UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06665

T. Rowe Price Mid-Cap Growth Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Growth Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Growth Fund - Investor Class | $79 | 0.75% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns over the past 12 months, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the presidential election ended a lengthy period of uncertainty, boosting stocks further. Within the mid-cap segment, growth stocks strongly outperformed value counterparts, with speculative, high-beta, and growth-at-any price stocks performing especially well.

Versus the style-specific Russell Midcap Growth Index, the leading contributor to relative performance was stock selection in communication services. Shares of social media network Reddit, which went public early in the first quarter of 2025, soared on strong results reflecting broad-based strength. Spotify and Trade Desk were also strong performers in the sector.

On the negative side, the leading detractor from relative performance was health care due to stock choices and an overweight allocation. An uneven post-pandemic recovery continued to frustrate investors in medical device manufacturing company Teleflex. The information technology sector also hindered relative results, with both stock selection and an underweight allocation negatively affecting performance. Not holding high-momentum software names Palantir Technologies and AppLovin hurt relative results.

The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. We pay careful attention to risk and valuation relative to growth prospects, and our focus remains on owning quality companies with durable growth prospects and prudent balance sheets.

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,652 | 10,180 | 10,538 |

|---|

| 2015 | 10,790 | 10,194 | 10,418 |

|---|

| 2015 | 10,134 | 9,455 | 9,585 |

|---|

| 2015 | 10,656 | 10,048 | 9,980 |

|---|

| 2016 | 10,611 | 10,145 | 10,038 |

|---|

| 2016 | 10,818 | 10,412 | 10,195 |

|---|

| 2016 | 11,274 | 10,870 | 10,663 |

|---|

| 2016 | 11,328 | 11,327 | 10,711 |

|---|

| 2017 | 12,252 | 11,978 | 11,450 |

|---|

| 2017 | 12,984 | 12,339 | 11,932 |

|---|

| 2017 | 13,543 | 12,903 | 12,563 |

|---|

| 2017 | 14,144 | 13,721 | 13,418 |

|---|

| 2018 | 14,717 | 13,633 | 13,710 |

|---|

| 2018 | 14,851 | 14,163 | 14,143 |

|---|

| 2018 | 15,953 | 15,172 | 15,214 |

|---|

| 2018 | 13,855 | 13,002 | 12,780 |

|---|

| 2019 | 16,101 | 14,828 | 15,288 |

|---|

| 2019 | 17,217 | 15,435 | 16,114 |

|---|

| 2019 | 17,091 | 15,614 | 16,005 |

|---|

| 2019 | 18,224 | 17,035 | 17,314 |

|---|

| 2020 | 13,997 | 13,475 | 13,844 |

|---|

| 2020 | 17,889 | 16,443 | 18,033 |

|---|

| 2020 | 19,361 | 17,957 | 19,724 |

|---|

| 2020 | 22,628 | 20,593 | 23,475 |

|---|

| 2021 | 23,314 | 21,900 | 23,342 |

|---|

| 2021 | 24,851 | 23,705 | 25,927 |

|---|

| 2021 | 24,881 | 23,681 | 25,730 |

|---|

| 2021 | 26,035 | 25,877 | 26,463 |

|---|

| 2022 | 23,104 | 24,512 | 23,134 |

|---|

| 2022 | 19,418 | 20,418 | 18,259 |

|---|

| 2022 | 18,631 | 19,506 | 18,140 |

|---|

| 2022 | 20,170 | 20,907 | 19,392 |

|---|

| 2023 | 21,628 | 22,408 | 21,163 |

|---|

| 2023 | 22,769 | 24,288 | 22,483 |

|---|

| 2023 | 21,685 | 23,497 | 21,308 |

|---|

| 2023 | 24,226 | 26,334 | 24,408 |

|---|

| 2024 | 26,277 | 28,973 | 26,726 |

|---|

| 2024 | 25,066 | 29,904 | 25,867 |

|---|

| 2024 | 26,553 | 31,767 | 27,559 |

|---|

| 2024 | 26,503 | 32,604 | 29,803 |

|---|

202501-4140694, 202502-4108647

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Mid-Cap Growth Fund (Investor Class) | 9.40% | 7.78% | 10.24% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell Midcap Growth Index (Strategy Benchmark) | 22.10 | 11.47 | 11.54 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$30,172,838

- Number of Portfolio Holdings142

- Investment Advisory Fees Paid (000s)$154,216

- Portfolio Turnover Rate22.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Health Care | 20.3% |

| Information Technology | 18.0 |

| Industrials & Business Services | 16.0 |

| Consumer Discretionary | 13.5 |

| Financials | 8.5 |

| Communication Services | 6.8 |

| Energy | 5.2 |

| Materials | 4.7 |

| Consumer Staples | 4.3 |

| Other | 2.7 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 3.2% |

| Trade Desk | 2.6 |

| Hologic | 2.0 |

| Agilent Technologies | 1.8 |

| Teleflex | 1.8 |

| PTC | 1.8 |

| Veeva Systems | 1.7 |

| Domino's Pizza | 1.7 |

| Cheniere Energy | 1.7 |

| Microchip Technology | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Growth Fund

Investor Class (RPMGX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Growth Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Growth Fund - Advisor Class | $106 | 1.01% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns over the past 12 months, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the presidential election ended a lengthy period of uncertainty, boosting stocks further. Within the mid-cap segment, growth stocks strongly outperformed value counterparts, with speculative, high-beta, and growth-at-any price stocks performing especially well.

Versus the style-specific Russell Midcap Growth Index, the leading contributor to relative performance was stock selection in communication services. Shares of social media network Reddit, which went public early in the first quarter of 2025, soared on strong results reflecting broad-based strength. Spotify and Trade Desk were also strong performers in the sector.

On the negative side, the leading detractor from relative performance was health care due to stock choices and an overweight allocation. An uneven post-pandemic recovery continued to frustrate investors in medical device manufacturing company Teleflex. The information technology sector also hindered relative results, with both stock selection and an underweight allocation negatively affecting performance. Not holding high-momentum software names Palantir Technologies and AppLovin hurt relative results.

The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. We pay careful attention to risk and valuation relative to growth prospects, and our focus remains on owning quality companies with durable growth prospects and prudent balance sheets.

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,645 | 10,180 | 10,538 |

|---|

| 2015 | 10,776 | 10,194 | 10,418 |

|---|

| 2015 | 10,114 | 9,455 | 9,585 |

|---|

| 2015 | 10,628 | 10,048 | 9,980 |

|---|

| 2016 | 10,576 | 10,145 | 10,038 |

|---|

| 2016 | 10,776 | 10,412 | 10,195 |

|---|

| 2016 | 11,224 | 10,870 | 10,663 |

|---|

| 2016 | 11,269 | 11,327 | 10,711 |

|---|

| 2017 | 12,181 | 11,978 | 11,450 |

|---|

| 2017 | 12,900 | 12,339 | 11,932 |

|---|

| 2017 | 13,447 | 12,903 | 12,563 |

|---|

| 2017 | 14,033 | 13,721 | 13,418 |

|---|

| 2018 | 14,593 | 13,633 | 13,710 |

|---|

| 2018 | 14,716 | 14,163 | 14,143 |

|---|

| 2018 | 15,796 | 15,172 | 15,214 |

|---|

| 2018 | 13,711 | 13,002 | 12,780 |

|---|

| 2019 | 15,927 | 14,828 | 15,288 |

|---|

| 2019 | 17,019 | 15,435 | 16,114 |

|---|

| 2019 | 16,880 | 15,614 | 16,005 |

|---|

| 2019 | 17,986 | 17,035 | 17,314 |

|---|

| 2020 | 13,800 | 13,475 | 13,844 |

|---|

| 2020 | 17,627 | 16,443 | 18,033 |

|---|

| 2020 | 19,065 | 17,957 | 19,724 |

|---|

| 2020 | 22,266 | 20,593 | 23,475 |

|---|

| 2021 | 22,926 | 21,900 | 23,342 |

|---|

| 2021 | 24,419 | 23,705 | 25,927 |

|---|

| 2021 | 24,431 | 23,681 | 25,730 |

|---|

| 2021 | 25,547 | 25,877 | 26,463 |

|---|

| 2022 | 22,656 | 24,512 | 23,134 |

|---|

| 2022 | 19,030 | 20,418 | 18,259 |

|---|

| 2022 | 18,250 | 19,506 | 18,140 |

|---|

| 2022 | 19,742 | 20,907 | 19,392 |

|---|

| 2023 | 21,155 | 22,408 | 21,163 |

|---|

| 2023 | 22,260 | 24,288 | 22,483 |

|---|

| 2023 | 21,186 | 23,497 | 21,308 |

|---|

| 2023 | 23,652 | 26,334 | 24,408 |

|---|

| 2024 | 25,638 | 28,973 | 26,726 |

|---|

| 2024 | 24,441 | 29,904 | 25,867 |

|---|

| 2024 | 25,875 | 31,767 | 27,559 |

|---|

| 2024 | 25,808 | 32,604 | 29,803 |

|---|

202501-4140694, 202502-4108647

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Mid-Cap Growth Fund (Advisor Class) | 9.12% | 7.49% | 9.95% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell Midcap Growth Index (Strategy Benchmark) | 22.10 | 11.47 | 11.54 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$30,172,838

- Number of Portfolio Holdings142

- Investment Advisory Fees Paid (000s)$154,216

- Portfolio Turnover Rate22.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Health Care | 20.3% |

| Information Technology | 18.0 |

| Industrials & Business Services | 16.0 |

| Consumer Discretionary | 13.5 |

| Financials | 8.5 |

| Communication Services | 6.8 |

| Energy | 5.2 |

| Materials | 4.7 |

| Consumer Staples | 4.3 |

| Other | 2.7 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 3.2% |

| Trade Desk | 2.6 |

| Hologic | 2.0 |

| Agilent Technologies | 1.8 |

| Teleflex | 1.8 |

| PTC | 1.8 |

| Veeva Systems | 1.7 |

| Domino's Pizza | 1.7 |

| Cheniere Energy | 1.7 |

| Microchip Technology | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Growth Fund

Advisor Class (PAMCX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Growth Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Growth Fund - R Class | $135 | 1.29% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns over the past 12 months, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the presidential election ended a lengthy period of uncertainty, boosting stocks further. Within the mid-cap segment, growth stocks strongly outperformed value counterparts, with speculative, high-beta, and growth-at-any price stocks performing especially well.

Versus the style-specific Russell Midcap Growth Index, the leading contributor to relative performance was stock selection in communication services. Shares of social media network Reddit, which went public early in the first quarter of 2025, soared on strong results reflecting broad-based strength. Spotify and Trade Desk were also strong performers in the sector.

On the negative side, the leading detractor from relative performance was health care due to stock choices and an overweight allocation. An uneven post-pandemic recovery continued to frustrate investors in medical device manufacturing company Teleflex. The information technology sector also hindered relative results, with both stock selection and an underweight allocation negatively affecting performance. Not holding high-momentum software names Palantir Technologies and AppLovin hurt relative results.

The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. We pay careful attention to risk and valuation relative to growth prospects, and our focus remains on owning quality companies with durable growth prospects and prudent balance sheets.

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| R Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,639 | 10,180 | 10,538 |

|---|

| 2015 | 10,763 | 10,194 | 10,418 |

|---|

| 2015 | 10,096 | 9,455 | 9,585 |

|---|

| 2015 | 10,603 | 10,048 | 9,980 |

|---|

| 2016 | 10,543 | 10,145 | 10,038 |

|---|

| 2016 | 10,735 | 10,412 | 10,195 |

|---|

| 2016 | 11,173 | 10,870 | 10,663 |

|---|

| 2016 | 11,213 | 11,327 | 10,711 |

|---|

| 2017 | 12,111 | 11,978 | 11,450 |

|---|

| 2017 | 12,817 | 12,339 | 11,932 |

|---|

| 2017 | 13,352 | 12,903 | 12,563 |

|---|

| 2017 | 13,927 | 13,721 | 13,418 |

|---|

| 2018 | 14,473 | 13,633 | 13,710 |

|---|

| 2018 | 14,585 | 14,163 | 14,143 |

|---|

| 2018 | 15,646 | 15,172 | 15,214 |

|---|

| 2018 | 13,572 | 13,002 | 12,780 |

|---|

| 2019 | 15,749 | 14,828 | 15,288 |

|---|

| 2019 | 16,819 | 15,435 | 16,114 |

|---|

| 2019 | 16,674 | 15,614 | 16,005 |

|---|

| 2019 | 17,755 | 17,035 | 17,314 |

|---|

| 2020 | 13,617 | 13,475 | 13,844 |

|---|

| 2020 | 17,381 | 16,443 | 18,033 |

|---|

| 2020 | 18,787 | 17,957 | 19,724 |

|---|

| 2020 | 21,926 | 20,593 | 23,475 |

|---|

| 2021 | 22,560 | 21,900 | 23,342 |

|---|

| 2021 | 24,017 | 23,705 | 25,927 |

|---|

| 2021 | 24,010 | 23,681 | 25,730 |

|---|

| 2021 | 25,091 | 25,877 | 26,463 |

|---|

| 2022 | 22,236 | 24,512 | 23,134 |

|---|

| 2022 | 18,663 | 20,418 | 18,259 |

|---|

| 2022 | 17,888 | 19,506 | 18,140 |

|---|

| 2022 | 19,338 | 20,907 | 19,392 |

|---|

| 2023 | 20,710 | 22,408 | 21,163 |

|---|

| 2023 | 21,773 | 24,288 | 22,483 |

|---|

| 2023 | 20,707 | 23,497 | 21,308 |

|---|

| 2023 | 23,100 | 26,334 | 24,408 |

|---|

| 2024 | 25,026 | 28,973 | 26,726 |

|---|

| 2024 | 23,842 | 29,904 | 25,867 |

|---|

| 2024 | 25,219 | 31,767 | 27,559 |

|---|

| 2024 | 25,138 | 32,604 | 29,803 |

|---|

202501-4140694, 202502-4108647

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Mid-Cap Growth Fund (R Class) | 8.82% | 7.20% | 9.66% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell Midcap Growth Index (Strategy Benchmark) | 22.10 | 11.47 | 11.54 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$30,172,838

- Number of Portfolio Holdings142

- Investment Advisory Fees Paid (000s)$154,216

- Portfolio Turnover Rate22.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Health Care | 20.3% |

| Information Technology | 18.0 |

| Industrials & Business Services | 16.0 |

| Consumer Discretionary | 13.5 |

| Financials | 8.5 |

| Communication Services | 6.8 |

| Energy | 5.2 |

| Materials | 4.7 |

| Consumer Staples | 4.3 |

| Other | 2.7 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 3.2% |

| Trade Desk | 2.6 |

| Hologic | 2.0 |

| Agilent Technologies | 1.8 |

| Teleflex | 1.8 |

| PTC | 1.8 |

| Veeva Systems | 1.7 |

| Domino's Pizza | 1.7 |

| Cheniere Energy | 1.7 |

| Microchip Technology | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Growth Fund

R Class (RRMGX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Growth Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Growth Fund - I Class | $66 | 0.63% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns over the past 12 months, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the presidential election ended a lengthy period of uncertainty, boosting stocks further. Within the mid-cap segment, growth stocks strongly outperformed value counterparts, with speculative, high-beta, and growth-at-any price stocks performing especially well.

Versus the style-specific Russell Midcap Growth Index, the leading contributor to relative performance was stock selection in communication services. Shares of social media network Reddit, which went public early in the first quarter of 2025, soared on strong results reflecting broad-based strength. Spotify and Trade Desk were also strong performers in the sector.

On the negative side, the leading detractor from relative performance was health care due to stock choices and an overweight allocation. An uneven post-pandemic recovery continued to frustrate investors in medical device manufacturing company Teleflex. The information technology sector also hindered relative results, with both stock selection and an underweight allocation negatively affecting performance. Not holding high-momentum software names Palantir Technologies and AppLovin hurt relative results.

The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. We pay careful attention to risk and valuation relative to growth prospects, and our focus remains on owning quality companies with durable growth prospects and prudent balance sheets.

How has the fund performed?

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 8/28/15 | 500,000 | 500,000 | 500,000 |

|---|

| 9/30/15 | 479,193 | 481,606 | 475,811 |

|---|

| 12/31/15 | 503,959 | 511,802 | 495,405 |

|---|

| 3/31/16 | 502,034 | 516,758 | 498,274 |

|---|

| 6/30/16 | 511,933 | 530,351 | 506,061 |

|---|

| 9/30/16 | 533,725 | 553,674 | 529,299 |

|---|

| 12/31/16 | 536,471 | 576,980 | 531,711 |

|---|

| 3/31/17 | 580,394 | 610,118 | 568,370 |

|---|

| 6/30/17 | 615,276 | 628,516 | 592,326 |

|---|

| 9/30/17 | 642,042 | 657,248 | 623,619 |

|---|

| 12/31/17 | 670,703 | 698,900 | 666,064 |

|---|

| 3/31/18 | 698,145 | 694,395 | 680,547 |

|---|

| 6/30/18 | 704,697 | 721,399 | 702,035 |

|---|

| 9/30/18 | 757,191 | 772,791 | 755,211 |

|---|

| 12/31/18 | 657,926 | 662,265 | 634,422 |

|---|

| 3/31/19 | 764,666 | 755,270 | 758,902 |

|---|

| 6/30/19 | 817,907 | 786,199 | 799,896 |

|---|

| 9/30/19 | 812,221 | 795,339 | 794,509 |

|---|

| 12/31/19 | 866,369 | 867,693 | 859,450 |

|---|

| 3/31/20 | 665,662 | 686,348 | 687,216 |

|---|

| 6/30/20 | 851,007 | 837,534 | 895,174 |

|---|

| 9/30/20 | 921,273 | 914,650 | 979,084 |

|---|

| 12/31/20 | 1,077,052 | 1,048,935 | 1,165,297 |

|---|

| 3/31/21 | 1,110,074 | 1,115,510 | 1,158,710 |

|---|

| 6/30/21 | 1,183,540 | 1,207,426 | 1,287,004 |

|---|

| 9/30/21 | 1,185,348 | 1,206,198 | 1,277,224 |

|---|

| 12/31/21 | 1,240,664 | 1,318,104 | 1,313,619 |

|---|

| 3/31/22 | 1,101,392 | 1,248,528 | 1,148,361 |

|---|

| 6/30/22 | 926,086 | 1,040,009 | 906,381 |

|---|

| 9/30/22 | 888,891 | 993,577 | 900,463 |

|---|

| 12/31/22 | 962,648 | 1,064,936 | 962,608 |

|---|

| 3/31/23 | 1,032,491 | 1,141,402 | 1,050,550 |

|---|

| 6/30/23 | 1,087,392 | 1,237,129 | 1,116,045 |

|---|

| 9/30/23 | 1,035,848 | 1,196,875 | 1,057,743 |

|---|

| 12/31/23 | 1,157,641 | 1,341,360 | 1,211,604 |

|---|

| 3/31/24 | 1,256,026 | 1,475,756 | 1,326,664 |

|---|

| 6/30/24 | 1,198,520 | 1,523,216 | 1,284,034 |

|---|

| 9/30/24 | 1,270,114 | 1,618,099 | 1,368,027 |

|---|

| 12/31/24 | 1,268,030 | 1,660,708 | 1,479,406 |

|---|

202501-4140694, 202502-4108647

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 8/28/15 |

|---|

| Mid-Cap Growth Fund (I Class) | 9.54% | 7.92% | 10.48% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.71 |

|---|

| Russell Midcap Growth Index (Strategy Benchmark) | 22.10 | 11.47 | 12.31 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$30,172,838

- Number of Portfolio Holdings142

- Investment Advisory Fees Paid (000s)$154,216

- Portfolio Turnover Rate22.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Health Care | 20.3% |

| Information Technology | 18.0 |

| Industrials & Business Services | 16.0 |

| Consumer Discretionary | 13.5 |

| Financials | 8.5 |

| Communication Services | 6.8 |

| Energy | 5.2 |

| Materials | 4.7 |

| Consumer Staples | 4.3 |

| Other | 2.7 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 3.2% |

| Trade Desk | 2.6 |

| Hologic | 2.0 |

| Agilent Technologies | 1.8 |

| Teleflex | 1.8 |

| PTC | 1.8 |

| Veeva Systems | 1.7 |

| Domino's Pizza | 1.7 |

| Cheniere Energy | 1.7 |

| Microchip Technology | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Growth Fund

I Class (RPTIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Mid-Cap Growth Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mid-Cap Growth Fund - Z Class | $0 | 0.00% |

|---|

What drove fund performance during the past 12 months?

U.S. equities posted strong returns over the past 12 months, lifted by favorable economic data and corporate earnings reports, easing inflationary pressures, and short-term interest rate reductions by the Federal Reserve. The results of the presidential election ended a lengthy period of uncertainty, boosting stocks further. Within the mid-cap segment, growth stocks strongly outperformed value counterparts, with speculative, high-beta, and growth-at-any price stocks performing especially well.

Versus the style-specific Russell Midcap Growth Index, the leading contributor to relative performance was stock selection in communication services. Shares of social media network Reddit, which went public early in the first quarter of 2025, soared on strong results reflecting broad-based strength. Spotify and Trade Desk were also strong performers in the sector.

On the negative side, the leading detractor from relative performance was health care due to stock choices and an overweight allocation. An uneven post-pandemic recovery continued to frustrate investors in medical device manufacturing company Teleflex. The information technology sector also hindered relative results, with both stock selection and an underweight allocation negatively affecting performance. Not holding high-momentum software names Palantir Technologies and AppLovin hurt relative results.

The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. We pay careful attention to risk and valuation relative to growth prospects, and our focus remains on owning quality companies with durable growth prospects and prudent balance sheets.

How has the fund performed?

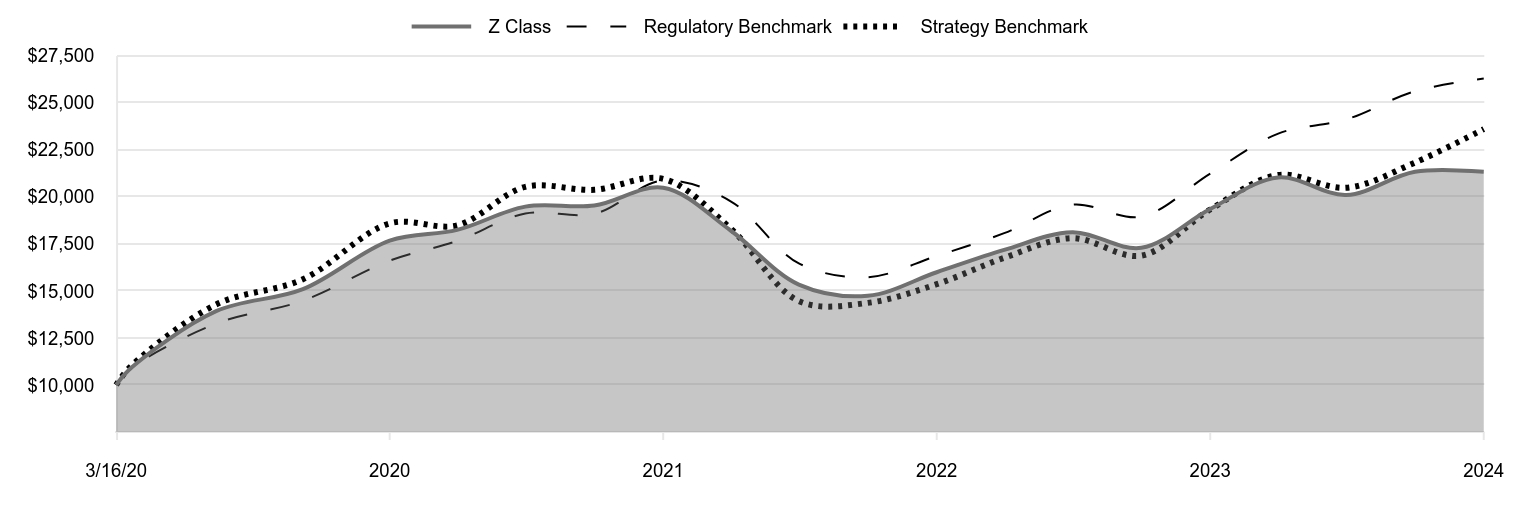

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/16/20 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/20 | 10,871 | 10,865 | 10,963 |

|---|

| 6/30/20 | 13,922 | 13,259 | 14,280 |

|---|

| 9/30/20 | 15,094 | 14,480 | 15,618 |

|---|

| 12/31/20 | 17,673 | 16,606 | 18,589 |

|---|

| 3/31/21 | 18,242 | 17,659 | 18,484 |

|---|

| 6/30/21 | 19,479 | 19,115 | 20,530 |

|---|

| 9/30/21 | 19,538 | 19,095 | 20,374 |

|---|

| 12/31/21 | 20,481 | 20,867 | 20,955 |

|---|

| 3/31/22 | 18,211 | 19,765 | 18,319 |

|---|

| 6/30/22 | 15,335 | 16,464 | 14,459 |

|---|

| 9/30/22 | 14,743 | 15,729 | 14,364 |

|---|

| 12/31/22 | 15,991 | 16,859 | 15,356 |

|---|

| 3/31/23 | 17,178 | 18,069 | 16,758 |

|---|

| 6/30/23 | 18,120 | 19,585 | 17,803 |

|---|

| 9/30/23 | 17,289 | 18,948 | 16,873 |

|---|

| 12/31/23 | 19,352 | 21,235 | 19,328 |

|---|

| 3/31/24 | 21,030 | 23,362 | 21,163 |

|---|

| 6/30/24 | 20,099 | 24,114 | 20,483 |

|---|

| 9/30/24 | 21,332 | 25,616 | 21,823 |

|---|

| 12/31/24 | 21,331 | 26,290 | 23,600 |

|---|

202501-4140694, 202502-4108647

Average Annual Total Returns

| | 1 Year | Since Inception 3/16/20 |

|---|

| Mid-Cap Growth Fund (Z Class) | 10.22% | 17.12% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 22.33 |

|---|

| Russell Midcap Growth Index (Strategy Benchmark) | 22.10 | 19.61 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$30,172,838

- Number of Portfolio Holdings142

- Investment Advisory Fees Paid (000s)$154,216

- Portfolio Turnover Rate22.6%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Health Care | 20.3% |

| Information Technology | 18.0 |

| Industrials & Business Services | 16.0 |

| Consumer Discretionary | 13.5 |

| Financials | 8.5 |

| Communication Services | 6.8 |

| Energy | 5.2 |

| Materials | 4.7 |

| Consumer Staples | 4.3 |

| Other | 2.7 |

Top Ten Holdings (as a % of Net Assets)

| Marvell Technology | 3.2% |

| Trade Desk | 2.6 |

| Hologic | 2.0 |

| Agilent Technologies | 1.8 |

| Teleflex | 1.8 |

| PTC | 1.8 |

| Veeva Systems | 1.7 |

| Domino's Pizza | 1.7 |

| Cheniere Energy | 1.7 |

| Microchip Technology | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Mid-Cap Growth Fund

Z Class (TRQZX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | | | 2024 | | | | | | 2023 | |

| | Audit Fees | | $ | 23,525 | | | | | | | $ | 24,714 | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | - | | | | | | | | - | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

RPMGX

Mid-Cap

Growth

Fund

PAMCX

Mid-Cap

Growth

Fund–

.

Advisor Class

RRMGX

Mid-Cap

Growth

Fund–

.

R Class

RPTIX

Mid-Cap

Growth

Fund–

.

I Class

TRQZX

Mid-Cap

Growth

Fund–

.

Z Class

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

100.04

$

88.71

$

117.34

$

113.08

$

95.33

Investment

activities

Net

investment

income

(loss)

(1)(2)

(0.02)

0.08

(0.13)

(0.33)

(0.06)

Net

realized

and

unrealized

gain/loss

9.90

17.60

(26.19)

16.93

22.93

Total

from

investment

activities

9.88

17.68

(26.32)

16.60

22.87

Distributions

Net

investment

income

—

(0.06)

—

—

—

Net

realized

gain

(10.19)

(6.29)

(2.31)

(12.34)

(5.12)

Total

distributions

(10.19)

(6.35)

(2.31)

(12.34)

(5.12)

NET

ASSET

VALUE

End

of

period

$

99.73

$

100.04

$

88.71

$

117.34

$

113.08

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

9.40%

20.11%

(22.52)%

15.06%

24.17%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.75%

0.76%

0.77%

0.72%

0.73%

Net

expenses

after

waivers/payments

by

Price

Associates

0.75%

0.76%

0.77%

0.72%

0.73%

Net

investment

income

(loss)

(0.02)%

0.08%

(0.13)%

(0.27)%

(0.06)%

Portfolio

turnover

rate

22.6%

21.7%

21.4%

13.9%

23.0%

Net

assets,

end

of

period

(in

millions)

$11,903

$12,450

$11,785

$22,145

$22,795

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

95.01

$

84.54

$

112.24

$

108.69

$

92.07

Investment

activities

Net

investment

loss

(1)(2)

(0.28)

(0.16)

(0.35)

(0.65)

(0.32)

Net

realized

and

unrealized

gain/loss

9.42

16.75

(25.04)

16.25

22.06

Total

from

investment

activities

9.14

16.59

(25.39)

15.60

21.74

Distributions

Net

realized

gain

(10.19)

(6.12)

(2.31)

(12.05)

(5.12)

NET

ASSET

VALUE

End

of

period

$

93.96

$

95.01

$

84.54

$

112.24

$

108.69

Ratios/Supplemental

Data

Total

return

(2)(3)

9.12%

19.80%

(22.72)%

14.73%

23.79%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.01%

1.01%

1.02%

1.00%

1.01%

Net

expenses

after

waivers/payments

by

Price

Associates

1.01%

1.01%

1.02%

1.00%

1.01%

Net

investment

loss

(0.28)%

(0.18)%

(0.38)%

(0.55)%

(0.35)%

Portfolio

turnover

rate

22.6%

21.7%

21.4%

13.9%

23.0%

Net

assets,

end

of

period

(in

millions)

$200

$223

$237

$479

$560

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

R

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

89.72

$

80.23

$

106.95

$

104.35

$

88.78

Investment

activities

Net

investment

loss

(1)(2)

(0.53)

(0.40)

(0.58)

(0.92)

(0.54)

Net

realized

and

unrealized

gain/loss

8.92

15.86

(23.83)

15.57

21.23

Total

from

investment

activities

8.39

15.46

(24.41)

14.65

20.69

Distributions

Net

realized

gain

(10.19)

(5.97)

(2.31)

(12.05)

(5.12)

NET

ASSET

VALUE

End

of

period

$

87.92

$

89.72

$

80.23

$

106.95

$

104.35

Ratios/Supplemental

Data

Total

return

(2)(3)

8.82%

19.45%

(22.93)%

14.43%

23.49%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.29%

1.30%

1.29%

1.27%

1.28%

Net

expenses

after

waivers/payments

by

Price

Associates

1.29%

1.30%

1.29%

1.27%

1.28%

Net

investment

loss

(0.56)%

(0.47)%

(0.66)%

(0.82)%

(0.61)%

Portfolio

turnover

rate

22.6%

21.7%

21.4%

13.9%

23.0%

Net

assets,

end

of

period

(in

thousands)

$28,579

$30,177

$30,084

$61,110

$89,697

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

100.25

$

88.90

$

117.41

$

113.18

$

95.31

Investment

activities

Net

investment

income

(loss)

(1)(2)

0.11

0.20

0.04

(0.19)

0.05

Net

realized

and

unrealized

gain/loss

9.93

17.65

(26.24)

16.95

22.96

Total

from

investment

activities

10.04

17.85

(26.20)

16.76

23.01

Distributions

Net

investment

income

(0.06)

(0.21)

—

—

(0.02)

Net

realized

gain

(10.19)

(6.29)

(2.31)

(12.53)

(5.12)

Total

distributions

(10.25)

(6.50)

(2.31)

(12.53)

(5.14)

NET

ASSET

VALUE

End

of

period

$

100.04

$

100.25

$

88.90

$

117.41

$

113.18

Ratios/Supplemental

Data

Total

return

(2)(3)

9.54%

20.26%

(22.41)%

15.19%

24.32%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.63%

0.63%

0.63%

0.61%

0.61%

Net

expenses

after

waivers/payments

by

Price

Associates

0.63%

0.63%

0.63%

0.61%

0.61%

Net

investment

income

(loss)

0.10%

0.21%

0.04%

(0.16)%

0.05%

Portfolio

turnover

rate

22.6%

21.7%

21.4%

13.9%

23.0%

Net

assets,

end

of

period

(in

millions)

$12,722

$12,370

$10,744

$9,378

$8,578

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

3/16/20

(1)

Through

12/31/20

12/31/24

12/31/23

12/31/22

12/31/21

NET

ASSET

VALUE

Beginning

of

period

$

100.79

$

89.28

$

117.53

$

113.24

$

67.37

Investment

activities

Net

investment

income

(2)(3)

0.78

0.81

0.63

0.55

0.46

Net

realized

and

unrealized

gain/loss

10.03

17.78

(26.28)

16.98

51.05

Total

from

investment

activities

10.81

18.59

(25.65)

17.53

51.51

Distributions

Net

investment

income

(0.69)

(0.79)

(0.29)

—

(0.20)

Net

realized

gain

(10.19)

(6.29)

(2.31)

(13.24)

(5.44)

Total

distributions

(10.88)

(7.08)

(2.60)

(13.24)

(5.64)

NET

ASSET

VALUE

End

of

period

$

100.72

$

100.79

$

89.28

$

117.53

$

113.24

Ratios/Supplemental

Data

Total

return

(3)(4)

10.22%

21.02%

(21.92)%

15.89%

76.73%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.61%

0.62%

0.61%

0.60%

0.61%

(5)

Net

expenses

after

waivers/

payments

by

Price

Associates

0.00%

0.00%

0.00%

0.00%

0.00%

(5)

Net

investment

income

0.73%

0.84%

0.66%

0.45%

0.58%

(5)

Portfolio

turnover

rate

22.6%

21.7%

21.4%

13.9%

23.0%

Net

assets,

end

of

period

(in

millions)

$5,320

$5,210

$4,521

$5,676

$5,955

0%

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amou

nts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

December

31,

2024

Shares

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

97.6%

COMMUNICATION

SERVICES

6.7%

Entertainment

2.3%

Liberty

Media

Corp-Liberty

Formula

One,

Class

C (1)

3,963,400

367,249

Roku (1)

995,700

74,020

Spotify

Technology (1)

565,000

252,770

694,039

Interactive

Media

&

Services

1.2%

Match

Group (1)

4,500,000

147,195

Reddit,

Class

A (1)

1,370,400

223,978

371,173

Media

3.2%

New

York

Times,

Class

A

3,320,800

172,848

Trade

Desk,

Class

A (1)

6,677,600

784,818

957,666

Total

Communication

Services

2,022,878

CONSUMER

DISCRETIONARY

13.2%

Diversified

Consumer

Services

0.7%

Bright

Horizons

Family

Solutions (1)

1,800,000

199,530

199,530

Hotels,

Restaurants

&

Leisure

7.1%

Domino's

Pizza

1,226,300

514,752

DraftKings,

Class

A (1)

8,989,800

334,420

Hilton

Worldwide

Holdings

1,837,000

454,033

Planet

Fitness,

Class

A (1)

2,739,300

270,835

Viking

Holdings (1)

3,982,800

175,482

Yum!

Brands

2,919,100

391,626

2,141,148

Household

Durables

0.3%

TopBuild (1)

245,000

76,278

76,278

Specialty

Retail

4.2%

Bath

&

Body

Works

4,300,000

166,711

Burlington

Stores (1)

1,115,400

317,956

Five

Below (1)

1,744,100

183,060

Ross

Stores

2,776,400

419,986

Tractor

Supply

1,365,000

72,427

Ulta

Beauty (1)

275,000

119,606

1,279,746

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Textiles,

Apparel

&

Luxury

Goods

0.9%

Birkenstock

Holding (1)

1,993,300

112,941

Lululemon

Athletica (1)

149,500

57,170

On

Holding,

Class

A (1)

1,642,800

89,976

260,087

Total

Consumer

Discretionary

3,956,789

CONSUMER

STAPLES

4.3%

Beverages

0.6%

Boston

Beer,

Class

A (1)

169,600

50,876

Constellation

Brands,

Class

A

647,800

143,164

194,040

Consumer

Staples

Distribution

&

Retail

2.7%

Casey's

General

Stores

781,700

309,733

Dollar

General

670,300

50,822

Dollar

Tree (1)

4,734,100

354,774

Maplebear (1)

2,292,500

94,955

810,284

Food

Products

0.6%

McCormick

1,544,800

117,776

TreeHouse

Foods (1)

1,935,000

67,976

185,752

Household

Products

0.4%

Reynolds

Consumer

Products

3,888,700

104,956

104,956

Total

Consumer

Staples

1,295,032

ENERGY

5.2%

Energy

Equipment

&

Services

1.5%

TechnipFMC

12,557,800

363,423

Weatherford

International

1,394,000

99,852

463,275

Oil,

Gas

&

Consumable

Fuels

3.7%

Cheniere

Energy

2,318,600

498,198

EQT

7,349,300

338,876

Expand

Energy

1,681,400

167,383

Range

Resources

3,456,600

124,369

1,128,826

Total

Energy

1,592,101

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

FINANCIALS

8.5%

Capital

Markets

4.4%

Cboe

Global

Markets

1,350,000

263,790

Intercontinental

Exchange

1,788,400

266,489

KKR

199,300

29,478

MarketAxess

Holdings

1,050,000

237,342

Raymond

James

Financial

1,985,900

308,470

TPG

744,900

46,810

Tradeweb

Markets,

Class

A

1,269,600

166,216

1,318,595

Financial

Services

1.8%

Corpay (1)

893,600

302,412

Toast,

Class

A (1)

6,474,600

235,999

538,411

Insurance

2.3%

Assurant

1,973,800

420,854

Axis

Capital

Holdings

1,480,400

131,193

Markel

Group (1)

74,300

128,259

680,306

Total

Financials

2,537,312

HEALTH

CARE

20.0%

Biotechnology

4.9%

Alnylam

Pharmaceuticals (1)

1,645,900

387,297

Argenx,

ADR (1)

224,200

137,883

Ascendis

Pharma,

ADR (1)

1,021,600

140,644

Biogen (1)

1,290,800

197,389

CRISPR

Therapeutics (1)

1,495,000

58,843

Cytokinetics (1)

1,985,900

93,417

Exact

Sciences (1)

1,642,800

92,309

Insmed (1)

253,845

17,526

Ionis

Pharmaceuticals (1)

5,277,100

184,487

Sarepta

Therapeutics (1)

888,000

107,972

Vaxcyte (1)

792,700

64,890

1,482,657

Health

Care

Equipment

&

Supplies

7.4%

Alcon

3,079,100

261,385

Align

Technology (1)

953,500

198,814

Cooper (1)

3,354,900

308,416

Enovis (1)(2)

3,000,000

131,640

Hologic (1)

8,500,000

612,765

Penumbra (1)

219,200

52,056

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

QuidelOrtho (1)

3,265,300

145,469

Teleflex (2)

2,989,900

532,142

2,242,687

Health

Care

Providers

&

Services

0.9%

Acadia

Healthcare (1)

2,980,500

118,177

Molina

Healthcare (1)

548,100

159,524

277,701

Health

Care

Technology

1.7%

Veeva

Systems,

Class

A (1)

2,500,000

525,625

525,625

Life

Sciences

Tools

&

Services

5.1%

Agilent

Technologies

3,972,700

533,693

Avantor (1)

20,000,000

421,400

Bruker

4,469,200

261,984

Mettler-Toledo

International (1)

174,600

213,655

West

Pharmaceutical

Services

299,000

97,940

1,528,672

Total

Health

Care

6,057,342

INDUSTRIALS

&

BUSINESS

SERVICES

16.0%

Aerospace

&

Defense

2.5%

BWX

Technologies

1,715,100

191,045

Howmet

Aerospace

592,100

64,758

Standardaero (1)

3,000,000

74,280

Textron

5,486,200

419,639

749,722

Commercial

Services

&

Supplies

0.9%

Veralto

1,593,100

162,257

Waste

Connections

687,300

117,927

280,184

Construction

&

Engineering

0.4%

Quanta

Services

394,800

124,777

124,777

Ground

Transportation

1.7%

JB

Hunt

Transport

Services

1,695,800

289,405

Old

Dominion

Freight

Line

700,000

123,480

XPO (1)

847,100

111,097

523,982

Industrial

Conglomerates

0.3%

Roper

Technologies

173,700

90,298

90,298

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Machinery

4.6%

Esab

2,942,700

352,947

Fortive

4,983,300

373,748

IDEX

814,100

170,383

Ingersoll

Rand

4,588,700

415,094

ITT

450,000

64,296

1,376,468

Professional

Services

4.5%

Broadridge

Financial

Solutions

1,200,000

271,308

Equifax

1,245,800

317,492

Paylocity

Holding (1)

1,770,146

353,091

TransUnion

1,644,400

152,453

UL

Solutions,

Class

A

1,500,000

74,820

Verisk

Analytics

692,300

190,680

1,359,844

Trading

Companies

&

Distributors

1.1%

Ferguson

Enterprises

1,000,000

173,570

United

Rentals

229,200

161,458

335,028

Total

Industrials

&

Business

Services

4,840,303

INFORMATION

TECHNOLOGY

17.5%

Electronic

Equipment,

Instruments

&

Components

1.9%

Amphenol,

Class

A

2,730,600

189,640

Cognex

2,242,500

80,416

Keysight

Technologies (1)

1,593,800

256,012

Littelfuse

204,972

48,302

574,370

IT

Services

0.2%

MongoDB (1)

244,800

56,992

56,992

Semiconductors

&

Semiconductor

Equipment

6.8%

Lattice

Semiconductor (1)(2)

7,869,300

445,796

Marvell

Technology

8,700,000

960,915

Microchip

Technology

8,000,000

458,800

Monolithic

Power

Systems

90,000

53,253

NXP

Semiconductors

666,200

138,469

2,057,233

Software

7.9%

Atlassian,

Class

A (1)

893,300

217,411

CCC

Intelligent

Solutions

Holdings (1)

25,140,645

294,900

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Fair

Isaac (1)

155,000

308,594

Fortinet (1)

3,272,200

309,157

Onestream (1)

1,196,000

34,110

PTC (1)

2,890,300

531,439

ServiceTitan,

Class

A (1)

146,882

15,110

Tyler

Technologies (1)

733,100

422,735

Zoom

Communications,

Class

A (1)

3,088,000

252,012

2,385,468

Technology

Hardware,

Storage

&

Peripherals

0.7%

Pure

Storage,

Class

A (1)

3,229,000

198,357

198,357

Total

Information

Technology

5,272,420

MATERIALS

4.6%

Chemicals

0.4%

RPM

International

996,600

122,642

122,642

Construction

Materials

1.0%

Martin

Marietta

Materials

578,500

298,795

298,795

Containers

&

Packaging

3.2%

Avery

Dennison

2,043,200

382,344

Ball

7,225,800

398,359

Sealed

Air

4,978,400

168,419

949,122

Total

Materials

1,370,559

REAL

ESTATE

0.7%

Real

Estate

Management

&

Development

0.7%

CoStar

Group (1)

3,089,700

221,192

Total

Real

Estate

221,192

Total

Miscellaneous

Common

Stocks

0.9% (3)

287,496

Total

Common

Stocks

(Cost

$19,256,346)

29,453,424

CONVERTIBLE

PREFERRED

STOCKS

0.4%

HEALTH

CARE

0.1%

Biotechnology

0.1%

Caris

Life

Sciences,

Series

D,

Acquisition

Date:

5/11/21,

Cost $26,556 (1)(4)(5)

3,278,524

16,130

Total

Health

Care

16,130

T.

ROWE

PRICE

Mid-Cap

Growth

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

INFORMATION

TECHNOLOGY

0.2%

Software

0.2%

Databricks,

Series

H,

Acquisition

Date:

8/31/21,

Cost $18,583 (1)(4)(5)

252,883

23,392

Databricks,

Series

I,

Acquisition

Date:

9/14/23,

Cost $7,088 (1)

(4)(5)

96,442

8,921

Databricks,

Series

J,

Acquisition

Date:

12/17/24,

Cost $16,136 (1)(4)(5)

174,443

16,136

Nuro,

Series

D,

Acquisition

Date:

10/29/21,

Cost $17,506 (1)

(4)(5)

839,788

5,996

Total

Information