UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPANIA CERVECERIAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23rdfloor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-FXForm 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ NoX

CCU REPORTS CONSOLIDATED FIRST QUARTER 2013 RESULTS1;2;3

Santiago, Chile, May 2, 2013–CCU announced today its consolidated financial results for the first quarter ended March 31, 2013:

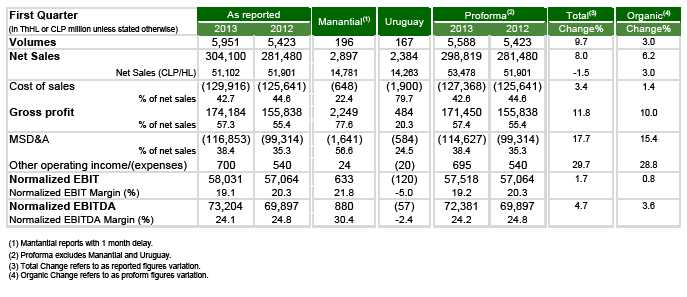

Consolidated volumesincreased 9.7%. The Chile business segment, contributed with an increase of 9.7% driven by 19.1% strong volume growth in the Non-alcoholic beverages operational segment. The Rio de la Plata business segment showed 12.8% increase while the Wine business segment decreased 4.5% this quarter. On organic basis, consolidated volumes grew 3.0% in Q1’13 driven by 10.3% growth in the Non-alcoholic beverages operational segment.

Total Net salesincreased 8.0%. Organically, it grew 6.2%, as a consequence of 3.0% higher consolidated volumes coupled with 3.0% higher average prices.

Gross profitincreased 11.8%. Organically, it grew 10.0%, as a combination of higher Net sales and a decrease in Cost of sales of 201 bps as a percentage of Net sales.

Normalized EBITDAincreased 4.7%. Organically, it grew 3.6% in Q1’13, driven by 6.9% increase in the Chile business segment.

1For an explanation of the terms used please refer to the Glossary in Further Information and Exhibits. For organic growth details please refer to page 6. Figures in tables and exhibits have been rounded off and may not add exactly the total shown.

2All references in this press release, shall be deemed to refer toQ1’13figures compared toQ1’12 figures.

3For a comparable basis, volumes figures consider energy drinks sales from CCU Argentina in both periods shown.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 1 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

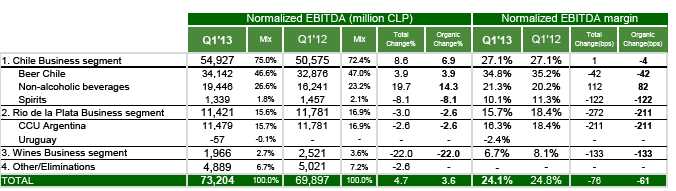

We are satisfied with CCU’s first quarter 2013 overall performance, where the NormalizedEBITDA grew 4.7%, including 1.1% positive consolidation impact related to the acquisition of Manantial and the one in Uruguay. Our Chile business segment delivered a positive quarter with a Normalized EBITDA increase of 8.6%, overshadowed by Rio de la Plata and Wine business segments. On organic basis, Normalized EBITDA increased 3.6% explained by Chile business segment increase of 6.9%, led by outperforming Non-alcoholic beverages operational segment growth of 14.3% and to a lesser extent Beer Chile with a growth of 3.9%.

The Normalized EBITDA margin, as reported, decreased 76 bps mainly due to lower EBITDA margin in Rio de la Plata and Wine business segments. On organic basis, the Normalized EBITDA margin decreased 61 bps. However, in Chile business segment, despite of higher marketing expenses as a percentage of Net sales and higher transportation costs, affected by high real salaries caused by almost full employment, the Normalized EBITDA margin was in line with the same quarter last year.

Consolidated volumes increased 9.7% including a positive consolidation impact of 363 thousand hectoliter. As reported Chile business segment grew 9.7%. On organic basis, consolidated volume grew 3.0% explained by Chile business segment increase of 4.7%, led by the Non-alcoholic beverages operational segment which increased 10.3% due to industry expansion coupled with market share gains, partially compensated by decreases in Spirits and Beer Chile operational segments. Beer Chile and Spirits decreased slightly more than the industry decline. As reported, Rio de la Plata business segment showed a 12.8% increase, while organically decreased 0.5%, which according to our best understanding was to a lesser degree than the industry contraction shown during the quarter.

As reported, Net sales grew 8.0%, including a positive consolidation impact of CLP 5,282 million. On organic basis, Net Sales grew by 6.2% in Q1’13, reflectingthe volume performance as well as the benefit of 3.0% price increase. This growth was led by 7.0% and 10.0% increases in Chile and Rio de la Plata business segments, respectively.

Latest innovations across our segments have delivered good performance and it encourages us to continue innovating as a way to strengthen our market position. The favorable economic environment in Chile given the low unemployment rate and higher salaries allowed us to increase prices in most of our segments, in order to offset the higher transportation costs.

We are optimistic that our strong financial position coupled with strategies for fostering our operational excellence and supporting market leadership through consistent branding efforts should keep CCU on the path of healthy development.

In line with our strategy and in the way we run the business, we realigned our operation in three business segments, as a diversified beverage company operating in the Southern Cone and with an extensive export business in wine, to more than 85 countries. The business segments are as follows: Chile4, Rio de la Plata5and Wine. In a future, on a date to be defined, releases will disclose this three business segments only.

Looking ahead, in terms of organic growth, per capita consumption increase coupled with our strong position in growing markets, will continue to drive top line growth.

4Chile includes the following operational segments: Beer Chile, Non-alcoholic beverages and Spirits.

5Rio de la Plata includes the following operational segments: CCU Argentina and Uruguay.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 2 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

|

| CONSOLIDATED INCOME STATEMENT HIGHLIGHTS(Exhibits 1 & 2) |

NET SALES | | |

| | | |

Q1’13 | | As reported, Total Net sales increased 8.0% to CLP 304,100 million as result of 9.7% higher volumes partially offset by 1.5% decrease in average prices. Volumes in the Chile business segment grew 9.7%, where the operational segments contributed as follows, Non-alcoholic beverages 19.1%, more than compensating the 2.8% drop in Beer Chile and 2.9% drop in Spirits. The Rio de la Plata business segment grew 12.8%, where CCU Argentina decreased 0.5%, and the Wine business segment decreased 4.5%. On organic basis, Total Net sales increased 6.2% as result of 3.0% higher volumes coupled with 3.0% increase in average prices. Volumes in the Chile business segment grew 4.7%, while Non-alcoholic beverages operational segment increased 10.3%. The Rio de la Plata business segment volumes decreased 0.5%. |

Net sales by segment

GROSS PROFIT

Q1’13 | | As reported, Gross profit increased 11.8% to CLP 174,184 million as result of 8.0% higher Net sales, partially offset by 3.4% higher Cost of sales. As a percentage of Net sales, Cost of sales decreased from 44.6% to 42.7%, consequently, Gross profit as a percentage of Net sales increased from 55.4% to 57.3%. On organic basis, Gross profit increased 10.0% to CLP 171,450 million as result of 6.2% higher Net sales, partially offset by 1.4% higher Cost of sales. As a percentage of Net sales, Cost of sales decreased from 44.6% to 42.6% in Q1’13, consequently,Gross profit as a percentage of Net sales increased from 55.4% to 57.4%. |

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page3of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

NORMALIZED EBIT

Q1’13 | | As reported, Normalized EBIT increased 1.7% to CLP 58,031 million mostly explained by 17.7% higher MSD&A expenses, which increased to CLP 116,853 million. MSD&A expenses, as a percentage of Net sales, increased from 35.3% to 38.4%, as result of higher distribution and marketing expenses, in Chile and Argentina, which were affected by high real salaries caused by almost full employment in Chile and higher transportation cost in both countries. On organic basis, Normalized EBIT increased 0.8% to CLP 57,518 million mostly explained by 15.4% higher MSD&A expenses, which increased to CLP 114,627 million. MSD&A expenses, as a percentage of Net sales, increased to 38.4%. |

Normalized EBIT and EBIT margin by segment

NORMALIZED EBITDA

Q1’13 | | As reported, Normalized EBITDA increased 4.7% to CLP 73,204 million and the normalized EBITDA margin decreased from 24.8% to 24.1%. On organic basis, Normalized EBITDA increased 3.6% to CLP 72,381 million and the normalized EBITDA margin decreased 61 bps to 24.2%. |

NormalizedEBITDA and EBITDA margin by segment

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 4 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

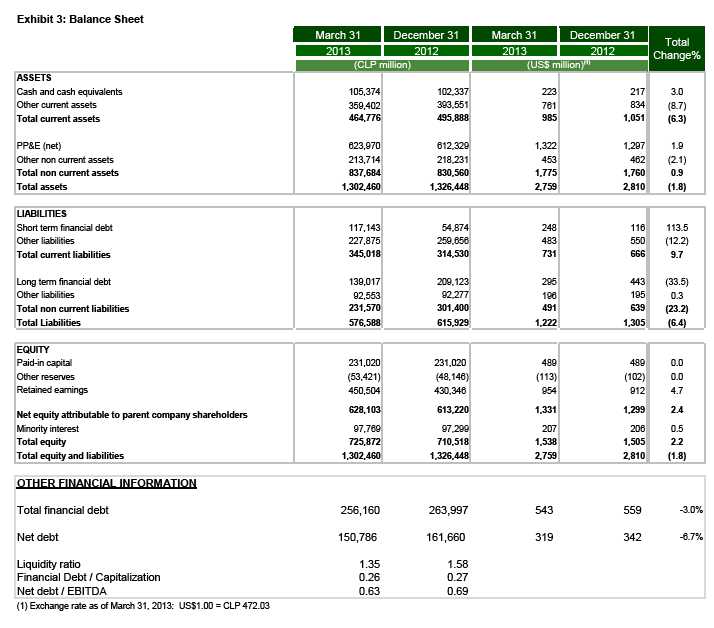

NON-OPERATING RESULT

Q1’13 | | In Non-operating result we include the following: Net financing expenses, Equity and income of JVs6,Foreign currency exchange differences, Results as per adjustment units, and Other gains/(losses). The total variation of these accounts, when compared to the same quarter last year, is a higher result of CLP 1,178 million explained by: ·Results as per adjustment unitswhich increased CLP 1,683 million, mainly due to 0.1% increase of the UF value inQ1’13compared with 1.1% increase of the UF inQ1’12. Additionally, lower debt indexed to UF. ·Other gains/(losses) and Foreign currency exchange differenceswhich increased CLP 1,973 million mainly dueto the absence in Q1’13 oflosses related to hedges covering foreign exchange variations on taxes. Partially compensated by: ·Net financial expenseswhich increased CLP 2,467 million to a loss of CLP 3,939 million, due to higher debt in Argentinain Q1’13at ARS nominal interest rate, taken to renew the proprietary bottle park, and lower cash and cash equivalents related to recent acquisitions. |

| | | |

INCOME TAXES |

| | | |

Q1’13 | | Income taxes increased CLP 2,126 million mainly explained by theabsence in Q1’13of a credit related with foreign exchange fluctuations on taxes recorded in Q1’12, and by higher income taxes in Chile. In September 2012, the Chilean government raised income tax from 18.5% to 20.0%. |

| | | |

NET INCOME |

| | | |

Q1’13 | | Increased CLP 91 million to CLP 40,315 million due to higher EBIT and Non-operating result, partially compensated by higher Income taxes. On organic basis, Net Income decreased 1.0%. |

6Includes changes in the consolidation scope as earlier adoption of IFRS 11 on December 2012. Further information;please refer to Q4’12Press Release.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 5 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

The following schedule details the effect of first time consolidation of the acquisition of Manantial and in Uruguay in Q1’13. For better performance measure, Proforma refers to consolidated results as reported, excluding the Manantial and Uruguay operation’s consolidation impact.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 6 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

|

BUSINESS SEGMENTS HIGHLIGHTS(Exhibit 2) |

Net salesincreased 8.6% to CLP 202,654 million as result of 9.7% higher sales volume, partially offset by 1.0% lower average prices. On organic basis, Net sales increase 7.0% as result of 4.7% higher organic sales volume coupled with 2.2% increase in average prices.

Normalized EBITincreased 6.5% to CLP 45,913 million due to 8.6% higher Net sales partially offset by 4.0% higher Cost of Sales and 16.8% higher MSD&A expenses. Cost of sales as a percentage of Net sales decreased from 44.5% to 42.7%. MSD&A as a percentage of Net sales increased from 32.4% to 34.9%, mainly explained by higher distribution costs and marketing expenses. The Normalized EBIT margin decreased from 23.1% to 22.7%. On organic basis, Normalized EBIT increased 5.0% due to 7.0% higher Net sales partially offset by 3.2% higher Cost of sales and 14.1% higher MSD&A expenses.

Normalized EBITDAincreased 8.6% to CLP 54,927 million and the Normalized EBITDA maintained in line with the previous year at 27.1%. On organic basis, Normalized EBITDA increased 6.9% to CLP 54,047 million.

CommentsOur Chile business segment, delivered a positive quarter led by outperforming Non-alcoholic beverages and in a lesser extent Beer Chile operational segments performance. Additionally, we had a positive impact in Non-Alcoholic beverages due to the inclusion of Manantial’s acquisition(HOD business).

In line with our strategy and in the way we run the business, we realigned our business segments, as a diversified beverage company operating in the Southern Cone and with an extensive export business, in wine, to more than 85 countries. The new financial reporting structure considers Chile business segment as of the following operational segments: Beer Chile, Non-alcoholic beverages and Spirits.

-BEER CHILE

Net salesincreased 5.1% to CLP 98,078 million as result of 8.2% higher average prices, partially compensated by 2.8% lower sales volumes.

Normalized EBITincreased 1.6% to CLP 29,148 million because of 5.1% higher Net sales and 0.5% lower Cost of Sales, partially offset by 16.5% higher MSD&A expenses. Cost of sales as a percentage of Net sales decreased from 40.4% to 38.2%. MSD&A as a percentage of Net sales increased from 29.0% to 32.1%, mainly explained by higher distribution costs and marketing expenses. Changes involume’smix caused by higher sales in cans, made the Normalized EBIT margin decrease from 30.7% to 29.7%.

Normalized EBITDAincreased 3.9% to CLP 34,142 million and the Normalized EBITDA margin decreased from 35.2% to 34.8%.

CommentsWe are pleased with the first results of both the launch of the new Cristal 1.2 liter returnable bottle as well as Cristal Light. The two launches, next to the 6% price increase in one way packaging that we implemented in January, are the mosttangible examples of our ambition to increase the value of our brand portfolio and strengthen our market leadership.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 7 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

-NON-ALCOHOLIC BEVERAGES

Net salesincreased 13.5% to CLP 91,319 million as result of 19.1% volume increase partially offset by 4.7% decrease in average prices forQ1’13. On organic basis, volume grew 10.3% partially compensated with 0.4% decrease in average prices. Outstanding volume growth was delivered by every category: water 39.7% (organic 5.2%), nectar 19.9% and soft drinks 10.3%.

Normalized EBITincreased 18.3% to CLP 15,928 million due to 18.2% higher Gross profit, as a consequence of higher Net sales partially compensated by 8.1% increase in Cost of sales. Nevertheless, Cost of sales as a percentage of Net sales decreased from 46.8% to 44.6%. The higher Gross profit was partially offset by 19.2 % growth in MSD&A expenses explained by higher distribution costs and in a lesser extent to higher marketing expenses. Normalized EBIT margin increased from 16.7% to 17.4%. On organic basis, Normalized EBIT increased 13.6% due to 12.9% higher Gross profit and 13.6% increase in MSD&A expenses.

Normalized EBITDAincreased 19.7% to CLP 19,446 million and the Normalized EBITDA margin increased from 20.2% to 21.3%. On organic basis, Normalized EBITDA increased 14.3% to CLP 18,565 million and its margin increased to 21.0%.

CommentsVolumes continued to have a remarkable performance in all categories following the growth path shown in 2012, as consequence of market share expansion related to first preference improvements. Additionally, we had a positive effect due to the inclusion of Manantial’sacquisition. In all, on organic basis, Normalized EBITDA margin increased 82 bps from 20.2% to 21.0%.

-SPIRITS

Net salesincreased 3.0% to CLP 13,257 million as result of 6.1% higher average price partially offset by 2.9% lower volumes.

Normalized EBITdecreased 12.8% to CLP 837 million mainly due to 1.2% lower Gross profit, as a consequence 5.7% higher Cost of sales, not fully compensated by 3.0% higher Net Sales. MSD&A expenses increase of 1.6% to CLP 4,148 million is mostly explained by higher distribution costs. Therefore, Normalized EBIT margin decreased from 7.5% to 6.3%.

Normalized EBITDAdecreased 8.1% to CLP 1,339 million, while the Normalized EBITDA margin decreased from 11.3% to 10.1%.

CommentsVolume decrease is mostly explained by a contraction in the rum category, which is mainly affecting the mainstream segment. The decrease in volume was partially compensated by 12.6% increase in Pernod Ricard products, mainly driven by whisky and vodka categories.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page8of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

Net salesmeasured in Chilean pesos, increased 13.7% to CLP 72,748 million as result of 12.8% higher sales volume coupled with 0.9% increase in average prices.

Normalized EBITmeasured in Chilean pesos, decreased 11.9% to CLP 8,974 million inQ1’13, as result of 21.8% increase in MSD&A expenses due to inflationary pressure, higher personnel and distribution costs, and marketing expenses, not compensated by higher Gross profit. Therefore, MSD&A as a percentage of Net sales increased from 46.4% to 49.6%. Normalized EBIT margin decreased from 15.9% to 12.3%. On organic basis, Normalized EBIT decreased 10.7% due to 19.8% increase in MSD&A expenses.

Normalized EBITDAmeasured in Chilean pesos, decreased 3.0% to CLP 11,421 million and Normalized EBITDA margin decreased from 18.4% to 15.7%. On organic basis, Normalized EBITDA decreased 2.6%.

CommentsAs mentioned before, we realigned our business segments. The new financial reporting structure considers Rio de la Plata business segment as of the following operational segments: CCU Argentina and Uruguay operation.

-CCU ARGENTINA

Net salesmeasured in Chilean pesos, increased 10.0% to CLP 70,364 million as result of 10.5% higher average prices partially offset by 0.5% lower sales volume.

Normalized EBITmeasured in Chilean pesos, decreased 10.7% to CLP 9,094 million mainly due to 19.8% higher MSD&A expenses, despite the Gross margin increase of 11.8% which, as a percentage of Net sales, increased from 62.1% to 63.1%. MSD&A as a percentage of Net sales increased from 46.4% to 50.5%, mainly due to higher distribution costs and marketing expenses. Normalized EBIT margin decreased from 15.9% to 12.9%.

Normalized EBITDAdecreased 2.6% to CLP 11,479 million this quarter, while Normalized EBITDA margin lowered from 18.4% to 16.3%. Measured in US$, increased from 24.0 million to 24.3 million.

CommentsDomestic beer volumes decreased 0.9%, but to our best understanding, we have seen market share gains in a contracting industry, as shown during this quarter.

-URUGUAY

The integration of the acquired operation in Uruguay is progressing well and in line with management plans. This mainly compromises integration of the main activities ofthe Uruguay’s operation into CCU Argentina systems, policies and procedures. Measured in Chilean pesos, this quarter results delivered CLP 2,384 million of Net sales and 167 thousand hectoliter volume sales. Normalized EBITDA amounted to a negative CLP 57 million.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 9 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

Net salesdecreased 6.6% to CLP 29,127 million due to 4.5% decrease in volumes coupled with 2.2% lower average price, when expressed in Chilean pesos. The Chile Domestic average price increased 1.9% as result of price increases and a better sales mix. The Chile Export remained flat in USD terms, but due to the appreciation of the Chilean peso, prices decreased 1.8%. The Argentina average prices increased 11.8% in CLP terms and volumes decreased 12.3%.

Normalized EBITdecreased 52.0% to CLP 406 million due to foreign exchange currency fluctuations. Cost of sales decreased 8.9% and as a percentage of Net sales, it decreased from 68.1% to 66.5%. MSD&A expenses increased 1.7% mainly due to higher marketing expenses and distribution costs. Normalized EBIT margin decreased from 2.7% to 1.4%.

Normalized EBITDAdecreased 22.0% to CLP 1,966 million and the Normalized EBITDA margin decreased from 8.1% to 6.7%.

CommentsThe results of our Domestic and Argentine operations are in line with our strategy to sell more premium wine, which translates in higher prices. Our Chile Export market has been affected by the appreciation of the Chilean peso and by lower sales volumes in some important markets like Latin American market.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 10 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

|

| FURTHER INFORMATION AND EXHIBITS |

ABOUT CCU

CCU is a diversified beverage company operating principally in Chile, Argentina and Uruguay. CCU is the largest Chilean brewer, the second-largest Argentine brewer, the second-largest Chilean soft drink producer, the second-largest Chilean wine producer, the largest Chilean mineral water and nectars producer, the largest pisco distributor and also participates in the HOD, rum and confectionery industries in Chile. The Company has licensing agreements with Heineken Brouwerijen B.V., Anheuser-Busch Incorporated, PepsiCo Inc., Paulaner Brauerei AG, Schweppes Holdings Limited, Guinness Brewing Worldwide Limited, Société des Produits Nestlé S.A., Pernod Ricard and Compañía Pisquera Bauzá S.A.. For more information, visit www.ccu.cl.

CAUTIONARY STATEMENT

Statements made in this press release that relate to CCU’s future performance or financialresults are forward-looking statements, which involve known and unknown risks and uncertainties that could cause actual performance or results to materially differ. We undertake no obligation to update any of these statements. Persons reading this press release are cautioned not to place undue reliance on these forward-looking statements. These statements should be taken in conjunction with the additional information about risk and uncertainties setforth in CCU’s annual report on Form 20-F filed with the US Securities and Exchange Commission and in the annual report submitted to the SVS and available in our web page.

GLOSSARY

Business Segments

Business segments are reflected as follows: 1. Chile, which considers Beer Chile, Spirits and Non Alcoholic (including nectars, water, as purified mineral and HOD, and softdrinks which also incorporates tea, sports and energy drinks); 2. Rio de la Plata, which includes CCU Argentina (including beer, cider, spirits, energy drinks and domestic wine from Tamarí sales)and Uruguay’s Operation(softdrinks and mineral water); 3. Wine, (including Chile domestic, Chile export and Argentina, export and domestic, except sales from Tamarí), 4. The“Other/Eliminations”considers the non-allocated corporate overhead expenses and the result of the logistics subsidiary. Corporate shared services, distribution and logistics expenses allocated to each business segment based on Service Level Agreements.

Cost of sales

Formerly referred to as Cost of Goods Sold (COGS), Cost of sales includes direct costs and manufacturing expenses.

Earnings Per Share (EPS)

Net profit divided by the weighted average number of shares during the year.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 11 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

EBIT

Stands for Earnings Before Interest and Taxes, and for management purposes it is defined, as earnings before other gains (losses), net financial expenses, equity and income of joint ventures, foreign currency exchange differences, results as per adjustment units and income taxes. EBIT is equivalent to Operating Result used in the 20-F Form.

EBITDA

EBITDA represents EBIT plus depreciation and amortization. EBITDA is not an accounting measure under IFRS. When analyzing the operating performance, investors should use EBITDA in addition to, not as an alternative for Net income, as this item is defined by IFRS.Investors should also note that CCU’s presentation of EBITDA may not be comparable tosimilarly titled indicators used by other companies. EBITDA is equivalent to ORBDA (Operating Result Before Depreciation and Amortization), used in the 20-F Form.

Exceptional Items (EI)

Formerly referred to as Non recurring items (NRI), Exceptional items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature.

Marketing, Selling, Distribution and Administrative expenses (MSD&A)

MSD&A include marketing, selling, distribution and administrative expenses.

Net Debt

Total financial debt minus cash & cash equivalents.

Net Debt / EBITDA

The ratio is based on a twele month rolling calculation for EBITDA.

Net Income

Net profit attributable to parent company shareholder as per IFRS.

Normalized

The term “normalized” refers to performance measures (EBITDA, EBIT,Net income, EPS) before exceptional items.

ROCE

ROCE stands for Return on Capital Employed.

Organic growth

Organic growth refers to growth excluding the effect of consolidation changes and the effect of first time consolidation an acquisition.

UF

The UF is a monetary unit indexed to the CPI variation.

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 12 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 13 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 14 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

| |

| Office Address: Vitacura 2670, 23rd Floor, Santiago, Chile | Page 15 of 15 |

| Bolsa de Comercio de Santiago: CCU | |

| NYSE: CCU | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

| |

| | /s/ Ricardo Reyes |

| | Chief Financial Officer |

| |

Date: May 6, 2013