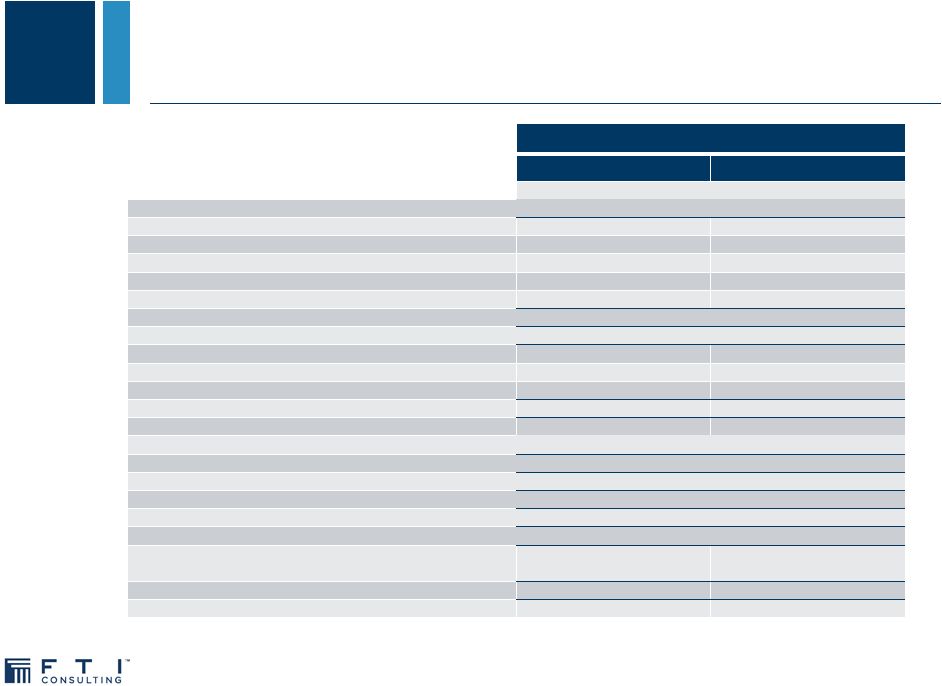

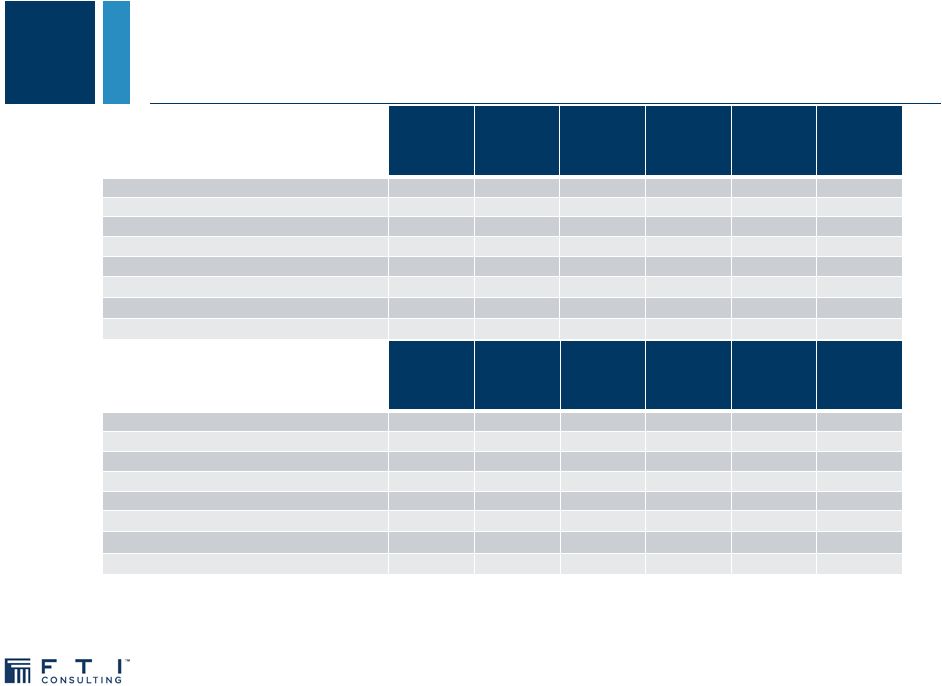

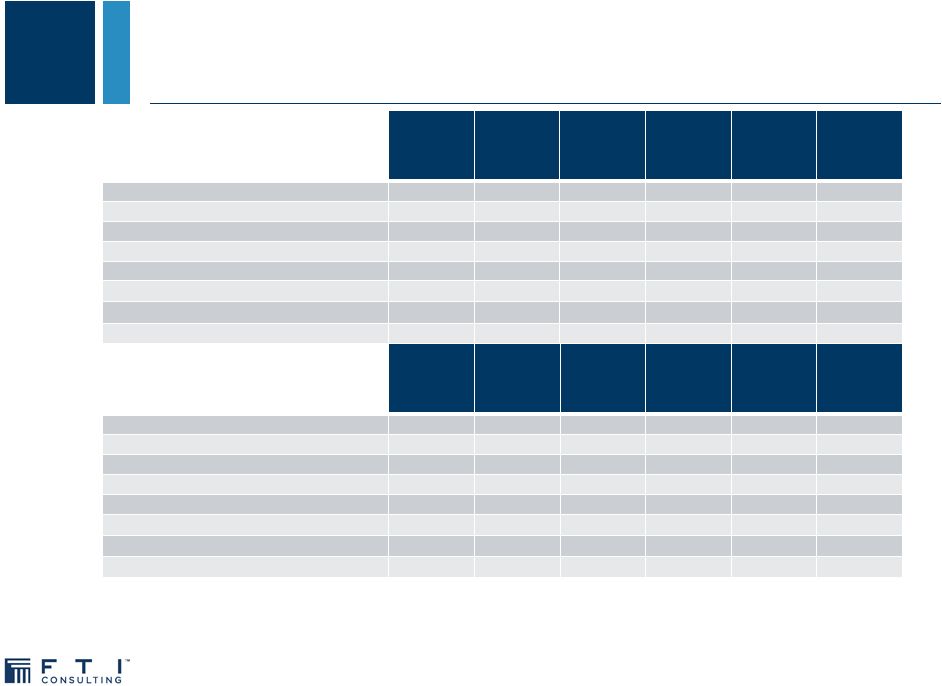

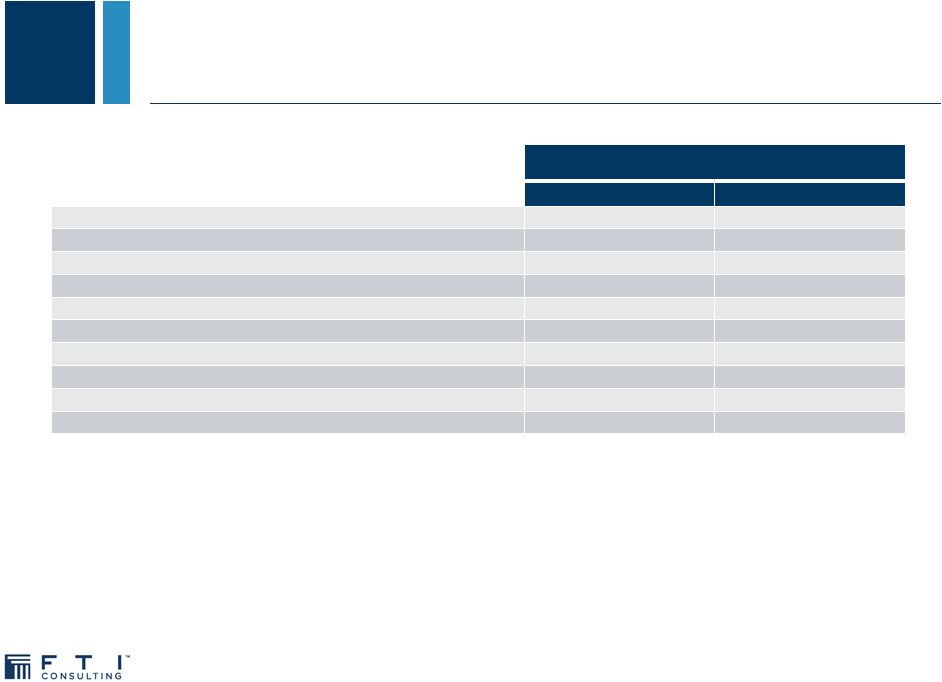

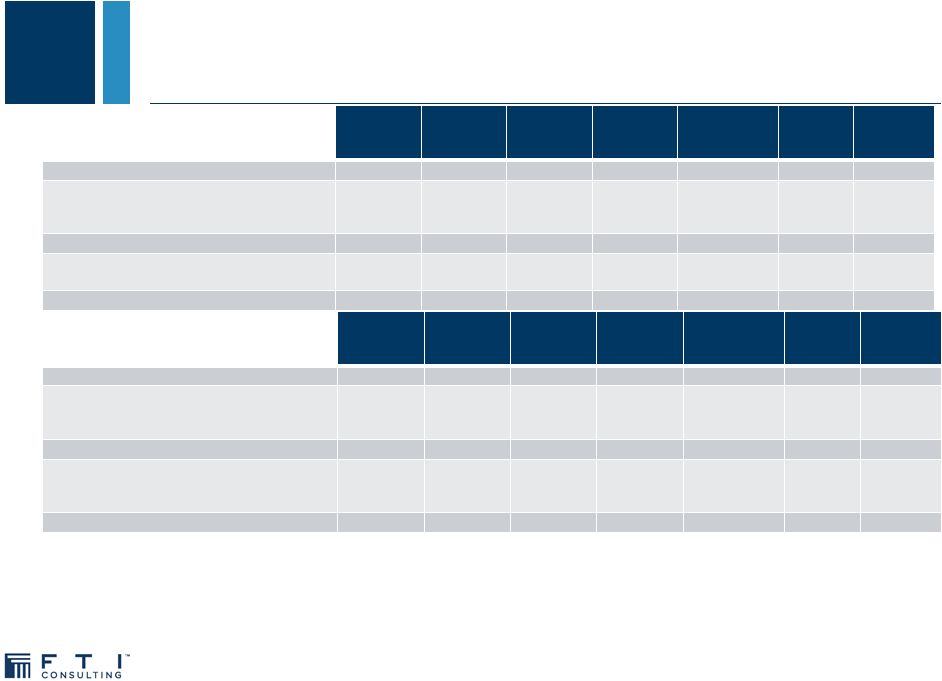

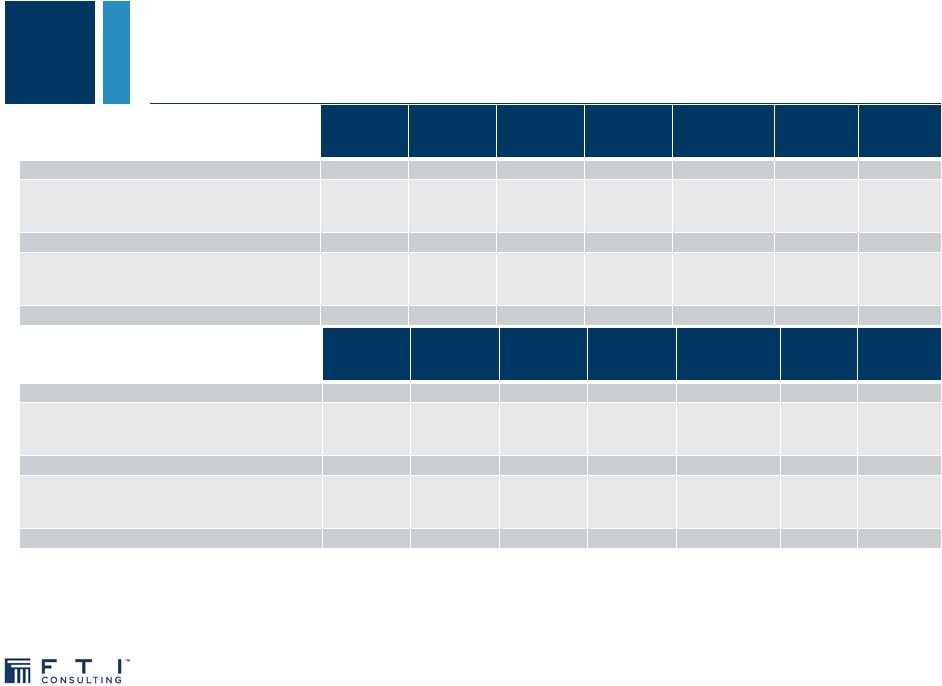

Second Quarter 2013 Results: Segment Performance ($ in thousands, except headcount data) Quarter Ended June 30, 2013 Revenues Adjusted EBITDA (1) Adjusted EBITDA (1) as a % of Revenue Utilization (4) Average Billable Rate (4) Revenue- Generating Headcount Corporate Finance/Restructuring (3) $96,714 $24,123 24.9% 62% $416 718 Forensic & Litigation Consulting (3) 105,120 20,693 19.7% 67% $307 969 Economic Consulting 111,014 20,803 18.7% 82% $505 499 Technology (2) 51,196 16,888 33.0% N/M N/M 285 Strategic Communications (2) 50,569 5,219 10.3% N/M N/M 611 Total $414,613 $87,726 21.2% 3,082 Unallocated Corporate Expenses (13,498) Adjusted EBITDA (1) $74,228 17.9% Quarter Ended June 30, 2012 Revenues Adjusted EBITDA (1) Adjusted EBITDA (1) as a % of Revenue Utilization (4) Average Billable Rate (4) Revenue- Generating Headcount Corporate Finance/Restructuring (3) $96,187 $27,296 28.4% 75% $413 596 Forensic & Litigation Consulting (3) 106,256 19,542 18.4% 68% $306 930 Economic Consulting 99,455 18,491 18.6% 80% $496 467 Technology (2) 47,697 12,849 26.9% N/M N/M 311 Strategic Communications (2) 46,648 4,970 10.7% N/M N/M 599 Total $396,243 $83,148 21.0% 2,903 Unallocated Corporate Expenses (16,532) Adjusted EBITDA (1) $66,616 16.8% 16 (1) We define Adjusted EBITDA as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, special charges and goodwill impairment charges. Amounts presented in the Adjusted EBITDA column for each segment reflect the segments' respective Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as a segment’s share of consolidated operating income before depreciation, amortization of intangible assets, special charges and goodwill impairment charges. We use Adjusted Segment EBITDA to internally evaluate the financial performance of our segments because we believe it is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We also believe that these measures, when considered together with our GAAP financial results, provide management and investors with a more complete understanding of our operating results, including underlying trends, by excluding the effects of special charges and goodwill impairment charges. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures, considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted EBITDA and Adjusted Segment EBITDA are not defined in the same manner by all companies and may not be comparable to other similarly titled measures of other companies. These non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Condensed Consolidated Statements of Comprehensive Income (Loss). See also our reconciliation of GAAP to non-GAAP financial measures. (2)The majority of the Technology and Strategic Communications segments' revenues are not generated based on billable hours. Accordingly, utilization and average billable rate metrics are not presented as they are not meaningful as a segment-wide metric. (3) Effective in the first quarter of 2013, we modified our reportable segments to reflect changes in how we operate our business and the related internal management reporting. The Company’s healthcare and life sciences practices from both our Corporate Finance/Restructuring segment and our Forensic and Litigation Consulting segment have been combined under a single organizational structure. This single integrated practice, our health solutions practice, is now aggregated in its entirety within the Forensic and Litigation Consulting reportable segment. Prior period Corporate Finance/Restructuring and Forensic and Litigation Consulting segment information has been reclassified to conform to the current period presentation. (4) 2013 and 2012 utilization and average bill rate calculations for our Corporate Finance/Restructuring, Forensic and Litigation Consulting, and Economic Consulting segments were updated to reflect the realignment of certain practices as well as information related to non-U.S. operations that was not previously available. |