Exhibit 1.2

NOTICE TO READER

The previously filed Management’s Discussion and Analysis for the Year ended December 31, 2011 has been amended to include the Disclosure Controls and Procedures discussion on page 27-28, which was inadvertently omitted.

Other than the above, there is no other change to the Management’s Discussion and Analysis for the Year ended December 31, 2011.

North American Palladium Ltd.

TABLE OF CONTENTS

| Page |

| |

Management’s Discussion and Analysis | 1 |

| |

INTRODUCTION | 1 |

| |

FORWARD-LOOKING INFORMATION | 1 |

| |

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES | 2 |

| |

OUR BUSINESS | 2 |

| |

KEY HIGHLIGHTS | 3 |

| |

FINANCIAL CONDITION | 3 |

| |

EXECUTIVE SUMMARY | 4 |

| |

PALLADIUM OPERATIONS — FINANCIAL, OPERATING & DEVELOPMENT RESULTS | 8 |

| |

GOLD OPERATIONS — FINANCIAL, OPERATING & DEVELOPMENT RESULTS | 12 |

| |

CONSOLIDATED FINANCIAL RESULTS | 14 |

| |

FINANCIAL CONDITION, CASH FLOWS, LIQUIDITY AND CAPITAL RESOURCES | 17 |

| |

OUTSTANDING SHARE DATA | 19 |

| |

OVERVIEW OF NAP’S EXPLORATION PROPERTIES | 19 |

| |

CRITICAL ACCOUNTING POLICIES AND ESTIMATES | 23 |

| |

RISKS AND UNCERTAINTIES | 27 |

| |

INTERNAL CONTROLS | 27 |

| |

OTHER INFORMATION | 28 |

| |

NON-IFRS MEASURES | 28 |

Management’s Discussion and Analysis

INTRODUCTION

Unless the context suggests otherwise, references to “NAP” or the “Company” or similar terms refer to North American Palladium Ltd. and its subsidiaries. “LDI” refers to Lac des Iles Mines Ltd., and “Cadiscor” refers to Cadiscor Resources Inc. On March 4, 2011, the name Cadiscor Resources Inc., was changed to NAP Quebec Mines Ltd.

The following is management’s discussion and analysis (“MD&A”) of the financial condition and results of operations to enable readers of the Company’s consolidated financial statements and related notes to assess material changes in financial condition and results of operations for the year ended December 31, 2011, compared to those of the respective periods in the prior year. This MD&A has been prepared as of February 23, 2012 and is intended to supplement and complement the consolidated financial statements and notes thereto for the year ended December 31, 2011 (collectively, the “Financial Statements”). Readers are encouraged to review the Financial Statements in conjunction with their review of this MD&A and the most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities, available at www.sec.gov and www.sedar.com, respectively.

All amounts are in Canadian dollars unless otherwise noted and all references to production ounces refer to payable production.

FORWARD-LOOKING INFORMATION

Certain information contained in this MD&A constitutes ‘forward-looking statements’ within the meaning of the ‘safe harbor’ provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. All statements other than statements of historical fact are forward-looking statements. The words ‘expect’, ‘believe’, ‘anticipate’, ‘contemplate’, ‘target’, ‘plan’, ‘may’, ‘will’, ‘intend’, ‘estimate’ and similar expressions identify forward-looking statements. Forward-looking statements included in this MD&A include, without limitation: information as to our strategy, plans or future financial or operating performance, such as the Company’s expansion plans, project timelines, production plans, projected cash flows or expenditures, operating cost estimates, mining or milling methods, projected exploration results and other statements that express management’s expectations or estimates of future performance. The Company cautions the reader that such forward-looking statements involve known and unknown risk factors that may cause the actual results to be materially different from those expressed or implied by the forward-looking statements. Such risk factors include, but are not limited to: the possibility that metal prices and foreign exchange rates may fluctuate, inherent risks associated with exploration, development, mining and processing including environmental hazards, uncertainty of mineral reserves and resources, the risk that the Company may not be able to obtain financing, the possibility that the Lac des Iles mine and Vezza project may not perform as planned, changes in legislation, taxation, regulations or political and economic developments in Canada and abroad, employee relations, litigation and the risks associated with obtaining necessary licenses and permits. For more details on these and other risk factors see the Company’s most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange Commission and Canadian provincial securities regulatory authorities. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The factors and assumptions contained in this MD&A, which may prove to be incorrect, include, but are not limited to: that metal prices and exchange rates between the Canadian and United States dollar will be consistent with the Company’s expectations, that there will be no material delays affecting operations or the timing of ongoing development projects, that prices for key mining and construction supplies, including labour costs, will remain consistent with the Company’s expectations, and that the Company’s current estimates of mineral reserves and resources are accurate. The forward-looking statements are not guarantees of future performance. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements

YEAR END REPORT 2011

1

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES

Mineral reserve and mineral resource information contained herein has been calculated in accordance with National Instrument 43-101 — Standards of Disclosure for Mineral Projects, as required by Canadian provincial securities regulatory authorities. Canadian standards differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information contained herein is not comparable to similar information disclosed in accordance with the requirements of the SEC. While the terms “measured”, “indicated” and “inferred” mineral resources are required pursuant to National Instrument 43-101, the SEC does not recognize such terms. U.S. investors should understand that “inferred” mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, U.S. investors are cautioned not to assume that any part or all of NAP’s mineral resources constitute or will be converted into reserves. For a more detailed description of the key assumptions, parametres and methods used in calculating NAP’s mineral reserves and mineral resources, see NAP’s most recent Annual Information Form/Form 40-F on file with Canadian provincial securities regulatory authorities and the SEC.

OUR BUSINESS

North American Palladium Ltd. (“NAP”) is an established precious metals producer that has been operating its flagship Lac des Iles (“LDI”) mine located in Ontario, Canada since 1993. LDI is one of only two primary producers of palladium in the world, and is currently undergoing a major expansion to increase production and reduce cash cost per ounce (1) . NAP also operates the Vezza gold mine located in the Abitibi region of Quebec.

The Company is expanding the LDI mine to transition from mining via ramp access to mining via shaft while utilizing a high volume bulk mining method. The shaft is targeted to be commissioned at the end of 2012, which will allow LDI to increase its underground mining rate and palladium production. It is expected that the mine expansion will transform LDI into a long life, low cost producer of palladium. The Vezza gold mine, which is targeted to commence commercial production in the second quarter of 2012, is expected to provide an additional source of cash flow to fund growth in the Company’s palladium initiatives.

The Company has significant exploration upside near the LDI mine, where a number of growth targets have been identified, and is engaged in a substantial exploration program aimed at increasing its palladium reserves and resources. As NAP pursues its organic growth strategy through the LDI mine expansion, exploration will continue to be a key focus for the Company for many years to come. As an established palladium-platinum group metal (“PGM”) producer with excess mill capacity on a permitted property, NAP has potential to convert exploration success into production and cash flow on an accelerated timeline.

With an experienced senior management team, a strong balance sheet of over $108 million in working capital (including $51 million in cash) as at December 31, 2011, NAP is well positioned to pursue its growth strategy. NAP trades on the TSX under the symbol PDL and on the NYSE Amex under the symbol PAL. The Company’s common shares are included in the S&P/TSX Composite Index.

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

2

KEY HIGHLIGHTS

(expressed in thousands of dollars except cash cost and per

share amounts) | | 2011 | | 2010 | | 2009* | |

FINANCIAL HIGHLIGHTS | | | | | | | |

| | | | | | | |

Revenue | | $ | 170,472 | | $ | 107,098 | | $ | 4,019 | |

| | | | | | | |

Unit sales | | | | | | | |

Palladium (oz) | | 146,457 | | 95,057 | | — | |

Gold (oz) | | 24,275 | | 21,573 | | — | |

Platinum (oz) | | 9,133 | | 4,894 | | — | |

Nickel (lb) | | 814,551 | | 395,622 | | — | |

Copper (lb) | | 1,593,479 | | 658,013 | | — | |

| | | | | | | |

Earnings | | | | | | | |

Net loss | | $ | (65,154 | ) | $ | (29,409 | ) | $ | (30,014 | ) |

Net loss per share | | $ | (0.40 | ) | $ | (0.21 | ) | $ | (0.29 | ) |

Adjusted net income (loss) (1) | | $ | 723 | | $ | 6,720 | | $ | (16,816 | ) |

EBITDA (1) | | $ | (44,786 | ) | $ | (17,073 | ) | $ | (28,465 | ) |

Adjusted EBITDA (1) | | $ | 21,091 | | $ | 19,056 | | $ | (15,267 | ) |

| | | | | | | |

Cash flow provided by (used in) operations | | | | | | | |

Cash flow provided by (used in) operations before changes in non-cash working capital (1) | | $ | 6,122 | | $ | (12,029 | ) | $ | (27,656 | ) |

Cash flow provided by (used in) operations before changes in non-cash working capital per share (1) | | $ | 0.04 | | $ | (0.08 | ) | $ | (0.27 | ) |

| | | | | | | |

Capital spending | | $ | 185,633 | | $ | 49,364 | | $ | 12,205 | |

| | | | | | | |

OPERATING HIGHLIGHTS | | | | | | | |

Production | | | | | | | |

Palladium (oz) | | 146,624 | | 95,057 | | — | |

Gold (oz) | | 21,890 | | 21,718 | | — | |

Platinum (oz) | | 9,143 | | 4,894 | | — | |

Nickel (lb) | | 816,037 | | 395,622 | | — | |

Copper (lb) | | 1,596,185 | | 658,013 | | — | |

| | | | | | | |

Realized metal prices | | | | | | | |

Palladium | | $ | 733 | | $ | 665 | | — | |

Gold | | $ | 1,534 | | $ | 1,208 | | — | |

| | | | | | | |

Cash cost per ounce (1) | | | | | | | |

Palladium (US$) | | $ | 448 | | $ | 283 | | | |

Gold (US$) | | $ | 1,819 | | $ | 1,549 | | | |

FINANCIAL CONDITION

| | As at December 31 | | As at December 31 | | As at December 31 | |

(expressed in thousands of dollars) | | 2011 | | 2010 | | 2009 * | |

Net working capital | | $ | 108,432 | | $ | 169,559 | | $ | 114,507 | |

Cash balance | | $ | 50,935 | | $ | 75,159 | | $ | 98,255 | |

Shareholders’ equity | | $ | 268,996 | | $ | 290,450 | | $ | 192,261 | |

* 2009 amounts have been prepared under Canadian GAAP and therefore may not be comparable to the 2011 and 2010 information

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

3

EXECUTIVE SUMMARY

Financial Highlights

Revenue for the year ended December 31, 2011 was $170.5 million compared to $107.1 million in the prior year. Net loss for the year, including a non-cash gold asset impairment charge of $49.2 million, was $65.2 million or $0.40 per share and EBITDA (1) was a negative $44.8 million. In 2010, the net loss was $29.4 million or $0.21 per share and EBITDA (1) was a negative $17.1 million. For 2011, adjusted net income (1) was $0.7 million and adjusted EBITDA (1) was $21.1 million, compared to adjusted net income (1) of $6.7 million and adjusted EBITDA (1) of $19.1 million in the prior year. The Company generated cash from operating activities of $6.1 million, before changes in non-cash working capital (1) .

Strong Balance Sheet

As at December 31, 2011, the Company had approximately $108.4 million in working capital, including $50.9 million cash on hand. Subsequent to year end, the Company completed a $15.0 million capital lease facility to fund equipment for the LDI mine expansion, of which $11.1 million has been utilized.

Investment in Growth

For the year ended December 31, 2011, the Company invested $16.7 million in exploration activities ($10.0 million at its palladium operations and $6.7 million at its gold operations) and $185.6 million in development expenditures ($148.3 million at its palladium operations, of which $142.1 million was invested in the LDI mine expansion, and $37.3 million at its gold operations).

LDI Mine Palladium Production

The LDI mine produced 146,624 ounces of payable palladium for the year ended December 31, 2011. During the year, 1,830,234 tonnes of ore were mined with 1,689,781 tonnes of ore processed by the LDI mill. The mill processed an average of 10,675 tonnes per operating day at an average palladium head grade of 3.70 grams per tonne, with a palladium recovery of 78.3%. For 2011, LDI’s cash cost per ounce (1) (net of byproduct credits) was US$448.

Production at the LDI mine in 2011 included the blending of higher grade underground ore (988,502 tonnes with an average palladium grade of 5.7 grams per tonne) with lower grade surface ore (841,732 tonnes with an average palladium grade of 1.8 grams per tonne).

LDI Mine Expansion Update

The Company is currently expanding the LDI mine to transition from mining via ramp access to mining via shaft while utilizing a high volume bulk mining method. The objective of the mine expansion is to increase future production and lower cash cost per ounce (1) . During 2011, the Company made significant progress in advancing the critical aspects of the mine expansion which remains on schedule to commission the shaft at the end of 2012.

The shaft, with a name plate capacity of approximately 7,000 tonnes per day, will allow LDI to increase its underground mining rate to 3,500 tonnes per day at the beginning of 2013 and then gradually increase the rate during 2013 and 2014 to 5,500 tonnes per day starting in 2015, at which point the Company is targeting production to exceed 250,000 ounces at a cash cost (1) of approximately US$200 per ounce (based on current by-product metal prices).

2011 mine expansion development highlights include:

· Constructing the head frame, hoist room, and electrical substation;

· Completing the shaft raise bore pilot hole and primary ventilation raise bore;

· Commencing the sub-collar work;

· Completing the pilot hole for the backfill aggregate raise to the surface;

· Advancing the ramp to a depth of 795 metres from surface; and

· Developing the 735-metre mine level in preparation for production.

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

4

In the year ended December 31, 2011, $143.1 million was invested in the mine expansion, including finance leases of $2.6 million and excluding capitalized interest of $1.6 million. In 2012, capital expenditures for the mine expansion are budgeted at $116.0 million. Development work in 2012 will be focused on completing the surface construction activities, advancing underground development, and completing the shaft sinking to the 795-metre level by year end.

Vezza Gold Mine Production and Development Update

During 2011, the Company made good progress in the development work at its Vezza gold mine and at the end of the year commenced processing Vezza’s bulk sample at the nearby Sleeping Giant mill. Accordingly, the Company expects commercial production to commence at a mining rate of 750 tonnes per day in the second quarter of 2012. The Company forecasts Vezza will produce approximately 30,000 ounces of gold at a cash cost of approximately US$1,150 per ounce for the remainder of 2012.

Production will come from a blend of long hole and alimak mining methods. The Company has entered into a contract with Promec Mining Inc., a Val d’Or mining contractor, to provide the mining workforce at Vezza. The total workforce is expected to be in the range of 150 people. Vezza’s ore will be trucked to the Sleeping Giant mill (approximately 85 kilometres away), which is expected to process an average head grade of 5.2 grams per tonne, with a gold recovery of 88%.

In 2011, the Company invested $28.2 million to advance Vezza to production, and plans to invest an additional $17.0 million in 2012 to continue underground development of the mine and to increase production in 2013. The capital expenditures in 2012 consist of development work associated with the underground infrastructure (such as drifts and ore passes), drilling costs, as well as a new camp for the workforce, a backfill cement plant, rock conveyor and pump, and other required equipment.

Sleeping Giant Mine Closure

The Company announced on January 17, 2012 that it is discontinuing production at the Sleeping Giant mine due to its insufficient operating margin.

After reviewing various mining scenarios, the Company concluded that mining would likely continue at high costs given the lack of grade continuity, with insufficient operating margin to justify continuing operations. The Company therefore ceased mining operations at Sleeping Giant and has restructured the gold division, resulting in a non-cash impairment charge on its gold assets of $49.2 million.

The Sleeping Giant mill will continue to process ore from the Vezza mine. The mill has a capacity of 900 tonnes per day which will be sufficient to process Vezza’s ore.

In 2011, the Sleeping Giant mine produced 14,623 ounces of gold. During the year, 73,701 tonnes of ore were hoisted from Sleeping Giant, with 74,154 tonnes processed by the mill at an average head grade of 6.36 grams per tonne, with a gold recovery of 96.4%. For the year ended December 31, 2011, Sleeping Giant’s cash cost per ounce (1) was US$1,819.

Exploration

In 2011, 261 holes totaling 84,686 metres were drilled on the LDI property. Underground drilling accounted for 41,343 metres (205 holes), of which approximately 13,290 metres (66 holes) were to support mine operations. Drilling from surface accounted for the remaining 43,343 metres (56 holes). The objective of NAP’s 2011 exploration program was to expand the Offset Zone, improve knowledge of the Offset Zone mineralization through infill drilling, and to identify potential surface targets.

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

5

Following the exploration success achieved in the past few years, the Company will continue to invest in exploration to expand the reserves and resources at LDI and to identify new targets. The Company’s 2012 exploration expenditures are expected to be approximately $16 million, comprised of approximately 70,000 metres of drilling, of which 64,000 metres will be at LDI, and 6,000 metres at the Company’s other nearby properties. Approximately $10 million of the $16 million in 2012 expenditures (55,000 of the 64,000 metres to be drilled at LDI) will be in connection with the mine expansion and is included in the $116 million capital expenditure budget for the mine expansion, leaving a balance of $6 million that will be expensed.

The main focus of the 2012 exploration program will be underground exploration at LDI targeting the Offset Zone, to conduct infill drilling as well as to test extensions of the Offset Zone mineralization towards surface, at depth, and to the south. In addition, drilling on surface will be conducted at North LDI, the North VT-Rim and Legris Lake.

In 2011, 376 holes totalling 79,434 metres were drilled in the gold division, which included approximately 36,746 metres of drilling at Sleeping Giant, and 79,434 metres of surface and development drilling at Vezza. In 2012, the Company intends to do minimal exploration activities on its non-producing gold properties.

Outlook

The supply and demand fundamentals of palladium remain strong, and most forecasters continue to have an optimistic outlook. A supporting factor behind the positive outlook for the metal’s future performance is the resilient industrial demand, increasing investment demand and constrained global supply.

In 2012, the Company plans to focus on the following milestones:

· Commissioning of the LDI mine shaft (target end of Q4, 2012);

· Completing the reserve and resource update for LDI (Q2, 2012);

· Achieving commercial production at the Vezza mine (Q2, 2012);

· Completing the reserve and resource update for Vezza (Q2, 2012); and

· Expanding reserves and resources at LDI through continuing exploration.

Selected Annual Information

(expressed in thousands of dollars, except per share amounts) | | 2011 | | 2010 | | 2009 | |

Revenue | | $ | 170,472 | | $ | 107,098 | | $ | 4,019 | |

Gold assets impairment charge | | 49,210 | | — | | — | |

Income (loss) from mining operations | | (33,081 | ) | 8,088 | | (6,232 | ) |

Net loss | | (65,154 | ) | (29,409 | ) | (30,014 | ) |

Net loss per share — Basic and diluted | | (0.40 | ) | (0.21 | ) | (0.29 | ) |

Cash flow provided by (used in) operations prior to changes in non-cash working capital (1) | | 6,122 | | (12,029 | ) | (27,656 | ) |

Total assets | | 416,045 | | 348,437 | | 221,777 | |

Obligations under finance leases | | 4,532 | | 2,391 | | 1,134 | |

| | | | | | | | | | |

For the year ended December 31, 2010, revenue was $107.1 million compared to $4.0 million in the prior year. Income from mining operations for the year ended December 31, 2010 was $8.1 million compared to a loss in the prior year of $6.2 million. Production from LDI was successfully restarted in April 2010 after being temporarily placed on care and maintenance in October 2008 due to low metal prices.

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

6

Metal Prices

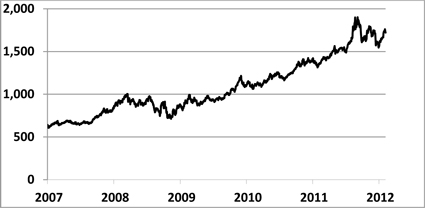

Palladium Price (US$/ Troy oz)

During 2011, the palladium price averaged US$733 per ounce, ranging from a low of US$565 to a high of US$859 per ounce. The global economic uncertainty surrounding the Eurozone Sovereign debt issues resulted in volatility for all commodities, but particularly affected the more industrial of the precious metals such as palladium with concerns of a potential global economic slowdown. These concerns were reflected in the liquidation of almost 700,000 ounces of palladium in ETF holdings, which was a primary factor in the declining price of palladium towards the end of 2011. Amid global economic uncertainty in Europe and U.S., the price of palladium continued to show strong support above US$550 per ounce level at the end of 2011. With confidence in European financial markets expected to improve, coupled with the continuing strength in global vehicle production, supports future increases in the price of palladium from its current level of around US$724 per ounce (as of February 22, 2012).

Average exchange rate (CDN$1=US$)

During 2011, the average Canadian dollar exchange rate was $1.01, ranging from a low of $0.95 to a high of $1.06 to the U.S. dollar. At the end of 2011, the U.S. dollar rallied as investors sought out safe-haven assets like U.S. treasury bills. The Canadian dollar closed at $0.98 cents to the U.S. dollar, compared to $1.00 at the end of the 2010. As of February 22, 2012, the Canadian dollar exchange rate was $1.00.

7

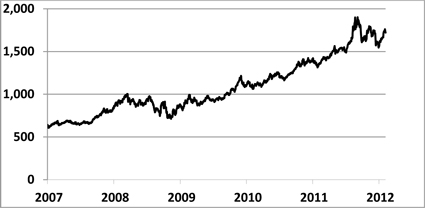

Gold Price (US$/ Troy oz)

During 2011, the average price of gold was US$1,706 per ounce, ranging from a low of US$1,488 to a high of US$1,900 per ounce. The price of gold was US$1,776 as of February 22, 2012.

NAP Realized Metal Prices and Exchange Rates

| | 2011 | | 2010 | |

Palladium — US$/oz | | $ | 733 | | $ | 665 | |

Platinum — US$/oz | | $ | 1,725 | | $ | 1,690 | |

Gold — US$/oz | | $ | 1,534 | | $ | 1,208 | |

Nickel — US$/lb | | $ | 10.52 | | $ | 10.11 | |

Copper — US$/lb | | $ | 4.06 | | $ | 3.58 | |

Average exchange rate — CDN$1 = US$ | | $ | 1.01 | | $ | 0.97 | |

Realized metal prices represent the weighted average metal prices received based on cash settlement of amounts owing from smelters for final outturn of metals during the year.

Spot Metal Prices* and Exchange Rates

For comparison purposes, the following table details recorded spot metal prices and exchange rates.

| | Dec-31 | | Sep-30 | | Jun-30 | | Mar-31 | | Dec-31 | | Sep-30 | | Jun-30 | | Mar 31 | |

| | 2011 | | 2011 | | 2011 | | 2011 | | 2010 | | 2010 | | 2010 | | 2010 | |

Palladium — US$/oz | | $ | 636 | | $ | 614 | | $ | 761 | | $ | 766 | | $ | 791 | | $ | 573 | | $ | 446 | | $ | 479 | |

Gold — US$/oz | | $ | 1,575 | | $ | 1,620 | | $ | 1,506 | | $ | 1,439 | | $ | 1,410 | | $ | 1,307 | | $ | 1,244 | | $ | 1,116 | |

Platinum — US$/oz | | $ | 1,381 | | $ | 1,511 | | $ | 1,722 | | $ | 1,773 | | $ | 1,731 | | $ | 1,662 | | $ | 1,532 | | $ | 1,649 | |

Nickel — US$/lb | | $ | 8.28 | | $ | 8.30 | | $ | 10.48 | | $ | 11.83 | | $ | 11.32 | | $ | 10.57 | | $ | 8.78 | | $ | 11.33 | |

Copper — US$/lb | | $ | 3.43 | | $ | 3.24 | | $ | 4.22 | | $ | 4.26 | | $ | 4.38 | | $ | 3.65 | | $ | 2.95 | | $ | 3.56 | |

Exchange rate (Bank of Canada) — CDN$1 = US$ | | $ | 0.98 | | $ | 0.96 | | US$ | 1.04 | | US$ | 1.03 | | US$ | 1.01 | | US$ | 0.97 | | US$ | 0.94 | | US$ | 0.98 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

* Based on the London Metal Exchange

PALLADIUM OPERATIONS — FINANCIAL, OPERATING & DEVELOPMENT RESULTS

The LDI mine consists of an open pit, an underground mine, and a mill with a design capacity of approximately 15,000 tonnes per day. The primary deposits on the property are the Roby Zone and the Offset Zone, both disseminated magmatic palladium-platinum group metal deposits.

Underground ore production from the LDI mine is operating at approximately 2,700 tonnes per day, seven days a week, on two 12-hour shifts per day. The Company has a workforce of approximately 270 people at LDI and its collective agreement with the United Steelworkers is effective until May 31, 2012.

8

Financial Results

Income from mining operations for the Palladium operations is summarized in the following table.

| | 2011 | | 2010 | |

Revenue | | $ | 143,659 | | $ | 84,813 | |

Mining operating expenses | | | | | |

Production costs | | $ | 89,657 | | $ | 46,269 | |

Smelting, refining and freight costs | | 9,206 | | 4,721 | |

Royalty expense | | 5,819 | | 4,202 | |

Inventory impairment charge | | 1,352 | | — | |

Depreciation and amortization | | 9,961 | | 5,396 | |

Gain on disposal of equipment | | (923 | ) | (268 | ) |

Total mining operating expenses | | $ | 115,072 | | $ | 60,320 | |

Income from mining operations | | $ | 28,587 | | $ | 24,493 | |

The Company has included income from mining operations as an additional IFRS measure as the Company believes it provides the user with information on the actual results of operations for each reporting segment.

Revenue

Revenue is affected by sales volumes, commodity prices and currency exchange rates. Metal sales for LDI are recognized in revenue at provisional prices when delivered to a smelter for treatment or designated shipping point. Final pricing is not determined until the refined metal is sold by the smelter, which in the case of LDI base metals is three months and precious metals is six months after delivery to the smelter. These final pricing adjustments can result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the U.S. dollar will result in additional revenues and a strengthening in the Canadian dollar will result in reduced revenues. For past production delivered to the smelter, the Company enters into financial contracts to mitigate the smelter agreements’ provisional pricing exposure to rising or declining palladium prices and an appreciating Canadian dollar. These financial contracts represent 69,500 ounces of palladium as at December 31, 2011 and mature from January 2012 through June 2012 at an average price of $697 per ounce of palladium. For substantially all of the palladium delivered to the customer under the smelter agreement, the quantities and timing of settlement specified in the financial contracts match final pricing settlement periods. The palladium financial contracts are being recognized on a mark-to-market basis as an adjustment to revenue. The fair value of these contracts at December 31, 2011 was $2.0 million, included in accounts receivable (December 31, 2010 — negative $11.1 million).

Sales volumes of LDI’s major commodities are set out in the table below.

| | 2011 | | 2010 | |

Sales volumes | | | | | |

Palladium (oz) | | 146,457 | | 95,057 | |

Gold (oz) | | 7,256 | | 4,023 | |

Platinum (oz) | | 9,133 | | 4,894 | |

Nickel (lbs) | | 814,551 | | 395,622 | |

Copper (lbs) | | 1,593,479 | | 658,013 | |

Cobalt (lbs) | | 20,839 | | 9,801 | |

Silver (oz) | | 3,752 | | 1,619 | |

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

9

Revenue from metal sales from the Palladium operations is set out below.

| | 2011 | | 2010 | |

Revenue before pricing adjustments | | $ | 148,480 | | $ | 77,429 | |

Pricing adjustments | | (4,821 | ) | 7,384 | |

Revenue after pricing adjustments | | $ | 143,659 | | $ | 84,813 | |

Revenue by metal | | | | | |

Palladium | | $ | 104,004 | | $ | 63,351 | |

Gold | | 11,971 | | 5,640 | |

Platinum | | 13,867 | | 8,659 | |

Nickel | | 7,585 | | 4,283 | |

Copper | | 5,804 | | 2,659 | |

Cobalt | | 304 | | 171 | |

Silver | | 124 | | 50 | |

| | $ | 143,659 | | $ | 84,813 | |

For the year ended December 31, 2011, revenue before pricing adjustments was $148.5 million, compared to $77.4 million in 2010, when we operated for nine months. 2011 reflected higher realized palladium prices and an increase in the quantity of palladium ounces sold.

Operating Expenses

For the year ended December 31, 2011, operating expenses were $115.1 million compared to $60.3 million in the prior year period, when we operated for nine months. The increase in operating expenses in 2011 result from processing lower grade stockpiles blended with the higher grade underground ore as well as higher contractor costs to process surface stockpiles, partially offset by electricity rebates.

Cash cost per ounce (1) of palladium sold, was US$448 for the year ended December 31, 2011 (2010 — US$283).

During the second quarter of 2011, the Company was advised of its inclusion in the Ontario government’s Northern Industrial Electricity Rate (“NIER”) program to receive electricity price rebates of two cents per kilowatt hour. The NIER program is a three-year initiative designed to help large industries in Northern Ontario improve energy efficiency and sustainability. It is available to industrial facilities that consume greater than 50,000 megawatt hours of electricity per year. The Company’s commitment to the preparation and implementation of comprehensive energy management plans qualified the Company to participate. For the year ended December 31, 2011, a rebate of $4.2 million was received (including a retroactive rebate of $1.9 million for LDI’s electricity costs for the period of April 1, 2010 through March 31, 2011). The rebate was treated as a reduction of operating expenses. LDI will be entitled to receive additional quarterly rebates until March 2013 if it continues to meet eligibility criteria, which the Company anticipates will be the case.

Smelting, refining and freight costs for the year ended December 31, 2011 were $9.2 million compared to $4.7 million in 2010. The increase over the prior year is primarily due to increased production volume in 2011 and increased freight and smelter costs on a unit basis.

For the year ended December 31, 2011, royalty expense was $5.8 million compared to $4.2 million in the prior year. Royalty expense was higher in the current year due to higher production volume and increased revenue.

Depreciation and amortization at the LDI mine for the year ended December 31, 2011 was $10.0 million, compared to $5.4 million for the year ended December 31, 2010. The increase over the prior year is due to higher production volume and an increase in depreciable assets in 2011.

For the year ended December 31, 2011, an impairment charge of $1.4 million was recorded on the write down of obsolete supplies inventory (2010 — nil).

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

10

Operating Results

The key operating results for the Palladium operations are set out in the following table.

| | 2011 | | 2010 | |

Tonnes of ore milled | | 1,689,781 | | 649,649 | |

Production | | | | | |

Palladium (oz) | | 146,624 | | 95,057 | |

Gold (oz) | | 7,267 | | 4,023 | |

Platinum (oz) | | 9,143 | | 4,894 | |

Nickel (lbs) | | 816,037 | | 395,622 | |

Copper (lbs) | | 1,596,185 | | 658,013 | |

Palladium head grade (g/t) | | 3.70 | | 6.06 | |

Palladium recoveries (%) | | 78.34 | | 80.80 | |

Tonnes of ore mined | | 1,830,234 | | 615,926 | |

Total cost per tonne milled | | $ | 54 | | $ | 62 | |

Cash cost ($USD) (1) | | $ | 448 | | $ | 283 | |

LDI Mine

2011 production at the LDI mine included the blending of higher grade underground ore with lower-grade surface sources. During the year ended December 31, 2011, 1,830,234 tonnes of ore was extracted, of which 988,502 tonnes came from underground sources with an average palladium grade of 5.7 grams per tonne (2010 — 615,926 tonnes with an average palladium grade of 6.2 grams per tonne), and 841,732 tonnes from surface sources with an average palladium grade of 1.8 grams per tonne (2010 — nil).

LDI Mill

For the year ended December 31, 2011, the LDI mill processed 1,689,781 tonnes of ore at an average of 10,675 tonnes per operating day, producing 146,624 ounces of payable palladium at an average palladium head grade of 3.7 grams per tonne, with a palladium recovery of 78.3%, and mill availability of 97.7% (2010 — 649,649 tonnes processed, producing 95,057 ounces at an average grade of 6.1 grams per tonne with a palladium recovery of 80.8%). Production costs, per tonne of ore milled, were $54 for the year ended December 31, 2011 (2010 - $62 per tonne of ore milled). To improve efficiencies and minimize processing costs, the mill is operating on a batch basis, with a two-week operating and a two-week non-operating schedule.

LDI’s cash cost per ounce (1) were US$448 per ounce (2010 — US$283 per ounce, when production consisted of only higher-grade underground ore).

LDI Mine Expansion

The Company is currently expanding the LDI mine to transition from mining via ramp access to mining via shaft while utilizing a high volume bulk mining method. The objective of the mine expansion is to increase future production at a lower cash cost per ounce (1). During the year, the Company made significant progress in advancing the critical aspects of the mine expansion and remains on schedule to commission the shaft at the end of 2012.

The shaft, which will have a name plate capacity of approximately 7,000 tonnes per day, will allow LDI to increase its underground mining rate to 3,500 tonnes per day at the beginning of 2013, then gradually increase the rate during 2013 and 2014 to 5,500 tonnes per day starting in 2015, at which point the Company is targeting production to exceed 250,000 ounces at a cash cost of approximately US$200 per ounce (based on current by-product metal prices).

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

11

The 2011 mine expansion development highlights include:

| · | Constructing the head frame, hoist room, and electrical substation; |

| | |

| · | Completing the shaft raise bore pilot hole and primary ventilation raise bore; |

| | |

| · | Commencing the sub-collar work; |

| | |

| · | Completing the pilot hole for the backfill aggregate raise to the surface; |

| | |

| · | Advancing the ramp to a depth of 795 metres from surface; and |

| | |

| · | Developing the 735-metre mine level in preparation for production. |

In the year ended December 31, 2011, $143.1 million was invested in the mine expansion, including finance leases of $2.6 million and excluding capitalized interest of $1.6 million. In 2012, capital expenditures for the mine expansion are budgeted at $116.0 million. Development work in 2012 will be focused on the following:

| · | Completing the surface construction activities; |

| | |

| · | Completing the shaft sinking to the 795-metre level by year end; |

| | |

| · | Completing development of the 735-metre mine level; and |

| | |

| · | Commencing set up of mining stopes for production in the Offset Zone. |

GOLD OPERATIONS — FINANCIAL, OPERATING & DEVELOPMENT RESULTS

The Company also owns the Vezza gold mine located 233 kilometers north of Val D’or, Quebec. The Vezza mine, which is targeted to commence commercial production in the second quarter of 2012, is expected to provide an additional source of cash flow to fund growth in the Company’s palladium initiatives.

The Sleeping Giant gold mine consists of a narrow vein underground mine and a mill with a capacity of 900 tonnes per operating day. Subsequent to December 31, 2011, the Company announced the closure of the Sleeping Giant mine due to its insufficient operating margin (see Sleeping Giant Mine below).

Financial Results

Income from mining operations for the Gold operations is summarized in the following table.

| | 2011 | | 2010 | |

Revenue | | $ | 26,813 | | $ | 22,285 | |

Mining operating expenses | | | | | |

Production costs | | $ | 31,601 | | $ | 28,440 | |

Smelting, refining and freight costs | | 54 | | 58 | |

Depreciation and amortization | | 7,460 | | 10,066 | |

Gold assets impairment charge | | 49,210 | | — | |

Loss (gain) on disposal of equipment | | (27 | ) | (2 | ) |

Total mining operating expenses | | $ | 88,298 | | $ | 38,562 | |

Loss from mining operations | | $ | (61,485 | ) | $ | (16,277 | ) |

The Company has included income from mining operations as an additional IFRS measure as the Company believes it provides the user with information of the actual results of operations for each reporting segment.

Revenue

Metal sales for the Sleeping Giant gold mine are recognized at the time the title is transferred to a third party. Sales volumes are set out in the table below.

| | 2011 | | 2010 | |

Sales volumes | | | | | |

Gold (oz) | | 17,019 | | 17,550 | |

Silver (oz) | | 31,150 | | 24,000 | |

12

For the year ended December 31, 2011, revenue was $26.8 million, reflecting gold sales of 17,019 ounces with a realized price of US$1,531 per ounce, compared to $22.3 million in the prior year with gold sales of 17,550 ounces with a realized price of US$1,204 per ounce.

Operating Expenses

For the year ended December 31, 2011, total production costs at the Sleeping Giant gold mine were $31.6 million as compared to $28.4 million in 2010 due to higher inventory adjustments in the current year. Cash cost per ounce (1) was US$1,819 for the year ended December 31, 2011, compared to US$1,549 per ounce in 2010 due to higher labour costs.

Depreciation and amortization at the Sleeping Giant gold mine was $7.5 million for the year ended December 31, 2011, compared to $10.1 million in the prior year due to fewer ounces produced in the current year period.

As a result of the Company’s decision to cease mining operations at Sleeping Giant and restructure the gold division, a gold asset impairment charge of $49.2 million was recorded at December 31, 2011.

Operating Results

The key operating results for the Gold operations are set out in the following table.

| | 2011 | | 2010 | |

Tonnes of ore milled | | 74,154 | | 93,296 | |

Production | | | | | |

Gold (oz) | | 14,623 | | 17,695 | |

Gold head grade (g/t) | | 6.36 | | 5.90 | |

Gold recoveries (%) | | 96.38 | | 95.50 | |

Tonnes of ore hoisted | | 73,701 | | 95,261 | |

Total cost per tonne milled | | $ | 426 | | $ | 305 | |

Cash cost ($USD) (1) | | $ | 1,819 | | $ | 1,549 | |

Sleeping Giant Mine

For the year ended December 31, 2011, 73,701 tonnes of ore were hoisted from the underground mine with an average gold grade of 6.36 grams per tonne (2010 — 95,261 tonnes hoisted with average grade of 5.90 grams per tonne).

During 2011, mining was focused above the 975-metre elevation (mining the lower grade remnant reserves left behind by the previous operator) and strived to reduce operating costs to achieve break-even cash flow while the Company continued its development at depth.

After reviewing various mining scenarios, the Company concluded that mining would likely continue at high costs given the lack of grade continuity, with insufficient operating margin to justify continuing operations. The Company has therefore ceased mining operations at Sleeping Giant on January 17, 2012 and has restructured the gold division, resulting in a non-cash impairment charge on its gold assets of $49.2 million.

Sleeping Giant Mill

For the year ended December 31, 2011, the mill processed 74,154 tonnes of ore, producing 14,623 ounces of gold at an average gold head grade of 6.36 grams per tonne, with a gold recovery of 96.4% and mill availability of 98.9% (2010 — 93,296 tonnes processed, producing 17,695 ounces at an average grade of 5.90 grams per tonne).

Sleeping Giant’s cash cost per ounce (1) was US$1,819 for the year ended December 31, 2011, compared to US$1,549 per ounce for the year ended December 31, 2010. Production costs per tonne of ore milled were $426 for the year ended December 31, 2011 (2010 - $305 per tonne).

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

13

At December 31, 2011, the mill contained approximately 2,742 ounces of gold that was included in inventory and valued at net realizable value, as it had not been sold by the end of the period, including 1,224 ounces of gold processed from Vezza.

The Sleeping Giant mill has a rated capacity of 900 tonnes per day and was operating at approximately 838 tonnes per operating day, for the year ended December 31, 2011. Despite the closure of the Sleeping Giant mine, the mill will continue to operate to process ore from the nearby Vezza mine that is expected to reach commercial production in the second quarter of 2012.

In 2011, the Company invested $1.8 million to establish a platform for potential future expansion of the mill, which includes the detailed engineering work, the geotechnical tests, building and foundation designs, receiving the required construction permits, materials procurement, and refurbishing the rod mill and jaw crusher.

Vezza Gold Project

In 2011, the Company made good progress in the development work at Vezza to establish the mine for production in 2012. During the fourth quarter, the Company commenced processing Vezza’s bulk sample at the Sleeping Giant mill, returning results that were within management’s expectations. For the year ended December 31, 2011, 8,832 tonnes of mineralization were hoisted from the underground mine for the bulk sample, producing 1,141 ounces of gold at an average gold grade of 4.46 grams per tonne. The Company expects commercial production to commence at Vezza with a mining rate of 750 tonnes per day at the beginning of the second quarter of 2012. Until the mine reaches commercial production, all costs associated with achievement of commercial production, net of preproduction revenue from gold sales, are capitalized. For the remainder of 2012, the Company forecasts Vezza will produce approximately 30,000 ounces of gold at a cash cost per ounce (1) of approximately US$1,150.

Production at Vezza will come from a blend of long hole and alimak mining methods. The Company has entered into a contract with Promec Mining Inc., a Val d’Or mining contractor, to provide the mining workforce at Vezza. The total workforce is expected to be in the range of 150 people. Vezza’s ore will be trucked to the Sleeping Giant mill (approximately 85 kilometres away by paved road), which is expected to process an average head grade of 5.2 grams per tonne, with a gold recovery of 88%.

In 2011, the Company invested $28.2 million to advance Vezza to production, and plans to invest an additional $17.0 million in 2012 to continue underground development of the mine and to increase production in 2013. The capital expenditures in 2012 consist of development work associated with the underground infrastructure (such as drifts and ore passes), drilling costs, as well as a new camp for the workforce, a backfill cement plant, rock conveyor and pump, and other required equipment.

CONSOLIDATED FINANCIAL RESULTS

General and administration

The Company’s general and administration expenses for the year ended December 31, 2011 were $12.3 million, compared to $10.6 million, an increase of $1.7 million. The increase is due to additional administration costs from increased activities and staff at the Corporate head office.

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

14

Exploration

Exploration expenditures for the year ended December 31, 2011 were $16.7 million compared to $30.1 million in the prior year. The decrease reflects $9.2 million of exploration costs capitalized to the mine expansion for the year ended December 31, 2011, compared to $2.3 million in the prior year. Exploration expenditures are comprised as follows:

| | 2011 | | 2010 | |

Palladium operations | | | | | |

Ontario exploration projects* | | 9,833 | | 13,998 | |

Gold operations | | | | | |

Sleeping Giant mine property | | 3,638 | | 3,437 | |

Other Quebec exploration projects** | | 5,441 | | 11,768 | |

Exploration tax credits | | (2,350 | ) | (201 | ) |

| | 6,729 | | 15,004 | |

Corporate and other | | 105 | | 1,124 | |

Total exploration expenditures | | $ | 16,667 | | $ | 30,126 | |

| | | | | | | |

* | Ontario exploration projects are comprised of LDI exploration projects, including the Cowboy, Outlaw and Sheriff zones, West LDI, North VT Rim, and the Legris Lake option and Shebandowan. |

| |

** | Other Quebec exploration projects are comprised of the Vezza, Flordin, Discovery, Dormex, Montbray, Harricana, Cameron Shear, Laflamme, and Florence properties. |

On February 18, 2011, the Company completed a flow-through share offering of 2,667,000 flow-through common shares and is required to spend gross proceeds of $22.0 million on Canadian exploration expenses prior to December 31, 2012. For the year ended December 31, 2011, $22.0 million was spent, fulfilling the spending requirement.

Interest and other costs (income)

Interest and other income for the year ended December 31, 2011 was $0.2 million compared to $2.1 million in the prior year. 2011 includes a gain on renouncement of flow-through expenditures of $1.8 million and $1.0 million of interest income, partially offset by financing costs of $0.7 million, accretion expense of $0.8 million and other items of $1.0 million. The prior year balance includes interest income of $2.9 million, partially offset by accretion expense of $0.2 million and interest expense of $0.4 million.

Income and Mining Tax Expense (Recovery)

The income and mining tax expense (recovery) for the years ended December 31 are provided in the table below.

| | 2011 | | 2010 | |

LDI palladium mine | | | | | |

Ontario transitional tax (debit) credit | | $ | 2,387 | | $ | (280 | ) |

Corporate minimum tax credit | | — | | (75 | ) |

Ontario resource allowance recovery | | — | | (315 | ) |

| | $ | 2,387 | | $ | (670 | ) |

Sleeping Giant gold mine and Vezza Gold Project | | | | | |

Quebec mining duties (expense) recovery | | $ | (1,775 | ) | $ | (246 | ) |

Quebec income tax recovery | | (107 | ) | (26 | ) |

Mining interests temporary difference expense | | 3,057 | | 372 | |

| | $ | 1,175 | | $ | 100 | |

Corporate and other | | | | | |

Expiration of warrants | | $ | (555 | ) | $ | (542 | ) |

| | $ | (555 | ) | $ | (542 | ) |

| | $ | 3,007 | | $ | (1,112 | ) |

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

15

For the year ended December 31, 2011, income and mining tax expense was $3.0 million compared to a $1.1 million recovery in the same period in 2010. In the current year, income and mining tax expense includes Ontario transitional tax debits ($2.4 million) and mining interest temporary differences ($3.1 million), partially offset by Quebec mining duties recovery ($1.8 million) and the tax recovery on the expiration of Series B warrants ($0.6 million). The prior year recovery includes the expiration of warrants ($0.5 million), Ontario resource allowance recovery ($0.3 million) and Ontario transitional tax credit ($0.3 million), partially offset by mining interest temporary differences ($0.4 million).

Net Income (loss)

For the year ended December 31, 2011, the Company reported a net loss of $65.2 million or $0.40 per share compared to net income of $29.4 million or $0.21 per share in the prior year.

Summary of Quarterly Results

(expressed in thousands of Canadian dollars except per share amounts)

| | 2011 | | 2010 | |

| | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | |

| | | | | | | | | | | | | | | | | |

Revenue | | $ | 44,050 | | $ | 38,310 | | $ | 51,398 | | $ | 36,714 | | $ | 39,502 | | $ | 38,451 | | $ | 21,215 | | $ | 7,930 | |

| | | | | | | | | | | | | | | | | |

Production costs | | 33,120 | | 28,928 | | 28,783 | | 30,427 | | 21,556 | | 20,452 | | 16,650 | | 16,051 | |

| | | | | | | | | | | | | | | | | |

Gold assets impairment charge | | 49,210 | | — | | — | | — | | — | | — | | — | | — | |

| | | | | | | | | | | | | | | | | |

Exploration expense | | 4,738 | | 1,956 | | 6,134 | | 3,839 | | 12,532 | | 7,008 | | 6,421 | | 4,165 | |

| | | | | | | | | | | | | | | | | |

Capital expenditures | | 52,565 | | 50,561 | | 41,363 | | 41,144 | | 20,142 | | 14,589 | | 10,146 | | 4,487 | |

| | | | | | | | | | | | | | | | | |

Net income (loss) | | (57,397 | ) | (2,816 | ) | 5,380 | | (10,321 | ) | (2,013 | ) | 2,804 | | (11,849 | ) | (18,351 | ) |

| | | | | | | | | | | | | | | | | |

Cash provided by (used in) operations | | (25,557 | ) | 15,883 | | 4,121 | | 24,647 | | (25,196 | ) | (20,007 | ) | (18,389 | ) | (10,158 | ) |

| | | | | | | | | | | | | | | | | |

Net income (loss) per share — basic and diluted | | $ | (0.35 | ) | $ | (0.02 | ) | $ | 0.03 | | $ | (0.06 | ) | $ | (0.01 | ) | $ | 0.02 | | $ | (0.08 | ) | $ | (0.14 | ) |

| | | | | | | | | | | | | | | | | |

Cash provided by (used in) operations prior to changes in non-cash working capital per share (1) | | (0.01 | ) | 0.02 | | 0.07 | | (0.04 | ) | 0.02 | | 0.04 | | (0.04 | ) | (0.10 | ) |

Revenue for the three months ended December 31, 2011 was $44.1 million compared to $39.5 million for the three months ended December 31, 2010. Net loss for the quarter, including a non-cash asset impairment charge of $49.2 million was $57.4 million or $0.35 per share compared to a net loss of $2.0 million or $0.01 per share in the comparative period in 2010.

For the three months ended December 31, 2011, the Company expensed $4.7 million in exploration activities compared to $12.5 million in 2010 and $52.6 million in development expenditures ($44.4 million at its palladium operations and $8.2 million at its gold operations). For the three months ended December 31, 2011, the Company used cash in operations, before changes in non-cash working capital of $1.6 million compared to cash used in operations, before changes in non-cash working capital of $0.2 million for the same period in 2010. For the three months ended December 31, 2011, financing activities provided cash of $71.0 million, primarily consisting of $69.7 million related to the issuance of senior secured notes, compared to cash provided by financing activities in 2010 of $6.5 million. Investing activities required cash of $51.9 million for the three months ended December 31, 2011 compared to $19.8 million required for investing activities in the comparative period in 2010.

The LDI mine produced 34,121 ounces of payable palladium for the three months ended December 31, 2011 compared to 32,798 ounces of payable palladium for the comparative period in 2010. During the quarter, 591,096 tonnes of ore were mined with 531,825 tonnes of ore processed by the LDI mill (2010 — 210,732 tonnes mined, 247,739 tonnes processed by the mill). For the three months ended December 31, 2011, LDI’s cash cost per ounce (1) was US$489 (2010 — US$347).

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

16

The Sleeping Giant mine produced 3,127 ounces of gold for the three months ended December 31, 2011 compared to 4,716 ounces of gold for the comparative period in 2010. During the quarter, 16,493 tonnes of ore were hoisted from Sleeping Giant, with 16,493 tonnes processed by the mill. For the comparative period in 2010, 22,185 tonnes were hoisted, with 21,750 tonnes processed by the mill. For the three months ended December 31, 2011, Sleeping Giant’s cash cost per ounce (1) was US$1,769 (2010 — US$1,690).

FINANCIAL CONDITION, CASH FLOWS, LIQUIDITY AND CAPITAL RESOURCES

Sources and Uses of Cash

| | 2011 | | 2010 | |

Cash provided by (used in) operations prior to changes in non-cash working capital | | $ | 6,122 | | $ | (12,029 | ) |

Changes in non-cash working capital | | 12,972 | | (61,721 | ) |

Cash provided by (used in) operations | | 19,094 | | (73,750 | ) |

Cash provided by (used in) financing | | 140,382 | | 99,211 | |

Cash provided by (used in) investing | | (183,700 | ) | (48,557 | ) |

Increase (decrease) in cash and cash equivalents | | $ | (24,224 | ) | $ | (23,096 | ) |

Operating Activities

For the year ended December 31, 2011, cash provided by operations prior to changes in non-cash working capital was $6.1 million, compared to cash used in operations of $12.0 million in the prior year, an increase of $18.1 million. This increase is primarily due to higher revenue ($63.4 million), partially offset by higher production costs ($46.5 million).

For the year ended December 31, 2011, changes in non-cash working capital resulted in a source of cash of $13.0 million compared to a use of cash of $61.7 million in the prior year. The 2011 balance of $13.0 million is primarily due to a decrease in accounts receivable ($7.6 million), a decrease in inventories ($7.4 million) and an increase in other assets ($3.5 million).

Financing Activities

For the year ended December 31, 2011, financing activities provided cash of $140.4 million consisting of $61.9 million related to the exercise of warrants and issuance of flow through common shares, $69.7 million related to the issuance of senior secured notes and $10.5 million of letters of credit in replacement of mine closure deposits, partially offset by net scheduled repayments and additions of $1.6 million of finance leases. This compared to cash provided by financing activities of $99.2 million in the prior year primarily related to net proceeds of $94.2 million received from the April 2010 equity offering discussed below.

In October 2009, as part of an equity offering, the Company issued warrants (Series A warrants) to purchase an additional common share at a price of $4.25 per share, at any time prior to September 30, 2011. Since the 20-day volume weighted average price of the common shares on the TSX was equal to or greater than C$5.75 per share (as per the acceleration event in the warrant indenture), on December 8, 2010 the Company announced the acceleration of the expiry of the Series A warrants to January 14, 2011. During the first quarter of 2011, $21.3 million of proceeds were received from the exercise of 5,009,986 Series A warrants. Total proceeds of $38.8 million were received from the exercise of Series A warrants.

(1) Non-IFRS measure. Please refer to Non-IFRS Measures on pages 28-31.

17

On April 28, 2010, the Company completed an equity offering of 20 million units at a price of $5.00 per unit for total net proceeds of $94.2 million (issue costs $5.8 million). Each unit consisted of one common share and one-half of one common share purchase warrant of the Company. Each whole warrant (Series B warrants) entitled the holder to purchase an additional common share at a price of $6.50, subject to adjustment, at any time prior to October 28, 2011. In 2010, 1,240,000 Series B warrants were exercised for total proceeds of $8.1 million. On October 28, 2011, the remaining Series B warrants expired.

Investing Activities

For the year ended December 31, 2011, investing activities required cash of $183.7 million, relating to additions to mining interests of $185.6 million and the Company received proceeds on disposal of equipment of $1.9 million. For the year ended December 31, 2010, investing activities required cash of $49.4 million, relating to additions to mining interests and the Company received proceeds on disposal of equipment of $0.8 million. The majority of the additions to mining interests were attributable to LDI’s mine expansion project, the Vezza gold project and the Sleeping Giant gold mine.

Additions to mining interests

| | 2011 | | 2010 | |

Palladium operations | | | | | |

Offset Zone development | | $ | 131,322 | | $ | 23,689 | |

Roby Zone development | | 316 | | 2,573 | |

Offset Zone exploration costs | | 9,216 | | 2,334 | |

Roby Zone exploration costs | | 45 | | 828 | |

Offset Zone capitalized interest | | 1,573 | | — | |

Jaw crusher | | — | | 1,124 | |

Mill flotation redesign | | — | | 798 | |

Tailings management facility | | 821 | | 642 | |

Other equipment and betterments | | 5,016 | | 3,744 | |

| | $ | 148,309 | | $ | 35,732 | |

Gold operations | | | | | |

Vezza project | | $ | 28,230 | | $ | 3,633 | |

Sleeping Giant Shaft deepening | | 4,829 | | 5,999 | |

Sleeping Giant Mill expansion | | 1,831 | | — | |

Sleeping Giant Underground and deferred development | | 2,058 | | 3,006 | |

Other equipment and betterments | | 376 | | 994 | |

| | $ | 37,324 | | $ | 13,632 | |

| | $ | 185,633 | | $ | 49,364 | |

In addition to the mining interests acquired by cash reflected in the above table, the Company also acquired by means of finance leases, equipment in the amount $3.7 million for the year ended December 31, 2011 (2010 - $3.0 million).

Capital Resources

As at December 31, 2011, the Company had cash and cash equivalents of $50.9 million compared to $75.2 million as at December 31, 2010. The funds are invested in short term interest bearing deposits at a major Canadian chartered bank.

In July 2011, the Company increased its operating line of credit with a Canadian chartered bank from US$30.0 million to US$60.0 million. The credit facility is secured by the Company’s accounts receivables and inventory and may be used for working capital liquidity and general corporate purposes. At December 31, 2011, the Company had US$48.0 million available to be drawn from the credit facility and US$12.0 million was utilized for letters of credit primarily for reclamation deposits.

18

During the fourth quarter of 2011, the Company sold $72.0 million of senior secured notes by way of a private placement for net proceeds of $69.6 million. The notes which mature on October 4, 2014, were issued in $1,000 denominations and bear interest at a rate of 9.25% per year, payable semi-annually. The Company also issued a palladium warrant with each $1,000 note. Each warrant held by the note holder entitles the holder to purchase 0.35 ounces of palladium at a purchase price of US$620 per ounce, anytime up to October 4, 2014. If the palladium warrants are exercised, the Company has the option to pay the amount owing to the warrant holder in either cash or common shares priced at a 7% discount. At the Company’s option, for a 2% fee, the maturity of the notes may be extended for one additional year to October 4, 2015.

Subsequent to year end, the Company established a $15.0 million capital lease facility to fund equipment for the LDI mine expansion, of which $11.1 million has been utilized.

Contractual Obligations

As at December 31, 2011 | | Payments Due by Period | |

(expressed in thousands of Canadian dollars) | | Total | | Less than 1 year | | 2-5 Years | | >5 years | |

Finance lease obligations | | $ | 4,905 | | $ | 2,677 | | $ | 2,228 | | — | |

Operating leases | | 6,894 | | 3,783 | | 2,918 | | 193 | |

Purchase obligations | | 110,612 | | 110,612 | | — | | — | |

| | $ | 122,411 | | $ | 117,072 | | $ | 5,146 | | $ | 193 | |

| | | | | | | | | | | | | |

In addition to the above, the Company also has asset retirement obligations at December 31, 2011 in the amount of $20.9 million that would become payable at the time of the closures of the LDI mine, Sleeping Giant mill and Vezza gold project. The Company obtained a letter of credit of $10.6 million to offset these future outlays. As a result, $10.3 million of funding is required prior to or upon closure of these properties.

Related Party Transactions

There were no related party transactions for the year ended December 31, 2011.

OUTSTANDING SHARE DATA

As of February 22, 2012, there were 162,960,939 common shares of the Company outstanding. In addition, there were options outstanding pursuant to the Amended and Restated 2010 Corporate Stock Option Plan entitling holders thereof to acquire 5,331,583 common shares of the Company at a weighted average exercise price of $3.91 per share.

OVERVIEW OF NAP’S EXPLORATION PROPERTIES

NAP expected its future growth will come from its significant exploration upside and through the continued exploration and development of the Company’s projects. With permits, mine infrastructure and available capacity at LDI, NAP can move from exploration success to production on an accelerated timeline. Excluding the significant exploration program at LDI, the Company’s 2012 exploration budget includes approximately 6,000 metres of drilling at NAP’s other Ontario properties near LDI.

With respect to the Company’s pipeline of non-producing gold properties, there will be minimal expenditures in 2012 and the Company will seek to realize value through either sale or joint venture opportunities.

LDI Mine & Property

Exploration is central to LDI’s future and will represent an important part of future growth for the mine and for the Company. Situated in unique geology, LDI’s substantial +33,000-acre land package offers exploration upside that is further complimented by the underutilized, 15,000-tonne per day mill. Beyond the immediate mine site, most of the land has had minimal historic exploration. The exploration success achieved during the past few years gives management great encouragement that there is strong potential to continue to grow the Company’s palladium reserve and resource base through exploration.

19

The LDI mine consists of the following underground mineralized zones:

| · | Roby Zone: underground production from Roby commenced in 2006. |

| | |

| · | Offset Zone: discovered in 2001, located below and approximately 250 metres south west of the Roby Zone. The Offset Zone remains open in all directions and continues to expand through exploration. LDI mine expansion is currently underway to access Offset Zone ore. |

| | |

| · | Cowboy Zone*: discovered in 2009 during infill drilling of the Offset Zone, located 30 to 60 metres to the west of the Offset Zone. This new discovery has the potential to extend LDI’s mine life and could potentially positively impact the economics of the mine. |

| | |

| · | Outlaw Zone*: discovered in 2009, located to the west of the Offset Zone and the Cowboy Zone. Further drilling is required to explore the vertical and lateral limit of this mineralization. |

| | |

| · | Sheriff Zone*: discovered in 2010, located approximately 100 metres south east of the Offset Zone. |

* The disclosure regarding these mineralized areas is conceptual in nature and there has been insufficient exploration to define a mineral resource in any of these areas.

The current LDI mine plan does not include the three nearby underground mineralized zones due to insufficient drilling: Cowboy, Outlaw and Sheriff.

In 2011, 261 holes totaling 84,686 metres were drilled on the LDI property. Underground drilling accounted for 41,343 metres (205 holes), of which approximately 13,290 metres (66 holes) were to support mine operations. Drilling from surface accounted for the remaining 43,343 metres (56 holes). The objective of NAP’s 2011 exploration program was to expand the Offset Zone, improve knowledge of the Offset Zone mineralization through infill drilling, and to identify potential surface targets

On January 30, 2012 the Company provided an update on the remaining drill results from its 2011 exploration program at LDI. Previous exploration updates on the 2011 program were issued by news release on June 28, 2011 and September 14, 2011.

The highlights from the recent update included:

| · | Infill drill results in the Offset Zone returned excellent grades, with good width and continuity, including 78 metres at 7.39 grams per tonne Palladium (“g/t Pd”) and 33 metres at 8.71 g/t Pd; |

| | |

| · | Good indication of a southern extension to the Offset Zone in an area previously reported as the Southern Norite Zone, including 39 metres at 4.02 g/t Pd and 15 metres at 5.13 g/t Pd; |

| | |

| · | Mineralization discovered 300 metres to the west of the Offset, Cowboy and Outlaw zones, including 10 metres of 3.05 g/t Pd, giving support to the interpretation that some mineralized zones manifest as a series of parallel stacked lenses; |

| | |

| · | Confirmed north and south lateral extensions of upper Roby Zone, including 18 metres at 12.82 g/t Pd; and |

| | |

| · | Bonanza grade surface mineralization encountered from trenches along the North VT Rim 500 metres northeast of the LDI open pit, including approximately 1 metre samples at 64.4 g/t Pd and 45.8 g/t Pd. |

The Company intends to issue its updated mineral reserves and resource estimates for LDI (as at December 31, 2011) in the second quarter of 2012.

Following the exploration success achieved in the past few years, NAP will continue to invest in exploration to expand the reserves and resources at LDI and to identify new targets. 2012 exploration expenditures are expected to be approximately $16 million, comprised of 70,000 metres of drilling, of which 64,000 metres will be at LDI, and 6,000 metres at NAP’s other nearby properties. Approximately $10 million of the $16 million in expenditures (55,000 of the 64,000 metres to be drilled at LDI) is in connection with the mine expansion and is included in the $116 million capital expenditure budget for the mine expansion, leaving a balance of $6 million that will be expensed.

20

Quebec Properties

Sleeping Giant Gold Mine & Property

In 2011, 116 drill holes were completed at Sleeping Giant, totaling 36,746 metres. The primary objective of the 2011 exploration program at Sleeping Giant was to define and extend zones within the current mine on the proposed three new mining levels at depth to allow future mine development planning. Drill results from the 2011 program indicated that Sleeping Giant’s gold zones continue to extend at depth however as more infill drilling was conducted the Company encountered a lack of continuity in the narrow vein structures and was unable to confirm those grades over sufficient strike length, thereby significantly reducing the tonnage that could be mined profitably.

Vezza Gold Mine

In 2011, 29 surface holes were completed at Vezza (totaling 6,258 metres) and 161 holes from underground (totaling 17,933 metres) for a combined total of 79,434 metres in 376 holes.

Exploration drilling conducted in 2011 confirmed grades, continuity and widths of Vezza’s known gold zone, which are similar or better than the last resource estimate (dated December 31, 2010). The widths and near vertical nature of the gold zone also confirmed that either alimak or long hole mining methods could be used at the Vezza mine.

Flordin Property

The Flordin project is located approximately 30 kilometres north of the town of Lebel-sur-Quévillion, and approximately 70 kilometres away from the Sleeping Giant mill. The Company conducted a significant drilling program in 2010, consisting of 212 holes totaling 25,720 metres, which revealed the presence of several parallel gold veins near surface. The Company believes that the Flordin gold project may have the potential to provide additional feed for the Sleeping Giant mill.

In 2011, the Company hired an independent consulting firm to conduct ore sorting tests on Flordin’s mineralized zones and waste rocks to evaluate potential pre-concentration of ore before trucking it to the Sleeping Giant mill. Preliminary results indicate that pre-concentration can reject in the order of 50% low-grade rock in run-of-mine material, reducing transport costs and increasing head grade. This technology could increase the mill feed head grade and offer significant cost savings with important implications for overall gold production costs in an eventual mining operation. A second phase of ore sorting test work involved two different sorting techniques to evaluate efficiency: optical and x-ray. The x-ray technique, which proved to offer more advantages, is currently being considered by NAP.

In 2011, the Company conducted a drill program consisting of 36 holes totaling 4,857 metres at Flordin.

Discovery Property

Discovery is an advanced-stage gold exploration project located approximately 35 kilometres northwest of the town of Lebel-sur-Quévillon, and approximately 70 kilometres from the Sleeping Giant mill. The Discovery project is contiguous to the Flordin project. A 2008 scoping study confirmed the project to be economically feasible and generate positive cash flow under certain assumptions, with potential to produce 44,000 ounces of gold per year for four years.

In 2011, the Company conducted a drill program consisting of 18 holes totaling 7,438 metres on the project, targeting the extension of the 1200E Zone. The 1200E zone was not considered in the 2008 Scoping Study, which considered the west gold zones only. Drilling the eastern extension of the 1200E zone revealed new gold zones at depth and followed known zones deeper, eastward and westward. In 2011 the Company received the Certificate of Authorization from the Quebec’s Ministry of Sustainable Development, Environment and Parks to conduct underground exploration as planned in the 2008 Scoping Study.

21

Dormex Property

Dormex is an early-stage gold exploration project located adjacent to the Sleeping Giant mill and is believed to have potential gold targets similar to the original mineralization mined at the Sleeping Giant mine. Exploration conducted in 2010 identified a series of promising targets and confirmed the presence of gold in the tills.

In 2011, the Company conducted follow up on gold anomalies discovered in the 2010 reverse circulation program and tested new geophysical targets. The drill program consisted of 10 holes totaling 4,060 metres of drilling.

Cameron Shear and Florence Properties

Cameron Shear and Florence are early-stage gold exploration projects adjacent to the east of the Discovery gold deposit, and near the Flordin deposit. Drilling on a number of geophysical targets has improved the Company’s understanding of the geology of these early-stage properties, although economic intersections have not yet been encountered at this juncture.

Laflamme Gold Property

Laflamme is an early-stage gold exploration project in the Abitibi region of Quebec, a joint venture with Midland Exploration Inc. (“Midland”). The property is situated on favourable geology, following the trend from the Company’s Discovery project to the Sleeping Giant mine.

In 2011, the Company conducted a drill program consisting of 6 holes totaling 2,142 metres of drilling and ground geophysics at Laflamme. On June 15, 2011, Midland announced the discovery of an unanticipated new mineralized zone with nickel, copper and platinum group elements. On July 31, 2011, the Company fulfilled the requirements to exercise the option to acquire a 50% interest in the project and has exercised this option. The Company is the Operator of the joint venture and may acquire an additional 15% interest by completing a feasibility study.

Ontario Properties

Shebandowan Property

The Company holds a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an Option and Joint Venture Agreement with Vale Inco Limited (“Vale”). The properties, known as the Shebandowan property, contain a series of nickel copper-PGM mineralized bodies. The land package, which totals approximately 7,842 hectares, is located 90 kilometres west of Thunder Bay, Ontario, and approximately 100 kilometres southwest from the Company’s LDI mine. Vale retains an option to increase its interest from 50% to 60%, exercisable in the event that a feasibility study on the property results in a mineral reserve and mineral resource estimate of the equivalent of 200 million pounds of nickel and other metals.

In 2010, the Company and Vale conducted a large ground geophysical survey on the property. Preliminary results support further exploration work on the property, but subsequent drilling on a portion of the property proved disappointing. No work was undertaken in 2011, and nothing is planned for 2012.

Legris Lake Property

The Legris Lake property is adjacent to the south east portion of the Company’s LDI property and is comprised of 15 claims and covering an area of approximately 4,297 hectares. The property is underlain by mafic and ultramafic rocks and was optioned for its historic anomalous PGE values. The property is at a preliminary exploration stage, however its PGM potential and close proximity to the LDI mill presents an encouraging exploration target.

Moose Calf and Kukkee Properties

In 2010, the Company entered into option agreements for the Moose Calf and Kukkee gold properties located west of Thunder Bay near McGraw Falls. The combined properties are now referred to as the Shabaqua Gold Project.

22

Salmi Property

On August 1, 2011, LDI entered into an option and purchase agreement whereby LDI obtained the exclusive right to conduct exploration and development activities as well as an exclusive right and option to purchase a 100% undivided interest in all or part of the property known as the Salmi property, comprised of eleven mineral claims located near the LDI mine and one additional adjacent mineral claim. The option and purchase agreement is subject to a 2% net smelter return royalty on future production from the property with LDI having the right to buy back one half of the net smelter return royalty for $0.5 million.

Tib Lake Property

On December 21, 2011, LDI entered into a letter of intent with Houston Lake Mining Inc. regarding the intention of the parties to enter into an option and purchase agreement where LDI would have an option to purchase a 100% unencumbered interest in 20 claims located northwest of the Lac des Iles mine, known as the Tib Lake property, subject to a 2.5% net smelter royalty in favour of a third party on a portion of the optional ground.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Critical accounting policies generally include estimates that are highly uncertain and for which changes in those estimates could materially impact the Company’s financial statements. The following accounting policies are considered critical:

a. Use of estimates