The system of governance practices followed by the Company is memorialized in the MRV Communications, Inc. Corporate Governance Guidelines and the charters of the four committees of the Board of Directors. The Governance Guidelines and charters are intended to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations and to make decisions that are independent of the Company’s management. The Governance Guidelines also are intended to align the interests of directors and management with those of MRV’s stockholders. The Governance Guidelines establish the practices the Board will follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer’s performance evaluation, board committees, and director compensation. The Board annually conducts a self-evaluation to assess compliance with the Governance Guidelines and identify opportunities to improve Board performance.

The Governance Guidelines and committee charters are reviewed periodically and updated as necessary to reflect changes in regulatory requirements and evolving oversight practices. The Governance Guidelines were most recently modified by the Board, effective September 24, 2004, to, among other things, assure compliance with corporate governance requirements contained in The Nasdaq Stock Market (“Nasdaq”) and make other enhancements to the Company’s corporate governance policies, including creating the role of lead independent director. The chair of the Nomination and Governance Committee, Dr. Igal Shidlovsky, has served as the lead independent director since the last annual meeting of stockholders. The lead independent director is responsible for coordinating the activities of the non-management directors, coordinating with the Chairman to set the agenda for Board meetings, chairing meetings of the non-management directors, and leading the Board’s review of the Chief Executive Officer. The Board has four committees: an Audit Committee, a Compensation Committee, a Nomination and Governance Committee and an Executive Committee. The Governance Guidelines, as well as current copies of the Charter for the Audit Committee, the Compensation Committee and the Nomination and Governance Committee are available on MRV’s website http://www.mrv.com.

The Board of Directors, the Audit Committee, the Compensation Committee and the Nomination and Governance Committee each hold regularly scheduled quarterly meetings. In addition to the quarterly meetings, there may be special meetings from time to time as the Board or its committees deem necessary. At each quarterly board meeting, time is set aside for the independent directors to meet in an executive session without management or management directors present. The Board of Directors met four times during 2005. All directors attended 75% or more of the Board meetings and meetings of the committees on which they served during 2005, except for Dr. Furchtgott-Roth who was elected to the Board of Directors in November 2005 and did not attend any meetings held during 2005.

The table below details the composition of each of the Board committees since the last annual meeting of stockholders. If stockholders elect Dr. Furchtgott-Roth to the board, the Company expects that he will be appointed to the Audit Committee.

Proxy Statement for Annual Meeting of Stockholders

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of the Board and of each committee (other than Dr. Margalit and Mr. Lotan who are officers and employees of MRV and serve on the Executive Committee) meets the standards of independence under the Governance Guidelines and applicable Nasdaq listing standards.

Audit Committee: The Audit Committee assists the Board of Directors in its oversight of the quality and integrity of the accounting, auditing, and reporting practices of the Company. The Audit Committee’s role includes overseeing the work of the Company’s internal accounting and auditing processes and discussing with management the Company’s processes to manage business and financial risk, and for compliance with significant applicable legal, ethical, and regulatory requirements. The Audit Committee is responsible for the appointment, compensation, retention, and oversight of the independent auditor engaged to prepare or issue audit reports on the financial statements of the Company. The Audit Committee relies on the expertise and knowledge of management and the independent auditor in carrying out its oversight responsibilities. The Committee’s specific responsibilities are delineated in the Audit Committee Charter, a copy of which is attached as Appendix A to MRV’s proxy statement for its 2004 annual meeting of stockholders and is available on MRV’s website http://www.mrv.com. The Board of Directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee. The members of the Audit Committee during 2005 are as stated in the Committee table above. The Board has determined that Dr. Guenter Jaensch and Dr. Harold W. Furchtgott-Roth are each an “audit committee financial expert” as defined by Item 401(h) of Regulation S-K of Securities and Exchange Commission (“SEC”) regulations and that they are independent as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934. For additional information concerning the Audit Committee, see “REPORT OF THE AUDIT COMMITTEE.”

Compensation Committee: During 2005, the Compensation Committee consisted of Dr. Shidlovsky, Dr. Jaensch, Professor Tsui and Professor Fischer. The Compensation Committee met three times during 2005. The primary responsibilities of the Compensation Committee are: (a) In consultation with senior management, to make recommendations to the Board as to the Company’s general compensation philosophy and to oversee the development and implementation of compensation programs; (b) To evaluate the performance of the CEO in light of Board-approved goals and objectives, and to recommend to the Board the CEO’s compensation level based on this evaluation; (c) To make recommendations to the Board regarding the compensation (including any new compensation programs) of the other executive officers, following its review of performance evaluations of the other executive officers; and (d) to review and make recommendations to the Board with respect to the Company’s incentive compensation plans and equity-based plans. The Compensation Committee’s role includes producing the report on executive compensation required by SEC rules and regulations. The specific responsibilities and functions of the Compensation Committee are delineated in the Compensation Committee Charter.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee was, during 2005, an officer or employee of MRV or any of its subsidiaries; or was formerly an officer of MRV or any of its subsidiaries. During 2005, no executive officer of MRV served as an executive officer, director or member of the compensation committee (or other board committee performing equivalent functions, or in the absence of such committee, the entire board of directors) of another entity, any of whose executive officers served as a member of the Compensation Committee or as a director of MRV.

Nomination and Governance Committee: The principal responsibilities of the Nomination and Governance Committee are to: (a) To lead the search for qualified individuals for election as directors to ensure the Board has the right mix of skills and expertise; (b) To retain and terminate any search firm to be used to identify director candidates, as it may deem appropriate in its discretion; (c) To solicit the views of the Chief Executive Officer, other members of the Company’s senior management, and other members of the Board regarding the qualifications and suitability of candidates; (d) To establish policies and procedures for the evaluation of candidates put forth by the Company’s stockholders; (e) To review and recommend to the full Board a set of corporate governance principles and a code of business conduct and ethics applicable to the Board and the Company, and, if deemed necessary by the Board, propose from time to time any amendments to such principles and such code; (f) To oversee and evaluate compliance by the Board and management of the Company with the Company’s corporate governance principles and ethics standards and its code of conduct. The Nomination and Governance Committee’s role also includes periodically reviewing the compensation paid to non-employee directors, and making recommendations to the Board for any adjustments. In addition, the Chair of the Nomination and Governance Committee acts as the lead independent director and is responsible for leading the Board of Directors’ annual review of the chief executive officer’s performance. The specific responsibilities and functions of the Nomination and Governance Committee are delineated in the Nomination and Governance Committee Charter, which is available on MRV’s website http://www.mrv.com. The Nomination and Governance Committee was established in September 2004 and met twice in 2005. The members of the Nomination and Governance Committee during 2005 are as stated in the Committee table above.

Nominees for the Board of Directors should be committed to enhancing long-term stockholder value and must possess a high level of personal and professional ethics, sound business judgment and integrity. The Nomination and Governance Committee annually reviews with the Board the applicable skills and characteristics required of Board nominees in the context of current Board composition and Company circumstances. In making its recommendations to the Board, the Nomination and Governance Committee considers, among other things, the qualifications of individual director candidates. The Nomination and Governance Committee works with the Board to determine the appropriate characteristics, skills, and experiences for the Board as a whole and its individual members with the objective of having a Board with business experience, diversity, and personal skills in technology, finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board. In evaluating the suitability of individual Board members, the Board takes into account many factors, including general understanding of marketing, finance, and

MRV Communications, Inc.

5

Proxy Statement for Annual Meeting of Stockholders

other disciplines relevant to the success of a publicly traded company in today’s business environment; understanding of the Company’s business and technology; educational and professional background; and personal accomplishment. The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of the Company’s business and represent stockholder interests through the exercise of sound judgment, using its diversity of experience. In determining whether to recommend a director for re-election, the Nomination and Governance Committee also considers the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

The Committee will consider stockholder recommendations for candidates for the Board. All stockholder nominating recommendations must be in writing, addressed to MRV Communications, Inc., 20415 Nordhoff Street, Chatsworth, California 91311, Attention: Secretary (or if MRV’s corporate headquarters have changed, to MRV’s new corporate headquarters as publicly announced). Submissions must be made by certified mail or commercial courier service (Federal Express, for example). Hand delivered or emailed submissions will not be considered.

Any stockholder wishing to nominate an individual for election to the Board must ensure that MRV receives it, not later than 120 calendar days prior to the first anniversary of the date of the proxy statement for the prior annual meeting of stockholders (e.g., for the 2007 annual meeting, by December 13, 2006). In the event that the date of the annual meeting of stockholders for any year is more than 30 days from the first anniversary date of the annual meeting of stockholders for the prior year, the submission of a recommendation will be considered timely if it is submitted a reasonable time in advance of the mailing of MRV’s proxy statement for the annual meeting of stockholders for the current year.

The nomination must contain the following information about the nominee: name; age; business and residence addresses; principal occupation or employment; the number of shares of common stock held by the nominee; the time period for which such shares have been held and a statement from the stockholder as to whether the stockholder has a good faith intention to continue to hold the reported shares through the date of MRV’s next annual meeting of stockholders; the information that would be required under SEC rules in a proxy statement soliciting proxies for the election of such nominee as a director; a description of any relationships between the proposed nominee and the recommending stockholder, and to any of MRV’s competitors, customers, suppliers, or other persons with special interests regarding MRV; a statement supporting the recommending stockholder’s view that the proposed nominee possesses the minimum qualifications set forth below to serve as a director, and briefly describing the contributions that the nominee would be expected to make to the board and to the governance of MRV; a statement whether, in the view of the recommending stockholder, the nominee, if elected, would represent all stockholders and not serve for the purpose of advancing or favoring any particular stockholder or other constituency of MRV; and a signed consent of the nominee to be interviewed and to serve as a director of MRV, if elected. Minimum qualifications for serving on the Board include integrity; absence of conflicts of interest; ability to provide fair and equal representation of all stockholders; demonstrated achievement in one or more fields of business, professional, governmental, community, scientific or educational endeavor; management or policy-making experience (which may be as an advisor or consultant); demonstrated ability to function effectively in an oversight role through management or policy-making experience that evidences an ability to function effectively in an oversight role; a general appreciation regarding major issues facing public companies of a size and operational scope similar to MRV, including regulatory obligations and governance concerns of a public issuer; strategic business planning; competition in a global economy; basic concepts of corporate finance; and the ability to devote the time and effort necessary to fulfill his or her responsibilities, in the context of the perceived needs of the Board at that time.

Executive Committee: The Executive Committee consists of Mr. Lotan and Dr. Margalit. The Executive Committee did not meet as a committee during 2005. The primary responsibility of the Executive Committee is to take any action that the Board is authorized to act upon, with the exception of the issuance of stock, the sale of all or substantially all of MRV’s assets and other significant corporate transactions.

Compensation of Outside Directors. Outside directors, i.e., directors who are not employees of MRV, receive cash compensation of $1,500 per month and $1,000 for each Board of Directors’ meeting attended, while serving as Directors. In January 2005, MRV granted to each outside director options to purchase 30,000 shares of its common stock at $3.62 per share. In December 2005, MRV granted to each audit committee member, Dr. Jaensch, Dr. Shidlovsky, Professor Tsui and Dr. Furchtgott-Roth, options to purchase 10,000 shares of its common stock at $2.05 per share.

Director Attendance at Annual Meetings. The Company uses reasonable efforts to schedule its annual meeting of stockholders at a time and date to maximize attendance by directors, taking into account the directors’ schedules. In cases where the Company, in its reasonable business judgment, believes that stockholder attendance at its annual meetings is significant, the Company encourages director attendance at such annual meeting. Directors make every effort to attend the Company’s annual meeting of stockholders when meaningful stockholder attendance at such meeting is anticipated. Noam Lotan attended the 2005 annual meeting of stockholders.

Relationships and Terms of Officers. Except for Dr. Near Margalit, the Chief Executive Officer of MRV’s subsidiary, LuminentOIC, Inc., who is the son of Dr. Shlomo Margalit, and Dr. Harold Furchtgott-Roth, who is the cousin of Noam Lotan’s wife, none of the Executive Officers, Directors or Director nominees of MRV are related by blood, marriage or adoption to any of MRV’s executive officers, Directors or Director nominees. The Board of Directors elects officers annually and those elected serve at the discretion of the Board, subject, in the cases of Dr. Shlomo Margalit and Mr. Lotan, to the terms of their respective employment agreements described in “EXECUTIVE COMPENSATION AND RELATED INFORMATION — Agreements With Certain Executive Officers.”

MRV Communications, Inc.

6

Proxy Statement for Annual Meeting of Stockholders

Ownership of Securities

The following table sets forth information known to MRV with respect to beneficial ownership of MRV common stock as of April 6, 2006 for (i) each director and nominee, (ii) MRV’s Chief Executive Officer and each of the Named Executive Officers listed in the table under “EXECUTIVE COMPENSATION AND RELATED INFORMATION” below and (iii) all executive officers and directors as a group. The table below indicates the number of shares owned by each person known to MRV to be the beneficial owner of 5% or more of the outstanding shares of MRV’s common stock.

Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table below have sole voting and investment power with respect to all shares of common stock beneficially owned. The number of shares beneficially owned by each person or group as of April 6, 2006 includes shares of common stock that such person or group had the right to acquire on or within 60 days after April 6, 2006, including, but not limited to, upon the exercise of options. References to options in the footnotes of the table below include only options to purchase shares that were exercisable on or within 60 days after April 6, 2006. For each individual and group included in the table below, percentage ownership is calculated by dividing the number of shares beneficially owned by such person or group by the sum of the 124,941,389 shares of common stock outstanding on the record date of April 6, 2006 plus the number of shares of common stock that such person or group had the right to acquire on or within 60 days after the record date.

| | | | Common Stock

|

|

|---|

Name and Address(1) of Beneficial Owner or Identity of Group

|

|

|

| Number of Shares

|

| Percentage Ownership

|

|---|

Deutsche Bank, AG London Branch

31 West 52nd Street, New York, NY 10019 | | | | | 9,913,794 | (2) | | | 7.4 | % |

| Shlomo Margalit | | | | | 3,260,660 | | | | 2.5 | % |

| Noam Lotan | | | | | 1,585,540 | (3) | | | 1.3 | |

| Kevin Rubin | | | | | 64,250 | (4) | | | * | |

| Shay Gonen | | | | | 127,150 | (5) | | | * | |

| Near Margalit | | | | | 177,875 | (6) | | | * | |

| Igal Shidlovsky | | | | | 234,050 | (7) | | | * | |

| Guenter Jaensch | | | | | 112,500 | (6) | | | * | |

| Daniel Tsui | | | | | 167,715 | (8) | | | * | |

| Baruch Fischer | | | | | 147,500 | (6) | | | * | |

| Harold Furchtgott-Roth | | | | | 10,000 | (6) | | | * | |

| All executive officers and directors as a group | | | | | 5,887,240 | (9) | | | 4.5 | |

| |

| * Less than 1% | | | | | | | | | | |

| (1) | | Unless otherwise indicated below, each person has sole voting and investment power with respect to the shares listed. Unless otherwise indicated in the table above, the address of each person is c/o MRV Communications, Inc., 20415 Nordhoff Street, Chatsworth, California 91311. |

| (2) | | Consists of shares issuable upon conversion of MRV’s $23.0 million principal amount of five-year 5% convertible notes due June 2008 that MRV sold in June 2003. The notes are convertible at any time prior to maturity into MRV’s common stock at a conversion price of $2.32 per share. The notes include a provision limiting any holder’s right to convert in excess of that portion of the principal amount that, upon giving effect to such conversion, would cause the aggregate number of shares beneficially owned by the holder and its affiliates to exceed 4.99% of our total outstanding shares following such conversion. The shares and percentage ownership of our outstanding shares indicated in the table above do not give effect to this limitation, but assume that all or any portion of the notes may be converted into our shares at any time prior to maturity. |

| (3) | | Includes 128,500 shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

| (4) | | Includes 59,250 shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

| (5) | | Includes 125,000 shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

| (6) | | Consists of shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

| (7) | | Includes 225,450 shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

| (8) | | Includes 167,500 shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

| (9) | | Includes 1,153,575 shares issuable pursuant to stock options exercisable within 60 days of April 6, 2006. |

MRV Communications, Inc.

7

Proxy Statement for Annual Meeting of Stockholders

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers and persons who own more than 10% of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Directors, executive officers and 10% or greater stockholders are required by the SEC regulations to furnish us with copies of all Section 16(a) forms they file.

We believe, based solely on a review of the copies of such reports furnished to the Company, that each report required of the Company’s executive officers, directors and 10% or greater stockholders was duly and timely filed during the year ended December 31, 2005.

Executive Compensation and Related Information

Executive Compensation

The following table shows information regarding compensation paid during each of the past three fiscal years to MRV’s Chief Executive Officer and each of its other executive officers serving at December 31, 2005 or during 2005, whose salary and bonus exceeds $100,000 for 2005 (collectively, the “Named Executive Officer”).

Summary Compensation Table

| | | | Year

|

| Salary

|

| Bonus

|

| Long-term

Compensation

Securities

Underlying –

Options (#)

|

| All Other

Compensation(1)

|

|---|

| Noam Lotan | | | | | 2005 | | | $ | 200,000 | | | $ | - | | | | 95,000 | | | $ | 5,932 | |

| President and Chief Executive Officer | | | | | 2004 | | | $ | 150,000 | | | $ | - | | | | 25,000 | | | $ | 4,394 | |

| | | | | | 2003 | | | $ | 150,000 | | | $ | - | | | | 20,000 | | | $ | 4,462 | |

| |

| Shlomo Margalit | | | | | 2005 | | | $ | 110,000 | | | $ | - | | | | - | | | $ | 3,299 | |

| Chairman, Chief Technical Officer | | | | | 2004 | | | $ | 110,000 | | | $ | - | | | | - | | | $ | 3,240 | |

| and Secretary | | | | | 2003 | | | $ | 110,000 | | | $ | - | | | | - | | | $ | 3,300 | |

| |

Kevin Rubin(2) | | | | | 2005 | | | $ | 150,000 | | | $ | 37,500 | | | | 145,000 | | | $ | 5,521 | |

| Chief Financial Officer and | | | | | 2004 | | | $ | 150,000 | | | $ | 31,000 | | | | 20,000 | | | $ | 5,430 | |

| Compliance Officer | | | | | 2003 | | | $ | 150,000 | | | $ | 29,625 | | | | 15,000 | | | $ | 5,388 | |

| |

Shay Gonen(2) | | | | | 2005 | | | $ | 183,850 | | | $ | 15,000 | | | | 50,000 | | | $ | 5,965 | |

| Chief Financial Officer | | | | | 2004 | | | $ | 155,000 | | | $ | 24,836 | | | | 75,000 | | | $ | 5,250 | |

| | | | | | 2003 | | | $ | 155,000 | | | $ | 25,000 | | | | 50,000 | | | $ | 5,400 | |

| |

| Near Margalit | | | | | 2005 | | | $ | 180,000 | | | $ | 10,000 | | | | 75,500 | | | $ | 5,676 | |

| Chief Executive Officer, | | | | | 2004 | | | $ | 160,000 | | | $ | - | | | | 36,000 | | | $ | 4,800 | |

| LuminentOIC, Inc. | | | | | 2003 | | | $ | 160,000 | | | $ | - | | | | 20,000 | | | $ | 4,800 | |

| (1) | | “All Other Compensation” includes Company contributions to its 401(K) savings plan on behalf of the Named Executive Officer. |

| (2) | | Mr. Rubin became Chief Financial Officer on December 5, 2005, succeeding Mr. Gonen who resigned as Chief Financial Officer on December 2, 2005. |

Option Grants in 2005

The following table sets forth information with respect to option grants to the Named Executive Officers during 2005:

| • | | the number of shares of MRV common stock underlying options granted during the year; |

| • | | the percentage that such options represent of all options granted to employees during the year; |

MRV Communications, Inc.

8

Proxy Statement for Annual Meeting of Stockholders

| • | | the exercise price (which in each case was equal to the fair market value of the stock on the date of grant); |

| • | | the expiration date; and |

| • | | the hypothetical present value, as of the grant date, of the options under the option pricing model discussed below. |

The hypothetical present value of the options as of their date of grant has been calculated using the Black-Scholes option pricing model, as permitted by SEC rules, based upon a set of assumptions set forth in footnote (2) to the table. It should be noted that this model is only one method of valuing options, and the Company’s use of the model should not be interpreted as an endorsement of its accuracy. The actual value of the options may be significantly different, and the value actually realized, if any, will depend upon the excess of the market value of the common stock over the option exercise price at the time of exercise.

MRV Communications, Inc.

9

Proxy Statement for Annual Meeting of Stockholders

Option Grants During Fiscal 2005

| | | |

| |

| |

| |

| |

| | Potential Realizable Value at

Assumed Annual Rate of Stock

Appreciation for Option Term

| |

|---|

|

|

|

| Number of

Securities Underlying

Options Granted

|

| Percentage of Total

Options Granted

to Employees

in 2005

|

| Exercise Price

($/sh)

|

| Expiration Date

|

| Hypothetical Value

at Grant

Date(2)

|

| 5%(1)

|

| 10%(1)

|

|---|

| Noam Lotan | | | | | 60,000 | | | | 2.7 | % | | $ | 3.70 | | | | 2/28/2015 | | | $ | 111,654 | | | $ | 122,395 | | | $ | 301,464 | |

| | | | | | 35,000 | | | | 1.6 | % | | $ | 2.05 | | | | 12/30/2015 | | | $ | 39,424 | | | $ | 39,558 | | | $ | 97,433 | |

| Shlomo Margalit | | | | | - | | | | - | | | $ | - | | | | N/A | | | | N/A | | | $ | - | | | $ | - | |

| Kevin Rubin | | | | | 20,000 | | | | 0.9 | % | | $ | 3.70 | | | | 2/28/2015 | | | $ | 37,218 | | | $ | 40,798 | | | $ | 100,488 | |

| | | | | | 10,000 | | | | 0.5 | % | | $ | 2.17 | | | | 6/30/2015 | | | $ | 12,685 | | | $ | 11,964 | | | $ | 29,467 | |

| | | | | | 15,000 | | | | 0.7 | % | | $ | 1.82 | | | | 11/30/2015 | | | $ | 15,018 | | | $ | 15,051 | | | $ | 37,072 | |

| | | | | | 100,000 | | | | 4.6 | % | | $ | 2.05 | | | | 12/30/2015 | | | $ | 112,640 | | | $ | 113,022 | | | $ | 278,379 | |

| Shay Gonen | | | | | 50,000 | | | | 2.3 | % | | $ | 3.70 | | | | 2/28/2015 | | | $ | 93,045 | | | $ | 101,996 | | | $ | 251,220 | |

| Near Margalit | | | | | 47,500 | | | | 2.2 | % | | $ | 3.70 | | | | 2/28/2015 | | | $ | 88,393 | | | $ | 96,896 | | | $ | 238,659 | |

| | | | | | 28,000 | | | | 1.3 | % | | $ | 2.05 | | | | 12/30/2015 | | | $ | 31,539 | | | $ | 31,646 | | | $ | 77,946 | |

| (1) | | The dollar amounts under these columns are the result of calculations assuming the price of MRV’s common stock on the date of the grant of the option increases at the hypothetical 5% and 10% rates set by the SEC for the term of the option. Neither the amounts reflected nor the rates applied are intended to forecast possible future appreciation, if any, of the Company’s stock price. |

| (2) | | The hypothetical present value at grant date of options granted during 2005 has been calculated using the Black-Scholes option pricing model, based upon the following assumptions: estimated time until exercise is four years; risk free interest rates ranging from 3.72% to 4.42%; volatility ranging from 61% to 76%; and a dividend yield of 0%. The approach used in developing the assumptions upon which the Black-Scholes valuations were calculated is consistent with the requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation.” The options generally vest over four equal installments beginning on the first anniversary of the date of grant. |

Option Exercises and Values for 2005

The table below sets forth the following information with respect to option exercises during fiscal 2005 by each of the Named Executive Officers and the status of their options at December 31, 2005:

| • | | the number of shares of MRV common stock acquired upon exercise of options during 2005; |

| • | | the aggregate dollar value realized upon the exercise of those options; |

| • | | the total number of exercisable and non-exercisable stock options held at December 31, 2005; and |

| • | | the aggregate dollar value of in-the-money exercisable and non-exercisable options at December 31, 2005. |

MRV Communications, Inc.

10

Proxy Statement for Annual Meeting of Stockholders

Aggregated Option Exercises During 2005 and Option Values on December 31, 2005

| | | |

| |

| | Number of Shares Underlying

Unexercised Options at

December 31, 2005

|

| Value of Unexercised

In-The-Money Options at

December 31, 2005(1)

|

|

|---|

|

|

|

| Number of Shares

Acquired Upon

Exercise of Options

|

| Value Realized

Upon Exercise

|

| Exercisable

|

| Unexercisable

|

| Exercisable

|

| Unexercisable

|

|---|

| Noam Lotan | | | | $ | - | | | $ | - | | | | 103,650 | | | | 246,350 | | | $ | 9,540 | | | $ | 109,180 | |

| Shlomo Margalit | | | | $ | - | | | $ | - | | | | - | | | | - | | | $ | - | | | $ | - | |

| Kevin Rubin | | | | $ | - | | | $ | - | | | | 50,000 | | | | 180,000 | | | $ | 39,160 | | | $ | 18,860 | |

| Shay Gonen | | | | $ | - | | | $ | - | | | | 198,375 | | | | 141,125 | | | $ | 56,115 | | | $ | 25,405 | |

| Near Margalit | | | | $ | - | | | $ | - | | | | 161,500 | | | | 160,000 | | | $ | 135,375 | | | $ | 45,125 | |

| (1) | | Based on the difference between the closing price of MRV common stock on December 31, 2005 and the exercise price. |

Employment Agreements

All of MRV’s executive officers are employed on an at-will basis, except Noam Lotan and Shlomo Margalit whose employment is subject to employment agreements that are described below.

In March 1992, MRV entered into three-year employment agreements with Mr. Lotan and Dr. Margalit. Upon expiration, these agreements automatically renew for one-year terms unless either party terminates them by giving the other three months’ notice of non-renewal prior to the expiration of the current term. Pursuant to the agreements, Mr. Lotan serves as President, Chief Executive Officer and a Director of MRV and Dr. Margalit serves as Chairman of the Board of Directors, Chief Technical Officer and Secretary. For 2005, Mr. Lotan and Dr. Margalit received base annual salaries of $200,000 and $110,000, respectively, and each is entitled to receive a bonus determined and payable at the discretion of the board of directors upon the recommendation of the Compensation Committee of the Board.

Each executive officer also received employee benefits, such as vacation, sick pay and insurance, in accordance with MRV’s policies, which are applicable to all employees. MRV has obtained, maintained during 2005, and is the beneficiary of, a key man life insurance policy in the amount of $1,000,000 on the life of Mr. Lotan. All benefits under this policy are payable to MRV upon his death during the policy term.

MRV Communications, Inc.

11

Proxy Statement for Annual Meeting of Stockholders

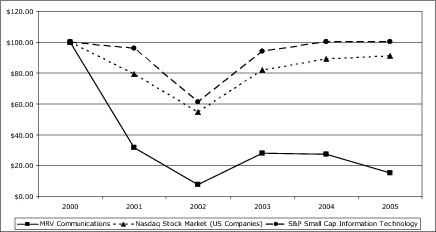

Performance Graph

The chart below compares the five-year cumulative total return, assuming the reinvestment of dividends, on MRV’s common stock with that of the Nasdaq Stock Market – U.S. Companies Index and the S&P Small Cap Information Technology Index. This graph assumes $100 was invested on December 31, 2000, in each of MRV common stock, the U.S. companies in the Nasdaq Stock Market index and the companies in the S&P Small Cap Information Technology Index.

Note: MRV management cautions that the stock price performance shown in the graph below should not be considered indicative of potential future stock price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG MRV COMMUNICATIONS, INC., THE NASDAQ STOCK MARKET – U.S. COMPANIES INDEX

AND THE S&P SMALL CAP INFORMATION TECHNOLOGY INDEX

| | | | Cumulative Total Return

|

|

|---|

| | | | 12/31/2000

|

| 12/31/2001

|

| 12/31/2002

|

| 12/31/2003

|

| 12/31/2004

|

| 12/31/2005

|

|---|

| MRV Communications | | | | $ | 100.00 | | | $ | 31.69 | | | $ | 8.00 | | | $ | 28.10 | | | $ | 27.43 | | | $ | 15.32 | |

| Nasdaq Stock Market (US Companies) | | | | $ | 100.00 | | | $ | 79.32 | | | $ | 54.84 | | | $ | 81.99 | | | $ | 89.22 | | | $ | 91.12 | |

| S&P Small Cap Information Technology | | | | $ | 100.00 | | | $ | 96.22 | | | $ | 61.19 | | | $ | 94.16 | | | $ | 100.44 | | | $ | 100.23 | |

MRV Communications, Inc.

12

Proxy Statement for Annual Meeting of Stockholders

Report of the Compensation Committee

The Compensation Committee (the “Committee”) has been formed to set and administer the policies governing MRV’s compensation programs, including stock option plans. The Committee receives and evaluates information regarding compensation practices for comparable businesses in similar industries and considers this information in determining base salaries, bonuses and stock-based compensation. The Committee is authorized to engage or employ such outside professional consultants or other services as in its discretion may be required to fulfill its responsibilities. The Committee also discusses and considers executive compensation matters and makes decisions thereon.

MRV’s compensation policies are structured to link the compensation of the chief executive officer and other executive officers to corporate performance. In March 1992, Mr. Lotan and Dr. Margalit entered into three-year employment agreements, which, upon expiration automatically renew for one-year terms unless either party terminates them by giving the other three months’ notice of non-renewal prior to the expiration of the current term. Mr. Lotan’s base compensation was revised in 2002. Through the establishment of compensation programs and employment agreements, MRV has attempted to align the financial interests of its executives with the results of MRV’s performance, which is designed to put MRV in a competitive position regarding executive compensation and to ensure corporate performance, which will then enhance stockholder value.

MRV’s executive compensation philosophy is to set base salaries by referring to those of comparable businesses and then to provide performance based variable compensation, such as bonuses, as determined by the Committee according to factors such as MRV’s financial performance and the performance of its share price. This philosophy allows total compensation to fluctuate from year to year. As a result, the Named Executive Officers’ actual compensation levels in any particular year may be above or below those of MRV’s competitors, depending upon the evaluation of the compensation factors described above by the Committee.

The base compensation for 2005, 2004 and 2003 for Dr. Margalit was determined in 1992, based upon his employment agreement with MRV. The base compensation of Mr. Lotan prior to 2002 was determined in 1992, based upon his employment agreement with MRV. Mr. Lotan’s base compensation was revised in 2002 and again in 2005. Mr. Lotan’s base compensation was not adjusted in 2003 or 2004 and remained at the 2002 level because neither the Committee nor Mr. Lotan believed, based on MRV’s financial and share performance during those years, that an adjustment was appropriate. In determining the amount of the increase in Mr. Lotan’s base compensation and stock option awards for 2005, the Committee reviewed surveys of executive compensation of comparable businesses and considered these surveys and such factors as the total compensation paid to other chief executives in such businesses, Mr. Lotan’s year’s of service with MRV, the compensation paid to Mr. Lotan and MRV’s other executives during years prior to 2005 and MRV’s financial and share-price performance since 2001 generally and in 2004 particularly. Based on these factors, the Committee concluded that Mr. Lotan’s 2005 compensation was appropriate and not excessive for the services he is performing for MRV. The Committee did not make any specific determination as to whether any particular factor was favorable or unfavorable to their ultimate conclusion or assign any particular weight to any factor, but conducted an overall analysis of the factors described above.

To the extent readily determinable and as one of the factors in its consideration of compensation matters, the Committee considers the anticipated tax treatment to MRV and to the executives of various types of compensation. Some types of compensation and their deductibility depend upon the timing of an executive’s vesting or exercise of previously granted rights. Further, interpretations of and changes in the tax laws also affect the deductibility of compensation. To the extent reasonably practicable and to the extent it is within the Committee’s control, the Committee intends to limit executive compensation in ordinary circumstances to that deductible under Section 162(m) of the Internal Revenue Code of 1986, as amended. In doing so, the Committee may utilize alternatives (such as deferring compensation) for qualifying executive compensation for deductibility and may rely on grandfathering provisions with respect to existing contractual commitments.

The Committee believes that its overall executive compensation program has been fair to the executives’ performance and to the stockholders.

2005 Compensation Committee of the Board of Directors

Baruch Fischer | |

MRV Communications, Inc.

13

Proxy Statement for Annual Meeting of Stockholders

Report of the Audit Committee

The Audit Committee (the “Committee”) oversees MRV’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for MRV’s financial statements and the overall reporting process, including MRV’s system of financial controls. In fulfilling its oversight responsibilities during 2005, the Committee periodically:

| • | | reviewed the unaudited and audited financial statements with management and MRV’s independent registered public accounting firm during 2005, Ernst & Young LLP; |

| • | | discussed the accounting principles, significant assumptions, estimates and matters of judgment used in preparing the financial statements with management and Ernst & Young; |

| • | | reviewed MRV’s financial controls and financial reporting process; and |

| • | | reviewed significant financial reporting issues and practices, including changes in accounting principles and disclosure practices. |

The Committee also reviewed with Ernst & Young, who was responsible in 2005 for expressing an opinion on the conformity of the audited financial statements with accounting principles generally accepted in the United States, their judgment as to the quality and not just the acceptability, of MRV’s accounting principles and such other matters as are required to be discussed with the Committee under accounting principles generally accepted in the United States. The Committee periodically met with Ernst & Young to discuss the results of their examinations, their evaluations of MRV’s internal controls and the overall quality of MRV’s financial reporting.

In addition, the Committee discussed with Ernst & Young their independence from management and MRV including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with Ernst & Young any matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees). The Committee also considered the compatibility of Ernst & Young’s non-audit services (principally tax advisory services) with the standards for auditors’ independence. The Committee discussed with Ernst & Young the overall scope and plans for their audit.

The Directors who serve on the Committee are all “independent” for purposes of the rules of the Nasdaq Stock Market. During 2005, the committee met six times, with all members of the committee during 2005 in attendance at each meeting, except Professor Tsui and Dr. Jaensch who each did not attend one of these meetings and Dr. Furchtgott-Roth who was appointed to the Board of Directors in November 2005 and did not attend any meetings held during 2005.

In reliance on the reviews and discussions referred to above and representations by management that the financial statements were prepared in accordance with generally accepted accounting principles, the Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2005.

2005 Audit Committee of the Board of Directors

Harold W. Furchtgott-Roth

MRV Communications, Inc.

14

Proxy Statement for Annual Meeting of Stockholders

Ratification of Independent Registered Public Accounting Firm

(Proposal No. 2)

General

The Audit Committee has recommended, and the Board has approved, the appointment of Ernst & Young LLP as MRV’s independent registered public accounting firm for the year ending December 31, 2006. Ratification of the independent auditor is not required by MRV’s Bylaws or applicable law, but has historically been submitted to stockholders as a matter of good corporate practice. In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent auditing firm at any time during the year if the Audit Committee determines that such a change would be in MRV’s and its stockholders’ best interests. THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE“FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP TO SERVE AS MRV’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDED DECEMBER 31, 2006.

Ernst & Young LLP has audited MRV’s consolidated financial statements annually since 2002. Representatives of Ernst & Young LLP are expected to be present at the meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that they will be available to respond to appropriate questions.

Principal Accountant Fees And Services

Ernst & Young LLP has audited MRV’s consolidated financial statements annually since 2002. The following is a summary of the fees billed to MRV by Ernst & Young LLP for professional services rendered for the years ended December 31, 2005 and 2004:

Fee Category

|

|

|

| 2005

|

| 2004

|

|---|

| Audit Fees | | | | $ | 1,639,000 | | | $ | 1,638,000 | |

| Audit-Related Fees | | | | | 43,000 | | | | 9,000 | |

| Tax Fees | | | | | 15,000 | | | | 118,000 | |

| All Other Fees | | | | | - | | | | - | |

| Total | | | | $ | 1,697,000 | | | $ | 1,765,000 | |

Audit Fees. Consists of fees billed for professional services rendered for the audits of MRV’s consolidated financial statements and internal control over financial reporting and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of MRV’s consolidated financial statements and are not reported under “Audit Fees.” These services include consultations in connection with acquisitions, attest services that are not required by statute or regulation and consultation concerning financial accounting and reporting standards.

Tax Fees. Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal, state and international tax compliance, tax audit defense and international tax planning.

All Other Fees. Consists of fees for products and services other than the services reported above.

Policy On Audit Committee Pre-Approval Of Audit And Permissible Non-Audit Services Of Independent Registered Public Accounting Firm

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit related services provided by the independent auditor. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

Other Matters

The management of MRV knows of no other matters that may properly be, or which are likely to be, brought before the meeting. However, if any other matters are properly brought before the meeting, the persons named in the enclosed proxy or their substitutes will vote in accordance with their best judgment on such matters.

Stockholder Proposals

Stockholders are hereby notified that if they wish a proposal to be included in MRV’s Proxy Statement and form of proxy relating to the 2007 annual meeting of stockholders, they must deliver a written copy of their proposal no later than December 13, 2006. Proposals must comply with the proxy rules relating to stockholder proposals, in particular Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), in order to be included in MRV’s proxy materials. Stockholders who wish to submit a proposal for consideration at MRV’s 2007 annual meeting of stockholders, but who do not wish to submit the proposal for inclusion in MRV’s proxy statement pursuant to Rule 14a-8 under the Exchange Act, must deliver a written copy of their proposal no later than February 26, 2007. In the event that the date of MRV’s annual meeting of stockholders for a particular year is more than 30 days from the first anniversary date of the annual meeting of stockholders for the prior year, the submission of proposals to be included in MRV’s Proxy Statement and form of proxy relating to an annual meeting of stockholders held in that year or proposals for

MRV Communications, Inc.

15

Proxy Statement for Annual Meeting of Stockholders

consideration at that annual meeting of stockholders but not submitted for inclusion in MRV’s proxy statement, will be considered timely received if submitted a reasonable time in advance of the printing and mailing of MRV’s proxy statement for the annual meeting of stockholders for that year. In any case, proposals should be delivered to MRV Communications, Inc., 20415 Nordhoff Street, Chatsworth, California 91311, Attention: Secretary. To avoid controversy and establish timely receipt by MRV, it is suggested that stockholders send their proposals by certified mail return receipt requested.

The information under the captions “Report of Compensation Committee,” “Report of Audit Committee,” “Performance Graph” and MRV’s Annual Report to Stockholders for the year ended December 31, 2005 are not “soliciting material,” are not deemed “filed” with the SEC, and are not incorporated by reference in any filing of MRV under the Securities Act of 1933 or the Securities Exchange Act of 1934 whether made before or after the date hereof and irrespective of any general incorporation language in any such filings.

By order of the Board of Directors

Shlomo Margalit

Secretary

Chatsworth, California

April 12, 2006

MRV Communications, Inc.

16

ANNUAL MEETING OF STOCKHOLDERS OF

MRV COMMUNICATIONS, INC.

May 19, 2006

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

â Please detach along perforated line and mail in the envelope provided.â

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS AND “FOR” PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HEREx

| 1. | | To elect the following directors to serve for a term ending upon the 2007 Annual Meeting of Stockholders or until their successors are elected and qualified. |

| | | | | | | |

| | | | | NOMINEES: |

| | | FOR ALL NOMINEES | | m | | Noam Lotan |

| | | | | m | | Shlomo Margalit |

| | | WITHHOLD AUTHORITY | | m | | Igal Shidlovsky |

| | | FOR ALL NOMINEES | | m | | Guenter Jaensch |

| | | | | m | | Daniel Tsui |

| | | FOR ALL EXCEPT | | m | | Baruch Fischer |

| | | (See instructions below) | | m | | Harold Furchtgott-Roth |

| | |

| INSTRUCTION: | | To withhold authority to vote for any individual nominee(s), mark“FOR ALL EXCEPT”and fill in the circle next to each nominee you wish to withhold, as shown here:l |

| | | |

| |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | o |

| |

| | | | | | | | | |

| | | | | FOR | | AGAINST | | ABSTAIN |

| 2. | | To ratify the appointment of Ernst & Young LLP as MRV’s independent accountants for the year ending December 31, 2006. | | o | | o | | o |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting.

The undersigned acknowledges receipt of the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

| | | | | | | | | | | | | | | |

| Signature of Stockholder | | | | Date: | | | | Signature of Stockholder | | | | Date: | | |

| | Note: | | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |

MRV COMMUNICATIONS, INC.

20415 NORDHOFF STREET

CHATSWORTH, CALIFORNIA 91311

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

MRV COMMUNICATIONS, INC.

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD May 19, 2006

The undersigned holder of common stock, par value $0.0017, of MRV Communications, Inc. ("MRV") hereby appoints Noam Lotan and Shlomo Margalit, or either of them, proxies for the undersigned, each with full power of substitution, to represent and to vote as specified in this Proxy all common stock of MRV that the undersigned stockholder would be entitled to vote if personally present at the Annual Meeting of Stockholders (the "Annual Meeting") to be held at the Warner Center Marriott Woodland Hills, 21850 Oxnard Street, Woodland Hills, California 91367 on Friday, May 19, 2006, at 9:00 a.m., Pacific Standard Time, and at any adjournments or postponements of the Annual Meeting. The undersigned stockholder hereby revokes any proxy or proxies heretofore executed for such matters.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER AS DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE DIRECTORS, FOR THE RATIFICATION OF ERNST & YOUNG LLP AS MRV'S INDEPENDENT ACCOUNTANTS FOR 2006, AND IN THE DISCRETION OF THE PROXIES AS TO ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING. THE UNDERSIGNED STOCKHOLDER MAY REVOKE THIS PROXY AT ANY TIME BEFORE IT IS VOTED BY DELIVERING TO THE CORPORATE SECRETARY OF MRV EITHER A WRITTEN REVOCATION OF THE PROXY OR A DULY EXECUTED PROXY BEARING A LATER DATE, OR BY APPEARING AT THE ANNUAL MEETING AND VOTING IN PERSON. THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF THE DIRECTORS AND "FOR" THE RATIFICATION OF ERNST & YOUNG LLP AS MRV'S INDEPENDENT ACCOUNTANTS FOR 2006.

IF YOU ARE VOTING BY MAIL, PLEASE MARK, SIGN, DATE AND RETURN THIS CARD PROMPTLY USING THE ENCLOSED RETURN ENVELOPE. IF YOU RECEIVE MORE THAN ONE PROXY CARD, PLEASE SIGN AND RETURN ALL CARDS IN THE ENCLOSED ENVELOPE.

(Continued and to be signed on the reverse side)

ANNUAL MEETING OF STOCKHOLDERS OF

MRV COMMUNICATIONS, INC.

May 19, 2006

| | | | |

| | | PROXY VOTING INSTRUCTIONS | | |

MAIL —Date, sign and mail your proxy card in the envelope provided as soon as possible.

- OR -

TELEPHONE —Call toll-free1-800-PROXIES

(1-800-776-9437) from any touch-tone telephone and follow the instructions. Have your proxy card available when you call.

- OR -

INTERNET —Access “www.voteproxy.com” and follow the on-screen instructions. Have your proxy card available when you access the web page.

| | | | | | |

| | COMPANY NUMBER | | | | |

| | ACCOUNT NUMBER | | | | |

| | | | | | |

| |

You may enter your voting instructions at 1-800-PROXIES or www.voteproxy.com up until 11:59 PM Eastern Time the day before the cut-off or meeting date.

â Please detach along perforated line and mail in the envelope providedIF you are not voting via telephone or the Internet.â

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS AND “FOR” PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HEREx

| 1. | | To elect the following directors to serve for a term ending upon the 2007 Annual Meeting of Stockholders or until their successors are elected and qualified. |

| | | | | | | |

| | | | | NOMINEES: |

| | | FOR ALL NOMINEES | | m | | Noam Lotan |

| | | | | m | | Shlomo Margalit |

| | | WITHHOLD AUTHORITY | | m | | Igal Shidlovsky |

| | | FOR ALL NOMINEES | | m | | Guenter Jaensch |

| | | | | m | | Daniel Tsui |

| | | FOR ALL EXCEPT | | m | | Baruch Fischer |

| | | (See instructions below) | | m | | Harold Furchtgott-Roth |

| | |

| INSTRUCTION: | | To withhold authority to vote for any individual nominee(s), mark“FOR ALL EXCEPT”and fill in the circle next to each nominee you wish to withhold, as shown here:l |

| | | |

| |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | o |

| |

| | | | | | | | | |

| | | | | FOR | | AGAINST | | ABSTAIN |

| 2. | | To ratify the appointment of Ernst & Young LLP as MRV’s independent accountants for the year ending December 31, 2006. | | o | | o | | o |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting.

The undersigned acknowledges receipt of the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

| | | | | | | | | | | | | | | |

| Signature of Stockholder | | | | Date: | | | | Signature of Stockholder | | | | Date: | | |

| | Note: | | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |