WASHINGTON, D. C. 20549

OCTOBER 31, 2012 Annual Report to Stockholders |

| |

DWS Global High Income Fund, Inc. Ticker Symbol: LBF |

|

Contents

3 Portfolio Management Review 24 Statement of Assets and Liabilities 26 Statement of Operations 27 Statement of Cash Flows 28 Statement of Changes in Net Assets 30 Notes to Financial Statements 41 Report of Independent Registered Public Accounting Firm 43 Stockholder Meeting Results 44 Dividend Reinvestment and Cash Purchase Plan 47 Investment Management Agreement Approval 51 Board Members and Officers 56 Additional Information |

The fund's primary investment objective is to seek high current income; capital appreciation is a secondary investment objective.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the fund's shares is determined by a number of factors, several of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset value.

Bond and loan investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Floating rate loans tend to be rated below investment grade and may be more vulnerable to economic or business changes than issuers with investment-grade credit. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Leverage results in additional risks and can magnify the effect of any gains or losses.

DWS Investments is part of Deutsche Bank's Asset Management division and, within the U.S., represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Portfolio Management Review (Unaudited)

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit www.dws-investments.com for the fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Please refer to pages 10 through 11 for more complete performance information.

Investment Strategy We use an active process that emphasizes relative value in a global environment, managing on a total return basis and using intensive research to identify stable-to-improving credit situations. The investment process involves a bottom-up approach, where relative value and fundamental analysis are used to select the best securities, along with a top-down approach to assess macroeconomic trends. |

DWS Global High Income Fund, Inc.'s total return based on net asset value (NAV) was 20.86% during the 12-month period ended October 31, 2012, while its total return based on market value was 22.57%.

The fund invests in sovereign and corporate emerging-markets bonds (70% of assets as October 31, 2012) and high-yield bonds (30%). Emerging-markets bonds, as gauged by the JPMorgan EMBI Global Diversified Index, returned 15.53% during the 12-month period ended October 31, 2012, while high-yield bonds, as measured by the Credit Suisse High Yield Index, returned 12.86%.

The stimulative policies of the U.S. Federal Reserve Board (the Fed), together with its pledge to maintain short-term interest rates near zero through 2015, caused U.S. Treasuries to trade at yield levels near all-time lows during the past year. This low-yield environment provided a boost to the non-Treasury, higher-yielding "spread sectors" of the bond market — a positive for both high-yield and emerging-markets debt.

The two asset classes also benefited from developments specific to each. The fundamentals of emerging-market issuers remained strong despite slowing economic growth, as governments in the asset class generally feature robust finances and relatively low levels of debt. The majority of emerging-market countries are now in fact rated investment-grade, a vast improvement from the low issuer quality that characterized the boom-bust cycle of the 1990s. The rise of the corporate bond market in emerging nations has also added depth to the asset class by providing investors with a wider range of options. The total value of the corporate bond market in the developing countries now exceeds $1 trillion, which is 10 times larger than it was in 2000. This positive backdrop enabled the emerging markets, which came into the period with attractive valuations compared to most other segments of the bond market, to gain a disproportionate benefit from investors' elevated risk appetites and thirst for yield.

High-yield bonds also benefited from strong fundamentals, as seen in the trailing 12-month dollar-weighted global speculative-grade default rate as reported by Moody's of 1.92% (which is very low by historical measures). High-yield companies are also exhibiting rising cash balances, reduced leverage and the ability to refinance existing debt at more attractive rates. Taken together, these factors created a nearly ideal backdrop for the high-yield market during the past year.

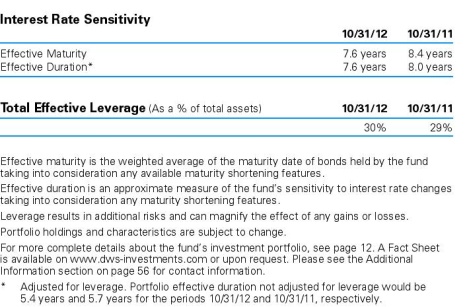

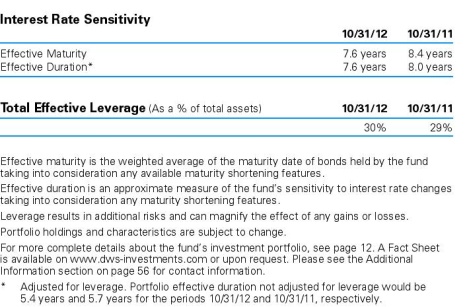

At the close of the period ended October 31, 2012, the portfolio was approximately 30% leveraged. In employing leverage, the fund uses a secure line of credit and then invests the proceeds in longer-term securities. The fund held a leverage position throughout the year, but we reduced net leverage (i.e. raised cash) from June through mid-September 2012. At that point, we elected to raise leverage again in order to add exposure to leveraged loans, where we believed there were opportunities to pick up incremental yield at acceptable risk.

Performance Attribution

We began the fund's fiscal year with a weighting of about 35% in emerging-markets corporates, and we increased the position to 40% over the balance of the year. The increased weighting was funded, in part, by a modest reduction in the fund's domestic high-yield position. This shift was based on our view that the emerging-markets segment offered an attractive relative value.

The largest contributor within emerging-market corporates was our position in the bonds of Bangko Sentral Ng Pilipinas, the central bank of the Philippines. This position allowed us to replicate Philippine sovereign risk while picking up greater yield with longer duration (i.e., interest rate exposure). This proved to be a positive for performance, as both Moody's and Standard & Poor's upgraded the ratings of the Philippines' government and central bank, based on the country's improved economic performance and financial stability. Positions in the Russian oil producer Lukoil International Finance BV and the Brazilian banking concern Banco Bradesco S.A. also assisted performance.

| "We strive to generate outperformance over a multiyear period by achieving an appropriate trade-off of risk and return." |

In the emerging-markets sovereign segment, our positions in Uruguay, Croatia and Poland — where we emphasized longer-term bonds in all cases — assisted performance. As was the case in the prior fund year, the long-term bonds of stable-to-improving sovereign credits benefited from falling U.S. Treasury yields. On the other hand, we reduced exposure to Argentina midway through the year, which cost performance. Our index weight in Serbia also detracted from performance, as it underperformed the broader emerging-markets universe when Standard & Poor's cut the country's credit rating, due in part to deteriorating economic conditions and the central bank's reduced independence from political influences.

Within the high-yield segment of the fund, our overweight in Cricket Communications, Inc., a subsidiary of Leap Wireless International, Inc., assisted performance as the bonds received a credit rating upgrade. In addition, the parent company was rumored to be considering a sale of Cricket to a stronger wireless telecommunications provider. Our overweight in the Canadian copper miner Quadra FNX Mining Ltd. also helped when the issuer was taken over by the larger miner, KGHM International Ltd. In addition, our lack of a position in the oil exploration company ATP Oil & Gas, a component of the benchmark, but not a fund holding, which filed for bankruptcy protection during the fund year, further assisted the fund's performance. Our overweight in the Australian iron ore miner Fortescue (FMG Resources Pty Ltd) detracted from performance due to the combination of a weaker near-term outlook for iron ore prices and the escalation of its project costs.

Outlook and Positioning

We maintain a cautiously optimistic outlook on both emerging-markets and high-yield bonds, as we believe that yield spreads continue to look reasonably attractive relative to global growth risks and the risks of contagion out of Europe. The yield spread of the JPMorgan EMBI Global Diversified Index, relative to Treasuries, was 279 basis points (or 2.79 percentage points), which is low on a historical basis but we believe that leaves room for yields to fall further. In addition, yields on emerging-markets corporates reflect the political risk of their underlying sovereigns, yet, in many cases, that risk has declined given that emerging-markets exhibit stronger growth, leverage to critical commodities and better overall debt profiles than many developed nations.

Having said this, we expect that market volatility could reassert itself given the ongoing European debt problems, slow global growth and the U.S. "fiscal cliff." While global central banks continue to provide liquidity, these underlying issues still need to be addressed. In this context, we remain true to our rigorous bottom-up credit research and security selection processes given that individual defaults are likely to have an amplified impact on performance.

As always, our investment process remains focused on using credit research to identify the most compelling investment opportunities for the portfolio. We manage the fund from a long-term perspective, which means that we do not take on excessive risk to boost one-year returns. Instead, we strive to generate outperformance over a multiyear period by achieving an appropriate trade-off of risk and return. At a time in which developed-market government bonds are offering paltry yields, we believe our global, multiasset class approach provides us with the best chance to strike this favorable balance over time.

Portfolio Manager

Gary Russell, CFA, Managing Director

Lead Portfolio Manager of the fund. Joined the fund in 2011.

• Joined Deutsche Asset Management in 1996. Served as the head of the High Yield group in Europe and as an Emerging Markets portfolio manager.

• Prior to that, four years at Citicorp as a research analyst and structurer of collateralized mortgage obligations. Prior to Citicorp, served as an officer in the U.S. Army from 1988 to 1991.

• Head of U.S. High Yield Bonds: New York.

• BS, United States Military Academy (West Point); MBA, New York University, Stern School of Business.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

The JPMorgan EMBI Global Diversified Index tracks total returns for U.S.-dollar- denominated debt instruments issued by emerging-market sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The unleveraged index limits exposure to any one country.

The Credit Suisse High Yield Index is an unmanaged, unleveraged trader-priced portfolio constructed to mirror the global high-yield debt market.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Spread refers to the excess yield various bond sectors offer over financial instruments with similar maturities. When spreads widen, yield differences are increasing between bonds in the two sectors being compared. When spreads narrow, the opposite is true.

Yield (or current yield) is the income generated by an investment divided by its current price.

Underweight means the fund holds a lower weighting in a given sector or security than the benchmark. Overweight means it holds a higher weighting.

Sovereign debt is debt that is issued by a national government.

One basis point equals 1/100 of a percentage point.

The trailing 12-month dollar-weighted global speculative-grade default rate as reported by Moody's .This figure calculates the dollar value of defaults divided by the total value of the rated high-yield bond market. The ratings of Moody's Investors Service, Inc. (Moody's) represent the company's opinions as to the quality of the securities it rates. Ratings are relative and subjective and are not absolute standards of quality. The fund's credit quality does not remove market risk.

Performance Summary October 31, 2012 (Unaudited)

All performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit www.dws-investments.com for the Fund's most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are not intended for trading purposes.

Average Annual Return as of 10/31/12 | |

| | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

Based on Net Asset Value(a) | | | 20.86 | % | | | 14.11 | % | | | 7.91 | % | | | 13.52 | % |

Based on Market Price(a) | | | 22.57 | % | | | 16.79 | % | | | 8.95 | % | | | 13.14 | % |

JPMorgan Emerging Markets Bond Global Diversified Index(b) | | | 15.53 | % | | | 12.11 | % | | | 9.73 | % | | | 11.34 | % |

Morningstar Closed-End Emerging Markets Bond Funds Category (based on Net Asset Value)(c) | | | 13.56 | % | | | 11.64 | % | | | 8.45 | % | | | 13.04 | % |

a Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period.

b The JPMorgan Emerging Markets Bond Global Diversified Index tracks total returns for U.S.-dollar-denominated debt instruments issued by emerging-market sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The index limits exposure to any one country.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

c Morningstar's Closed-End Emerging Markets Bond Funds category represents portfolios that invest more than 65% of their assets in foreign bonds from developing countries. The largest portion of the emerging-markets bond market comes from Latin America, followed by Eastern Europe. Africa, the Middle East and Asia make up the rest. Morningstar figures represent the average of the total returns based on net asset value reported by all of the closed-end funds designated by Morningstar, Inc. as falling into the Closed-End Emerging Markets Bond Funds category. Category returns assume reinvestment of all distributions. It is not possible to invest directly in a Morningstar category.

| Net Asset Value and Market Price | |

| | | As of 10/31/12 | | | As of 10/31/11 | |

| Net Asset Value | | $ | 9.80 | | | $ | 8.62 | |

| Market Price | | $ | 8.82 | | | $ | 7.65 | |

Prices and Net Asset Value fluctuate and are not guaranteed.

| Distribution Information | |

Twelve Months as of 10/31/12: Income Dividends | | $ | .51 | |

| October Income Dividend | | $ | .0440 | |

Current Annualized Distribution Rate (based on Net Asset Value) as of 10/31/12† | | | 5.39 | % |

Current Annualized Distribution Rate (based on Market Price) as of 10/31/12† | | | 5.99 | % |

† Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on October 31, 2012. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Distribution rates are historical, not guaranteed, and will fluctuate.

Morningstar Rankings — Closed-End Emerging Markets Bond Funds Category as of 10/31/12 |

| Period | Rank | | Number of Funds Tracked | Percentile Ranking (%) |

| 1-Year | 1 | of | 9 | 1 |

| 3-Year | 1 | of | 8 | 1 |

| 5-Year | 7 | of | 8 | 85 |

| 10-Year | 4 | of | 6 | 60 |

Source: Morningstar, Inc. Rankings are historical and do not guarantee future results. Rankings are based on net asset value total return with distributions reinvested.

Investment Portfolio as of October 31, 2012 | | | Principal Amount ($)(a) | | | Value ($) | |

| | | | |

| Bonds 116.7% | |

| Argentina 0.1% | |

| Republic of Argentina, 0.739%**, 4/30/2013 (Cost $0) | | | | 48,750 | | | | 45,839 | |

| Australia 3.2% | |

| FMG Resources (August 2006) Pty Ltd.: | |

| 144A, 6.0%, 4/1/2017 | | | | 340,000 | | | | 326,400 | |

| 144A, 6.375%, 2/1/2016 | | | | 640,000 | | | | 640,000 | |

| 144A, 6.875%, 4/1/2022 | | | | 245,000 | | | | 230,300 | |

| 144A, 7.0%, 11/1/2015 | | | | 1,040,000 | | | | 1,050,400 | |

| (Cost $2,297,889) | | | | 2,247,100 | |

| Austria 0.2% | |

| OGX Austria GmbH, 144A, 8.375%, 4/1/2022 (Cost $200,000) | | | | 200,000 | | | | 168,000 | |

| Bermuda 3.4% | |

| Digicel Ltd., 144A, 8.25%, 9/1/2017 (Cost $2,296,522) | | | | 2,200,000 | | | | 2,365,000 | |

| Brazil 16.9% | |

| Banco Bradesco SA: | |

| 144A, 5.75%, 3/1/2022 | | | | 425,000 | | | | 459,000 | |

| 144A, 5.9%, 1/16/2021 | | | | 2,000,000 | | | | 2,200,000 | |

| Banco do Brasil SA, 3.875%, 10/10/2022 | | | | 635,000 | | | | 633,095 | |

| Banco Votorantim SA, 144A, 5.25%, 2/11/2016 | | | | 2,000,000 | | | | 2,135,000 | |

| Centrais Eletricas Brasileiras SA, 144A, 6.875%, 7/30/2019 | | | | 2,000,000 | | | | 2,365,000 | |

| Fibria Overseas Finance Ltd., 144A, 6.75%, 3/3/2021 | | | | 1,545,000 | | | | 1,707,225 | |

| Independencia International Ltd., REG S, 12.0%, 12/30/2016* | | | | 577,088 | | | | 4,386 | |

| Odebrecht Finance Ltd., 144A, 6.0%, 4/5/2023 | | | | 200,000 | | | | 231,500 | |

| Petrobras International Finance Co., 5.375%, 1/27/2021 | | | | 1,770,000 | | | | 2,007,279 | |

| (Cost $11,924,628) | | | | 11,742,485 | |

| Canada 3.8% | |

| Bombardier, Inc., 144A, 5.75%, 3/15/2022 | | | | 930,000 | | | | 979,987 | |

| KGHM International Ltd., 144A, 7.75%, 6/15/2019 | | | | 1,250,000 | | | | 1,290,625 | |

| MEG Energy Corp., 144A, 6.5%, 3/15/2021 | | | | 75,000 | | | | 80,438 | |

| Novelis, Inc., 8.375%, 12/15/2017 | | | | 20,000 | | | | 21,750 | |

| Videotron Ltd., 5.0%, 7/15/2022 | | | | 230,000 | | | | 238,050 | |

| (Cost $2,506,524) | | | | 2,610,850 | |

| Cayman Islands 4.1% | |

| IPIC GMTN Ltd.: | |

| 144A, 3.75%, 3/1/2017 | | | | 1,500,000 | | | | 1,590,000 | |

| 144A, 5.5%, 3/1/2022 | | | | 500,000 | | | | 576,250 | |

| JBS Finance II Ltd., 144A, 8.25%, 1/29/2018 | | | | 410,000 | | | | 427,425 | |

| Offshore Group Investment Ltd., 144A, 7.5%, 11/1/2019 | | | | 45,000 | | | | 44,325 | |

| Offshore Group Investments Ltd., 11.5%, 8/1/2015 | | | | 5,000 | | | | 5,494 | |

| Sable International Finance Ltd., 144A, 8.75%, 2/1/2020 | | | | 205,000 | | | | 233,700 | |

| (Cost $2,631,361) | | | | 2,877,194 | |

| Chile 3.5% | |

| Corporacion Nacional del Cobre de Chile, REG S, 5.625%, 9/21/2035 (Cost $1,628,879) | | | | 2,000,000 | | | | 2,455,280 | |

| Croatia 5.0% | |

| Republic of Croatia: | |

| 144A, 6.25%, 4/27/2017 | | | | 280,000 | | | | 307,720 | |

| 144A, 6.375%, 3/24/2021 | | | | 1,770,000 | | | | 2,006,154 | |

| REG S, 6.625%, 7/14/2020 | | | | 1,000,000 | | | | 1,143,670 | |

| (Cost $3,034,122) | | | | 3,457,544 | |

| Dominican Republic 1.7% | |

| Dominican Republic, 144A, 7.5%, 5/6/2021 (Cost $1,057,828) | | | | 1,000,000 | | | | 1,175,000 | |

| El Salvador 1.0% | |

| Republic of El Salvador, REG S, 7.65%, 6/15/2035 (Cost $590,982) | | | | 570,000 | | | | 662,625 | |

| Germany 1.3% | |

| Techem GmbH, 144A, 6.125%, 10/1/2019 | EUR | | | 200,000 | | | | 271,543 | |

| Unitymedia Hessen GmbH & Co., KG, 144A, 8.125%, 12/1/2017 | | | | 600,000 | | | | 648,000 | |

| (Cost $890,690) | | | | 919,543 | |

| Ghana 1.2% | |

| Republic of Ghana, REG S, 8.5%, 10/4/2017 (Cost $729,042) | | | | 720,000 | | | | 835,200 | |

| Hong Kong 2.0% | |

| Pacnet Ltd., 144A, 9.25%, 11/9/2015 | | | | 850,000 | | | | 847,875 | |

| CNOOC Finance 2012 Ltd., 144A, 3.875%, 5/2/2022 | | | | 530,000 | | | | 569,010 | |

| (Cost $1,403,687) | | | | 1,416,885 | |

| Indonesia 0.8% | |

| Perusahaan Penerbit SBSN, 144A, 4.0%, 11/21/2018 (Cost $500,000) | | | | 500,000 | | | | 528,125 | |

| Japan 0.2% | |

| eAccess Ltd., 144A, 8.25%, 4/1/2018 (Cost $105,000) | | | | 105,000 | | | | 117,600 | |

| Kazakhstan 2.2% | |

| KazMunayGaz National Co., Series 2, REG S, 9.125%, 7/2/2018 (Cost $1,070,948) | | | | 1,150,000 | | | | 1,499,347 | |

| Lithuania 2.6% | |

| Republic of Lithuania: | |

| 144A, 6.125%, 3/9/2021 | | | | 1,000,000 | | | | 1,202,500 | |

| 144A, 7.375%, 2/11/2020 | | | | 500,000 | | | | 635,000 | |

| (Cost $1,532,061) | | | | 1,837,500 | |

| Luxembourg 5.9% | |

| Aguila 3 SA, 144A, 7.875%, 1/31/2018 | | | | 245,000 | | | | 259,088 | |

| Alrosa Finance SA, 144A, 8.875%, 11/17/2014 | | | | 100,000 | | | | 110,880 | |

| APERAM, 144A, 7.375%, 4/1/2016 | | | | 150,000 | | | | 130,500 | |

| Beverage Packaging Holdings Luxembourg II SA, 144A, 8.0%, 12/15/2016 | EUR | | | 340,000 | | | | 442,894 | |

| CHC Helicopter SA, 9.25%, 10/15/2020 | | | | 125,000 | | | | 126,875 | |

| CSN Resources SA, 144A, 6.5%, 7/21/2020 | | | | 1,170,000 | | | | 1,322,100 | |

| Dufry Finance SCA, 144A, 5.5%, 10/15/2020 | | | | 415,000 | | | | 422,262 | |

| Intelsat Jackson Holdings SA, 7.5%, 4/1/2021 | | | | 280,000 | | | | 300,300 | |

| Intelsat Luxembourg SA, 11.5%, 2/4/2017 (PIK) | | | | 140,000 | | | | 147,350 | |

| Telenet Finance Luxembourg SCA, 144A, 6.375%, 11/15/2020 | EUR | | | 425,000 | | | | 571,521 | |

| Telenet Finance V Luxembourg SCA: | |

| 144A, 6.25%, 8/15/2022 | EUR | | | 110,000 | | | | 146,854 | |

| 144A, 6.75%, 8/15/2024 | EUR | | | 110,000 | | | | 147,210 | |

| (Cost $3,951,030) | | | | 4,127,834 | |

| Mexico 0.3% | |

| Petroleos Mexicanos, 5.5%, 6/27/2044 (Cost $214,037) | | | | 215,000 | | | | 234,350 | |

| Netherlands 3.3% | |

| Lukoil International Finance BV, 144A, 6.656%, 6/7/2022 | | | | 1,000,000 | | | | 1,207,900 | |

| Schaeffler Finance BV: | |

| 144A, 7.75%, 2/15/2017 | EUR | | | 485,000 | | | | 691,508 | |

| 144A, 8.75%, 2/15/2019 | EUR | | | 100,000 | | | | 145,816 | |

| UPC Holding BV, 144A, 9.75%, 4/15/2018 | EUR | | | 160,000 | | | | 220,864 | |

| (Cost $2,086,417) | | | | 2,266,088 | |

| Panama 0.6% | |

| Republic of Panama, 6.7%, 1/26/2036 (Cost $282,750) | | | | 300,000 | | | | 427,050 | |

| Peru 0.6% | |

| Volcan Cia Minera SAA, 144A, 5.375%, 2/2/2022 (Cost $420,000) | | | | 420,000 | | | | 452,550 | |

| Philippines 4.0% | |

| Bangko Sentral Ng Pilipinas, Series A, 8.6%, 6/15/2027 (Cost $1,923,034) | | | | 1,800,000 | | | | 2,799,000 | |

| Poland 4.2% | |

| Republic of Poland, 5.125%, 4/21/2021 (Cost $2,491,250) | | | | 2,500,000 | | | | 2,937,850 | |

| Russia 2.2% | |

| Russian Federation, REG S, 7.5%, 3/31/2030 (Cost $1,191,208) | | | | 1,185,750 | | | | 1,501,515 | |

| Serbia 2.0% | |

| Republic of Serbia: | |

| REG S, 6.75%, 11/1/2024 | | | | 583,333 | | | | 577,500 | |

| 144A, 7.25%, 9/28/2021 | | | | 760,000 | | | | 809,400 | |

| (Cost $1,284,430) | | | | 1,386,900 | |

| Sweden 0.4% | |

| Cyfrowy Polsat Finance AB, 144A, 7.125%, 5/20/2018 (Cost $256,167) | EUR | | | 200,000 | | | | 278,672 | |

| Turkey 2.1% | |

| Akbank TAS, 144A, 5.125%, 7/22/2015 (Cost $1,402,657) | | | | 1,390,000 | | | | 1,456,025 | |

| Ukraine 3.0% | |

| Government of Ukraine: | |

| REG S, 7.65%, 6/11/2013 | | | | 1,000,000 | | | | 1,006,500 | |

| 144A, 7.95%, 2/23/2021 | | | | 1,000,000 | | | | 1,058,940 | |

| (Cost $2,047,511) | | | | 2,065,440 | |

| United Kingdom 0.3% | |

| Virgin Media Finance PLC, 4.875%, 2/15/2022 (Cost $200,000) | | | | 200,000 | | | | 202,000 | |

| United States 21.8% | |

| Ally Financial, Inc., 4.625%, 6/26/2015 | | | | 460,000 | | | | 477,882 | |

| Alpha Natural Resources, Inc., 6.0%, 6/1/2019 | | | | 45,000 | | | | 39,487 | |

| AMC Entertainment, Inc., 8.75%, 6/1/2019 | | | | 500,000 | | | | 552,500 | |

| AMC Networks, Inc., 7.75%, 7/15/2021 | | | | 10,000 | | | | 11,325 | |

| Antero Resources Finance Corp., 7.25%, 8/1/2019 | | | | 40,000 | | | | 43,200 | |

| ARAMARK Holdings Corp., 144A, 8.625%, 5/1/2016 | | | | 35,000 | | | | 35,788 | |

| Arch Coal, Inc.: | |

| 7.0%, 6/15/2019 | | | | 15,000 | | | | 13,313 | |

| 7.25%, 6/15/2021 | | | | 25,000 | | | | 22,063 | |

| Aviv Healthcare Properties LP, 7.75%, 2/15/2019 | | | | 35,000 | | | | 36,881 | |

| Cablevision Systems Corp., 8.625%, 9/15/2017 | | | | 500,000 | | | | 583,750 | |

| Caesar's Entertainment Operating Co., Inc., 10.0%, 12/15/2018 | | | | 200,000 | | | | 125,000 | |

| Calpine Corp., 144A, 7.875%, 7/31/2020 | | | | 185,000 | | | | 202,575 | |

| CCO Holdings LLC, 7.25%, 10/30/2017 | | | | 860,000 | | | | 939,550 | |

| Cequel Communications Holdings I LLC, 144A, 8.625%, 11/15/2017 | | | | 500,000 | | | | 535,000 | |

| Cincinnati Bell, Inc., 8.25%, 10/15/2017 | | | | 500,000 | | | | 535,000 | |

| CIT Group, Inc., 4.25%, 8/15/2017 | | | | 925,000 | | | | 948,871 | |

| Clear Channel Worldwide Holdings, Inc., Series B, 9.25%, 12/15/2017 | | | | 500,000 | | | | 536,250 | |

| CNH Capital LLC, 144A, 3.875%, 11/1/2015 | | | | 180,000 | | | | 184,500 | |

| Community Health Systems, Inc., 7.125%, 7/15/2020 | | | | 35,000 | | | | 37,013 | |

| Crestwood Midstream Partners LP, 7.75%, 4/1/2019 | | | | 195,000 | | | | 199,387 | |

| Cricket Communications, Inc., 7.75%, 10/15/2020 | | | | 400,000 | | | | 412,500 | |

| Crown Media Holdings, Inc., 10.5%, 7/15/2019 | | | | 20,000 | | | | 22,550 | |

| Dole Food Co., Inc., 144A, 8.0%, 10/1/2016 | | | | 1,110,000 | | | | 1,158,562 | |

| Ducommun, Inc., 9.75%, 7/15/2018 | | | | 25,000 | | | | 26,438 | |

| Eagle Rock Energy Partners LP, 8.375%, 6/1/2019 | | | | 35,000 | | | | 34,913 | |

| Energy Future Holdings Corp., Series Q, 6.5%, 11/15/2024 | | | | 60,000 | | | | 23,550 | |

| Energy Future Intermediate Holding Co., LLC, 10.0%, 12/1/2020 | | | | 10,000 | | | | 10,925 | |

| Equinix, Inc., 7.0%, 7/15/2021 | | | | 35,000 | | | | 38,850 | |

| Exopack Holding Corp., 10.0%, 6/1/2018 | | | | 30,000 | | | | 27,750 | |

| First Data Corp., 144A, 7.375%, 6/15/2019 | | | | 55,000 | | | | 56,925 | |

| Florida East Coast Railway Corp., 8.125%, 2/1/2017 | | | | 75,000 | | | | 79,500 | |

| Ford Motor Credit Co., LLC, 5.0%, 5/15/2018 | | | | 1,000,000 | | | | 1,103,044 | |

| Fresenius Medical Care U.S. Finance, Inc., 144A, 6.5%, 9/15/2018 | | | | 20,000 | | | | 22,400 | |

| Frontier Communications Corp., 8.125%, 10/1/2018 | | | | 600,000 | | | | 679,500 | |

| Harron Communications LP, 144A, 9.125%, 4/1/2020 | | | | 70,000 | | | | 75,600 | |

| HCA, Inc.: | |

| 6.5%, 2/15/2020 | | | | 165,000 | | | | 182,325 | |

| 7.5%, 2/15/2022 | | | | 120,000 | | | | 134,100 | |

| Hughes Satellite Systems Corp., 7.625%, 6/15/2021 | | | | 30,000 | | | | 33,375 | |

| IMS Health, Inc., 144A, 6.0%, 11/1/2020 | | | | 40,000 | | | | 40,700 | |

| International Lease Finance Corp.: | |

| 5.75%, 5/15/2016 | | | | 15,000 | | | | 15,838 | |

| 6.25%, 5/15/2019 | | | | 35,000 | | | | 37,721 | |

| 8.625%, 9/15/2015 | | | | 500,000 | | | | 563,000 | |

| JBS U.S.A. LLC, 144A, 8.25%, 2/1/2020 | | | | 80,000 | | | | 82,600 | |

| Level 3 Financing, Inc., 8.125%, 7/1/2019 | | | | 25,000 | | | | 26,688 | |

| Meritor, Inc., 10.625%, 3/15/2018 | | | | 500,000 | | | | 504,375 | |

| MGM Resorts International: | |

| 7.625%, 1/15/2017 | | | | 55,000 | | | | 57,887 | |

| 9.0%, 3/15/2020 | | | | 500,000 | | | | 557,500 | |

| National CineMedia LLC, 7.875%, 7/15/2021 | | | | 35,000 | | | | 38,238 | |

| NII Capital Corp., 7.625%, 4/1/2021 | | | | 105,000 | | | | 82,950 | |

| Norcraft Companies LP, 10.5%, 12/15/2015 | | | | 500,000 | | | | 501,250 | |

| Nortek, Inc., 8.5%, 4/15/2021 | | | | 115,000 | | | | 123,625 | |

| Oasis Petroleum, Inc., 7.25%, 2/1/2019 | | | | 55,000 | | | | 58,850 | |

| Old AII, Inc., 144A, 7.875%, 11/1/2020 | | | | 5,000 | | | | 4,975 | |

| Peabody Energy Corp.: | |

| 6.0%, 11/15/2018 | | | | 15,000 | | | | 15,563 | |

| 6.25%, 11/15/2021 | | | | 20,000 | | | | 20,650 | |

| Pinnacle Foods Finance LLC, 8.25%, 9/1/2017 | | | | 325,000 | | | | 349,375 | |

| Toys "R" Us-Delaware, Inc., 144A, 7.375%, 9/1/2016 | | | | 500,000 | | | | 510,625 | |

| U.S. Foods, Inc., 144A, 8.5%, 6/30/2019 | | | | 15,000 | | | | 15,713 | |

| United States Steel Corp., 7.375%, 4/1/2020 | | | | 500,000 | | | | 502,500 | |

| Univision Communications, Inc., 144A, 8.5%, 5/15/2021 | | | | 10,000 | | | | 10,050 | |

| Visteon Corp., 6.75%, 4/15/2019 | | | | 140,000 | | | | 144,025 | |

| Windstream Corp., 7.75%, 10/1/2021 | | | | 650,000 | | | | 702,812 | |

| (Cost $14,511,190) | | | | 15,149,652 | |

| Uruguay 6.9% | |

| Republic of Uruguay, 7.875%, 1/15/2033 (Cost $3,500,599) | | | | 3,080,000 | | | | 4,774,000 | |

| Venezuela 5.9% | |

| Petroleos de Venezuela SA, 144A, 8.5%, 11/2/2017 | | | | 410,000 | | | | 367,975 | |

| Republic of Venezuela: | |

| 7.65%, 4/21/2025 | | | | 900,000 | | | | 708,750 | |

| 10.75%, 9/19/2013 | | | | 2,949,000 | | | | 3,022,725 | |

| (Cost $3,956,209) | | | | 4,099,450 | |

Total Bonds (Cost $74,118,652) | | | | 81,119,493 | |

| | |

| Loan Participations and Assignments 16.5% | |

| Senior Loans 5.9% | |

| Germany 0.1% | |

| Kabel Deutschland GmbH, Term Loan F, 4.25%, 2/1/2019 (Cost $40,000) | | | | 40,000 | | | | 40,300 | |

| United States 5.8% | |

| Burger King Corp., Term Loan B, 3.75%, 9/27/2019 | | | | 180,000 | | | | 180,788 | |

| Goodyear Tire & Rubber Co., Second Lien Term Loan, 4.75%, 4/30/2019 | | | | 665,000 | | | | 670,653 | |

| Ineos U.S. Finance LLC, 6 year Term Loan, 6.5%, 5/4/2018 | | | | 407,950 | | | | 414,239 | |

| MetroPCS Wireless, Inc., Term Loan B3, 4.0%, 3/16/2018 | | | | 334,151 | | | | 335,299 | |

| NRG Energy, Inc., Term Loan B, 4.0%, 7/2/2018 | | | | 268,638 | | | | 270,639 | |

| Par Pharmaceutical Companies, Inc., Term Loan B, 5.0%, 9/30/2019 | | | | 315,000 | | | | 314,639 | |

| Pilot Travel Centers LLC: | |

| Term Loan B, 3.75%, 3/30/2018 | | | | 135,000 | | | | 135,827 | |

| Term Loan B2, 4.25%, 8/7/2019 | | | | 267,899 | | | | 269,852 | |

| Pinnacle Foods Finance LLC, Term Loan F, 4.75%, 10/17/2018 | | | | 264,338 | | | | 265,409 | |

| Plains Exploration & Production, 7 year Term Loan, LIBOR plus 3.0%, 9/13/2019 | | | | 320,000 | | | | 322,058 | |

| Samson Investment Co., Second Lien Term Loan, 6.0%, 9/13/2018 | | | | 530,000 | | | | 535,631 | |

| Warner Chilcott Co., LLC, Term Loan B2, 4.25%, 3/15/2018 | | | | 71,879 | | | | 72,239 | |

| Warner Chilcott Corp., Term Loan B1, 4.25%, 3/15/2018 | | | | 198,352 | | | | 199,343 | |

| WC Luxco SARL, Term Loan B3, 4.25%, 3/15/2018 | | | | 98,834 | | | | 99,328 | |

| (Cost $4,049,074) | | | | 4,085,944 | |

| Sovereign Loans 10.6% | |

| Russia 9.9% | |

| Bank of Moscow, 144A, 6.699%, 3/11/2015 | | | | 1,000,000 | | | | 1,069,000 | |

| Gazprom OAO, 144A, 4.95%, 5/23/2016 | | | | 420,000 | | | | 447,989 | |

| Russian Agricultural Bank OJSC, REG S, 7.75%, 5/29/2018 | | | | 1,370,000 | | | | 1,633,445 | |

| Sberbank of Russia, 144A, 6.125%, 2/7/2022 | | | | 200,000 | | | | 223,806 | |

| Vimpel Communications, 144A, 6.493%, 2/2/2016 | | | | 1,500,000 | | | | 1,601,325 | |

| VTB Bank OJSC: | |

| 144A, 6.315%, 2/22/2018 | | | | 500,000 | | | | 528,125 | |

| 144A, 6.875%, 5/29/2018 | | | | 1,270,000 | | | | 1,370,152 | |

| (Cost $6,418,823) | | | | 6,873,842 | |

| Ukraine 0.7% | |

| Ukreximbank, REG S, 8.375%, 4/27/2015 (Cost $500,958) | | | | 500,000 | | | | 490,624 | |

Total Loan Participations and Assignments (Cost $11,008,855) | | | | 11,490,710 | |

| | |

| Preferred Securities 0.5% | |

| Cayman Islands 0.4% | |

| PHBS Ltd., 6.625%, 9/29/2015 (b) (Cost $277,500) | | | | 300,000 | | | | 299,850 | |

| United States 0.1% | |

| Citigroup, Inc., 5.95%, 1/30/2023 (b) (Cost $80,000) | | | | 80,000 | | | | 82,450 | |

Total Preferred Securities (Cost $357,500) | | | | 382,300 | |

| | | Contract Amount | | | Value ($) | |

| | | | |

| Call Options Purchased 0.1% | |

| Options on Interest Rate Swap Contracts | |

| Fixed Rate — 3.583% - Floating — LIBOR, Swap Expiration Date 5/11/2026, Option Expiration Date 5/9/2016 | | | 200,000 | | | | 6,195 | |

| Fixed Rate — 3.635% - Floating — LIBOR, Swap Expiration Date 4/27/2026, Option Expiration Date 4/25/2016 | | | 600,000 | | | | 17,647 | |

| Fixed Rate — 3.72% - Floating — LIBOR, Swap Expiration Date 4/22/2026, Option Expiration Date 4/20/2016 | | | 600,000 | | | | 16,546 | |

Total Call Options Purchased (Cost $68,670) | | | | 40,388 | |

| | | Shares | | | Value ($) | |

| | | | |

| Cash Equivalents 6.1% | |

| Central Cash Management Fund, 0.18% (c) (Cost $4,235,185) | | | 4,235,185 | | | | 4,235,185 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $89,788,862)† | | | 139.9 | | | | 97,268,076 | |

| Notes Payable | | | (44.6 | ) | | | (31,000,000 | ) |

| Other Assets and Liabilities, Net | | | 4.7 | | | | 3,244,019 | |

| Net Assets | | | 100.0 | | | | 69,512,095 | |

The following table represents bonds that are in default:

| Security | | Coupon | | Maturity Date | | Principal Amount ($) | | | Acquisition Cost ($) | | | Value ($) | |

| Independencia International Ltd.* | | | 12.0 | % | 12/30/2016 | | | 577,088 | | | | 1,050,571 | | | | 4,386 | |

* Non-income producing security.

** Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of October 31, 2012.

† The cost for federal income tax purposes was $89,791,137. At October 31, 2012, net unrealized appreciation for all securities based on tax cost was $7,476,939. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $9,728,484 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $2,251,545.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) Date shown is call date; not a maturity date for the perpetual preferred securities.

(c) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

LIBOR: London Interbank Offered Rate

PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal.

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

At October 31, 2012, open written options contracts were as follows:

| Options on Interest Rate Swap Contracts | |

| | Swap Effective/ Expiration Date | | Contract Amount | | Option Expiration Date | | Premiums Received ($) | | | Value ($) (d) | |

Call Options Fixed — 4.083% - Floating — LIBOR | 5/11/2016 5/11/2026 | | | 200,000 | | 5/9/2016 | | | 6,800 | | | | (4,392 | ) |

| Fixed — 4.135% - Floating — LIBOR | 4/27/2016 4/27/2026 | | | 600,000 | | 4/25/2016 | | | 22,200 | | | | (12,494 | ) |

| Fixed — 4.22% - Floating — LIBOR | 4/22/2016 4/22/2026 | | | 600,000 | | 4/20/2016 | | | 21,390 | | | | (11,727 | ) |

| Total Call Options | | | 50,390 | | | | (28,613 | ) |

Put Options Fixed — 1.9% - Floating — LIBOR | 4/24/2013 4/24/2023 | | | 600,000 | | 4/22/2013 | | | 8,220 | | | | (13,046 | ) |

| Fixed — 2.07% - Floating — LIBOR | 5/10/2013 5/10/2043 | | | 200,000 | | 5/8/2013 | | | 3,200 | | | | (2,271 | ) |

| Fixed — 2.09% - Floating — LIBOR | 4/25/2013 4/25/2043 | | | 600,000 | | 4/23/2013 | | | 11,280 | | | | (6,543 | ) |

| Total Put Options | | | 22,700 | | | | (21,860 | ) |

| Total | | | 73,090 | | | | (50,473 | ) |

(d) Unrealized appreciation on written options on interest rate swap contracts at October 31, 2012 was $22,617.

As of October 31, 2012, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Depreciation ($) | | Counterparty |

| EUR | | | 2,247,600 | | USD | | | 2,907,675 | | 11/16/2012 | | | (5,970 | ) | JPMorgan Chase Securities, Inc. |

| GBP | | | 586,500 | | USD | | | 940,541 | | 11/16/2012 | | | (5,870 | ) | Citigroup, Inc. |

| Total unrealized depreciation | | | | | (11,840 | ) |

| Currency Abbreviations |

EUR Euro GBP British Pound USD United States Dollar |

For information on the Fund's policy and additional disclosures regarding options purchased, written option contracts and forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2012 in valuing the Fund's investments and other receivable. For information on the Fund's policy regarding the valuation of investments and other receivables, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Fixed Income Investments (e) | |

| Bonds | | $ | — | | | $ | 81,119,493 | | | $ | — | | | $ | 81,119,493 | |

| Loan Participations and Assignments | | | — | | | | 11,490,710 | | | | — | | | | 11,490,710 | |

| Preferred Securities | | | — | | | | 382,300 | | | | — | | | | 382,300 | |

| Other Receivable*** | | | — | | | | — | | | | 899,002 | | | | 899,002 | |

| Short-Term Investments (e) | | | 4,235,185 | | | | — | | | | — | | | | 4,235,185 | |

| Derivatives (f) | | | | | | | | | | | | | | | | |

| Purchased Options | | | — | | | | 40,388 | | | | — | | | | 40,388 | |

| Total | | $ | 4,235,185 | | | $ | 93,032,891 | | | $ | 899,002 | | | $ | 98,167,078 | |

| Liabilities | |

| Derivatives (f) | | | | | | | | | | | | | | | | |

| Written Options | | $ | — | | | $ | (50,473 | ) | | $ | — | | | $ | (50,473 | ) |

| Forward Foreign Currency Exchange Contracts | | | — | | | | (11,840 | ) | | | — | | | | (11,840 | ) |

| Total | | $ | — | | | $ | (62,313 | ) | | $ | — | | | $ | (62,313 | ) |

There have been no transfers between fair value measurement levels during the year ended October 31, 2012.

(e) See Investment Portfolio for additional detailed categorizations.

(f) Derivatives include value of options purchased, written options, at value, and unrealized depreciation on forward foreign currency exchange contracts.

Level 3 Reconciliation

The following is a reconciliation of the Fund's level 3 other receivable for which significant unobservable inputs were used in determining value:

| | | Other Receivable*** | |

| Balance as of October 31, 2011 | | $ | — | |

| Realized gains (loss) | | | — | |

| Change in unrealized appreciation (depreciation) | | | 899,002 | |

| Amortization premium/discount | | | — | |

| Purchases | | | 0 | |

| (Sales) | | | — | |

| Transfers into Level 3 | | | — | |

| Transfers (out) of Level 3 | | | — | |

| Balance as of October 31, 2012 | | $ | 899,002 | |

| Net change in unrealized appreciation (depreciation) from other receivable still held as of October 31, 2012 | | $ | 899,002 | |

| Quantitative Disclosure About Significant Unobservable Inputs |

| Asset Class | | Fair Value at 10/31/12 | | Valuation Technique(s) | Unobservable Input |

| Other Receivable*** | | $ | 899,002 | | Broker Quote | Broker Quote — 96 |

| Discount for Lack of Marketability — 5% |

Transfers between price levels are recognized at the beginning of the reporting period.

*** Lehman Brothers International issued a Claims Determination Deed for the Fund as a partial settlement for a loss written off by the Fund in 2008. Other receivable represents the fair value of this pending claim.

Qualitative Disclosure About Unobservable Inputs

Significant unobservable inputs developed by the Pricing Committee and used in the fair value measurement of the Fund's holdings in other receivables are the broker quote with a discount for lack of marketability. A significant change in the broker quote could have a material change on the fair value measurement.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities | as of October 31, 2012 | |

| Assets | |

Investments: Investments in non-affiliated securities, at value (cost $85,553,677) | | $ | 93,032,891 | |

| Investment in Central Cash Management Fund (cost $4,235,185) | | | 4,235,185 | |

| Total investments in securities, at value (cost $89,788,862) | | | 97,268,076 | |

| Cash | | | 2,472,230 | |

| Foreign currency, at value (cost $22,821) | | | 16,521 | |

| Interest receivable | | | 1,307,454 | |

| Foreign taxes recoverable | | | 8,555 | |

| Other receivable*** | | | 899,002 | |

| Other assets | | | 4,033 | |

| Total assets | | | 101,975,871 | |

| Liabilities | |

| Payable for investments purchased | | | 1,162,375 | |

| Notes payable | | | 31,000,000 | |

| Interest on notes payable | | | 28,621 | |

| Options written, at value (premium received $73,090) | | | 50,473 | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 11,840 | |

| Accrued management fee | | | 58,790 | |

| Accrued Directors' fee | | | 1,508 | |

| Other accrued expenses and payables | | | 150,169 | |

| Total liabilities | | | 32,463,776 | |

| Net assets, at value | | $ | 69,512,095 | |

*** Lehman Brothers International issued a Claims Determination Deed for the Fund as a partial settlement for a loss written off by the Fund in 2008. Other receivable represents the fair value of this pending claim.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities as of October 31, 2012 (continued) | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 445,520 | |

Net unrealized appreciation (depreciation) on: Investments | | | 7,479,214 | |

| Other receivable | | | 899,002 | |

| Foreign currency | | | (17,342 | ) |

| Written options | | | 22,617 | |

| Accumulated net realized gain (loss) | | | (5,577,746 | ) |

| Cost of 2,860,801 shares held in Treasury | | | (24,393,035 | ) |

| Paid-in capital | | | 90,653,865 | |

| Net assets, at value | | $ | 69,512,095 | |

| Net Asset Value | |

Net asset value per share ($69,512,095 ÷ 7,091,818 shares of common stock issued and outstanding, $.01 par value, 100,000,000 shares authorized) | | $ | 9.80 | |

The accompanying notes are an integral part of the financial statements.

| for the year ended October 31, 2012 | |

| Investment Income | |

| Interest | | $ | 5,759,896 | |

| Income distributions — Central Cash Management Fund | | | 2,482 | |

| Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates | | | 3,305 | |

| Total income | | | 5,765,683 | |

Expenses: Management fee | | | 648,161 | |

| Services to shareholders | | | 5,270 | |

| Custodian and accounting fees | | | 99,265 | |

| Audit fees | | | 85,799 | |

| Legal fees | | | 111,956 | |

| Reports to shareholders | | | 68,043 | |

| Directors' fees and expenses | | | 9,601 | |

| Interest expense | | | 443,202 | |

| Stock exchange listing fees | | | 23,745 | |

| Other | | | 32,135 | |

| Total expenses | | | 1,527,177 | |

| Net investment income | | | 4,238,506 | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) from: Investments | | | 557,655 | |

| Foreign currency | | | (36,031 | ) |

| | | | 521,624 | |

Change in net unrealized appreciation (depreciation) on: Investments | | | 6,203,031 | |

| Other receivable*** | | | 899,002 | |

| Written options | | | 22,617 | |

| Foreign currency | | | 11,981 | |

| | | | 7,136,631 | |

| Net gain (loss) | | | 7,658,255 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 11,896,761 | |

*** Lehman Brothers International issued a Claims Determination Deed for the Fund as a partial settlement for a loss written off by the Fund in 2008. Other receivable represents the fair value of this pending claim.

The accompanying notes are an integral part of the financial statements.

| for the year ended October 31, 2012 | |

Increase (Decrease) in Cash: Cash Flows from Operating Activities | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | 11,896,761 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used) by operating activities: Purchases of long-term investments | | | (22,228,135 | ) |

| Net purchases, sales and maturities of short-term investments | | | (2,962,550 | ) |

| Net amortization of premium/(accretion of discount) | | | 255,469 | |

| Proceeds from sales and maturities of long-term investments | | | 24,013,804 | |

| (Increase) decrease in interest receivable | | | 56,262 | |

| (Increase) decrease in other assets | | | 65,980 | |

| Increase (decrease) in written options, at value | | | 50,473 | |

| Increase (decrease) in payable for investments purchased | | | (935,994 | ) |

| Increase (decrease) in interest on notes payables | | | 28,621 | |

| Increase (decrease) in other accrued expenses and payables | | | (41,120 | ) |

| Change in unrealized (appreciation) depreciation on investments and other receivable | | | (7,102,033 | ) |

| Change in unrealized (appreciation) depreciation on forward foreign currency exchange contracts | | | (5,365 | ) |

| Net realized (gain) loss from investments | | | (557,655 | ) |

| Cash provided (used) by operating activities | | $ | 2,534,518 | |

| Cash Flows from Financing Activities | | | | |

| Net increase (decrease) in notes payable | | | 5,000,000 | |

| Payment for shares repurchased from shareholders | | | (1,455,454 | ) |

| Distributions paid to shareholders | | | (3,633,937 | ) |

| Cash provided (used) for financing activities | | | (89,391 | ) |

| Increase (decrease) in cash | | | 2,445,127 | |

| Cash at beginning of period (including foreign currency) | | | 43,624 | |

| Cash at end of period (including foreign currency) | | $ | 2,488,751 | |

| Supplemental Disclosure | | | | |

| Interest paid on notes | | $ | (414,581 | ) |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | | | Years Ended October 31, | |

| Increase (Decrease) in Net Assets | | 2012 | | | 2011 | |

Operations: Net investment income | | $ | 4,238,506 | | | $ | 3,717,892 | |

| Net realized gain (loss) | | | 521,624 | | | | 5,970,245 | |

| Change in net unrealized appreciation (depreciation) | | | 7,136,631 | | | | (8,248,013 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 11,896,761 | | | | 1,440,124 | |

| Distributions to shareholders from net investment income | | | (3,633,937 | ) | | | (4,074,416 | ) |

Fund share transactions: Cost of shares tendered | | | — | | | | (21,350,347 | ) |

| Cost of shares repurchased | | | (1,408,553 | ) | | | (1,105,376 | ) |

| Net increase (decrease) in net assets from Fund share transactions | | | (1,408,553 | ) | | | (22,455,723 | ) |

| Increase (decrease) in net assets | | | 6,854,271 | | | | (25,090,015 | ) |

| Net assets at beginning of period | | | 62,657,824 | | | | 87,747,839 | |

| Net assets at end of period (including undistributed net investment income and distributions in excess of net investment income of $445,520 and $19,300, respectively) | | $ | 69,512,095 | | | $ | 62,657,824 | |

| Other Information | |

| Shares outstanding at beginning of period | | | 7,268,504 | | | | 9,884,418 | |

| Shares tendered | | | — | | | | (2,471,105 | ) |

| Shares repurchased | | | (176,686 | ) | | | (144,809 | ) |

| Shares outstanding at end of period | | | 7,091,818 | | | | 7,268,504 | |

The accompanying notes are an integral part of the financial statements.

| | | Years Ended October 31, | |

| | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| Per Share Operating Performance | |

| Net asset value, beginning of period | | $ | 8.62 | | | $ | 8.88 | | | $ | 8.04 | | | $ | 5.99 | | | $ | 10.06 | |

Income (loss) from investment operations: Net investment incomea | | | .59 | | | | .50 | | | | .55 | | | | .55 | | | | .71 | |

| Net realized and unrealized gain (loss) | | | 1.08 | e | | | (.26 | ) | | | .79 | | | | 2.30 | | | | (4.18 | ) |

| Total from investment operations | | | 1.67 | | | | .24 | | | | 1.34 | | | | 2.85 | | | | (3.47 | ) |

Less distributions from: Net investment income | | | (.51 | ) | | | (.55 | ) | | | (.51 | ) | | | (.57 | ) | | | (.60 | ) |

| Return of capital | | | — | | | | — | | | | — | | | | (.23 | ) | | | — | |

| Total distributions | | | (.51 | ) | | | (.55 | ) | | | (.51 | ) | | | (.80 | ) | | | (.60 | ) |

NAV accretion resulting from repurchases of shares and shares tendered at a discount to NAVa | | | .02 | | | | .05 | | | | .01 | | | | — | | | | — | |

| Net asset value, end of period | | $ | 9.80 | | | $ | 8.62 | | | $ | 8.88 | | | $ | 8.04 | | | $ | 5.99 | |

| Market value, end of period | | $ | 8.82 | | | $ | 7.65 | | | $ | 8.44 | | | $ | 6.75 | | | $ | 5.03 | |

| Total Return | |

Per share net asset value (%)b | | | 20.86 | e | | | 4.12 | | | | 18.08 | | | | 53.24 | | | | (35.75 | ) |

Per share market value (%)b | | | 22.57 | | | | (2.78 | ) | | | 33.67 | | | | 53.20 | | | | (37.09 | ) |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 70 | | | | 63 | | | | 88 | | | | 80 | | | | 60 | |

| Ratio of expenses (including interest expense) (%) | | | 2.36 | | | | 2.22 | | | | 1.68 | | | | 1.59 | | | | 2.52 | |

| Ratio of expenses (excluding interest expense) (%) | | | 1.67 | | | | 1.86 | | | | 1.68 | | | | 1.55 | | | | 1.48 | |

| Ratio of net investment income (%) | | | 6.54 | | | | 5.75 | | | | 6.53 | | | | 7.77 | | | | 7.61 | |

| Portfolio turnover rate (%) | | | 25 | | | | 89 | | | | 31 | | | | 47 | c | | | 69 | c |

| Total debt outstanding, end of period ($ thousands) | | | 31,000 | | | | 26,000 | | | | — | | | | — | | | | — | |

Asset coverage per $1,000 of debtd | | | 3,242 | | | | 3,410 | | | | — | | | | — | | | | — | |

a Based on average shares outstanding during the period. b Total return based on net asset value reflects changes in the Fund's net asset value during the period. Total return based on market value reflects changes in market value. Each figure includes reinvestments of distributions. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares trade during the period. c The portfolio turnover rate including reverse repurchase agreements was 87% and 275% for the years ended October 31, 2009 and 2008, respectively. d Asset coverage equals the total net assets plus borrowings of the Fund divided by the borrowings outstanding at period end. e During the year ended October 31, 2012, Lehman Brothers International issued a Claims Determination Deed for the Fund as a partial settlement for a loss written off by the Fund in 2008. The impact of this claim amounted to $0.13 per share. Excluding this pending claim, total return would have been 1.39% lower. | |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

DWS Global High Income Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end, diversified management investment company organized as a Maryland corporation.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Debt securities and loan participations and assignments are valued at prices supplied by independent pricing services approved by the Fund's Board. If the pricing services are unable to provide valuations, securities are valued at the most recent bid quotation or evaluated price, as applicable, obtained from one or more broker-dealers. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. These securities are generally categorized as Level 2.

Money market instruments purchased with an original or remaining maturity of sixty days or less, maturing at par, are valued at amortized cost, which approximates value, and are categorized as Level 2. Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are categorized as Level 1. Over-the-counter written or purchased options are valued at the price provided by the broker-dealer with which the option was traded and are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities; the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurement is included in a table following the Fund's Investment Portfolio.

New Accounting Pronouncement. In December 2011, Accounting Standards Update 2011-11 (ASU 2011-11), Disclosures about Offsetting Assets and Liabilities, was issued and is effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods. ASU 2011-11 is intended to enhance disclosure requirements on the offsetting of financial assets and liabilities. Management is currently evaluating the application of ASU 2011-11 and its impact, if any, on the Fund's financial statements.

Securities Lending. The Fund lends securities to certain financial institutions. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the issuer of securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments. The Fund had no securities on loan as of October 31, 2012.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

Loan Participations/Assignments. Loan Participations and Assignments are portions of loans originated by banks and sold in pieces to investors. These U.S.-dollar-denominated fixed and floating rate loans ("Loans") in which the Fund invests, are arranged between the borrower and one or more financial institutions ("Lenders"). These Loans may take the form of Senior Loans, which are corporate obligations often issued in connection with recapitalizations, acquisitions, leveraged buy-outs and refinancings, and Sovereign Loans, which are debt instruments between a foreign sovereign entity and one or more financial institutions. The Fund invests in such Loans in the form of participations in Loans ("Participations") or assignments of all or a portion of Loans from third parties ("Assignments"). Participations typically result in the Fund having a contractual relationship only with the Lender, not with the borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing Participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the Loan, or any rights of set-off against the borrower, and the Fund will not benefit directly from any collateral supporting the Loan in which it has purchased the Participation. As a result, the Fund assumes the credit risk of both the borrower and the Lender that is selling the Participation. Assignments typically result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement. Senior loans held by the Fund are generally in the form of Assignments, but the Fund may also invest in Participations. All Loan Participations and Assignments involve interest rate risk, liquidity risk and credit risk, including the potential default or insolvency of the borrower.

Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At October 31, 2012, the Fund had a net tax basis capital loss carryforward of $5,120,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains until October 31, 2017, or until fully utilized, whichever occurs first.

The Fund has reviewed the tax positions for the open tax years as of October 31, 2012 and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Net investment income of the Fund, if any, is declared and distributed to shareholders monthly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in forward currency contracts, recognition of certain currency gain (loss) as ordinary income (loss), foreign denominated securities and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

At October 31, 2012, the Fund's components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed ordinary income* | | $ | 470,185 | |

| Capital loss carryforwards | | $ | (5,120,000 | ) |

| Net unrealized appreciation (depreciation) on investments | | $ | 7,476,939 | |

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| | | Years Ended October 31, | |

| | | 2012 | | | 2011 | |

| Distributions from ordinary income* | | $ | 3,633,937 | | | $ | 4,074,416 | |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.

Statement of Cash Flows. Information on financial transactions which have been settled through the receipt and disbursement of cash is presented in the Statement of Cash Flows. The cash amount shown in the Statement of Cash Flows represents the cash and foreign currency position at the Fund's custodian bank at October 31, 2012.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes with the exception of securities in default of principal. The Fund uses the specific identification method for determining realized gain or loss on investments. The value of additional securities received as an interest payment is recorded as income and as the cost basis of such securities.

B. Derivative Instruments

Options. An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option), or sell to (put option), the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices and interest rate options, will require cash settlement by the Fund if exercised. For the year ended October 31, 2012, the Fund entered into options on interest rate swaps in order to hedge against potential adverse interest rate movements of portfolio assets.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

A summary of the open purchased option contracts as of October 31, 2012 is included in the Fund's Investment Portfolio. A summary of open written option contracts is included in the table following the Fund's Investment Portfolio. For the year ended October 31, 2012, the investment in written option contracts had a total value generally indicative of a range from $0 to approximately $76,000, and purchased option contracts had a total value generally indicative of a range from $0 to approximately $68,670.

Forward Foreign Currency Exchange Contracts. A forward foreign currency exchange contract (forward currency contract) is a commitment to purchase or sell a foreign currency at the settlement date at a negotiated rate. For the year ended October 31, 2012, the Fund entered into forward currency contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign currency denominated portfolio holdings and to facilitate transactions in foreign currency denominated securities.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and unrealized gain (loss) is recorded daily. On the settlement date of the forward currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was closed. Certain risks may arise upon entering into forward currency contracts from the potential inability of counterparties to meet the terms of their contracts. The maximum counterparty credit risk to the Fund is measured by the unrealized gain on appreciated contracts. Additionally, when utilizing forward currency contracts to hedge, the Fund gives up the opportunity to profit from favorable exchange rate movements during the term of the contract.

A summary of the open forward currency contracts as of October 31, 2012 is included in a table following the Fund's Investment Portfolio. For the year ended October 31, 2012, the investment in forward currency contracts short vs. U.S. dollars had a total contract value generally indicative of a range from approximately $599,000 to $3,848,000, and the investment in forward currency contracts long vs. U.S. dollars had a total contract value generally indicative of a range from $0 to approximately $66,000.

The following tables summarize the value of the Fund's derivative instruments held as of October 31, 2012 and the related location in the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

| Asset Derivative | | Purchased Options | |

| Interest Rate Contracts (a) | | $ | 40,388 | |

The above derivative is located in the following Statement of Assets and Liabilities account:

(a) Investments in securities, at value (includes purchased options)

| Liability Derivatives | | Written Options | | | Forward Contracts | | | Total | |

| Interest Rate Contracts (a) | | $ | (50,473 | ) | | $ | — | | | $ | (50,473 | ) |

| Foreign Exchange Contracts (b) | | | — | | | | (11,840 | ) | | | (11,840 | ) |

| | | $ | (50,473 | ) | | $ | (11,840 | ) | | $ | (62,313 | ) |

Each of the above derivatives is located in the following Statement of Assets and Liabilities accounts:

(a) Options written, at value

(b) Unrealized depreciation on forward foreign currency exchange contracts

Additionally, the amount of unrealized and realized gains and losses on derivative instruments recognized in Fund earnings during the year ended October 31, 2012 and the related location in the accompanying Statement of Operations is summarized in the following tables by primary underlying risk exposure:

| Realized Gain (Loss) | | Forward Contracts | |

| Foreign Exchange Contracts (a) | | $ | (11,929 | ) |

The above derivative is located in the following Statement of Operations account:

(a) Net realized gain (loss) from foreign currency (Statement of Operations includes both forward currency contracts and foreign currency transactions)

| Change in Net Unrealized Appreciation (Depreciation) | | Purchased Options | | | Written Options | | | Forward Contracts | | | Total | |

| Interest Rate Contracts (a) | | $ | (28,282 | ) | | $ | 22,617 | | | $ | — | | | $ | (5,665 | ) |

| Foreign Exchange Contracts (b) | | | — | | | | — | | | | 5,365 | | | | 5,365 | |

| | | $ | (28,282 | ) | | $ | 22,617 | | | $ | 5,365 | | | $ | (300 | ) |

Each of the above derivatives is located in the following Statement of Operations accounts:

(a) Change in net unrealized appreciation (depreciation) on investments (includes purchased options) and written options, respectively

(b) Change in net unrealized appreciation (depreciation) on foreign currency (Statement of Operations includes both forward currency contracts and foreign currency transactions)

C. Purchases and Sales of Securities

During the year ended October 31, 2012, purchases and sales of investment securities (excluding short-term investments) aggregated $22,228,135 and $24,013,804, respectively.

For the year ended October 31, 2012, transactions for written options on interest rate swap contracts were as follows:

| | | Contracts | | | Premium | |

| Outstanding, beginning of period | | $ | — | | | $ | — | |

| Options written | | | 2,800,000 | | | | 73,090 | |

| Outstanding, end of period | | $ | 2,800,000 | | | $ | 73,090 | |

D. Related Parties

Management Agreement. Under the Investment Advisory, Management and Administration Agreement ("Management Agreement") with Deutsche Investment Management Americas Inc. ("DIMA" or the "Manager"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Manager directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Manager determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund. In addition to portfolio management services, the Manager provides certain administrative services in accordance with the Management Agreement. The management fee payable under the Management Agreement is equal to an annual rate of 1.00% of the Fund's average weekly net assets, computed and accrued daily and payable monthly.