|

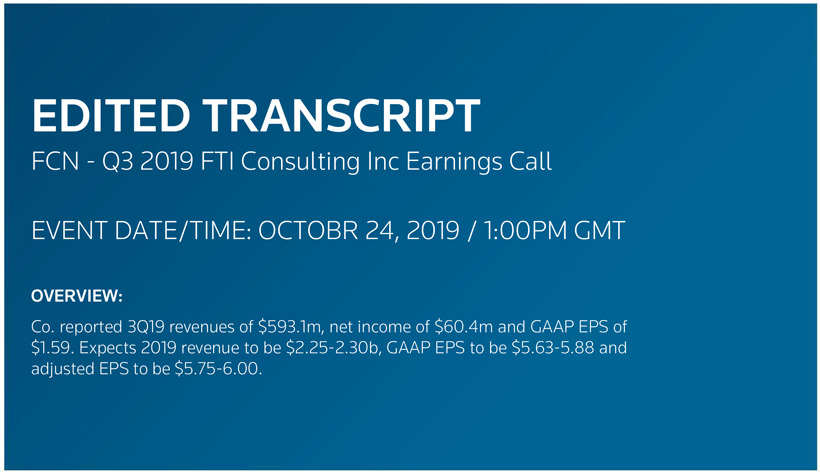

| OCTOBER 24, 2019 / 1:00PM, FCN - Q3 2019 FTI Consulting Inc Earnings Call |

Of note, during today’s prepared remarks, management will not speak directly to the quarterly earnings presentation posted to the Investor Relations section of our website. To ensure our disclosures are consistent, these slides provide the same details as they have historically, and as I have said, are available on the Investor Relations section of our website.

With these formalities out of the way, I’m joined today by Steven Gunby, our President and Chief Executive Officer; and Ajay Sabherwal, our Chief Financial Officer.

At this time, I will turn the call over to our President and Chief Executive Officer, Steve Gunby.

Steven H. Gunby - FTI Consulting, Inc. - President, CEO & Director

Thank you, Mollie. Good morning, everyone, and thank you all for joining us. Those are the formalities. Let me start with some particular informalities, and say, I hope you all got a chance to see the Washington Nationals last night. And Mollie says, I’m not allowed to spend much time on this, I will point out to those of you who are not a baseball fan that the last time the Washington — that last time Washington had a team in the World Series was 1933. So those of us who are baseball fans in Washington are somewhat excited. And since that’s the last I’m allowed to say, I will point out there is a Q&A session. So anybody who is a Nationals fan and wants to comment during that Q&A session, feel free. Houston fans are not allowed.

What Mollie does want me to talk about today instead of the Nationals is instead of their incredible run is our incredible run, incredible run over the last few quarters, but importantly, our incredible run over the last few years and what it could mean for the future.

So let me spend a bit of time on both of those topics. In terms of our run, I assume most of us have seen this quarter’s financial results, which were, once again, extraordinary.

The third quarter revenues increased 16% year-over-year, and that’s compared to what was already a strong third quarter performance a year ago. And that revenue growth translated into terrific earnings growth for the company as well with GAAP EPS of $1.59 and adjusted EPS of $1.63. So it was an extraordinary quarter. And importantly, it was the ninth extraordinary quarter in a row.

Now most of you know, in every [terms] going forward, I always take every opportunity I can to underscore that quarterly results aren’t good measures. They’re not perfect measures of the underlying strength of the company and not particularly good indicators of the future. I’m sure you’ve heard me say, “Don’t take this quarter and multiply by 4.” And that’s because any given quarter’s results can be substantially affected, either negatively or positively, by short-term factors. And I have also talked about the fact that, though, I think this company is terrific, and I’ll come back to this, and we are moving, in any given quarter or 2, we can be down.

So I recently encountered a skeptic who had heard me say this. And that skeptic says, “Steve, you keep saying that, but is it really true? I mean you’ve had 8 quarters in a row.” At that time, it was 8 quarters in a row, now it’s 9 of terrific results. There’s no volatility in your business, essentially suggesting that we’re going to grow without hiccups straight to the sky. That question worried me because I believe it misses the core dynamics of this business, and what’s necessary to build an institution and create lasting shareholder value and lasting value for our clients and our people over time.

So let me spend the rest of my time together with you not elaborating on the quarter but to share a little bit longer articulation of my beliefs.

And what I want to do is make 3 points. First, notwithstanding what I’m going to say about quarters, please understand, I am extraordinarily bullish about where we can take this company over the next years. In fact, I am at least as bullish about where we can take this company over the next 5 years as I have been over the last 5 years. So I am bullish about the medium- and long-term trajectory of this company.

The second point is, having said that, there is always a risk of down quarters in this company. In fact, there’s always a risk of multiple down quarters and I think it’s important for investors to know that fact. In my view, I’ll talk about it a little later, I also believe it’s important for investors to not to be too worried about short-term results in quarters.

3