Exhibit 99.2

FOCUSED ON NEW THERAPIES FOR ONCOLOGY

Annual Meeting of Stockholders

September 2006

Forward Looking Statements

This presentation includes forward-looking statements that reflect Somanta’s current views with respect to future events and financial performance. The words “believe,” “expect,” “intend”, “plan”, “will”, “plan”, “may”, “anticipate,” and similar expressions identify forward-looking statements. Forward-looking statements are subject to a variety of risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed in any such forward-looking statements. These factors include, but are not limited to: (1) the ability to successfully complete development and commercialization of products, including the cost, scope and results of preclinical and clinical testing; (2) the ability to successfully complete product research and further development, including preclinical and clinical studies; (3) the time, cost and uncertainty of obtaining regulatory approvals; (4) the ability to obtain substantial additional funding; (5) the ability to develop and commercialize products before competitors; and (6) other factors detailed from time to time in filings with the Securities and Exchange Commission and in particular Somanta’s most recently file 10-KSB.

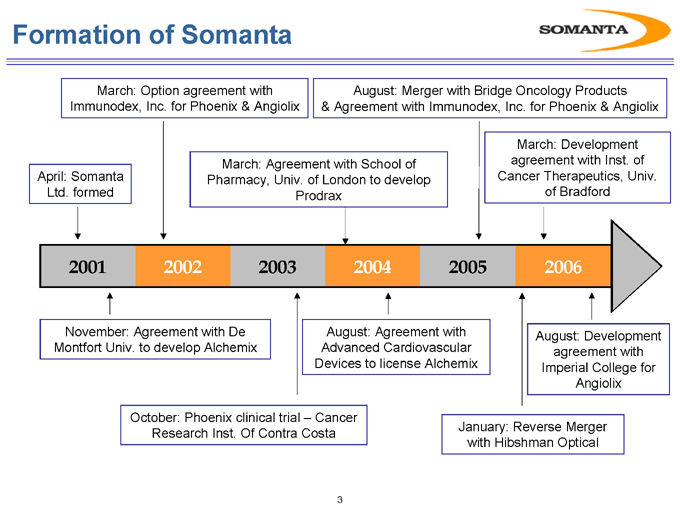

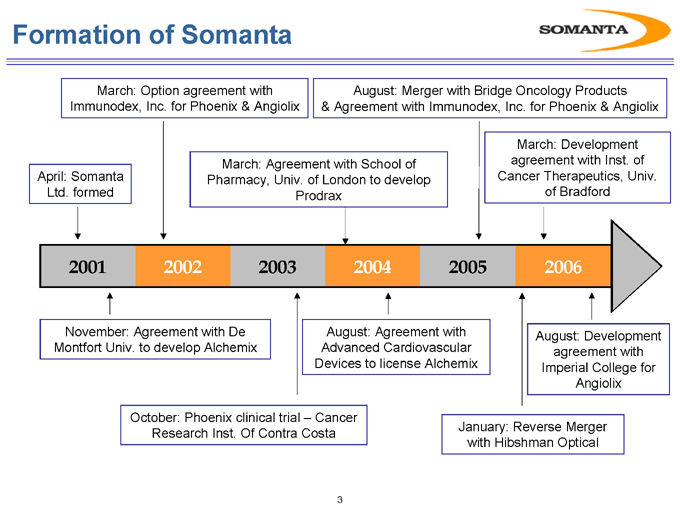

Formation of Somanta

March: Option agreement with Immunodex, Inc. for Phoenix & Angiolix

August: Merger with Bridge Oncology Products & Agreement with Immunodex, Inc. for Phoenix & Angiolix

April: Somanta Ltd. formed

March: Agreement with School of Pharmacy, Univ. of London to develop Prodrax

March: Development agreement with Inst. of Cancer Therapeutics, Univ. of Bradford

2001 2002 2003 2004 2005 2006

November: Agreement with De Montfort Univ. to develop Alchemix

August: Agreement with Advanced Cardiovascular Devices to license Alchemix

August: Development agreement with Imperial College for Angiolix

October: Phoenix clinical trial – Cancer Research Inst. Of Contra Costa

January: Reverse Merger with Hibshman Optical

Results of Annual Meeting

Re-election of Board

Michael Ashton – retired CEO of SkyePharma, Chair of Nominating and Corporate Governance Committee, member of Audit and Compensation Committees

Terrance Bruggeman – Executive Chairman and CFO

Jeffrey Davis – President of SCO Financial Group, Chair of Compensation Committee and member of Audit Committee

Agamemnon Epenetos MD PhD- President and Chief Executive Officer

John Gibson MD – Senior VP, Global Development of Allergan. Member of Compensation Committee and Nominating Committee

Kathleen Van Sleen – Principal REventures and former CFO of Diversa. Chair of Audit Committee and member of Nominating Committee

Ratification of Stonefield Josephson as independent registered public accountants for fiscal year ended April 30, 2007

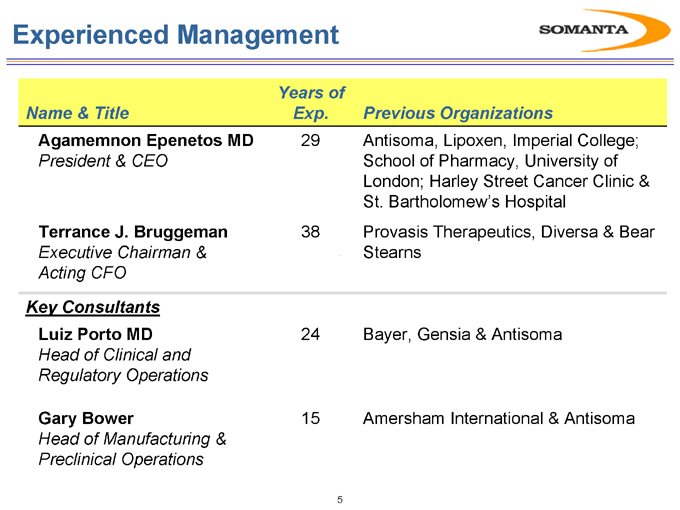

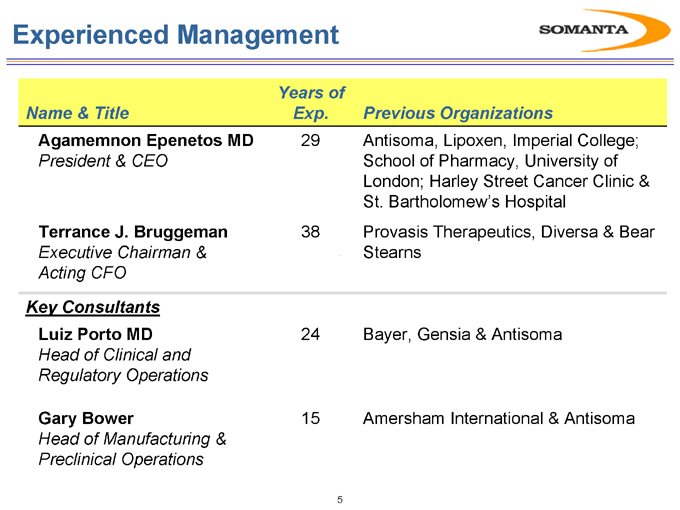

Experienced Management

Name & Title

Agamemnon Epenetos MD

President & CEO

Terrance J. Bruggeman

Executive Chairman & Acting CFO

Key Consultants

Luiz Porto MD

Head of Clinical and Regulatory Operations

Gary Bower

Head of Manufacturing & Preclinical Operations

Years of Exp.

29 38 24 15

Previous Organizations

Antisoma, Lipoxen, Imperial College; School of Pharmacy, University of London; Harley Street Cancer Clinic & St. Bartholomew’s Hospital Provasis Therapeutics, Diversa & Bear Stearns

Bayer, Gensia & Antisoma

Amersham International & Antisoma

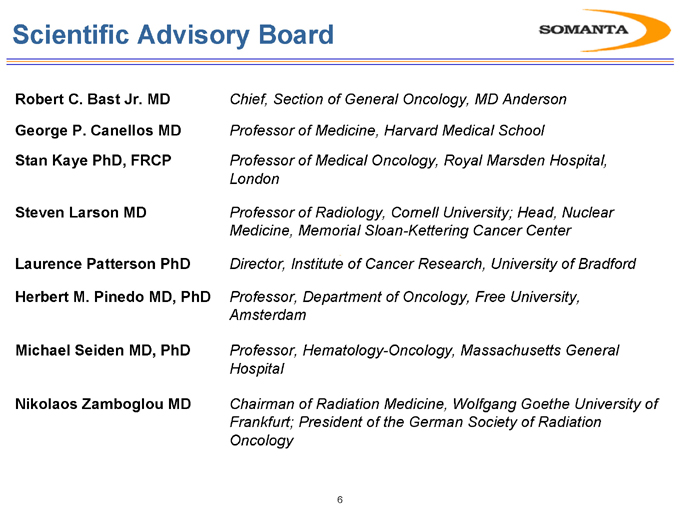

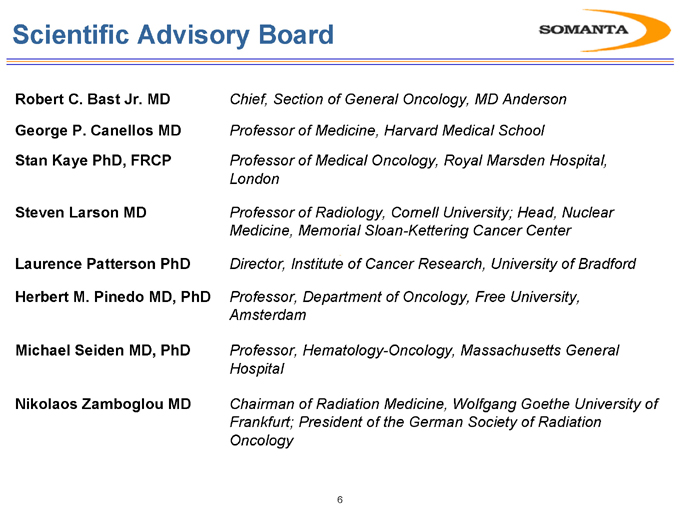

Scientific Advisory Board

Robert C. Bast Jr. MD

George P. Canellos MD Stan Kaye PhD, FRCP

Steven Larson MD

Laurence Patterson PhD

Herbert M. Pinedo MD, PhD

Michael Seiden MD, PhD

Nikolaos Zamboglou MD

Chief, Section of General Oncology, MD Anderson

Professor of Medicine, Harvard Medical School

Professor of Medical Oncology, Royal Marsden Hospital, London

Professor of Radiology, Cornell University; Head, Nuclear Medicine, Memorial Sloan-Kettering Cancer Center

Director, Institute of Cancer Research, University of Bradford

Professor, Department of Oncology, Free University, Amsterdam

Professor, Hematology-Oncology, Massachusetts General Hospital

Chairman of Radiation Medicine, Wolfgang Goethe University of Frankfurt; President of the German Society of Radiation Oncology

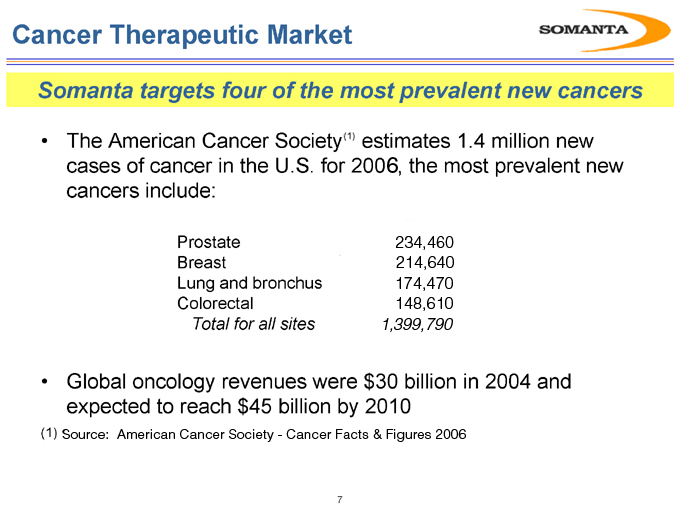

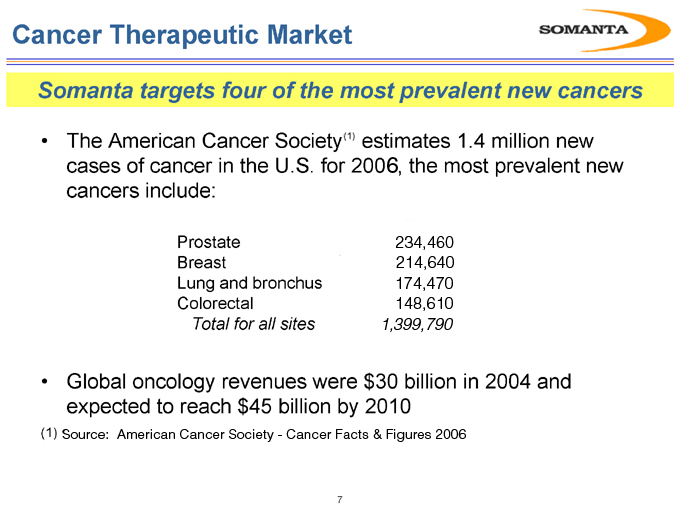

Cancer Therapeutic Market

Somanta targets four of the most prevalent new cancers

The American Cancer Society(1) estimates 1.4 million new cases of cancer in the U.S. for 2006, the most prevalent new cancers include:

Prostate 234,460

Breast 214,640

Lung and bronchus 174,470

Colorectal 148,610

Total for all sites 1,399,790

Global oncology revenues were $30 billion in 2004 and expected to reach $45 billion by 2010

(1) | | Source: American Cancer Society—Cancer Facts & Figures 2006 |

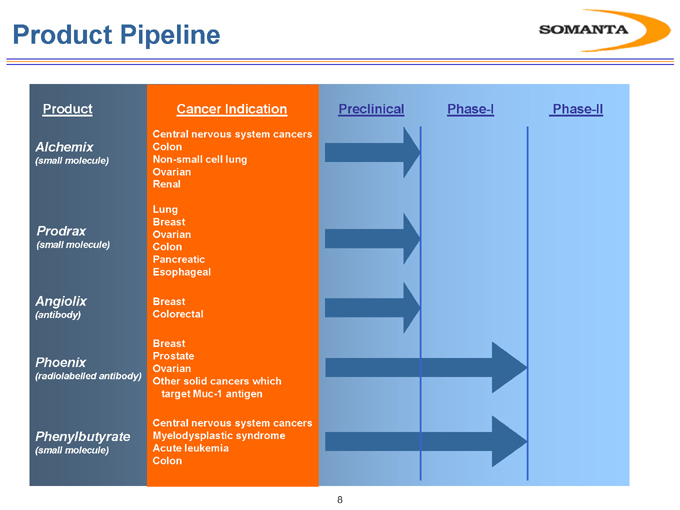

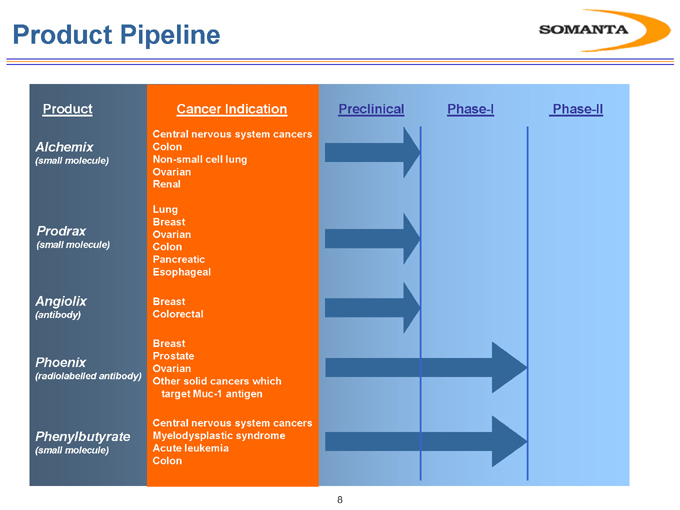

Product Pipeline

Product

Alchemix

(small molecule)

Prodrax

(small molecule)

Angiolix

(antibody)

Phoenix

(radiolabelled antibody)

Phenylbutyrate

(small molecule)

Cancer Indication

Central nervous system cancers Colon Non-small cell lung Ovarian Renal

Lung Breast Ovarian Colon Pancreatic Esophageal

Breast Colorectal

Breast Prostate Ovarian

Other solid cancers which target Muc-1 antigen

Central nervous system cancers Myelodysplastic syndrome Acute leukemia Colon

Preclinical Phase-I Phase-II

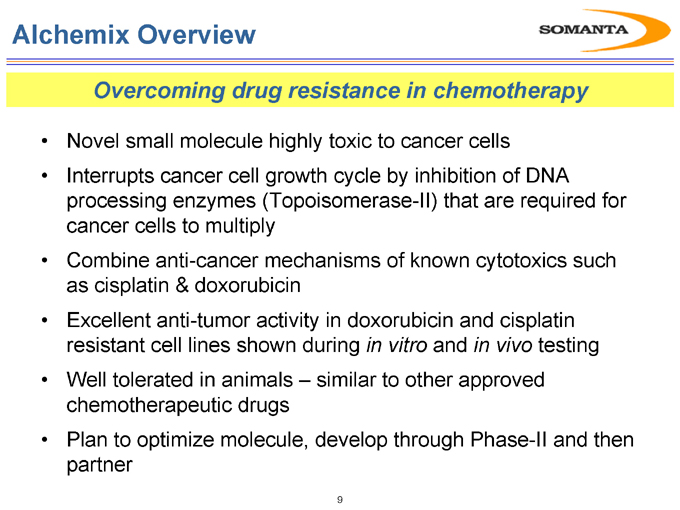

Alchemix Overview

Overcoming drug resistance in chemotherapy

Novel small molecule highly toxic to cancer cells

Interrupts cancer cell growth cycle by inhibition of DNA processing enzymes (Topoisomerase-II) that are required for cancer cells to multiply

Combine anti-cancer mechanisms of known cytotoxics such as cisplatin & doxorubicin

Excellent anti-tumor activity in doxorubicin and cisplatin resistant cell lines shown during in vitro and in vivo testing

Well tolerated in animals – similar to other approved chemotherapeutic drugs

Plan to optimize molecule, develop through Phase-II and then partner

9

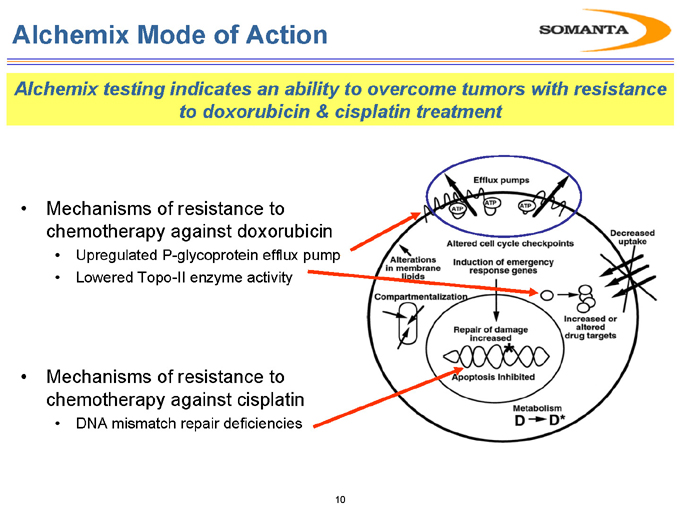

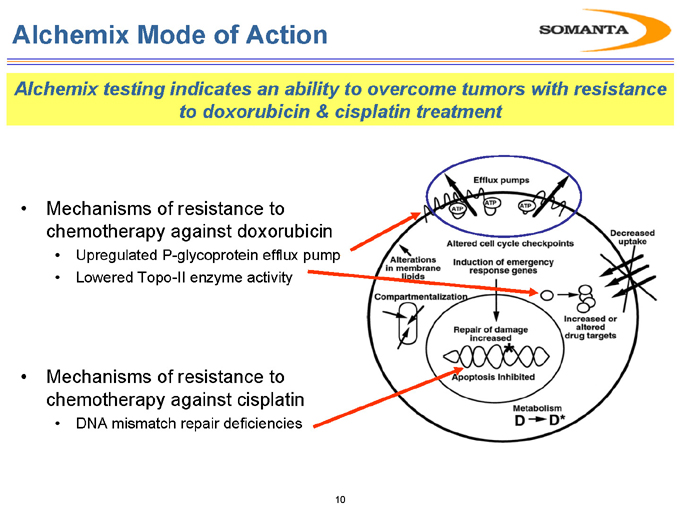

Alchemix Mode of Action

Alchemix testing indicates an ability to overcome tumors with resistance to doxorubicin & cisplatin treatment

Mechanisms of resistance to chemotherapy against doxorubicin

Upregulated P-glycoprotein efflux pump

Lowered Topo-II enzyme activity

Mechanisms of resistance to chemotherapy against cisplatin

DNA mismatch repair deficiencies

10

Prodrax Overview

Taking cancer’s strength and turning it into its weakness

A family of small molecule “prodrugs” which are inactive in normally oxygenated cells but convert to highly toxic DNA binding agents in hypoxic tumors

Estimated that over 50% of all solid tumors exhibit clinically significant hypoxic areas

Radiation is markedly less effective in hypoxic areas and conventional chemotherapy has more limited penetration

Plan to optimize molecule, develop through Phase-II and then partner

11

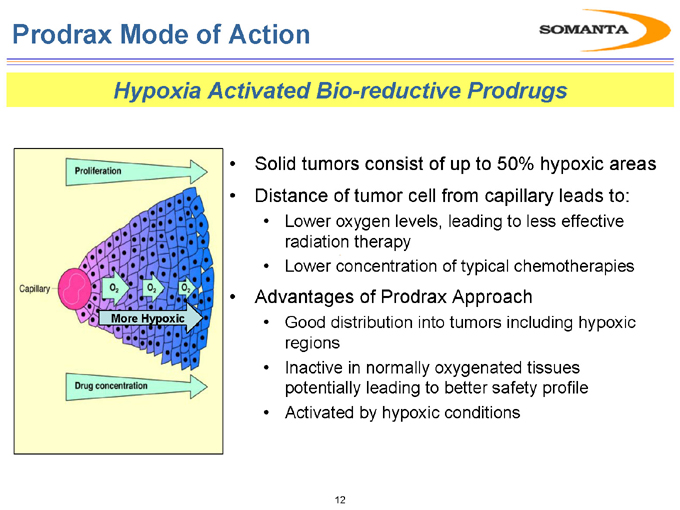

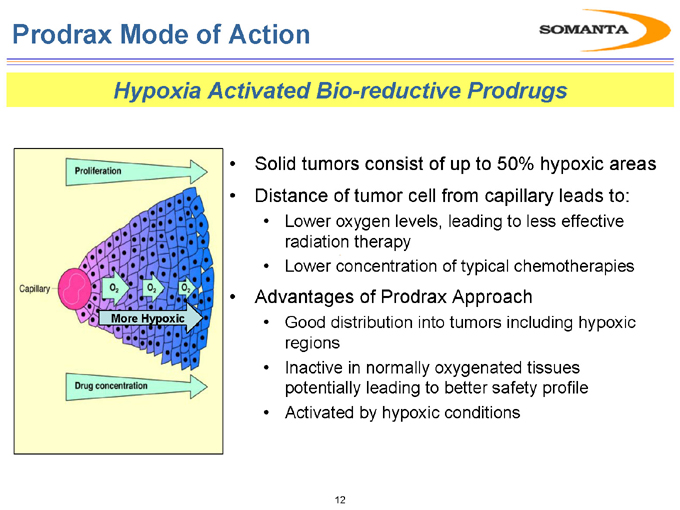

Prodrax Mode of Action

Hypoxia Activated Bio-reductive Prodrugs

Solid tumors consist of up to 50% hypoxic areas

Distance of tumor cell from capillary leads to:

Lower oxygen levels, leading to less effective radiation therapy

Lower concentration of typical chemotherapies

Advantages of Prodrax Approach

Good distribution into tumors including hypoxic regions

Inactive in normally oxygenated tissues potentially leading to better safety profile

Activated by hypoxic conditions

12

Angiolix Overview

Targeting Angiogenesis

A humanized monoclonal antibody (huMc3) that targets Lactadherin

Lactadherin is a protein expressed in and around blood vessels of tumors and has a critical role in promoting the growth of new blood vessels to support tumor growth

Angiolix binds to Lactadherin and inhibits formation of new blood vessels, blocking blood supply to the tumor and causing the tumor to die

Angiolix has similar effects to Avastin® which targets VEGF instead of Lactadherin

No other product against Lactadherin for the treatment of cancer can be developed without a sub-license from Somanta

Plan to develop through Phase-II and then partner

13

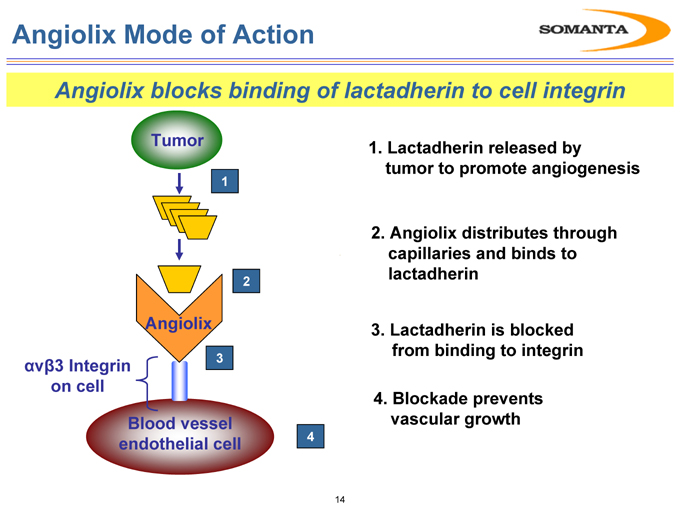

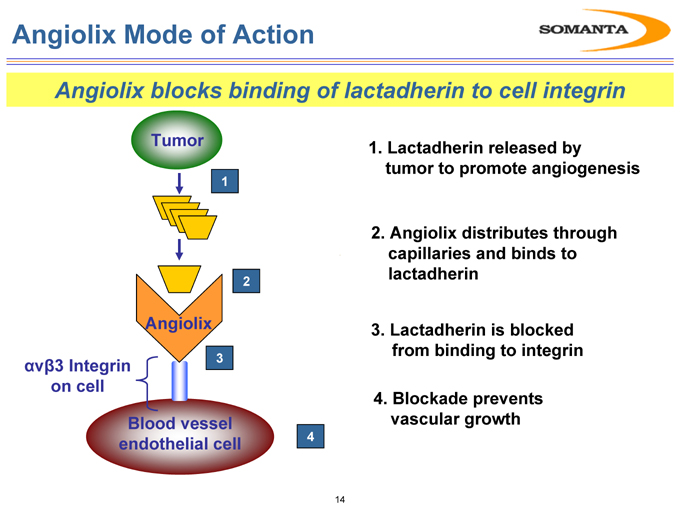

Angiolix Mode of Action

Angiolix blocks binding of lactadherin to cell integrin

Tumor

Angiolix

?v?3 Integrin on cell

Blood vessel endothelial cell

1. Lactadherin released by tumor to promote angiogenesis

2. Angiolix distributes through capillaries and binds to lactadherin

3. Lactadherin is blocked from binding to integrin

4. Blockade prevents vascular growth

14

Phoenix Overview

Targeting cancer related antigen

Phoenix (huBrE-3 tiuxetan)—a patented radiolabeled humanized monoclonal antibody delivering high-energy radiation to cancer cells by targeting PEM

PEM – polymorphic epithelial mucin – an antigen over expressed in tumor cells; encoded by MUC-1 gene

Phoenix binds to PEM on the surface of cancer cells; when radiolabelled can deliver a localized dose of high-energy beta radiation (Yttrium-90) directly to tumors

Clinical studies have shown antibody can be localized and tumor shrinkage was evident

Seeking partner for further clinical development

15

Phoenix Clinical Study

25% response rate in Stage IV Breast Cancer patients in Phase-I Study

Phase-I study at University Hospital, Denver, Colorado

17 patients

Advanced (stage IV) breast cancer

Single dose

Radiation myelotoxicity as expected

4/17 PI-defined responses (~25% response rate)

16

Sodium Phenylbutyrate

A new use for an approved drug

Well-tolerated: many years of clinical use for hyperuremia (a rare genetic disorder in infants)

Renewed interest as an anti-cancer drug

Phase-I dose established (IV and oral)

Indications of activity in Phase-II

Novel mechanism of action for cancer therapy as non-cytotoxic HDAC inhibitor

Sodium phenylbutyrate works in synergy with radiation and chemotherapy

17

Sodium Phenylbutyrate

Ongoing trials and development plans

Our licensor, Virium Pharmaceuticals, to initiate Phase-I/II in recurrent glioblastoma in combination with radiation

Somanta to evaluate Virium data and then initiate Phase-IIb trials for glioblastoma + other cancers in Europe and elsewhere

Opportunity for development of improved formulation

18

Corporate Objectives

Create and develop a diversified pipeline of cancer therapeutics

Advance clinical programs of three most promising products through Phase-II clinical trials

Seek high value corporate partnerships for two products currently in Phase-II

Continue to seek additional in-licensing opportunities

19

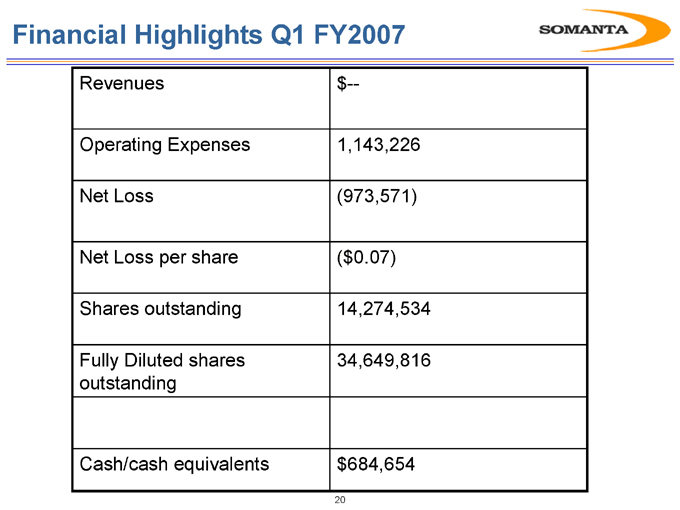

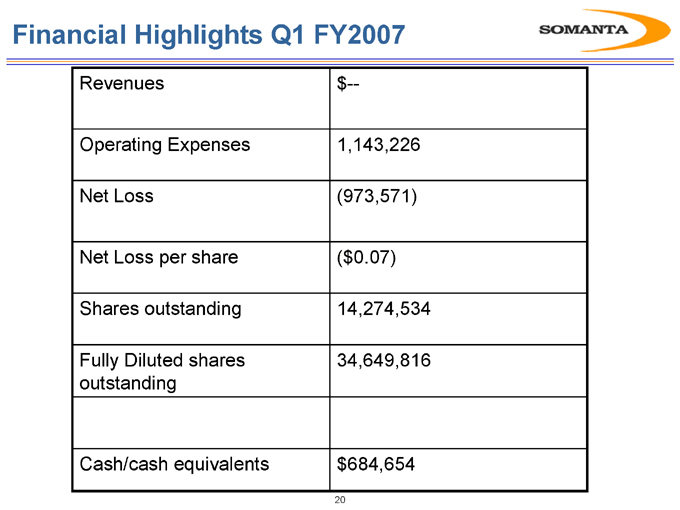

Financial Highlights Q1 FY2007

Revenues $—

Operating Expenses 1,143,226

Net Loss (973,571)

Net Loss per share ($0.07)

Shares outstanding 14,274,534

Fully Diluted shares 34,649,816

outstanding

Cash/cash equivalents $684,654

20

Investment Highlights

Focused on oncology therapies targeting 11 tumor types

Management team with proven oncology drug development expertise and commercialization background

In-licensing driven business model mitigates R&D risk

Diversified oncology portfolio with 3 small molecules and 2 antibodies in development

All products are novel approaches with defined Modes of Action

Strong IP position for all products

Low-cost “virtual” operation: 5 employees & key service providers

Bulk of investor dollars going to product development

21

APPENDIX

ALCHEMIX

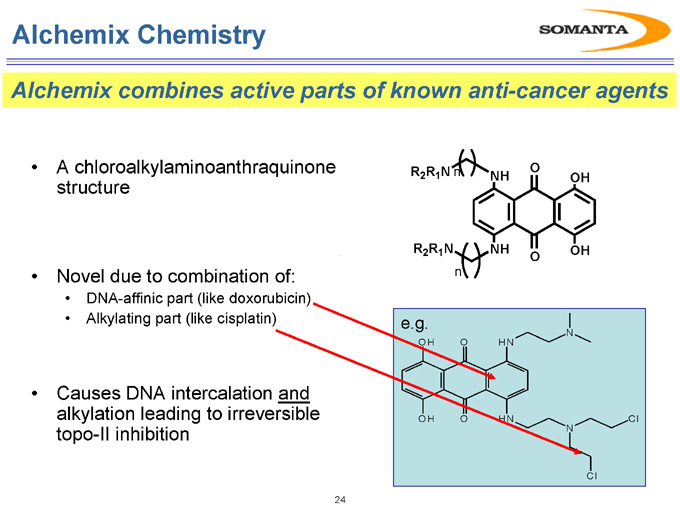

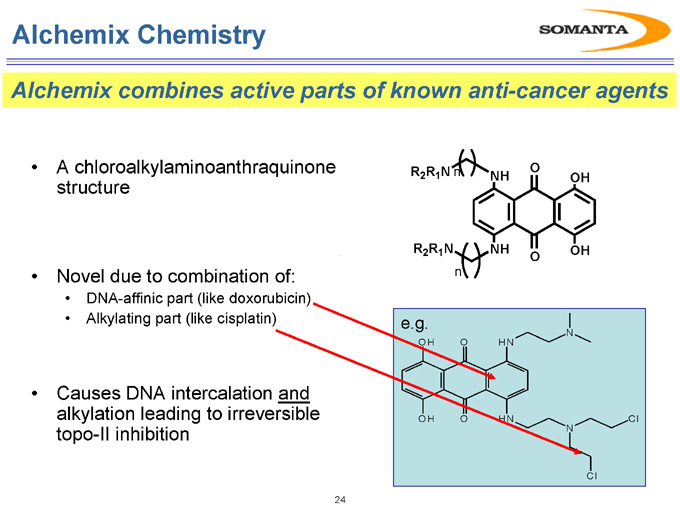

Alchemix Chemistry

Alchemix combines active parts of known anti-cancer agents

A chloroalkylaminoanthraquinone structure

Novel due to combination of:

DNA-affinic part (like doxorubicin)

Alkylating part (like cisplatin)

Causes DNA intercalation and alkylation leading to irreversible topo-II inhibition

R2R1Nn NH O OH

O n

e.g.

N O H O H N

O H O H N C l N

C l

24

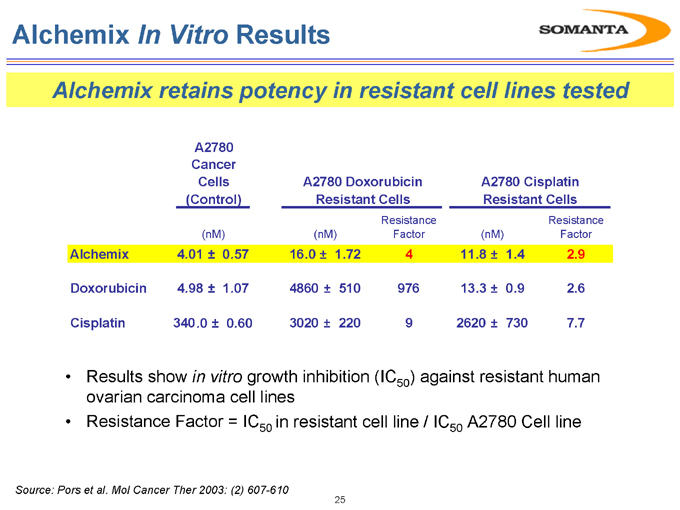

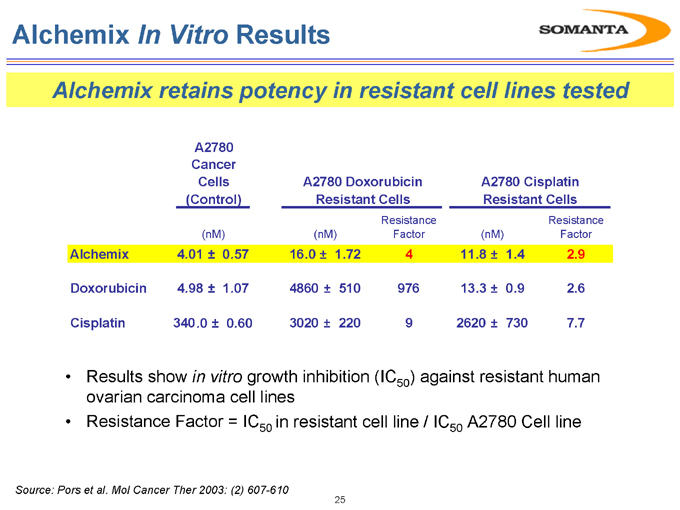

Alchemix In Vitro Results

Alchemix retains potency in resistant cell lines tested

A2780 Cancer

Cells A2780 Doxorubicin A2780 Cisplatin (Control) Resistant Cells Resistant Cells

Alchemix Doxorubicin Cisplatin

(nM)

4 .01 ± 0.57

4.98 ± 1.07 340.0 ± 0.60

(nM)

16.0 ± 1.72 4860 ± 510 3020 ± 220

Resistance Factor

(nM)

11.8 ± 1.4 13.3 ± 0.9 2620 ± 730

Resistance Factor

2.9 2.6 7.7

Results show in vitro growth inhibition (IC50) against resistant human

ovarian carcinoma cell lines

Resistance Factor = IC50 in resistant cell line / IC50 A2780 Cell line

Source: Pors et al. Mol Cancer Ther 2003: (2) 607-610

25

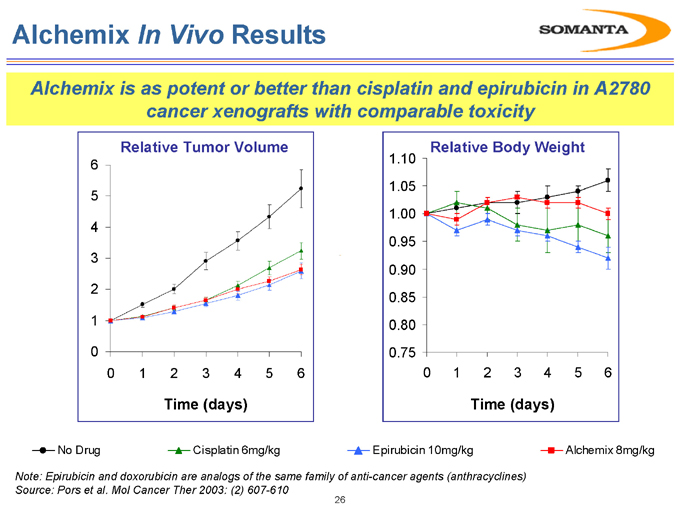

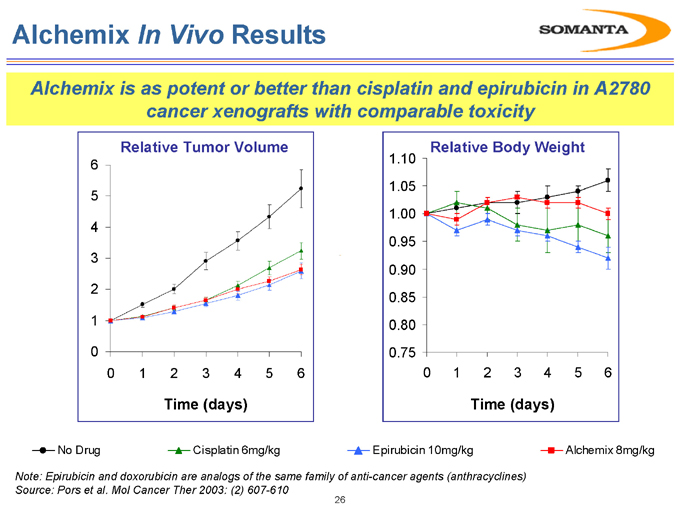

Alchemix In Vivo Results

Alchemix is as potent or better than cisplatin and epirubicin in A2780 cancer xenografts with comparable toxicity

Relative Tumor Volume

0 1 2 3 4 5 6

Time (days)

Relative Body Weight

1.10 1.05 1.00 0.95

0.90 0.85 0.80 0.75

0 1 2 3 4 5 6

Time (days)

No Drug Cisplatin 6mg/kg Epirubicin 10mg/kg Alchemix 8mg/kg

Note: Epirubicin and doxorubicin are analogs of the same family of anti-cancer agents (anthracyclines) Source: Pors et al. Mol Cancer Ther 2003: (2) 607-610

26

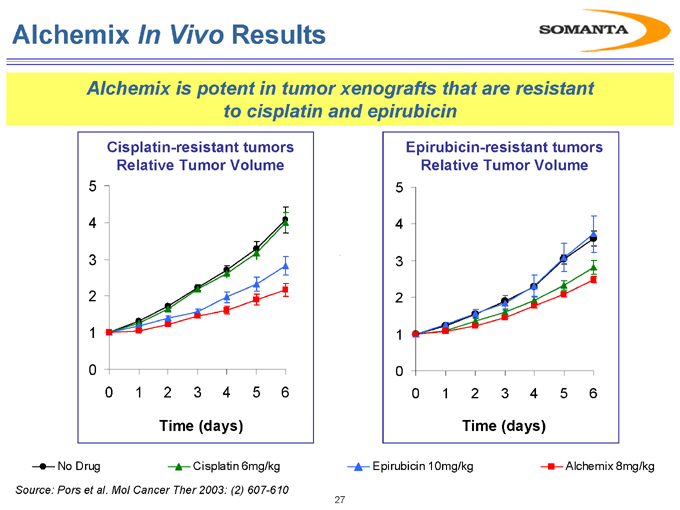

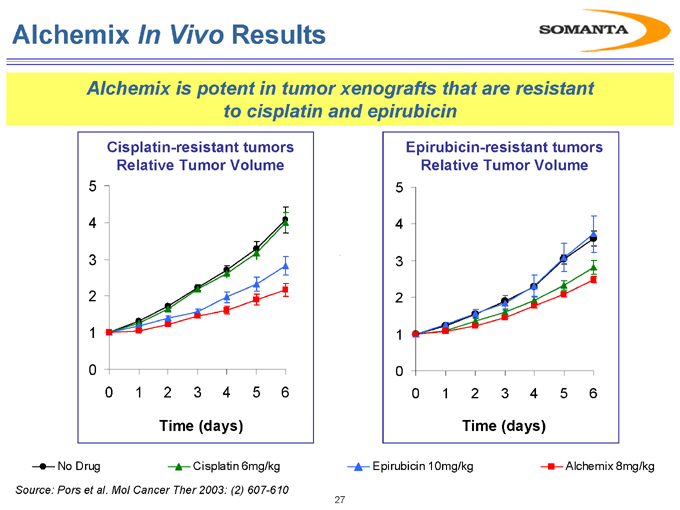

Alchemix In Vivo Results

Alchemix is potent in tumor xenografts that are resistant to cisplatin and epirubicin

Cisplatin-resistant tumors Relative Tumor Volume

0 1 2 3 4 5 6

Time (days)

Epirubicin-resistant tumors Relative Tumor Volume

0 1 2 3 4 5 6

Time (days)

No Drug Cisplatin 6mg/kg Epirubicin 10mg/kg Alchemix 8mg/kg

Source: Pors et al. Mol Cancer Ther 2003: (2) 607-610

27

PRODRAX

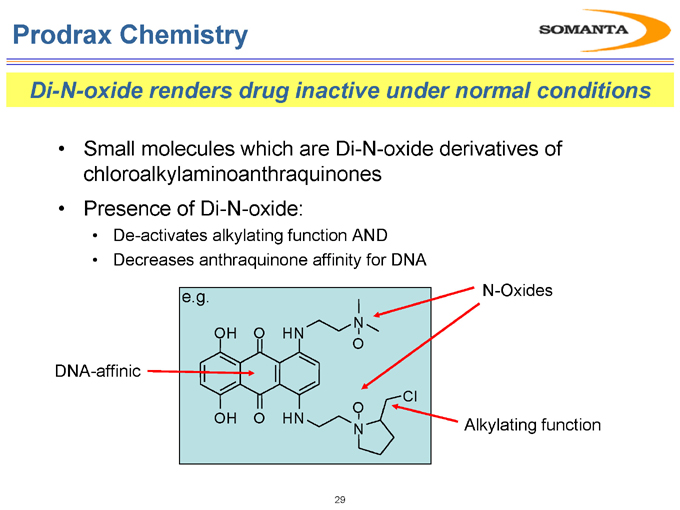

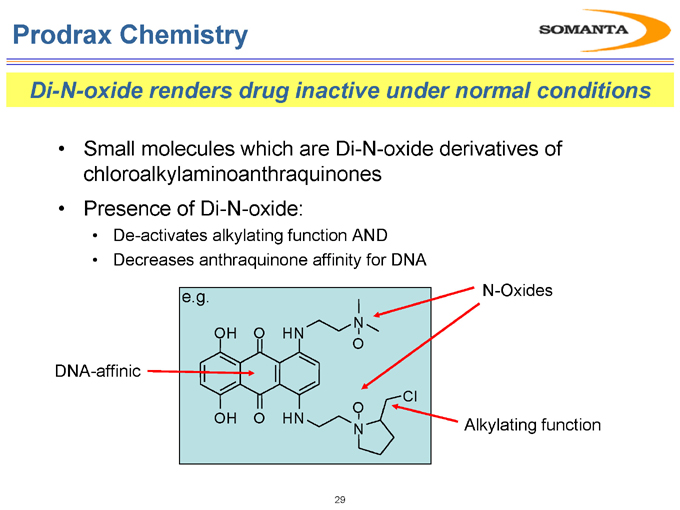

Prodrax Chemistry

Di-N-oxide renders drug inactive under normal conditions

Small molecules which are Di-N-oxide derivatives of chloroalkylaminoanthraquinones

Presence of Di-N-oxide:

De-activates alkylating function AND

Decreases anthraquinone affinity for DNA

DNA-affinic

N-Oxides

Alkylating function

e.g.

N OH O HN

O

Cl O

OH O HN

N

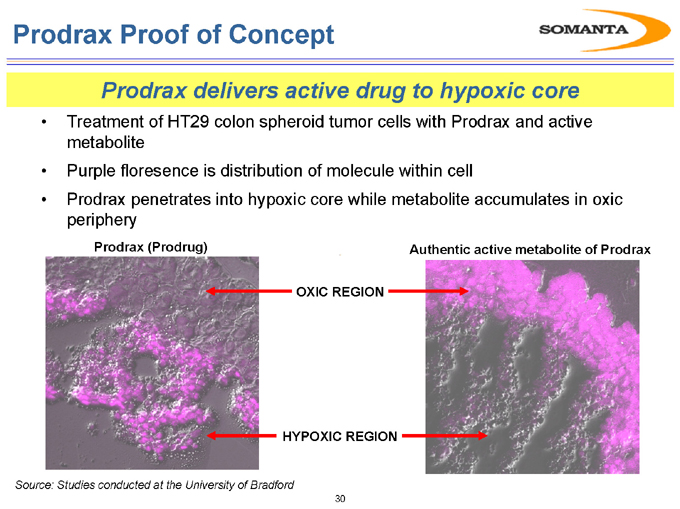

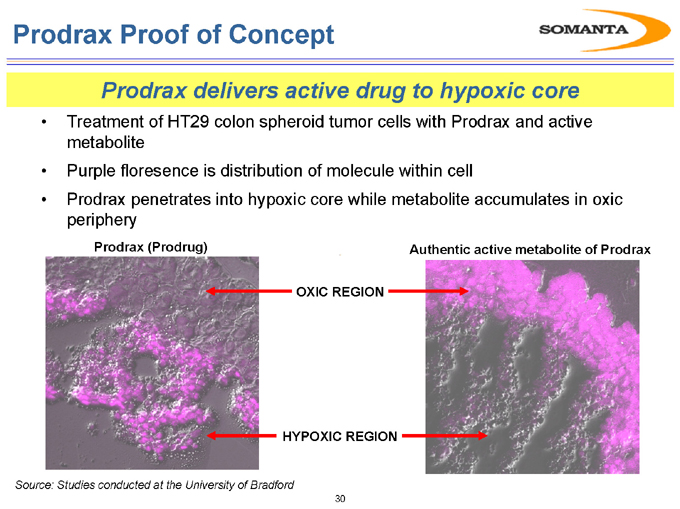

Prodrax Proof of Concept

Prodrax delivers active drug to hypoxic core

Treatment of HT29 colon spheroid tumor cells with Prodrax and active metabolite

Purple floresence is distribution of molecule within cell

Prodrax penetrates into hypoxic core while metabolite accumulates in oxic periphery

Prodrax (Prodrug)

Authentic active metabolite of Prodrax

OXIC REGION

HYPOXIC REGION

Source: Studies conducted at the University of Bradford

30

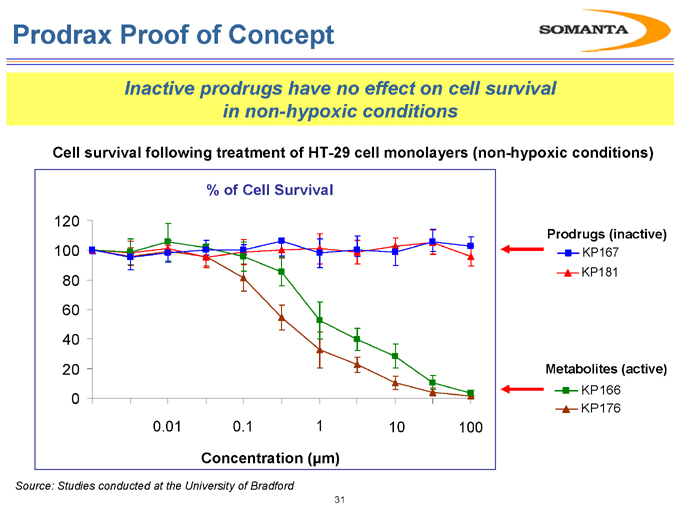

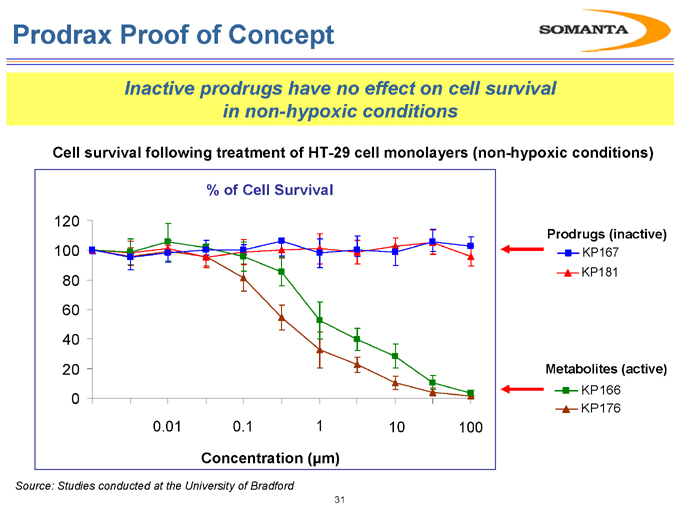

Prodrax Proof of Concept

Inactive prodrugs have no effect on cell survival in non-hypoxic conditions

Cell survival following treatment of HT-29 cell monolayers (non-hypoxic conditions)

% of Cell Survival

Prodrugs (inactive)

KP167 KP181

Metabolites (active)

KP166 KP176

120 100 80 60 40 20 0

0.01 0.1 1 10 100

Concentration (µm)

Source: Studies conducted at the University of Bradford

31

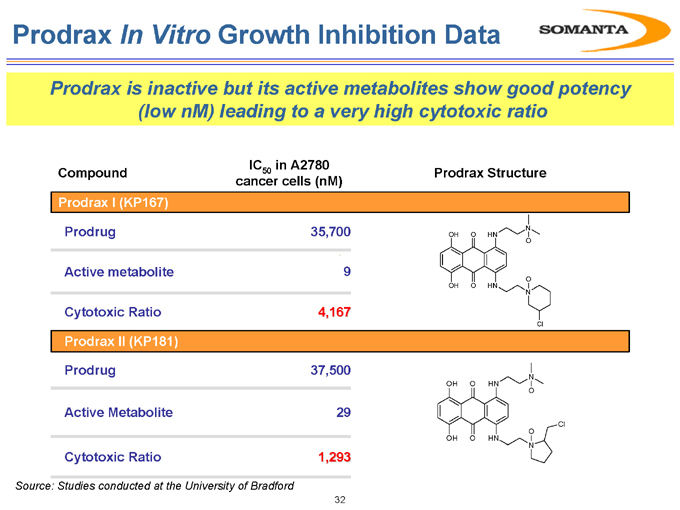

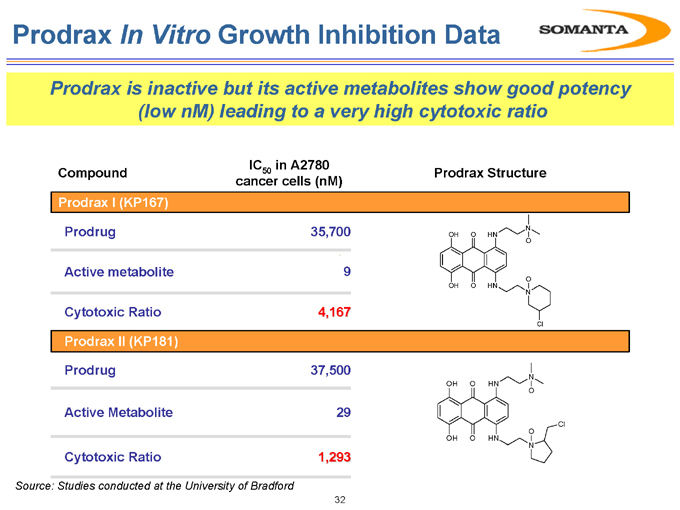

Prodrax In Vitro Growth Inhibition Data

Prodrax is inactive but its active metabolites show good potency (low nM) leading to a very high cytotoxic ratio

Compound IC50 in A2780 Prodrax Structure cancer cells (nM)

Prodrax I (KP167)

Prodrug

Active metabolite

Cytotoxic Ratio Prodrax II (KP181) Prodrug

Active Metabolite

Cytotoxic Ratio

35,700 9 4,167

37,500 29 1,293

N OH O HN

O

O OH O HN

N

Cl

N OH O HN

O

Cl O

OH O HN

N

Source: Studies conducted at the University of Bradford

32

ANGIOLIX

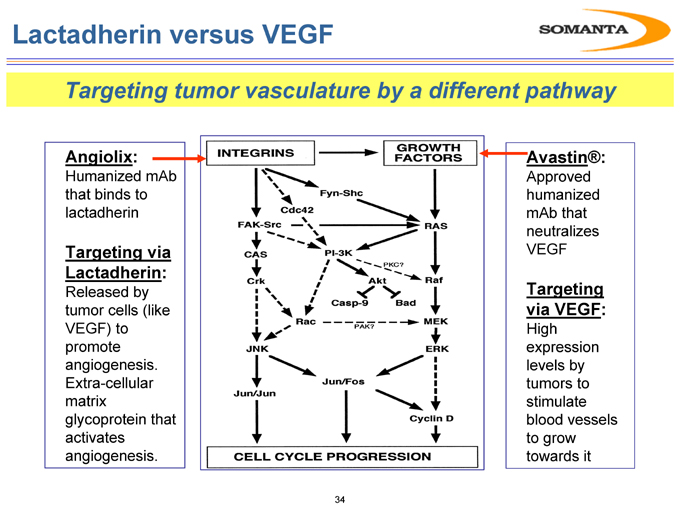

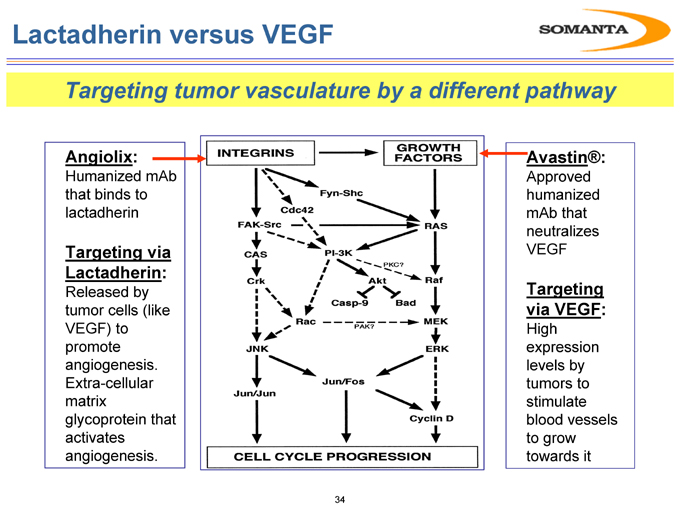

Lactadherin versus VEGF

Targeting tumor vasculature by a different pathway

Angiolix:

Humanized mAb that binds to lactadherin

Targeting via Lactadherin:

Released by tumor cells (like VEGF) to promote angiogenesis. Extra-cellular matrix glycoprotein that activates angiogenesis.

Avastin®:

Approved humanized mAb that neutralizes VEGF

Targeting via VEGF:

High expression levels by tumors to stimulate blood vessels to grow towards it

34

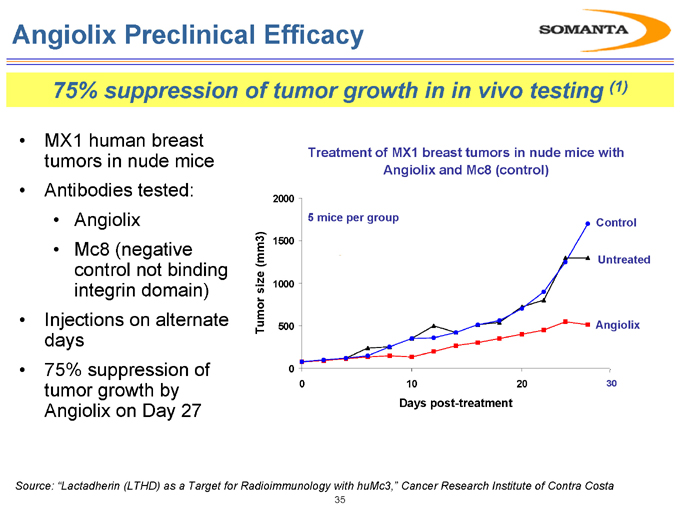

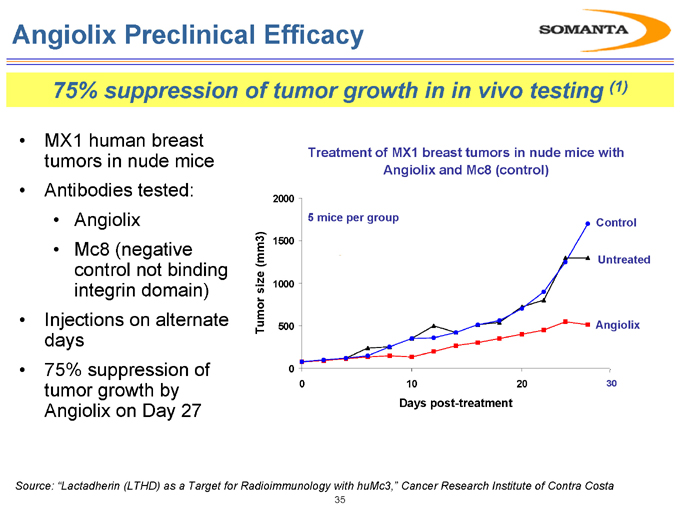

Angiolix Preclinical Efficacy

75% suppression of tumor growth in in vivo testing (1)

• MX1 human breast tumors in nude mice

• Antibodies tested:

• Angiolix

• Mc8 (negative control not binding integrin domain)

• Injections on alternate days

• 75% suppression of tumor growth by Angiolix on Day 27

Treatment of MX1 breast tumors in nude mice with Angiolix and Mc8 (control)

Control

Untreated

Angiolix

2000 1500 1000 500 0

0 10 20 30

Days post-treatment

Tumor size (mm3)

Source: “Lactadherin (LTHD) as a Target for Radioimmunology with huMc3,” Cancer Research Institute of Contra Costa

35

PHOENIX

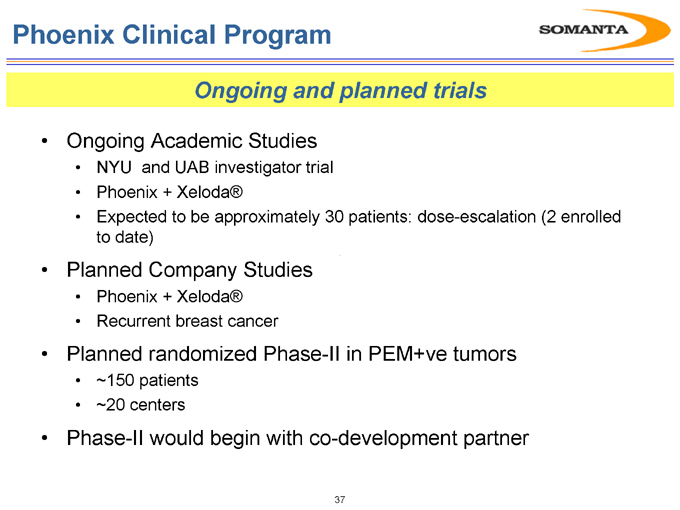

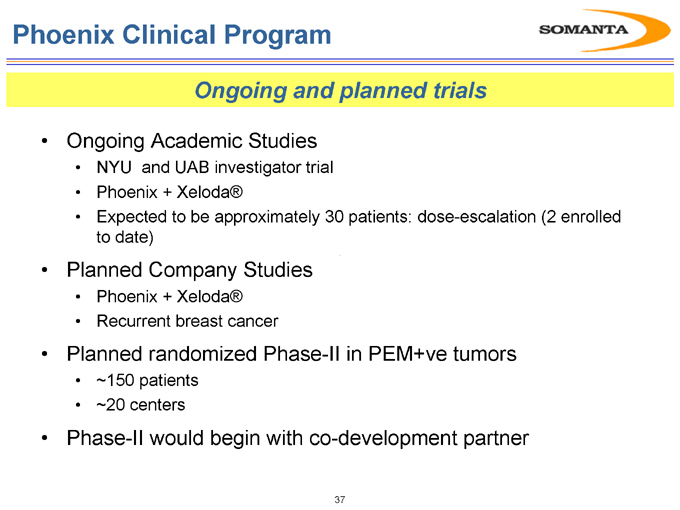

Phoenix Clinical Program

Ongoing and planned trials

Ongoing Academic Studies

NYU and UAB investigator trial

Phoenix + Xeloda®

Expected to be approximately 30 patients: dose-escalation (2 enrolled to date)

Planned Company Studies

Phoenix + Xeloda®

Recurrent breast cancer

Planned randomized Phase-II in PEM+ve tumors

~150 patients

~20 centers

Phase-II would begin with co-development partner

37

SODIUM PHENYLBUTYRATE

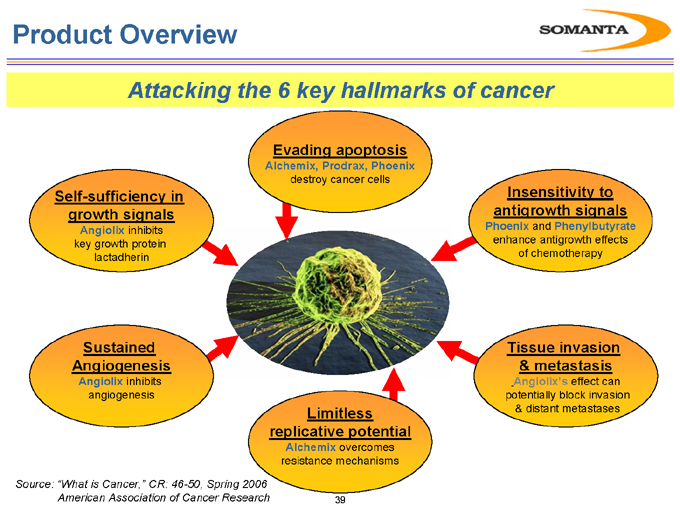

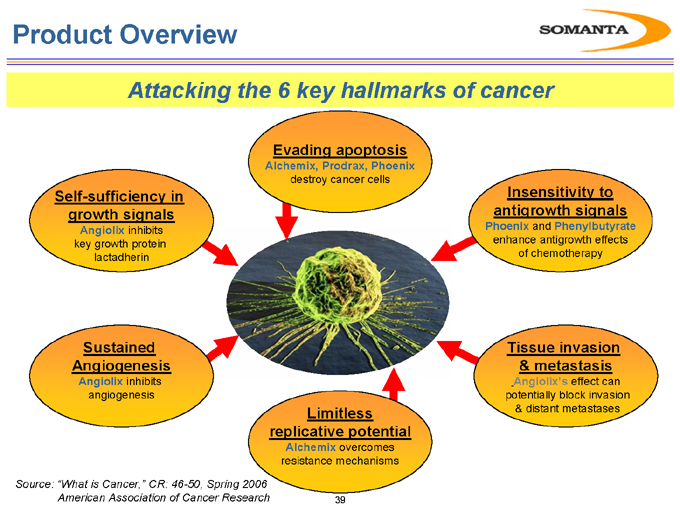

Product Overview

Attacking the 6 key hallmarks of cancer

Self-sufficiency in growth signals

Angiolix inhibits key growth protein lactadherin

Sustained Angiogenesis

Angiolix inhibits angiogenesis

Limitless replicative potential

Alchemix overcomes resistance mechanisms

Tissue invasion & metastasis

Angiolix’s effect can potentially block invasion & distant metastases

Insensitivity to antigrowth signals

Phoenix and Phenylbutyrate enhance antigrowth effects of chemotherapy

Evading apoptosis

Alchemix, Prodrax, Phoenix destroy cancer cells

Source: “What is Cancer,” CR: 46-50, Spring 2006

American Association of Cancer Research 39

FINANCIAL OVERVIEW

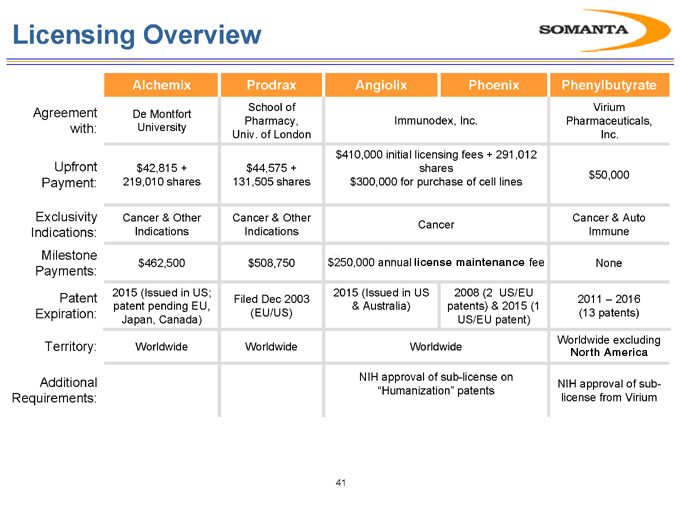

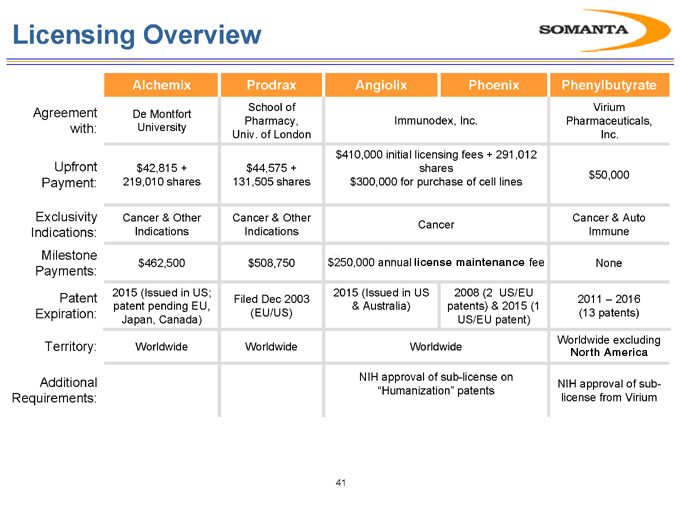

Licensing Overview

Agreement with:

Upfront Payment:

Exclusivity Indications: Milestone Payments:

Patent Expiration:

Territory:

Additional Requirements:

Alchemix

De Montfort University

$42,815 + 219,010 shares

Cancer & Other Indications

$462,500

2015 (Issued in US; patent pending EU, Japan, Canada)

Worldwide

Prodrax

School of Pharmacy, Univ. of London

$44,575 + 131,505 shares

Cancer & Other Indications

$508,750

Filed Dec 2003 (EU/US)

Worldwide

Angiolix Phoenix

Immunodex, Inc.

$410,000 initial licensing fees + 291,012 shares $300,000 for purchase of cell lines

Cancer

$250,000 annual license maintenance fee

2015 (Issued in US

& Australia)

2008 (2 US/EU patents) & 2015 (1 US/EU patent)

Worldwide

NIH approval of sub-license on “Humanization” patents

Phenylbutyrate

Virium Pharmaceuticals, Inc.

$50,000

Cancer & Auto Immune

None

2011 – 2016 (13 patents)

Worldwide excluding North America

NIH approval of sub-license from Virium

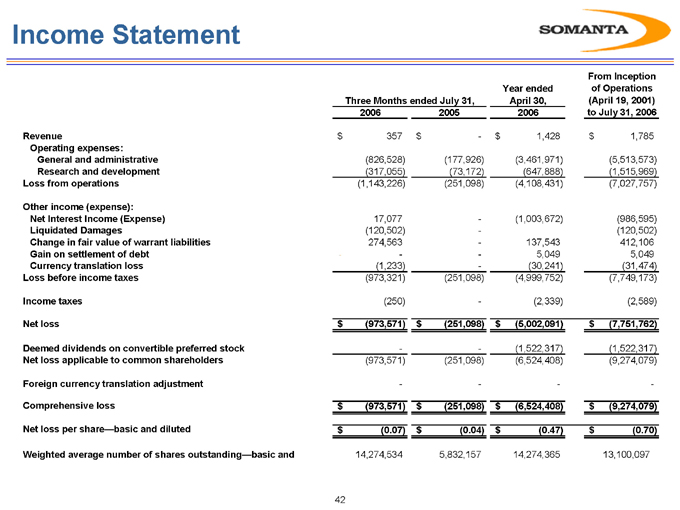

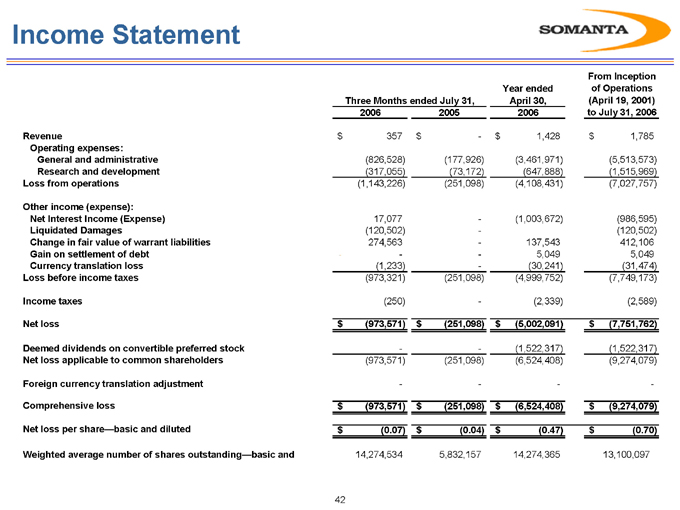

Income Statement

Three Months ended July 31, Year ended April 30, 2006 From Inception of Operations (April 19, 2001) to July 31, 2006

2006 2005

Revenue $357 $- $1,428 $1,785

Operating expenses:

General and administrative (826,528) (177,926) (3,461,971) (5,513,573)

Research and development (317,055) (73,172) (647,888) (1,515,969)

Loss from operations (1,143,226) (251,098) (4,108,431) (7,027,757)

Other income (expense):

Net Interest Income (Expense) 17,077 — (1,003,672) (986,595)

Liquidated Damages (120,502) — (120,502)

Change in fair value of warrant liabilities 274,563 — 137,543 412,106

Gain on settlement of debt —— 5,049 5,049

Currency translation loss (1,233) — (30,241) (31,474)

Loss before income taxes (973,321) (251,098) (4,999,752) (7,749,173)

Income taxes (250) — (2,339) (2,589)

Net loss $(973,571) $(251,098) $(5,002,091) $(7,751,762)

Deemed dividends on convertible preferred stock —— (1,522,317) (1,522,317)

Net loss applicable to common shareholders (973,571) (251,098) (6,524,408) (9,274,079)

Foreign currency translation adjustment ——— -

Comprehensive loss $(973,571) $(251,098) $(6,524,408) $(9,274,079)

Net loss per share—basic and diluted $(0.07) $(0.04) $(0.47) $(0.70)

Weighted average number of shares outstanding—basic and 14,274,534 5,832,157 14,274,365 13,100,097

42

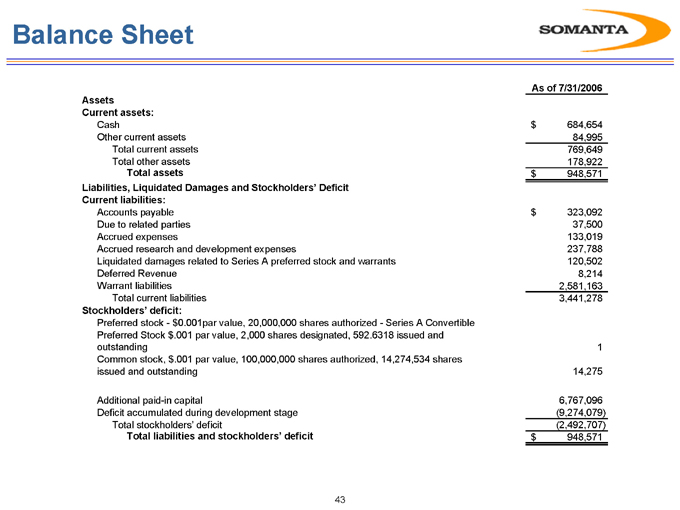

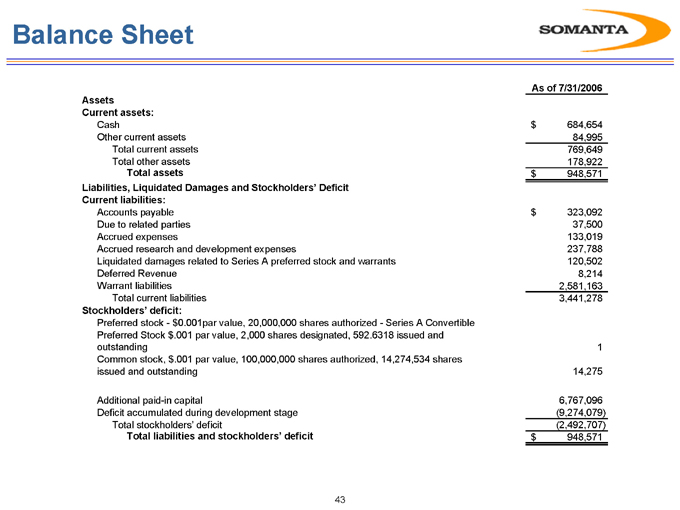

Balance Sheet

As of 7/31/2006

Assets

Current assets:

Cash $684,654

Other current assets 84,995

Total current assets 769,649

Total other assets 178,922

Total assets $948,571

Liabilities, Liquidated Damages and Stockholders’ Deficit

Current liabilities:

Accounts payable $323,092

Due to related parties 37,500

Accrued expenses 133,019

Accrued research and development expenses 237,788

Liquidated damages related to Series A preferred stock and warrants 120,502

Deferred Revenue 8,214

Warrant liabilities 2,581,163

Total current liabilities 3,441,278

Stockholders’ deficit:

Preferred stock—$0.001par value, 20,000,000 shares authorized—Series A Convertible

Preferred Stock $.001 par value, 2,000 shares designated, 592.6318 issued and

outstanding 1

Common stock, $.001 par value, 100,000,000 shares authorized, 14,274,534 shares

issued and outstanding 14,275

Additional paid-in capital 6,767,096

Deficit accumulated during development stage (9,274,079)

Total stockholders’ deficit (2,492,707)

Total liabilities and stockholders’ deficit $948,571

43

Capitalization Table

As of 7/31/2006

Cash $684,654

Capitalization

Debt

Warrant liabilities 2,581,163 (1)

Shareholder’s Deficit

Preferred stock 1

Common stock 14,275

Additional paid-in capital 6,767,096

Deficit accumulated during development stage (9,274,079)

Total stockholders’ deficit (2,492,707)

Total Capitalization $88,456

(1) | | Net cash settlement value of warrants if company fails to issue and deliver common stop upon exercise |

44

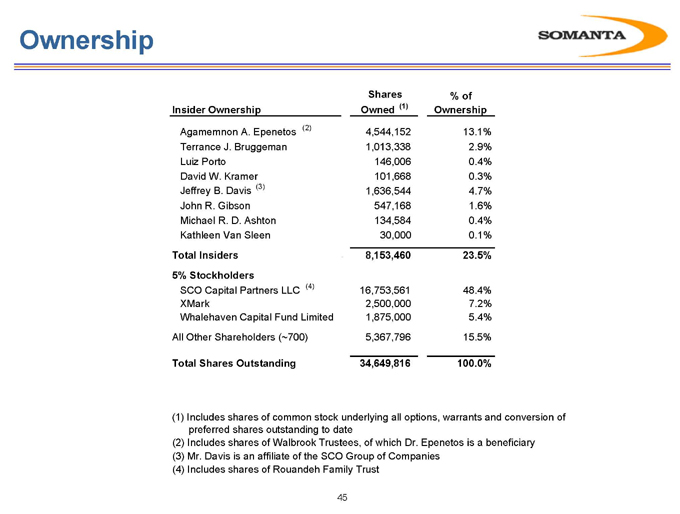

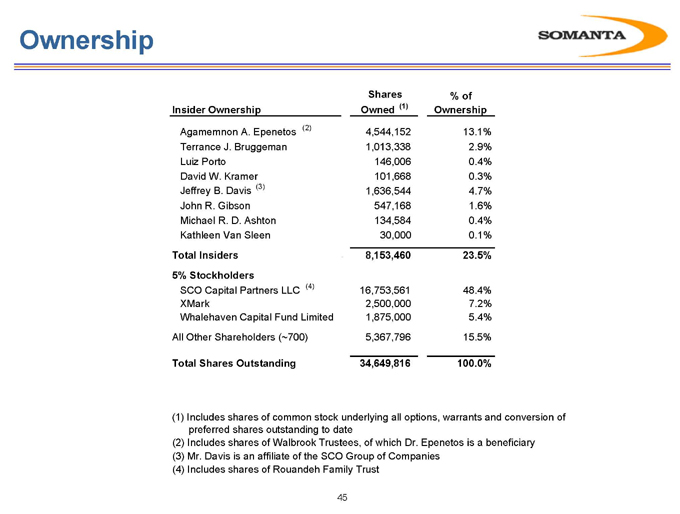

Ownership

Insider Ownership Shares Owned (1) % of Ownership

Agamemnon A. Epenetos (2) 4,544,152 13.1%

Terrance J. Bruggeman 1,013,338 2.9%

Luiz Porto 146,006 0.4%

David W. Kramer 101,668 0.3%

Jeffrey B. Davis (3) 1,636,544 4.7%

John R. Gibson 547,168 1.6%

Michael R. D. Ashton 134,584 0.4%

Kathleen Van Sleen 30,000 0.1%

Total Insiders 8,153,460 23.5%

5% Stockholders

SCO Capital Partners LLC (4) 16,753,561 48.4%

XMark 2,500,000 7.2%

Whalehaven Capital Fund Limited 1,875,000 5.4%

All Other Shareholders (

700) 5,367,796 15.5%

Total Shares Outstanding 34,649,816 100.0%

(1) | | Includes shares of common stock underlying all options, warrants and conversion of preferred shares outstanding to date |

(2) Includes shares of Walbrook Trustees, of which Dr. Epenetos is a beneficiary (3) Mr. Davis is an affiliate of the SCO Group of Companies (4) Includes shares of Rouandeh Family Trust

45

FOCUSED ON NEW THERAPIES FOR ONCOLOGY