Exhibit 2

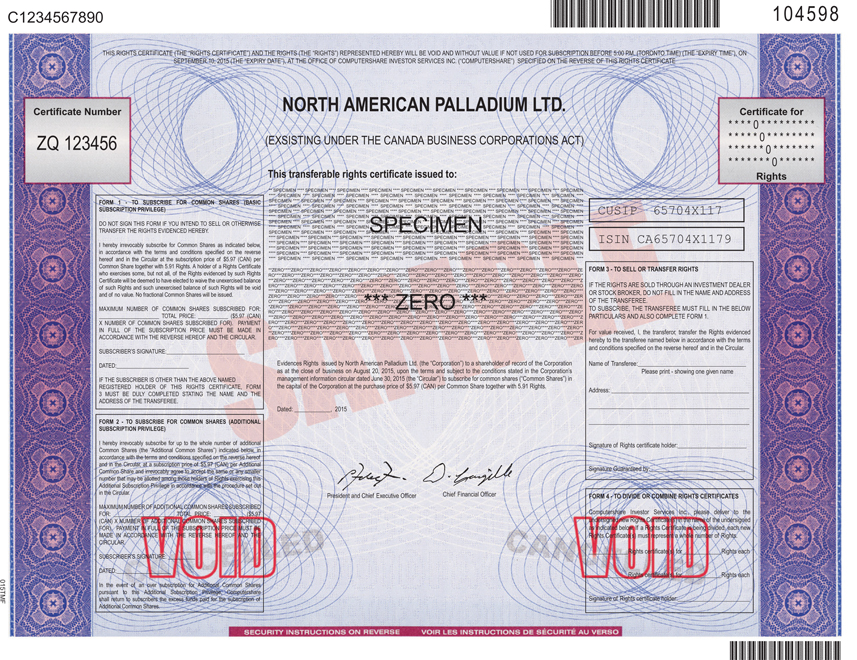

C1234567890104598 Certifi cate Number ZQ 123456 THIS RIGHTS CERTIFICATE (THE “RIGHTS CERTIFICATE”) AND THE RIGHTS (THE “RIGHTS”) REPRESENTED HEREBY WILL BE VOID AND WITHOUT VALUE IF NOT USED FOR SUBSCRIPTION BEFORE 5:00 P.M. (TORONTO TIME) (THE “EXPIRY TIME”), ONSEPTEMBER 10, 2015 (THE “EXPIRY DATE”), AT THE OFFICE OF COMPUTERSHARE INVESTOR SERVICES INC. (“COMPUTERSHARE”) SPECIFIED ON THE REVERSE OF THIS RIGHTS CERTIFICATE NORTH AMERICAN PALLADIUM LTD. (EXSISTING UNDER THE CANADA BUSINESS CORPORATIONS ACT) This transferable rights certifi cate issued to: Certifi cate for * * * * 0 * * * * * * * * ** * * * * 0 * * * * * * * ** * * * * * 0 * * * * * * ** * * * * * * 0 * * * * * *Rights FORM 1 - TO SUBSCRIBE FOR COMMON SHARES (BASICSUBSCRIPTION PRIVILEGE)DO NOT SIGN THIS FORM IF YOU INTEND TO SELL OR OTHERWISETRANSFER THE RIGHTS EVIDENCED HEREBY.I hereby irrevocably subscribe for Common Shares as indicated below,in accordance with the terms and conditions specifi ed on the reversehereof and in the Circular at the subscription price of $5.97 (CAN) perCommon Share together with 5.91 Rights. A holder of a Rights Certifi catewho exercises some, but not all, of the Rights evidenced by such RightsCertifi cate will be deemed to have elected to waive the unexercised balanceof such Rights and such unexercised balance of such Rights will be voidand of no value. No fractional Common Shares will be issued.MAXIMUM NUMBER OF COMMON SHARES SUBSCRIBED FOR: TOTAL PRICE: ($5.97 (CAN)X NUMBER OF COMMON SHARES SUBSCRIBED FOR). PAYMENTIN FULL OF THE SUBSCRIPTION PRICE MUST BE MADE INACCORDANCE WITH THE REVERSE HEREOF AND THE CIRCULAR.SUBSCRIBER’S SIGNATURE: DATED: IF THE SUBSCRIBER IS OTHER THAN THE ABOVE NAMEDREGISTERED HOLDER OF THIS RIGHTS CERTIFICATE, FORM3 MUST BE DULY COMPLETED STATING THE NAME AND THEADDRESS OF THE TRANSFEREE.FORM 2 - TO SUBSCRIBE FOR COMMON SHARES (ADDITIONALSUBSCRIPTION PRIVILEGE)I hereby irrevocably subscribe for up to the whole number of additionalCommon Shares (the “Additional Common Shares”) indicated below, inaccordance with the terms and conditions specifi ed on the reverse hereofand in the Circular, at a subscription price of $5.97 (CAN) per AdditionalCommon Share and irrevocably agree to accept the same or any smallernumber that may be allotted among those holders of Rights exercising thisAdditional Subscription Privilege in accordance with the procedure set outin the Circular.MAXIMUM NUMBER OF ADDITIONAL COMMON SHARES SUBSCRIBEDFOR: TOTAL PRICE: ($5.97(CAN) X NUMBER OF ADDITIONAL COMMON SHARES SUBSCRIBEDFOR). PAYMENT IN FULL OF THE SUBSCRIPTION PRICE MUST BEMADE IN ACCORDANCE WITH THE REVERSE HEREOF AND THECIRCULAR.SUBSCRIBER’S SIGNATURE: DATED: In the event of an over subscription for Additional Common Sharespursuant to this Additional Subscription Privilege, Computershareshall return to subscribers the excess funds paid for the subscription ofAdditional Common Shares. SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN ****SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN ****SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN ****SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN ****SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN**** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN **** SPECIMEN ****SPECIMEN**ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO*** *ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO ****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****Z ERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO** **ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZER O****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO****ZERO**** ZERO****ZERO****ZERO****ZERO****ZERO****ZER Evidences Rights issued by North American Palladium Ltd. (the “Corporation”) to a shareholder of record of the Corporationas at the close of business on August 20, 2015, upon the terms and subject to the conditions stated in the Corporation’smanagement information circular dated June 30, 2015 (the “Circular”) to subscribe for common shares (“Common Shares”) inthe capital of the Corporation at the purchase price of $5.97 (CAN) per Common Share together with 5.91 Rights.Dated: , 2015 Evidences Rights issued by North American Palladium Ltd. (the “Corporation”) to a shareholder of record of the Corporationas at the close of business on August 20, 2015, upon the terms and subject to the conditions stated in the Corporation’smanagement information circular dated June 30, 2015 (the “Circular”) to subscribe for common shares (“Common Shares”) inthe capital of the Corporation at the purchase price of $5.97 (CAN) per Common Share together with 5.91 Rights. CUSIP 65704X117ISIN CA65704X1179 FORM 3 - TO SELL OR TRANSFER RIGHTSIF THE RIGHTS ARE SOLD THROUGH AN INVESTMENT DEALEROR STOCK BROKER, DO NOT FILL IN THE NAME AND ADDRESSOF THE TRANSFEREE.TO SUBSCRIBE, THE TRANSFEREE MUST FILL IN THE BELOWPARTICULARS AND ALSO COMPLETE FORM 1.For value received, I, the transferor, transfer the Rights evidencedhereby to the transferee named below in accordance with the termsand conditions specifi ed on the reverse hereof and in the Circular.Name of Transferee: Please print - showing one given nameAddress: Signature of Rights certifi cate holder: Signature Guaranteed by: FORM 4 - TO DIVIDE OR COMBINE RIGHTS CERTIFICATESComputershare Investor Services Inc., please deliver to theundersigned new Rights Certifi cate(s) in the name of the undersignedas indicated below. If a Rights Certifi cate is being divided, each newRights Certifi cate(s) must represent a whole number of Rights. Rights certifi cate(s) for Rights each Rights certifi cate(s) for Rights eachSignature of Rights certifi cate holder:

THE HOLDER OF THIS SECURITY AGREES FOR THE BENEFIT OF THE CORPORATION THAT (A) THIS SECURITY MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED TO RESIDENTS OR NATIONALS OF ANY JURISDICTION OUTSIDE OF CANADA, THE UNITED STATES OR SUCH OTHER JURISDICTIONS AS DETERMINED BY THE CORPORATION AND (B) THE HOLDER WILL, AND EACH SUBSEQUENT HOLDER IS REQUIRED TO, NOTIFY ANY PURCHASER OF THIS SECURITY FROM SUCH HOLDER OF THE RESTRICTIONS REFERRED TO IN (A) ABOVE.

This Rights Certificate will be void and without value if not used for subscription before 5:00 p.m. (Toronto time), on September 10, 2015, at the office of Computershare Investor Services Inc. specified below.

CIRCULAR

The Rights represented hereby are subject to the terms and conditions set forth in the Circular.

TO SUBSCRIBE

A holder of this Rights Certificate wishing to subscribe for Common Shares must complete Form 1 and deliver this Rights Certificate together with payment in full of the subscription price to Computershare at its office shown below prior to 5:00 p.m. (Toronto time) on September 10, 2015.

The Common Shares will be subscribed for on a one Common Share per 5.91 Rights basis at a price of Cdn$5.97 per share. Only subscriptions for whole Common Shares will be accepted. Completion of Form 1 constitutes a representation by the holder that such holder is not a resident or national of any jurisdiction outside of Canada, the United States or such other jurisdictions as determined by the Corporation or the agent of any such person.

BY EXECUTION AND DELIVERY OF THIS RIGHTS CERTIFICATE, EACH SUBSCRIBER CERTIFIES TO THE CORPORATION THAT SUCH SUBSCRIBER IS ENTITLED TO EXERCISE THE RIGHTS EVIDENCED HEREBY IN ACCORDANCE WITH THE TERMS AND CONDITIONS SET OUT IN THE CIRCULAR.

ADDITIONAL SUBSCRIPTION PRIVILEGE

If Form 1 is completed with respect to the maximum number of Common Shares that can be subscribed for with the rights evidenced hereby, the holder may, by completing Form 2, subscribe for his proportionate part of the Common Shares which are not subscribed for by the expiration of the rights, subject to any maximum number specified by the holder in Form 2. Payment in full of the subscription price of the maximum number of Additional Common Shares so subscribed for must accompany this certificate when it is delivered to Computershare.

PAYMENT

Payment for the number of Common Shares subscribed for must be made by certified cheque, bank draft, money order or other form of payment acceptable to Computershare in Canadian funds payable to the order of “Computershare Investor Services Inc.”. Payment for all Common Shares subscribed for must be paid at the time of subscription at the office of Computershare shown below prior to 5:00 p.m. (Toronto time), on September 10, 2015. In the event of an over subscription for Additional Common Shares pursuant to the Additional Subscription Privilege, Computershare will return to subscribers the excess funds paid for the subscription of such Additional Common Shares not available to be issued to such subscribers.

TO SELL OR TRANSFER RIGHTS

Complete Form 3 and deliver this Rights Certificate in ample time for the transferee to use it before Expiry Time on the Expiry Date. IF FORM 3 IS PROPERLY COMPLETED, THE TRANSFEREE MAY USE IT FOR SUBSCRIPTION WITHOUT OBTAINING A NEW RIGHTS CERTIFICATE. The signature of the Rights Certificate holder must correspond with the name set forth on the face of this Rights Certificate, in every particular, without any change whatsoever, and must be guaranteed by a Canadian Schedule 1 bank, or a member of the acceptable Medallion Signature Guarantee Program (including a member of the Securities Transfer Agent Medallion Program (STAMP), a member of the Stock Exchanges Medallion Program (SEMP) or a member of the New York Stock Exchange Inc. Medallion Signature Program (MSP)). If Form 3 is signed by a trustee, executor, administrator, curator, tutor, guardian, attorney, officer of a corporation, partnership, association or any person acting in a fiduciary or representative capacity, it should be accompanied by satisfactory evidence of authority to act.

The Rights may be transferred only in transactions outside of the United States in accordance with Regulation S under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), which will permit the resale of the Rights by persons through the facilities of the TSX, provided that the offer is not made to a person in the United States, neither the seller nor any person acting on its behalf knows that the transaction has been prearranged with a buyer in the United States, and no “directed selling efforts”, as that term is defined in Regulation S, are conducted in the United States in connection with the resale. Certain additional conditions are applicable to the Corporation’s “affiliates”, as that term is defined under the U.S. Securities Act. In order to enforce this resale restriction, U.S. holders hereof will be required to execute a declaration certifying that such sale is being made outside the United States in accordance with Regulation S.

TO DIVIDE OR COMBINE CERTIFICATES

Complete Form 4 and deliver this Rights Certificate to Computershare at its office shown below in ample time for the new Rights Certificate(s) to be issued and used before the expiration of the Rights. Rights Certificate(s) representing fractional Rights will not be issued

SUBSCRIBERS NOT RESIDENT IN CANADA

This offering of Rights is being made only in Canada, the United States and such other jurisdictions as determined by the Corporation. This offering of Rights is not being made outside of Canada, the United States or such other jurisdictions as determined by the Corporation and is not, and under no circumstances is it to be construed as, an offering of any securities for sale in or to a national or resident of a jurisdiction outside of Canada, the United States or such other jurisdictions as determined by the Corporation or a solicitation therein of an offer to buy any securities. Notwithstanding the foregoing, if a shareholder as of the close of business on September 1, 2015, whose address of record is in, or who is a resident or national of, a jurisdiction outside of Canada, the United States or such other jurisdictions as determined by the Corporation, contacts the Corporation to request a Rights Certificate and provides the Corporation with such evidence of compliance with all applicable securities laws as more particularly described in the Circular, then the Corporation may, if it so chooses in its sole discretion, deliver a Rights Certificate to, and accept subscriptions for Common Shares from or on behalf of, such holder.

OFFICE OF COMPUTERSHARE INVESTOR SERVICES INC.

| | |

| By Hand or Courier to: | | By Mail to: |

| 8th Floor, 100 University Ave. | | P.O. Box 7021 |

| Toronto, Ontario M5J 2Y1 | | 31 Adelaide St. E. |

| Attention: Corporate Actions | | Toronto, Ontario M5C 3H2 |

| | Attention: Corporate Actions |

Signature Guarantee: The signature on this assignment must correspond with the name as written upon the face of the certificate(s), in every particular, without alteration or enlargement, or any change whatsoever and must be guaranteed by a major Canadian Schedule I chartered bank or a member of an acceptable Medallion Signature Guarantee Program (STAMP, SEMP, MSP). The Guarantor must affix a stamp bearing the actual words “Signature Guaranteed”.

In the USA, signature guarantees must be done by members of a “Medallion Signature Guarantee Program” only.

Signature guarantees are not accepted from Treasury Branches, Credit Unions or Caisses Populaires unless they are members of the Stamp Medallion Program.

Computershare’s Privacy Notice: In the course of providing services to you and our corporate clients, Computershare receives non-public personal information about you - your name, address, social insurance number, securities holdings, transactions, etc. We use this to administer your account, to better serve your and our clients’ needs and for other lawful purposes. We have prepared a Privacy Code to tell you more about our information practices and how your privacy is protected. It is available at our website, computershare.com, or by writing us at 100 University Avenue, Toronto, Ontario, M5J 2Y1. *You are required to provide your SIN if you will receive income on these securities. We will use this number for income reporting. Computershare may also ask for your SIN as an identification-security measure if you call or write to request service on your account; however you may decline this usage.

| | |

| | The IRS (Internal Revenue Service) requires cost basis reporting of securities acquired for U.S. residents after January 1, 2011. For more information, please visit www.irs.gov. L’IRS (Internal Revenue Service) exige la déclaration du prix de base des titres acquis pour les résidents des États-Unis après le 1er janvier 2011. Pour plus d’informations, veuillez visiter le www.irs.gov. |

| |

| | 015TNE |