FTI Consulting November 2012 Exhibit 99.1 |

2 Cautionary Note About Forward-Looking Statements This presentation includes "forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues, future results and performance, expectations, plans or intentions relating to acquisitions and other matters, business trends and other information that is not historical, including statements regarding estimates of our future financial results. When used in this presentation, words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, estimates of our future financial results, are based upon our expectations at the time we make them and various assumptions. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and estimates will be achieved, and the Company’s actual results may differ from our expectations, beliefs and estimates. The Company has experienced fluctuating revenues, operating income and cash flow in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and products that we offer, the mix of the geographic locations where our clients are located or where services are performed, adverse financial, real estate or other market and general economic conditions, which could impact each of our segments differently, the pace and timing of the consummation and integration of past and future acquisitions, the Company's ability to realize cost savings and efficiencies, competitive and general economic conditions, retention of staff and clients and other risks described under the heading “Item 1A. Risk Factors” in the Company’s most recent Form 10-K and in the Company's other filings with the Securities and Exchange Commission, including the risks set forth under “Risks Related to Our Business Segments” and “Risks Related to Our Operations”. We are under no duty to update any of the forward-looking statements to conform such statements to actual results or events and do not intend to do so. |

3 Investment Thesis FTI Consulting is a global business advisory firm dedicated to helping organizations protect and enhance their enterprise value in an increasingly complex legal, regulatory and economic environment Scalable business model – Flexible and attractive business model with the opportunity to leverage cross-practice engagements Well positioned to benefit from key trends – Global regulatory activism, overhaul of financial and credit regulatory markets and the overall complexity of doing business globally Strong competitive position to capture market share in global investigations – LIBOR probe, FCPA investigations, whistleblower investigations and trading probes Management of expenses and recent restructuring actions create room for margin expansion – Expect these actions to result in approximately $14 million in cost savings in 2012 Executable growth strategy – Adding scale to established global infrastructure should yield higher incremental margins Balanced approach to enhanced stockholder value – Capital deployment focused on value-enhancing initiatives – $250 million stock buyback program approved in June 2012 Healthy balance sheet, consistent cash flows and access to capital |

4 Critical Thinking At The Critical Time™ Corporate Finance/Restructuring is the world leader in restructuring and crisis management – #1 crisis management firm in league tables of crisis management firms for 5 consecutive years (2007-2012) Economic Consulting is unmatched in reputation and expertise Forensic and Litigation Consulting is a pioneer of visual support in the courtroom and the global leader in commercial arbitration Technology is a leading provider of E-Discovery software and services Strategic Communications is the global leader in strategic business communications FTI Consulting is an advisor to 93 of the world’s top 100 law firms, 64 of the world’s 100 largest companies and 9 of the world’s top 10 bank holding companies – Named Leading Antitrust Economics Firm and 1 of the 20 Best Economics Firms in the World by Global Competition Review for 7 consecutive years (2005-2012) – #1 on Who’s Who Legal List of most highly regarded firms for Commercial Arbitration for 3 consecutive years (2010-2012) – Member of the “Challengers" Quadrant in Gartner's "Magic Quadrant for E-Discovery Software" Report for 2012 – Ringtail® 8.2 E-discovery Software Named to KMWorld magazine's 2012 Trend-Setting Products List – Named Corporate Agency of the Year by The Holmes Report in April of 2012 – #1 Communications Advisor in mergermarket League Tables of PR Advisers in Global M&A by deal volume as of September 30th , 2012 |

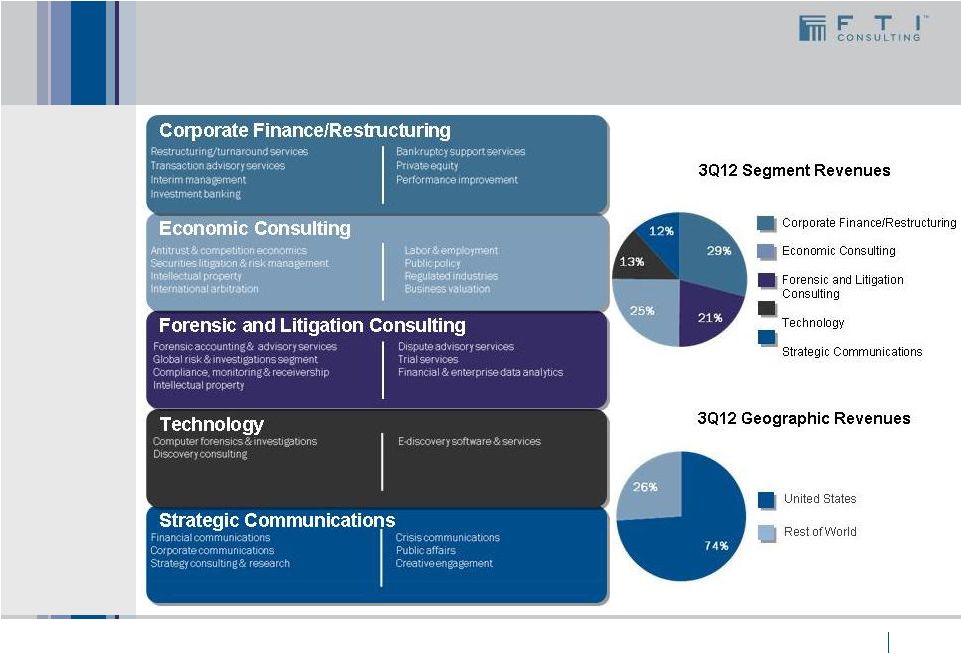

5 Global Business with Diverse Event-Driven Offering FTI Consulting has built a balanced portfolio of global businesses that offer event-driven services and solutions |

BUSINESS SEGMENT OVERVIEW |

7 Corporate Finance/Restructuring Provides consulting and advisory services focused on strategic, operational, financial and capital needs of businesses – #1 crisis management firm in league tables of crisis management firms for 5 consecutive years (2007-2012) Focused on increasing market share and ability to leverage collaborative segment, industry and geographic resources and expertise to deliver higher convert rates Expect global economic volatility to continue in the near-term despite improved availability of credit in the U.S., with continued softness in demand for restructuring and bankruptcy services Opportunities remain strong in Asia Pacific, Europe, Latin America and Healthcare – Shift to company-side work as companies are moving to preemptively structure and restructure in anticipation of tougher credit and economic environments – Strengthened transaction support business in anticipation of a more vibrant financing market |

8 Economic Consulting Provides law firms, corporations and government agencies with analyses related to economics, finance and valuation – Critical insight and expert testimony in legal and regulatory proceedings, strategic decision making and public policy debates – Deep expertise in antitrust issues, M&A, securities litigation and risk management, valuation and international arbitration Leader in antitrust reputation and expertise – Named Leading Antitrust Economics Firm and 1 of the 20 Best Economics Firms in the World by Global Competition Review for 7 consecutive years (2005-2012) Expect sustained high rates of utilization in financial economics business Pursuing opportunities to increase market share in the fast growing labor litigation market |

9 Forensic and Litigation Consulting Provides multidisciplinary, independent dispute advisory, investigative, data acquisition/analysis and forensic accounting services Pioneer of visual support in the courtroom and the global leader in commercial arbitration – #1 on Who’s Who Legal List of most highly regarded firms for Commercial Arbitration for 3 consecutive years (2010-2012) Some short-term challenges related to lower volume of government driven investigations, correlated to U.S. election cycle Investments in global infrastructure position FTI Consulting to compete for large, multi-jurisdictional global engagements Strong pipeline of mortgage backed security engagements and recent uptick in whistleblower generated activity and reactive and proactive FCPA investigations |

10 Technology Provides electronic discovery (“e-discovery”) and information management software and services to companies, law firms, courts and government agencies Leading provider of e-discovery software and services – Member of the “Challengers" Quadrant in Gartner's "Magic Quadrant for E-Discovery Software" Report for 2012 – Ringtail® 8.2 E-discovery Software Named to KMWorld magazine's 2012 Trend-Setting Products List – Recently launched Predictive Discovery, a complete and defensible solution that significantly reduces the cost and time of legal review – As of September 30 th , 2012, year to date the number of new matters is up 22% and the number of new clients is up 29% compared to the same period in 2011 Investments in sales force resulting in winning more matters for more clients Opportunity to target corporations as buyers driven by shift in demand for managed services |

11 Strategic Communications Helps clients use communications assets to protect, enhance, develop and defend their enterprise value One of the most highly regarded communications consultancies with more than 25 years of experience advising management teams in critical situations – Named Corporate Agency of the Year by The Holmes Report in April of 2012 – #1 Communications Advisor in mergermarket League Tables of PR Advisers in Global M&A by deal volume as of September 30 , 2012 The prolonged global economic downturn continues to challenge underlying performance Growth opportunities remain broad-based ranging from restructuring, crisis, capital markets and corporate communications engagements to employee engagement assignments, particularly in Healthcare and Energy, as these sectors improve th |

THE VALUE OF FTI CONSULTING |

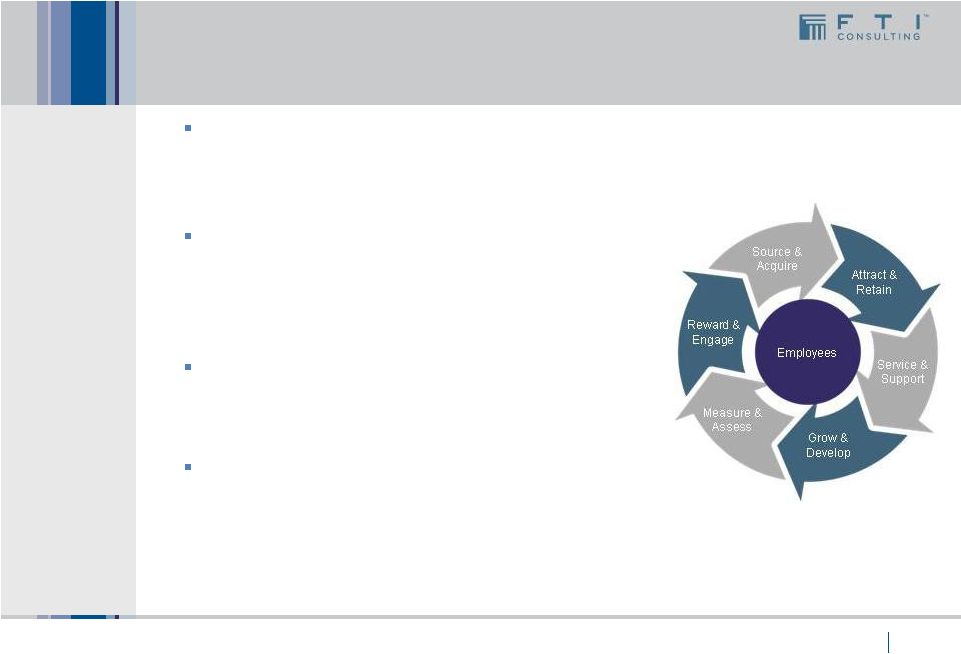

13 Our People FTI Consulting’s most valuable asset is our people – Over 3,800 employees in 92 offices and 24 countries – 364 Senior Managing Directors, 471 Managing Directors and access to three Nobel Laureates FTI Consulting is a global company with global leaders and advisors – The FTI Consulting matrix establishes global leadership – Expanded Board of Directors offering global insights, extensive experience and tenured leadership Our collective expertise spans a wide range of practices, business and industries and fuels our ability to address even the most complex challenges We hire the best and continue to invest in their on- going development – FTI Consulting employees are supported throughout their career development through our educational and thought leadership initiatives: New Hire Orientation, New Director School, FTI Consulting University and Executive Leadership Forums FTI Consulting’s unique integrated approach to protect and enhance enterprise value requires exceptional talent |

14 The FTI Consulting Matrix FTI Consulting’s matrix organizational structure appropriately emphasizes the segment, geographic and industry drivers of our businesses, allowing for improved understanding and response to our client’s needs and increased leverage of resources, knowledge and solutions in our rapidly growing markets Three strategies that drive our business: Segment: Continue to build out diverse platform of services and solutions Geography: Replicate North American business model across existing global platform Industry: Develop integrated industry focused solutions Industry Segment Geography |

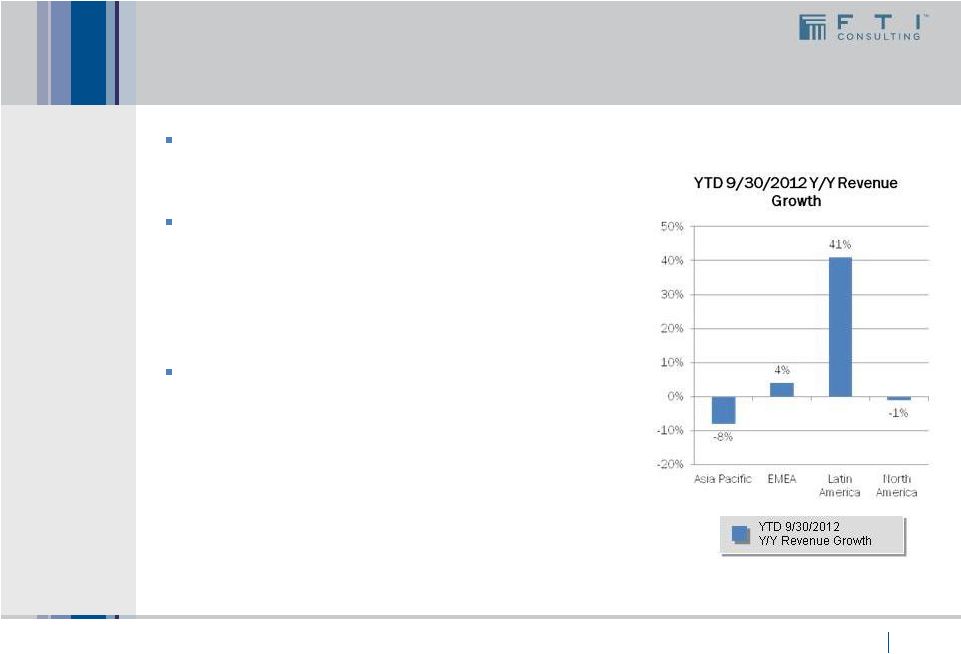

15 The Globalization of FTI Consulting FTI Consulting will continue to add scale and expertise to the company’s global infrastructure The increasingly aggressive regulatory and enforcement environment should bode very well for large consulting firms with global reach and reputations like FTI Consulting North America – Strong demand for Healthcare, Energy and Insurance industry solutions Europe, Middle East and Africa (EMEA) – Depressed valuations present M&A opportunities – Continue to invest based on pockets of demand – Global Risk and Investigations Practice (GRIP), Restructuring, and Anticorruption, Compliance and Remediation Practice Asia Pacific & Latin America – Continue to build out geographic presence and capabilities – Restructuring and Global Risk and Investigations Practice (GRIP) driven by rapid influx of capital – Strong demand for Healthcare, Energy and Real Estate industry solutions |

16 2013 Growth Catalysts Improved post election regulatory environment Uptick in the pace of M&A activity – Currently have a high level of M&A “first look” retentions – M&A touches every business segment, with the potential to represent approximately 10% of total company revenues Restructuring and investigations activity in Europe, Asia Pacific and Latin America – Demand in our Global Risk and Investigations Practice (GRIP), Restructuring, and Anticorruption, Compliance and Remediation Practice in Europe – Opportunities in Restructuring and Global Risk and Investigations Practice (GRIP) driven by rapid influx of capital in Asia Pacific and Latin America Attractive macro drivers in Asia Pacific and Latin America Industry solutions opportunities in Healthcare, Energy and Insurance – Need for business advisory in the ever-changing Healthcare industry – Demand globally for Energy services irrespective of macroeconomic backdrop – Insurance expected to be driven by increased disputes related to insurance payments and adjudications Demand for FTI Consulting’s services and expertise is expected to be driven by multiple catalysts in 2013 |

17 Case Study: M&A Lifecycle and FTI Consulting’s Integrated Service Offering Testing, Design & Implementation of Internal Controls Employee Outreach & Engagement M&A Digital/Social Media Strategies Media Relations Investor Relations First Look Services Antitrust & Competition Economics Investigative Due Diligence & Integrity Investigations Emerging Market Entry Analysis, Political & Corruption Index Assessments Merger Integration Services Post-Acquisition Disputes Purchase Price Dispute Services Global Risk & Investigation Services Compliance Monitoring & Remediation Services Post-Merger Communication Implementation Change Management Communications Corporate Finance/Restructuring Forensic Litigation and Consulting Economic Consulting Technology Strategic Communications Valuation Services Buyer Services Seller Services Lender Services M&A Fraud Services Intellectual Property Valuation & Protection Transactional Due Diligence System Audits/IT Due Diligence Compliance & Accounting Internal Controls Reviews Foreign Bribery & Corruption Risk Assessments Subsidiary, Joint Venture & Controlled Entity Investigations E-discovery Tax Services Second Requests M&A Communications Proxy Communications |

18 Case Study: Cross – Practice Engagements – This is an opportunity that is unique to FTI Consulting and a competitive advantage that makes FTI Consulting much more powerful when our people go-to-market – Clients that face the most complex and critical situations want an integrated FTI Consulting team, a team that has the right combination of skills to solve all of their problems Expect cross- segment engagements to bolster FTI Consulting’s organic growth, brand visibility and reputation FTI Consulting has established a global platform with deep expertise and broad capabilities FTI Consulting leverages this platform by presenting our full set of services to current and potential clients as “one firm” Our clients’ problems, more often than not, need to benefit from services provided by more than one of our business practices FTI Consulting’s biggest and most profitable projects are cross-practice engagements |

19 FTI Consulting’s Financial Position Is Strong Long-term track record of industry-leading growth in revenue and profitability Significant cash flow generation – Consistent and strong net cash provided by operating activities - $173.8 million in 2011 and $195.1 million in 2010 – $126.9 million in cash and cash equivalents on the balance sheet as of September 30 , 2012 – Leverage as of September 30 , 2012 – less than 3:1 Balanced capital deployment aimed at productive and value enhancing initiatives for stockholders – Maintain market leadership positions, impressive credentials and established reputation by investing in talent – Investments in R&D and innovation should drive organic growth – Acquisition strategy focused on building attractive, sustainable businesses – $250 million stock buyback program authorized in June 2012 Recently announced debt offering resulting in decreased interest expense, longer maturity profile and increased access to capital Portfolio investments, coupled with continued cash generation and operational discipline, demonstrated in financial results th th |

20 FTI Consulting Summary FTI Consulting is a global business advisory firm dedicated to helping organizations protect and enhance their enterprise value in an increasingly complex legal, regulatory and economic environment Scalable business model – Flexible and attractive business model with the opportunity to leverage cross-practice engagements Well positioned to benefit from key trends – Global regulatory activism, overhaul of financial and credit regulatory markets and the overall complexity of doing business globally Strong competitive position to capture market share in global investigations – LIBOR probe, FCPA investigations, whistleblower investigations and trading probes Management of expenses and recent restructuring actions create room for margin expansion – Expect these actions to result in approximately $14 million in cost savings in 2012 Executable growth strategy – Adding scale to established global infrastructure should yield higher incremental margins Balanced approach to enhanced stockholder value – Capital deployment focused on value-enhancing initiatives – $250 million stock buyback program approved in June 2012 Healthy balance sheet, consistent cash flows and access to capital |

21 Nine Months Ended September 30, 2012 ($ in thousands, except per share data) (1) We define adjusted earnings per diluted share as earnings per diluted share, excluding the net impact of special charges and loss on early extinguishment of debt that were incurred in that period. $114,367 $137,243 Nine Months Ended September 30, 2012 2011 $1,177,526 $1,176,055 $283,958 $280,364 $29,557 $15,212 ($2,581) $2,538 Unaudited $4,503 $5,409 ($43,607) ($44,129) $75,263 $98,523 $26,372 $34,501 $48,891 $64,022 $1.17 $1.47 41,882 43,671 $1.62 $1.68 Revenues Operating expenses Direct cost of revenues Selling, general & administrative expense Special charges Operating income Other income (expense) Interest expense Income before income tax provision Income tax provision Net income Earnings per common share - diluted Adjusted earnings per common share - diluted Interest income & other $1,063,159 $1,038,812 $16,773 $16,795 Acquisition-related contingent consideration $735,452 $723,903 Amortization of other intangible assets Weighted average common shares outstanding - diluted (1) |

22 YTD Results: Segment Performance |

APPENDIX |

24 Reconciliation of non-GAAP Financial Measures ($ in thousands, except per share data) Nine Months Ended September 30, 2012 2011 $19,115 $9,285 $1.17 $1.47 41,882 43,671 Net income Add back: Special charges, net of tax effect (1) Adjusted Net income Earnings per common share - diluted Adjusted earnings per common share (2) $68,006 $73,307 Add back: Special charges, net of tax effect (1) $1.62 $1.68 Weighted average common shares outstanding - diluted $48,891 $64,022 $0.45 $0.21 (1) The tax effect takes into account the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). As a result, the effective tax rates for the adjustments for the nine months ended September 30, 2012 was 35.3% and 39.0% for the nine months ended September 30, 2011. The tax expense related to the adjustments for the nine months ended September 30, 2012 was $10.4 million or a $0.25 impact on diluted earnings per share. The tax expense related to the adjustments for the nine months ended September 30, 2011 was$5.9million or a $0.14 impact on diluted earnings per share. (2) We define Adjusted Net Income and Adjusted EPS as net income and earnings per diluted share, respectively, excluding the net impact of any special charges and any loss on early extinguishment of debt that were incurred in that period. |

25 Reconciliation of Operating Income and Net Income to Adjusted EBITDA ($ in thousands) Nine Months Ended Sept. 30, 2012 Corporate Finance / Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net Income $48,891 Interest Income and other interest expense Income tax provision ($4,503) $43,607 $26,372 Operating Income $61,885 $30,963 $51,681 $23,403 $6,161 ($59,726) $114,367 Depreciation and amortization Amortization of other intangible assets Special charges $2,528 $4,654 $11,936 $2,812 $1,469 $7,672 $2,131 $1,199 $991 $9,262 $5,960 $3,114 $1,913 $3,491 $4,712 $3,514 - $1,132 $22,160 $16,773 $29,557 Adjusted EBITDA (1) $81,003 $42,916 $56,002 $41,739 $16,277 ($55,080) $182,857 Nine Months Ended Sept. 30, 2011 Corporate Finance / Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net Income $64,022 Interest Income and other interest expense Income tax provision ($5,409) $44,129 $34,501 Operating Income $42,771 $47,746 $45,565 $44,026 $13,449 ($56,314) $137,243 Depreciation and amortization Amortization of other intangible assets Special charges $2,617 $4,345 $9,440 $2,579 $1,852 $839 $1,883 $1,094 $2,093 $8,407 $5,929 - $2,243 $3,575 - $3,778 - $2,840 $21,507 $16,795 $15,212 Adjusted EBITDA (1) $59,173 $53,016 $50,635 $58,362 $19,267 ($49,696) $190,757 (1) We define Adjusted EBITDA as net income before income tax provision, other income (expense), depreciation, amortization of intangible assets and special charges. Amounts presented in the Adjusted EBITDA column for each segment reflect the segments' respective Adjusted segment EBITDA. Wedefine Adjustedsegment EBITDA as thesegments'share ofconsolidatedoperatingincome beforedepreciation, amortization of intangibleassetsand specialcharges. AlthoughAdjustedEBITDAand Adjustedsegment EBITDA arenotmeasures of financial condition or performancedeterminedinaccordancewith generally acceptedaccounting principles ("GAAP"), we believe thatthesemeasures can be auseful operating performance measure for evaluating our results of operations ascompared from period to periodand as compared to our competitors. Weuse AdjustedEBITDA andAdjusted segmentEBITDAto evaluateandcompare the operating performance ofoursegments. We defineAdjustedNet Income and AdjustedEPS as netincome and earnings per dilutedshare, respectively,excluding the net impactof any specialcharges and any loss on early extinguishment of debt that wereincurredinthat period. Adjusted EBITDA andAdjustedPractice EBITDA arenotdefined in the same manner by allcompaniesand maynotbecomparable toother similarly titled measures of othercompanies. These non-GAAP measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Condensed Consolidated Statements of Comprehensive Income (Loss). |

Critical thinking at the critical time™ |