Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Number: 333-284105

February 6, 2025

February 2025 Capstone Holding Corp. Investor Presentation Building Products Consolidation Distribution Augmented by Select Vertical Integration Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration Number: 333 - 284105 February 6, 2025 1

Legal Disclosure & Disclaimer 2 Capstone Holding Corp . (“Capstone") is offering shares of common stock (the “Securities”) in a public offering (the “Offering”) . The proceeds of the Offering, if completed, are intended primarily to be used for the repayment of a term loan and general corporate purposes . Information included herein has been prepared by Capstone or obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed by, and should not be construed as a representation by Joseph Gunnar & Co . , LLC, Capstone or any other person . Any representations and warranties will be contained only in an underwriting agreement signed by Capstone . If this Offering is completed, Capstone will become subject to the informational filing requirements of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”), and be required to file periodic reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”) . Certain documents are currently available at no charge by visiting EDGAR on the SEC website at http : //www . sec . gov .

Free Writing Prospectus Statement 3 Capstone has filed a registration statement (including a prospectus) with the SEC for the Offering to which this communication relates . Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering . You may get these documents for free by visiting EDGAR on the SEC Web site at www . sec . gov . Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you request it by contacting Joseph Gunnar & Co . , LLC, telephone : 212 - 440 - 9600 .

Special Note Regarding Forward - Looking Statements and Industry Data 4 This presentation includes forward - looking statements within the meaning of Section 27 A of the Act and Section 21 E of the Exchange Act . Except for statements of historical fact, any information contained in this presentation may be a forward - looking statement that reflects, Capstone’s current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or results to differ significantly from those expressed in any forward - looking statement . In some cases, you can identify forward - looking statements by terminology such as “may”, “will”, “could”, “would”, “should”, “plan”, “predict”, “potential”, “project”, “expect”, “estimate”, “anticipate”, “intend”, “goal”, “strategy”, “believe”, and similar expressions and variations thereof . Forward - looking statements may include statements regarding the Offering, the effect of the Offering on Capstone’s business strategy, the market size, and potential growth opportunities of Capstone, capital requirements, and use of proceeds . Although Capstone believes that the expectations reflected in such forward - looking statements are reasonable, such statements are based upon numerous estimates and assumptions with respect to industry performance and competition, general business, economic, market and financial conditions and matters specific to the business of Capstone, all of which are difficult to predict and many of which are beyond the control of Capstone . Capstone cannot guarantee future events, results, actions, levels of activity, performance, or achievements . These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those described under the heading “Risk Factors” in Capstone’s filings with the SEC as well as risks, uncertainties, and assumptions relating to or arising from : ( 1 ) the structure, timing and ability to satisfy the conditions to closing the Offering ; ( 2 ) Capstone’s ability to have its initial listing application approved by Nasdaq ; ( 3 ) the ability to realize the benefits of the Offering, including the impact on future financial and operating results of Capstone ; ( 4 ) the cooperation of those involved in the development of our current and future products ; ( 5 ) costs related to the Offering, known and unknown, including costs of any potential litigation or regulatory actions relating to the Offering ; and ( 6 ) changes in applicable laws or regulations . Actual results and the timing of events could differ from those anticipated in such forward - looking statement as a result of these risks . These forward - looking statements speak only as of the date of this presentation and Capstone undertakes no obligation to revise or update any forward - looking statements to reflect events or circumstances after the date hereof . This presentation also contains estimates and other statistical data made by independent parties and by Capstone relating to the building products industry . This data involves a number of assumptions and limitations and you are cautioned not to give undue weight to such estimates . The trademarks included herein are the property of the owners thereof and are used for reference purposes only . Such use should not be construed as an endorsement of such products .

Table of Contents 5 Transaction & Management Overview I. Key Investment Highlights II. Industry & Strategy Overview III. Product Overview IV. Value Drivers & Customer Overview V. Platform Overview VI. Company Overview Appendix.

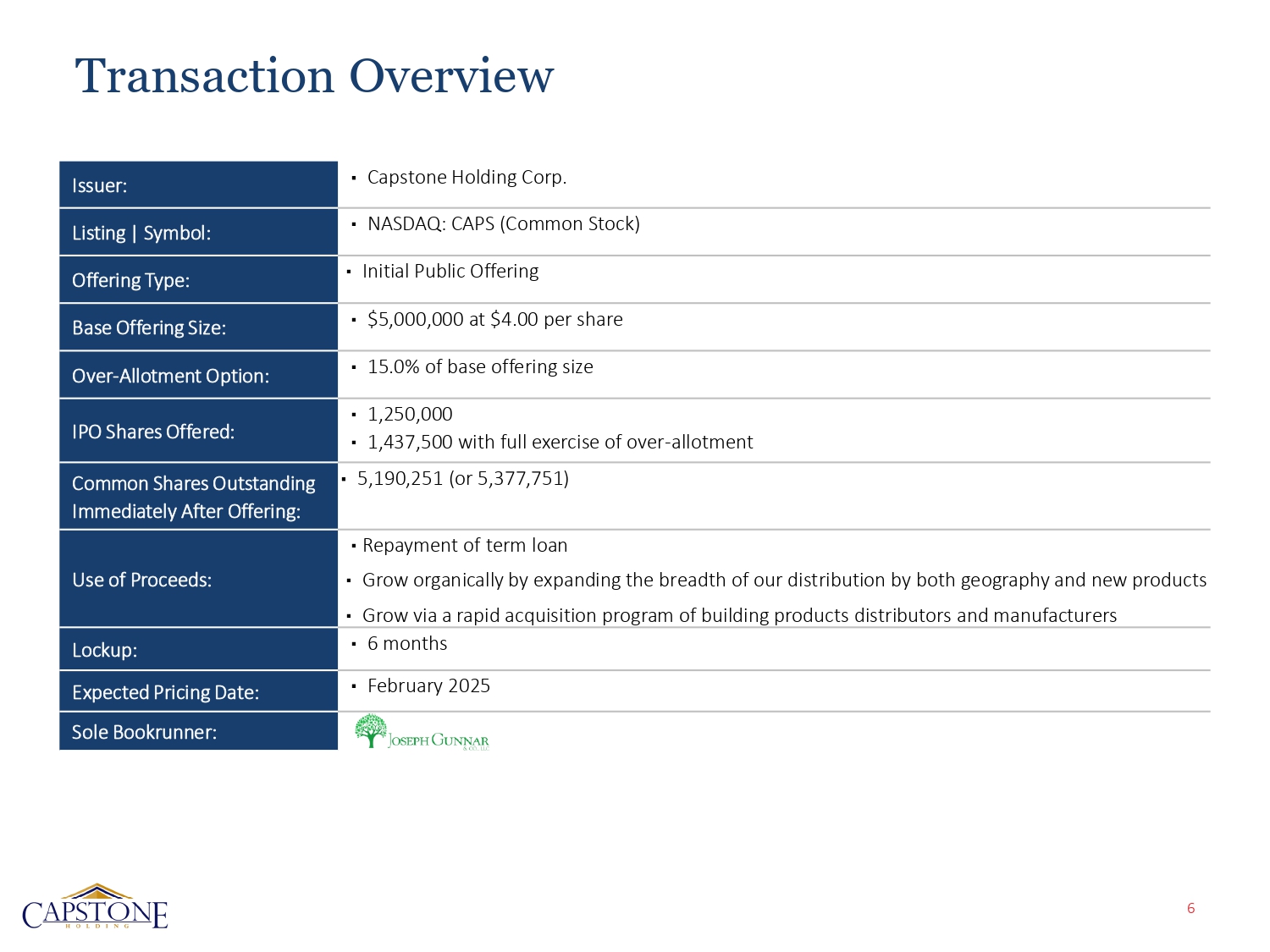

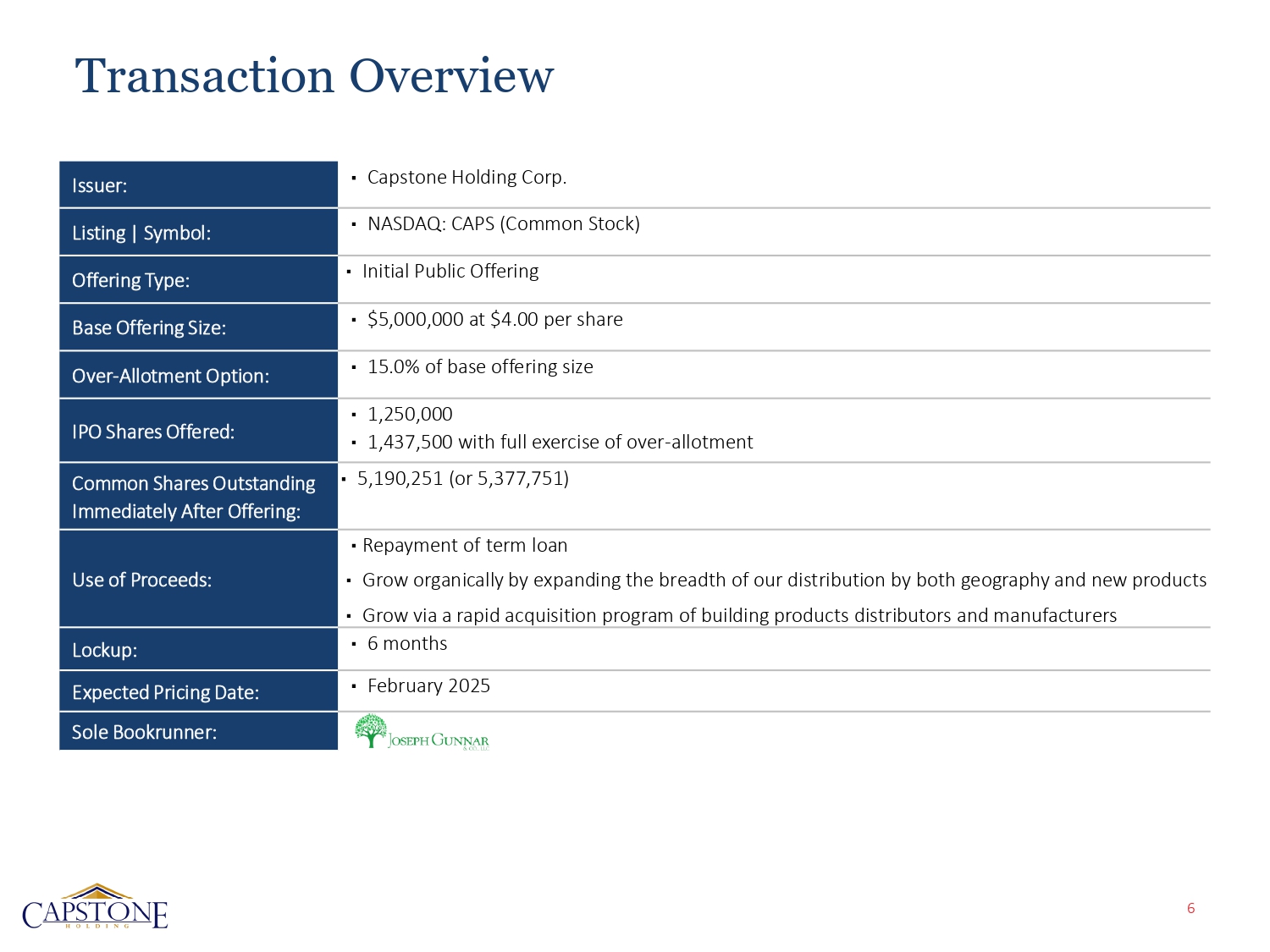

Transaction Overview Issuer: Capstone Holding Corp. Listing | Symbol: NASDAQ: CAPS (Common Stock) Offering Type: Initial Public Offering Base Offering Size: $5,000,000 at $4.00 per share Over - Allotment Option: 15.0% of base offering size IPO Shares Offered: 1,250,000 1,437,500 with full exercise of over - allotment Common Shares Outstanding Immediately After Offering: 5,190,251 (or 5,377,751) Use of Proceeds: Repayment of term loan Grow organically by expanding the breadth of our distribution by both geography and new products Grow via a rapid acquisition program of building products distributors and manufacturers Lockup: 6 months Expected Pricing Date: February 2025 Sole Bookrunner: 6

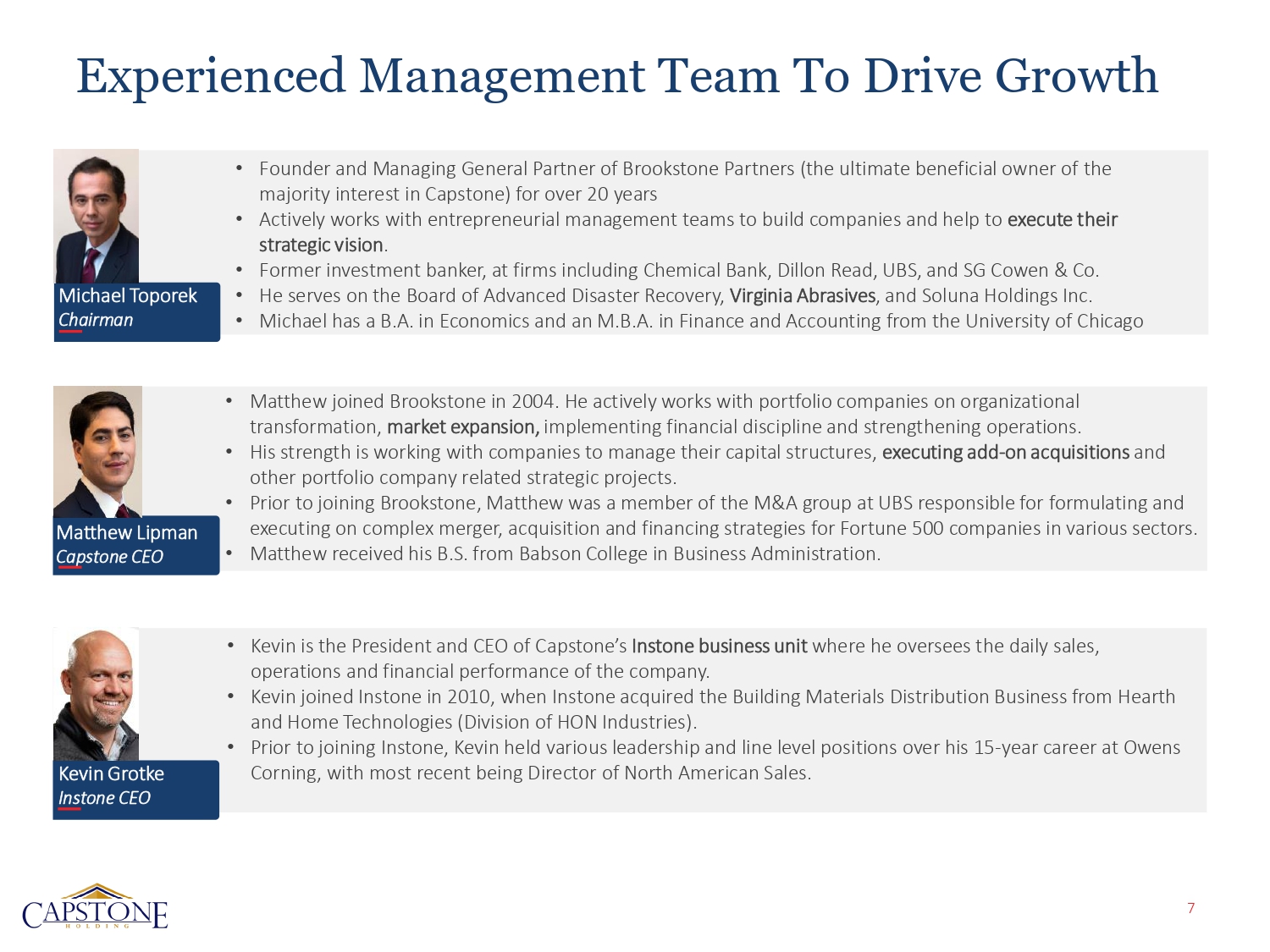

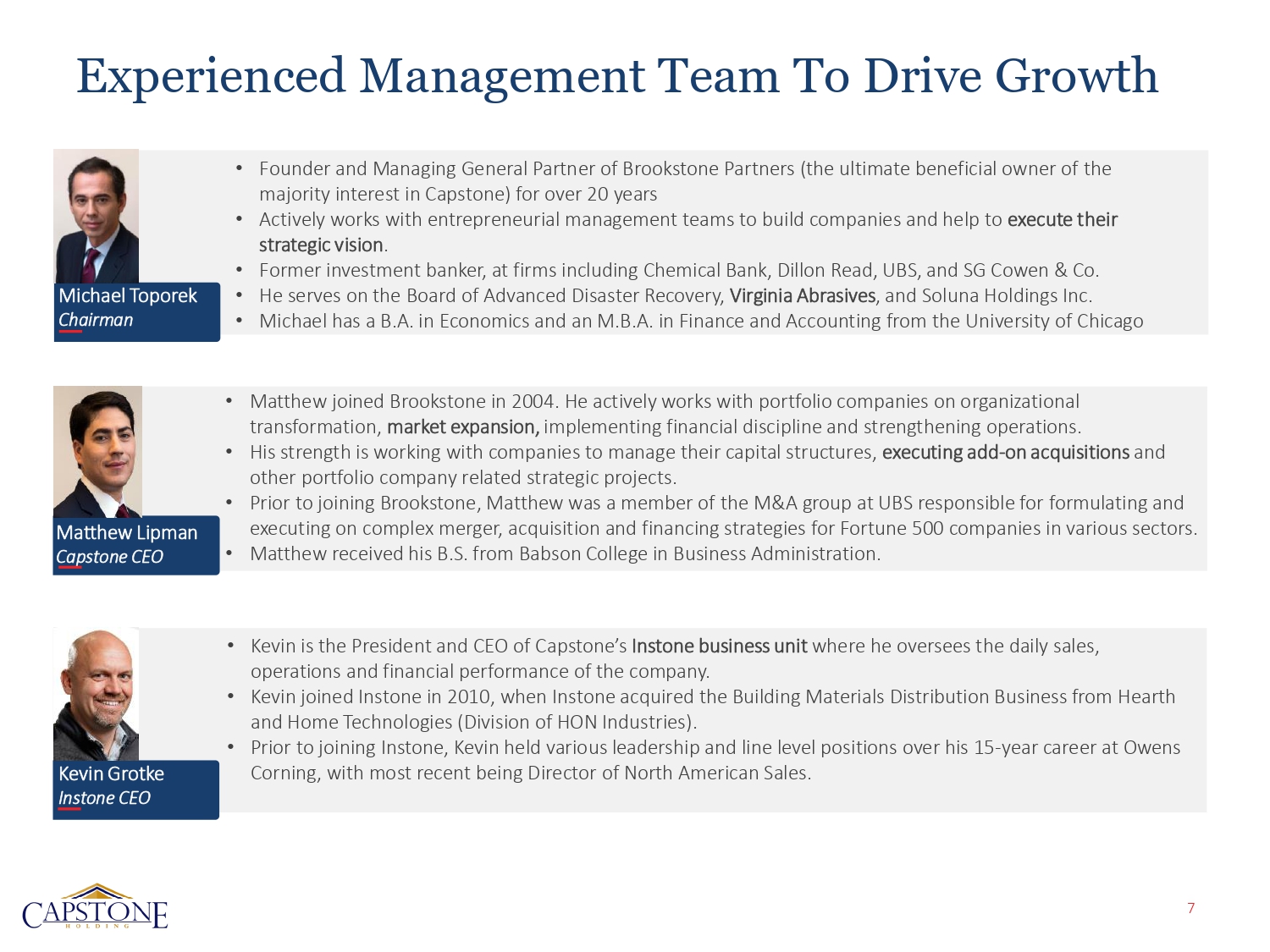

Michael Toporek Ch airman • Founder and Managing General Partner of Brookstone Partners (the ultimate beneficial owner of the majority interest in Capstone) for over 20 years • Actively works with entrepreneurial management teams to build companies and help to execute their strategic vision. • Former investment banker, at firms including Chemical Bank, Dillon Read, UBS, and SG Cowen & Co. • He serves on the Board of Advanced Disaster Recovery, Virginia Abrasives, and Soluna Holdings Inc. • Michael has a B.A. in Economics and an M.B.A. in Finance and Accounting from the University of Chicago Kevin Grotke Ins tone CEO • Kevin is the President and CEO of Capstone’s Instone business unit where he oversees the daily sales, operations and financial performance of the company. • Kevin joined Instone in 2010, when Instone acquired the Building Materials Distribution Business from Hearth and Home Technologies (Division of HON Industries). • Prior to joining Instone, Kevin held various leadership and line level positions over his 15 - year career at Owens Corning, with most recent being Director of North American Sales. Matthew Lipman Cap stone CEO • Matthew joined Brookstone in 2004. He actively works with portfolio companies on organizational transformation, market expansion, implementing financial discipline and strengthening operations. • His strength is working with companies to manage their capital structures, executing add - on acquisitions and other portfolio company related strategic projects. • Prior to joining Brookstone, Matthew was a member of the M&A group at UBS responsible for formulating and executing on complex merger, acquisition and financing strategies for Fortune 500 companies in various sectors. • Matthew received his B.S. from Babson College in Business Administration. Experienced Management Team To Drive Growth 7

Michael Toporek Chairman • Chuck has 40+ years of financial and general management experience. • He started his career at GE and eventually became the President of GE Locomotives Indonesia. • Chuck joined Owens Corning in 1995, where as President of the Composite Solutions Business, he grew sales from $1.2 to $2.4 billion over seven years, through both organic growth and acquisitions • Mr. Dana eventually ran every business unit at Owens Corning (roofing, insulation and composites), producing 18 consecutive quarters of net income growth under his leadership • He retired from Owens Corning and served as Executive Vice President of the Molded Fiber Glass Companies. • In 2016, he joined Brookstone Partners as an operating partner. • Chuck received a B.A. from Dartmouth College in Economics. Experienced Management Team To Drive Growth • Gordon founded Instone and then partnered with Brookstone Partners in 2006, and was President & CEO through April 2021. • Gordon has 35+ years of experience in the Building Products distribution industry. • Gordon has played an integral role in the growth trajectory of Instone since its inception. • Gordon received a B.A. from the University of Miami. M G o a r t d t h o e n w S t L r i o p u m t a n C D a i r p e s c t t o o n r e N C o E m O i n ee Charles (“Chuck”) E. Dana Director Nominee (Lead Independent Director) 8

9 Right Team ▪ Private equity sponsor with 25 years of deep building products investment experience has a significant stake and is driving strategy. ▪ Current platform company has executed acquisitions and integrations . ▪ Chuck Dana, a long - time operating partner is a director nominee. Right Time ▪ Historically acquiring companies in the building product sector at interest rate peaks has provided excellent returns and strategic investment points. Right Platform ▪ Current operating Company services 31 US states in its distribution area. ▪ Plugging in other distributors or manufacturers can provide solid path to revenue growth. Premium For Size ▪ As the company grows EBITDA the valuation premium for size coupled with earning growth drives the share price. Key Investment Highlights

10 M&A Performance: Right Timing, Right Strategy (1) Source: Bain & Company Global M&A Report 2024 M&A Results ▪ “Building products companies that make frequent and material acquisitions substantially outpace inactive companies in total shareholder returns, 9.6% vs 2.7%”, according to Bain & Co. (1) ▪ “Successful companies will pursue scope M&A to build product, geography, and capability adjacencies” (1) Ideal Time for M&A Activity ▪ “Financial investors have taken a step back, especially in North America, removing a potentially formidable layer of competition” (1) ▪ ”Just the type of environment that has proved to offer opportunities to companies willing to make bold moves” (1)

▪ Most distributors privately held ▪ Over 7,000 distributors ▪ Most manufacturers fail to leverage distribution ▪ Over cycles sector has grown 5 - 7% Market Environment ▪ Acquisition platform: Proven history of success ▪ Improving Logistics through Technology ▪ Controlled by Brookstone Partners with over 77% of the common equity Capstone Holdings/Instone Investment Thesis: ▪ Key differentiator: The company owns or controls five of the eight brands it sells through: • Contract • Joint Ventures • Acquiring selected manufacturers and ramping up their distribution Well Timed, Attractive Opportunity Set Building Products Distribution Consolidation 11

Business Growth Strategy ▪ Expand geography and product breadth of distribution platform ▪ Own/outsource manufacturing with owned brands ▪ Contractual relationship with unowned brands ▪ Identify and acquire under distributed manufacturing company. ▪ Seamlessly integrate acquired manufacturers into the distribution infrastructure. ▪ Strengthen the supply chain, diversify product offerings, and expand market reach. Reach Further, Offer More Buy Manufacturers, Fortify Distribution Core Owned & Controlled Services Distribution Backbone Customers Owned & Controlled Products 12

Product Overview: Owned & Controlled Product Offerings Aura (Landscape Stone) Interloc (Stone Veneer) Toro Stone (Stone Veneer) Pangea (Stone Veneer) Product Portfolio Control ▪ Key strategy is to own or control brands and products that the Company sells ▪ Five of the eight brands we sell are under the Company’s own brands or brands for which it holds exclusive distribution rights in its trade territory. Owned/Controlled Brands (53%) Other Brands (47%) 13

New Product Driving Growth: Toro National brand of man - made stone No Logo on all pages Quality Product ▪ Jointly developed with a manufacturer in Mexico. ▪ Optimal quality vs. price value relationship engineered into popular SKU’s. ▪ 30 SKUs offered currently, further product development in progress. Smart Packaging ▪ Distributor and mason - friendly packaging/stacking design allowing 3x more storage space in the warehouse. User - Friendly Design & Purchase Tools ▪ Product visualizer and stone calculator help design and implement projects. Market Timing and Opportunity ▪ Market Context: During and post - Covid, leading market incumbents faced significant supply and quality issues. ▪ Current Situation: Natural Stone is highly fragmented due to regionality and logistics. Our products and services provide a unique offering to the market. ▪ Opportunity: It is our belief that Toro is ideally positioned as the "Fill In" supplier, offering a reliable and manageable alternative to address the weaknesses in current market leaders. 14

Quality Product ▪ Natural Stone priced competitively against premium manufactured stone options. ▪ Each stone is tooled, trimmed, fitted with GripSet® technology. Smart Packaging ▪ Each layer is formulated to achieve optimal yield for mason. User - Friendly Design & Purchase Tools ▪ Product visualizer helps design and implement projects. Market Timing and Opportunity ▪ Market Context: During and post - Covid, leading market incumbents faced significant supply and quality issues. ▪ Current Situation: Natural Stone is highly fragmented due to regionality and logistics. Our products and services provide a unique offering to the market. ▪ Opportunity: It is our belief that Pangaea is ideally positioned as the premium Thin Veneer product for the market. It delivers enhanced value over any other Thin Veneer in the market at a competitive price point. New Product Driving Growth: Pangaea National brand of Natural Stone

Value Driver: Service Platform 16 Frequent Delivery ▪ Smaller orders grouped together, minimizing LTL Costs ▪ Customers can get products twice a week with short lead time, improving service level Product Offering Wide range of complimentary products, ▪ prices, and applications Differentiated brands ▪ Customer Portal Check inventory availability ▪ Place orders online ▪ Pay online ▪ Better Inventory Management ▪ Customers can work from Instone inventory and minimize their capital tied up in inventory as well as their warehouse space optimisation. ▪ Bundling of products creates even greater results and vendor consolidation.

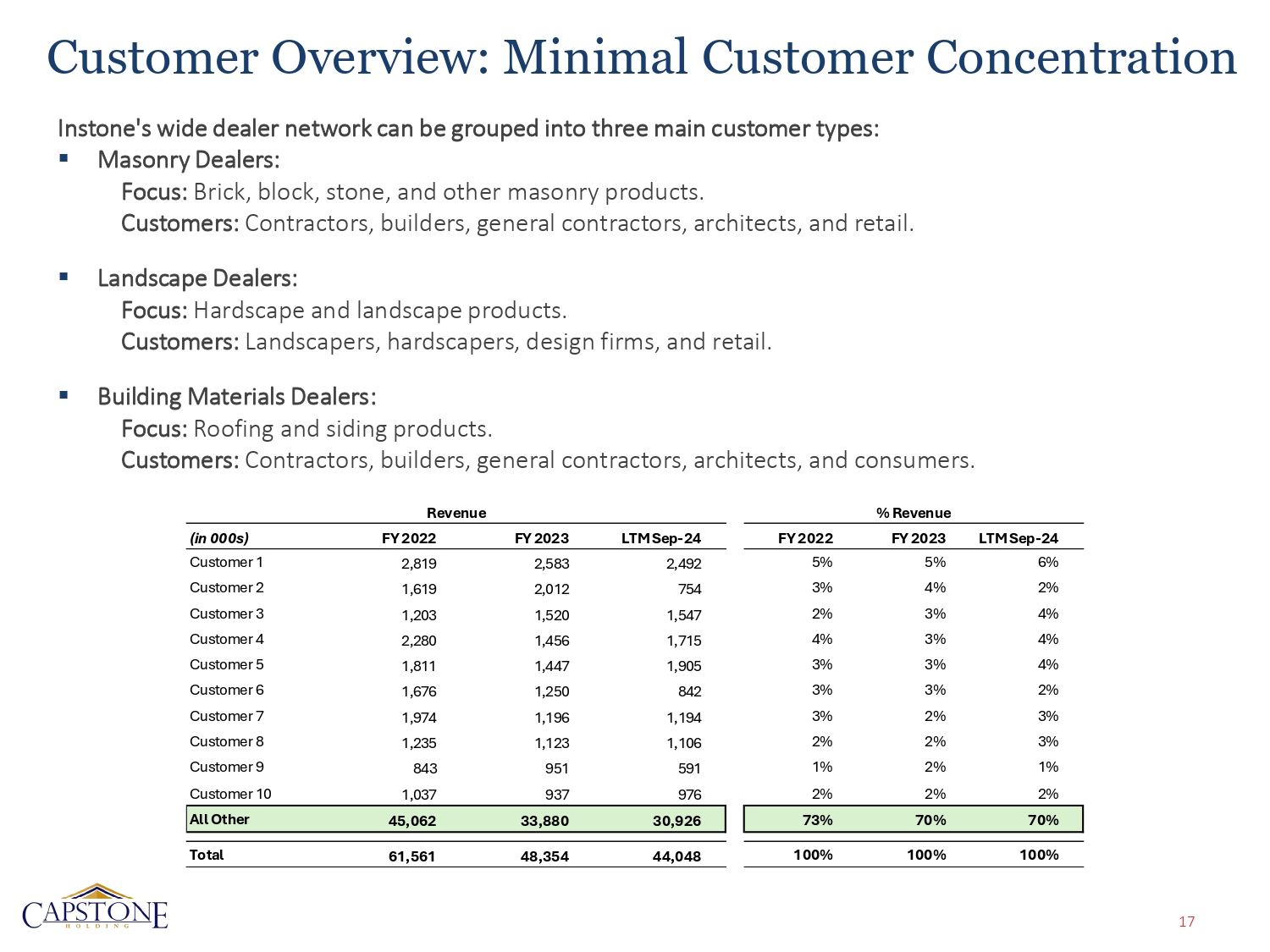

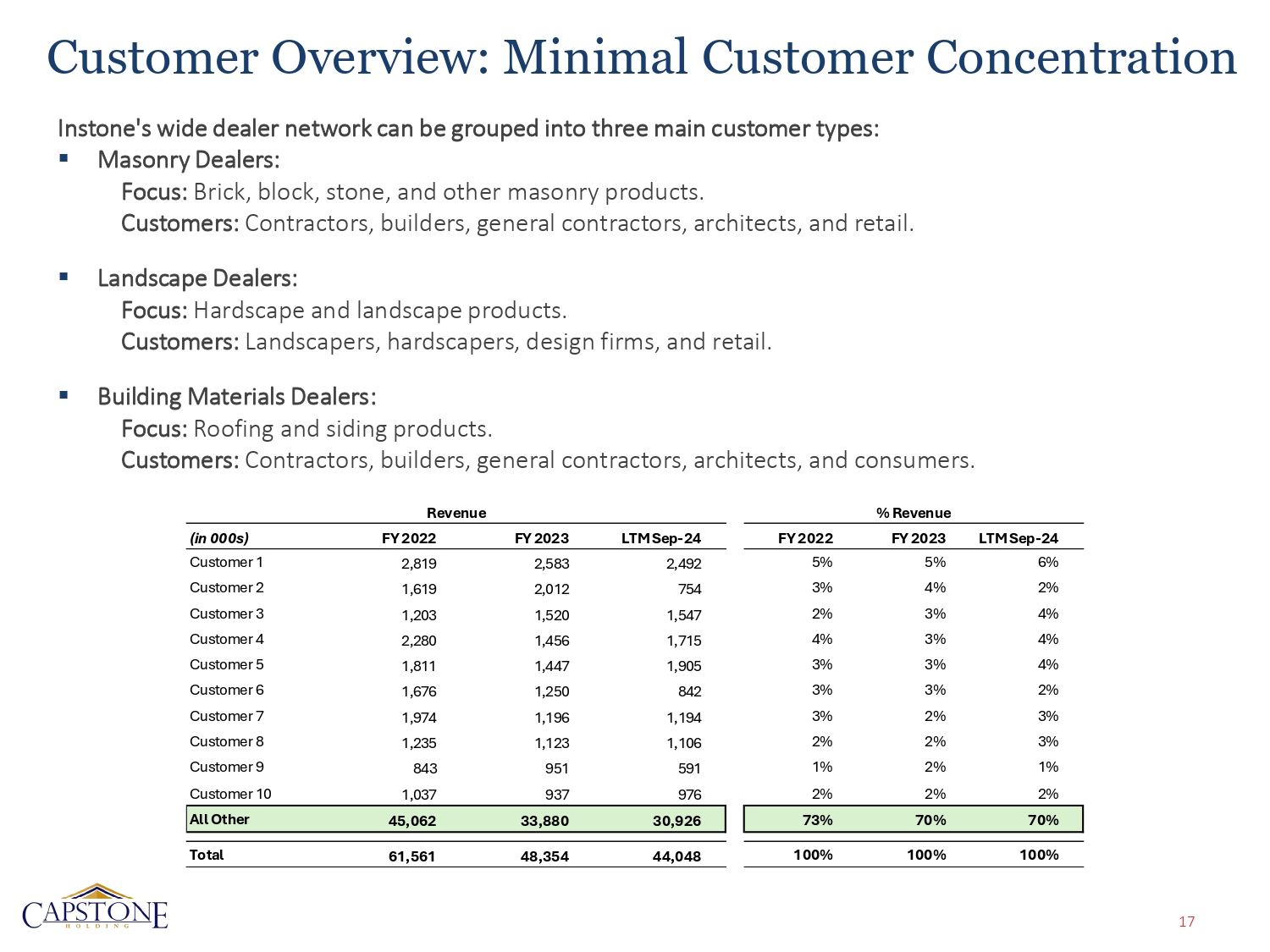

LTM Sep - 24 FY 2023 FY 2022 LTM Sep - 24 FY 2023 FY 2022 (in 000s) 6% 5% 5% 2,462 2,583 2,816 Customer 1 2% 4% 3% 754 2,012 1,616 Customer 2 4% 3% 2% 1,547 1,520 1,203 Customer 3 4% 3% 4% 1,715 1,456 2,280 Customer 4 4% 3% 3% 1,605 1,447 1,811 Customer 5 2% 3% 3% 842 1,250 1,676 Customer 6 3% 2% 3% 1,164 1,166 1,674 Customer 7 3% 2% 2% 1,106 1,123 1,235 Customer 8 1% 2% 1% 561 651 843 Customer 6 2% 2% 2% 676 637 1,037 Customer 10 70% 70% 73% 30,G26 33,880 45,062 All Other 100% 100% 100% 44,048 48,354 61,561 Total 17 Instone's wide dealer network can be grouped into three main customer types: ▪ Masonry Dealers: Focus: Brick, block, stone, and other masonry products. Customers: Contractors, builders, general contractors, architects, and retail. ▪ Landscape Dealers: Focus: Hardscape and landscape products. Customers: Landscapers, hardscapers, design firms, and retail. ▪ Building Materials Dealers: Focus: Roofing and siding products. Customers: Contractors, builders, general contractors, architects, and consumers. No Logo on all pages Customer Overview: Minimal Customer Concentration Revenue % Revenue

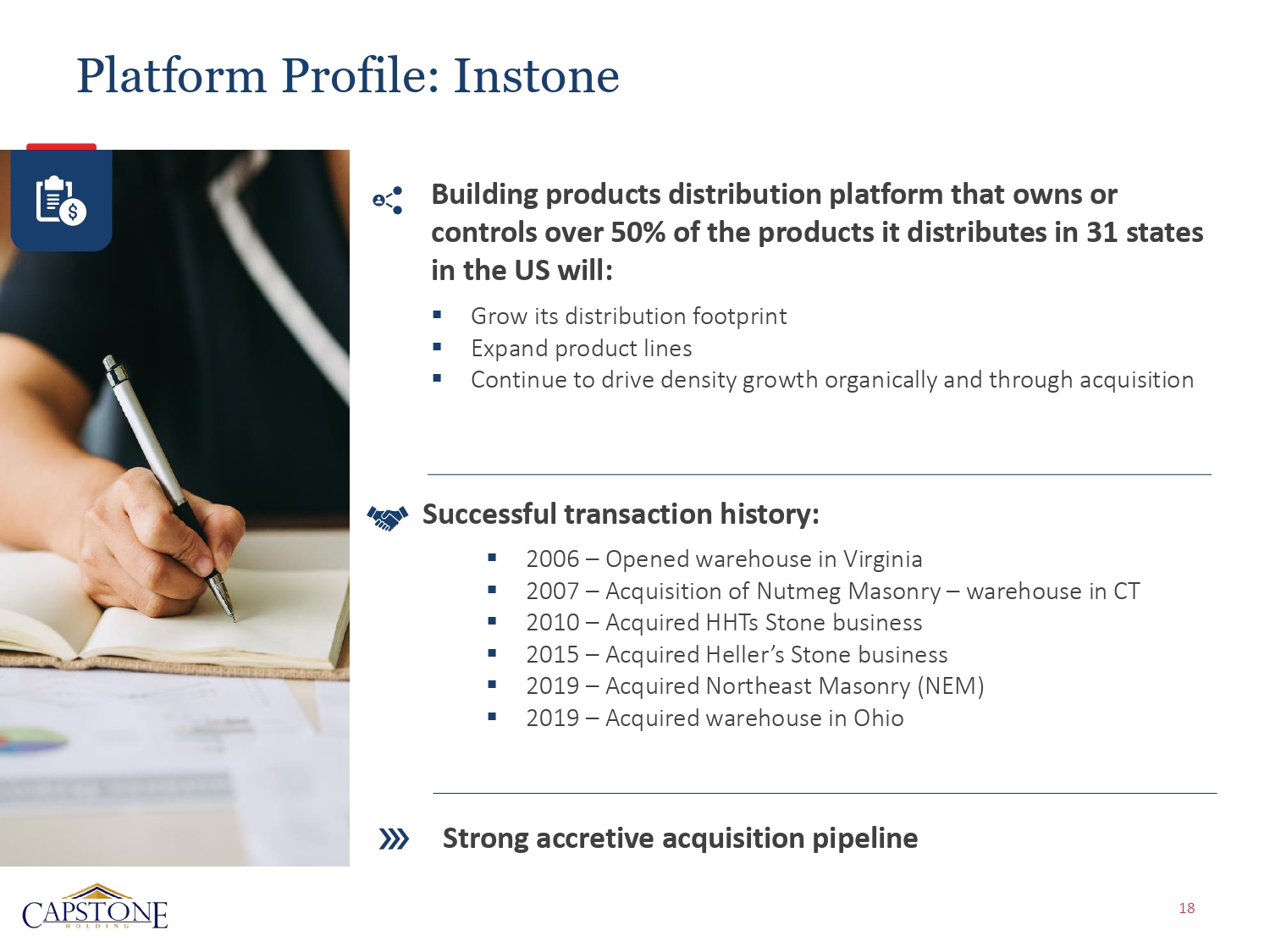

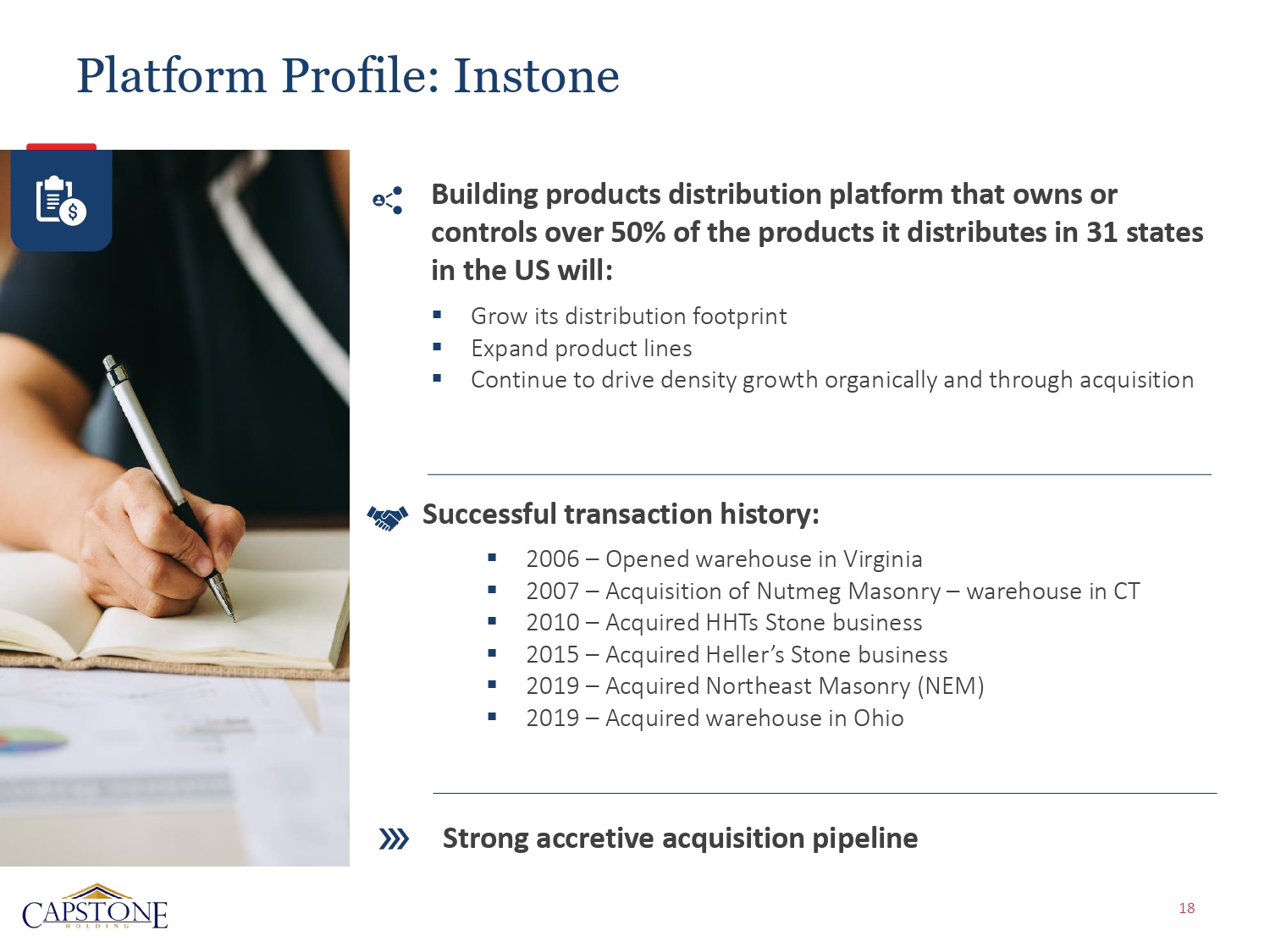

Platform Profile: Instone Building products distribution platform that owns or controls over 50% of the products it distributes in 31 states in the US will: ▪ Grow its distribution footprint ▪ Expand product lines ▪ Continue to drive density growth organically and through acquisition Successful transaction history: ▪ 2006 – Opened warehouse in Virginia ▪ 2007 – Acquisition of Nutmeg Masonry – warehouse in CT ▪ 2010 – Acquired HHTs Stone business ▪ 2015 – Acquired Heller’s Stone business ▪ 2019 – Acquired Northeast Masonry (NEM) ▪ 2019 – Acquired warehouse in Ohio Strong accretive acquisition pipeline 18

Building Businesses, Investing in People Closing Thoughts Platform run by industry veterans that understand the business cycle and buying patterns of customers Conservative capital structure Solid cash flow generation and anticipated share price appreciation 19

For More Information: Matthew Lipman Chief Executive Officer and Director +1 (212) 302 - 0699 matt.lipman@capstoneholding.net

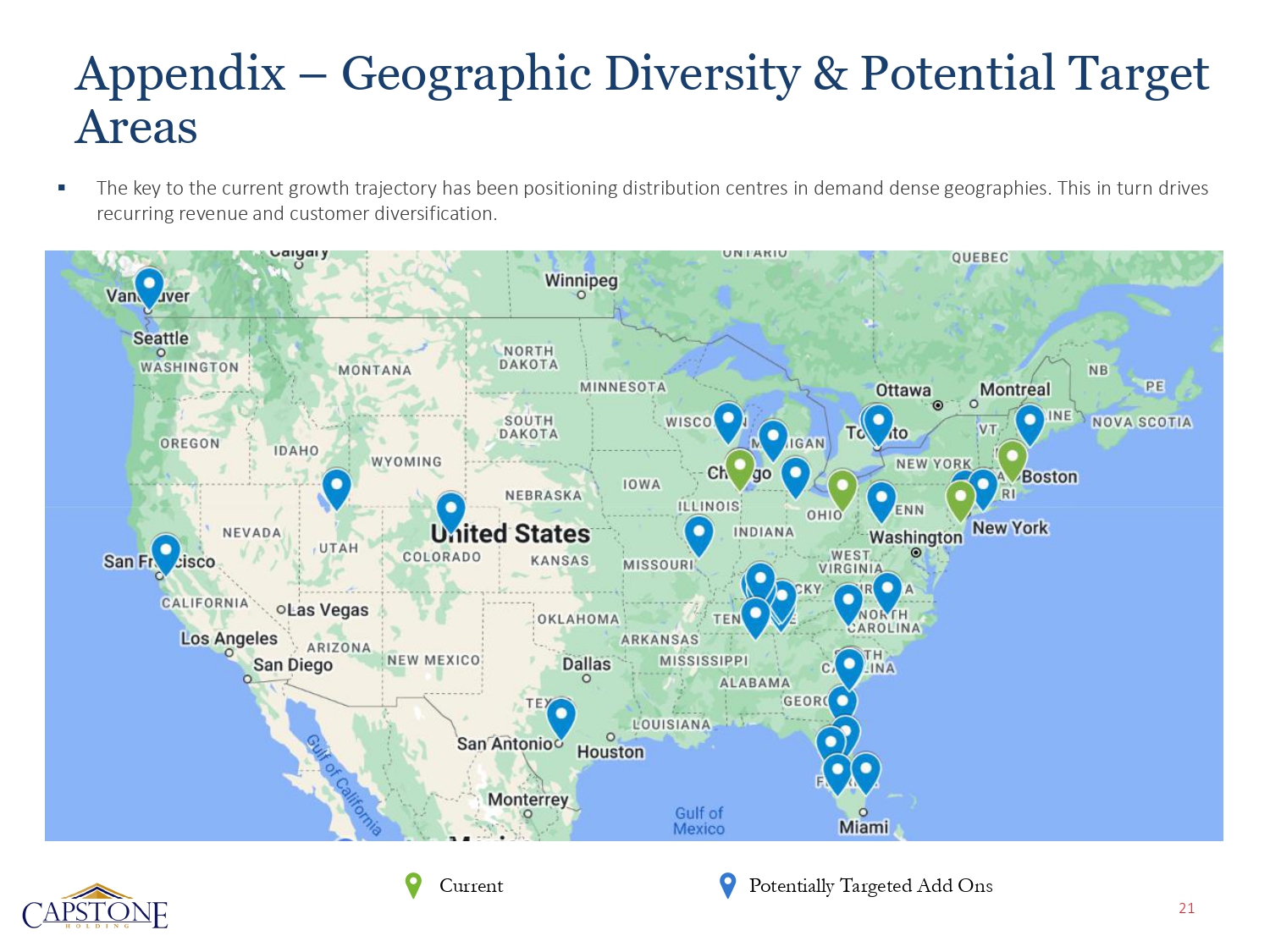

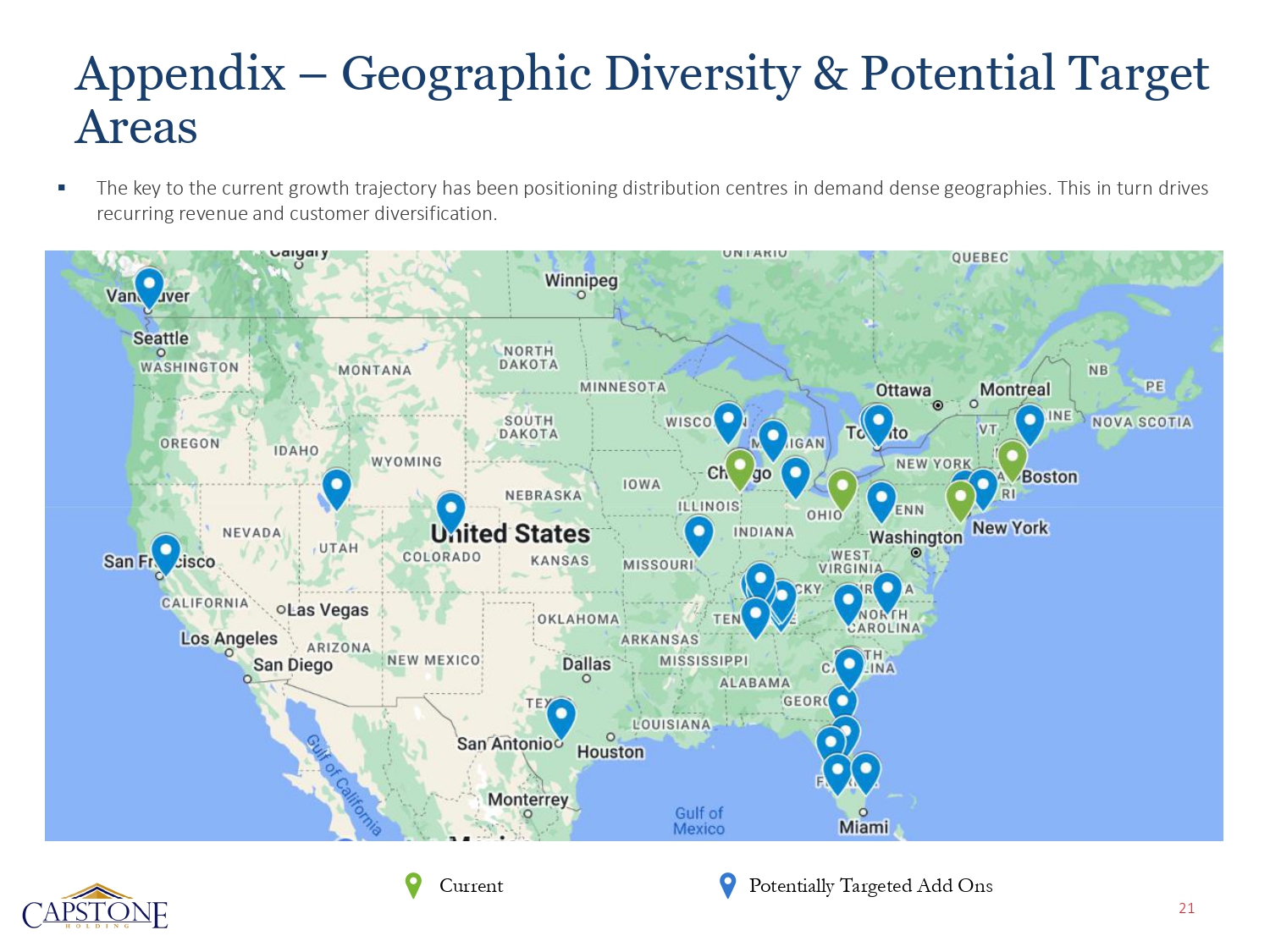

▪ The key to the current growth trajectory has been positioning distribution centres in demand dense geographies. This in turn drives recurring revenue and customer diversification. Potentially Targeted Add Ons Current Appendix – Geographic Diversity & Potential Target Areas 21

Building Businesses, Investing in People Appendix - Company History Brookstone Investment • CAPS had an NOL in excess of $150 million Ownership Increase • Brookstone expanded its ownership as a portion of debt was repaid with equity but did not trigger NOL constraints. Currently at about 77% of common. Delisting • Brookstone de - registered the common stock of Capstone under the Exchange Act to save costs and the common stock of Capstone was delisted by Nasdaq on July 21, 2011. TotalStone – Instone Transaction Regulatory and shareholder status • CAPS posts its annual report and quarterly reports to OTCmarkets.com site. 2017 2017 2020 2019 2020 • April 2020, Capstone bought ownership of about 89% of TotalStone LLC (a Brookstone Portfolio Company) in exchange for newly issued shares of preferred stock. 2024

Appendix - Current Capitalization Summary (in thousands)Actual as of September 30, 2024 (unaudited)Pro Forma (unaudited)Pro Forma as Adjusted(unaudited)Cash and cash equivalents13$ 3,571$ 2,825$ Total current assets16,481 20,039 19,293 Total current liabilities15,469 15,469 14,723 Total long-term liabilities23,871 23,871 24,132 TotalStone, LLC - Class B Class C Preferred Interests28,580 28,580 -TotalStone, LLC - Special Preferred Membership Interests1,006 1,006 -Stockholders' Equity:Common stock: $0.0005 par value; 50,000,000 shares authorized;157,610 shares issued and outstanding at September 30, 2024 and-1 2 and 1,407,610 issued and outstanding on a pro forma basis and5,190,251 on a pro forma as adjusted basisAdditional paid in capital193,044 196,601 225,180 Accumulated deficit(194,967) (194,967) (194,967) Total stockholders' equity (deficit)(1,923)$ 1,635$ 30,215

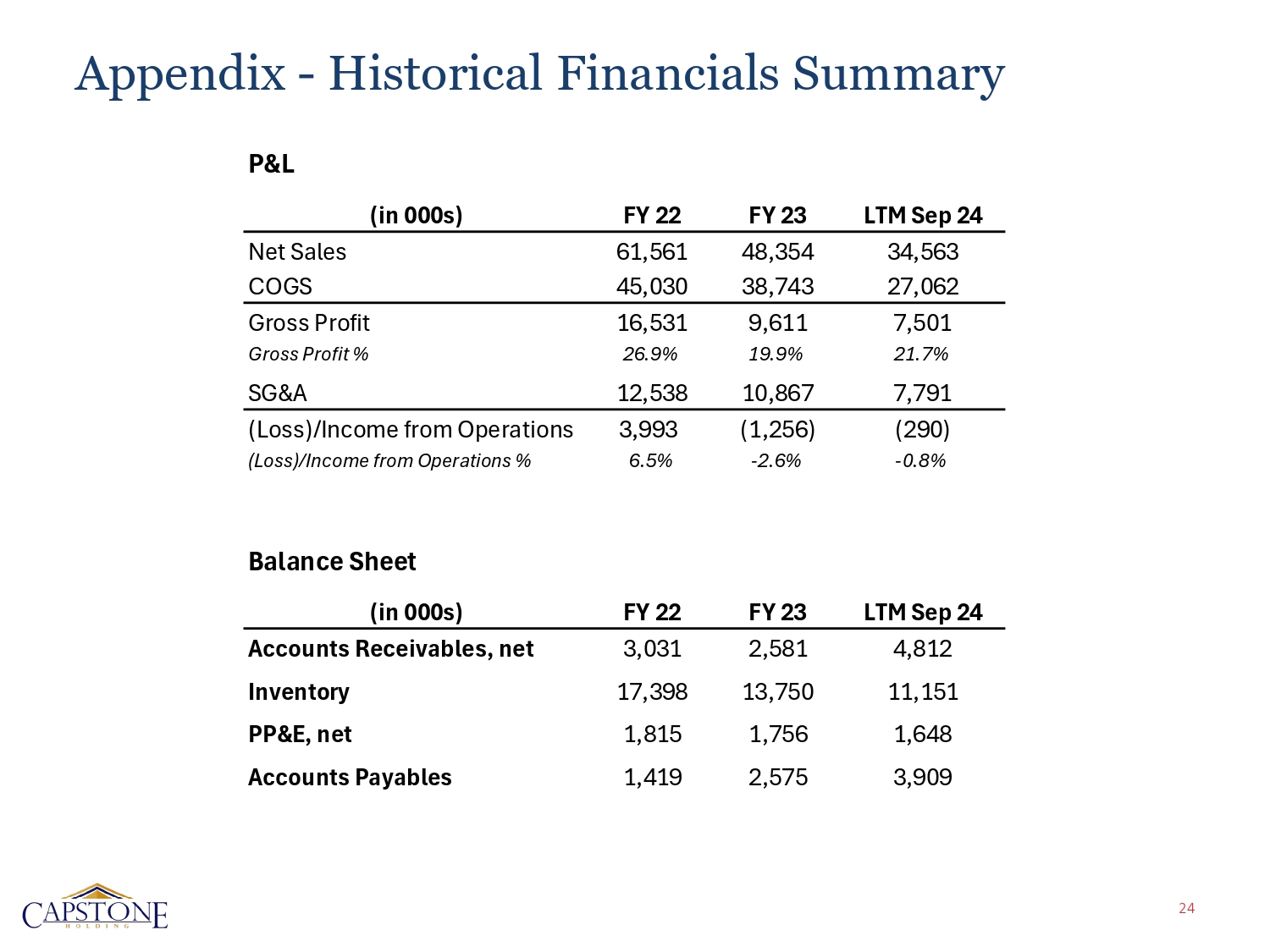

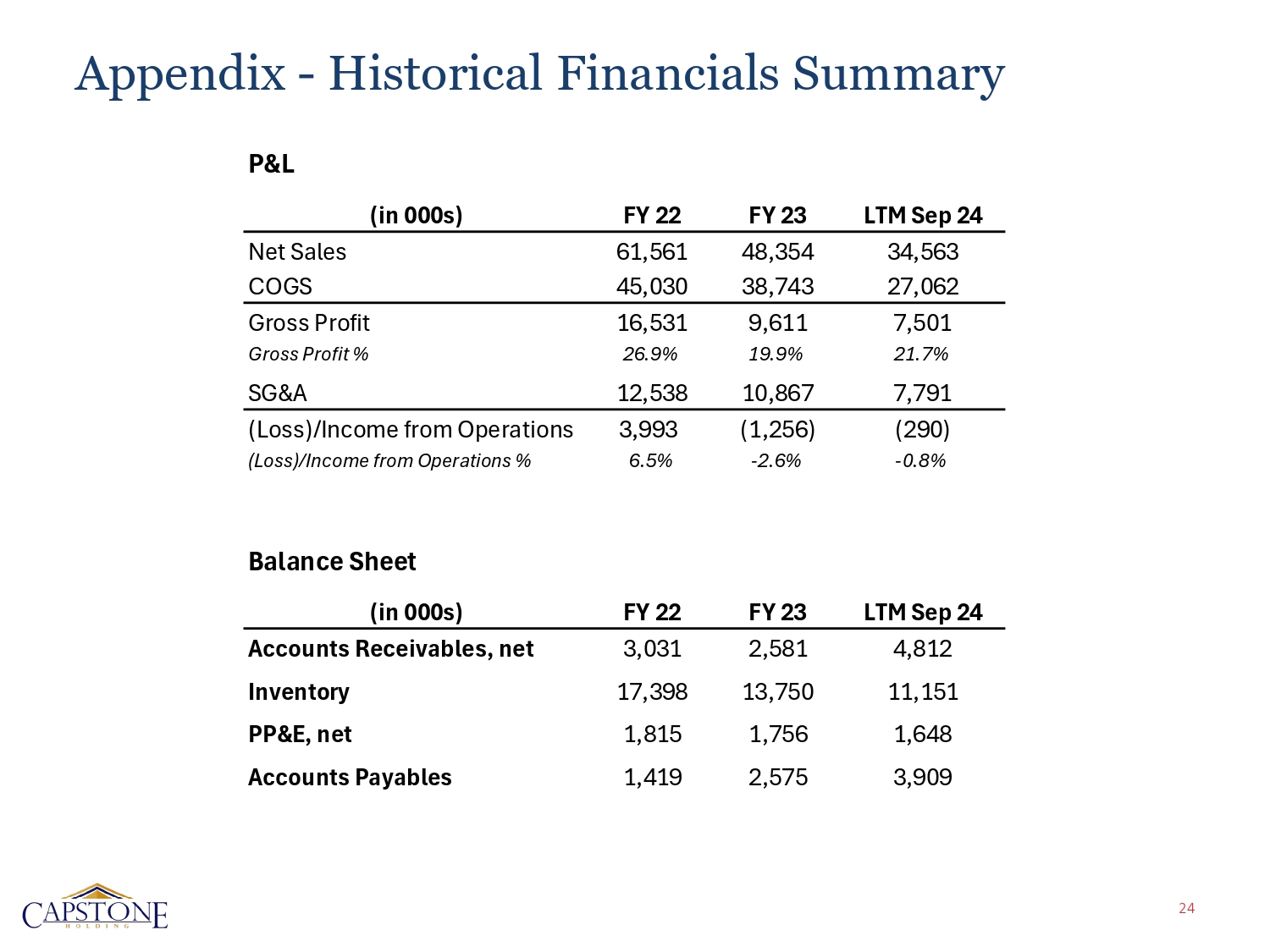

Appendix - Historical Financials Summary 24 PGL LTM Sep 24 FY 23 (in 000s) FY 22 34,563 48,354 61,561 Net Sales 27,062 38,743 45,030 COGS 7,501 9,611 16,531 Gross Profit 21.7% 12.2% 2c.2% Gross Profit % 7,791 10,867 12,538 SG&A (290) (1,256) 3,993 (Loss)/Income from Operations - 0.8% - 2.c% c.5% (Loss)/Income from Operations % Balance Sheet LTM Sep 24 FY 23 FY 22 (in 000s) 4,812 2,581 3,031 Accounts Receivables, net 11,151 13,750 17,398 Inventory 1,648 1,756 1,815 PPGE, net 3,909 2,575 1,419 Accounts Payables