As filed with the Securities and Exchange Commission on March 5, 2010

Securities Act File No. 333-

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

| | |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | | |

| Pre-Effective Amendment No. | | ¨ |

| Post-Effective Amendment No. | | ¨ |

| (Check appropriate box or boxes) | | |

BLACKROCK FUNDAMENTAL GROWTH FUND, INC.

(Exact Name of Registrant as Specified in the Articles of Incorporation)

100 Bellevue Parkway Wilmington, Delaware 19809

(Address of Principal Executive Offices)

Telephone Number: (800) 441-7762 (Area Code and Telephone Number)

Anne F. Ackerley

Chief Executive Officer

55 East 52nd Street, New York, New York 10055

(Name and Address of Agent for Service)

Copies to:

| | |

Maria Gattuso, Esq. Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, New York 10019-6099 | | Howard B. Surloff, Esq. BlackRock Advisors, LLC 55 East 52nd Street New York, New York 10055 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of securities being registered: Shares of common stock, par value $0.10 per share. Calculation of Registration Fee under the Securities Act of 1933: No filing fee is required because of reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

It is proposed that this filing will become effective April 19, 2010, pursuant to Rule 488 under the Securities Act of 1933.

EXPLANATORY NOTE

This Registration Statement is organized as follows:

| 1. | Letter to Shareholders of BlackRock Capital Appreciation Portfolio, a series of BlackRock Funds |

| 2. | Questions and Answers for Shareholders of BlackRock Capital Appreciation Portfolio, a series of BlackRock FundsSM |

| 3. | Notice of Special Meeting of Shareholders of BlackRock Capital Appreciation Portfolio, a series of BlackRock Funds |

| 4. | Combined Prospectus/Proxy Statement regarding the proposed reorganization of BlackRock Capital Appreciation Portfolio, a series of BlackRock Funds, into BlackRock Fundamental Growth Fund, Inc. |

| 5. | Statement of Additional Information regarding the proposed reorganization of BlackRock Capital Appreciation Portfolio, a series of BlackRock Funds, into BlackRock Fundamental Growth Fund, Inc. |

[ ], 2010

Dear Shareholder:

You are cordially invited to attend a special shareholder meeting (the “Special Meeting”) of BlackRock Capital Appreciation Portfolio (the “Capital Appreciation Portfolio”), a series of BlackRock FundsSM (the “Trust”), to be held on June 8, 2010 at 10:00 A.M., Eastern time. Before the Special Meeting, I would like to provide you with additional background and ask for your vote on an important proposal affecting the Capital Appreciation Portfolio.

The proposal you will be asked to consider at the Special Meeting, as described in the enclosed Combined Prospectus/Proxy Statement, is the proposed reorganization (the “Reorganization”) of the Capital Appreciation Portfolio into BlackRock Fundamental Growth Fund, Inc. (the “Fundamental Growth Fund”). The Reorganization has been proposed to eliminate the redundancies of managing two similar funds and achieve certain operating efficiencies by combining the funds. BlackRock Advisors, LLC (“BlackRock Advisors”), each fund’s investment adviser, believes that the shareholders of each fund will benefit more from the potential operating efficiencies and economies of scale that may be achieved by combining the funds’ assets in the Reorganization, than by continuing to operate the two funds separately. BlackRock Advisors believes that the Fundamental Growth Fund’s investment objective and strategies make it a compatible fund within the BlackRock Advisors complex for a reorganization with the Capital Appreciation Portfolio. The Board of Trustees of the Trust believes the Reorganization is in the best interests of the Capital Appreciation Portfolio, and recommends that you vote “for” the proposed Reorganization.

I encourage you to carefully review the enclosed materials, which explain this proposal in more detail. As a shareholder, your vote is important, and we hope that you will respond today to ensure that your shares will be represented at the Special Meeting. You may vote using one of the methods below by following the instructions on your proxy card:

| | • | | By touchtone telephone; |

| | • | | By returning the enclosed proxy card in the postage-paid envelope; or |

| | • | | In person at the Special Meeting. |

If you do not vote using one of these methods, you may be called by [ ] our proxy solicitor, to vote your shares.

As always, we appreciate your support.

Sincerely,

ANNE F. ACKERLEY

President and Chief Executive Officer

BlackRock Capital Appreciation Portfolio

BlackRock FundsSM

100 Bellevue Parkway Wilmington, DE 19809 (800) 441-7762

|

| |

| Please vote now. Your vote is important. |

| |

| To avoid the wasteful and unnecessary expense of further solicitation, we urge you to promptly indicate your voting instructions on the enclosed proxy card, date and sign it and return it in the envelope provided (or vote by touchtone telephone or through the Internet, following the instructions on the enclosed proxy card), no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares to be voted, your shares will be voted “for” the Reorganization. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to submit your vote at the Special Meeting. |

QUESTIONS & ANSWERS

We recommend that you read the complete Combined Prospectus/Proxy Statement. For your convenience, we have provided a brief overview of the proposal to be voted on.

| Q: | Why is a shareholder meeting being held? |

| A: | You are being asked to consider the proposed reorganization (“Reorganization”) and to approve an agreement and plan of reorganization (the “Reorganization Agreement”) between BlackRock Capital Appreciation Portfolio (the “Capital Appreciation Portfolio”), a series of BlackRock FundsSM (the “Trust”), which is a Massachusetts business trust, and BlackRock Fundamental Growth Fund, Inc. (the “Fundamental Growth Fund” and together with the Capital Appreciation Portfolio, the “Funds”), which is a Maryland corporation. The Fundamental Growth Fund pursues an investment objective that is identical to that of the Capital Appreciation Portfolio and has investment strategies similar to those of the Capital Appreciation Portfolio. If the proposed Reorganization is approved and completed, an account at the Fundamental Growth Fund will be set up in your name, you will become a shareholder of the Fundamental Growth Fund, and the Capital Appreciation Portfolio will be terminated, dissolved and liquidated as a series of the BlackRock Funds. Please refer to the Combined Prospectus/Proxy Statement for a detailed explanation of the proposed Reorganization and for a more complete description of the Fundamental Growth Fund. |

| Q: | How does the Board of Trustees suggest that I vote? |

| A: | After careful consideration, the Board of Trustees of the Trust (the “Trust Board”) determined that the proposed Reorganization is in the best interests of the Capital Appreciation Portfolio, and that the interests of the Capital Appreciation Portfolio’s existing shareholders will not be diluted as a result of the Reorganization. The Trust Board therefore, recommends that you cast your vote “For” the proposed Reorganization. The Trust Board has determined that shareholders of the Capital Appreciation Portfolio may benefit from the following: |

(i) Shareholders of the Capital Appreciation Portfolio will remain invested in a diversified, open-end fund that has greater net assets;

(ii) The larger net asset size of the combined fund (e.g., the Fundamental Growth Fund following the closing of the Reorganization) (the “Combined Fund”) is expected to give rise to possible operating efficiencies;

(iii) The Combined Fund will have projected gross and/or net annual fund operating expenses that are expected to be equal to or below those of the Capital Appreciation Portfolio prior to the Reorganization. The projected gross annual fund operating expenses are expected to slightly increase for Investor C Shares of the Capital Appreciation Portfolio, but it is expected that the Combined Fund will have projected net operating expenses equal to or below those of the Capital Appreciation Portfolio prior to the Reorganization for all Share classes, including for Investor C Shares, after taking into account applicable contractual fee waivers and/or expense reimbursements (excluding the effects of certain fees and expenses) that BlackRock Advisors has agreed to implement following the closing of the Reorganization;

(iv) The compatibility of the types of portfolio securities held by each of the Funds, the identical investment objectives of each Fund, the similar principal investment strategies of each Fund, and certain similarities between the risk profiles and non-principal investment strategies of each Fund;

(v) The substantially greater net assets of the Combined Fund are expected to result in a lower effective contractual management fee rate under the Fundamental Growth Fund’s management fee schedule, which provides for a lower contractual management fee rate to apply when certain asset levels are reached due to the existence of management fee breakpoints; and

(vi) Although the Capital Appreciation Portfolio’s management fee breakpoint schedule is set at lower asset levels than those of the Fundamental Growth Fund, the Capital Appreciation Portfolio’s assets are not currently sufficient, and are not expected to increase enough in the near future, for a lower effective contractual management fee rate to apply. Thus the Capital Appreciation Portfolio’s current effective contractual management fee rate is higher than that of the Fundamental Growth Fund or the Combined Fund

following the closing of the Reorganization. Although the Capital Appreciation Portfolio has benefited from certain management fee waivers resulting from certain contractual caps on class expenses, these waivers, which are discussed in more detail on p. 20, may not be required for the Combined Fund following the closing of the Reorganization.

| Q: | How will the Reorganization affect me? |

| A: | If shareholders of the Capital Appreciation Portfolio approve the proposed Reorganization, all of the assets and substantially all of the liabilities of the Capital Appreciation Portfolio will be combined with those of the Fundamental Growth Fund, an account will be set up in your name at the Fundamental Growth Fund and you will receive shares of the Fundamental Growth Fund. You will receive the same class of shares of the Fundamental Growth Fund as you currently hold of the Capital Appreciation Portfolio, with the exception of shareholders of Institutional Shares of the Capital Appreciation Portfolio. Shareholders of Institutional Shares of the Capital Appreciation Portfolio will receive newly created BlackRock Shares of the Fundamental Growth Fund. The aggregate net asset value of the shares you receive in the Reorganization will equal the aggregate net asset value of the shares you own immediately prior to the Reorganization. As a result of the Reorganization, however, a shareholder of the Capital Appreciation Portfolio will hold a smaller percentage of ownership in the Combined Fund than he or she held in the Capital Appreciation Portfolio prior to the Reorganization. |

| Q: | Will I own the same number of shares of the Fundamental Growth Fund as I currently own of the Capital Appreciation Portfolio? |

| A: | No, you will receive shares of the Fundamental Growth Fund with the same aggregate net asset value as the shares of the Capital Appreciation Portfolio you own prior to the Reorganization. However, the number of shares you receive will depend on the relative net asset value of the shares of the Capital Appreciation Portfolio and the Fundamental Growth Fund as of the close of trading on the New York Stock Exchange on the business day immediately before the closing of the Reorganization (“Valuation Time”). Thus, if as of the Valuation Time the net asset value of an Investor A share of the Fundamental Growth Fund is lower than the net asset value of an Investor A share of the Capital Appreciation Portfolio, you will receive a greater number of shares of the Fundamental Growth Fund in the Reorganization than you held in the Capital Appreciation Portfolio before the Reorganization. On the other hand, if the net asset value of an Investor A share of the Fundamental Growth Fund is higher than the net asset value of an Investor A share of the Capital Appreciation Portfolio, you will receive fewer shares of the Fundamental Growth Fund in the Reorganization than you held in the Capital Appreciation Portfolio before the Reorganization. The aggregate net asset value of your Fundamental Growth Fund shares immediately following the closing of the Reorganization will be the same as the aggregate net asset value of your Capital Appreciation Portfolio shares immediately prior to the Reorganization. |

| Q: | In the Reorganization, will I receive shares of the Fundamental Growth Fund of the same class as the shares of the Capital Appreciation Portfolio that I now hold? |

| A: | With the exception of shareholders of Institutional Shares, you will receive shares of the Fundamental Growth Fund of the same class as the shares you own of the Capital Appreciation Portfolio. Shareholders of Institutional Shares of the Capital Appreciation Portfolio will receive newly created BlackRock Shares of the Fundamental Growth Fund. |

Special Considerations for Institutional Shareholders of the Capital Appreciation Portfolio. As discussed above, Institutional shareholders of the Capital Appreciation Portfolio will receive newly created BlackRock Shares of the Fundamental Growth Fund in connection with the Reorganization. There are certain differences between the Institutional and BlackRock Shares. BlackRock Shares are offered without a sales charge to institutional investors, registered investment advisers and certain fee-based programs and qualified employee benefit plans. The minimum investment for BlackRock Shares is $5 million for institutions and individuals. There is no minimum initial investment requirement for fee-based programs with an annual fee

ii

of at least 0.50% or certain qualified employee benefit plans. BlackRock Shares are available to clients of registered investment advisers who have $250,000 invested in the Fund. Institutional Shares are offered without a sales charge to institutional investors, certain retirement plans, participants in certain programs sponsored by BlackRock Advisors or its affiliates or financial intermediaries and certain employees and affiliates of BlackRock Advisors or its affiliates. The minimum investment for Institutional Shares is $2 million for institutions and individuals. Institutional Shares are available to clients of registered investment advisers who have $250,000 invested in the Fund. Shareholders of Institutional Shares of the Capital Appreciation Portfolio that acquire BlackRock Shares through the Reorganization will be eligible to purchase additional BlackRock Shares of the Combined Fund following the closing of the Reorganization.

| Q: | Who will advise the Combined Fund once the Reorganization is completed? |

| A: | BlackRock Advisors, LLC (“BlackRock Advisors”), each Fund’s current investment adviser, will serve as the Combined Fund’s investment adviser and BlackRock Investment Management, LLC, each Fund’s current sub-adviser, will serve as the Combined Fund’s sub-adviser. The portfolio managers who currently manage the day-to-day operations of each of the Capital Appreciation Portfolio and the Fundamental Growth Fund will manage the Combined Fund following the closing of the Reorganization. The same portfolio management team currently manages both Funds and has managed the Capital Appreciation Portfolio since 2005 and has managed the Fundamental Growth Fund since November 2008. |

| Q: | How do operating expenses paid by the Fundamental Growth Fund compare to those payable by the Capital Appreciation Portfolio? |

| A: | Following the closing of the Reorganization, the Fundamental Growth Fund’s projected net annual fund operating expenses are expected to be equal to or below those of the Capital Appreciation Portfolio after taking into account certain contractual fee waivers and/or expense reimbursements (excluding Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) that BlackRock Advisors has agreed to implement. BlackRock Advisors has contractually agreed to waive fees and/or reimburse expenses of the Combined Fund following the closing of the Reorganization for certain share classes. Following the closing of the Reorganization, the Combined Fund’s projected gross annual fund operating expenses are expected to be equal to or below those of the Capital Appreciation Portfolio for Investor A, Investor B and Institutional Shares of the Capital Appreciation Portfolio. The projected gross annual fund operating expenses are expected to slightly increase for Investor C Shares of the Capital Appreciation Portfolio; however, as noted above, the projected net annual fund operating expenses are expected to be equal to or below those of the Capital Appreciation Portfolio prior to the Reorganization for all share classes, including for Investor C Shares, after taking into account certain contractual fee waivers and/or expense reimbursement arrangements that BlackRock Advisors has agreed to implement following the closing of the Reorganization. The table below sets forth the estimated total net assets and estimated total expense ratios (including distribution and service fees) of the classes of shares for each of the Funds and the Combined Fund, each as of September 30, 2009. |

| | | | |

| | | Total Annual Expense Ratio (Excluding interest

expense and acquired fund fees and expenses) |

| | | Excluding contractual

waivers, if applicable | | Including contractual

waivers, if applicable |

Capital Appreciation | | | | |

Investor A | | 1.35% | | 1.25%** |

Investor B | | 2.36% | | 2.16%** |

Investor C | | 2.04% | | 1.94%** |

Institutional* | | 0.92% | | 0.72%** |

iii

| | | | |

| | | Total Annual Expense Ratio (Excluding interest

expense and acquired fund fees and expenses) |

| | | Excluding contractual

waivers, if applicable | | Including contractual

waivers, if applicable |

Fundamental Growth | | | | |

Investor A | | 1.20% | | 1.20% |

Investor B | | 2.13% | | 2.13% |

Investor C | | 2.11% | | 2.11% |

| | |

Combined Fund | | | | |

Investor A | | 1.19% | | 1.19%*** |

Investor B | | 2.12% | | 2.12%*** |

Investor C | | 2.09% | | 1.94%*** |

BlackRock* | | 0.76% | | 0.72%*** |

| * | The Fundamental Growth Fund BlackRock Shares will be issued to holders of the Capital Appreciation Portfolio’s Institutional Shares in the Reorganization. |

| ** | BlackRock Advisors has contractually agreed to waive and/or reimburse fees or expenses in order to limit the Capital Appreciation Portfolio’s Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements (excluding Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) to 1.39% (for Investor A Shares), 2.16% (for Investor B and Investor C Shares) and 0.72% (for Institutional Shares) until February 1, 2011. The Fund may have to repay some of these waivers and reimbursements to BlackRock Advisors in the following two years. The agreement may be terminated by a majority of the non-interested Trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund, in each case upon 90 days’ prior notice. The table reflects the waiver. |

| *** | BlackRock Advisors has contractually agreed to waive fees and/or reimburse expenses following the closing of the Reorganization in order to limit the Combined Fund’s Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements (excluding Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) to 1.94% (for Investor C Shares) and 0.72% (for BlackRock Shares) of average daily net assets. This contractual waiver may be terminated by a majority of the non-interested directors of the Fundamental Growth Fund or by a vote of a majority of the outstanding voting securities of the Fundamental Growth Fund, in each case upon 90 days’ prior notice. |

| Q: | Are there any differences in front-end sales loads or contingent deferred sales charges? |

| A: | The front-end sales loads for Investor A, Investor B and Investor C Shares of each Fund are identical. However, there are certain differences in the contingent deferred sales charges (“CDSCs”) of the Investor A Shares of the Funds, which are described in the table below. The Fundamental Growth Fund Investor A Shares and Capital Appreciation Portfolio Investor A Shares both have a front-end sales load of 5.25% and service fees of 0.25%; however, the Fundamental Growth Fund Investor A Shares impose a CDSC of 1.00% on redemptions of investments of $1 million or more within 18 months of purchase while the Capital Appreciation Portfolio Investor A Shares imposes a CDSC of 0.75% on redemptions of investments of $1 million or more within 18 months of purchase. While the Combined Fund will have the higher CDSC of the Fundamental Growth Fund on such redemptions of Investor A Shares, following the closing of the Reorganization, the Fundamental Growth Fund’s projected gross and net annual fund operating expenses for Investor A Shares are expected to be below those of the Investor A Shares of the Capital Appreciation Portfolio both before and after taking into account the applicable contractual fee waivers and/or expense reimbursements that BlackRock Advisors has agreed to implement following the closing of the Reorganization. The CDSCs and distribution fees for the Investor B and Investor C Shares of each Fund are identical. The Institutional Shares of the Capital Appreciation Portfolio and the newly created BlackRock Shares of the Fundamental Growth Fund do not impose any front-end sales loads, CDSCs or distribution fees. Below is a chart that summarizes the front-end sales loads and CDSCs for each of the share classes. |

iv

| | | | |

| | | Capital Appreciation Portfolio

Investor A Shares | | Fundamental Growth Fund

and Combined Fund

Investor A Shares |

Front-end Sales Charge | | 5.25% | | 5.25% |

CDSCs | | A CDSC of 0.75% may be imposed on investments of $1 million or more if redeemed within eighteen months | | A CDSC of 1.00% may be imposed on investments of $1 million or more if redeemed within eighteen months |

Service Fees | | 0.25% | | 0.25% |

| | | | |

| | | Capital Appreciation Portfolio

Investor B Shares | | Fundamental Growth Fund

and Combined Fund

Investor B Shares |

Front-end Sales Charge | | None | | None |

CDSCs | | A CDSC of up to 4.50% if redeemed within one year | | A CDSC of up to 4.50% if redeemed within one year |

Service and Distribution Fees | | 1.00% | | 1.00% |

| | | | |

| | | Capital Appreciation Portfolio

Investor C Shares | | Fundamental Growth Fund

and Combined Fund

Investor C Shares |

Front-end Sales Charge | | None | | None |

CDSCs | | A CDSC of 1.00% if redeemed within one year | | A CDSC of 1.00% if redeemed within one year |

Service and Distribution Fees | | 1.00% | | 1.00% |

| | | | |

| | | Capital Appreciation Portfolio

Institutional Shares | | Fundamental Growth Fund

and Combined Fund

BlackRock Shares |

Front-end Sales Charge | | None | | None |

CDSCs | | None | | None |

Service and Distribution Fees | | None | | None |

| Q: | Will I have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| A: | No, you will not pay any sales load, commission or other similar fee in connection with the Reorganization. As more fully discussed in the Combined Prospectus/Proxy Statement, the holding period with respect to any contingent deferred sales charge that applies to shares of the Fundamental Growth Fund acquired by you in the Reorganization will be measured from the earlier of the time (i) you purchased your Capital Appreciation Portfolio shares or (ii) you purchased your shares of any other fund advised by BlackRock Advisors and subsequently exchanged them for shares of the Capital Appreciation Portfolio. |

| Q: | What will I have to do to open an account in the Fundamental Growth Fund? What happens to my account if the Reorganization is approved? |

| A: | If the Reorganization is approved, an account will be set up in your name and your shares automatically will be converted into shares of the Fundamental Growth Fund, and we will send you written confirmation that this change has taken place. You will receive Investor A, Investor B, Investor C or BlackRock Shares of the Fundamental Growth Fund depending on what share class of the Capital Appreciation Portfolio you own immediately prior to the Reorganization, as indicated in the table below. You will receive shares of the Fundamental Growth Fund with an aggregate net asset value equal to the aggregate net asset value of the shares of the Capital Appreciation Portfolio that you own immediately prior to the Reorganization. |

| | |

Capital Appreciation Portfolio shares | | Fundamental Growth Fund shares |

Investor A Shares | | Investor A Shares |

Investor B Shares | | Investor B Shares |

Investor C Shares | | Investor C Shares |

Institutional Shares | | BlackRock Shares |

v

No certificates for shares will be issued in connection with the Reorganization. If you currently hold certificates representing your shares of the Capital Appreciation Portfolio, it is not necessary to surrender such certificates.

| Q: | What happens if the Reorganization is not approved? |

| A: | If the Reorganization is not approved by shareholders of the Capital Appreciation Portfolio, the Trust Board will consider other alternatives. |

| Q: | Will I have to pay any federal taxes as a result of the Reorganization? |

| A: | The Reorganization is expected to qualify as a tax-free “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. If the Reorganization so qualifies, in general, the Capital Appreciation Portfolio will not recognize any gain or loss as a result of the transfer of all of its assets and substantially all of the liabilities in exchange for shares of the Fundamental Growth Fund or as a result of its liquidation, and you will not recognize any gain or loss upon your receipt of shares of the Fundamental Growth Fund in connection with the Reorganization. |

BlackRock does not expect to sell portfolio assets of the Capital Appreciation Portfolio in connection with the Reorganization. However, the tax impact of any such sales will depend on the difference between the price at which such portfolio assets are sold and the Capital Appreciation Portfolio’s basis in such assets. Any capital gains recognized in these sales on a net basis will be distributed to the Capital Appreciation Portfolio’s shareholders as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale, and such distributions will be taxable to shareholders. In addition, prior to the Reorganization the Capital Appreciation Portfolio will distribute to its shareholders all investment company taxable income, net tax-exempt income and net realized capital gains not previously distributed to shareholders, and such distribution of investment company taxable income and net realized capital gains will be taxable to shareholders.

| Q: | Who will pay for the Reorganization? |

| A: | BlackRock Advisors or its affiliates will pay the expenses incurred in connection with the preparation of the Combined Prospectus/Proxy Statement, including all direct and indirect expenses and out-of-pocket costs. |

| Q: | What if I redeem my shares before the Reorganization takes place? |

| A: | If you choose to redeem your shares before the Reorganization takes place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction and may be subject to any applicable CDSC. |

| Q: | How do I vote my proxy? |

| A: | You may cast your vote by mail, telephone or internet or in person at the special shareholder meeting of the Capital Appreciation Portfolio shareholders (“Special Meeting”). To vote by mail, please mark your vote on the enclosed proxy card and sign, date and return the card in the postage-paid envelope provided. To vote by telephone or over the internet, please have the proxy card in hand and call the number or go to the website address listed on the enclosed proxy card and follow the instructions. To vote at the Special Meeting, please attend the Special Meeting in person and have the proxy card in hand. |

| Q: | When will the Reorganization occur? |

| A: | If approved by shareholders, the Reorganization is expected to occur during the second quarter of 2010. The Reorganization will not take place if the Reorganization is not approved by the Capital Appreciation Portfolio’s shareholders at the Special Meeting. |

vi

| Q: | Whom do I contact for further information? |

| A: | You can contact your financial adviser for further information. You may also call [ ], our proxy solicitation firm, at [ ]. |

Important additional information about the proposal is set forth in the accompanying Combined Prospectus/Proxy Statement. Please read it carefully.

vii

BLACKROCK FUNDSSM

BlackRock Capital Appreciation Portfolio

100 Bellevue Parkway

Wilmington, Delaware

(800) 441-7762

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 8, 2010

[ ], 2010

To the Shareholders:

This is to notify you that a Special Meeting of Shareholders (the “Special Meeting”) of BlackRock Capital Appreciation Portfolio (the “Capital Appreciation Portfolio”), a series of BlackRock FundsSM (the “Trust”), will be held on June 8, 2010 at 10:00 A.M., Eastern time, at the offices of BlackRock Advisors, LLC at 800 Scudders Mill Road, Plainsboro, New Jersey 08536, for the following purposes:

| 1. | To consider a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) pursuant to which the Capital Appreciation Portfolio would transfer of all of its assets to the BlackRock Fundamental Growth Fund, Inc. (the “Fundamental Growth Fund”), in exchange for the assumption by the Fundamental Growth Fund of substantially all of the liabilities of the Capital Appreciation Portfolio and shares of the Fundamental Growth Fund, as detailed in the Reorganization Agreement, which shares will be distributed by the Capital Appreciation Portfolio to the holders of its shares in complete liquidation thereof; and |

| 2. | To transact such other business as may properly be presented at the Special Meeting or any adjournment or postponement thereof. |

The Board of Trustees of the Trust has fixed the close of business on April 15, 2010 as the record date for determination of shareholders of the Capital Appreciation Portfolio entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

It is very important that your voting instructions be received prior to the meeting date. Instructions for shares held of record in the name of a nominee, such as a broker-dealer or director of an employee benefit plan, may be subject to earlier cut-off dates established by such intermediaries for receipt of such instructions.

Your vote is important regardless of the size of your holdings in the Capital Appreciation Portfolio. Whether or not you expect to be present at the Special Meeting, please complete and sign the enclosed proxy card and return it promptly in the enclosed envelope. Shareholders may also vote by telephone or over the Internet; please see pages [ ] for details. If you vote by proxy and then desire to change your vote or vote in person at the Special Meeting, you may revoke your proxy at any time prior to the votes being tallied at the Special Meeting. Please refer to the section of the enclosed Combined Prospectus/Proxy Statement entitled “Voting Information and Requirements—Manner of Voting” for more information.

By Order of the Board of Trustees,

Howard B. Surloff

Secretary

COMBINED PROSPECTUS/PROXY STATEMENT

BLACKROCK CAPITAL APPRECIATION PORTFOLIO

BLACKROCK FUNDSSM

100 Bellevue Parkway

Wilmington, Delaware 19809

(800) 441-7762

BLACKROCK FUNDAMENTAL GROWTH FUND, INC.

100 Bellevue Parkway

Wilmington, Delaware 19809

(800) 441-7762

This Combined Prospectus/Proxy Statement is furnished to you as a shareholder of BlackRock Capital Appreciation Portfolio (the “Capital Appreciation Portfolio”), a series of BlackRock FundsSM (the “BlackRock Funds”). A special meeting of shareholders of the Capital Appreciation Portfolio (the “Special Meeting”) will be held at the offices of BlackRock Advisors, LLC at 800 Scudders Mill Road, Plainsboro, New Jersey 08536 on June 8, 2010 at 10:00 A.M., Eastern time, to consider the items that are listed below and discussed in greater detail elsewhere in this Combined Prospectus/Proxy Statement. Shareholders of record of the Capital Appreciation Portfolio at the close of business on April 15, 2010 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting or any adjournments or postponements thereof. This Combined Prospectus/Proxy Statement, proxy card and accompanying Notice of Special Meeting of Shareholders are first being sent or given to shareholders of the Capital Appreciation Portfolio on or about April 29, 2010. Whether or not you expect to attend the Special Meeting or any adjournment or postponement thereof, the Board of Trustees of the Trust (the “Trust Board”) requests that shareholders vote their shares by completing and returning the enclosed proxy card, by calling the toll-free number, or over the Internet. Shareholders may also attend the Special Meeting and vote in person.

The purposes of the Special Meeting are:

1. To consider a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) pursuant to which the Capital Appreciation Portfolio would transfer of all of its assets to the BlackRock Fundamental Growth Fund, Inc. (the “Fundamental Growth Fund”), in exchange for the assumption by the Fundamental Growth Fund of substantially all of the liabilities of the Capital Appreciation Portfolio and shares of the Fundamental Growth Fund, as detailed in the Reorganization Agreement, which shares will be distributed by the Capital Appreciation Portfolio to the holders of its shares in complete liquidation thereof (the “Reorganization”); and

2. To transact such other business as may properly be presented at the Special Meeting or any adjournment or postponement thereof.

The Trust Board and the Board of Directors of the Fundamental Growth Fund (the “Fundamental Growth Fund Board”) have each approved the Reorganization. The Reorganization has been proposed to eliminate the redundancies of managing two similar Funds in an effort and achieve certain operating efficiencies by combining the Funds. The investment objectives of the Capital Appreciation Portfolio and the Fundamental Growth Fund are identical. The investment objective of each Fund is long term growth of capital. Each Fund generally invests in equity securities of medium and large capitalization companies. The Capital Appreciation Portfolio and the Fundamental Growth Fund, however, employ certain differing investment strategies to achieve their respective objectives. The principal difference between the principal strategies of the Funds is that the Capital Appreciation Portfolio invests, under normal circumstances, at least 80% of its total assets in common and preferred stock of mid- and large-size companies and convertible securities, while the Fundamental Growth Fund will generally invest at least 65% of its total assets in equity securities, including common stock, convertible preferred stock, securities convertible into common stock and rights to subscribe to common stock and emphasizes investments in

companies with medium to large market capitalization. While the Funds have differing investment strategies, there is substantial overlap in the Funds’ investment programs. In particular, as of January 1, 2010, over 99% of the portfolio securities held by the Capital Appreciation Portfolio were held by the Fundamental Growth Fund. The Fundamental Growth Fund also has certain non-principal strategies that are compatible with the principal and non-principal strategies of the Capital Appreciation Portfolio.

If Capital Appreciation Portfolio shareholders approve the proposed Reorganization, then the Fundamental Growth Fund will acquire all of the assets, and assume substantially all of the liabilities, of the Capital Appreciation Portfolio and shareholders will receive Investor A, Investor B, Investor C or BlackRock Shares of the Fundamental Growth Fund.

| | • | | Investor A shareholders of the Capital Appreciation Portfolio will receive Investor A Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Investor A Shares of the Capital Appreciation Portfolio that Investor A shareholders own immediately prior to the Reorganization; |

| | • | | Investor B shareholders of the Capital Appreciation Portfolio will receive Investor B Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Investor B Shares of the Capital Appreciation Portfolio that Investor B shareholders own immediately prior to the Reorganization; |

| | • | | Investor C shareholders of the Capital Appreciation Portfolio will receive Investor C Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Investor C Shares of the Capital Appreciation Portfolio that Investor C shareholders own immediately prior to the Reorganization; and |

| | • | | Institutional shareholders of the Capital Appreciation Portfolio will receive newly created BlackRock Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Institutional Shares of the Capital Appreciation Portfolio that Institutional shareholders own immediately prior to the Reorganization. |

After distributing these shares, the Capital Appreciation Portfolio will be terminated, dissolved and liquidated as a series of the Trust. When the Reorganization is complete, shareholders of Investor A Shares of the Capital Appreciation Portfolio will hold Investor A Shares of the Fundamental Growth Fund, shareholders of Investor B Shares of the Capital Appreciation Portfolio will hold Investor B Shares of the Fundamental Growth Fund, shareholders of Investor C Shares of the Capital Appreciation Portfolio will hold Investor C Shares of the Fundamental Growth Fund, and shareholders of Institutional Shares of the Capital Appreciation Portfolio will hold newly created BlackRock Shares of the Fundamental Growth Fund. Following the closing of the Reorganization, the Fundamental Growth Fund will continue to operate as a registered open-end investment company.

This Combined Prospectus/Proxy Statement sets forth concisely the information shareholders of the Capital Appreciation Portfolio should know before voting on the Reorganization and constitutes an offering of the Fundamental Growth Fund shares to be issued in the Reorganization. Please read it carefully and retain it for future reference.

The following documents each have been filed with the Securities and Exchange Commission (the “SEC”), and are incorporated herein by reference into (each legally forms a part of) this Combined Prospectus/Proxy Statement:

| | • | | A Statement of Additional Information dated [ ], 2010 (the “Reorganization SAI”), relating to this Combined Prospectus/Proxy Statement; |

| | • | | The prospectus relating to the Investor A, Investor B, Investor C, and Institutional Shares of the Capital Appreciation Portfolio, dated January 29, 2010, as supplemented (the “Capital Appreciation Portfolio Prospectus”); |

ii

| | • | | The Statement of Additional Information relating to the Capital Appreciation Portfolio, dated January 29, 2010, as supplemented (the “Capital Appreciation Portfolio SAI”); |

| | • | | The Annual Report to Shareholders of the Capital Appreciation Portfolio for the fiscal period ended September 30, 2009; and |

| | • | | The Fundamental Growth Fund Statement of Additional Information (the “Fundamental Growth Fund SAI”) dated December 29, 2009, as supplemented. |

The following documents each have been filed with the SEC, and are incorporated herein by reference into (each legally forms a part of) and also accompany this Combined Prospectus/Proxy Statement:

| | • | | The prospectus relating to the Investor A, Investor B, Investor C, Institutional and Class R Shares of the Fundamental Growth Fund dated December 29, 2009, as supplemented (the “Fundamental Growth Fund Investor Class Prospectus”), and the prospectus relating to the BlackRock Shares of the Fundamental Growth Fund dated April [ ], 2010, as supplemented (the “Fundamental Growth Fund BlackRock Class Prospectus” and together with the Fundamental Growth Fund Investor Class Prospectus, the “Fundamental Growth Fund Prospectus”); and |

| | • | | The Annual Report to Shareholders of the Fundamental Growth Fund for the fiscal year ended August 31, 2009 (the “Fundamental Growth Fund Annual Report”). |

Except as otherwise described herein, the policies and procedures set forth under “About Your Investment” in the Fundamental Growth Fund Prospectus will apply to the Investor A, Investor B, Investor C and BlackRock Shares to be issued by the Fundamental Growth Fund in connection with the Reorganization. The Funds are subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, as amended (the “Investment Company Act”), and in accordance therewith, file reports and other information, including proxy materials and charter documents, with the SEC.

Copies of the foregoing and any more recent reports filed after the date hereof may be obtained without charge by calling or writing:

| | |

BlackRock Capital Appreciation Portfolio | | BlackRock Fundamental Growth Fund, Inc. |

BlackRock FundsSM | | 100 Bellevue Parkway |

100 Bellevue Parkway | | Wilmington, Delaware 19809 |

Wilmington, Delaware 19809 | | (800) 441-7762 |

(800) 441-7762 | | |

If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” The Reorganization SAI may also be obtained without charge at (800) 441-7762.

You also may view or obtain these documents from the SEC:

| | |

In Person: | | At the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. |

By Mail: | | Public Reference Section

Office of Consumer Affairs and Information Services

Securities and Exchange Commission

100 F Street, N.E. Washington, DC 20549

(duplicating fee required) |

By E-mail: | | publicinfo@sec.gov

(duplicating fee required) |

By Internet: | | www.sec.gov |

iii

The Trust Board knows of no business other than that discussed above that will be presented for consideration at the Special Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Combined Prospectus/Proxy Statement and, if so given or made, such information or representation must not be relied upon as having been authorized. This Combined Prospectus/Proxy Statement does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

Neither the SEC nor any state regulator has approved or disapproved of these securities or passed upon the adequacy of this Combined Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

The date of this Combined Prospectus/Proxy Statement is [ ], 2010.

iv

TABLE OF CONTENTS

v

SUMMARY

The following is a summary of certain information contained elsewhere in this Combined Prospectus/Proxy Statement and is qualified in its entirety by reference to the more complete information contained herein. Shareholders should read the entire Combined Prospectus/Proxy Statement carefully.

Each of the Trust and the Fundamental Growth Fund is an open-end management investment company registered with the SEC. The Capital Appreciation Portfolio is organized as a separate series of the Trust, a business trust organized under the laws of the Commonwealth of Massachusetts. The Fundamental Growth Fund is organized as a corporation under the laws of the State of Maryland. The investment objective of each Fund is identical. Each Fund’s investment objective is long term growth of capital. Each Fund employs similar strategies in achieving its respective objective. The Capital Appreciation Portfolio has a policy under which it invests at least 80% of its total assets in common and preferred stock of mid- and large-size companies and convertible securities, while the Fundamental Growth Fund generally emphasizes investing in common stock of companies that have a medium to large stock market capitalization, and will generally invest at least 65% of its total assets in common stock, convertible preferred stock, securities convertible into common stock and rights to subscribe to common stock. If shareholders approve the Reorganization, the Fundamental Growth Fund will be renamed the “BlackRock Capital Appreciation Fund, Inc.” upon the closing of the Reorganization. The Fundamental Growth Fund, following completion of the Reorganization, may be referred to as the “Combined Fund,” as the surviving Fund, after the Reorganization in this Combined Prospectus/Proxy Statement.

BlackRock Advisors, LLC (“BlackRock Advisors”) serves as the investment adviser of each of the Funds. BlackRock Investment Management, LLC (“BIM” or the “Sub-Adviser”) serves as the sub-adviser of each of the Funds. The portfolio managers of each of the Capital Appreciation Portfolio and the Fundamental Growth Fund are Jeffrey Lindsey, CFA and Edward Dowd, and they are expected to continue to be the portfolio managers of the Combined Fund following the closing of the Reorganization. Each of the Funds publicly offers its shares on a continuous basis, and shares may be purchased through each Fund’s distributor, BlackRock Investments, LLC (“BRIL” or the “Distributor”), and numerous intermediaries.

The Proposed Reorganization

Each of the Trust Board, including the Trustees who are not “interested persons” (as defined in the Investment Company Act) of the Trust (the “Independent Trustees”), and the Fundamental Growth Fund Board, including the Directors who are not “interested persons” (as defined in the Investment Company Act) of the Corporation, has approved the Reorganization Agreement. Subject to approval by the Capital Appreciation Portfolio shareholders, the Reorganization Agreement provides for:

| | • | | the transfer of all of the assets of the Capital Appreciation Portfolio to the Fundamental Growth Fund in exchange for the assumption by the Fundamental Growth Fund of substantially all of the liabilities of the Capital Appreciation Portfolio and shares of the Fundamental Growth Fund having an aggregate net asset value equal to the value of the assets of the Capital Appreciation Fund acquired by the Fundamental Growth Fund reduced by the amount of such assumed liabilities; |

| | • | | the distribution of such shares to the Capital Appreciation Portfolio’s shareholders; and |

| | • | | the subsequent liquidation, termination and dissolution of the Capital Appreciation Portfolio as a series of the Trust. |

If the proposed Reorganization is approved by shareholders of the Capital Appreciation Portfolio and completed, then the Fundamental Growth Fund will acquire all of the assets and assume substantially all of the liabilities of the Capital Appreciation Portfolio, and shareholders of the Capital Appreciation Portfolio will receive Investor A, Investor B, Investor C and BlackRock Shares of the Fundamental Growth Fund as set out below:

| | • | | Investor A shareholders of the Capital Appreciation Portfolio will receive Investor A Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Investor A Shares of the Capital Appreciation Portfolio that shareholders own immediately prior to the Reorganization; |

1

| | • | | Investor B shareholders of the Capital Appreciation Portfolio will receive Investor B Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Investor B Shares of the Capital Appreciation Portfolio that shareholders own immediately prior to the Reorganization; |

| | • | | Investor C shareholders of the Capital Appreciation Portfolio will receive Investor C Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Investor C Shares of the Capital Appreciation Portfolio that shareholders own immediately prior to the Reorganization; and |

| | • | | Institutional shareholders of the Capital Appreciation Portfolio will receive newly created BlackRock Shares of the Fundamental Growth Fund, with an aggregate net asset value equal to the aggregate net asset value of Institutional Shares of the Capital Appreciation Portfolio that shareholders own immediately prior to the Reorganization. |

Background and Reasons for the Proposed Reorganization

The Reorganization has been proposed to eliminate the redundancies of managing two similar funds and in an effort to achieve certain operating efficiencies by combining the Funds. BlackRock Advisors believes that each Fund will benefit more from the potential operating efficiencies and economies of scale that may be achieved by combining the Funds’ assets in the Reorganization, than by continuing to operate the two Funds separately. BlackRock Advisors further believes that it is in the best interests of the Capital Appreciation Portfolio’s shareholders to combine the Capital Appreciation Portfolio’s assets with those of a Fund that is expected to have the same or lower expenses. Following the closing of the Reorganization, the Combined Fund’s projected gross annual fund operating expenses are expected to be equal to or below those of the Capital Appreciation Portfolio for Investor A, Investor B and Institutional Shares of the Capital Appreciation Portfolio and although the projected gross annual fund operating expenses are expected to slightly increase for Investor C Shares of the Capital Appreciation Portfolio, following the closing of the Reorganization, the Combined Fund’s projected net operating expenses are expected to be equal to or below those of the Capital Appreciation Portfolio prior to the Reorganization (including for Investor C Shares) after taking into account applicable contractual fee waivers and/or expense reimbursements (excluding certain fees and expenses) that BlackRock Advisors has agreed to implement following the closing of the Reorganization.

In approving the Reorganization Agreement, the Trust Board, including the Independent Trustees, determined that the Reorganization is in the best interests of the Capital Appreciation Portfolio and that the interests of the shareholders of the Capital Appreciation Portfolio will not be diluted with respect to net asset value as a result of the Reorganization. Before reaching this conclusion, the Trust Board engaged in a thorough review process relating to the proposed Reorganization. The Trust Board approved the Reorganization on February 23, 2010. The Trust Board has directed that the Reorganization be submitted to shareholders for consideration at the Special Meeting.

The factors considered by the Trust Board with regard to the Reorganization include, but are not limited to, the following:

| | • | | The fact that the investment objectives of the Capital Appreciation Portfolio and the Fundamental Growth Fund are identical and certain strategies of the Capital Appreciation Portfolio and the Fundamental Growth Fund are similar and compatible, while others are different. The Trust Board considered that each Fund generally invests in common stock of medium and large capitalization companies. The Trust Board considered that the Capital Appreciation Portfolio and the Fundamental Growth Fund, however, employ certain differing investment strategies to achieve their respective objectives. The Trust Board further considered that the principal difference between the principal strategies of Funds is that the Capital Appreciation Portfolio invests, under normal circumstances, at least 80% of its total assets in common and preferred stock of mid- and large-size companies and convertible securities, while the Fundamental Growth Fund will generally invest at least 65% of its |

2

| | total assets in equity securities, including common stock, convertible preferred stock, securities convertible into common stock and rights to subscribe to common stock and emphasizes investments in companies with medium to large market capitalization. The Trust Board considered that there is substantial overlap in the portfolio securities held by the Funds, the investment strategies of the Funds are similar, and the Fundamental Growth Fund also has certain non-principal strategies that are compatible with the principal and non-principal strategies of the Capital Appreciation Portfolio. In particular, as of January 1, 2010, over 99% of the portfolio securities held by the Capital Appreciation Portfolio were held by the Fundamental Growth Fund. See “Comparison of the Capital Appreciation Portfolio and the Fundamental Growth Fund—Investment Objectives and Principal Investment Strategies.” |

| | • | | The Combined Fund will have projected gross and/or net annual fund operating expenses that are expected to be equal to or below those of the Capital Appreciation Portfolio prior to the Reorganization. The projected gross annual fund operating expenses are expected to slightly increase for Investor C Shares of the Capital Appreciation Portfolio, but it is expected that the Combined Fund will have projected net operating expenses equal to or below those of the Capital Appreciation Portfolio prior to the Reorganization for all Share classes, including for Investor C Shares, after taking into account applicable contractual fee waivers and/or expense reimbursements (excluding Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses as described on page 19) that BlackRock Advisors has agreed to implement following the closing of the Reorganization. The Trust Board also considered that the substantially greater net assets of the Combined Fund are expected to result in a lower effective contractual management fee rate under the Fundamental Growth Fund’s management fee schedule, which provides for a lower contractual management fee rate to apply when certain asset levels are reached due to the existence of management fee breakpoints. The Trust Board considered that although the Capital Appreciation Portfolio’s management fee breakpoint schedule is set at lower asset levels than those of the Fundamental Growth Fund, the Capital Appreciation Portfolio’s assets are not currently sufficient, and are not expected to increase enough in the near future, for a lower contractual management fee rate to apply. Thus the Capital Appreciation Portfolio’s current effective contractual management fee rate is higher than that of the Fundamental Growth Fund or the Combined Fund following the closing of the Reorganization. See (“Comparison of the Capital Appreciation Portfolio and the Fundamental Growth Fund—Management of the Funds.”) |

| | • | | The expectation that the Combined Fund will achieve certain operating efficiencies from its larger net asset size and the potential for further reduced expense ratios by sharing certain fixed costs over a larger asset base. |

| | • | | The fact that the same portfolio management team (as described below under “Comparison of the Capital Appreciation Portfolio and the Fundamental Growth Fund—Management of the Funds) that currently manages both Funds is expected to manage the Combined Fund following the closing of the Reorganization. |

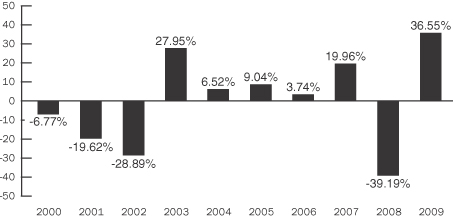

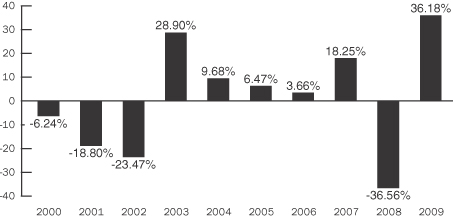

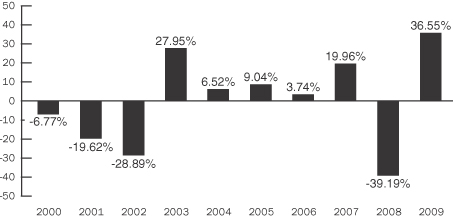

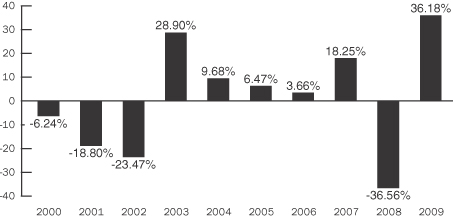

| | • | | The relative performance histories of each Fund. See “Comparison of the Capital Appreciation Portfolio and the Fundamental Growth Fund—Performance History.” |

| | • | | The fact that Capital Appreciation Portfolio shareholders will not pay any sales charges in connection with the Reorganization. Shareholders of the Capital Appreciation Portfolio will receive shares of the Fundamental Growth Fund. The fact that there are certain differences in the contingent deferred sales charges (“CDSCs”) of the Investor A shares of the Funds. The Fundamental Growth Fund Investor A shares and Capital Appreciation Portfolio Investor A shares both have a front-end sales load of 5.25% and service and distribution fees of 0.25%; however, the Fundamental Growth Fund Investor A shares imposes a CDSC of 1.00% on redemptions of investments of $1 million or more within 18 months of purchase while the Capital Appreciation Portfolio Investor A shares imposes a CDSC of 0.75% on redemptions of investments of $1 million or more within 18 months of purchase. The CDSCs and distribution fees for the Investor B and Investor C Shares of each Fund are identical. The Institutional Shares of the Capital Appreciation Portfolio and the newly created BlackRock Shares of the Fundamental Growth Fund do not impose any front-end sales loads, CDSCs or distribution fees. |

3

| | • | | The fact that there is expected to be no gain or loss recognized by shareholders for federal income tax purposes as a result of the Reorganization, as the Reorganization is expected to be a tax-free transaction. In addition, prior to the Reorganization the Capital Appreciation Portfolio will distribute to its shareholders all investment company taxable income, net tax-exempt income and net realized capital gains not previously distributed to shareholders, and such distribution of investment company taxable income and net realized capital gains will be taxable to shareholders. |

| | • | | The fact that the aggregate net asset value of the shares that shareholders of the Capital Appreciation Portfolio will receive in the Reorganization is expected to equal the aggregate net asset value of the shares that shareholders of the Capital Appreciation Portfolio own immediately prior to the Reorganization, and that shareholders of the Capital Appreciation Portfolio will not be diluted as a result of the Reorganization. |

| | • | | The fact that the asset base of the Capital Appreciation Portfolio is not expected to grow from its current level of approximately $396 million as of September 30, 2009, and that the Fundamental Growth Fund’s assets have grown consistently over the last few years. The Fundamental Growth Fund’s total assets as of September 30, 2009 were approximately $2.9 billion. |

| | • | | The costs associated with the Reorganization will be paid by BlackRock Advisors or its affiliates, and will not be borne by shareholders of either Fund. |

The Trust Board unanimously concluded that, based upon the factors and considerations summarized above, the Reorganization is advisable and in the best interests of the Capital Appreciation Portfolio and that the interests of the shareholders of the Capital Appreciation Portfolio will not be diluted as a result of the Reorganization. The Fundamental Growth Fund Board unanimously concluded that completion of the Reorganization is advisable and in the best interests of the Fundamental Growth Fund and that the interests of the shareholders of the Fundamental Growth Fund will not be diluted with respect to net asset value as a result of the Reorganization. The determinations were made on the basis of each Trustee’s/Director’s business judgment after consideration of all of the factors taken as a whole, though individual Trustees/Directors may have placed different weight on various factors and assigned different degrees of materiality to various conclusions.

If the Reorganization is not approved by shareholders of the Capital Appreciation Portfolio, the Trust Board will consider other alternatives.

The Trust Board recommends that you vote “for” the Reorganization.

Investment Objectives and Principal Investment Strategies

Investment Objectives. The investment objective of the Capital Appreciation Portfolio is long term growth of capital. The investment objective of the Capital Appreciation Portfolio is a non-fundamental policy, which means it may be changed without the approval of a majority of the Capital Appreciation Portfolio’s shareholders. Should the Trust’s Board of Trustees determine that the investment goal of the Fund should be changed, shareholders will be given at least 30 days’ notice before any such change is made.

The investment objective of the Fundamental Growth Fund is also long term growth of capital. The Fundamental Growth Fund’s investment objective is a “fundamental” policy and may not be changed by the Fundamental Growth Fund Board without approval of the Fundamental Growth Fund’s shareholders.

Principal Investment Strategies. Under normal circumstances the Capital Appreciation Portfolio invests at least 80% of its total assets in common and preferred stock of mid- and large-size companies and convertible securities. While the Fund generally expects to invest across a broad range of industries, it may favor companies in those industries that appear to offer higher potential for long-term growth. The Fund intends to buy and hold securities to allow it to capture long-term gains.

4

The Capital Appreciation Portfolio management may, when consistent with the Fund’s investment objective, buy or sell options or futures on a security or an index of securities (commonly known as derivatives). Although the Capital Appreciation Portfolio does not expect to do so as a matter of course, it is permitted to invest up to 20% of its total assets in other types of securities (for example, bonds or stocks of small-size companies).

The Fundamental Growth Fund tries to achieve its investment objective by investing primarily in a diversified portfolio consisting primarily of common stock of U.S. companies that Fund management believes have shown above-average growth rates in earnings over the long-term. In other words, Fund management tries to choose investments that will increase in value over the long term. To a lesser extent the Fund may also invest in securities convertible into common stock and rights to subscribe to common stock of these companies. The Fund emphasizes investments in companies with medium to large market capitalization (currently, approximately $2 billion or more).

The Fundamental Growth Fund will generally invest at least 65% of its total assets in common stock, convertible preferred stock, securities convertible into common stock, and rights to subscribe to common stock. Of these securities the Fund will generally invest in common stock.

The Combined Fund’s principal investment strategies will be those of the Fundamental Growth Fund.

Comparison. The investment objectives of the Capital Appreciation Portfolio and the Fundamental Growth Fund are identical. However, in the case of the Capital Appreciation Portfolio, the investment objective is not a fundamental policy and thus may be changed after providing shareholders with 30 days’ prior notice but without shareholder approval. In the case of the Fundamental Growth Fund, on the other hand, the investment policy is fundamental and may only be changed with the prior approval of the Fund’s shareholders. Each Fund employs similar strategies in achieving its respective objective. Each Fund generally invests in common stock of medium and large capitalization companies.

The principal difference between the principal strategies of the Funds is that the Capital Appreciation Portfolio invests, under normal circumstances, at least 80% of its total assets in common and preferred stock of mid- and large-size companies and convertible securities, while the Fundamental Growth Fund will generally invest at least 65% of its total assets in equity securities, including common stock, convertible preferred stock, securities convertible into common stock and rights to subscribe to common stock and emphasizes investments in companies with medium to large market capitalization.

Another difference is that as part of its principal strategies, the Capital Appreciation Portfolio may, when consistent with the Fund’s investment objective, use derivatives to hedge and also to maintain liquidity and commit cash pending investment. The Fundamental Growth Fund may also use derivatives to hedge its portfolio against market and currency risks but as part of its non-principal strategies.

In addition, as part of its principal strategies, the Capital Appreciation Portfolio is permitted to invest up to 20% of its total assets in other types of securities (for example, bonds or stocks of small-size companies); however, as a matter of course, the Fund does not expect to do so. The Fundamental Growth Fund may also invest in other types of securities, including bonds and can invest in companies with small market capitalizations but as part of its non-principal investment strategies; however, like the Capital Appreciation Portfolio, the Fundamental Growth Fund emphasizes medium and large market capitalization companies. While the Fundamental Growth Fund has the ability to invest 20% of its assets in European Depositary Receipts (“EDRs”) as part of its non-principal strategies, the Fund does not currently invest a significant portion of its assets in EDRs. The Capital Appreciation Portfolio has no such policy as part of its strategies.

The Fundamental Growth Fund also has certain non-principal strategies that are compatible with those of the principal and non-principal strategies of the Capital Appreciation Portfolio.

5

As noted above, the investment objectives of the Funds are identical. As a result, there is substantial overlap in the portfolio securities currently owned by the Funds. The Funds are currently managed by the same management team, which is also expected to manage the Combined Fund following the closing of the Reorganization. Consistent with the flexibility permitted by each Fund’s investment strategies, the portfolio management team is generally managing the Funds in the same manner. In particular, as of January 1, 2010, over 99% of the portfolio securities held by the Capital Appreciation Portfolio were held by the Fundamental Growth Fund. Thus, the proposed Reorganization is not expected to cause significant portfolio turnover or transaction expenses associated with the sale of securities held by the Capital Appreciation Portfolio.

If shareholders approve the Reorganization, the Fundamental Growth Fund will be renamed the “BlackRock Capital Appreciation Fund, Inc.” upon the closing of the Reorganization.

For additional information on risks, see “Comparison of the Capital Appreciation Portfolio and the Fundamental Growth Fund—Principal Investment Risks.” For information about the fundamental investment restrictions applicable to each Fund, see Appendix A.

Fees and Expenses

Assuming shareholders of the Capital Appreciation Portfolio approve the proposed Reorganization, all of the assets and substantially all of the liabilities of the Capital Appreciation Portfolio will be combined with those of the Fundamental Growth Fund. If the Reorganization is approved and completed, holders of Capital Appreciation Portfolio Investor A Shares will receive Fundamental Growth Fund Investor A Shares, holders of Capital Appreciation Portfolio Investor B Shares will receive Fundamental Growth Fund Investor B Shares, holders of Capital Appreciation Portfolio Investor C Shares will receive Fundamental Growth Fund Investor C Shares, and holders of Capital Appreciation Portfolio Institutional Shares will receive Fundamental Growth Fund BlackRock Shares.

6

Fee Table of the Capital Appreciation Portfolio, Fundamental Growth Fund and the Pro Forma Combined Fund, each as of September 30, 2009 (unaudited)

The fee table below provides information about the estimated fees and expenses attributable to the Investor A, Investor B, Investor C, and Institutional Shares of the Capital Appreciation Portfolio, the Investor A, Investor B, Investor C and BlackRock Shares of the Fundamental Growth Fund, each as of September 30, 2009 and, assuming the Reorganization had taken place on September 30, 2009, the estimated pro forma fees and expenses attributable to the Investor A, Investor B and Investor C Shares of the Pro Forma Combined Fund. Since Institutional Shares of the Fundamental Growth Fund will not be issued to Capital Appreciation Portfolio shareholders in the Reorganization, the fee table set forth below does not provide information for such class of shares. Future fees and expenses may be greater or less than those indicated below. For information concerning the net assets of each Fund as of September 30, 2009, see “Other Information—Capitalization.” You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in the BlackRock-advised fund complex. More information about these and other discounts is available from your financial professional and in the “Details About the Share Classes” section of the Fundamental Growth Fund Prospectus, which accompanies this Combined Prospectus/Proxy Statement and is incorporated herein by reference and in the “Purchase of Shares” section of the Fundamental Growth Fund SAI, which is incorporated herein by reference.

| | | | | | | | | |

| | | Capital Appreciation

Portfolio

Investor A | | | Fundamental

Growth Fund

Investor A | | | Pro Forma

Combined Fund

Investor A Shares (1) | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | 5.25 | % | | 5.25 | % | | 5.25 | % |

Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) | | None | (2) | | None | (2) | | None | (2) |

Redemption Fee (as a percentage of amount redeemed or exchanged, only within 30 days) | | None | | | None | | | None | |

| | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets): | | | | | | | | | |

Management Fee | | 0.65 | %(10) | | 0.62 | % | | 0.62 | % |

Distribution and/or Service (12b-1) Fees | | 0.25 | % | | 0.25 | % | | 0.25 | % |

Other Expenses | | 0.45 | % | | 0.33 | % | | 0.32 | % |

Acquired Fund Fees and Expenses (5) | | 0.01 | % | | — | %(9) | | — | %(9) |

Total Annual Fund Operating Expenses (5) | | 1.36 | % | | 1.20 | % | | 1.19 | % |

Fee Waivers and/or Expense Reimbursements (6) | | — | % | | — | % | | — | % |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (6) | | 1.36 | % | | 1.20 | % | | 1.19 | % |

Footnotes begin on page 9.

7

| | | | | | | | | |

| | | Capital Appreciation

Portfolio

Investor B | | | Fundamental

Growth Fund

Investor B | | | Pro Forma

Combined Fund

Investor B Shares (1) | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) | | 4.50 | %(3) | | 4.50 | %(3) | | 4.50 | %(3) |

Redemption Fee (as a percentage of amount redeemed or exchanged, only within 30 days) | | None | | | None | | | None | |

| | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets): | | | | | | | | | |

Management Fee | | 0.65 | %(10) | | 0.62 | % | | 0.62 | % |

Distribution and/or Service (12b-1) Fees | | 1.00 | % | | 1.00 | % | | 1.00 | % |

Other Expenses | | 0.71 | % | | 0.51 | % | | 0.50 | % |

Acquired Fund Fees and Expenses (5) | | 0.01 | % | | — | %(9) | | — | %(9) |

Total Annual Fund Operating Expenses (5) | | 2.37 | % | | 2.13 | % | | 2.12 | % |

Fee Waivers and/or Expense Reimbursements (6) | | (0.20 | )% | | — | % | | — | % |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (6) | | 2.17 | % | | 2.13 | % | | 2.12 | % |

Footnotes begin on page 9.

| | | | | | | | | |

| | | Capital Appreciation

Portfolio

Investor C | | | Fundamental

Growth Fund

Investor C | | | Pro Forma

Combined Fund

Investor C Shares (1)(8) | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) | | 1.00 | %(4) | | 1.00 | %(4) | | 1.00 | %(4) |

Redemption Fee (as a percentage of amount redeemed or exchanged, only within 30 days) | | None | | | None | | | None | |

| | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets): | | | | | | | | | |

Management Fee | | 0.65 | %(10) | | 0.62 | % | | 0.62 | % |

Distribution and/or Service (12b-1) Fees | | 1.00 | % | | 1.00 | % | | 1.00 | % |

Other Expenses | | 0.39 | % | | 0.49 | % | | 0.47 | % |

Acquired Fund Fees and Expenses (5) | | 0.01 | % | | — | %(9) | | — | %(9) |

Total Annual Fund Operating Expenses (5) | | 2.05 | % | | 2.11 | % | | 2.09 | % |

Fee Waivers and/or Expense Reimbursements (6) | | — | % | | — | % | | (0.15 | )% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (6) | | 2.05 | % | | 2.11 | % | | 1.94 | % |

Footnotes begin on page 9.

8

| | | | | | | | | |

| | | Capital Appreciation

Portfolio

Institutional

Shares | | | Fundamental

Growth Fund

BlackRock

Shares (8) | | | Pro Forma

Combined Fund

BlackRock

Shares (1),(7),(8) | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) | | None | | | None | | | None | |

Redemption Fee (as a percentage of amount redeemed or exchanged, only within 30 days) | | None | | | None | | | None | |

| | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets): | | | | | | | | | |

Management Fee | | 0.65 | %(10) | | 0.62 | % | | 0.62 | % |

Distribution and/or Service (12b-1) Fees | | None | | | None | | | None | |

Other Expenses | | 0.27 | % | | 0.15 | % | | 0.14 | % |

Acquired Fund Fees and Expenses (5) | | 0.01 | % | | — | %(9) | | — | %(9) |

Total Annual Fund Operating Expenses (5) | | 0.93 | % | | 0.77 | % | | 0.76 | % |

Fee Waivers and/or Expense Reimbursements (6) | | (0.20 | )% | | (0.05 | )% | | (0.04 | )% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (6) | | 0.73 | % | | 0.72 | % | | 0.72 | % |

| (1) | Assumes the Reorganization had taken place on September 30, 2009. |

| (2) | For each Fund, a contingent deferred sales charge (“CDSC”) is assessed on certain redemptions of Investor A Shares made within 18 months after purchase where no initial sales charge was paid at time of purchase as part of an investment of $1,000,000 or more. For the Capital Appreciation Portfolio, this fee is 0.75% and for the Fundamental Growth Fund this fee is 1.00%. |

| (3) | The CDSC is 4.50% if shares are redeemed in less than one year. The CDSC for Investor B Shares decreases for redemptions made in subsequent years. After six years there is no CDSC on Investor B Shares. |

| (4) | There is no CDSC on Investor C Shares after one year. |

| (5) | For the Capital Appreciation Portfolio, the Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to average net assets given in the Fund’s annual report, which does not include Acquired Fund Fees and Expenses. |