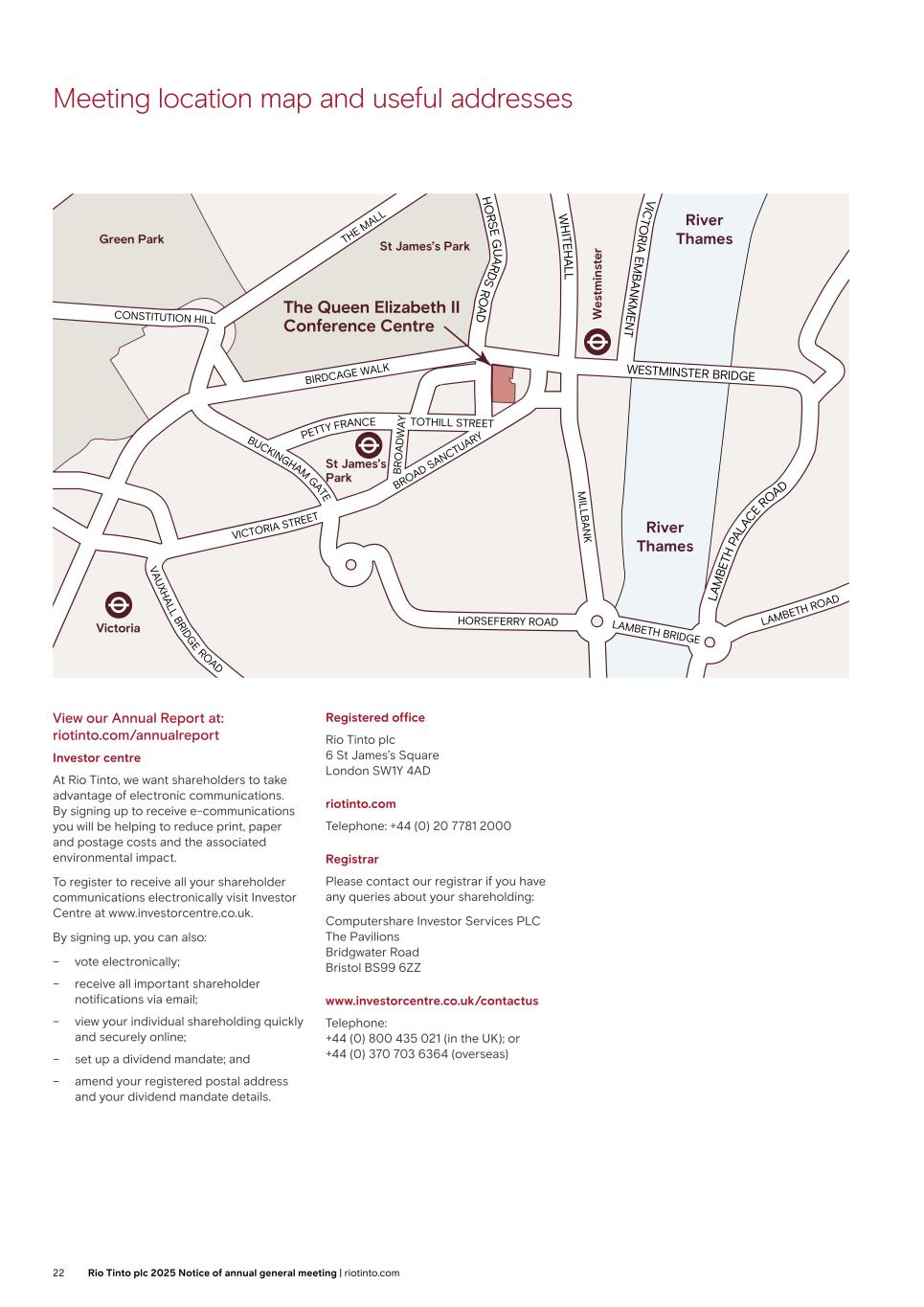

The annual general meeting of Rio Tinto plc will be held at 11:00am on Thursday, 3 April 2025 at The Queen Elizabeth II Centre, Broad Sanctuary, Westminster, London SW1P 3EE. For those shareholders attending the meeting virtually, we will facilitate participation through the Lumi platform where you will be able to watch the meeting live, vote and ask questions. Details of how to attend virtually can be found on page 18. To vote ahead of the annual general meeting, please complete and submit a proxy form in line with the instructions set out in this notice. This document is important and requires your immediate attention. If you have any doubts about the action you should take, contact your stockbroker, solicitor, accountant or other professional adviser, immediately. If you have sold or transferred all of your shares in Rio Tinto plc, please send this document, together with the accompanying documents, at once to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee. A copy of this notice and other information required by section 311A of the Companies Act 2006 can be found by visiting riotinto.com/agm. This notice of annual general meeting replaces the notice of annual general meeting dated 19 February 2025. 2025 Notice of annual general meeting EXHIBIT 99.2

Letter from the Chair Dear shareholders, I am pleased to invite you to Rio Tinto plc’s annual general meeting (AGM), which will be held at 11:00am on Thursday, 3 April 2025 at The Queen Elizabeth II Centre, Broad Sanctuary, Westminster, London SW1P 3EE. This notice of meeting describes the business that will be proposed at the AGM and sets out the procedures for your participation and voting. Your participation is highly valued and an important opportunity for the Rio Tinto’s Board and shareholders to discuss the Group’s priorities and performance. Please note that only shareholders, proxy holders and corporate representatives in attendance at the meeting, either in person or online, will be eligible to ask questions of the Directors. Board changes As we reported last year, the size of the Board peaked at 14 Directors as we retained the expertise and experience of our longer-serving Directors during a transitional period as newer Directors familiarised themselves with the Group. That transitional phase is now largely concluded so we will make the following changes to the Board during 2025. At the conclusion of the Rio Tinto Limited AGM in May 2025, Sam Laidlaw will step down as a Director of the Company. Sam was appointed to the Board in February 2017 and has served as Chair of our People & Remuneration Committee and as the Senior Independent Director. I would like to express my sincere thanks to Sam, on behalf of the Board, for his outstanding contribution to Rio Tinto. Ben Wyatt will succeed Sam as Chair of the People & Remuneration Committee and Sharon Thorne will become our Senior Independent Director. In the second half of 2025, Simon Henry will step down as a Director. Simon was appointed to the Board in April 2017 and has served as Chair of the Audit & Risk Committee since May 2019. We are grateful to Simon for his invaluable contribution to the Group. Sharon Thorne will succeed Simon as Chair of the Audit & Risk Committee. Kaisa Hietala will also step down as a Director at the conclusion of the Rio Tinto Limited AGM in May 2025. The recent growth in our Lithium business has increasingly created potential conflicts of interest with Kaisa’s non-executive directorship with Exxon Mobil. Out of an abundance of caution, Kaisa has offered to resolve this potential conflict by stepping down from the Rio Tinto Board. Kaisa has been a very welcome and valuable addition to the Board since her appointment in March 2023, and her guidance on energy transition and business transformation in particular have contributed significantly and insightfully to our discussions. While she will be greatly missed, we have accepted her decision to step down and wish Kaisa well for the future. 2025 Climate Action Plan This year we are seeking shareholder approval for our 2025 Climate Action Plan (2025 CAP). The plan sets out our continued strategy to provide the materials that are needed for the energy transition, retain our commitments to reduce emissions from our operations, and work with our partners to cut emissions through the value chain. The 2025 CAP is underpinned by a clear pathway to reduce Scope 1 and 2 emissions by 50% by 2030, and ultimately targets net zero operational emissions by 2050. It details how Rio Tinto will decarbonise its operations and value chain through partnerships, disciplined investment in projects, and by developing new technologies. These actions are putting us in a strong position today, and for a low-carbon future. Board recommendation The Board is unanimously of the opinion that Resolutions 1 to 23 (inclusive) proposed in this notice are in the best interests of shareholders and of Rio Tinto as a whole and recommends that you vote FOR these resolutions. However, Resolution 24 has not been proposed by the Board. The resolution was requisitioned by certain shareholders of the Company pursuant to section 338 of the UK Companies Act 2006, and an equivalent resolution is being submitted as a Joint Decision Matter at the Rio Tinto Limited AGM. Resolution 24 and the requisitioning shareholders’ accompanying explanatory statement (which is set out in Appendix 1 on page 14), should be read together. The Board considers that Resolution 24 is against the best interests of shareholders and of Rio Tinto as a whole and recommends that you vote AGAINST this resolution for the reasons set out on pages 12–13 and in Appendix 2 on pages 15-17. Voting and results Shareholders who are unable to participate in the meeting are strongly encouraged to complete and submit a proxy form by no later than 11:00am on Tuesday, 1 April 2025 in line with the instructions on pages 19-20. Submitting a proxy form will ensure your vote is recorded, but does not prevent you from participating and voting at the meeting either in person, or online, as described on page 18. The corresponding Rio Tinto Limited AGM will take place in Perth on Thursday, 1 May 2025. The result of the votes on Resolutions 1 to 19 (inclusive) and Resolution 24, which are also being proposed to the Rio Tinto Limited AGM, will be determined when the relevant polls are closed at the end of the Rio Tinto Limited meeting. The results of the polls on these resolutions will be announced to the relevant stock exchanges and posted on our website after that date. The result of the polls on Resolutions 20 to 23 (inclusive), which only apply to Rio Tinto plc, will be released as soon as possible after the Rio Tinto plc AGM. I look forward to welcoming you to the AGM and thank you for your continued support of Rio Tinto. Yours sincerely Dominic Barton Chair 3 March 2025 2 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Notice of annual general meeting Notice is given that the AGM of Rio Tinto plc (the Company) will be held at The Queen Elizabeth II Centre, Broad Sanctuary, Westminster, London SW1P 3EE at 11:00am on Thursday, 3 April 2025, for the purposes set out below: The Board recommends that shareholders vote FOR Resolutions 1 to 23 (inclusive). The Board recommends that shareholders vote AGAINST Resolution 24. Resolution 1 Receipt of the 2024 Annual Report To receive the financial statements, Strategic Report and the reports of the Directors and auditors for the year ended 31 December 2024. Resolution 2 Approval of the Directors’ Remuneration Report: Implementation Report To receive and approve the Directors’ Remuneration Report: Implementation Report for the year ended 31 December 2024, as set out in the 2024 Annual Report on pages 119-122 and 127-145, comprising the Annual Statement by the People & Remuneration Committee Chair and the Implementation Report (together, the Implementation Report). This resolution is advisory and is required for UK law purposes. Resolution 3 Approval of the Directors’ Remuneration Report To approve the Directors’ Remuneration Report for the year ended 31 December 2024, as set out in the 2024 Annual Report on pages 119-145. This resolution is advisory and is required for Australian law purposes. Resolution 4 To elect Sharon Thorne as a Director Resolution 5 To re-elect Dominic Barton BBM as a Director Resolution 6 To re-elect Peter Cunningham as a Director Resolution 7 To re-elect Dean Dalla Valle as a Director Resolution 8 To re-elect Simon Henry as a Director Resolution 9 To re-elect Susan Lloyd-Hurwitz as a Director Resolution 10 To re-elect Martina Merz as a Director Resolution 11 To re-elect Jennifer Nason as a Director Resolution 12 To re-elect Joc O’Rourke as a Director Resolution 13 To re-elect Jakob Stausholm as a Director Resolution 14 To re-elect Ngaire Woods CBE as a Director Resolution 15 To re-elect Ben Wyatt as a Director Resolution 16 Re-appointment of auditors To re-appoint KPMG LLP as auditors of Rio Tinto plc to hold office until the conclusion of Rio Tinto’s 2026 AGMs. Resolution 17 Remuneration of auditors To authorise the Audit & Risk Committee to determine the auditors’ remuneration. Resolution 18 Authority to make political donations To authorise Rio Tinto plc, and any company which is a subsidiary of Rio Tinto plc at the time this resolution is passed or becomes a subsidiary of Rio Tinto plc at any time during the period for which this resolution has effect, to: (a) make donations to political parties and independent election candidates; (b) make donations to political organisations other than political parties; and (c) incur political expenditure, provided that in each case any such donations or expenditure made by Rio Tinto plc or a subsidiary of Rio Tinto plc shall not exceed £50,000 per company, and that the total amount of all such donations and expenditure made by all companies to which this authority relates shall not exceed £100,000. This authority shall expire at the close of the AGM of Rio Tinto Limited held in 2026 (or, if earlier, at the close of business on 30 June 2026). 3Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Notice of annual general meeting Resolution 19 2025 Climate Action Plan To approve Rio Tinto Group’s 2025 Climate Action Plan, as set out in pages 41-75 of the 2024 Annual Report. This resolution is advisory. Resolution 20 General authority to allot shares To authorise the Directors, pursuant to and in accordance with section 551 of the UK Companies Act 2006 (the Companies Act), to exercise all the powers of the Company to allot, or to grant rights to subscribe for or convert any securities into, shares in the Company up to an aggregate nominal amount of £41,768,389. Such authority to apply in substitution for all previous authorities pursuant to section 551 of the Companies Act (but without prejudice to any allotment of shares or grant of rights pursuant to an offer or agreement made before the expiry of the authority pursuant to which such offer or agreement was made) and to expire (unless previously renewed, varied or revoked by the Company in general meeting) at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026) but, so that the Company may make offers and enter into agreements during this period, which would, or might, require shares to be allotted or rights to subscribe for or to convert any security into shares to be granted after the authority ends and the Directors may allot shares and grant rights in pursuance of that offer or agreement as if this authority had not expired. Resolution 21 Disapplication of pre-emption rights To pass the following resolution as a special resolution: To authorise the Directors, pursuant to section 570 and section 573 of the Companies Act, if Resolution 20 above is passed, to allot equity securities (as defined in section 560(1) of the Companies Act) wholly for cash under the authority given by Resolution 20 and/or to sell ordinary shares held by the Company as treasury shares for cash as if section 561 of the Companies Act did not apply to any such allotment or sale, such authority to be limited to: (a) the allotment of equity securities or sale of treasury shares made in connection with a pre-emptive offer; and (b) otherwise than in connection with a pre-emptive offer, the allotment of equity securities or sale of treasury shares up to an aggregate nominal amount of £8,121,339. Such authority to apply in substitution for all existing authorities pursuant to section 570 and section 573 of the Companies Act (but without prejudice to any allotment of equity securities or sale of treasury shares pursuant to an offer or agreement made before the expiry of the authority pursuant to which such offer or agreement was made) and such authority to expire (unless previously renewed, varied or revoked by the Company) at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026) but, in each case, prior to its expiry the Company may make offers and enter into agreements which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the authority expires and the Directors may allot equity securities (and sell treasury shares) under any such offer or agreement as if the authority had not expired. For the purposes of this Resolution: (a) pre-emptive offer means an offer of equity securities, open for acceptance for a period fixed by the Directors, to (i) holders (other than the Company) on the register on a record date fixed by the Directors of ordinary shares in proportion (as nearly as may be practicable) to their respective holdings and (ii) other persons so entitled by virtue of the rights attaching to any other securities held by them, but subject in both cases to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to treasury shares, fractional entitlements, record dates or legal, regulatory or practical problems in, or under the laws of, any territory; (b) references to an allotment of equity securities shall include a sale of treasury shares; and (c) the nominal amount of any securities shall be taken to be, in the case of rights to subscribe for or convert any securities into shares of the Company, the nominal amount of such shares that may be allotted pursuant to such rights. Resolution 22 Authority to purchase Rio Tinto plc shares To pass the following resolution as a special resolution: That: (a) Rio Tinto plc, Rio Tinto Limited and/or any subsidiaries of Rio Tinto Limited be generally and unconditionally authorised to purchase ordinary shares issued by the Company (RTP Ordinary Shares), such purchases to be made in the case of the Company by way of market purchase (as defined in section 693 of the Companies Act), provided that this authority shall be limited: (i) so as to expire at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026), unless such authority is renewed, varied or revoked prior to that time (except in relation to a purchase of RTP Ordinary Shares, the contract for which was concluded before the expiry of such authority and which might be executed wholly or partly after such expiry); (ii) so that the number of RTP Ordinary Shares, which may be purchased pursuant to this authority, shall not exceed 125,305,168; (iii) so that the maximum price (exclusive of expenses) payable for each such RTP Ordinary Share is an amount equal to the higher of: (a) 5% above the average of the middle market quotations for an RTP Ordinary Share as derived from the London Stock Exchange Daily Official List during the period of five business days immediately preceding the day on which such share is contracted to be purchased; and (b) the higher of the price of the last independent trade of an RTP Ordinary Share and the highest current independent bid for an RTP Ordinary Share on the trading venue where the purchase is carried out; (iv) so that the minimum price (exclusive of expenses) payable for each such RTP Ordinary Share shall be its nominal value; and 4 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Notice of annual general meeting (b) the Company be authorised for the purpose of section 694 of the Companies Act to purchase off-market from Rio Tinto Limited and/or any of its subsidiaries any RTP Ordinary Shares acquired under the authority set out under (a) above pursuant to one or more contracts between the Company and Rio Tinto Limited and/or any of its subsidiaries on the terms of the form of contract which has been produced to the meeting (and is for the purpose of identification marked “C” and initialled by the Company Secretary) (each, a Contract) and such Contracts be approved, provided that: (i) such authorisation shall expire at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026); (ii) the maximum total number of RTP Ordinary Shares to be purchased pursuant to such Contracts shall be 125,305,168; and (iii) the price of RTP Ordinary Shares purchased pursuant to a Contract shall be equal to the average of the middle market quotations for an RTP Ordinary Share as derived from the London Stock Exchange Daily Official List during the period of five business days immediately preceding the day on which such share is contracted to be purchased multiplied by the number of RTP Ordinary Shares the subject of the Contract, or such lower price as may be agreed between the Company and Rio Tinto Limited, being not less than one penny. Resolution 23 Notice period for general meetings other than AGMs To pass the following resolution as a special resolution: That a general meeting other than an AGM may be called on not less than 14 clear days’ notice. Resolution 24 Shareholder requisitioned resolution To pass the following resolution as a special resolution: THAT the Company immediately instigates an independent and comprehensive review on whether unification of the dual-listed companies structure of the Company and Rio Tinto Limited (the “DLC structure”) into a single Australian-domiciled holding company is in the best interests of the shareholders of the Company and the shareholders of Rio Tinto Limited (the “Review”), which Review shall be conducted by a committee (the “Committee”) consisting of the most recently appointed independent directors of the Company and Rio Tinto Limited (with an external shareholder representative in attendance) and shall include the Committee: (i) commissioning a comprehensive independent expert report from a leading international firm to opine on whether unification of the DLC structure would be in the best interests of the shareholders of the Company and Rio Tinto Limited; and (ii) making public (including on the Company’s website) a detailed report of its findings, along with the full independent expert report and other material information it has relied upon which can reasonably be disclosed. Resolution 24 has not been proposed by the Board. The resolution was requisitioned by certain shareholders of the Company pursuant to section 338 of the UK Companies Act 2006, and an equivalent resolution is being submitted as a Joint Decision Matter at the Rio Tinto Limited AGM. Resolution 24 should be read together with the requisitioning shareholders’ explanatory statement set out in Appendix 1 on page 14, which the Company is required to circulate to shareholders pursuant to section 314 of the Companies Act. The Board considers that Resolution 24 is against the best interests of shareholders and of Rio Tinto as a whole and unanimously recommends that you vote AGAINST Resolution 24 for the reasons set out on pages 12-13 and in Appendix 2 on pages 15-17. Note: In accordance with Rio Tinto’s DLC structure, as Joint Decision Matters, Resolutions 1 to 19 (inclusive) and Resolution 24, will be voted on by Rio Tinto plc and Rio Tinto Limited shareholders as a joint electorate. Resolutions 20 to 23 (inclusive) will be voted on by Rio Tinto plc shareholders only. Resolutions 1 to 20 (inclusive) will be proposed as ordinary resolutions and Resolutions 21 to 24 (inclusive) will be proposed as special resolutions. By order of the Board Andy Hodges Group Company Secretary 6 St James’s Square London SW1Y 4AD 3 March 2025 5Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Resolution 1 Receipt of the 2024 Annual Report The Directors are required by company law to present the 2024 Annual Report comprising the 2024 financial statements, the Strategic Report, the Directors’ Report and the Auditors’ Report to the AGM. These can be accessed at riotinto.com/annualreport. Resolution 2 Approval of the Directors’ Remuneration Report: Implementation Report The Implementation Report for the year ended 31 December 2024, comprising the Annual Statement by the People & Remuneration Committee Chair and the Implementation Report, is set out on pages 119-122 and 127-145 of the 2024 Annual Report. The Implementation Report describes the remuneration arrangements in place for each Executive Director, other members of the Executive Committee and the Non-Executive Directors (including the Chair) during 2024. The Annual Statement by the People & Remuneration Committee Chair provides context to 2024 remuneration outcomes, together with information to help shareholders understand what the executives were paid in 2024. This resolution is advisory and is required for UK law purposes. Resolution 3 Approval of the Directors’ Remuneration Report The Directors’ Remuneration Report for the year ended 31 December 2024 consists of the Annual Statement by the People & Remuneration Committee Chair, Remuneration at a glance – a summary of the Remuneration Policy, and the Implementation Report. The Remuneration Report is set out on pages 119-145 of the 2024 Annual Report. This resolution is advisory and is required for Australian law purposes. Resolutions 4-15 Election and re-election of Directors The Board has adopted a policy, whereby all Directors are required to seek re-election by shareholders on an annual basis. Accordingly, other than Sharon Thorne, who was appointed to the Board as an independent Non-Executive Director with effect from 1 July 2024 and is seeking election for the first time, and Sam Laidlaw and Kaisa Hietala, who will step down from the Board at the conclusion of the Rio Tinto Limited AGM on 1 May 2025 and therefore will not be seeking re-election, all other Directors will retire and offer themselves for re-election. Rio Tinto has satisfactorily undertaken checks into Sharon’s background and experience prior to her appointment. Sharon brings significant financial expertise to the Board and will succeed Simon Henry as Chair of the Audit & Risk Committee when Simon steps down from the Board later this year. More generally, the Board is of the view that all of the Directors seeking election or re-election continue to be effective and their contribution supports the long-term sustainable success of the Company. Each Director demonstrates the level of commitment required in connection with their role and the needs of the business (including making sufficient time available for Board and committee meetings and other duties). The skills and experience of each Director, which can be found below and on pages 102-103 of the 2024 Annual Report, demonstrate why their contribution is, and continues to be, important to Rio Tinto’s long-term sustainable success. The Board has also adopted a framework on Directors’ independence and is satisfied that each Non-Executive Director standing for election or re-election at the meeting is independent in accordance with this framework. Biographical details in support of each Director’s election or re-election are provided below. Sharon Thorne Independent Non-Executive Director, BA (Hons), FCA, Chartered Accountant (England and Wales). Age 60. Appointed July 2024. Member of the Audit & Risk Committee. Skills and experience: Sharon has extensive experience of auditing and advising clients across a broad range of sectors. She had a 36-year career with Deloitte, becoming an audit partner in 1998. During her time at Deloitte, she held numerous Executive and Board roles before becoming Deputy CEO Deloitte North-West Europe in 2017 and Global Chair from 2019, before retiring at the end of 2023. Sharon is an advocate for collective action on environmental sustainability and climate change and is a strong believer in the need for greater diversity, equity, and inclusion in business and civil society, and she has long championed greater diversity in senior leadership roles. Current external appointments: Governor, London Business School; Trustee, Royal United Services Institute; Advisory Board Member, Common Goal; and Advisory Council Member, Deloitte Centre for Sustainable Progress. Sharon is recommended for election. 6 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Dominic Barton BBM Chair, BA (Hons), M.Phil, Age 62. Appointed April 2022; Chair from May 2022. Chair of the Nominations Committee. Member of People & Remuneration Committee and Sustainability Committee. Skills and experience: Dominic spent over 30 years at McKinsey & Company, including 9 years as the Global Managing Partner, and has also held a broad range of public sector leadership positions. He has served as Canada’s Ambassador to China, Chair of Canada’s Advisory Council for Economic Growth, and Chair of the International Advisory Committee to the President of South Korea on National Future and Vision. Dominic brings a wealth of global business experience, including deep insight of geopolitics, corporate sustainability and governance. His business acumen and public sector experience position him to provide balanced guidance to Rio Tinto. Current external appointments: Chair of LeapFrog Investments. Dominic is recommended for re-election. Peter Cunningham Chief Financial Officer, BA (Hons), Chartered Accountant (England and Wales). Age 58. Appointed June 2021. Skills and experience: As Chief Financial Officer, Peter brings extensive commercial expertise from working across the Group in various geographies. He is strongly focused on the decarbonisation of our assets, investing in the commodities essential for the energy transition, and delivering attractive returns to shareholders while maintaining financial discipline. During over 3 decades with Rio Tinto, Peter has held a number of senior leadership roles, including Group Controller, Chief Financial Officer – Organisational Resources, Global Head of Health, Safety, Environment & Communities, Head of Energy and Climate Strategy, and Head of Investor Relations. Current external appointments: None. Peter is recommended for re-election. Dean Dalla Valle Independent Non-Executive Director, MBA. Age 65. Appointed June 2023. Chair of Sustainability Committee, Member of People & Remuneration Committee and Nominations Committee. Skills and experience: Dean brings over 4 decades of operational and project management experience in the resources and infrastructure sectors. He draws on 40 years’ experience at BHP where he was Chief Commercial Officer, President of Coal and Uranium, President and Chief Operating Officer Olympic Dam, President Cannington, Vice President Ports Iron Ore and General Manager Illawarra Coal. He has had direct operating responsibility in 11 countries, working across major mining commodities and brings a wealth of experience in engaging with a broad range of stakeholders globally, including governments, investors and communities. Dean was Chief Executive Officer of Pacific National from 2017 to 2021. Current external appointments: Chair of Hysata. Dean is recommended for re-election. Simon Henry Independent Non-Executive Director, MA, FCMA. Age 63. Appointed April 2017. Chair of Audit & Risk Committee, Member of Nominations Committee. Skills and experience: Simon has significant experience in global finance, corporate governance, mergers and acquisitions, international relations, and strategy. He draws on over 30 years’ experience at Royal Dutch Shell plc, where he was Chief Financial Officer between 2009 to 2017. Current external appointments: Senior Independent Director of Harbour Energy plc, Adviser to the Board of Oxford Flow Ltd, member of the Board of the Audit Committee Chairs’ Independent Forum, member of the Advisory Board of the Centre for European Reform and Advisory Panel of the Chartered Institute of Management Accountants (CIMA), and trustee of the Cambridge China Development Trust. Simon is recommended for re-election. 7Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Susan Lloyd-Hurwitz Independent Non-Executive Director, BA (Hons) MBA (Dist). Age 57. Appointed June 2023. Member of People & Remuneration Committee. Skills and experience: Susan brings significant experience in the built environment sector with a global career spanning over 30 years. Most recently Susan was Chief Executive Officer and Managing Director of Mirvac Group for over a decade. Prior to this, she was Managing Director at LaSalle Investment Management, and held senior executive positions at MGPA, Macquarie Group and Lendlease Corporation. Current external appointments: President of Chief Executive Women, Chair of the Australian National Housing Supply and Affordability Council and the Australian Centre for Gender Equality and Inclusion @ Work Advisory Board, Non-Executive Director of Macquarie Group and Spacecube, Member of the Sydney Opera House Trust and Global Board member at INSEAD. Susan is recommended for re-election. Martina Merz Independent Non-Executive Director, B.Eng. Age 61. Appointed February 2024. Member of Sustainability Committee. Skills and experience: Martina brings over 38 years of extensive leadership and operational experience, most recently as CEO of industrial engineering and steel production conglomerate ThyssenKrupp AG. She has held numerous leadership roles, including at Robert Bosch GmbH and at Chassis Brakes International. Martina also has extensive listed company experience and is known for her expertise in the areas of strategy, risk management, legal/compliance and human resources. Current external appointments: Member of the Supervisory Board at AB Volvo and Member of the Shareholder Council of the Foundation Carl-Zeiss-Stiftung as the owner of Zeiss AG and Scott AG. Martina is recommended for re-election. Jennifer Nason Independent Non-Executive Director, BA, BCom (Hons). Age 64. Appointed March 2020. Member of Audit & Risk Committee and People & Remuneration Committee. Skills and experience: Jennifer has over 38 years’ experience in corporate finance and capital markets. She was the Global Chair of Investment Banking at JP Morgan, based in the US, and for the past 20 years, led the Technology, Media and Telecommunications global client practice. During her time at JP Morgan, she worked in the metals and mining sector team in Australia and co-founded and chaired the Investment Banking Women’s Network and sat on the Executive Committee for the Investment Bank. Current external appointments: Co-Chair of the American Australian Business Council, Non-Executive Director of Accenture and Independent Trustee of Dodge and Cox. Jennifer is recommended for re-election. Joc O’Rourke Independent Non-Executive Director, BSc, EMBA. Age 64. Appointed October 2023. Member of the Audit & Risk Committee. Skills and experience: Joc has over 35 years’ experience across the mining and minerals industry. He was the Chief Executive Officer of The Mosaic Company, the world’s leading integrated producer and marketer of concentrated phosphate and potash, from 2015 to 2023. He also served as President of Mosaic until recently and previously held roles there including Executive Vice President of Operations and Chief Operating Officer. Prior to this, he was President of Australia Pacific at Barrick Gold Corporation, leading gold and copper mines in Australia and Papua New Guinea. Joc is known for his deep knowledge of the mining industry, and passion for improving safety and operational performance. Current external appointments: Non-Executive Director at the Toro Company, and The Weyerhaeuser Company. Joc is recommended for re-election. 8 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Jakob Stausholm Chief Executive, Ms Economics. Age 56. Appointed Chief Financial Officer September 2018; Chief Executive from January 2021. Skills and experience: As Chief Executive, Jakob brings strategic and commercial expertise and governance experience. He is committed to building trust with communities, building a strong workplace culture, and to continuously improving operational performance while delivering attractive returns to shareholders. Jakob joined Rio Tinto in 2018 as Chief Financial Officer. He has over 20 years’ experience, primarily in senior finance roles at Maersk Group and Royal Dutch Shell plc, including in capital-intensive, long-cycle businesses, as well as in innovative technology and supply chain optimisation. He was also a Non-Executive Director of Woodside Petroleum and Statoil (now Equinor). Current external appointments: None. Jakob is recommended for re-election. Ngaire Woods CBE Independent Non-Executive Director, BA/LLB, DPhil. Age 62. Appointed September 2020. Member of Sustainability Committee and Nominations Committee. Skills and experience: Ngaire is the founding Dean of the Blavatnik School of Government, Professor of Global Economic Governance and the Founder of the Global Economic Governance Programme at Oxford University. As a recognised expert in public policy, international development and governance, she has served as an adviser to the African Development Bank, the Asian Infrastructure Investment Bank, the Center for Global Development, the International Monetary Fund, and the European Union. Current external appointments: Trustee of the Schwarzman Education Foundation and Member of the Conseil d’administration of L’Institut national du service public. Ngaire is recommended for re-election. Ben Wyatt Independent Non-Executive Director, LLB, MSc. Age 50. Appointed September 2021. Member of Audit & Risk Committee and People & Remuneration Committee. Skills and experience: Ben had a prolific career in the Western Australian Parliament before retiring in 2021. He held a number of ministerial positions and became the first Indigenous treasurer of an Australian parliament. His extensive knowledge of public policy, finance, international trade and Indigenous affairs brings valuable insight and adds to the depth of knowledge on the Board. Ben was previously an officer in the Australian Army Reserves, and went on to have a career in the legal profession as a barrister and solicitor. Current external appointments: Non-Executive Director of Woodside Energy Group Ltd, Telethon Kids Institute and West Coast Eagles, and member of the Advisory Committee of Australian Capital Equity. Ben is recommended for re-election. Resolutions 16-17 Re-appointment and remuneration of auditors Under UK law, the shareholders are required to approve the appointment of Rio Tinto plc’s auditor each year. The appointment runs until the conclusion of Rio Tinto’s 2026 AGMs. Under Rio Tinto’s DLC structure, the appointment of Rio Tinto plc’s auditors is a Joint Decision Matter and has therefore been considered by Rio Tinto Limited and Rio Tinto plc shareholders at each AGM since the DLC structure was established in 1995. On recommendation of the Audit & Risk Committee, the Board proposes the re-appointment of Rio Tinto plc’s current auditors. KPMG LLP have expressed their willingness to continue in office for a further year. In accordance with UK company law and good corporate governance practice, shareholders are also asked to authorise the Audit & Risk Committee to determine the auditors’ remuneration. Resolution 18 Authority to make political donations Under UK law there is a prohibition against making political donations without authorisation of a company’s shareholders in a general meeting. The authority being sought is not proposed or intended to alter Rio Tinto’s policy of not making political donations, within the normal meaning of that expression. However, the definitions of political donation, political expenditure and/or political organisation in the UK Companies Act are defined very widely. Because of this, it may be that some of Rio Tinto’s activities could fall within this definition and, without the necessary authorisation, Rio Tinto’s ability to communicate its views effectively to political audiences and to relevant interest groups could be inhibited. In particular, the definition of political organisations may extend to bodies such as those concerned with policy review, law reform, the representation of the business community and special interest groups, such as those concerned with the environment. 9Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions As a result, the definition may cover legitimate business activities that would not, in the ordinary sense, be considered to be political donations or political expenditure. The authority that the Board is requesting is a precautionary measure to ensure Rio Tinto does not inadvertently breach the UK Companies Act. In accordance with the United States Federal Election Campaign Act, Rio Tinto provides administrative support for the Rio Tinto America Political Action Committee (PAC). The PAC was created in 1990 and encourages voluntary employee participation in the political process. All Rio Tinto America PAC employee contributions are reviewed for compliance with federal and state law and are publicly reported in accordance with US election laws. The PAC is controlled by neither Rio Tinto nor any of its subsidiaries but instead by a governing board of five employee members on a voluntary basis. In 2024, contributions to Rio Tinto America PAC by 14 employees amounted to US$14,815, and Rio Tinto America PAC donated US$10,500 in political contributions in 2024. Accordingly, the Directors believe that supporting the authority sought in this resolution is in the interests of shareholders. Any expenditure that may be incurred under this authority will be disclosed in next year’s Annual Report. Details of political expenditure by Rio Tinto during the past year are set out on page 150 in the 2024 Annual Report. Words and expressions used in Resolution 18 that are defined in Part 14 of the UK Companies Act shall have the same meanings for the purposes of Resolution 18. Resolution 19 2025 Climate Action Plan Resolution 19 is a non-binding advisory vote in relation to Rio Tinto’s 2025 Climate Action Plan (2025 CAP). The 2025 CAP is set out in pages 41-75 of the 2024 Annual Report and is available at riotinto.com/annualreport. It sets out the company’s climate ambitions and strategy, emissions targets and the actions to achieve them. We will continue to publish our progress annually in line with reporting standards and to regularly engage with shareholders and other stakeholders on our climate commitments. Rio Tinto has a key role to play in the global transition to a low carbon economy. This includes producing the materials the world needs to decarbonise such as the copper, aluminium and iron ore increasingly required for electrification and transition of energy systems and by reducing our own, operational emissions, and helping our customers reduce theirs. Our first CAP was approved by shareholders at our 2022 AGMs with the support of 84.3% of the votes cast, and included a commitment to report on our progress annually and to update the CAP every 3 years. The 2025 CAP builds on our 2022 CAP by detailing our strategy to grow production of transition materials, retaining our commitments to reduce operational emissions and demonstrating that working together with our customers, suppliers and others will support the decarbonising of our value chains. In particular, the 2025 CAP includes: – How our Group Scenarios are utilised to identify climate risks and portfolio opportunities, and are applied to test the resilience of our strategy and business under a range of outcomes. – The carbon footprint of our operations and value chain, the medium and long-term decarbonisation targets for our Scope 1 and 2 emissions and how we are working with customers and suppliers on the emissions of our value chains. – The pathway and approach to reducing operational emissions including: 1) developing renewable electricity solutions at our Pacific Aluminium Operations and other assets, 2) transitioning from diesel usage by our mining operations’ mobile equipment, and 3) addressing hard-to-abate processing emissions in our smelting and refining facilities. – How we are integrating high – integrity nature-based solutions into our decarbonisation strategy and the limited use of offsets towards our 2030 decarbonisation targets. – Capital and other expenditure allocated to achieving our decarbonisation targets and the disciplined investment approach taken to determining allocation of this capital. – How we are working with communities and host countries to facilitate a transition that puts people at the centre while working to minimise impacts and optimise socio-economic opportunities. – Our approach to supporting policies which enable the decarbonisation of operational emissions, the production of metals and minerals required for the energy transition, and progress towards the goals of the Paris Agreement directly with host governments and indirectly via industry associations. – The strategies which are enhancing our physical resilience to a changing climate, and supporting the viability of our assets, people, and communities. – Details of the integration of decarbonisation progress into short- and long-term incentives, and how the Board engages on climate issues. The CAP is underpinned by a clear pathway to achieving 50% reductions in Scope 1 and 2 emissions by 2030 and ultimately targeting net zero operational emissions by 2050. The Board regularly reviews progress against our climate commitments is fully aligned with this action plan and believes it will deliver value for our shareholders, our customers and wider society positioning Rio Tinto strongly for the low carbon future. This advisory vote in no way removes the Board’s responsibility for the Group’s climate strategy, but rather offers shareholders the opportunity for a more informed dialogue on Rio Tinto’s climate ambition, in addition to other engagement opportunities. The Board recommends that shareholders vote in favour of the proposed 2025 CAP which retains ambitious emissions reduction targets and strengthens the company by positioning Rio Tinto to produce the materials in increasing demand from the energy transition and reducing our exposure to volatile fossil fuel prices and higher carbon penalty costs. The Board is ultimately responsible for determining our climate strategy, and this vote is non-binding. The Board will consider the outcome and discussions from the meeting in advancing the 2025 CAP. The Board and the management team are committed to ensuring that the CAP will guide the actions of all Group product groups, entities and functions. 10 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions Resolution 20 General authority to allot shares Under section 551 of the Companies Act, the Directors may only allot shares or grant rights to subscribe for, or convert any security into, shares if authorised to do so by shareholders. This Resolution would give the Directors the authority to allot new shares, and grant rights to subscribe for, or convert other securities into shares, up to an aggregate nominal amount equal to £41,768,389 (representing 417,683,890 ordinary shares of 10p each). This amount represents not more than one third of the total issued ordinary share capital of the Company, exclusive of treasury shares, as at 7 February 2025, the latest practicable date prior to publication of this notice (the Latest Practicable Date). For the avoidance of doubt this Resolution does not seek authority to allot new shares in connection with a rights issue or other pre-emptive offer up to a further (second) one third of the total issued ordinary share capital of the Company. At the Latest Practicable Date, the Company held 2,907,902 treasury shares, which represents 0.23% of the total number of the Company’s ordinary shares in issue, excluding treasury shares, at that date. The authority sought under this resolution, if approved, will expire at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026) unless renewed, varied or revoked by the Company in general meeting. The Directors have no present plans to exercise authority sought under this resolution, except in connection with employee share and incentive plans. The Directors consider it desirable, however, to have flexibility, as permitted by corporate governance guidelines including the Investment Association’s Share Capital Management Guidelines, to manage the Group’s capital resources. Resolutions 21 Disapplication of pre-emption rights The Directors are also seeking authority to allot new shares (and other equity securities), or sell treasury shares, for cash without first offering them to existing shareholders in proportion to their existing holdings. The authority granted under this resolution would be limited to: (a) where the Company undertakes a pre-emptive offer by way of an open offer or rights issue, then the Directors may make exclusions or other arrangements in order to deal with treasury shares, fractional entitlements or legal or practical problems arising under the laws of any overseas jurisdiction, or the requirements of any recognised regulatory body or stock exchange, or other matters; or (b) otherwise up to an aggregate nominal amount of £8,121,339 (representing 81,213,390 ordinary shares of 10p each). As historically agreed with the Association of British Insurers (the precursor body to the Investment Association), this aggregate amount represents not more than 5% of the combined issued ordinary share capital of the Company and Rio Tinto Limited (exclusive of shares held in treasury by the Company) as at the Latest Practicable Date. If Resolution 21 is passed, the authority will expire at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026) unless renewed, varied or revoked by the Company in general meeting. For the avoidance of doubt, we are not this year seeking approval for the increased level of disapplication of pre-emption rights published by the Pre-emption Group on 4 November 2022 or approval for a separate additional authority in respect of acquisitions or specified capital investments. The Board confirms that it intends to follow the shareholder protections contained in Part 2B of the Pre-Emption Group Principles. Resolution 22 Authority to purchase Rio Tinto plc shares Consistent with its practice in prior years, the Board is seeking authority to buy back shares in the Group. The overall purpose of the buy-back resolutions of the Company and Rio Tinto Limited is to provide the Group with flexibility in the conduct of its capital management initiatives, whether through on – or off-market share buy-backs in either or both of the Company and/or Rio Tinto Limited. The Directors have no current intention to exercise the authority conferred pursuant to Resolution 22, and would only intend to do so when that would be in the best interests of the Company and its shareholders. The authority conferred by the resolutions to be approved at the Company’s and Rio Tinto Limited’s 2025 AGMs would allow buy-backs of ordinary shares in the Company, either by the Company on-market or by Rio Tinto Limited (or a subsidiary of Rio Tinto Limited) on-market, and buy-backs by Rio Tinto Limited of its ordinary shares, either under off-market buy-back tenders or on-market. In 2024, there were no capital management share purchase programmes. Under the DLC agreements, the approval for a buy-back of the Company’s ordinary shares, whether by the Company or by Rio Tinto Limited (or a subsidiary of Rio Tinto Limited), is voted on by the Company’s shareholders only. Similarly, the approval for Rio Tinto Limited to buy back its ordinary shares is voted on by Rio Tinto Limited shareholders only. These approvals were most recently renewed at the 2024 AGMs and expire on the date of the 2025 AGMs. Authority is sought for the Company, Rio Tinto Limited and/or any of Rio Tinto Limited’s subsidiaries, to purchase up to 10% of the issued ordinary share capital of the Company during the period stated below. The authority will expire at the end of the AGM of the Company held in 2026 (or, if earlier, at the close of business on 30 June 2026). The authority sought would permit the Company, Rio Tinto Limited and/or any of Rio Tinto Limited’s subsidiaries to purchase up to 125,305,168 of the Company’s ordinary shares, representing approximately 10% of its issued ordinary share capital, excluding the shares held in treasury, as at the Latest Practicable Date. The maximum price that may be paid for an ordinary share (exclusive of expenses) is an amount equal to the higher of: (a) 5% above the average of the middle market quotations for an RTP Ordinary Share as derived from the London Stock Exchange Daily Official List during the period of five business days immediately prior to the day on which such share is contracted to be purchased; or (b) the higher of the price of the last independent trade and the highest current independent bid on the trading venue where the purchase is carried out. 11Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions The minimum price that may be paid for an ordinary share (exclusive of expenses) is its nominal value. By way of illustration, the purchase of ordinary shares in the Company with a total value of US$500 million at exchange rates prevailing on 31 December 2024 would (if funded by debt), increase the Group’s net debt and reduce equity attributable to shareholders by US$500 million and, on the basis of the Group’s 2024 financial statements, would increase the ratio of net debt to total capital by 0.7 percentage points, from 8.7% to approximately 9.4%. The total number of outstanding employee share awards at the Latest Practicable Date was 4,326,194, which represents 0.35% of the issued ordinary share capital, excluding the shares held in treasury at that date. If the Company were to buy back the maximum number of shares permitted pursuant to this resolution, then this number of awards would represent 0.38% of the issued ordinary share capital, excluding the shares held in treasury. Pursuant to the Companies Act, the Company can hold the ordinary shares that have been repurchased itself as treasury shares and resell them for cash, cancel them (either immediately or at a point in the future) or use them for the purposes of its employee share plans. Whenever any ordinary shares are held as treasury shares, all dividend and voting rights on these shares are suspended. Any shares purchased under the authority, if approved, would be cancelled. The authority being sought in paragraph (a) of Resolution 23 extends to Rio Tinto Limited and/or any of its subsidiaries. Any purchase by the Company from Rio Tinto Limited (or such subsidiaries) of the Company’s ordinary shares would be an off-market purchase and the Companies Act requires the terms of any proposed contract for an off-market purchase to be approved by a special resolution of the Company before the contract is entered into. Such approval is sought in paragraph (b) of Resolution 23. The Company is seeking the approval of shareholders for such off-market purchases from Rio Tinto Limited and/or any of its subsidiaries as may take place to be made at a price not less than one penny per parcel of shares. It is expected that such purchases would occur for nominal consideration. It is immaterial to the shareholders of either the Company or Rio Tinto Limited if Rio Tinto Limited or any of Rio Tinto Limited’s subsidiaries make a gain or a loss on such transactions as they have no effect on the Group’s overall resources. The underlying purpose of these transactions would be to facilitate any capital management programme that the Group may be implementing at the relevant time, with the intention of returning surplus cash to shareholders in the most efficient manner. The DLC Merger Sharing Agreement contains the principles of equalisation, which ensure that entitlements to distributions of income and capital will be the same for all continuing shareholders regardless of whether the Company’s or Rio Tinto Limited’s shares are purchased or whether the Company, Rio Tinto Limited or a subsidiary of Rio Tinto Limited acts as the purchaser. Rio Tinto Limited will also seek to renew its shareholder approval to buy back its own ordinary shares at its 2025 AGM on 1 May 2025. Resolution 23 Notice period for general meetings other than AGMs Changes made to the Companies Act by the Companies (Shareholder Rights) Regulations 2009 (the Regulations) increased the notice period required for general meetings of the Company to 21 days, unless shareholders approve a shorter notice period, which cannot, however, be less than 14 clear days. AGMs will continue to be held on at least 21 clear days’ notice. Before the Regulations came into force on 3 August 2009, the Company was able to call general meetings, other than an AGM, on 14 clear days’ notice without obtaining such shareholder approval. To preserve this ability, the Company has sought and obtained the required shareholder approval at each AGM since 2009. Resolution 24 seeks to renew this approval. The approval will be effective until the Company’s AGM in 2026, when it is intended that a similar resolution will be proposed. The shorter notice period would not be used as a matter of routine for such meetings but only where the flexibility is merited by the business of the meeting and is thought to be to the advantage of shareholders as a whole. Resolution 24 Shareholder requisitioned resolution Resolution 24 has not been proposed by the Board. The resolution was requisitioned by certain shareholders of the Company pursuant to section 338 of the UK Companies Act 2006, and an equivalent resolution is being submitted as a Joint Decision Matter at the Rio Tinto Limited AGM. Their explanatory statement is set out in Appendix 1 on page 14, which the Company is required to circulate to its shareholders pursuant to section 314 of the Companies Act. This statement is also circulated to Rio Tinto Limited shareholders in the Rio Tinto Limited notice of meeting. Statement by the Board The Board considers that Resolution 24 is against the best interests of shareholders and of Rio Tinto as a whole and unanimously recommends that you vote AGAINST Resolution 24. The reasons for this recommendation are summarised below and are set out in more detail in Appendix 2 on pages 15-17. Rio Tinto periodically reviews the merits of retaining the DLC structure as part of evaluating options to maximise sustainable value for all Rio Tinto shareholders. A comprehensive review of the DLC structure by the full Board was completed in 2024. That review lasted several months and included substantial input and advice from external financial advisers (Goldman Sachs and J.P. Morgan) and legal advisers (Linklaters LLP and Allens). Detailed tax analysis was undertaken by professional services firm EY. The Board carefully considered the findings of the review and reached the unanimous conclusions summarised below. The DLC structure continues to be effective and provide benefits to Rio Tinto and its shareholders (i) The DLC structure provides access to significant depth of liquidity in demand for, and trading of, Rio Tinto shares. This is achieved through primary listings and premium index inclusion in two major capital markets and mining investment centres, with a pre-eminent position in the UK market. 12 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Explanatory notes to the resolutions (ii) The DLC structure provides flexibility to raise capital, pursue strategic M&A and deliver shareholder returns. The DLC structure provides optionality for the Group to offer equity in either Rio Tinto plc or Rio Tinto Limited to raise capital or use as share consideration in acquisitions. The DLC structure fully supports the Group’s shareholder returns policy with Rio Tinto plc being one of the top five dividend payers in the FTSE-100. (iii) The DLC structure enables a more efficient utilisation of franking credits. Since the DLC structure was established, Rio Tinto Limited has always paid fully franked dividends to its shareholders and it is anticipated that Rio Tinto Limited will continue to do so in the longer term. Under a unified Rio Tinto, franking credits would need to be attached to all dividends paid, even though shareholders not tax-resident in Australia could not utilise them. It is anticipated that the Group would not be able to pay fully franked dividends in the longer term under a unified structure. A unification under Rio Tinto Limited would be value destructive for the Group (i) Unification is expected to result in tax costs in the mid-single digit billions of US dollars. This would reduce the Group’s net asset value per share. These tax costs were subject to detailed analysis by professional services firm EY. The nature and scope of these tax costs are specific to Rio Tinto, taking into account its structure, with significant operations outside Australia being held by Rio Tinto plc, and the tax positions across the large number of jurisdictions in which it operates. It is therefore misleading to compare the costs of unification for Rio Tinto to other companies. (ii) Unification is not expected to result in a unified Rio Tinto trading at or above the Rio Tinto Limited share price. There is unlikely to be sufficient incremental demand from Australian tax-resident shareholders to absorb the very significant number of new Rio Tinto Limited shares that would be issued on unification and therefore to support a higher unified Rio Tinto share price. As such, it is more likely that a re-rated unified Rio Tinto share price would trend towards the weighted average of the Rio Tinto plc and Rio Tinto Limited share prices. The Board firmly rejects Palliser’s claim that the DLC structure has resulted in value destruction of c.US$50 billion The Board believes that the assertions made by Palliser Capital Master Fund Ltd and its affiliates (together Palliser) are unfounded and misleading. They are based on flawed and highly selective assumptions. As set out in further detail in Appendix 2, Palliser attributes c.US$35.6 billion of this value to the “inability to issue stock for M&A” based on hypothetical assumptions for historical acquisitions by Rio Tinto. Palliser has failed to consider the matrix of factors that would have been considered by Rio Tinto at the time of each acquisition including, but not limited to, Rio Tinto’s capital allocation framework, the expectation of shareholder returns under different funding sources, and each acquisition counterparty’s willingness to accept Rio Tinto shares. Palliser attributes c.US$14.7 billion of value to franking credits that would have been utilised without the DLC in place. This is based on an unreasonable assumption that there would have been sufficient incremental demand for unified Rio Tinto shares from Australian tax-residents to utilise these franking credits and does not account for the resulting depletion of franking credits to facilitate fully-franked dividends in the longer term. The Board firmly rejects the notion that the DLC structure has resulted in value destruction of c.US$50 billion, and reiterates its strong focus on sustainable shareholder value creation and effective capital management. Resolution 24 is therefore against the best interests of shareholders and Rio Tinto as a whole Given the comprehensive review conducted in 2024 and the conclusive findings from that review in support of retaining the DLC structure, the Board unanimously believes that the proposal as set out in Resolution 24 is highly duplicative and unnecessary. There is no basis for expecting that an additional review including an independent expert report would lead to a different conclusion. In addition, there would be limited information that could be reasonably disclosed publicly given the confidential and highly commercially sensitive nature of the information, including detailed analysis of tax costs and forecast financial information. Publication of the full findings would be materially prejudicial to shareholders’ interests. Your Directors therefore unanimously recommend that you vote AGAINST Resolution 24, as the Directors intend to do so in respect of their own beneficial holdings. Appendix 2 on pages 15-17 contains further details setting out the reasons for the Board’s recommendation. Further information in relation to Resolution 24 may be published on the Rio Tinto website at riotinto.com/agm. 13Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Resolution 24 is a special resolution and has been requisitioned by certain shareholders, who have also requested that the Company circulates the statement set out below. The Company is legally required to circulate this statement to you. However, neither your Board nor the Company is responsible for its contents or for any inaccurate or misleading statements contained in it. “Our resolution seeks an independent, comprehensive and transparent review on whether Rio Tinto’s dual listed companies (“DLC”) structure should be unified into a single Australian-domiciled holding company. Management’s decision to retain the DLC structure conflicts starkly with the global opinion that the archaic structure lacks durability and that the interests of shareholders are best served though a conventional company structure. With such an extreme difference of opinion on a topic of such critical importance, the logical next step must be to test the anomalous conclusions of management’s internal review through our requested review. There is so much at stake for shareholders – indeed, Palliser Capital (UK) Limited and its affiliates (together, “Palliser”) believe that unification has the potential to unlock US$28 billion (27%) of upside in the near term for the shareholders of Rio Tinto Plc and further upside for the combined group over the medium term: https://unifyrio.com. Almost every other company with a DLC structure has already successfully unified it. Their directors – a cumulative >136 of them – concluded that the outdated structure was no longer working because of its serious inefficiencies. In all but one case, both ISS and Glass Lewis found their reasons for unification so persuasive that they recommended shareholders vote in favour of it.1 And that is exactly what shareholders did – by an overwhelming c.98%, on average. Indeed, the DLC-unwind of Rio Tinto’s closest peer, BHP, was recommended by each of its directors and approved by 97% of the shareholders who voted, many of whom are also shareholders in Rio Tinto. Even though BHP’s Australian line traded at a premium of 15%-20% to its UK line at the time, the shareholders in the Australian entity (98%) still believed that they would be better off under a single holding company rather than in two asymmetrical parts. BHP’s independent expert, Grant Samuel, set out the compelling rationale for why its shareholders were better off in a unified structure, much of which would evidently apply to Rio Tinto: https://www.bhp.com/-/media/documents/investors/ shareholderinformation/2021/unification/3circular.pdf. Time and time again, similar shortcomings of the DLC structure have been identified by directors and experts alike, as the reason for an unwind: (1) an inefficient capital structure; (2) impediment on capital allocation options; (3) a sub-optimal corporate governance regime; and (4) in the case of the UK/Australian DLCs, under-utilisation of franking credits. Palliser have assessed the financial impact of some of these deficiencies on Rio Tinto’s shareholders over the 30 year period since Rio Tinto incepted its DLC structure – which has seen 6 chairmen, 7 CEOs, 5 CFOs, 71 directors, 60 members of the executive committee and multiple market cycles come and go. 1. Since establishment in 2004, Glass Lewis recommended for unification, save for Thomson Reuters’ because the post-unification legal requirements on executive pay were not as stringent as those under the DLC structure. 2. Based on Rio Tinto’s reported taxes for 2023. 3. Excludes tender offers for minority shareholders in existing listed subsidiaries which included a cash or scrip alternative. 4. Rio Tinto implied total shareholder return based on weighting of total shares outstanding across Plc and Limited. 5. All figures are calculated as at 29 November 2024. Through independent expert analysis, they estimate that shareholders would have been c.US$50 billion better off so far, without the legacy structure: – Rio Tinto’s inability to offer an industry standard mix of cash and equity for its acquisitions has cost shareholders c.US$35.6 billion in additional book value; and – in a failure to achieve the DLC’s own stated objective, an estimated c.US$14.7 billion less franking credits have been utilised under the DLC structure compared to if Rio Tinto had been set up as an Australian holding company in 1995. Today, the outdated structure is alone responsible for a glaring US$24 billion valuation gap between the supposedly “equivalent” shares of Rio Tinto Plc and Rio Tinto Limited. With such a persuasive rationale for unification, management’s conclusion to maintain a corporate structure that every other large cap DLC has moved on from makes little sense: – Management asserts that unification would cost “mid-single digit billions of dollars”: Palliser estimates that the one-off transaction costs would total c.US$400 million. Furthermore, their independent tax analysis indicates that management’s figure consists primarily of an estimated c.US$140 million of additional annual tax expenses that would be payable by a unified Rio Tinto going forward, representing a <2% increase in annual tax paid by Rio Tinto2 and <0.6% of the group’s annual EBITDA. – Management claims that the DLC structure is no impediment to stock-based M&A: In reality, Rio Tinto has funded 100% of its acquisitions entirely with cash over the last 3 decades.3 This position is not only unsustainable but could seriously hinder Rio Tinto’s ability to diversify its portfolio at a time when key mining industry players are racing to secure scarce supply of metals critical to the energy transition. – Management predicts that the share price of a unified Rio Tinto would trade “down in a double-digit percent”: This did not happen in the highly comparable case of BHP, so why would it happen to Rio Tinto? Indeed, BHP’s total shareholder return has consistently outperformed Rio Tinto’s since announcement and completion of its own unification.4 – Management asserts that shareholder approval for unification would “be impossible”: Past precedents highlight the unequivocal preference of former DLC shareholders for a simplified corporate structure. With an average DLC shelf life of 9 years (excluding the Shell and Unilever anomalies), their shareholders did not have to wait so long before they were afforded the choice to unify. Management’s reasons to retain the status quo do not stand up against the weight of global evidence in favour of unification. With Palliser demonstrating the severe value-destruction caused by the DLC structure as well as the value-maximising opportunity unlocked through unification, it is only appropriate that Rio Tinto now conducts the more vigorous review we are seeking. Our request is not onerous but it is essential to properly assure shareholders that their ownership structure is truly suitable for the second largest mining company in the world.5” Appendix 1 – Statement provided by Palliser and other requisitioning shareholders in support of Resolution 24 14 Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com

Appendix 2 – Statement by the Board in response to Resolution 24 The Board considers that Resolution 24 is against the best interests of shareholders and of Rio Tinto as a whole and unanimously recommends that you vote AGAINST Resolution 24. A comprehensive review of the DLC structure by the full Board was completed in 2024 The Board regularly evaluates options to maximise sustainable value for all Rio Tinto shareholders. In this capacity, the Board periodically reviews the merits of retaining the DLC structure, most recently with a comprehensive review undertaken in 2024. The review was conducted over several months in 2024 and included substantial input and advice from external financial advisers (Goldman Sachs and J.P. Morgan) and legal advisers (Linklaters LLP and Allens). Detailed tax analysis was undertaken by professional services firm EY. The review considered alternative scenarios and took account of the specific characteristics and circumstances of Rio Tinto’s DLC structure, recognising that the reasons why other companies have unified their DLC structure, and the costs and benefits associated with doing so, do not apply to Rio Tinto given the materially different facts and circumstances of Rio Tinto’s own DLC structure. Specific factors considered include: (i) the geographic locations of the Group’s businesses with significant assets outside Australia held under Rio Tinto plc; (ii) the distribution of the Group’s shareholders which is heavily weighted towards Rio Tinto plc; and (iii) that a unification under Rio Tinto Limited would require the approval by special resolution of shareholders of each of Rio Tinto plc and Rio Tinto Limited. The findings were carefully considered by the full Board, including independent non-executive directors, at a specially convened board meeting in June 2024. The conclusions and recommendations of the review were critically and comprehensively tested and challenged by the Board, the majority of whom are independent directors appointed in the last three years. The Board concluded unanimously that unification under Rio Tinto Limited (or any other approach to unification of the DLC structure) is against the best interests of Rio Tinto, and of Rio Tinto plc’s and Rio Tinto Limited’s shareholders as a whole, and that the DLC structure should be retained. Rio Tinto has also engaged with Palliser at six meetings in 2024 and reviewed the analysis produced by Palliser. The Board has unanimously reaffirmed its conclusion in light of the assertions made by Palliser. An additional review as proposed by Resolution 24 is highly duplicative and proposed disclosure would be materially prejudicial to shareholders’ interests Given the rigorous process undertaken and the findings of the comprehensive review in 2024, the Board firmly believes that a further review as proposed by Resolution 24 would be highly duplicative of the comprehensive review already undertaken and is therefore unnecessary. It is the Board’s view that an additional review including an independent expert report would lead to the same conclusion. In addition, the findings of a further review would contain confidential and highly commercially sensitive information, including detailed analysis of tax costs and forecast financial information. If published, such analysis and information would be materially prejudicial to shareholders’ interests and could have unintended and adverse consequences for Rio Tinto. The Board therefore believes that the information which could reasonably be disclosed, as proposed by Resolution 24, would be limited. The Board further considers the attendance by a shareholder representative at a committee, as proposed by Resolution 24, to be inappropriate. The shareholder may not be representative of the views of the Group’s wider investment community. They would also have access to confidential and highly commercially sensitive information that could not be made publicly available to other shareholders. Consistent with best practice, Rio Tinto’s established programmes for shareholder engagement already facilitate feedback and open dialogue to maximise the long-term value of the Group. Why the Board unanimously supports retaining the DLC structure 1. The DLC structure continues to be effective and provides benefits to Rio Tinto and its shareholders (i) The DLC structure provides Rio Tinto with access to global capital markets. The DLC structure provides access to significant depth of liquidity in demand for, and trading of, Rio Tinto shares. This is achieved through primary listings and premium index inclusion in two major capital markets and mining investment centres. Rio Tinto plc has a pre-eminent position in the UK market as the default investment in the mining sector and one of the ten largest companies in the FTSE-100 index. (ii) The DLC structure provides flexibility to raise capital, pursue strategic M&A and deliver shareholder returns. – The DLC structure provides optionality for raising capital and executing strategic M&A. The DLC structure provides the ability to offer equity in either Rio Tinto plc or Rio Tinto Limited to raise capital or use as share consideration in acquisitions. The choice of cash or equity, in either Rio Tinto plc or Rio Tinto Limited (or both), to fund acquisitions is a function of a broad range of factors including, amongst others, balance sheet capacity, impact on earnings per share and target shareholders’ preferences. Since the formation of the DLC structure, Rio Tinto has undertaken strategic M&A using stock and/or cash. In each case Rio Tinto carefully evaluates all acquisition funding options to deliver the optimal outcome for shareholders. – The DLC structure fully supports the Group’s shareholder returns policy. Rio Tinto intends to continue to distribute significant amounts of cash to shareholders, which the Board acknowledges is at the core of the Group’s investment proposition. Since implementing its shareholder returns policy in 2016, the Group has consistently delivered cash returns to shareholders at the upper end of the 40% to 60% range, in line with or above key peers. Rio Tinto plc is one of the top five dividend payers in the FTSE-100. The Board expects total cash returns to shareholders over the longer term to be in a range of 40% to 60% of underlying earnings in aggregate through the cycle. 15Rio Tinto plc 2025 Notice of annual general meeting | riotinto.com