Management's Discussion and Analysis

The following is management's discussion and analysis ("MD&A") of the financial condition and results of operations to enable a reader to assess material changes in financial condition and results of operations for the year ended December 31, 2008, compared to those of the respective periods in the prior years. This MD&A has been prepared as of February 23, 2009 and is intended to supplement and complement the audited consolidated financial statements and notes thereto for the year ended December 31, 2008 (collectively, the "Financial Statements"). You are encouraged to review the Financial Statements in conjunction with your review of this MD&A and the most recent Form 40-F/Annual Information Form on file with the US Securities and Exchange Commission and Canadian provincial securities regulatory authorities. All amounts are in Canadian dollars unless otherwise noted.

INDUSTRY OVERVIEW

Palladium is a precious metal, along with gold, silver and platinum. It is one of the six platinum group metals ("PGMs"), which also include platinum, rhodium, ruthenium, iridium and osmium. Palladium is used in the manufacture of catalytic converters in the automotive industry, the manufacture of jewellery and electronics, and in dental and chemical applications. As a precious metal, there is also investment demand for palladium in bar format by exchange traded funds and institutional investors.

Supply

Palladium is typically produced as a by-product metal from platinum mines and nickel mines. According to the CPM Group, a leading commodities market research and consulting firm, most of the world's palladium is supplied by Russia (36%), the Republic of South Africa (31%) and North America (10%). The CPM Group estimates that global supply of palladium decreased by approximately 1% in 2008 to 8,452,000 ounces. Of this total, mine production accounts for approximately 6,762,000 ounces (an estimated decrease of 4% from the prior year) and secondary recovery of palladium accounts for approximately 1,690,000 ounces.

Demand

The CPM Group estimates that global fabrication demand for palladium (excluding investor demand) decreased by approximately 1% in 2008 to 7,741,000 ounces, primarily as a result of reduced demand in the U.S. and European automotive industries. The year 2008 marked the first time since 2001 that overall palladium demand has declined.

The CPM Group also estimates that 53% of the global demand for palladium in 2008 stemmed from the automotive industry for use in auto catalysts, 15% from electronics, 10% from dental applications, 9% from Chinese demand, and 13% from other uses such as jewellery, chemical catalysts and petroleum refining catalysts.

The primary use for palladium in the automotive industry is in the manufacture of catalytic converters which reduce harmful vehicle exhaust emissions by converting them into less harmful carbon dioxide, nitrogen and water vapour. Palladium, platinum and, to a lesser extent, rhodium are the primary components in catalytic converters. The demand for palladium in the automotive industry has more than doubled in the last ten years due to the larger number of vehicles being manufactured and the tightening of emissions standards worldwide, resulting in steady growth in the use of catalytic converters. Catalytic converters are now included in over 96% of new cars worldwide. With the palladium price currently substantially below that of platinum automakers have increasingly been switching their catalyst formulations from those based on platinum to palladium. The use of palladium in diesel auto catalysts also has increased due to continuing technological improvements. Until a few years ago there was no palladium used in diesel auto catalysts, since the residual sulfur in diesel fuel coats the palladium and renders it inert. Technological innovations now allow some of the platinum in diesel catalysts to be substituted with palladium, a trend that has been underway for several years. Palladium can now comprise up to approximately 30% of the PGM content of a diesel catalytic converter.

In the electronics industry, palladium is used mainly in the production of multi-layer ceramic capacitors, which are used in electrical components for cellular telephones, personal and notebook computers, fax

2

machines and home electronics. In the dental industry, palladium is widely used in alloys for dental restoration. Palladium is also used in the manufacture of jewellery and may be used either on its own or as an alloy in white gold. Additionally, various chemical applications use palladium, including the manufacture of paints, adhesives, fibers and coatings. Palladium is also used in the manufacture of polyester.

An important macroeconomic trend has been increased investor demand for palladium as a precious metal along with the other precious metals (i.e., platinum, gold and silver). Strong investor sentiment for these precious metals has provided support for palladium pricing. Increased participation by a greater variety of market participants, the resulting improvement in liquidity, and the introduction of new investment vehicles are all influencing investment demand for palladium. Palladium exchange traded funds ("ETFs") were introduced in 2007 by the same firms that have introduced platinum ETFs.

COMPANY OVERVIEW

Overview of North American Palladium's Business

North American Palladium Ltd. is Canada's only primary producer of PGMs. Prior to the temporary shut down of the Lac des Iles mine, the Company produced an estimated 4% of annual global palladium production. While the bulk of the Company's revenue is derived from the sale of palladium, the Company also generates a considerable portion of its revenue from the sale of platinum, gold, nickel, and copper, all of which are by-products of the Company's palladium mining operations. North American Palladium's principal properties and projects are at Lac des Iles, including the Lac des Iles mine and the Offset High Grade Zone ("Offset Zone").

Lac des Iles mine

The Company owns and operates the Lac des Iles mine located 85 kilometers from Thunder Bay, Ontario, Canada. The Lac des Iles mine consists of an open pit mine, an underground mine and two processing plants (one of which was decommissioned in June 2001). The primary deposits on the property are the Roby Zone and the Offset Zone. The Company began mining the Roby Zone in 1993 using open pit mining methods. In April 2006, an underground mine went into commercial production to access a higher grade portion of the Roby Zone.

The Offset Zone is located on the Lac des Iles property and was discovered by the Company's exploration team in 2001. The Offset Zone is considered to be the fault-displaced continuation of the Roby Zone mineralization and is located below and approximately 250 metres to the west of the Roby Zone. An updated mineral resource estimate was prepared by Scott Wilson Roscoe Postle Associates Inc. ("Scott Wilson RPA") in January 2009. The report showed that the Offset Zone has significantly more mineral resources than the current underground mine at the Roby Zone at similar grades, and remains open along strike to the north, south and at depth. A detailed prefeasibility report is underway with the objectives of converting indicated resources to probable reserves, and assessing the optimal mining and milling configuration and economics of developing the upper portion of the Offset Zone. The report is expected to be completed by the end of the second quarter of 2009.

On October 21, 2008, the Company announced that, due to declining metal prices, it was temporarily placing its Lac des Iles mine on a care and maintenance basis effective October 29, 2008. The closure resulted in the layoff of approximately 350 employees.

Shebandowan West Project

On December 10, 2007, the Company earned a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an option and joint venture agreement with Vale Inco. The Shebandowan West Project contains a series of nickel-copper-PGM mineralized bodies and is located approximately 100 kilometers southwest of the Company's Lac des Iles mine. On October 25, 2007, the Company announced the completion of a NI 43-101 compliant mineral resource estimate for the Shebandowan West Project by an independent Qualified Person. Management was considering a mine development scenario that would entail excavation of the Shebandowan West Project by means of

3

ramp-accessed underground mining methods at a rate of 500 to 1,000 tonnes per day, crushing the material on site and transporting it by truck for processing at the original mill on the Lac des Iles property. In light of the sharp decline in metal prices in the fall of 2008, the Company ceased all activities with the Shebandowan Joint Venture, including at the Shebandowan West Project. A decision on when and whether to resume activities will largely depend on the long term outlook for nickel prices.

Arctic Platinum Project

The Company was party to an agreement with Gold Fields Limited that would have entitled it to a 60% interest in a series of mining licenses and claims known as the Arctic Platinum Project ("APP").

In order to satisfy the requirements of its earn-in, the Company had to satisfy a number of conditions on or before August 31, 2008, including: (i) complete a re-scoping and exploration program; (ii) complete a feasibility study; (iii) make a production decision and prepare the initial formal development proposal and associated budget based on the feasibility study; (iv) incur expenditures of US$12.5 million on the APP; and (v) issue 9,227,033 common shares to Gold Fields BV to earn a 60% interest or if Gold Fields exercised a claw-back right, issue 7,381,636 common shares to earn a 50% interest. The Company had completed the re-scoping study, incurred over US$18.8 million in expenditures and commissioned a feasibility study.

The Company received a draft feasibility study in the summer of 2008 which showed that lower commodity prices coupled with the increased price of steel and diesel fuel, the strength of the euro relative to the U.S. dollar and other variables had adversely impacted the economics of the project. As a result of these findings, the Company determined that it would not deliver a positive feasibility study for the Arctic Platinum Project prior to the August 31, 2008 deadline. The Company advised Gold Fields of the outcome and the parties discussed strategic alternatives for the project. The parties failed to reach an agreement and the Company's option over the APP has since lapsed. All interests in APP have now reverted back to Gold Fields Limited.

Year Ended December 31, 2008 Highlights

- •

- Revenue after pricing adjustments for the year ended December 31, 2008 of $125.5 million decreased by $70.4 million (36%) compared to $195.9 million in 2007. On October 29, 2008, due to dramatically declining metal prices, the Company's Lac des Iles mine was temporarily placed on a care and maintenance basis that resulted in a 26% decrease in palladium production in 2008.

- •

- The net loss for the year ended December 31, 2008 of $160.7 million was due to a non-cash asset impairment charge, the temporary closure of the Lac des Iles mine and a significant decline in the price of palladium, platinum, nickel and copper. The Company recorded a $90.0 million non-cash impairment charge on its investment in the Lac des Iles mine due to prevailing market conditions. The net loss for the year ended December 31, 2008 also included negative mark-to-market commodities pricing adjustments of $38.6 million and a $3.9 million write down of ore and concentrate inventories due to lower metal prices.

- •

- The net loss for the year ended December 31, 2008 was $160.7 million or $1.94 per share compared to a net loss of $28.7 million or $0.51 per share in 2007. The net loss for the year includes the $90.0 million or $1.09 per share non-cash impairment charge on the Company's investment in the Lac des Iles mine.

- •

- Operating cash flow for the year ended December 31, 2008 of $6.9 million compared to operating cash flow of $25.5 million in 2007.

- •

- Palladium production of 212,046 ounces decreased 26% compared to last year due primarily to the Lac des Iles mine being placed on a temporary care and maintenance basis in October 2008.

- •

- Palladium sales settled during the year ended December 31, 2008 were realized at an average price of US$378 per ounce compared to US$346 per ounce last year, an increase of 9%. Palladium sales not settled as at December 31, 2008 were provisionally valued at US$183 per ounce compared to US$364 as at December 31, 2007, a decrease of 50%. The Company's performance is highly correlated to prevailing

4

palladium and by-product metal prices as it continues to sell all its metal production into the spot markets.

- •

- Palladium accounted for 45% of the year's total revenues while platinum and nickel continued to be important sources of revenue, each at 16% of the year's total revenue.

- •

- Cash cost per ounce of palladium produced1, net of by-product metal revenues and royalties, was US$283 for 2008 compared to US$164 the previous year. The significant increase in cash cost per ounce is attributable to the reduction of by-product revenue due to lower commodity prices.

- •

- Concentrate awaiting settlement as at December 31, 2008 was $43.1 million and included 125,747 ounces of palladium provisionally valued at US$183 per ounce.

- •

- The Company's total outstanding debt position at December 31, 2008 was $7.6 million, a reduction of $31.5 million (81%) compared to total outstanding debt of $39.1 million at December 31, 2007 due primarily to the repayment of $25.7 million of convertible notes during 2008.

- •

- Net working capital as at December 31, 2008 was $86.1 million compared to $128.4 million as at December 31, 2007.

KEY RESULTS

Key Operating Statistics | | | | | | | |

| Year Ended December 31 | | 2008* | | 2007 | | 2006** | |

|

| Palladium (oz) | | 212,046 | | 286,334 | | 237,338 | |

| Payable Palladium (oz) | | 195,083 | | 263,046 | | 217,022 | |

| Platinum (oz) | | 16,311 | | 24,442 | | 22,308 | |

| Gold (oz) | | 15,921 | | 20,092 | | 17,237 | |

| Copper (lbs) | | 4,623,278 | | 5,536,044 | | 5,155,588 | |

| Nickel (lbs) | | 2,503,902 | | 3,066,973 | | 2,721,042 | |

|

| Ore Tonnes Milled | | 3,722,732 | | 5,006,383 | | 4,570,926 | |

| Palladium Head Grade (g/t) | | 2.33 | | 2.39 | | 2.18 | |

| Palladium Recoveries (%) | | 75.3 | | 74.8 | | 74.0 | |

| Ore Tonnes Mined – Underground | | 615,630 | | 768,841 | | 721,179 | |

| Ore Tonnes Mined – Open Pit | | 3,060,788 | | 4,374,225 | | 3,926,911 | |

| Waste Tonnes Mined – Open Pit | | 6,989,845 | | 7,231,026 | | 8,888,037 | |

|

| Waste Strip Ratio | | 2.28:1 | | 1.65:1 | | 2.26:1 | |

|

- *

- The 2008 key operating statistics reflect the period from January 1 to October 29, 2008 when the Company's Lac des Iles mine was temporarily placed on a care and maintenance basis.

- **

- Metal production, tonnes milled and underground ore tonnes mined include pre-production activities from the underground mine that was not recorded as revenue but rather offset against the underground mine's capital development costs. Metal production from the underground pre-production included 9,004 oz of palladium and other associated by-product metals.

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

5

Selected Annual Information

(thousands of dollars)

| | | | 2008 | | | 2007* | | | 2006* | | |

|

| Revenue after pricing adjustments | | $ | 125,491 | | $ | 195,932 | | $ | 159,200 | | |

| Asset impairment charge | | | (90,000 | ) | | – | | | – | | |

| Income (loss) from mining operations | | | (127,759 | ) | | 505 | | | 453 | | |

| Net income (loss) | | | (160,679 | ) | | (28,680 | ) | | (34,109 | ) | |

| Net loss per share (dollars) | | | | | | | | | | | |

| • Basic and diluted | | $ | (1.94 | ) | $ | (0.51 | ) | $ | (0.65 | ) | |

| Cash flow from (used in) operations prior to changes in non-cash working capital 1 | | | (467 | ) | | 42,884 | | | 3,760 | | |

| Total assets | | | 146,904 | | | 305,374 | | | 265,157 | | |

| Total long-term debt, including current portion | | $ | 7,552 | | $ | 39,081 | | $ | 74,906 | | |

| Cash dividends declared | | | Nil | | | Nil | | | Nil | | |

|

- *

- Certain prior period amounts have been reclassified to conform to a classification adopted in the current year.

RESULTS OF OPERATIONS

Revenue

Revenue is affected by sales volumes, commodity prices and currency exchange rates. Sales of metals in concentrate are recognized in revenue when concentrate is delivered to a third party smelter for treatment, however, final pricing is not determined until the refined metal is sold, which can be up to six months later. Accordingly, revenue in the year is based on current US dollar denominated commodity prices and foreign exchange rates for sales occurring in the year and ongoing pricing adjustments from prior sales that are still subject to final pricing. These final pricing adjustments result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the US dollar will result in additional revenues and a strengthening in the Canadian dollar will result in reduced revenues. Since April 1, 2007, the amount of the final pricing adjustments recognized on any commodity price changes are also reduced by any price participation deductions as provided for in the Company's smelting and refining agreement.

Average Realized Metal Prices and Exchange Rates – Year ended December 31

| | | 2008 | | 2007 | | 2006 | |

|

| Palladium – US$/oz | | $ 378 | | $ 346 | | $ 318 | |

| Platinum – US$/oz | | $1,547 | | $1,297 | | $1,121 | |

| Gold – US$/oz | | $ 862 | | $ 695 | | $ 592 | |

| Nickel – US$/lb | | $10.13 | | $16.73 | | $ 9.88 | |

| Copper – US$/lb | | $ 3.29 | | $ 3.22 | | $ 2.92 | |

|

| Average exchange rate (Bank of Canada) – CDN$1 = US$ | | US$ 0.96 | | US$ 0.93 | | US$ 0.88 | |

|

For the year ended December 31, 2008, revenue before pricing adjustments of $148.4 million decreased by $52.9 million (26%) compared to 2007, reflecting the impact of lower sales volumes ($54.1 million) and an unfavourable foreign exchange rate impact ($0.7 million) offset partially by higher average realized metal prices ($1.9 million). The lower sales volume is mainly a result of the temporary closure of the Company's Lac des Iles mine on October 29, 2008 and the consequent reduction in production. During 2008, the spot price of palladium per ounce ranged from a high of US$582 to a low of US$164. Palladium sales that were settled during the year ended December 31, 2008, realized an average of US$378 per ounce, an increase of

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

6

9% compared to a realized average of US$346 in 2007. The Canadian dollar strengthened to an average of US$0.96 against the US dollar during 2008 compared to US$0.93 during 2007.

Recorded Spot Metal Prices and Exchange Rates – Mark-to-Market – Year ended December 31

| | | 2008 | | 2007 | | 2006 | |

|

| Palladium – US$/oz | | $ 183 | | $ 364 | | $ 322 | |

| Platinum – US$/oz | | $ 898 | | $1,530 | | $1,115 | |

| Gold – US$/oz | | $ 869 | | $ 836 | | $ 635 | |

| Nickel – US$/lb | | $4.90 | | $11.70 | | $15.11 | |

| Copper – US$/lb | | $1.32 | | $ 3.03 | | $ 2.85 | |

|

| Exchange rate (Bank of Canada) – CDN$1 = US$ | | US$0.82 | | US$ 1.01 | | US$ 0.86 | |

|

Negative pricing adjustments from settlements and the mark-to-market of concentrate awaiting settlement for the year ended December 31, 2008 reduced revenue by $22.9 million ($38.6 million negative commodity price adjustment, partially offset by a $15.7 million favourable foreign exchange adjustment). This compares with unfavourable pricing adjustments for the year ended December 31, 2007 of $5.4 million ($14.2 million unfavourable foreign exchange adjustment partially offset by an $8.8 million positive commodity price adjustment). The Canadian dollar weakened by 19% against the US dollar to $0.82 at December 31, 2008 compared to US$1.01 at December 31, 2007.

For the year ended December 31, 2008, revenue after pricing adjustments of $125.5 million decreased $70.4 million (36%), compared to 2007. Revenue after pricing adjustments from the sale of palladium in 2008 decreased by 39% to $56.3 million (45% of total revenue) compared to $91.8 million (47% of total revenue) in 2007.

For the year ended December 31, 2008, total by-product revenues before pricing adjustments were $76.4 million, a decrease of $29.8 million (28%) as compared to $106.2 million in 2007, reflecting decreased sales volumes ($26.0 million), lower overall average realized metal prices ($3.2 million), and an unfavourable foreign exchange rate impact ($0.6 million). The impact of higher average realized prices for platinum ($6.3 million), gold ($3.0 million), and copper and other metals ($1.7 million) was more than offset by the 39% ($14.2 million) decrease in average realized nickel prices.

For the year ended December 31, 2008, total by-product revenues after pricing adjustments were $69.2 million, a decrease of $34.9 million (34%) as compared to $104.1 million in 2007. Platinum, nickel and copper revenue declined by $10.8 million (35%), $22.5 million (53%) and $2.8 million (19%) respectively, while gold revenue increased by $1.4 million (11%) due to higher gold prices.

Operations

For the year ended December 31, 2008, palladium ounces produced decreased by 26%. The mill processed 3,722,732 tonnes of ore or an average of 12,577 tonnes per operating day, producing 212,046 ounces of palladium compared to 5,006,383 tonnes of ore or an average of 13,716 tonnes per operating day, producing 286,334 ounces of palladium in 2007. The 26% reduction in mill throughput in 2008 was due primarily to the Lac des Iles mine being temporarily placed on a care and maintenance basis on October 29, 2008. In 2008, the average palladium head grade was 2.33 grams per tonne compared to 2.39 grams per tonne in 2007. For the year ended December 31, 2008, 615,630 tonnes of ore was extracted from the underground mine, with an average palladium grade of 5.71 grams per tonne compared to 768,841 tonnes of ore, with an average palladium grade of 5.79 grams per tonne in 2007. For 2008 the palladium recoveries were 75.3%, compared to 74.8% in 2007.

In the Lac des Iles open pit, for the year ended December 31, 2008, 3,060,788 tonnes of ore were extracted with an average palladium grade of 1.85 grams per tonne compared to 4,374,225 tonnes at an average palladium grade of 1.79 grams per tonne the previous year. For the year ended December 31, 2008 the strip ratio increased to 2.28 compared to 1.65 in 2007.

7

Operating Expenses

For the year ended December 31, 2008, total production costs of $115.0 million decreased by $9.9 million (8%) compared to 2007, due mainly to a $16.5 million reduction of costs as a result of the mine being placed on a care and maintenance basis in October 2008 and the capitalization of $3.0 million of major spare parts and insurance spares to mining interests following adoption of Canadian Institute of Chartered Accountants ("CICA") Handbook Section 3031, offset partially by severance and other mine closure costs of $7.9 million. Unit cash costs1 to produce palladium (production costs including overhead and smelter treatment, refining and freight costs), net of by-product metal revenues and royalties, increased to US$283 per ounce for the year ended December 31, 2008 compared to US$164 per ounce in 2007. The increase in unit cash costs was primarily due to decreased by-product revenues as a result of lower by-product commodity prices offset by the weakening Canadian dollar.

For the year ended December 31, 2008, inventory pricing adjustments were $3.9 million (2007 – $0.1 million) and reflect the write down of ore and concentrate inventories to net realizable value as a result of the decline in metal prices.

Smelter treatment, refining and freight charges for the year ended December 31, 2008 of $19.3 million decreased by $3.1 million (14%) compared to 2007. The decrease is attributable to lower sales volumes ($4.8 million) and a favourable foreign exchange adjustment ($0.4 million) relating to refining costs, offset partially by higher costs associated with the Company's new smelter agreement ($2.1 million) that came into effect April 1, 2007.

Non-cash amortization decreased by $10.9 million (23%) to $36.0 million for the year ended December 31, 2008 compared to $46.9 million in 2007. The lower amortization is attributable to the 26% decrease in palladium production ($13.1 million), offset by a decrease in the amortization capitalized to inventory ($2.2 million) due to the write down of ore and concentrate inventory to net realizable value.

The Company reviews and evaluates its long-lived assets for impairment when events or changes in circumstances arise that may result in impairments in the carrying value of those assets. Impairment is considered to exist if total estimated future undiscounted cash flows are less than the carrying amount of the asset. During 2007, the Company engaged Scott Wilson RPA an independent geotechnical consulting company to complete a Mineral Resource and Mineral Reserve audit and to prepare an independent Technical NI 43-101 Report on the Lac des Iles mine as of June 2007. This was updated by a senior geologist with Lac des Iles Mines Ltd. (a qualified person) to December 31, 2008, to account for production at the mine. In light of the volatile current market conditions, for the purposes of its review and evaluation, the Company utilized the average of commodity price forecasts released since October 2008. Based on this review, management has concluded that an impairment of $90.0 million exists and has been provided for as at December 31, 2008. Assumptions underlying future cash flow estimates are subject to risk and uncertainty. Any differences between significant assumptions and market conditions such as metal prices, exchange rates, recoverable metal, and/or the Company's operating performance could have a material effect on the Company's ability to recover the carrying amounts of its long-lived assets resulting in possible additional impairment charges.

For the year ended December 31, 2008, the Company reported a loss on disposal of equipment of $2.5 million, which reflects primarily the unamortized value ($1.2 million) of component parts of equipment replaced in the period following the adoption of the CICA Handbook Section 3031, and the disposal of old and obsolete equipment ($1.0 million).

For the year ended December 31, 2008, asset retirement costs were $0.3 million compared to $1.0 million in 2007. The reduction in the asset retirement costs for 2008 is the result of a recovery of accretion charges ($0.2 million) due to the net effect of a revaluation of the asset retirement cost and obligation based on the revised estimated cash flows within the Company's most recent mine plan and decreased amortization due to the 26% decrease in palladium production ($0.1 million) during the year. A further reduction of

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

8

asset retirement costs in 2008 is attributable to the initial revision of the mine plan in 2007 to reflect a shorter period for accreting the asset retirement obligation. As a result, an additional charge ($0.3 million) was recognized in the three months ended June 30, 2007 to adjust the previously recorded accretion to the reduced term.

For the year ended December 31, 2008, the Company recorded a loss from mining operations, before an insurance recovery of $13.8 million, of $141.6 million compared to income of $0.5 million in 2007. The insurance recovery relates to an insurance claim filed by the Company in connection with the failure of the Lac des Iles mine primary crusher in 2002. In June 2008 a final settlement of $14.5 million was received and an amount of $13.8 million has been included as income from mining operations and $0.7 million received for costs has been included as a reduction of general and administrative expenses.

Other Expenses

For the year ended December 31, 2008, other expenses totaled $35.2 million, an increase of $5.1 million compared to other expenses of $30.1 million in 2007. An increase in exploration expenses of $11.0 million and an unfavourable foreign exchange impact of $9.4 million were partially offset by a $15.2 million decrease in interest and other financing charges and a $0.1 million decrease in general and administrative expenses.

General and administrative expenses for the year ended December 31, 2008 of $7.7 million decreased $0.1 million compared to $7.8 million incurred in 2007. Significant items contributing to the decrease include the Ontario Government's elimination of the capital tax ($1.8 million) and the insurance recovery of costs ($0.7 million), offset by the windup of APP ($0.8 million), severance costs ($0.6 million) and corporate development expenditures ($0.5 million).

Exploration expense for the year ended December 31, 2008 of $23.1 million increased $11.0 million compared to 2007 expenditure of $12.1 million. The increase is due primarily to expenditures on the Shebandowan West nickel-copper-PGM project of $8.9 million (2007 – $1.1 million) and on the Arctic Platinum Project of $9.4 million (2007 – $5.9 million). In addition, the Company spent $1.8 million (2007 – $3.5 million) on continued exploration of the Offset Zone at the Lac des Iles mine and the Mine Block Intrusion and North LDI on the large under explored Lac des Iles mine property.

Interest and other financing charges decreased by $15.2 million for the year ended December 31, 2008 due primarily to lower interest and accretion expenses relating to the convertible notes payable of $11.7 million, which were fully repaid on December 1, 2008, and increased interest income of $2.0 million.

The unfavourable foreign exchange impact of $9.4 million for the year ended December 31, 2008, compared to 2007, is due to a 2008 foreign exchange loss of $1.0 million (2007 – foreign exchange gain of $8.4 million). The 2008 foreign exchange loss of $1.0 million, is due primarily to the translation of the Company's US dollar denominated convertible notes, capital leases and credit facilities ($2.3 million) partially offset by a foreign exchange gain ($1.8 million) related to the Arctic Platinum Project in Finland reflecting the strengthening of the Canadian dollar against the euro.

Income and Mining Taxes

For the year ended December 31, 2008, the Company's income and mining tax recovery was $2.2 million compared to a $0.9 million income and mining tax recovery in 2007. This recovery relates primarily to the recovery of future mining taxes resulting from current period losses, recovery of current mining taxes resulting from the settlement of an exposure previously accrued for in a prior year, and the recovery of future income tax liability arising on the renunciation of exploration expenditures to investors.

Net Loss

For the year ended December 31, 2008, the net loss was $160.7 million or $1.94 per share, compared to a net loss of $28.7 million or $0.51 per share in 2007.

9

Summary of Quarterly Results

(thousands of dollars except per share amounts)

| | | | 2007* | | | 2008* | | |

|

| | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | |

|

| Revenue – before pricing adjustments | | $ | 60,305 | | $ | 53,450 | | $ | 42,674 | | $ | 44,938 | | $ | 51,052 | | $ | 52,403 | | $ | 35,331 | | $ | 9,642 | | |

| Pricing adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commodities | | | 9,141 | | | (2,421 | ) | | 237 | | | 1,799 | | | 15,178 | | | 581 | | | (47,203 | ) | | (7,189 | ) | |

| Foreign exchange | | | (1,007 | ) | | (6,534 | ) | | (6,419 | ) | | (231 | ) | | 4,558 | | | (743 | ) | | 2,992 | | | 8,889 | | |

|

| Revenue – after pricing adjustments | | $ | 68,439 | | $ | 44,495 | | $ | 36,492 | | $ | 46,506 | | $ | 70,788 | | $ | 52,241 | | $ | (8,880 | ) | $ | 11,342 | | |

|

| Cash flow from operations 1, prior to changes in non-cash working capital** | | | 15,108 | | | 15,743 | | | 6,479 | | | 5,554 | | | 8,153 | | | 18,061 | | | (10,691 | ) | | (15,990 | ) | |

| Exploration expense | | | 3,228 | | | 798 | | | 2,933 | | | 5,179 | | | 7,054 | | | 7,115 | | | 4,231 | | | 4,670 | | |

| Net income (loss) | | | 5,507 | | | (9,066 | ) | | (14,033 | ) | | (11,088 | ) | | 12,595 | | | 10,387 | | | (71,242 | ) | | (112,419 | ) | |

| Net income (loss) per share | | $ | 0.10 | | $ | (0.17 | ) | $ | (0.25 | ) | $ | (0.19 | ) | $ | 0.16 | | $ | 0.13 | | $ | (0.85 | ) | $ | (1.31 | ) | |

| Fully diluted net income (loss) per share | | $ | 0.10 | | $ | (0.17 | ) | $ | (0.25 | ) | $ | (0.19 | ) | $ | 0.15 | | $ | 0.13 | | $ | (0.85 | ) | $ | (1.31 | ) | |

|

- *

- Certain prior period amounts have been reclassified to conform to a classification adopted in the current period.

- **

- Includes exploration expense

FOURTH QUARTER

Fourth Quarter Highlights

- •

- Revenue after pricing adjustments for the fourth quarter of 2008 of $11.3 million decreased $35.2 million (76%) compared to the same period last year.

- •

- The net loss for the quarter ended December 31, 2008 of $112.4 million was due to a non-cash asset impairment charge, the temporary closure of the Lac des Iles mine and a significant decline in the price of palladium, platinum, nickel and copper. The Company recorded a $90.0 million non-cash impairment charge on the value of its investment in the Lac des Iles mine due to prevailing market conditions. On October 29, 2008, due to dramatically declining metal prices, the Company's Lac des Iles mine was temporarily placed on a care and maintenance basis that resulted in a 70% decrease in palladium production in the fourth quarter 2008 compared to the same period last year.

- •

- The net loss for the three months ended December 31, 2008 was $112.4 million or $1.31 per share compared to a net loss of $11.1 million or $0.19 per share in the same period last year. The net loss for the quarter is due primarily to the $90.0 million or $1.05 per share non-cash impairment charge on the value of the Company's investment in the Lac des Iles mine.

- •

- Cash used in operations for the fourth quarter of 2008 was $16.6 million compared to cash provided by operations of $10.5 million in the same period last year.

- •

- Palladium production for the three months ended December 31, 2008 was 21,373 ounces, compared to 71,595 ounces in 2007 and reflects the Lac des Iles mine being placed on a temporary care and maintenance basis on October 29, 2008.

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

10

- •

- Palladium sales settled during the fourth quarter of 2008 were realized at an average price of US$207 per ounce compared to US$348 per ounce in the comparable quarter last year. Palladium accounted for 66% of the quarter's total revenues while platinum and gold were important sources of revenue, at 14% and 21% of the quarter's total revenue respectively.

- •

- Cash cost per ounce of palladium produced,1 net of by-product metal revenues and royalties, was US$464 for the fourth quarter 2008 compared to US$221 in the same period last year, primarily due to the reduction of by-product revenue due to lower commodity prices offset by the weakening Canadian dollar.

Fourth Quarter Financial Results

Revenue

On October 29, 2008, due to a dramatic decline in the Company's main metals, palladium and platinum, the Lac des Iles mine was temporarily placed on a care and maintenance basis.

Average Realized Metal Prices and Exchange Rates – Quarter ended December 31

| | | 2008 | | 2007 | |

|

| Palladium – US$/oz | | $ 207 | | $ 348 | |

| Platinum – US$/oz | | $ 873 | | $1,406 | |

| Gold – US$/oz | | $ 802 | | $ 755 | |

| Nickel – US$/lb | | $5.78 | | $13.62 | |

| Copper – US$/lb | | $2.21 | | $ 3.35 | |

|

| Average exchange rate (Bank of Canada) – CDN$1 = US$ | | US$0.82 | | US$ 1.01 | |

|

Revenue before pricing adjustments for the fourth quarter of 2008 of $9.6 million decreased $35.3 million compared to the fourth quarter of 2007 and reflects the impact of reduced sales volumes ($39.0 million) and lower commodity prices ($7.4 million), offset partially by a favourable foreign exchange rate impact ($11.1 million). Palladium sales settled during the three months ended December 31, 2008, realized an average of US$207 per ounce, down 41% compared to an average of US$348 in the same period last year. Revenue from palladium sales before pricing adjustments in the fourth quarter of 2008 of $4.9 million decreased by $17.1 million (78%) compared to the same period last year.

Positive pricing adjustments from settlements and the mark-to-market of concentrate awaiting settlement in the fourth quarter of 2008 increased revenue in the quarter by $1.7 million ($8.9 million favourable foreign exchange adjustment offset partially by a $7.2 million negative commodity price adjustment). This compares to positive pricing adjustments in the fourth quarter of 2007 of $1.6 million ($1.8 million positive commodity price adjustment and a $0.2 million negative foreign exchange adjustment).

Revenue after pricing adjustments for the three months ended December 31, 2008 of $11.3 million decreased by $35.2 million compared to the same period last year. Revenue after pricing adjustments from palladium sales for the three months ended December 31, 2008 was $7.5 million compared to $23.8 million in the same period last year.

For the three months ended December 31, 2008, total by-product revenues before pricing adjustments of $4.8 million decreased by $18.2 million (79%), reflecting the impact of lower sales volumes ($20.3 million) and lower average realized metal prices ($3.5 million), offset by a favourable foreign exchange rate impact ($5.6 million).

Revenue after pricing adjustments from by-product metal sales in the three months ended December 31, 2008 decreased by $18.9 million (83%) to $3.8 million compared to $22.7 million in the same period last year.

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

11

Operations

During the three months ended December 31, 2008, the mill processed 265,950 tonnes of ore at an average of 12,089 tonnes per operating day, producing 21,373 ounces of palladium. During the same period in 2007, the mill processed 1,165,769 tonnes of ore at an average of 12,671 tonnes per operating day, producing 71,595 ounces of palladium. The average palladium head grade was 2.91 grams per tonne in the fourth quarter of 2008, compared to 2.58 grams per tonne in the corresponding period of 2007. In the fourth quarter of 2008, palladium recoveries were 76.0% as compared to 75.2% in the fourth quarter of 2007, while mill availability in the period was 87.9% compared to 86.9% last year. The 70% reduction in ounces produced in the fourth quarter of 2008 reflects the Lac des Iles mine being placed on a temporary care and maintenance basis on October 29, 2008.

During the three months ended December 31, 2008, 46,446 tonnes of ore were extracted from the Lac des Iles underground mine, with an average palladium grade of 6.72 grams per tonne, compared to 202,230 tonnes with an average palladium grade of 5.98 grams per tonne during the same period last year. In the Lac des Iles open pit operation for the three months ended December 31, 2008, 216,845 tonnes of ore were extracted with an average palladium grade of 2.55 grams per tonne compared to 994,152 tonnes of ore extracted at an average palladium grade of 1.92 grams per tonne in the same period last year. Over this period, the strip ratio increased to 2.04 compared to 1.74 in the same period for 2007.

Operating Expenses

Total production costs for the three months ended December 31, 2008 of $22.4 million reflected an $8.0 million (26%) decrease over the $30.4 million in same period of 2007 due mainly to a $17.3 million reduction of costs as a result of the mine being placed on a care and maintenance basis in October offset partially by severance and other mine closure costs of $7.9 million. Unit cash costs1 to produce palladium (production costs including overhead and smelter treatment, refining and freight costs), net of by-product metal revenues and royalties, increased to US$464 per ounce in the fourth quarter of 2008 compared to US$221 per ounce in the corresponding period in 2007. The increase in unit cash costs is primarily due to decreased by-product revenues as a result of lower by-product commodity prices offset by the weakening Canadian dollar.

For the three months ended December 31, 2008, the inventory pricing adjustments were $1.6 million (2007 – $0.1 million write down) and reflect the write up of ore and concentrate inventories to net realizable value due to the weakening of the Canadian dollar partially offset by the decrease in metal prices.

Smelter treatment, refining and freight charges for the three months ended December 31, 2008 of $1.3 million decreased by $4.7 million (79%) compared to 2007. The decrease is attributable to lower sales volumes ($4.3 million) due to the mine being placed on a care and maintenance basis and a foreign exchange adjustment of $0.4 million relating to refining costs.

Non-cash amortization decreased by $7.7 million (71%) to $3.2 million in the fourth quarter of 2008 compared to $10.9 million in the corresponding period in 2007. The lower amortization is attributable to the 70% decrease in palladium production ($7.5 million), and an increase in the amortization capitalized to inventory ($0.2 million) due to the write-down of ore and concentrate inventory to net realizable value.

The Company reviews and evaluates its long-lived assets for impairment when events or changes in circumstances arise that may result in impairments in the carrying value of those assets. Impairment is considered to exist if total estimated future undiscounted cash flows are less than the carrying amount of the asset. Based on this review, management has concluded that an impairment of $90.0 million exists and has been provided for as at December 31, 2008. Assumptions underlying future cash flow estimates are subject to risk and uncertainty. Any differences between significant assumptions and market conditions such as metal prices, exchange rates, recoverable metal, and/or the Company's operating performance

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

12

could have a material effect on the Company's ability to recover the carrying amounts of its long-lived assets resulting in possible additional impairment charges.

For the three months ended December 31, 2008, the loss on disposal of equipment was $0.9 million and reflects the disposal of old and obsolete equipment.

For the three months ended December 31, 2008, asset retirement costs were a recovery of $0.1 million compared to an expense of $0.2 million in 2007. The reduction in the asset retirement costs for 2008 is the result of a recovery of accretion charges ($0.2 million) due to the net effect of a revaluation of the asset retirement cost and obligation based on the revised estimated cash flows within the Company's most recent mine plan and decreased amortization due to the 70% decrease in palladium production ($0.1 million).

For the three months ended December 31, 2008, the loss from mining operations was $104.6 million, a decline of $103.6 million compared to last year's loss of $1.0 million.

Other Expenses

For the three months ended December 31, 2008, other expenses totaled $8.4 million compared to an expense of $10.1 million in the corresponding period of 2007, a decrease of $1.7 million. The decrease in 2008 reflects a reduction of interest and other financing charges of $2.7 million, lower exploration expenses of $0.5 million and lower general and administrative expenses of $0.2 million, offset partially by the net negative impact of a foreign exchange loss compared to last year of $1.7 million, which relates primarily to the translation of the Company's US dollar denominated loans. The reduced interest and other financing charges are due primarily to lower interest and accretion expenses of $2.6 million relating to the convertible notes payable and reflects the scheduled repayment of the notes which were fully repaid on December 1, 2008.

Administrative expenses for the three months ended December 31, 2008 of $1.8 million decreased by $0.2 million (11%) compared to 2007, due mainly to the recovery of capital taxes.

Exploration expense was $4.7 million in the fourth quarter of 2008 compared to $5.2 million in the corresponding period last year, a decrease of $0.5 million (10%). The decrease is due primarily to lower expenditures on APP of $0.1 million (2007 – $2.8 million) partially offset by increased expenditures on the Shebandowan West nickel-copper-PGM project of $2.6 million (2007 – $0.5 million).

Income and Mining Taxes

For the three months ended December 31, 2008, the Company's income and mining tax recovery was $0.6 million compared to a $0.1 million income and mining tax recovery in 2007. This recovery relates primarily to the recovery of current mining taxes resulting from the settlement of an exposure previously accrued for in prior periods.

Net Loss

For the three months ended December 31 2008, the Company reported a net loss of $112.4 million or $1.31 per share compared to a net loss of $11.1 million or $0.19 per share for the three months ended December 31, 2007.

13

LIQUIDITY

Sources and Uses of Cash | | | | | | | | | | | |

| Year ended December 31 | | | 2008 | | | 2007 | | | 2006 | | |

|

| Cash generated (consumed) by operations before working capital changes | | $ | (467 | ) | $ | 42,884 | | $ | 3,760 | | |

| Changes in non-cash working capital | | | 7,317 | | | (17,408 | ) | | (37,549 | ) | |

|

| Cash generated (consumed) by operations | | | 6,850 | | | 25,476 | | | (33,789 | ) | |

| Cash provided (used) by financing | | | 2,001 | | | 61,323 | | | 41,295 | | |

| Cash used in investing | | | (40,389 | ) | | (15,346 | ) | | (19,384 | ) | |

|

| Increase (decrease) in cash and cash equivalents | | $ | (31,538 | ) | $ | 71,453 | | $ | (11,878 | ) | |

|

For the year ended December 31 2008, cash used in operations1 (prior to changes in non-cash working capital) was $0.5 million, a deterioration of $43.4 million compared to 2007 when cash provided by operations1 was $42.9 million. This deterioration is due primarily to the increased net loss ($132.0 million), the impact of an unrealized foreign exchange gain ($24.4 million), lower non-cash amortization expense ($12.9 million), and a lower non-cash add back for accretion expense relating to the convertible notes payable ($9.6 million), offset by the non-cash asset impairment charge ($90.0 million), the impact of an unrealized commodity price adjustment ($47.0 million), and loss on disposal of equipment ($2.5 million).

For the year ended December 31, 2008, non-cash working capital declined by $7.3 million compared to an increase of $17.4 million in 2007, a decrease of $24.7 million. The decrease of $24.7 million is due primarily to a lower concentrate awaiting settlement balance ($25.2 million), and lower inventories and stockpiles ($7.0 million), offset by a decrease in accounts payable and accrued liabilities ($6.0 million).

Palladium awaiting settlement decreased slightly to 125,747 ounces at December 31, 2008 compared to 125,802 ounces at December 31, 2007. The lower prices used to value the concentrate awaiting settlement combined with a slight decrease in the physical quantities of metal in the concentrate awaiting settlement, offset partially by the weakening in the Canadian dollar, resulted in a $36.0 million (46%) decrease in the value of concentrate awaiting settlement as at December 31, 2008, compared to December 31, 2007.

After allowing for non-cash working capital changes, cash provided by operations was $6.9 million for the year ended December 31, 2008 compared to cash provided by operations of $25.5 million in 2007.

Financing activities for the year ended December 31, 2008 provided cash of $2.0 million and includes equity financings of $10.5 million less the scheduled repayment of debt of $8.2 million (2007 – $14.0 million). In December 2007 the Company completed an equity offering of 18.7 million units at a price of US$4.00 per unit. In connection with the offering the Company granted the underwriter's an over allotment option of 15% at US$4.00 per unit. This option was subsequently exercised in January 2008, increasing the gross proceeds of the offering to US$85.9 million. In February 27, 2007, the Company completed a private placement of 550,000 flow-through common shares at $11.00 per share for gross proceeds of $6.0 million. These proceeds were used to expedite work on the Shebandowan Project.

The Company's total debt position decreased to $7.6 million at December 31, 2008 compared to $39.1 million at December 31, 2007. During 2008, five principal payments related to Tranche I convertible notes totaling US$17.5 million and six principal payments related to the Tranche II convertible note totaling US$9.0 million were made. At the noteholder's option, these payments were settled in a non-cash transaction by the issuance of 7,598,772 common shares which, in accordance with the terms of the convertible notes loan agreement, are valued at 90% of the five day volume weighted average price on the NYSE-Alternext exchange, (AMEX prior to December 1, 2008) immediately prior to the payment date. As at December 1, 2008, the convertible notes had been fully repaid. For the year ended December 31, 2008, the reduction in debt also includes scheduled long term debt repayments (US$4.0 million and $2.0 million) and

- 1

- Non-GAAP measure. Reference should be made to footnote 1 at the end of this MD&A.

14

scheduled capital lease repayments ($1.9 million). In addition, the weakening of the Canadian dollar resulted in an unrealized foreign exchange translation loss on US dollar denominated debt at December 31, 2008 of $2.3 million.

Investing activities required $40.4 million of cash in 2008, the majority of which was attributable to the 2008 expansion of the tailings management facilities ($26.7 million) and the ongoing lateral development and sustaining capital for the underground mine ($3.5 million). The investing activities amount also includes $8.5 million of purchased major spare parts following the implementation of the CICA Handbook Section 3031 as fully described in note 2 of the December 31, 2008 financial statements. This compares with $15.3 million of investing activities last year, which was mainly related to the underground mine development and sustaining capital ($9.2 million) and the 2007 expansion of the tailings management facilities ($4.3 million).

CAPITAL RESOURCES

As at December 31, 2008 the Company had cash and cash equivalents of $43.1 million compared to $74.6 million at the same time last year. The funds are invested in guaranteed investment certificates and short term interest bearing deposits at a major Canadian chartered bank.

In addition to cash and cash equivalents as at December 31, 2008 of $43.1 million the Company had concentrate awaiting settlement of $43.1 million comprised of 125,747 ounces of palladium provisionally valued at US$185 per ounce (115,786 ounces of palladium provisionally valued at spot of US$183 per ounce and 9,961 ounces of palladium at contract value of US$206), 6,895 ounces of platinum provisionally valued at US$898 per ounce, 6,222 ounces of gold provisionally valued at $869 per ounce, 0.4 million pounds of nickel provisionally valued at US$4.90 per pound, and 0.8 million pounds of copper provisionally valued at US$1.32 per pound. Final price adjustments on concentrate awaiting settlement will increase or decrease the Company's revenue in subsequent quarters depending on metal prices at the time final settlement is made.

To meet working capital requirements and for lateral development of the underground mine, the Company entered into a palladium and platinum advance purchase facility with Auramet Trading, LLC on January 19, 2007 pursuant to which the Company could, at its election, receive advance payments not exceeding an aggregate maximum amount of US$25.0 million. Under the terms of this facility no advances were be received after June 2008 and any amounts advanced had to be repaid by December 2008. As at December 31, 2008, the Company had no advances outstanding under this facility and the Company has elected not to renew the facility.

The Company anticipates that current cash resources and the final settlement of concentrate awaiting settlement will provide sufficient capital to meet the needs of the Company for the foreseeable future.

Contractual Obligations

| As at December, 2008 | | | Payments Due by Period

| |

| (thousands of dollars) | | | Total | | | 1 Year | | | 2-3 Years | | | 4-5 Years 1 | |

|

| Senior credit facility | | $ | 4,430 | | $ | 4,430 | | $ | – | | $ | – | |

| Capital lease obligations | | | 3,122 | | | 1,992 | | | 976 | | | 154 | |

| Interest obligations | | | 277 | | | 216 | | | 58 | | | 3 | |

| Operating leases | | | 1,899 | | | 794 | | | 1,020 | | | 85 | |

| Other purchase obligations | | | 1,966 | | | 1,966 | | | – | | | – | |

|

| | | $ | 11,694 | | $ | 9,398 | | $ | 2,054 | | $ | 242 | |

|

- 1

- There are no payments due after five years.

RELATED PARTY TRANSACTIONS

On October 12, 2006 the Company closed a transaction with Kaiser-Francis Oil Company ("Kaiser-Francis") for a US$5.0 million short term working capital loan maturing December 31, 2006. On

15

December 13, 2006, the maturity date was extended to March 31, 2007. Interest on this new facility was based on the 30-day LIBOR plus 2.5% and the standby fee was 0.125% per annum. This facility was repaid on March 7, 2007. As of January 20, 2009 Kaiser-Francis reported that it held approximately 44% of the issued and outstanding common shares of the Company.

On December 13, 2007 the Company completed a public offering of 18,666,667 units at a price of US$4.00 per unit ($4.04 per unit) for total gross proceeds of approximately US$74.7 million. Each unit consisted of one common share and one half of a common share purchase warrant of the Company. Each whole warrant entitles the holder to purchase one common share at a price of US$5.05 per share at any time on or prior to December 13, 2009. Pursuant to the terms of the securities purchase agreement dated March 24, 2006 between the Company, Kaiser-Francis and IP Synergy Finance Inc. ("IP Synergy") relating to the Company's convertible notes due 2008, Kaiser-Francis and IP Synergy each had a right to subscribe at the public offering price for up to 12.5% of the total securities being offered by the Company in this offering. If either Kaiser-Francis or IP Synergy subscribed for less than its 12.5% share, the unused right was to be offered to the non-declining party, Kaiser-Francis or IP Synergy, as the case may be. IP Synergy elected not to participate in this offering pursuant to its pre-existing participation right, and, in accordance with the terms of the securities purchase agreement, Kaiser-Francis, a related party, elected to subscribe for 25% of this offering.

On January 9, 2008, the Company issued an additional 2,800,000 units under a 30-day over-allotment option granted to the underwriters at an exercise price of US$4.00 per unit, ($4.04 per unit) for total net proceeds of US$10,391 (issue costs US$725). Kaiser-Francis also exercised its pre-existing right under the securities purchase agreement to subscribe for 25% of the over-allotment units.

REVIEW OF OPERATIONS AND PROJECTS

Lac des Iles Property

The Lac des Iles mine consists of an open pit mine, an underground mine, a processing plant with a nominal capacity of approximately 15,000 tonnes per day, and the original mill (which has been idle since 2001) with a nominal capacity of approximately 2,400 tonnes per day. The primary deposits on the property are the Roby Zone, a disseminated magmatic nickel-copper-PGM deposit and the Offset Zone.

On October 21, 2008 the Company announced that, due to depressed metal prices, it was temporarily placing its Lac des Iles Mine on a care and maintenance basis effective October 29, 2008. The closure resulted in the lay off of approximately 350 employees.

Mining Operations

The Company began mining the Roby Zone in 1993 using open pit mining methods. Ore and waste from the open pit is mined using conventional hydraulic 27 cubic meter and 23 cubic meter shovels, 190 tonne trucks, 187 millimeter blast hole drills and a fleet of conventional ancillary equipment. Mine waste is stockpiled outside of design pit limits.

Development of the underground mine commenced in the second quarter of 2004 in order to access the higher grade portion of the Roby Zone. The underground deposit lies below the ultimate pit bottom of the open pit and extends to a depth of approximately 660 meters below the surface where it is truncated by an offset fault. Commercial production from the underground mine commenced on April 1, 2006. For the year ended December 31, 2008, the underground mine had an average head grade of 5.71 grams per tonne of palladium compared to 5.79 grams per tonne in 2007.

The chosen mining method for the underground mine is sublevel retreat longitudinal longhole stoping with no fill. The mining block interval is 70 meters floor to floor including a 15 meter to 25 meter sill pillar below each haulage level. Stopes are 45 meters to 55 meters high by the width of the ore body. Total intake ventilation for the mine is designed to be 205 cubic meters per minute. There is one intake ventilation raise/secondary egress situated outside the ultimate open pit limits and air exhausts up the main ramp.

At the rate of production prior to being placed on temporary care and maintenance on October 29, 2008, open pit ore reserves would have been exhausted during the first half of 2009 and the current underground

16

mining operation would have continued until late 2010 or early 2011. It is not envisaged that the open pit will return to operation. High grade ore at the current pit bottom will be accessed from the Roby underground mine.

When operations resume, it is envisaged that the Roby underground mine and higher grade stockpiles will support production, at lower tonnage levels but higher grade than historical production. The Roby underground has identified reserves for approximately two years. During this period, development work on the Offset Zone will commence with the objective of achieving a seamless changeover from the Roby underground to the Offset Zone. A preliminary economic assessment of the Offset Zone released in May 2008 indicated that the Offset Zone could extend underground mining operations to 2018, with production of 6,000 tonnes per day by 2012 and producing 250,000 ounces of palladium annually.

A detailed preliminary feasibility study currently underway will assess whether to reopen the mine as an underground operation only. As currently envisaged, the Company could continue mining the Roby Zone, using underground mining methods, for two years while developing the Offset Zone for production. The Company believes that the mine could resume operations within three months of a start-up decision.

Milling Operations

Ore is first crushed in a gyratory crusher and conveyed to a coarse ore stockpile. With the commissioning of the secondary crusher in 2004, the coarse ore stream can be split so that a portion is crushed in the secondary crusher producing a fine material feed which is then combined with the coarse feed to the 15,000 tonne per day mill. This mill was commissioned in 2001 and utilizes a conventional flotation technology to produce a palladium rich concentrate that also contains platinum, nickel, gold and copper. This mixture of coarse and fine material feeds to the SAG mill to increase mill throughput. The ore is ground to a nominal P80 (the size of an opening through which 80% of the product will pass) of 74 microns in a conventional semi-autogenous mill/ball mill/pebble crusher (SABC) circuit. The ground ore then feeds a flotation circuit that is comprised of rougher/scavengers and four stages of cleaning. One flotation circuit in the mine's original mill is currently connected to the new mill to provide additional cleaner flotation capacity. The final concentrate is thickened and dewatered using two pressure filters.

The detailed preliminary feasibility study currently in progress will consider a lower tonnage, higher grade operation that could yield up to 250,000 ounces of palladium from the current underground mine and the Offset Zone. If adopted, the scenario currently being contemplated would require that the mill be reconfigured from a 15,000 tonne per day operation to a 6,000 to 7,500 tonne per day operation.

For the year ended December 31, 2008, the concentrator processed 3,722,732 tonnes of ore or 12,577 tonnes per operating day at an average palladium head grade of 2.33 grams per tonne and an average palladium recovery of 75.3%. In 2007, the concentrator processed 5,006,383 tonnes of ore or 13,716 tonnes per operating day at an average palladium head grade of 2.39 grams per tonne and an average palladium recovery of 74.8%. Palladium production for the year ended December 31, 2008 was 212,046 ounces compared to production of 286,334 ounces in 2007. Production costs per tonne of ore milled were $30.90 in 2008 compared to $24.98 in 2007. Cash costs, which include direct and indirect operating costs, smelting, refining, transportation and sales costs and royalties, net of credits for by-products, were US$283 per ounce of palladium in 2008 as compared to US$164 per ounce of palladium in 2007.

Offset Zone

The Offset Zone is located on the Lac des Iles property and was discovered by the Company's exploration team in 2001. The Offset Zone is considered to be the fault-displaced continuation of the Roby Zone mineralization and is located below and approximately 250 metres to the west of the Roby Zone. A mineral resource estimate prepared by Scott Wilson Roscoe Postle Associates in January 2009 estimated that the Offset Zone has significantly more mineral resources than the current underground mine at the Roby Zone at similar grades, while remaining open along strike to the north and south and at depth.

17

On May 7, 2008, the Company announced the results of a preliminary economic assessment prepared by Micon International Limited, which concluded that the Offset Zone could extend the Company's underground mining operation to 2018 based on a palladium price in excess of US$350 per ounce. Micon examined the economic viability of several mining scenarios for the Offset Zone, including a continuation of the existing ramp system from the current underground mine, several shaft options and a conveying option. The study concluded that in order to achieve a production rate of 250,000 ounces of palladium per annum, the underground mine could be operated at 4,000 - 7,000 tonnes per day using a series of conveyors and access ramps at an initial estimated capital cost of $37 million.

The Micon study proposes continuation of the longhole stoping mining method, which was the Company's mining method prior to the temporary mine closure, at the existing underground operations. Using a conveying system to bring ore to surface was found to be advantageous since it provides a great deal of flexibility in decision making and spreads capital expenditures over the life of the mine. The prefeasibility study now under way is reconsidering a staged implementation of the shaft option.

When operating at 6,000 tonnes per day, the study estimates that the Offset Zone operation could yield approximately 250,000 ounces of palladium, 16,000 ounces of platinum, 17,000 ounces of gold, 2 million pounds of nickel and 4 million pounds of copper annually. This economic assessment is preliminary in nature and includes measured, indicated and inferred mineral resources. Approximately 80% of the resources included in the 2007 preliminary economic assessment are in the inferred category. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable the resource to be categorized as mineral reserves. The study's level of accuracy is deemed to be plus or minus 25%.

An updated mineral resource estimate was prepared by Scott Wilson RPA in January 2009. As a result of the 2007 underground drill program, there is a higher confidence level in the mineral resource and approximately 73% of the resources are now classified in the indicated category. The Offset Zone is open for extensional exploration drilling along strike to the north and south end down dip.

A detailed prefeasibility report is underway with the objectives of converting mineral resources into mineral reserves, and assessing the optimal mining and milling configuration and economics of developing the Offset Zone. The report is expected to be completed by the end of the second quarter of 2009.

Drill programs are planned for 2009 and 2010 to increase confidence in existing mineral resources and to delineate more resources. Potential exists to add new resources along strike to the north and south and down-dip. Thus far the Offset Zone has been traced to a depth of 1,670 metres below surface, and along a strike length of approximately 600 metres.

Exploration

In addition to the Company's mining, development and exploration activities around the Lac des Iles property, grassroots exploration is an important ongoing part of the growth strategy. In 2008, the primary projects were the Shebandowan West Project and the Arctic Platinum Project.

The Company's vision is to create a mid tier precious metals company producing gold, platinum and palladium. Traditionally, North American Palladium has examined PGM and nickel opportunities near the Company's Lac des Iles mine, given the existing infrastructure at the Lac des Iles mine and the Company's years of experience in mining PGM-nickel deposits. Management is now also now considering gold opportunities that could be accretive to shareholders.

Shebandowan West Project

On December 10, 2007, the Company earned a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an option and joint venture agreement with Vale Inco. The properties, known as the Shebandowan property, contain a series of nickel copper-PGM mineralized bodies and the land package totals approximately 7,842 hectares. These properties are located 90 kilometres west of Thunder Bay, Ontario, and approximately 100 kilometres southwest from the

18

Company's Lac des Iles mine. Vale Inco retains an option to increase its interest from 50% to 60%, exercisable in the event that a feasibility study on the properties results in a mineral reserve and mineral resource estimate of the equivalent of 200 million pounds of nickel and other metals. As currently envisaged, the Shebandowan West Project will not trigger Vale Inco's back-in right.

The Shebandowan West Project covers a small portion of the Shebandowan property and encompasses three shallow mineralized zones known as the West, Road and "D" zones, all of which are located at shallow depths immediately to the west of the former Shebandowan mine in an area known as the Shebandowan West district. The Shebandowan West Project's nickel-copper-PGM mineralization is considered by management to represent the western extension of the Shebandowan mine ore body. The former Shebandowan mine, which was in operation from 1972 to 1998, produced 8.7 million tonnes of ore at grades of 2.07% nickel, 1.00% copper and approximately 3.0 g/t PGM and gold. A 43-101 Technical Report disclosing the results of a mineral resource estimate by an independent Qualified Person was filed on October 26, 2007.

In December 2007, the Company retained SRK Consulting to prepare a preliminary economic assessment of a mine development scenario that would entail excavation of the Shebandowan West Project by means of ramp-accessed underground mining methods at a rate of 500 to 1,000 tonnes per day, crushing the material on site and transporting it by truck to the Lac des Iles property for processing at the mine's original mill. The original mill at Lac des Iles has been idle since 2001 and the Company believes that it could be refurbished quickly and at a relatively low cost if the project were to proceed. Preliminary metallurgical testing supports the possibility of producing a bulk sulphide concentrate from the Shebandowan West Project at the original mill.

The Company received a preliminary economic assessment on the project. However, in light of the sharp decline in metal prices in the fall of 2008, the Company ceased all activities with the Shebandowan Joint Venture, including at the Shebandowan West Project. A decision on when and whether to resume activities will largely depend on the long term outlook for nickel prices.

Arctic Platinum Project

The Company was party to an agreement with Gold Fields Limited that would have entitled it to a 60% interest in a series of mining leases and claims known as the Arctic Platinum Project ("APP").

In order to satisfy the requirements of its earn-in, the Company had to satisfy a number of conditions on or before August 31, 2008, including: (i) complete a re-scoping and exploration program; (ii) complete a feasibility study; (iii) make a production decision and prepare the initial formal development proposal and associated budget based on the feasibility study; (iv) incur expenditures of US$12.5 million on the APP; and (v) issue 9,227,033 common shares to Gold Fields BV to earn a 60% interest or if Gold Fields exercised a claw-back right, issue 7,381,636 common shares to earn a 50% interest. As at December 31, 2008, the Company had completed the re-scoping study, incurred over US$18.8 million in expenditures charged to exploration expense and commissioned a feasibility study.

The Company received a draft feasibility study in the summer of 2008 which showed that lower commodity prices, coupled with the increased price of steel and diesel fuel, the strength of the euro relative to the U.S. dollar and other variables had adversely impacted the economics of the project. As a result of these findings, the Company determined that it would not deliver a positive feasibility study for the APP prior to the August 31, 2008 deadline. The Company advised Gold Fields of the outcome and the parties discussed strategic alternatives for the project. The parties failed to reach an agreement and the Company's option over the APP has since lapsed. All interests in APP have now reverted back to Gold Fields Limited.

Metal Sales

The Company has been selling palladium and platinum both into the spot market and to Auramet Trading, LLC, a precious metals merchant ("Auramet"), under a palladium and platinum advance purchase facility that the Company entered into in January 2007. The facility provided for the sale, at the Company's option, of an average of 10,000 ounces of palladium and 500 ounces of platinum per month.

19

Under the terms of the facility, up to June 30, 2008, the Company was able to receive advance payments not exceeding, at any time, an aggregate maximum of US$25 million. To secure the obligations of the Company under the agreement, the Company had granted to Auramet a security interest in the concentrate mined at the Lac des Iles mine, together with the proceeds arising from the sale of the concentrate, and, by way of security, an assignment of its smelting and refining agreement. Under this agreement with Auramet no advances could be received after June 2008 and any amounts advanced had to be repaid by December 2008. As at December 31, 2008, the Company had no advances outstanding under this facility.

Spot Metal Prices*

| | | | 2006 | | | 2007 | | | Q1 2008 | | | Q2 2008 | | | Q3 2008 | | | Q4 2008 | | % Inc (Dec)

vs. December

2007 | |

|

| Palladium – US$/oz | | $ | 322 | | $ | 364 | | $ | 445 | | $ | 467 | | $ | 199 | | $ | 183 | | (50%) | |

| Platinum – US$/oz | | $ | 1,115 | | $ | 1,530 | | $ | 2,040 | | $ | 2,064 | | $ | 1,004 | | $ | 898 | | (41%) | |

| Gold – US$/oz | | $ | 635 | | $ | 836 | | $ | 936 | | $ | 930 | | $ | 884 | | $ | 869 | | 4% | |

| Nickel – US$/lb | | $ | 15.11 | | $ | 11.70 | | $ | 13.52 | | $ | 9.83 | | $ | 7.15 | | $ | 4.90 | | (58%) | |

| Copper – US$/lb | | $ | 2.85 | | $ | 3.03 | | $ | 3.81 | | $ | 3.89 | | $ | 2.90 | | $ | 1.32 | | (56%) | |

|

- *

- Based on the London Metal Exchange ("LME") afternoon price fix. Year end prices for 2006 and 2007 and quarter end prices for 2008.

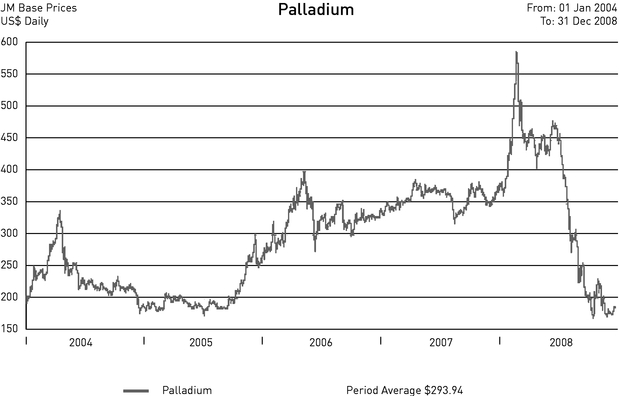

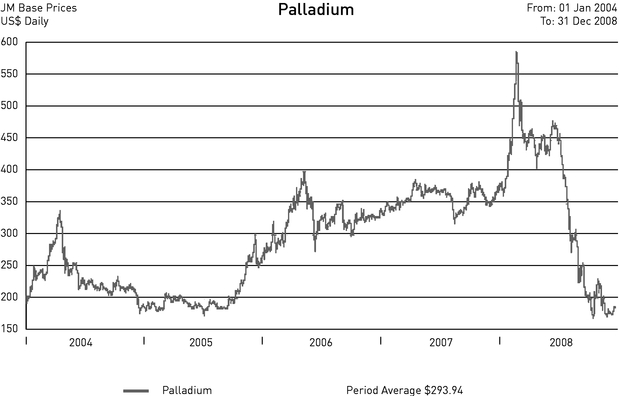

For the year ended December 31, 2008, the Company realized a weighted average cash price of US$378 per ounce on its physical deliveries of palladium into the spot market, compared to an average price of US$346 per ounce for 2007. After peaking in March 2008 at US$582 per ounce the price of palladium has declined by 69% to US$183 per ounce at the end of December 2008 as indicated in the chart below from Johnson Matthey.

Source: Johnson Matthey

20

OUTLOOK

Lac des Iles mine

On October 21, 2008, the Company announced that, due to declining metal prices, it was temporarily placing its Lac des Iles mine on a care and maintenance basis effective October 29, 2008. The closure resulted in the layoff of approximately 350 employees.

The price of palladium and platinum, the Company's two main metals, has changed dramatically over a very short period of time. As recently as June 2008, palladium and platinum traded at highs of US$475 per ounce and US$2,103 per ounce respectively. As of February 23, 2009, the spot price of palladium and platinum was US$204 per ounce and US$1,074 per ounce respectively.

Over 50% of palladium and platinum demand is for the manufacture of automotive catalytic converters. The outlook for the automotive industry over the near term is challenging. On the other hand, the medium to longer term outlook for the pricing of palladium and platinum appears to be quite positive based on credible forecasts predicting renewed growth in global automotive sales, particularly in the BRIC countries.

The temporary closing of the Lac des Iles mine will cut expenses and maintain the Company's strong cash position. As at December 31, 2008 the Company had cash and cash equivalents of $43.1 million, total debt of $7.6 million and net working capital of $86.1 million. In addition to the cash on hand, management expects to realize significant cash flow over the next few months as payment is received for metal sales made prior to the closure.

While in care and maintenance mode, the Company has retained senior mine management and facility security. The Company also retained its exploration and financial teams in Thunder Bay and the corporate staff in Toronto. Management estimates that corporate overhead, personnel costs and facility and maintenance expenditures at the mine will be in the range of $5.0 million to $6.0 million per quarter, excluding discretionary investment in exploration activities.

Going forward, management intends to focus on strategic initiatives, including:

- 1.

- Continuing the work required to complete a prefeasibility study on the Offset Zone to a depth of 1,200 metres below surface. This project has the potential to extend the life of the Lac des Iles mine significantly. Mineralization is currently known to exist to a depth of at least 1,670 metres.

- 2.

- Carrying out drilling and exploration operations at Lac des Iles to further delineate resources as well as maintaining grassroots exploration on the property adjacent to the mine; and

- 3.

- Leveraging the Company's strong balance sheet to pursue potential acquisitions and joint venture opportunities that may emerge in these difficult and volatile markets.

In the current environment, management expects that there will be many attractive strategic options to consider. The Company will pursue acquisition opportunities aggressively but with discipline to ensure that only those transactions that can deliver enhanced shareholder value over the long-term are pursued.

While the Lac des Iles mine is on care and maintenance, management will take the opportunity to re-evaluate the current mine plan and mill configuration with a view to reducing the breakeven point.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Critical accounting policies generally include estimates that are highly uncertain and for which changes in those estimates could materially impact the Company's financial statements. The following accounting policies are considered critical:

- (a)

- Impairment assessments of long-lived assets

Each year, the Company reviews the mining plan for the remaining life of mine. Significant changes in the mine plan can occur as a result of mining experience, mineral reserve estimates based on assessed geological and engineering analysis, new discoveries, changes in mining methods and production rates,

21