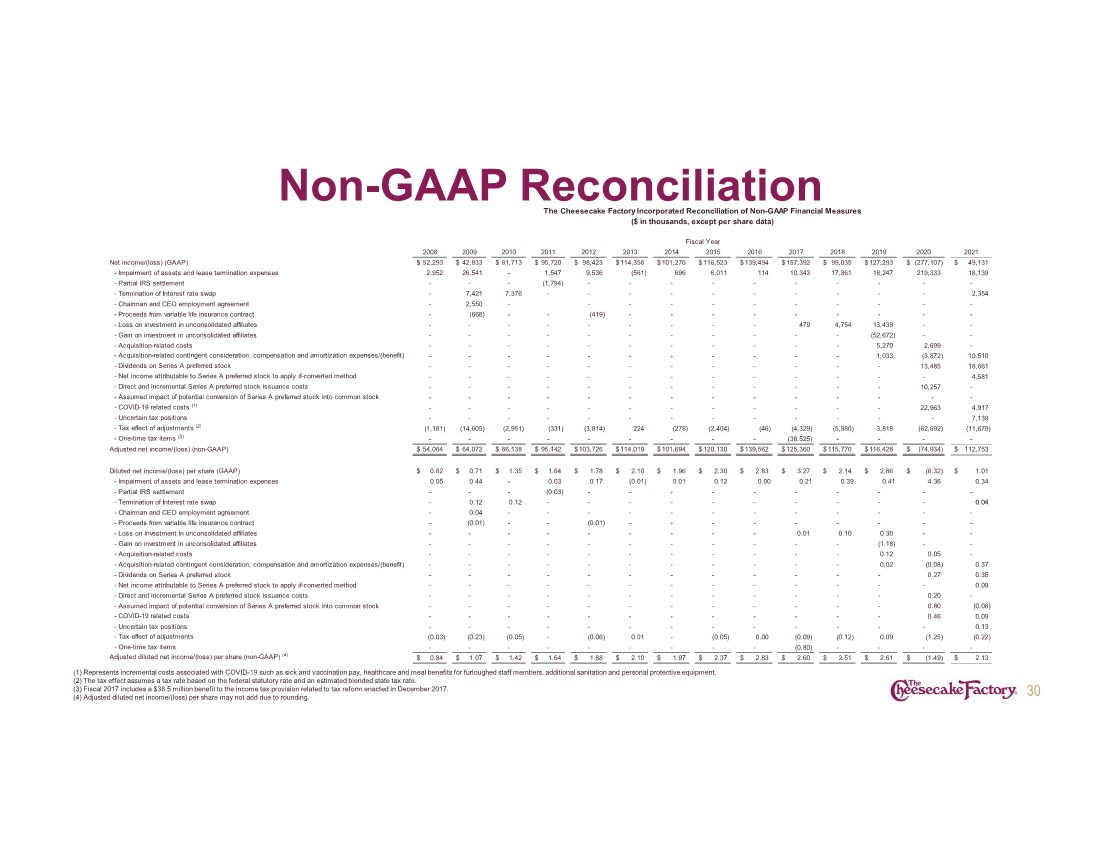

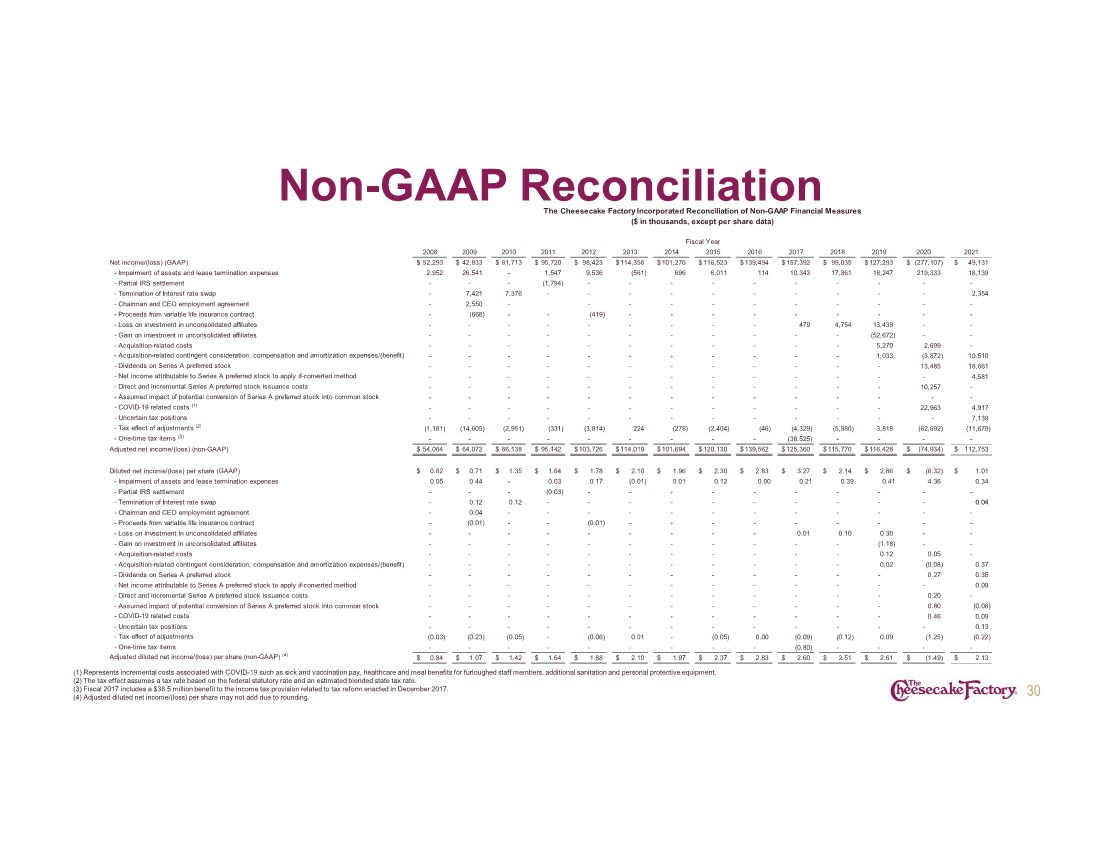

| Non-GAAP Reconciliation (1) Represents incremental costs associated with COVID-19 such as sick and vaccination pay, healthcare and meal benefits for furloughed staff members, additional sanitation and personal protective equipment. (2) The tax effect assumes a tax rate based on the federal statutory rate and an estimated blended state tax rate. (3) Fiscal 2017 includes a $38.5 million benefit to the income tax provision related to tax reform enacted in December 2017. (4) Adjusted diluted net income/(loss) per share may not add due to rounding. 30 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Net income/(loss) (GAAP) 52,293 $ 42,833 $ 81,713 $ 95,720 $ 98,423 $ 114,356 $ 101,276 $ 116,523 $ 139,494 $ 157,392 $ 99,035 $ 127,293 $ (277,107) $ 49,131 $ - Impairment of assets and lease termination expenses 2,952 26,541 - 1,547 9,536 (561) 696 6,011 114 10,343 17,861 18,247 219,333 18,139 - Partial IRS settlement - - - (1,794) - - - - - - - - - - - Termination of Interest rate swap - 7,421 7,376 - - - - - - - - - - 2,354 - Chairman and CEO employment agreement - 2,550 - - - - - - - - - - - - Proceeds from variable life insurance contract - (668) - - (419) - - - - - - - - - - Loss on investment in unconsolidated affiliates - - - - - - - - - 479 4,754 13,439 - - - Gain on investment in unconsolidated affiliates - - - - - - - - - - - (52,672) - - - Acquisition-related costs - - - - - - - - - - - 5,270 2,699 - - Acquisition-related contingent consideration, compensation and amortization expenses/(benefit) - - - - - - - - - - - 1,033 (3,872) 19,510 - Dividends on Series A preferred stock - - - - - - - - - - - - 13,485 18,661 - Net income attributable to Series A preferred stock to apply if-converted method - - - - - - - - - - - - - 4,581 - Direct and incremental Series A preferred stock issuance costs - - - - - - - - - - - - 10,257 - - Assumed impact of potential conversion of Series A preferred stock into common stock ------------ - - - COVID-19 related costs (1) - - - - - - - - - - - - 22,963 4,917 - Uncertain tax positions ------------ - 7,139 - Tax effect of adjustments (2) (1,181) (14,605) (2,951) (331) (3,814) 224 (278) (2,404) (46) (4,329) (5,880) 3,818 (62,692) (11,679) - One-time tax items (3) - - - - - - - - - (38,525) - - - - Adjusted net income/(loss) (non-GAAP) 54,064 $ 64,072 $ 86,138 $ 95,142 $ 103,726 $ 114,019 $ 101,694 $ 120,130 $ 139,562 $ 125,360 $ 115,770 $ 116,428 $ (74,934) $ 112,753 $ Diluted net income/(loss) per share (GAAP) 0.82 $ 0.71 $ 1.35 $ 1.64 $ 1.78 $ 2.10 $ 1.96 $ 2.30 $ 2.83 $ 3.27 $ 2.14 $ 2.86 $ (6.32) $ 1.01 $ - Impairment of assets and lease termination expenses 0.05 0.44 - 0.03 0.17 (0.01) 0.01 0.12 0.00 0.21 0.39 0.41 4.36 0.34 - Partial IRS settlement - - - (0.03) - - - - - - - - - - - Termination of Interest rate swap - 0.12 0.12 - - - - - - - - - - 0.04 - Chairman and CEO employment agreement - 0.04 - - - - - - - - - - - - - Proceeds from variable life insurance contract - (0.01) - - (0.01) - - - - - - - - - - Loss on investment in unconsolidated affiliates - - - - - - - - - 0.01 0.10 0.30 - - - Gain on investment in unconsolidated affiliates - - - - - - - - - - - (1.18) - - - Acquisition-related costs - - - - - - - - - - - 0.12 0.05 - - Acquisition-related contingent consideration, compensation and amortization expenses/(benefit) - - - - - - - - - - - 0.02 (0.08) 0.37 - Dividends on Series A preferred stock - - - - - - - - - - - - 0.27 0.35 - Net income attributable to Series A preferred stock to apply if-converted method - - - - - - - - - - - - - 0.09 - Direct and incremental Series A preferred stock issuance costs - - - - - - - - - - - - 0.20 - - Assumed impact of potential conversion of Series A preferred stock into common stock - - - - - - - - - - - - 0.80 (0.08) - COVID-19 related costs - - - - - - - - - - - - 0.46 0.09 - Uncertain tax positions - - - - - - - - - - - - - 0.13 - Tax effect of adjustments (0.03) (0.23) (0.05) - (0.06) 0.01 - (0.05) 0.00 (0.09) (0.12) 0.09 (1.25) (0.22) - One-time tax items - - - - - - - - - (0.80) - - - - Adjusted diluted net income/(loss) per share (non-GAAP) (4) 0.84 $ 1.07 $ 1.42 $ 1.64 $ 1.88 $ 2.10 $ 1.97 $ 2.37 $ 2.83 $ 2.60 $ 2.51 $ 2.61 $ (1.49) $ 2.13 $ Fiscal Year The Cheesecake Factory Incorporated Reconciliation of Non-GAAP Financial Measures ($ in thousands, except per share data) |