Exhibit 99.2

RBC Capital Markets

2005 Financial Institutions Conference

September 21, 2005

Forward Looking Statement

• This material includes forward looking statements, which management believes are a benefit to shareholders. These forward looking statements describe Columbia’s management’s expectations regarding future events and developments such as future operating results, growth in loans and deposits, continued success of Columbia’s style of banking and the strength of the local economy. The words “will,” “believe,” “expect,” “should,” and “anticipate” and words of similar construction are intended in part to help identify forward looking statements. Future events are difficult to predict, and the expectations described above are necessarily subject to risk and uncertainty that may cause actual results to differ materially and adversely. In addition to discussions about risks and uncertainties set forth from time to time in Columbia’s filings with the SEC, factors that may cause actual results to differ materially from those contemplated by such forward looking statements include, among others, the following possibilities: (1) local and national general and economic conditions are less favorable than expected or have a more direct and pronounced effect on Columbia than expected and adversely affect Columbia’s ability to continue its internal growth at historical rates and maintain the quality of its earning assets; (2) changes in interest rates reduce interest margins more than expected and negatively affect funding sources; (3) projected business increases following strategic expansion or opening or acquiring new branches are lower than expected; (4) costs or difficulties related to the integration of acquisitions are greater than expected; (5) competitive pressure among financial institutions increases significantly; (6) legislation or regulatory requirements or changes adversely affect the businesses in which Columbia is engaged; (7) the Company’s ability to realize the efficiencies it expects to receive from its investments in personnel and infrastructure.

Discussion Outline

History

Financial Performance Summary

Our Strategic Vision

Historical Overview

As of June 30, 2005

Tacoma area expansion began in August 1993

Since 1993 reorganization, Columbia has grown from 4 branches to 41 branches

Assets have grown from $211 million to $2.3 billion

Loans have grown from $145 million to $1.5 billion

Deposits have grown from $153 million to $1.9 billion

Financial Performance

Gary Schminkey

EVP, Chief Financial Officer

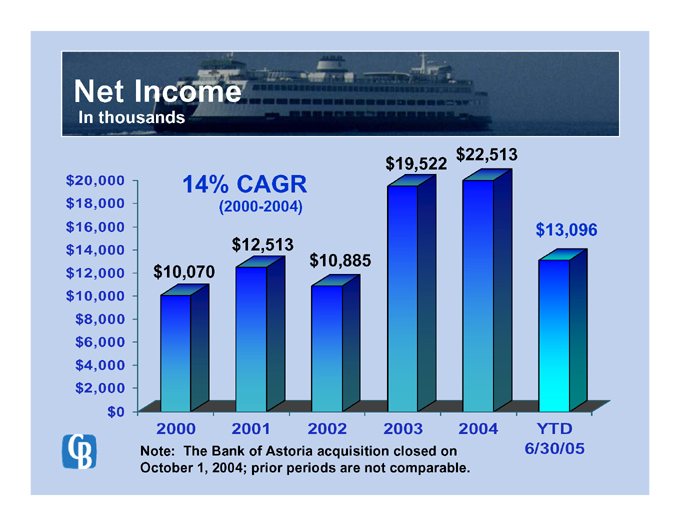

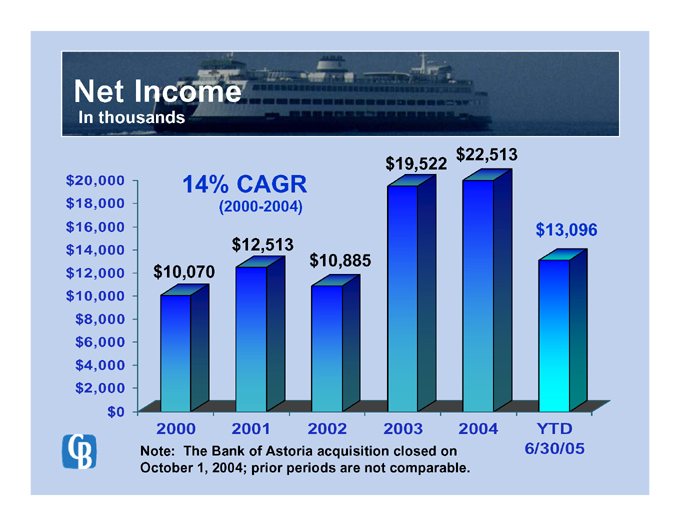

Net Income

In thousands $22,513 $19,522 $20,000 14% CAGR $18,000 (2000-2004)

$16,000 $13,096 $12,513 $10,885 $14,000 $10,070 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0

2004 2003 2002 2001 2000 YTD

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

6/30/05

Earnings per Share

(Diluted)

$1.52

$1.37

14% CAGR

$1.50

(2000-2004)

$1.30

$0.83

$1.10

$0.87

$0.78

$0.69

$0.90

$0.70

$0.50

$0.30

$0.10

2004

2003

2002

2001

2000

YTD

6/30/05

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

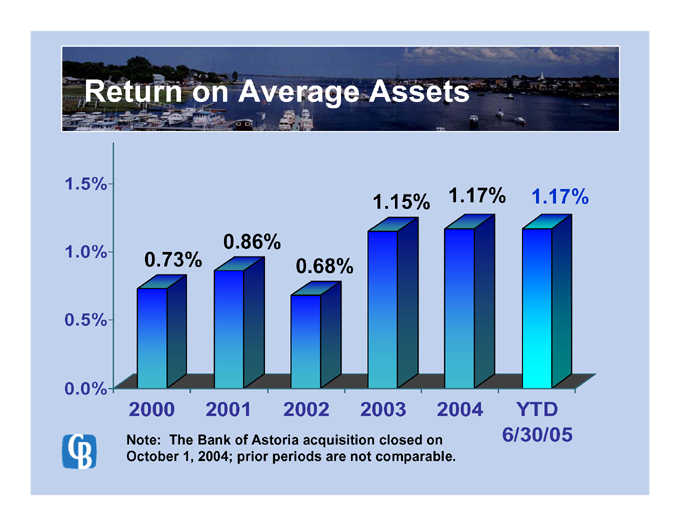

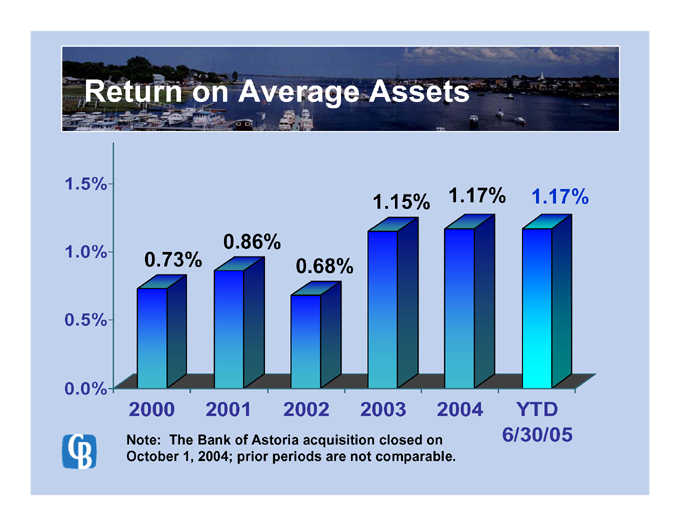

Return on Average Assets

1.17%

1.15%

1.17%

0.86%

0.68%

0.73%

2004

2003

2002

2001

2000

1.5%

1.0%

0.5%

0.0%

YTD

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

6/30/05

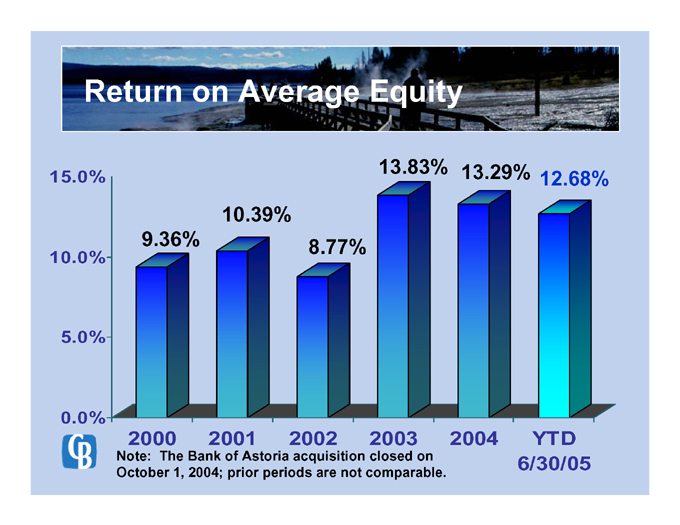

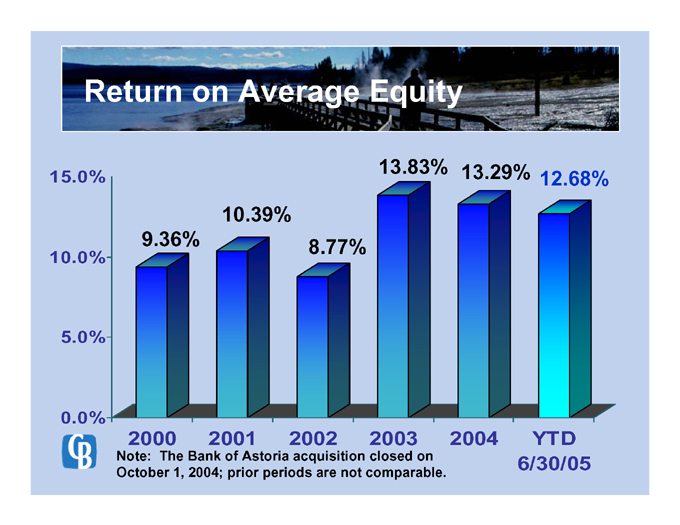

Return on Average Equity

13.83%

12.68%

13.29%

15.0%

10.39%

9.36%

8.77%

10.0%

5.0%

0.0%

2004

2003

2002

2001

2000

YTD

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

6/30/05

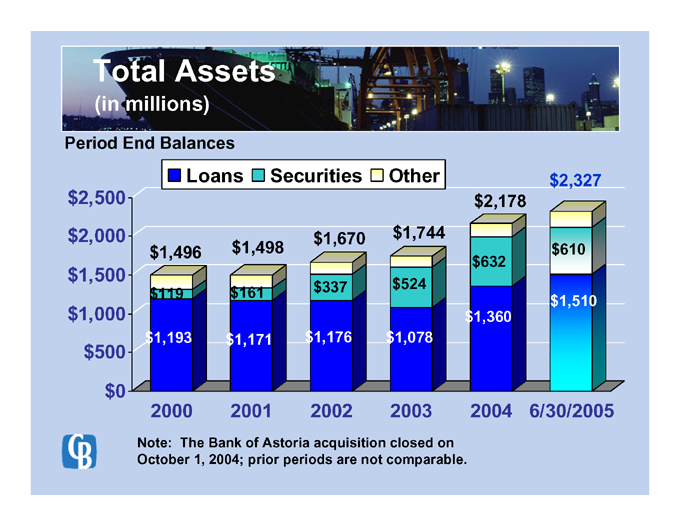

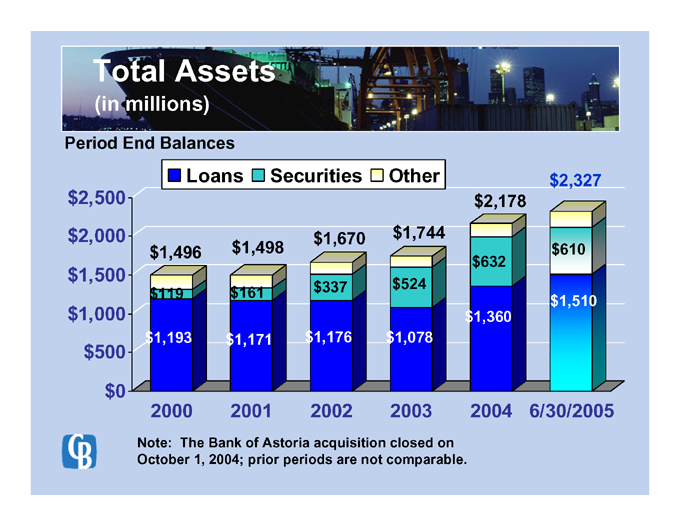

Total Assets

(in millions)

Period End Balances

Other

Securities

Loans

$2,327

$2,178

$2,500

$1,744

$1,670

$2,000

$610

$1,496

$1,498

$632

$1,500

$524

$337

$119

$161

$1,510

$1,360

$1,000

$1,078

$1,193

$1,171

$1,176

$500

$0

2004

2003

2002

2001

2000

6/30/2005

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

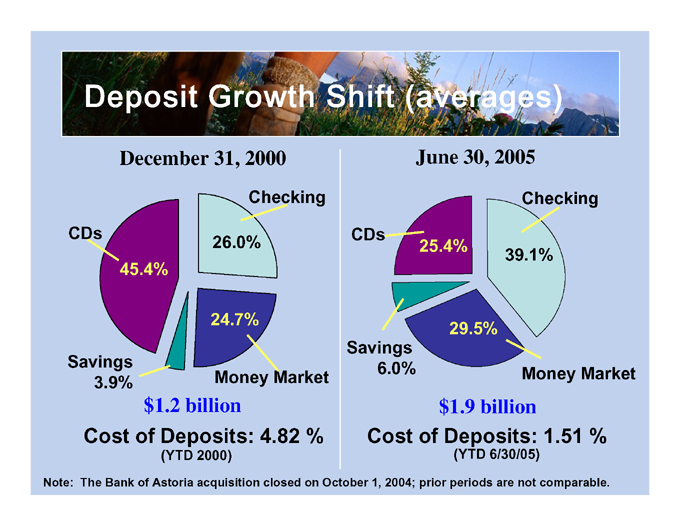

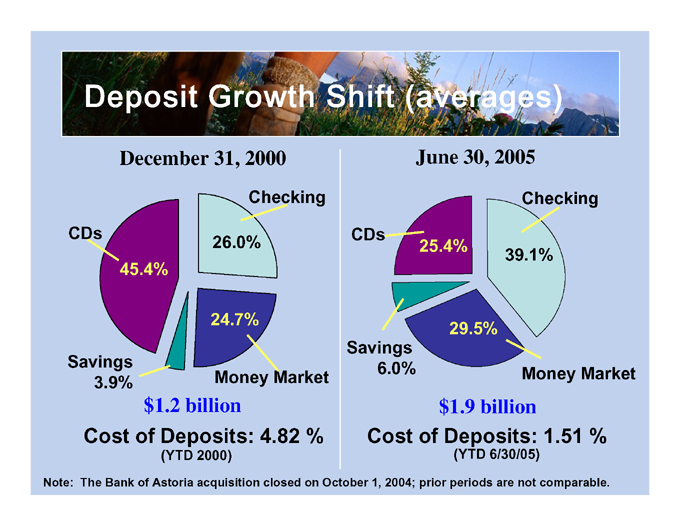

Deposit Growth Shift (averages)

December 31, 2000

June 30, 2005

Checking

Checking

CDs

CDs

25.4%

26.0%

39.1%

45.4%

24.7%

29.5%

Savings

6.0%

Savings

Money Market

Money Market

3.9%

$1.9 billion

$1.2 billion

Cost of Deposits: 4.82 %

Cost of Deposits: 1.51 %

(YTD 2000)

(YTD 6/30/05)

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

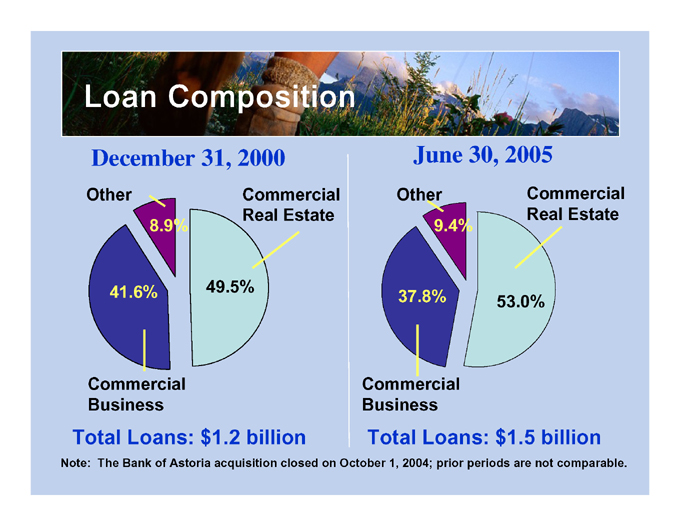

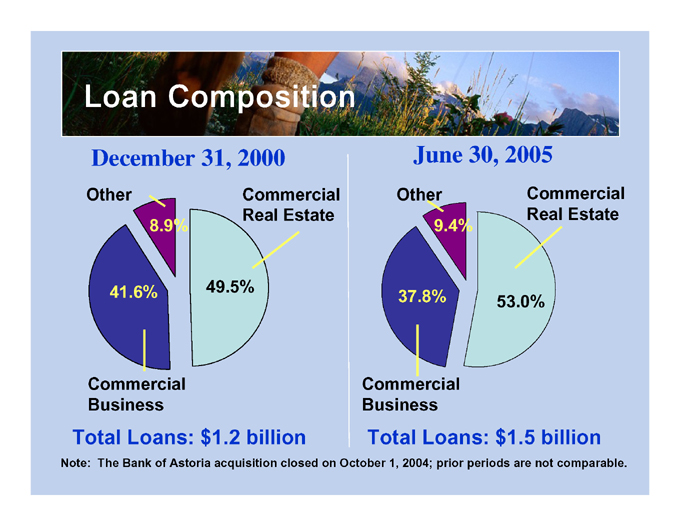

Loan Composition

December 31, 2000

June 30, 2005

Commercial Real Estate

Other

Other

Commercial Real Estate

9.4%

8.9%

41.6%

49.5%

53.0%

37.8%

Commercial Business

Commercial Business

Total Loans: $1.2 billion

Total Loans: $1.5 billion

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

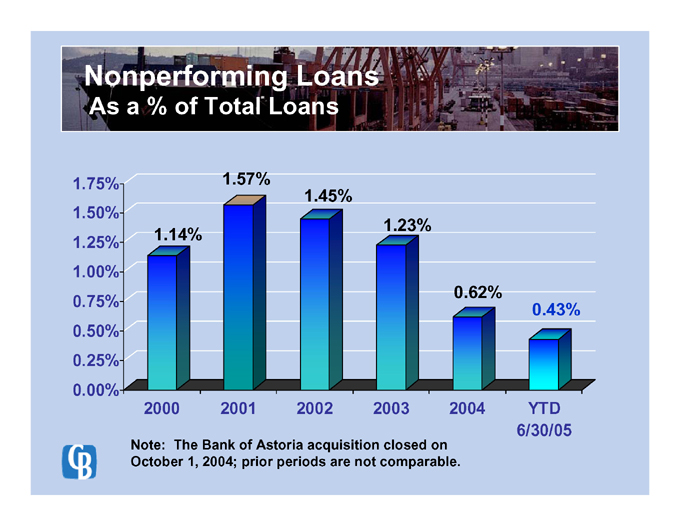

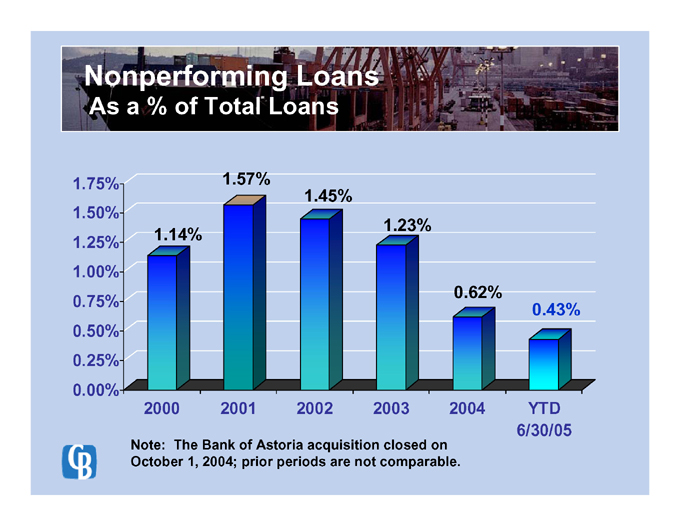

Nonperforming Loans

As a % of Total Loans

1.57%

1.75%

1.45%

1.50%

1.23%

1.14%

1.25%

1.00%

0.62%

0.43%

0.75%

0.50%

0.25%

0.00%

2004

2003

2002

2001

2000

YTD

6/30/05

Note: The Bank of Astoria acquisition closed on October 1, 2004; prior periods are not comparable.

Building on our Strengths

Shareholders are also customers

Broad base of products & services

Decision-making kept as close to the client as possible

Strong branch network

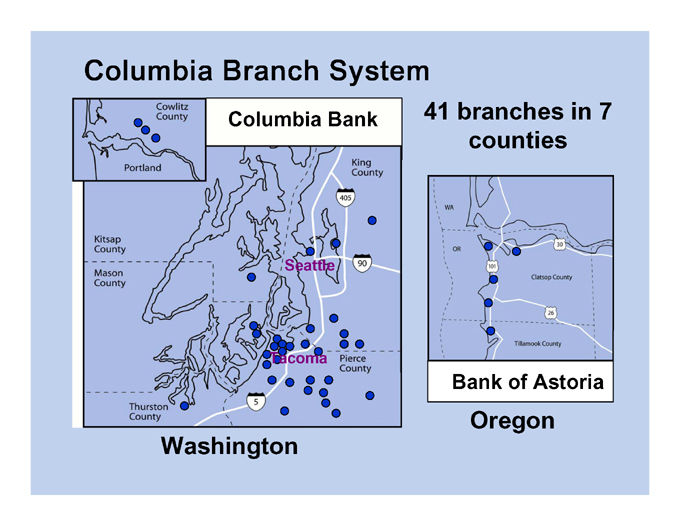

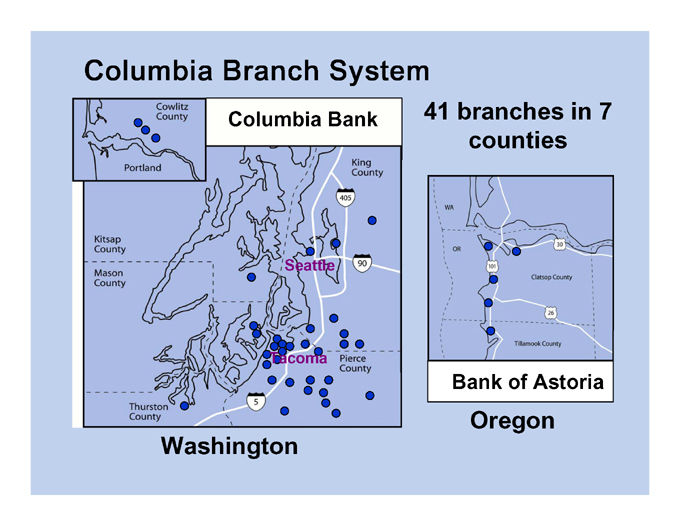

Columbia Branch System

41 branches in 7 counties

Columbia Bank

Seattle

Tacoma

Bank of Astoria

Oregon

Washington

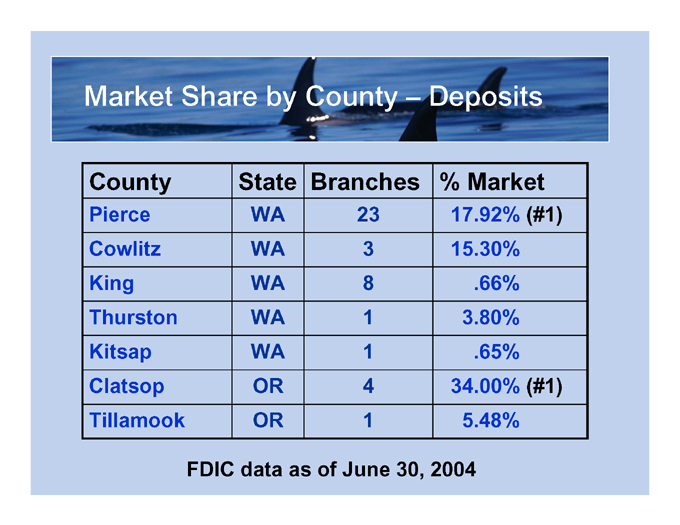

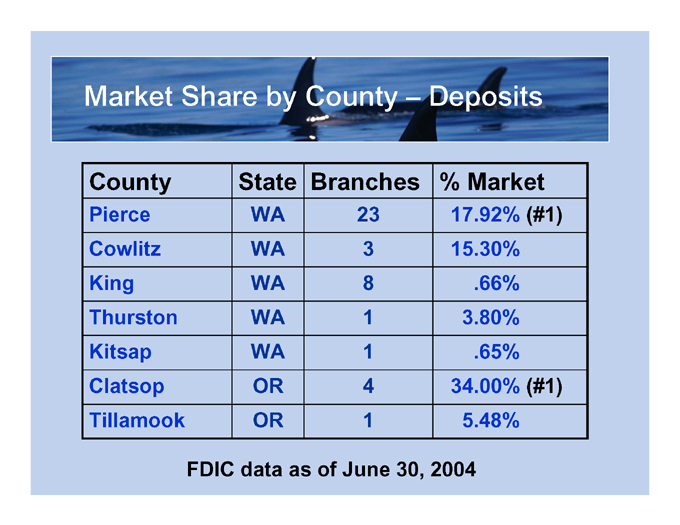

Market Share by County - Deposits

County State Branches % Market

Pierce WA 23 17.92% (#1)

Cowlitz WA 3 15.30%

King WA 8 .66%

Thurston WA 1 3.80%

Kitsap WA 1 .65%

Clatsop OR 4 34.00% (#1)

Tillamook OR 1 5.48%

FDIC data as of June 30, 2004

Building on our Strengths

Commitment to customer service

Strive to be the community bank in all the communities we serve

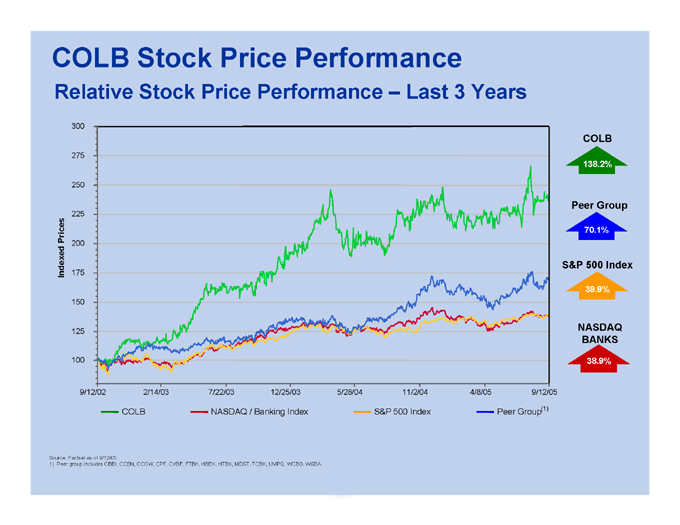

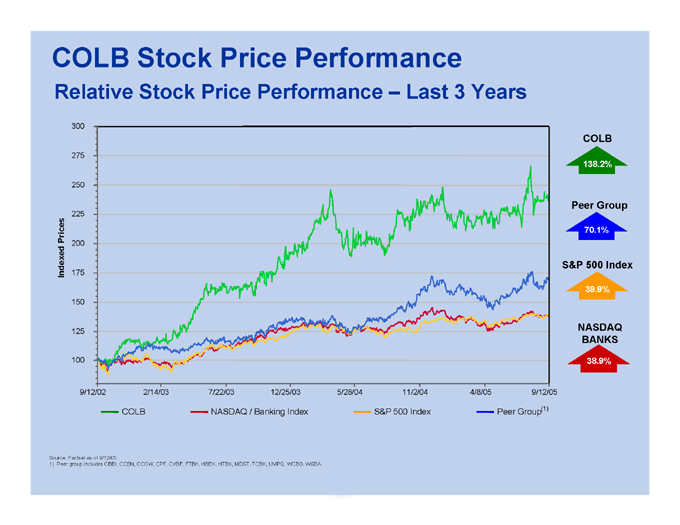

COLB Stock Price Performance

Relative Stock Price Performance - Last 3 Years

300

COLB

275

138.2%

250

Peer Group

225

70.1%

200

Indexed Prices

S&P 500 Index

175

39.9%

150

NASDAQ BANKS

125

100

38.9%

9/12/05

4/8/05

11/2/04

5/28/04

12/25/03

7/22/03

2/14/03

9/12/02

Source: Factset as of 9/12/05.

1) Peer group includes CBBI, CCBN, CCOW, CPF, CVBF, FTBK, HBEK, HTBK, MDST, TCBK, UMPQ, WCBO, WSBA.

Strategic Direction

Build value for our shareholders

Foundation for continued growth in market share by leveraging strong retail branch system

Continue to extend footprint of existing branch network - selective branching in Washington & Oregon

Consider strategic acquisition opportunities

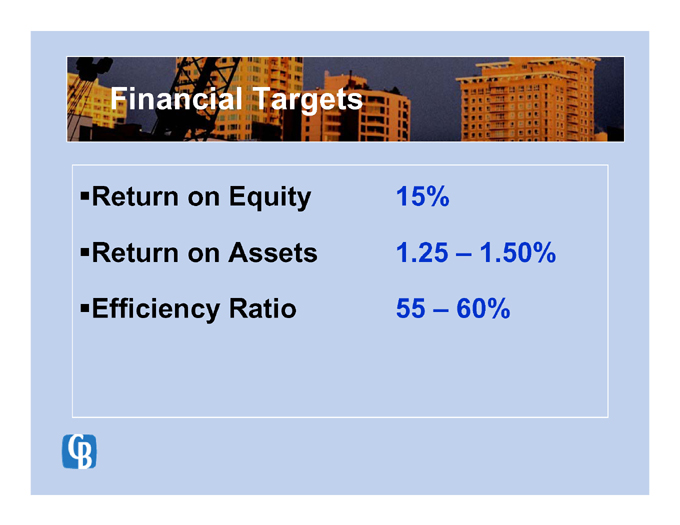

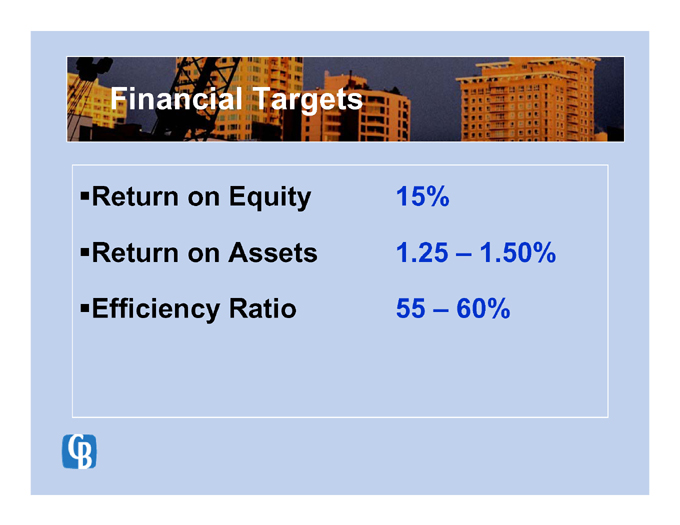

Financial Targets

Financial Targets

Return on Equity 15%

Return on Assets 1.25 - 1.50%

Efficiency Ratio 55 - 60%

Melanie J. Dressel

President & Chief Executive Officer

P.O. Box 2156

Tacoma, WA 98401-2156

253-305-1911

mdressel@columbiabank.com

Gary R. Schminkey

EVP & Chief Financial Officer

P.O. Box 2156

Tacoma, WA 98401-2156

253-305-1966

garys@columbiabank.com