D.A. Davidson 16th Annual Engineering & Construction Conference September 2017 Exhibit 99.1

Safe harbor This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act of 1934. Such statements may include, but are not limited to, statements of plans and objectives, statements of future economic performance and statements of assumptions underlying such statements, and statements of management's intentions, hopes, beliefs, expectations or predictions of the future. Forward-looking statements can often be identified by the use of forward-looking terminology, such as "should," "intended," "continue," "believe," "may," "hope," "anticipate," "goal," "forecast," "plan," "estimate" and similar words or phrases. Such statements are based on current expectations and are subject to certain risks, uncertainties and assumptions, including but not limited to: estimates and assumptions regarding Layne's strategic direction and business strategy, the timely and effective execution of Layne's strategy for Water Resources, the extent and timing of a recovery in the mining industry, prevailing prices for various commodities, longer term weather patterns, unanticipated slowdowns in Layne's major markets, the availability of credit, the risks and uncertainties normally incident to Layne's industries of operation, the impact of competition, the availability of equity or debt capital needed for the business, including the refinancing of Layne's existing indebtedness as it matures or accelerates, worldwide economic and political conditions and foreign currency fluctuations that may affect Layne's results of operations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially and adversely from those anticipated, estimated or projected. These forward-looking statements are made as of the date of this filing, and Layne assumes no obligation to update such forward-looking statements or to update the reasons why actual results could differ materially from those anticipated in such forward-looking statements.

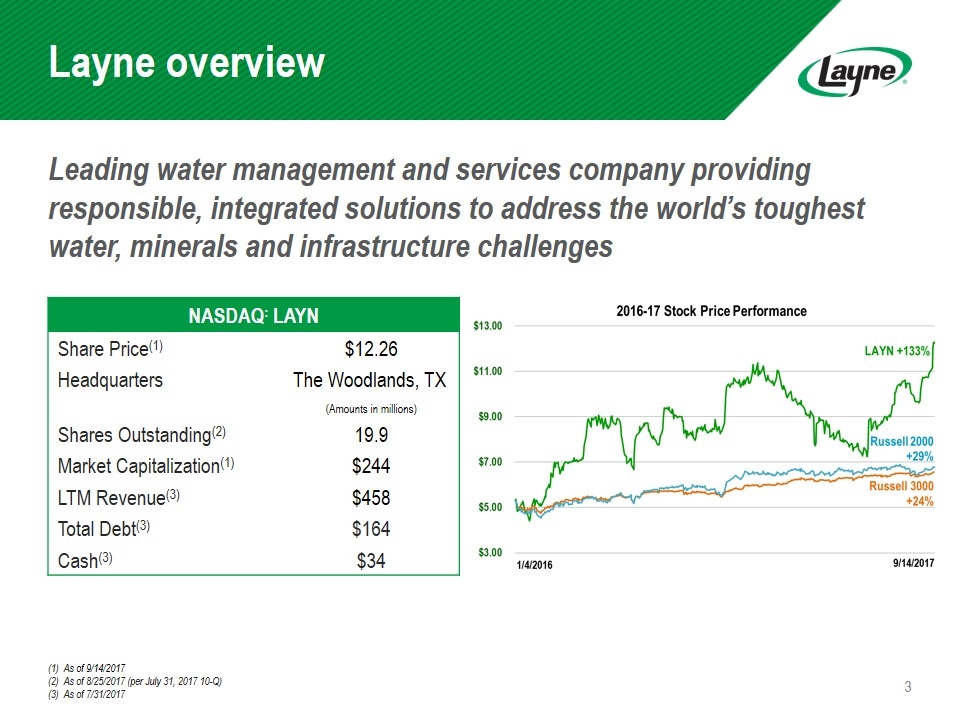

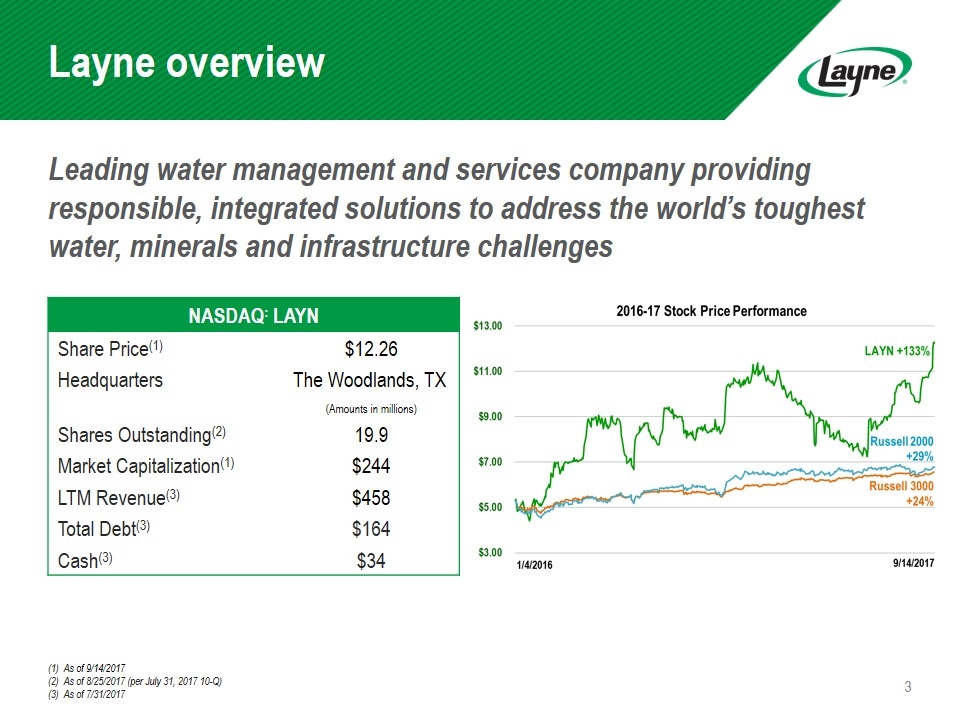

Leading water management and services company providing responsible, integrated solutions to address the world’s toughest water, minerals and infrastructure challenges Layne overview (1) As of 9/14/2017 (2) As of 8/25/2017 (per July 31, 2017 10-Q) (3) As of 7/31/2017 NASDAQ: LAYN Share Price(1) $12.26 Headquarters The Woodlands, TX (Amounts in millions) Shares Outstanding(2) 19.9 Market Capitalization(1) $244 LTM Revenue(3) $458 Total Debt(3) $164 Cash(3) $34

Safety and sustainability are core values “We operate our business in a way that protects and preserves the environment, and we constantly look for ways to use less fuel and water, reduce emissions, recycle waste and otherwise reduce our impacts.” – Michael Caliel, Chief Executive Officer Layne’s one-of-a-kind solution to prevent saltwater intrusion into a major aquifer that supplies water to Baton Rouge, Louisiana won the award that recognizes a project that demonstrates outstanding science, engineering or innovation in supplying groundwater 2015 Project of the Year Expectation of ZERO Incidents Cured in Place Pipe Rehabilitation Ranney Collector Wells Water Well Rehabilitation Hydrogeological Services Water Treatment Solutions Layne provides a number of sustainable solutions

Investment highlights Why now 1 2 3 5 What we do Unlocking value Who we are 4 Why water Track record of leadership and innovation in water sector since 1882 Business units with leading positions in attractive growth markets Management team intensely focused on profitability and creating shareholder value Positive long-term market dynamics for water align with Layne core competencies Earnings momentum and significant opportunity for stock price appreciation

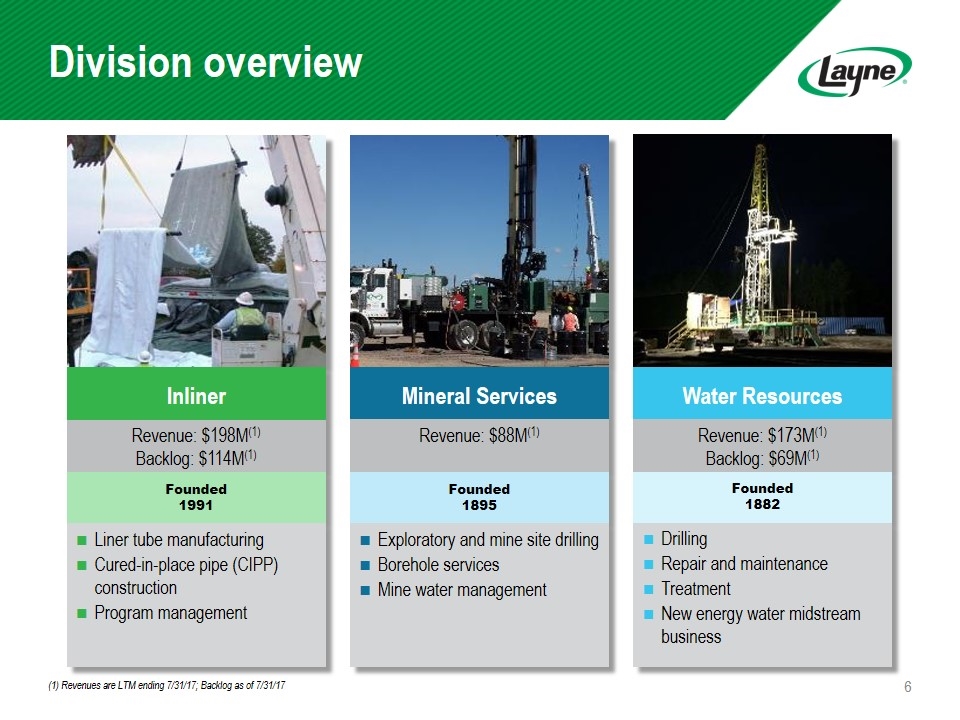

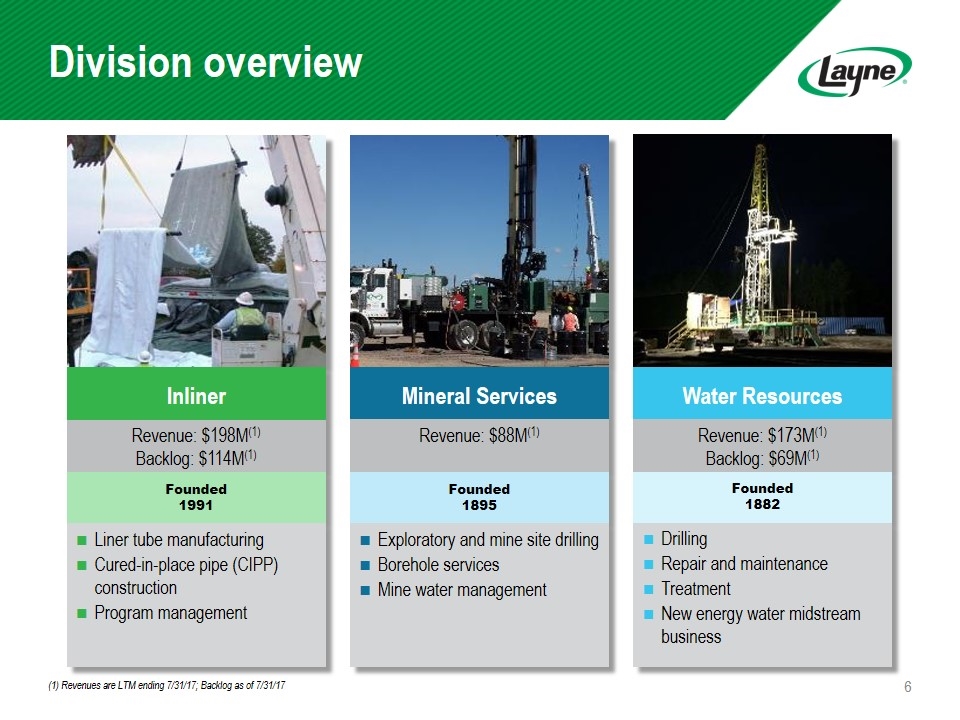

Division overview (1) Revenues are LTM ending 7/31/17; Backlog as of 7/31/17 Water Resources Revenue: $173M(1) Backlog: $69M(1) Drilling Repair and maintenance Treatment New energy water midstream business Founded 1882 Mineral Services Revenue: $88M(1) Exploratory and mine site drilling Borehole services Mine water management Founded 1895 Revenue: $198M(1) Backlog: $114M(1) Liner tube manufacturing Cured-in-place pipe (CIPP) construction Program management Inliner Founded 1991

Why a water-focused strategy Large portion of the U.S. population lives in areas of water scarcity or economic water shortage Groundwater withdrawals often exceed recharge rates Crisis issues are raising sensitivity to water quality Stressed Water Supplies and Quality Population growth occurring in the most water-challenged regions Drought conditions are exacerbating water stress Growing demand in key markets – agriculture and industrial Population Growth and Migration Municipal water industry dependent on government funding Stricter drinking water regulations issued over recent decades Increasing environmental quality standards for discharge Increasing Government Regulations Increasing regulation leading to required infrastructure improvements 2016 Water Infrastructure Improvements Act for the Nation (WIIN) and other infrastructure initiatives Aging and Insufficient Infrastructure

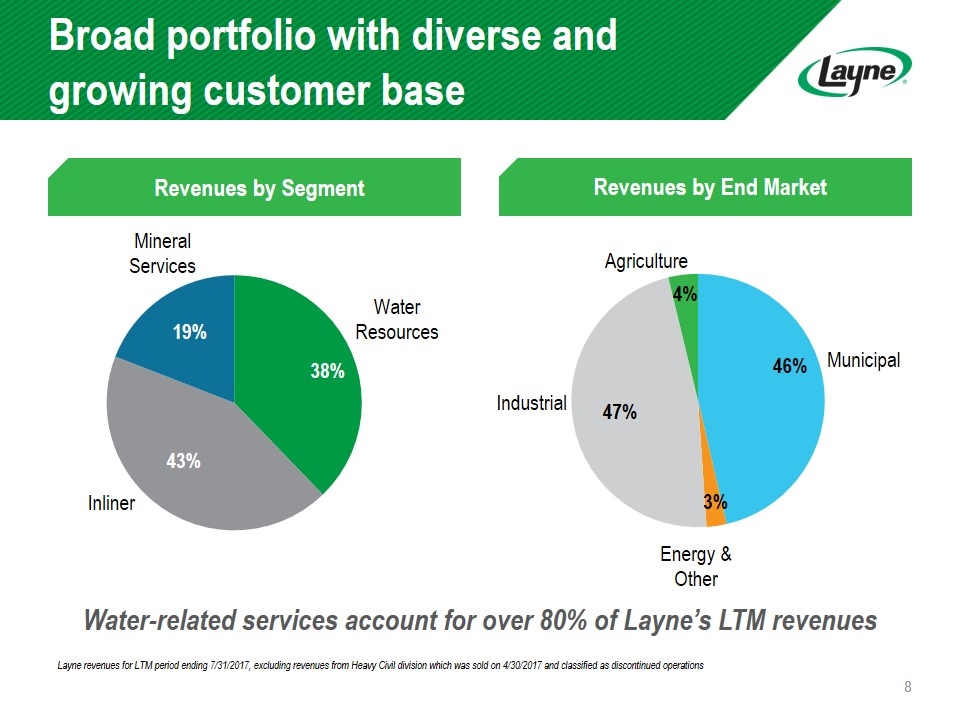

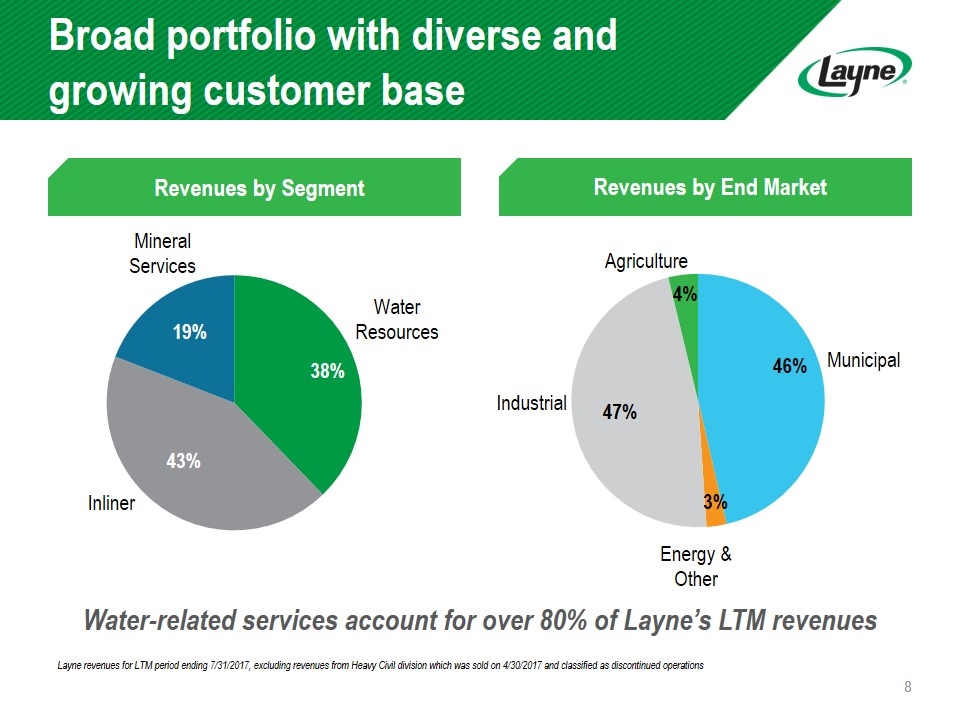

Broad portfolio with diverse and growing customer base Revenues by Segment Revenues by End Market Layne revenues for LTM period ending 7/31/2017, excluding revenues from Heavy Civil division which was sold on 4/30/2017 and classified as discontinued operations Water-related services account for over 80% of Layne’s LTM revenues

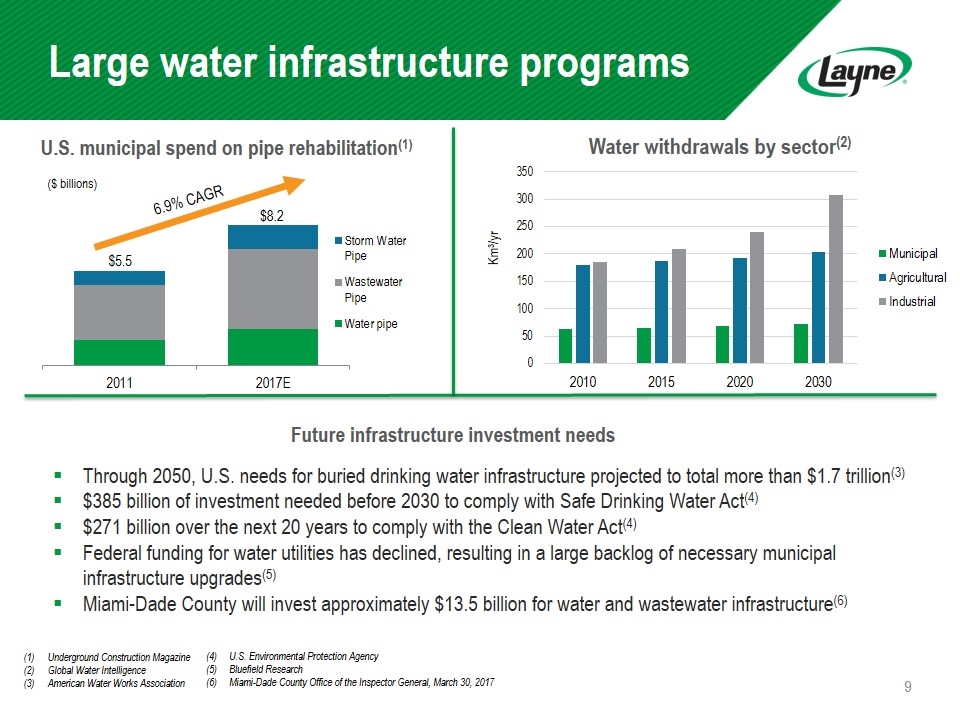

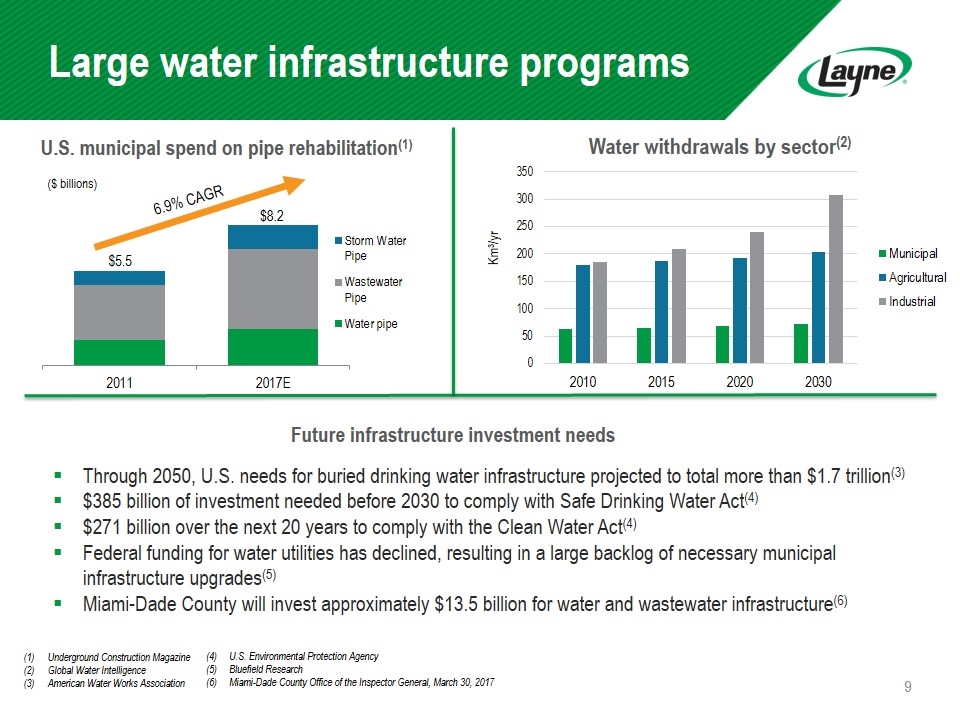

Large water infrastructure programs Future infrastructure investment needs Through 2050, U.S. needs for buried drinking water infrastructure projected to total more than $1.7 trillion(3) $385 billion of investment needed before 2030 to comply with Safe Drinking Water Act(4) $271 billion over the next 20 years to comply with the Clean Water Act(4) Federal funding for water utilities has declined, resulting in a large backlog of necessary municipal infrastructure upgrades(5) Miami-Dade County will invest approximately $13.5 billion for water and wastewater infrastructure(6) Underground Construction Magazine Global Water Intelligence American Water Works Association U.S. municipal spend on pipe rehabilitation(1) ($ billions) (4) U.S. Environmental Protection Agency (5) Bluefield Research (6) Miami-Dade County Office of the Inspector General, March 30, 2017

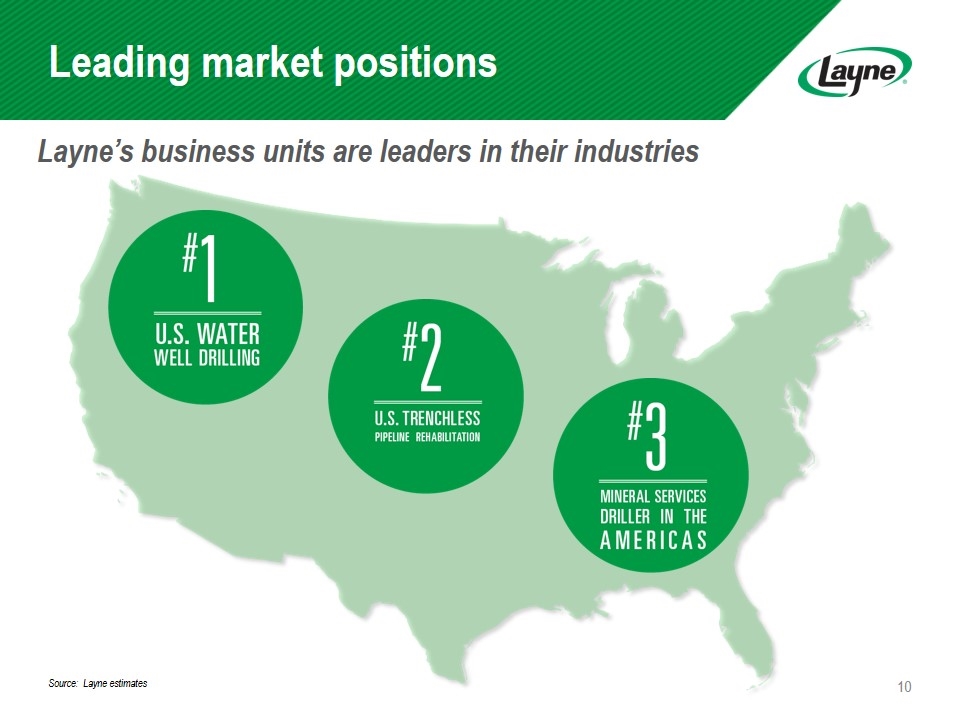

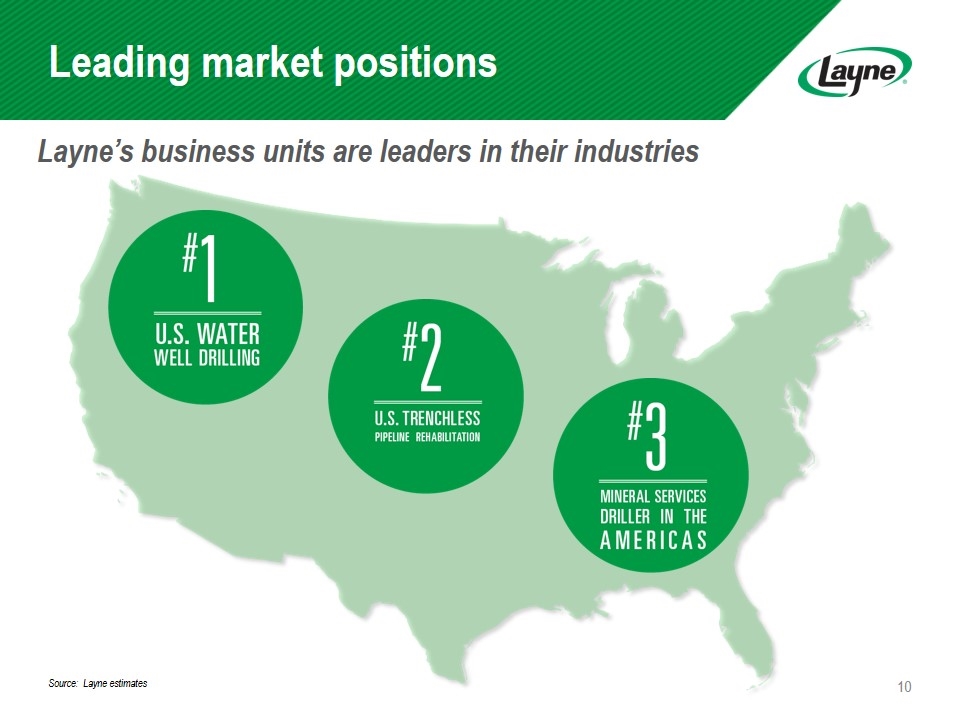

Layne’s business units are leaders in their industries Leading market positions Source: Layne estimates

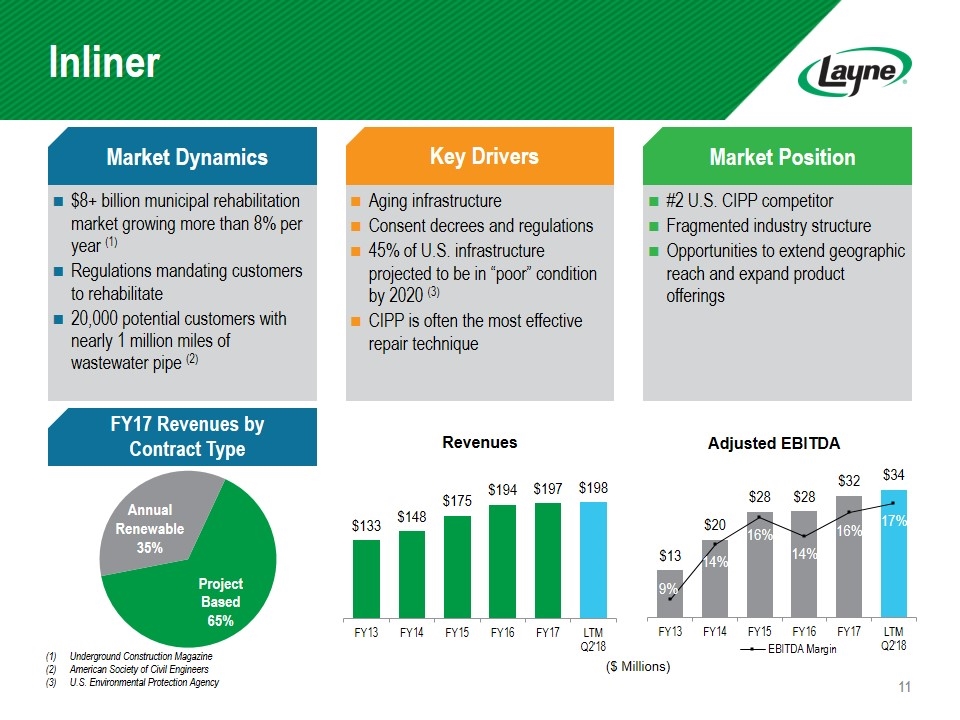

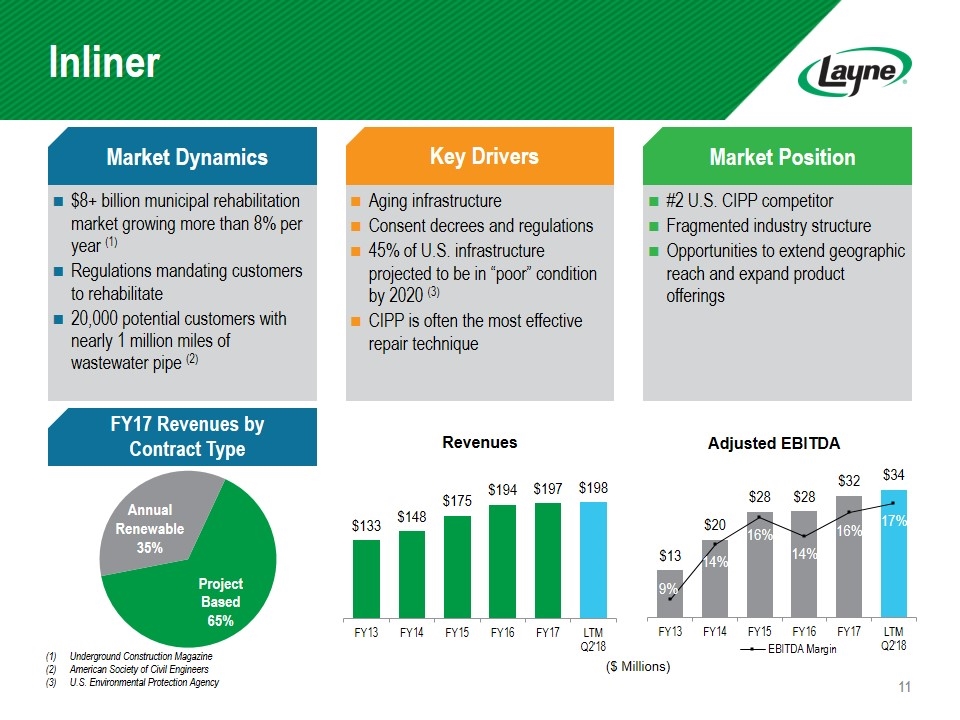

Inliner Market Dynamics $8+ billion municipal rehabilitation market growing more than 8% per year (1) Regulations mandating customers to rehabilitate 20,000 potential customers with nearly 1 million miles of wastewater pipe (2) Market Position Key Drivers #2 U.S. CIPP competitor Fragmented industry structure Opportunities to extend geographic reach and expand product offerings Aging infrastructure Consent decrees and regulations 45% of U.S. infrastructure projected to be in “poor” condition by 2020 (3) CIPP is often the most effective repair technique ($ Millions) Underground Construction Magazine American Society of Civil Engineers U.S. Environmental Protection Agency Revenues FY17 Revenues by Contract Type

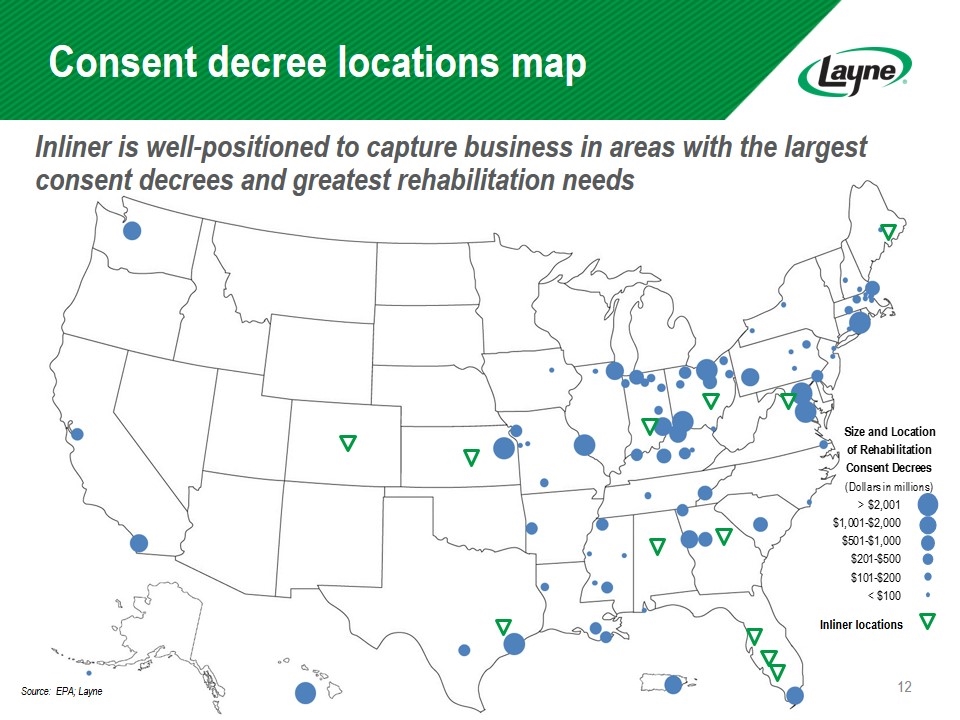

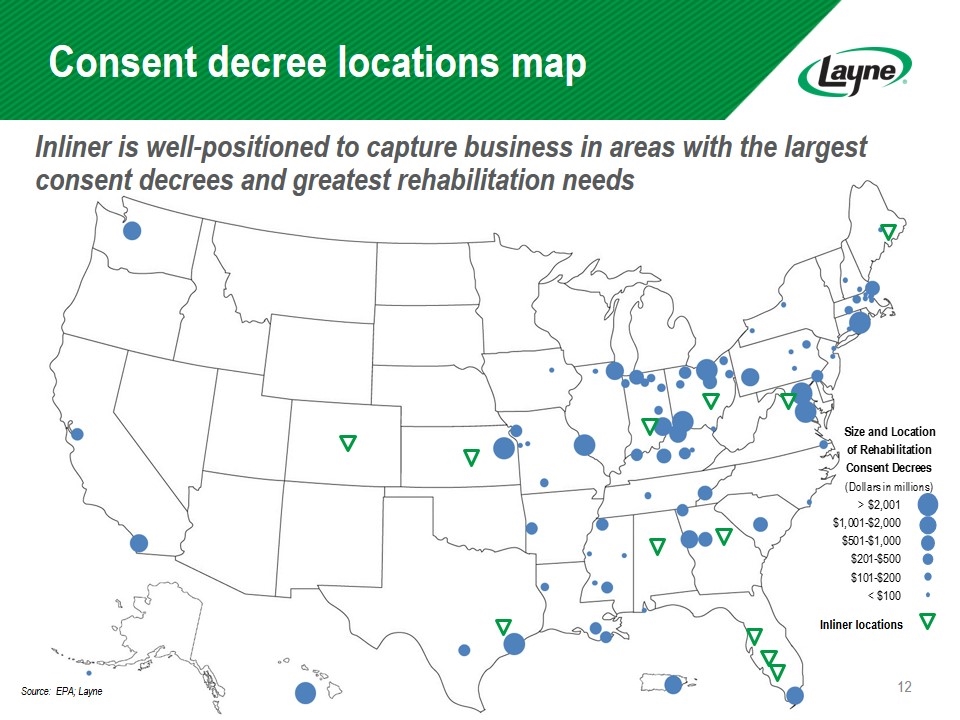

Consent decree locations map Inliner is well-positioned to capture business in areas with the largest consent decrees and greatest rehabilitation needs Source: EPA; Layne Inliner locations

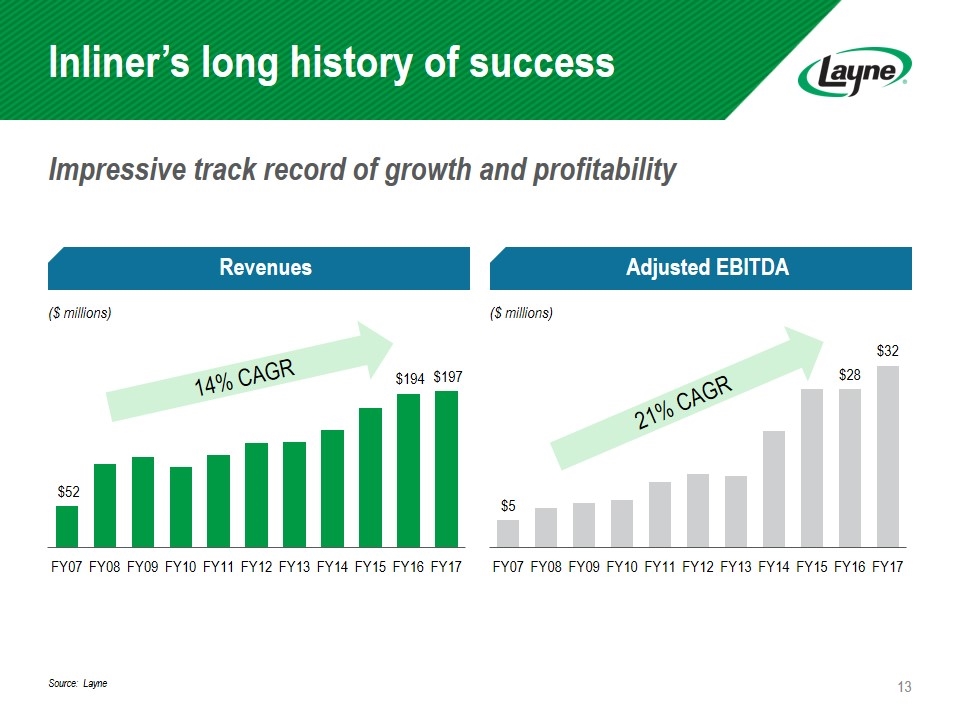

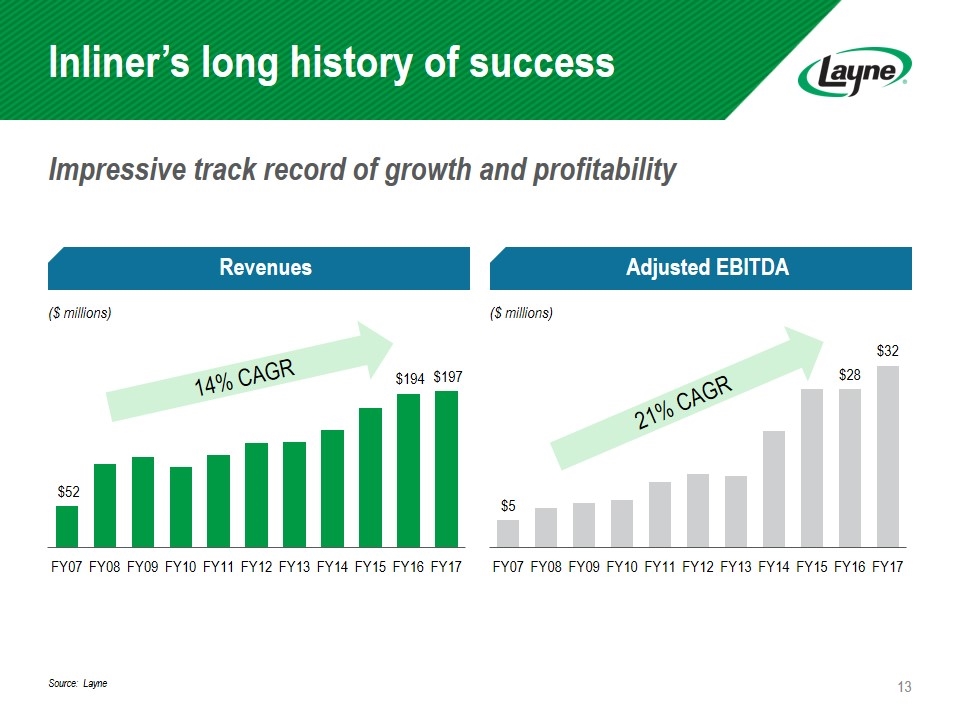

Impressive track record of growth and profitability Inliner’s long history of success ($ millions) ($ millions) Revenues Adjusted EBITDA 14% CAGR 21% CAGR Source: Layne

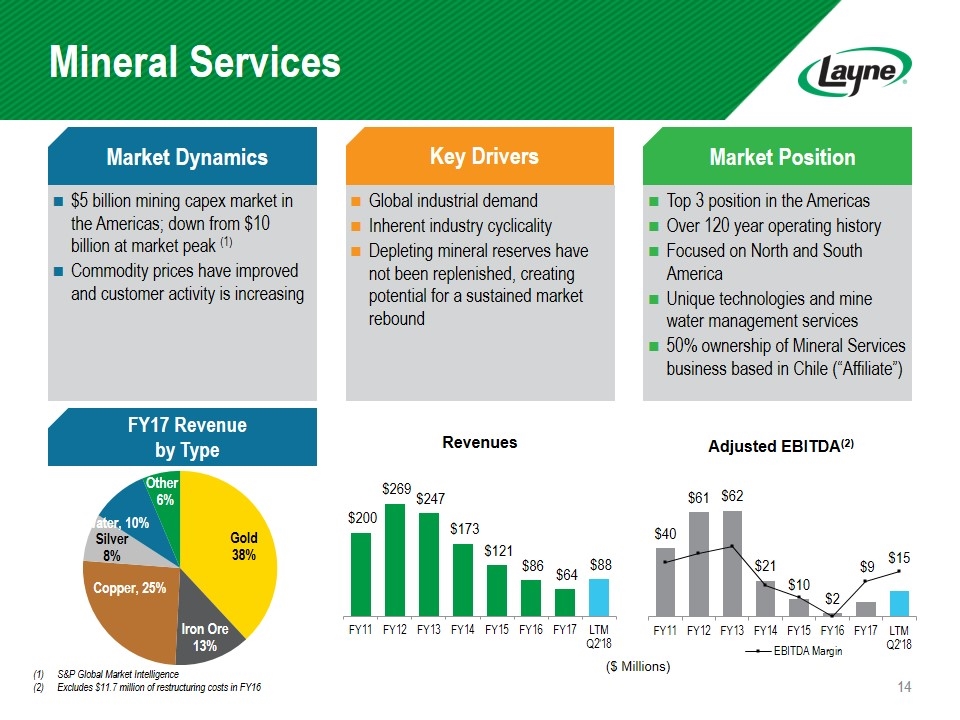

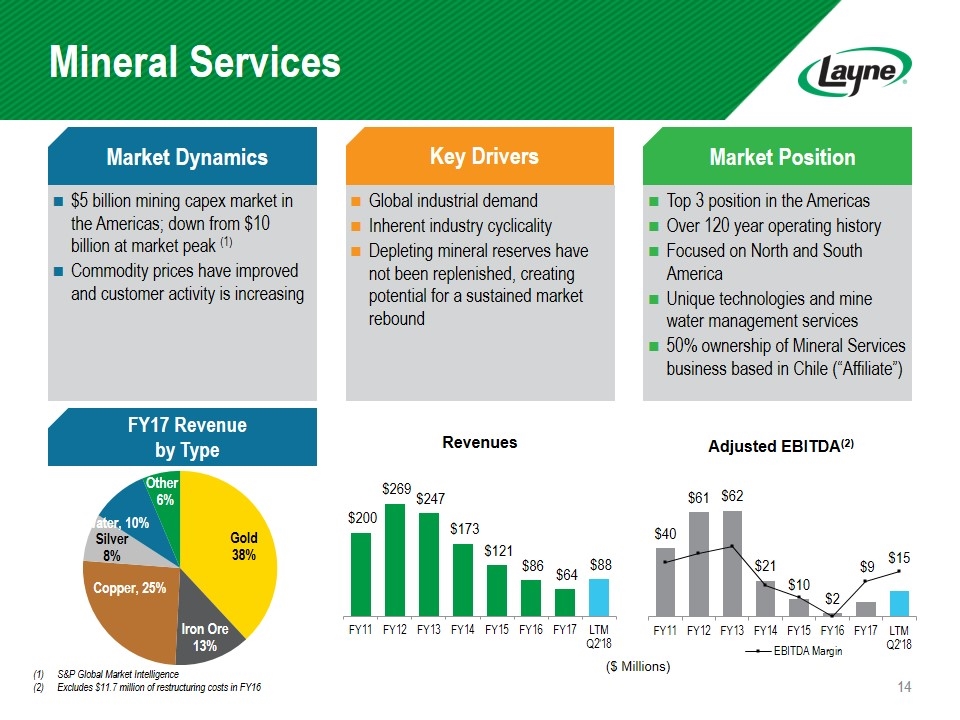

Mineral Services S&P Global Market Intelligence Excludes $11.7 million of restructuring costs in FY16 Market Dynamics $5 billion mining capex market in the Americas; down from $10 billion at market peak (1) Commodity prices have improved and customer activity is increasing Market Position Key Drivers Top 3 position in the Americas Over 120 year operating history Focused on North and South America Unique technologies and mine water management services 50% ownership of Mineral Services business based in Chile (“Affiliate”) Global industrial demand Inherent industry cyclicality Depleting mineral reserves have not been replenished, creating potential for a sustained market rebound FY17 Revenue by Type Revenues ($ Millions)

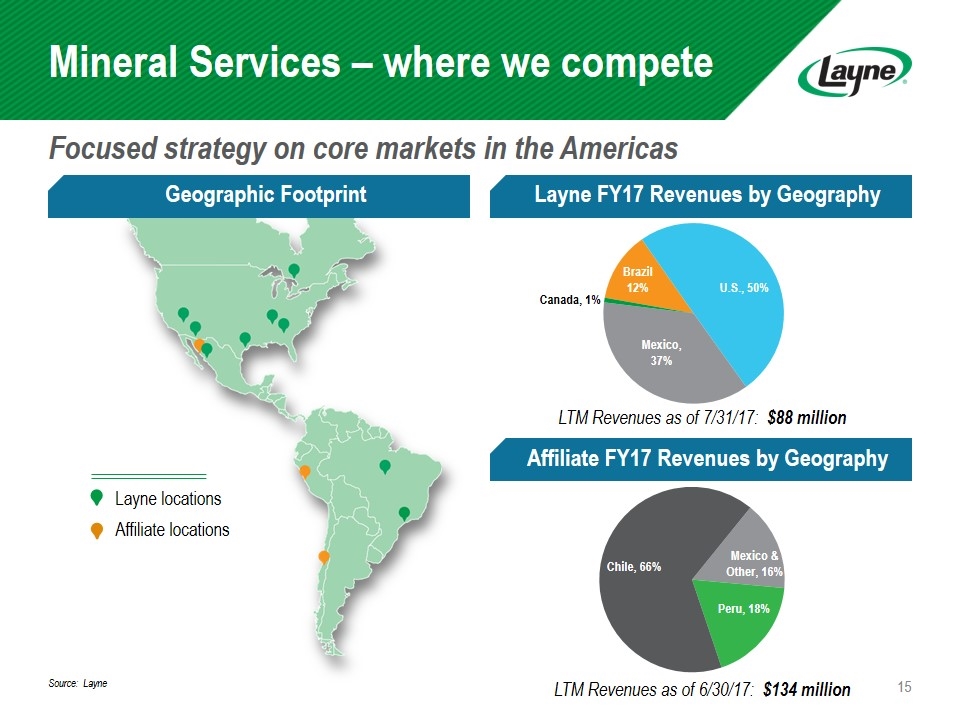

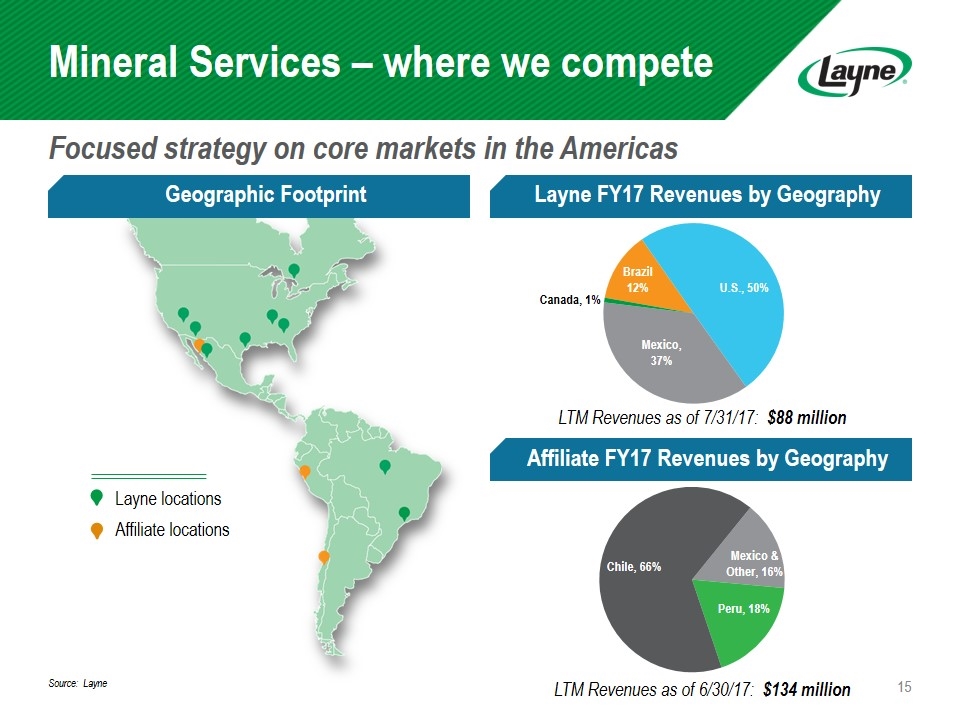

Layne locations Affiliate locations Focused strategy on core markets in the Americas Layne FY17 Revenues by Geography Affiliate FY17 Revenues by Geography Source: Layne Geographic Footprint Mineral Services – where we compete LTM Revenues as of 7/31/17: $88 million LTM Revenues as of 6/30/17: $134 million

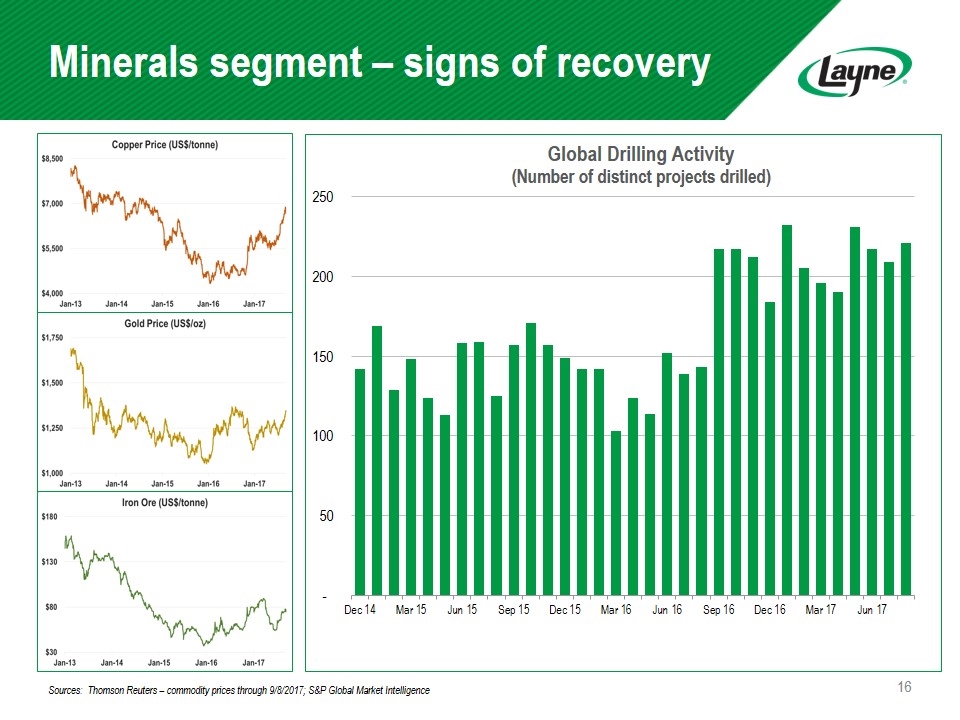

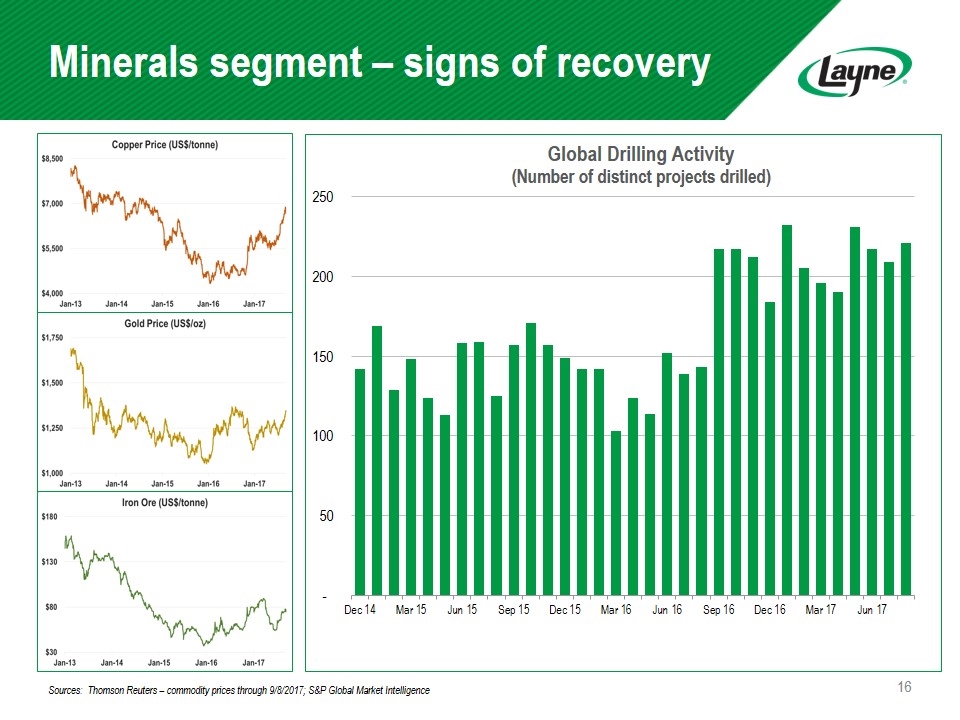

Minerals segment – signs of recovery Sources: Thomson Reuters – commodity prices through 9/8/2017; S&P Global Market Intelligence

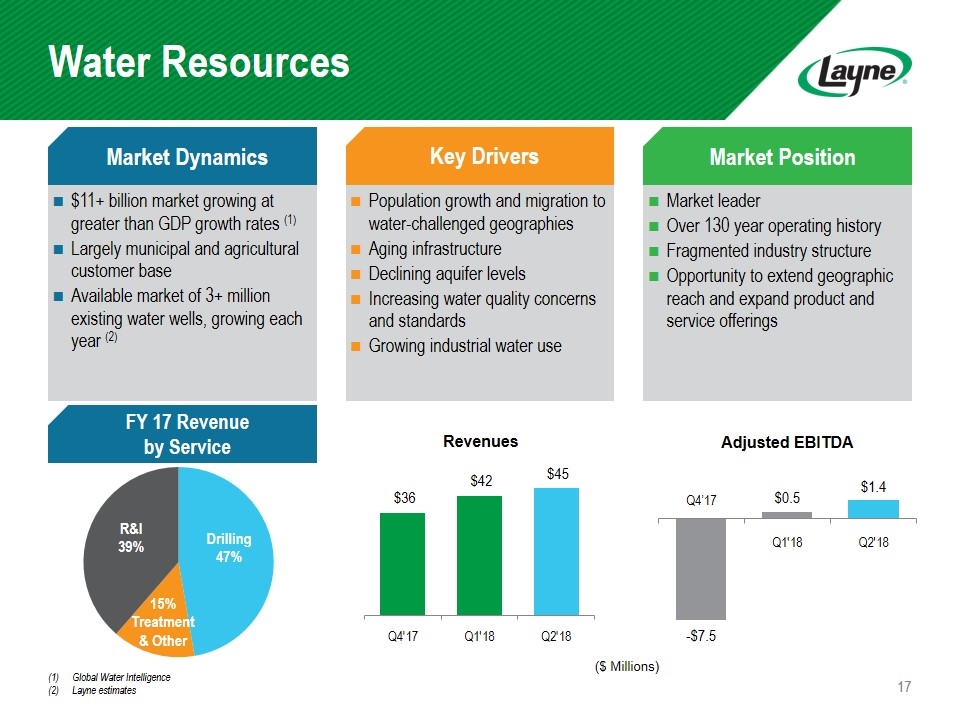

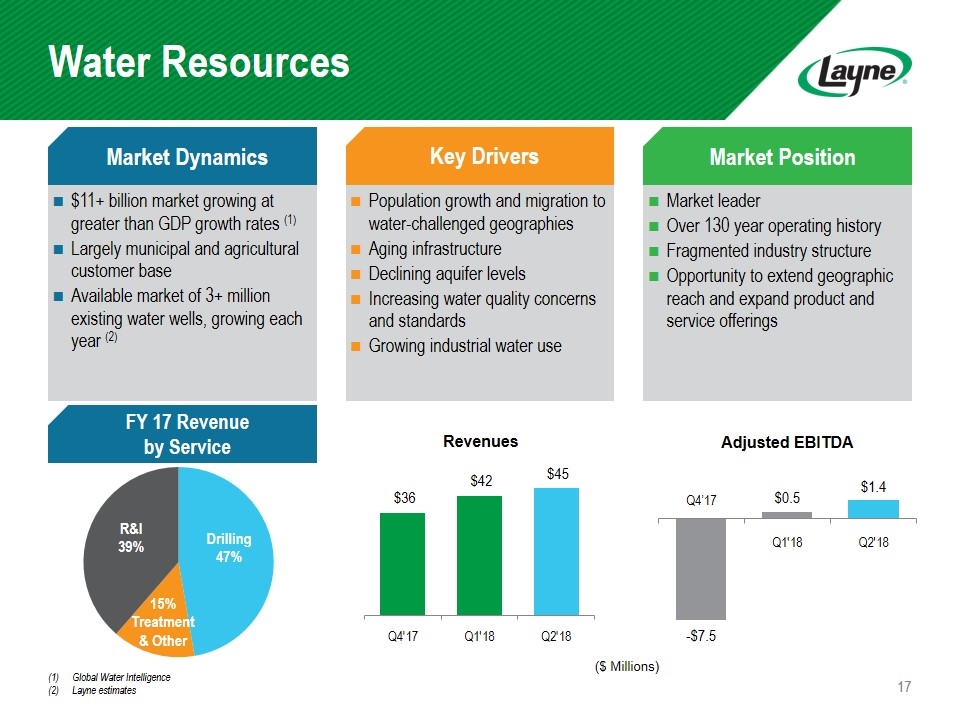

Water Resources Market Dynamics $11+ billion market growing at greater than GDP growth rates (1) Largely municipal and agricultural customer base Available market of 3+ million existing water wells, growing each year (2) Market Position Key Drivers Market leader Over 130 year operating history Fragmented industry structure Opportunity to extend geographic reach and expand product and service offerings Population growth and migration to water-challenged geographies Aging infrastructure Declining aquifer levels Increasing water quality concerns and standards Growing industrial water use Global Water Intelligence Layne estimates Revenues FY 17 Revenue by Service ($ Millions) Q4’17

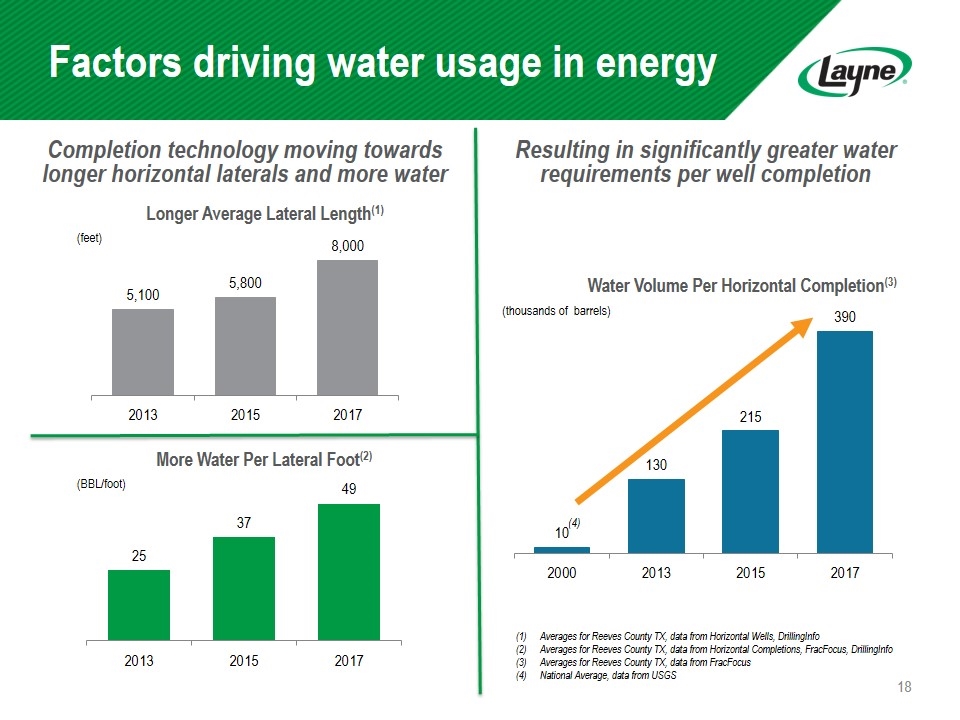

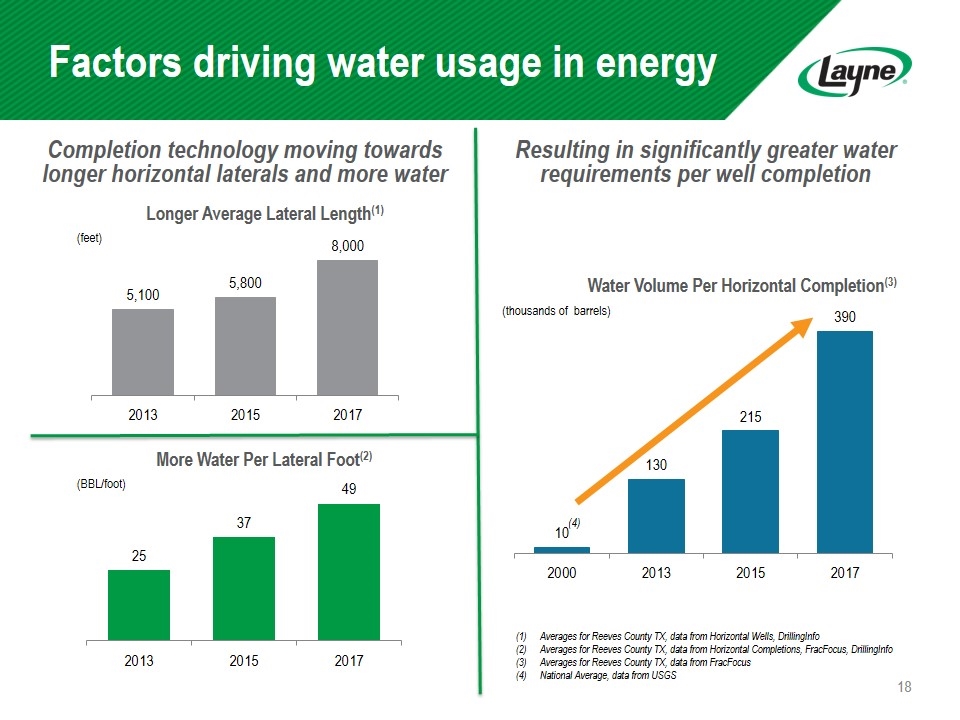

Factors driving water usage in energy Averages for Reeves County TX, data from Horizontal Wells, DrillingInfo Averages for Reeves County TX, data from Horizontal Completions, FracFocus, DrillingInfo Averages for Reeves County TX, data from FracFocus National Average, data from USGS (BBL/foot) Completion technology moving towards longer horizontal laterals and more water Resulting in significantly greater water requirements per well completion (feet) (thousands of barrels) (4)

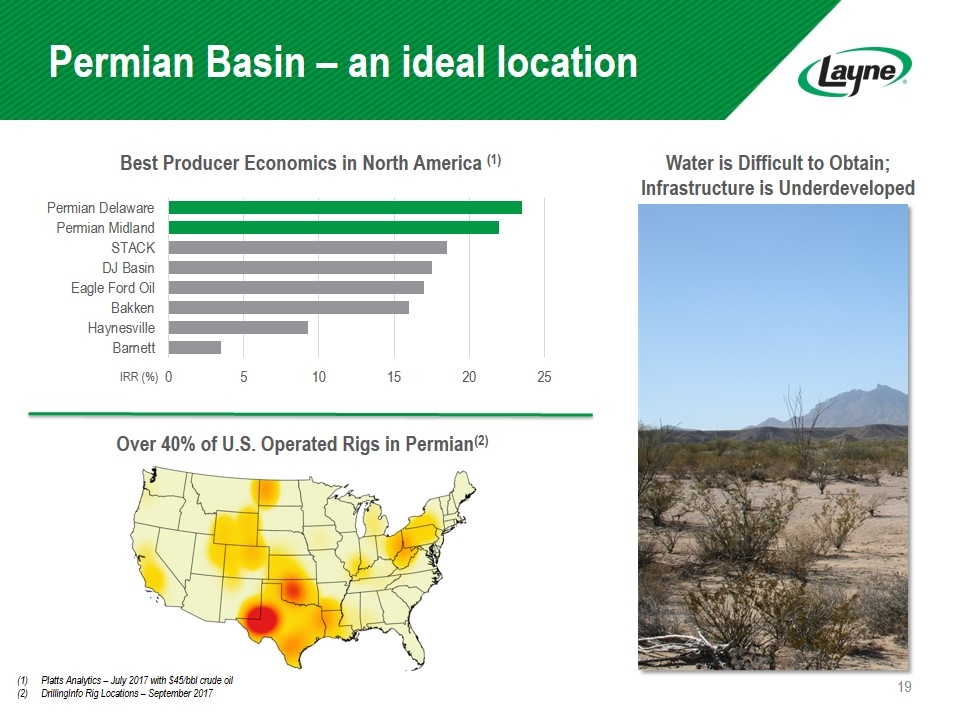

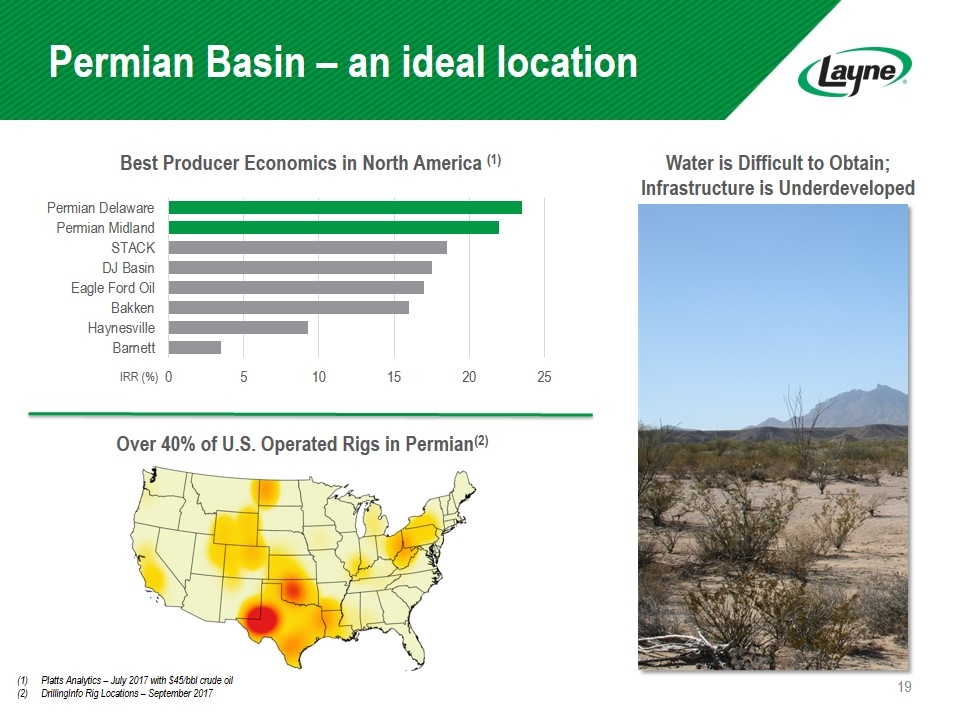

Permian Basin – an ideal location Best Producer Economics in North America (1) Over 40% of U.S. Operated Rigs in Permian(2) Water is Difficult to Obtain; Infrastructure is Underdeveloped Platts Analytics – July 2017 with $45/bbl crude oil DrillingInfo Rig Locations – September 2017 IRR (%)

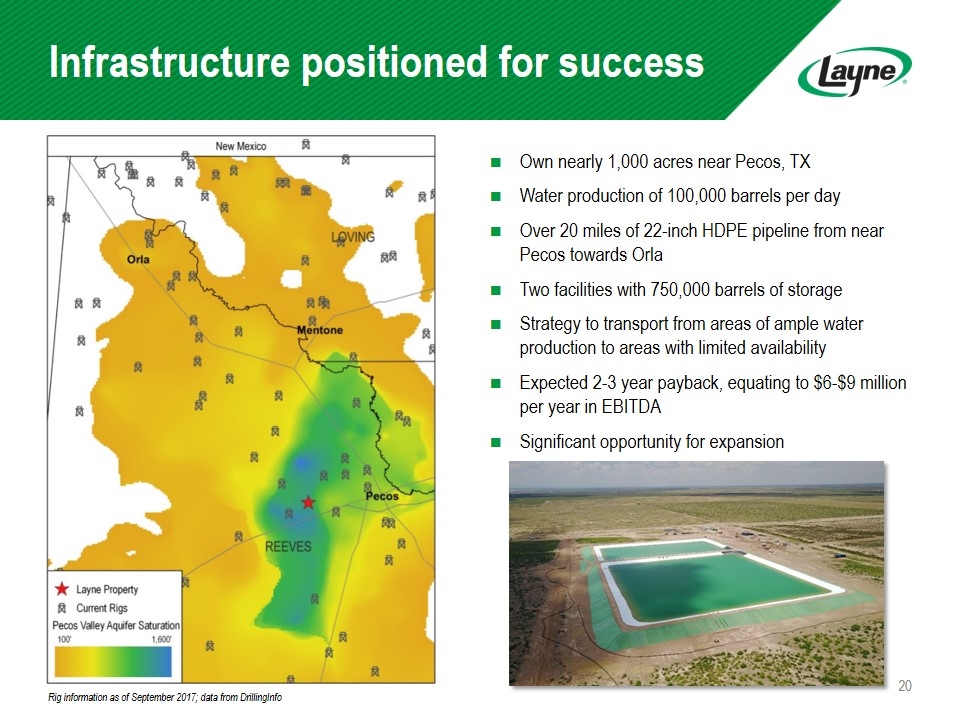

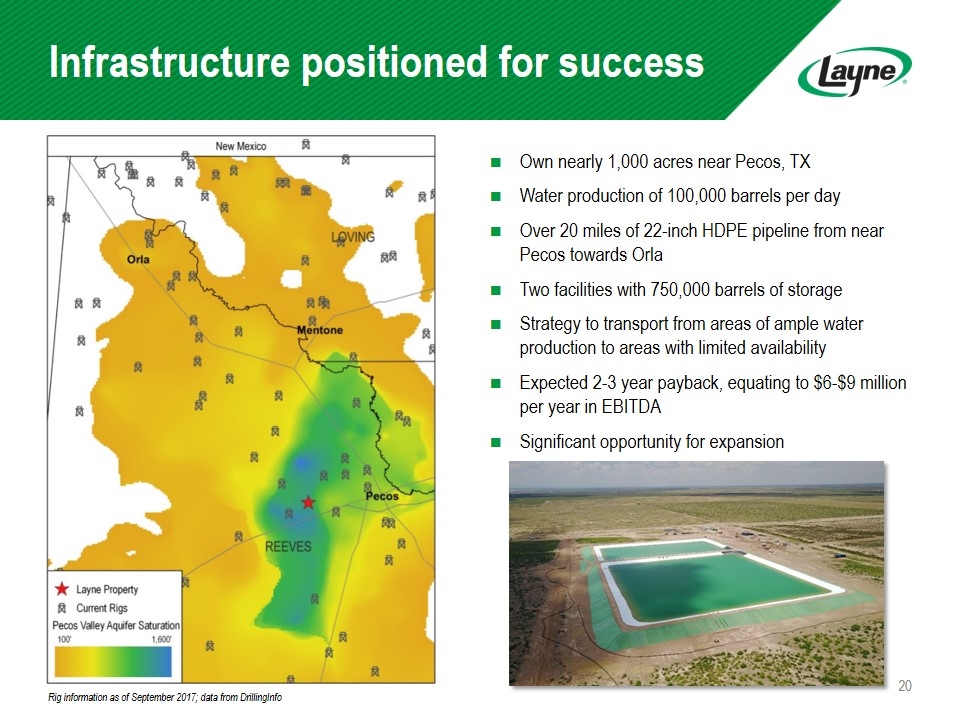

Infrastructure positioned for success Own nearly 1,000 acres near Pecos, TX Water production of 100,000 barrels per day Over 20 miles of 22-inch HDPE pipeline from near Pecos towards Orla Two facilities with 750,000 barrels of storage Strategy to transport from areas of ample water production to areas with limited availability Expected 2-3 year payback, equating to $6-$9 million per year in EBITDA Significant opportunity for expansion Rig information as of September 2017; data from DrillingInfo

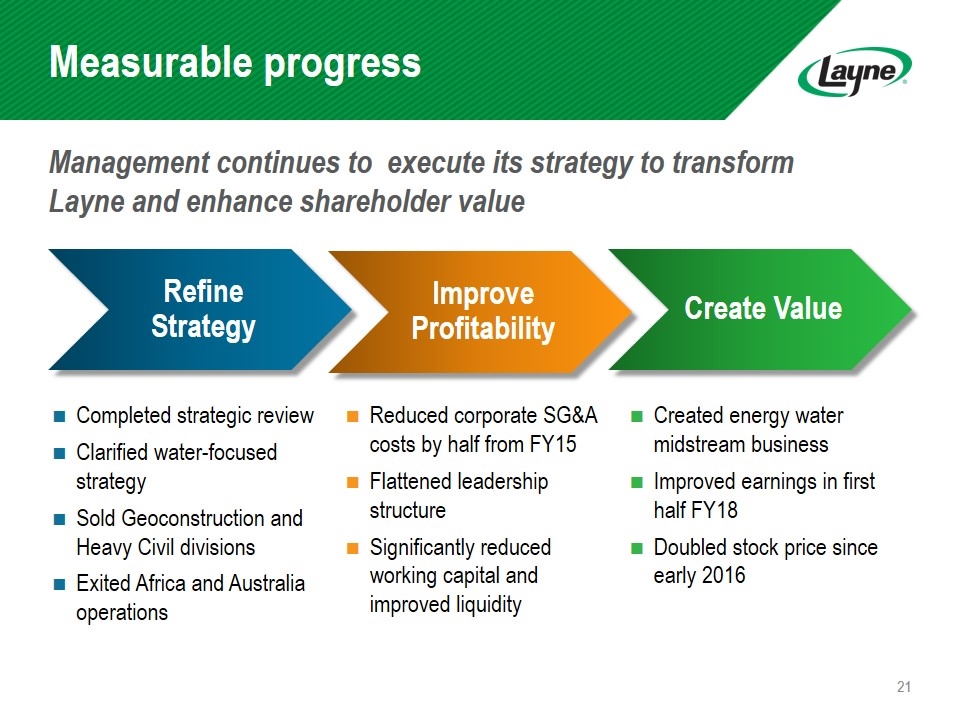

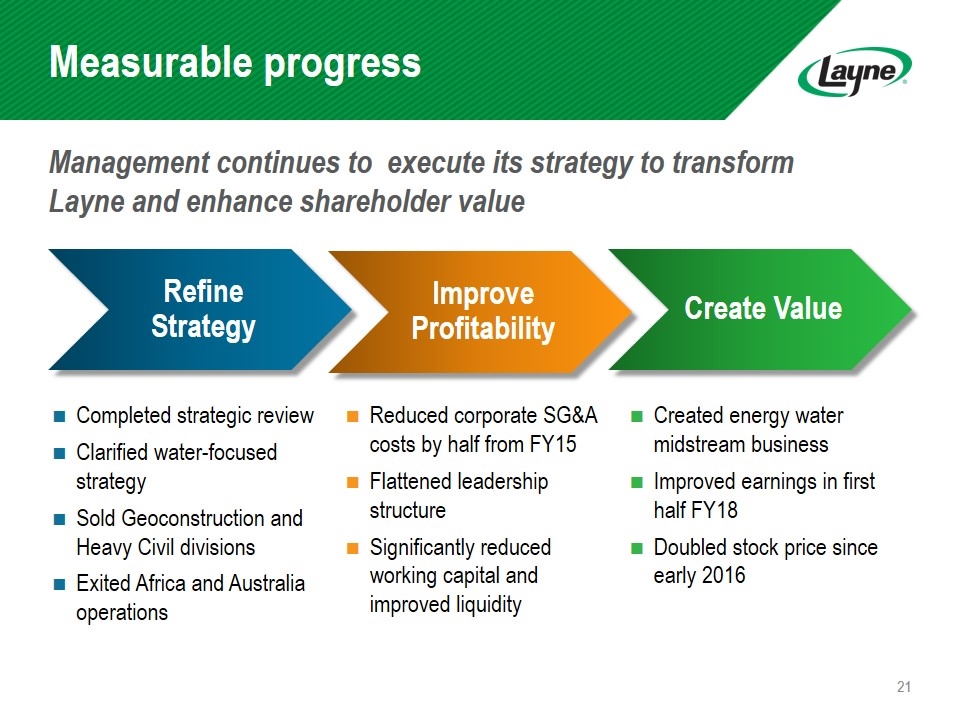

Management continues to execute its strategy to transform Layne and enhance shareholder value Measurable progress Refine Strategy Improve Profitability Create Value Completed strategic review Clarified water-focused strategy Sold Geoconstruction and Heavy Civil divisions Exited Africa and Australia operations Created energy water midstream business Improved earnings in first half FY18 Doubled stock price since early 2016 Reduced corporate SG&A costs by half from FY15 Flattened leadership structure Significantly reduced working capital and improved liquidity

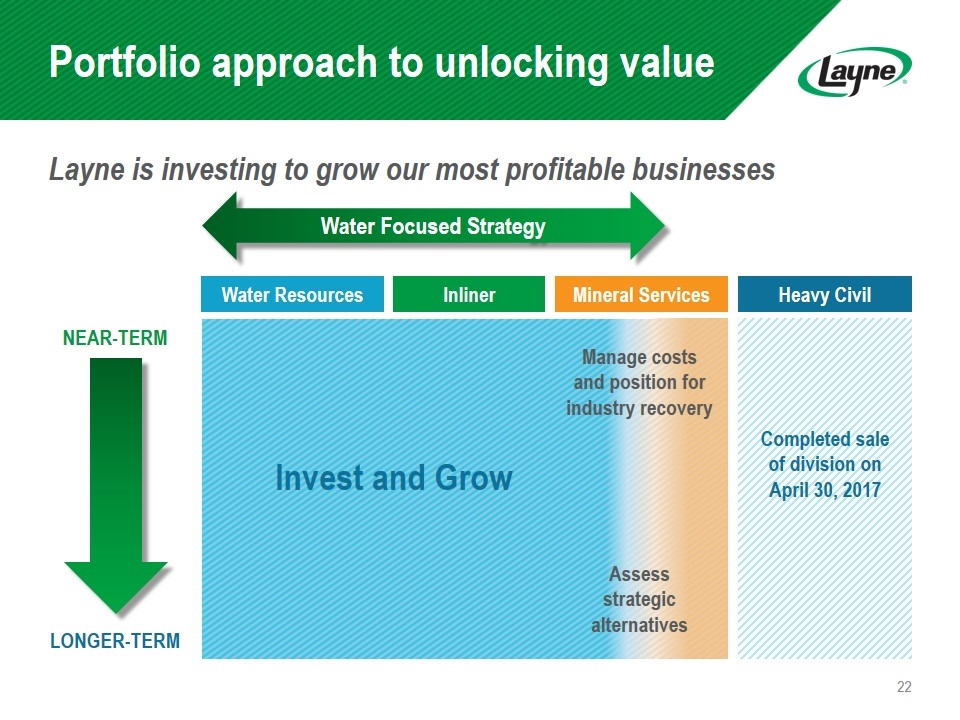

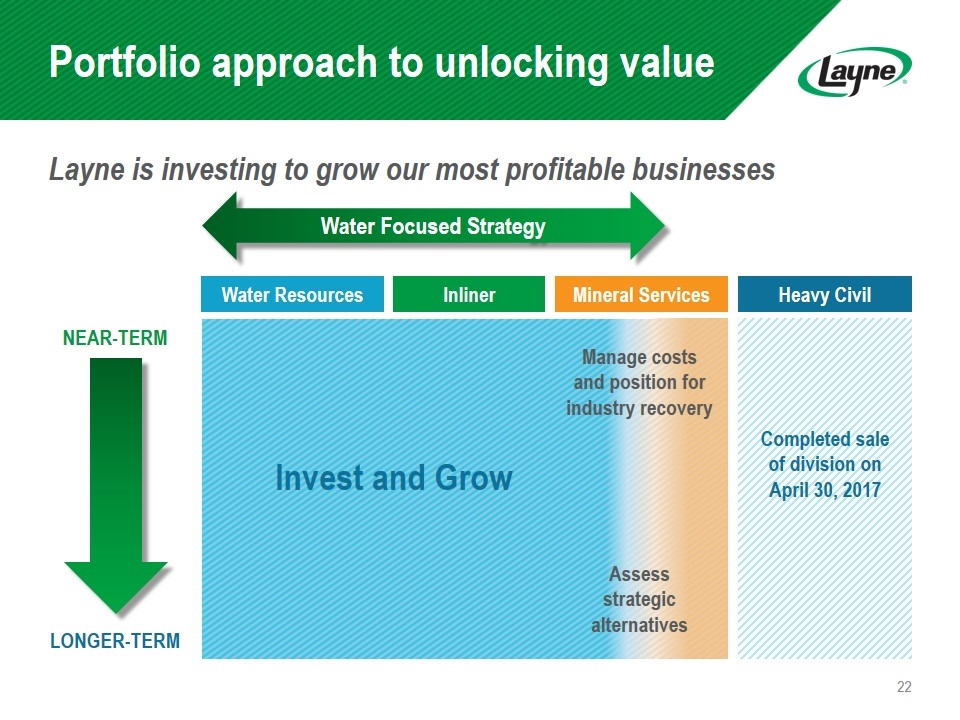

Portfolio approach to unlocking value Water Focused Strategy Water Resources Inliner Heavy Civil Mineral Services NEAR-TERM LONGER-TERM Assess strategic alternatives Manage costs and position for industry recovery Invest and Grow Layne is investing to grow our most profitable businesses Completed sale of division on April 30, 2017

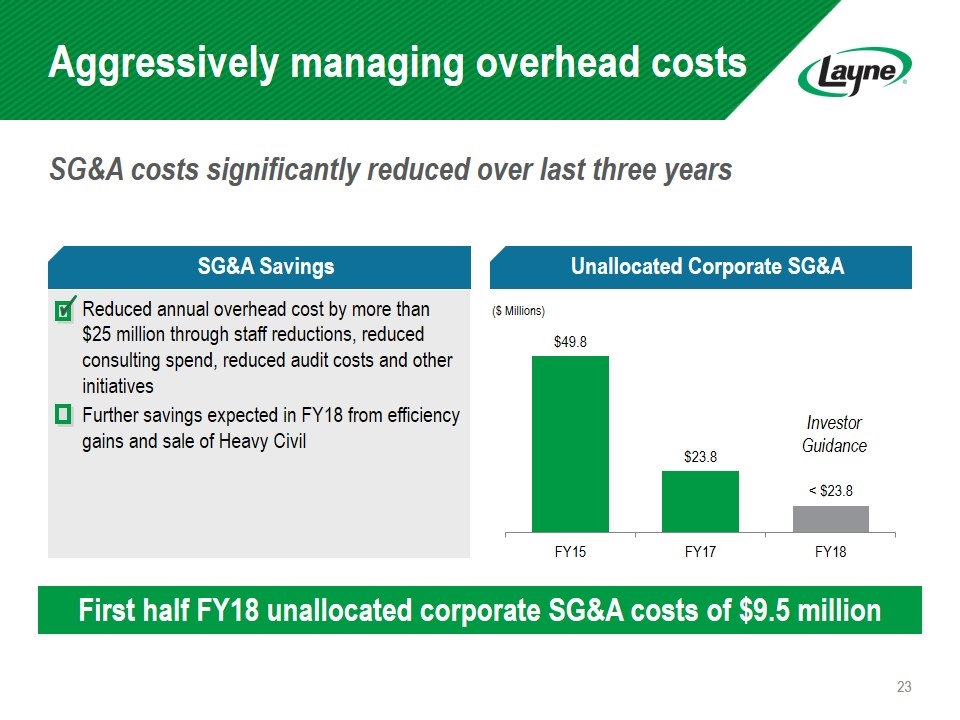

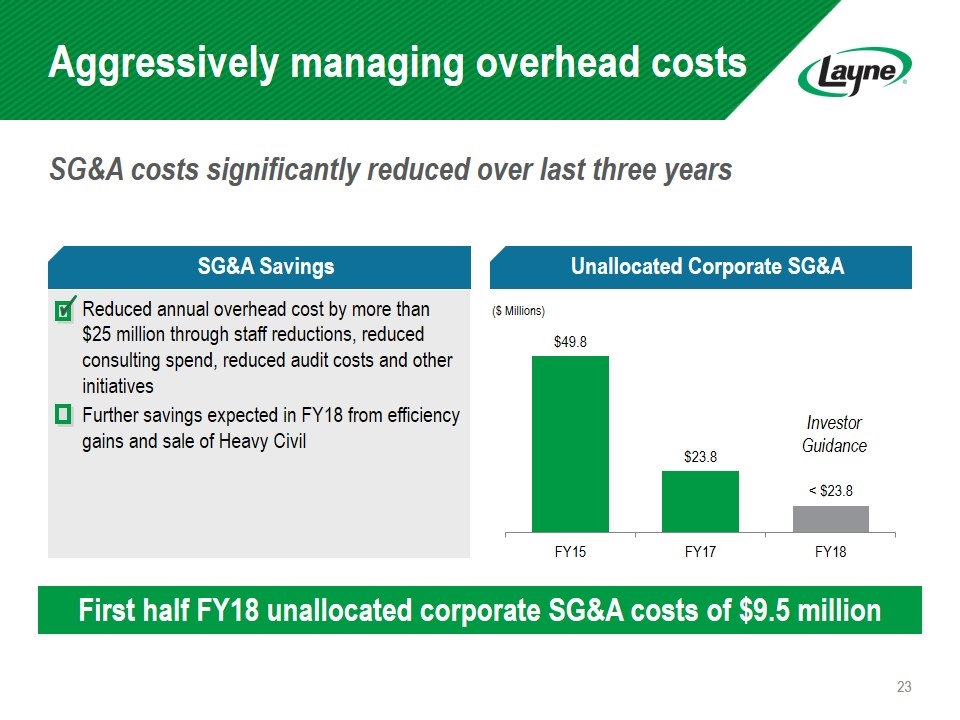

Aggressively managing overhead costs SG&A costs significantly reduced over last three years Reduced annual overhead cost by more than $25 million through staff reductions, reduced consulting spend, reduced audit costs and other initiatives Further savings expected in FY18 from efficiency gains and sale of Heavy Civil SG&A Savings Unallocated Corporate SG&A ($ Millions) Investor Guidance First half FY18 unallocated corporate SG&A costs of $9.5 million

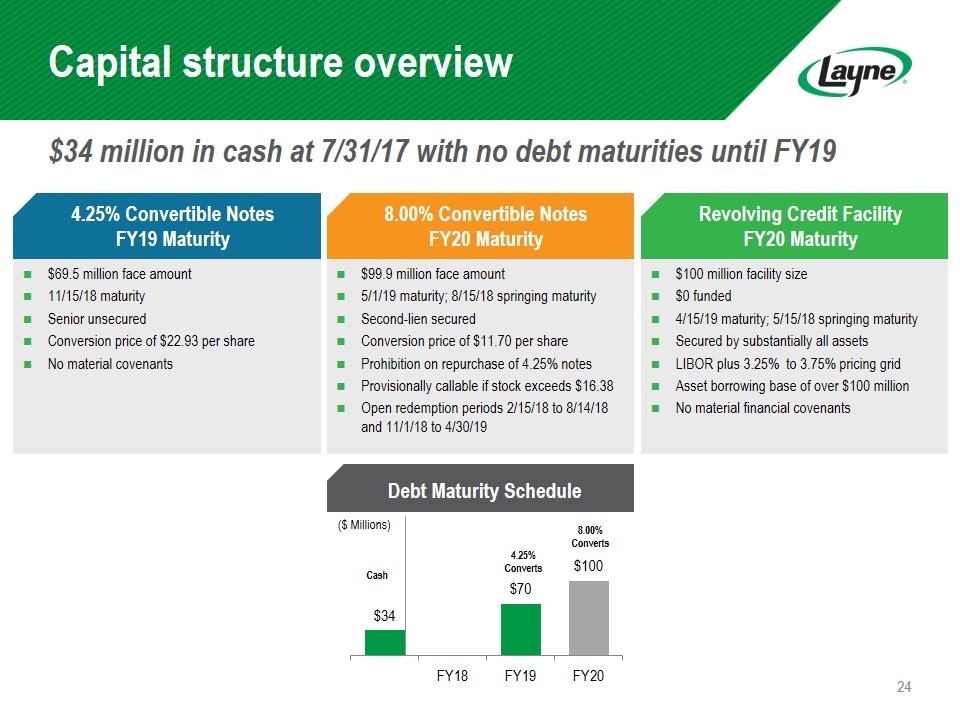

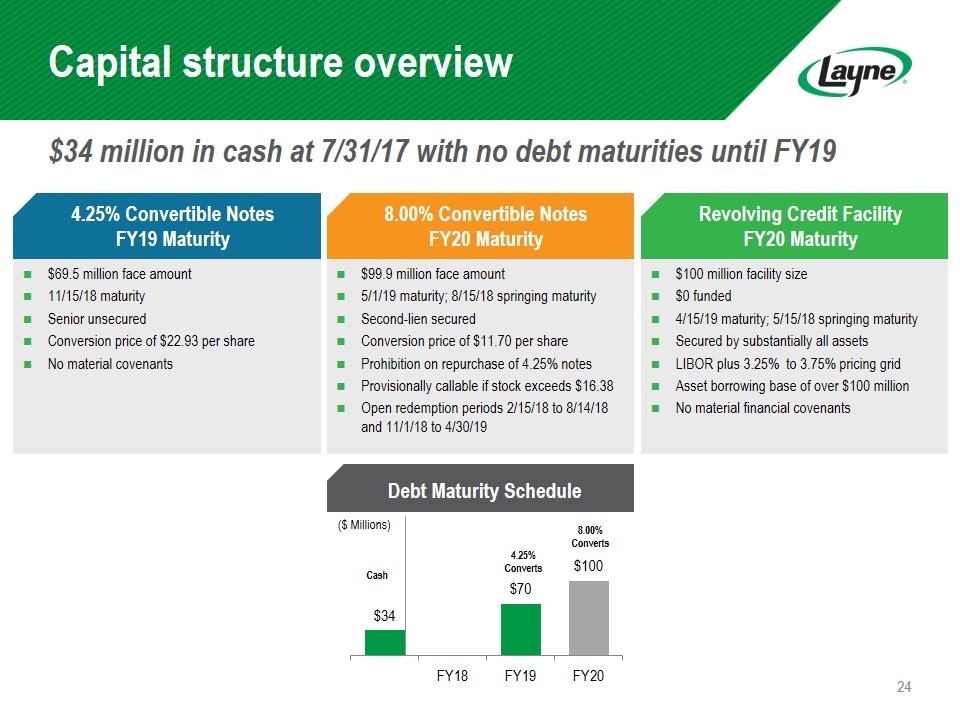

Capital structure overview $34 million in cash at 7/31/17 with no debt maturities until FY19 4.25% Convertible Notes FY19 Maturity 8.00% Convertible Notes FY20 Maturity Revolving Credit Facility FY20 Maturity $100 million facility size $0 funded 4/15/19 maturity; 5/15/18 springing maturity Secured by substantially all assets LIBOR plus 3.25% to 3.75% pricing grid Asset borrowing base of over $100 million No material financial covenants $99.9 million face amount 5/1/19 maturity; 8/15/18 springing maturity Second-lien secured Conversion price of $11.70 per share Prohibition on repurchase of 4.25% notes Provisionally callable if stock exceeds $16.38 Open redemption periods 2/15/18 to 8/14/18 and 11/1/18 to 4/30/19 $69.5 million face amount 11/15/18 maturity Senior unsecured Conversion price of $22.93 per share No material covenants Debt Maturity Schedule ($ Millions) Cash 4.25% Converts 8.00% Converts

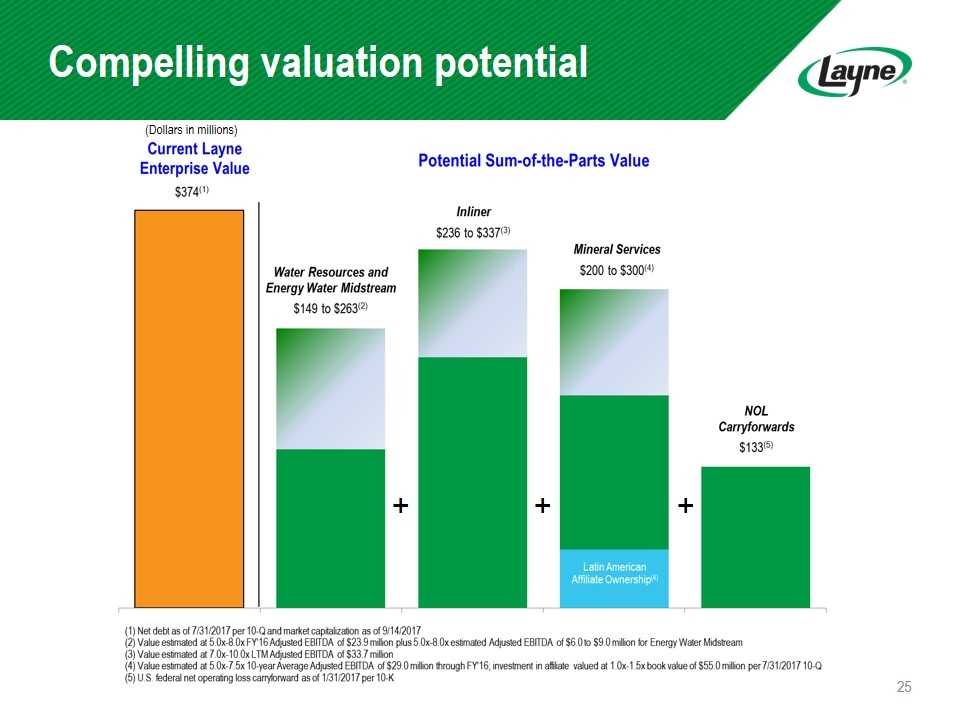

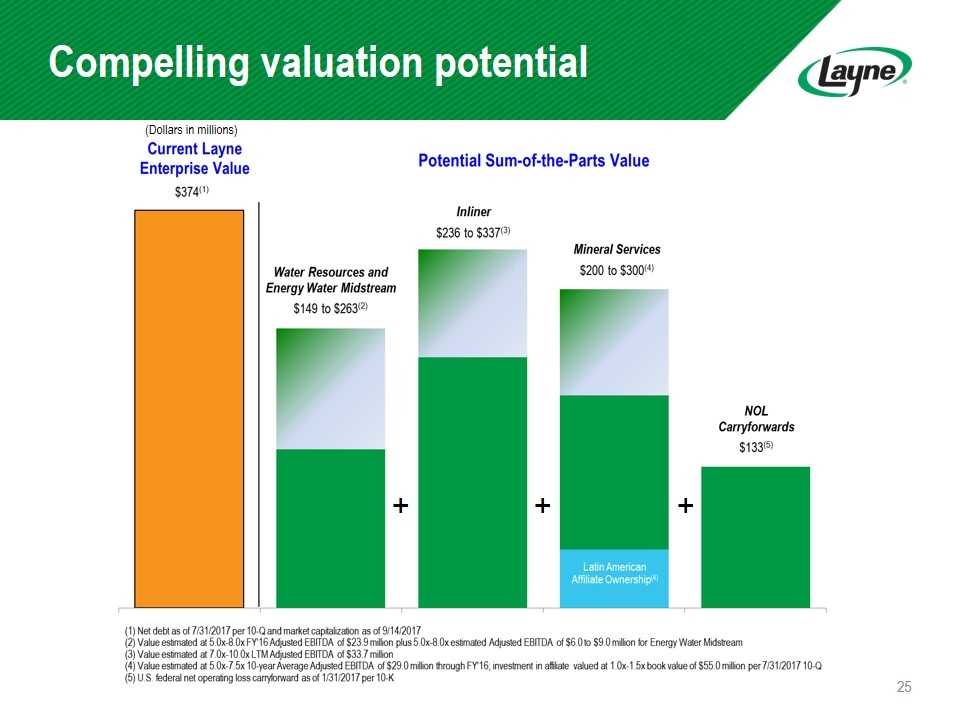

Compelling valuation potential + + + (Dollars in millions)

Investment highlights Why now 1 2 3 5 What we do Unlocking value Who we are 4 Why water Track record of leadership and innovation in water sector since 1882 Business units with leading positions in attractive growth markets Management team intensely focused on profitability and creating shareholder value Positive long-term market dynamics for water align with Layne core competencies Earnings momentum and significant opportunity for stock price appreciation

Total Adjusted EBITDA Use of Non- GAAP Financial Information Layne’s measure of Total Adjusted EBITDA, which may not be comparable to other companies’ measure of Total Adjusted EBITDA, represents net loss before discontinued operations, taxes, interest, depreciation and amortization, gain or loss on sale of fixed assets, non-cash equity-based compensation, equity in earnings or losses from affiliates, certain non-recurring items such as restructuring costs, and certain other gains or losses, plus dividends received from affiliates. Total Adjusted EBITDA is included as a complement to results provided in accordance with generally accepted accounting principles (GAAP) because management believes this non-GAAP financial measure helps in understanding and evaluating Layne’s operating performance and trends and may be useful to investors. Layne management evaluates segment performance based on the segment’s revenues and Adjusted EBITDA, among other factors. In addition, we use Total Adjusted EBITDA as a factor in incentive compensation decisions and our credit facility agreement uses measures similar to Total Adjusted EBITDA to measure compliance with certain covenants.

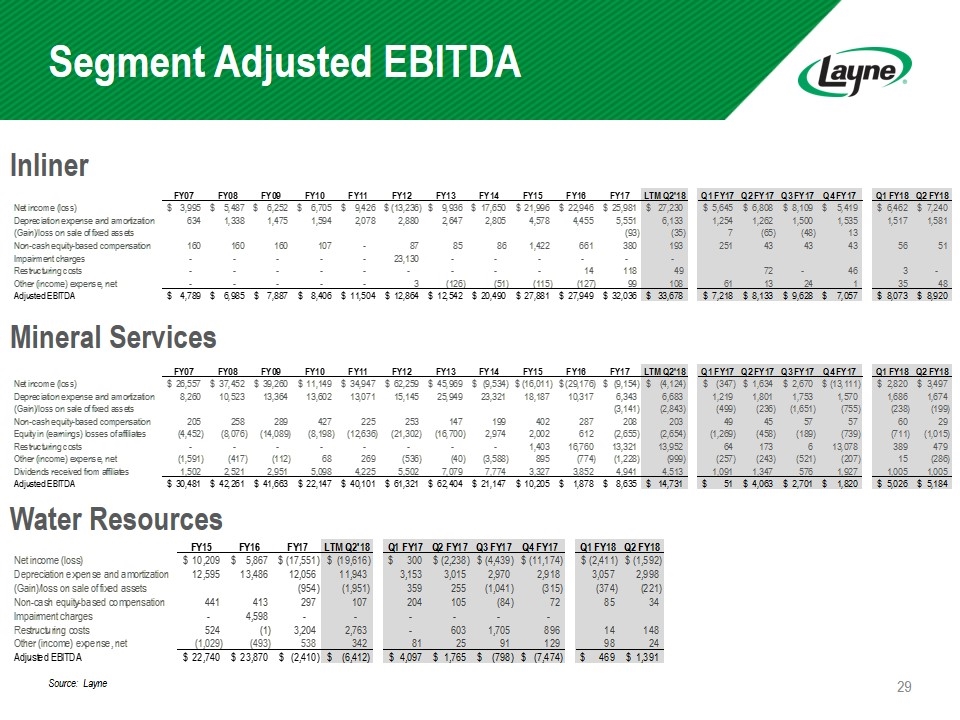

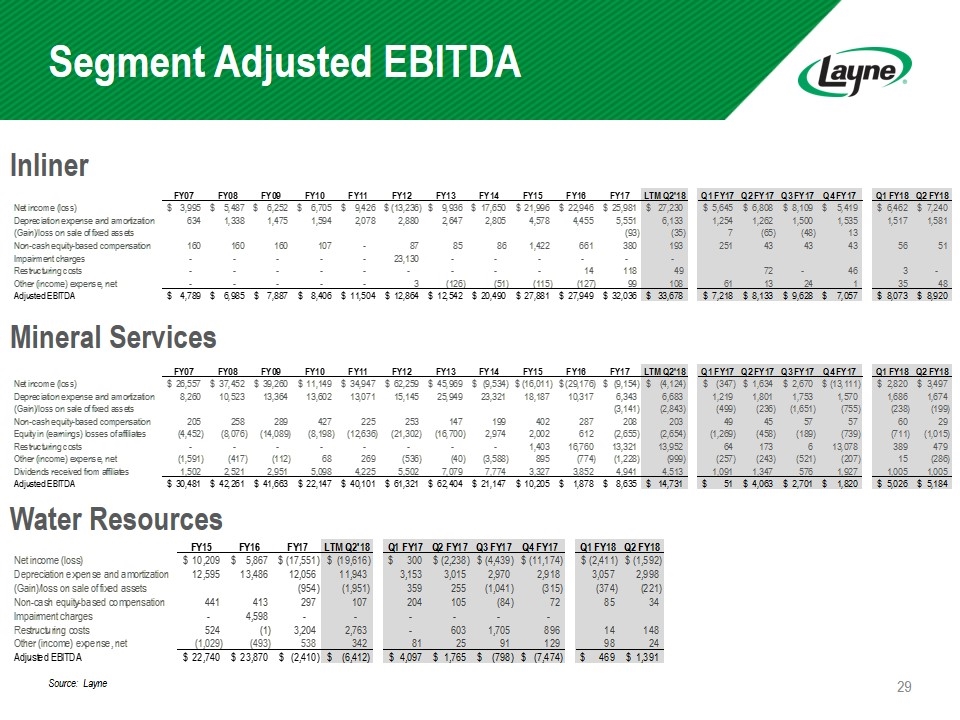

Segment Adjusted EBITDA Inliner Source: Layne Mineral Services Water Resources