|

Exhibit 99.6

|

Filed by Columbia Banking System, Inc.

pursuant to Rule 425 under the Securities

Act of 1933 and deemed filed pursuant to

Rule 14a-12 under the Securities

Exchange Act of 1934

Subject Company: Intermountain

Community Bancorp

Commission File No.: 001-35775

Acquisition of

Intermountain Community Bancorp/

Panhandle State Bank

Investor Presentation

July 24, 2014

Cautionary Note: Forward Looking Statements

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact are forward-looking statements. These forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause Columbia’s or Intermountain Community Bancorp’s (“Intermountain”) performance or

achievements to be materially different from any expected future results, performance, or achievements.

Forward-looking statements speak only as of the date they are made and neither Columbia nor Intermountain assumes any duty to update forward

looking statements. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination

transaction involving Columbia and Intermountain, including future financial and operating results, the combined company’s plans, objectives,

expectations and intentions and other statements that are not historical facts. The following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements: (i) the possibility that the merger does not close when expected or at all because

required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (ii)

changes in Columbia’s stock price before closing, including as a result of the financial performance of Intermountain prior to closing, or more

generally due to broader stock market movements, and the performance of financial companies and peer group companies; (iii) the risk that the

realized or may take longer to benefits from the transaction may not be fully realize than expected, including as a result of changes in general

economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of

competition in the geographic and business areas in which Columbia and Intermountain operate; (iv) the ability to promptly and effectively integrate

the businesses of Columbia and Intermountain; (v) the reaction to the transaction of the companies’ customers, employees and counterparties; (vi)

diversion of management time on merger-related issues; (vii) lower than expected revenues, credit quality deterioration or a reduction in real estate

values or a reduction in net earnings; and (viii) other risks that are described in Columbia’s and Intermountain’s public filings with the Securities and

Exchange Commission (the “SEC”). For more information, see the risk factors described in each of Columbia’s and Intermountain’s Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC.

Annualized, pro forma, projected and estimated numbers and percentages are used for illustrative purposes only, are not forecasts and may not

reflect actual results.

2

Transaction Highlights

Natural extension into Idaho, a neighboring state

IMCB, with 19 branches, is the 3rd largest community bank headquartered in Idaho

COLB’s Transaction

Rationale

Bolsters COLB s position as the premier regional community bank in the Pacific Northwest

Complementary community-focused banking models built around strong core deposit bases

Noninterest bearing deposits of 36.8% and 33.4% for COLB and IMCB, respectively

Enhances loan portfolio diversification

Delivers COLB’s expanded product suite and higher lending capacity to IMCB customer base

Opportunity to expand in Boise, 3rd largest deposit MSA in the Pacific Northwest

Risk

Management

Pro forma assumptions driven by significant due diligence

Track record of 9 successfully integrated acquisitions over the last 10 years

Continued pro-Attractive

Financial

~2% earnings accretion / ~22% incremental earnings accretion in 2016(1)

> 15% IRR

Continued, strong pro forma capital ratios position COLB well for potential future acquisitions

Returns Tangible Book Value Earnback of ~3 years

~1% TBV Dilution at Close

(1) Incremental earnings accretion is the percentage increase of earnings per share attributable to the shares issued.

3

Transaction Overview

Transaction Value(1) $121.5 million

Price per Share(1) $18.22

Consideration(2)

Pro Forma Ownership

Exchange ratio of 0.6426x + $2.2930 cash per share

86% stock / 14% cash (1)

92.6% COLB / 7.4% IMCB

Board

Management

One current community-based member from IMCB to join COLB

Board of Directors, pro forma board will have 12 members

IMCB CEO joining COLB to assist with integration and Idaho

Due Diligence

Termination Fee

expansion

Completed; including an extensive loan and fixed asset review

$5 5 million Required Approval

Targeted Closing

5.5 for superior offer and other customary events

Customary regulatory and IMCB shareholder approvals

Fourth quarter of 2014

(1) Based on COLB’s closing stock price as of 7/23/2014 and IMCB’s diluted share count of 6.7 million. Transaction value, price per share, and

relative value of consideration mix will change based on the fluctuation in COLB’s stock price. Please see Appendix.

(1) Aggregate consideration mix is 4,233,707 COLB shares issued and $16.5 million of cash including $1.4 million in cash to warrant holders.

4

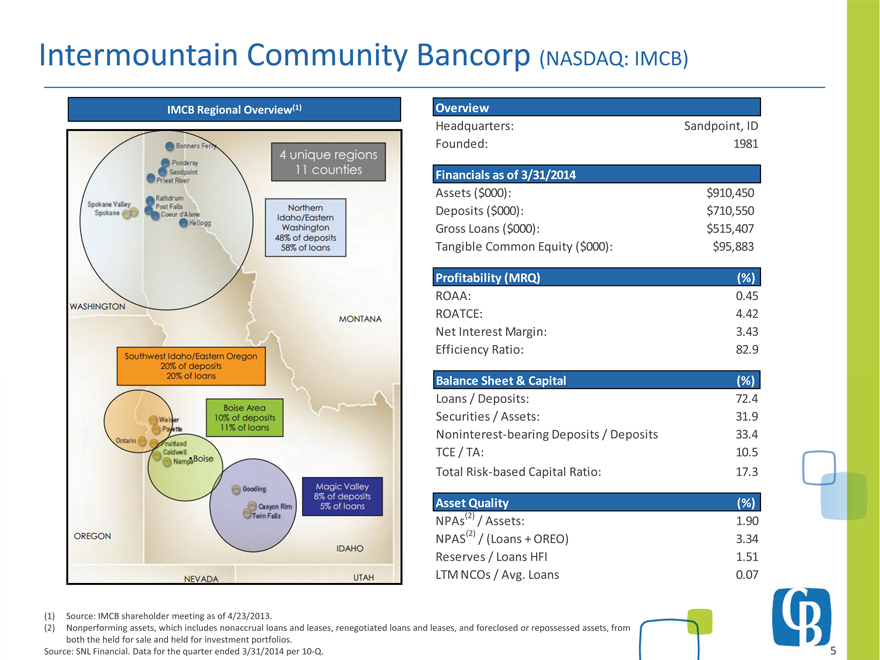

Intermountain Community Bancorp (NASDAQ: IMCB)

Financials as of 3/31/2014

A ($000) $910 450

IMCB Regional Overview(1) Overview

Headquarters: Sandpoint, ID

Founded: 1981

Profitability MRQ) (%)

Assets 000): 910,450

Deposits ($000): $710,550

Gross Loans ($000): $515,407

Tangible Common Equity ($000): $95,883

y ( Q) ( )

ROAA: 0.45

ROATCE: 4.42

Net Interest Margin: 3.43

Efficiency Ratio: 82.9

Balance Sheet & Capital (%)

Loans / Deposits: 72.4

Securities / Assets: 31.9

Noninterest-bearing Deposits / Deposits 33.4

TCE / TA: 10.5

Total 17 3

Asset Quality (%)

NPAs(2) / Assets: 1.90

NPAS(2) / (Loans + OREO) 3.34

Reserves / Loans HFI 1.51

Risk-based Capital Ratio: 17.3

LTM NCOs / Avg. Loans 0.07

(1) Source: IMCB shareholder meeting as of 4/23/2013.

(2) Nonperforming assets, which includes nonaccrual loans and leases, renegotiated loans and leases, and foreclosed or repossessed assets, from

both the held for sale and held for investment portfolios.

Source: SNL Financial. Data for the quarter ended 3/31/2014 per 10-Q.

5

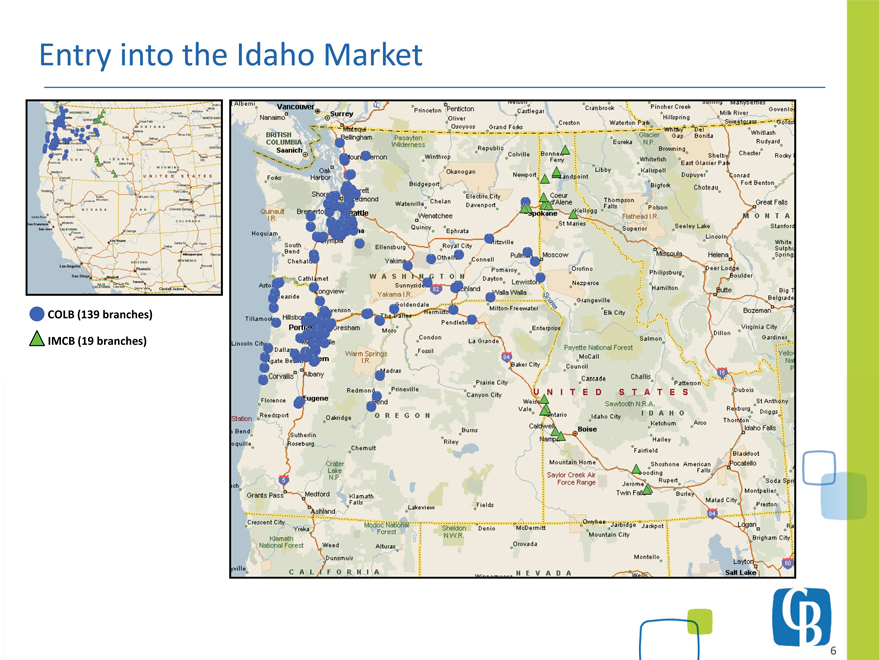

Entry into the Idaho Market

IMCB (19 branches)

6

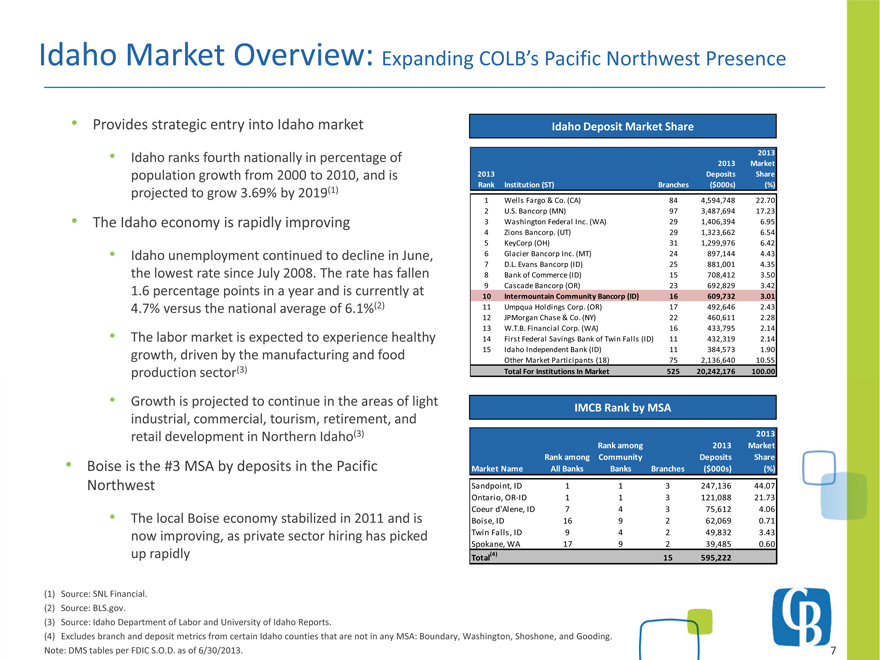

Idaho Market Overview: Expanding COLB’s Pacific Northwest Presence

Provides strategic entry into Idaho market

Idaho ranks fourth nationally in percentage of

population growth from 2000 to 2010, and is

j d 3 69% b 2019(1)

2013

Rank Institution ( ST) Branches

2013

Deposits

($000s)

2013

Market

Share

(%)

Idaho Deposit Market Share

projected to grow 3.69% by The Idaho economy is rapidly improving

Idaho unemployment continued to decline in June,

the lowest rate since July 2008. The rate has fallen

) ( ) ( )

1 Wells Fargo & Co. (CA) 84 4,594,748 22.70

2 U.S. Bancorp (MN) 97 3,487,694 17.23

3 Washington Federal Inc. (WA) 29 1,406,394 6.95

4 Zions Bancorp. (UT) 29 1,323,662 6.54

5 KeyCorp (OH) 31 1,299,976 6.42

6 Glacier Bancorp Inc. (MT) 24 897,144 4.43

7 D.L. Evans Bancorp (ID) 25 881,001 4.35

8 Bank of Commerce (ID) 15 708,412 3.50

1.6 percentage points in a year and is currently at 9 C d B 23 692 829 3 42

4.7% versus the national average of 6.1%(2)

The labor market is expected to experience healthy

growth, driven by the manufacturing and food

production sector(3)

Cascade Bancorp (OR) 692,829 3.42

10 Intermountain Community Bancorp (ID) 16 609,732 3.01

11 Umpqua Holdings Corp. (OR) 17 492,646 2.43

12 JPMorgan Chase & Co. (NY) 22 460,611 2.28

13 W.T.B. Financial Corp. (WA) 16 433,795 2.14

14 First Federal Savings Bank of Twin Falls (ID) 11 432,319 2.14

15 Idaho Independent Bank (ID) 11 384,573 1.90

Other Market Participants (18) 75 2,136,640 10.55

Total For Institutions In Market 525 20,242,176 100.00

Market Name

Rank among

All Banks

Rank among

Community

Banks Branches

2013

Deposits

($ 000s)

2013

Market

Share

(%)

p

Growth is projected to continue in the areas of light

industrial, commercial, tourism, retirement, and

retail development in Northern Idaho(3)

Boise is the #3 MSA by deposits in the Pacific

IMCB Rank by MSA

) ( )

Sandpoint, ID 1 1 3 247,136 44.07

Ontario, OR-ID 1 1 3 121,088 21.73

Coeur d’Alene, ID 7 4 3 75,612 4.06

Boise, ID 16 9 2 62,069 0.71

Twin Falls, ID 9 4 2 49,832 3.43

Spokane, WA 17 9 2 39,485 0.60

Total(4) 15 595,222

y p

Northwest

The local Boise economy stabilized in 2011 and is

now improving, as private sector hiring has picked

up rapidly

(1) Source: SNL Financial.

(2) Source: BLS.gov.

(3) Source: Idaho Department of Labor and University of Idaho Reports.

(4) Excludes branch and deposit metrics from certain Idaho counties that are not in any MSA: Boundary, Washington, Shoshone, and Gooding.

Note: DMS tables per FDIC S.O.D. as of 6/30/2013.

7

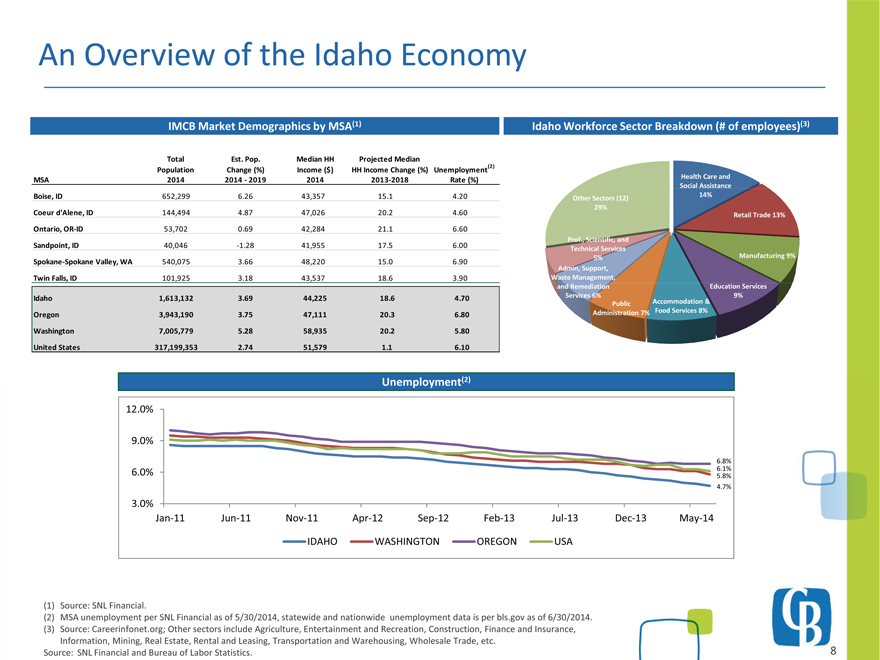

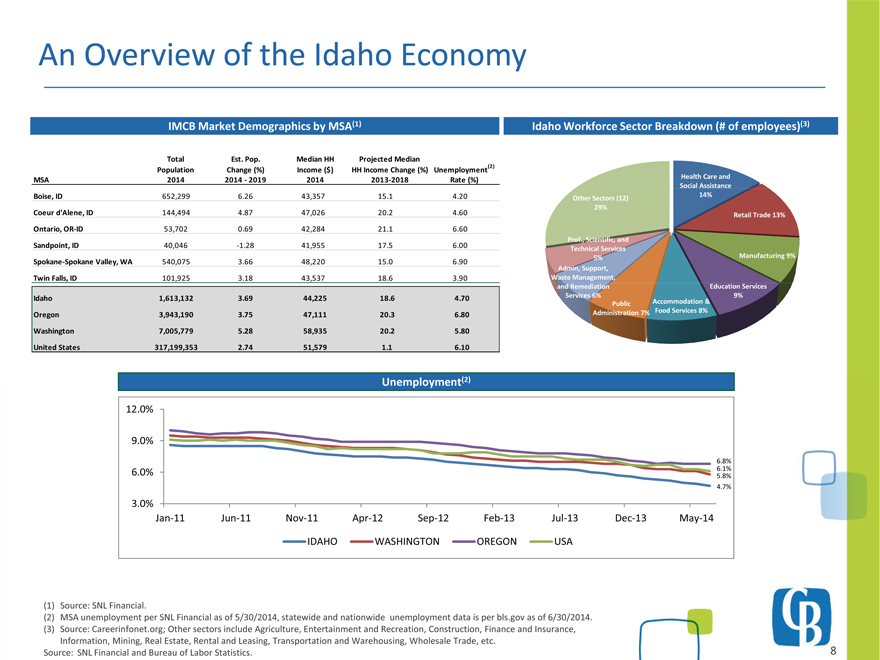

An Overview of the Idaho Economy

Health Care and

Social Assistance

IMCB Market Demographics by MSA(1) Idaho Workforce Sector Breakdown (# of employees)(3)

Total Est. Pop. Median HH Projected Median

Population Change (%) Income ($) HH Income Change (%) Unemployment(2)

MSA 2014 2014 - 2019 2014 2013-2018 Rate (%)

14%

Retail Trade 13%

Manufacturing 9%

Admin, Support,

Waste Management,

Prof., Scientific, and

Technical Services

5%

Other Sectors (12)

29%

Boise, ID 652,299 6.26 43,357 15.1 4.20

Coeur d’Alene, ID 144,494 4.87 47,026 20.2 4.60

Ontario, OR-ID 53,702 0.69 42,284 21.1 6.60

Sandpoint, ID 40,046 -1.28 41,955 17.5 6.00

Spokane-Spokane Valley, WA 540,075 3.66 48,220 15.0 6.90

Twin Falls, ID 101,925 3.18 43,537 18.6 3.90

Education Services

9%

Accommodation &

Food Services 8%

Public

Administration 7%

and Remediation

Services 6%

l (2)

Idaho 1,613,132 3.69 44,225 18.6 4.70

Oregon 3,943,190 3.75 47,111 20.3 6.80

Washington 7,005,779 5.28 58,935 20.2 5.80

United States 317,199,353 2.74 51,579 1.1 6.10

6 0%

9.0%

12.0%

6.8%

Unemployment(6.1%

3.0%

6.0%

Jan-11 Jun-11 Nov-11 Apr-12 Sep-12 Feb-13 Jul-13 Dec-13 May-14

IDAHO WASHINGTON OREGON USA

5.8%

4.7%

(1) Source: SNL Financial.

(2) MSA unemployment per SNL Financial as of 5/30/2014, statewide and nationwide unemployment data is per bls.gov as of 6/30/2014.

(3) Source: Careerinfonet.org; Other sectors include Agriculture, Entertainment and Recreation, Construction, Finance and Insurance,

Information, Mining, Real Estate, Rental and Leasing, Transportation and Warehousing, Wholesale Trade, etc.

Source: SNL Financial and Bureau of Labor Statistics.

8

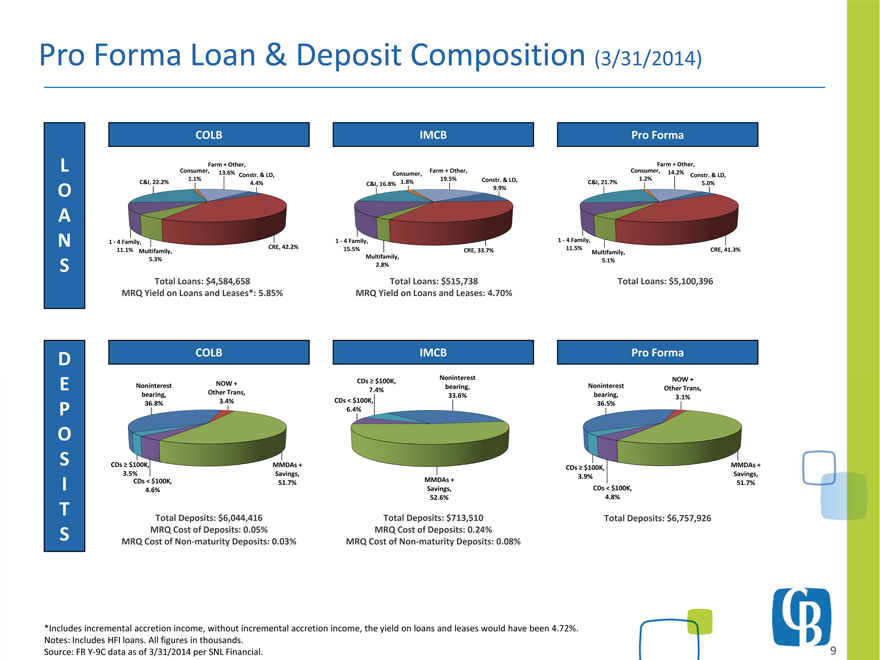

Pro Forma Loan & Deposit Composition (3/31/2014)

Constr. & LD,

C&I, 21.7% 5.0%

Consumer,

1.2%

Farm + Other,

14.2%

Constr. & LD,

C&I, 16.8% 9 9%

Consumer,

1.8%

Farm + Other,

Constr. & LD, 19.5%

C&I, 22.2% 4.4%

Consumer,

1.1%

Farm + Other,

13.6% LO

COLB IMCB Pro Forma

Multifamily, CRE, 41.3%

5.1%

1 - 4 Family,

11.5%

9.9%

CRE, 33.7%

Multifamily,

2.8%

1 - 4 Family,

CRE, 42.2% 15.5%

Multifamily,

5.3%

1 - 4 Family,

11.1%

OANS

4,584,658

515,738

5,100,396

Noninterest

NOW

DE

Total Loans: $MRQ Yield on Loans and Leases*: 5.85%

Total Loans: $MRQ Yield on Loans and Leases: 4.70%

COLB IMCB Pro Forma

Total Loans: $Noninterest

bearing,

36.5%

+

Other Trans,

3.1%

MMDAs +

S i

CDs = $100K,

bearing,

33.6%

CDs < $100K,

6.4%

CDs = $100K,

Noninterest 7.4%

bearing,

36.8%

NOW +

Other Trans,

3.4%

MMDAs +

S i

CDs = $100K,

3 5%

EPOS

Savings,

51.7%

CDs < $100K,

4.8%

MMDAs + 3.9%

Savings,

52.6%

Savings,

CDs < $100K, 51.7%

4.6%

3.5% ITS

Total Deposits: $6,044,416

MRQ Cost of Deposits: 0.05%

MRQ Cost of Non-maturity Deposits: 0.03%

Total Deposits: $713,510

MRQ Cost of Deposits: 0.24%

MRQ Cost of Non-maturity Deposits: 0.08%

Total Deposits: $6,757,926

*Includes incremental accretion income, without incremental accretion income, the yield on loans and leases would have been 4.72%.

Notes: Includes HFI loans. All figures in thousands.

Source: FR Y-9C data as of 3/31/2014 per SNL Financial.

9

Pro Forma Financial Impact

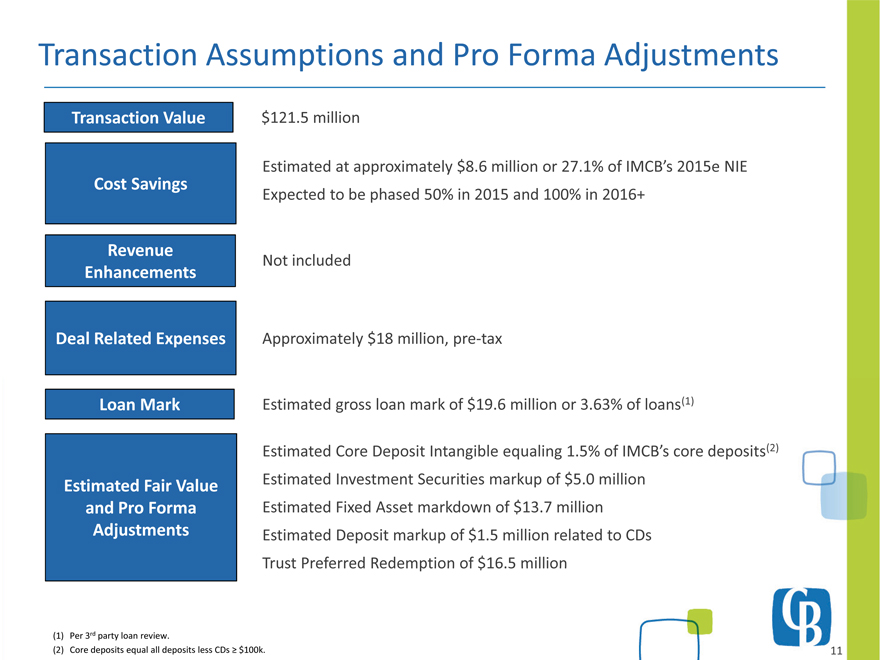

Transaction Assumptions and Pro Forma Adjustments

Cost Savings

Estimated at approximately $8.6 million or 27.1% of IMCB’s 2015e NIE

d b h d d

Transaction Value $121.5 million

Revenue

Enhancements

Not included

Expected to be phased 50% in 2015 and 100% in 2016+

Deal Related Expenses Approximately $18 million, pre-tax

Estimated Core Deposit Intangible equaling 1.5% of IMCB’s core deposits(2)

$

Loan Mark Estimated gross loan mark of $19.6 million or 3.63% of loans(1)

Estimated Investment Securities markup of 5.0 million

Estimated Fixed Asset markdown of $13.7 million

Estimated Deposit markup of $1.5 million related to CDs

Redemption of $million

Estimated Fair Value

and Pro Forma

Adjustments

(1) Per 3rd party loan review.

(2) Core deposits equal all deposits less CDs = $100k. 11

Preferred 16.5

11

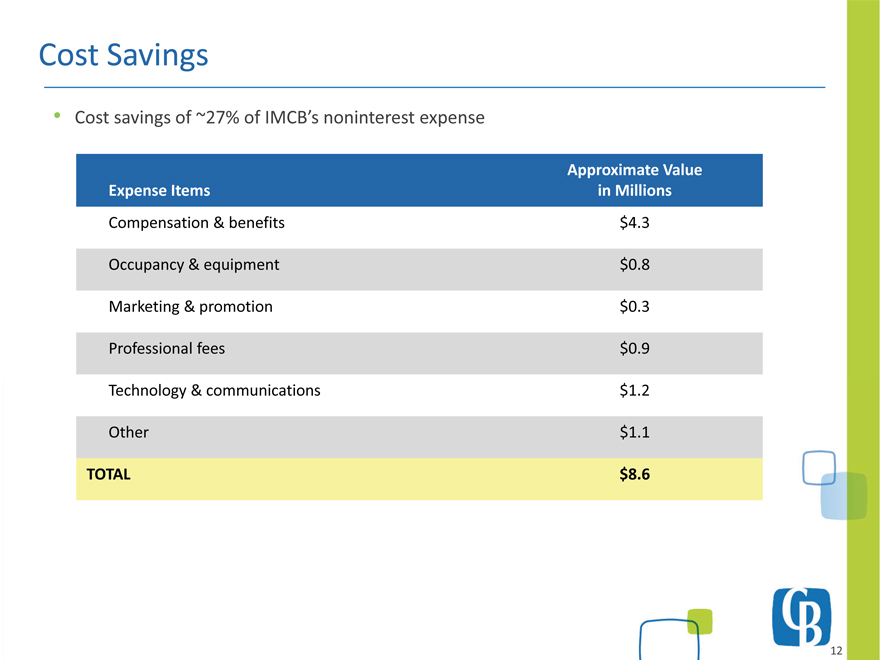

Cost Savings

Cost savings of ~27% of IMCB’s noninterest expense

Expense Items

Approximate Value

in Millions

Compensation & benefits $4.3

Occupancy & equipment $0.8

Marketing & promotion $0.3

Professional fees $0.9

Technology & communications $1.2

Other $1.1

TOTAL $8.6

12

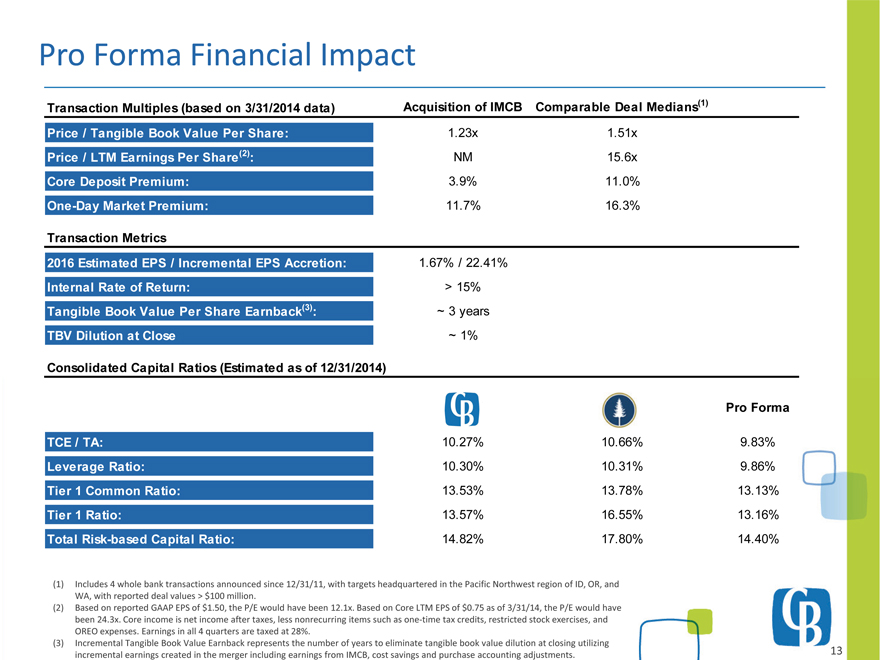

Pro Forma Financial Impact

Transaction Multiples (based on 3/31/2014 data) Acquisition of IMCB Comparable Deal Medians(1)

Price / Tangible Book Value Per Share: 1.23x 1.51x

Price / LTM Earnings Per Share(2): NM 15.6x

Core Deposit Premium: 3.9% 11.0%

One-Day Market Premium: 11.7% 16.3%

Transaction Metrics

2016 Estimated EPS / Incremental EPS Accretion: 1.67% / 22.41%

Internal Rate of Return: > 15%

Tangible Book Value Per Share Earnback(3): ~ 3 years

TBV Dilution at Close ~ 1%

Consolidated Capital Ratios (Estimated as of 12/31/2014)

Pro Forma

TCE / TA: 10.27% 10.66% 9.83%

Leverage Ratio: 10.30% 10.31% 9.86%

Tier 1 Common Ratio: 13.53% 13.78% 13.13%

Tier 1 Ratio: 13.57% 16.55% 13.16%

Total Risk-based Capital Ratio: 14.82% 17.80% 14.40%

(1) Includes 4 whole bank transactions announced since 12/31/11, with targets headquartered in the Pacific Northwest region of ID, OR, and

WA, with reported deal values > $100 million.

(2) Based on reported GAAP EPS of $1.50, the P/E would have been 12.1x. Based on Core LTM EPS of $0.75 as of 3/31/14, the P/E would have

been 24.3x. Core income is net income after taxes, less nonrecurring items such as one-time tax credits, restricted stock exercises, and

OREO expenses. Earnings in all 4 quarters are taxed at 28%.

(3) Incremental Tangible Book Value Earnback represents the number of years to eliminate tangible book value dilution at closing utilizing

incremental earnings created in the merger including earnings from IMCB, cost savings and purchase accounting adjustments.

13

Attractive Investment Opportunity

Acquisition is in line with COLB’s strategic plan, and meets COLB’s investment criteria

Entry into Idaho provides COLB a solid foothold in a contiguous state with strong growth potential

Culturally compatible banks with similar core deposit bases and commercial banking orientation

Increased size and scale favorably positions COLB for further acquisitions and growth strategies

Pacific Northwest considered a “region to watch” for brightest economic future(1)

Transaction should enhance COLB’s long-term shareholder value

(1) Source: “The U.S. Economy: Regions To Watch in 2012” per www.forbes.com, published on 1/4/2012.

14

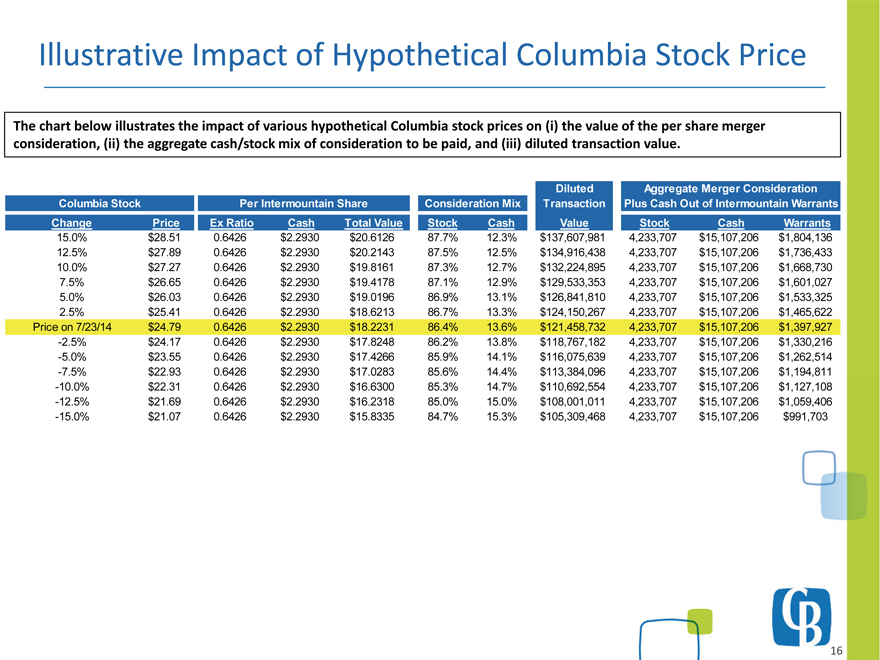

Appendix: Merger Consideration

Illustrative Impact of Hypothetical Columbia Stock Price

The chart below illustrates the impact of various hypothetical Columbia stock prices on (i) the value of the per share merger consideration, (ii) the aggregate cash/stock mix of consideration to be paid, and (iii) diluted transaction value.

Diluted Aggregate Merger Consideration

Columbia Stock Per Intermountain Share Consideration Mix Transaction Plus Cash Out of Intermountain Warrants

Change Price Ex Ratio Cash Total Value Stock Cash Value Stock Cash Warrants

15.0% $28.51 0.6426 $2.2930 $ 20.6126 87.7% 12.3% $137,607,981 4,233,707 $15,107,206 $1,804,136

12.5% $27.89 0.6426 $2.2930 $ 20.2143 87.5% 12.5% $134,916,438 4,233,707 $15,107,206 $1,736,433

10.0% $27.27 0.6426 $2.2930 $ 19.8161 87.3% 12.7% $132,224,895 4,233,707 $15,107,206 $1,668,730

75%. $26.65 0.6426 $2.2930 $ 19.4178 87.1% 12.9% $129,533,353 4233, ,707 $15,107,206 $1,601,027

5.0% $26.03 0.6426 $2.2930 $ 19.0196 86.9% 13.1% $126,841,810 4,233,707 $15,107,206 $1,533,325

2.5% $25.41 0.6426 $2.2930 $ 18.6213 86.7% 13.3% $124,150,267 4,233,707 $15,107,206 $1,465,622

Price on 7/23/14 $24.79 0.6426 $2.2930 $ 18.2231 86.4% 13.6% $121,458,732 4,233,707 $15,107,206 $1,397,927

-2.5% $24.17 0.6426 $2.2930 $ 17.8248 86.2% 13.8% $118,767,182 4,233,707 $15,107,206 $1,330,216

-5.0% $23.55 0.6426 $2.2930 $ 17.4266 85.9% 14.1% $116,075,639 4,233,707 $15,107,206 $1,262,514

-7.5% $22.93 0.6426 $2.2930 $ 17.0283 85.6% 14.4% $113,384,096 4,233,707 $15,107,206 $1,194,811

-10.0% $22.31 0.6426 $2.2930 $ 16.6300 85.3% 14.7% $110,692,554 4,233,707 $15,107,206 $1,127,108

-12.5% $21.69 0.6426 $2.2930 $ 16.2318 85.0% 15.0% $108,001,011 4,233,707 $15,107,206 $1,059,406

-15.0% $21.07 0.6426 $2.2930 $ 15.8335 84.7% 15.3% $105,309,468 4,233,707 $15,107,206 $991,703

16

Appendix II:

Summary of 2nd Quarter Performance

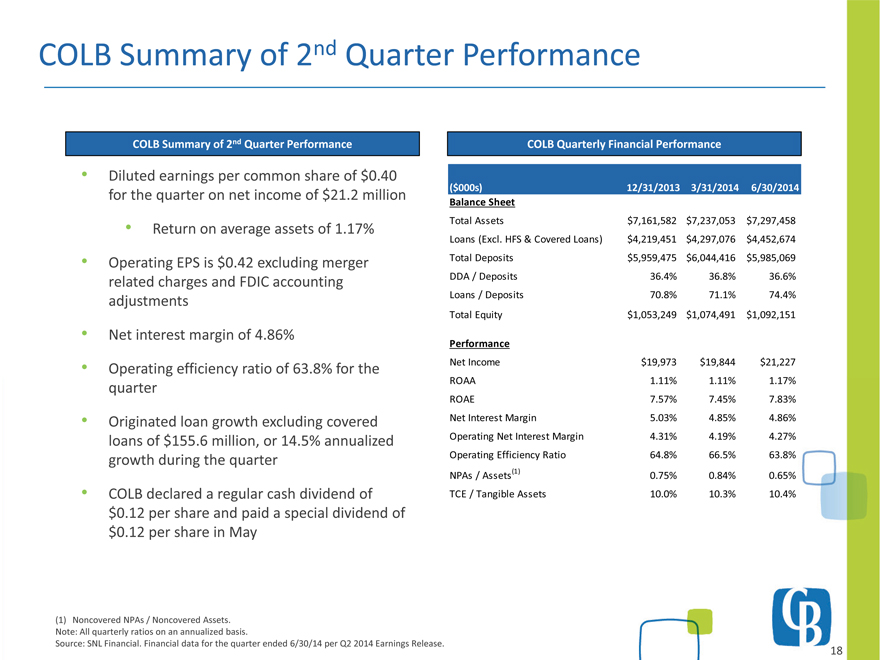

COLB Summary of 2nd Quarter Performance

COLB Summary of 2nd Quarter Performance

Diluted earnings per common share of $0.40 for the quarter on net income of $21.2 million

Return on average assets of 1.17%

Operating EPS is $0.42 excluding merger related charges and FDIC accounting adjustments

Net interest margin of 4.86%

Operating efficiency ratio of 63.8% for the quarter

Originated loan growth excluding covered loans of $155.6 million, or 14.5% annualized growth during the quarter

COLB declared a regular cash dividend of $0.12 per share and paid a special dividend of $0.12 per share in May

COLB Quarterly Financial Performance

($000s) 12/31/2013 3/31/2014 6/30/2014

Balance Sheet

Total Assets $7,161,582 $7,237,053 $7,297,458

Loans (Excl. HFS & Covered Loans) $4,219,451 $4,297,076 $4,452,674

Total Deposits $5,959,475 $6,044,416 $5,985,069

DDA / Deposits 36.4% 36.8% 36.6%

Loans / Deposits 70.8% 71.1% 74.4%

Total Equity $1,053,249 $1,074,491 $1,092,151

Performance

Net Income $19,973 $19,844 $21,227

ROAA 1.11% 1.11% 1.17%

ROAE 7.57% 7.45% 7.83%

Net Interest Margin 5.03% 4.85% 4.86%

Operating Net Interest Margin 4.31% 4.19% 4.27%

Operating Efficiency Ratio 64.8% 66.5% 63.8%

NPAs / Assets(1) 0.75% 0.84% 0.65%

TCE / Tangible Assets 10.0% 10.3% 10.4%

(1) Noncovered NPAs / Noncovered Assets. Note: All quarterly ratios on an annualized basis.

Source: SNL Financial. Financial data for the quarter ended 6/30/14 per Q2 2014 Earnings Release.

1

18

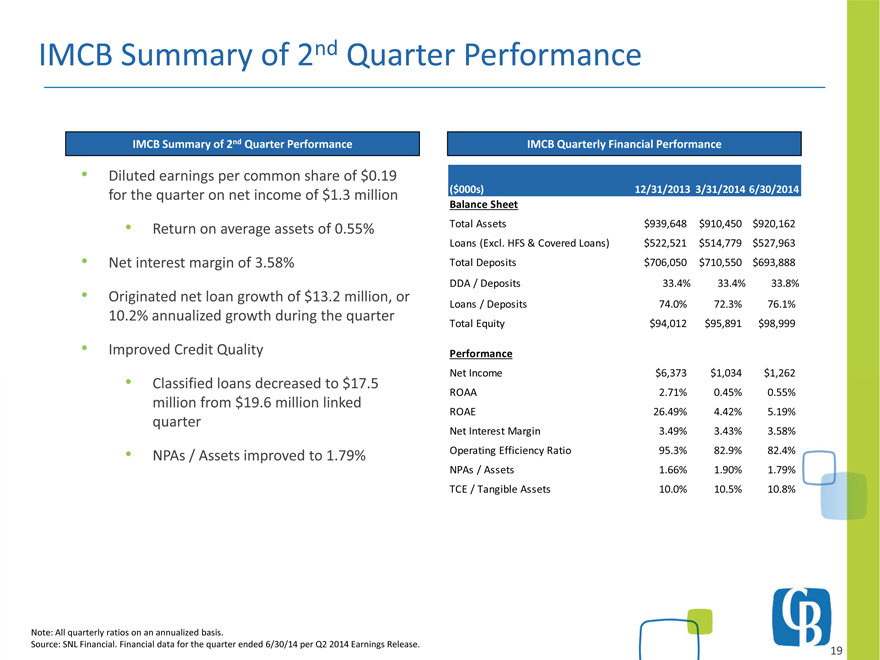

IMCB Summary of 2nd Quarter Performance

IMCB Summary of 2nd Quarter Performance

Diluted earnings per common share of $0.19 for the quarter on net income of $1.3 million

Return on average assets of 0.55%

Net interest margin of 3.58%

Originated net loan growth of $13.2 million, or 10.2% annualized growth during the quarter

Improved Credit Quality

Classified loans decreased to $17.5 million from $19.6 million linked quarter

NPAs / Assets improved to 1.79%

IMCB Quarterly Financial Performance

($000s) 12/31/2013 3/31/2014 6/30/2014

Balance Sheet

Total Assets $939,648 $910,450 $920,162

Loans (Excl. HFS & Covered Loans) $522,521 $514,779 $527,963

Total Deposits $706,050 $710,550 $693,888

Loans / Deposits 74.0% 72.3% 76.1%

Total Equity $94,012 $95,891 $98,999

Performance

Net Income $6,373 $1,034 $1,262

ROAA 2.71% 0.45% 0.55%

ROAE 26.49% 4.42% 5.19%

Net Interest Margin 3.49% 3.43% 3.58%

Operating Efficiency Ratio 95.3% 82.9% 82.4%

NPAs / Assets 1.66% 1.90% 1.79%

TCE / Tangible Assets 10.0% 10.5% 10.8%

Note: All quarterly ratios on an annualized basis.

Source: SNL Financial. Financial data for the quarter ended 6/30/14 per Q2 2014 Earnings Release.

19

Additional Information

In connection with the proposed transaction, Columbia will file with the SEC a Registration Statement on Form S-4 that will include a Proxy

Statement of Intermountain and a Prospectus of Columbia, as well as other relevant documents concerning the proposed transaction. Shareholders of Columbia and Intermountain are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. The Proxy Statement/Prospectus and other relevant materials (when they become available) filed with the SEC may be obtained free of charge at the SEC’s Website at http://www.sec.gov. Intermountain shareholders are urged to read the Proxy Statement and the other relevant materials before voting on the transaction.

Investors will also be able to obtain these documents, free of charge, from Intermountain by accessing Intermountain’s website at www.intermountainbank.com under the link to “About Us” and then the link to “Investor Relations” or from Columbia at www.columbiabank.com under the tab “About Us” and then under the heading “Investor Relations.” Copies can also be obtained, free of charge, by directing a written request to Columbia Banking System, Inc., Attention: Corporate Secretary, 1301 A Street, Suite 800, Tacoma, Washington 98401-2156 or to Intermountain Community Bancorp, 414 Church Street, P.O. Box 967, Sandpoint, Idaho 83864.

Intermountain and Columbia and certain of their directors and executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from the shareholders of Intermountain in connection with the merger. Information about the directors and executive officers of Intermountain and their ownership of Intermountain common stock is set forth in the proxy statement for Intermountain’s 2014 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 12, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

20

Melanie J. Dressel Curt Hecker

President & Chief Executive Officer President & Chief Executive Officer 253-305-1911; mdressel@columbiabank.com 208-265-3300; curt.hecker@intermountainbank.com

Clint E. Stein

EVP & Chief Financial Officer

253-593-8304; cstein@columbiabank.com