Exhibit 99.1

Investor Presentation June 2017

Management Update Dave Watza, President & CEO Rick VanValkenburg, Vice President of Global Sales & Marketing 2

Cautionary Statement Certain statements made or incorporated by reference in this presentation reflects management’s estimates and beliefs and are intended to be, and are hereby identified as, “Forward - Looking Statements” under the meaning of the Private Securities Litigation Reform Act of 1995 . Whenever possible, we have identified these forward - looking statements by words such as “target,” “will,” “should,” “could,” “believes,” “expects,” “anticipates,” “estimates,” “prospects,” “outlook” or similar expressions . While we believe that our forward - looking statements are reasonable , you should not place undue reliance on any such forward - looking statements, which speak only as of the date made . Because these forward - looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual results could be materially different . Please see our SEC filings for factors that may cause such a difference, including those listed in “Item 1 A – Risk Factors ” section of our Annual Report on Form 10 - K . Except as required by applicable law, we do not undertake, and expressly disclaim, any obligation to publicly update or alter our statements whether as a result of new information, events or circumstances occurring after the date of this report or otherwise . 3 Safe Harbor Statement

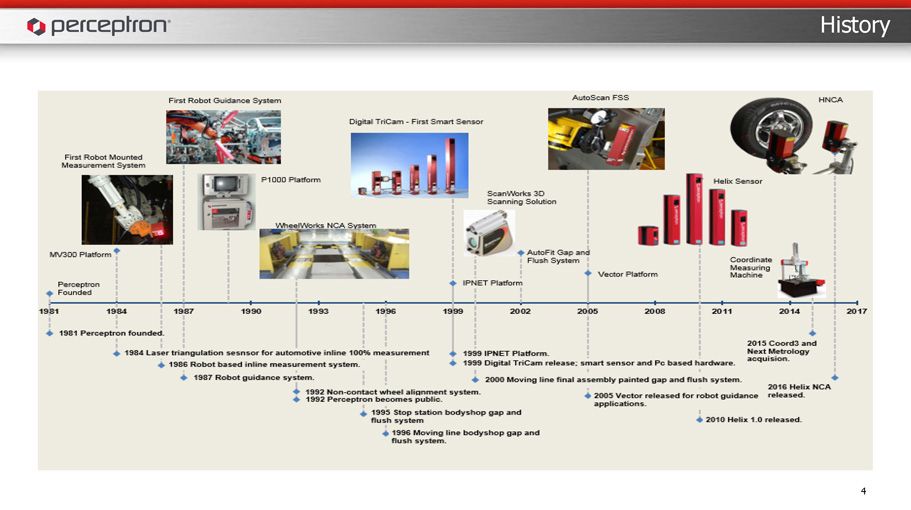

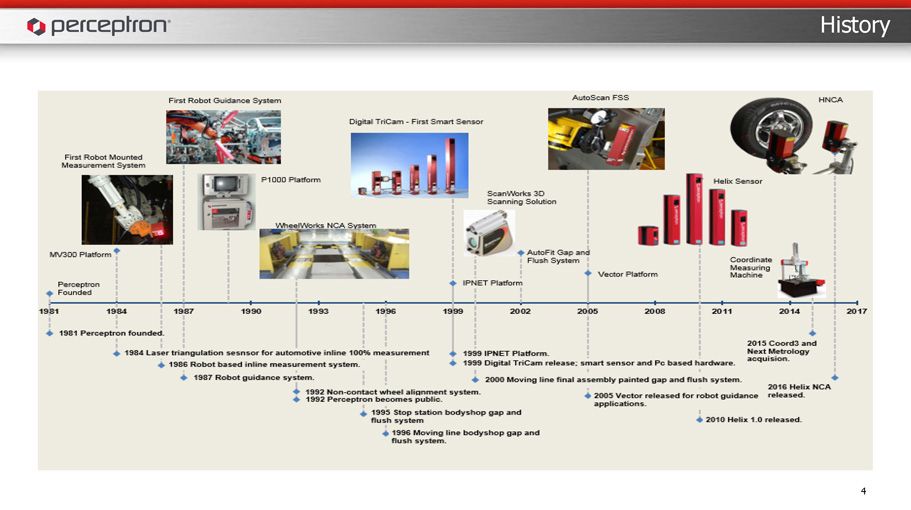

History 4

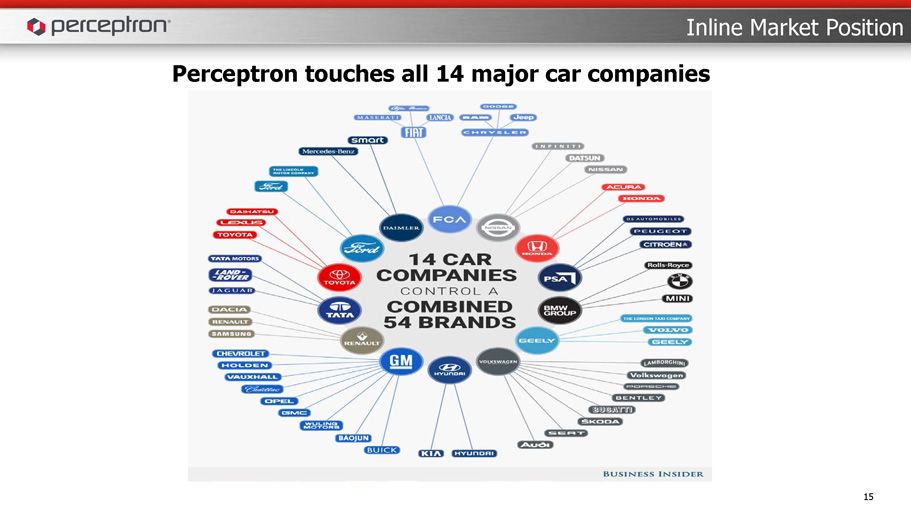

Overview Global Solutions, Supported Locally . International Headquarters Plymouth, MI USA - Since 1981 Perceptron Brazil Sao Paulo - Since 1997 European Headquarters – Perceptron GmbH Munich, Germany - Since 1985 Perceptron Asia Headquarters Singapore - Since 2005 Perceptron Japan Tokyo - Since 1990 Perceptron China Shanghai - Since 2007 Perceptron India Chennai - Since 2007 Coord3 Italy Bruzolo - Since 2015 Today we have over 900 active systems in over 200 plants owned by 40+ automobile makers and Tier 1 suppliers. 12,000 sensors and 3,000 + Coord3 CMMs are in daily use. We have integrated more than 1,000 measurement robots from 11 different robot manufacturers. 5

• Near term turnaround – Continue to focus on profitability under new management – Invest in our core technologies • Long - term outlook and strategy – Maintain and grow market leadership in core technologies – Potential to expand technology within automotive – Continue on diversification path into newer industries – Aspire to grow bookings and revenue equal to or faster than the global markets we serve – Gross profit growth should reflect efficiencies and volume gains 6 Strategy Update

Auto Applications 7 Press Shop Final Assembly Body Shop Body Shop Finish Paintshop Final gap & flushness validation Gap & Flush Inspection after assembly Automated, robot - based Scanning Closure Panels Dimensional control (In - line, distributed meas. strategy) Robot Guidance – Insertion of closure panels, roof, etc. Central Database Robot Guidance for glass decking, sealer apply, etc. Automated, robot - based Scanning Piece Parts

8 AUTO: Market leading gap and flush technology AutoFit

Innovative Sensor Technology • 3D Scanning System Feature extraction from the acquired point cloud • Intelligent Illumination Flexible configuration (number + orientation of laser lines) for each part feature; this enables optimized measurements • Very large measurement volume More measurement information without adding system complexity or increasing cycle time 9

STRENGTHS • Technology – Helix, Vector, Argus, • Talented workforce with excellent domain knowledge: calibration, robotics, controls • Reputation • Great service for our critical - path systems • Global footprint 10 Traditional Products Strategy ACTIONS • Implementing lean culture • Cutting costs efficiently & effectively • Strengthening our core products • Product Roadmap is now strategic: • Improving link between market needs and product development • Developing next generation of multiple product families • Reducing our internal deployment costs • Improving “Ease of Use” to increase value

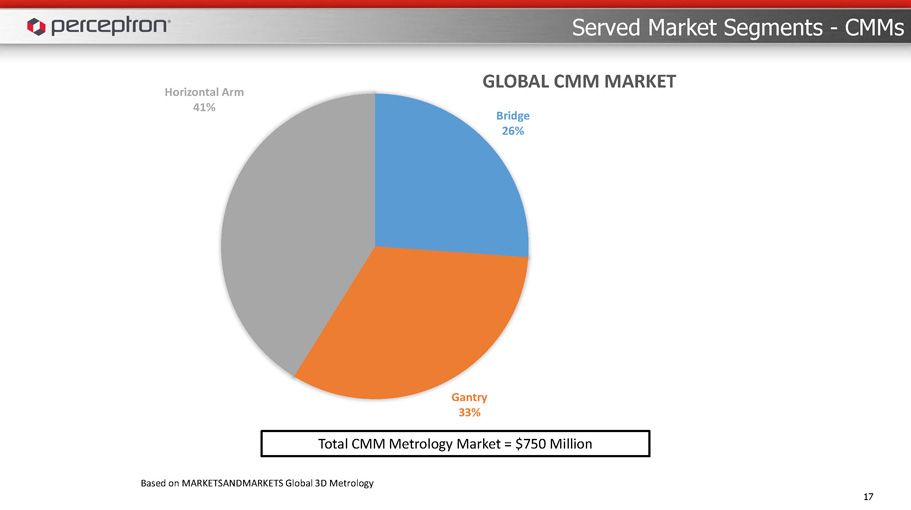

Coordinate Measurement Machines Bridge CMM Gantry CMM Horizontal Arm CMM Shop - Floor CMM STRENGTHS • Full CMM lines portfolio (Bridge, Gantry, Horizontal) • Strong market s hare in Italy • Long term business OEM metrology customers (Zeiss, Nikon, EROWA, NEXTEC) 11

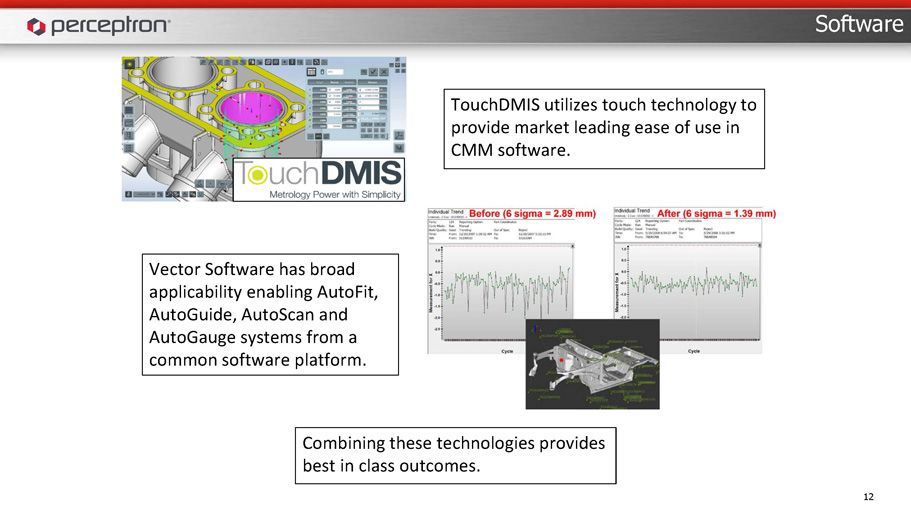

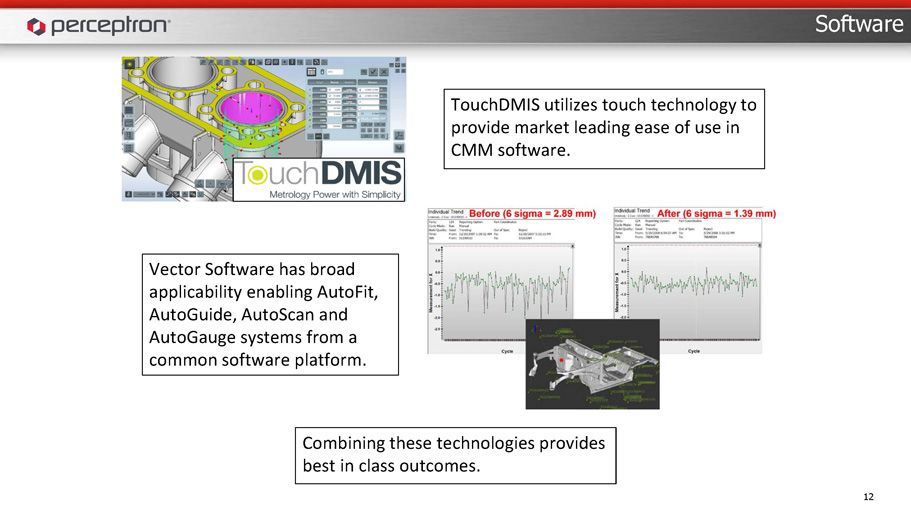

Software 12 TouchDMIS utilizes touch technology to provide market leading ease of use in CMM software. Vector Software has broad applicability enabling AutoFit, AutoGuide, AutoScan and AutoGauge systems from a common software platform. Combining these technologies provides best in class outcomes.

STRENGTHS • European product quality & Italian style • Desirable gantry product family • Open architecture • TouchDMIS software • Service and flexibility • Global footprint 13 CMM and TouchDMIS Strategy ACTIONS • Implementing lean culture • Cutting costs efficiently & effectively • Invigorating sales in low volume regions • Narrowing business focus to play to our strengths • Market focused software development

Markets 14

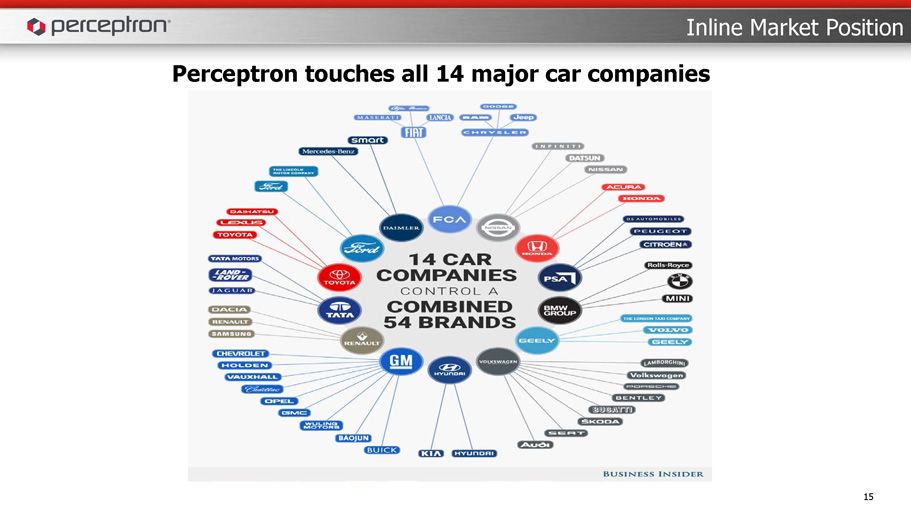

15 Inline Market Position Perceptron touches all 14 major car companies

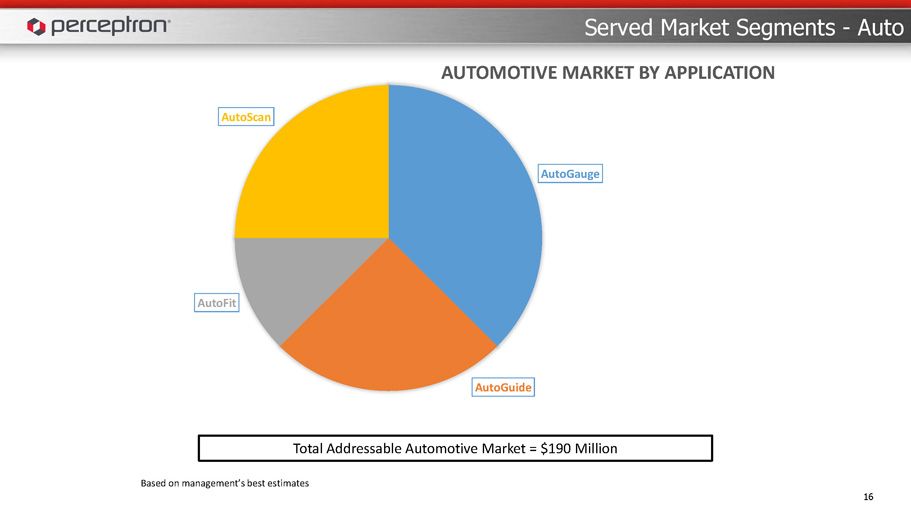

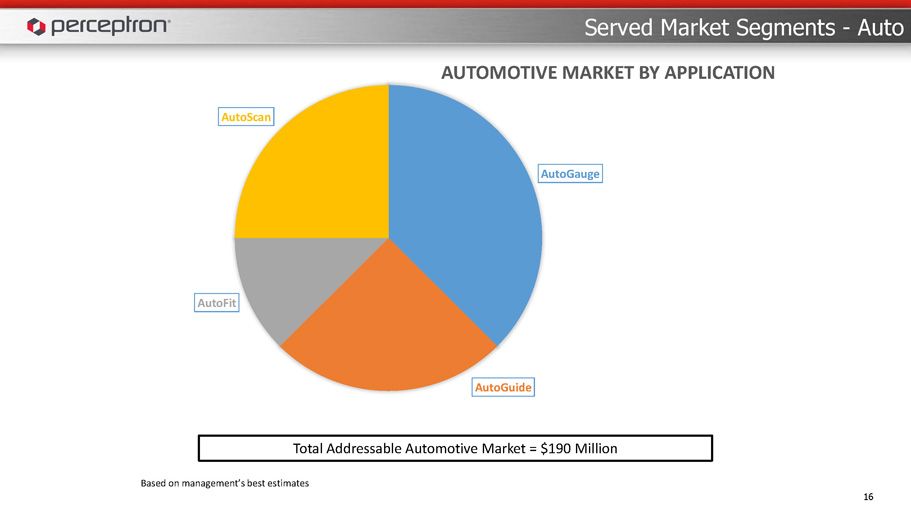

Served Market Segments - Auto 16 Based on management’s best estimates Total Addressable Automotive Market = $190 Million AutoGauge AutoGuide AutoFit AutoScan AUTOMOTIVE MARKET BY APPLICATION

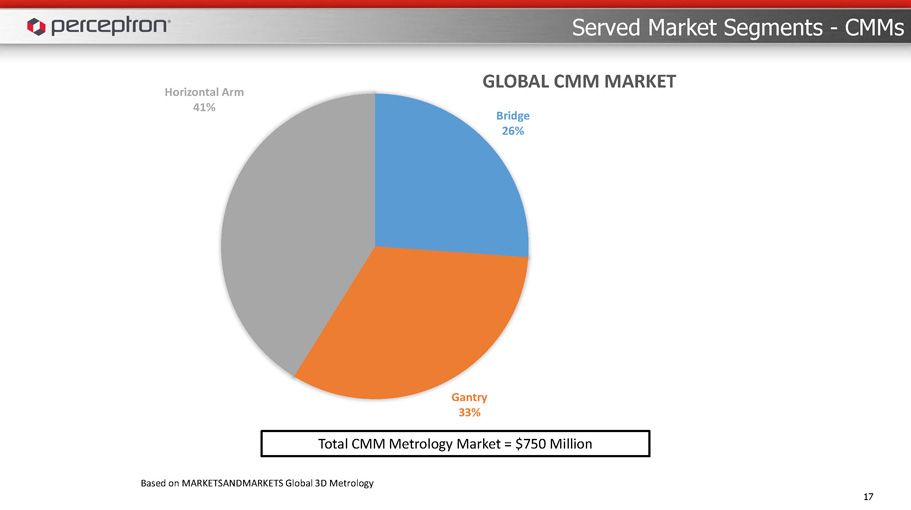

Served Market Segments - CMMs 17 Based on MARKETSANDMARKETS Global 3D Metrology Total CMM Metrology Market = $750 Million Bridge 26% Gantry 33% Horizontal Arm 41% GLOBAL CMM MARKET

Finance 18

19 Bookings History • Four quarters in excess of $20M • Q3 2017 was a record quarter • Driving forces: -- Asia recovery -- Number of new tooling programs -- Strength in Americas’ demand -- Capitalizing on Helix technology

20 Bookings History Annual Bookings

21 Revenue History

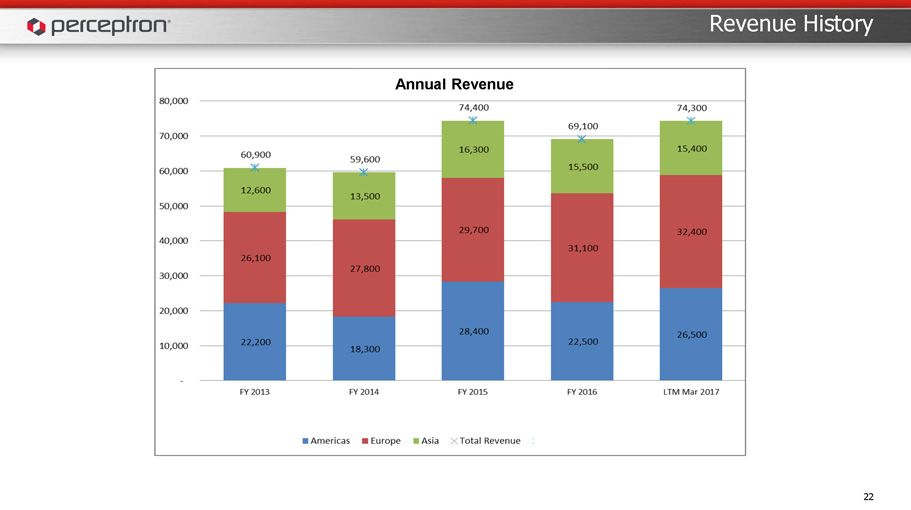

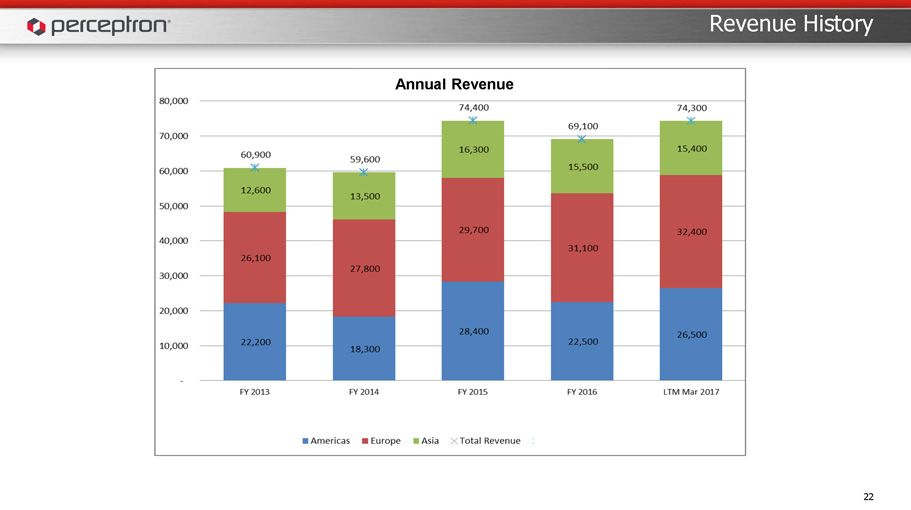

22 Revenue History Annual Revenue

23 Profitability Key quarterly financial metrics: Turnaround is gaining momentum Sep-30- 2015 Dec-31- 2015 Mar-31- 2016 Jun-30- 2016 Sep-30- 2016 Dec-31- 2016 Mar-31- 2017 Revenue 15,068 17,211 18,082 18,774 17,520 21,751 16,325 ` 4,426 5,095 5,202 6,416 4,574 9,444 5,190 Gross Profit % 29.4% 29.6% 28.8% 34.2% 26.1% 43.4% 31.9% Engineering 2,228 1,969 1,740 1,443 1,610 1,657 1,650 SG&A 5,270 5,386 4,701 4,959 4,287 4,469 4,039 Total Operating Expenses 7,499 7,355 6,442 6,402 5,897 6,126 5,688 Operating Income (Loss) (3,072) (2,261) (3,807) (244) (1,979) 3,257 (502) Operating Income (Loss) % -20.4% -13.1% -21.1% -1.3% -11.3% 15.0% -3.0% Severance, Impairment and Other charges - - (2,567) (259) (656) (61) (3) Recurring Operating Income (Loss) (3,072) (2,261) (1,240) 15 (1,323) 3,318 (499) Recurring Operating Income (Loss) % -20.4% -13.1% -6.9% 0.1% -7.6% 15.3% -3.0%

24 Profitability Turnaround began in mid - 2016; benchmark years are FY 2012 and 2013 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 LTM March 2017 Revenue 57,379 60,886 59,612 74,405 69,135 74,370 Gross Profit 24,170 28,120 24,849 28,271 21,139 25,624 Gross Profit % 42.1% 46.2% 41.7% 38.0% 30.6% 34.5% Operating Income (Loss) 5,596 6,866 2,942 (37) (9,384) 532 Operating Income (Loss) % 9.8% 11.3% 4.9% 0.0% -13.6% 0.7% Severance, Impairment and Other charges - - - - (2,826) (979) Recurring Operating Income (Loss) 5,596 6,866 2,942 (37) (6,558) 1,511 Recurring Operating Income (Loss) % 9.8% 11.3% 4.9% 0.0% -9.5% 2.0%

• Near term turnaround – Continue to focus on profitability under new management – Invest in our core technologies • Long - term outlook and strategy – Maintain and grow market leadership in core technologies – Potential to expand technology within automotive – Continue on diversification path into newer industries – Aspire to grow bookings and revenue equal to or faster than the global markets we serve – Gross profit growth should reflect efficiencies and volume gains 25 Strategy Update

26 Questions Thank you for your time and interest in our Company!