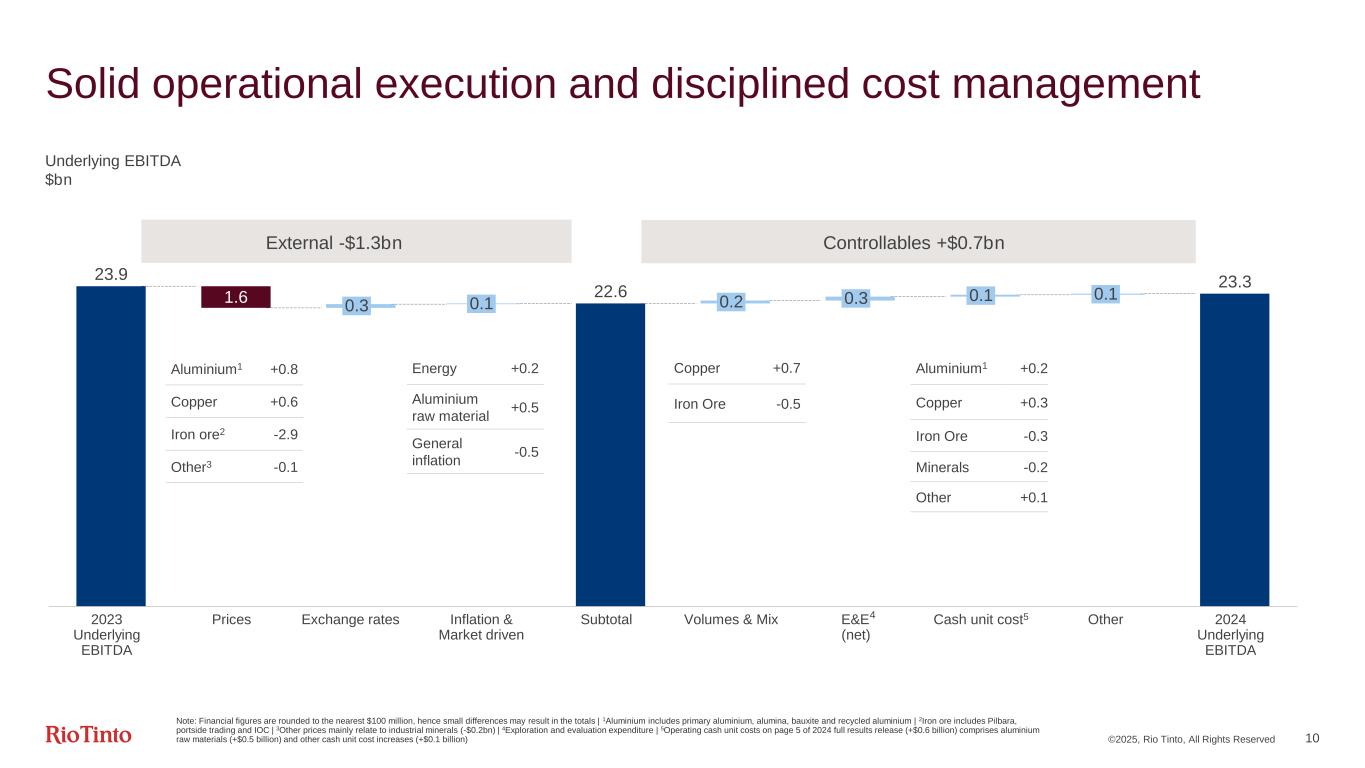

©2025, Rio Tinto, All Rights Reserved 10 Solid operational execution and disciplined cost management 23.9 22.6 23.3 1.6 2023 Underlying EBITDA Prices 0.3 Exchange rates 0.1 Inflation & Market driven Subtotal 0.2 Volumes & Mix 0.3 E&E (net) 0.1 Cash unit cost5 0.1 Other 2024 Underlying EBITDA External -$1.3bn Controllables +$0.7bn Aluminium1 +0.8 Copper +0.6 Iron ore2 -2.9 Other3 -0.1 Energy +0.2 Aluminium raw material +0.5 General inflation -0.5 Aluminium1 +0.2 Copper +0.3 Iron Ore -0.3 Minerals -0.2 Other +0.1 Note: Financial figures are rounded to the nearest $100 million, hence small differences may result in the totals | 1Aluminium includes primary aluminium, alumina, bauxite and recycled aluminium | 2Iron ore includes Pilbara, portside trading and IOC | 3Other prices mainly relate to industrial minerals (-$0.2bn) | 4Exploration and evaluation expenditure | 5Operating cash unit costs on page 5 of 2024 full results release (+$0.6 billion) comprises aluminium raw materials (+$0.5 billion) and other cash unit cost increases (+$0.1 billion) 4 Underlying EBITDA $bn Copper +0.7 Iron Ore -0.5

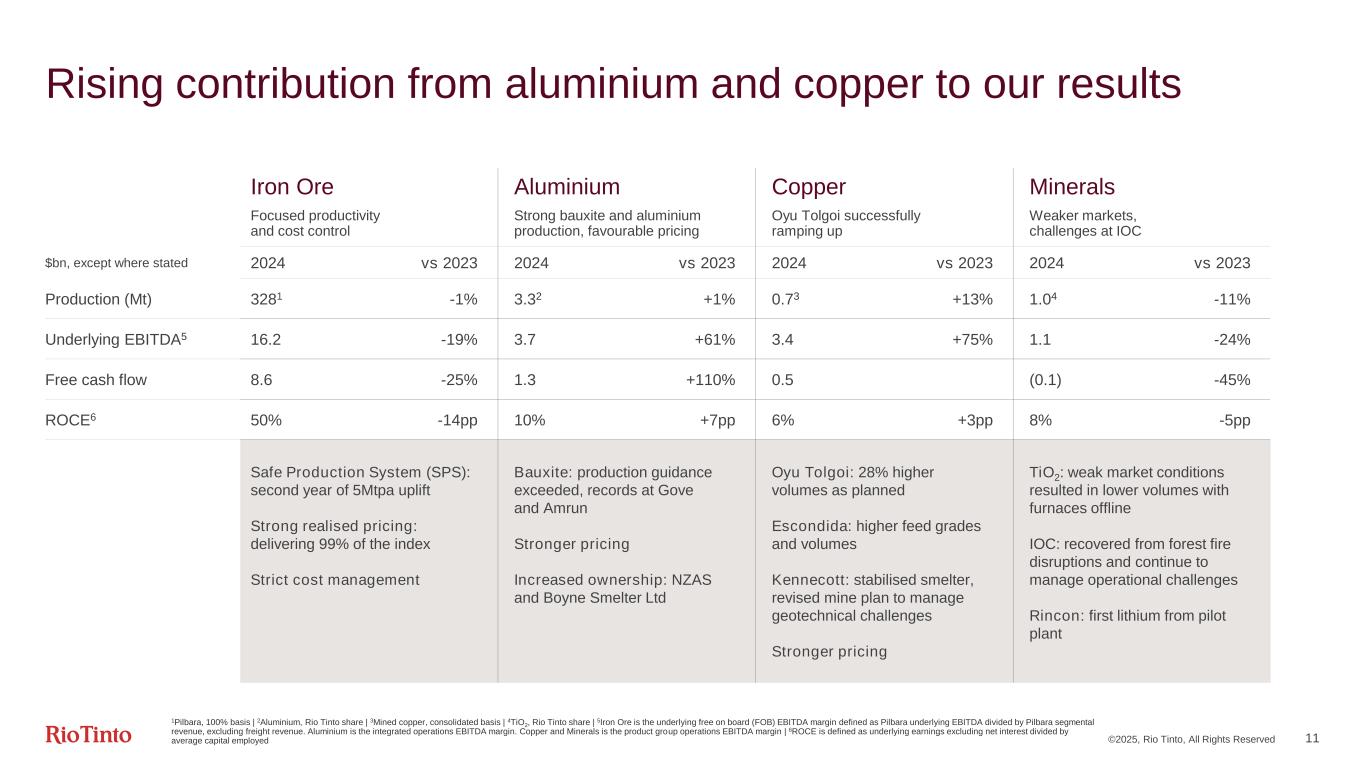

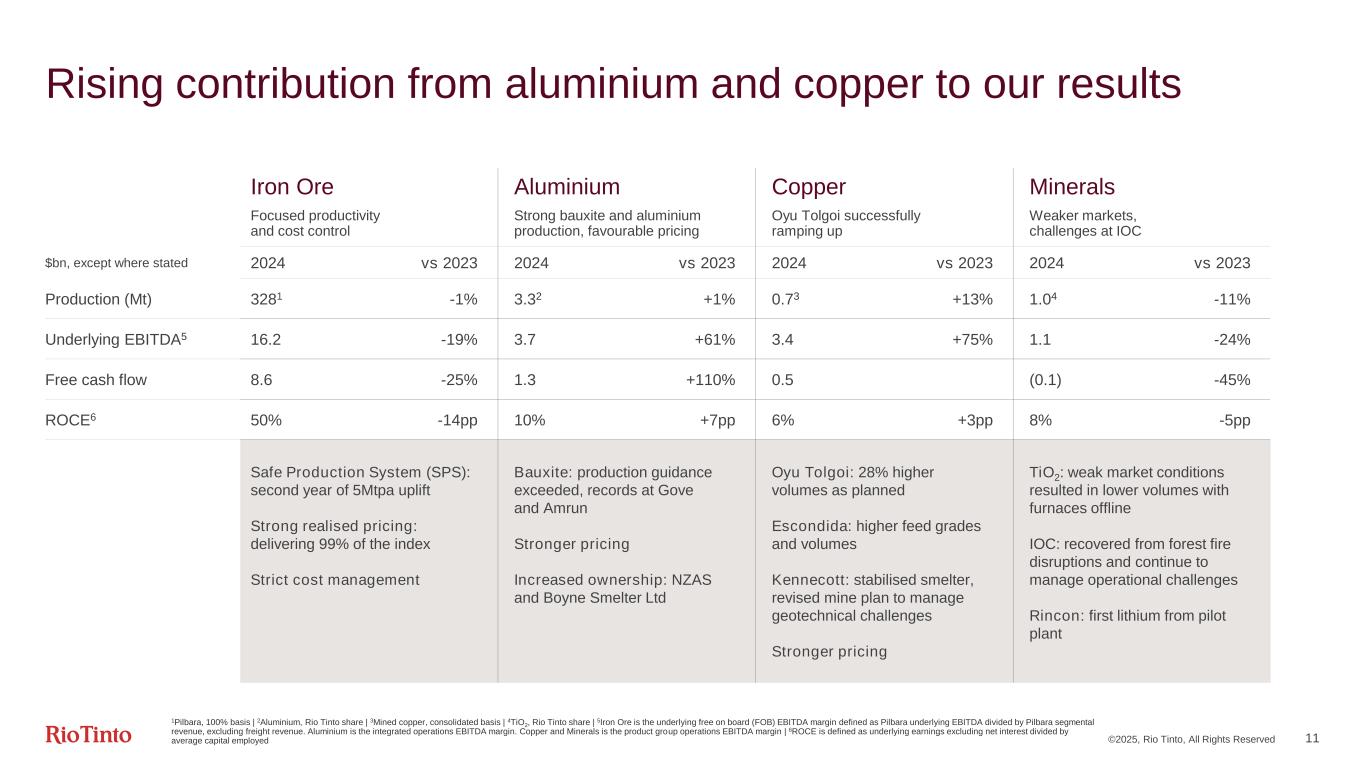

©2025, Rio Tinto, All Rights Reserved 11 Rising contribution from aluminium and copper to our results Iron Ore Aluminium Copper Minerals Focused productivity and cost control Strong bauxite and aluminium production, favourable pricing Oyu Tolgoi successfully ramping up Weaker markets, challenges at IOC $bn, except where stated 2024 vs 2023 2024 vs 2023 2024 vs 2023 2024 vs 2023 Production (Mt) 3281 -1% 3.32 +1% 0.73 +13% 1.04 -11% Underlying EBITDA5 16.2 -19% 3.7 +61% 3.4 +75% 1.1 -24% Free cash flow 8.6 -25% 1.3 +110% 0.5 (0.1) -45% ROCE6 50% -14pp 10% +7pp 6% +3pp 8% -5pp Safe Production System (SPS): second year of 5Mtpa uplift Strong realised pricing: delivering 99% of the index Strict cost management Bauxite: production guidance exceeded, records at Gove and Amrun Stronger pricing Increased ownership: NZAS and Boyne Smelter Ltd Oyu Tolgoi: 28% higher volumes as planned Escondida: higher feed grades and volumes Kennecott: stabilised smelter, revised mine plan to manage geotechnical challenges Stronger pricing TiO2: weak market conditions resulted in lower volumes with furnaces offline IOC: recovered from forest fire disruptions and continue to manage operational challenges Rincon: first lithium from pilot plant 1Pilbara, 100% basis | 2Aluminium, Rio Tinto share | 3Mined copper, consolidated basis | 4TiO2, Rio Tinto share | 5Iron Ore is the underlying free on board (FOB) EBITDA margin defined as Pilbara underlying EBITDA divided by Pilbara segmental revenue, excluding freight revenue. Aluminium is the integrated operations EBITDA margin. Copper and Minerals is the product group operations EBITDA margin | 6ROCE is defined as underlying earnings excluding net interest divided by average capital employed

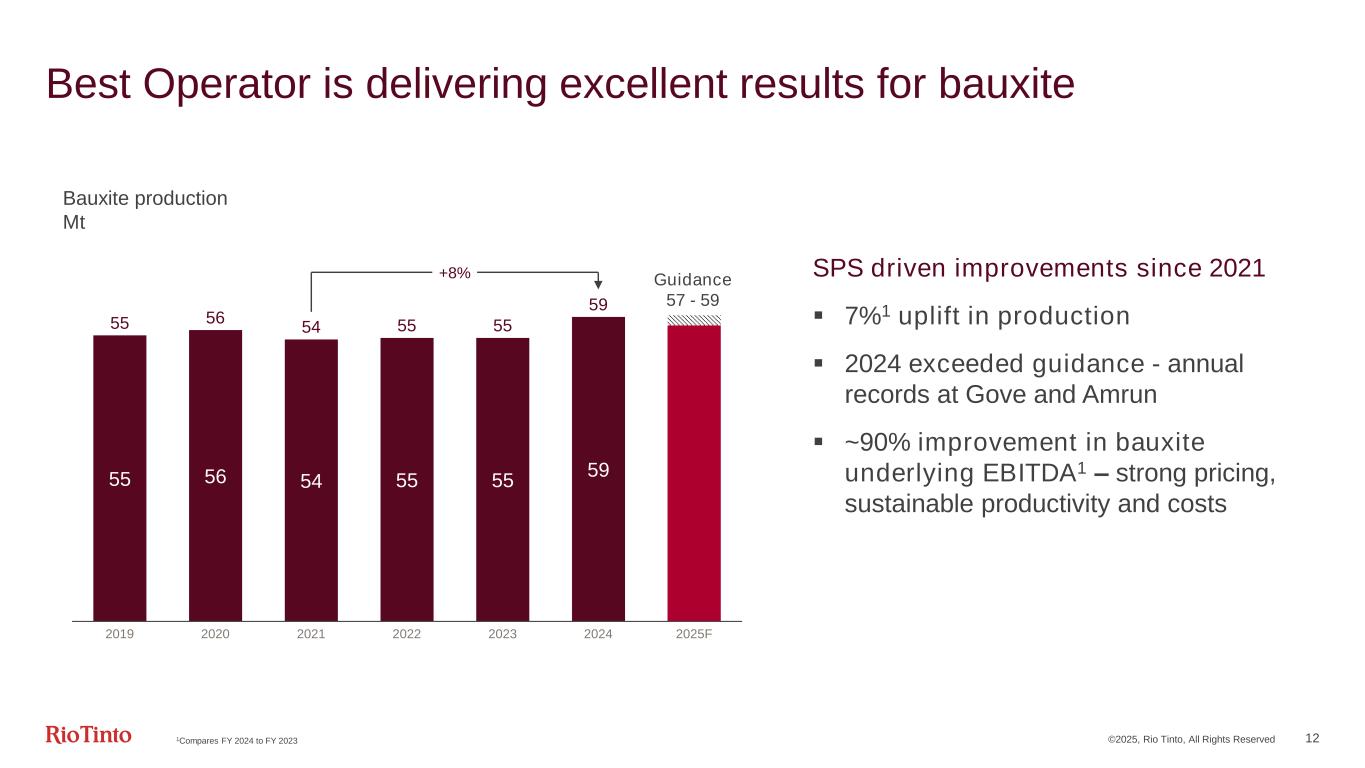

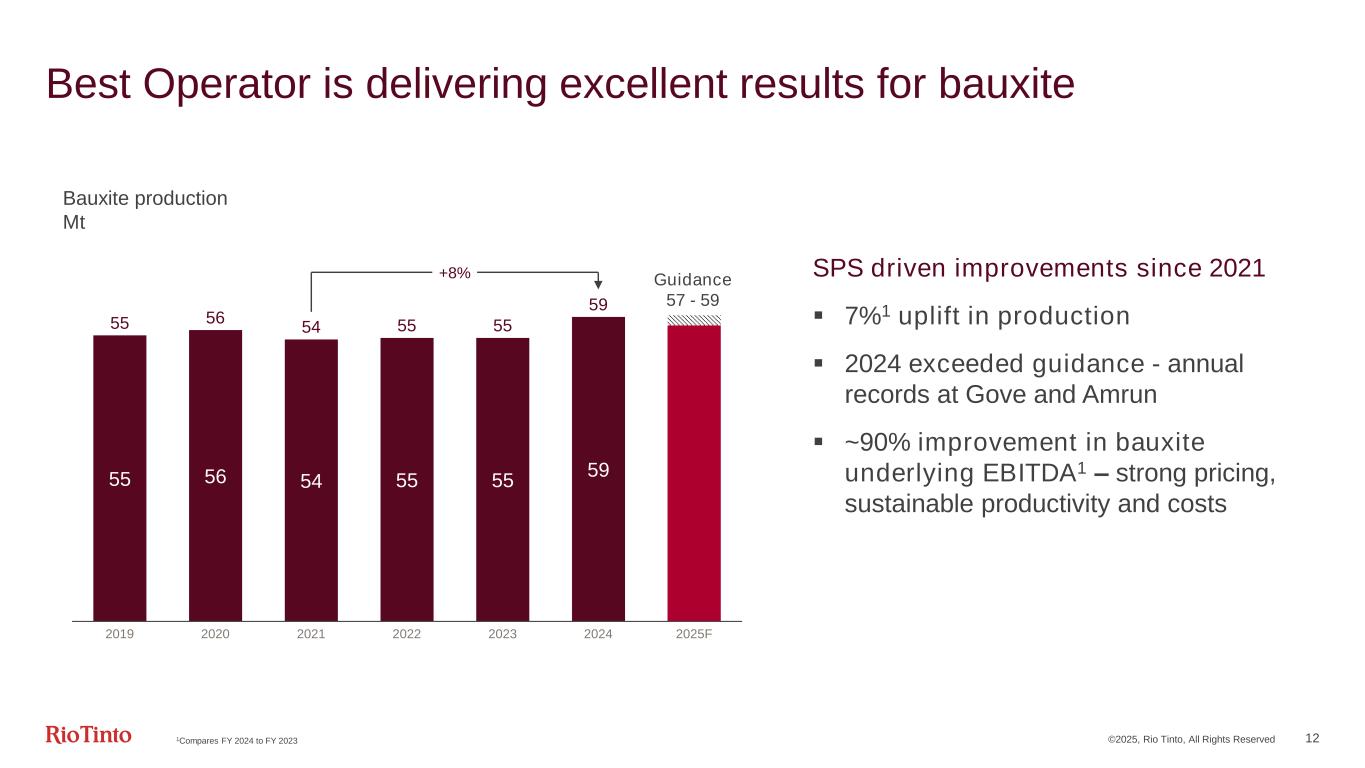

©2025, Rio Tinto, All Rights Reserved 12 Best Operator is delivering excellent results for bauxite 55 2019 56 2020 54 2021 55 2022 55 2023 59 2024 2025F 55 56 54 55 55 59 +8% Guidance 57 - 59 SPS driven improvements since 2021 ▪ 7%1 uplift in production ▪ 2024 exceeded guidance - annual records at Gove and Amrun ▪ ~90% improvement in bauxite underlying EBITDA1 – strong pricing, sustainable productivity and costs 1Compares FY 2024 to FY 2023 Bauxite production Mt

13 Best Operator excellence at Oyu Tolgoi 2025 – pivotal year of transformation with increasing production and grade 124 of 124 Panel 0 drawbells complete ahead of schedule First ore on conveyor to surface in October Q4 2025 Primary Crusher 2 commissioning Q2 2025 Concentrator conversion completion Moving to a world-class cost position 2024 copper cost curve C1 + sustaining capital CuEq costs, c/lb2 1See supporting references for the Oyu Tolgoi production target on slide 2 | 2Source: Wood Mackenzie Q4 2024 Copper Mine Costs, Rio Tinto Shaft 3 & 4 ventilation commissioned Q3 2025 Panel 2 North Undercut ©2025, Rio Tinto, All Rights Reserved Cumulative production 600 500 300 200 100 0 20151050 400 Oyu Tolgoi 2023 2024 2030F Production growth: >50% increase in 2025 Ktpa On track for 500ktpa from 2028 to 20361 and set to become world’s 4th largest copper mine by 2030 2024: achieved all ramp-up milestones to date 2025: complete core underground infrastructure 0 100 200 300 400 500 600 2022 2023 2024 2025F 2028-2036F +28% >50%

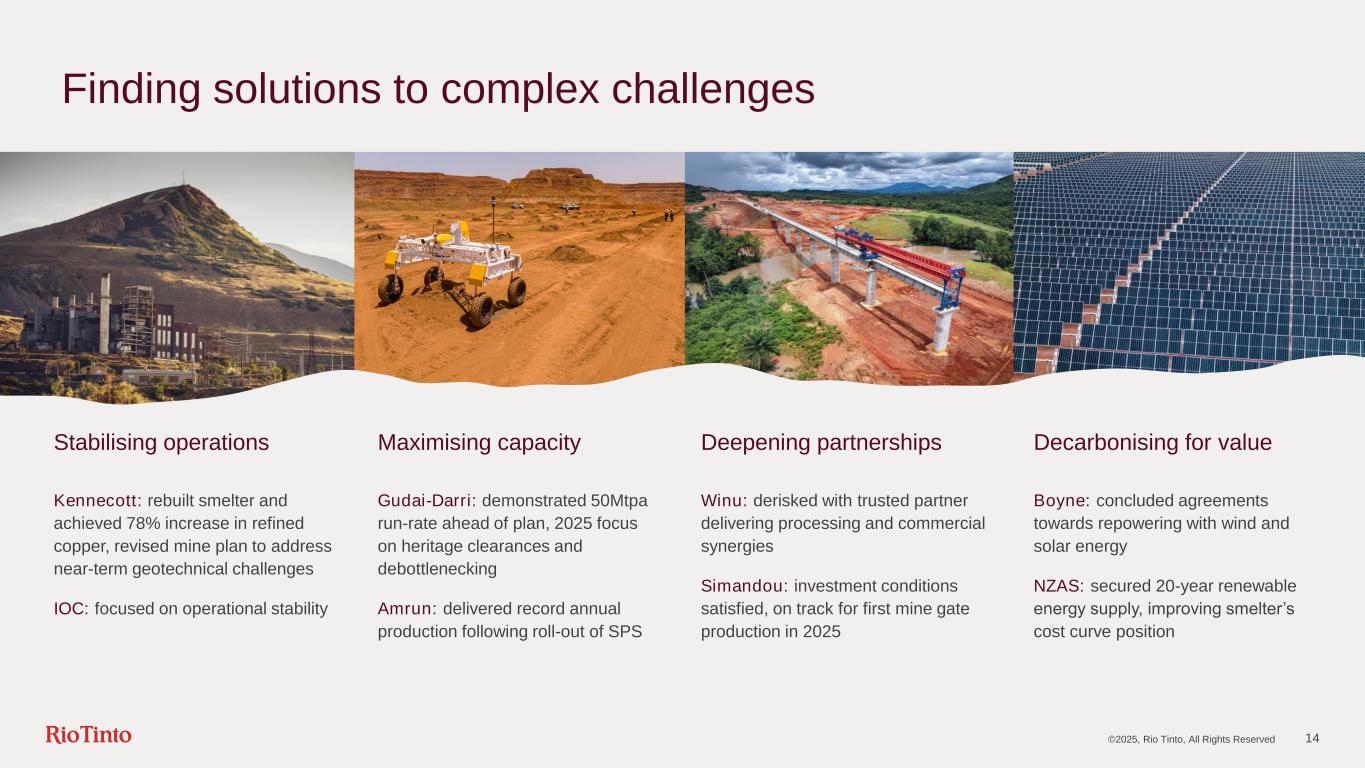

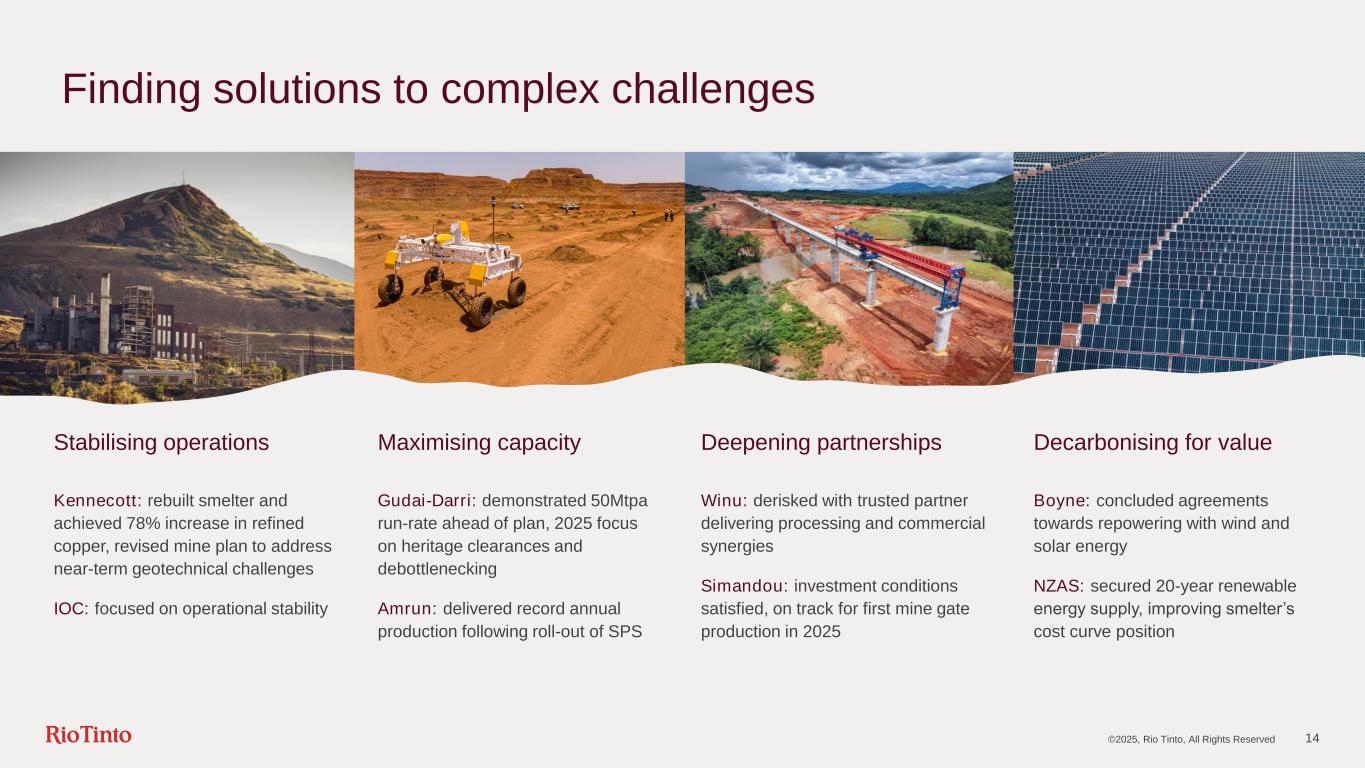

14 Finding solutions to complex challenges ©2025, Rio Tinto, All Rights Reserved Stabilising operations Kennecott: rebuilt smelter and achieved 78% increase in refined copper, revised mine plan to address near-term geotechnical challenges IOC: focused on operational stability Maximising capacity Gudai-Darri: demonstrated 50Mtpa run-rate ahead of plan, 2025 focus on heritage clearances and debottlenecking Amrun: delivered record annual production following roll-out of SPS Deepening partnerships Winu: derisked with trusted partner delivering processing and commercial synergies Simandou: investment conditions satisfied, on track for first mine gate production in 2025 Decarbonising for value Boyne: concluded agreements towards repowering with wind and solar energy NZAS: secured 20-year renewable energy supply, improving smelter’s cost curve position

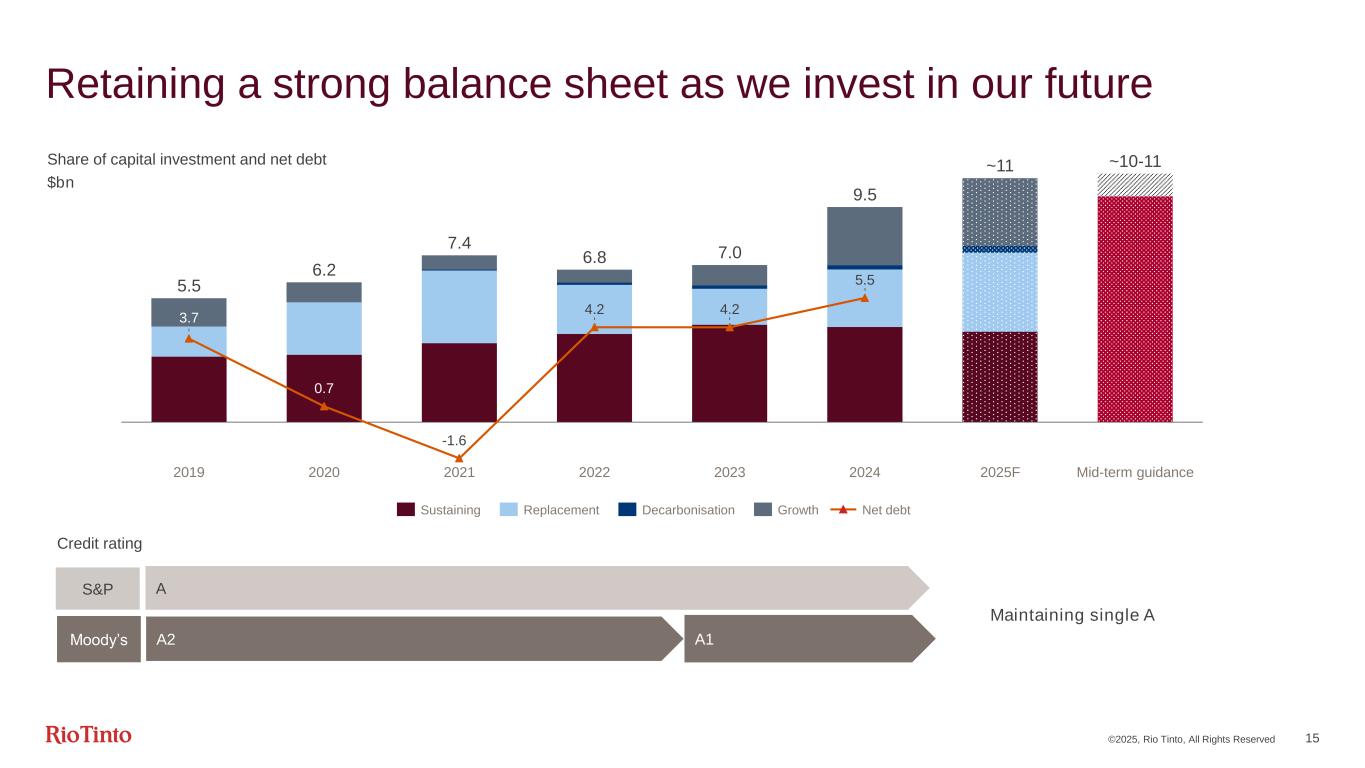

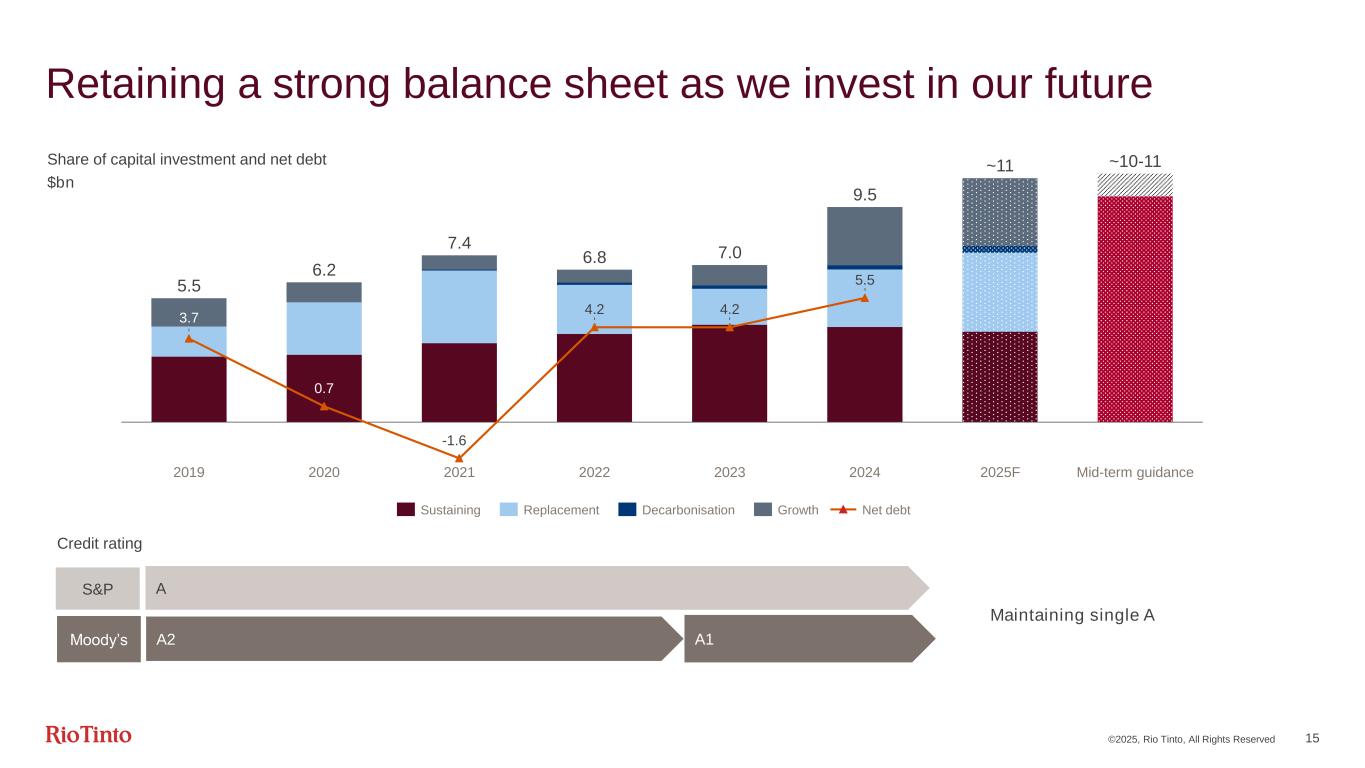

Retaining a strong balance sheet as we invest in our future S&P Moody’s A A2 A1 Credit rating ©2025, Rio Tinto, All Rights Reserved 15 0.7 4.2 4.2 5.5 3.7 2019 2020 -1.6 2021 2022 2023 2024 2025F Mid-term guidance 5.5 6.2 7.4 6.8 7.0 9.5 ~11 ~10-11 Sustaining Replacement Decarbonisation Growth Net debt Share of capital investment and net debt $bn Maintaining single A

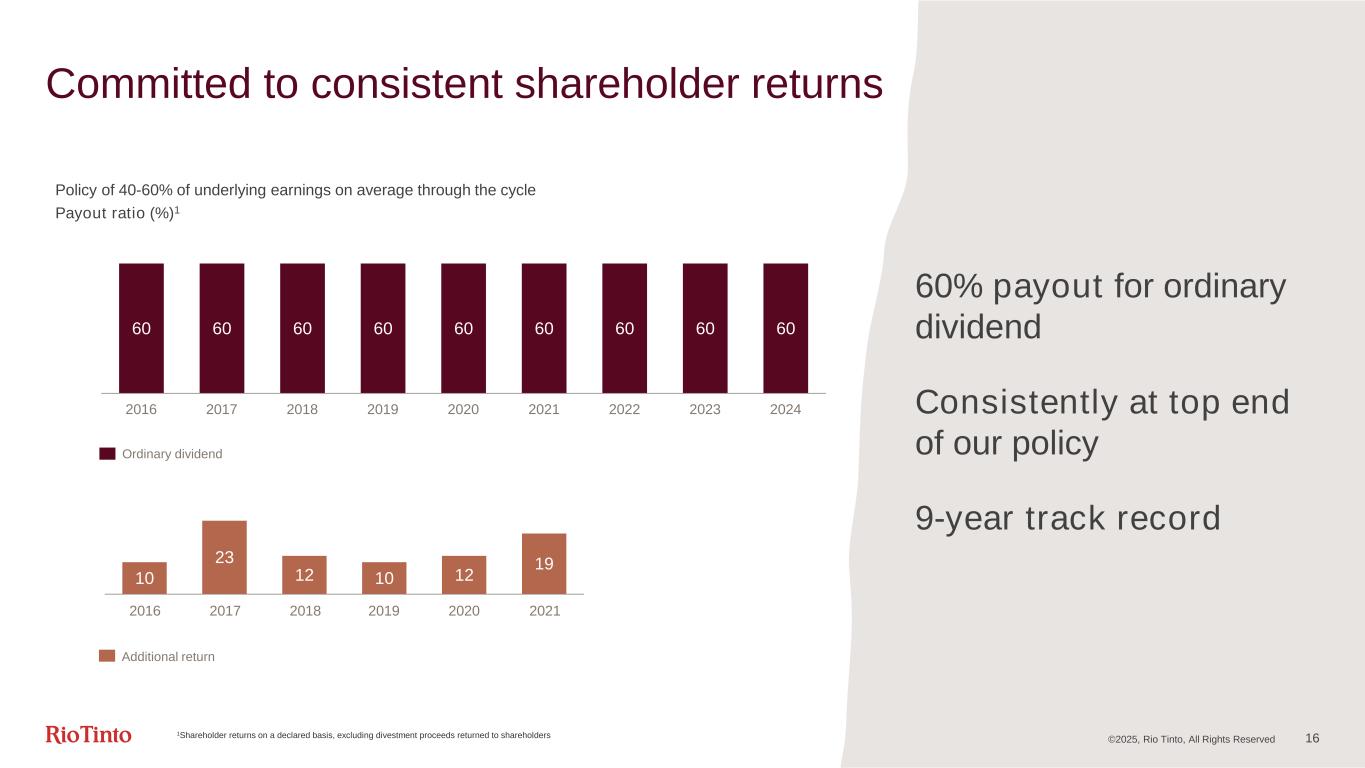

©2025, Rio Tinto, All Rights Reserved 16 Committed to consistent shareholder returns 60% payout for ordinary dividend Consistently at top end of our policy 9-year track record Policy of 40-60% of underlying earnings on average through the cycle Payout ratio (%)1 60 60 60 60 60 60 60 60 60 2016 2017 2018 2019 2020 2021 2022 2023 2024 Ordinary dividend 1Shareholder returns on a declared basis, excluding divestment proceeds returned to shareholders 10 23 12 10 12 19 2016 2017 2018 2019 2020 2021 Additional return

Jakob Stausholm Chief Executive ©2025, Rio Tinto, All Rights ReservedOyu Tolgoi, Mongolia 17

Continued successful execution in 2024 1Compares FY2024 and FY2023 | 2See supporting references for the Rincon production target on slide 2 Creating a world-class lithium business Rincon: first production just 32 months after acquisition; now scaling up to 60ktpa2 capacity Arcadium: acquisition advancing at pace Bauxite: production up 7%1 Aluminium: stable performance and increased equity ownerships Iron Ore: SPS delivers second consecutive 5 Mtpa uplift for Pilbara Oyu Tolgoi copper-gold: critical milestones successfully achieved Simandou iron ore: largest greenfield integrated mine and infrastructure investment in Africa Western Range iron ore: construction over 90% complete Momentum towards Best Operator Excelling in project development Portfolio diversification well underway Our strategy enables us to be resilient in an uncertain world… ©2025, Rio Tinto, All Rights Reserved 18

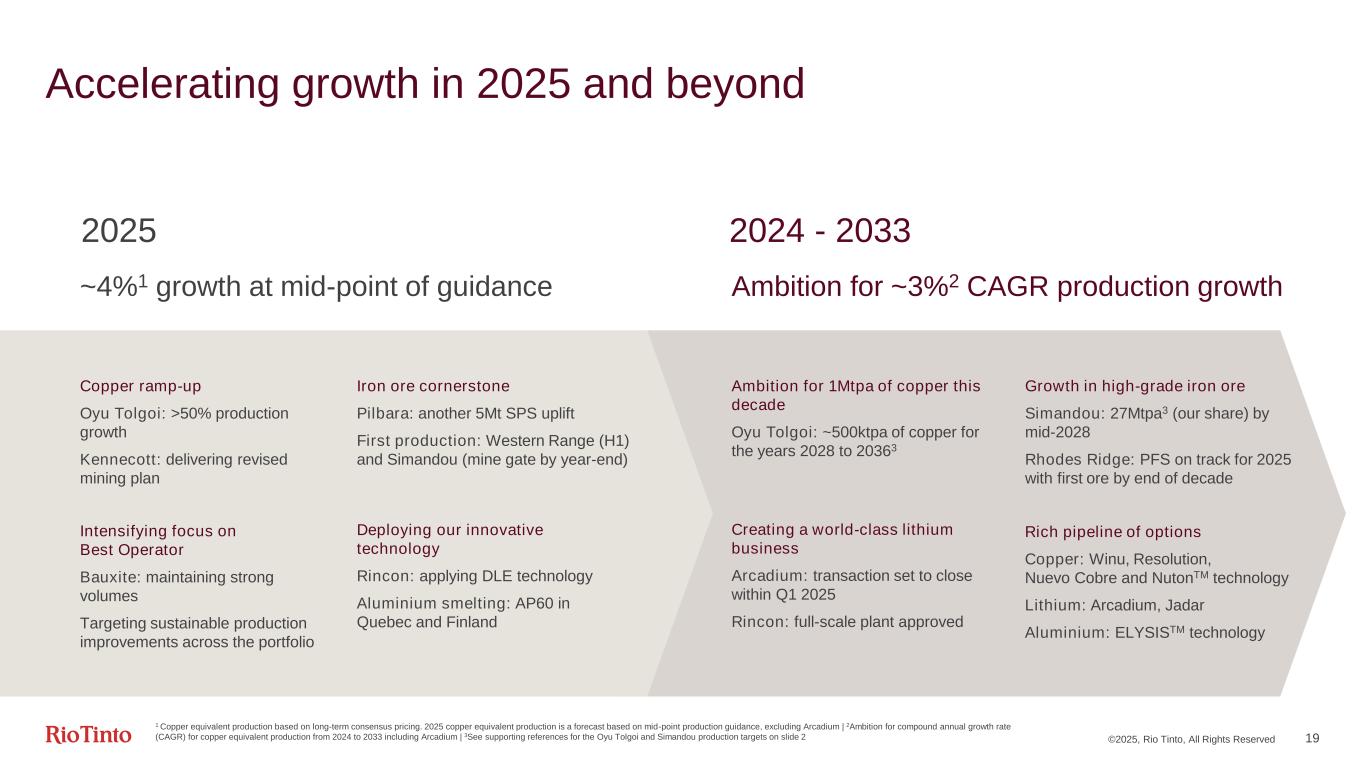

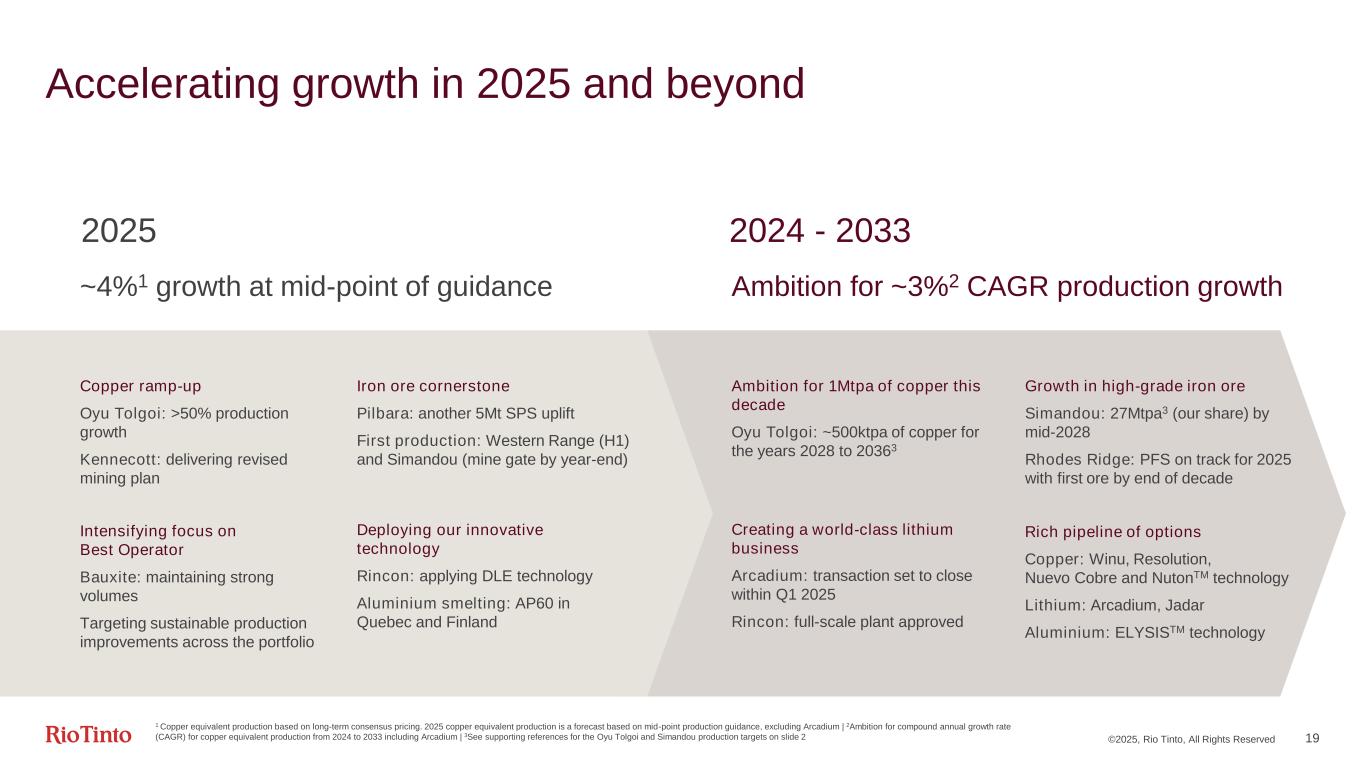

©2025, Rio Tinto, All Rights Reserved 19 Accelerating growth in 2025 and beyond 1 Copper equivalent production based on long-term consensus pricing. 2025 copper equivalent production is a forecast based on mid-point production guidance, excluding Arcadium | 2Ambition for compound annual growth rate (CAGR) for copper equivalent production from 2024 to 2033 including Arcadium | 3See supporting references for the Oyu Tolgoi and Simandou production targets on slide 2 2025 Copper ramp-up Oyu Tolgoi: >50% production growth Kennecott: delivering revised mining plan Iron ore cornerstone Pilbara: another 5Mt SPS uplift First production: Western Range (H1) and Simandou (mine gate by year-end) Deploying our innovative technology Rincon: applying DLE technology Aluminium smelting: AP60 in Quebec and Finland Intensifying focus on Best Operator Bauxite: maintaining strong volumes Targeting sustainable production improvements across the portfolio Ambition for ~3%2 CAGR production growth Ambition for 1Mtpa of copper this decade Oyu Tolgoi: ~500ktpa of copper for the years 2028 to 20363 Growth in high-grade iron ore Simandou: 27Mtpa3 (our share) by mid-2028 Rhodes Ridge: PFS on track for 2025 with first ore by end of decade Creating a world-class lithium business Arcadium: transaction set to close within Q1 2025 Rincon: full-scale plant approved Rich pipeline of options Copper: Winu, Resolution, Nuevo Cobre and NutonTM technology Lithium: Arcadium, Jadar Aluminium: ELYSISTM technology ~4%1 growth at mid-point of guidance 2024 - 2033

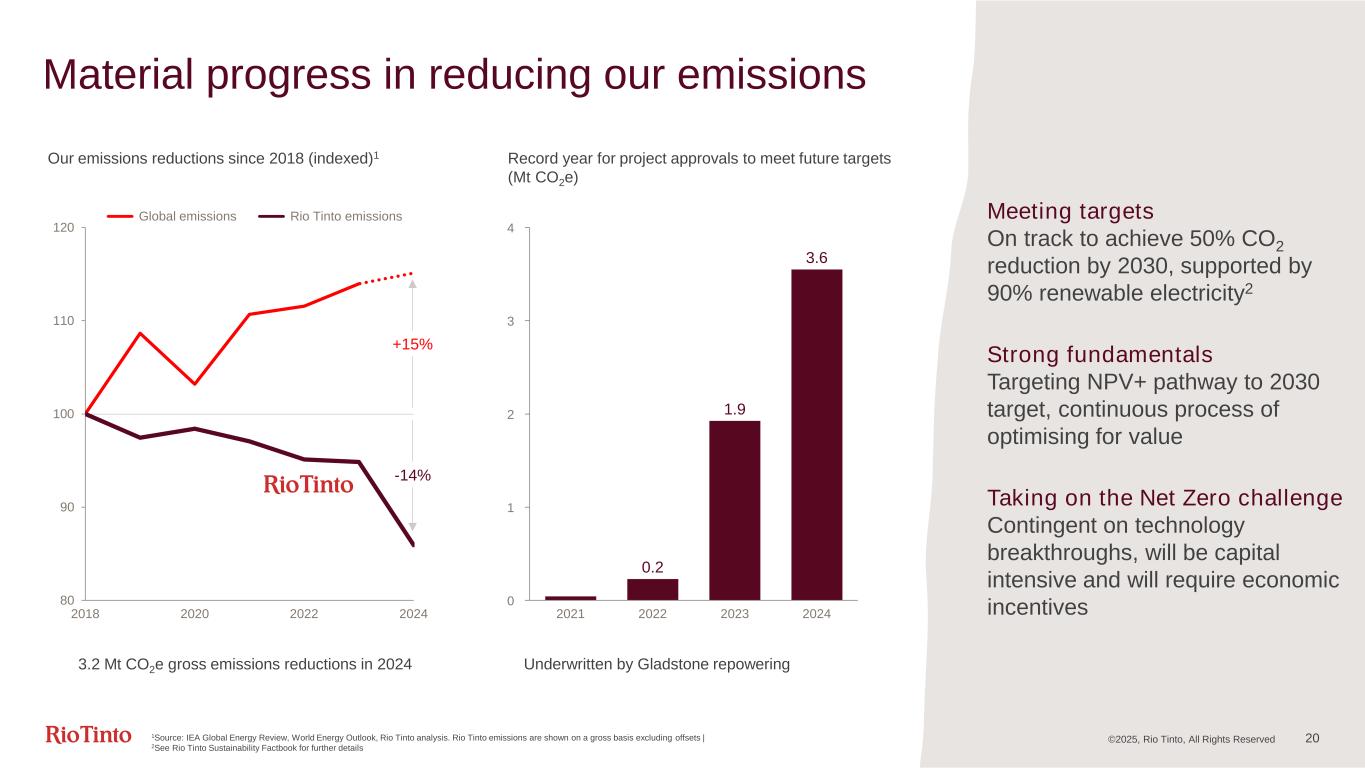

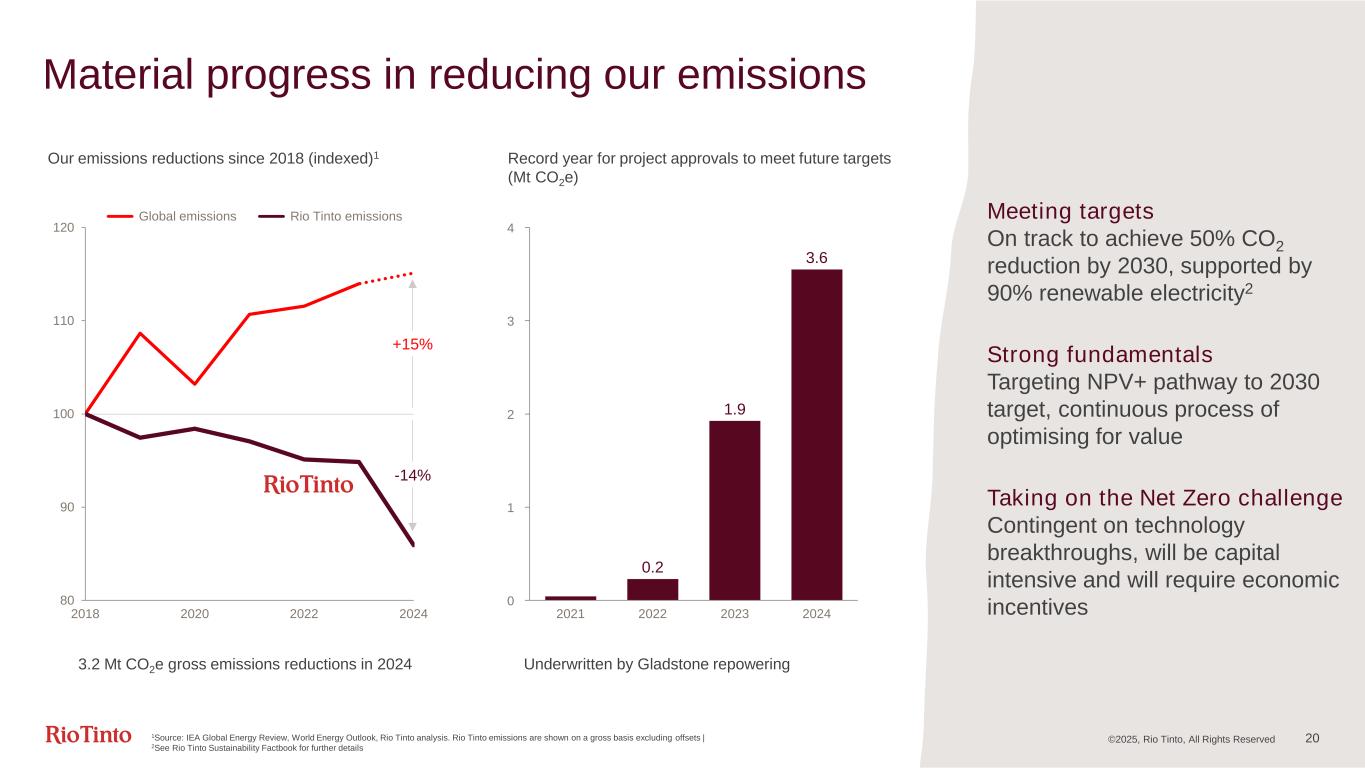

Material progress in reducing our emissions 80 90 100 110 120 2018 2020 2022 2024 0 1 2 3 4 2021 2022 2023 2024 0.2 1.9 3.6 Record year for project approvals to meet future targets (Mt CO2e) Our emissions reductions since 2018 (indexed)1 Meeting targets On track to achieve 50% CO2 reduction by 2030, supported by 90% renewable electricity2 Strong fundamentals Targeting NPV+ pathway to 2030 target, continuous process of optimising for value Taking on the Net Zero challenge Contingent on technology breakthroughs, will be capital intensive and will require economic incentives 1Source: IEA Global Energy Review, World Energy Outlook, Rio Tinto analysis. Rio Tinto emissions are shown on a gross basis excluding offsets | 2See Rio Tinto Sustainability Factbook for further details 3.2 Mt CO2e gross emissions reductions in 2024 Underwritten by Gladstone repowering -14% +15% ©2025, Rio Tinto, All Rights Reserved Global emissions Rio Tinto emissions 20

Excellent growth momentum Leadership in project development Delivering consistent shareholder value as we diversify our portfolio We have an excellent team, and together we are on track to deliver significant future growth, creating value at each step 21©2025, Rio Tinto, All Rights ReservedRincon, Argentina

Appendix 23©2025, Rio Tinto, All Rights ReservedSimandou, Guinea

Other financials appendix 24©2025, Rio Tinto, All Rights Reserved

• €417m bond with 2.875% coupon matured in December 2024 • No further corporate bond maturities until 2028 • At 31 December weighted average outstanding debt maturity of corporate bonds ~15 years (~11 years for Group debt) • Liquidity remains strong under stress tests • $7.5bn back-stop Revolving Credit Facility matures in November 2028 Debt maturity profile $m 1Based on December 2024 accounting value. The debt maturity profile shows ~$1.4bn of capitalised leases under IFRS 16 At 31 December 20241 0 500 1,000 1,500 2,000 2 0 2 5 2 0 2 6 2 0 2 7 2 0 2 8 2 0 2 9 2 0 3 0 2 0 3 1 2 0 3 2 2 0 3 3 2 0 3 4 2 0 3 5 2 0 3 6 2 0 3 7 2 0 3 8 2 0 3 9 2 0 4 0 2 0 4 1 2 0 4 2 2 0 4 3 2 0 4 4 2 0 4 5 2 0 4 6 2 0 4 7 2 0 4 8 2 0 4 9 2 0 5 0 2 0 5 1 2 0 5 2 2 0 5 3 2 0 5 4 2 0 5 5 External borrowings Leases ©2025, Rio Tinto, All Rights Reserved 25

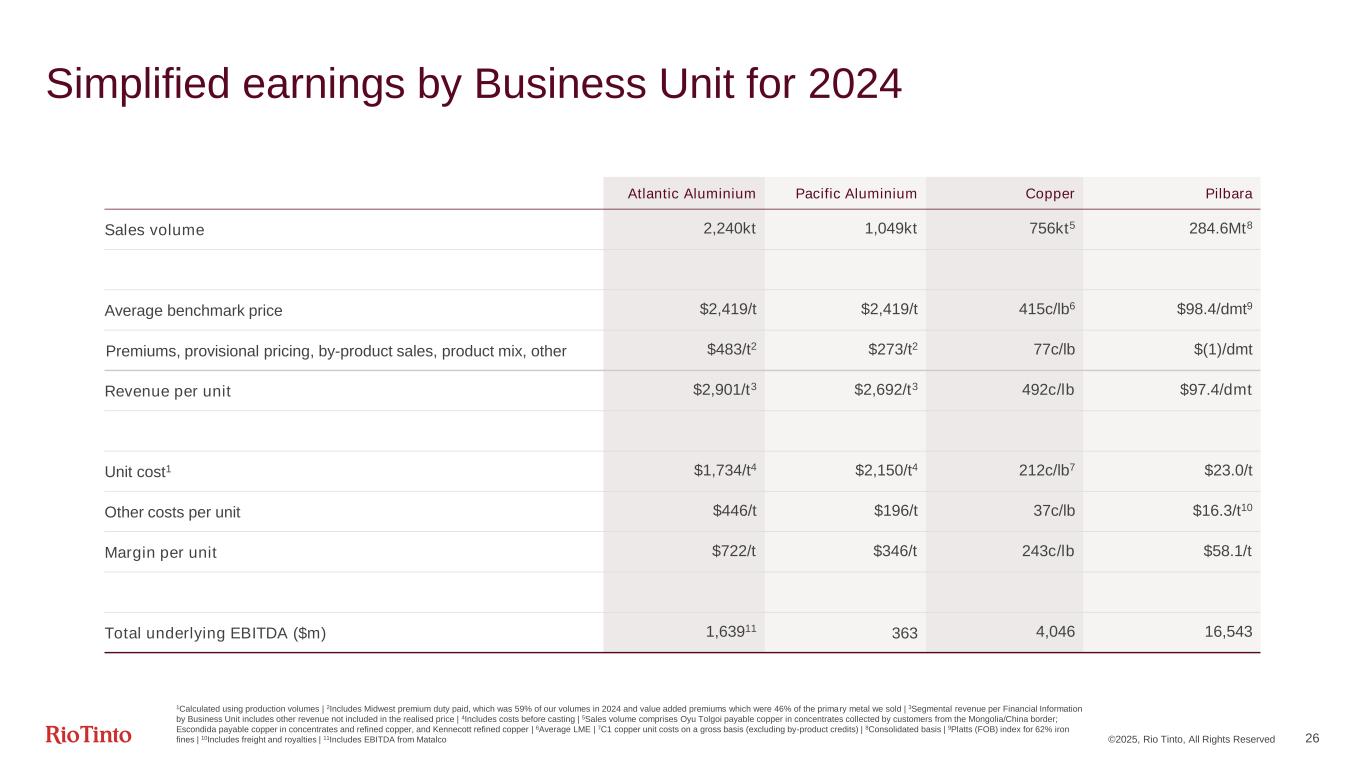

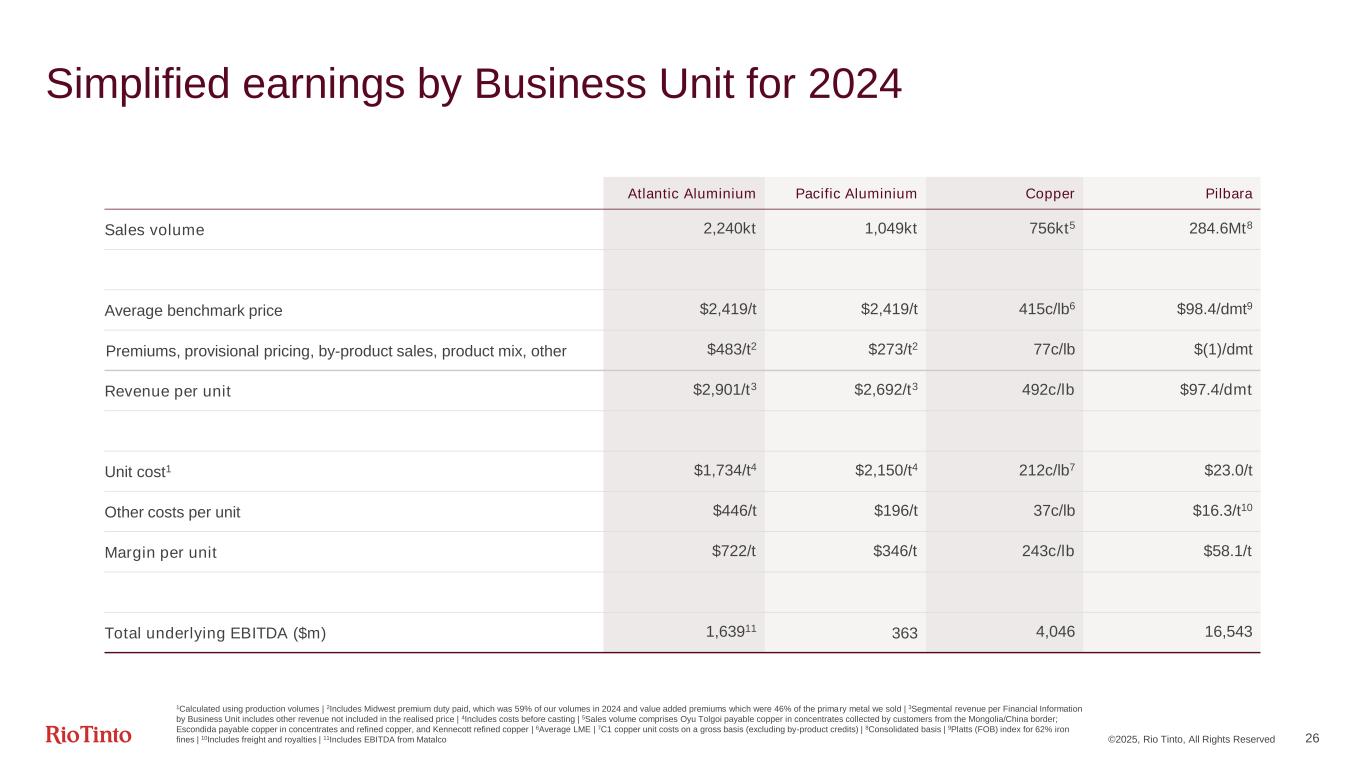

©2025, Rio Tinto, All Rights Reserved 26 Simplified earnings by Business Unit for 2024 Atlantic Aluminium Pacific Aluminium Copper Pilbara Sales volume 2,240kt 1,049kt 756kt5 284.6Mt8 Average benchmark price $2,419/t $2,419/t 415c/lb6 $98.4/dmt9 Premiums, provisional pricing, by-product sales, product mix, other $483/t2 $273/t2 77c/lb $(1)/dmt Revenue per unit $2,901/t3 $2,692/t3 492c/lb $97.4/dmt Unit cost1 $1,734/t4 $2,150/t4 212c/lb7 $23.0/t Other costs per unit $446/t $196/t 37c/lb $16.3/t10 Margin per unit $722/t $346/t 243c/lb $58.1/t Total underlying EBITDA ($m) 1,63911 363 4,046 16,543 1Calculated using production volumes | 2Includes Midwest premium duty paid, which was 59% of our volumes in 2024 and value added premiums which were 46% of the primary metal we sold | 3Segmental revenue per Financial Information by Business Unit includes other revenue not included in the realised price | 4Includes costs before casting | 5Sales volume comprises Oyu Tolgoi payable copper in concentrates collected by customers from the Mongolia/China border; Escondida payable copper in concentrates and refined copper, and Kennecott refined copper | 6Average LME | 7C1 copper unit costs on a gross basis (excluding by-product credits) | 8Consolidated basis | 9Platts (FOB) index for 62% iron fines | 10Includes freight and royalties | 11Includes EBITDA from Matalco

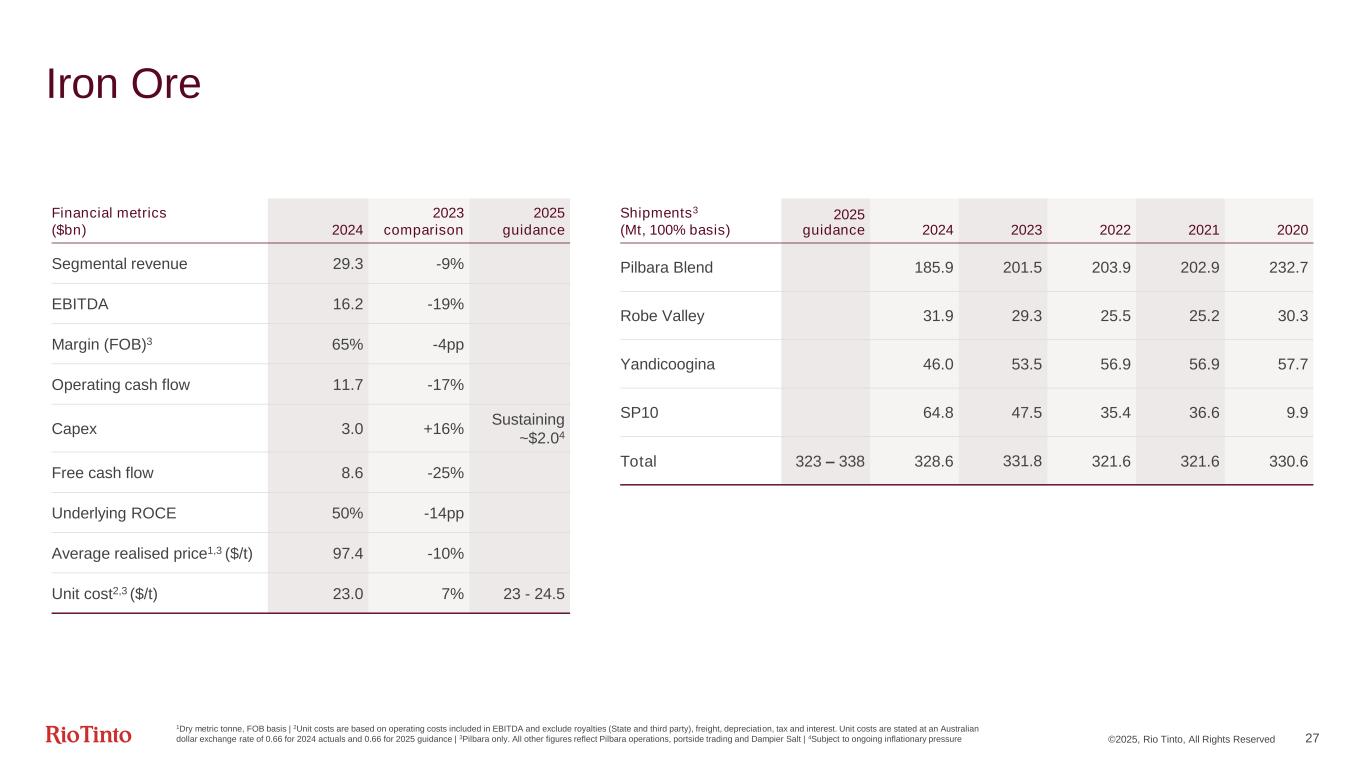

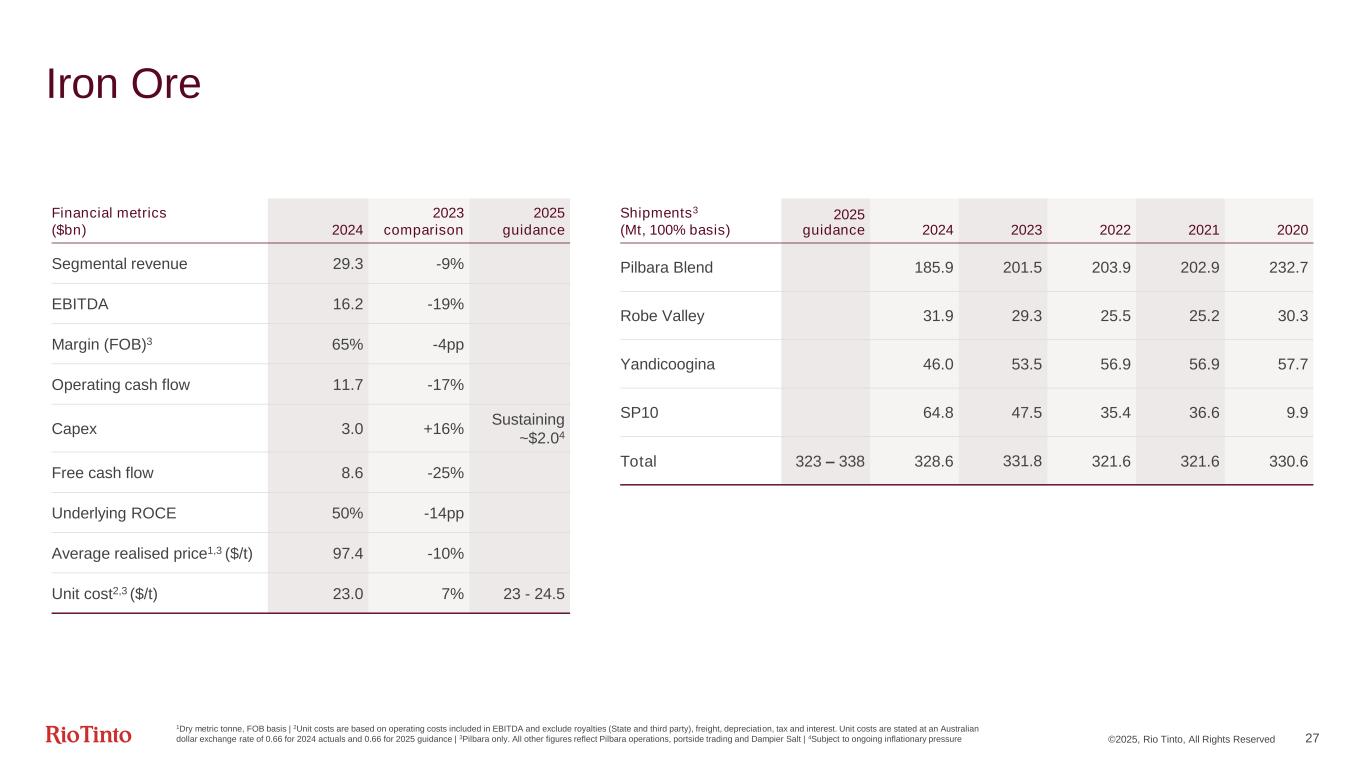

©2025, Rio Tinto, All Rights Reserved 27 Iron Ore Financial metrics ($bn) 2024 2023 comparison 2025 guidance Segmental revenue 29.3 -9% EBITDA 16.2 -19% Margin (FOB)3 65% -4pp Operating cash flow 11.7 -17% Capex 3.0 +16% Sustaining ~$2.04 Free cash flow 8.6 -25% Underlying ROCE 50% -14pp Average realised price1,3 ($/t) 97.4 -10% Unit cost2,3 ($/t) 23.0 7% 23 - 24.5 Shipments3 (Mt, 100% basis) 2025 guidance 2024 2023 2022 2021 2020 Pilbara Blend 185.9 201.5 203.9 202.9 232.7 Robe Valley 31.9 29.3 25.5 25.2 30.3 Yandicoogina 46.0 53.5 56.9 56.9 57.7 SP10 64.8 47.5 35.4 36.6 9.9 Total 323 – 338 328.6 331.8 321.6 321.6 330.6 1Dry metric tonne, FOB basis | 2Unit costs are based on operating costs included in EBITDA and exclude royalties (State and third party), freight, depreciation, tax and interest. Unit costs are stated at an Australian dollar exchange rate of 0.66 for 2024 actuals and 0.66 for 2025 guidance | 3Pilbara only. All other figures reflect Pilbara operations, portside trading and Dampier Salt | 4Subject to ongoing inflationary pressure

©2025, Rio Tinto, All Rights Reserved 28 Aluminium Production (Mt, Rio Tinto share) 2025 guidance 2024 2023 2022 2021 2020 Bauxite 57 – 59 58.7 54.6 54.6 54.3 56.1 Alumina 7.4 – 7.8 7.3 7.5 7.5 7.9 8.0 Aluminium 3.25 – 3.45 3.3 3.3 3.0 3.2 3.2 1LME plus all-in premiums (product and market) | 2Platts Alumina Index (PAX) FOB Australia | 3CM Group CIF China $/t Financial metrics ($bn) 2024 2023 comparison Segmental revenue 13.7 +11% EBITDA 3.7 +61% Margin (integrated operations) 30% +9pp Operating cash flow 3.0 +53% Capex (excl. EAUs) 1.7 +27% Free cash flow 1.3 +110% Underlying ROCE 10% +7pp Aluminium realised price1 2,834 +4% Average alumina price2 504 +47% Average Bauxite CBIX Australia HT3 62 +26%

©2025, Rio Tinto, All Rights Reserved 29 Composition of alumina and aluminium production costs Alumina refining Production cash costs Aluminium smelting (hot metal) Input Costs (Index price) H1 2023 H2 2023 H1 2024 H2 2024 Inventory Flow3 FY24 Annual Cost Sensitivity Caustic Soda1 ($/t) 424 369 376 430 3 – 4 months $11m per $10/t Natural Gas2 ($/mmbtu) 2.54 2.79 2.21 2.61 0 - 1 month $4m per $0.10/GJ Brent Oil ($/bbl) 79.7 85.5 84 77.5 N/A $2m per $10/barrel Input Costs (Index price) H1 2023 H2 2023 H1 2024 H2 2024 Inventory Flow3 FY24 Annual Cost Sensitivity Alumina4 ($/t) 352 335 400 603 1 - 2 months $65m per $10/t Petroleum Coke5 ($/t) 631 491 394 391 2 - 3 months $11m per $10/t Coal Tar Pitch6 ($/t) 1,386 1,130 958 910 1 - 2 months $3m per $10/t 4. Australia (FOB) 5. US Gulf (FOB) 6. North America (FOB) 1. North East Asia FOB 2. Henry Hub 3. Based on quarterly standard costing (moving average) 34% 32% 36% 38% 39% 38% 31% 31% 31% 33% 32% 33% 22% 24% 20% 17% 17% 17% 13% 13% 13% 12% 12% 12% FY 23 H1 23 H2 23 H1 24 100% 100% 100% 100% FY 24 H2 24 100% 100% Energy Caustic Bauxite Conversion 21% 20% 22% 20% 22% 19% 18% 18% 19% 20% 19% 21% 21% 23% 19% 15% 16% 13% 38% 37% 38% 43% 41% 45% 2% FY 23 2% H1 23 2% H2 23 2% H1 24 100% 100% 100% 100% FY 24 H1 24 100% 2% 100% 2% Alumina Carbon Power Materials Conversion

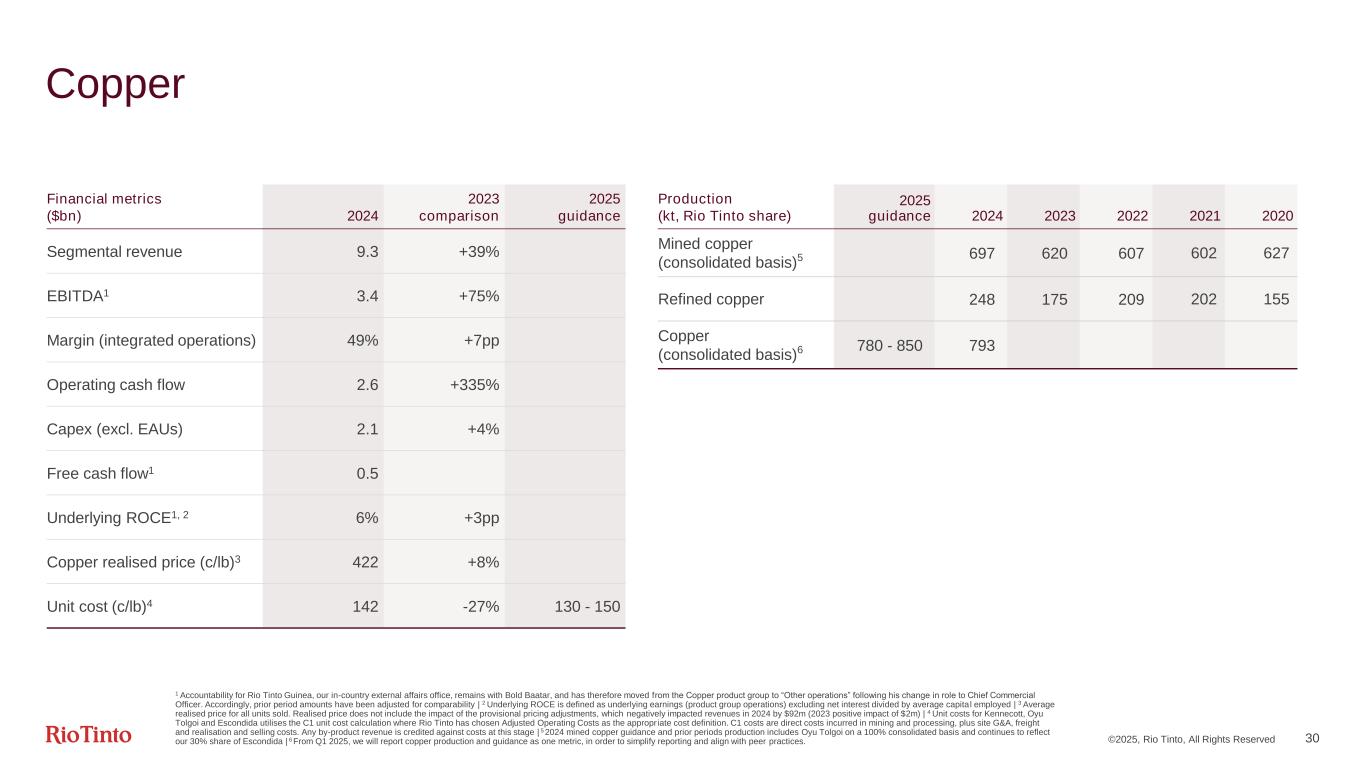

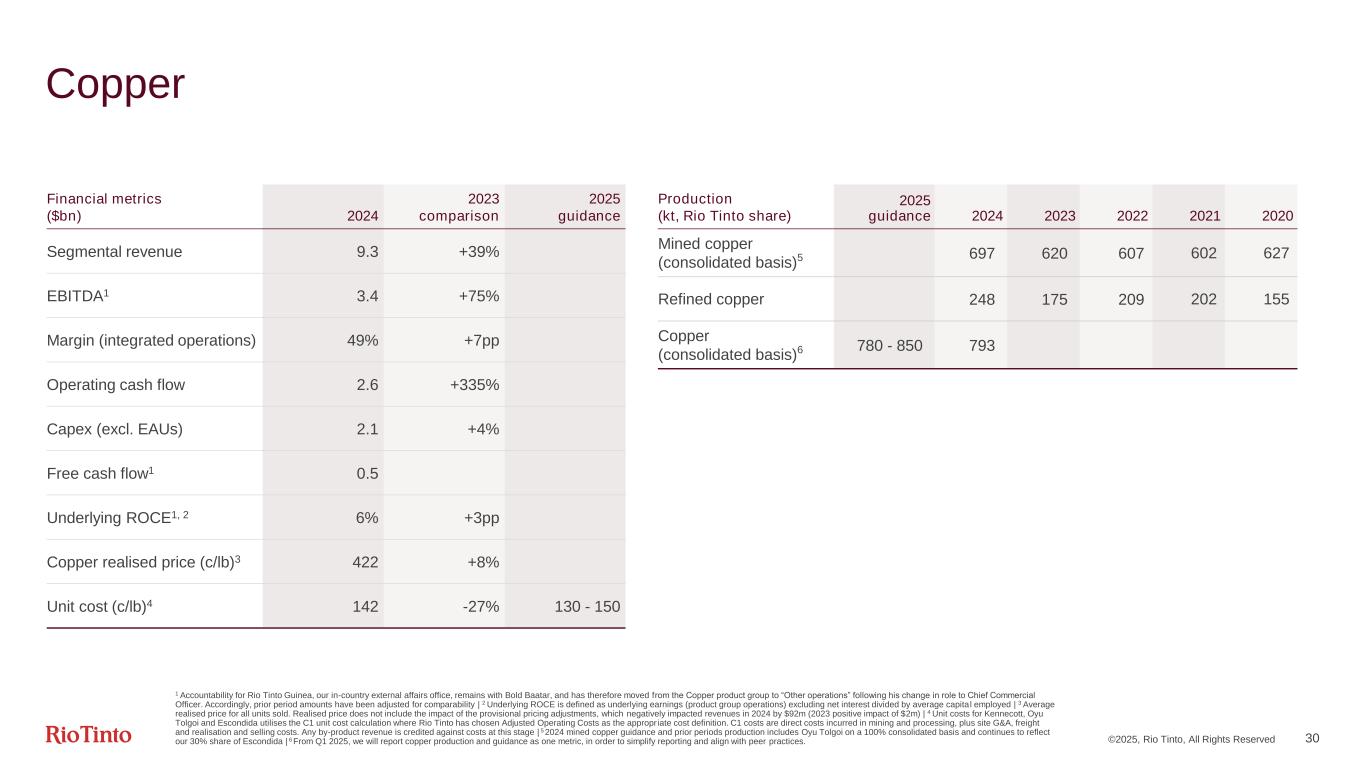

©2025, Rio Tinto, All Rights Reserved 30 Copper 1 Accountability for Rio Tinto Guinea, our in-country external affairs office, remains with Bold Baatar, and has therefore moved from the Copper product group to “Other operations” following his change in role to Chief Commercial Officer. Accordingly, prior period amounts have been adjusted for comparability | 2 Underlying ROCE is defined as underlying earnings (product group operations) excluding net interest divided by average capital employed | 3 Average realised price for all units sold. Realised price does not include the impact of the provisional pricing adjustments, which negatively impacted revenues in 2024 by $92m (2023 positive impact of $2m) | 4 Unit costs for Kennecott, Oyu Tolgoi and Escondida utilises the C1 unit cost calculation where Rio Tinto has chosen Adjusted Operating Costs as the appropriate cost definition. C1 costs are direct costs incurred in mining and processing, plus site G&A, freight and realisation and selling costs. Any by-product revenue is credited against costs at this stage | 5 2024 mined copper guidance and prior periods production includes Oyu Tolgoi on a 100% consolidated basis and continues to reflect our 30% share of Escondida | 6 From Q1 2025, we will report copper production and guidance as one metric, in order to simplify reporting and align with peer practices. Production (kt, Rio Tinto share) 2025 guidance 2024 2023 2022 2021 2020 Mined copper (consolidated basis)5 697 620 607 602 627 Refined copper 248 175 209 202 155 Copper (consolidated basis)6 780 - 850 793 Financial metrics ($bn) 2024 2023 comparison 2025 guidance Segmental revenue 9.3 +39% EBITDA1 3.4 +75% Margin (integrated operations) 49% +7pp Operating cash flow 2.6 +335% Capex (excl. EAUs) 2.1 +4% Free cash flow1 0.5 Underlying ROCE1, 2 6% +3pp Copper realised price (c/lb)3 422 +8% Unit cost (c/lb)4 142 -27% 130 - 150

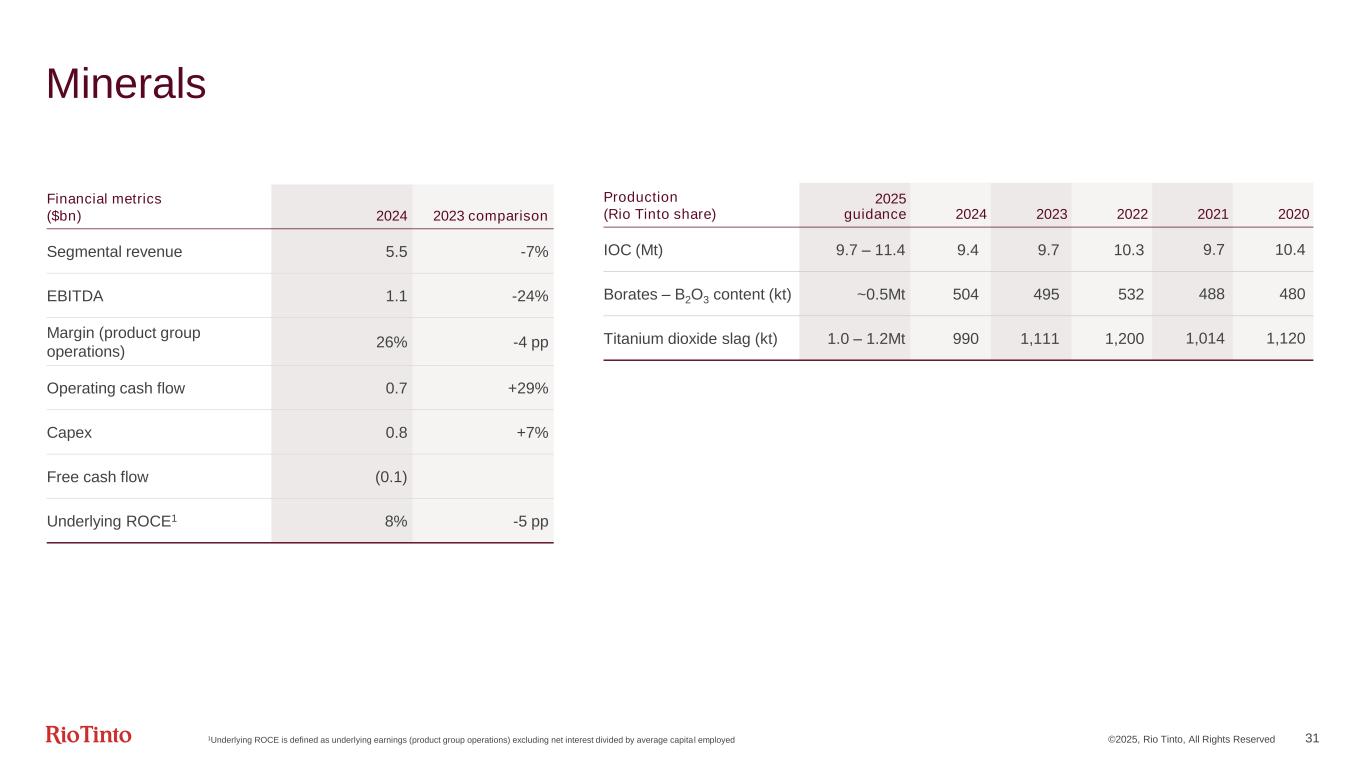

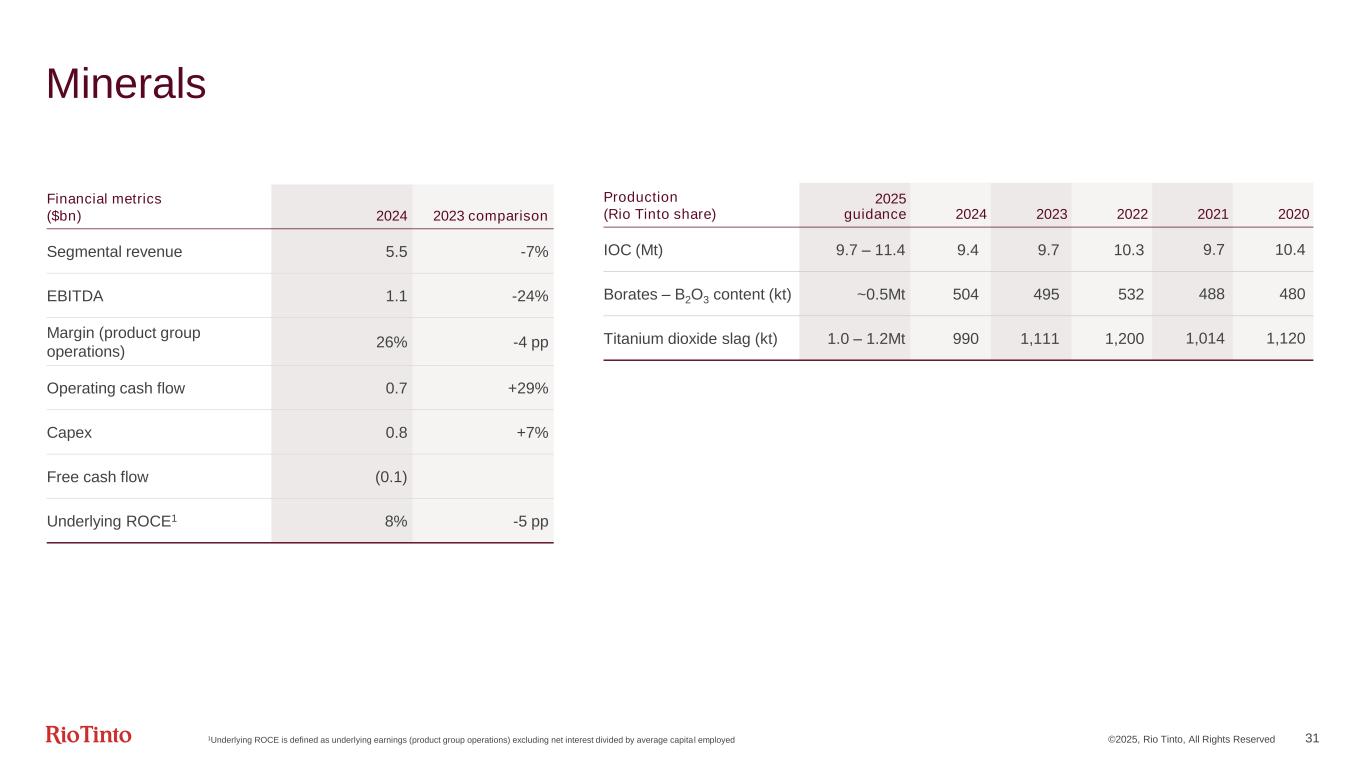

1Underlying ROCE is defined as underlying earnings (product group operations) excluding net interest divided by average capital employed ©2025, Rio Tinto, All Rights Reserved 31 Minerals Production (Rio Tinto share) 2025 guidance 2024 2023 2022 2021 2020 IOC (Mt) 9.7 – 11.4 9.4 9.7 10.3 9.7 10.4 Borates – B2O3 content (kt) ~0.5Mt 504 495 532 488 480 Titanium dioxide slag (kt) 1.0 – 1.2Mt 990 1,111 1,200 1,014 1,120 Financial metrics ($bn) 2024 2023 comparison Segmental revenue 5.5 -7% EBITDA 1.1 -24% Margin (product group operations) 26% -4 pp Operating cash flow 0.7 +29% Capex 0.8 +7% Free cash flow (0.1) Underlying ROCE1 8% -5 pp

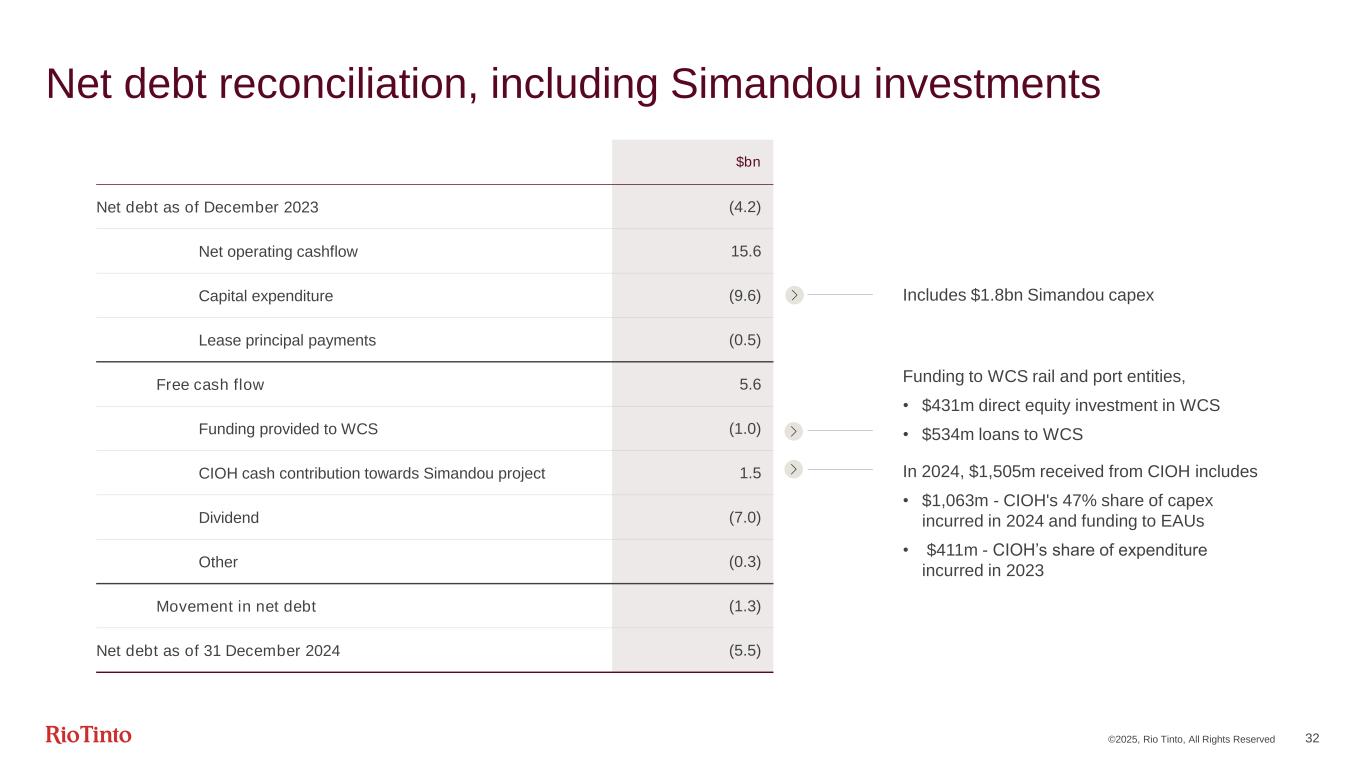

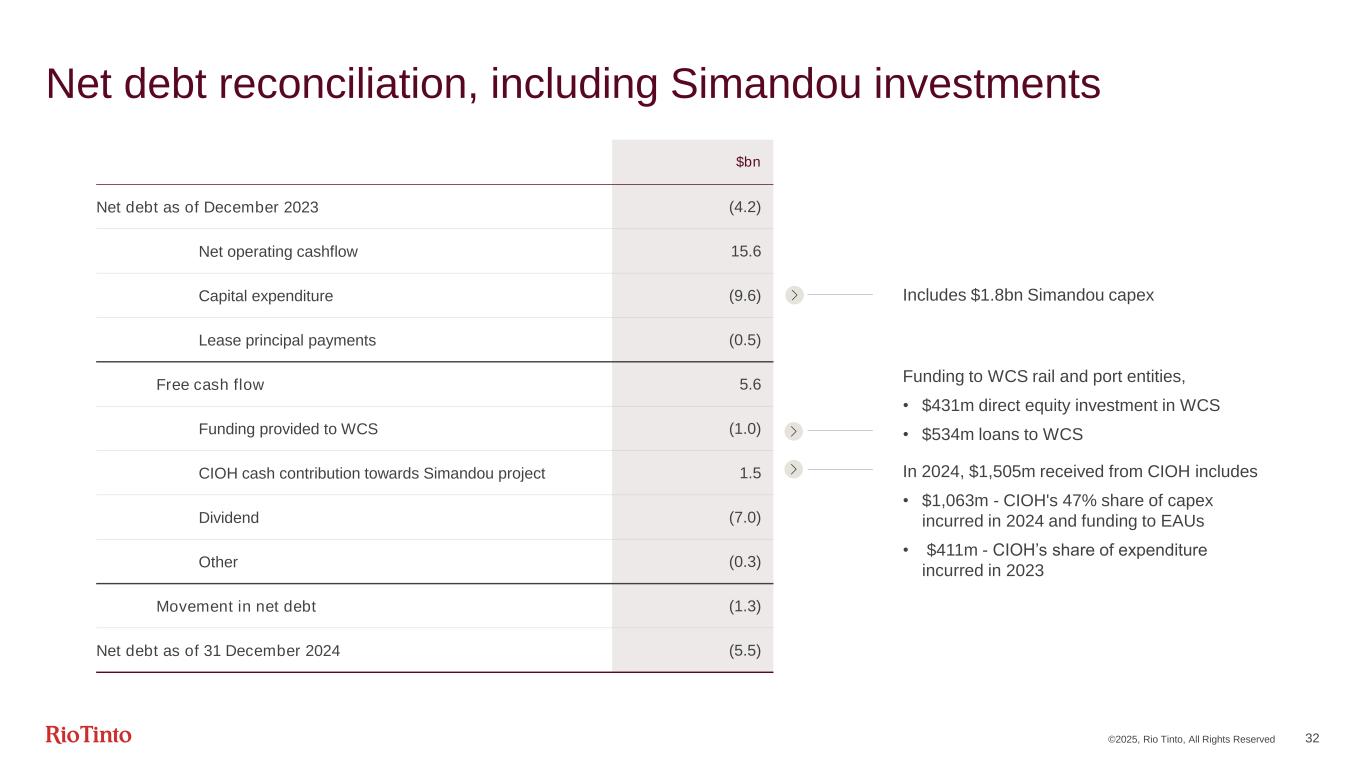

©2025, Rio Tinto, All Rights Reserved 32 Net debt reconciliation, including Simandou investments $bn Net debt as of December 2023 (4.2) Net operating cashflow 15.6 Capital expenditure (9.6) Lease principal payments (0.5) Free cash flow 5.6 Funding provided to WCS (1.0) CIOH cash contribution towards Simandou project 1.5 Dividend (7.0) Other (0.3) Movement in net debt (1.3) Net debt as of 31 December 2024 (5.5) Includes $1.8bn Simandou capex Funding to WCS rail and port entities, • $431m direct equity investment in WCS • $534m loans to WCS In 2024, $1,505m received from CIOH includes • $1,063m - CIOH's 47% share of capex incurred in 2024 and funding to EAUs • $411m - CIOH’s share of expenditure incurred in 2023

Guidance ©2025, Rio Tinto, All Rights Reserved 33

©2025, Rio Tinto, All Rights Reserved 34 Production guidance 1 Pilbara shipments guidance remains subject to weather, market conditions and management of cultural heritage 2 Includes Oyu Tolgoi on a 100% consolidated basis and continues to reflect our 30% share of Escondida 3 From Q1 2025, we will report copper production and guidance as one metric, in order to simplify reporting and align with peer practices. 4 Iron Ore Company of Canada 2024 Actual 2025 Guidance Pilbara iron ore shipments1 (100% basis) 328.6Mt 323 – 338Mt Copper Copper consolidated 792.6kt 780 – 850kt3 Mined Copper (consolidated basis)2 697.1kt Refined Copper 248.3kt Aluminium Bauxite 58.7Mt 57 – 59Mt Alumina 7.3Mt 7.4 – 7.8Mt Aluminium 3.3Mt 3.25 – 3.45Mt Minerals TiO2 1.0Mt 1.0 – 1.2Mt IOC pellets and concentrate4 9.4 Mt 9.7 – 11.4Mt B2O3 0.5Mt ~0.5Mt

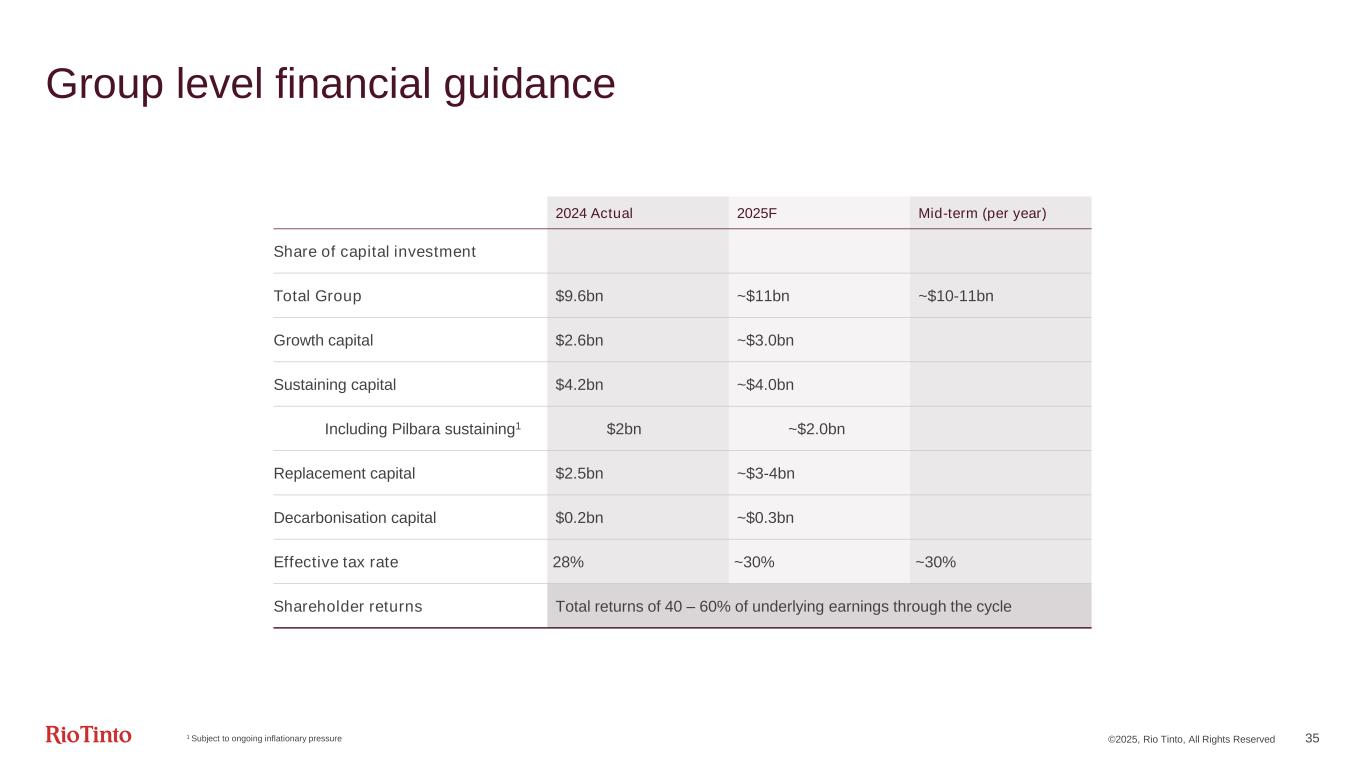

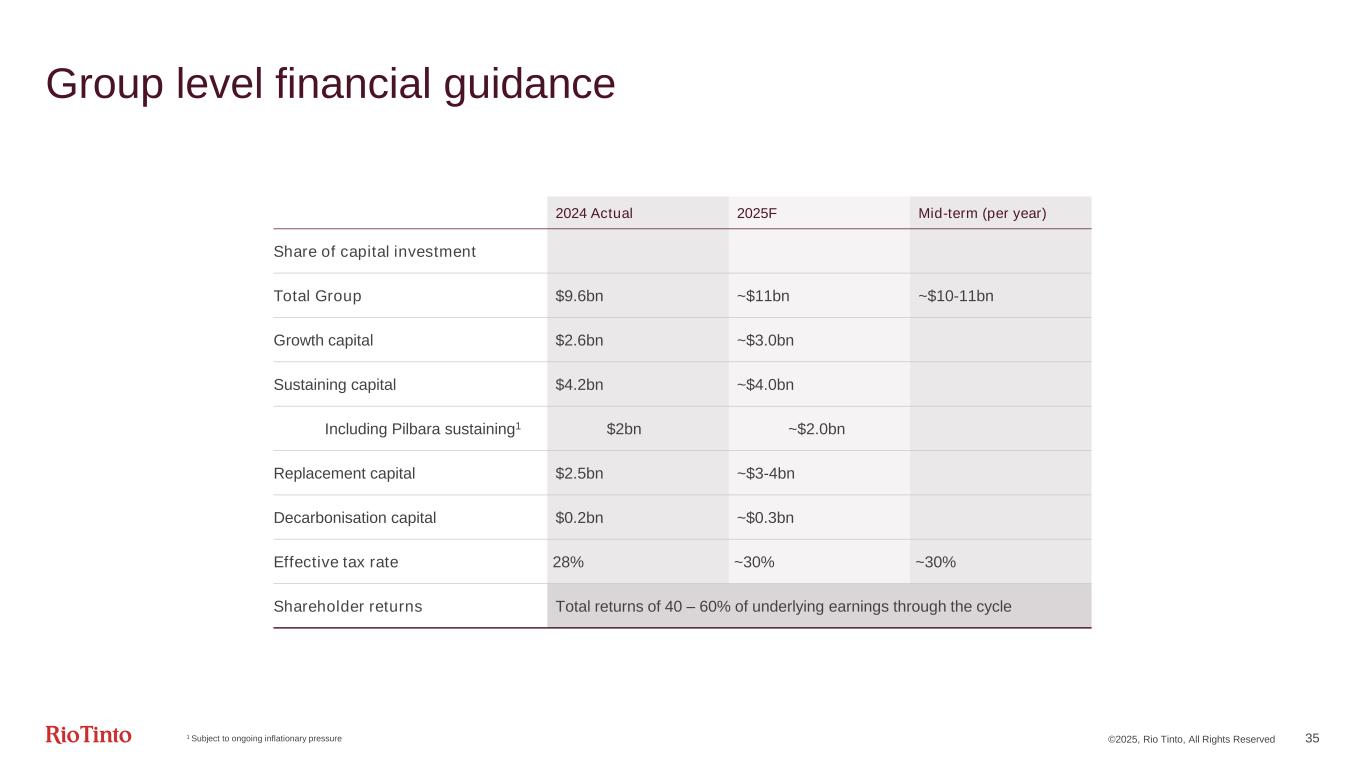

©2025, Rio Tinto, All Rights Reserved 35 Group level financial guidance 2024 Actual 2025F Mid-term (per year) Share of capital investment Total Group $9.6bn ~$11bn ~$10-11bn Growth capital $2.6bn ~$3.0bn Sustaining capital $4.2bn ~$4.0bn Including Pilbara sustaining1 $2bn ~$2.0bn Replacement capital $2.5bn ~$3-4bn Decarbonisation capital $0.2bn ~$0.3bn Effective tax rate 28% ~30% ~30% Shareholder returns Total returns of 40 – 60% of underlying earnings through the cycle 1 Subject to ongoing inflationary pressure

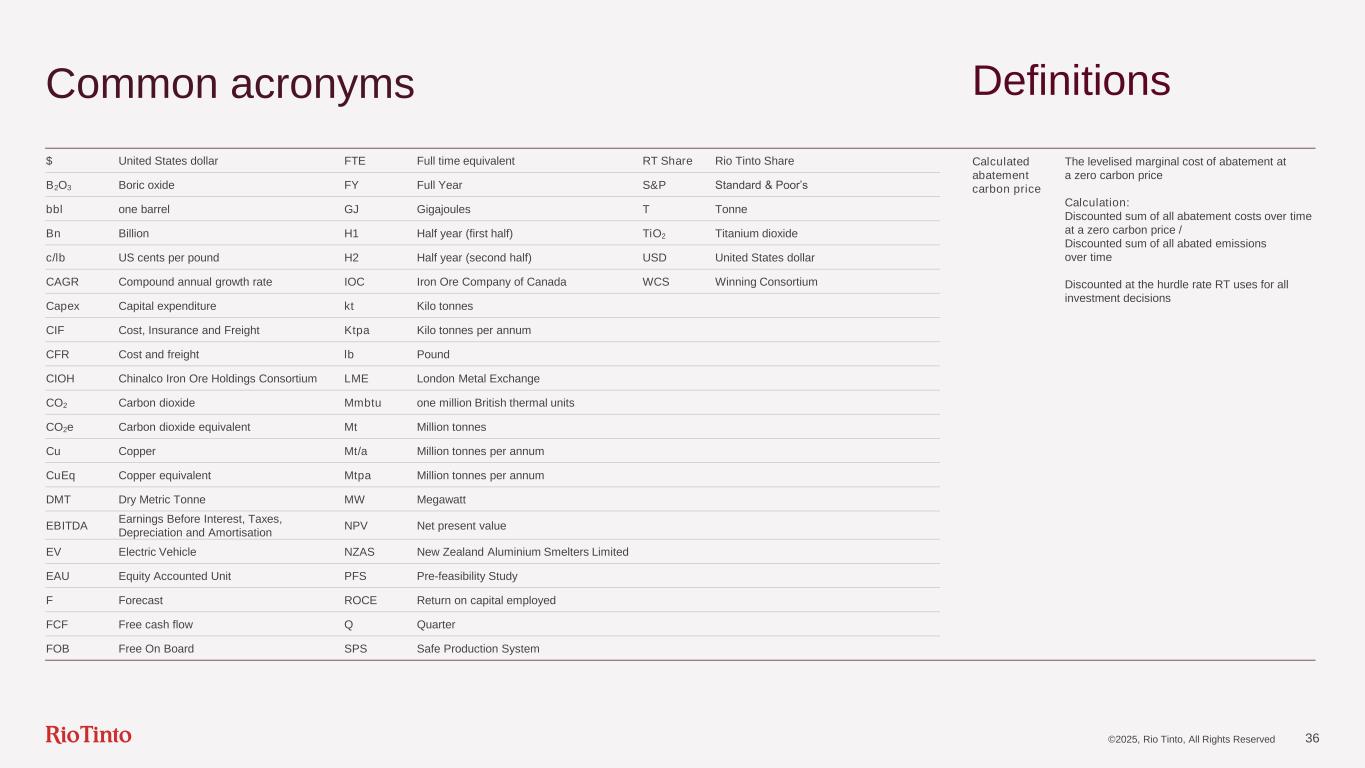

Common acronyms $ United States dollar FTE Full time equivalent RT Share Rio Tinto Share Calculated abatement carbon price The levelised marginal cost of abatement at a zero carbon price Calculation: Discounted sum of all abatement costs over time at a zero carbon price / Discounted sum of all abated emissions over time Discounted at the hurdle rate RT uses for all investment decisions B2O3 Boric oxide FY Full Year S&P Standard & Poor’s bbl one barrel GJ Gigajoules T Tonne Bn Billion H1 Half year (first half) TiO2 Titanium dioxide c/lb US cents per pound H2 Half year (second half) USD United States dollar CAGR Compound annual growth rate IOC Iron Ore Company of Canada WCS Winning Consortium Capex Capital expenditure kt Kilo tonnes CIF Cost, Insurance and Freight Ktpa Kilo tonnes per annum CFR Cost and freight lb Pound CIOH Chinalco Iron Ore Holdings Consortium LME London Metal Exchange CO2 Carbon dioxide Mmbtu one million British thermal units CO2e Carbon dioxide equivalent Mt Million tonnes Cu Copper Mt/a Million tonnes per annum CuEq Copper equivalent Mtpa Million tonnes per annum DMT Dry Metric Tonne MW Megawatt EBITDA Earnings Before Interest, Taxes, Depreciation and Amortisation NPV Net present value EV Electric Vehicle NZAS New Zealand Aluminium Smelters Limited EAU Equity Accounted Unit PFS Pre-feasibility Study F Forecast ROCE Return on capital employed FCF Free cash flow Q Quarter FOB Free On Board SPS Safe Production System Definitions ©2025, Rio Tinto, All Rights Reserved 36

©2025, Rio Tinto, All Rights Reserved 37 Useful reference material Annual Report 2024 Annual Report 2024 Annual Results 2024 - release Annual results 2024 Quarterly operations review Quarterly operation review Investor Seminars Investor Seminars Sustainability Sustainability Presentations and webcasts Presentations Fact Book Fact Book Financial calendar Financial calendar Shareholder information Shareholder information Corporate governance Corporate governance West Angelas, Australia

©2025, Rio Tinto, All Rights Reserved 38 Contacts Investor Relations, United Kingdom Investor Relations, Australia Rachel Arellano M +44 7584 609 644 Tom Gallop M +61 439 353 948 David Ovington M +44 7920 010 978 Amar Jambaa M +61 472 865 948 Laura Brooks M +44 7826 942 797 Weiwei Hu M +44 7825 907 230 Rio Tinto plc 6 St James's Square London SW1Y 4AD UK T: +44 20 7781 2000 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333