the level of collectibility certainty required by the standard to record the straight-line rent receivable. Accordingly, we wrote-off the straight-line rent receivable and lease incentive balances associated with these leases. Also, we wrote-off our 1% general straight-line rent receivable reserve. These balances totaled $42,808,000 and were written-off to equity effective January 1, 2019 as required by ASC 842.

During the nine months ended September 30, 2019, we received cash rent from Anthem, Thrive, Preferred Care and Senior Care. The total amount of rental income received from these operators was $26,135,000 and is included in Rental Income on the Consolidated Statements of Income and Comprehensive Income. Of the $26,135,000 received, $5,571,000 and $22,542,000 are comprised of cash payments received for amounts previously written-off in transition to ASC 842 (“Recoveries”) during the three and nine months ended September 30, 2019, respectively.

New Accounting Standards Not Yet Adopted by Our Company

In 2016, the FASB issued ASU No. 2016-13, Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). This standard requires a new forward looking “expected loss” model to be used for receivables, held-to-maturity debt, loans, and other instruments. When shared risk characteristics exist, ASU 2016-13 requires a collective basis measurement of expected credit losses of the financial assets. ASU 2016-13 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2019, and early adoption is permitted for fiscal years beginning after December 15, 2018. We are currently evaluating the impact that the standard will have on our consolidated financial statements.

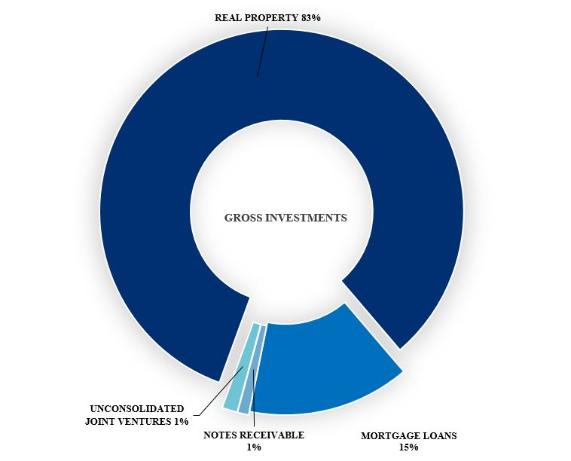

2. | Real Estate Investments |

Assisted living communities, independent living communities, memory care communities and combinations thereof are included in the assisted living property classification (collectively “ALF”).

Any reference to the number of properties or facilities, number of units, number of beds, number of operators and yield on investments in real estate are unaudited and outside the scope of our independent registered public accounting firm’s review of our consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board.

Owned Properties. Our Owned properties are leased pursuant to non-cancelable operating leases generally with an initial term of 10 to 15 years. Each lease is a triple net lease which requires the lessee to pay all taxes, insurance, maintenance and repairs, capital and non-capital expenditures and other costs necessary in the operations of the facilities. Many of the leases contain renewal options. The leases provide for fixed minimum base rent during the initial and renewal periods. The majority of our leases contain provisions for specified annual increases over the rents of the prior year that are generally computed in one of 4 ways depending on specific provisions of each lease:

(i)a specified percentage increase over the prior year’s rent, generally between 2.0% and 3.0%;

(ii)a calculation based on the Consumer Price Index;

(iii)as a percentage of facility net patient revenues in excess of base amounts; or

(iv)specific dollar increases.

Our leases that contain fixed annual rental escalations and/or have annual rental escalations that are contingent upon changes in the Consumer Price Index, are generally recognized on a straight-line