WASHINGTON, D. C. 20549

DWS Global High Income Fund, Inc.

April 30, 2014

Semiannual Report

to Shareholders

DWS Global High Income Fund, Inc.

(On August 11, 2014, DWS Global High Income Fund, Inc. will be renamed Deutsche Global High Income Fund, Inc.)

Ticker Symbol: LBF

Contents

28 Statement of Assets and Liabilities 30 Statement of Operations 32 Statement of Cash Flows 34 Statement of Changes in Net Assets 37 Notes to Financial Statements 51 Dividend Reinvestment and Cash Purchase Plan 55 Additional Information |

The fund's primary investment objective is to seek high current income; capital appreciation is a secondary investment objective.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the fund's shares is determined by a number of factors, several of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset value.

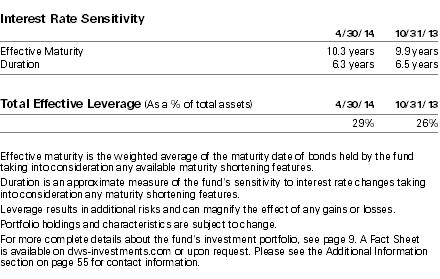

Bond and loan investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Floating rate loans tend to be rated below-investment grade and may be more vulnerable to economic or business changes than issuers with investment-grade credit. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Leverage results in additional risks and can magnify the effect of any gains or losses.

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its subsidiaries, including the Advisor and DWS Investments Distributors, Inc.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary April 30, 2014 (Unaudited)

All performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit dws-investments.com for the Fund's most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are not intended for trading purposes.

Average Annual Return as of 4/30/14 |

| | 6-Month‡ | 1-Year | 5-Year | 10-Year |

Based on Net Asset Value(a) | 4.05% | 0.73% | 13.65% | 10.37% |

Based on Market Price(a) | 2.51% | –2.62% | 11.57% | 10.34% |

JPMorgan Emerging Markets Bond Global Diversified Index(b) | 3.75% | –1.08% | 10.77% | 8.87% |

Morningstar Closed-End Emerging Markets Bond Funds Category (based on Net Asset Value)(c) | 1.37% | –5.82% | 10.91% | 9.43% |

‡ Total returns shown for periods less than one year are not annualized.

a Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. Expenses of the Fund include management fee, interest expense and other fund expenses. Total returns shown take into account these fees and expenses. The expense ratio of the Fund for the six months ended April 30, 2014 was 2.25%.

b The unmanaged, unleveraged JPMorgan Emerging Markets Bond Global Diversified Index tracks total returns for U.S.-dollar-denominated debt instruments issued by emerging-market sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The index limits exposure to any one country.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

c Morningstar's Closed-End Emerging Markets Bond Funds category represents portfolios that invest more than 65% of their assets in foreign bonds from developing countries. The largest portion of the emerging-markets bond market comes from Latin America, followed by Eastern Europe. Africa, the Middle East and Asia make up the rest. Morningstar figures represent the average of the total returns based on net asset value reported by all of the closed-end funds designated by Morningstar, Inc. as falling into the Closed-End Emerging Markets Bond Funds category. Category returns assume reinvestment of all distributions. It is not possible to invest directly in a Morningstar category.

| Net Asset Value and Market Price | |

| | | As of 4/30/14 | | | As of 10/31/13 | |

| Net Asset Value | | $ | 9.36 | | | $ | 9.29 | |

| Market Price | | $ | 8.22 | | | $ | 8.29 | |

Prices and Net Asset Value fluctuate and are not guaranteed.

| Distribution Information | |

Six Months as of 4/30/14: Income Dividends | | $ | .27 | |

| April Income Dividend | | $ | .0450 | |

Current Annualized Distribution Rate (based on Net Asset Value) as of 4/30/14† | | | 5.77 | % |

Current Annualized Distribution Rate (based on Market Price) as of 4/30/14† | | | 6.57 | % |

† Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on April 30, 2014. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Distribution rates are historical, not guaranteed and will fluctuate. Distributions do not include return of capital or other non-income sources.

Gary Russell, CFA, Managing Director

Portfolio Manager of the fund. Began managing the fund in 2011.

— Joined Deutsche Asset & Wealth Management in 1996. Served as the head of the High Yield group in Europe and as an Emerging Markets portfolio manager.

— Prior to that, he spent four years at Citicorp as a research analyst and structurer of collateralized mortgage obligations. Prior to Citicorp, he served as an officer in the US Army from 1988 to 1991.

— Head of US High Yield Bonds: New York.

— BS, United States Military Academy (West Point); MBA, New York University, Stern School of Business.

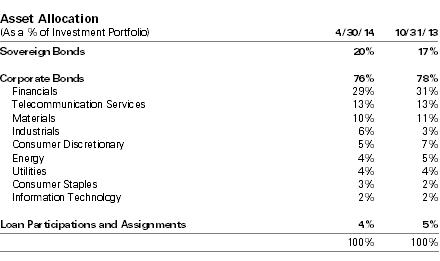

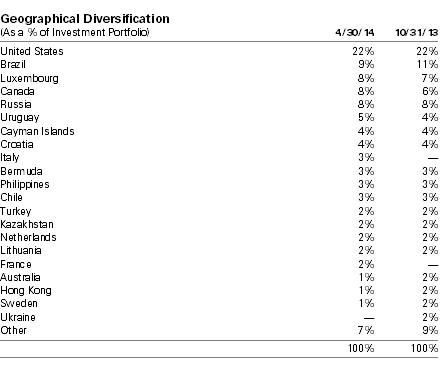

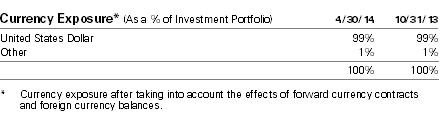

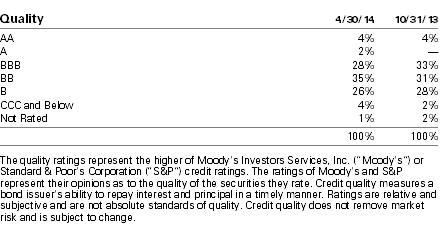

Portfolio Summary (Unaudited)

Investment Portfolio as of April 30, 2014 (Unaudited) | | | Principal Amount ($)(a) | | | Value ($) | |

| | | | |

| Bonds 127.2% | |

| Australia 0.7% | |

| FMG Resources (August 2006) Pty Ltd.: | |

| 144A, 6.0%, 4/1/2017 | | | | 340,000 | | | | 357,850 | |

| 144A, 6.875%, 4/1/2022 | | | | 70,000 | | | | 74,900 | |

| (Cost $410,000) | | | | 432,750 | |

| Austria 0.5% | |

| JBS Investments GmbH: | |

| 144A, 7.25%, 4/3/2024 | | | | 125,000 | | | | 126,719 | |

| 144A, 7.75%, 10/28/2020 | | | | 200,000 | | | | 212,750 | |

| (Cost $325,000) | | | | 339,469 | |

| Bermuda 4.0% | |

| Digicel Group Ltd.: | |

| 144A, 7.125%, 4/1/2022 | | | | 65,000 | | | | 65,325 | |

| 144A, 8.25%, 9/30/2020 | | | | 147,000 | | | | 156,555 | |

| Digicel Ltd., 144A, 8.25%, 9/1/2017 | | | | 2,200,000 | | | | 2,282,610 | |

| (Cost $2,477,253) | | | | 2,504,490 | |

| Brazil 12.6% | |

| Banco Bradesco SA: | |

| 144A, 5.75%, 3/1/2022 | | | | 425,000 | | | | 443,594 | |

| 144A, 5.9%, 1/16/2021 | | | | 2,000,000 | | | | 2,092,500 | |

| Banco do Brasil SA: | |

| 3.875%, 10/10/2022 | | | | 635,000 | | | | 588,169 | |

| 144A, 6.25%, 12/29/2049 | | | | 625,000 | | | | 531,250 | |

| Banco Santander Brasil SA, 144A, 8.0%, 3/18/2016 | BRL | | | 300,000 | | | | 123,713 | |

| Centrais Eletricas Brasileiras SA, 144A, 6.875%, 7/30/2019 | | | | 2,000,000 | | | | 2,162,500 | |

| Fibria Overseas Finance Ltd., 144A, 6.75%, 3/3/2021 | | | | 1,545,000 | | | | 1,695,637 | |

| Independencia International Ltd., REG S, 12.0%, 12/30/2016* | | | | 577,088 | | | | 0 | |

| Samarco Mineracao SA, 144A, 5.75%, 10/24/2023 | | | | 200,000 | | | | 203,000 | |

| (Cost $8,851,845) | | | | 7,840,363 | |

| Canada 9.6% | |

| AuRico Gold, Inc., 144A, 7.75%, 4/1/2020 | | | | 40,000 | | | | 39,100 | |

| Bombardier, Inc.: | |

| 144A, 4.75%, 4/15/2019 | | | | 35,000 | | | | 35,613 | |

| 144A, 5.75%, 3/15/2022 | | | | 485,000 | | | | 493,487 | |

| 144A, 6.0%, 10/15/2022 | | | | 65,000 | | | | 66,137 | |

| Cogeco Cable, Inc., 144A, 4.875%, 5/1/2020 | | | | 185,000 | | | | 185,925 | |

| First Quantum Minerals Ltd.: | |

| 144A, 6.75%, 2/15/2020 | | | | 84,000 | | | | 84,840 | |

| 144A, 7.0%, 2/15/2021 | | | | 84,000 | | | | 85,155 | |

| Garda World Security Corp., 144A, 7.25%, 11/15/2021 | | | | 50,000 | | | | 52,688 | |

| KGHM International Ltd., 144A, 7.75%, 6/15/2019 | | | | 1,250,000 | | | | 1,343,750 | |

| Kodiak Oil & Gas Corp., 5.5%, 1/15/2021 | | | | 70,000 | | | | 72,100 | |

| MDC Partners, Inc., 144A, 6.75%, 4/1/2020 | | | | 45,000 | | | | 47,588 | |

| MEG Energy Corp.: | |

| 144A, 6.5%, 3/15/2021 | | | | 675,000 | | | | 710,437 | |

| 144A, 7.0%, 3/31/2024 | | | | 95,000 | | | | 100,700 | |

| Novelis, Inc., 8.75%, 12/15/2020 | | | | 130,000 | | | | 144,950 | |

| Telesat Canada, 144A, 6.0%, 5/15/2017 | | | | 1,025,000 | | | | 1,059,594 | |

| Valeant Pharmaceuticals International, 144A, 6.75%, 8/15/2018 | | | | 1,115,000 | | | | 1,206,987 | |

| Videotron Ltd., 5.0%, 7/15/2022 | | | | 230,000 | | | | 231,725 | |

| (Cost $5,791,508) | | | | 5,960,776 | |

| Cayman Islands 5.9% | |

| IPIC GMTN Ltd., 144A, 5.5%, 3/1/2022 | | | | 500,000 | | | | 563,750 | |

| Offshore Group Investment Ltd.: | |

| 7.125%, 4/1/2023 | | | | 65,000 | | | | 64,025 | |

| 7.5%, 11/1/2019 | | | | 80,000 | | | | 83,200 | |

| Sable International Finance Ltd., 144A, 8.75%, 2/1/2020 | | | | 205,000 | | | | 229,600 | |

| Seagate HDD Cayman, 144A, 3.75%, 11/15/2018 | | | | 100,000 | | | | 103,500 | |

| UPCB Finance III Ltd., 144A, 6.625%, 7/1/2020 | | | | 2,055,000 | | | | 2,193,713 | |

| Wynn Macau Ltd., 144A, 5.25%, 10/15/2021 | | | | 425,000 | | | | 431,375 | |

| (Cost $3,551,909) | | | | 3,669,163 | |

| Chile 3.9% | |

| Corporacion Nacional del Cobre de Chile, REG S, 5.625%, 9/21/2035 | | | | 2,000,000 | | | | 2,157,206 | |

| Inversiones CMPC SA, 144A, 4.375%, 5/15/2023 | | | | 250,000 | | | | 243,219 | |

| (Cost $1,887,108) | | | | 2,400,425 | |

| Croatia 5.3% | |

| Republic of Croatia: | |

| 144A, 6.25%, 4/27/2017 | | | | 280,000 | | | | 300,650 | |

| 144A, 6.375%, 3/24/2021 | | | | 1,770,000 | | | | 1,902,750 | |

| REG S, 6.625%, 7/14/2020 | | | | 1,000,000 | | | | 1,090,000 | |

| (Cost $3,034,944) | | | | 3,293,400 | |

| Dominican Republic 1.8% | |

| Dominican Republic, 144A, 7.5%, 5/6/2021 (Cost $1,049,815) | | | | 1,000,000 | | | | 1,110,000 | |

| France 2.2% | |

| Autodis SA, 144A, 6.5%, 2/1/2019 | EUR | | | 150,000 | | | | 214,866 | |

| Credit Agricole SA, 144A, 7.875%, 1/29/2049 | | | | 130,000 | | | | 139,867 | |

| Financiere Gaillon 8 SAS, 144A, 7.0%, 9/30/2019 | EUR | | | 215,000 | | | | 301,263 | |

| Numericable Group SA: | |

| 144A, 4.875%, 5/15/2019 (b) | | | | 125,000 | | | | 126,250 | |

| 144A, 6.0%, 5/15/2022 (b) | | | | 200,000 | | | | 204,750 | |

| Societe Generale SA, 144A, 7.875%, 12/29/2049 | | | | 160,000 | | | | 167,264 | |

| SPCM SA, 144A, 6.0%, 1/15/2022 | | | | 185,000 | | | | 196,100 | |

| (Cost $1,303,472) | | | | 1,350,360 | |

| Germany 0.5% | |

| Techem GmbH, 144A, 6.125%, 10/1/2019 (Cost $260,750) | EUR | | | 200,000 | | | | 302,154 | |

| Ghana 1.2% | |

| Republic of Ghana, REG S, 8.5%, 10/4/2017 (Cost $726,659) | | | | 720,000 | | | | 733,500 | |

| Greece 0.2% | |

| FAGE Dairy Industry SA, 144A, 9.875%, 2/1/2020 (Cost $100,777) | | | | 100,000 | | | | 108,000 | |

| Hong Kong 0.8% | |

| CNOOC Finance 2012 Ltd., 144A, 3.875%, 5/2/2022 (Cost $529,306) | | | | 530,000 | | | | 523,801 | |

| Indonesia 0.8% | |

| Perusahaan Penerbit SBSN, 144A, 4.0%, 11/21/2018 (Cost $500,000) | | | | 500,000 | | | | 512,500 | |

| Ireland 0.8% | |

| Ardagh Packaging Finance PLC, 144A, 9.125%, 10/15/2020 | | | | 250,000 | | | | 278,125 | |

| MMC Finance Ltd., 144A, 5.55%, 10/28/2020 | | | | 200,000 | | | | 193,000 | |

| (Cost $468,387) | | | | 471,125 | |

| Israel 0.1% | |

| B Communications Ltd., 144A, 7.375%, 2/15/2021 (Cost $60,000) | | | | 60,000 | | | | 63,450 | |

| Italy 4.1% | |

| Astaldi SpA, 144A, 7.125%, 12/1/2020 | EUR | | | 880,000 | | | | 1,320,795 | |

| Enel SpA, 144A, 8.75%**, 9/24/2073 | | | | 450,000 | | | | 518,625 | |

| Snai SpA, 144A, 12.0%, 12/15/2018 | EUR | | | 440,000 | | | | 700,497 | |

| (Cost $2,243,019) | | | | 2,539,917 | |

| Japan 0.2% | |

| eAccess Ltd., 144A, 8.25%, 4/1/2018 (Cost $105,000) | | | | 105,000 | | | | 114,188 | |

| Kazakhstan 2.9% | |

| KazMunayGas National Co. JSC: | |

| 144A, 4.4%, 4/30/2023 | | | | 250,000 | | | | 235,938 | |

| 144A, 7.0%, 5/5/2020 | | | | 200,000 | | | | 224,750 | |

| Series 2, REG S, 9.125%, 7/2/2018 | | | | 1,150,000 | | | | 1,374,250 | |

| (Cost $1,564,501) | | | | 1,834,938 | |

| Lithuania 2.8% | |

| Republic of Lithuania: | |

| 144A, 6.125%, 3/9/2021 | | | | 1,000,000 | | | | 1,149,500 | |

| 144A, 7.375%, 2/11/2020 | | | | 500,000 | | | | 605,000 | |

| (Cost $1,526,054) | | | | 1,754,500 | |

| Luxembourg 10.7% | |

| Aguila 3 SA, 144A, 7.875%, 1/31/2018 | | | | 245,000 | | | | 259,394 | |

| Altice Financing SA, 144A, 7.875%, 12/15/2019 | | | | 200,000 | | | | 218,404 | |

| Altice Finco SA, 144A, 9.875%, 12/15/2020 | | | | 200,000 | | | | 229,300 | |

| Altice SA, 144A, 7.25%, 5/15/2022 (b) | EUR | | | 110,000 | | | | 158,885 | |

| CSN Resources SA, 144A, 6.5%, 7/21/2020 | | | | 1,170,000 | | | | 1,196,325 | |

| Empark Funding SA, 144A, 6.75%, 12/15/2019 | EUR | | | 210,000 | | | | 311,737 | |

| Intelsat Jackson Holdings SA: | |

| 144A, 5.5%, 8/1/2023 | | | | 565,000 | | | | 552,994 | |

| 7.25%, 10/15/2020 | | | | 260,000 | | | | 280,800 | |

| 7.5%, 4/1/2021 | | | | 850,000 | | | | 931,812 | |

| Intelsat Luxembourg SA: | |

| 7.75%, 6/1/2021 | | | | 120,000 | | | | 125,100 | |

| 8.125%, 6/1/2023 | | | | 15,000 | | | | 15,750 | |

| MHP SA, 144A, 8.25%, 4/2/2020 | | | | 645,000 | | | | 528,900 | |

| Millicom International Cellular SA, 144A, 4.75%, 5/22/2020 | | | | 200,000 | | | | 193,000 | |

| Minerva Luxembourg SA, 144A, 7.75%, 1/31/2023 | | | | 210,000 | | | | 216,038 | |

| Play Finance 1 SA, 144A, 6.5%, 8/1/2019 | EUR | | | 100,000 | | | | 147,406 | |

| Play Finance 2 SA, 144A, 5.25%, 2/1/2019 | EUR | | | 200,000 | | | | 286,488 | |

| Telenet Finance Luxembourg SCA, 144A, 6.375%, 11/15/2020 | EUR | | | 425,000 | | | | 632,267 | |

| Telenet Finance V Luxembourg SCA: | |

| 144A, 6.25%, 8/15/2022 | EUR | | | 110,000 | | | | 165,749 | |

| 144A, 6.75%, 8/15/2024 | EUR | | | 110,000 | | | | 167,869 | |

| Wind Acquisition Finance SA, 144A, 6.5%, 4/30/2020 | | | | 30,000 | | | | 32,175 | |

| (Cost $6,479,039) | | | | 6,650,393 | |

| Marshall Islands 0.2% | |

| Navios Maritime Holdings, Inc., 144A, 7.375%, 1/15/2022 (Cost $145,000) | | | | 145,000 | | | | 146,450 | |

| Mexico 0.5% | |

| America Movil SAB de CV, 8.46%, 12/18/2036 | MXN | | | 1,700,000 | | | | 122,236 | |

| Petroleos Mexicanos, 5.5%, 6/27/2044 | | | | 215,000 | | | | 210,700 | |

| (Cost $334,645) | | | | 332,936 | |

| Netherlands 2.8% | |

| Adria Bidco BV, 144A, 7.875%, 11/15/2020 | EUR | | | 270,000 | | | | 399,869 | |

| Ajecorp BV, 144A, 6.5%, 5/14/2022 | | | | 200,000 | | | | 188,000 | |

| Cable Communications Systems NV, 144A, 7.5%, 11/1/2020 | EUR | | | 100,000 | | | | 150,895 | |

| Lukoil International Finance BV, 144A, 6.656%, 6/7/2022 | | | | 1,000,000 | | | | 1,026,250 | |

| (Cost $1,761,274) | | | | 1,765,014 | |

| Peru 1.2% | |

| Ferreycorp SAA, 144A, 4.875%, 4/26/2020 | | | | 325,000 | | | | 315,250 | |

| Volcan Cia Minera SAA, 144A, 5.375%, 2/2/2022 | | | | 420,000 | | | | 414,750 | |

| (Cost $742,624) | | | | 730,000 | |

| Philippines 3.9% | |

| Bangko Sentral Ng Pilipinas, Series A, 8.6%, 6/15/2027 (Cost $1,915,785) | | | | 1,800,000 | | | | 2,445,750 | |

| Russia 10.1% | |

| Bank of Moscow, 144A, 6.699%, 3/11/2015 | | | | 1,000,000 | | | | 1,010,550 | |

| Rosneft Oil Co., 144A, 3.149%, 3/6/2017 | | | | 215,000 | | | | 203,712 | |

| Russian Agricultural Bank OJSC: | |

| 144A, 5.1%, 7/25/2018 | | | | 200,000 | | | | 186,250 | |

| REG S, 7.75%, 5/29/2018 | | | | 1,370,000 | | | | 1,390,550 | |

| Sberbank of Russia, 144A, 6.125%, 2/7/2022 | | | | 200,000 | | | | 194,000 | |

| Vimpel Communications, 144A, 6.493%, 2/2/2016 | | | | 1,500,000 | | | | 1,526,250 | |

| VTB Bank OJSC: | |

| 144A, 6.315%, 2/22/2018 | | | | 500,000 | | | | 499,250 | |

| 144A, 6.875%, 5/29/2018 | | | | 1,270,000 | | | | 1,270,000 | |

| (Cost $6,352,502) | | | | 6,280,562 | |

| Serbia 1.8% | |

| Republic of Serbia: | |

| REG S, 6.75%, 11/1/2024 | | | | 264,336 | | | | 267,640 | |

| 144A, 7.25%, 9/28/2021 | | | | 760,000 | | | | 844,550 | |

| (Cost $982,967) | | | | 1,112,190 | |

| Sweden 1.5% | |

| Ciech Group Financing AB, 144A, 9.5%, 11/30/2019 | EUR | | | 250,000 | | | | 400,510 | |

| Cyfrowy Polsat Finance AB, 144A, 7.125%, 5/20/2018 | EUR | | | 200,000 | | | | 292,731 | |

| Perstorp Holding AB, 144A, 8.75%, 5/15/2017 | | | | 210,000 | | | | 224,700 | |

| (Cost $847,505) | | | | 917,941 | |

| Turkey 3.3% | |

| Akbank TAS, 144A, 5.125%, 7/22/2015 | | | | 1,390,000 | | | | 1,426,140 | |

| Arcelik AS, 144A, 5.0%, 4/3/2023 | | | | 435,000 | | | | 408,683 | |

| Yapi ve Kredi Bankasi AS, 144A, 5.25%, 12/3/2018 | | | | 200,000 | | | | 201,040 | |

| (Cost $2,025,367) | | | | 2,035,863 | |

| United States 22.4% | |

| ACI Worldwide, Inc., 144A, 6.375%, 8/15/2020 | | | | 20,000 | | | | 21,050 | |

| Activision Blizzard, Inc., 144A, 5.625%, 9/15/2021 | | | | 160,000 | | | | 170,600 | |

| ADT Corp.: | |

| 4.125%, 4/15/2019 | | | | 10,000 | | | | 9,975 | |

| 144A, 6.25%, 10/15/2021 | | | | 30,000 | | | | 31,275 | |

| Air Lease Corp., 4.75%, 3/1/2020 | | | | 50,000 | | | | 53,250 | |

| Ally Financial, Inc., 3.5%, 1/27/2019 | | | | 165,000 | | | | 165,619 | |

| Alphabet Holding Co., Inc., 7.75%, 11/1/2017 (PIK) | | | | 55,000 | | | | 56,925 | |

| AMC Entertainment, Inc., 144A, 5.875%, 2/15/2022 | | | | 45,000 | | | | 46,013 | |

| AMC Networks, Inc., 7.75%, 7/15/2021 | | | | 10,000 | | | | 11,200 | |

| AmeriGas Finance LLC: | |

| 6.75%, 5/20/2020 | | | | 70,000 | | | | 76,125 | |

| 7.0%, 5/20/2022 | | | | 50,000 | | | | 55,000 | |

| Antero Resources Finance Corp., 144A, 5.375%, 11/1/2021 | | | | 20,000 | | | | 20,450 | |

| APX Group, Inc., 8.75%, 12/1/2020 | | | | 5,000 | | | | 5,100 | |

| Artesyn Escrow, Inc., 144A, 9.75%, 10/15/2020 | | | | 45,000 | | | | 41,850 | |

| Asbury Automotive Group, Inc., 8.375%, 11/15/2020 | | | | 10,000 | | | | 11,200 | |

| Ashland, Inc., 3.875%, 4/15/2018 | | | | 205,000 | | | | 210,637 | |

| Ashtead Capital, Inc., 144A, 6.5%, 7/15/2022 | | | | 160,000 | | | | 173,600 | |

| Audatex North America, Inc., 144A, 6.0%, 6/15/2021 | | | | 30,000 | | | | 32,175 | |

| Avis Budget Car Rental LLC, 5.5%, 4/1/2023 | | | | 35,000 | | | | 35,350 | |

| Aviv Healthcare Properties LP: | |

| 6.0%, 10/15/2021 | | | | 20,000 | | | | 21,000 | |

| 7.75%, 2/15/2019 | | | | 35,000 | | | | 37,538 | |

| BC Mountain LLC, 144A, 7.0%, 2/1/2021 | | | | 30,000 | | | | 29,175 | |

| Beazer Homes U.S.A., Inc., 144A, 5.75%, 6/15/2019 | | | | 150,000 | | | | 148,125 | |

| Berry Petroleum Co., LLC: | |

| 6.375%, 9/15/2022 | | | | 35,000 | | | | 35,875 | |

| 6.75%, 11/1/2020 | | | | 60,000 | | | | 63,375 | |

| BMC Software Finance, Inc., 144A, 8.125%, 7/15/2021 | | | | 95,000 | | | | 99,512 | |

| BOE Intermediate Holding Corp., 144A, 9.0%, 11/1/2017 (PIK) | | | | 52,275 | | | | 54,889 | |

| Boxer Parent Co., Inc., 144A, 9.0%, 10/15/2019 (PIK) | | | | 80,000 | | | | 78,400 | |

| BreitBurn Energy Partners LP, 7.875%, 4/15/2022 | | | | 100,000 | | | | 108,250 | |

| Cablevision Systems Corp., 5.875%, 9/15/2022 | | | | 25,000 | | | | 25,313 | |

| Calpine Corp., 144A, 7.875%, 7/31/2020 | | | | 171,000 | | | | 187,459 | |

| Century Intermediate Holding Co. 2, 144A, 9.75%, 2/15/2019 (PIK) | | | | 25,000 | | | | 26,625 | |

| CenturyLink, Inc.: | |

| Series V, 5.625%, 4/1/2020 | | | | 20,000 | | | | 21,025 | |

| Series W, 6.75%, 12/1/2023 | | | | 75,000 | | | | 80,437 | |

| Cequel Communications Holdings I LLC: | |

| 144A, 5.125%, 12/15/2021 | | | | 55,000 | | | | 53,625 | |

| 144A, 6.375%, 9/15/2020 | | | | 165,000 | | | | 172,837 | |

| Chaparral Energy, Inc., 7.625%, 11/15/2022 | | | | 10,000 | | | | 10,650 | |

| Chesapeake Energy Corp.: | |

| 3.25%, 3/15/2016 | | | | 90,000 | | | | 91,012 | |

| 3.467%, 4/15/2019 | | | | 75,000 | | | | 75,750 | |

| Chiquita Brands International, Inc., 7.875%, 2/1/2021 | | | | 20,000 | | | | 22,300 | |

| Cincinnati Bell, Inc.: | |

| 8.375%, 10/15/2020 | | | | 90,000 | | | | 99,000 | |

| 8.75%, 3/15/2018 | | | | 60,000 | | | | 63,000 | |

| CIT Group, Inc.: | |

| 3.875%, 2/19/2019 | | | | 235,000 | | | | 237,644 | |

| 4.25%, 8/15/2017 | | | | 925,000 | | | | 968,937 | |

| Clear Channel Communications, Inc., 9.0%, 12/15/2019 | | | | 125,000 | | | | 133,125 | |

| Clear Channel Worldwide Holdings, Inc.: | |

| Series A, 6.5%, 11/15/2022 | | | | 70,000 | | | | 74,550 | |

| Series B, 6.5%, 11/15/2022 | | | | 185,000 | | | | 197,950 | |

| CNH Capital LLC, 3.25%, 2/1/2017 | | | | 150,000 | | | | 153,000 | |

| Community Health Systems, Inc.: | |

| 144A, 5.125%, 8/1/2021 | | | | 10,000 | | | | 10,200 | |

| 144A, 6.875%, 2/1/2022 | | | | 45,000 | | | | 46,631 | |

| 7.125%, 7/15/2020 | | | | 35,000 | | | | 37,538 | |

| CONSOL Energy, Inc., 144A, 5.875%, 4/15/2022 | | | | 25,000 | | | | 25,750 | |

| Covanta Holding Corp., 5.875%, 3/1/2024 | | | | 45,000 | | | | 45,921 | |

| Crestwood Midstream Partners LP: | |

| 144A, 6.125%, 3/1/2022 | | | | 30,000 | | | | 31,350 | |

| 7.75%, 4/1/2019 | | | | 145,000 | | | | 156,962 | |

| Crown Media Holdings, Inc., 10.5%, 7/15/2019 | | | | 20,000 | | | | 22,700 | |

| CTP Transportation Products LLC, 144A, 8.25%, 12/15/2019 | | | | 55,000 | | | | 59,400 | |

| Darling International, Inc., 144A, 5.375%, 1/15/2022 | | | | 45,000 | | | | 46,238 | |

| Delphi Corp., 5.0%, 2/15/2023 | | | | 45,000 | | | | 47,700 | |

| Denbury Resources, Inc., 4.625%, 7/15/2023 | | | | 30,000 | | | | 28,538 | |

| DigitalGlobe, Inc., 5.25%, 2/1/2021 | | | | 25,000 | | | | 24,375 | |

| DISH DBS Corp.: | |

| 4.25%, 4/1/2018 | | | | 50,000 | | | | 52,250 | |

| 5.0%, 3/15/2023 | | | | 75,000 | | | | 76,500 | |

| Ducommun, Inc., 9.75%, 7/15/2018 | | | | 65,000 | | | | 72,475 | |

| E*TRADE Financial Corp.: | |

| 6.0%, 11/15/2017 | | | | 214,000 | | | | 224,432 | |

| 6.375%, 11/15/2019 | | | | 65,000 | | | | 70,606 | |

| EarthLink Holdings Corp., 7.375%, 6/1/2020 | | | | 40,000 | | | | 41,700 | |

| Endeavor Energy Resources LP, 144A, 7.0%, 8/15/2021 | | | | 115,000 | | | | 121,325 | |

| Endo Finance LLC, 144A, 5.75%, 1/15/2022 | | | | 40,000 | | | | 41,300 | |

| Energy Future Holdings Corp., Series Q, 6.5%, 11/15/2024* | | | | 25,000 | | | | 10,500 | |

| Entegris, Inc., 144A, 6.0%, 4/1/2022 | | | | 40,000 | | | | 40,500 | |

| EP Energy LLC, 7.75%, 9/1/2022 | | | | 25,000 | | | | 27,844 | |

| Equinix, Inc.: | |

| 5.375%, 4/1/2023 | | | | 120,000 | | | | 122,100 | |

| 7.0%, 7/15/2021 | | | | 35,000 | | | | 39,060 | |

| EXCO Resources, Inc., 8.5%, 4/15/2022 | | | | 35,000 | | | | 35,963 | |

| Exopack Holding Corp., 144A, 10.0%, 6/1/2018 | | | | 30,000 | | | | 32,250 | |

| First Data Corp.: | |

| 144A, 6.75%, 11/1/2020 | | | | 65,000 | | | | 69,387 | |

| 144A, 7.375%, 6/15/2019 | | | | 55,000 | | | | 58,987 | |

| 144A, 8.75%, 1/15/2022 (PIK) | | | | 65,000 | | | | 70,850 | |

| Florida East Coast Holdings Corp., 144A, 6.75%, 5/1/2019 | | | | 115,000 | | | | 118,162 | |

| Freescale Semiconductor, Inc., 144A, 6.0%, 1/15/2022 | | | | 50,000 | | | | 52,250 | |

| Fresenius Medical Care U.S. Finance, Inc., 144A, 6.5%, 9/15/2018 | | | | 20,000 | | | | 22,450 | |

| Frontier Communications Corp.: | |

| 7.125%, 1/15/2023 | | | | 160,000 | | | | 165,200 | |

| 7.625%, 4/15/2024 | | | | 20,000 | | | | 20,750 | |

| 8.125%, 10/1/2018 | | | | 600,000 | | | | 698,250 | |

| GenCorp, Inc., 7.125%, 3/15/2021 | | | | 70,000 | | | | 75,950 | |

| Halcon Resources Corp., 144A, 9.75%, 7/15/2020 | | | | 45,000 | | | | 48,037 | |

| Harron Communications LP, 144A, 9.125%, 4/1/2020 | | | | 90,000 | | | | 101,250 | |

| HCA, Inc.: | |

| 6.5%, 2/15/2020 | | | | 165,000 | | | | 183,975 | |

| 7.5%, 2/15/2022 | | | | 120,000 | | | | 136,860 | |

| Hexion U.S. Finance Corp., 6.625%, 4/15/2020 | | | | 95,000 | | | | 98,681 | |

| Hot Topic, Inc., 144A, 9.25%, 6/15/2021 | | | | 25,000 | | | | 27,313 | |

| Hughes Satellite Systems Corp.: | |

| 6.5%, 6/15/2019 | | | | 40,000 | | | | 44,000 | |

| 7.625%, 6/15/2021 | | | | 30,000 | | | | 33,825 | |

| Huntsman International LLC, 5.125%, 4/15/2021 | EUR | | | 210,000 | | | | 303,755 | |

| IAC/InterActiveCorp., 4.75%, 12/15/2022 | | | | 35,000 | | | | 34,388 | |

| IMS Health, Inc., 144A, 6.0%, 11/1/2020 | | | | 40,000 | | | | 42,200 | |

| Interactive Data Corp., 144A, 5.875%, 4/15/2019 (b) | | | | 65,000 | | | | 65,244 | |

| International Lease Finance Corp.: | |

| 3.875%, 4/15/2018 | | | | 100,000 | | | | 101,500 | |

| 5.75%, 5/15/2016 | | | | 15,000 | | | | 16,144 | |

| 6.25%, 5/15/2019 | | | | 35,000 | | | | 38,631 | |

| JBS U.S.A. LLC: | |

| 144A, 7.25%, 6/1/2021 | | | | 95,000 | | | | 102,481 | |

| 144A, 8.25%, 2/1/2020 | | | | 80,000 | | | | 87,560 | |

| Jo-Ann Stores Holdings, Inc., 144A, 9.75%, 10/15/2019 (PIK) | | | | 40,000 | | | | 41,700 | |

| Kenan Advantage Group, Inc., 144A, 8.375%, 12/15/2018 | | | | 30,000 | | | | 32,138 | |

| Level 3 Financing, Inc.: | |

| 144A, 6.125%, 1/15/2021 | | | | 30,000 | | | | 31,500 | |

| 8.125%, 7/1/2019 | | | | 25,000 | | | | 27,344 | |

| LifePoint Hospitals, Inc., 144A, 5.5%, 12/1/2021 | | | | 55,000 | | | | 57,200 | |

| Live Nation Entertainment, Inc., 144A, 7.0%, 9/1/2020 | | | | 70,000 | | | | 76,300 | |

| Mediacom Broadband LLC, 144A, 5.5%, 4/15/2021 | | | | 10,000 | | | | 9,975 | |

| Meritor, Inc.: | |

| 6.25%, 2/15/2024 | | | | 50,000 | | | | 49,875 | |

| 6.75%, 6/15/2021 | | | | 60,000 | | | | 63,450 | |

| MGM Resorts International, 7.625%, 1/15/2017 | | | | 55,000 | | | | 62,562 | |

| Micron Technology, Inc., 144A, 5.875%, 2/15/2022 | | | | 25,000 | | | | 26,375 | |

| Midstates Petroleum Co., Inc.: | |

| 9.25%, 6/1/2021 | | | | 125,000 | | | | 127,812 | |

| 10.75%, 10/1/2020 | | | | 70,000 | | | | 75,512 | |

| Morgan Stanley, Series H, 5.45%, 7/15/2019 | | | | 35,000 | | | | 35,306 | |

| MPT Operating Partnership LP, (REIT), 5.75%, 10/1/2020 | EUR | | | 185,000 | | | | 274,626 | |

| Murphy Oil U.S.A., Inc., 144A, 6.0%, 8/15/2023 | | | | 60,000 | | | | 61,950 | |

| NCR Corp.: | |

| 144A, 5.875%, 12/15/2021 | | | | 10,000 | | | | 10,600 | |

| 144A, 6.375%, 12/15/2023 | | | | 25,000 | | | | 26,750 | |

| Nortek, Inc., 8.5%, 4/15/2021 | | | | 70,000 | | | | 77,175 | |

| Northern Oil & Gas, Inc., 8.0%, 6/1/2020 | | | | 10,000 | | | | 10,625 | |

| NRG Energy, Inc., 144A, 6.25%, 5/1/2024 | | | | 185,000 | | | | 185,694 | |

| Oasis Petroleum, Inc.: | |

| 144A, 6.875%, 3/15/2022 | | | | 80,000 | | | | 86,800 | |

| 6.875%, 1/15/2023 | | | | 25,000 | | | | 27,063 | |

| 7.25%, 2/1/2019 | | | | 55,000 | | | | 58,712 | |

| Oshkosh Corp., 144A, 5.375%, 3/1/2022 | | | | 37,500 | | | | 38,344 | |

| Par Pharmaceutical Companies, Inc., 7.375%, 10/15/2020 | | | | 35,000 | | | | 37,975 | |

| Plastipak Holdings, Inc., 144A, 6.5%, 10/1/2021 | | | | 50,000 | | | | 52,000 | |

| Ply Gem Industries, Inc., 144A, 6.5%, 2/1/2022 | | | | 60,000 | | | | 60,000 | |

| PNK Finance Corp., 144A, 6.375%, 8/1/2021 | | | | 50,000 | | | | 52,500 | |

| Post Holdings, Inc., 144A, 6.75%, 12/1/2021 | | | | 105,000 | | | | 109,987 | |

| Regency Energy Partners LP, 5.875%, 3/1/2022 | | | | 5,000 | | | | 5,238 | |

| Reynolds Group Issuer, Inc., 5.75%, 10/15/2020 | | | | 130,000 | | | | 135,200 | |

| Roundy's Supermarkets, Inc., 144A, 10.25%, 12/15/2020 | | | | 40,000 | | | | 43,000 | |

| Sabine Pass Liquefaction LLC, 5.625%, 2/1/2021 | | | | 225,000 | | | | 232,312 | |

| Salix Pharmaceuticals Ltd., 144A, 6.0%, 1/15/2021 | | | | 30,000 | | | | 32,175 | |

| Samson Investment Co., 144A, 10.75%, 2/15/2020 | | | | 35,000 | | | | 36,925 | |

| SandRidge Energy, Inc., 7.5%, 3/15/2021 | | | | 65,000 | | | | 69,062 | |

| Seminole Hard Rock Entertainment, Inc., 144A, 5.875%, 5/15/2021 | | | | 20,000 | | | | 19,950 | |

| Signode Industrial Group Lux SA, 144A, 6.375%, 5/1/2022 | | | | 50,000 | | | | 50,500 | |

| Sirius XM Holdings, Inc., 144A, 5.875%, 10/1/2020 | | | | 40,000 | | | | 41,750 | |

| SIWF Merger Sub, Inc., 144A, 6.25%, 6/1/2021 | | | | 55,000 | | | | 57,200 | |

| Spirit AeroSystems, Inc., 144A, 5.25%, 3/15/2022 | | | | 65,000 | | | | 65,894 | |

| Sprint Communications, Inc., 6.0%, 11/15/2022 | | | | 60,000 | | | | 60,450 | |

| Sprint Corp., 144A, 7.125%, 6/15/2024 | | | | 55,000 | | | | 57,750 | |

| Starz LLC, 5.0%, 9/15/2019 | | | | 30,000 | | | | 31,088 | |

| T-Mobile U.S.A., Inc.: | |

| 6.125%, 1/15/2022 | | | | 20,000 | | | | 21,025 | |

| 6.464%, 4/28/2019 | | | | 60,000 | | | | 63,600 | |

| 6.5%, 1/15/2024 | | | | 20,000 | | | | 20,975 | |

| 6.625%, 4/1/2023 | | | | 40,000 | | | | 42,800 | |

| Taylor Morrison Communities, Inc., 144A, 5.25%, 4/15/2021 | | | | 40,000 | | | | 40,400 | |

| Tenet Healthcare Corp., 4.375%, 10/1/2021 | | | | 60,000 | | | | 57,525 | |

| The Goldman Sachs Group, Inc., Series L, 5.7%, 5/10/2019 | | | | 65,000 | | | | 66,381 | |

| Titan International, Inc., 144A, 6.875%, 10/1/2020 | | | | 115,000 | | | | 121,900 | |

| TransDigm, Inc., 7.5%, 7/15/2021 | | | | 80,000 | | | | 88,000 | |

| tw telecom holdings, Inc.: | |

| 5.375%, 10/1/2022 | | | | 10,000 | | | | 10,150 | |

| 6.375%, 9/1/2023 | | | | 50,000 | | | | 53,250 | |

| U.S. Coatings Acquisition Inc.2, 1.0%, 2/1/2020 | | | | 149,373 | | | | 149,224 | |

| U.S. Foods, Inc., 8.5%, 6/30/2019 | | | | 15,000 | | | | 16,163 | |

| United Rentals North America, Inc., 7.375%, 5/15/2020 | | | | 180,000 | | | | 199,350 | |

| Univision Communications, Inc., 144A, 8.5%, 5/15/2021 | | | | 10,000 | | | | 11,000 | |

| Visteon Corp., 6.75%, 4/15/2019 | | | | 44,000 | | | | 46,258 | |

| Whiting Petroleum Corp., 5.0%, 3/15/2019 | | | | 50,000 | | | | 52,625 | |

| Windstream Corp.: | |

| 6.375%, 8/1/2023 | | | | 45,000 | | | | 43,763 | |

| 7.75%, 10/1/2021 | | | | 720,000 | | | | 779,400 | |

| Woodbine Holdings LLC, 12.0%, 5/15/2016 | | | | 215,000 | | | | 228,975 | |

| Zayo Group LLC, 8.125%, 1/1/2020 | | | | 30,000 | | | | 32,925 | |

| (Cost $13,386,778) | | | | 13,979,993 | |

| Uruguay 6.2% | |

| Republic of Uruguay, 4.125%, 11/20/2045 (Cost $4,638,860) | | | | 4,685,716 | | | | 3,889,144 | |

| Venezuela 1.7% | |

| Petroleos de Venezuela SA, 144A, 8.5%, 11/2/2017 | | | | 410,000 | | | | 369,000 | |

| Republic of Venezuela, 7.65%, 4/21/2025 | | | | 900,000 | | | | 666,000 | |

| (Cost $971,795) | | | | 1,035,000 | |

Total Bonds (Cost $77,351,448) | | | | 79,180,505 | |

| | |

| Loan Participations and Assignments 7.8% | |

| Senior Loans*** | |

| Canada 0.7% | |

| Quebecor Media, Inc., Term Loan B1, 3.25%, 8/17/2020 | | | | 104,475 | | | | 103,887 | |

| Valeant Pharmaceuticals International, Inc.: | |

| Series C2, Term Loan B, 3.75%, 12/11/2019 | | | | 153,442 | | | | 153,347 | |

| Series D2, Term Loan B, 3.75%, 2/13/2019 | | | | 158,392 | | | | 158,570 | |

| (Cost $416,823) | | | | 415,804 | |

| United States 7.1% | |

| Albertson's LLC: | |

| Term Loan B1, 4.25%, 3/21/2016 | | | | 72,075 | | | | 72,278 | |

| Term Loan B2, 4.75%, 3/21/2019 | | | | 57,001 | | | | 57,243 | |

| Ardagh Holdings U.S.A, Inc., Term Loan B, 4.25%, 12/17/2019 | | | | 100,000 | | | | 99,958 | |

| Asurion LLC, Second Lien Term Loan, 8.50%, 3/3/2021 | | | | 70,000 | | | | 72,012 | |

| Avis Budget Car Rental LLC, Term Loan B, 3.0%, 3/15/2019 | | | | 89,548 | | | | 89,520 | |

| Burger King Corp., Term Loan B, 3.75%, 9/28/2019 | | | | 177,300 | | | | 178,358 | |

| Community Health Systems, Inc., Term Loan D, 4.25%, 1/27/2021 | | | | 49,875 | | | | 50,140 | |

| Del Monte Foods, Inc., First Lien Term Loan, 4.25%, 2/18/2021 | | | | 75,000 | | | | 74,789 | |

| DigitalGlobe, Inc., Term Loan B, 3.75%, 1/31/2020 | | | | 19,800 | | | | 19,864 | |

| First Data Corp., Term Loan, 4.152%, 3/24/2021 | | | | 85,000 | | | | 84,915 | |

| Freescale Semiconductor, Inc., Term Loan B4, 4.25%, 2/28/2020 | | | | 70,000 | | | | 70,066 | |

| Goodyear Tire & Rubber Co., Second Lien Term Loan, 4.75%, 4/30/2019 | | | | 665,000 | | | | 669,469 | |

| Hilton Worldwide Finance LLC, Term Loan B2, 3.5%, 10/26/2020 | | | | 106,842 | | | | 106,567 | |

| HJ Heinz Co., Term Loan B2, 3.5%, 6/5/2020 | | | | 307,675 | | | | 308,618 | |

| Level 3 Financing, Inc., Term Loan B, 4.0%, 1/15/2020 | | | | 135,000 | | | | 135,464 | |

| NRG Energy, Inc., Term Loan B, 2.75%, 7/2/2018 | | | | 314,775 | | | | 312,021 | |

| Par Pharmaceutical Companies, Inc., Term Loan B2, 4.0%, 9/30/2019 | | | | 307,976 | | | | 306,975 | |

| Pilot Travel Centers LLC: | |

| Term Loan B, 3.75%, 3/30/2018 | | | | 268,123 | | | | 268,795 | |

| Term Loan B2, 4.25%, 8/7/2019 | | | | 127,725 | | | | 128,283 | |

| Pinnacle Foods Finance LLC, Term Loan G, 3.25%, 4/29/2020 | | | | 133,650 | | | | 132,666 | |

| Ply Gem Industries, Inc., Term Loan, 4.0%, 2/1/2021 | | | | 70,000 | | | | 69,615 | |

| Polymer Group, Inc., First Lien Term Loan B, 5.25%, 12/19/2019 | | | | 99,750 | | | | 100,311 | |

| Ruby Western Pipeline Holdings LLC, Term Loan B, 3.5%, 3/27/2020 | | | | 31,163 | | | | 31,189 | |

| Samson Investment Co., Second Lien Term Loan, 5.0%, 9/25/2018 | | | | 530,000 | | | | 530,729 | |

| Spansion LLC, Term Loan, 4.0%, 12/19/2019 | | | | 45,000 | | | | 45,000 | |

| Syniverse Holdings, Inc., Term Loan B, 4.0%, 4/23/2019 | | | | 109,677 | | | | 109,636 | |

| Vogue International, Inc., Term Loan, 5.25%, 2/14/2020 | | | | 30,000 | | | | 30,000 | |

| Weight Watchers International, Inc., Term Loan B1, 3.16%, 4/2/2016 | | | | 129,347 | | | | 116,978 | |

| WP CPP Holdings LLC, First Lien Term Loan, 4.75%, 12/27/2019 | | | | 181,023 | | | | 181,702 | |

| (Cost $4,453,926) | | | | 4,453,161 | |

Total Loan Participations and Assignments (Cost $4,870,749) | | | | 4,868,965 | |

| | | Shares | | | Value ($) | |

| | | | |

| Preferred Stock 0.1% | |

| United States | |

| Ally Financial, Inc., Series G, 144A, 7.0% (Cost $46,589) | | | 47 | | | | 46,783 | |

| | | Contract Amount | | | Value ($) | |

| | | | |

| Call Options Purchased 0.0% | |

| Options on Interest Rate Swap Contracts | |

Pay Fixed Rate — 3.72% – Receive Floating — LIBOR, Swap Expiration Date 4/22/2026, Option Expiration Date 4/20/20161 (Cost $29,610) | | | 600,000 | | | | 19,068 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $82,298,396)† | | | 135.1 | | | | 84,115,321 | |

| Notes Payable | | | (41.7 | ) | | | (26,000,000 | ) |

| Other Assets and Liabilities, Net | | | 6.6 | | | | 4,161,229 | |

| Net Assets | | | 100.0 | | | | 62,276,550 | |

The following table represents bonds that are in default:

| Security | | Coupon | | Maturity Date | | Principal Amount ($) | | | Cost ($) | | | Value ($) | |

| Independencia International Ltd.* | | | 12.0 | % | 12/30/2016 | | | 577,088 | | | | 1,014,646 | | | | 0 | |

| Energy Future Holdings Corp.* | | | 6.5 | % | 11/15/2024 | | | 25,000 | | | | 14,503 | | | | 10,500 | |

| | | | | | | | | | | | | 1,029,149 | | | | 10,500 | |

* Non-income producing security.

** Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill. These securities are shown at their current rate as of April 30, 2014.

*** Senior loans in the Fund's portfolio generally are subject to mandatory and/or optional payment. As a result, the actual remaining maturity of senior loans in the Fund's portfolio may be substantially less than the stated maturities shown in this report. Senior loans pay interest at rates which vary based on prevailing interest rates, such as the prime rate offered by a major U.S. bank or LIBOR, and are shown at their current rate as of April 30, 2014.

† The cost for federal income tax purposes was $82,298,476. At April 30, 2014, net unrealized appreciation for all securities based on tax cost was $1,816,845. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $4,170,030 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $2,353,185.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) When-issued security.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

LIBOR: London Interbank Offered Rate

PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal.

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

REIT: Real Estate Investment Trust

At April 30, 2014, open written options contracts were as follows:

| Options on Interest Rate Swap Contracts | |

| | Swap Effective/ Expiration Date | | Contract Amount | | Option Expiration Date | | Premiums Received ($) | | | Value ($) (c) | |

Call Options Receive Fixed — 4.22% – Pay Floating — LIBOR | 4/22/2016 4/22/2026 | | | 600,000 | 1 | 4/20/2016 | | | 21,390 | | | | (11,043 | ) |

(c) Unrealized appreciation on written options on interest rate swap contracts at April 30, 2014 was $10,347.

At April 30, 2014, open credit default swap contracts sold were as follows:

| Bilateral Swaps | |

Effective/ Expiration Dates | | Notional Amount ($) (d) | | | Fixed Cash Flows Received | | Underlying Debt Obligation/ Quality Rating (e) | | Value ($) | | | Upfront Payments Paid/ (Received) ($) | | | Unrealized Appreciation ($) | |

6/20/2013 9/20/2018 | | | 50,000 | 2 | | | 5.0 | % | DISH DBS Corp., 6.75%, 6/1/2021, BB– | | | 7,629 | | | | 3,922 | | | | 3,707 | |

(d) The maximum potential amount of future undiscounted payments that the Fund could be required to make under a credit default swap contract would be the notional amount of the contract. These potential amounts would be partially offset by any recovery values of the referenced debt obligation or net amounts received from the settlement of buy protection credit default swap contracts entered into by the Fund for the same referenced debt obligation, if any.

(e) The quality ratings represent the higher of Moody's Investors Service, Inc. ("Moody's") or Standard & Poor's Corporation ("S&P") credit ratings and are unaudited.

Counterparties:

1 Nomura International PLC

2 Credit Suisse

As of April 30, 2014, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Appreciation ($) | | Counterparty |

| USD | | | 151,978 | | EUR | | | 110,000 | | 5/7/2014 | | | 628 | | Citigroup, Inc. |

| EUR | | | 4,705,000 | | USD | | | 6,537,971 | | 5/22/2014 | | | 10,838 | | Citigroup, Inc. |

| Total unrealized appreciation | | | | | 11,466 | |

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Depreciation ($) | | Counterparty |

| GBP | | | 25,000 | | USD | | | 41,834 | | 5/22/2014 | | | (369 | ) | JPMorgan Chase Securities, Inc. |

| Currency Abbreviations |

BRL Brazilian Real EUR Euro GBP British Pound MXN Mexican Peso USD United States Dollar |

For information on the Fund's policy and additional disclosures regarding options purchased, written option contracts, credit default swap contracts and forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of April 30, 2014 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments and other receivables, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Fixed Income Investments (f) | |

| Bonds | | $ | — | | | $ | 79,180,505 | | | $ | 0 | | | $ | 79,180,505 | |

| Loan Participations and Assignments | | | — | | | | 4,868,965 | | | | — | | | | 4,868,965 | |

| Preferred Stock (f) | | | — | | | | 46,783 | | | | — | | | | 46,783 | |

| Derivatives (g) | | | | | | | | | | | | | | | | |

| Purchased Options | | | — | | | | 19,068 | | | | — | | | | 19,068 | |

| Credit Default Swap Contracts | | | — | | | | 3,707 | | | | — | | | | 3,707 | |

| Forward Foreign Currency Exchange Contracts | | | — | | | | 11,466 | | | | — | | | | 11,466 | |

| Total | | $ | — | | | $ | 84,130,494 | | | $ | 0 | | | $ | 84,130,494 | |

| Liabilities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Derivatives (g) | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | | $ | — | | | $ | (369 | ) | | $ | — | | | $ | (369 | ) |

| Written Options | | | — | | | | (11,403 | ) | | | — | | | | (11,403 | ) |

| Total | | $ | — | | | $ | (11,772 | ) | | $ | — | | | $ | (11,772 | ) |

(f) See Investment Portfolio for additional detailed categorizations.

(g) Derivatives include value of options purchased, value of written options and unrealized appreciation (depreciation) on credit default swap contracts and forward foreign currency exchange contracts.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities | as of April 30, 2014 (Unaudited) | |

| Assets | |

| Investments in non-affiliated securities, at value (cost $82,298,396) | | $ | 84,115,321 | |

| Cash | | | 3,830,047 | |

| Foreign currency, at value (cost $258,023) | | | 246,078 | |

| Receivable for investments sold — when-issued securities | | | 95,219 | |

| Dividends receivable | | | 795 | |

| Interest receivable | | | 1,273,543 | |

| Unrealized appreciation on swap contracts | | | 3,707 | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 11,466 | |

| Upfront payments paid on swap contracts | | | 3,922 | |

| Foreign taxes recoverable | | | 20,193 | |

| Other asset | | | 1,809 | |

| Total assets | | | 89,602,100 | |

| Liabilities | |

| Payable for investments purchased | | | 481,331 | |

| Payable for investments purchased — when-issued securities | | | 638,274 | |

| Notes payable | | | 26,000,000 | |

| Interest on notes payable | | | 41,920 | |

| Options written, at value (premium received $21,390) | | | 11,043 | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 369 | |

| Accrued management fee | | | 50,800 | |

| Accrued Directors' fees | | | 280 | |

| Other accrued expenses and payables | | | 101,533 | |

| Total liabilities | | | 27,325,550 | |

| Net assets, at value | | $ | 62,276,550 | |

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities as of April 30, 2014 (Unaudited) (continued) | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 343,098 | |

Net unrealized appreciation (depreciation) on: Investments | | | 1,816,925 | |

| Swap contracts | | | 3,707 | |

| Foreign currency | | | (1,774 | ) |

| Written options | | | 10,347 | |

| Accumulated net realized gain (loss) | | | (2,632,091 | ) |

| Paid-in capital | | | 62,736,338 | |

| Net assets, at value | | $ | 62,276,550 | |

| Net Asset Value | |

Net asset value per share ($62,276,550 ÷ 6,657,025 shares of common stock issued and outstanding, $.01 par value, 100,000,000 shares authorized) | | $ | 9.36 | |

The accompanying notes are an integral part of the financial statements.

| for the six months ended April 30, 2014 (Unaudited) | |

| Investment Income | |

| Interest | | $ | 2,523,988 | |

| Dividends | | | 795 | |

| Total income | | | 2,524,783 | |

Expenses: Management fee | | | 306,597 | |

| Services to shareholders | | | 3,288 | |

| Custodian fees | | | 30,904 | |

| Accounting fees | | | 42,004 | |

| Audit fees | | | 44,406 | |

| Legal fees | | | 85,879 | |

| Reports to shareholders | | | 32,241 | |

| Directors' fees and expenses | | | 4,405 | |

| Interest expense | | | 146,847 | |

| Stock exchange listing fees | | | 11,778 | |

| Other | | | 20,638 | |

| Total expenses | | | 728,987 | |

| Net investment income | | | 1,795,796 | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) from: Investments | | | (175,630 | ) |

Other receivable**** | | | 317,400 | |

| Swap contracts | | | 814 | |

| Foreign currency | | | (129,578 | ) |

| | | | 13,006 | |

Change in net unrealized appreciation (depreciation) on: Investments | | | 538,706 | |

Other receivable**** | | | (281,369 | ) |

| Swap contracts | | | 1,603 | |

| Written options | | | 8,690 | |

| Foreign currency | | | (10,226 | ) |

| | | | 257,404 | |

| Net gain (loss) | | | 270,410 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 2,066,206 | |

**** Lehman Brothers International issued a Claims Determination Deed for the Fund as a partial settlement for a loss written off by the Fund in 2008. During the period, the Fund received the final two payments.

The accompanying notes are an integral part of the financial statements.

| for the six months ended April 30, 2014 (Unaudited) | |

Increase (Decrease) in Cash: Cash Flows from Operating Activities | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | 2,066,206 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used) by operating activities: Purchases of long-term investments | | | (14,994,982 | ) |

| Net amortization of premium/(accretion of discount) | | | 133,319 | |

| Proceeds from sales and maturities of long-term investments | | | 15,359,739 | |

| (Increase) decrease in interest receivable | | | 12,255 | |

| (Increase) decrease in dividends receivable | | | (795 | ) |

| (Increase) decrease in deferred loan costs | | | 76,823 | |

| (Increase) decrease in other assets | | | (14,713 | ) |

| Increase (decrease) in upfront payments paid/received on credit default swap contracts | | | 442 | |

| (Increase) decrease in receivable for investments and when-issued securities sold | | | 61,360 | |

| Increase (decrease) in interest on notes payable | | | 1,565 | |

| Increase (decrease) in payable for investments and when-issued securities purchased | | | (822,474 | ) |

| (Increase) decrease in written options, at value | | | (8,690 | ) |

| Increase (decrease) in other accrued expenses and payables | | | (57,250 | ) |

| Change in unrealized (appreciation) depreciation on investments and other receivable | | | (257,337 | ) |

| Change in unrealized (appreciation) depreciation on swaps | | | (1,603 | ) |

| Change in unrealized (appreciation) depreciation on forward foreign currency exchange contracts | | | 8,160 | |

| Net realized (gain) loss from investments and other receivable | | | (141,770 | ) |

| Cash provided (used) by operating activities | | | 1,420,255 | |

| Cash Flows from Financing Activities | | | | |

| Net increase (decrease) in notes payable | | | 3,000,000 | |

| Payment for shares repurchased | | | (1,315,528 | ) |

| Distributions paid | | | (1,825,160 | ) |

| Cash provided (used) for financing activities | | | (140,688 | ) |

| Increase (decrease) in cash | | | 1,279,567 | |

| Cash at beginning of period (including foreign currency) | | | 2,796,558 | |

| Cash at end of period (including foreign currency) | | $ | 4,076,125 | |

| Supplemental Disclosure | | | | |

| Interest paid on notes | | | (145,282 | ) |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | Increase (Decrease) in Net Assets | | Six Months Ended April 30, 2014 (Unaudited) | | | Year Ended October 31, 2013 | |

Operations: Net investment income | | $ | 1,795,796 | | | $ | 3,855,527 | |

Operations: Net investment income | | $ | 1,795,796 | | | $ | 3,855,527 | |

| Net realized gain (loss) | | | 13,006 | | | | 2,854,488 | |

| Change in net unrealized appreciation (depreciation) | | | 257,404 | | | | (6,811,690 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 2,066,206 | | | | (101,675 | ) |

| Distributions to shareholders from net investment income | | | (1,825,160 | ) | | | (3,850,424 | ) |

Fund share transactions: Cost of shares repurchased | | | (1,248,682 | ) | | | (2,275,810 | ) |

| Net increase (decrease) in net assets from Fund share transactions | | | (1,248,682 | ) | | | (2,275,810 | ) |

| Increase (decrease) in net assets | | | (1,007,636 | ) | | | (6,227,909 | ) |

| Net assets at beginning of period | | | 63,284,186 | | | | 69,512,095 | |

| Net assets at end of period (including undistributed net investment income of $343,098 and $372,462, respectively) | | $ | 62,276,550 | | | $ | 63,284,186 | |

| Other Information | |

| Shares outstanding at beginning of period | | | 6,811,025 | | | | 7,091,818 | |

| Shares repurchased | | | (154,000 | ) | | | (280,793 | ) |

| Shares outstanding at end of period | | | 6,657,025 | | | | 6,811,025 | |

The accompanying notes are an integral part of the financial statements.

| | | | Years Ended October 31, | |

| | Six Months Ended 4/30/14 (Unaudited) | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per Share Operating Performance | |

| Net asset value, beginning of period | | $ | 9.29 | | | $ | 9.80 | | | $ | 8.62 | | | $ | 8.88 | | | $ | 8.04 | | | $ | 5.99 | |

Income (loss) from investment operations: Net investment incomea | | | .27 | | | | .55 | | | | .59 | | | | .50 | | | | .55 | | | | .55 | |

| Net realized and unrealized gain (loss) | | | .05 | | | | (.55 | ) | | | 1.08 | e | | | (.26 | ) | | | .79 | | | | 2.30 | |

| Total from investment operations | | | .32 | | | | (.00 | )*** | | | 1.67 | | | | .24 | | | | 1.34 | | | | 2.85 | |

Less distributions from: Net investment income | | | (.27 | ) | | | (.55 | ) | | | (.51 | ) | | | (.55 | ) | | | (.51 | ) | | | (.57 | ) |

| Return of capital | | | — | | | | — | | | | — | | | | — | | | | — | | | | (.23 | ) |

| Total distributions | | | (.27 | ) | | | (.55 | ) | | | (.51 | ) | | | (.55 | ) | | | (.51 | ) | | | (.80 | ) |

NAV accretion resulting from repurchases of shares and shares tendered at a discount to NAVa | | | .02 | | | | .04 | | | | .02 | | | | .05 | | | | .01 | | | | — | |

| Net asset value, end of period | | $ | 9.36 | | | $ | 9.29 | | | $ | 9.80 | | | $ | 8.62 | | | $ | 8.88 | | | $ | 8.04 | |

| Market value, end of period | | $ | 8.22 | | | $ | 8.29 | | | $ | 8.82 | | | $ | 7.65 | | | $ | 8.44 | | | $ | 6.75 | |

| Total Return | |

Per share net asset value (%)b | | | 4.05 | ** | | | 1.06 | | | | 20.86 | e | | | 4.12 | | | | 18.08 | | | | 53.24 | |

Per share market value (%)b | | | 2.51 | ** | | | .20 | | | | 22.57 | | | | (2.78 | ) | | | 33.67 | | | | 53.20 | |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 62 | | | | 63 | | | | 70 | | | | 63 | | | | 88 | | | | 80 | |

| Ratio of expenses (including interest expense) (%) | | | 2.25 | * | | | 2.21 | | | | 2.36 | | | | 2.22 | | | | 1.68 | | | | 1.59 | |

| Ratio of expenses (excluding interest expense) (%) | | | 1.77 | * | | | 1.68 | | | | 1.67 | | | | 1.86 | | | | 1.68 | | | | 1.55 | |

| Ratio of net investment income (%) | | | 5.98 | * | | | 5.77 | | | | 6.54 | | | | 5.75 | | | | 6.53 | | | | 7.77 | |

| Portfolio turnover rate (%) | | | 18 | ** | | | 48 | | | | 25 | | | | 89 | | | | 31 | | | | 47 | c |

| Total debt outstanding, end of period ($ thousands) | | | 26,000 | | | | 23,000 | | | | 31,000 | | | | 26,000 | | | | — | | | | — | |

Asset coverage per $1,000 of debtd | | | 3,395 | | | | 3,751 | | | | 3,242 | | | | 3,410 | | | | — | | | | — | |

| | |

a Based on average shares outstanding during the period. b Total return based on net asset value reflects changes in the Fund's net asset value during the period. Total return based on market value reflects changes in market value. Each figure includes reinvestments of distributions. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares trade during the period. c The portfolio turnover rate including reverse repurchase agreements was 87% for the year ended October 31, 2009. d Asset coverage equals the total net assets plus borrowings of the Fund divided by the borrowings outstanding at period end. e During the year ended October 31, 2012, Lehman Brothers International issued a Claims Determination Deed to the Fund as a partial settlement for a loss written off by the Fund in 2008. The impact of this claim amounted to $0.13 per share. Excluding this pending claim, total return would have been 1.39% lower. * Annualized ** Not annualized *** Amount is less than $.005. |

Notes to Financial Statements (Unaudited)

A. Organization and Significant Accounting Policies

DWS Global High Income Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end, diversified management investment company organized as a Maryland corporation.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Debt securities and loan participations and assignments are valued at prices supplied by independent pricing services approved by the Fund's Board. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers and loan participations and assignments are valued at the mean of the most recent bid and ask quotations or evaluated prices, as applicable, obtained from broker-dealers. These securities are generally categorized as Level 2.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are generally categorized as Level 1. Over-the-counter written or purchased options are valued at the price provided by the broker-dealer with which the option was traded and are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurement is included in a table following the Fund's Investment Portfolio.

Securities Lending. DWS Global High Income Fund, Inc. is approved to participate in securities lending, but had no securities on loan during the six months ended April 30, 2014. Deutsche Bank AG, as lending agent, lends securities of the Fund to certain financial institutions under the terms of the Security Lending Agreement. The Fund retains the benefits of owning the securities it has loaned and continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

Loan Participations and Assignments. Loan Participations and Assignments are portions of loans originated by banks and sold in pieces to investors. These floating-rate loans ("Loans") in which the Fund invests are arranged between the borrower and one or more financial institutions ("Lenders"). These Loans may take the form of Senior Loans, which are corporate obligations often issued in connection with recapitalizations, acquisitions, leveraged buy outs and refinancing. The Fund invests in such Loans in the form of participations in Loans ("Participations") or assignments of all or a portion of Loans from third parties ("Assignments"). Participations typically result in the Fund having a contractual relationship with only the Lender, not with the borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing Participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the Loan, or any rights of set off against the borrower, and the Fund will not benefit directly from any collateral supporting the Loan in which it has purchased the Participation. As a result, the Fund assumes the credit risk of both the borrower and the Lender that is selling the Participation. Assignments typically result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement. Loans held by the Fund are generally in the form of Assignments, but the Fund may also invest in Participations. All Loans involve interest rate risk, liquidity risk and credit risk, including the potential default or insolvency of the borrower.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction, it is required to segregate cash or other liquid assets at least equal to the amount of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses incurred post-enactment may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At October 31, 2013, the Fund had a net tax basis capital loss carryforward of $2,345,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains until October 31, 2017, or until fully utilized, whichever occurs first.

The Fund has reviewed the tax positions for the open tax years as of October 31, 2013 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders monthly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in forward currency contracts, recognition of certain currency gain (loss) as ordinary income (loss), foreign denominated securities and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Statement of Cash Flows. Information on financial transactions which have been settled through the receipt and disbursement of cash is presented in the Statement of Cash Flows. The cash amount shown in the Statement of Cash Flows represents the cash and foreign currency position at the Fund's custodian bank at April 30, 2014.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes with the exception of securities in default of principal. The Fund uses the specific identification method for determining realized gain or loss on investments. The value of additional securities received as an interest payment is recorded as income and as the cost basis of such securities.

B. Derivative Instruments

Swaps. A swap is a contract between two parties to exchange future cash flows at periodic intervals based on the notional amount of the swap. A bilateral swap is a transaction between the fund and a counterparty where cash flows are exchanged between the two parties. A centrally cleared swap is a transaction executed between the fund and a counterparty, then cleared by a clearing member through a central clearinghouse. The central clearinghouse serves as the counterparty, with whom the fund exchanges cash flows.

The value of a swap is adjusted daily, and the change in value, if any, is recorded as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. Gains or losses are realized when the swap expires or is closed. Certain risks may arise when entering into swap transactions including counterparty default; liquidity; or unfavorable changes in interest rates or the value of the underlying reference security, commodity or index. In connection with bilateral swaps, securities and/or cash may be identified as collateral in accordance with the terms of the swap agreement to provide assets of value and recourse in the event of default. The maximum counterparty credit risk is the net present value of the cash flows to be received from or paid to the counterparty over the term of the swap, to the extent that this amount is beneficial to the Fund, in addition to any related collateral posted to the counterparty by the Fund. This risk may be partially reduced by a master netting arrangement between the Fund and the counterparty. Upon entering into a centrally cleared swap, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the notional amount of the swap. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value of the swap. In a cleared swap transaction, counterparty risk is minimized as the central clearinghouse acts as the counterparty.

An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Payments received or made at the end of the measurement period are recorded as realized gain or loss in the Statement of Operations.

Credit default swaps are agreements between a buyer and a seller of protection against predefined credit events for the reference entity. The Fund may enter into credit default swaps to gain exposure to an underlying issuer's credit quality characteristics without directly investing in that issuer or to hedge against the risk of a credit event on debt securities. As a seller of a credit default swap, the Fund is required to pay the par (or other agreed-upon) value of the referenced entity to the counterparty with the occurrence of a credit event by a third party, such as a U.S. or foreign corporate issuer, on the reference entity, which would likely result in a loss to the Fund. In return, the Fund receives from the counterparty a periodic stream of payments over the term of the swap provided that no credit event has occurred. If no credit event occurs, the Fund keeps the stream of payments with no payment obligations. The Fund may also buy credit default swaps, in which case the Fund functions as the counterparty referenced above. This involves the risk that the swap may expire worthless. It also involves counterparty risk that the seller may fail to satisfy its payment obligations to the Fund with the occurrence of a credit event. When the Fund sells a credit default swap, it will cover its commitment. This may be achieved by, among other methods, maintaining cash or liquid assets equal to the aggregate notional value of the reference entities for all outstanding credit default swaps sold by the Fund. For the six months ended April 30, 2014, the Fund entered into credit default swap agreements to gain exposure to the underlying issuer's credit quality characteristics.

Under the terms of a credit default swap, the Fund receives or makes periodic payments based on a specified interest rate on a fixed notional amount. These payments are recorded as a realized gain or loss in the Statement of Operations. Payments received or made as a result of a credit event or termination of the swap are recognized, net of a proportional amount of the upfront payment, as realized gains or losses in the Statement of Operations.

A summary of the open credit default swap contracts as of April 30, 2014 is included in a table following the Fund's Investment Portfolio. For the six months ended April 30, 2014, the investment in credit default swap contracts sold had a total notional value of $50,000.

Options. An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option), or sell to (put option), the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices and interest rate options, will require cash settlement by the Fund if exercised. For the six months ended April 30, 2014, the Fund entered into options on interest rate swaps in order to hedge against potential adverse interest rate movements of portfolio assets.