UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to §240.14a-12 | ||

ZOLL MEDICAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

ZOLL MEDICAL CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, JANUARY 24, 2007

NOTICE IS HEREBY GIVEN that the 2007 Annual Meeting of Shareholders (the “Annual Meeting”) of ZOLL Medical Corporation (the “Company”) will be held on Wednesday, January 24, 2007 at 10:00 a.m. at the Conference Center at Goodwin Procter LLP, Exchange Place, Boston, Massachusetts 02109 for the following purposes:

1. To elect two Class III directors of the Company to serve until the 2010 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

2. To ratify and approve the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm; and

3. To consider and act upon any other matters which may properly be brought before the Annual Meeting and at any adjournments or postponements thereof.

Any action may be taken on the foregoing matters at the Annual Meeting on the date specified above, or on any date or dates to which, by original or later adjournment, the Annual Meeting may be adjourned, or to which the Annual Meeting may be postponed.

The Board of Directors has fixed the close of business on December 8, 2006 as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof. Shareholders of record of the Company’s common stock, par value $0.02 per share, at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

You are requested to complete and sign the enclosed form of proxy which is being solicited by the Board of Directors and to mail it promptly in the enclosed postage-prepaid envelope. Any proxy may be revoked by delivery of a later dated proxy. Shareholders of record who attend the Annual Meeting may vote in person, even if they have previously delivered a signed proxy.

By Order of the Board of Directors

STEPHEN KORN

Secretary

Chelmsford, Massachusetts

December 20, 2006

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE POSTAGE-PREPAID ENVELOPE PROVIDED. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY CARD.

ZOLL MEDICAL CORPORATION

269 Mill Road

Chelmsford, Massachusetts 01824

PROXY STATEMENT

2007 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on Wednesday, January 24, 2007

December 20, 2006

General Information

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of ZOLL Medical Corporation (the “Company”) for use at the 2007 Annual Meeting of Shareholders of the Company to be held on Wednesday, January 24, 2007 at 10:00 a.m., and at any adjournments or postponements thereof, at the Conference Center at Goodwin Procter LLP, Exchange Place, Boston, Massachusetts 02109 (the “Annual Meeting”). At the Annual Meeting, shareholders will be asked to vote upon (1) the election of two Class III directors of the Company, (2) the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm, and (3) any other matters properly brought before the Annual Meeting.

Voting

This proxy statement and the accompanying Notice of Annual Meeting and proxy card are first being sent to shareholders on or about December 20, 2006. The Board of Directors has fixed the close of business on December 8, 2006 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). Only shareholders of record of Company common stock, par value $0.02 per share (the “Common Stock”), at the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 9,950,130 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Holders of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held by them.

The presence, in person or by proxy, of holders of at least a majority in interest of the total number of issued and outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes are each included in the number of shares present at the Annual Meeting for purposes of establishing a quorum. Directors are elected by a plurality of the votes cast at the Annual Meeting. Votes may be cast FOR or WITHHELD FROM each nominee. Votes cast FOR the nominees will count as “yes votes”; votes that are WITHHELD FROM the nominees will be excluded entirely from the vote and will have no effect. The ratification of the selection of the independent registered public accounting firm shall be approved by a majority of the shares voting on such proposal. Votes may be cast FOR or AGAINST the approval of the ratification of the selection of the independent registered public accounting firm. Abstentions and broker non-votes will have no effect on the outcome of the election of directors or the ratification of the selection of the independent registered public accounting firm.

Shareholders of the Company are requested to complete, date, sign and promptly return the accompanying proxy card in the enclosed postage-prepaid envelope. Shares represented by a properly executed proxy received prior to the vote at the Annual Meeting and not revoked will be voted at the Annual Meeting as directed on the proxy. If a properly executed proxy is submitted and no instructions are given, the proxy will be voted FOR the election of the nominees for the Class III directors of the

1

Company named in this proxy statement and FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. It is not anticipated that any matter other than that set forth in this proxy statement will be presented at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders. The Board of Directors unanimously recommends a vote FOR the nominees and FOR the approval of the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm.

A shareholder of record may revoke a proxy at any time before it has been exercised by (1) filing a written revocation with the Secretary of the Company at the address of the Company set forth above, (2) filing a duly executed proxy bearing a later date, or (3) appearing in person and voting by ballot at the Annual Meeting. Any shareholder of record as of the Record Date attending the Annual Meeting may vote in person whether or not a proxy has been previously given, but the presence (without further action) of a shareholder at the Annual Meeting will not constitute revocation of a previously given proxy.

The Company’s 2006 Annual Report, including the Company’s audited financial statements for the fiscal year ended October 1, 2006, is being mailed to shareholders concurrently with this proxy statement.

PROPOSAL 1

ELECTION OF A CLASS OF DIRECTORS

Currently there are six members of the Board of Directors. The Board of Directors is divided into three classes, with the directors in each class serving for a term of three years and until their successors are duly elected and qualified. As the term of one class expires, a successor class is elected at each succeeding annual meeting of shareholders. Dr. James W. Biondi and Robert J. Halliday are currently serving as Class III Directors. On May 30, 2006, Mr. William J. Mercer was elected to serve as a Class III Director, but he died unexpectedly on October 11, 2006. The Board of Directors is currently in the process of seeking a new director to fill the vacancy created by Mr. Mercer’s death.

Therefore, at the Annual Meeting, two Class III directors will be elected to serve until the 2010 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified. Based on the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated Dr. Biondi and Mr. Halliday for election as Class III directors (the “Nominees”). The Board of Directors anticipates that each of the Nominees will serve as a director if elected. However, if the Nominees nominated by the Board of Directors are unable to accept election, the proxies will be voted for the election of such other person as the Board of Directors may recommend.

Proxies may not be voted for a greater number of persons than the number of nominees named below. In order to be elected, each nominee must receive the affirmative vote of a plurality of the issued and outstanding shares of the Common Stock represented in person or by proxy at the Annual Meeting and entitled to vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE TWO DIRECTOR NOMINEES LISTED BELOW.

2

Information Regarding Nominees and Directors

The following table sets forth certain information with respect to the Nominees for election as directors at the Annual Meeting and those continuing directors of the Company whose terms expire at the Annual Meetings of Shareholders in 2008 and 2009 based on information furnished to the Company by each director. The following information is as of December 1, 2006 unless otherwise specified.

Name and Principal Occupation | Age | Director Since | Amount and Nature of Beneficial Ownership of Common Stock(1) | Percent Of Class | |||||

| Class III Nominees for Election at the 2007 Annual Meeting | |||||||||

James W. Biondi, M.D. | 50 | 1999 | 13,500 | (2) | * | ||||

Dr. Biondi founded and served as Chairman of the Board of Directors of Cardiopulmonary Corporation, a medical device company, since 1988 and Chief Executive Officer since 1992. Dr. Biondi also serves as Chairman of the Board of Directors of Ivy Biomedical Systems, Inc. Dr. Biondi received a B.S. degree from Rensselaer Polytechnic Institute and a M.D. degree from Albany Medical College. | |||||||||

Robert J. Halliday | 52 | 2003 | 11,500 | (3) | * | ||||

Mr. Halliday is the Executive Vice President and Chief Financial Officer of Varian Semiconductor Equipment Associates, Inc. Mr. Halliday has been the Chief Financial Officer of Varian Semiconductor since March 2001. Prior to joining Varian Semiconductor, Mr. Halliday was Vice President and Chief Financial Officer of Unica Corporation, a software company. Previously, Mr. Halliday had held the positions of Chief Operating Officer and Chief Financial Officer of Ionics, Inc., a manufacturer of water treatment equipment. Mr. Halliday had been Chief Financial Officer of Ionics, Inc. from 1990 and Group Vice President of the Consumer Water Group of Ionics, Inc. from 1996 to 2000. Mr. Halliday received an M.B.A. degree from The Wharton School of Finance and a B.S. degree from the University of Pennsylvania’s Wharton School, and he is a Certified Public Accountant. | |||||||||

| Class I Continuing Directors—Term to Expire 2008 | |||||||||

Daniel M. Mulvena | 58 | 1998 | 12,500 | (4) | * | ||||

Mr. Mulvena is the owner of Commodore Associates, Inc., a consulting company. From 1992 to 1995, Mr. Mulvena was a Group Vice President of Boston Scientific Corporation. Mr. Mulvena is a director of Thoratec Corporation, where he serves as chairman of its Compensation Committee. | |||||||||

Benson F. Smith | 59 | 2000 | 14,194 | (5) | * | ||||

Mr. Smith is an author and speaker, primarily for the Sales Research Group, a research organization. Mr. Smith was formerly President, Chief Operating Officer and a member of the Board of Directors of C.R. Bard, Inc. Mr. Smith worked at C.R. Bard, Inc. in various capacities for 25 years until his retirement in 1998. Mr. Smith currently serves as a director of Rochester Medical Corporation, Teleflex Inc., and Solace Therapeutics, as well as a board member for a variety of academic and health-related organizations. | |||||||||

3

Name and Principal Occupation | Age | Director Since | Amount and Nature of Beneficial Ownership of Common Stock(1) | Percent Of Class | ||||||

| Class II Continuing Directors—Term to Expire 2009 | ||||||||||

Thomas M. Claflin, II | 65 | 1980 | 16,252 | (6) | * | |||||

Mr. Claflin is a principal of Claflin Capital Management, Inc., a venture capital firm, and general partner of its venture capital partnerships. Mr. Claflin is a director of Point Therapeutics, Inc., where he serves as a member of its Audit Committee. | ||||||||||

Richard A. Packer | 49 | 1996 | 215,800 | (7) | 2.1 | % | ||||

Mr. Packer joined the Company in 1992 and in November 1999 was appointed Chairman of the Board of Directors and Chief Executive Officer. Mr. Packer served as President, Chief Operating Officer and Director from 1996 to his appointment as CEO. From 1992 to 1996 he has served as Chief Financial Officer and Vice President of Operations of the Company. From 1987 to 1992, Mr. Packer served as Vice President of various functions for Whistler Corporation, a consumer electronics company. Prior to this, Mr. Packer was a manager with the consulting firm of PRTM/KPMG, specializing in operations of high technology companies. Mr. Packer received B.S. and M. Eng. degrees from the Rensselaer Polytechnic Institute and an M.B.A. degree from the Harvard Graduate School of Business Administration. | ||||||||||

All directors and executive officers as a group (14 persons) | 527,963 | (8) | 5.1 | % | ||||||

| * | Less than 1%. |

| (1) | The persons named in this table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to the information contained in the other footnotes to this table. |

| (2) | Includes 12,500 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Includes 1,000 shares owned indirectly for the benefit of minor children. Does not include 3,500 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. |

| (3) | Represents 11,500 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Does not include 3,500 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. |

| (4) | Represents 12,500 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Does not include 3,500 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. |

| (5) | Includes 12,500 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Does not include 3,500 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. |

| (6) | Includes 2,500 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Does not include 3,500 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. |

| (7) | Includes 202,500 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Does not include 87,500 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. |

| (8) | Includes 488,375 shares of Common Stock issuable upon exercise of options to purchase Common Stock which are exercisable within 60 days after December 1, 2006. Does not include 217,125 options to purchase Common Stock which are not exercisable within 60 days of December 1, 2006. Does not include shares of Common Stock owned by two executive officers through one of the funds (the ZOLL Medical Corporation Employer Stock Fund) in the ZOLL Medical Corporation Employee Savings Plan. |

4

The Board of Directors and Its Committees

The Board of Directors of the Company held five meetings and took action by unanimous written consent on one occasion during the fiscal year ended October 1, 2006. Each of the directors attended more than 75% of the aggregate of the total number of meetings of the Board of Directors and of the committees of which he was a member which were held during the period he was a director or committee member. Our Annual Meeting of Shareholders is generally held to coincide with one of the Board’s regularly scheduled meetings. The Company does not have a formal policy requiring members of the Board of Directors to attend our annual meetings, although all directors typically attend the annual meeting. Each of the directors attended the 2006 Annual Meeting of Shareholders.

The Company has standing Audit, Compensation, and Nominating and Corporate Governance Committees.

Audit Committee. During the 2006 fiscal year the members of the Audit Committee were Messrs. Smith (as Chairman) and Halliday and Dr. Biondi. The Board of Directors has determined that each of the members of the Audit Committee is “independent” under the rules of the National Association of Security Dealers and the Securities and Exchange Commission. The Board of Directors has also determined that Mr. Halliday qualifies as the “audit committee financial expert” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee has a written charter adopted by the Board of Directors, which charter was amended in 2006 and which is attached asExhibit A to this proxy statement. The charter is also available on the Company’s website atwww.zoll.com and will be sent in paper form to any shareholder who submits a request to the Company’s Secretary at the address listed on page 1. The Board of Directors and the Audit Committee have adopted an Audit Committee Complaint Procedure, which is available on the Company’s website atwww.zoll.com and will be sent in paper form to any shareholder who submits a request to the Company’s Secretary at the address listed on page 1. The Audit Committee is responsible for selecting the Company’s independent registered public accounting firm, and assisting the Board of Directors in general oversight and monitoring of management’s and the independent auditor’s participation in the Company’s financial reporting process. The primary objective in fulfilling these responsibilities is to promote and preserve the integrity of the Company’s financial statements and the independence of the Company’s external independent auditor. During the fiscal year ended October 1, 2006, the Audit Committee held five meetings. The Audit Committee’s report on the Company’s audited financial statements for the fiscal year ended October 1, 2006 appears elsewhere in this proxy statement.

Compensation Committee. During the 2006 fiscal year, the members of the Compensation Committee were Mr. Mulvena (as Chairman) and Dr. Biondi. The Board of Directors has determined that each member of the Compensation Committee is “independent” under the rules of the National Association of Security Dealers and the Securities and Exchange Commission. The Company has adopted a Compensation Committee Charter. A copy of the Compensation Committee Charter is available on the Company’s website atwww.zoll.com and will be sent in paper form to any shareholder who submits a request to the Company’s Secretary at the address listed on page 1. The Compensation Committee (1) annually reviews and makes recommendations to the Board of Directors with respect to the compensation of all directors, officers and members of senior management of the Company; (2) reviews and approves the corporate goals and objectives that may be relevant to the compensation of the Chief Executive Officer and evaluates the Chief Executive Officer’s performance in light of the goals and objectives that were set for the Chief Executive Officer and determines the Chief Executive Officer’s compensation based on such evaluation; and (3) administers the Company’s Amended and Restated 2001 Stock Incentive Plan, 1992 Stock Option Plan, the Non-Employee Director Stock Option Plan and the 2006 Non-Employee Director Stock Option Plan. During the fiscal year ended October 1, 2006, the Compensation Committee held two meetings and took action by unanimous written consent on one occasion. The Compensation Committee’s report on executive compensation appears elsewhere in this proxy statement.

Nominating and Corporate Governance Committee. During the 2006 fiscal year, the members of the Nominating and Corporate Governance Committee were Messrs. Claflin (as Chairman) and Mulvena. The Board

5

of Directors has determined that each member of the Nominating and Corporate Governance Committee is “independent” under the rules of the National Association of Security Dealers and the Securities and Exchange Commission. The Company has adopted a Nominating and Corporate Governance Committee Charter. A copy of the Nominating and Corporate Governance Committee Charter is available on the Company’s website atwww.zoll.com and will be sent in paper form to any shareholder who submits a request to the Company’s Secretary at the address listed on page 1. The Nominating and Corporate Governance Committee is responsible for developing and recommending to the Board of Directors a set of corporate governance guidelines and periodically reviewing such guidelines and recommending any changes to them. The Company has adopted Corporate Governance Guidelines, which are available on the Company’s website atwww.zoll.com and will be sent in paper form to any shareholder who submits a request to the Company’s Secretary at the address listed on page 1. In addition, the Nominating and Corporate Governance Committee reviews and evaluates potential nominees for election or appointment to the Board of Directors and recommends such nominees to the full Board of Directors. The Nominating and Corporate Governance Committee will consider a nominee for election to the Board of Directors recommended by a shareholder of record if the shareholder submits the nomination following the timing and information requirements of the Company’s Amended and Restated By-laws. Such proposal should specify whether the named person(s) should be considered by the Nominating and Corporate Governance Committee for inclusion as a Board of Directors nominee or whether the named person(s) are to be considered shareholder nominees under the Amended and Restated By-Laws. Please see the section of this proxy statement entitled “Other Matters—Shareholder Proposals” for a summary of these requirements. At a minimum, each nominee, whether proposed by a shareholder or any other party, is expected to have the highest personal and professional integrity, shall demonstrate sound judgment, have an experience base useful to the Company and complementary to the other directors, and shall be expected to effectively interact with other members of the Board to serve the long-term interests of the Company and its shareholders. The Nominating and Corporate Governance Committee recommended that Dr. Biondi and Mr. Halliday each be nominated for election to serve as Class III directors to serve until the 2010 Annual Meeting of Shareholders. During the fiscal year ended October 1, 2006, the Nominating and Corporate Governance Committee held no meetings, but took action by unanimous written consent on three occasions.

Please note that the information contained in our website is not incorporated by reference in, or considered to be a part of, this proxy statement.

Director Independence

The Board of Directors has determined that each of Dr. Biondi, Mr. Claflin, Mr. Halliday, Mr. Mulvena and Mr. Smith is an “independent director” in accordance with corporate governance rules of the National Association of Securities Dealers as a result of having no relationship with the Company other than (1) serving as a director and a Board of Directors committee member, (2) receiving related fees as disclosed in this proxy statement, and (3) having beneficial ownership of Company Common Stock as disclosed in the section of this proxy statement entitled “Proposal 1—Election of a Class of Directors—Information Regarding Nominees and Directors.” Therefore, the Company currently has a majority of “independent directors.”

Meetings of Independent Directors

Independent directors of the Company regularly meet in executive sessions outside the presence of management. Currently, the independent directors of the Company are Dr. Biondi, Mr. Claflin, Mr. Halliday, Mr. Mulvena and Mr. Smith. The presiding director for these meetings is currently Mr. Claflin, who is the lead independent director. Any interested parties who wish to make their concerns known to the independent directors may avail themselves of the same procedures utilized with respect to the Company’s Audit Committee Complaint Procedures. The Audit Committee Complaint Procedures are available on the Company’s website atwww.zoll.com.

Communication with the Board of Directors

If you wish to communicate with any of our Directors or the Board of Directors as a group, you may do so by either (1) following the same procedures with respect to the Company’s Audit Committee Complaint

6

Procedures (available on the Company’s website atwww.zoll.com), or (2) by writing to the Board of Directors, or such individual director(s) c/o the Secretary, ZOLL Medical Corporation, 269 Mill Road, Chelmsford, Massachusetts 01824-4105.

We recommend that all correspondence be sent via certified U.S. mail, return receipt requested. All correspondence received by the Secretary will be forwarded promptly to the appropriate addressee(s).

Employee Code of Conduct

The Company has adopted an Employee Code of Conduct, which is available on the Company’s website atwww.zoll.com and will be sent in paper form to any shareholder who submits a request to the Company’s Secretary at the address listed on page 1. The Employee Code of Conduct applies to all employees of the Company and the Board of Directors of the Company, and is meant to provide a general framework for the Company’s expectations with respect to the conduct of its employees and directors.

Director Compensation

Beginning in calendar 2006, non-employee directors of the Company received: (1) a $22,000 annual retainer, payable quarterly, (2) a $4,000 annual retainer for each of the Compensation and Nominating and Corporate Governance Committee Chairman, payable quarterly, (3) a $6,000 annual retainer for the Audit Committee Chairman, payable quarterly, (4) a $2,000 meeting fee for each Board of Directors meeting attended, (5) a $750 meeting fee for each Compensation Committee and Nominating and Corporate Governance Committee meeting attended, (6) a $1,000 meeting fee for each Audit Committee meeting attended, and (7) a $500 meeting fee for each telephonic meeting of the Board or a Committee of the Board. Previously, the annual retainer was $15,000, the Board of Directors meeting fee was $1,000, the committee meeting fee was $500, the telephonic meeting fee was $200, and each Committee Chairman was paid a $2,000 annual retainer.

1996 Non-Employee Directors’ Stock Option Plan. The Company’s Non-Employee Directors’ Stock Option Plan, which was adopted in April 1996 and expired in April 2006, provided that each director of the Company who was not also an employee of the Company would be granted options to purchase 10,000 shares of the Company’s Common Stock. Each non-employee director of the Company who served in such position on April 23, 1996, the effective date of the plan, received a grant of options as of that date. Each non-employee director who was first elected to the Board of Directors after that date was automatically granted an option to purchase 10,000 shares of Common Stock on the date such person was initially elected to the Board. The exercise price of options granted under the plan was equal to the fair market value of the Common Stock on the date of grant. All options granted under the plan vest in four equal annual installments beginning on the first anniversary of the date of grant.

On November 15, 2005, the Company issued to each of its non-employee directors a non-qualified option to purchase 2,000 shares of Common Stock pursuant to the Non-Employee Directors’ Stock Option Plan. The exercise price of each option is $22.51 per share, the closing price of the Company’s Common Stock on November 15, 2005.

2006 Non-Employee Director Stock Option Plan. On November 15, 2005, the Board of Directors of the Company adopted the 2006 Non-Employee Director Stock Option Plan, which was approved by the shareholders on January 25, 2006.

The 2006 Non-Employee Director Stock Option Plan provides that each eligible director who is first elected to the Board of Directors after the Company’s 2006 Annual Meeting receives non-qualified options to purchase 10,000 shares of Common Stock upon election to the Board of Directors. Incentive options may not be granted under the 2006 Non-Employee Director Stock Option Plan. The Board of Directors may also grant, from time to

7

time, additional options to non-employee directors. All options granted under this plan vest in four equal annual installments over a four-year period beginning on the first anniversary of the date of grant. The exercise price of the options granted to eligible directors is the fair market value of the Common Stock on the date of grant. Generally, vested options expire six months following the date a director retires from the Board of Directors.

On November 14, 2006, the Company awarded to each of its non-employee directors a non-qualified stock option to purchase 2,000 shares of common stock pursuant to the 2006 Non-Employee Director Stock Option Plan. The exercise price of each stock option is $40.45 per share (the closing price of the common stock on the date of grant).

Non-Employee Director Compensation for 2006

| Retainer ($) | Director Meetings Fees ($) | Committee Meetings Fees ($) | Shares Options Granted | |||||

James W. Biondi, M.D. | 20,250 | 7,500 | 4,400 | 2,000 | ||||

Thomas M. Claflin, II | 23,750 | 7,500 | — | 2,000 | ||||

Robert J. Halliday | 20,250 | 7,500 | 3,700 | 2,000 | ||||

Daniel M. Mulvena | 23,750 | 7,500 | 700 | 2,000 | ||||

Benson F. Smith | 24,750 | 7,500 | 3,700 | 2,000 |

Executive Compensation

Summary Compensation Table. The following table sets forth the aggregate cash compensation paid by the Company with respect to the three fiscal years ended October 1, 2006, October 2, 2005, and October 3, 2004, respectively, to the Company’s Chief Executive Officer and each of the four other most highly compensated executive officers in fiscal year 2006 (collectively, the “Named Executive Officers”).

| Annual Compensation | Long-Term Compensation Awards | ||||||||||||

Name and Principal Position | Year | Salary($) | Bonus($)(1) | Other Annual Compensation($) | Shares Options | All Other Compensation($)(2) | |||||||

Richard A. Packer | 2006 | 350,000 | 375,000 | — | 50,000 | 4,490 | |||||||

Chief Executive Officer | 2005 | 305,000 | 29,000 | — | 12,500 | 4,240 | |||||||

and President | 2004 | 305,000 | 29,250 | — | 12,500 | 3,990 | |||||||

A. Ernest Whiton | 2006 | 220,000 | 133,500 | — | 15,000 | 4,312 | |||||||

Chief Financial Officer and | 2005 | 205,000 | 32,000 | — | 4,500 | 4,062 | |||||||

Vice President, Administration | 2004 | 205,000 | 37,000 | — | 4,500 | 3,812 | |||||||

Alexander N. Moghadam | 2006 | 186,000 | 113,675 | — | 12,500 | 386 | |||||||

Vice President—International | 2005 | (3) | 129,050 | 79,400 | — | 22,500 | — | ||||||

Operations | 2004 | — | — | — | — | — | |||||||

Steven K. Flora | 2006 | 210,000 | 180,500 | — | 15,000 | 4,185 | |||||||

Vice President—North | 2005 | 195,000 | 10,000 | — | 4,500 | 4,022 | |||||||

American Sales | 2004 | 195,000 | 38,000 | — | 4,500 | 3,772 | |||||||

Ward M. Hamilton | 2006 | 190,000 | 102,500 | — | 10,000 | 1,111 | |||||||

Vice President—Marketing | 2005 | 175,000 | 6,500 | — | 2,500 | 1,171 | |||||||

| 2004 | 175,000 | 16,000 | — | 2,500 | 1,211 | ||||||||

| (1) | Amounts shown for each fiscal year include bonuses paid during the succeeding fiscal year. Thus, the 2004 bonus includes an amount paid in fiscal 2005 for fiscal 2004, the 2005 bonus includes an amount paid in fiscal 2006 for fiscal 2005 and the 2006 bonus includes an amount to be paid in fiscal 2007 for fiscal 2006. |

8

| (2) | All Other Compensation represents life insurance premiums and 401(k) Plan contributions paid by the Company for all the Named Executive Officers. |

| (3) | Mr. Moghadam joined the Company in January 2005. |

Option Grants in Last Fiscal Year. The following table sets forth certain information regarding options granted during the fiscal year ended October 1, 2006 by the Company to the Named Executive Officers.

Number of Securities Underlying Options Granted(#) | Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(1) | |||||||||||

% of Total Options Granted to Employees in 2006 | Exercise or Base Price ($/Sh) | Expiration Date | |||||||||||

Name | 5%($) | 10%($) | |||||||||||

Richard A. Packer | 50,000 | 24.9 | % | 22.51 | 11/15/2015 | 707,821 | 1,793,757 | ||||||

A. Ernest Whiton | 15,000 | 7.5 | % | 22.51 | 11/15/2015 | 212,346 | 538,127 | ||||||

Alexander N. Moghadam | 12,500 | 6.2 | % | 22.51 | 11/15/2015 | 176,955 | 448,439 | ||||||

Steven K. Flora | 15,000 | 7.5 | % | 22.51 | 11/15/2015 | 212,346 | 538,127 | ||||||

Ward M. Hamilton | 10,000 | 5.0 | % | 22.51 | 11/15/2015 | 141,564 | 358,751 | ||||||

| (1) | Represents the value of the options granted at the end of the option terms if the price of the Company’s Common Stock were to appreciate annually by 5% and 10%, respectively. There is no assurance that the stock price will appreciate at the rates shown in the table. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values. The following table sets forth certain information regarding stock options exercised during the fiscal year ended October 1, 2006 and stock options held as of October 1, 2006 by each Named Executive Officer.

Name | Shares Acquired Exercise(#) | Value Realized($) | Number of Shares Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In-the-Money Options at Fiscal Year-End(1) | ||||||||

| Exercisable(#)(2) | Unexercisable(#) | Exercisable($)(2) | Unexercisable($) | |||||||||

Richard A. Packer | — | — | 202,500 | 37,500 | 528,963 | 501,750 | ||||||

A. Ernest Whiton | — | — | 66,000 | 11,250 | 668,022 | 150,525 | ||||||

Alexander N. Moghadam | — | — | 14,375 | 20,625 | 102,206 | 247,669 | ||||||

Steven K. Flora | — | — | 41,750 | 11,250 | 156,768 | 150,525 | ||||||

Ward M. Hamilton | — | — | 42,000 | 7,500 | 341,805 | 100,350 | ||||||

| (1) | Year-end value is based on the closing market price per share on September 29, 2006 ($35.89), less the applicable aggregate option exercise price(s) of in-the-money options multiplied by the number of unexercised in-the-money options which are exercisable and unexercisable, respectively. |

| (2) | Includes options exercisable within 60 days after October 1, 2006. |

9

Stock Performance Chart

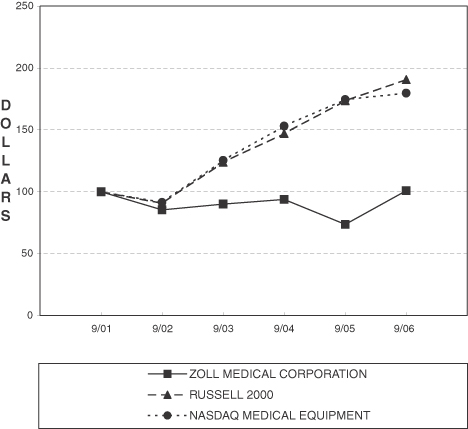

The following chart provides an annual comparison, from September 30, 2001, of the cumulative total shareholder return (assuming reinvestment of any dividends) among ZOLL Medical Corporation, the Russell 2000 Index and Nasdaq Medical Equipment Index. The Russell 2000 Index and the Nasdaq Medical Equipment Index cover a broad cross-section of public companies, many of which have relatively small market capitalizations. The historical information set forth below is not necessarily indicative of future performance.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN*

AMONG ZOLL MEDICAL CORPORATION, THE RUSSELL 2000 INDEX

AND THE NASDAQ MEDICAL EQUIPMENT INDEX

| 9/01 | 9/02 | 9/03 | 9/04 | 9/05 | 9/06 | |||||||

ZOLL Medical Corporation | 100.00 | 85.39 | 90.03 | 93.79 | 73.68 | 100.81 | ||||||

Russell 2000 | 100.00 | 90.70 | 123.80 | 147.04 | 173.44 | 190.65 | ||||||

Nasdaq Medical Equipment | 100.00 | 91.38 | 125.35 | 153.10 | 174.45 | 179.70 |

| * | $100 invested on 9/30/01 in stock or index—including reinvestment of dividends. Fiscal year ending September 30. |

10

Report of the Compensation Committee

Objective of the Company’s Compensation Program. The Company’s executive compensation program is intended to attract, retain and reward executives who are capable of leading the Company effectively and continuing its growth in the competitive marketplace for cardiac resuscitation equipment. The Company’s objective is to utilize a combination of cash and equity-based compensation to provide appropriate incentives for executives while aligning their interests with those of the Company’s shareholders.

Like many other public companies, the Company uses a three-pronged approach to its compensation for each executive for the following twelve months. First, the executive’s base salary is intended to create a reasonably competitive minimum level of compensation for each executive for the following twelve months. Second, the Company maintains an incentive bonus program for executive officers and certain other members of management under which discretionary bonuses may be offered based upon the achievement of corporate and individual performance goals. The objective of the incentive bonus program is to reward executives for their past twelve months’ performance. Finally, the Company utilizes stock options and restricted stock granted under its option plans as a long-term incentive for the executive officers as well as for many other employees of the Company. The Company believes that stock options are important in aligning management and shareholder interests and in encouraging management to adopt a longer-term perspective. Accordingly, options generally provide for incremental vesting over a four-year period. In determining each component of compensation, the Compensation Committee considers all elements of an executive’s total compensation package. The Compensation Committee has also used Restricted Stock Awards under the Amended and Restated 2001 Stock Incentive Plan in lieu of stock options as an element of compensation for key employees other than executive officers.

Compensation Committee Procedures. The Company’s executive compensation program is administered under the direction of the Company’s Compensation Committee, which is currently composed of two non-employee directors, Mr. Mulvena and Dr. Biondi. The Compensation Committee meets periodically and may consult by telephone at other times. The determinations of the Compensation Committee relating to the compensation of the Company’s executive officers and the granting of options and/or restricted stock are then approved or ratified by all of the non-employee directors.

Factors Considered in Setting Compensation of the Chief Executive Officer and President. Mr. Packer, who has served as President of the Company since 1996, became Chief Executive Officer and Chairman in November 1999. The Compensation Committee considers the Company’s financial performance, as measured by sales and earnings growth, to be a significant determinant in Mr. Packer’s overall compensation package. In making its determinations, however, the Compensation Committee also considers a number of other factors which are not subject to precise quantitative measurement and which the Compensation Committee believes can only be properly assessed over the long term.

Compensation Decisions for Chief Executive Officer. Each year the Compensation Committee reviews the performance of the Company’s Chief Executive Officer. For 2006, the Compensation Committee considered a number of factors, including the Company’s strong financial performance, the growth of the international operations, development and introduction of next generation products, and continued development of a strong management team. At the beginning of 2006, the Compensation Committee established Mr. Packer’s annual salary at $350,000 and at the end of the year awarded Mr. Packer a bonus of $375,000 for fiscal 2006.

Factors Considered in Setting Compensation of the Officers Other than the Chief Executive Officer. The Compensation Committee also reviews and makes recommendations to the Board of Directors with respect to the compensation of all other executive officers and members of senior management of the Company, as described below.

Base Salary. The base salary of each executive officer is reviewed annually by the Compensation Committee in consultation with the Chief Executive Officer. Annual salary adjustments are determined by

11

evaluating the financial performance of the Company during the prior year, varying levels of responsibilities, prior experience, each executive officer’s contribution to the profitability, sales growth, return on equity and market share of the Company during the prior year and the compensation programs and levels generally paid to executives at other companies.

Incentive Bonus Program. Discretionary cash bonuses are based upon the achievement of corporate and individual performance goals. At the beginning of each fiscal year, target corporate and individual performance goals are established for each executive officer. Assessment of individual performance is based on the previously established goals for each executive officer comprised of both subjective and objective elements. At the end of the fiscal year, the annual incentive bonuses are calculated based on the actual results for each performance goal. In addition, the Compensation Committee establishes minimum achievement thresholds and maximum bonus levels for each of these performance goals.

Stock Options. During fiscal 2006, the Compensation Committee granted stock options to the executive officers taking into account such factors as the executives’ levels of responsibility, prior experience, historical award data, individual performance, total compensation package and compensation at peer companies. Mr. Packer was granted stock options for a total of 50,000 shares. Awards to the Named Executive Officers are detailed in the “Summary Compensation Table” in this proxy statement.

Submitted by the Compensation Committee for

fiscal 2006

DANIEL M. MULVENA,Chairman and

JAMES W. BIONDI, M.D.

Compensation Committee Interlocks and Insider Participation

All executive officer compensation decisions are made by the Compensation Committee. The current members of the Compensation Committee are Mr. Mulvena and Dr. Biondi, neither of whom is an officer of the Company. The Company is not aware of any compensation committee interlocks or relationships involving members of the Compensation Committee requiring disclosure in this proxy statement.

Report of the Audit Committee

The Audit Committee has:

| • | Reviewed and discussed the audited financial statements with management. |

| • | Discussed with the independent registered public accounting firm, Ernst & Young LLP, the matters required to be discussed by SAS 61. |

| • | Received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1, and has discussed with the independent registered public accounting firm its independence. |

| • | Based on the review and discussions above, recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission. |

Submitted by the Audit Committee for fiscal 2006

BENSON F. SMITH,Chairman,

ROBERT J. HALLIDAY and

JAMES W. BIONDI, M.D.

12

Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has selected the accounting firm of Ernst & Young LLP (Ernst & Young) to serve as its independent registered public accounting firm for the 2007 fiscal year, subject to approval of Ernst & Young’s proposed fee schedule. Ernst & Young has served as the Company’s independent registered public accounting firm since 1984. A representative of Ernst & Young will be present at the Annual Meeting, will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Audit Fees. During fiscal 2006, the aggregate fees and expenses billed for professional services rendered by Ernst & Young for the audit of the Company’s annual financial statements, review of the Company’s quarterly financial statements, internal control reporting, statutory filings, and services related to registration statements totaled $984,000. During fiscal 2005, the aggregate fees and expenses billed by Ernst & Young for such services totaled $1,130,000.

Audit-Related Fees. During fiscal 2006, the aggregate fees and expenses billed by Ernst & Young related to services for assistance with internal control reporting and accounting consultations totaled $55,000. During fiscal 2005, the aggregate fees and expenses billed for such services totaled $146,000.

Tax Fees. During fiscal 2006, the aggregate fees and expenses billed for professional services rendered by Ernst & Young for tax compliance, tax advice and tax planning totaled $93,000. During fiscal 2005, the aggregate fees and expenses billed for professional services rendered by Ernst & Young for such services totaled $73,000.

All Other Fees. During fiscal 2006 and 2005 there were no fees and expenses billed for professional services rendered by Ernst & Young to the Company not covered in the three preceding paragraphs.

The Audit Committee must pre-approve all audit and permitted non-audit services to be provided by our independent registered public accounting firm unless an exception to such pre-approval exists under the Exchange Act or the rules of the Securities and Exchange Commission. Each year, the Audit Committee approves the appointment of the independent registered public accounting firm to audit our financial statements, including the associated fee. All of the services described in the four preceding paragraphs were approved by the Audit Committee. The Audit Committee has considered whether the provisions of such services, including non-audit services, by Ernst & Young is compatible with maintaining Ernst & Young’s independence and has concluded that it is.

Severance Arrangements

Mr. Packer has an employment agreement with the Company providing for a severance payment of twelve months’ salary in the event his employment is terminated by the Company without cause. The agreement provides for non-competition for a period of three years following termination. At his fiscal 2006 base salary, Mr. Packer would be entitled to receive a severance payment of approximately $350,000 upon termination.

Each of the Named Executive Officers has a severance agreement with the Company that may be triggered upon a change in control of the Company. Mr. Packer’s agreement provides for a severance payment if, within 36 months after a change in control, the Company terminates his employment for any reason or Mr. Packer resigns from the Company for any reason. In either case, Mr. Packer is entitled to receive 2.5 times the sum of (1) his then current base salary and (2) his most recent bonus paid prior to the change in control in one lump-sum payment, as well as health and dental insurance coverage for 30 months after his separation from the Company. Generally, if Mr. Whiton is terminated by the Company without cause (as defined in his severance agreement) or resigns from the Company for good reason (as defined in his severance agreement) within 18 months after a change in control of the Company, the Company must pay Mr. Whiton two times the sum of his base salary and

13

the average of the bonuses paid to him over the three most recent years prior to the change in control in one lump-sum payment, as well as provide him with health and dental insurance coverage for 18 months after his separation from the Company. Messrs. Flora, Hamilton and Moghadam each have severance agreements that provide that if such executive is terminated by the Company without cause (as defined in their respective severance agreements) or resigns from the Company for good reason (as defined in their respective severance agreements) within 18 months after a change in control of the Company, the Company must pay such executive 1.5 times the sum of his base salary and the average of his three most recent bonuses in one lump sum payment, as well as provide him with health and dental insurance coverage for 18 months after separation.

Certain Relationships and Related Party Transactions

Raymond C. Zemlin, the Assistant Secretary of the Company, is a partner in the law firm of Goodwin Procter LLP, outside counsel to the Company.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership of, and transactions in, the Company’s securities with the Securities and Exchange Commission and the Nasdaq Stock Market. Such directors, executive officers and 10% shareholders are also required to furnish the Company with copies of all Section 16(a) forms they file. Based solely upon a review of reports furnished to the Company, and on written representations from certain reporting persons, the Company believes that, with respect to the fiscal year ended October 1, 2006, each director, executive officer and 10% shareholder of the Company’s securities made timely filings of all reports required by Section 16 of the Exchange Act, except that Mr. Packer, a director and officer of the Company, amended one Form 4, which reported the grant of a stock option for 50,000 shares, because the original Form 4, which was timely filed, included incorrect option grant data as a result of an inadvertent error made by the Company’s SEC electronic filing service provider.

Equity Compensation Plan Information

The following table provides information as of the end of the fiscal year ended October 1, 2006 regarding shares of Common Stock of the Company that may be issued under our existing equity compensation plans, including the Company’s Amended and Restated 2001 Stock Incentive Plan, the Company’s 2006 Non-Employee Director Stock Option Plan, the Company’s 1996 Non-Employee Directors’ Stock Option Plan (under which no additional option grants may be made), and the Company’s 1992 Stock Option Plan (under which no additional option grants may be made).

| Equity Compensation Plan Information | |||||||||

Plan category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plan (Excluding Securities Referenced in Column (a)) | ||||||

| (a) | (b) | (c) | |||||||

Equity compensation plans approved by security holders | 1,286,601 | (1) | $ | 30.49 | 562,061 | (2) | |||

Equity compensation plans not approved by security holders | 0 | N/A | 0 | ||||||

Total | 1,286,601 | (1) | $ | 30.49 | 562,061 | (2) | |||

| (1) | Does not include 19,050 shares of restricted common stock issued under the Company’s Amended and Restated 2001 Stock Incentive Plan, since such shares are issued and outstanding. |

| (2) | Includes 40,950 shares available for issuance as restricted common stock under the Company’s Amended and Restated 2001 Stock Incentive Plan. |

14

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors of the Company has selected the accounting firm of Ernst & Young LLP to serve as the independent registered public accounting firm of the Company for the fiscal year ending September 30, 2007. Ernst & Young LLP has served as the Company’s independent registered public accounting firm since 1984. Ernst & Young LLP is considered by management of the Company to be well qualified. A representative of Ernst & Young LLP will be present at the Annual Meeting, will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Although the Company is not required to submit the ratification of the selection of its independent registered public accounting firm to a vote of shareholders, the Audit Committee of the Board of Directors believes that it is sound policy to do so. In the event that the majority of the votes cast are against the selection of Ernst & Young LLP, the Audit Committee will consider the vote and the reasons for it in future decisions on the selection of independent registered public accounting firms.

Vote Required For Approval

The affirmative vote of holders of a majority of shares of Common Stock voting on the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is required to approve the ratification.

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE RATIFICATION OF THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

15

OTHER MATTERS

Principal and Management Shareholders

The following table presents information regarding beneficial ownership of the Company’s Common Stock as of December 1, 2006 by (1) each of the Named Executive Officers and (2) the persons or entities believed by the Company to be beneficial owners of more than 5% of the Company’s Common Stock based on certain filings made under Section 13 of the Exchange Act. All such information was provided by the shareholders listed and reflects their beneficial ownership as of the dates specified in the footnotes to the table.

Name and Address of Beneficial Owner | No. of Shares Beneficially Owned | Percent of Class | |||

Richard A. Packer(1) | 215,800 | 2.1 | % | ||

A. Ernest Whiton(2) | 61,000 | * | |||

Alexander N. Moghadam(3) | 14,375 | * | |||

Steven K. Flora(4) | 34,500 | * | |||

Ward M. Hamilton(5) | 45,842 | * | |||

Dimensional Fund Advisors, Inc.(6) | 727,339 | 7.3 | % | ||

1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 | |||||

Barclays Global Investors NA(7) | 971,191 | 9.8 | % | ||

45 Fremont Street San Francisco, CA 94105 | |||||

| * | Less than 1%. |

| (1) | Includes 202,500 shares of Common Stock issuable upon exercise of stock options which are exercisable within 60 days after December 1, 2006. Does not include options to purchase 87,500 shares of Common Stock which are not exercisable within 60 days after December 1, 2006. |

| (2) | Represents 61,000 shares of Common Stock issuable upon exercise of options which are exercisable within 60 days after December 1, 2006. Does not include options to purchase 26,250 shares of Common Stock which are not exercisable within 60 days after December 1, 2006. |

| (3) | Represents 14,375 shares of Common Stock issuable upon exercise of options which are exercisable within 60 days after December 1, 2006. Does not include options to purchase 30,625 shares of Common Stock which are not exercisable within 60 days after December 1, 2006. |

| (4) | Includes 4,000 shares of Common Stock held by Robert W. Baird & Co., Inc. TTEE FBO Steven K. Flora IRA. Includes 30,500 shares of Common Stock issuable upon exercise of options which are exercisable within 60 days after December 1, 2006. Does not include options to purchase 21,250 shares of Common Stock which are not exercisable within 60 days after December 1, 2006. |

| (5) | Includes 42,000 shares of Common Stock issuable upon exercise of options which are exercisable within 60 days after December 1, 2006. Does not include options to purchase 17,500 shares of Common Stock which are not exercisable within 60 days after December 1, 2006. |

| (6) | Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 6, 2006. |

| (7) | Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on September 11, 2006. Includes 130,384 shares held by its affiliate, Barclays Global Fund Advisors. |

Solicitation of Proxies

The cost of solicitation of proxies in the form enclosed herewith will be borne by the Company. In addition to the solicitation of proxies by mail, the directors, officers and employees of the Company may also solicit proxies personally or by telephone without special compensation for such activities. The Company will also

16

request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send proxy materials to and obtain proxies from such beneficial owners. The Company will reimburse such holders for their reasonable expenses.

Shareholder Proposals

For a proposal of a shareholder to be included in the Company’s proxy statement for the Company’s 2008 Annual Meeting of Shareholders, it must be received at the principal executive offices of the Company on or before August 22, 2007. Such a proposal must also comply with the requirements as to form and substance established by the Securities and Exchange Commission for such a proposal to be included in the proxy statement.

In addition, the Company’s Amended and Restated By-laws provide that any shareholder wishing to nominate a director or have a shareholder proposal considered at an annual meeting must provide written notice of such nomination or proposal and appropriate supporting documentation, as set forth in the Amended and Restated By-laws, to the Company at its principal executive offices (a) not less than 75 calendar days nor more than 120 calendar days prior to the anniversary date of the immediately preceding annual meeting of shareholders or special meeting in lieu thereof (the “Anniversary Date”) or (b) in the case of a special meeting of shareholders in lieu of the annual meeting or in the event that the annual meeting of shareholders is called for a date more than 30 calendar days prior to the Anniversary Date, not later than the close of business on (i) the 10th calendar day (or if that day is not a business day for the Company, on the next succeeding business day) following the earlier of (1) the date on which notice of the date of such meeting was mailed to shareholders or (2) the date on which the date of such meeting was publicly disclosed or (ii) if such date of notice or public disclosure occurs more than 75 calendar days prior to the scheduled date of such meeting, the 75th calendar day prior to such scheduled date of such meeting (or if that day is not a business day for the Company, on the next succeeding business day). For next year’s scheduled annual meeting, the deadline for submission of notice is November 9, 2007. Any proposal or nomination submitted after November 9, 2007 will be untimely. Any such proposal should be mailed to: ZOLL Medical Corporation, 269 Mill Road, Chelmsford, Massachusetts 01824, Attention: Secretary.

REGARDLESS OF THE NUMBER OF SHARES YOU OWN, YOUR VOTE IS

IMPORTANT TO THE COMPANY. PLEASE COMPLETE, DATE, SIGN

AND PROMPTLY RETURN THE ENCLOSED PROXY CARD TODAY.

ZOLL MEDICAL CORPORATION

December 20, 2006

17

EXHIBIT A

ZOLL Medical Corporation

Amended and Restated

Audit Committee Charter

(As Amended through November 14, 2006)

I. General Statement of Purpose

The purposes of the Audit Committee (the “Audit Committee”) of the Board of Directors of ZOLL Medical Corporation (the “Company”) are to:

| • | oversee the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements; |

| • | assist the Board of Directors (the “Board”) in general oversight and monitoring of the qualifications, independence and performance of the Company’s independent auditors; and |

| • | prepare any reports required by the rules of the Securities and Exchange Commission (“SEC”) and perform such other actions as may be required from time to time. |

II. Audit Committee Composition

The Audit Committee shall consist of at least three members of the Board each of whom must (1) be “independent” as defined under the Marketplace Rules of the National Association of Securities Dealers, Inc. (“NASD”), (2) meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), subject to the exemptions provided in Rule 10A-3(c) and (3) not have participated in the preparation of the Company’s or any current subsidiary’s financial statements at any time during the past three years.

Each member of the Audit Committee must be able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. At least one member of the Audit Committee must have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. One or more members of the Audit Committee may qualify as an “audit committee financial expert” under the rules promulgated by the SEC.

The members of the Audit Committee shall be appointed annually by the Board and may be replaced or removed by the Board with or without cause. Resignation or removal of a Director from the Board, for whatever reason, shall automatically and without any further action constitute resignation or removal, as applicable, from the Audit Committee. Any vacancy on the Audit Committee, occurring for whatever reason, may be filled only by the Board. The Board shall designate one member of the Audit Committee to be Chairman of the Audit Committee.

III. Meetings

The Audit Committee shall meet as often as it determines is appropriate to carry out its responsibilities under this charter, but not less frequently than quarterly. A majority of the members of the Audit Committee shall constitute a quorum for purposes of holding a meeting and the Audit Committee may act by a vote of a majority of the members present at such meeting.

A-1

IV. Audit Committee Activities

The principal activities of the Audit Committee will generally include the following:

| A. | Review of Charter |

| • | Review and reassess the adequacy of this Charter annually and recommend to the Board any amendments or modifications to the Charter that the Audit Committee deems appropriate. |

| B. | Matters Relating to Selection, Performance and Independence of Independent Auditors |

| • | The Audit Committee shall have the sole authority to appoint, determine compensation for and terminate the engagement of the Company’s independent auditor. |

| • | The Audit Committee shall be directly responsible for oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. The Audit Committee may consult with management in fulfilling these duties, but may not delegate these responsibilities to management. |

| • | The Audit Committee shall instruct the independent auditor that the independent auditor shall report directly to the Audit Committee. |

| • | The Audit Committee shall pre-approve all auditing services and the terms thereof (which may include providing comfort letters in connection with securities underwritings) and non-audit services (other than non-audit services prohibited under Section 10A(g) of the Exchange Act or the applicable rules of the SEC or the Public Company Accounting Oversight Board) to be provided to the Company by the independent auditor;provided,however, the pre-approval requirement is waived with respect to the provision of non-audit services for the Company if the “de minimus” provisions of Section 10A(i)(1)(B) of the Exchange Act are satisfied. This authority to pre-approve non-audit services may be delegated to one or more members of the Audit Committee, who shall present all decisions to pre-approve an activity to the full Audit Committee at its first meeting following such decision. |

| • | The Audit Committee shall request that the independent auditor provide the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1, as modified or supplemented, require that the independent auditor submit to the Audit Committee on a periodic basis a formal written statement delineating all relationships between the independent auditor and the Company, discuss with the independent auditor any disclosed relationships or services that may impact the objectivity and independence of the independent auditor, and based on such disclosures, statement and discussion take or recommend that the Board take appropriate action in response to the independent auditor’s report to satisfy itself of the independent auditor’s independence. |

| • | The Audit Committee may recommend to the Board policies with respect to the potential hiring of current or former employees of the independent auditors. |

| C. | Audited Financial Statements and Annual Audit |

| • | The Audit Committee shall review the overall audit plan with the independent auditor and the members of management who are responsible for preparing the Company’s financial statements, including the Company’s Chief Financial Officer and/or principal accounting officer or principal financial officer (the Chief Financial Officer and such other officer or officers are referred to herein collectively as the “Senior Accounting Executive”). |

| • | The Audit Committee shall review and discuss with management (including the Company’s Senior Accounting Executive) and with the independent auditor: |

| (i) | the Company’s annual audited financial statements, including (a) all critical accounting policies and practices used or to be used by the Company and (b) any significant financial reporting issues that have arisen in connection with the preparation of such audited financial statements; |

A-2

| (ii) | any analyses prepared by management or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative generally accepted accounting principles methods on the financial statements. The Audit Committee may consider the ramifications of the use of such alternative disclosures and treatments on the financial statements, and the treatment preferred by the independent auditor. The Audit Committee shall also consider other material written communications between the independent accountants and management, such as any management letter or schedule of unadjusted differences; |

| (iii) | the adequacy of the Company’s internal controls and procedures for financial reporting; |

| (iv) | major changes in and other issues regarding accounting and auditing principles and procedures, including any significant changes in the Company’s selection or application of accounting principles; and |

| (v) | the effect of regulatory and accounting initiatives, as well as off-balance sheet transactions and structures, on the financial statements of the Company. |

| • | The Audit Committee shall review and discuss with the independent auditor (outside of the presence of management) how the independent auditor plans to handle its responsibilities under the Private Securities Litigation Reform Act of 1995, and request assurance from the auditor that Section 10A of the Private Securities Litigation Reform Act of 1995 has not been implicated. |

| • | The Audit Committee shall review and discuss with the independent auditor any audit problems or difficulties and management’s response thereto. This review shall include any difficulties encountered by the auditor in the course of performing its audit work, including any restrictions on the scope of its activities or its access to information and any significant disagreements with management. |

| • | The Audit Committee shall review and discuss with the independent auditor those matters brought to the attention of the Audit Committee by the auditors pursuant to Statement on Auditing Standards No. 61 (“SAS 61”). |

| • | The Audit Committee shall review and discuss with the independent auditors the report required to be delivered by such auditors pursuant to Section 10A(k) of the Exchange Act. |

| • | If brought to the attention of the Audit Committee, the Audit Committee shall discuss with the CEO and CFO of the Company (1) all significant deficiencies and material weaknesses in the design or operation of internal controls and procedures for financial reporting which could adversely affect the Company’s ability to record, process, summarize and report financial information required to be disclosed by the Company in the reports that it files or submits under the Exchange Act, within the time periods specified in the SEC’s rules and forms, and (2) any fraud involving management or other employees who have a significant role in the Company’s internal controls and procedures for financial reporting. |

| • | Based on the Audit Committee’s review and discussions (1) with management of the audited financial statements, (2) with the independent auditor of the matters required to be discussed by SAS 61 and (3) with the independent auditor concerning the independent auditor’s independence, the Audit Committee shall make a recommendation to the Board as to whether the Company’s audited financial statements should be included in the Company’s Annual Report on Form 10-K for the last fiscal year. |

| • | The Audit Committee shall prepare the Audit Committee report required by Item 306 of Regulation S-K of the Exchange Act (or any successor provision) to be included in the Company’s annual proxy statement. |

A-3

| D. | Unaudited Quarterly Financial Statements |

| • | The Audit Committee shall review and discuss with management and the independent auditor such issues as may be brought to the Audit Committee’s attention by the independent auditor pursuant to Statement on Auditing Standards No. 100. |

| E. | Procedures for Addressing Complaints and Concerns |

| • | The Audit Committee shall establish procedures for (1) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and (2) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

V. Additional Authority

The Audit Committee is authorized, on behalf of the Board, to do any of the following as it deems necessary or appropriate:

| A. | Engagement of Advisors |

| • | The Audit Committee may engage independent counsel and such other advisors it deems necessary or advisable to carry out its responsibilities and powers, and, if such counsel or other advisors are engaged, shall determine the compensation or fees payable to such counsel or other advisors. |

| B. | General |

| • | The Audit Committee may form and delegate authority to subcommittees consisting of one or more of its members as the Audit Committee deems appropriate to carry out its responsibilities and exercise its powers. |

| • | The Audit Committee may perform such other oversight functions as may be requested by the Board from time to time. |

| • | In performing its oversight function, the Audit Committee shall be entitled to rely upon advice and information that it receives in its discussions and communications with management, the independent auditor and such experts, advisors and professionals as may be consulted with by the Audit Committee. |

| • | The Audit Committee is authorized to request that any officer or employee of the Company, the Company’s outside legal counsel, the Company’s independent auditor or any other professional retained by the Company to render advice to the Company attend a meeting of the Audit Committee or meet with any members of or advisors to the Audit Committee. |

| C. | Conflicts of Interest |

| • | The Audit Committee shall conduct an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis, and the approval of the Audit Committee shall be required for all such transactions. |

| • | For purposes of this section, the term “related party transaction” shall refer to transactions required to be disclosed pursuant to SEC Regulation S-K, Item 404. Pursuant to SEC Regulation S-K, Item 404, a “related person” includes directors, director nominees, executive officers, 5% stockholders and their respective immediate family members and other persons sharing their households. |

A-4

Notwithstanding the responsibilities and powers of the Audit Committee set forth in this Charter, the Audit Committee does not have the responsibility of planning or conducting audits of the Company’s financial statements or determining whether or not the Company’s financial statements are complete, accurate and in accordance with generally accepted accounting principles. Such responsibilities are the duty of management and, to the extent of the independent auditor’s audit responsibilities, the independent auditor. It also is not the duty of the Audit Committee to resolve disagreements, if any, between management and the independent auditor or to conduct investigations or to assure compliance with laws, regulations or Company policies.

A-5

Zoll Medical Corporation

| ¨ | Mark this box with an X if you have made changes to your name or address details above. |

Annual Meeting Proxy Card

A Election of Directors

| 1. | Proposal to elect the following persons as Class III Directors to serve |

| until the 2010 Annual Meeting and until their successors are duly |

| elected and qualified: |

| For | Withhold | |||

01 - James W. Biondi | ¨ | ¨ | ||

02 - Robert J. Halliday | ¨ | ¨ | ||

B Issues

| For | Against | Abstain | ||||||

2. | Proposal to ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2007. | ¨ | ¨ | ¨ | ||||

3. | In their discretion, the proxies are authorized to vote upon any other business that may properly come before the meeting or at any adjournment(s) thereof. | |||||||

C Authorized Signatures - Sign Here - This section must be completed for your instructions to be executed.

Please sign this proxy exactly as your name(s) appear(s) on the books of the Company. Joint owners should each sign personally. Trustees and other fiduciaries should indicate the capacity in which they sign, and where more than one name appears, a majority must sign. If a corporation, this signature should be that of an authorized officer who should state his or her title.

Date (mm/dd/yyyy)

| Signature 1 - Please keep signature within the box | Signature 2 - Please keep signature within the box | ||||||||||

| / / |

Proxy - Zoll Medical Corporation

Annual Meeting of Shareholders

January 24, 2007

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS