Exhibit 99.1

| ABOUT FORWARD LOOKING STATEMENTS This presentation contains certain "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. These forward looking statements include information about possible or assumed future results of our operations. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that we expect or anticipate may occur in the future, including, such things as future capital expenditures, business strategies, competitive strengths, goals, growth of our business and operations, plans, and references to future successes may be considered forward looking statements. Also, when we use the words such as "anticipate", "believe", "estimate", "expect", "intend", "plan", "probably", or similar expressions, we are making forward looking statements. Many risks and uncertainties may impact the matters addressed in these forward looking statements. Many possible events or factors could affect our future financial results and performance. These could cause our results or performance to differ materially from those we express in our forward looking statements. Although we believe that the assumptions underlying our forward looking statements are reasonable, any of these assumptions, and therefore also the forward looking statements based on these assumptions, could themselves prove to be inaccurate. In light of the significant uncertainties inherent in the forward looking statements included in this presentation, our inclusion of this information is not a representation by us or any other person that our objectives and plans will be achieved. Our forward looking statements speak only as of the date made and we will not update these forward looking statements unless the securities laws require us to do so. In light of these risks, uncertainties and assumptions, the forward looking events discussed in this presentation may not occur. |

| OVERVIEW |

| CORPORATE PROFILE Specialty Insurance since 1974 Based in Houston, Texas with offices across the USA and international offices in Bermuda, Spain and the U.K. Operations include Insurance Companies, Underwriting Agencies and Intermediaries Rated A+ (Superior) by A.M. Best Company and AA (Very Strong) by Standard & Poor's |

| CORPORATE PHILOSOPHY Long Term Growth of Shareholders' Equity Capital Preservation Diversification of Operations Conservative Investments Cycle Management |

| SHAREHOLDERS EQUITY ($ in millions) $1,200 $800 $400 1997 1999 2001 2003 2005 Est. $1,600 See Forward Looking Statement |

| SHAREHOLDERS EQUITY ($ in millions) 2002 $883 2003 $1,047 $1,324 2005 Estimate $1,575 2004 See Forward Looking Statement |

| RETURN ON BEGINNING EQUITY 2002 14% 2003 16% 16% 2005 Estimate 17% 2004 See Forward Looking Statement |

| GROWTH IN BOOK VALUE (per share data) 2002 $14.15 2003 $16.37 $19.45 2004 2005 Estimate $22.50 See Forward Looking Statement |

| OPERATIONS |

| EXECUTIVE MANAGEMENT Robert F. Thomas Age 41 Senior VP - Surety Craig J. Kelbel Age 50 Executive VP - Life, A&H Edward H. Ellis Age 62 Executive VP & CFO Stephen L. Way Age 55 Chairman & CEO |

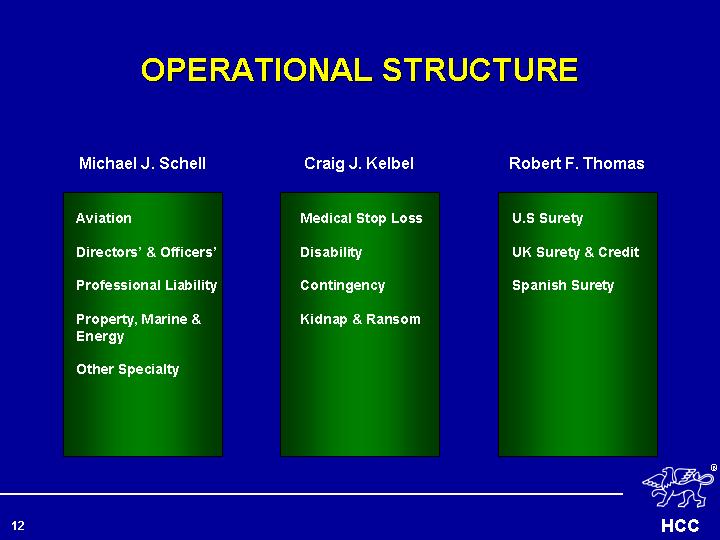

| OPERATIONAL STRUCTURE Aviation Directors' & Officers' Professional Liability Property, Marine & Energy Other Specialty Craig J. Kelbel Medical Stop Loss Disability Contingency Kidnap & Ransom Robert F. Thomas U.S Surety UK Surety & Credit Spanish Surety |

| OPERATING MANAGEMENT Barry J. Cook RML (London) Laurence C. Donnelly HCCIG (NYC) Michael J. Donovan Aviation (Houston) William F. Hubbard ASU (Boston) R. Matthew Fairfield HCC Global (Barcelona) Nick Hutton-Penman HC (London) Craig J. Kelbel HCC Life (Atlanta) Charles C. Manchester HCCD (London) Michel A. Pascual HCC Europe (Madrid) Robert F. Thomas HCC Surety (Houston) Andrew G. Stone HCC Global (Hartford) Mark E. Rattner PIA (New York) |

| LINES OF BUSINESS Group Life, Accident & Health Diversified Financial Products Aviation London Market Operations Other Specialty Operations |

| GROUP LIFE, ACCIDENT & HEALTH Medical Stop Loss protection for small and medium size corporations that self insure their employee medical benefits Accident & Health for vehicle owner-operators Accident & Health for Texas companies that self insure their Workers' Compensation risk |

| DIVERSIFIED FINANCIAL PRODUCTS D&O for Fortune 1000 and multinational companies D&O for non-public companies and not-for-profit groups Professional Liability (E&O) for small businesses and professionals Surety including court, fiduciary, license, permit and small contractors Employers' Practice Liability Insurance (EPLI) for small businesses and franchises Financial Products including mortgage, title and residual value insurance |

| AVIATION Privately owned aircraft in the USA General Aviation written in USA, EU, Far East, Africa, Central and South America No major airlines, satellites or major manufacturers |

| LONDON MARKET OPERATIONS Large Property business worldwide, such as Fortune 1000 and multinational accounts Large Energy accounts worldwide, such as refineries, offshore platforms and drilling rigs Blue water marine fleets, worldwide A&H business including travel insurance, sports teams and high net worth individual disability |

| OTHER SPECIALTY OPERATIONS Marine business including crew boats, tugs and barges in the USA Quota share arrangement with AGII on surplus lines business Contingency, Event Cancellation High Net Worth Individual Disability |

| GROSS WRITTEN PREMIUM ($ in millions) 2002 $1,159 2003 $1,740 $1,975 2004 2005 Estimate $2,075 See Forward Looking Statement |

| NET WRITTEN PREMIUM ($ in millions) 2002 $546 2003 $866 $1,106 2004 2005 Estimate $1,500 See Forward Looking Statement |

| LINES OF BUSINESS (net written premium in millions) Diversified Financial Products Group Life, Accident & Health Aviation London Market Operations Other Specialty Operations 2004 $405 $344 $145 $108 $84 $650 $450 $150 $75 $125 2005 Estimate |

| DIVERSIFIED FINANCIAL PRODUCTS (net written premium in millions) D&O (U.S.) D&O (International) Professional Liability (E&O) Surety Other 2004 $121 $49 $151 $64 $20 $170 $100 $225 $100 $55 2005 Estimate |

| FINANCIALS |

| BALANCE SHEET |

| STRONG BALANCE SHEET Conservative Loss Reserves Strong Liquidity Rising Investment Assets and Low Risk Investment Portfolio Reinsurance Recoverables Assets of more than $5.9 Billion |

| Net Reserves Gross Reserves $457 $1,155 $1,535 $1,059 $2,089 $1,400 $2,375 LOSS RESERVES ($ in millions) 2002 2003 2004 2005 Estimate $705 See Forward Looking Statement |

| CASH FLOW ($ in millions) 2002 $175 2003 $528 $669 2004 2005 Estimate $525 See Forward Looking Statement |

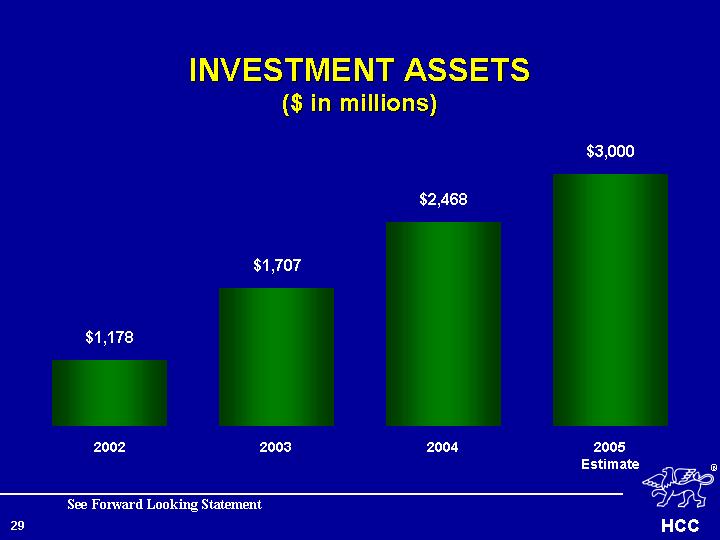

| INVESTMENT ASSETS ($ in millions) 2002 $1,178 2003 $1,707 $2,468 2004 2005 Estimate $3,000 See Forward Looking Statement |

| 1st Qtr Tax Exempt Securities 30 Short Term Investments 30 Other 1 Taxable Securities 39 Taxable Securities - 39% Average Rating - AA+ Average Maturity: 3.0 years Duration: 2.4 years Tax Exempt Securities - 30% Average Rating - AAA Average Maturity: 7.2 years Duration: 5.8 years Other 1% December 31, 2004 $2,468 million Short Term Investments - 30% CONSERVATIVE INVESTMENT PORTFOLIO |

| REINSURANCE RECOVERABLES ($ in millions) 2002 $799 2003 $916 $1,099 2004 2005 Estimate $1,100 See Forward Looking Statement |

| TOTAL ASSETS ($ in millions) 2002 $3,704 2003 $4,875 $5,933 2004 2005 Estimate $6,400 See Forward Looking Statement |

| INCOME STATEMENT |

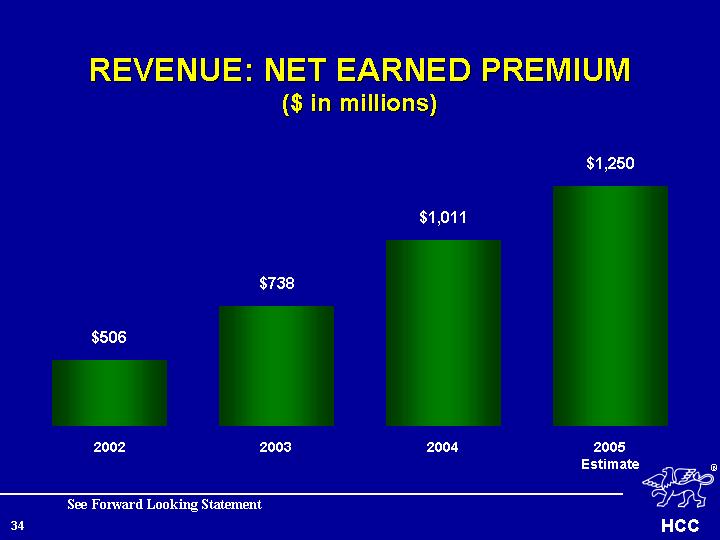

| REVENUE: NET EARNED PREMIUM ($ in millions) 2002 $506 2003 $738 $1,011 2004 2005 Estimate $1,250 See Forward Looking Statement |

| REVENUE: FEE & COMMISSION INCOME ($ in millions) 2002 $116 2003 $143 $182 2004 2005 Estimate $130 See Forward Looking Statement |

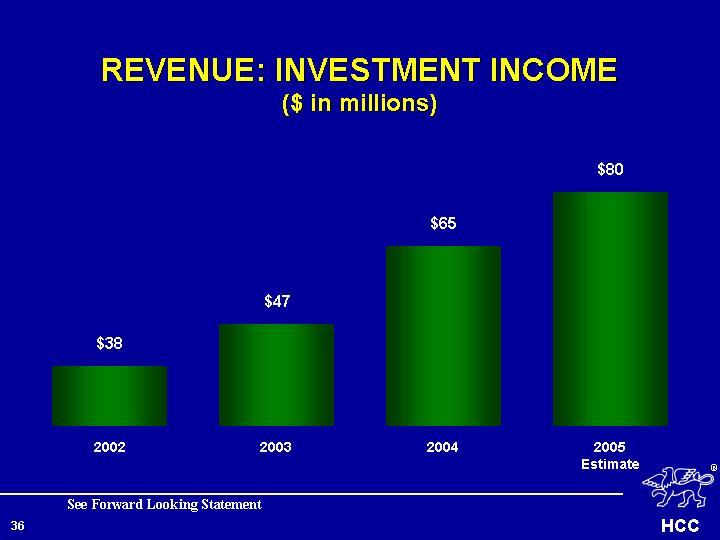

| REVENUE: INVESTMENT INCOME ($ in millions) 2002 $38 2003 $47 $65 2004 2005 Estimate $80 See Forward Looking Statement |

| TOTAL REVENUE ($ in millions) 2002 $667 2003 $942 $1,283 2004 2005 Estimate $1,475 See Forward Looking Statement |

| NET EARNINGS ($ in millions) 2002 $106 2003 $144 $163 2005 Estimate $225 2004 See Forward Looking Statement |

| NET EARNINGS PER SHARE 2002 $1.68 2003 $2.23 $2.47 2004 2005 Estimate $3.25 See Forward Looking Statement |

| 2005 PROJECTIONS Net Earned Premium Growth 25% Investment Income Growth 25% Total Revenue Growth 20% EPS Range $3.15 to $3.25 See Forward Looking Statement |

| ABOUT FORWARD LOOKING STATEMENTS This presentation contains certain "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. These forward looking statements include information about possible or assumed future results of our operations. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that we expect or anticipate may occur in the future, including, such things as future capital expenditures, business strategies, competitive strengths, goals, growth of our business and operations, plans, and references to future successes may be considered forward looking statements. Also, when we use the words such as "anticipate", "believe", "estimate", "expect", "intend", "plan", "probably", or similar expressions, we are making forward looking statements. Many risks and uncertainties may impact the matters addressed in these forward looking statements. Many possible events or factors could affect our future financial results and performance. These could cause our results or performance to differ materially from those we express in our forward looking statements. Although we believe that the assumptions underlying our forward looking statements are reasonable, any of these assumptions, and therefore also the forward looking statements based on these assumptions, could themselves prove to be inaccurate. In light of the significant uncertainties inherent in the forward looking statements included in this presentation, our inclusion of this information is not a representation by us or any other person that our objectives and plans will be achieved. Our forward looking statements speak only as of the date made and we will not update these forward looking statements unless the securities laws require us to do so. In light of these risks, uncertainties and assumptions, the forward looking events discussed in this presentation may not occur. |