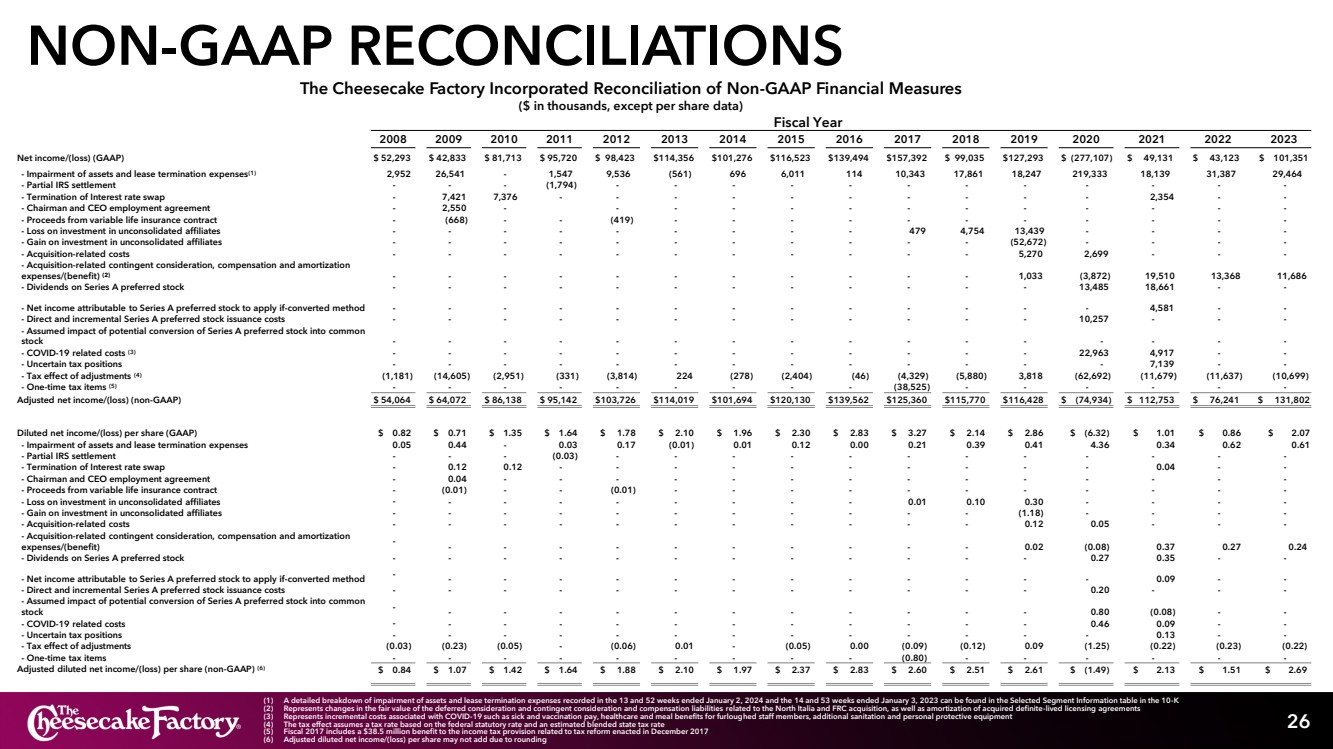

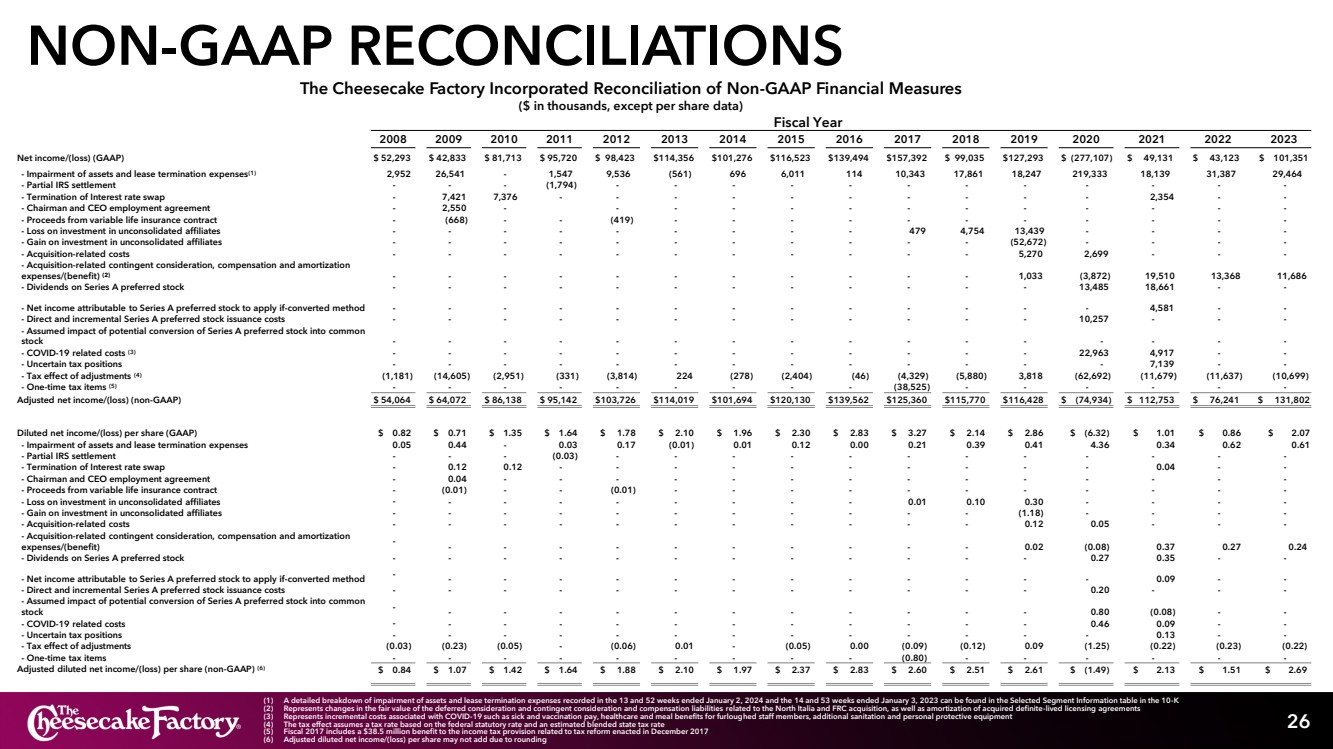

| NON-GAAP RECONCILIATIONS 26 The Cheesecake Factory Incorporated Reconciliation of Non-GAAP Financial Measures ($ in thousands, except per share data) Fiscal Year 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Net income/(loss) (GAAP) $ 52,293 $ 42,833 $ 81,713 $ 95,720 $ 98,423 $114,356 $101,276 $116,523 $139,494 $157,392 $ 99,035 $127,293 $ (277,107) $ 49,131 $ 43,123 $ 101,351 - Impairment of assets and lease termination expenses(1) 2,952 26,541 - 1,547 9,536 (561) 696 6,011 114 10,343 17,861 18,247 219,333 18,139 31,387 29,464 - Partial IRS settlement - - - (1,794) - - - - - - - - - - - - - Termination of Interest rate swap - 7,421 7,376 - - - - - - - - - - 2,354 - - - Chairman and CEO employment agreement - 2,550 - - - - - - - - - - - - - - Proceeds from variable life insurance contract - (668) - - (419) - - - - - - - - - - - - Loss on investment in unconsolidated affiliates - - - - - - - - - 479 4,754 13,439 - - - - - Gain on investment in unconsolidated affiliates - - - - - - - - - - - (52,672) - - - - - Acquisition-related costs - - - - - - - - - - - 5,270 2,699 - - - - Acquisition-related contingent consideration, compensation and amortization expenses/(benefit) (2) - - - - - - - - - - - 1,033 (3,872) 19,510 13,368 11,686 - Dividends on Series A preferred stock - - - - - - - - - - - - 13,485 18,661 - - - Net income attributable to Series A preferred stock to apply if-converted method - - - - - - - - - - - - - 4,581 - - - Direct and incremental Series A preferred stock issuance costs - - - - - - - - - - - - 10,257 - - - - Assumed impact of potential conversion of Series A preferred stock into common stock - - - - - - - - - - - - - - - - - COVID-19 related costs (3) - - - - - - - - - - - - 22,963 4,917 - - - Uncertain tax positions - - - - - - - - - - - - - 7,139 - - - Tax effect of adjustments (4) (1,181) (14,605) (2,951) (331) (3,814) 224 (278) (2,404) (46) (4,329) (5,880) 3,818 (62,692) (11,679) (11,637) (10,699) - One-time tax items (5) - - - - - - - - - (38,525) - - - - - - Adjusted net income/(loss) (non-GAAP) $ 54,064 $ 64,072 $ 86,138 $ 95,142 $103,726 $114,019 $101,694 $120,130 $139,562 $125,360 $115,770 $116,428 $ (74,934) $ 112,753 $ 76,241 $ 131,802 Diluted net income/(loss) per share (GAAP) $ 0.82 $ 0.71 $ 1.35 $ 1.64 $ 1.78 $ 2.10 $ 1.96 $ 2.30 $ 2.83 $ 3.27 $ 2.14 $ 2.86 $ (6.32) $ 1.01 $ 0.86 $ 2.07 - Impairment of assets and lease termination expenses 0.05 0.44 - 0.03 0.17 (0.01) 0.01 0.12 0.00 0.21 0.39 0.41 4.36 0.34 0.62 0.61 - Partial IRS settlement - - - (0.03) - - - - - - - - - - - - - Termination of Interest rate swap - 0.12 0.12 - - - - - - - - - - 0.04 - - - Chairman and CEO employment agreement - 0.04 - - - - - - - - - - - - - - - Proceeds from variable life insurance contract - (0.01) - - (0.01) - - - - - - - - - - - - Loss on investment in unconsolidated affiliates - - - - - - - - - 0.01 0.10 0.30 - - - - - Gain on investment in unconsolidated affiliates - - - - - - - - - - - (1.18) - - - - - Acquisition-related costs - - - - - - - - - - - 0.12 0.05 - - - - Acquisition-related contingent consideration, compensation and amortization expenses/(benefit) - - - - - - - - - - - 0.02 (0.08) 0.37 0.27 0.24 - Dividends on Series A preferred stock - - - - - - - - - - - - 0.27 0.35 - - - Net income attributable to Series A preferred stock to apply if-converted method - - - - - - - - - - - - - 0.09 - - - Direct and incremental Series A preferred stock issuance costs - - - - - - - - - - - - 0.20 - - - - Assumed impact of potential conversion of Series A preferred stock into common stock - - - - - - - - - - - - 0.80 (0.08) - - - COVID-19 related costs - - - - - - - - - - - - 0.46 0.09 - - - Uncertain tax positions - - - - - - - - - - - - - 0.13 - - - Tax effect of adjustments (0.03) (0.23) (0.05) - (0.06) 0.01 - (0.05) 0.00 (0.09) (0.12) 0.09 (1.25) (0.22) (0.23) (0.22) - One-time tax items - - - - - - - - - (0.80) - - - - - - Adjusted diluted net income/(loss) per share (non-GAAP) (6) $ 0.84 $ 1.07 $ 1.42 $ 1.64 $ 1.88 $ 2.10 $ 1.97 $ 2.37 $ 2.83 $ 2.60 $ 2.51 $ 2.61 $ (1.49) $ 2.13 $ 1.51 $ 2.69 (1) A detailed breakdown of impairment of assets and lease termination expenses recorded in the 13 and 52 weeks ended January 2, 2024 and the 14 and 53 weeks ended January 3, 2023 can be found in the Selected Segment Information table in the 10-K (2) Represents changes in the fair value of the deferred consideration and contingent consideration and compensation liabilities related to the North Italia and FRC acquisition, as well as amortization of acquired definite-lived licensing agreements (3) Represents incremental costs associated with COVID-19 such as sick and vaccination pay, healthcare and meal benefits for furloughed staff members, additional sanitation and personal protective equipment (4) The tax effect assumes a tax rate based on the federal statutory rate and an estimated blended state tax rate (5) Fiscal 2017 includes a $38.5 million benefit to the income tax provision related to tax reform enacted in December 2017 (6) Adjusted diluted net income/(loss) per share may not add due to rounding |