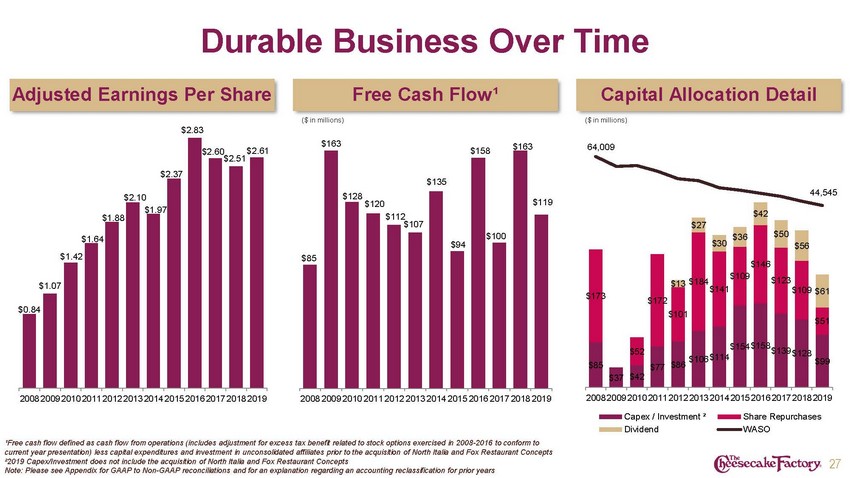

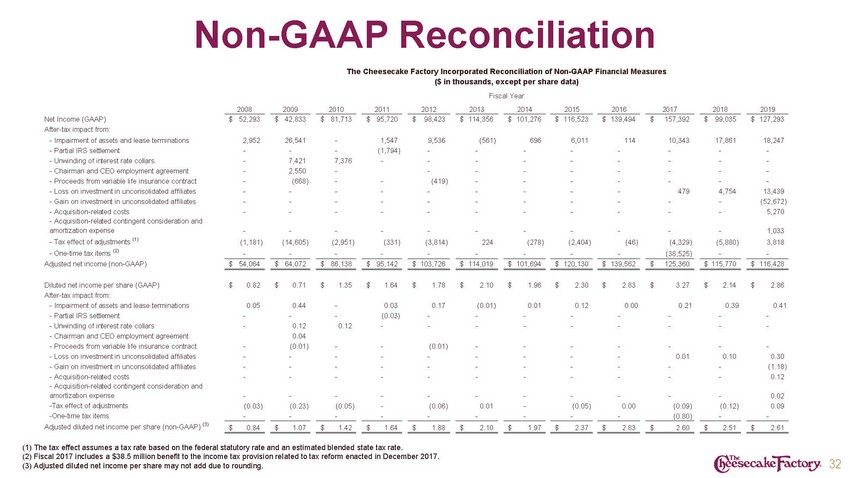

| Non-GAAP Reconciliation The Cheesecake Factory Incorporated Reconciliation of Non-GAAP Financial Measures ($ in thousands, except per share data) Fiscal Year 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net Income (GAAP) After-tax impact from: - Impairment of assets and lease terminations - Partial IRS settlement - Unwinding of interest rate collars - Chairman and CEO employment agreement - Proceeds from variable life insurance contract - Loss on investment in unconsolidated affiliates - Gain on investment in unconsolidated affiliates - Acquisition-related costs - Acquisition-related contingent consideration and amortization expense - Tax effect of adjustments (1) - One-time tax items (2) Adjusted net income (non-GAAP) $ 52,293 $ 42,833 $ 81,713 $ 95,720 $ 98,423 $ 114,356 $ 101,276 $ 116,523 $ 139,494 $ 157,392 $ 99,035 $ 127,293 2,952 - - - - - - - 26,541 - 7,421 2,550 (668) - - - - - 7,376 - - - - - 1,547 (1,794) - 9,536 - - - (419) - - - (561) 696 6,011 - - - - - - - 114 10,343 - - - - 479 - - 17,861 - - - - 4,754 - - 18,247 - - - - 13,439 (52,672) 5,270 - - - - - - - - - - - - - - - - - - - - - - - - - - (1,181) - - (14,605) - - (2,951) - - - (3,814) - - - - (2,404) - - - (4,329) (38,525) - (5,880) - 1,033 3,818 - (331) 224 (278) (46) - - - - $ 54,064 $ 64,072 $ 86,138 $ 95,142 $ 103,726 $ 114,019 $ 101,694 $ 120,130 $ 139,562 $ 125,360 $ 115,770 $ 116,428 Diluted net income per share (GAAP) After-tax impact from: - Impairment of assets and lease terminations - Partial IRS settlement - Unwinding of interest rate collars - Chairman and CEO employment agreement - Proceeds from variable life insurance contract - Loss on investment in unconsolidated affiliates - Gain on investment in unconsolidated affiliates - Acquisition-related costs - Acquisition-related contingent consideration and amortization expense -Tax effect of adjustments -One-time tax items Adjusted diluted net income per share (non-GAAP) (3) $ 0.82 $ 0.71 $ 1.35 $ 1.64 $ 1.78 $ 2.10 $ 1.96 $ 2.30 $ 2.83 $ 3.27 $ 2.14 $ 2.86 0.05 0.44 - - 0.03 (0.03) - 0.17 (0.01) - - 0.01 0.12 0.00 0.21 0.39 0.41 - - - - - - - - - - - - - - - - - 0.12 0.04 (0.01) - - - 0.12 - - - - - - - - - - - - (0.01) - - - - - - - - - - - - - - - - - - - - - - 0.01 0.10 0.30 (1.18) 0.12 - - - - - (0.03) - - (0.23) - - (0.05) - - - - - (0.06) - - - - - - (0.05) - - - - (0.12) - 0.02 0.09 0.01 0.00 (0.09) (0.80) - - - $ 0.84 $ 1.07 $ 1.42 $ 1.64 $ 1.88 $ 2.10 $ 1.97 $ 2.37 $ 2.83 $ 2.60 $ 2.51 $ 2.61 (1) The tax effect assumes a tax rate based on the federal statutory rate and an estimated blended state tax rate. (2) Fiscal 2017 includes a $38.5 million benefit to the income tax provision related to tax reform enacted in December 2017. (3) Adjusted diluted net income per share may not add due to rounding. 32 |