North American Palladium Ltd.

TABLE OF CONTENTS

| | Page |

| | |

| Management’s Discussion and Analysis | |

| | |

| INTRODUCTION | 1 |

| | |

| FORWARD-LOOKING INFORMATION | 1 |

| | |

| CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES | 2 |

| | |

| OUR BUSINESS | 2 |

| | |

| KEY HIGHLIGHTS | 3 |

| | |

| FINANCIAL CONDITION | 3 |

| | |

| EXECUTIVE SUMMARY | 4 |

| | |

| PALLADIUM OPERATIONS – FINANCIAL, OPERATING & DEVELOPMENT RESULTS | 7 |

| | |

| GOLD OPERATIONS – FINANCIAL, OPERATING & DEVELOPMENT RESULTS | 12 |

| | |

| CONSOLIDATED FINANCIAL RESULTS | 14 |

| | |

| FINANCIAL CONDITION, CASH FLOWS, LIQUIDITY AND CAPITAL RESOURCES | 16 |

| | |

| OUTSTANDING SHARE DATA | 18 |

| | |

| OVERVIEW OF NAP’S EXPLORATION PROPERTIES | 19 |

| | |

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES | 23 |

| | |

| RISKS AND UNCERTAINTIES | 26 |

| | |

| INTERNAL CONTROLS | 26 |

| | |

| OTHER INFORMATION | 27 |

| | |

| NON-IFRS MEASURES | 27 |

North American Palladium Ltd.

Management’s Discussion and Analysis

INTRODUCTION

Unless the context suggests otherwise, references to “NAP” or the “Company” or similar terms refer to North American Palladium Ltd. and its subsidiaries. “LDI” refers to Lac des Iles Mines Ltd. and “NAP Quebec” refers to NAP Quebec Mines Ltd. On March 4, 2011, the name Cadiscor Resources Inc. was changed to NAP Quebec Mines Ltd.

The following is management’s discussion and analysis (“MD&A”) of the financial condition and results of operations to enable readers of the Company’s consolidated financial statements and related notes to assess material changes in financial condition and results of operations for the three and nine months ended September 30, 2012, compared to those of the respective periods in the prior year. This MD&A has been prepared as of November 7, 2012 and is intended to supplement and complement the consolidated financial statements and notes thereto for the three and nine months ended September 30, 2012 (collectively, the “Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards (“IFRS”). Readers are encouraged to review the Financial Statements in conjunction with their review of this MD&A and the most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities, available at www.sec.gov and www.sedar.com, respectively.

All amounts are in Canadian dollars unless otherwise noted and all references to production ounces refer to payable production.

FORWARD-LOOKING INFORMATION

Certain information contained in this MD&A constitutes ‘forward-looking statements’ within the meaning of the ‘safe harbor’ provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. All statements other than statements of historical fact are forward-looking statements. The words ‘expect’, ‘believe’, ‘anticipate’, ‘contemplate’, ‘target’, ‘plan’, ‘may’, ‘will’, ‘intend’, ‘estimate’ and similar expressions identify forward-looking statements. Forward-looking statements included in this MD&A include, without limitation: information as to our strategy, plans or future financial or operating performance, such as the Company’s expansion plans, project timelines, production plans, projected cash flows or expenditures, operating cost estimates, mining or milling methods, projected exploration results and other statements that express management's expectations or estimates of future performance. The Company cautions the reader that such forward-looking statements involve known and unknown risk factors that may cause the actual results to be materially different from those expressed or implied by the forward-looking statements. Such risk factors include, but are not limited to: the possibility that metal prices and foreign exchange rates may fluctuate, inherent risks associated with exploration, development, mining and processing including environmental hazards, uncertainty of mineral reserves and resources, the risk that the Company may not be able to obtain financing, the possibility that the Lac des Iles mine and Vezza project may not perform as planned, changes in legislation, taxation, regulations or political and economic developments in Canada and abroad, employee relations, litigation and the risks associated with obtaining necessary licenses and permits. For more details on these and other risk factors see the Company’s most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange Commission and Canadian provincial securities regulatory authorities. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The factors and assumptions contained in this MD&A, which may prove to be incorrect, include, but are not limited to: that metal prices and exchange rates between the Canadian and United States dollar will be consistent with the Company’s expectations , that there will be no material delays affecting operations or the timing of ongoing development projects, that prices for key mining and construction supplies, including labour costs, will remain consistent with the Company’s expectations, and that the Company’s current estimates of mineral reserves and resources are accurate. The forward-looking statements are not guarantees of future performance. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements.

1

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES

Mineral reserve and mineral resource information contained herein has been calculated in accordance with National Instrument 43-101 –Standards of Disclosure for Mineral Projects, as required by Canadian provincial securities regulatory authorities. Canadian standards differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information contained herein is not comparable to similar information disclosed in accordance with the requirements of the SEC. While the terms “measured”, “indicated” and “inferred” mineral resources are required pursuant to National Instrument 43-101, the SEC does not recognize such terms. U.S. investors should understand that “inferred” mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, U.S. investors are cautioned not to assume that any part or all of NAP’s mineral resources constitute or will be converted into reserves. For a more detailed description of the key assumptions, parametres and methods used in calculating NAP’s mineral reserves and mineral resources, see NAP’s most recent Annual Information Form/Form 40-F on file with Canadian provincial securities regulatory authorities and the SEC.

OUR BUSINESS

North American Palladium Ltd. (“NAP” or the “Company”) is an established precious metals producer that has been operating its flagship Lac des Iles (“LDI”) mine located in Ontario, Canada since 1993. LDI is one of only two primary producers of palladium in the world, and is currently undergoing a major expansion to increase production and reduce cash cost per ounce1. The Company also operates the Vezza gold mine located in the Abitibi region of Quebec.

The Company is expanding the LDI mine to transition from mining via ramp access to mining via shaft while utilizing a high volume bulk mining method which will allow LDI to increase its underground mining rate and palladium production. It is expected that the mine expansion will transform LDI into a long life, low cost producer of palladium.

The Company has significant exploration potential near the LDI mine, where a number of growth targets have been identified, and is engaged in a substantial exploration program aimed at increasing its palladium reserves and resources. As NAP pursues its organic growth strategy through the LDI mine expansion, exploration will continue to be a key focus for the Company for many years to come. As an established palladium-platinum group metal (“PGM”) producer with excess mill capacity on a permitted property, NAP has potential to convert exploration success into production and cash flow on an accelerated timeline.

With an experienced senior management team and a strong balance sheet, NAP is well positioned to pursue its growth strategy. NAP trades on the TSX under the symbol PDL and on the NYSE MKT under the symbol PAL.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

2

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

KEY HIGHLIGHTS

| (expressed in thousands of dollars except cash cost per ounce, | | Three months

ended September 30 | | | Nine months ended

September 30 | |

| metal units, metal prices and per share amounts) | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | | |

| Revenue | | $ | 36,193 | | | $ | 38,310 | | | $ | 121,340 | | | $ | 126,422 | |

| Unit sales | | | | | | | | | | | | | | | | |

| Palladium (oz) | | | 36,218 | | | | 34,524 | | | | 117,451 | | | | 111,341 | |

| Gold (oz) | | | 2,742 | | | | 4,977 | | | | 9,761 | | | | 17,877 | |

| Platinum (oz) | | | 2,665 | | | | 2,278 | | | | 8,155 | | | | 6,570 | |

| Nickel (lb) | | | 267,590 | | | | 159,476 | | | | 1,053,406 | | | | 464,924 | |

| Copper (lb) | | | 677,222 | | | | 380,287 | | | | 1,996,710 | | | | 944,778 | |

| Earnings | | | | | | | | | | | | | | | | |

| Net loss | | $ | (8,046 | ) | | $ | (2,816 | ) | | $ | (12,027 | ) | | $ | (7,757 | ) |

| Net loss per share | | $ | (0.05 | ) | | $ | (0.02 | ) | | $ | (0.07 | ) | | $ | (0.05 | ) |

| Adjusted net income (loss)1 | | $ | (2,459 | ) | | $ | (860 | ) | | $ | 3,617 | | | $ | 4,172 | |

| EBITDA1 | | $ | (499 | ) | | $ | 1,727 | | | $ | 3,842 | | | $ | 7,475 | |

| Adjusted EBITDA1 | | $ | 5,088 | | | $ | 3,683 | | | $ | 19,486 | | | $ | 19,404 | |

| Cash flow provided by operations | | | | | | | | | | | | | | | | |

| Cash flow provided by (used in) operations before changes in non-cash working capital1 | | $ | (491 | ) | | | 3,061 | | | $ | 7,403 | | | $ | 7,850 | |

| Cash flow provided by (used in) operations before changes in non-cash working capital per share1 | | $ | (0.00 | ) | | $ | 0.02 | | | $ | 0.04 | | | $ | 0.05 | |

| Capital spending | | $ | 40,447 | | | $ | 50,561 | | | $ | 126,117 | | | $ | 133,068 | |

| OPERATING HIGHLIGHTS | | | | | | | | | �� | | | | | | | |

| Production | | | | | | | | | | | | | | | | |

| Palladium (oz) | | | 37,908 | | | | 34,871 | | | | 119,685 | | | | 112,503 | |

| Gold (oz) | | | 2,871 | | | | 4,747 | | | | 9,459 | | | | 16,287 | |

| Platinum (oz) | | | 2,754 | | | | 2,309 | | | | 8,282 | | | | 6,639 | |

| Nickel (lb) | | | 263,445 | | | | 164,126 | | | | 1,053,004 | | | | 472,606 | |

| Copper (lb) | | | 702,015 | | | | 390,800 | | | | 2,028,735 | | | | 960,385 | |

| Realized metal prices | | | | | | | | | | | | | | | | |

| Palladium | | $ | 632 | | | $ | 742 | | | $ | 640 | | | $ | 762 | |

| Gold | | $ | 1,655 | | | $ | 1,667 | | | $ | 1,663 | | | $ | 1,506 | |

| Cash cost per ounce1 | | | | | | | | | | | | | | | | |

| Palladium (US$) | | $ | 423 | | | $ | 496 | | | $ | 412 | | | $ | 436 | |

| Gold (US$) | | | - | | | $ | 1,869 | | | $ | 1,248 | | | $ | 1,835 | |

1 Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

3

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

FINANCIAL CONDITION

| | | As at September 30 | | | As at December 31 | |

| (expressed in thousands of dollars) | | 2012 | | | 2011 | |

| Net working capital | | $ | 61,134 | | | $ | 108,432 | |

| Cash balance | | $ | 23,462 | | | $ | 50,935 | |

| Shareholders’ equity | | $ | 297,639 | | | $ | 268,996 | |

EXECUTIVE SUMMARY

Financial Highlights

Revenue for the quarter was $36.2 million, compared to $38.3 million in the prior year. In 2012, revenue increased from the palladium operations by $3.5 million however this was more than offset by the decrease in revenue from the gold operations of $5.6 million due to the closure of the Sleeping Giant gold mine at the beginning of this year. Net loss for the quarter was $8.0 million or $0.05 per share and EBITDA1 was negative $0.5 million, compared to a net loss of $2.8 million or $0.02 per share and EBITDA1 of $1.7 million in the same period in the prior year. For the third quarter of 2012, adjusted net loss1 was $2.5 million and adjusted EBITDA1 was $5.1 million, compared to an adjusted net loss1 of $0.9 million and adjusted EBITDA1 of $3.7 million in the prior year period. The Company used cash from operating activities of $0.5 million, before changes in non-cash working capital1.

Financings and Balance Sheet

During the third quarter, the Company closed a $43.0 million convertible debenture financing. As at September 30, 2012, the Company had approximately $61.1 million in working capital, including $23.5 million of cash on hand. As at September 30, 2012, the Company has a balance of US$28.2 million available on its US$60.0 million credit facility.

Investment in Growth

For the quarter ended September 30, 2012, the Company invested $3.1 million in exploration activities and $40.4 million in development expenditures ($34.1 million at its palladium operations, of which $28.1 million was invested in the LDI mine expansion and $6.3 million on the Vezza gold mine).

LDI Mine Palladium Production

The LDI mine produced 37,908 ounces of payable palladium for the quarter ended September 30, 2012. During the quarter, 480,675 tonnes of ore were mined with 504,022 tonnes of ore processed by the mill. The mill processed an average of 12,623 tonnes per operating day at an average palladium head grade of 3.33 grams per tonne, with a palladium recovery of 76.9%. For the third quarter, LDI’s cash cost per ounce1 (net of byproduct credits) was US$423.

Production at the LDI mine in the quarter included the blending of higher grade underground ore (172,879 tonnes with an average palladium grade of 5.20 grams per tonne) with lower grade surface ore (331,143 tonnes with an average palladium grade of 2.35 grams per tonne).

Operations in the third quarter were somewhat affected by underground flooding that occurred in late August following a severe rainstorm, of similar magnitude to the rainstorm that occurred in May of this year. The improvements to LDI's water management systems, which commenced following the first rainstorm, have been completed and are expected to limit the impact of flooding to underground operations in the future. The one-time costs that were incurred relating to pumping, as well as surface and underground mitigation efforts, were $1.6 million and are reflected in the financial statements as “Other” charges, and were excluded from the cash cost per ounce1 of US$423.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

4

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

LDI Mine Expansion Update

In the third quarter, mine expansion expenditures totaled $28.1 million, excluding capitalized interest of $2.2 million. Development work in 2012 has been focused on completing the surface construction activities, advancing underground development (including mine level development and setting up mining stopes) and sinking the shaft.

The Company continues to make steady progress with its mine expansion development activities.

The surface construction at the mine site is essentially completed, and most recently, the service hoist, auxiliary hoist and all the related power systems at the hoist house were successfully commissioned, including the main electrical substation. Mining of the first Offset Zone stope has commenced, stope development remains on schedule and the shaft sinking is in progress. In November, the major components for the production hoist arrived at site and the installation of the hoist has commenced.

Management also recently conducted a comprehensive review of its development schedule with its contractors, and based on the current projected rates of advancement, provided further clarity on the timelines related to the full operation of the shaft in 2013. The Company expects to begin shaft commissioning by year-end, and expects the production hoist to be operational for hoisting Offset Zone ore at the beginning of the third quarter.

Development work in 2012 has been focused on completing the surface construction activities, advancing underground development (including mine level development and setting up mining stopes), and sinking the shaft.

Vezza Gold Mine Development Update

During the third quarter, the Company reviewed the operating parameters used for the initial stoping, with the objective of optimizing its mining techniques, and reducing dilution and stope preparation times. The Company is adding and improving long-hole benching techniques and reducing alimak stope mining. Concurrent with this change in method is a review of the optimal mining rates that will balance development requirements and available manpower.

In the third quarter, capitalized expenditures totaled $6.3 million. Until the mine reaches commercial production, all costs associated with achievement of commercial production (net of pre-production revenue from gold sales) will be capitalized.

Exploration

In the third quarter of 2012, the Company expensed $3.1 million in exploration costs and capitalized an additional $0.3 million associated with the LDI mine expansion. Due to flooding at the mine site and other operational constraints, there was minimal drilling completed at LDI in the third quarter. For the nine month period ending September 30, 2012, 87 holes were drilled totaling 23,721 metres.

Outlook

Palladium spot prices averaged US$613 per ounce in the third quarter, ranging from a low of US$563 per ounce, to a high of US$697 per ounce. Despite some temporary price weakness stemming from the uncertainty of the European debt crisis, the long term supply and demand fundamentals of palladium remain strong, and most forecasters continue to have a positive outlook. Supporting factors behind the positive outlook for the metal's future performance are strong industrial demand, continuing investment demand, and constrained global supply.

For the remainder of the year, the Company plans to focus on the following milestones:

| · | Advancing its mine expansion; |

| · | Exploring divestiture opportunities for the gold division assets; and |

| · | Advancing its ongoing near-mine and greenfields palladium exploration programs. |

5

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Metal Prices

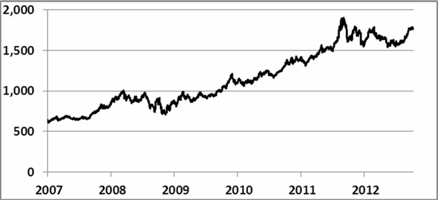

Palladium Price (US$/ Troy oz)

During the third quarter, the palladium price averaged US$613 per ounce, ranging from a low of US$563 to a high of US$697 per ounce. As of November 6, 2012, the palladium price was US$619 per ounce.

Canadian dollar exchange rate (CDN$1=US$)

During the third quarter, the average Canadian dollar exchange rate was $1.00, ranging from a low of $0.98 to a high of $1.03 to the U.S. dollar. The Canadian dollar closed at $1.01 to the U.S. dollar on September 30, 2012, compared to $0.98 at June 30, 2012. As of November 6, 2012, the Canadian dollar exchange rate was $1.01.

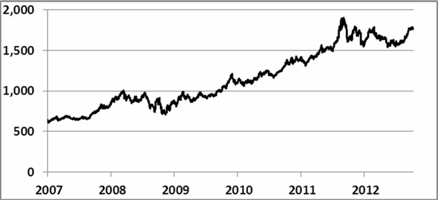

Gold Price (US$/ Troy oz)

During the third quarter, the average price of gold was US$1,653 per ounce, ranging from a low of US$1,567 to a high of US$1,777 per ounce. The price of gold was US$1,716 as of November 6, 2012.

6

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

NAP Realized Metal Prices and Exchange Rates

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Palladium – US$/oz | | $ | 632 | | | $ | 742 | | | $ | 640 | | | $ | 762 | |

| Platinum – US$/oz | | $ | 1,551 | | | $ | 1,764 | | | $ | 1,539 | | | $ | 1,774 | |

| Gold – US$/oz | | $ | 1,655 | | | $ | 1,667 | | | $ | 1,663 | | | $ | 1,506 | |

| Nickel – US$/lb | | $ | 7.27 | | | $ | 9.86 | | | $ | 7.87 | | | $ | 10.80 | |

| Copper – US$/lb | | $ | 3.47 | | | $ | 4.09 | | | $ | 3.58 | | | $ | 4.19 | |

| Average exchange rate – CDN$1 = US$ | | $ | 1.00 | | | $ | 1.02 | | | $ | 1.00 | | | $ | 1.02 | |

Realized metal prices in the chart above represent the weighted average metal prices on amounts settled from smelters for final outturn of metals during the year.

Spot Metal Prices* and Exchange Rates

For comparison purposes, the following table sets out spot metal prices and exchange rates.

| | | Sep-30 | | | Jun-30 | | | Mar-31 | | | Dec-31 | | | Sep-30 | | | Jun-30 | | | Mar-31 | | | Dec-31 | |

| | | 2012 | | | 2012 | | | 2012 | | | 2011 | | | 2011 | | | 2011 | | | 2011 | | | 2010 | |

| Palladium – US$/oz | | $ | 642 | | | $ | 578 | | | $ | 651 | | | $ | 636 | | | $ | 614 | | | $ | 761 | | | $ | 766 | | | $ | 791 | |

| Gold – US$/oz | | $ | 1,776 | | | $ | 1,599 | | | $ | 1,663 | | | $ | 1,575 | | | $ | 1,620 | | | $ | 1,506 | | | $ | 1,439 | | | $ | 1,410 | |

| Platinum – US$/oz | | $ | 1,668 | | | $ | 1,428 | | | $ | 1,640 | | | $ | 1,381 | | | $ | 1,511 | | | $ | 1,722 | | | $ | 1,773 | | | $ | 1,731 | |

| Nickel – US$/lb | | $ | 8.40 | | | $ | 7.46 | | | $ | 7.91 | | | $ | 8.28 | | | $ | 8.30 | | | $ | 10.48 | | | $ | 11.83 | | | $ | 11.32 | |

| Copper – US$/lb | | $ | 3.75 | | | $ | 3.44 | | | $ | 3.83 | | | $ | 3.43 | | | $ | 3.24 | | | $ | 4.22 | | | $ | 4.26 | | | $ | 4.38 | |

| Exchange rate (Bank of Canada) – CDN$1 = US$ | | | US$1.02 | | | | US$0.98 | | | | US$1.00 | | | | US$0.98 | | | | US$0.96 | | | | US$1.04 | | | | US$1.03 | | | | US$1.01 | |

* Based on the London Metal Exchange

PALLADIUM OPERATIONS – FINANCIAL, OPERATING & DEVELOPMENT RESULTS

The LDI mine consists of an open pit, an underground mine, and a mill with a processing capacity of approximately 15,000 tonnes per day. The primary deposits on the property are the Roby Zone open pit, the underground Roby Zone and the new underground Offset Zone, all disseminated magmatic palladium-platinum group metal deposits.

For the three months ended September 30, 2012, underground ore production from the LDI mine operated at approximately 1,880 tonnes per day (2,240 tonnes for the nine months ended September 30, 2012), seven days a week, on two 12-hour shifts per day. The LDI mine has a workforce of approximately 317 employees. During the third quarter, the Company signed a new three year agreement with its union.

Operations in the third quarter were somewhat affected by underground flooding that occurred in late August following a severe rainstorm, of similar magnitude to the rainstorm that occurred in May of this year. The improvements to LDI's water management systems, which commenced following the first rainstorm, have been completed and are expected to limit the impact of flooding to underground operations in the future. The one-time costs that were incurred relating to pumping, and electrical repairs, as well as surface and underground mitigation efforts, were $1.6 million and are reflected in the financial statements as “Other” charges ($2.3 million for the nine months ended September 30, 2012).

During the third quarter, the Company also capitalized $2.7 million related to necessary upgrades to its tailings management facility (“TMF”). Due to the two severe rainstorms this year, the extra water pumped to the TMF accelerated the timeline for the upgrades to the TMF that were planned for 2013.

7

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Financial Results

Income from mining operations for the Palladium operations is summarized in the following table.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Revenue | | $ | 36,193 | | | $ | 32,689 | | | $ | 118,336 | | | $ | 106,454 | |

| Mining operating expenses | | | | | | | | | | | | | | | | |

| Production costs | | $ | 24,257 | | | $ | 22,497 | | | $ | 76,865 | | | $ | 63,667 | |

| Smelting, refining and freight costs | | | 3,417 | | | | 2,425 | | | | 10,153 | | | | 5,970 | |

| Royalty expense | | | 1,691 | | | | 1,106 | | | | 4,756 | | | | 4,131 | |

| Other | | | 1,595 | | | | - | | | | 2,329 | | | | - | |

| Depreciation and amortization | | | 4,967 | | | | 2,693 | | | | 13,575 | | | | 7,042 | |

| (Gain) loss on disposal of equipment | | | 28 | | | | (891 | ) | | | 125 | | | | (1,133 | ) |

| Total mining operating expenses | | $ | 35,955 | | | $ | 27,830 | | | $ | 107,803 | | | $ | 79,677 | |

| Income from mining operations | | $ | 238 | | | $ | 4,859 | | | $ | 10,533 | | | $ | 26,777 | |

The Company has included income from mining operations as an additional IFRS measure to provide the user with information on the actual results of operations for each reporting segment.

Revenue

Revenue is affected by sales volumes, commodity prices and currency exchange rates. Metal sales for LDI are recognized in revenue at provisional prices when delivered to a smelter for treatment or designated shipping point. Final pricing is determined in accordance with LDI’s smelter agreements. In most cases, final pricing is determined two months after delivery to the smelter for gold, nickel and copper and four months after delivery for palladium and platinum. These final pricing adjustments can result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the U.S. dollar will result in additional revenues and a strengthening in the Canadian dollar will result in reduced revenues. The Company enters into financial contracts for past production delivered to the smelter to mitigate the smelter agreements’ provisional pricing exposure to rising or declining palladium and gold prices and an appreciating Canadian dollar. These financial contracts represent 85,500 ounces of palladium and 1,915 ounces of gold as at September 30, 2012 and mature from October 2012 through January 2013 at an average price of $633 per ounce of palladium and $1,692 per ounce of gold. For substantially all of the palladium delivered to the customer under the smelter agreement, the quantities and timing of settlement specified in the financial contracts match final pricing settlement periods. The palladium financial contracts are being recognized on a mark-to-market basis as an adjustment to revenue. The fair value of these contracts at September 30, 2012 was $0.1 million, which is included in accounts receivable (December 31, 2011 – $2.0 million).

Sales volumes of LDI’s major commodities are set out in the table below.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Sales volumes | | | | | | | | | | | | | | | | |

| Palladium (oz) | | | 36,218 | | | | 34,524 | | | | 117,451 | | | | 111,341 | |

| Gold (oz) | | | 2,742 | | | | 1,736 | | | | 8,098 | | | | 4,726 | |

| Platinum (oz) | | | 2,665 | | | | 2,278 | | | | 8,155 | | | | 6,570 | |

| Nickel (lbs) | | | 267,590 | | | | 159,476 | | | | 1,053,406 | | | | 464,924 | |

| Copper (lbs) | | | 677,222 | | | | 380,287 | | | | 1,996,710 | | | | 944,778 | |

| Cobalt (lbs) | | | 76 | | | | 4,588 | | | | 12,327 | | | | 12,295 | |

| Silver (oz) | | | 1,442 | | | | 1,519 | | | | 5,643 | | | | 2,364 | |

8

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Revenue from metal sales from the Palladium operations is set out in the table below.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Revenue before pricing adjustments | | $ | 35,509 | | | $ | 34,417 | | | $ | 118,206 | | | $ | 110,735 | |

| Pricing adjustments | | | 684 | | | | (1,728 | ) | | | 130 | | | | (4,281 | ) |

| Revenue after pricing adjustments | | $ | 36,193 | | | $ | 32,689 | | | $ | 118,336 | | | $ | 106,454 | |

| Revenue by metal | | | | | | | | | | | | | | | | |

| Palladium | | $ | 22,149 | | | $ | 23,423 | | | $ | 74,990 | | | $ | 80,187 | |

| Gold | | | 5,056 | | | | 3,568 | | | | 14,041 | | | | 7,903 | |

| Platinum | | | 4,623 | | | | 3,413 | | | | 13,602 | | | | 10,363 | |

| Nickel | | | 1,955 | | | | 1,085 | | | | 8,103 | | | | 4,385 | |

| Copper | | | 2,349 | | | | 1,101 | | | | 7,250 | | | | 3,345 | |

| Cobalt | | | 1 | | | | 68 | | | | 169 | | | | 186 | |

| Silver | | | 60 | | | | 31 | | | | 181 | | | | 85 | |

| | | $ | 36,193 | | | $ | 32,689 | | | $ | 118,336 | | | $ | 106,454 | |

For the three months ended September 30, 2012, revenue before pricing adjustments was $35.5 million, compared to $34.4 million in the same period last year. The increased revenue in the third quarter of 2012 reflected an increase in the quantity of palladium ounces sold, partially offset by lower realized prices, compared to the same quarter last year. For the nine months ended September 30, 2012, revenue before pricing adjustments was $118.2 million, compared to $110.7 million for the same period last year, reflecting higher quantities of palladium ounces sold in the current year, partially offset by lower realized prices.

Operating Expenses

For the three months ended September 30, 2012, operating expenses were $36.0 million, compared to $27.8 million in the prior year period. Operating expenses for the nine months ended September 30, 2012 were $107.8 million compared to $79.7 million in the same period last year. The increase in operating expenses in 2012 resulted primarily from mining and processing more tonnage from the open pit and higher costs of contractor labour, power, parts and supplies, and fuel charges, compared to the same period last year.

Cash cost per ounce1 of palladium sold, was US$423 for the quarter ended September 30, 2012 (2011 – US$496) and US$412 for the nine months ended September 30, 2012 (2011 – US$436).

Due to the Company’s commitment to a comprehensive energy management plan the Company qualified for the Ontario government’s Northern Industrial Electricity Rate (“NIER”) program to receive electricity price rebates of two cents per kilowatt hour. In the second quarter of 2011, the Company was accepted into the program and a retroactive rebate of $1.9 million was received for the period April 1, 2010 through March 31, 2011. For the three months ended September 30, 2012, a rebate of $0.8 million was received ($2.6 million for the nine months ended September 30, 2012). The rebate was treated as a reduction of operating expenses. The Company expects to continue to meet the eligibility criteria such that LDI will be entitled to receive additional quarterly rebates until March 2013.

During the third quarter, LDI’s electricity costs increased significantly due to an annual reassessment of its power consumption. The higher power rates will apply from July 1, 2012 until June 30, 2013, at which time new electricity rates will be determined. The Company continues to pursue strategies to reduce power consumption to mitigate its electricity costs.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

9

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Smelting, refining and freight costs for the three months ended September 30, 2012 were $3.4 million compared to $2.4 million in the same period in 2011 and for the nine months ended September 30, 2012, costs were $10.2 million compared to $6.0 million in the prior year. The increase over the prior year for the three and nine months ended September 30, 2012 is primarily due to more tonnes of concentrate being processed and higher smelting and refining charges associated with the current smelter contracts compared to the previous contracts.

For the three months ended September 30, 2012, royalty expense was $1.7 million compared to $1.1 million in the prior year. Royalty expense was $4.8 million for the nine months ended September 30, 2012 compared to $4.1 million for the same period last year. Royalty expense was higher in the current year due to higher revenue, net of higher smelting and refining, and freight charges in the current year.

Depreciation and amortization at the LDI mine for the three months ended September 30, 2012 was $5.0 million, compared to $2.7 million for the three months ended September 30, 2011. For the nine months ended September 30, 2012, depreciation and amortization was $13.6 million compared to $7.0 million in the same period last year. The increase over the prior year is due to a significant increase in depreciable assets associated with the LDI mine expansion.

Other charges at the LDI mine for the three months ended September 30, 2012 were $1.6 million ($2.3 million for the nine months ended September 30, 2012), compared to $nil in the prior year. These additional costs related to dewatering and repairing the damage caused by flooding due to unprecedented rainfalls in the Thunder Bay region in May and August, which was excluded from the cash cost per ounce1 of US$423.

Operating Results

The key operating results for the Palladium operations are set out in the following table.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Tonnes of ore milled | | | 504,022 | | | | 442,253 | | | | 1,552,034 | | | | 1,157,956 | |

| Production | | | | | | | | | | | | | | | | |

| Palladium (oz) | | | 37,908 | | | | 34,871 | | | | 119,685 | | | | 112,503 | |

| Gold (oz) | | | 2,871 | | | | 1,771 | | | | 8,260 | | | | 4,791 | |

| Platinum (oz) | | | 2,754 | | | | 2,309 | | | | 8,282 | | | | 6,639 | |

| Nickel (lbs) | | | 263,445 | | | | 164,126 | | | | 1,053,004 | | | | 472,606 | |

| Copper (lbs) | | | 702,015 | | | | 390,800 | | | | 2,028,735 | | | | 960,385 | |

| Palladium head grade (g/t) | | | 3.33 | | | | 3.46 | | | | 3.38 | | | | 4.07 | |

| Palladium recoveries (%) | | | 76.9 | | | | 76.4 | | | | 77.2 | | | | 79.7 | |

| Tonnes of ore mined | | | 480,675 | | | | 477,923 | | | | 1,517,607 | | | | 1,239,138 | |

| Total cost per tonne milled | | $ | 48 | | | $ | 51 | | | $ | 49 | | | $ | 55 | |

| Cash cost per ounce of palladium ($USD)1 | | $ | 423 | | | $ | 496 | | | $ | 412 | | | $ | 436 | |

LDI Mine

Production during the third quarter of 2012 at the LDI mine included the blending of higher grade underground ore with lower-grade surface ore. During the quarter, 480,675 tonnes of ore was extracted (2011 – 477,923 tonnes of ore extracted). For the nine months ended September 30, 2012, 1,517,607 tonnes of ore was extracted (2011 – 1,239,138 tonnes of ore extracted).

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

10

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

LDI Mill

For the three months ended September 30, 2012, the LDI mill processed 504,022 tonnes of ore at an average of 12,623 tonnes per operating day, producing 37,908 ounces of payable palladium at an average palladium head grade of 3.33 grams per tonne, with a palladium recovery of 76.9%, and mill availability of 97.7%. For the three months ended September 30, 2011, 442,253 tonnes were processed, producing 34,871 ounces at an average grade of 3.46 grams per tonne, with a palladium recovery of 76.4% and mill availability of 99.0%.

For the nine months ended September 30, 2012, the mill processed 1,552,034 tonnes of ore at an average of 12,866 tonnes per operating day, producing 119,685 ounces of payable palladium at an average palladium head grade of 3.38 grams per tonne, palladium recovery of 77.2% and mill availability of 98.1% (2011 – 1,157,956 tonnes processed, producing 112,503 ounces at an average grade of 4.07 grams per tonne, with a palladium recovery of 79.7% and mill availability of 97.3%).

Production costs of $48 per tonne milled for the three months ended September 30, 2012 were lower, compared to $51 per tonne in the same quarter last year due primarily to more tonnage being produced and processed in the quarter. For the nine months ended September 30, 2012, production costs were $49 per tonne milled (2011 - $55 per tonne milled). To improve efficiencies and minimize processing costs, the mill is operating on a batch basis, with a two-week operating and a two-week non-operating schedule.

LDI’s cash cost per ounce1 was US$423 for the three months ended September 30, 2012, compared to $496 per ounce1 in the prior year period. For the nine months ended September 30, 2012, LDI’s cash cost per ounce1 was US$412, compared to US$436 per ounce1 in the prior year period.

LDI Mine Expansion

The Company is currently expanding the LDI mine to transition from mining via ramp access to mining via shaftwhile utilizing a high volume bulk mining method. The objective of the mine expansion isto increase future production at a lower cash cost per ounce1. The Company made significant progress during the quarter in advancing the critical aspects of its mine expansion. Recent mine expansion development highlights include:

| · | Surface construction for the shaft is essentially completed; |

| · | Service hoist, auxiliary hoist, main electrical substation, and all the related power systems at the hoist house were successfully commissioned; |

| · | Mining of the first Offset Zone stope has commenced; |

| · | Shaft sinking is underway and on target for the production hoist to be operational for hoisting ore at the beginning of the third quarter in 2013; |

| · | Underground ramp and stope development progressing on schedule; and |

| · | Major components for the production hoist have arrived on site and installation has commenced. |

For the three months ended September 30, 2012, $28.1 million was invested in the mine expansion, excluding capitalized interest of $2.2 million. For the nine months ended September 30, 2012, $93.0 million has been invested in the mine expansion. With the substantial development investments already made, the capital spend is not expected to differ materially from the $116 million budget for the year. Development work in 2012 has been focused on completing the surface construction activities, advancing underground development (including mine level development and setting up mining stopes), and sinking the shaft.

The Company expects to begin shaft commissioning by year-end, and expects the production hoist to be operational for hoisting Offset Zone ore at the beginning of the third quarter of 2013.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

11

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

GOLD OPERATIONS – FINANCIAL, OPERATING & DEVELOPMENT RESULTS

NAP’s gold division consists of the operating Vezza gold mine, the Sleeping Giant mill, the closed Sleeping Giant mine and a number of nearby exploration projects, all located in the Abitibi region of Quebec. With permits in place and the development well advanced, the Company believes it is the appropriate time to explore divestiture opportunities for its gold assets.

The mine production for the nine months ended September 30, 2012 is from the remaining ore from the Sleeping Giant mine during the first quarter before operations were suspended. Until the Vezza mine reaches commercial production, all costs (net of pre-production revenue from gold sales) will be capitalized.

Financial Results

The following table summarizes the mining operations for the Gold operations and excludes the Vezza mine results, where all costs are being capitalized until commercial production has been achieved.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Revenue | | | - | | | $ | 5,621 | | | $ | 3,004 | | | $ | 19,968 | |

| Mining operating expenses | | | | | | | | | | | | | | | | |

| Production costs | | | - | | | $ | 6,431 | | | $ | 2,157 | | | $ | 24,471 | |

| Smelting, refining and freight costs | | | - | | | | 7 | | | | 4 | | | | 37 | |

| Depreciation and amortization | | | 15 | | | | 1,464 | | | | 185 | | | | 6,126 | |

| Gold mine closure, care and maintenance costs | | | 104 | | | | - | | | | 1,455 | | | | - | |

| Loss (gain) on disposal of equipment | | | (56 | ) | | | - | | | | (421 | ) | | | - | |

| Total mining operating expenses | | $ | 63 | | | $ | 7,902 | | | $ | 3,380 | | | $ | 30,634 | |

| Loss from mining operations | | $ | (63 | ) | | $ | (2,281 | ) | | $ | (376 | ) | | $ | (10,666 | ) |

The Company has included income from mining operations as an additional IFRS measure to provide the user with information of the actual results of operations for each reporting segment.

Revenue

Metal sales for the Sleeping Giant gold mine are recognized when metal is sold to a third party. Sales volumes are set out in the table below.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Sales volumes | | | | | | | | | | | | | | | | |

| Gold (oz) | | | - | | | | 3,241 | | | | 1,663 | | | | 13,151 | |

| Silver (oz) | | | - | | | | 14,300 | | | | 2,578 | | | | 25,700 | |

As operations for the Sleeping Giant gold mine were suspended at the beginning 2012 and pre-production revenue from the Vezza gold mine was capitalized, for the three months ended September 30, 2012, revenue was $nil compared to $5.6 million in the prior year reflecting gold sales of 3,241 ounces with an average realized price of US$1,596 per ounce. Revenue was $3.0 million for the nine months ended September 30, 2012, compared to $20.0 million in the prior year, reflecting gold sales of 1,663 ounces with an average realized price of US$1,762 per ounce (2011 – 13,151 ounces with an average realized price of US$1,482).

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

12

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Operating Expenses

For the three months ended September 30, 2012, total production costs at the Sleeping Giant gold mine were $nil as compared to $6.4 million in the prior year quarter due to mine operations ceasing at the beginning of 2012. Total production costs were $2.2 million for the nine months ended September 30, 2012, compared to $24.5 million in 2011.

Depreciation and amortization for the Gold operations was $nil for the three months ended September 30, 2012 compared to $1.5 million in the prior year quarter due to mine operations ceasing at the beginning of 2012. For the nine months ended September 30, 2012, depreciation and amortization was $0.2 million compared to $6.1 million in the prior year.

As a result of the Company’s decision to cease mining operations at Sleeping Giant and restructure the gold division, closure costs and care and maintenance costs of $0.1 million were recorded during the third quarter and $1.5 million (primarily severance) during the nine months ended September 30, 2012.

Operating Results

The key operating results for the Gold operations are set out in the following table.

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Tonnes of ore milled | | | - | | | | 14,322 | | | | 6,369 | | | | 57,661 | |

| Production | | | | | | | | | | | | | | | | |

| Gold (oz) | | | - | | | | 2,976 | | | | 1,199 | | | | 11,496 | |

| Gold head grade (g/t) | | | - | | | | 6.68 | | | | 6.14 | | | | 6.43 | |

| Gold recoveries (%) | | | - | | | | 96.7 | | | | 95.4 | | | | 96.4 | |

| Tonnes of ore hoisted | | | - | | | | 14,322 | | | | 6,369 | | | | 57,208 | |

| Total cost per tonne milled | | | - | | | $ | 449 | | | $ | 339 | | | $ | 424 | |

| Cash cost per ounce ($USD)1 | | | - | | | $ | 1,869 | | | $ | 1,248 | | | $ | 1,835 | |

Sleeping Giant Mine

As operations for the Sleeping Giant gold mine were suspended at the beginning of 2012, there were no tonnes hoisted for the three months ended September 30, 2012, compared to 14,322 tonnes of ore hoisted from the underground mine in the prior year with an average gold grade of 6.68 grams per tonne. For the nine months ended September 30, 2012, 6,369 tonnes of ore were hoisted with an average gold grade of 6.14 grams per tonne, compared to 57,208 tonnes hoisted with an average gold grade of 6.43 grams per tonne in 2011.

Sleeping Giant Mill

For the three months ended September 30, 2012, the mill did not process any ore from the Sleeping Giant gold mine, compared to the prior year when 14,322 tonnes of ore were processed, producing 2,976 ounces of gold at an average gold head grade of 6.68 grams per tonne, with a gold recovery of 96.7% and mill availability of 100.0%.

In the prior year, Sleeping Giant’s cash cost per ounce1 was US$1,869 for the three months ended September 30, 2011 and production costs per tonne of ore milled were $449. For the nine months ended September 30, 2012, Sleeping Giant’s cash cost per ounce1 was US$1,248 (2011 – US$1,835) and production costs per tonne of ore milled were $339 (2011 - $424).

At September 30, 2012, the mill contained approximately 2,097 ounces (2011 – 1,656 ounces) of gold being processed from Vezza that was included in inventory and valued at net realizable value. Despite the closure of the Sleeping Giant mine, the mill will continue to operate to process ore from the nearby Vezza mine.

1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

13

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Vezza Gold Mine

During the third quarter, the Company reviewed the operating parameters used during the initial stoping in the second quarter, with the objective of optimizing its mining techniques, and reducing dilution and stope preparation times. The Company is adding and improving long-hole benching techniques and reducing alimak stope mining. Concurrent with this change in method is a review of the optimal mining rates that will balance development requirements and available manpower.

CONSOLIDATED FINANCIAL RESULTS

General and administration

The Company’s general and administration expenses for the three months ended September 30, 2012 were $3.2 million, comparable to $2.9 million in the prior year quarter. For the nine months ended September 30, 2012, general and administration costs were $9.7 million, compared to $9.5 million in the prior year.

Exploration

Exploration expenditures for the three months ended September 30, 2012 were $3.1 million compared to $2.0 million in the prior year quarter. Exploration expenditures were $11.1 million for the nine months ended September 30, 2012 compared to $11.9 million for the nine months ended September 30, 2011. Exploration expenditures are comprised as follows:

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Palladium operations | | | | | | | | | | | | | | | | |

| Ontario exploration projects* | | $ | 2,590 | | | $ | 1,718 | | | $ | 8,529 | | | $ | 7,475 | |

| Gold operations | | | | | | | | | | | | | | | | |

| Quebec exploration projects** | | | 585 | | | | 1,340 | | | | 2,062 | | | | 5,572 | |

| Other exploration expenses | | | (87 | ) | | | (1,126 | ) | | | 460 | | | | (1,192 | ) |

| | | | 498 | | | | 214 | | | | 2,522 | | | | 4,380 | |

| Corporate and other*** | | | 14 | | | | 24 | | | | 23 | | | | 74 | |

| Total exploration expenditures | | $ | 3,102 | | | $ | 1,956 | | | $ | 11,074 | | | $ | 11,929 | |

| * | Ontario exploration projects include the LDI Mine Block intrusion, comprising the Roby, Offset, Cowboy, Sheriff, Baker, Creek and North VT Rim mineralized zones and the South LDI and South Rim target areas, the North Lac des Iles intrusive complex, several greenfields PGE properties in the LDI region, and two greenfields Au properties in the LDI-Thunder Bay region (Salmi Lake, Shabaqua). |

| ** | Other Quebec exploration projects are comprised of Vezza, the Sleeping Giant mine property, Flordin, Discovery, Dormex and Laflamme. |

| *** | Corporate and other includes the Shebandowan Ni project (JV with Vale). |

Interest expense & other costs and Other income

Interest expense and other costs for the three months ended September 30, 2012 was $1.0 million compared to income of $0.3 million in the prior year quarter. The current year balance includes a gain on the renouncement of flow-through expenditures of $0.8 million and interest income of $0.1 million, partially offset by accretion expense of $0.8 million, an unrealized loss on palladium warrants of $0.6 million and other interest charges of $0.4 million. The prior year balance includes a gain on renouncement of flow-through expenditures of $0.5 million and interest income of $0.2 million, partially offset by interest charges of $0.4 million.

For the nine months ended September 30, 2012, interest expense and other costs was $0.6 million compared to income of $1.7 million in the prior year. Interest expense and other income in 2012 balance includes an unrealized gain on palladium warrants of $1.7 million, a gain on the renouncement of flow-through expenditures of $1.0 million and interest income of $0.2 million, partially offset by accretion expense of $2.4 million and other interest charges of $1.2 million. The prior year balance includes a gain on renunciation of flow-through expenditures of $1.8 million and interest income of $0.8 million, partially offset by interest charges of $0.6 million and accretion expense of $0.3 million.

14

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Interest expense and other income include interest on finance leases, asset retirement obligation accretion, accretion expense on long-term debt, interest expense, unrealized gains/losses on palladium warrants, gains on renouncement of flow-through expenditures and interest income in the current and prior year periods.

Income and Mining Tax Expense (Recovery)

The income and mining tax expense (recovery) for the three and nine months ended September 30, are provided as follows:

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| LDI palladium mine | | | | | | | | | | | | | | | | |

| Ontario transitional tax credit | | $ | - | | | $ | - | | | $ | - | | | $ | 2,387 | |

| | | $ | - | | | | - | | | $ | - | | | $ | 2,387 | |

| Sleeping Giant gold mine and Vezza gold mine | | | | | | | | | | | | | | | | |

| Quebec mining duties expense (recovery) | | $ | 853 | | | $ | (925 | ) | | $ | (58 | ) | | $ | (833 | ) |

| Quebec income tax recovery | | | - | | | | - | | | | - | | | | (107 | ) |

| Mining interests temporary difference expense (recovery) | | | 674 | | | | 1,555 | | | | 1,406 | | | | 2,219 | |

| | | $ | 1,527 | | | $ | 630 | | | $ | 1,348 | | | $ | 1,279 | |

| Corporate and other | | | | | | | | | | | | | | | | |

| Expiration of warrants | | | - | | | | - | | | | - | | | $ | (3 | ) |

| | | | - | | | | - | | | | - | | | $ | (3 | ) |

| Income and Mining Tax Expense (Recovery) | | $ | 1,527 | | | $ | 630 | | | $ | 1,348 | | | $ | 3,663 | |

For the three months ended September 30, 2012, income and mining tax expense was $1.5 million compared to $0.6 million in the same period in 2011. In the current quarter, income and mining tax expense includes mining interest temporary differences ($0.7 million) and Quebec mining duties expense ($0.9 million). The prior quarter balance includes mining interest temporary differences ($1.6 million), partially offset by Quebec mining duties recovery ($0.9 million). Income and mining tax expense for the nine months ended September 30, 2012 was $1.3 million compared to $3.7 million in the same period last year. In the current year, income and mining tax expense includes mining interest temporary differences ($1.4 million), partially offset by Quebec mining duties recovery ($0.1 million). The prior year balance includes Ontario transitional tax credits ($2.4 million) and mining interest temporary differences ($2.2 million), partially offset by Quebec mining duties expense ($0.8 million).

Net Loss

For the three months ended September 30, 2012, the Company reported a net loss of $8.0 million or $0.05 per share compared to a net loss of $2.8 million or $0.02 per share in the three months ended September 30, 2011. The increase in the net loss is primarily due to higher smelter and refining costs, higher depreciation and amortization costs, flood costs, higher interest charges and exploration expenses, as well as a lower realized palladium price than last year.

The Company reported a net loss of $12.0 million or $0.07 per share for the nine months ended September 30, 2012, compared to a net loss of $7.8 million or $0.05 per share in the prior year.

15

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Summary of Quarterly Results

(expressed in thousands of Canadian dollars except per share amounts)

| | | 2012 | | | 2011 | | | 2010 | |

| | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | |

| Revenue | | $ | 36,193 | | | $ | 40,565 | | | $ | 44,582 | | | $ | 44,050 | | | $ | 38,310 | | | $ | 51,398 | | | $ | 36,714 | | | $ | 39,502 | |

| Production costs | | | 24,257 | | | | 27,214 | | | | 27,551 | | | | 33,120 | | | | 28,928 | | | | 28,783 | | | | 30,427 | | | | 21,556 | |

| Gold assets impairment charge | | | - | | | | - | | | | - | | | | 49,210 | | | | - | | | | - | | | | - | | | | - | |

| Exploration expense | | | 3,102 | | | | 3,969 | | | | 4,003 | | | | 4,738 | | | | 1,956 | | | | 6,134 | | | | 3,839 | | | | 12,532 | |

| Capital expenditures | | | 40,447 | | | | 40,746 | | | | 44,924 | | | | 52,565 | | | | 50,561 | | | | 41,363 | | | | 41,144 | | | | 20,142 | |

| Net income (loss) | | | (8,046 | ) | | | (3,053 | ) | | | (928 | ) | | | (57,397 | ) | | | (2,816 | ) | | | 5,380 | | | | (10,321 | ) | | | (2,013 | ) |

| Cash provided by (used in) operations | | | 4,513 | | | | 671 | | | | 4,751 | | | | (25,557 | ) | | | 15,883 | | | | 4,121 | | | | 4,870 | | | | (25,196 | ) |

| Net income (loss) per share – basic | | $ | (0.05 | ) | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | (0.35 | ) | | $ | (0.02 | ) | | $ | 0.03 | | | $ | (0.06 | ) | | $ | (0.01 | ) |

| Net income (loss) per share – diluted | | | (0.05 | ) | | | (0.03 | ) | | | (0.01 | ) | | | (0.35 | ) | | | (0.02 | ) | | | 0.03 | | | | (0.06 | ) | | | (0.01 | ) |

| Cash provided by (used in) operations prior to changes in non-cash working capital per share1 | | | (0.00 | ) | | | 0.02 | | | | 0.03 | | | | (0.01 | ) | | | 0.02 | | | | 0.07 | | | | (0.04 | ) | | | 0.02 | |

FINANCIAL CONDITION, CASH FLOWS, LIQUIDITY AND CAPITAL RESOURCES

Sources and Uses of Cash

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Cash provided by (used in) operations prior to changes in non-cash working capital | | $ | (491 | ) | | $ | 3,061 | | | $ | 7,403 | | | $ | 7,850 | |

| Changes in non-cash working capital | | | 5,004 | | | | 12,822 | | | | 2,532 | | | | 17,024 | |

| Cash provided by operations | | | 4,513 | | | | 15,883 | | | | 9,935 | | | | 24,874 | |

| Cash provided by financing | | | 35,286 | | | | 67 | | | | 88,163 | | | | 69,211 | |

| Cash used in investing | | | (40,223 | ) | | | (49,710 | ) | | | (125,571 | ) | | | (131,765 | ) |

| Decrease in cash and cash equivalents | | $ | (424 | ) | | $ | (33,760 | ) | | $ | (27,473 | ) | | $ | (37,680 | ) |

Operating Activities

For the three months ended September 30, 2012, cash used in operations prior to changes in non-cash working capital was $0.5 million, compared to cash provided by operations of $3.1 million in the prior year, a decrease of $3.6 million. This decrease is primarily due to lower revenue ($2.1 million), higher smelter, royalty and flood costs ($3.2 million) and higher exploration and net interest costs ($2.4 million), partially offset by lower production costs ($4.7 million). Cash provided by operations prior to changes in non-cash working capital was $7.4 million for the nine months ended September 30, 2012, compared to cash provided by operations of $7.9 million in prior year, a decrease of $0.5 million.

For the three months ended September 30, 2012, changes in non-cash working capital resulted in a source of cash of $5.0 million compared to a source of cash of $12.8 million in the prior year. The 2012 balance of $5.0 million is primarily due to a decrease in accounts receivable ($6.4 million) and a decrease in other assets ($1.0 million), partially offset by a decrease in accounts payable and accrued liabilities ($3.8 million). Changes in non-cash working capital for the nine months ended September 30, 2012 provided cash of $2.5 million compared to cash provided of $17.0 million in the prior year. The 2012 balance is primarily due to a decrease in inventory ($1.5 million) and a decrease in other assets ($6.1 million), partially offset by an increase in accounts receivable ($5.0 million).

1 Non-IFRS measure. Please refer to Non-IFRS Measures on pages 27-30.

16

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Financing Activities

For the three months ended September 30, 2012, financing activities provided cash of $35.3 million consisting of $40.8 million related to the issuance of convertible debentures, partially offset by repayments of finance leases of $1.2 million and interest payments of $4.2 million. This compared to cash provided by financing activities of $0.1 million in the prior year consisting of $0.5 million related to the issuance of commons shares, partially offset by the scheduled repayment of finance leases of $0.4 million. For the nine months ended September 30, 2012, financing activities provided cash of $88.2 million consisting of $40.8 million related to the issuance of convertible debentures, $32.8 million related to the issuance of flow-through common shares, $11.2 million utilized from the $15.0 million finance lease facility and $15.3 million was drawn down on the credit facility, partially offset by repayments of finance leases of $3.7 million and interest payments ($8.2 million). This compared to cash provided by financing activities in the prior year of $69.2 million, of which $41.1 million was related to the exercise of warrants, $20.6 million from the issuance of flow through shares and $8.4 million related to proceeds received for mine closure deposits.

Investing Activities

For the three months ended September 30, 2012, investing activities required cash of $40.2 million, relating to additions to mining interests of $40.4 million and the Company received proceeds on disposal of equipment of $0.2 million. For the three months ended September 30, 2011, investing activities required cash of $49.7 million, relating to additions to mining interests ($50.6 million), partially offset by proceeds on disposal of equipment ($0.9 million). Investing activities required cash of $125.6 million for the nine months ended September 30, 2012, compared to $131.8 million cash required by investing activities for the nine months ended September 30, 2011. The majority of the additions to mining interests were attributable to LDI’s mine expansion project and the Vezza gold mine.

Additions to mining interests

Additions to mining interests are comprised as follows:

| | | Three months ended

September 30 | | | Nine months ended

September 30 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Palladium operations | | | | | | | | | | | | | | | | |

| Offset Zone development | | $ | 27,839 | | | $ | 36,622 | | | $ | 91,336 | | | $ | 90,821 | |

| Offset Zone exploration costs | | | 260 | | | | 1,893 | | | | 1,646 | | | | 8,260 | |

| Tailings management facility | | | 2,681 | | | | 391 | | | | 2,877 | | | | 584 | |

| Other equipment and betterments | | | 3,308 | | | | 767 | | | | 7,511 | | | | 4,198 | |

| | | $ | 34,088 | | | $ | 39,673 | | | $ | 103,370 | | | $ | 103,863 | |

| Gold operations | | | | | | | | | | | | | | | | |

| Vezza mine development | | $ | 1,206 | | | $ | 8,333 | | | $ | 5,250 | | | $ | 20,941 | |

| Vezza equipment | | | 1,844 | | | | - | | | | 3,603 | | | | - | |

| Vezza pre-production revenue | | | (8,051 | ) | | | - | | | | (16,422 | ) | | | - | |

| Vezza pre-production costs | | | 11,347 | | | | - | | | | 30,159 | | | | - | |

| Other equipment and betterments | | | 13 | | | | 2,555 | | | | 157 | | | | 8,264 | |

| | | $ | 6,359 | | | $ | 10,888 | | | $ | 22,747 | | | $ | 29,205 | |

| | | $ | 40,447 | | | $ | 50,561 | | | $ | 126,117 | | | $ | 133,068 | |

In addition to the mining interests acquired by cash reflected in the table above, the Company also acquired equipment by means of finance leases. For the three months ended September 30, 2012, $0.2 million of equipment was acquired by means of finance leases compared to $0.1 million in the prior year. For the nine months ended September 30, 2012, $2.3 million ($1.7 million at LDI and $0.6 million at Vezza) of equipment was acquired by means of finance leases compared to $1.0 million in the prior year.

17

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

During the second quarter, the Company issued 11,300,000 flow-through common shares at a price of $3.10 per share for net proceeds of $32.8 million. The Company is required to spend the gross proceeds of $35.0 million on eligible exploration and mine development expenditures, which expenditures are expected to be renounced to investors for the 2012 tax year. As at September 30, 2012, $26.6 million was spent.

Capital Resources

As at September 30, 2012, the Company had cash and cash equivalents of $23.5 million compared to $50.9 million as at December 31, 2011. The decrease is due primarily to the investment in LDI’s mine expansion plan and the Vezza gold mine. The funds are invested in short term interest bearing deposits at a major Canadian chartered bank.

The Company has a US$60.0 million credit facility that is secured by the Company's accounts receivables and inventory and may be used for working capital liquidity and general corporate purposes. Under the credit agreement, the Company utilized US$16.8 million for letters of credit primarily for reclamation deposits and has taken a drawdown of US$15.0 million, leaving US$28.2 million available at September 30, 2012.

During the first quarter of 2012, the Company established a $15.0 million lease facility to fund equipment for the LDI mine expansion, of which $11.2 million ($10.2 million, net of repayments) has been utilized as at September 30, 2012.

On July 31, 2012, the Company completed an offering of 43,000 convertible unsecured subordinated debentures of the Company at a price of $1,000 per debenture, for total gross proceeds of $43.0 million ($40.8 million net proceeds). The debentures mature on September 30, 2017 and bear interest at a rate of 6.15% per year, payable semi-annually. At the option of the holder, the debentures may be converted into common shares of the Company at a conversion price of $2.90 per common share. Of the net proceeds of $40.8 million, $33.9 million has been allocated to long-term debt, and the remaining portion of $6.9 million has been allocated to the conversion feature, recorded in equity.

During the second quarter, LDI signed a three-year contract for the majority of the smelting and refining of the mine’s concentrate. This new contract has higher smelting and refining charges from the previous contract, but has a shorter payment period, which will enable the Company to reduce its investment in working capital.

Contractual Obligations

Contractual obligations are comprised as follows:

| As at September 30, 2012 | | Payments Due by Period | |

| (expressed in thousands of Canadian dollars) | | Total | | | Less than 1 year | | | 2-5 Years | |

| Finance lease obligations | | $ | 16,755 | | | $ | 4,757 | | | $ | 11,998 | |

| Operating leases | | | 4,347 | | | | 2,582 | | | | 1,765 | |

| Purchase obligations | | | 57,948 | | | | 57,948 | | | | - | |

| | | $ | 79,050 | | | $ | 65,287 | | | $ | 13,763 | |

In addition to the above, the Company also has asset retirement obligations at September 30, 2012 in the amount of $21.0 million for the LDI mine, Sleeping Giant mill and Vezza gold mine. The Company obtained a letter of credit of $15.2 million to offset these future outlays. As a result, $5.8 million of funding is required prior to or upon closure of these properties.

Related Party Transactions

There were no related party transactions for the period ended September 30, 2012.

OUTSTANDING SHARE DATA

As of November 6, 2012, there were 174,702,834 common shares of the Company outstanding. In addition, there were options outstanding pursuant to the Amended and Restated 2010 Corporate Stock Option Plan entitling holders thereof to acquire 4,217,249 common shares of the Company at a weighted average exercise price of $3.69 per share.

18

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

OVERVIEW OF NAP’S EXPLORATION PROPERTIES

NAP expects future growth will come from continued exploration and development of the Company’s grassroots and near-mine projects. With permits, mine infrastructure and available capacity at LDI, NAP can move from exploration success to production on an accelerated timeline. In addition to the significant exploration program at LDI, the Company’s 2012 exploration budget includes reconnaissance exploration on several, recently acquired greenfields PGE properties – all of which are located within 30 km of the LDI mill.

With respect to the Company’s pipeline of non-producing gold properties, there will be minimal expenditures in 2012 as the Company explores divestiture opportunities for all of its gold assets.

Ontario Properties

LDI Mine & Property

The LDI Mine Block comprises ~21,000 acres and offers significant exploration upside that is complimented by the 15,000-tonne per day mill, which currently has excess capacity. Beyond the immediate mine site, most of the land has had minimal historic exploration. The exploration success achieved during the past few years gives management encouragement that there is strong potential to continue to grow the Company’s palladium reserve and resource base through exploration.

Exploration is underway in the following underground mineralized zones:

| · | Roby Zone: underground production from Roby commenced in 2006. |

| · | Offset Zone: discovered in 2001, located below and approximately 250 metres south west of the Roby Zone. The Offset Zone remains open in all directions and continues to expand through exploration. LDI mine expansion is currently underway to access Offset Zone ore. |

| · | Cowboy Zone*: discovered in 2009 during infill drilling of the Offset Zone, located 30 to 60 metres to the west of the Offset Zone. This new discovery has the potential to extend LDI’s mine life and could positively impact the economics of the mine. |

| · | Outlaw Zone*: discovered in 2009, located to the west of the Offset Zone and the Cowboy Zone. Further drilling is required to explore the vertical and lateral limit of this mineralization. |

| · | Sheriff Zone*: discovered in 2010, located approximately 100 metres south east of the Offset Zone. Further drilling is required to confirm the geometry and resource potential. |

* The disclosure regarding these mineralized areas is conceptual in nature and there has been insufficient exploration to define a mineral resource of these areas.

The current LDI mine plan does not include the three nearby underground mineralized zones (Cowboy, Outlaw and Sheriff) due to insufficient drilling at the present time. The main focus of the 2012 near-mine exploration program is underground exploration at LDI targeting the Offset Zone, including infill drilling and extension drilling towards surface, at depth, and to the south. In addition, In Q2, the Company commenced a resource delineation drilling program on the Sheriff Zone to determine if this zone could provide a future source of near-surface, pit grade resources. Trenching on the Sheriff Zone commenced in Q3 and additional delineation drilling is planned for the fourth quarter.

19

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

On August 8, 2012, the Company updated its mineral reserves and resource estimates for LDI (as at December 31, 2011) with the following highlights:

| · | Offset Zone infill drill program achieved its objective to upgrade the resource model: |

| · | Measured resources nearly tripled in size to 7.1 million tonnes (1.25 million contained palladium ounces); |

| · | Measured and Indicated resources totaled 14.2 million tonnes (2.38 million contained palladium ounces); and |

| · | Inferred resources nearly doubled to 6.3 million tonnes (0.89 million contained palladium ounces) |

| · | The new resource model confirms the potential for additional resources in the Cowboy and Outlaw zones and southern parts of the Offset Zone deposit. |

| · | Significant potential exists to increase LDI’s mineral reserves and resources with: |

| · | Additional step-out drilling on the Offset Zone |

| · | Extension drilling on the Roby Zone; and |

| · | Delineation drilling on the recently discovered Sheriff Zone |

Limited drilling occurred in the third quarter due to the floods. A total of 87 holes and 23,721 metres have been completed in the first nine months of 2012.

On July 16, 2012, the Company provided an exploration update with the following highlights:

| · | Sheriff Zone drilling improves prospect for additional near-surface resources at LDI; |

| · | Offset Zone infill drilling continues to deliver excellent results providing increased confidence in the resource; and |

| · | The Company’s Ontario land package has increased through strategic property acquisitions consolidating the Company’s LDI regional PGE property portfolio. |

On January 30, 2012, the Company provided an update on the remaining drill results from its 2011 exploration program at LDI. Previous exploration updates on the 2011 program were issued by news release on June 28, 2011 and September 14, 2011.

The highlights from the update included:

| · | Infill drill results in the Offset Zone returned excellent grades, with good width and continuity, including 78 metres at 7.39 grams per tonne Palladium ("g/t Pd") and 33 metres at 8.71 g/t Pd; |

| · | Good indication of a southern extension to the Offset Zone in an area previously reported as the Southern Norite Zone, including 39 metres at 4.02 g/t Pd and 15 metres at 5.13 g/t Pd; |

| · | Mineralization discovered 300 metres to the west of the Offset, Cowboy and Outlaw zones, including 10 metres of 3.05 g/t Pd, giving support to the interpretation that some mineralized zones manifest as a series of parallel stacked lenses; |

| · | Confirmed north and south lateral extensions of upper Roby Zone, including 18 metres at 12.82 g/t Pd; and |

| · | Bonanza grade surface mineralization encountered from trenches along the North VT Rim 500 metres northeast of the LDI open pit, including approximately 1 metre samples at 64.4 g/t Pd and 45.8 g/t Pd. |

PGE Greenfields Properties

North Lac des Iles Intrusive Complex

The North Lac des Iles intrusive (NLDI) property is a composite ultramafic intrusion located immediately north of the LDI Mine Block Intrusion. The NLDI complex has received only limited, reconnaissance-level exploration work in the past. The company recently completed an airborne magnetic and electromagnetic survey over the NLDI property and plans to conduct approximately 3,500m of diamond drilling on priority geology and geophysical targets before the end of this year.

20

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Legris Lake Property

The Legris Lake property is adjacent to the south east portion of the Company’s LDI property and is comprised of 15 optioned claims and 5 LDI Mines Ltd staked claims, covering an area of approximately 10,520 acres. The property is underlain by mafic and ultramafic rocks and was optioned for its historic anomalous PGE values. The property is at a preliminary exploration stage, however its PGM potential and close proximity to the LDI mill presents an encouraging exploration target.

Tib Lake Property

On May 3, 2012, LDI entered into an option and purchase agreement with Houston Lake Mining Inc. (“HLM”) whereby LDI obtained an exclusive right and option to purchase a 100% interest in 20 claims located northwest of the Lac des Iles mine, known as the Tib Lake property. The property is subject to a 2.5% net smelter royalty in favour of a third party on a portion of the claims and a 2.5% net smelter royalty in favour of HLM on the remaining claims. The property includes an addition 19 claims staked by LDI. The area covered by the property is approximately 16,000 acres.

New Properties

NAP has acquired a significant land position comprising intrusions in the immediate vicinity of the LDI mine property. All of these intrusions are believed to be part of the same magmatic event that produced the Lac des Iles intrusive complex and its PGE-Cu-Ni resources. During the first three quarters of 2012, the company acquired nine additional greenfields PGE properties through staking (7 properties), option (1 property and 1 property extension) and purchase agreement (1 property). The seven staked properties are referred to as Buck Lake, Bullseye, Chisamore, Demars Lake, Dog River, Taman Lake and Wakinoo Lake. The location of these properties is shown in the company’s July 16th, 2012 press release. The area covered by these new properties is approximately 25,000 acres.

In the third quarter of 2012, the company commenced a significant reconnaissance exploration program on these recently acquired greenfields PGE properties. This program has included surface trenching and mapping, surface rock sampling, soil and till geochemical surveys and airborne magnetic and electromagnetic surveys. Initial drilling on the greenfields properties is expected to commence in the fourth quarter of 2012.

Shebandowan Property

The Company holds a 50% interest in the former producing Shebandowan mine and the surrounding Haines and Conacher properties pursuant to an Option and Joint Venture Agreement with Vale Canada Limited (“Vale”). The properties, known as the Shebandowan property, contain a series of nickel copper-PGM mineralized bodies. The land package, which totals approximately 19,626 acres, is located 90 kilometres west of Thunder Bay, Ontario, and approximately 100 kilometres southwest from the Company’s LDI mine. Vale retains an option to increase its interest from 50% to 60%, exercisable in the event that a feasibility study on the property results in a mineral reserve and mineral resource estimate of the equivalent of 200 million pounds of nickel and other metals.

In 2008, The Company initiated an underground test of the Shebandowan West nickel, copper and PGE project. A decline was excavated and mineralization was sampled before work was suspended due to declining metal prices at that time. The intent of the program was to ship mineralization compatible with that of the Roby zone to the LDI mill for processing.

Moose Calf and Kukkee Properties

In 2010, the Company entered into option agreements for the Moose Calf and Kukkee gold properties located west of Thunder Bay near McGraw Falls. The combined properties are now referred to as the Shabaqua Gold Project.

21

THIRD QUARTER REPORT 2012 |

North American Palladium Ltd.

Salmi Property

On August 1, 2011, LDI entered into an option and purchase agreement whereby LDI obtained the exclusive right to conduct exploration and development activities as well as an exclusive right and option to purchase a 100% undivided interest in all or part of the property known as the Salmi property, comprised of eleven mineral claims located near the LDI mine and one additional adjacent mineral claim. The option and purchase agreement is subject to a 2% net smelter return royalty on future production from the property with LDI having the right to buy back one half of the net smelter return royalty for $0.5 million.

Quebec Properties

The primary focus during the quarter was the logging and sampling of core drilled this year and in late 2011 from various properties. During the first nine months of 2012, a few holes were drilled in the gold division, primarily to meet work commitments. For the remainder of 2012, the Company intends to do minimal exploration activities on its gold properties.

Vezza