JUNE 30, 2012 Semiannual Report to Shareholders |

| |

| DWS S&P 500 Index Fund |

|

Contents

DWS S&P 500 Index Fund 9 Statement of Assets and Liabilities 10 Statement of Operations 11 Statement of Changes in Net Assets 16 Notes to Financial Statements 23 Information About Your Fund's Expenses DWS Equity 500 Index Portfolio 42 Statement of Assets and Liabilities 43 Statement of Operations 44 Statement of Changes in Net Assets 46 Notes to Financial Statements 52 Summary of Management Fee Evaluation by Independent Fee Consultant 56 Account Management Resources |

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Various factors, including costs, cash flows and security selection, may cause the fund's performance to differ from that of the index. The fund may lend securities to approved institutions. Stocks may decline in value. See the prospectus for details.

This fund is not sponsored, endorsed, sold, nor promoted by Standard & Poor's®, and Standard & Poor's makes no representation regarding the advisability of investing in the portfolio.

DWS Investments is part of Deutsche Bank's Asset Management division and, within the U.S., represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary June 30, 2012 Average Annual Total Returns as of 6/30/12 |

| Unadjusted for Sales Charge | 6-Month‡ | 1-Year | 3-Year | 5-Year | 10-Year |

| Class A | 9.16% | 4.84% | 15.73% | -0.36% | 4.70% |

| Class B | 8.78% | 4.13% | 14.91% | -1.10% | 3.92% |

| Class C | 8.78% | 4.04% | 14.88% | -1.10% | 3.93% |

S&P 500® Index+ | 9.49% | 5.45% | 16.40% | 0.22% | 5.33% |

| Adjusted for the Maximum Sales Charge | | | | | |

Class A (max 4.50% load) | 4.25% | 0.12% | 13.97% | -1.28% | 4.22% |

Class B (max 4.00% CDSC) | 4.78% | 1.13% | 14.40% | -1.30% | 3.92% |

Class C (max 1.00% CDSC) | 7.78% | 4.04% | 14.88% | -1.10% | 3.93% |

S&P 500® Index+ | 9.49% | 5.45% | 16.40% | 0.22% | 5.33% |

| No Sales Charges | | | | | |

| Class S | 9.36% | 5.13% | 16.07% | -0.09% | 4.97% |

S&P 500® Index+ | 9.49% | 5.45% | 16.40% | 0.22% | 5.33% |

‡ Total returns shown for periods less than one year are not annualized.

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit www.dws-investments.com for the Fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2012 are 0.71%, 1.40%, 1.40% and 0.39% for Class A, Class B, Class C and Class S shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Returns shown for Class A, B and C shares prior to their inception on February 18, 2005 are derived from the historical performance of Class S shares of DWS S&P 500 Index Fund and have been adjusted to reflect the higher total annual operating expenses of each specific class. Any difference in expenses will affect performance.

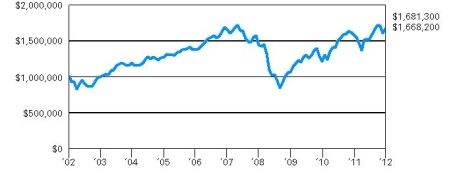

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge) |

|

|

| Yearly periods ended June 30 |

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 4.50%. This results in a net initial investment of $9,550.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

+ The Standard & Poor's 500 (S&P 500) Index is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. "Standard & Poor's," "S&P 500," "Standard & Poor's 500" and "500" are trademarks of The McGraw-Hill Companies Inc., and have been licensed for use by the Fund's investment advisor.

| Net Asset Value and Distribution Information | |

| | | Class A | | | Class B | | | Class C | | | Class S | |

Net Asset Value: 6/30/12 | | $ | 18.09 | | | $ | 18.07 | | | $ | 18.06 | | | $ | 18.13 | |

| 12/31/11 | | $ | 16.67 | | | $ | 16.65 | | | $ | 16.64 | | | $ | 16.70 | |

Distribution Information: Six Months as of 6/30/12: Income Dividends | | $ | .11 | | | $ | .04 | | | $ | .04 | | | $ | .13 | |

Morningstar Rankings — Large Blend Funds Category as of 6/30/12 |

| Period | Rank | | Number of Fund Classes Tracked | Percentile Ranking (%) |

Class A 1-Year | 320 | of | 1,731 | 19 |

| 3-Year | 403 | of | 1,539 | 26 |

| 5-Year | 566 | of | 1,346 | 42 |

Class B 1-Year | 467 | of | 1,731 | 27 |

| 3-Year | 625 | of | 1,539 | 41 |

| 5-Year | 822 | of | 1,346 | 61 |

Class C 1-Year | 491 | of | 1,731 | 29 |

| 3-Year | 634 | of | 1,539 | 41 |

| 5-Year | 820 | of | 1,346 | 61 |

Class S 1-Year | 245 | of | 1,731 | 14 |

| 3-Year | 290 | of | 1,539 | 19 |

| 5-Year | 453 | of | 1,346 | 34 |

| 10-Year | 327 | of | 838 | 39 |

Source: Morningstar, Inc. Rankings are historical and do not guarantee future results. Rankings are based on total return unadjusted for sales charges with distributions reinvested. If sales charges had been included, rankings might have been less favorable.

Subadvisor

Northern Trust Investments, Inc. ("NTI"), a subsidiary of Northern Trust Corporation, is the subadvisor for the fund.

Portfolio Manager

Brent Reeder, Senior Vice President of Northern Trust Investments, Inc.

Portfolio Manager of the fund. Joined the fund in 2007.

• Joined Northern Trust Investments, Inc. in 1993 and is responsible for the management of quantitative equity portfolios.

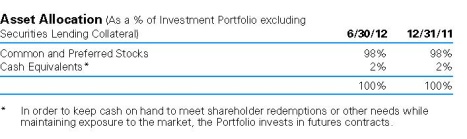

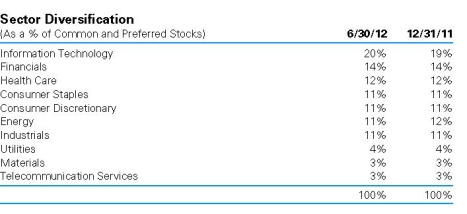

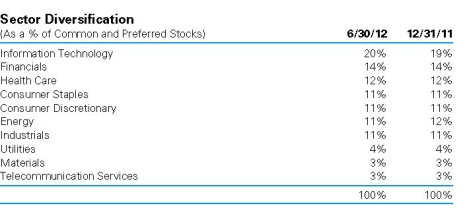

Portfolio Summary (Unaudited)

Ten Largest Equity Holdings at June 30, 2012 (20.5% of Net Assets) |

1. Apple, Inc. Manufacturer of personal computers and communication solutions | 4.3% |

2. Exxon Mobil Corp. Explorer and producer of oil and gas | 3.2% |

3. Microsoft Corp. Developer of computer software | 1.8% |

4. International Business Machines Corp. Manufacturer of computers and provider of information processing services | 1.8% |

5. General Electric Co. A diversified company provider of services to the technology, media and financial industries | 1.7% |

6. AT&T, Inc. An integrated telecommunications company | 1.7% |

7. Chevron Corp. Operator of petroleum exploration, delivery and refining facilities | 1.7% |

8. Johnson & Johnson Provider of health care products | 1.5% |

9. Wells Fargo & Co. A diversified financial company | 1.4% |

10. Coca-Cola Co. Bottler and distributor of soft drinks | 1.4% |

Portfolio holdings and characteristics are subject to change. For more complete details about the Portfolio's investment portfolio, see page 26. A quarterly Fact Sheet is available on www.dws-investments.com or upon request. Please see the Account Management Resources section on page 56 for contact information. |

Statement of Assets and Liabilities | as of June 30, 2012 (Unaudited) | |

| Assets | |

| Investment in the DWS Equity 500 Index Portfolio, at value | | $ | 721,901,546 | |

| Receivable for Fund shares sold | | | 964,806 | |

| Other assets | | | 41,720 | |

| Total assets | | | 722,908,072 | |

| Liabilities | |

| Cash overdraft | | | 2,540 | |

| Payable for Fund shares redeemed | | | 2,271,469 | |

| Accrued Trustees' fees | | | 1,552 | |

| Other accrued expenses and payables | | | 524,504 | |

| Total liabilities | | | 2,800,065 | |

| Net assets, at value | | $ | 720,108,007 | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 1,170,452 | |

| Net unrealized appreciation (depreciation) on investments and futures | | | 172,985,714 | |

| Accumulated net realized gain (loss) | | | (38,580,544 | ) |

| Paid-in capital | | | 584,532,385 | |

| Net assets, at value | | $ | 720,108,007 | |

| Net Asset Value | |

Class A Net Asset Value and redemption price per share ($201,886,824 ÷ 11,158,940 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 18.09 | |

| Maximum offering price per share (100 ÷ 95.50 of $18.09) | | $ | 18.94 | |

Class B Net Asset Value, offering and redemption price per share ($2,329,179 ÷ 128,923 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 18.07 | |

Class C Net Asset Value, offering and redemption price per share ($21,325,579 ÷ 1,180,549 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 18.06 | |

Class S Net Asset Value, offering and redemption price per share ($494,566,425 ÷ 27,277,463 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 18.13 | |

The accompanying notes are an integral part of the financial statements.

| for the six months ended June 30, 2012 (Unaudited) | |

| Investment Income | |

Income and expenses allocated from DWS Equity 500 Index Portfolio: Dividends (net of foreign taxes withheld of $8,513) | | $ | 6,636,070 | |

| Interest | | | 464 | |

| Income distributions — Central Cash Management Fund | | | 4,813 | |

| Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates | | | 129,161 | |

| Expenses | | | (288,618 | ) |

| Net investment income allocated from DWS Equity 500 Index Portfolio | | | 6,481,890 | |

Expenses: Administration fee | | | 307,516 | |

| Services to shareholders | | | 549,726 | |

| Distribution and service fees | | | 261,397 | |

| Professional fees | | | 23,938 | |

| Reports to shareholders | | | 38,228 | |

| Registration fees | | | 33,124 | |

| Trustees' fees and expenses | | | 2,854 | |

| Other | | | 3,919 | |

| Total expenses before expense reductions | | | 1,220,702 | |

| Expense reductions | | | (24,146 | ) |

| Total expenses after expense reductions | | | 1,196,556 | |

| Net investment income (loss) | | | 5,285,334 | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) allocated from DWS Equity 500 Index Portfolio: Investments | | | 37,117,368 | |

| Futures | | | 1,359,212 | |

| | | | 38,476,580 | |

Change in net unrealized appreciation (depreciation) allocated from DWS Equity 500 Index Portfolio on: Investments | | | 6,976,606 | |

| Futures | | | 116,754 | |

| | | | 7,093,360 | |

| Net gain (loss) | | | 45,569,940 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 50,855,274 | |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | Increase (Decrease) in Net Assets | | Six Months Ended June 30, 2012 (Unaudited) | | | Year Ended December 31, 2011 | |

Operations: Net investment income (loss) | | $ | 5,285,334 | | | $ | 8,967,353 | |

Operations: Net investment income (loss) | | $ | 5,285,334 | | | $ | 8,967,353 | |

| Net realized gain (loss) | | | 38,476,580 | | | | 48,050,938 | |

| Change in net unrealized appreciation (depreciation) | | | 7,093,360 | | | | (47,198,785 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 50,855,274 | | | | 9,819,506 | |

Distributions to shareholders from: Net investment income: Class A | | | (951,447 | ) | | | (1,614,031 | ) |

| Class B | | | (4,219 | ) | | | (9,383 | ) |

| Class C | | | (39,470 | ) | | | (86,730 | ) |

| Class S | | | (3,392,186 | ) | | | (7,177,588 | ) |

| Total distributions | | | (4,387,322 | ) | | | (8,887,732 | ) |

Fund share transactions: Proceeds from shares sold | | | 44,659,293 | | | | 66,688,567 | |

| Net assets acquired in tax-free reorganization* | | | 203,828,842 | | | | — | |

| Reinvestment of distributions | | | 4,202,928 | | | | 8,493,763 | |

| Payment for shares redeemed | | | (109,749,751 | ) | | | (105,642,229 | ) |

| Net increase (decrease) in net assets from Fund share transactions | | | 142,941,312 | | | | (30,459,899 | ) |

| Increase (decrease) in net assets | | | 189,409,264 | | | | (29,528,125 | ) |

| Net assets at beginning of period | | | 530,698,743 | | | | 560,226,868 | |

| Net assets at end of period (including undistributed net investment income of $1,170,452 and $272,440, respectively) | | $ | 720,108,007 | | | $ | 530,698,743 | |

* On April 27, 2012, DWS S&P 500 Plus Fund was acquired by the Fund through a tax-free reorganization (see Note D).

The accompanying notes are an integral part of the financial statements.

| | | | | | Years Ended December 31, | |

| Class A | | Six Months Ended 6/30/12 (Unaudited) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 16.67 | | | $ | 16.67 | | | $ | 14.77 | | | $ | 11.96 | | | $ | 19.45 | | | $ | 18.78 | |

Income (loss) from investment operations: Net investment incomea | | | .14 | | | | .24 | | | | .22 | | | | .23 | | | | .28 | | | | .26 | |

| Net realized and unrealized gain (loss) | | | 1.39 | | | | .00 | *** | | | 1.90 | | | | 2.82 | | | | (7.51 | ) | | | .66 | |

| Total from investment operations | | | 1.53 | | | | .24 | | | | 2.12 | | | | 3.05 | | | | (7.23 | ) | | | .92 | |

Less distributions from: Net investment income | | | (.11 | ) | | | (.24 | ) | | | (.22 | ) | | | (.24 | ) | | | (.26 | ) | | | (.25 | ) |

| Net asset value, end of period | | $ | 18.09 | | | $ | 16.67 | | | $ | 16.67 | | | $ | 14.77 | | | $ | 11.96 | | | $ | 19.45 | |

Total Return (%)b,c | | | 9.16 | ** | | | 1.49 | | | | 14.47 | | | | 25.88 | | | | (37.45 | ) | | | 4.90 | |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 202 | | | | 110 | | | | 118 | | | | 110 | | | | 72 | | | | 95 | |

| Ratio of expenses before expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | .70 | * | | | .71 | | | | .72 | | | | .70 | | | | .71 | | | | .72 | |

| Ratio of expenses after expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | .67 | * | | | .67 | | | | .67 | | | | .62 | | | | .65 | | | | .64 | |

| Ratio of net investment income (%) | | | 1.58 | * | | | 1.43 | | | | 1.43 | | | | 1.81 | | | | 1.69 | | | | 1.33 | |

a Based on average shares outstanding during the period. b Total return does not reflect the effect of any sales charges. c Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized *** Amount is less than $.005. | |

| | | | | | Years Ended December 31, | |

| Class B | | Six Months Ended 6/30/12 (Unaudited) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 16.65 | | | $ | 16.64 | | | $ | 14.74 | | | $ | 11.94 | | | $ | 19.41 | | | $ | 18.74 | |

Income (loss) from investment operations: Net investment incomea | | | .07 | | | | .12 | | | | .10 | | | | .13 | | | | .15 | | | | .11 | |

| Net realized and unrealized gain (loss) | | | 1.39 | | | | .01 | | | | 1.90 | | | | 2.81 | | | | (7.48 | ) | | | .66 | |

| Total from investment operations | | | 1.46 | | | | .13 | | | | 2.00 | | | | 2.94 | | | | (7.33 | ) | | | .77 | |

Less distributions from: Net investment income | | | (.04 | ) | | | (.12 | ) | | | (.10 | ) | | | (.14 | ) | | | (.14 | ) | | | (.10 | ) |

| Net asset value, end of period | | $ | 18.07 | | | $ | 16.65 | | | $ | 16.64 | | | $ | 14.74 | | | $ | 11.94 | | | $ | 19.41 | |

Total Return (%)b | | | 8.78 | ** | | | .73 | | | | 13.66 | c | | | 24.87 | c | | | (37.90 | )c | | | 4.11 | c |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 2 | | | | 1 | | | | 2 | | | | 2 | | | | 2 | | | | 3 | |

| Ratio of expenses before expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | 1.44 | * | | | 1.40 | | | | 1.46 | | | | 1.50 | | | | 1.52 | | | | 1.54 | |

| Ratio of expenses after expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | 1.44 | * | | | 1.40 | | | | 1.43 | | | | 1.37 | | | | 1.42 | | | | 1.40 | |

| Ratio of net investment income (%) | | | .81 | * | | | .69 | | | | .67 | | | | 1.05 | | | | .93 | | | | .57 | |

a Based on average shares outstanding during the period. b Total return does not reflect the effect of any sales charges. c Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized | |

| | | | | | Years Ended December 31, | |

| Class C | | Six Months Ended 6/30/12 (Unaudited) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 16.64 | | | $ | 16.64 | | | $ | 14.74 | | | $ | 11.94 | | | $ | 19.41 | | | $ | 18.74 | |

Income (loss) from investment operations: Net investment incomea | | | .08 | | | | .12 | | | | .10 | | | | .13 | | | | .16 | | | | .11 | |

| Net realized and unrealized gain (loss) | | | 1.38 | | | | .00 | *** | | | 1.90 | | | | 2.81 | | | | (7.49 | ) | | | .66 | |

| Total from investment operations | | | 1.46 | | | | .12 | | | | 2.00 | | | | 2.94 | | | | (7.33 | ) | | | .77 | |

Less distributions from: Net investment income | | | (.04 | ) | | | (.12 | ) | | | (.10 | ) | | | (.14 | ) | | | (.14 | ) | | | (.10 | ) |

| Net asset value, end of period | | $ | 18.06 | | | $ | 16.64 | | | $ | 16.64 | | | $ | 14.74 | | | $ | 11.94 | | | $ | 19.41 | |

Total Return (%)b | | | 8.78 | ** | | | .76 | | | | 13.63 | c | | | 24.88 | c | | | (37.90 | )c | | | 4.11 | c |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 21 | | | | 12 | | | | 12 | | | | 10 | | | | 5 | | | | 7 | |

| Ratio of expenses before expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | 1.35 | * | | | 1.40 | | | | 1.45 | | | | 1.47 | | | | 1.46 | | | | 1.50 | |

| Ratio of expenses after expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | 1.35 | * | | | 1.40 | | | | 1.42 | | | | 1.37 | | | | 1.41 | | | | 1.40 | |

| Ratio of net investment income (%) | | | .89 | * | | | .70 | | | | .68 | | | | 1.05 | | | | .93 | | | | .56 | |

a Based on average shares outstanding during the period. b Total return does not reflect the effect of any sales charges. c Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized *** Amount is less than $.005. | |

| | | | | | Years Ended December 31, | |

| Class S | | Six Months Ended 6/30/12 (Unaudited) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 16.70 | | | $ | 16.70 | | | $ | 14.80 | | | $ | 11.99 | | | $ | 19.49 | | | $ | 18.81 | |

Income (loss) from investment operations: Net investment incomea | | | .16 | | | | .29 | | | | .26 | | | | .26 | | | | .32 | | | | .31 | |

| Net realized and unrealized gain (loss) | | | 1.40 | | | | .00 | *** | | | 1.90 | | | | 2.82 | | | | (7.51 | ) | | | .67 | |

| Total from investment operations | | | 1.56 | | | | .29 | | | | 2.16 | | | | 3.08 | | | | (7.19 | ) | | | .98 | |

Less distributions from: Net investment income | | | (.13 | ) | | | (.29 | ) | | | (.26 | ) | | | (.27 | ) | | | (.31 | ) | | | (.30 | ) |

| Net asset value, end of period | | $ | 18.13 | | | $ | 16.70 | | | $ | 16.70 | | | $ | 14.80 | | | $ | 11.99 | | | $ | 19.49 | |

| Total Return (%) | | | 9.36 | ** | | | 1.72 | | | | 14.81 | b | | | 26.14 | b | | | (37.25 | )b | | | 5.22 | b |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 495 | | | | 408 | | | | 428 | | | | 403 | | | | 343 | | | | 599 | |

| Ratio of expenses before expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | .39 | * | | | .39 | | | | .42 | | | | .46 | | | | .44 | | | | .44 | |

| Ratio of expenses after expense reductions, including expenses allocated from DWS Equity 500 Index Portfolio (%) | | | .39 | * | | | .39 | | | | .39 | | | | .35 | | | | .39 | | | | .39 | |

| Ratio of net investment income (%) | | | 1.80 | * | | | 1.71 | | | | 1.70 | | | | 2.07 | | | | 1.95 | | | | 1.58 | |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized *** Amount is less than $.005. | |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

DWS S&P 500 Index Fund (the "Fund") is a diversified series of the DWS Institutional Funds (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust.

The Fund, a feeder fund, seeks to achieve its investment objective by investing all of its investable assets in a master portfolio, DWS Equity 500 Index Portfolio (the "Portfolio"), a diversified open-end management investment company registered under the 1940 Act and organized as a New York trust advised by Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG. A master/feeder fund structure is one in which a fund (a "feeder fund"), instead of investing directly in a portfolio of securities, invests most or all of its investment assets in a separate registered investment company (the "master fund") with substantially the same investment objective and policies as the feeder fund. Such a structure permits the pooling of assets of two or more feeder funds, preserving separate identities or distribution channels at the feeder fund level. On June 30, 2012, the Fund owned approximately 32% of the Portfolio.

The Fund offers multiple classes of shares which provide investors with different purchase options. Class A shares are offered to investors subject to an initial sales charge. Class B shares of the Fund are closed to new purchases, except exchanges or the reinvestment of dividends or other distributions. Class B shares were offered to investors without an initial sales charge and are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions. Class B shares automatically convert to Class A shares six years after issuance. Class C shares are offered to investors without an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class C shares do not automatically convert into another class. Class S shares are not subject to initial or contingent deferred sales charges and are generally not available to new investors except under certain circumstances.

Investment income, realized and unrealized gains and losses and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class such as distribution and services fees, services to shareholders and certain other class-specific expenses. Differences in class-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject to class-specific arrangements.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements. The financial statements of the Portfolio, including the Investment Portfolio, are contained elsewhere in this report and should be read in conjunction with the Fund's financial statements.

Security Valuation. The Fund records its investment in the Portfolio at value, which reflects its proportionate interest in the net assets of the Portfolio. Valuation of the securities held by the Portfolio is discussed in the notes to the Portfolio's financial statements included elsewhere in this report.

Disclosure about the classification of fair value measurements is included in a table following the Portfolio's Investment Portfolio.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders. Accordingly, the Fund paid no federal income taxes and no federal income tax provision was required.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At December 31, 2011, the Fund had a net tax basis capital loss carryforward of approximately $77,043,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until December 31, 2012 ($21,570,000), December 31, 2013 ($7,108,000), December 31, 2014 ($6,496,000), December 31, 2016 ($16,675,000), December 31, 2017 ($17,522,000) and December 31, 2018 ($7,672,000), the respective expiration dates, whichever occurs first.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2011, and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Net investment income of the Fund, is declared and distributed to shareholders quarterly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to futures contracts and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. The Fund receives a daily allocation of the Portfolio's income, expenses and net realized and unrealized gains and losses in proportion to its investment in the Portfolio. Expenses directly attributed to a fund are charged to that fund, while expenses which are attributable to the Trust are allocated among the funds in the Trust on the basis of relative net assets.

B. Related Parties

Management Agreement. Under its Investment Management Agreement with the Fund, the Advisor serves as investment manager to the Fund. The Advisor receives a management fee from the Portfolio pursuant to the master/feeder structure noted above in Note A.

Pursuant to the Investment Management Agreement, the Fund pays no management fee to the Advisor so long as the Fund is a feeder fund that invests substantially all of its assets in the Portfolio. In the event the Board of Trustees determines it is in the best interests of the Fund to withdraw its investment from the Portfolio, the Advisor may become responsible for directly managing the assets of the Fund under the Investment Management Agreement. In such event, the Fund would pay the Advisor an annual fee of 0.15% of the Fund's average daily net assets, accrued daily and payable monthly.

The Advisor has voluntarily agreed to waive its fees and/or reimburse certain operating expenses of the Fund to the extent necessary to maintain the operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) for each class as follows:

| Class A | .67% |

| Class B | 1.47% |

| Class C | 1.47% |

| Class S | .47% |

This voluntary waiver or reimbursement may be terminated at any time at the option of the Advisor.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays the Advisor an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly. For the six months ended June 30, 2012, the Administration Fee was $307,516, of which $57,665 is unpaid.

Service Provider Fees. DWS Investments Service Company ("DISC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent of the Fund. Pursuant to a sub-transfer agency agreement between DISC and DST Systems, Inc. ("DST"), DISC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DISC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended June 30, 2012, the amounts charged to the Fund by DISC were as follows:

| Services to Shareholders | | Total Aggregated | | | Waived | | | Unpaid at June 30, 2012 | |

| Class A | | $ | 145,036 | | | $ | 24,146 | | | $ | 88,071 | |

| Class B | | | 1,100 | | | | — | | | | 568 | |

| Class C | | | 5,244 | | | | — | | | | 2,756 | |

| Class S | | | 302,182 | | | | — | | | | 124,081 | |

| | | $ | 453,562 | | | $ | 24,146 | | | $ | 215,476 | |

Distribution and Service Agreement. Under the Fund's Class B and C 12b-1 Plans, DWS Investments Distributors, Inc. ("DIDI"), a subsidiary of the Advisor, receives a fee ("Distribution Fee") of 0.75% of average daily net assets of each of Class B and C shares. In accordance with the Fund's Underwriting and Distribution Services Agreement, DIDI enters into related selling group agreements with various firms at various rates for sales of Class B and C shares. For the six months ended June 30, 2012, the Distribution Fee was as follows:

| Distribution Fee | | Total Aggregated | | | Unpaid at June 30, 2012 | |

| Class B | | $ | 6,282 | | | $ | 1,318 | |

| Class C | | | 57,855 | | | | 12,575 | |

| | | $ | 64,137 | | | $ | 13,893 | |

In addition, DIDI provides information and administrative services for a fee ("Service Fee") to Class A, B and C shareholders at an annual rate of up to 0.25% of average daily net assets for each such class. DIDI in turn has various agreements with financial services firms that provide these services and pays these fees based upon the assets of shareholder accounts the firms service. For the six months ended June 30, 2012, the Service Fee was as follows:

| Service Fee | | Total Aggregated | | | Unpaid at June 30, 2012 | | | Annualized Effective Rate | |

| Class A | | $ | 176,002 | | | $ | 91,559 | | | | .24 | % |

| Class B | | | 2,069 | | | | 1,105 | | | | .25 | % |

| Class C | | | 19,189 | | | | 9,568 | | | | .25 | % |

| | | $ | 197,260 | | | $ | 102,232 | | | | | |

Underwriting Agreement and Contingent Deferred Sales Charge. DIDI is the principal underwriter for the Fund. Underwriting commissions paid to DIDI in connection with the distribution of Class A shares for the six months ended June 30, 2012 aggregated $9,158.

In addition, DIDI receives any contingent deferred sales charge ("CDSC") from Class B share redemptions occurring within six years of purchase and Class C share redemptions occurring within one year of purchase. There is no such charge upon redemption of any share appreciation or reinvested dividends. The CDSC is based on declining rates ranging from 4% to 1% for Class B and 1% for Class C, of the value of the shares redeemed. For the six months ended June 30, 2012, the CDSC for Class B and C shares aggregated $1,872 and $255, respectively. A deferred sales charge of up to 1% is assessed on certain redemptions of Class A shares. For the six months ended June 30, 2012, DIDI received $3,089 for Class A shares.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the six months ended June 30, 2012, the amount charged to the Fund by DIMA included in the Statement of Operations under "reports to shareholders" aggregated $14,330, all of which is unpaid.

Trustees' Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and to each committee Chairperson.

C. Share Transactions

The following table summarizes share and dollar activity in the Fund:

| | | Six Months Ended June 30, 2012 | | | Year Ended December 31, 2011 | |

| | | Shares | | | Dollars | | | Shares | | | Dollars | |

| Shares sold | |

| Class A | | | 1,351,622 | | | $ | 24,367,271 | | | | 1,772,678 | | | $ | 29,669,678 | |

| Class B | | | 1,686 | | | | 30,189 | | | | 4,440 | | | | 76,314 | |

| Class C | | | 142,207 | | | | 2,548,740 | | | | 171,599 | | | | 2,882,748 | |

| Class S | | | 982,634 | | | | 17,713,093 | | | | 2,011,748 | | | | 34,059,827 | |

| | | | | | | $ | 44,659,293 | | | | | | | $ | 66,688,567 | |

| Shares issued in tax-free reorganization* | |

| Class A | | | 4,591,013 | ** | | $ | 85,530,455 | ** | | | — | | | $ | — | |

| Class B | | | 60,005 | | | | 1,116,050 | | | | — | | | | — | |

| Class C | | | 469,468 | | | | 8,727,139 | | | | — | | | | — | |

| Class S | | | 5,805,817 | | | | 108,455,198 | | | | — | | | | — | |

| | | | | | | $ | 203,828,842 | | | | | | | $ | — | |

| Shares issued to shareholders in reinvestment of distributions | |

| Class A | | | 52,080 | | | $ | 938,617 | | | | 97,901 | | | $ | 1,593,468 | |

| Class B | | | 230 | | | | 4,136 | | | | 568 | | | | 9,164 | |

| Class C | | | 2,141 | | | | 38,537 | | | | 5,327 | | | | 85,847 | |

| Class S | | | 177,658 | | | | 3,221,638 | | | | 416,840 | | | | 6,805,284 | |

| | | | | | | $ | 4,202,928 | | | | | | | $ | 8,493,763 | |

| Shares redeemed | |

| Class A | | | (1,426,086 | ) | | $ | (27,109,205 | ) | | | (2,373,913 | ) | | $ | (40,029,931 | ) |

| Class B | | | (10,298 | ) | | | (203,324 | ) | | | (20,842 | ) | | | (357,845 | ) |

| Class C | | | (145,771 | ) | | | (2,784,337 | ) | | | (207,587 | ) | | | (3,480,680 | ) |

| Class S | | | (4,094,038 | ) | | | (79,652,885 | ) | | | (3,651,599 | ) | | | (61,773,773 | ) |

| | | | | | | $ | (109,749,751 | ) | | | | | | $ | (105,642,229 | ) |

| Net increase (decrease) | |

| Class A | | | 4,568,629 | | | $ | 83,727,138 | | | | (503,334 | ) | | $ | (8,766,785 | ) |

| Class B | | | 51,623 | | | | 947,051 | | | | (15,834 | ) | | | (272,367 | ) |

| Class C | | | 468,045 | | | | 8,530,079 | | | | (30,661 | ) | | | (512,085 | ) |

| Class S | | | 2,872,071 | | | | 49,737,044 | | | | (1,223,011 | ) | | | (20,908,662 | ) |

| | | | | | | $ | 142,941,312 | | | | | | | $ | (30,459,899 | ) |

* On April 27, 2012, DWS S&P 500 Plus Fund was acquired by the Fund through a tax-free reorganization (see Note D).

** On April 27, 2012, Class R shares of DWS S&P 500 Plus Fund converted into Class A shares of the Fund.

D. Acquisition of Assets

On April 27, 2012, the Fund acquired all of the net assets of DWS S&P 500 Plus Fund pursuant to a plan of reorganization approved by shareholders on April 16, 2012. The acquisition was accomplished by a tax-free exchange of 5,340,422 Class A shares, 86,606 Class B shares, 675,809 Class C shares, 1,091,801 of Class R shares (converted into Class A shares) and 8,188,815 Class S shares of DWS S&P 500 Plus Fund for 4,591,013 Class A shares, 60,005 Class B shares, 469,468 Class C shares and 5,805,817 Class S shares of DWS S&P 500 Index Fund, respectively, outstanding on April 27, 2012. DWS S&P 500 Plus Fund's net assets at that date, $203,828,842, including $60,535,843 of net unrealized appreciation, were combined with those of the Fund. The aggregate net assets of the Fund immediately before the acquisition were $588,808,565. The combined net assets of the Fund immediately following the acquisition were $792,637,407.

The financial statements reflect the operations of the Fund for the period prior to the acquisition and the combined fund for the period subsequent to the fund merger. Assuming the acquisition had been completed on January 1, 2012, the Fund's pro forma results of operations for the six months ended June 30, 2012, are as follows:

| Net investment income* | | $ | 6,247,966 | |

| Net gain (loss) on investments | | $ | 63,534,353 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 69,782,319 | |

* Net investment income includes $117,984 of pro forma additional expenses, of which $52,437 is attributable to the expenses of the Portfolio.

Because the combined investment portfolios have been managed as a single integrated Fund since the acquisition was completed, it is not practicable to separate the amounts of revenue and earnings of DWS S&P 500 Plus Fund that have been included in the Fund's Statement of Operations since April 27, 2012.

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads) and account maintenance fees, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. In the most recent six-month period, Class A shares limited these expenses; had it not done so, expenses would have been higher. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (January 1, 2012 to June 30, 2012).

The tables illustrate your Fund's expenses in two ways:

•Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

•Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. An account maintenance fee of $6.25 per quarter for Class S shares may apply for certain accounts whose balances do not meet the applicable minimum initial investment. This fee is not included in these tables. If it was, the estimate of expenses paid for Class S shares during the period would be higher, and account value during the period would be lower, by this amount.

Expenses and Value of a $1,000 Investment for the six months ended June 30, 2012 (Unaudited) | |

| Actual Fund Return* | | Class A | | | Class B | | | Class C | | | Class S | |

| Beginning Account Value 1/1/12 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/12 | | $ | 1,091.60 | | | $ | 1,087.80 | | | $ | 1,087.80 | | | $ | 1,093.60 | |

| Expenses Paid per $1,000** | | $ | 3.48 | | | $ | 7.48 | | | $ | 7.01 | | | $ | 2.03 | |

| Hypothetical 5% Fund Return* | | Class A | | | Class B | | | Class C | | | Class S | |

| Beginning Account Value 1/1/12 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/12 | | $ | 1,021.53 | | | $ | 1,017.70 | | | $ | 1,018.15 | | | $ | 1,022.92 | |

| Expenses Paid per $1,000** | | $ | 3.37 | | | $ | 7.22 | | | $ | 6.77 | | | $ | 1.96 | |

* Expenses include amounts allocated proportionally from the master portfolio.

** Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 182 (the number of days in the most recent six-month period), then divided by 366.

| Annualized Expense Ratios | Class A | Class B | Class C | Class S |

| DWS S&P 500 Index Fund | .67% | 1.44% | 1.35% | .39% |

For more information, please refer to the Fund's prospectuses.

(The following financial statements of the DWS Equity 500 Index Portfolio should be read in conjunction with the Fund's financial statements.)

Investment Portfolio as of June 30, 2012 (Unaudited) | | | Shares | | | Value ($) | |

| | | | |

| Common Stocks 97.7% | |

| Consumer Discretionary 10.7% | |

| Auto Components 0.2% | |

| BorgWarner, Inc.* (a) | | | 19,875 | | | | 1,303,601 | |

| Goodyear Tire & Rubber Co.* (a) | | | 46,396 | | | | 547,937 | |

| Johnson Controls, Inc. (a) | | | 120,601 | | | | 3,341,854 | |

| | | | | | | | 5,193,392 | |

| Automobiles 0.4% | |

| Ford Motor Co. (a) | | | 671,548 | | | | 6,440,145 | |

| Harley-Davidson, Inc. (a) | | | 41,382 | | | | 1,892,399 | |

| | | | | | | | 8,332,544 | |

| Distributors 0.1% | |

| Genuine Parts Co. (a) | | | 27,472 | | | | 1,655,188 | |

| Diversified Consumer Services 0.1% | |

| Apollo Group, Inc. "A"* | | | 18,883 | | | | 683,376 | |

| DeVry, Inc. (a) | | | 10,600 | | | | 328,282 | |

| H&R Block, Inc. (a) | | | 51,186 | | | | 817,952 | |

| | | | | | | | 1,829,610 | |

| Hotels, Restaurants & Leisure 1.9% | |

| Carnival Corp. | | | 79,579 | | | | 2,727,172 | |

| Chipotle Mexican Grill, Inc.* | | | 5,597 | | | | 2,126,580 | |

| Darden Restaurants, Inc. (a) | | | 22,280 | | | | 1,128,036 | |

| International Game Technology (a) | | | 50,064 | | | | 788,508 | |

| Marriott International, Inc. "A" (a) | | | 46,363 | | | | 1,817,430 | |

| McDonald's Corp. | | | 179,614 | | | | 15,901,228 | |

| Starbucks Corp. (a) | | | 133,701 | | | | 7,128,937 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 34,293 | | | | 1,818,901 | |

| Wyndham Worldwide Corp. (a) | | | 25,314 | | | | 1,335,060 | |

| Wynn Resorts Ltd. | | | 14,000 | | | | 1,452,080 | |

| Yum! Brands, Inc. (a) | | | 81,431 | | | | 5,245,785 | |

| | | | | | | | 41,469,717 | |

| Household Durables 0.2% | |

| D.R. Horton, Inc. (a) | | | 49,800 | | | | 915,324 | |

| Harman International Industries, Inc. (a) | | | 13,100 | | | | 518,760 | |

| Leggett & Platt, Inc. (a) | | | 24,370 | | | | 514,938 | |

| Lennar Corp. "A" (a) | | | 28,300 | | | | 874,753 | |

| Newell Rubbermaid, Inc. | | | 51,450 | | | | 933,303 | |

| Pulte Group, Inc.* (a) | | | 63,374 | | | | 678,102 | |

| Whirlpool Corp. | | | 13,133 | | | | 803,214 | |

| | | | | | | | 5,238,394 | |

| Internet & Catalog Retail 1.0% | |

| Amazon.com, Inc.* | | | 63,567 | | | | 14,515,524 | |

| Expedia, Inc. (a) | | | 15,885 | | | | 763,592 | |

| Netflix, Inc.* (a) | | | 10,245 | | | | 701,475 | |

| Priceline.com, Inc.* (a) | | | 8,824 | | | | 5,863,725 | |

| TripAdvisor, Inc.* (a) | | | 17,485 | | | | 781,405 | |

| | | | | | | | 22,625,721 | |

| Leisure Equipment & Products 0.1% | |

| Hasbro, Inc. (a) | | | 21,685 | | | | 734,471 | |

| Mattel, Inc. | | | 59,014 | | | | 1,914,414 | |

| | | | | | | | 2,648,885 | |

| Media 3.3% | |

| Cablevision Systems Corp. (New York Group) "A" (a) | | | 39,073 | | | | 519,280 | |

| CBS Corp. "B" | | | 115,754 | | | | 3,794,416 | |

| Comcast Corp. "A" (a) | | | 475,963 | | | | 15,216,537 | |

| DIRECTV "A"* (a) | | | 115,610 | | | | 5,644,080 | |

| Discovery Communications, Inc. "A"* (a) | | | 44,646 | | | | 2,410,884 | |

| Gannett Co., Inc. (a) | | | 42,786 | | | | 630,238 | |

| Interpublic Group of Companies, Inc. | | | 78,995 | | | | 857,096 | |

| McGraw-Hill Companies, Inc. | | | 48,793 | | | | 2,195,685 | |

| News Corp. "A" (a) | | | 371,908 | | | | 8,289,829 | |

| Omnicom Group, Inc. (a) | | | 48,062 | | | | 2,335,813 | |

| Scripps Networks Interactive "A" (a) | | | 16,200 | | | | 921,132 | |

| Time Warner Cable, Inc. | | | 55,051 | | | | 4,519,687 | |

| Time Warner, Inc. (a) | | | 169,417 | | | | 6,522,555 | |

| Viacom, Inc. "B" | | | 93,253 | | | | 4,384,756 | |

| Walt Disney Co. (a) | | | 315,645 | | | | 15,308,783 | |

| Washington Post Co. "B" | | | 800 | | | | 299,056 | |

| | | | | | | | 73,849,827 | |

| Multiline Retail 0.8% | |

| Big Lots, Inc.* (a) | | | 11,396 | | | | 464,843 | |

| Dollar Tree, Inc.* | | | 40,800 | | | | 2,195,040 | |

| Family Dollar Stores, Inc. | | | 20,572 | | | | 1,367,627 | |

| J.C. Penney Co., Inc. (a) | | | 25,321 | | | | 590,233 | |

| Kohl's Corp. (a) | | | 42,325 | | | | 1,925,364 | |

| Macy's, Inc. | | | 73,350 | | | | 2,519,572 | |

| Nordstrom, Inc. (a) | | | 27,832 | | | | 1,382,972 | |

| Sears Holdings Corp.* (a) | | | 6,918 | | | | 413,005 | |

| Target Corp. (a) | | | 116,729 | | | | 6,792,460 | |

| | | | | | | | 17,651,116 | |

| Specialty Retail 2.0% | |

| Abercrombie & Fitch Co. "A" (a) | | | 15,600 | | | | 532,584 | |

| AutoNation, Inc.* (a) | | | 8,200 | | | | 289,296 | |

| AutoZone, Inc.* (a) | | | 4,690 | | | | 1,722,027 | |

| Bed Bath & Beyond, Inc.* (a) | | | 41,012 | | | | 2,534,541 | |

| Best Buy Co., Inc. (a) | | | 50,631 | | | | 1,061,226 | |

| CarMax, Inc.* (a) | | | 39,263 | | | | 1,018,482 | |

| GameStop Corp. "A" | | | 22,400 | | | | 411,264 | |

| Home Depot, Inc. (a) | | | 270,118 | | | | 14,313,553 | |

| Limited Brands, Inc. (a) | | | 43,240 | | | | 1,838,997 | |

| Lowe's Companies, Inc. | | | 207,656 | | | | 5,905,737 | |

| O'Reilly Automotive, Inc.* (a) | | | 22,200 | | | | 1,859,694 | |

| Ross Stores, Inc. | | | 39,802 | | | | 2,486,431 | |

| Staples, Inc. (a) | | | 119,774 | | | | 1,563,051 | |

| The Gap, Inc. (a) | | | 57,958 | | | | 1,585,731 | |

| Tiffany & Co. (a) | | | 22,016 | | | | 1,165,747 | |

| TJX Companies, Inc. | | | 130,798 | | | | 5,615,158 | |

| Urban Outfitters, Inc.* (a) | | | 19,661 | | | | 542,447 | |

| | | | | | | | 44,445,966 | |

| Textiles, Apparel & Luxury Goods 0.6% | |

| Coach, Inc. (a) | | | 50,953 | | | | 2,979,731 | |

| Fossil, Inc.* (a) | | | 9,009 | | | | 689,549 | |

| NIKE, Inc. "B" | | | 64,625 | | | | 5,672,783 | |

| Ralph Lauren Corp. | | | 11,700 | | | | 1,638,702 | |

| VF Corp. (a) | | | 15,540 | | | | 2,073,813 | |

| | | | | | | | 13,054,578 | |

| Consumer Staples 11.0% | |

| Beverages 2.7% | |

| Beam, Inc. | | | 27,654 | | | | 1,728,099 | |

| Brown-Forman Corp. "B" | | | 17,422 | | | | 1,687,321 | |

| Coca-Cola Co. (a) | | | 398,165 | | | | 31,132,521 | |

| Coca-Cola Enterprises, Inc. (a) | | | 54,224 | | | | 1,520,441 | |

| Constellation Brands, Inc. "A"* | | | 28,500 | | | | 771,210 | |

| Dr. Pepper Snapple Group, Inc. (a) | | | 36,897 | | | | 1,614,244 | |

| Molson Coors Brewing Co. "B" | | | 27,804 | | | | 1,156,924 | |

| Monster Beverage Corp.* | | | 27,091 | | | | 1,928,879 | |

| PepsiCo, Inc. (a) | | | 276,097 | | | | 19,509,014 | |

| | | | | | | | 61,048,653 | |

| Food & Staples Retailing 2.4% | |

| Costco Wholesale Corp. | | | 76,299 | | | | 7,248,405 | |

| CVS Caremark Corp. (a) | | | 226,191 | | | | 10,569,905 | |

| Kroger Co. | | | 98,427 | | | | 2,282,522 | |

| Safeway, Inc. (a) | | | 44,411 | | | | 806,060 | |

| Sysco Corp. (a) | | | 103,882 | | | | 3,096,722 | |

| Wal-Mart Stores, Inc. (a) | | | 304,671 | | | | 21,241,662 | |

| Walgreen Co. (a) | | | 152,108 | | | | 4,499,355 | |

| Whole Foods Market, Inc. (a) | | | 28,874 | | | | 2,752,270 | |

| | | | | | | | 52,496,901 | |

| Food Products 1.7% | |

| Archer-Daniels-Midland Co. | | | 116,026 | | | | 3,425,087 | |

| Campbell Soup Co. (a) | | | 31,970 | | | | 1,067,159 | |

| ConAgra Foods, Inc. | | | 74,478 | | | | 1,931,215 | |

| Dean Foods Co.* (a) | | | 33,400 | | | | 568,802 | |

| General Mills, Inc. | | | 114,728 | | | | 4,421,617 | |

| H.J. Heinz Co. (a) | | | 56,140 | | | | 3,052,893 | |

| Hormel Foods Corp. (a) | | | 25,300 | | | | 769,626 | |

| Kellogg Co. (a) | | | 43,234 | | | | 2,132,733 | |

| Kraft Foods, Inc. "A" | | | 312,629 | | | | 12,073,732 | |

| McCormick & Co., Inc. (a) | | | 24,100 | | | | 1,461,665 | |

| Mead Johnson Nutrition Co. (a) | | | 36,394 | | | | 2,930,081 | |

| The Hershey Co. | | | 26,760 | | | | 1,927,523 | |

| The JM Smucker Co. (a) | | | 19,757 | | | | 1,492,049 | |

| Tyson Foods, Inc. "A" (a) | | | 50,500 | | | | 950,915 | |

| | | | | | | | 38,205,097 | |

| Household Products 2.1% | |

| Clorox Co. (a) | | | 23,432 | | | | 1,697,883 | |

| Colgate-Palmolive Co. (a) | | | 84,102 | | | | 8,755,018 | |

| Kimberly-Clark Corp. | | | 69,009 | | | | 5,780,884 | |

| Procter & Gamble Co. (a) | | | 483,601 | | | | 29,620,561 | |

| | | | | | | | 45,854,346 | |

| Personal Products 0.1% | |

| Avon Products, Inc. | | | 77,597 | | | | 1,257,847 | |

| Estee Lauder Companies, Inc. "A" (a) | | | 39,700 | | | | 2,148,564 | |

| | | | | | | | 3,406,411 | |

| Tobacco 2.0% | |

| Altria Group, Inc. (a) | | | 359,648 | | | | 12,425,838 | |

| Lorillard, Inc. | | | 23,054 | | | | 3,041,975 | |

| Philip Morris International, Inc. | | | 301,175 | | | | 26,280,531 | |

| Reynolds American, Inc. (a) | | | 58,580 | | | | 2,628,485 | |

| | | | | | | | 44,376,829 | |

| Energy 10.6% | |

| Energy Equipment & Services 1.6% | |

| Baker Hughes, Inc. (a) | | | 77,438 | | | | 3,182,702 | |

| Cameron International Corp.* | | | 43,382 | | | | 1,852,845 | |

| Diamond Offshore Drilling, Inc. (a) | | | 12,130 | | | | 717,247 | |

| FMC Technologies, Inc.* (a) | | | 41,812 | | | | 1,640,285 | |

| Halliburton Co. | | | 162,568 | | | | 4,615,306 | |

| Helmerich & Payne, Inc. (a) | | | 19,252 | | | | 837,077 | |

| Nabors Industries Ltd.* | | | 52,938 | | | | 762,307 | |

| National Oilwell Varco, Inc. | | | 74,844 | | | | 4,822,947 | |

| Noble Corp.* (a) | | | 45,187 | | | | 1,469,933 | |

| Rowan Companies PLC "A"* (a) | | | 21,139 | | | | 683,424 | |

| Schlumberger Ltd. | | | 235,779 | | | | 15,304,415 | |

| | | | | | | | 35,888,488 | |

| Oil, Gas & Consumable Fuels 9.0% | |

| Alpha Natural Resources, Inc.* | | | 41,159 | | | | 358,495 | |

| Anadarko Petroleum Corp. | | | 88,148 | | | | 5,835,398 | |

| Apache Corp. | | | 68,543 | | | | 6,024,244 | |

| Cabot Oil & Gas Corp. (a) | | | 37,500 | | | | 1,477,500 | |

| Chesapeake Energy Corp. (a) | | | 116,689 | | | | 2,170,415 | |

| Chevron Corp. (a) | | | 348,750 | | | | 36,793,125 | |

| ConocoPhillips (a) | | | 223,709 | | | | 12,500,859 | |

| CONSOL Energy, Inc. (a) | | | 39,212 | | | | 1,185,771 | |

| Denbury Resources, Inc.* (a) | | | 67,818 | | | | 1,024,730 | |

| Devon Energy Corp. (a) | | | 71,009 | | | | 4,117,812 | |

| EOG Resources, Inc. | | | 47,411 | | | | 4,272,205 | |

| EQT Corp. (a) | | | 26,200 | | | | 1,405,106 | |

| Exxon Mobil Corp. (a) | | | 825,918 | | | | 70,673,803 | |

| Hess Corp. | | | 53,165 | | | | 2,310,019 | |

| Kinder Morgan, Inc. (a) | | | 89,289 | | | | 2,876,892 | |

| Marathon Oil Corp. | | | 124,818 | | | | 3,191,596 | |

| Marathon Petroleum Corp. (a) | | | 60,309 | | | | 2,709,080 | |

| Murphy Oil Corp. (a) | | | 33,918 | | | | 1,705,736 | |

| Newfield Exploration Co.* | | | 23,857 | | | | 699,249 | |

| Noble Energy, Inc. | | | 31,091 | | | | 2,637,139 | |

| Occidental Petroleum Corp. | | | 143,428 | | | | 12,301,820 | |

| Peabody Energy Corp. (a) | | | 47,631 | | | | 1,167,912 | |

| Phillips 66* | | | 110,604 | | | | 3,676,477 | |

| Pioneer Natural Resources Co. (a) | | | 21,800 | | | | 1,922,978 | |

| QEP Resources, Inc. (a) | | | 31,700 | | | | 950,049 | |

| Range Resources Corp. (a) | | | 27,742 | | | | 1,716,398 | |

| Southwestern Energy Co.* (a) | | | 61,136 | | | | 1,952,073 | |

| Spectra Energy Corp. | | | 115,173 | | | | 3,346,927 | |

| Sunoco, Inc. (a) | | | 19,172 | | | | 910,670 | |

| Tesoro Corp.* | | | 24,000 | | | | 599,040 | |

| Valero Energy Corp. | | | 97,801 | | | | 2,361,894 | |

| Williams Companies, Inc. | | | 110,598 | | | | 3,187,434 | |

| WPX Energy, Inc.* (a) | | | 34,674 | | | | 561,025 | |

| | | | | | | | 198,623,871 | |

| Financials 14.1% | |

| Capital Markets 1.8% | |

| Ameriprise Financial, Inc. | | | 38,686 | | | | 2,021,730 | |

| Bank of New York Mellon Corp. | | | 210,047 | | | | 4,610,532 | |

| BlackRock, Inc. | | | 22,732 | | | | 3,860,348 | |

| Charles Schwab Corp. (a) | | | 192,033 | | | | 2,482,987 | |

| E*TRADE Financial Corp.* | | | 45,476 | | | | 365,627 | |

| Federated Investors, Inc. "B" (a) | | | 15,200 | | | | 332,120 | |

| Franklin Resources, Inc. (a) | | | 25,376 | | | | 2,816,482 | |

| Invesco Ltd. | | | 80,150 | | | | 1,811,390 | |

| Legg Mason, Inc. | | | 20,800 | | | | 548,496 | |

| Morgan Stanley | | | 271,167 | | | | 3,956,327 | |

| Northern Trust Corp. (a) | | | 43,102 | | | | 1,983,554 | |

| State Street Corp. | | | 86,268 | | | | 3,851,003 | |

| T. Rowe Price Group, Inc. (a) | | | 45,476 | | | | 2,863,169 | |

| The Goldman Sachs Group, Inc. (a) | | | 86,665 | | | | 8,307,707 | |

| | | | | | | | 39,811,472 | |

| Commercial Banks 2.9% | |

| BB&T Corp. | | | 123,292 | | | | 3,803,558 | |

| Comerica, Inc. | | | 34,968 | | | | 1,073,867 | |

| Fifth Third Bancorp. | | | 161,289 | | | | 2,161,273 | |

| First Horizon National Corp. (a) | | | 46,813 | | | | 404,933 | |

| Huntington Bancshares, Inc. (a) | | | 154,101 | | | | 986,246 | |

| KeyCorp | | | 165,545 | | | | 1,281,318 | |

| M&T Bank Corp. (a) | | | 22,153 | | | | 1,829,173 | |

| PNC Financial Services Group, Inc. | | | 93,064 | | | | 5,687,141 | |

| Regions Financial Corp. | | | 254,468 | | | | 1,717,659 | |

| SunTrust Banks, Inc. | | | 93,162 | | | | 2,257,315 | |

| U.S. Bancorp. (a) | | | 335,055 | | | | 10,775,369 | |

| Wells Fargo & Co. | | | 938,537 | | | | 31,384,677 | |

| Zions Bancorp. (a) | | | 33,656 | | | | 653,600 | |

| | | | | | | | 64,016,129 | |

| Consumer Finance 0.9% | |

| American Express Co. (a) | | | 178,055 | | | | 10,364,581 | |

| Capital One Financial Corp. | | | 102,463 | | | | 5,600,628 | |

| Discover Financial Services | | | 93,833 | | | | 3,244,745 | |

| SLM Corp. | | | 86,290 | | | | 1,355,616 | |

| | | | | | | | 20,565,570 | |

| Diversified Financial Services 2.8% | |

| Bank of America Corp. | | | 1,902,515 | | | | 15,562,573 | |

| Citigroup, Inc. | | | 517,657 | | | | 14,188,978 | |

| CME Group, Inc. "A" (a) | | | 11,773 | | | | 3,156,459 | |

| IntercontinentalExchange, Inc.* | | | 12,648 | | | | 1,719,875 | |

| JPMorgan Chase & Co. | | | 672,050 | | | | 24,012,347 | |

| Leucadia National Corp. (a) | | | 35,200 | | | | 748,704 | |

| Moody's Corp. (a) | | | 34,000 | | | | 1,242,700 | |

| NYSE Euronext (a) | | | 45,100 | | | | 1,153,658 | |

| The NASDAQ OMX Group, Inc. | | | 21,100 | | | | 478,337 | |

| | | | | | | | 62,263,631 | |

| Insurance 3.5% | |

| ACE Ltd. | | | 60,185 | | | | 4,461,514 | |

| Aflac, Inc. | | | 82,427 | | | | 3,510,566 | |

| Allstate Corp. | | | 86,886 | | | | 3,048,830 | |

| American International Group, Inc.* (a) | | | 112,948 | | | | 3,624,501 | |

| Aon PLC | | | 57,224 | | | | 2,676,939 | |

| Assurant, Inc. (a) | | | 14,700 | | | | 512,148 | |

| Berkshire Hathaway, Inc. "B"* (a) | | | 310,561 | | | | 25,879,048 | |

| Chubb Corp. | | | 47,759 | | | | 3,477,810 | |

| Cincinnati Financial Corp. (a) | | | 28,954 | | | | 1,102,279 | |

| Genworth Financial, Inc. "A"* (a) | | | 91,000 | | | | 515,060 | |

| Hartford Financial Services Group, Inc. | | | 76,876 | | | | 1,355,324 | |

| Lincoln National Corp. (a) | | | 50,674 | | | | 1,108,240 | |

| Loews Corp. | | | 53,623 | | | | 2,193,717 | |

| Marsh & McLennan Companies, Inc. | | | 95,853 | | | | 3,089,342 | |

| MetLife, Inc. (a) | | | 187,267 | | | | 5,777,187 | |

| Principal Financial Group, Inc. (a) | | | 53,887 | | | | 1,413,456 | |

| Progressive Corp. (a) | | | 108,014 | | | | 2,249,932 | |

| Prudential Financial, Inc. | | | 83,495 | | | | 4,043,663 | |

| The Travelers Companies, Inc. (a) | | | 68,737 | | | | 4,388,170 | |

| Torchmark Corp. (a) | | | 17,065 | | | | 862,636 | |

| Unum Group | | | 49,894 | | | | 954,472 | |

| XL Group PLC | | | 53,732 | | | | 1,130,521 | |

| | | | | | | | 77,375,355 | |

| Real Estate Investment Trusts 2.1% | |

| American Tower Corp. (REIT) | | | 69,536 | | | | 4,861,262 | |

| Apartment Investment & Management Co. "A" (REIT) (a) | | | 21,686 | | | | 586,172 | |

| AvalonBay Communities, Inc. (REIT) | | | 16,889 | | | | 2,389,456 | |

| Boston Properties, Inc. (REIT) | | | 26,300 | | | | 2,850,131 | |

| Equity Residential (REIT) (a) | | | 53,460 | | | | 3,333,765 | |

| HCP, Inc. (REIT) (a) | | | 74,246 | | | | 3,277,961 | |

| Health Care REIT, Inc. (REIT) (a) | | | 36,872 | | | | 2,149,638 | |

| Host Hotels & Resorts, Inc. (REIT) (a) | | | 125,810 | | | | 1,990,314 | |

| Kimco Realty Corp. (REIT) | | | 74,300 | | | | 1,413,929 | |

| Plum Creek Timber Co., Inc. (REIT) (a) | | | 28,748 | | | | 1,141,296 | |

| Prologis, Inc. (REIT) (a) | | | 81,300 | | | | 2,701,599 | |

| Public Storage (REIT) (a) | | | 25,230 | | | | 3,643,464 | |

| Simon Property Group, Inc. (REIT) (a) | | | 53,695 | | | | 8,358,164 | |

| Ventas, Inc. (REIT) (a) | | | 50,961 | | | | 3,216,658 | |

| Vornado Realty Trust (REIT) | | | 32,610 | | | | 2,738,588 | |

| Weyerhaeuser Co. (REIT) (a) | | | 94,947 | | | | 2,123,015 | |

| | | | | | | | 46,775,412 | |

| Real Estate Management & Development 0.0% | |

| CBRE Group, Inc.* | | | 59,100 | | | | 966,876 | |

| Thrifts & Mortgage Finance 0.1% | |

| Hudson City Bancorp., Inc. (a) | | | 96,668 | | | | 615,775 | |

| People's United Financial, Inc. (a) | | | 62,075 | | | | 720,691 | |

| | | | | | | | 1,336,466 | |

| Health Care 11.7% | |

| Biotechnology 1.4% | |

| Alexion Pharmaceuticals, Inc.* (a) | | | 33,417 | | | | 3,318,308 | |

| Amgen, Inc. | | | 137,470 | | | | 10,040,809 | |

| Biogen Idec, Inc.* (a) | | | 42,298 | | | | 6,106,985 | |

| Celgene Corp.* | | | 77,409 | | | | 4,966,561 | |

| Gilead Sciences, Inc.* | | | 133,753 | | | | 6,858,854 | |

| | | | | | | | 31,291,517 | |

| Health Care Equipment & Supplies 1.7% | |

| Baxter International, Inc. | | | 97,077 | | | | 5,159,643 | |

| Becton, Dickinson & Co. | | | 35,571 | | | | 2,658,932 | |

| Boston Scientific Corp.* (a) | | | 251,443 | | | | 1,425,682 | |

| C.R. Bard, Inc. | | | 14,583 | | | | 1,566,797 | |

| CareFusion Corp.* | | | 40,477 | | | | 1,039,449 | |

| Covidien PLC (a) | | | 85,026 | | | | 4,548,891 | |

| DENTSPLY International, Inc. (a) | | | 25,400 | | | | 960,374 | |

| Edwards Lifesciences Corp.* (a) | | | 20,239 | | | | 2,090,689 | |

| Intuitive Surgical, Inc.* (a) | | | 6,997 | | | | 3,874,869 | |

| Medtronic, Inc. | | | 183,530 | | | | 7,108,117 | |

| St. Jude Medical, Inc. | | | 55,110 | | | | 2,199,440 | |

| Stryker Corp. (a) | | | 57,302 | | | | 3,157,340 | |

| Varian Medical Systems, Inc.* (a) | | | 19,300 | | | | 1,172,861 | |

| Zimmer Holdings, Inc. | | | 31,001 | | | | 1,995,224 | |

| | | | | | | | 38,958,308 | |

| Health Care Providers & Services 2.0% | |

| Aetna, Inc. | | | 61,295 | | | | 2,376,407 | |

| AmerisourceBergen Corp. (a) | | | 44,010 | | | | 1,731,794 | |

| Cardinal Health, Inc. | | | 61,779 | | | | 2,594,718 | |

| CIGNA Corp. | | | 50,513 | | | | 2,222,572 | |

| Coventry Health Care, Inc. (a) | | | 25,358 | | | | 806,131 | |

| DaVita, Inc.* (a) | | | 16,900 | | | | 1,659,749 | |

| Express Scripts Holding Co.* (a) | | | 141,877 | | | | 7,920,993 | |

| Humana, Inc. | | | 29,051 | | | | 2,249,709 | |

| Laboratory Corp. of America Holdings* (a) | | | 17,372 | | | | 1,608,821 | |

| McKesson Corp. | | | 41,467 | | | | 3,887,531 | |

| Patterson Companies, Inc. (a) | | | 16,300 | | | | 561,861 | |

| Quest Diagnostics, Inc. (a) | | | 28,502 | | | | 1,707,270 | |

| Tenet Healthcare Corp.* (a) | | | 69,748 | | | | 365,480 | |

| UnitedHealth Group, Inc. (a) | | | 183,018 | | | | 10,706,553 | |

| WellPoint, Inc. | | | 58,246 | | | | 3,715,512 | |

| | | | | | | | 44,115,101 | |

| Health Care Technology 0.1% | |

| Cerner Corp.* | | | 25,710 | | | | 2,125,189 | |

| Life Sciences Tools & Services 0.4% | |

| Agilent Technologies, Inc. | | | 61,857 | | | | 2,427,269 | |

| Life Technologies Corp.* | | | 31,765 | | | | 1,429,107 | |

| PerkinElmer, Inc. | | | 20,263 | | | | 522,786 | |

| Thermo Fisher Scientific, Inc. | | | 64,020 | | | | 3,323,278 | |

| Waters Corp.* (a) | | | 16,005 | | | | 1,271,917 | |

| | | | | | | | 8,974,357 | |

| Pharmaceuticals 6.1% | |

| Abbott Laboratories (a) | | | 277,800 | | | | 17,909,766 | |

| Allergan, Inc. | | | 54,424 | | | | 5,038,030 | |

| Bristol-Myers Squibb Co. (a) | | | 298,471 | | | | 10,730,032 | |

| Eli Lilly & Co. (a) | | | 180,380 | | | | 7,740,106 | |

| Forest Laboratories, Inc.* | | | 46,347 | | | | 1,621,681 | |

| Hospira, Inc.* (a) | | | 28,322 | | | | 990,704 | |

| Johnson & Johnson (a) | | | 484,961 | | | | 32,763,965 | |

| Merck & Co., Inc. (a) | | | 537,145 | | | | 22,425,804 | |

| Mylan, Inc.* (a) | | | 74,919 | | | | 1,601,019 | |

| Perrigo Co. (a) | | | 16,400 | | | | 1,934,052 | |

| Pfizer, Inc. | | | 1,322,233 | | | | 30,411,359 | |

| Watson Pharmaceuticals, Inc.* | | | 22,257 | | | | 1,646,795 | |

| | | | | | | | 134,813,313 | |

| Industrials 10.2% | |

| Aerospace & Defense 2.5% | |

| Boeing Co. | | | 132,221 | | | | 9,824,020 | |

| General Dynamics Corp. | | | 63,450 | | | | 4,185,162 | |

| Goodrich Corp. | | | 22,238 | | | | 2,822,002 | |

| Honeywell International, Inc. | | | 137,409 | | | | 7,672,918 | |

| L-3 Communications Holdings, Inc. (a) | | | 17,368 | | | | 1,285,406 | |

| Lockheed Martin Corp. (a) | | | 46,821 | | | | 4,077,173 | |

| Northrop Grumman Corp. | | | 44,831 | | | | 2,859,769 | |

| Precision Castparts Corp. | | | 25,528 | | | | 4,199,101 | |

| Raytheon Co. (a) | | | 58,862 | | | | 3,331,001 | |

| Rockwell Collins, Inc. (a) | | | 25,144 | | | | 1,240,856 | |

| Textron, Inc. (a) | | | 50,654 | | | | 1,259,765 | |

| United Technologies Corp. (a) | | | 160,862 | | | | 12,149,907 | |

| | | | | | | | 54,907,080 | |

| Air Freight & Logistics 1.0% | |

| C.H. Robinson Worldwide, Inc. (a) | | | 28,232 | | | | 1,652,419 | |

| Expeditors International of Washington, Inc. | | | 37,300 | | | | 1,445,375 | |

| FedEx Corp. | | | 55,560 | | | | 5,089,851 | |

| United Parcel Service, Inc. "B" (a) | | | 169,422 | | | | 13,343,677 | |

| | | | | | | | 21,531,322 | |

| Airlines 0.1% | |

| Southwest Airlines Co. (a) | | | 135,614 | | | | 1,250,361 | |

| Building Products 0.0% | |

| Masco Corp. (a) | | | 62,305 | | | | 864,170 | |

| Commercial Services & Supplies 0.4% | |

| Avery Dennison Corp. | | | 18,831 | | | | 514,840 | |

| Cintas Corp. | | | 19,766 | | | | 763,165 | |

| Iron Mountain, Inc. | | | 29,600 | | | | 975,616 | |

| Pitney Bowes, Inc. (a) | | | 34,985 | | | | 523,725 | |

| R.R. Donnelley & Sons Co. (a) | | | 30,361 | | | | 357,349 | |

| Republic Services, Inc. | | | 55,199 | | | | 1,460,566 | |

| Stericycle, Inc.* (a) | | | 15,400 | | | | 1,411,718 | |

| Waste Management, Inc. (a) | | | 81,307 | | | | 2,715,654 | |

| | | | | | | | 8,722,633 | |

| Construction & Engineering 0.1% | |

| Fluor Corp. | | | 30,450 | | | | 1,502,403 | |

| Jacobs Engineering Group, Inc.* | | | 23,500 | | | | 889,710 | |

| Quanta Services, Inc.* | | | 35,800 | | | | 861,706 | |

| | | | | | | | 3,253,819 | |

| Electrical Equipment 0.5% | |

| Cooper Industries PLC | | | 27,998 | | | | 1,908,904 | |

| Emerson Electric Co. (a) | | | 129,536 | | | | 6,033,787 | |

| Rockwell Automation, Inc. | | | 25,121 | | | | 1,659,493 | |

| Roper Industries, Inc. | | | 17,466 | | | | 1,721,798 | |

| | | | | | | | 11,323,982 | |

| Industrial Conglomerates 2.7% | |

| 3M Co. (a) | | | 122,678 | | | | 10,991,949 | |

| Danaher Corp. (a) | | | 101,134 | | | | 5,267,059 | |

| General Electric Co. (a) | | | 1,870,194 | | | | 38,974,843 | |

| Tyco International Ltd. | | | 82,032 | | | | 4,335,391 | |

| | | | | | | | 59,569,242 | |

| Machinery 1.8% | |

| Caterpillar, Inc. | | | 115,068 | | | | 9,770,424 | |

| Cummins, Inc. | | | 33,978 | | | | 3,292,808 | |

| Deere & Co. (a) | | | 70,278 | | | | 5,683,382 | |

| Dover Corp. (a) | | | 32,272 | | | | 1,730,102 | |

| Eaton Corp. (a) | | | 59,640 | | | | 2,363,533 | |

| Flowserve Corp. (a) | | | 9,992 | | | | 1,146,582 | |

| Illinois Tool Works, Inc. (a) | | | 84,560 | | | | 4,472,378 | |

| Ingersoll-Rand PLC | | | 52,514 | | | | 2,215,041 | |

| Joy Global, Inc. | | | 18,303 | | | | 1,038,329 | |

| PACCAR, Inc. (a) | | | 62,681 | | | | 2,456,468 | |

| Pall Corp. (a) | | | 20,310 | | | | 1,113,191 | |

| Parker Hannifin Corp. | | | 26,552 | | | | 2,041,318 | |

| Snap-on, Inc. (a) | | | 10,032 | | | | 624,492 | |

| Stanley Black & Decker, Inc. (a) | | | 29,888 | | | | 1,923,592 | |

| Xylem, Inc. (a) | | | 32,005 | | | | 805,566 | |

| | | | | | | | 40,677,206 | |

| Professional Services 0.1% | |

| Dun & Bradstreet Corp. (a) | | | 8,214 | | | | 584,590 | |

| Equifax, Inc. (a) | | | 22,009 | | | | 1,025,620 | |

| Robert Half International, Inc. (a) | | | 25,775 | | | | 736,392 | |

| | | | | | | | 2,346,602 | |

| Road & Rail 0.8% | |

| CSX Corp. (a) | | | 183,290 | | | | 4,098,364 | |

| Norfolk Southern Corp. | | | 57,463 | | | | 4,124,120 | |

| Ryder System, Inc. | | | 9,790 | | | | 352,538 | |

| Union Pacific Corp. (a) | | | 84,064 | | | | 10,029,676 | |

| | | | | | | | 18,604,698 | |

| Trading Companies & Distributors 0.2% | |

| Fastenal Co. (a) | | | 52,000 | | | | 2,096,120 | |

| W.W. Grainger, Inc. (a) | | | 10,709 | | | | 2,047,989 | |

| | | | | | | | 4,144,109 | |

| Information Technology 19.3% | |

| Communications Equipment 1.8% | |

| Cisco Systems, Inc. (a) | | | 945,886 | | | | 16,240,863 | |

| F5 Networks, Inc.* (a) | | | 13,910 | | | | 1,384,880 | |

| Harris Corp. (a) | | | 19,300 | | | | 807,705 | |

| JDS Uniphase Corp.* (a) | | | 43,039 | | | | 473,429 | |

| Juniper Networks, Inc.* | | | 94,334 | | | | 1,538,587 | |

| Motorola Solutions, Inc. (a) | | | 51,698 | | | | 2,487,191 | |

| QUALCOMM, Inc. | | | 302,386 | | | | 16,836,852 | |

| | | | | | | | 39,769,507 | |

| Computers & Peripherals 5.5% | |

| Apple, Inc.* | | | 165,111 | | | | 96,424,824 | |

| Dell, Inc.* | | | 262,678 | | | | 3,288,729 | |

| EMC Corp.* | | | 366,490 | | | | 9,393,139 | |

| Hewlett-Packard Co. | | | 349,175 | | | | 7,021,909 | |

| Lexmark International, Inc. "A" (a) | | | 13,757 | | | | 365,661 | |

| NetApp, Inc.* (a) | | | 64,109 | | | | 2,039,948 | |

| SanDisk Corp.* | | | 43,400 | | | | 1,583,232 | |

| Seagate Technology PLC | | | 66,820 | | | | 1,652,459 | |

| Western Digital Corp.* | | | 40,435 | | | | 1,232,459 | |

| | | | | | | | 123,002,360 | |

| Electronic Equipment, Instruments & Components 0.4% | |

| Amphenol Corp. "A" (a) | | | 28,330 | | | | 1,555,884 | |

| Corning, Inc. | | | 265,997 | | | | 3,439,341 | |

| FLIR Systems, Inc. (a) | | | 26,700 | | | | 520,650 | |

| Jabil Circuit, Inc. | | | 32,289 | | | | 656,435 | |

| Molex, Inc. (a) | | | 24,886 | | | | 595,771 | |

| TE Connectivity Ltd. (a) | | | 75,932 | | | | 2,422,990 | |

| | | | | | | | 9,191,071 | |

| Internet Software & Services 1.8% | |

| Akamai Technologies, Inc.* | | | 30,800 | | | | 977,900 | |

| eBay, Inc.* | | | 202,932 | | | | 8,525,173 | |

| Google, Inc. "A"* | | | 44,940 | | | | 26,068,346 | |

| VeriSign, Inc.* (a) | | | 28,600 | | | | 1,246,102 | |

| Yahoo!, Inc.* (a) | | | 214,333 | | | | 3,392,891 | |

| | | | | | | | 40,210,412 | |

| IT Services 3.8% | |

| Accenture PLC "A" (a) | | | 113,786 | | | | 6,837,401 | |

| Automatic Data Processing, Inc. (a) | | | 86,310 | | | | 4,804,014 | |

| Cognizant Technology Solutions Corp. "A"* | | | 54,222 | | | | 3,253,320 | |

| Computer Sciences Corp. | | | 28,543 | | | | 708,437 | |

| Fidelity National Information Services, Inc. | | | 40,939 | | | | 1,395,201 | |

| Fiserv, Inc.* (a) | | | 24,005 | | | | 1,733,641 | |

| International Business Machines Corp. | | | 203,700 | | | | 39,839,646 | |

| MasterCard, Inc. "A" | | | 18,700 | | | | 8,043,057 | |

| Paychex, Inc. (a) | | | 58,401 | | | | 1,834,375 | |

| SAIC, Inc. (a) | | | 45,632 | | | | 553,060 | |

| Teradata Corp.* | | | 29,508 | | | | 2,124,871 | |

| Total System Services, Inc. | | | 28,359 | | | | 678,631 | |

| Visa, Inc. "A" (a) | | | 87,901 | | | | 10,867,201 | |

| Western Union Co. | | | 109,496 | | | | 1,843,913 | |

| | | | | | | | 84,516,768 | |

| Office Electronics 0.1% | |

| Xerox Corp. | | | 238,526 | | | | 1,877,200 | |

| Semiconductors & Semiconductor Equipment 2.2% | |

| Advanced Micro Devices, Inc.* (a) | | | 103,697 | | | | 594,184 | |

| Altera Corp. | | | 56,944 | | | | 1,926,985 | |

| Analog Devices, Inc. (a) | | | 52,368 | | | | 1,972,703 | |

| Applied Materials, Inc. | | | 226,204 | | | | 2,592,298 | |

| Broadcom Corp. "A"* | | | 86,883 | | | | 2,936,645 | |

| First Solar, Inc.* (a) | | | 10,695 | | | | 161,067 | |

| Intel Corp. (a) | | | 888,409 | | | | 23,676,100 | |

| KLA-Tencor Corp. | | | 29,985 | | | | 1,476,761 | |

| Lam Research Corp.* (a) | | | 36,313 | | | | 1,370,453 | |

| Linear Technology Corp. (a) | | | 41,396 | | | | 1,296,937 | |

| LSI Corp.* | | | 101,955 | | | | 649,453 | |

| Microchip Technology, Inc. (a) | | | 34,800 | | | | 1,151,184 | |

| Micron Technology, Inc.* | | | 172,949 | | | | 1,091,308 | |

| NVIDIA Corp.* (a) | | | 109,843 | | | | 1,518,030 | |

| Teradyne, Inc.* (a) | | | 32,958 | | | | 463,389 | |

| Texas Instruments, Inc. | | | 201,115 | | | | 5,769,989 | |

| Xilinx, Inc. (a) | | | 45,803 | | | | 1,537,607 | |

| | | | | | | | 50,185,093 | |

| Software 3.7% | |

| Adobe Systems, Inc.* (a) | | | 88,044 | | | | 2,849,984 | |

| Autodesk, Inc.* (a) | | | 40,948 | | | | 1,432,771 | |

| BMC Software, Inc.* | | | 27,866 | | | | 1,189,321 | |

| CA, Inc. (a) | | | 62,515 | | | | 1,693,531 | |

| Citrix Systems, Inc.* | | | 32,714 | | | | 2,746,013 | |

| Electronic Arts, Inc.* | | | 56,006 | | | | 691,674 | |

| Intuit, Inc. | | | 52,530 | | | | 3,117,656 | |

| Microsoft Corp. | | | 1,320,060 | | | | 40,380,635 | |

| Oracle Corp. | | | 685,150 | | | | 20,348,955 | |

| Red Hat, Inc.* | | | 34,593 | | | | 1,953,813 | |

| Salesforce.com, Inc.* (a) | | | 24,000 | | | | 3,318,240 | |

| Symantec Corp.* (a) | | | 127,164 | | | | 1,857,866 | |

| | | | | | | | 81,580,459 | |

| Materials 3.3% | |

| Chemicals 2.3% | |

| Air Products & Chemicals, Inc. (a) | | | 37,518 | | | | 3,028,828 | |

| Airgas, Inc. | | | 12,450 | | | | 1,045,925 | |

| CF Industries Holdings, Inc. | | | 11,624 | | | | 2,252,034 | |

| Dow Chemical Co. (a) | | | 211,958 | | | | 6,676,677 | |

| E.I. du Pont de Nemours & Co. (a) | | | 165,345 | | | | 8,361,497 | |

| Eastman Chemical Co. (a) | | | 24,538 | | | | 1,235,979 | |

| Ecolab, Inc. (a) | | | 51,621 | | | | 3,537,587 | |

| FMC Corp. | | | 24,100 | | | | 1,288,868 | |

| International Flavors & Fragrances, Inc. (a) | | | 14,216 | | | | 779,037 | |

| Monsanto Co. | | | 94,166 | | | | 7,795,061 | |

| PPG Industries, Inc. | | | 27,162 | | | | 2,882,431 | |

| Praxair, Inc. (a) | | | 52,754 | | | | 5,735,942 | |

| Sigma-Aldrich Corp. (a) | | | 21,016 | | | | 1,553,713 | |

| The Mosaic Co. | | | 52,275 | | | | 2,862,579 | |

| The Sherwin-Williams Co. (a) | | | 15,305 | | | | 2,025,617 | |

| | | | | | | | 51,061,775 | |

| Construction Materials 0.0% | |

| Vulcan Materials Co. (a) | | | 21,976 | | | | 872,667 | |

| Containers & Packaging 0.1% | |

| Ball Corp. (a) | | | 27,148 | | | | 1,114,425 | |

| Bemis Co., Inc. (a) | | | 17,530 | | | | 549,390 | |

| Owens-Illinois, Inc.* | | | 30,200 | | | | 578,934 | |

| Sealed Air Corp. | | | 35,272 | | | | 544,600 | |

| | | | | | | | 2,787,349 | |

| Metals & Mining 0.7% | |

| Alcoa, Inc. (a) | | | 192,738 | | | | 1,686,457 | |

| Allegheny Technologies, Inc. | | | 18,179 | | | | 579,728 | |

| Cliffs Natural Resources, Inc. (a) | | | 25,533 | | | | 1,258,522 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 167,136 | | | | 5,694,323 | |

| Newmont Mining Corp. | | | 87,154 | | | | 4,227,841 | |

| Nucor Corp. (a) | | | 55,799 | | | | 2,114,782 | |