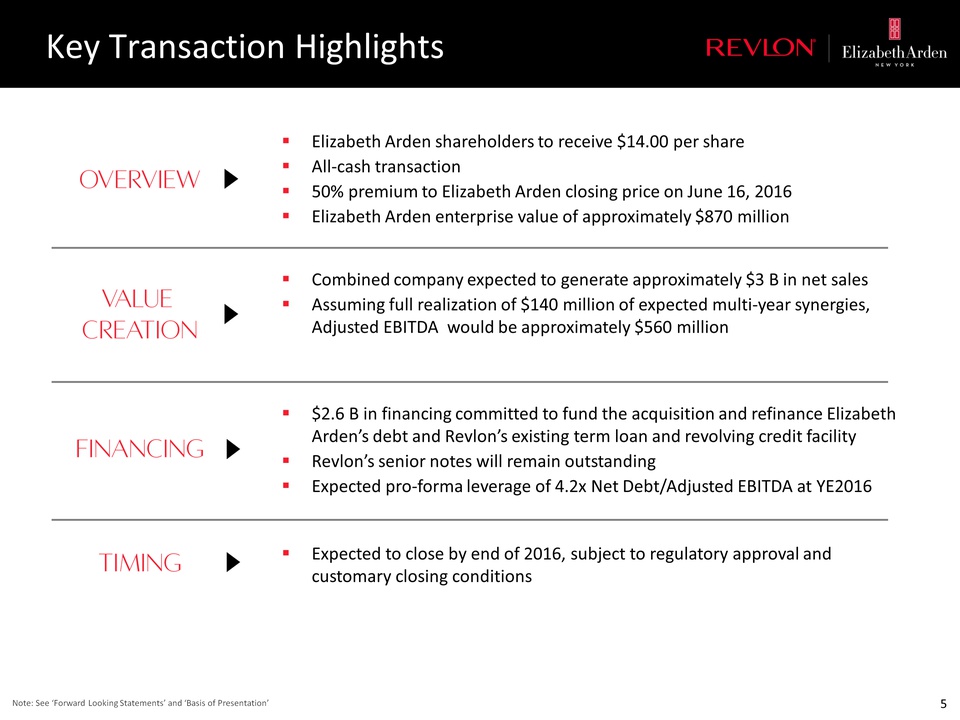

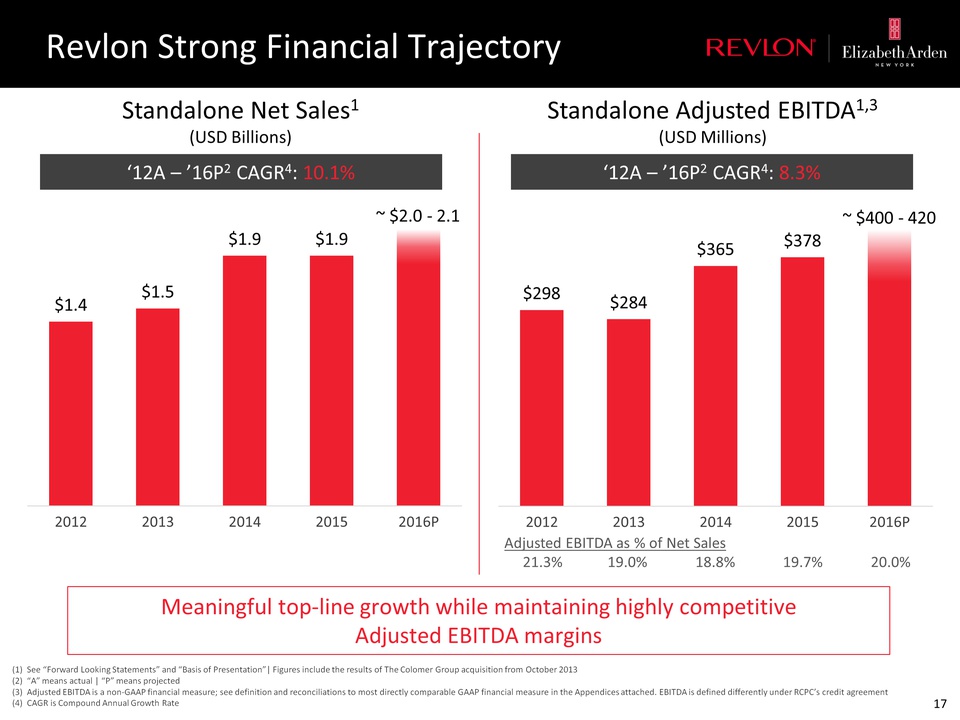

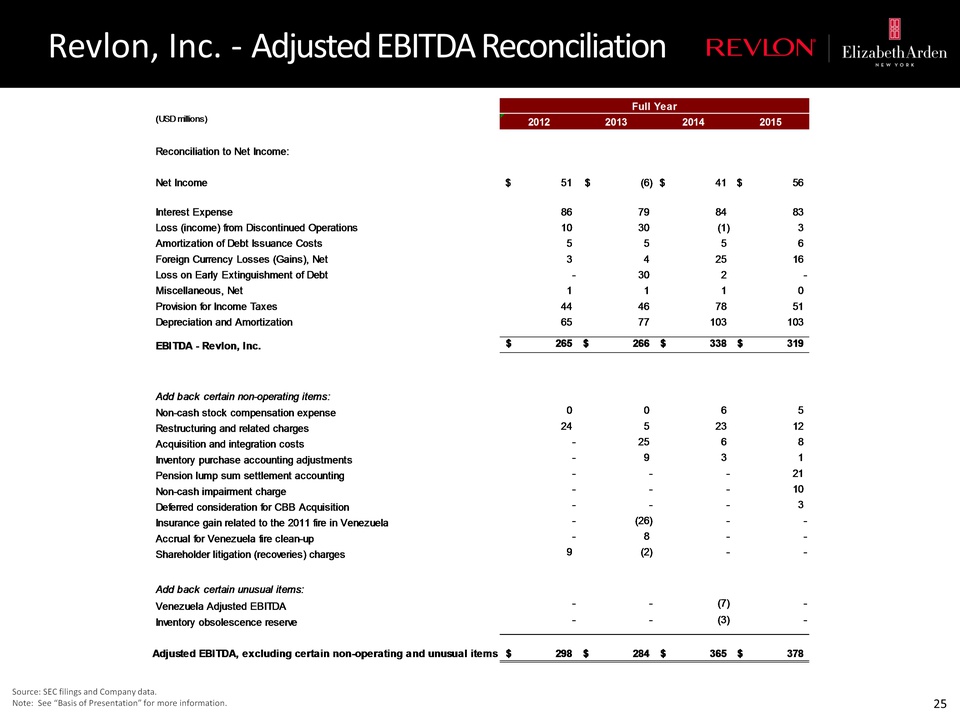

Forward Looking Statements Statements made in this presentation that are not historical facts, including statements about Revlon’s and Elizabeth Arden’s plans, projected financial results and liquidity, strategies, focus, beliefs and expectations, are forward-looking and subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements speak only as of the date they are made and, except for Revlon’s and Elizabeth Arden’s ongoing obligations under the U.S. federal securities laws, neither Revlon nor Elizabeth Arden undertakes any obligation to publicly update any forward-looking statement, whether to reflect actual results of operations; changes in financial condition; changes in results of operations and liquidity, changes in general U.S. or international economic or industry conditions; changes in estimates, expectations or assumptions; or other circumstances, conditions, developments or events arising after the date of this presentation. Revlon is providing the financial guidance in this presentation to provide investors with certain useful information to assist them with evaluating the acquisition. This information should not be considered in isolation or as a substitute for Revlon’s and Elizabeth Arden’s respective as reported financial results prepared in accordance with US GAAP. This guidance should be read in conjunction with Revlon’s and Elizabeth Arden’s respective financial statements and related footnotes filed with the SEC. Neither Revlon nor Elizabeth Arden expect to continue to provide financial guidance other than in connection with the pending acquisition and disclaim any obligation to update such information, as noted above. The forward-looking statements in this presentation include, without limitation, Revlon’s or Elizabeth Arden’s beliefs, expectations, guidance, focus and/or plans regarding future events, including, without limitation the following: (i) Revlon’s and Elizabeth Arden’s plans to consummate the acquisition and the related financing transactions, as well as the terms and conditions of such transactions, and as to the timing thereof; (ii) the expected strategic and financial benefits of such transactions, including, without limitation, the anticipated synergies and cost reductions; and (iii) the Company’s guidance for 2016, including that for 2016, on a standalone constant currency basis, without taking into account the pending acquisition, Revlon expects to generate net sales between $2.0 billion and $2.1 billion, implying a high single-digit growth rate, and between $400 million and $420 million in Adjusted EBITDA; and that for the twelve months ending December 31, 2016, the combined company would be expected to have annualized net sales of approximately $3 billion and, assuming full realization of approximately $140 million of expected multi-year synergies and cost reductions, Adjusted EBITDA of approximately $560 million; and that by the end of 2016 combined company Net Debt/Adjusted EBITDA is expected to be 4.2x. Actual results may differ materially from such forward-looking statements for a number of reasons, including as a result of the risks described and other items Revlon’s or Elizabeth Arden’s filings with the SEC, including Revlon’s and Elizabeth Arden’s respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC during 2015 and 2016 (which may be viewed on the SEC’s website at http://www.sec.gov or on Revlon, Inc.’s website at http://www.revloninc.com or on Elizabeth Arden’s website at http://corporate.elizabetharden.com, as applicable). Additional important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: (i) the acquisition not being timely completed, if completed at all; (ii) risks associated with the financing of the transaction; (iii) prior to the completion of the acquisition, Revlon’s or the Elizabeth Arden’s respective businesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, business partners or governmental entities; (iv) the parties being unable to successfully implement integration strategies or realize the anticipated benefits of the acquisition, including the possibility that the expected synergies and cost reductions from the proposed acquisition will not be realized or will not be realized within the expected time period; and/or (v) difficulties with, delays in or the inability to achieve the Company’s net sales and Adjusted EBITDA guidance for 2016, such as due to, among other things, unanticipated circumstances, trends or events affecting the Company's financial performance, including decreased consumer spending in response to weak economic conditions or weakness in the consumption of beauty-related products; lower than expected acceptance of the Company’s new products; adverse changes in foreign currency exchange rates; decreased sales of the Company's products as a result of increased competitive activities by the Company's competitors; and/or decreased performance by third party suppliers. Factors other than those referred to above could also cause Revlon’s or Elizabeth Arden’s results to differ materially from expected results. Additionally, the business and financial materials and any other statement or disclosure on, or made available through, Revlon’s or Elizabeth Arden’s websites or other websites referenced herein shall not be incorporated by reference into this presentation. With respect to projected full year 2016 Adjusted EBITDA for each of Revlon on a stand-alone basis and the combined company, we are unable to prepare a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable effort, as, among other things, certain items that impact these measures, such as adjustments to the provision for income taxes, depreciation of fixed assets, amortization of intangibles, costs related to restructuring actions and interest expense, have not yet occurred, are out of our control and cannot be predicted.