| | Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Number: 333-284105

February 13, 2025 |

February 2025 Capstone Holding Corp. Investor Presentation Addendum Building Products Consolidation Distribution Augmented by Select Vertical Integration Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration Number: 333 - 284105 February 13, 2025 1

Legal Disclosure & Disclaimer 2 Capstone Holding Corp . (“Capstone") is offering shares of common stock (the “Securities”) in a public offering (the “Offering”) . The proceeds of the Offering, if completed, are intended primarily to be used for the repayment of a term loan and general corporate purposes . Information included herein has been prepared by Capstone or obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed by, and should not be construed as a representation by Joseph Gunnar & Co . , LLC, Capstone or any other person . Any representations and warranties will be contained only in an underwriting agreement signed by Capstone . If this Offering is completed, Capstone will become subject to the informational filing requirements of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”), and be required to file periodic reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”) . Certain documents are currently available at no charge by visiting EDGAR on the SEC website at http : //www . sec . gov .

Free Writing Prospectus Statement 3 Capstone has filed a registration statement (including a prospectus) with the SEC for the Offering to which this communication relates . Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering . You may get these documents for free by visiting EDGAR on the SEC Web site at www . sec . gov . Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you request it by contacting Joseph Gunnar & Co . , LLC, telephone : 212 - 440 - 9600 .

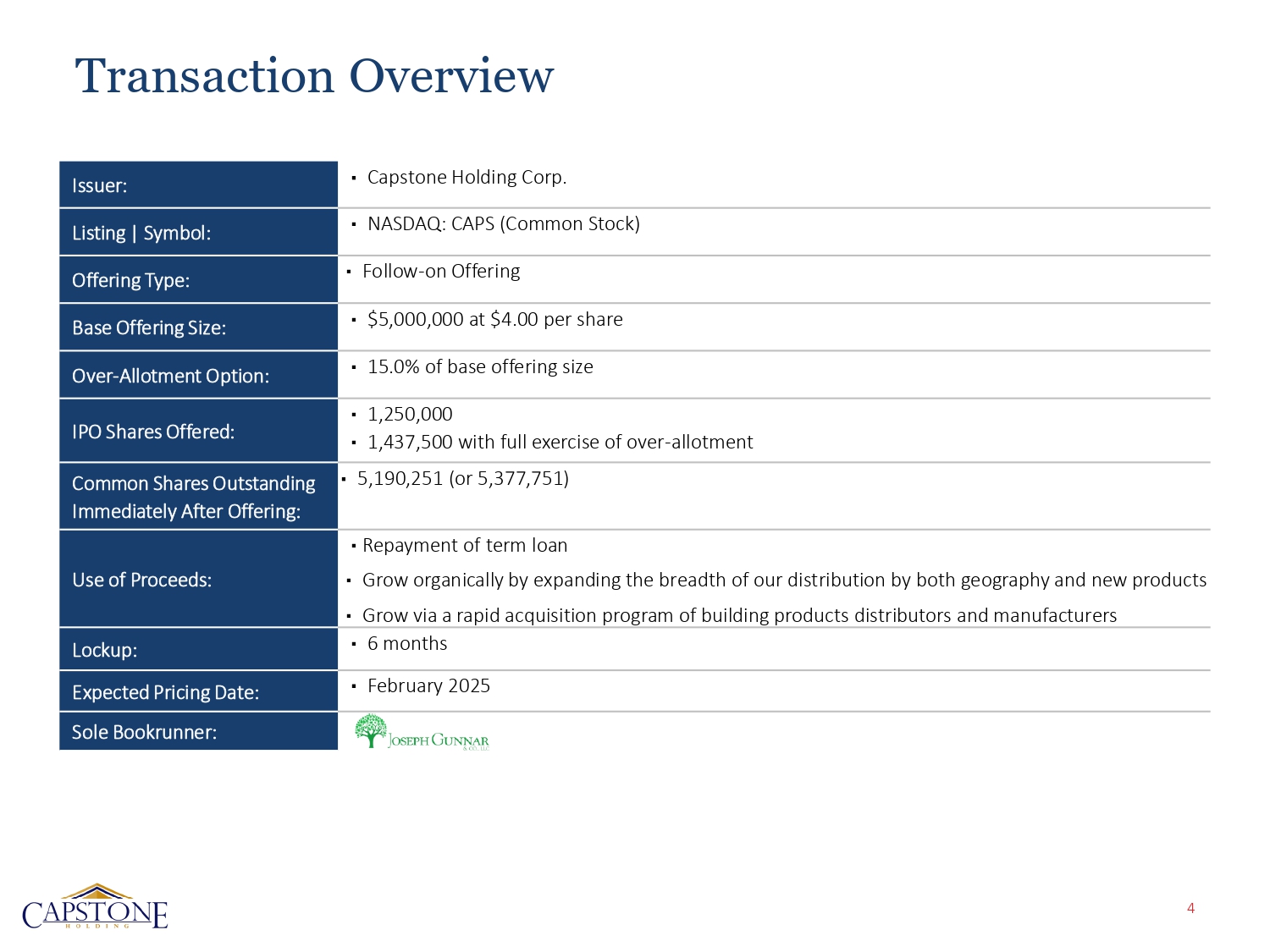

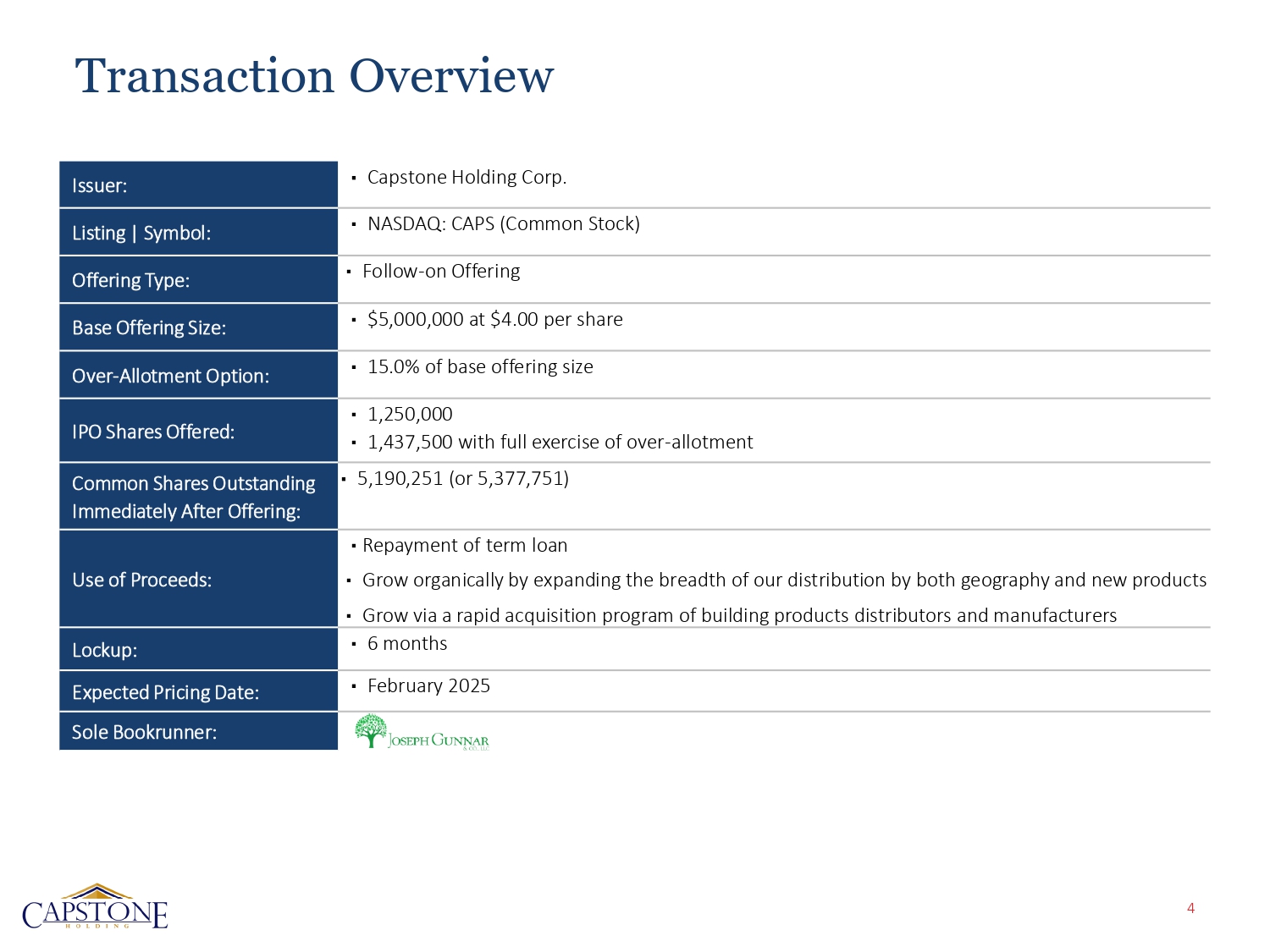

Transaction Overview Issuer: Capstone Holding Corp. Listing | Symbol: NASDAQ: CAPS (Common Stock) Offering Type: Follow - on Offering Base Offering Size: $5,000,000 at $4.00 per share Over - Allotment Option: 15.0% of base offering size IPO Shares Offered: 1,250,000 1,437,500 with full exercise of over - allotment Common Shares Outstanding Immediately After Offering: 5,190,251 (or 5,377,751) Use of Proceeds: Repayment of term loan Grow organically by expanding the breadth of our distribution by both geography and new products Grow via a rapid acquisition program of building products distributors and manufacturers Lockup: 6 months Expected Pricing Date: February 2025 Sole Bookrunner: 4

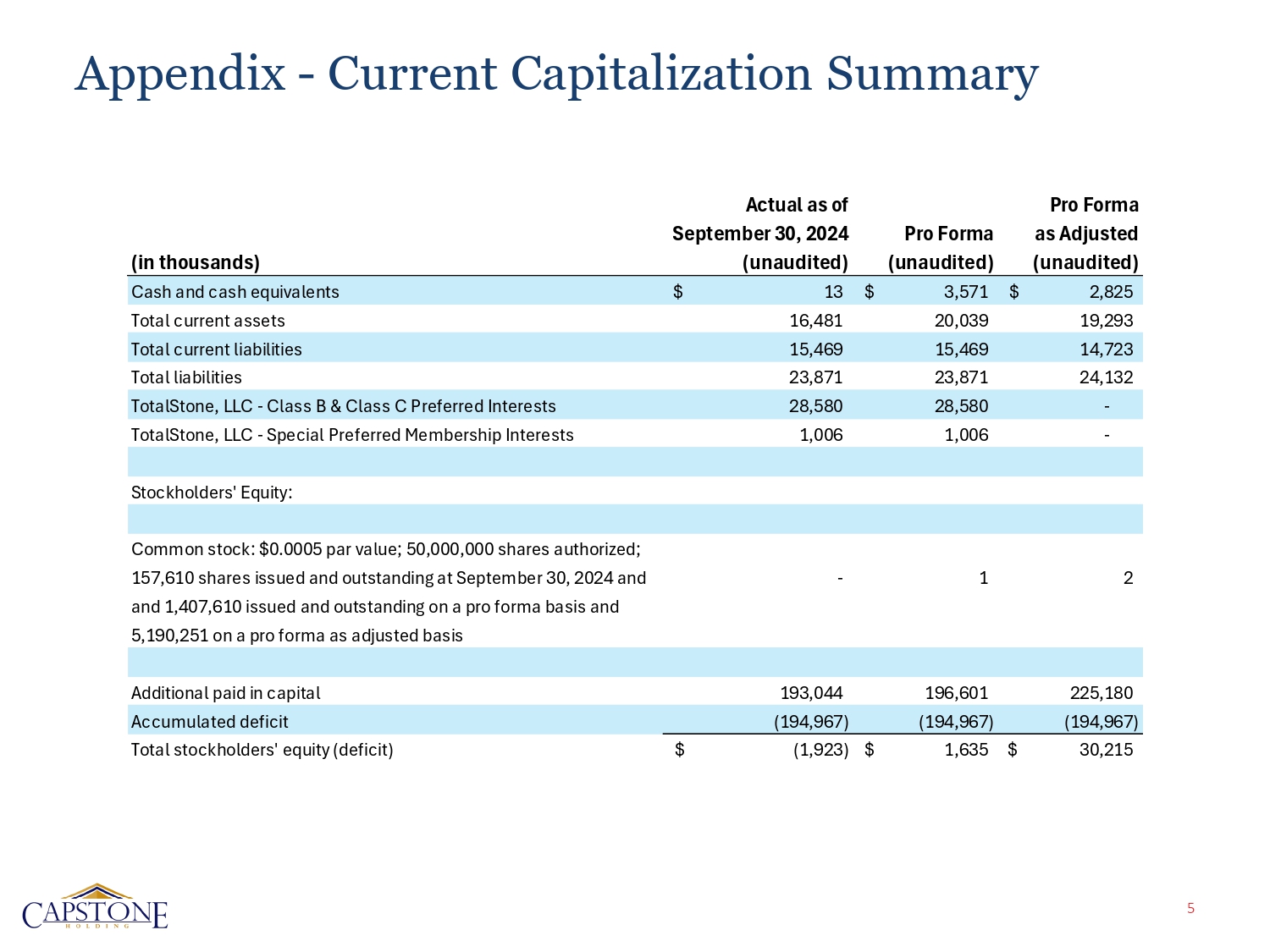

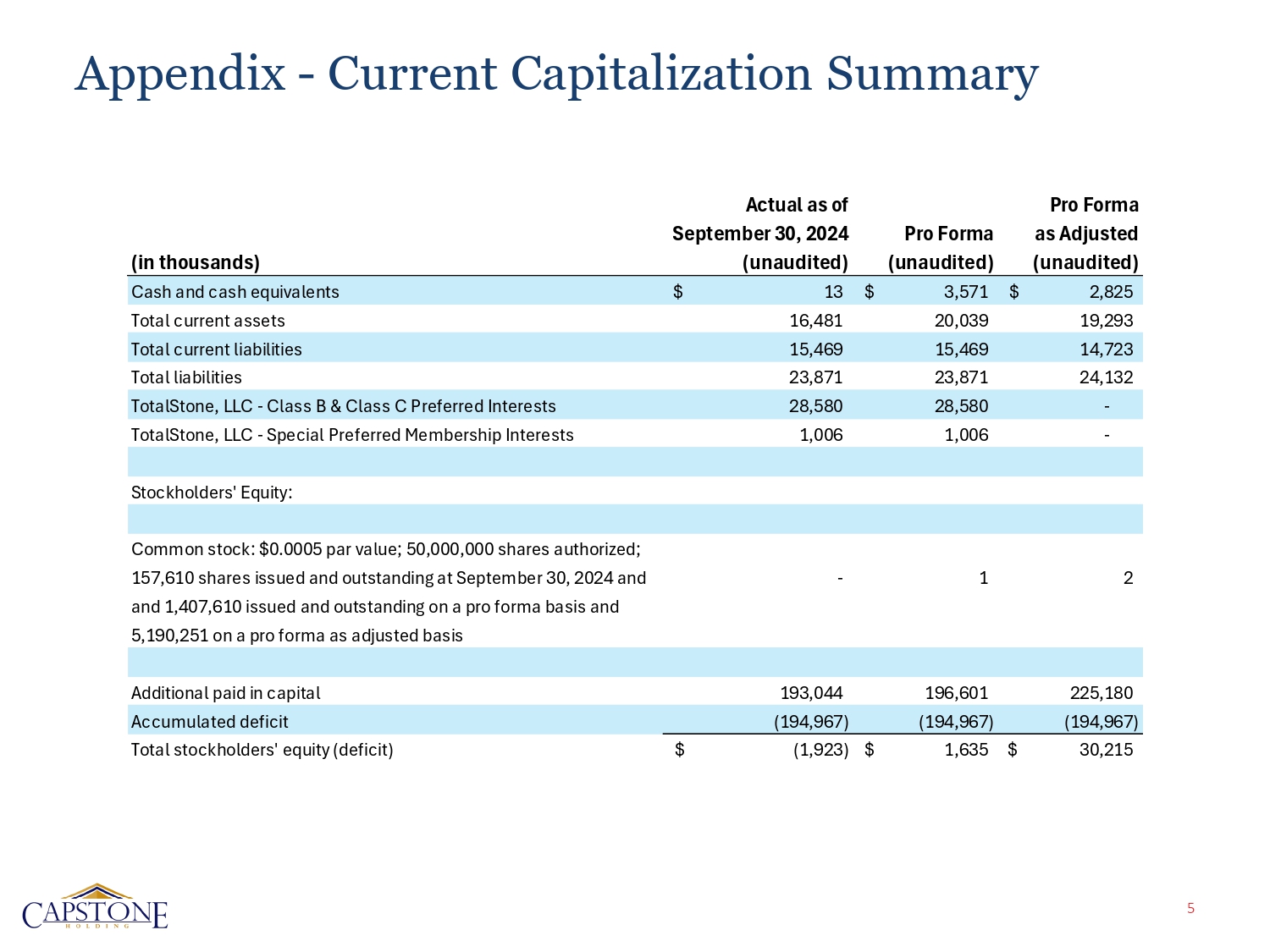

Appendix - Current Capitalization Summary 5 Pro Forma as Adjusted (unaudited) Pro Forma (unaudited) Actual as of September 30, 2024 (unaudited) (in thousands) $ 2,825 $ 3,571 $ 13 Cash and cash equivalents 19,293 20,039 16,481 Total current assets 14,723 15,469 15,469 Total current liabilities 24,132 23,871 23,871 Total liabilities - 28,580 28,580 TotalStone, LLC - Class B & Class C Preferred Interests - 1,006 1,006 TotalStone, LLC - Special Preferred Membership Interests Stockholders' Equity: 2 1 - Common stock: $0.0005 par value; 50,000,000 shares authorized; 157,610 shares issued and outstanding at September 30, 2024 and and 1,407,610 issued and outstanding on a pro forma basis and 5,190,251 on a pro forma as adjusted basis 225,180 196,601 193,044 Additional paid in capital (194,967) (194,967) (194,967) Accumulated deficit Total stockholders' equity (deficit) (1,923) $ $ 1,635 $ 30,215

Appendix - Historical Financials Summary 6 PGL Nine Months Ended Sept 30, 2024 (in 000s) FY 22 FY 23 34,563 48,354 61,561 Net Sales 27,062 38,743 45,030 COGS 7,501 9,611 16,531 Gross Profit 21.7% 12.2% 2c.2% Gross Profit % 7,791 10,867 12,538 SG&A (290) (1,256) 3,993 (Loss)/Income from Operations - 0.8% - 2.c% c.5% (Loss)/Income from Operations % Balance Sheet Sept 30, 2024 FY 23 FY 22 (in 000s) 4,812 2,581 3,031 Accounts Receivables, net 11,151 13,750 17,398 Inventory 1,648 1,756 1,815 PPGE, net 3,909 2,575 1,419 Accounts Payables