SECURITIES DEALING POLICY 15 December 2020 Exhibit 11.1

Securities Dealing Policy Page 2 of 10 Contents INTRODUCTION 3 1. Background 3 2. Purpose 3 3. Scope 3 4. Compliance with Policy 4 INSIDER DEALING 4 5. Insider Dealing is prohibited at all times 4 DEALINGS BY RESTRICTED PERSONS 5 6. Restricted Persons 5 7. Dealing by Results Restricted Persons 5 8. Dealing by Project Restricted Persons 5 9. Dealing by Permanent Restricted Persons 5 10. Dealings excluded from this Policy 6 11. No hedging 6 DEALING BY PDMRS AND THEIR PCAS 6 12. Additional restrictions for PDMRs 6 13. PCAs 7 CLEARANCE TO DEAL 7 14. Clearance to Deal 7 15. Dealing during Closed Periods or undertaking short-term trading in exceptional circumstances 8 DEFINITIONS 8 16. Defined terms under the Policy 8

Securities Dealing Policy Page 3 of 10 Insider Dealing is prohibited at all times. This Policy governs the securities dealing activities of Rio Tinto employees, directors and officers, contractors and secondees. In particular, the Policy has specific application to four categories of people: 1. Permanent Restricted Persons – these people must always seek clearance before undertaking any Dealings in Rio Tinto Securities; 2. Results Restricted Persons – these people cannot Deal in Rio Tinto Securities during Closed Periods; 3. Project Restricted Persons – depending on the significance and maturity of the project, these people may either need to seek clearance or be prohibited from Dealing in Rio Tinto Securities; 4. PDMRs – these people must not Deal in Rio Tinto Securities during Closed Periods and are required to notify the Group Company Secretary of any Dealings in Rio Tinto Securities. (They are also required to inform each of their PCAs of certain restrictions and obligations that apply to them under this Policy). At any given time, you may fall into one or more, or possibly all, of these categories. Further details are set out in the Policy. It is essential that you read, understand and comply with the Policy. If you are unclear on how the Policy applies to you, please speak with Company Secretariat prior to undertaking any Dealing in Rio Tinto Securities. There is also a set of FAQs available on the Company intranet to help guide you around the Policy. INTRODUCTION 1. Background 1.1 Rio Tinto plc and Rio Tinto Limited (collectively referred to as Rio Tinto or the Company) operate under a dual listed companies structure, with securities in Rio Tinto plc listed on the London Stock Exchange (LSE) and securities in Rio Tinto Limited listed on the Australian Securities Exchange (ASX). Rio Tinto plc also has a sponsored American Depositary Receipts (ADRs) facility with the underlying American Depositary Shares registered with the US Securities and Exchange Commission (SEC) and listed on the New York Stock Exchange (NYSE). 2. Purpose 2.1 The purpose of this policy (Policy) is to establish a best practice procedure for employees, directors and officers, contractors and secondees of Rio Tinto and its subsidiaries (Rio Tinto Group or the Group) (Rio Tinto Personnel) have a clear understanding of applicable Insider Dealing laws, and to prevent the misuse or perceived misuse of Rio Tinto’s Inside Information by restricting certain Dealings in Rio Tinto Securities by Rio Tinto Personnel. 2.2 Definitions of the capitalised terms are set out in section 16 of the Policy. 3. Scope 3.1 This Policy applies to all Rio Tinto Personnel. 3.2 Certain restrictions detailed in this Policy apply only to Restricted Persons, Persons Discharging Managerial Responsibilities (PDMRs), and the Persons Closely Associated (PCA) with the PDMRs.

Securities Dealing Policy Page 4 of 10 4. Compliance with Policy 4.1 This Policy is supplemented by training and guidance. Rio Tinto Personnel may contact Company Secretariat for clarification on any matter related to this Policy. 4.2 It is a responsibility of all Rio Tinto Personnel to comply with this Policy. Strict compliance with this Policy is mandatory. 4.3 Failure to comply with this Policy may lead to disciplinary action being taken against Rio Tinto Personnel, including dismissal. Breach of securities laws, including Insider Dealing and market abuse laws have serious consequences for the Rio Tinto Personnel concerned, Rio Tinto, and any other person involved and may result in criminal (including imprisonment) and/or civil penalties. INSIDER DEALING 5. Insider Dealing is prohibited at all times 5.1 All Rio Tinto Personnel who have access to Inside Information about the Rio Tinto Group must not: (a) Deal in Rio Tinto Securities (on their own account or for the account of another person); (b) advise, procure, recommend, encourage or induce another person to Deal in Rio Tinto Securities; and/or (c) disclose Inside Information to any other person (whether directly or indirectly), if the Rio Tinto Personnel knows or ought reasonably to know that the other person may use the Inside Information to Deal (or advise, procure or encourage someone else to Deal) in Rio Tinto Securities. Participation in any of the activities listed above is called Insider Dealing and is unlawful, irrespective of the purpose or motive for participating in the activity, or whether a profit is made from the activity. Any person who unlawfully receives Inside Information from Rio Tinto Personnel and Deals in Rio Tinto Securities may also be participating in an Insider Dealing activity. 5.2 For the purpose of this Policy, Inside Information is information: (a) which is not generally or publicly available; and (b) if the information was generally or publicly available, it would or would be likely to have a significant or material effect on the price or value of Rio Tinto's or another company’s Securities (judged by whether a reasonable investor would use the information as part of the basis of their investment decision). 5.3 The prohibition on Insider Dealing is not limited to Rio Tinto Securities. If any Rio Tinto Personnel is in possession of Inside Information relating to any other entity (including, but not limited to, Rio Tinto’s customers, suppliers, contractors or business partners), such Rio Tinto Personnel must not participate in any of the activities in clause 5.1 above in relation to that company or the Securities of that entity. 5.4 If any Rio Tinto Personnel is in doubt about whether a particular piece of information is Inside Information, they should consult with Company Secretariat before acting or act on the basis that the information is Inside Information.

Securities Dealing Policy Page 5 of 10 DEALINGS BY RESTRICTED PERSONS 6. Restricted Persons 6.1 Rio Tinto Personnel may be designated as a Restricted Person where they are considered likely to have access to information that is or has the potential to become Inside Information due to: (a) their position within the Group, this includes PDMRs (Permanent Restricted Persons); and/or (b) their involvement in full-year and half year results (Results Restricted Persons); and/or (c) their involvement in other matters relating to specific transactions or business situations (Project Restricted Persons), (each a Restricted Person and collectively referred to as Restricted Persons). 6.2 Company Secretariat will notify Rio Tinto Personnel if they are a Restricted Person, of the Dealing prohibitions applicable to them (if any), and if they cease to be a Restricted Person. 7. Dealing by Results Restricted Persons 7.1 Results Restricted Persons are not permitted to Deal in Rio Tinto Securities: (a) during the longer of: (i) the period from the end of the relevant financial period up to the date of publication of the full year or half-year financial results; or (ii) the period of 30 calendar days before the date of such publication; and (b) any extended or additional periods as specified by Company Secretariat, (each a Closed Period and collectively referred to as Closed Periods). 8. Dealing by Project Restricted Persons 8.1 Project Restricted Persons may Deal in Rio Tinto Securities, provided: (a) they are not subject to Dealing prohibitions relating to their designation as Project Restricted Persons; (b) they are not a Results Restricted Person, PDMR subject to a Closed Period at the time of the proposed Dealing; (c) they are not in possession of any Inside Information at the time of the proposed Dealing; and (d) they have obtained prior written clearance to Deal and Dealing is carried out in accordance with sections 14 and 15 of this Policy. 9. Dealing by Permanent Restricted Persons 9.1 Permanent Restricted Persons may Deal in Rio Tinto Securities, provided: (a) they are not a Results Restricted Person, PDMR subject to a Closed Period at the time of the proposed Dealing; (b) they are not a Project Restricted Person subject to a Dealing prohibition at the time of proposed Dealing; (c) they are not in possession of any Inside Information at the time of the proposed Dealing; and

Securities Dealing Policy Page 6 of 10 (d) they have obtained prior written clearance to Deal and Dealing is carried out in accordance with sections 14 and 15 of this Policy. 10. Dealings excluded from this Policy The following types of Dealings are excluded from the operation of this Policy and may be undertaken by Restricted Persons at any time, without prior written clearance, subject to the prohibition against Insider Dealing in section 5.1: (a) Dealings that do not result in a change in beneficial ownership of Rio Tinto Securities; (b) an investment in, or trading in units of, a fund or other scheme (other than a scheme only investing in Rio Tinto Securities) where the assets of the fund or scheme are invested at the discretion of a third party; (c) a disposal of Rio Tinto Securities arising from a scheme of arrangement or acceptance of a takeover offer; (d) acquiring Rio Tinto Securities under an offer or invitation made to all or most holders of Rio Tinto’s Securities, such as a rights issue, where the timing and structure of the offer has been approved by the Rio Tinto Board; (e) acquisition or automatic disposal without need for instruction of Rio Tinto Securities under an employee share plan or a dividend reinvestment plan, provided that Restricted Persons do not commence or amend their participation or instructions in the relevant plan during a Closed Period (other than in exceptional circumstances and with the relevant prior written clearance); and (f) a disposal of Rio Tinto Securities that is the result of a secured lender exercising their rights. 11. No hedging 11.1 Rio Tinto prohibits Permanent Restricted Persons, from entering into arrangements which have the effect of limiting the economic risk related to an unvested share, option or other Rio Tinto Security granted or awarded under a Rio Tinto employee share plan (or a vested share, option or other Rio Tinto Security granted, awarded or acquired under a Rio Tinto employee share plan that is still subject to disposal restrictions). DEALING BY PDMRS AND THEIR PCAS 12. Additional restrictions for PDMRs 12.1 In addition to the Dealing restrictions applicable to Restricted Persons set out above, PDMRs must not Deal in Rio Tinto Securities on their own account, or for the account of a third party, directly or indirectly, during Closed Periods, unless the PDMR has been granted prior clearance to Deal in accordance with sections 14 and 15 of this Policy. 12.2 Dealings by PDMRs are required to be disclosed to the ASX and UK Financial Conduct Authority within stipulated time frames. Immediately after Dealing in Rio Tinto Securities, PDMRs must notify the Group Company Secretary of the details of the transaction. Rio Tinto will make the relevant notification on behalf of the PDMR. 12.3 PDMRs are prohibited from undertaking any of the following Dealings with respect to Rio Tinto Securities: (a) Dealing in derivative products issued over or in respect of Rio Tinto Securities; (b) Dealing in Rio Tinto Securities on a short-term trading basis, being a period of three months between purchase and sale of any Rio Tinto Securities; (c) engaging in the practice of short selling in Rio Tinto Securities; and

Securities Dealing Policy Page 7 of 10 (d) entering into margin lending or other secure financing arrangements in respect of Rio Tinto Securities. 13. PCAs 13.1 PDMRs must: (a) inform each of their PCAs in writing of their restrictions and disclosure obligations in relation to Dealing in Rio Tinto Securities and receive acknowledgement from the PCA that they understand their obligations, being that: (i) they must not Deal in Rio Tinto Securities during a Closed Period; and (ii) immediately after Dealing in Rio Tinto Securities, they must notify the Group Company Secretary of the transaction details; (b) keep a copy of the notification to the PCA in 13.1(a) above; (c) take appropriate steps to ensure that their PCAs are aware of their responsibilities and do not breach this Policy; (d) provide the Group Company Secretary a list of all their PCAs, and any changes to that list; and (e) seek clearance in accordance with section 14 prior to any proposed Dealing in Rio Tinto Securities by a PCA, other than a Dealing excluded by section 10. 13.2 PDMRs must also notify their PCAs that Dealings by PCAs may be required to be disclosed to the ASX and UK Financial Conduct Authority within stipulated time frames, and that Rio Tinto will make the relevant notification on the PCA’s behalf. CLEARANCE TO DEAL 14. Clearance to Deal 14.1 Permanent Restricted Persons and Project Restricted Persons are required to seek clearance prior to any proposed Dealing in Rio Tinto Securities, other than a Dealing excluded by section 10. 14.2 The requests for clearance to Deal must be in writing and submitted via the Rio Tinto Dealing Rules portal on the Company intranet. Company Secretariat maintains records of all Dealing requests received and any responses including clearances granted. 14.3 Requests for clearance to Deal may be granted in the case of: (a) the Chairman of the board (Chairman), by the Senior Independent Directors or the Chief Executive; (b) non-executive directors (other than the Chairman) and the Group Company Secretary, by the Chairman or the Chief Executive; (c) the Chief Executive, by the Chairman; (d) PDMRs (other than the non-executive directors, but including the Chief Financial Officer), by the Chief Executive; and (e) Permanent Restricted Persons, Results Restricted Persons and Project Restricted Persons not otherwise captured under paragraphs (a) – (d), by the Group Company Secretary or a delegate of Group Company Secretary. 14.4 In considering whether to grant clearance to Deal, the relevant approver will consider whether any Inside Information exists in relation to the Group, and whether the relevant Permanent Restricted Persons or Project Restricted Persons hold any Inside Information.

Securities Dealing Policy Page 8 of 10 14.5 Whether or not to grant clearance to Deal is in the relevant approver's absolute discretion. A clearance to Deal can also be withdrawn if new information comes to light or there is a change in circumstances. If Rio Tinto refuses to grant clearance to Deal, any refusal must be kept confidential and must not be discussed with any other person. 14.6 If clearance to Deal is granted, Permanent Restricted Persons and Project Restricted Persons must Deal in Rio Tinto Securities within the period specified in the written clearance to Deal, or in the absence of a period being specified, within two Business Days of the receipt of the clearance to Deal. 14.7 Within two business days of Dealing, Restricted Persons are required to submit a Post Trade Notification via the Rio Tinto Dealing Rules portal on the Company intranet. After receiving the clearance to deal, if Restricted Persons decide not to deal in Rio Tinto Securities, you still need to submit a Post Trading Notification promptly, indicating that you did not deal in Rio Tinto Securities (Post Trading Notification). 15. Dealing during Closed Periods or undertaking short-term trading in exceptional circumstances 15.1 Clearance may be given to PDMRs and Restricted Persons to Deal in Rio Tinto Securities during Closed Periods or to undertake short-term trading if they are not in possession of Inside Information in relation to Rio Tinto, the particular Dealing cannot be executed at any time other than in the relevant Closed Period, and where exceptional circumstances, such as severe financial difficulty or compulsion by court order exist, which require an immediate sale of Rio Tinto Securities. 15.2 The determination of whether there is severe financial difficulty or whether there are other exceptional circumstances can be made only by the Group Company Secretary or the Chairman of the Board. 15.3 If clearance to Deal is granted, Restricted Persons must Deal in Rio Tinto Securities within the period specified in the written clearance to Deal, or in the absence of a period being specified, within two Business Days of the receipt of the clearance to Deal. Restricted Persons must also submit a Post Trading Notification as per section 14.7. DEFINITIONS 16. Defined terms under the Policy Term Definition ADR American Depositary Receipts. ASX Australian Securities Exchange. Business Days Any day which is not (a) a Saturday, Sunday, Christmas Day or Good Friday, (b) a bank holiday in the United Kingdom for matters in relation to the United Kingdom, or (c) a public holiday in any Australian State or Territory for matters in relation to Australia. Chairman As defined in section 14.3(a) of this Policy. Closed Period As defined in section 7.1 of this Policy. Company Secretariat Rio Tinto Group Company Secretariat function. Deal, Dealing Dealing in Securities covers a wide range of transactions affecting the title or interest in those securities including: (a) acquisition or disposal;

Securities Dealing Policy Page 9 of 10 (b) exercising options, awards or rights under Rio Tinto employee share plans; (c) using as security, or otherwise granting a charge, lien or other encumbrance; (d) any other transaction or the exercise of any power or discretion, effecting a change of ownership of beneficial interest; (e) entering into a transaction the economic outcome of which is dependent upon the price of a Rio Tinto Security, including but not limited to a transaction which has the effect of limiting the economic risk of holding a Rio Tinto Security; (f) electing to participate in a Rio Tinto employee share purchase plan (such as myShare); (g) electing to participate in a dividend reinvestment plan; and (h) entering into any margin lending, derivative contract or other secured financial arrangement pursuant to which a charge is granted over the Rio Tinto Securities. Insider Dealing As defined in section 5.1 of this Policy. Inside Information As defined in section 5.2 of this Policy. For the purposes of clause 5.2 above, information that is “not publicly available” may include: (a) information available to a select group of institutional investors; (b) undisclosed facts that are the subject of rumours, even if the rumours are widely circulated; or (c) information that has been entrusted to Rio Tinto Personnel on a confidential basis until a public announcement of the information has been made and enough time has elapsed for the market to respond to a public announcement of the information. LSE London Stock Exchange. MAR Market Abuse Regulation (EU) 596/2014 (as amended) NYSE New York Stock Exchange. PCA A person closely associated with a PDMR, being: (a) a family member (meaning a spouse, civil partner, or dependent children or stepchildren of the PDMR or a relative who has shared the same household as the PDMR for at least one year on the date of Dealing) or (b) a company, trust, partnership or entity: • which is managed by the PDMR or a family member; • which is directly or indirectly controlled by the PDMR or a family member; • which is set up for the benefit of the PDMR or a family member; or • the economic interests of which are substantially equivalent to the PDMR’s or a family member’s.

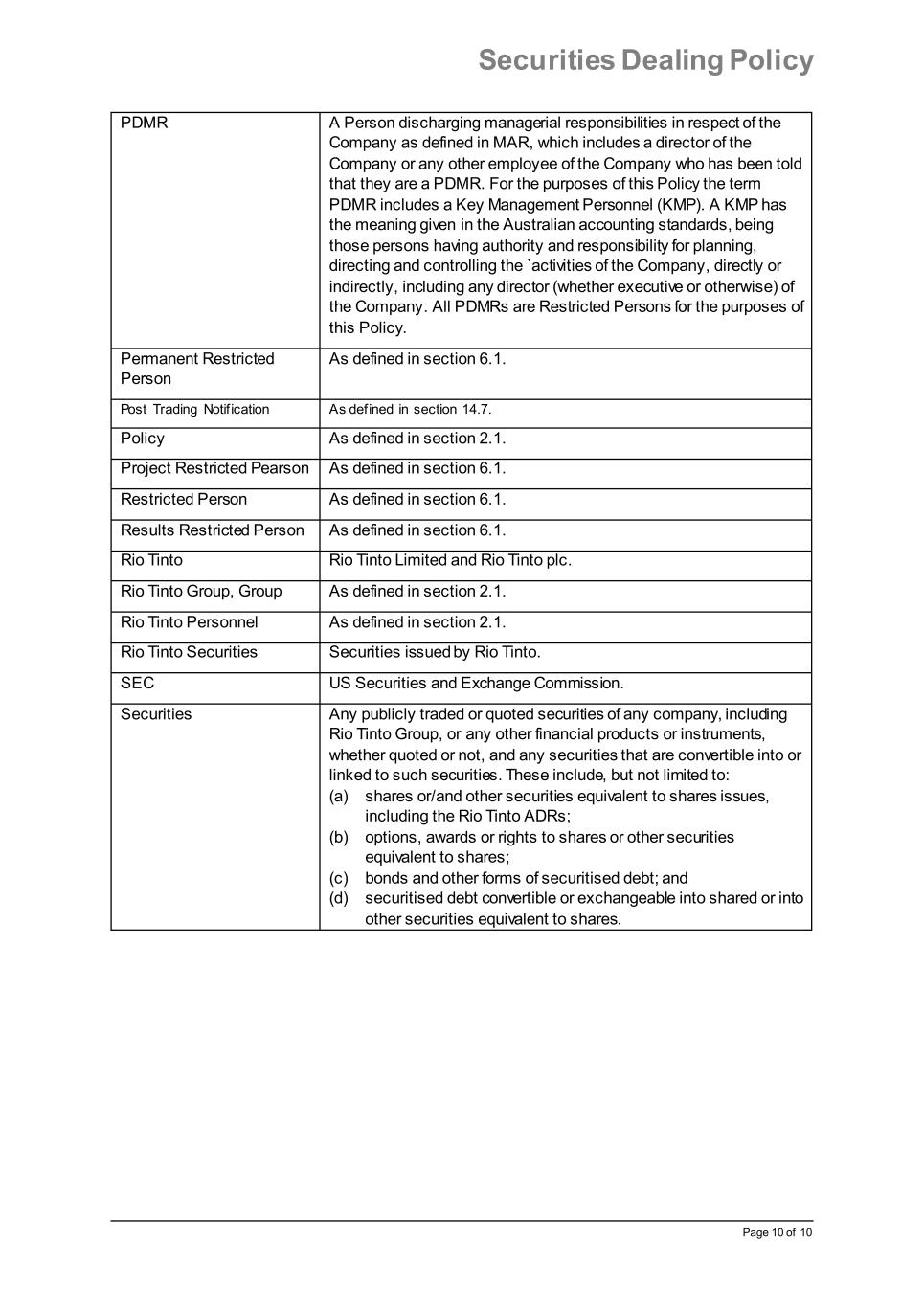

Securities Dealing Policy Page 10 of 10 PDMR A Person discharging managerial responsibilities in respect of the Company as defined in MAR, which includes a director of the Company or any other employee of the Company who has been told that they are a PDMR. For the purposes of this Policy the term PDMR includes a Key Management Personnel (KMP). A KMP has the meaning given in the Australian accounting standards, being those persons having authority and responsibility for planning, directing and controlling the `activities of the Company, directly or indirectly, including any director (whether executive or otherwise) of the Company. All PDMRs are Restricted Persons for the purposes of this Policy. Permanent Restricted Person As defined in section 6.1. Post Trading Notif ication As defined in section 14.7. Policy As defined in section 2.1. Project Restricted Pearson As defined in section 6.1. Restricted Person As defined in section 6.1. Results Restricted Person As defined in section 6.1. Rio Tinto Rio Tinto Limited and Rio Tinto plc. Rio Tinto Group, Group As defined in section 2.1. Rio Tinto Personnel As defined in section 2.1. Rio Tinto Securities Securities issued by Rio Tinto. SEC US Securities and Exchange Commission. Securities Any publicly traded or quoted securities of any company, including Rio Tinto Group, or any other financial products or instruments, whether quoted or not, and any securities that are convertible into or linked to such securities. These include, but not limited to: (a) shares or/and other securities equivalent to shares issues, including the Rio Tinto ADRs; (b) options, awards or rights to shares or other securities equivalent to shares; (c) bonds and other forms of securitised debt; and (d) securitised debt convertible or exchangeable into shared or into other securities equivalent to shares.