The following is a summary of the inputs used as of December 31, 2008 in valuing the Fund’s assets and liabilities carried at fair value:

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of the securities held at period-end. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of securities sold during the period. Accordingly, realized and unrealized foreign currency gains (losses) are included in the reported net realized and unrealized gains (losses) on investments.

Unrealized currency gains (losses) resulting from valuing foreign currency denominated assets and liabilities at period-end exchange rates are reflected as a component of accumulated net unrealized gain (loss) on investments, foreign currency holdings, and other assets and liabilities denominated in foreign currencies.

Income and capital gain distributions are determined in accordance with Federal income tax regulations and may differ from those determined in accordance with GAAP.

An affiliated issuer may be considered one which is under common control with a Fund. For the purposes of the report, the Fund assumes the following to be an affiliated issuer:

Affiliate

|

|

|

| Value at

December 31, 2007

|

| Sales

Proceeds

|

| Realized

Gain/(Loss)

|

| Shares at

December 31, 2008

|

| Value at

December 31, 2008

|

|---|

JF China Pioneer

A-Share Fund | | | | $ | 4,631,588 | | | $ | 4,002,511 | | | $ | 1,986,383 | | | | — | | | $ | — | |

vii) Foreign Taxes — The Fund may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

3. Investment Transactions

The investment objective, policies, program, and risk factors of the Fund are described fully in the Fund’s Prospectus.

During the year ended December 31, 2008, the Fund made purchases of $113,083,706 and sales of $118,955,748 of investment securities other than short-term investments. There were no purchases or sales of U.S. Government securities.

4. Related party, Other Service Provider Transactions and Directors

i) JF International Management Inc. (the Investment ‘Adviser’), an indirect wholly-owned subsidiary of JPMorgan Chase & Co., provides investment advisory services to the Fund under the terms of an investment advisory agreement. The Adviser is paid a fee, computed weekly and payable monthly, at the annual rate of 1.00% of the Fund’s weekly net assets. Investments in funds on which the Adviser or its affiliates charges a management fee are excluded from the calculation.

ii) During the year ended December 31, 2008, the Fund did not pay any brokerage commissions to JPMorgan Chase Group companies or affiliated brokers/dealers.

iii) Other Service Providers — Pursuant to an Administration Agreement, JPMorgan Investor Services, Co. (the “Administrator”), an indirect, wholly-owned subsidiary of JPMorgan Chase & Co., provides certain administration services to the Fund. The Fund pays an annual administration fee of $87,500 in respect of tax, compliance, financial reporting and regulatory services.

JPMorgan Chase Bank N.A. (‘JPMCB’), an affiliate of the Fund, provides portfolio custody and accounting services for the Fund. The amounts paid directly to JPMCB by the Fund for custody and accounting services are included in Custodian and accounting fees in the Statement of Operations. In consideration of the accounting services, JPMCB receives a fee computed daily and paid monthly at the annual rate of 0.02% of the first $12.5 billion of the average daily net assets of all funds in the JPMorgan International Fund Complex and 0.0175% of the average daily net assets in excess of $12.5 billion of all such funds subject to a minimum annual fee of $25,000. The custodian fees are split between safekeeping and transaction changes and vary by market.

iv) Directors — With effect from April 1, 2008, the Fund pays each of its Directors who is not a director, officer or employee of the Adviser, Administrator or any affiliate thereof, an annual fee of $22,000, the Audit Committee Chairman $26,000 and the Chairman $32,000 plus a $3,000 attendance fee for each Board meeting, Management Engagement Committee meeting and Audit Committee meeting attended. In addition, the Fund reimburses all Directors for travel and out-of-pocket expenses incurred in connection with Board of Directors meetings. Under normal circumstances, in order to minimize expenses, the Board expects to hold two meetings a year by telephone.

DECEMBER 31, 2008 JF CHINA REGION FUND, INC. 17

NOTES TO FINANCIAL STATEMENTS

AT DECEMBER 31, 2008 (continued)

Prior to April 1, 2008, the Fund paid each of its Directors who is not a director, officer or employee of the Adviser, Administrator or any affiliate thereof an annual fee of $21,000 and the Chairman $30,000 plus $2,000 attendance fee for each Board meeting, $1,500 for each Management Engagement Committee meeting and $1,750 for each Audit Committee meeting attended.

5. Capital Share Transactions

On September 3, 2008, the Board of Directors renewed an authority for the Fund to purchase shares of its common stock from Fund stockholders, as described below. When shares trade at a discount to net asset value, any purchase of shares by the Fund has the effect of increasing the net asset value per share of the Fund’s remaining shares outstanding. All shares purchased by the Fund are thereafter considered authorized and unissued.

i) Share Repurchase Program — The Fund was authorized to repurchase up to 458,516 shares (10% of its then issued and outstanding shares) in the open market through September 10, 2009. Repurchases can be made only when the Fund’s shares are trading at less than net asset value and at such times and amounts as it is believed to be in the best interest of the Fund’s stockholders.

During the year ended December 31, 2008 and the year ended December 31, 2007, the Fund did not repurchase any shares under the share repurchase program.

6. Risks and Uncertainties

i) China Region — Investing in securities of “China Region companies” may include certain risks and considerations not typically associated with investing in U.S. securities. In general, China Region companies are those that are organized under the laws of, or has a principal office in, the People’s Republic of China (including Hong Kong and Macau) (“China”), or Taiwan; the principal securities market for which is China or Taiwan; that derives at least 50% of its total revenues or profits from goods or services that are produced or sold, investments made, or services performed in China or Taiwan; or at least 50% of the assets of which are located in China or Taiwan. Such risks include fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, these securities may not be as liquid as U.S. securities. At December 31, 2008, the Fund had 32.8%, 41.1%, and 26.1% of its total investments invested in China, Hong Kong, and Taiwan, respectively.

ii) Foreign Transactions — Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

iii) Other — In the normal course of business, the Fund may enter into contracts that provide general indemnifications. The maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of any loss from such claims is considered remote.

7. Tax Status

U.S. Federal Income Taxes — No provision for federal income taxes is required since the Fund intends to continue to qualify as a regulated investment company under subchapter M of the Internal Revenue Code and distribute substantially all of its taxable income.

Financial Accounting Standards Board (the “FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes — an Interpretation of FASB Statement No. 109” (the “Interpretation”) establishes for all entities, including pass-through

18 JF CHINA REGION FUND, INC. DECEMBER 31, 2008

entities such as the Fund, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. The Fund has recorded no tax liabilities pursuant to the Interpretation. However, the conclusions regarding the Interpretation may be subject to review and adjustment at a later date based on factors including, but not limited to, further interpretation from FASB, new tax laws, regulations and interpretations thereof. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

The tax character of distributions paid for the year ended December 31, 2008 was $6,655,440 from ordinary income and $14,871,886 from realized capital gains. Distributions deemed to be from PFICs are reflected in dividends from net investment income.

The tax character of distributions paid for the year ended December 31, 2007 was $12,988,245 from ordinary income and $10,983,246 from realized capital gains.

At December 31, 2008, the components of net assets (excluding paid-in capital) on a tax basis were as follows:

| Tax Basis Ordinary Income | | | | | | | | $ | 398,971 | |

| Tax Basis Capital Loss Carryover | | | | | | | | | (2,664,784 | ) |

| Tax Unrealized Depreciation on Investments and Foreign Currencies | | | | | | | | | (28,601,766 | ) |

| Other Cumulative Temporary Differences | | | | | | | | | (6,934,491 | ) |

| Net Assets (Excluding Paid-In Capital) | | | | | | | | $ | (37,802,070 | ) |

The cumulative timing differences primarily consist of wash sale loss deferrals and post-October loss deferrals.

Net capital losses incurred after October 31 and within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year. For the year ended December 31, 2008, the Fund deferred to January 1, 2009 post-October capital losses of $6,929,267 and post-October currency losses of $5,224.

During the year ended December 31, 2008, the Fund reclassified $2,206,305 to undistributed net investment income from accumulated realized gains on investments as a result of permanent book and tax differences relating to distribution reclasses and PFIC gains and losses. Net assets were not affected by the reclassifications.

As of December 31, 2008, the Fund had capital loss carryforwards of $2,664,784, expiring in 2016, which are available to offset future realized gains.

8. Recent Accounting Pronouncement

In March 2008, Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“SFAS 161”) was issued and is effective for fiscal years and interim periods beginning after November 15, 2008. SFAS 161 requires enhanced disclosures about a fund’s derivative and hedging activities. Management is currently evaluating the impact the adoption of SFAS 161 will have on the Fund’s financial statement disclosures.

DECEMBER 31, 2008 JF CHINA REGION FUND, INC. 19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

JF China Region Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of JF China Region Fund, Inc. (hereafter referred to as the “Fund”) at December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2008 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 27, 2009

20 JF CHINA REGION FUND, INC. DECEMBER 31, 2008

RESULTS OF THE ANNUAL STOCKHOLDERS’ MEETING

The Fund held its annual stockholders’ meeting on May 8, 2008. At this meeting, stockholders re-elected the following nominee to the Fund’s Board of Directors.

I) Election of Directors

Nominee

|

|

|

| Votes For

|

| Votes Withheld

|

| Non-Voting Shares

|

| Total Voting Shares

|

|---|

| Julian M.I. Reid | | | | | 3,457,372 | | | | 145,271 | | | | 937,780 | | | | 4,585,160 | |

OTHER INFORMATION

Information About Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the ‘Commission’) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Tax Letter (Unaudited)

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements. 0.02% of ordinary income distributions were eligible for the 70% dividend received deduction for corporate rate shareholders for the fiscal year ended December 31, 2008. For the fiscal year ended December 31, 2008, certain dividends paid by the Fund may be subject to a maximum tax rate of 15%. $301,627 of ordinary income distributions was treated as qualified dividends. The Fund hereby designates $14,871,886 as long-term capital gain distributions for the purpose of the dividend paid deduction on its respective tax return for the fiscal year ended December 31, 2008. For the fiscal year ended December 31, 2008, the Fund intends to elect to pass through to shareholders the income tax credit for taxes paid to foreign countries. Gross income and foreign tax expenses are $3,099,170 and $320,251, respectively.

Proxy Voting Policies and Procedures and

Proxy Voting Record

A description of the policies and procedures that are used by the Fund’s investment adviser to vote proxies relating to the Fund’s portfolio securities is available (1) without charge, upon request, by calling +44 20 7742 3477; and (2) as an exhibit to the Fund’s annual report on Form N-CSR which is available on the website of the Securities and Exchange Commission (the “Commission”) at http://www.sec.gov. Information regarding how the investment adviser votes these proxies is now available by calling the same number and on the Commission’s website. The Fund has filed its report on Form N-PX covering the Fund’s proxy voting record for the 12 month period ending June 30, 2008.

Certifications

Simon J. Crinage, as the Fund’s President, has certified to the New York Stock Exchange that, as of October 7, 2008, he was not aware of any violation by the Fund of applicable NYSE corporate governance listing standards. The Fund’s reports to the Commission on Forms N-CSR and N-CSRS contain certifications by the Fund’s principal executive officer and principal financial officer that relate to the Fund’s disclosure in such reports and that are required by Rule 30a-2(a) under the 1940 Act.

DECEMBER 31, 2008 JF CHINA REGION FUND, INC. 21

APPROVAL OF INVESTMENT ADVISORY CONTRACT

On November 24, 2008, the Fund’s Board of Directors (the “Board”) considered and approved the renewal of the Investment Advisory Contract (the “Agreement”) between the Fund and JFIMI for an additional term of twelve months. At this meeting, the Board reviewed extensive materials prepared by JFIMI and discussed these materials with representatives of JPMAM. The Directors considered the recommendation of the Management Engagement Committee (the “Committee”) that the Agreement be renewed, noting that the Committee had discussed, in executive session with independent counsel, the nature, extent and quality of the advisory services provided to the Fund by JFIMI, the level of advisory fees, the costs of the services provided and the profits realized by JFIMI, the Fund’s expense ratio, its relative and absolute performance, any economies of scale with respect to the management of the Fund, any ancillary benefits received by JFIMI and its affiliates as a result of their relationship with the Fund, and various other matters included in the materials provided by JFIMI. In approving the renewal of the Agreement, the Committee, and the Board, concluded that:

| • | | The annual investment advisory fee rate paid by the Fund to JFIMI for investment advisory services was reasonable relative to the Fund’s peer group and relative to other non-U.S. funds managed by JFIMI. |

| • | | The Committee and the Board were satisfied with the nature, quality and extent of services provided by JFIMI. In reaching this conclusion, the Committee and the Board reviewed, among other things, JFIMI’s investment experience in the China region markets, the background and experience of JFIMI’s senior management, including the firm’s new head of the Greater China team. The Committee and the Board also received information regarding JFIMI’s compliance with applicable laws and SEC and other regulatory inquiries or audits of the Fund and JFIMI. |

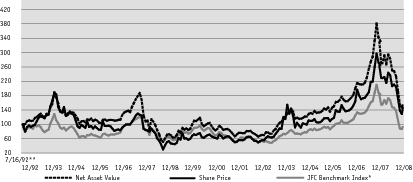

| • | | The Fund’s performance, particularly in the one-year period, was improving as compared to the Fund’s peer group and the Fund’s benchmark, the MSCI Golden Dragon Index. (The Board and the Committee reviewed the Fund’s performance in comparison to the peer group and the benchmark for the 1 year, 3 year, 5 year and since inception periods.) The Board and Committee concluded that, during the most recent fiscal year, JFIMI had made improvements with respect to the investment processes used in managing the Fund. |

| • | | The Fund’s expense ratio remained at an acceptable level, and that JFIMI had been successful in negotiating reductions of certain of the Fund’s operating expenses. |

| • | | Any potential economies of scale were being shared between the Fund and JFIMI in an appropriate manner. |

| • | | In light of the costs of providing advisory services to the Fund, the profits and ancillary benefits that JFIMI received, with respect to providing investment advisory services to the Fund, were reasonable. The Board and the Committee noted that beginning in May 2005, the Fund discontinued using JFIMI’s affiliates to affect Fund securities trades, unless in exceptional circumstances, effectively eliminating brokerage commissions as an ancillary benefit for JFIMI. |

22 JF CHINA REGION FUND, INC. DECEMBER 31, 2008

FUND MANAGEMENT

(Unaudited)

Information pertaining to the Directors and officers of the Fund is set forth below.

Name, (DOB), Address and

Position(s) with Fund

|

|

|

| Term of

Office and

Length of

Time Served

|

| Principal Occupation(s)

During Past 5 Years

|

| Number of

Portfolios in

Fund Complex

Overseen by

Director*

|

| Other Trusteeships/

Directorships Held by Director

|

|---|

Independent Directors |

The Rt. Hon.

The Earl of Cromer

(June 3, 1946)

Finsbury Dials

20 Finsbury Street London, EC2Y 9AQ

United Kingdom

Chairman and Class I Director | | | | Three year term ends in 2009; Chairman and Director since 1994. | | Chairman of the Board of the Fund; Chief Executive Officer of Cromer Associates Limited (family business). Director of Schroder Asia Pacific Fund Limited (financial), London Asia Capital plc (financial), Pedder Street Asia Absolute Return Fund Limited (financial); Chairman of Japan High Yield Property Fund Limited (financial), China IPO Group Limited (financial) and Western Provident Association (insurance). | | 1 | | See Principal Occupation. |

Alexander Reid Hamilton (October 4, 1941)

P.O. Box 12343

General Post Office

Hong Kong

Class II Director | | | | Three year term ends in 2010; Director since 1994. | | Director of Citic Pacific Limited (infrastructure), China Cosco Holdings Company Limited (shipping), Esprit Holdings Limited (clothing retail), Shangri-La Asia Limited (hotels), Octopus Cards Limited (financial services) and China Central Properties Limited (property). | | 1 | | See Principal Occupation. |

Julian M. I. Reid (August 7, 1944)

Finsbury Dials,

20 Finsbury Street London, EC2Y 9AQ

United Kingdom

Class III Director | | | | Three year term ends

in 2011; Director since 1998. | | Chief Executive Officer of 3a Asset Management Limited (financial); Director and Chairman of Morgan’s Walk Properties Limited (property); Director and Chairman of Prosperity Voskhod Fund (financial); Director and Chairman of ASA Limited (financial) and Director of 3a Global Growth Fund Limited (financial). | | 1 | | Director and Chairman of The Korea Fund, Inc. |

DECEMBER 31, 2008 JF CHINA REGION FUND, INC. 23

FUND MANAGEMENT

(Unaudited) (continued)

Name, (DOB), Address and

Position(s) with Fund

|

|

|

| Term of

Office and

Length of

Time Served

|

| Principal Occupation(s) During

Past 5 Years

|

| Number of

Portfolios in

Fund Complex

Overseen by

Director*

|

| Other Trusteeships/

Directorships Held by Director

|

|---|

Independent Directors (continued) |

John R. Rettberg

(September 1, 1937)

1 Beacon St.

Boston, MA 02108

USA

Class II Director | | | | Term ends in 2010; Director since 2008 | | Director of Enalasys (energy); Director of VLPS (lighting) | | 1 | | See Principle Occupation |

| * | | The Fund is the only fund in the Fund Complex. |

24 JF CHINA REGION FUND, INC. DECEMBER 31, 2008

Information pertaining to the Directors and officers of the Fund is set forth below.

Name, (DOB), Address and

Position(s) with Fund

|

|

|

| Term of Office and

Length of Time Served

|

| Principal Occupation(s)

During Past 5 Years

|

|---|

Officers who are not Directors |

Simon J. Crinage

(May 10, 1965)

Finsbury Dials,

20 Finsbury Street London, EC2Y 9AQ

United Kingdom

President | | | | Since 2003** | | President of the Fund; Managing Director, J.P. Morgan Asset Management. |

Michael J. James (May 11, 1967)

Finsbury Dials,

20 Finsbury Street London, EC2Y 9AQ

United Kingdom

Treasurer | | | | Since 2006** | | Treasurer of the Fund; Vice President, J.P. Morgan Asset Management. |

Christopher D. Legg (March 12, 1982)

Finsbury Dials,

20 Finsbury Street London, EC2Y 9AQ

United Kingdom

Secretary | | | | Since 2008** | | Secretary of the Fund; Associate, J.P. Morgan Asset Management. |

Muriel Y.K. Sung

(September 25, 1966)

8 Connaught Road

Central/Hong Kong | | | | Since 2004** | | Chief Compliance Officer of the Fund; Vice President, J.P. Morgan Asset Management. |

| ** | | The officers of the Fund serve at the discretion of the Board. |

DECEMBER 31, 2008 JF CHINA REGION FUND, INC. 25

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

(Unaudited)

The Fund operates an optional Dividend Reinvestment and Cash Purchase Plan (the ‘Plan’) whereby:

| a) | | shareholders may elect to receive dividend and capital gain distributions in the form of additional shares of the Fund (the Share Distribution Plan). |

| b) | | shareholders may make optional payments (any amount between $100 and $3,000) which will be used to purchase additional shares in the open market (the Share Purchase Plan). |

For a copy of the Plan brochure, as well as a dividend reinvestment authorization card, please contact the Plan Agent:

| | Computershare Trust Company, N.A.

P. O. Box 43010

Providence, RI 02940-3010

USA Telephone No.: 800-426-5523 (toll-free)

www.computershare.com |

The following should be noted with respect to the Plan:

If you participate in the Share Distribution Plan, whenever the Board of Directors of the Fund declares an income dividend or net capital gain distribution, you will automatically receive your distribution in newly issued shares (cash will be paid in lieu of fractional shares) if the market price of the shares on the date of the distribution is at or above the net asset value of the shares. The number of shares to be issued to you by the Fund will be determined by dividing the amount of the cash distribution to which you are entitled (net of any applicable withholding taxes) by the greater of the net asset value (‘NAV’) per share on such date or 95% of the market price of a share on such date. If the market price of the shares on such a distribution date is below the NAV, the Plan Agent will, as agent for the participants, buy shares on the open market, on the New York Stock Exchange or elsewhere, for the participant’s account on, or after, the payment date. There is no service charge for purchases under this Plan.

For U.S. federal income tax purposes, shareholders receiving newly issued shares pursuant to the Share Distribution Plan will be treated as receiving income or capital gains in an amount equal to the fair market value (determined as of the distribution date) of the shares received and will have a cost basis equal to such fair market value. Shareholders receiving a distribution in the form of shares purchased in the open market pursuant to the Plan will be treated as receiving a distribution of the cash distribution that such shareholder would have received had the shareholder not elected to have such distribution reinvested and will have a cost basis in such shares equal to the amount of the distribution.

There will be no brokerage charge to participants for shares issued directly by the Fund under the Plan. Each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases of shares in connection with the Plan. The Fund will pay the fees of the Plan Agent for handling the Plan.

You may terminate your account under the Share Distribution Plan by notifying the Plan Agent in writing. The Plan may be terminated by the Plan Agent or the Fund with notice to you at least 30 days prior to any record date for the payment of any distribution by the Fund. Upon any termination, the Plan Agent will deliver a certificate or certificates for the full shares held for you under the Plan and a cash adjustment for any fractional shares.

You also have the option of instructing the Plan Agent to make semi-annual cash purchases of shares in the open market. There is a service charge of $1.25 for each purchase under this Share Purchase Plan.

26 JF CHINA REGION FUND, INC. DECEMBER 31, 2008

DIRECTORS AND ADMINISTRATION

(Unaudited)

| Officers and Directors | | | | The Rt. Hon. The Earl of Cromer —

Director and Chairman of the Board

Alexander R. Hamilton — Director

Julian M. I. Reid — Director

John R. Rettberg — Director

Simon J. Crinage — President

Michael J. James — Treasurer

Christopher D. Legg — Secretary* | | | | |

| Investment Adviser | | | | JF International Management Inc.

P.O. Box 3151

Road Town, Tortola

British Virgin Islands | | | | |

| Administrator | | | | J.P. Morgan Investor Services, Co.

1 Beacon Street, 18th Floor

Boston, Massachusetts 02108

U.S.A. | | |

| Custodian | | | | JPMorgan Chase Bank N.A.

1 Beacon Street, 18th Floor

Boston, Massachusetts 02108

U.S.A. | | |

Independent Registered

Public Accounting Firm | | | | PricewaterhouseCoopers LLP

300 Madison Avenue

New York, New York 10017

U.S.A. | | | | |

| Legal Counsel | | | | Cleary Gottlieb Steen & Hamilton LLP

New York:

1 Liberty Plaza

New York, New York 10006

U.S.A. | | | | |

| | | | | Hong Kong:

Bank of China Tower

1 Garden Road

Hong Kong | | | | |

| Registrar, Transfer Agent, and Dividend Paying Agent | | | | Computershare Trust Company, N.A.

P. O. Box 43010

Providence, Rhode Island 02940-3010

U.S.A. | | | | |

* | | Christopher D. Legg replaced Philip Jones as Fund Secretary effective March 6, 2008. |

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that from time to time the Fund may purchase shares of its common stock in the open market.

www.jfchinaregion.com

DECEMBER 31, 2008 JF CHINA REGION FUND, INC. 27

THIS PAGE IS INTENTIONALLY LEFT BLANK

This report, including the financial statements herein, is sent to the stockholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

© JPMorgan Chase & Co., 2008 All rights reserved. December 2008. | | |

ITEM 2. CODE OF ETHICS.

(a) The JF China Region Fund, Inc. (the "Fund") has adopted a Code of Ethics that applies to the Fund's principal executive officer and principal financial officer.

(c) There have been no amendments to the Fund's Code of Ethics during the reporting period for this Form N-CSR.

(d) There have been no waivers granted by the Fund to individuals covered by the Fund's Code of Ethics during the reporting period for this Form N-CSR.

(f) A copy of the Fund's Code of Ethics is attached as exhibit 12(a)(1) to this Form N-CSR.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

(a) (1) The Board of Directors of the Fund has determined that the Fund has one member serving on the Fund's Audit Committee that possesses the attributes identified in Instruction 2(b) of Item 3 to Form N-CSR to qualify as "audit committee financial expert."

(2) The name of the audit committee financial expert is John R.Rettberg. Mr. Rettberg has been deemed to be "independent" as that term is defined in Item 3(a)(2) of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

a) Audit Fees

For the fiscal year ended December 31, 2008, PricewaterhouseCoopers, LLP (“PwC”), the Fund's independent registered public accounting firm, billed the Fund aggregate fees of US$55,000 for professional services rendered for the audit of the Fund's annual financial statements and review of financial statements included in the Fund's annual report to shareholders.

For the fiscal years ended December 31, 2007, PwC billed the Fund aggregate fees of US$53,885 for professional services rendered for the audit of the Fund's annual financial statements and review of financial statements included in the Fund's annual report to shareholders.

(b) Audit-Related Fees

For the fiscal year ended December 31, 2008, PwC did not bill the Fund any fees for assurances and related services that are reasonably related to the performance of the audit or review of the Fund's financial statements and are not reported under the section Audit Fees above.

For the fiscal year ended December 31, 2007, PwC did not bill the Fund any fees for assurances and related services that are reasonably related to the performance of the audit or review of the Fund's financial statements and are not reported under the section Audit Fees above.

(c) Tax Fees

For the fiscal year ended December 31, 2008, PwC billed the Fund aggregate fees of US$5,740 for professional services rendered for tax compliance, tax advice, and tax planning. The nature of the services comprising the Tax Fees was the review of the Fund's income tax returns and tax distribution requirements.

For the fiscal year ended December 31, 2007, PwC billed the Fund aggregate fees of US$5,600 for professional services rendered for tax compliance, tax advice, and tax planning. The nature of the services comprising the Tax Fees was the review of the Fund's income tax returns and tax distribution requirements.

(d) All Other Fees

For the fiscal years ended December 31, 2008, PwC billed the Fund aggregate fees of $9,408 in connection with non-recurring tax advice provided in connection with the 2007 spillback dividend and the 2008 excise tax dividend. For the fiscal year ended December 31, 2007, PwC did not bill the Fund any other fees.

(e) The Fund’s Audit Committee Charter requires the Audit Committee pre-approve all audit and non-audit services to be provided by the independent registered public accounting firm to the Fund, and all non-audit services to be provided by the auditors to the Fund’s Investment Adviser and any service providers controlling, controlled by or under common control with the Fund’s Investment Adviser that provide on-going services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund. All of the audit, audit-related and tax services described above for which PwC billed the Fund for the fiscal years ended December 31, 2007 and December 31, 2008 were pre-approved by the Audit Committee.

For the fiscal years ended December 31, 2008 and December 31, 2007, the Fund's Audit Committee did not waive the pre-approval requirement of any non-audit services to be provided to the Fund by PwC.

(f) Not applicable to the Fund.

(g) For the fiscal year ended December 31, 2008, the aggregate non-audit fees for services rendered by PwC to the Fund’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provided ongoing services to the Fund were $24.7 million.

For the fiscal year ended December 31, 2007, the aggregate non-audit fees for services rendered by PwC to the Fund’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provided ongoing services to the Fund were $19.9 million.

(h) The Fund's Audit Committee has considered whether the provision of non-audit services that were rendered to Fund’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Fund that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

(a) The Fund has a separately-designated audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Fund's audit committee are: The Rt. Hon. The Earl of Cromer, Alexander R. Hamilton, John R. Rettberg and Julian M.I. Reid.

ITEM 6. SCHEDULE OF INVESTMENTS

(a) Schedule of Investments is included as part of Item 1.

(b) Not applicable to the Fund.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Attached to this Form N-CSR as exhibit 12(a)(4) are copies of the proxy voting policies and procedures of the Fund and JPMorgan Asset Management (“JPMAM”) (formerly JF Asset Management), parent company of the Fund’s adviser, JF International Management Inc. (the “Adviser”).

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

(a)(1) The day-to-day management of the Fund's portfolio is handled by the Greater China investment team of JPMAM. The Greater China Investment Team is based in Hong Kong. The head of this team is Howard Wang and Emerson Yip and Kevin Chan are portfolio managers.

Mr. Wang joined JPMAM in Hong Kong in July 2005. Prior to his appointment, Mr. Wang spent eight years with Goldman Sachs, where in 2004, he was appointed Managing Director, Equities and General Manager of the Taipei branch office.

Mr. Yip joined JPMAM in Hong Kong in May 2006. Prior to his appointment, Mr.Yip was a director of Newbridge Capital where, since 1998, he held various positions of responsibility.

Mr. Chan joined JPMAM in Hong Kong in May 2007. Prior to his appointment, Mr. Chan worked at Morgan Stanley for five years where he was an executive director in the institutional equities division.

The chart below shows the number, type and market value as of December 31, 2008 of the accounts other than the Fund that are managed by each of the Fund’s portfolio managers. The potential for conflicts of interest exists when a portfolio manager manages other accounts with similar or different investment objectives and strategies as the Fund ("Other Accounts"). Potential conflicts may include, for example, conflicts between investment strategies and conflicts in the allocation of investment opportunities.

(a) (2)

| | | | | |

Howard Wang | | | | | |

(a)(2)(ii) | | | | | |

Registered Investment companies | Other Pooled Investment Vehicles | Other Accounts |

Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) |

1 | 6m | 8 | 1,147m | Nil | Nil |

| | | | | |

(a)(2)(iii) - Performance fee | | | | |

Registered Investment companies | Other Pooled Investment Vehicles | Other Accounts |

Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) |

Nil | Nil | 1 | 20m | Nil | Nil |

| | | | | |

Emerson Yip | | | | | |

(a)(2)(ii) | | | | | |

Registered Investment companies | Other Pooled Investment Vehicles | Other Accounts |

Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) |

2 | 40m | 3 | 764m | 3 | 277m |

| | | | | |

(a)(2)(iii) - Performance fee | | | | |

Registered Investment companies | Other Pooled Investment Vehicles | Other Accounts |

Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) |

Nil | Nil | Nil | Nil | Nil | Nil |

| | | | | |

Kevin Chan | | | | | |

(a)(2)(ii) | | | | | |

Registered Investment companies | Other Pooled Investment Vehicles | Other Accounts |

Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) |

1 | 6m | 4 | 203m | Nil | Nil |

| | | | | |

(a)(2)(iii) - Performance fee | | | | |

Registered Investment companies | Other Pooled Investment Vehicles | Other Accounts |

Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) | Number of accounts | Total Assets (USD) |

Nil | Nil | 1 | 20m | Nil | Nil |

| | | | | |

(a)(4) Ownership of Securities | | | | |

Portfolio Manager | None | $1-$10,000 | $10,000-$50,000 | | |

Howard Wang | x | | | | |

Emerson Yip | x | | | | |

Kevin Chan | x | | | | |

| | | | | |

Responsibility for managing the client portfolios of the Adviser and the Adviser's participating affiliates is organized according to the mandates of each account. The Fund's portfolio managers manage other accounts with similar objectives, approach and philosophy to the Fund. The portfolio holdings, relative position sizes and industry and sector exposures tend to be similar across these similar portfolios, which minimizes the potential for conflicts of interest. For Howard Wang, these similar portfolios include one registered investment company and seven of the eight other pooled investment vehicles as described under ITEM 8 (a)(2)(ii) above that invest in the Greater China/China/Asia markets and only take long positions in securities. On the other hand, the other pooled investment vehicle described under ITEM 8 (a)(2)(iii) also invests in the Greater China markets but may take long and short positions in securities as part of its investment strategy. When the portfolio manager engages for this other pooled investment vehicle in short sales of securities which the Fund has purchased, the portfolio manager could be seen as harming the performance of the Fund for the benefit of the accounts engaging in short sales if the short sales cause the market value of those securities to fall.

For Emerson Yip, the similar portfolios include two registered investment companies, three other pooled investment vehicles as described under ITEM 8 (a)(2)(ii) above that invest in Greater China/Hong Kong markets and only take long positions in securities, and three other accounts as described under ITEM 8 (a)(2)(ii) above that invest in Hong Kong/China markets.

For Kevin Chan, these similar portfolios include one registered investment company and three of the four other pooled investment vehicles as described under ITEM 8 (a)(2)(ii) above that invest in the Greater China/Hong Kong markets and only take long positions in securities. On the other hand, the other pooled investment vehicle described under ITEM 8 (a)(2)(iii) also invests in the Greater China markets but may take long and short positions in securities as part of its investment strategy. When the portfolio manager engages for this other pooled investment vehicle in short sales of securities which the Fund has purchased, the portfolio manager could be seen as harming the performance of the Fund for the benefit of the accounts engaging in short sales if the short sales cause the market value of those securities to fall.

The Adviser and the Adviser's participating affiliates receive more compensation with respect to certain Other Accounts than that received with respect to the Fund and receive compensation based in part on the performance of one of the Other Accounts as described under ITEM 8 (a)(2)(iii). This may create a potential conflict of interest for the Adviser or the Fund's portfolio managers by providing an incentive to favor these Other Accounts when, for example, placing securities transactions. The conflicts of interest may arise with both the aggregation and allocation of securities transactions and allocation of limited investment opportunities. Allocations of aggregated trades, particularly trade orders that were only partially completed due to limited availability, and allocation of investment opportunities generally, could raise a potential conflict of interest, as the Adviser or the portfolio manager may have an incentive to allocate securities that are expected to increase in value to favored accounts. Initial public offerings, in particular, are frequently of very limited availability. The portfolio manager may be perceived as causing accounts he manages to participate in an offering to increase the Adviser's overall allocation of securities in that offering. A potential conflict of interest also may be perceived to arise if transactions in one account closely follow related transactions in a different account, such as when a purchase increases the value of securities previously purchased by another account, or when a sale in one account lowers the sale price received in a sale by a second account.

The Adviser has policies and procedures designed to manage these conflicts described above such as allocation of investment opportunities to achieve fair and equitable allocation of investment opportunities among its clients over time. For example, orders for the same equity security are aggregated on a continual basis throughout each trading day consistent with the Adviser's duty of best execution for its clients. If aggregated trades are fully executed, accounts participating in the trade will be allocated their pro rata share on an average price basis. Partially completed orders generally will be allocated among the participating accounts on a pro-rata average price basis, subject to certain limited exceptions. For example, accounts that would receive a de minimis allocation relative to their size may be excluded from the allocation. Another exception may occur when thin markets or price volatility require that an aggregated order be completed in multiple executions over several days. If partial completion of the order would result in an uneconomic allocation to an account due to fixed transaction or custody costs, the dealer may have the discretion to complete and exclude the small orders.

Purchases of money market instruments and fixed income securities cannot always be allocated pro-rata across the accounts with the same investment strategy and objective. However, the Adviser attempts to mitigate any potential unfairness by basing non-pro rata allocations upon an objective predetermined criteria for the selection of investments and a disciplined process for allocating securities with similar duration, credit quality and liquidity in the good faith judgment of the Adviser so that fair and equitable allocation will occur over time.

(a)(3) Portfolio Manager Compensation

The Fund's portfolio managers participate in a competitive compensation program that is designed to attract and retain outstanding people and closely link their performance to client investment objectives. The total compensation program includes a base salary fixed from year to year and a variable performance bonus consisting of cash incentives and restricted stock and, in some cases, mandatory deferred compensation. These elements reflect individual performance and the performance of the Adviser's business as a whole.

Each portfolio manager's performance is formally evaluated annually based on a variety of factors including the aggregate size and blended performance of the portfolios that he manages. Individual contribution relative to client goals carries the highest impact. The compensation is primarily driven by meeting or exceeding clients' risk and return objectives, relative performance to

competitors or competitive indices and compliance with firm policies and regulatory requirements. In evaluating the portfolio manager's performance with respect to the mutual funds (including the Fund) he manages, the funds' pre-tax performance is compared to the appropriate market peer group and to each fund's benchmark index listed in the fund's prospectus over one, three and five year periods (or such shorter time as the portfolio manager has managed the fund). Investment performance is generally more heavily weighted to the long-term.

Stock awards are granted as the annual performance bonus and comprise from 0% to 35% of each portfolio manager's total award. As the level of incentive compensation increases, the percentage of compensation awarded in restricted stock also increases.

ITEM 9. PURCHASE OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable to the Fund.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the Fund’s board of directors since the Fund filed its last form NCSR

ITEM 11. CONTROLS AND PROCEDURES.

(a) The Fund's principal executive and principal financial officers have concluded that the Fund's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of this Form N-CSR based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the 1934 Act (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the Fund's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d))) that occurred during the Fund's second fiscal quarter that has materially affected, or is reasonably likely to materially affect, the Fund's internal control over financial reporting.

ITEM 12. EXHIBITS.

| (a)(1) | | Code of Ethics is attached hereto in response to Item 2(f). |

| (a)(2) | | Certifications pursuant to Rule 30a-2(a) under the Investment Company Act of 1940. |

| (a)(4) | | Proxy voting policies and procedures of the Fund and its investment adviser are attached hereto in response to Item 7. |

| (b) | | The certifications required by Rule 30a-2(b) of the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

JF China Region Fund, Inc.

By:

/s/_____________________________

Simon Crinage

President and Principal Executive Officer

March 9, 2009

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By:

/s/___________________________

Simon Crinage

President and Principal Executive Officer

March 9, 2009

By:

/s/____________________________

Michael J. James

Treasurer and Principal Financial Officer

March 9, 2009