UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06670 |

|

CREDIT SUISSE INSTITUTIONAL FUND, INC. |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

J. Kevin Gao, Esq.

Credit Suisse Institutional Fund, Inc.

Eleven Madison Avenue

New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | October 31st | |

|

Date of reporting period: | November 1, 2006 to October 31, 2007 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

CREDIT SUISSE

INSTITUTIONAL FUND

Annual Report

October 31, 2007

CREDIT SUISSE INSTITUTIONAL FUND, INC.

n INTERNATIONAL FOCUS PORTFOLIO

The Portfolio's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, is provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Institutional Fund, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Institutional Fund is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolio's management are as of the date of the letter and Portfolio holdings described in this document are as of October 31, 2007; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report

October 31, 2007 (unaudited)

November 30, 2007

Dear Shareholder:

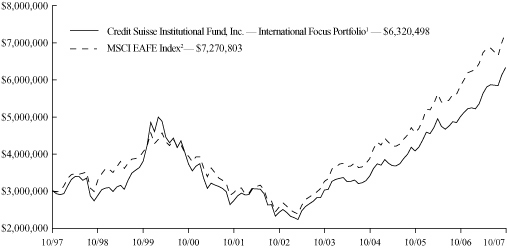

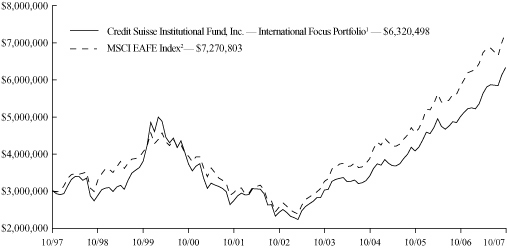

For the twelve-month period ended October 31, 2007, Credit Suisse Institutional Fund, Inc. — International Focus Portfolio1 had a gain of 26.56% versus an increase of 24.91% for the Morgan Stanley Capital International EAFE Index (net dividends).2

Market Review: U.S. economy and sub-prime crisis have global effects

For the 12-month period ended October 31, 2007, returns from international equities were positive. While the Japanese equity market lagged other markets, emerging market equities generated particularly strong returns.

The year saw a surge in oil prices, with crude oil moving from just over $50 per barrel to close to $100 per barrel by the end of October. Additionally, other commodities also showed strong increases in price during the year. In the first half of the year, private equity activity drove the prices of small and mid-cap stocks to high levels. Activity slowed, however, after the sub-prime mortgage crisis became apparent. As expected, financials were weak as a result of the sub-prime mortgage crisis. And market participants became increasingly concerned about the effect that a housing slump in the United States would have on the U.S. economy.

Strategic Review and Outlook: Expecting continued positive returns

Positive contributors to performance included our overweight position in energy. Conversely, our underweight position in capital goods detracted from relative performance, as we were incorrect in our view that the slowdown in the United States economy would have a large impact on the capital goods stocks.

Currently, the portfolio remains overweight in energy. However, within this, we have an overweight position in oil services and are underweight the integrated energy companies. We are overweight specific plays in emerging markets — specifically, some emerging market telecommunications services issuers. Additionally, earlier in the year, we were overweight in Korean shipbuilders.

While we believe that financials look cheap, we are not prepared to overweight them fully, as we expect there could be further bad news to come.

In our opinion, one of the main themes that will drive equity markets is whether Asian economies have "decoupled" from the United States economy. Growth in Asia remains strong; however, there is a concern that a slowing U.S. economy will have a detrimental impact on growth in Asia.

1

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Further, we believe that equity market valuations are less attractive than they were one year ago. And while emerging markets have outperformed developed markets, they now trade at premium valuations. We expect to see positive returns from equity markets; however, we do not believe that they will be as high as they have been in previous years.

The Credit Suisse International Equity Team

Neil Gregson

Tom Mann

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. The Portfolio's fifteen largest holdings may account for 40% or more of the Portfolio's assets. As a result of this strategy, the Portfolio may be subject to greater volatility than a portfolio that invests in a larger number of issuers.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

2

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Comparison of Change in Value of $3,000,000 Investment in the

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio1 and

MSCI EAFE Index2 for Ten Years.

3

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Average Annual Returns as of September 30, 20071

| 1 Year | | 5 Years | | 10 Years | | Since

Inception3 | |

| | 26.59 | % | | | 21.47 | % | | | 6.16 | % | | | 9.42 | % | |

Average Annual Returns as of October 31, 20071

| 1 Year | | 5 Years | | 10 Years | | Since

Inception3 | |

| | 26.56 | % | | | 21.19 | % | | | 7.74 | % | | | 9.59 | % | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Morgan Stanley Capital International EAFE Index (Europe, Australasia, Far East) net dividends is a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the U.S. and Canada. It is the exclusive property of Morgan Stanley Capital International, Inc. Investors cannot invest directly in an index.

3 Inception date 9/1/92.

4

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2007.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

5

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended October 31, 2007

| Actual Portfolio Return | |

| Beginning Account Value 5/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 10/31/07 | | $ | 1,124.00 | | |

| Expenses Paid per $1,000* | | $ | 5.09 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 5/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 10/31/07 | | $ | 1,020.42 | | |

| Expenses Paid per $1,000* | | $ | 4.84 | | |

| Annualized Expense Ratios* | | | 0.95 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements has not been in effect, the Portfolio's actual expenses would have been higher.

For more information, please refer to the Portfolio's prospectus.

6

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

7

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments

October 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS (95.1%) | |

| Austria (1.1%) | |

| Energy Equipment & Services (1.1%) | |

| C.A.T. oil AG* | | | 9,652 | | | $ | 259,379 | | |

| TOTAL AUSTRIA | | | | | | | 259,379 | | |

| Belgium (1.2%) | |

| Metals & Mining (1.2%) | |

| Umicore§ | | | 1,196 | | | | 298,668 | | |

| TOTAL BELGIUM | | | | | | | 298,668 | | |

| Brazil (1.5%) | |

| Oil & Gas (1.5%) | |

| Petroleo Brasileiro SA - Petrobras ADR§ | | | 4,520 | | | | 376,019 | | |

| TOTAL BRAZIL | | | | | | | 376,019 | | |

| Denmark (1.4%) | |

| Pharmaceuticals (1.4%) | |

| Novo Nordisk AS Series B* | | | 2,817 | | | | 349,624 | | |

| TOTAL DENMARK | | | | | | | 349,624 | | |

| France (11.6%) | |

| Banks (3.1%) | |

| BNP Paribas§ | | | 3,030 | | | | 335,404 | | |

| Societe Generale§ | | | 2,514 | | | | 424,191 | | |

| | | | | | | | 759,595 | | |

| Beverages (1.3%) | |

| Pernod Ricard SA§ | | | 1,356 | | | | 313,625 | | |

| Insurance (2.3%) | |

| Axa§ | | | 12,618 | | | | 566,053 | | |

| Metals & Mining (1.5%) | |

| Vallourec SA | | | 1,237 | | | | 359,770 | | |

| Oil & Gas (1.2%) | |

| Total SA§ | | | 3,665 | | | | 295,385 | | |

| Pharmaceuticals (1.0%) | |

| Sanofi-Aventis§ | | | 2,646 | | | | 232,465 | | |

| Textiles & Apparel (1.2%) | |

| LVMH Moet Hennessy Louis Vuitton SA§ | | | 2,347 | | | | 302,818 | | |

| TOTAL FRANCE | | | | | | | 2,829,711 | | |

| Germany (9.1%) | |

| Auto Components (2.0%) | |

| Continental AG | | | 3,221 | | | | 486,546 | | |

| Banks (1.3%) | |

| Deutsche Bank AG§ | | | 2,434 | | | | 323,228 | | |

See Accompanying Notes to Financial Statements.

8

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

October 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Germany | |

| Electric Utilities (2.4%) | |

| E.ON AG | | | 2,967 | | | $ | 579,331 | | |

| Electrical Equipment (1.1%) | |

| Norddeutsche Affinerie AG§ | | | 6,493 | | | | 269,789 | | |

| Multi-Utilities (2.3%) | |

| RWE AG | | | 4,016 | | | | 547,943 | | |

| TOTAL GERMANY | | | | | | | 2,206,837 | | |

| Greece (1.6%) | |

| Wireless Telecommunication Services (1.6%) | |

| Cosmote Mobile Telecommunications SA | | | 11,143 | | | | 386,173 | | |

| TOTAL GREECE | | | | | | | 386,173 | | |

| India (2.1%) | |

| Diversified Telecommunication Services (2.1%) | |

| Bharti Airtel, Ltd.* | | | 20,281 | | | | 525,573 | | |

| TOTAL INDIA | | | | | | | 525,573 | | |

| Israel (1.6%) | |

| Pharmaceuticals (1.6%) | |

| Teva Pharmaceutical Industries, Ltd. ADR§ | | | 8,753 | | | | 385,220 | | |

| TOTAL ISRAEL | | | | | | | 385,220 | | |

| Italy (2.6%) | |

| Banks (2.6%) | |

| Intesa Sanpaolo | | | 64,228 | | | | 508,891 | | |

| UniCredito Italiano SpA | | | 13,856 | | | | 119,047 | | |

| TOTAL ITALY | | | | | | | 627,938 | | |

| Japan (14.2%) | |

| Automobiles (1.1%) | |

| Toyota Motor Corp. | | | 4,813 | | | | 275,707 | | |

| Banks (2.3%) | |

| Mitsubishi UFJ Financial Group, Inc. | | | 21,000 | | | | 210,275 | | |

| Mizuho Financial Group, Inc.§ | | | 62 | | | | 348,709 | | |

| | | | | | | | 558,984 | | |

| Chemicals (2.9%) | |

| Kuraray Company, Ltd. | | | 24,068 | | | | 314,496 | | |

| Shin-Etsu Chemical Company, Ltd. | | | 6,251 | | | | 401,255 | | |

| | | | | | | | 715,751 | | |

| Diversified Financials (1.4%) | |

| Daiwa Securities Group, Inc.§ | | | 34,591 | | | | 333,586 | | |

| Electronic Equipment & Instruments (1.3%) | |

| Omron Corp. | | | 13,185 | | | | 324,507 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

October 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Japan | |

| Household Products (1.5%) | |

| Uni-Charm Corp. | | | 5,994 | | | $ | 357,810 | | |

| Machinery (1.7%) | |

| Komatsu, Ltd. | | | 12,004 | | | | 402,733 | | |

| Specialty Retail (2.0%) | |

| Yamada Denki Company, Ltd.§ | | | 4,669 | | | | 481,719 | | |

| TOTAL JAPAN | | | | | | | 3,450,797 | | |

| Luxembourg (1.0%) | |

| Energy Equipment & Services (1.0%) | |

| Acergy SA§ | | | 8,908 | | | | 257,006 | | |

| TOTAL LUXEMBOURG | | | | | | | 257,006 | | |

| Mexico (2.0%) | |

| Wireless Telecommunication Services (2.0%) | |

| America Movil SAB de CV ADR Series L§ | | | 7,307 | | | | 477,805 | | |

| TOTAL MEXICO | | | | | | | 477,805 | | |

| Netherlands (7.0%) | |

| Energy Equipment & Services (1.2%) | |

| Fugro NV* | | | 3,449 | | | | 302,797 | | |

| Food Products (1.6%) | |

| Koninklijke Numico NV*§ | | | 4,851 | | | | 383,279 | | |

| Household Durables (1.5%) | |

| Koninklijke (Royal) Philips Electronics NV | | | 8,506 | | | | 351,479 | | |

| IT Consulting & Services (2.7%) | |

| Exact Holding NV | | | 8,235 | | | | 366,179 | | |

| Ordina NV* | | | 15,276 | | | | 298,978 | | |

| | | | | | | | 665,157 | | |

| TOTAL NETHERLANDS | | | | | | | 1,702,712 | | |

| Norway (5.2%) | |

| Banks (1.7%) | |

| DNB NOR ASA | | | 25,242 | | | | 416,410 | | |

| Energy Equipment & Services (1.0%) | |

| Sevan Marine ASA* | | | 19,799 | | | | 245,109 | | |

| Oil & Gas (2.5%) | |

| DNO ASA*§ | | | 110,078 | | | | 205,572 | | |

| Prosafe SE§ | | | 22,463 | | | | 398,467 | | |

| | | | | | | | 604,039 | | |

| TOTAL NORWAY | | | | | | | 1,265,558 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

October 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Singapore (1.9%) | |

| Banks (1.9%) | |

| United Overseas Bank, Ltd. | | | 30,325 | | | $ | 454,300 | | |

| TOTAL SINGAPORE | | | | | | | 454,300 | | |

| Spain (4.1%) | |

| Banks (1.7%) | |

| Banco Santander SA§ | | | 18,337 | | | | 400,529 | | |

| Diversified Telecommunication Services (1.4%) | |

| Telefonica SA§ | | | 10,292 | | | | 340,359 | | |

| Tobacco (1.0%) | |

| Altadis SA* | | | 3,473 | | | | 247,368 | | |

| TOTAL SPAIN | | | | | | | 988,256 | | |

| Sweden (1.0%) | |

| Communications Equipment (1.0%) | |

| Telefonaktiebolaget LM Ericsson | | | 84,762 | | | | 253,247 | | |

| TOTAL SWEDEN | | | | | | | 253,247 | | |

| Switzerland (4.2%) | |

| Banks (1.5%) | |

| UBS AG | | | 6,818 | | | | 365,324 | | |

| Food Products (1.2%) | |

| Nestle SA | | | 647 | | | | 298,670 | | |

| Pharmaceuticals (1.5%) | |

| Novartis AG | | | 6,731 | | | | 357,850 | | |

| TOTAL SWITZERLAND | | | | | | | 1,021,844 | | |

| Taiwan (1.1%) | |

| Diversified Telecommunication Services (1.1%) | |

| Chunghwa Telecom Company, Ltd. ADR | | | 14,184 | | | | 272,333 | | |

| TOTAL TAIWAN | | | | | | | 272,333 | | |

| United Kingdom (19.6%) | |

| Aerospace & Defense (1.3%) | |

| BAE Systems PLC | | | 30,894 | | | | 320,659 | | |

| Banks (2.9%) | |

| Barclays PLC | | | 11,359 | | | | 143,629 | | |

| HSBC Holdings PLC§ | | | 18,436 | | | | 363,130 | | |

| Royal Bank of Scotland Group PLC | | | 19,653 | | | | 212,048 | | |

| | | | | | | | 718,807 | | |

| Beverages (1.9%) | |

| SABMiller PLC | | | 15,332 | | | | 461,384 | | |

| Commercial Services & Supplies (0.5%) | |

| Hays PLC | | | 38,651 | | | | 110,603 | | |

See Accompanying Notes to Financial Statements.

11

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Schedule of Investments (continued)

October 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| United Kingdom | |

| Food & Drug Retailing (1.6%) | |

| Tesco PLC | | | 38,016 | | | $ | 386,359 | | |

| Metals & Mining (2.9%) | |

| BHP Billiton PLC | | | 18,120 | | | | 695,245 | | |

| Oil & Gas (2.7%) | |

| BP | PL | C | | | 24,372 | | | | 316,782 | | |

| Royal Dutch Shell PLC Class A§ | | | 7,659 | | | | 335,611 | | |

| | | | | | | | 652,393 | | |

| Pharmaceuticals (2.5%) | |

| AstraZeneca PLC | | | 4,180 | | | | 205,651 | | |

| GlaxoSmithKline PLC | | | 15,567 | | | | 399,478 | | |

| | | | | | | | 605,129 | | |

| Tobacco (1.7%) | |

| Imperial Tobacco Group PLC | | | 8,218 | | | | 416,748 | | |

| Wireless Telecommunication Services (1.6%) | |

| Vodafone Group PLC | | | 100,281 | | | | 394,790 | | |

| TOTAL UNITED KINGDOM | | | | | | | 4,762,117 | | |

| TOTAL COMMON STOCKS (Cost $15,670,444) | | | | | | | 23,151,117 | | |

| SHORT-TERM INVESTMENTS (28.4%) | |

| State Street Navigator Prime Portfolio§§ | | | 6,491,707 | | | | 6,491,707 | | |

| | | Par | | (000) | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.600%, 11/01/07 | | $ | 408 | | | | 408,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $6,899,707) | | | 6,899,707 | | |

| TOTAL INVESTMENTS AT VALUE (123.5%) (Cost $22,570,151) | | | 30,050,824 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-23.5%) | | | (5,714,257 | ) | |

| NET ASSETS (100.0%) | | $ | 24,336,567 | | |

INVESTMENT ABBREVIATION

ADR = American Depositary Receipt

* Non-income producing security.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

12

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Statement of Assets and Liabilities

October 31, 2007

| Assets | |

Investments at value, including collateral for securities on loan of $6,491,707

(Cost $22,570,151) (Note 2) | | $ | 30,050,8241 | | |

| Cash | | | 15 | | |

| Foreign currency at value (cost $771,920) (Note 2) | | | 775,518 | | |

| Dividend and interest receivable | | | 41,311 | | |

| Receivable from investment adviser (Note 3) | | | 3,067 | | |

| Prepaid expenses and other assets | | | 14,888 | | |

| Total Assets | | | 30,885,623 | | |

| Liabilities | |

| Administrative services fee payable (Note 3) | | | 1,553 | | |

| Payable upon return of securities loaned (Note 2) | | | 6,491,707 | | |

| Directors' fee payable | | | 10,269 | | |

| Other accrued expenses payable | | | 45,527 | | |

| Total Liabilities | | | 6,549,056 | | |

| Net Assets | |

| Capital stock, $0.001 par value (Note 6) | | | 1,436 | | |

| Paid-in capital (Note 6) | | | 154,146,213 | | |

| Undistributed net investment income | | | 476,502 | | |

| Accumulated net realized loss on investments and foreign currency transactions | | | (137,772,007 | ) | |

| Net unrealized appreciation from investments and foreign currency translations | | | 7,484,423 | | |

| Net Assets | | $ | 24,336,567 | | |

| Shares outstanding | | | 1,435,624 | | |

| Net asset value, offering price, and redemption price per share | | $ | 16.95 | | |

1 Including $6,204,865 of securities on loan.

See Accompanying Notes to Financial Statements.

13

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Statement of Operations

For the Year Ended October 31, 2007

| Investment Income (Note 2) | |

| Dividends | | $ | 745,467 | | |

| Interest | | | 52,144 | | |

| Securities lending | | | 25,533 | | |

| Foreign taxes withheld | | | (72,828 | ) | |

| Total investment income | | | 750,316 | | |

| Expenses | |

| Investment advisory fees (Note 3) | | | 219,698 | | |

| Administrative services fees (Note 3) | | | 16,157 | | |

| Printing fees (Note 3) | | | 34,658 | | |

| Audit and tax fees | | | 23,898 | | |

| Directors' fees | | | 21,570 | | |

| Registration fees | | | 19,707 | | |

| Custodian fees | | | 19,537 | | |

| Legal fees | | | 17,099 | | |

| Interest expense (Note 4) | | | 4,375 | | |

| Transfer agent fees | | | 2,654 | | |

| Insurance expense | | | 1,640 | | |

| Commitment fees (Note 4) | | | 656 | | |

| Miscellaneous expense | | | 14,813 | | |

| Total expenses | | | 396,462 | | |

| Less: fees waived (Note 3) | | | (135,569 | ) | |

| Net expenses | | | 260,893 | | |

| Net investment income | | | 489,423 | | |

| Net Realized and Unrealized Gain (Loss) from Investments and Foreign Currency Related Items | |

| Net realized gain from investments | | | 7,099,401 | | |

| Net realized loss from foreign currency transactions | | | (12,907 | ) | |

| Net change in unrealized appreciation (depreciation) from investments | | | (1,028,500 | ) | |

| Net change in unrealized appreciation (depreciation) from foreign currency translations | | | 19,398 | | |

| Net realized and unrealized gain from investments and foreign currency related items | | | 6,077,392 | | |

| Net increase in net assets resulting from operations | | $ | 6,566,815 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Statements of Changes in Net Assets

| | | For the Year

Ended

October 31, 2007 | | For the Year

Ended

October 31, 2006 | |

| From Operations | |

| Net investment income | | $ | 489,423 | | | $ | 470,013 | | |

| Net realized gain from investments and foreign currency transactions | | | 7,086,494 | | | | 3,537,314 | | |

Net change in unrealized appreciation (depreciation)

from investments and foreign currency translations | | | (1,009,102 | ) | | | 2,229,296 | | |

| Net increase in net assets resulting from operations | | | 6,566,815 | | | | 6,236,623 | | |

| From Dividends | |

| Dividends from net investment income | | | (435,704 | ) | | | (664,128 | ) | |

| From Capital Share Transactions (Note 6) | |

| Proceeds from sale of shares | | | 265,757 | | | | 1,155,205 | | |

| Reinvestment of dividends | | | 356,087 | | | | 561,640 | | |

| Net asset value of shares redeemed | | | (12,622,705 | ) | | | (5,743,628 | ) | |

| Net decrease in net assets from capital share transactions | | | (12,000,861 | ) | | | (4,026,783 | ) | |

| Net increase (decrease) in net assets | | | (5,869,750 | ) | | | 1,545,712 | | |

| Net Assets | |

| Beginning of year | | | 30,206,317 | | | | 28,660,605 | | |

| End of year | | $ | 24,336,567 | | | $ | 30,206,317 | | |

| Undistributed net investment income | | $ | 476,502 | | | $ | 435,690 | | |

See Accompanying Notes to Financial Statements.

15

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Financial Highlights

(For a Share of the Portfolio Outstanding Throughout Each Year)

| | | For the Year Ended October 31, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per share data | |

| Net asset value, beginning of year | | $ | 13.58 | | | $ | 11.32 | | | $ | 9.73 | | | $ | 8.92 | | | $ | 7.19 | | |

| INVESTMENT OPERATIONS | |

| Net investment income1 | | | 0.26 | | | | 0.19 | | | | 0.16 | | | | 0.13 | | | | 0.09 | | |

Net gain on investments and foreign currency

related items (both realized and unrealized) | | | 3.31 | | | | 2.33 | | | | 1.75 | | | | 0.97 | | | | 1.69 | | |

| Total from investment operations | | | 3.57 | | | | 2.52 | | | | 1.91 | | | | 1.10 | | | | 1.78 | | |

| LESS DIVIDENDS AND DISTRIBUTIONS | |

| Dividends from net investment income | | | (0.20 | ) | | | (0.26 | ) | | | (0.32 | ) | | | (0.05 | ) | | | (0.05 | ) | |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | (0.24 | ) | | | — | | |

| Total dividends and distributions | | | (0.20 | ) | | | (0.26 | ) | | | (0.32 | ) | | | (0.29 | ) | | | (0.05 | ) | |

| Net asset value, end of year | | $ | 16.95 | | | $ | 13.58 | | | $ | 11.32 | | | $ | 9.73 | | | $ | 8.92 | | |

| Total return2 | | | 26.56 | % | | | 22.55 | % | | | 19.95 | % | | | 12.50 | % | | | 24.90 | % | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of year (000s omitted) | | $ | 24,337 | | | $ | 30,206 | | | $ | 28,661 | | | $ | 55,190 | | | $ | 161,971 | | |

| Ratio of expenses to average net assets | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | |

| Ratio of net investment income to average net assets | | | 1.78 | % | | | 1.55 | % | | | 1.55 | % | | | 1.38 | % | | | 1.17 | % | |

Decrease reflected in above operating expense

ratios due to waivers/reimbursements | | | 0.49 | % | | | 0.46 | % | | | 0.38 | % | | | 0.22 | % | | | 0.22 | % | |

| Portfolio turnover rate | | | 36 | % | | | 48 | % | | | 55 | % | | | 98 | % | | | 151 | % | |

1 Per share information is calculated using the average shares outstanding method.

2 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the years shown, total returns would have been lower.

See Accompanying Notes to Financial Statements.

16

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements

October 31, 2007

Note 1. Organization

The Credit Suisse Institutional Fund, Inc. (the "Fund"), is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company and currently offers two managed investment funds, one of which, the International Focus Portfolio (the "Portfolio"), is contained in this report. The Portfolio is classified as diversified and has long-term capital appreciation as its investment objective. The Fund was incorporated under the laws of the State of Maryland on May 14, 1992.

Note 2. Significant Accounting Policies

A) SECURITY VALUATION — The net asset value of the Portfolio is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest asked quotation in the case of a short sale of securities. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will matur e in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that using this method would not represent fair value. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation. Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Portfolio's Valuation Time but after the close of the securities' primary markets, are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. The Portfolio may utilize a service provided by an independent third party which has been approved by the Board of Directors to fair value certain securities. When fair-value pricing is employed, the prices of securities used by a portfolio to calculate its net asset value may differ from quoted or published prices for t he same securities.

B) FOREIGN CURRENCY TRANSACTIONS — The books and records of the Portfolio are maintained in U.S. dollars. Transactions denominated in foreign currencies are recorded at the current prevailing exchange rates. All assets and liabilities denominated in foreign currencies are translated into

17

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 2. Significant Accounting Policies

U.S. dollar amounts at the current exchange rate at the end of the period. Translation gains or losses resulting from changes in the exchange rate during the reporting period and realized gains and losses on the settlement of foreign currency transactions are reported in the results of operations for the current period. The Portfolio does not isolate that portion of realized gains and losses on investments in equity securities which is due to changes in the foreign exchange rate from that which is due to changes in market prices of equity securities. The Portfolio isolates that portion of realized gains and losses on investments in debt securiti es which is due to changes in the foreign exchange rate from that which is due to changes in market prices of debt securities.

C) SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes.

D) DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid at least annually. However, to the extent that a net realized capital gain can be reduced by a capital loss carryforward, such gain will not be distributed. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America ("GAAP").

E) FEDERAL INCOME TAXES — No provision is made for federal taxes as it is the Portfolio's intention to continue to qualify for and elect the tax treatment applicable to regulated investment companies under the Internal Revenue Code of 1986, as amended, and to make the requisite distributions to its shareholders, which will be sufficient to relieve it from federal income and excise taxes.

F) USE OF ESTIMATES — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

G) SHORT-TERM INVESTMENTS — The Portfolio, together with other funds/portfolios, advised by Credit Suisse Asset Management, LLC ("Credit Suisse"), an indirect, wholly-owned subsidiary of Credit Suisse Group, pools available cash into either a short-term variable rate time deposit issued

18

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 2. Significant Accounting Policies

by State Street Bank and Trust Company ("SSB"), the Portfolio's custodian, or a money market fund advised by Credit Suisse. The short-term time deposit issued by SSB is a variable rate account classified as a short-term investment.

H) FORWARD FOREIGN CURRENCY CONTRACTS — The Portfolio may enter into forward foreign currency contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. Risks may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency. The Portfolio will enter into forward foreign currency contracts primarily for hedging purposes. Forward foreign currency contracts are adjusted by the daily forward exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the contract settlement date or an offsetting position is entered into. At October 31, 2007, the Portfolio had no open forward foreign currency contracts.

I) SECURITIES LENDING — Loans of securities are required at all times to be secured by collateral at least equal to 102% of the market value of domestic securities on loan (including any accrued interest thereon) and 105% of the market value of foreign securities on loan (including any accrued interest thereon). Cash collateral received by the Portfolio in connection with securities lending activity may be pooled together with cash collateral for other funds/portfolios advised by Credit Suisse and may be invested in a variety of investments, including certain Credit Suisse-advised funds, funds advised by SSB, the Fund's securities lending agent, or money market instruments. However, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

SSB has been engaged by the Portfolio to act as the Portfolio's securities lending agent. The Portfolio's securities lending arrangement provides that the Portfolio and SSB will share the net income earned from securities lending activities. During the year ended October 31, 2007, total earnings from the Portfolio's investment in cash collateral received in connection with securities lending arrangements was $324,749 of which $293,435 was rebated to borrowers (brokers). The Portfolio retained $25,533 in income from the cash collateral investment and SSB, as lending agent, was paid $5,781. The Portfolio may also be entitled to certain minimum amounts of income from their securities lending activities. Securities lending income is accrued as earned.

19

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 2. Significant Accounting Policies

J) OTHER — The Portfolio may invest in securities of foreign countries and governments which involve certain risks in addition to those inherent in domestic investments. Such risks generally include, among others, currency risks (fluctuations in currency exchange rates), information risk (key information may be inaccurate or unavailable) and political risk (expropriation, nationalization or the imposition of capital or currency controls or punitive taxes). Other risks of investing in foreign securities include liquidity and valuation risks.

The Portfolio may be subject to taxes imposed by countries in which it invests with respect to its investments in issuers existing or operating in such countries. Such taxes are generally based on income earned or repatriated and capital gains realized on the sale of such investments. The Portfolio accrues such taxes when the related income is earned or gains are realized.

The Portfolio may invest up to 10% of its net assets in non-publicly traded securities. Non-publicly traded securities may be less liquid than publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices realized from such sales could differ from the price originally paid by the Portfolio or the current carrying values and the difference could be material.

Note 3. Transactions with Affiliates and Related Parties

Credit Suisse serves as investment adviser for the Portfolio. For its investment advisory services, Credit Suisse is entitled to receive a fee from the Portfolio at an annual rate of 0.80% of the Portfolio's average daily net assets. For the year ended October 31, 2007, investment advisory fees earned and voluntarily waived were $219,698 and $135,569, respectively. Credit Suisse will not recapture from the Portfolio any fees they waived or reimbursed for the fiscal year ended October 31, 2007. Fee waivers and reimbursements are voluntary and may be discontinued by Credit Suisse at any time.

Credit Suisse Asset Management Limited ("Credit Suisse U.K.") and Credit Suisse Asset Management Limited ("Credit Suisse Australia"), each an affiliate of Credit Suisse, are sub-investment advisers to the Portfolio (the "Sub-Advisors"). Credit Suisse U.K.'s and Credit Suisse Australia's sub-investment advisory fees are paid by Credit Suisse out of Credit Suisse's net investment advisory fee and are not paid by the Portfolio.

Credit Suisse Asset Management Securities, Inc. ("CSAMSI"), an affiliate of Credit Suisse, and SSB serve as co-administrators to the Portfolio. For its

20

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 3. Transactions with Affiliates and Related Parties

co-administrative services, CSAMSI received a fee calculated at an annual rate of 0.10% of the Portfolio's average daily net assets. For the year ended October 31, 2007, co-administrative services fees earned by CSAMSI were $2,494. Effective December 1, 2006, CSAMSI is no longer charging a fee.

For its co-administrative services, SSB receives a fee, exclusive of out-of-pocket expenses, calculated in total for all the Credit Suisse funds/portfolios co-administered by SSB and allocated based upon relative average net assets of each fund/portfolio, subject to an annual minimum fee. For the year ended October 31, 2007, co-administrative services fees earned by SSB (including out-of-pocket expenses) were $13,663.

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, has been engaged by the Portfolio to provide certain financial printing and fulfillment services. For the year ended October 31, 2007, Merrill was paid $27,165 for its services to the Portfolio.

Note 4. Line of Credit

The Portfolio, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participates in a $50 million committed, unsecured line of credit facility ("Credit Facility") for temporary or emergency purposes with Deutsche Bank, A.G. as administrative agent and syndication agent and SSB as operations agent. Under the terms of the Credit Facility, the Participating Funds pay an aggregate commitment fee at a rate of 0.10% per annum on the average unused amount of the Credit Facility, which is allocated among the Participating Funds in such manner as is determined by the governing Boards of the Participating Funds. In addition, the Participating Funds pay interest on borrowings at the Federal funds rate plus 0.50%. At October 31, 2007, the Portfolio had no loans outstanding under the Credit Facility. During the year ended October 31, 2007, the Portfolio had borrowings under the Credit Facility as follow s:

Average Daily

Loan Balance | | Weighted Average

Interest Rate% | | Maximum Daily

Loan Outstanding | |

| $ | 1,817,133 | | | | 5.779 | % | | $ | 5,108,000 | | |

Note 5. Purchases and Sales of Securities

For the year ended October 31, 2007, purchases and sales of investment securities (excluding short-term investments) were $9,478,711 and $20,853,245, respectively.

21

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 6. Capital Share Transactions

The Fund is authorized to issue up to sixteen billion full and fractional shares of common stock of separate series having a $.001 par value per share. Shares of two series have been classified, one of which constitutes the interest in the Portfolio. Transactions in capital shares of the Portfolio were as follows:

| | | For the Year Ended

October 31, 2007 | | For the Year Ended

October 31, 2006 | |

| Shares sold | | | 17,878 | | | | 94,928 | | |

| Shares issued in reinvestment of dividends | | | 25,399 | | | | 46,881 | | |

| Shares redeemed | | | (831,406 | ) | | | (449,545 | ) | |

| Net decrease | | | (788,129 | ) | | | (307,736 | ) | |

Effective March 1, 2007, the Portfolio imposes a 2% redemption fee on shares currently being offered that are purchased on or after March 1, 2007 and redeemed or exchanged within 30 days from the date of purchase. Reinvested dividends and distributions are not subject to the fee. The fee is charged based on the value of shares at redemption, is paid directly to the Portfolio and becomes part of the Portfolio's daily net asset value calculation. When shares are redeemed that are subject to the fee, reinvested dividends are redeemed first, followed by the shares held longest.

On October 31, 2007, the number of shareholders that held 5% or more of the outstanding shares of the Portfolio was as follows:

Number of

Shareholders | | Approximate Percentage

of Outstanding Shares | |

| | 2 | | | | 89 | % | |

Some of the shareholders are omnibus accounts, which hold shares on behalf of individual shareholders.

Note 7. Federal Income Taxes

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The tax characteristics of dividends paid during the years ended October 31, 2007 and 2006 were as follows:

| | | Ordinary Income | |

| | | 2007 | | 2006 | |

| | $ | 435,704 | | | $ | 664,128 | | |

22

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 7. Federal Income Taxes

The tax basis components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to losses deferred on wash sales and cumulative basis adjustments on Partnerships. At October 31, 2007, the components of distributable earnings on a tax basis were as follows:

| Undistributed net investment income | | $ | 479,076 | | |

| Accumulated realized loss | | | (137,721,958 | ) | |

| Unrealized appreciation | | | 7,431,800 | | |

| | | $ | (129,811,082 | ) | |

At October 31, 2007, Portfolio had capital loss carryforwards available to offset possible future capital gains as follows:

| | | Expires October 31, | |

| | | 2009 | | 2010 | |

| | $ | 63,200,470 | | | $ | 74,521,488 | | |

Included in the Portfolio's capital loss carryforwards which expire in 2009 and 2010 is $3,582,266 and $3,062,409 respectively, acquired in the Credit Suisse International Fund merger, which is subject to IRS limitations.

During the tax year ended October 31, 2007, the Portfolio utilized $7,118,443 of the capital loss carryforward.

It is uncertain whether the Portfolio will be able to realize the benefits of the capital loss carryforward before they expire.

As of October 31, 2007, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $22,622,775, $7,820,520, $(392,471) and $7,428,049, respectively.

At October 31, 2007, the Portfolio reclassified $12,907 from accumulated net realized loss from investments to accumulated undistributed net investment income, to adjust for current period permanent book/tax differences that arose principally from differing book/tax treatments of foreign currency contracts. Net assets were not affected by these reclassifications.

Note 8. Contingencies

In the normal course of business, the Portfolio may provide general indemnifications pursuant to certain contracts and organizational documents.

23

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Notes to Financial Statements (continued)

October 31, 2007

Note 8. Contingencies

The Portfolio's maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolio and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 9. Recent Accounting Pronouncements

During June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation 48 ("FIN 48" or the "Interpretation"), Accounting for Uncertainty in Income Taxes — an interpretation of FASB statement 109. FIN 48 supplements FASB Statement 109, Accounting for Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 prescribes a comprehensive model for how a fund should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the fund has taken or expects to take on a tax return. FIN 48 requires that the t ax effects of a position be recognized only if it is "more likely than not" to be sustained based solely on its technical merits. Management must be able to conclude that the tax law, regulations, case law, and other objective information regarding the technical merits sufficiently support the position's sustainability with a likelihood of more than 50 percent. On December 22, 2006, the SEC indicated that they would not object if the Portfolio implements FIN 48 in the first required financial statement reporting period for its fiscal year beginning after December 15, 2006. Management is evaluating the application of the Interpretation to the Portfolio and is not in a position at this time to estimate the significance of its impact, if any, on the Portfolio's financial statements.

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 "Fair Value Measurements" ("FAS 157"). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years, beginning after November 15, 2007 and interim periods within those fiscal years. As of October 31, 2007, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required in subsequent reports.

24

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of

Credit Suisse Institutional Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the International Focus Portfolio (one portfolio of the Credit Suisse Institutional Fund, Inc., hereafter referred to as the "Fund") at October 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

December 26, 2007

25

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Information Concerning Directors and Officers (unaudited)

Name, Address

(Year of Birth) | | Position(s)

Held with

Fund | | Term

of Office1

and

Length

of Time

Served | | Principal

Occupation(s) During

Past Five Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Director | | Other

Directorships

Held by Director | |

| Independent Directors | |

|

Enrique Arzac

c/o Credit Suisse Asset

Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

(1941) | | Director, Nominating Committee Member and Audit Committee Chairman | | Since 2005 | | Professor of Finance and Economics, Graduate School of Business, Columbia University since 1971. | | | 36 | | | Director of Epoch Holding Corporation (an investment management and investment advisory services company); Director of The Adams Express Company (a closed-end investment company); Director of Petroleum and Resources Corporation (a closed-end investment company). | |

|

Richard H. Francis

c/o Credit Suisse Asset

Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

(1932) | | Director, Nominating and Audit Committee Member | | Since 1999 | | Currently retired | | | 29 | | | None | |

|

Jeffrey E. Garten2

Box 208200

New Haven, Connecticut

06520-8200

(1946) | | Director, Nominating and Audit Committee Member | | Since 1998 | | The Juan Trippe Professor in the Practice of International Trade, Finance and Business from July 2005 to present; Partner and Chairman of Garten Rothkopf (consulting firm) from October 2005 to present; Dean of Yale School of Management from November 1995 to June 2005. | | | 29 | | | Director of Aetna, Inc. (insurance company); Director of CarMax Group (used car dealers); Director of Alcan, Inc. (smelting and refining of nonferrous metals company). | |

|

1 Each Director and Officer serves until his or her respective successor has been duly elected and qualified.

26

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Information Concerning Directors and Officers (unaudited) (continued)

Name, Address

(Year of Birth) | | Position(s)

Held with

Fund | | Term

of Office1

and

Length

of Time

Served | | Principal

Occupation(s) During

Past Five Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Director | | Other

Directorships

Held by Director | |

| Independent Directors | |

|

Peter F. Krogh

SFS/ICC 702

Georgetown University

Washington, DC 20057

(1937) | | Director, Nominating and Audit Committee Member | | Since 2001 | | Dean Emeritus and Distinguished Professor of International Affairs at the Edmund A. Walsh School of Foreign Service, Georgetown University from June 1995 to present. | | | 29 | | | Director of Carlisle Companies Incorporated (diversified manufacturing company). | |

|

Steven N. Rappaport

Lehigh Court, LLC

555 Madison Avenue

29th Floor

New York, New York

10022

(1948) | | Chairman of the Board of Directors, Nominating Committee Chairman and Audit Committee Member | | Director since 1999 and Chairman since 2005 | | Partner of Lehigh Court, LLC and RZ Capital (private investment firms) from July 2002 to present. | | | 36 | | | Director of iCAD, Inc. (surgical and medical instruments and apparatus company); Director of Presstek, Inc. (digital imaging technologies company); Director of Wood Resources, LLC. (plywood manufacturing company). | |

|

| Interested Director | |

|

Michael E. Kenneally2

c/o Credit Suisse Asset

Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

(1954) | | Director | | Since 2004 | | Chairman and Global Chief Executive Officer of Credit Suisse from March 2003 to July 2005; Chairman and Chief Investment Officer of Banc of America Capital Management from 1998 to March 2003. | | | 29 | | | None | |

|

2 Mr. Kenneally is a Director who is an "interested person" of the Fund as defined in the Investment Company Act of 1940, as amended, because he was an officer of Credit Suisse within the last two fiscal years.

27

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Information Concerning Directors and Officers (unaudited) (continued)

Name, Address

(Year of Birth) | | Position(s)

Held with

Fund | | Term

of Office1

and

Length

of Time

Served | | Principal Occupation(s) During Past Five Years | |

| Officers | | | | | | | |

|

Lawrence D. Haber

c/o Credit Suisse Asset

Management, LLC.

Attn: General Counsel

Eleven Madison Avenue

New York, New York 10010

(1951) | | Chief Executive Officer and President | | Since 2007 | | Managing Director and Chief Operating Officer of Credit Suisse; Member of Credit Suisse's Management Committee; Chief Financial Officer of Merrill Lynch Investment Managers from 1997 to 2003. | |

|

Michael A. Pignataro

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1959) | | Chief Financial Officer | | Since 1999 | | Director and Director of Fund Administration of Credit Suisse; Associated with Credit Suisse or its predecessor since 1984; Officer of other Credit Suisse Funds. | |

|

Emidio Morizio

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1966) | | Chief Compliance Officer | | Since 2004 | | Director and Global Head of Compliance of Credit Suisse; Associated with Credit Suisse since July 2000; Officer of other Credit Suisse Funds. | |

|

J. Kevin Gao

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1967) | | Chief Legal Officer since 2006, Vice President and Secretary since 2004 | | Since 2004 | | Director and Legal Counsel of Credit Suisse; Associated with Credit Suisse since July 2003; Associated with the law firm of Willkie Farr & Gallagher LLP from 1998 to 2003; Officer of other Credit Suisse Funds. | |

|

Robert Rizza

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1965) | | Treasurer | | Since 2006 | | Vice President of Credit Suisse; Associated with Credit Suisse since 1998; Officer of other Credit Suisse Funds. | |

|

The Statement of Additional Information includes additional information about the Directors and is available, without charge, upon request, by calling 800-222-8977.

28

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

October 31, 2007 (unaudited)

Important Tax Information for Shareholders

For the fiscal year ended October 31, 2007, the Portfolio designates approximately $435,704, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual's tax bracket. If the Portfolio pays a distribution during calendar year 2007, complete information will be reported in conjunction with Form 1099-DIV.

29

Credit Suisse Institutional Fund, Inc. — International Focus Portfolio

Proxy Voting and Portfolio Holdings Information (unaudited)

Information regarding how the Portfolio voted proxies related to its portfolio securities during the 12 month period ended June 30 of each year, as well as the policies and procedures that the Portfolio uses to determine how to vote proxies relating to its portfolio securities are available:

• By calling 1-800-222-8977

• On the Fund's website, www.credit-suisse.com/us

• On the website of the Securities and Exchange Commission, www.sec.gov.

The Portfolio files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Portfolio's Forms N-Q are available on the SEC's website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the SEC's Public Reference Room may be obtained by calling 1-202-551-8090.

30

This page intentionally left blank

This page intentionally left blank

P.O. BOX 55030, BOSTON, MA 02205-5030

800-222-8977 n www.credit-suisse.com/us

CREDIT SUISSE ASSET MANAGEMENT SECURITIES, INC., DISTRIBUTOR. INSTFUND-AR-1007

CREDIT SUISSE

INSTITUTIONAL FUND

Annual Report

October 31, 2007

CREDIT SUISSE INSTITUTIONAL FUND, INC.

n ASIA BOND PORTFOLIO

The Portfolio's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Institutional Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Institutional Fund is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolio's management are as of the date of the letter and the Portfolio holdings described in this document are as of October 31, 2007; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Annual Investment Adviser's Report

October 31, 2007 (unaudited)

December 3, 2007

Dear Shareholder:

The Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio1 commenced operations on May 1, 2007. The Portfolio seeks to maximize total investment return consistent with prudent investment management, consisting of a combination of interest income, currency gains and capital appreciation. To pursue this goal, the Portfolio invests primarily in bonds and other debt securities of Asian sovereign and corporate issuers. Under normal market conditions, the Portfolio invests at least 80% of its net assets, plus any borrowings for investment purposes, in bonds of Asian issuers and derivatives that reflect the performance of bonds of Asian issuers. The portion of the Portfolio's assets not invested in those investments may be invested in debt securities issued by the U.S. government, its agencies and instrumentalities, U.S. companies and multinational organizations, such as the Asian Development Bank, as well as non-Asian derivatives and other assets. The Portfolio may invest without limit in emerging markets and in issuers of any market capitalization, including start-ups.

For the period from May 1, 2007 to October 31, 2007, Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio1 had a gain of 4.05% versus an increase of 4.74% for the HSBC Asian Local Bond Index.2

Market Review: Asian currencies perform strongly

The period ended October 31, 2007, was a strong one for Asian markets.

Since the launch of the Portfolio in May 2007, we have seen financial markets enter a period of heightened volatility. Clearly this has been led by the slowdown in U.S. housing, specifically the sub-prime mortgage sector. Despite this weakness in the United States economy investors have begun to seek alternatives to the U.S. dollar as the global economy is expected to remain resilient. Additionally, Asian markets are performing well as fundamentals remain supportive. In particular, Asian currencies have performed strongly, as the region is well placed as a lender to the United States.

Bond yields in the region have been mixed, highlighting the increasing focus on domestic considerations as a driver of fixed income markets in the region. Although domestic sources of inflationary pressures in many economies remain contained, a fact that has facilitated an easing in monetary policy by the Indonesian, Philippines and Thai central banks, higher food and energy prices are cause for caution from central bankers. India and Korea had rate increases during the period (although both now have more neutral stances).

1

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Policy makers appear willing to promote a gradual shift toward more balanced economic growth by supporting domestic consumption and investment growth. In the absence of inflation, this means easier monetary policy is likely.

In local currency terms, Asian bond markets underperformed in the period of heightened risk aversion as some investors retreated to the traditional safe haven bond markets.

In U.S. dollar terms, Asian fixed income markets performed well as the Asian currencies have generally performed strongly over the period, up between 2.5% and 4.5% on average. The best performing currency was the Philippine peso, up 10% as the government made significant progress in its fiscal consolidation program. Additionally, sustained inflows from overseas worker remittances and investments continue to provide support. Greater currency flexibility appears to be the objective of Asian policy makers as many note the disinflationary benefits of an appreciation in their currency. The Monetary Authority of Singapore raised its targeted exchange rate appreciation as robust economic activity continued — the Singapore dollar rallied by 5%. The Chinese authorities are also dealing with the challenges of a rapidly growing economy and significant cap ital inflows. They continue to allow gradual appreciation in the Chinese Renminbi, up 3.75%.

In credit markets, the first half of the year was a continuation of 2006, when many investors piled into all manner of risky assets in search of yield. Accordingly, in a market with a generally favorable fundamental picture (there were no defaults recorded for the 12 months ended October 2007), the high yield credit sub-sector outperformed its investment grade cousin. This was notwithstanding a material increase in high yield supply, particularly in Chinese property development. Subsequently, credit became increasingly expensive with spreads at historical highs.

Since August, however, the gains to credit of the previous 12 months were erased as the reaction to the U.S. sub-prime story forced a global liquidity squeeze and generic spread widening. As an industry, banks were hit first and hardest in Asia. In addition to their potential exposure to the distressed U.S. mortgages via collateralized debt obligations, banks are the largest, most frequent issuers in Asia (hence greater price discovery). This has compounded difficulties for faster growing issuers, such as Indian banks, who are effectively forced to pay very high spreads relative to their perceived credit quality in order to meet immediate funding needs. Asian high yield credit has also underperformed significantly against its U.S. high yield equivalent. This could be reflective of generally weaker issue structures, perceived lower liquidity, and continued new supply (again, largely in the Chinese property sector) in the windows of relative c alm.

2

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Strategic Review and Market Outlook: Expecting Asian currencies to continue outperforming over the medium term high

For the period ended October 31, 2007, the Fund returned 4.05%, as compared to 4.74% for the benchmark. Contributing to performance was the Portfolio's long positions in a basket of Asian currencies and short position in U.S. Dollars. Detracting from performance was the relatively small exposure to credit, which nonetheless hurt performance given underperforming credit markets globally.

During the period, we have maintained a long currency exposure to South East Asian currencies. We believe the U.S. Dollar is likely to continue to under perform relative to these currencies — as medium to longer term valuations remain attractive.

We expect the U.S. Dollar will continue to come under pressure as the global economy rebalances away from U.S.-consumer led growth — growth that has been financed by borrowing from Asia, as demonstrated by its large current account surpluses and foreign exchange reserves.

Asia retains its export competitiveness while domestic investment is encouraged. In our opinion, initiatives such as development of domestic bond markets, recycling of FX reserves into Asia, and easier monetary policy (as real yields fall courtesy of structurally lower inflationary trajectories) are positive developments for Asian fixed income and currency markets.

Additionally, in some markets such as Singapore, currency appreciation may be used as a means to counter imported inflationary food and commodity pressures. Although inflationary pressures appear contained, we do maintain a vigilant local interest rate stance.

We have maintained a relative defensive position in Asian credit markets, with a very small weighting to Asian High Yield. While we believe fundamentals in the region argue for an out performance of Asian credits relative to global credit markets, we are wary of the correlation credit markets are likely to exhibit in the short to medium term.

Further, we have been underweight in the Asian high yield sector, with a preference for investment-grade quasi sovereign and higher rated bank exposure — primarily reflecting our view of relative value.

Asian high-grade corporate credit markets remain relatively more robust fundamentally than their European and North American peers, with a strong macroeconomic backdrop and defensive industry characteristics. At current spreads, the high-grade sector appears to be more attractively priced. We are likely to maintain our overweight view of this sub-sector as we are of the opinion

3

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

that the recent spread widening is driven largely by technical and liquidity issues, rather than fundamental concerns. Our outlook for the high yield sub-sector, however, remains more cautious as even though macro fundamentals remain reasonably strong, valuations are still relatively expensive. Further, with the potential for U.S. recession, or at least a slow down, default rates are likely to rise from their historic lows (i.e., risks are broadly to the downside fundamentally). Our strategy will continue to selectively hold high yield names where we see fundamental improvement and cheap valuations.

The Credit Suisse Asia Bond Management Team

Robert Mann

Victor Rodriguez

Andrew Bartlett

Adam McCabe

Thomas Kwan

Fixed income investing entails credit risks and interest rate risks. Typically, when interest rates rise, the market value of fixed income securities generally declines and the share price of the Portfolio can fall. Additionally, the Portfolio may involve a greater degree of risk than other funds that invest in larger, more-developed markets. International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods; these risks are heightened for emerging-market investments.

High-yield bonds are lower-quality bonds that are also known as "junk bonds." Such bonds entail greater risk than those found in higher rated securities. The Portfolio is non-diversified, which means that it may invest a greater proportion of its assets in the securities of a smaller number of issuers and may, therefore, be subject to greater volatility.

In addition to historical information, this report contains forward-looking statements that may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

4

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Comparison of Change in Value of $1,000,000 Investment in the

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio1 and the

HSBC Asian Local Bond Index2 from Inception (5/01/07).

Cumulative Returns as of September 30, 20071

Cumulative Returns as of October 31, 20071

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of portfolio shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The HSBC Asian Local Bond Index (ALBI), tracks the total return performance of a bond portfolio which consists of local currency denominated high quality and liquid bonds in Asia ex-Japan. The ALBI includes bonds from the following countries/region: Korea, Hong Kong SAR, India, Singapore, Taiwan, Malaysia, Thailand, Philippines, Indonesia and China. Investors cannot invest directly in an index.

5

Credit Suisse Institutional Fund, Inc. — Asia Bond Portfolio

Annual Investment Adviser's Report (continued)

October 31, 2007 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2007.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.