QuickLinks -- Click here to rapidly navigate through this document

Exhibit 1.2

TABLE OF CONTENTS

| | Page

|

|

|---|

|

| Management's Discussion and Analysis | | | |

| Introduction | | 1 | |

| Forward-Looking Information | | 1 | |

| Cautionary Note to US Investors Concerning Mineral Reserves and Resources | | 1 | |

| Our Business | | 2 | |

| Executive Summary | | 2 | |

| Acquisition of Cadiscor Resources Inc. | | 4 | |

| Financial Review | | 5 | |

| Financial Condition, Cash Flows, Liquidity and Capital Resources | | 10 | |

| Outstanding Share Data | | 12 | |

| Review of Operations | | 13 | |

| Exploration Update | | 15 | |

| Critical Accounting Policies and Estimates | | 18 | |

| Adoption of New Accounting Standards | | 20 | |

| Future Accounting Standards | | 20 | |

| Risks and Uncertainties | | 22 | |

| Internal Controls | | 22 | |

| Other Information | | 24 | |

| Non-GAAP Measures | | 24 | |

Management's Discussion and Analysis

INTRODUCTION

Unless the context suggests otherwise, references to "NAP" or the "Company" or similar terms refer to North American Palladium Ltd. and its subsidiaries. "LDI" refers to Lac des Iles Mines Ltd., and "Cadiscor" refers to Cadiscor Resources Inc.

The following is management's discussion and analysis ("MD&A") of the financial condition and results of operations to enable readers of the Company's consolidated financial statements and related notes to assess material changes in financial condition and results of operations for the year ended December 31, 2009, compared to those of the respective periods in the prior years. This MD&A has been prepared as of February 25, 2010 and is intended to supplement and complement the audited consolidated financial statements and notes thereto for the year ended December 31, 2009 (collectively, the "Financial Statements"). Readers are encouraged to review the Financial Statements in conjunction with their review of this MD&A and the most recent Form 40-F/Annual Information Form on file with the US Securities and Exchange Commission ("SEC") and Canadian provincial securities regulatory authorities, available at www.sec.gov and www.sedar.com, respectively.

All amounts are in Canadian dollars unless otherwise noted.

FORWARD-LOOKING INFORMATION

Certain information included in this MD&A, including any information as to the Company's future financial or operating performance and other statements, which include future-oriented financial information, that express management's expectations or estimates of future performance, constitute 'forward-looking statements' within the meaning of the 'safe harbor' provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. The words 'expect', 'believe', 'will', 'intend', 'estimate', 'plan', 'targeting', 'goal', 'vision' and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies. The Company cautions the reader that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual financial results, performance or achievements of the Company to be materially different from the Company's estimated future results, performance or achievements expressed or implied by those forward-looking statements and that the forward-looking statements are not guarantees of future performance. These statements are also based on certain factors and assumptions including factors and assumptions related to future prices of palladium, gold and other metals, the Canadian dollar exchange rate, the ability of the Company to meet operating cost estimates, inherent risks associated with mining and processing, as well as those estimates, risks, assumptions and factors described in the Company's most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities. In addition, there can be no assurance that the Company's LDI and Sleeping Giant mines will operate as anticipated, or that the other properties can be successfully developed. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements.

CAUTIONARY NOTE TO US INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES

Mineral reserve and mineral resource information contained herein has been calculated in accordance with National Instrument 43-101 as required by Canadian securities regulatory authorities. Canadian standards differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information contained herein is not comparable to similar information disclosed in accordance with the requirements of the SEC. While the terms "measured", "indicated" and "inferred" mineral resources are required pursuant to National Instrument 43-101, the SEC does not recognize such terms. US investors should understand that "inferred" mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, US investors are cautioned not to assume that any part or all of NAP's mineral resources constitute or will be converted into

1

reserves. For a more detailed description of the key assumptions, parameters and methods used in calculating NAP's mineral reserves and mineral resources, see NAP's most recent Annual Information Form/Form 40-F on file with Canadian provincial securities regulatory authorities and the SEC.

OUR BUSINESS

North American Palladium Ltd. (TSX: PDL, NYSE AMEX: PAL) is a Canadian-based precious metals company with assets in mining-friendly jurisdictions in Canada. The Company owns the LDI palladium mine in northwestern Ontario, the Sleeping Giant gold mine in northwestern Quebec, several exploration properties in the Abitibi region of Quebec, and has a 50% joint venture interest in the Shebandowan property located 100 kilometres southwest of the LDI mine. Although the Sleeping Giant gold mine is operating and pouring gold, the LDI mine, which produces palladium as well as platinum, gold, nickel and copper, was temporarily on care and maintenance during 2009 due to low metal prices. With the recent recovery in these metals, in particular palladium, the Company announced its plan to restart the LDI mine's Roby Underground mine in the second quarter of 2010. The Company's vision is to build a diversified mid-tier precious metals company by restarting the LDI mine and the Sleeping Giant gold mine, by continuing an aggressive exploration program at LDI and in Quebec, and by its continued diversification into gold and/or PGMs through accretive yet disciplined acquisitions.

EXECUTIVE SUMMARY

On December 8, 2009, the Company announced the planned restart of the LDI mine's Roby Underground mine which is expected to produce approximately 140,000 ounces of palladium per year over a two-year period, mined via ramp access at a rate of 76,000 tonnes per month. The Company expects cash costs per ounce, net of byproduct credits, to be between US$335 and US$350 per ounce of palladium produced and intends to hire approximately 150 employees which will bring the total workforce at LDI to approximately 180 employees when the mine is expected to resume full operations in the second quarter of 2010.

NAP also announced that it intends to commence initial development of the Offset Zone via a 1,500-metre ramp to a depth of over 200 metres that will take approximately 12 months to complete at a cost of approximately $16 million. The ramp will provide access for a platform for the installation of a raise-bore shaft to surface which management believes, in combination with a high-volume bulk mining method, is expected to make NAP a low cost producer of palladium. NAP's objective is to commence production in the Offset Zone once the Roby Zone ore has been depleted, so there will be no interruption in production.

NAP intends to build on its 2009 exploration success, and has more than doubled its exploration budget to $15 million for LDI for 2010. The program's objectives are to identify additional resources, upgrade resource classifications, and facilitate future mine development planning. The Company plans to spend $12 million drilling 53,000 metres in the Offset Zone, and $3 million drilling in the West Pit area adjacent to the current pit, and the Creek Zone area approximately 1.6 kilometres northeast of the Offset Zone.

On May 26, 2009, Company acquired the Sleeping Giant gold mine in the Abitibi region of Quebec through the acquisition of Cadiscor Resources Inc. The mine was successfully restarted on schedule and on budget and poured its first gold on October 6, 2009. The Sleeping Giant gold mine achieved commercial production as of January 1, 2010. Commencing in the second quarter, the Company expects Sleeping Giant's steady state cash costs per ounce to be approximately US$550 per ounce with annualized production of 50,000 ounces per year. In the first quarter of 2010, as the mine continues to ramp up, the Company expects cash costs to be higher than the remainder of 2010, and expects to produce annually approximately 50,000 ounces of gold with cash costs of approximately US$550 per ounce once the mill achieves a projected run rate of 15,000 tonnes per month.

NAP has commenced deepening the mine shaft at the Sleeping Giant gold mine by 200 metres due to positive drill results. The shaft deepening will be completed by year end and will allow for the development of three new mining levels at depth. The capital cost of the project is expected to be approximately $4.5 million for the shaft deepening and an additional $1.5 million for auxiliary equipment.

NAP plans to spend $6.2 million on a 53,000 metre gold exploration program for 2010 focused on extending Sleeping Giant zones at depth, drilling the Dormex property (adjacent to the Sleeping Giant gold mine),

2

advancing its Flordin property, surface drilling at its Discovery property, and ground geophysical surveys and drilling at its Laflamme gold property.

Financial Highlights

The fourth quarter of 2009 saw a continued improvement in the price of palladium, platinum, gold, and to a lesser extent, nickel. As a result of the increase in metal prices, the Company announced the restart of the LDI mine, which was placed on care and maintenance in October 2008. The results of operations for the year and quarter ended December 31, 2009 are not comparable to the same period last year, when the LDI mine was in full production until October 2008.

On September 30, 2009, NAP completed an equity offering of 16.0 million units at a price of $3.15 per unit for gross proceeds of $50.4 million on September 30, 2009. The underwriters were also granted an over-allotment option of an additional 2.4 million units which were subsequently exercised on October 8, 2009, providing additional gross proceeds of $7.6 million. On October 8, 2009, NAP also completed a private placement of 4,000,000 flow-through common shares at a price of $3.75 per share, for gross proceeds of $15.0 million. The total gross proceeds from these financings were $73.0 million.

The net loss for the year ended December 31, 2009 was $30.0 million or $0.29 per share compared to a net loss of $160.7 million or $1.94 per share in 2008. The net loss for the quarter ended December 31, 2009 was $14.4 million or $0.11 per share compared to a net loss of $112.4 million or $1.31 per share in the same quarter last year.

Revenue after pricing adjustments for the year ended December 31, 2009 was $3.8 million compared to $125.5 million in 2008. Revenue after pricing adjustments for the quarter ended December 31, 2009 was nominal compared to $11.3 million in the fourth quarter last year.

Cash provided by operations for the year ended December 31, 2009 was $3.9 million, a decline of $2.8 million, compared to cash provided by operations of $6.7 million in 2008. Cash used in operations for the quarter ended December 31, 2009 was $13.1 million, an improvement of $3.5 million, compared to cash used in operations of $16.6 million in the same quarter last year.

NAP used cash in operating activities of $28.6 million before changes in non-cash working capital for the year ended December 31, 2009, or $0.28 per share,1 as compared to cash used by operations of $25.5 million, or $0.31 per share,1 for the year ended 2008. NAP recorded cash used in operating activities of $13.9 million before changes in non-cash working capital for the quarter ended December 31, 2009, or $0.11 per share,1 as compared to $16.7 million, or $0.19 per share,1 for the same quarter last year.

Net working capital as at December 31, 2009 was $114.5 million (including cash and cash equivalents and short-term investments of $98.3 million), compared to $86.1 million as at December 31, 2008.

The Company has repaid in full all of its senior credit facilities in 2009.

Operational Highlights

For the year and quarter ended December 31, 2009, there was no palladium production due to the LDI mine being on care and maintenance as compared to 212,046 ounces and 21,373 ounces, respectively in the prior year.

The Company poured its first gold at the recently acquired Sleeping Giant mine on October 6, 2009, and during the year ended December 31, 2009, 34,132 tonnes of ore was hoisted from the underground mine, with 32,822 tonnes being processed by the mill.

Although the LDI mine remained on care and maintenance in 2009, the Company retained key senior mine management personnel, facility security, a large exploration team, finance personnel in Thunder Bay, and corporate staff in Toronto.

- 1

Non-GAAP measure. Please refer to Non-GAAP Measures on page 24.

3

Exploration Highlights

The Company's focus at the LDI mine has been to increase its understanding of the mineralization in the mine, and increase its reserves and resources. Exploration has been targeted on the Offset Zone, the Cowboy Zone, and since their recent discoveries, the Outlaw Zone and West Pit. In 2009, NAP incurred $13.6 million in exploration expenses, before an exploration tax credit of $0.4 million, compared to $23.1 million in 2008. For the quarter ended December 31, 2009, NAP incurred $4.7 million in exploration expenses, before an exploration tax credit of $0.4 million, compared to $4.7 million in the same quarter last year.

The discovery of the Cowboy and Outlaw Zones has resulted in the decision to expand the exploration effort at the LDI mine to define the limits, size and grade of the Offset Zone, as well as the other two new zones, and pursue other possible mineralized zones that were identified as a result of this exploration effort.

The Company has retained Scott Wilson Roscoe Postle Associates Inc. ("RPA") to prepare a resource update that will include the results of all the drilling completed in 2009. NAP expects this resource update to be available early in the second quarter of 2010. The Company, assisted by Nordmin Engineering Ltd. ("Nordmin"), will also work towards completing a scoping study that will incorporate the resource update prepared by RPA. This scoping study is expected to be available in the third quarter of 2010.

At the Sleeping Giant gold mine, the Company has continued an infill drill zone delineation program aimed at building on previous exploration success, adding to its mine life and upgrading the mine's resources. The Company is also continuing its exploration drilling under the Sleeping Giant gold mine to identify additional resources.

Outlook

The Company's management team believes it is delivering on its vision to create a diversified mid-tier precious metals company. The LDI mine offers significant leverage to the price of palladium, which NAP believes will increase due to increased demand and limited supply. The Company's renewed commitment to exploration is yielding results at the LDI mine and investments in the Abitibi region of Quebec are consistent with NAP's goal of becoming a 250,000 ounce annual producer of gold.

Management expects there will be attractive strategic opportunities to consider in the current environment. The Company will use its strong balance sheet to pursue PGM and/or gold acquisition and joint venture opportunities, but with discipline to ensure it pursues only those transactions that can deliver enhanced and sustainable shareholder value.

Selected Annual Information

(thousands of dollars)

| | | 2009 | | 2008 | * | 2007 | * | |

|

| Revenue after pricing adjustments | | $3,818 | | $125,491 | | $195,932 | | |

| Asset impairment charge | | – | | (90,000 | ) | – | | |

| Income (loss) from mining operations | | (6,232 | ) | (127,759 | ) | 505 | | |

| Net income (loss) | | (30,014 | ) | (160,679 | ) | (28,680 | ) | |

| Net loss per share (dollars) – Basic and diluted | | $(0.29 | ) | $(1.94 | ) | $(0.51 | ) | |

| Cash flow from (used in) operations prior to changes in non-cash working capital1 | | (28,567 | ) | (25,544 | ) | 27,770 | | |

| Total assets | | 219,211 | | 146,904 | | 305,374 | | |

| Total long-term debt, including current portion | | $1,134 | | $7,552 | | $39,081 | | |

| Cash dividends declared | | Nil | | Nil | | Nil | | |

|

- *

- Certain prior period amounts have been reclassified to conform to a classification adopted in the current year

- 1

- Non-GAAP measure. Please refer to Non-GAAP Measures on page 24.

4

ACQUISITION OF CADISCOR RESOURCES INC.

In May 2009, the Company acquired all of the outstanding common shares of Cadiscor in an all-equity transaction. Prior to the acquisition, the Company advanced to Cadiscor $7.5 million, consisting of a $5.4 million 12% convertible debenture, and a $2.1 million 12% debenture, the proceeds of which would be used by Cadiscor to bring the Sleeping Giant gold mine in Quebec back into production.

The results of Cadiscor's operations have been included in the Company's consolidated financial statements since the date of acquisition.

Pursuant to the acquisition agreement, Cadiscor shareholders received 0.33 common shares of the Company for each common share of Cadiscor. The Company issued approximately 14.5 million common shares on closing at a price of $1.89 per share based on the volume weighted average closing stock price of the Company's common shares for the period from March 27, 2009 to April 2, 2009.

In addition, all of Cadiscor's outstanding stock options and warrants as at the date of acquisition were exchanged for equivalent instruments in the Company. Approximately 0.9 million stock options and 1.4 million warrants were issued by the Company in the exchange. The Company recorded $1.0 million and $1.2 million as part of the purchase consideration, representing the fair value of these stock options and warrants respectively. The Company also assumed the equity conversion option relating to the convertible debentures with an assigned fair value of $1.4 million at the date of acquisition.

FINANCIAL REVIEW

Revenue

Revenue is affected by sales volumes, commodity prices and currency exchange rates. Metal sales are recognized in revenue at provisional prices when delivered to a third party smelter or refinery for treatment; however, final pricing is not determined until the refined metal is sold, which in the case of LDI metal sales, can be up to six months later. These final pricing adjustments result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the US dollar will result in additional revenues and a strengthening in the Canadian dollar will result in reduced revenues.

For each of the year and quarter ended December 31, 2009, revenue before pricing adjustments was $nil compared to $148.4 million and $9.6 million, respectively in 2008, reflecting no production from the LDI mine during 2009. Although revenue in the amount of $2.3 million was realized from the Sleeping Giant gold mine in 2009, this revenue was recorded as a credit against related costs, which were capitalized as part of the mining interests during the pre-production period. Subsequent to the year-end results, the Company announced that the Sleeping Giant mine reached commercial production on January 1, 2010.

Pricing adjustments from metal settlements and the mark-to-market of concentrate awaiting settlement in the year ended December 31, 2009 were $3.8 million ($4.4 million positive commodity price adjustment partially offset by a $0.6 million negative foreign exchange adjustment). This compares to negative pricing adjustments in the year ended December 31, 2008 of $22.9 million ($38.6 million negative commodity price adjustment partially offset by a $15.7 million positive foreign exchange adjustment). Pricing adjustments from metal settlements and the mark-to-market of concentrate awaiting settlement in the fourth quarter of 2009 were nominal. This compares to positive pricing adjustments in the fourth quarter of 2008 of $1.7 million ($8.9 million positive foreign exchange adjustment partially offset by a $7.2 million negative commodity price adjustment).

For the year ended December 31, 2009, revenue after pricing adjustments was $3.8 million compared to $125.5 million last year, and for the quarter ended December 31, 2009, revenue after pricing adjustments was nominal compared to $11.3 million in the same period last year, which reflects no production at the LDI mine during 2009.

The balance of the palladium sales were settled in the first six months of 2009. Final pricing on palladium sales settled during year ended December 31, 2009 realized an average price of US$204 per ounce, a

5

decrease of 46% compared to an average price of US$378 per ounce in 2008, as set out in the following table:

Average Realized Metal Prices and Exchange Rates

| | | Three months ended

December 31 | | Year ended

December 31 | |

| | | 2009 | | 2008 | | 2009 | | 2008 | |

|

| Palladium – US$/oz | | $– | | $207 | | $204 | | $378 | |

| Platinum – US$/oz | | $– | | $873 | | $1,025 | | $1,547 | |

| Gold – US$/oz | | $1,079 | | $802 | | $941 | | $862 | |

| Nickel – US$/lb | | $– | | $5.78 | | $4.80 | | $10.13 | |

| Copper – US$/lb | | $– | | $2.21 | | $1.45 | | $3.29 | |

|

| Average exchange rate (Bank of Canada) – CDN$1 = US$ | | US$0.95 | | US$0.83 | | US$0.88 | | US$0.94 | |

|

All of the concentrate awaiting settlement has been realized by the end of 2009. For comparison purposes, the following table details the recorded spot metal prices and exchange rate for the specified metals:

Spot Metal Prices* and Exchange Rates

| | | February 23

2010 | | December 31

2009 | | September 30

2009 | | June 30

2009 | | March 31

2009 | | December 31

2008 | | December 31

2007 | |

|

| Palladium – US$/oz | | $438 | | $393 | | $294 | | $249 | | $215 | | $183 | | $364 | |

| Platinum – US$/oz | | $1,518 | | $1,461 | | $1,287 | | $1,186 | | $1,124 | | $898 | | $1,530 | |

| Gold – US$/oz | | $1,107 | | $1,104 | | $996 | | $934 | | $916 | | $869 | | $836 | |

| Nickel – US$/lb | | $9.31 | | $8.38 | | $7.86 | | $7.26 | | $4.27 | | $4.90 | | $11.70 | |

| Copper – US$/lb | | $3.33 | | $3.33 | | $2.78 | | $2.31 | | $1.83 | | $1.32 | | $3.03 | |

|

| Exchange rate (Bank of Canada) – CDN$1 = US$ | | US$0.95 | | US$0.96 | | US$0.93 | | US$0.86 | | US$0.79 | | US$0.82 | | US$1.01 | |

|

- *

- Based on the London Metal Exchange

Operating Expenses

For the year ended December 31, 2009, total care and maintenance costs at the LDI mine were $13.0 million compared to $nil in 2008. Due to the LDI mine closure, no palladium was produced in the quarter and year ended December 31, 2009. Total production costs for the year ended December 31, 2008 were $115.0 million. In the year ended 2008, unit cash costs,1 which include direct and indirect operating costs, smelting, refining, transportation and sales costs and royalties, net of credits for by-products, were US$283 per ounce of palladium. For the three months ended December 31, 2009, total care and maintenance costs were $4.2 million compared to $nil in the same period of 2008. Total production costs for the three months ended December 31, 2008 were $22.4 million and unit cash costs1 were US$464 per ounce of palladium.

Inventory pricing adjustments for the year ended December 31, 2009 were favourable $3.6 million (2008 – unfavourable $3.9 million) and reflect the adjustment of ore inventories to net realizable value due to the increase in metal prices partially offset by the strengthening of the Canadian dollar during the quarter. For the three months ended December 31, 2009, the inventory pricing adjustments were $nil (2008 – favourable $1.6 million).

- 1

- Non-GAAP measure. Please refer to Non-GAAP Measures on page 24.

Smelter treatment, refining and freight costs for the year ended December 31, 2009 were $0.1 million compared to $19.3 million in 2008. The $0.1 million cost reflects final pricing and assay adjustments on concentrate shipments made prior to the October 2008 mine shutdown. For the three months ended

6

December 31, 2009, smelter treatment, refining and freight costs were nominal compared to $1.3 million in the corresponding period in 2008.

Non-cash amortization was $0.3 million in year ended December 31, 2009 compared to $36.0 million in 2008. For the three months ended December 31, 2009, non-cash amortization was $0.1 million compared to $3.2 million in the corresponding period in 2008. The lower amortization expense for the year and quarter ended December 31, 2009 is due to the lack of palladium production at the LDI mine, as the majority of the mining interests are amortized using the unit of production method. With respect to the Sleeping Giant gold mine, there is no amortization expense associated with this mine since it was in the development phase. Upon reaching commercial production as of January 1, 2010, the Sleeping Giant gold mine will commence amortization of its mining interests using the unit of production and straight line methods of amortization. The amortization expense for the year and quarter ended December 31, 2009 reflects amortization of vehicles still in use while the LDI mine is on a care and maintenance basis as well as computer equipment and vehicles in use at the Sleeping Giant gold mine.

The Company reviews and evaluates its long-lived assets for impairment when events or changes in circumstances arise that may result in impairments in the carrying value of those assets. Impairment is considered to exist if total estimated future undiscounted cash flows are less than the carrying amount of the asset. In the opinion of the Company's management, during 2009 there were no events or changes in circumstances giving rise to an impairment in the carrying value of long-lived assets. Assumptions underlying future cash flow estimates are subject to risk and uncertainty. Any differences between significant assumptions and market conditions such as metal prices, exchange rates, recoverable metal, and/or the Company's operating performance could have a material effect on the Company's ability to recover the carrying amounts of its long-lived assets resulting in possible additional impairment charges.

For the year and quarter ended December 31, 2009, the gain on disposal of equipment was nominal compared to a loss of $2.5 million and $0.9 million respectively, as compared to the same periods last year. The losses in 2008 represented the unamortized value of component parts of equipment.

For the year ended December 31, 2009, asset retirement obligation accretion was $0.4 million, consisting of $0.3 million and $0.1 million in accretion charges recognized for each of LDI and Sleeping Giant gold mines respectively. The prior year's asset retirement obligation accretion was $0.3 million, consisting of $0.5 million of accretion and amortization charges relating to the LDI mine, which were offset by a $0.2 million recovery as a result of reduced estimated closure costs based on the revised 2008 mine plan. For the three months ended December 31, 2009, asset retirement obligation accretion was nominal, compared to a recovery of $0.1 million in the same period in 2008, consisting of a $0.1 million accretion charge relating to the LDI mine, which was offset by the $0.2 million recovery.

For the year ended December 31, 2009, the Company recorded a loss from mining operations of $6.2 million, compared to last year's loss of $141.6 million, before an insurance recovery of $13.8 million, and reflects the LDI mine being on care and maintenance during the year. For the three months ended December 31, 2009, the Company recorded a loss from mining operations of $4.3 million, compared to $104.6 million for the same period last year.

Other Expenses

General and administration expenses for the year ended December 31, 2009 were $9.0 million compared to $7.7 million in 2008, and for the quarter ended December 31, 2009, general and administration expenses were $3.0 million compared to $1.8 million in the same period in 2008, due primarily to the additional administration as a result of the acquisition of Cadiscor.

7

Exploration expenditures for the year ended December 31, 2009 were $13.2 million compared to $23.1 million in 2008, and for the quarter ended December 31, 2009, exploration expenditures were $4.3 million, compared to $4.7 million in the corresponding period in 2008, and are comprised as follows:

| | | Three months ended

December 31 | | Year ended

December 31 | |

| | | 2009 | | 2008 | | 2009 | | 2008 | |

|

| Offset Zone project | | $1,777 | | $384 | | $7,234 | | $1,826 | |

| LDI property | | 1,220 | | 2,535 | | 4,197 | | 3,725 | |

| Shebandowan West nickel- copper-PGM project | | 20 | | 2,558 | | 133 | | 8,925 | |

| Cameron Shear property | | 117 | | – | | 117 | | – | |

| Flordin property | | 49 | | – | | 49 | | – | |

| Sleeping Giant mine property | | 988 | | – | | 988 | | – | |

| Discovery project | | 88 | | – | | 488 | | – | |

| Dormex property | | 80 | | – | | 80 | | – | |

| Harricana project | | 90 | | – | | 90 | | – | |

| LaFlamme property | | 157 | | – | | 157 | | – | |

| Prospect project | | 69 | | – | | 69 | | – | |

| Arctic Platinum Project | | – | | (807 | ) | – | | 8,594 | |

|

| | | $4,655 | | $4,670 | | $13,602 | | $23,070 | |

| Exploration tax credits | | (368 | ) | – | | (368 | ) | – | |

|

| Total exploration expenditures | | $4,287 | | $4,670 | | $13,234 | | $23,070 | |

|

For the year and quarter ended December 31, 2009 there were no expenditures on the Arctic Platinum Project ("APP") as all interests in the APP reverted back to Gold Fields Limited in the latter part of 2008.

In light of the sharp decline in nickel prices in the latter half of the previous year, the Company ceased all activities late 2008 on the Shebandowan joint venture, including at the Shebandowan West project.

Interest and other income for the year ended December 31, 2009 was $2.0 million compared to a cost of $3.4 million in the corresponding period last year, an increase of $5.4 million. The reduced interest and other costs are due primarily to lower interest and accretion expenses of $4.0 million relating to the convertible notes payable, which were fully repaid in the fourth quarter of 2008, lower interest paid on senior credit facilities of $0.6 million, which were fully repaid in the fourth quarter of 2009, recovery of interest expense relating to the 2006 flow through financing of $0.2 million, and $0.7 million in realized gains on investments offset by lower interest income earned on short term interest bearing deposits. For the three months ended December 31, 2009, interest and other income was $0.4 million compared to a cost of $0.5 million in the same period last year, an increase of $0.9 million. The reduced interest and other costs are due primarily to the unrealized mark-to-market adjustment on investments of $0.6 million, recovery of interest expense relating to the 2006 flow through financing of $0.3 million, offset by lower interest income earned on short term interest bearing deposits.

The foreign exchange loss for the year ended December 31, 2009 was $0.2 million compared to $1.0 million last year. The prior year included a foreign exchange loss of $2.8 million on the translation of the Company's US dollar denominated convertible notes, capital leases and credit facilities, offset partially by a $1.8 million foreign exchange gain related to the APP in Finland that reflected the strengthening of the Canadian dollar against the euro. For the three months ended December 31, 2009, the foreign exchange gain was nominal compared to a foreign exchange loss of $1.4 million in the corresponding period last year, resulting in a favourable foreign exchange impact of $1.4 million. The corresponding period in the prior year included a foreign exchange loss of $1.6 million on the translation of the Company's US dollar denominated convertible notes, capital leases and credit facilities, offset partially by a $0.2 million foreign exchange gain related to the Arctic Platinum Project in Finland that reflected the strengthening of the Canadian dollar against the euro.

8

Income and Mining Tax Expense

For the year and quarter ended December 31, 2009, the Company's income and mining tax expense was $3.2 million, due to a tax liability arising in respect of the Ontario harmonization transition rules ($2.0 million), current income tax expense relating to additional taxes payable to Ontario in respect of its estimated resource allowance ($0.3 million), and future mining tax expense resulting from the Cadiscor operations ($0.9 million), compared to a recovery of $2.2 million and $0.6 million in the same periods last year. The prior year recovery of $2.2 million mostly reflected the recovery of future mining taxes resulting from realized losses, recovery of mining taxes resulting from the settlement of an exposure previously accrued for in a prior year, and the recovery of future income taxes created on the renunciation of exploration expenses related to a previous flow-through share offering. The prior period recovery of $0.6 million related primarily to the recovery of mining taxes resulting from the settlement of an exposure previously accrued for in prior periods. Given the substantial unrecognized tax benefits already available to the Company, no additional tax benefits were recorded in respect of current period losses.

Net Loss

For the year ended December 31, 2009, the Company's LDI mine remained on care of maintenance and, as a result, did not generate revenue from production resulting in a net loss of $30.0 million or $0.29 per share compared to a net loss of $160.7 million or $1.94 per share in 2008. Similarly, for the three months ended December 31, 2009, the Company reported a net loss of $14.4 million or $0.11 per share compared to a net loss of $112.4 million or $1.31 per share in the same period last year.

Summary of Quarterly Results

(expressed in thousands of Canadian dollars except per share amounts)

| | | 2009 | | 2008 | |

|

| | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | |

|

| Revenue – before pricing adjustments | | $– | | $– | | $– | | $– | | $9,642 | | $35,331 | | $52,403 | | $51,052 | |

| Pricing adjustments: | | | | | | | | | | | | | | | | | |

| | Commodities | | 2 | | 10 | | 354 | | 4,018 | | (7,189 | ) | (47,203 | ) | 581 | | 15,178 | |

| | Foreign exchange | | (1 | ) | (9 | ) | (1,568 | ) | 1,012 | | 8,889 | | 2,992 | | (743 | ) | 4,558 | |

|

| Revenue – after pricing adjustments | | $1 | | $1 | | $(1,214 | ) | $5,030 | | $11,342 | | $(8,880 | ) | $52,241 | | $70,788 | |

|

| Cash provided by (used in) operations* | | (13,097 | ) | (8,911 | ) | 11,464 | | 14,455 | | (16,637 | ) | 7,463 | | 5,821 | | 10,099 | |

| Exploration expense | | 4,287 | | 2,623 | | 3,916 | | 2,408 | | 4,670 | | 4,231 | | 7,115 | | 7,054 | |

| Net income (loss) | | (14,361 | ) | (6,194 | ) | (9,806 | ) | 347 | | (112,419 | ) | (71,242 | ) | 10,387 | | 12,595 | |

| Net income (loss) per share | | $(0.11 | ) | $(0.06 | ) | $(0.11 | ) | $0.00 | | $(1.31 | ) | $(0.85 | ) | $0.13 | | $0.16 | |

| Fully diluted net income (loss) per share | | $(0.11 | ) | $(0.06 | ) | $(0.11 | ) | $0.00 | | $(1.31 | ) | $(0.85 | ) | $0.13 | | $0.15 | |

|

9

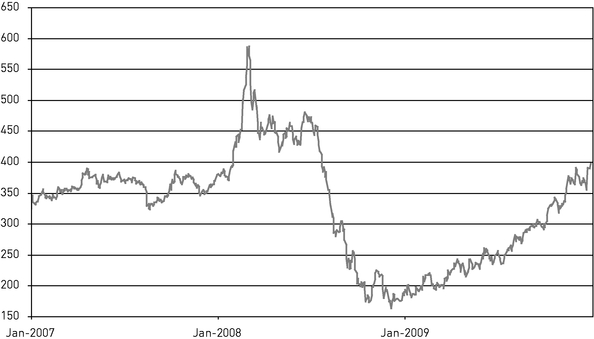

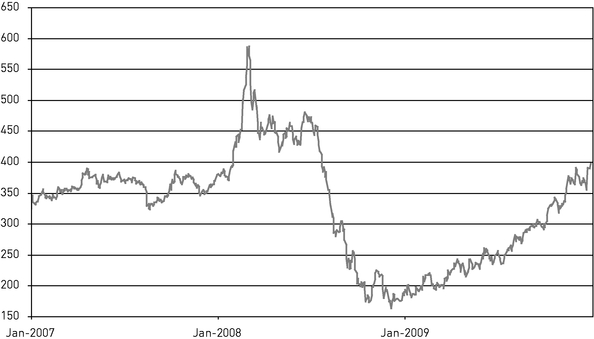

| Nymex Palladium Cash Price US$/ Troy oz | | |

| US$ Daily | | From: 01 Jan.2007 |

| | | To: 19 Feb. 2010 |

After peaking in March 2008 at US$582 per ounce, the price of palladium declined by 69% to US$183 per ounce on December 31, 2008. In October 2008 the Company decided to put the LDI mine on temporary care and maintenance in October 2008. The price of palladium has subsequently increased to US$393 at December 31, 2009, resulting in the Company announcing the planned restart of the LDI mine.

FINANCIAL CONDITION, CASH FLOWS, LIQUIDITY AND CAPITAL RESOURCES

Sources and Uses of Cash

| | | Three months ended

December 31 | | Year ended

December 31 | | |

| | | 2009 | | 2008 | | 2009 | | 2008 | | 2007 | | |

|

| Cash provided by (used in) operations prior to changes in non-cash working capital | | $(13,898 | ) | $(16,684 | ) | $(28,567 | ) | $(25,544 | ) | $27,770 | | |

| Changes in non-cash working capital | | 801 | | 46 | | 32,478 | | 32,290 | | (2,170 | ) | |

|

| Cash provided by (used in) operations | | (13,097 | ) | (16,638 | ) | 3,911 | | 6,746 | | 25,600 | | |

| Cash provided by (used in) financing | | 21,748 | | (2,185 | ) | 63,669 | | 2,105 | | 61,199 | | |

| Cash used in investing | | (3,524 | ) | (4,536 | ) | (12,393 | ) | (40,389 | ) | (15,346 | ) | |

|

| Increase (decrease) in cash and cash equivalents | | $5,127 | | $(23,359 | ) | $55,187 | | $(31,538 | ) | $71,453 | | |

|

For the year ended December 31, 2009, cash used in operations prior to changes in non-cash working capital was $28.6 million, compared to $25.5 million in 2008, a deterioration of $3.1 million. This deterioration is due primarily to the reductions of the asset impairment charge ($90.0 million), amortization expense ($35.8 million), accretion expense relating to the convertible notes payable ($3.4 million), impact of the loss on disposal of equipment ($2.5 million), unrealized foreign exchange loss ($2.4 million), interest on convertible notes settled in shares ($0.7 million) and stock based compensation and employee benefits ($0.8 million), offset by the decreased net loss ($130.7 million) and a decreased future income tax recovery ($2.2 million).

10

For the three months ended December 31, 2009, cash used in operations prior to changes in non-cash working capital was $13.9 million, compared to $16.7 million in the same period last year, an improvement of $2.8 million. This improvement is due primarily to the decreased net loss ($98.1 million), offset by the lower asset impairment charge ($90.0 million), decreased amortization ($3.1 million), the impact of the unrealized foreign exchange loss ($1.1 million), and loss on disposal of equipment ($0.9 million).

For the year ended December 31, 2009, non-cash working capital decreased by $32.5 million compared to $32.3 million last year. Various non-cash working capital balances have been impacted by the acquisition of Cadiscor as disclosed in note 3 to the consolidated financial statements. The $32.5 million decrease is due to concentrate awaiting settlement being fully realized ($43.1 million), decrease in other assets ($0.7 million), before an adjustment of Cadiscor's opening balance ($0.6 million), and an increase of taxes payable ($2.5 million) largely due to the Ontario harmonization transition rules, offset by increases in inventories ($8.7 million) due primarily to unrealized foreign exchange and commodity price adjustments on crushed and broken ore and gold inventories, before an adjustment of Cadiscor's opening balance ($0.4 million), and a decrease in accounts payable and accrued liabilities ($2.8 million), before an adjustment of Cadiscor's opening balance ($3.2 million).

For the three months ended December 31, 2009, non-cash working capital decreased by $0.8 million compared to $0.1 million in the same period last year. The $0.8 million decrease is due an increase in accounts payable and accrued liabilities ($3.8 million), before an adjustment relating to Cadiscor's acquisition ($1.8 million), and taxes payable ($2.3 million) that is due largely to the Ontario harmonization transition rules, and the realization of concentrate awaiting settlement ($0.1 million), offset by an increase in inventories ($2.6 million) due primarily to unrealized foreign exchange and commodity price adjustments on crushed and broken ore and gold inventories, and other assets ($1.1 million).

After allowing for non-cash working capital changes, cash provided by operations was $3.9 million for the year ended December 31, 2009 compared to $6.7 million in 2008. For the three months ending December 31, 2009, cash used in operations was $13.1 million compared to $16.6 million in the corresponding period last year.

Financing activities for the year ended December 31, 2009 provided cash of $63.7 million and reflected the $70.1 million net proceeds received from the September 2009 equity offering, offset by the scheduled repayment of debt of $6.4 million compared to $2.1 million in 2008. In the prior year the underwriters of the December 2007 equity offering exercised an over-allotment option that increased the net proceeds of the offering by $10.5 million, which was recorded in 2008. For the three months ending December 31, 2009, financing activities provided cash of $21.7 million and reflected the $22.7 million net proceeds received from the exercise of the over-allotment option relating to the September 2009 equity offering and the private placement of flow-through common shares, compared to a use of cash of $2.2 million in the same period last year.

On September 30, 2009, the Company completed an equity offering of 18.4 million units at a price of $3.15 per unit, for gross proceeds of $58.0 million (net proceeds of $53.6 million). Each unit consists of one common share and one-half of one common share purchase warrant of the Company. Each whole warrant entitles the holder to purchase an additional common share at a price of $4.25 per share, subject to adjustment, at any time on or prior to September 30, 2011, subject to early termination in certain circumstances. The Company intends to use the net proceeds of the sale of the units for exploration and development expenditures at the Company's LDI property and Sleeping Giant gold mine, to fund capital expenditures and working capital requirements at the LDI mine, and for general corporate purposes, which may include future acquisitions.

The Company also completed a private placement of 4,000,000 flow-through common shares at an exercise price of $3.75 per share, for total gross proceeds of $15.0 million (net proceeds of $14.1 million).

The Company's total debt position decreased to $1.1 million at December 31, 2009 from $7.6 million at December 31, 2008. The senior credit facilities have been fully repaid by December 31, 2009. For the three

11

months ended December 31, 2009, the reduction in debt includes scheduled repayments of the senior credit facilities ($0.5 million) and scheduled capital lease repayments ($0.4 million).

Investing activities required $12.4 million of cash for the year ended December 31, 2009, the majority of which was attributable to the development of the Sleeping Giant gold mine ($10.1 million), the tailings management facility at the LDI mine ($0.5 million), the computer systems upgrades ($0.3 million), and costs associated with the acquisition of Cadiscor ($1.1 million). For the year ended December 31, 2008, investing activities required $40.4 million of cash, the majority of which was attributable to the expansion of the tailings management facility ($26.7 million), the ongoing lateral development and sustaining capital for the underground mine ($4.1 million), purchase of major spare parts ($8.5 million). In the quarter ended December 31, 2009, there were $3.5 million of investing activities associated the development of the Sleeping Giant gold mine ($3.2 million) and the tailings management facility at the LDI mine ($0.3 million). This compares with $4.5 million for the same period last year, which was mainly related to the expansion of the tailings management facility ($1.8 million), the ongoing lateral development and sustaining capital for the underground mine ($0.8 million) and purchase of major spare parts ($1.5 million).

Capital Resources

As at December 31, 2009 the Company had cash and cash equivalents of $98.3 million compared to $43.1 million as at December 31, 2008. The funds are largely invested in short term interest bearing deposits at a major Canadian chartered bank.

The Company has sufficient cash resources to restart the LDI mine. The cash flow from the Sleeping Giant mine, together with the Company's cash reserves, are expected to be sufficient to meet the Company's requirements in the near term. In 2010, the Company intends to deepen the mine shaft at the Sleeping Giant gold mine at an estimated cost of $4.5 million plus an additional $1.5 million for auxiliary equipment, and pursuing LDI's Offset Zone ramp development, estimated to be $16.0 million. Also, NAP plans to spend $6.2 million on its Quebec properties as well as $15.0 million on its Ontario properties. The Company will also use resources to fund the additional working capital required to restart the LDI mine in 2010.

Contractual Obligations

| As at December 31, 2009 | Payments Due by Period | |

| (expressed in thousands of Canadian dollars) | Total | | 1 Year | | 2-3 Years | | 4-5 Years | | >5 years | |

|

| Capital lease obligations | $1,223 | | $605 | | $509 | | $109 | | $– | |

| Operating leases | 1,356 | | 659 | | 456 | | 146 | | 95 | |

| Purchase obligations | 858 | | 858 | | – | | – | | – | |

|

| | $3,437 | | $2,122 | | $965 | | $255 | | $95 | |

|

On October 8, 2009, the Company completed a private placement of 4,000,000 flow-through common shares. The gross proceeds of $15,000 must be spent on Canadian exploration expenses prior to December 31, 2010 and renounced to investors.

In addition to the above, the Company also has asset retirement obligations in the amount of $12,921 that would become payable at the time of the closures of its LDI and Sleeping Giant mines. The expected life of these mines is presently projected to 2012. Deposits established by the Company to offset these future outlays amount to $10,503. As a result, a shortfall of $2,418 is required to be funded prior to closure of the mines.

Related Party Transactions

There were no related party transactions to report for the quarter and year ended December 31, 2009.

OUTSTANDING SHARE DATA

As of February 25, 2010, there were 127,383,051 common shares of the Company outstanding. In addition, there were options outstanding pursuant to the 1995 Corporate Stock Option Plan entitling holders thereof to acquire 3,057,800 common shares of the Company at a weighted average exercise price of $3.50. As of

12

the same date, there were also 2,756,665 and 9,530,000 warrants outstanding each warrant entitling the holder thereof to purchase one common share at a weighted average exercise price of US$9.74 and $4.18, respectively.

REVIEW OF OPERATIONS

Lac des Iles Property

The LDI mine consists of an open pit mine, an underground mine, a processing plant with a nominal capacity of approximately 15,000 tonnes per day, and the original mill (idle since 2001) with a nominal capacity of approximately 2,400 tonnes per day. The primary deposits on the property are the Roby Zone and the Offset Zone, both disseminated magmatic nickel-copper-platinum group metals ("PGM") deposits. On October 21, 2008 the Company announced that, due to depressed metal prices, it was temporarily placing its LDI mine on care and maintenance effective October 29, 2008. The closure resulted in the layoff of approximately 350 employees.

LDI Mine

During the year ended December 31, 2009, no ore was extracted from the LDI underground mine, compared to 615,630 tonnes extracted with an average palladium grade of 5.11 grams per tonne last year. In the LDI open pit operation, no ore was extracted for the year ended December 31, 2009, compared to 3,060,788 tonnes of ore extracted at an average palladium grade of 1.5 grams per tonne in the previous year. The strip ratio for the year ended December 31, 2008 was 2.28. During the three months ended December 31, 2009, no ore was extracted from the LDI underground mine. During the same period last year, 46,446 tonnes were extracted with an average palladium grade of 6.72 grams per tonne. In the LDI open pit operation no ore was extracted for the three months ended December 31, 2009, compared to 216,845 tonnes of ore extracted at an average palladium grade of 2.55 grams per tonne in the same period last year. The strip ratio for the three months ended December 31, 2008 was 2.04.

Development of the underground mine commenced in the second quarter of 2004 in order to access the higher grade portion of the Roby Zone. The underground deposit lies below the ultimate pit bottom of the open pit and extends to a depth of approximately 660 metres below the surface where it is truncated by an offset fault. Commercial production from the underground mine commenced on April 1, 2006.

The chosen mining method for the underground mine is sublevel retreat longitudinal longhole stoping with unconsolidated rock fill. The mining block interval is 95 metres floor to floor with two sublevels in between and 20 metre sill pillars between blocks. Stopes average 60 metres in length with 7 to 10 metre-wide vertical rib pillars between stopes. Total intake ventilation for the mine is designed to be 205 cubic metres per minute. There is one intake ventilation raise/secondary egress situated outside the ultimate open pit limits and air exhausts up the main ramp.

At the time the mine was placed on temporary care and maintenance on October 29, 2008, open pit ore reserves would have had another nine months of mine life and the underground mining operation would have continued for another one and a half years. The Company expects that the higher grade ore remaining in the pit bottom will be accessed from the Roby underground mine.

When operations resume, the Company expects that the Roby underground mine will support production, at lower tonnage levels but higher grade than historical production. During this period, it is anticipated that development work on the Offset Zone will commence with the objective of achieving a seamless changeover from the Roby underground to the Offset Zone. A preliminary economic assessment of the Offset Zone, released in May 2008 indicated that the Offset Zone could extend underground mining operations to 2018, with production of 6,000 tonnes per day by 2012 and producing 250,000 ounces of palladium annually.

As currently envisaged, the Company would continue mining the Roby Zone, using underground mining methods, for two years while developing the Offset Zone which could add up to ten years of additional mine life. The Company has begun the process of restarting operations at the LDI mine and expects to produce its first concentrate in the second quarter of 2010.

13

LDI Mill

The LDI mill did not process any ore during the year ended December 31, 2009. During 2008, the mill processed 3,722,732 tonnes of ore at an average of 12,577 tonnes per operating day, producing 212,046 ounces of palladium at an average palladium head grade of 2.33 grams per tonne, with a palladium recovery of 75.3%, and mill availability of 80.3%. During the three months ended December 31, 2009, the mill did not process any ore. During the same period in 2008, the mill processed 265,950 tonnes of ore at an average of 12,089 tonnes per operating day, producing 21,373 ounces of palladium at an average palladium head grade of 2.91 grams per tonne, with a palladium recovery of 76.0%, and mill availability of 87.9%.

Ore from the open pit and underground mine was first crushed in a gyratory crusher and conveyed to a coarse ore stockpile. With the commissioning of the secondary crusher in 2004, the coarse ore stream could be split so that a portion was crushed in the secondary crusher producing a fine material feed which was then combined with the coarse feed. The processing operation utilized a conventional flotation technology to produce a palladium rich concentrate that also contains platinum, nickel, gold and copper. This mixture of coarse and fine material fed to the SAG mill to increase mill throughput. The ore was ground to a nominal P80 (the size of an opening through which 80% of the product would pass) of 74 microns in a conventional semi-autogenous mill/ball mill/pebble crusher (SABC) circuit. The ground ore then fed a flotation circuit comprised of rougher/scavengers and four stages of cleaning. The flotation circuit in the old concentrator was connected to the new mill to provide additional cleaner flotation capacity. The final concentrate was thickened and dewatered using two pressure filters.

Total production costs (mining and milling) per tonne of ore milled for the year ended December 31, 2008 were $30.90. For the year ended December 31, 2008 cash costs,1 including direct and indirect operating costs, smelting, refining, transportation and sales costs and royalties, net of credits for by-products, were US$283 per ounce of palladium.

Sleeping Giant Property

The Sleeping Giant gold mine is composed of four mining leases and 69 mining claims surrounding the mining infrastructures, and consists of an underground mine and a mill.

Sleeping Giant Mine

During the year ended December 31, 2009, 34,132 tonnes of ore was hoisted from the underground mine, with 32,822 tonnes being processed by the mill. For the quarter ended December 31, 2009, 23,852 tonnes of ore was hoisted from the underground mine, with 23,048 tonnes being processed by the mill. Until the mine reaches commercial production, which occurred on January 1, 2010, all costs associated with achievement of commercial production, net of preproduction revenue from gold sales, are capitalized.

The Sleeping Giant gold mine was in production from 1988 to 1991 and from 1993 to September 2008, when it was placed on care and maintenance by its previous owner. At the end of 2008, cumulative production was approximately 960,000 ounces of gold at an average grade of about 11.44 grams per tonne gold.

The mine is accessed by a four-compartment production shaft with a total depth of 1,053 metres. Levels are spaced at 45 metres from surface to a depth of 235 metres, and from there to a depth of 975 metres are spaced at 60 metres. The exploration shaft and various raises allow all portions of the mine to be ventilated with fresh air. An ore pass and a waste pass allow material to be handled and raised to the surface. The deepest working level of the mine is presently 975 metres. The mine uses 3 and 5 tonne electric locomotives and rail cars.

Three mining methods have been used to extract ore, with the method being determined according to the dip of a particular zone. For slopes over 65 degrees, long-hole and shrinkage stope extraction is used. For

- 1

- Non-GAAP measure. Please refer to Non-GAAP Measures on page 24.

14

slopes between 65 and 45 degrees, the method employed is generally shrinkage stope mining (with some stopes mined by long-hole methods). For slopes below 45 degrees, the room and pillar extraction method is used.

Sleeping Giant Mill

At December 31, 2009, the mill contained approximately 1,631 ounces of gold, which was included in inventory and valued at net realizable value, as it had not been sold by the end of the year.

The mill was originally built to use the Merrill-Crowe process. However, in 1998 the mill process was changed to a carbon-in-leach plant, which resulted in increased recoveries and decreased costs. This system also reduces the demand for fresh water, as well as the amount of water that needs to be treated. The Sleeping Giant mill has a rated capacity of 900 tonnes per day and was operating at approximately 570 tonnes per scheduled operating day in December 2009.

The Sleeping Giant mill produces gold-silver doré bars that are transported by a licensed armoured car services company to Johnson Matthey Ltd.'s refinery in Brampton, Ontario for refining. The Company expects to sell its refined gold to banks, bullion dealers and/or refiners based on prevailing spot prices at the time of such sales.

EXPLORATION UPDATE

Lac des Iles Property

Offset Zone

The Offset Zone of the LDI property was discovered by the Company's exploration team in 2001. The Offset Zone is considered to be the fault-displaced continuation of the Roby Zone mineralization and is located below and approximately 250 meters to the southwest of the Roby Zone. An updated mineral resource estimate was prepared by RPA in January 2009. The report showed that the Offset Zone has significantly more mineral resources than the current underground mine of the Roby Zone at similar grades, and remains open along strike to the north, south and at depth.

Following the updated resource estimate for the Offset Zone, the Company engaged Nordmin Engineering ("Nordmin") to assist in assessing the optimal mining and milling configuration of developing the upper portion of the Offset Zone. The discovery of two new PGM zones, named the Cowboy and Outlaw Zones, has resulted in the decision to expand the exploration effort to define the limits, size and grade of the Offset Zone and to pursue other possible mineralized zones that were identified as a result of this initial exploration effort. Accordingly, the Company, assisted by Nordmin will instead work towards completing an advanced preliminary economic assessment, expected to be available by the second quarter of 2010.

The advanced preliminary economic assessment will take into account a resource update to be prepared by RPA, which will include the results of drilling completed in 2009. The Company expects this resource update to be available early in the second quarter of 2010.

Based on the work done to date with Nordmin, and recent exploration success, the Company believes that the most efficient way to mine the Offset Zone is by way of shaft access, with a capacity of approximately 5,000 tonnes per day. The mining method to be utilized is "Large Scale Shrinkage", a high volume bulk mining method similar to that used by Agnico-Eagle Limited at their Goldex mine in Quebec. This method increases the overall upfront capital requirements but is expected to significantly reduce the operating costs compared to other mining methods. This mining method entails drilling off and blasting an entire ore zone and pulling the ore from the bottom horizon. Slim ore pillars are left in lower grade ore areas where possible in order to minimize ground control issues. Preliminary work suggests that mining costs might be similar to the Goldex mine.

The 2009 drill program was planned to increase the tonnage and grade of the mineral resource in the upper part of the Offset Zone, upgrade resources from inferred to indicated, and discover new resources. Phase 1 of the drill program was completed in June 2009 and consisted of 38 infill holes for 21,150 metres in the upper south quadrant. Phase 2 of the Offset Zone drill program commenced in mid-July 2009 and was completed by December 31, 2009. The program plan consisted of 45 infill drill holes for 19,000 metres

15

which decreased the drill hole spacing to approximately 30 metres in the upper part of the Offset Zone. Full assay results are available and will be used in the RPA new resource estimation.

Cowboy Zone

The Cowboy Zone is located 30 to 60 metres to the west of the Offset Zone and was discovered in 2009 during infill drilling of the Offset Zone. This new discovery has the potential to extend the life of the LDI mine and could potentially impact the economics of the LDI mine. The first phase of the drilling campaign indicated that the Zone extends for up to 250 metres along strike and 300 metres down dip from the Offset Zone. The assay results from the Phase 2 drilling extended the limit of the Cowboy Zone 50 metres farther to the north for a total strike length of 300 metres. An initial mineral resource estimate for the Cowboy Zone is anticipated by the second quarter of 2010.

Outlaw Zone

A 750-metre long underground exploration hole was designed to test the contact of the favourable LDI intrusion and the unmineralized country rock on section 502N. This long underground exploration hole, did not reach the contact due to drill rig limitations. It did, however, intersect a significant interval of platinum group element ("PGE") mineralization within the intrusion, to the west of the Offset Zone and the Cowboy Zone. Referred to as the Outlaw Zone, this new potential zone of mineralization is hosted by gabbro, like the Cowboy Zone. Future drill programs will be designed to explore the lateral and vertical limits of the Outlaw Zone, and establish its orientation, geometry and internal continuity. Nevertheless, it is apparent from these results that PGE mineralization at LDI remains open to the west.

West Pit

The surface drill program in the West Pit area of the LDI mine property was planned to follow up on historic and previous drill results and discover new mineralized zones adjacent to the open pit mine. In total, 29 holes were drilled in 2009 from within 150 metres of the west wall of the open pit with assays that were of higher grade than the historic average grade of 1.99 grams per tonne palladium at the LDI open pit mine. The combination of these assay results and the close proximity of the PGE mineralized intersections provides encouragement for follow up exploration drilling and consideration of possible open pit mining scenarios.

North LDI

In addition to the Company's mining, development and exploration activities at the LDI mine, grassroots exploration is an integral part of the growth strategy. In 2008, the grassroots exploration projects involved trenching on the North LDI area, north of the LDI mine, and trenching and drilling on the Mine Block Intrusion, east of the LDI mine. Individual project areas on the Mine Block Intrusion that saw exploration activities were the North VT Rim, South VT Rim, Baker Zone and Creek Zone.

For 2009, a follow up 19 hole drill program was realised on North LDI. The drill holes were designed to test under mineralized trenches from which samples returned up to 7.0 grams per tonne PGM plus gold. They were also designed to test the nested intrusion model for the North LDI area, based on the results of a historic airborne geophysical survey. As at the date of this MD&A, all holes were completed and assay results were not significant.

Sleeping Giant Mine Property

In December 2007 Cadiscor commenced a 19,000 metre underground exploration program costing $2.4 million to test for the presence of gold mineralization below the deepest mine level (-975 metres). Cadiscor engaged GENIVAR L.P. ("GENIVAR") to validate the geological interpretation and the known mineralized zones at the mine. In their NI 43-101 report,2 GENIVAR concluded that Sleeping Giant Mine had

- 2

- The Technical Report was issued on October 8, 2008 and was prepared under the supervision of Tyson Birkett, Josée Couture and Christian Bézy, all of whom were qualified persons and independent of Cadiscor.

16

measured and indicated resources of 489,200 tonnes at an average grade of 9.7 grams per tonne gold for 152,743 ounces of in situ gold. Within this geological resource, GENIVAR engineering studies identified mineral proven and probable reserves accessible via current workings totaling 235,300 tonnes at an average grade of 9.3 grams per tonne gold for 70,350 ounces of in situ gold. The Company has commenced an infill drill program zone delineation and upgrade resources to follow up on the previous very successful exploration program. A new resources calculation is in progress, including the 2009 drilling results and should be released early in the first half of 2010.

Discovery Property

Following a successful 2007-2008 drilling program, Cadiscor hired InnovExplo to update the previous NI 43-101 report on the Discovery gold deposit. The new NI 43-101 resource estimate3 increased the measured and indicated resource by 15%, for a total of 1,282,082 tonnes grading 5.75 grams per tonne gold (237,075 ounces of gold). In addition, the inferred resource increased by 56% to 1,545,500 tonnes grading 5.93 grams per tonne gold (294,473 ounces of gold). In September 2008, InnovExplo completed a preliminary economic assessment that confirmed the project to be economically feasible and generate positive cash flow under certain assumptions. The Discovery gold deposit is 70 kilometres east of Sleeping Giant and is accessible by established logging roads. During 2009, the company has advanced in permitting the property toward a future underground exploration program, recommended in the preliminary economic assessment report. An environmental impact study was prepared during the last quarter of 2009 and will be filed in the first quarter of 2010.

Flordin, Cameron Shear and Florence Properties

In 2008, Cadiscor carried out preliminary exploration drilling on the Flordin property at a cost of $0.3 million and the Cameron Shear property at a cost of $0.2 million. Drilling on Flordin intersected several mineralized zones, expanding their lateral and depth dimensions and confirming the exploration potential of the property.

The Company has an option to earn a 50% interest in the Cameron Shear property, which is currently 100% owned by Canadian Royalties Inc. Florence is a small 100% Cadiscor-owned property which is located north and adjacent to the Cameron Shear property. These properties are adjacent and to the east of the Discovery gold deposit.

During the last quarter of 2009, the Company hired InnovExplo of Val D'Or, a consulting firm to prepare a 43-101 resource estimation on the Flordin gold deposit. The results should be available at the end of the first quarter 2010.

Laflamme Gold Property

During the third quarter of 2009, the Company signed a letter of agreement with Midland Exploration Inc. ("Midland") to earn an interest in the Laflamme gold property. Strategically located between the Company's Sleeping Giant gold mine and the Comtois gold deposit in Quebec's Abitibi region, the Laflamme gold property consists of 410 claims covering a surface area of approximately 220 square kilometres west of Lebel-sur-Quevillon. Laflamme offers excellent potential for gold mineralization. A recent study conducted by the Ministère des Ressources naturelles et de la Faune du Québec ("MNRF") has identified a list of gold-bearing targets in major structures that appear on the property. The Laflamme property stretches 20 to 60 kilometres east of the Sleeping Giant mine. In the fourth quarter of 2009, the company conducted a VTEM aerial survey over the property in order to identify exploration targets. The survey results will be analyzed during the first quarter of 2010.

The Company has the option to acquire a 50% interest in the Laflamme Property over a period of four years for the following consideration: cash payments totalling $0.1 million, including a $0.03 million payment upon signing; and exploration expenditures totalling $1.0 million over four years, including $0.3 million in work expenditures during the first year. The Company will be the operator and, following the acquisition of

- 3

- The Technical Report was issued on August 1, 2008 and was prepared under the supervision of Carl Pelletier, a qualified person who was independent of Cadiscor.

17

the initial 50% interest, will have the option to acquire an additional 15% interest upon delivery of a feasibility study.

Shebandowan West Project

The Company holds a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an option and joint venture agreement with Vale Inco. The properties, known as the Shebandowan property, contain a series of nickel-copper-PGM mineralized bodies. The land package, which totals approximately 7,842 hectares, is located 90 kilometres west of Thunder Bay, Ontario, and approximately 100 kilometres southwest from the Company's LDI mine. Vale Inco retains an option to increase its interest from 50% to 60%, exercisable in the event that a feasibility study on the properties results in a mineral reserve and mineral resource estimate of the equivalent of 200 million pounds of nickel and other metals.

The Shebandowan West Project covers a small portion of the Shebandowan property and encompasses three shallow mineralized zones known as the West, Road and "D" zones, all of which are located at shallow depths immediately to the west of the former Shebandowan mine. Management considers the Shebandowan West Project's nickel-copper-PGM mineralization to represent the western extension of the Shebandowan mine ore body. The former Shebandowan mine, in operation from 1972 to 1998, produced 8.7 million tonnes of ore at grades of 2.07% nickel, 1.00% copper and approximately 3.0 grams per tonne PGM plus gold. An NI 43-101 Technical Report disclosing the results of a mineral resource estimate by an independent Qualified Person was filed on October 26, 2007. As currently envisaged, the Shebandowan West Project will not trigger Vale Inco's back-in right.

In December 2007, the Company retained SRK Consulting to prepare a preliminary economic assessment of a mine development scenario entailing excavation of the Shebandowan West Project by means of ramp-accessed underground mining methods at a rate of 500 to 1,000 tonnes per day, crushing the material on site, and transporting it by truck to the LDI property for processing at that mine's original mill. Preliminary metallurgical testing supports the possibility of producing a bulk sulphide concentrate from the Shebandowan West Project at the original mill.

The Company received a preliminary economic assessment on the project from SRK. However, in light of the sharp decline in metal prices in the fall of 2008, the Company ceased all activities with the Shebandowan joint venture, including at the Shebandowan West Project.

In light for a more favourable outlook for nickel prices, the Company and Vale Inco plans to conduct a $250,000 exploration program in 2010.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Critical accounting policies generally include estimates that are highly uncertain and for which changes in those estimates could materially impact the Company's financial statements. The following accounting policies are considered critical:

- (a)

- Use of Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Significant estimates and assumptions relate to recoverability of mining operations and mineral exploration properties. While management believes that these estimates and assumptions are reasonable, actual results could vary significantly.

Certain assumptions are dependent upon reserves, which represent the estimated amount of ore that can be economically and legally extracted from the Company's properties. In order to estimate reserves, assumptions are required about a range of geological, technical and economic factors, including quantities, grades, production techniques, recovery rates, production costs, transportation costs, commodity demand, commodity prices and exchange rates. Estimating the quantity and/or grade of reserves requires the size, shape and depth of ore bodies to be determined by analyzing geological

18

data such as drilling samples. This process may require complex and difficult geological judgments to interpret the data.

Because the economic assumptions used to estimate reserves change from period to period, and because additional geological data is generated during the course of operations, estimates of reserves may change from period to period. Changes in reported reserves may affect the Company's financial results and financial position in a number of ways, including the following:

- (a)

- Asset carrying values may be affected due to changes in estimated future cash flows;

- (b)

- Amortization charged in the income statement may change where such charges are determined by the units of production basis, or where the useful economic lives of assets change;

- (c)

- Overburden removal costs recorded on the balance sheet or charged to the income statement may change due to changes in the units of production basis of amortization;

- (d)

- Decommissioning, site restoration and environmental provisions may change where changes in estimated reserves affect expectations about the timing or cost of these activities; and

- (e)

- The carrying value of future tax assets may change due to changes in estimates of the likely recovery of the tax benefits.

- (b)

- Impairment assessments of long-lived assets

Each year, the Company reviews mining plans for the remaining life of each property. Significant changes in the mine plan can occur as a result of mining experience, new discoveries, changes in mining methods and rates, process changes, investments in new equipment and technology and other factors. The Company reviews its accounting estimates and adjusts these estimates based on year-end recoverable minerals determined by the Company, in the current mine plan

The Company reviews and evaluates its long-lived assets for impairment when events or changes in circumstances arise that may result in impairments in the carrying value of those assets. Impairment is considered to exist if total estimated future undiscounted cash flows are less than the carrying amount of the asset. Future cash flows are estimated based on quantities of recoverable minerals, expected palladium, gold, and other commodity prices and expected foreign exchange rates (considering current, historical and expected future prices and foreign exchange rates and related factors), production levels and cash costs of production and capital and reclamation expenditures, all based on detailed life-of-mine plans and projections. The term "recoverable minerals" refers to the estimate of recoverable production from measured, indicated and inferred mineral resources that are considered economically mineable and are based on management's confidence in converting such resources to proven and probable reserves. Assumptions underlying future cash flow estimates are subject to risk and uncertainty. Any differences between significant assumptions and market conditions such as metal prices, exchange rates, recoverable metal, and/or the Company's operating performance could have a material effect on the Company's ability to recover the carrying amounts of its long-lived assets resulting in possible additional impairment charges.

- (c)

- Amortization of mining interests

The Company amortizes a large portion of its mining interests using the unit of production method based on proven and probable reserves to which they relate or on a straight-line basis over their estimated useful lives, ranging from three to seven years.

- (d)

- Revenue recognition

Revenue from the sale of palladium and by-product metals from the LDI mine is provisionally recognized net of royalties based on quoted market prices upon the delivery of concentrate to the smelter, which is when title transfers and the rights and obligations of ownership pass. The Company's smelter contract provides for final prices to be determined by quoted market prices in a period subsequent to the date of concentrate delivery. Variations from the provisionally priced sales are recognized as revenue adjustments when final pricing is determined. Concentrate awaiting settlement

19

is an accounts receivable that is recorded net of estimated treatment and refining costs which is subject to final assay adjustments.

Revenue from the sale of gold-silver doré bars from Sleeping Giant is recognized when the significant risks and awards of ownership have transferred to the buyer and selling prices are known or can be reasonably estimated.

- (e)

- Asset retirement obligations

Asset retirement obligations are recognized when incurred and recorded as liabilities at fair value. The amount of the liability is subject to re-measurement at each reporting period. The liability is accreted over time through periodic charges to earnings. In addition, the asset retirement cost is capitalized as part of mining interests and amortized over the estimated life of the mine.

ADOPTION OF NEW ACCOUNTING STANDARDS

Goodwill and Intangible Assets