Exhibit (a)(5)(D)

| | | | | | |

| | | | EFiled: Feb 06 2013 09:34AM EST Transaction ID 49314042 Case No. 8280– | |  |

| | | | |

| | | | |

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

| | | | | | |

JAMES J. SCERRA, On Behalf of Himself and All | | | ) | | | |

Others Similarly Situated, | | | ) | | | |

| | | ) | | | |

| Plaintiff, | | | ) | | | C.A. No. |

| | | ) | | | |

v. | | | ) | | | |

| | | ) | | | |

JOSEPH L. COWAN, JOHN C. DORMAN, | | | ) | | | |

EDWARD D. HOROWITZ, BRUCE A. JAFFE, | | | ) | | | |

DONALD W. LAYDEN, JR., MICHAEL E. | | | ) | | | |

LEITNER, ERVIN R. SHAMES, WILLIAM H. | | | ) | | | |

WASHECKA, BARRY D. WESSLER, ONLINE | | | ) | | | |

RESOURCES CORPORATION, ACI | | | ) | | | |

WORLDWIDE, INC. and OCELOT | | | ) | | | |

ACQUISITION CORP., | | | ) | | | |

| | | ) | | | |

| Defendants. | | | ) | | | |

VERIFIED CLASS ACTION COMPLAINT

Plaintiff James J. Scerra (“Plaintiff”), on behalf of himself and all others similarly situated, by his attorneys, alleges the following upon information and belief, except as to those allegations pertaining to Plaintiff which are alleged upon personal knowledge:

NATURE OF THE ACTION

1. This is a shareholder class action brought by Plaintiff on behalf of holders of the common stock of Online Resources Corporation (“Online Resources” or the “Company”) to enjoin the acquisition of the publicly owned shares of Online Resources common stock by ACI Worldwide, Inc. (“ACI”) through its wholly owned subsidiary Ocelot Acquisition Corp., (“Acquisition Sub”).

2. On January 31, 2013, Online Resources and ACI jointly announced that they had entered into a definitive transaction agreement for ACI to acquire Online Resources, via a tender offer, in a deal with a total enterprise value of approximately $263 million. Under the terms of the Proposed Buyout (defined below), Online Resources common shareholders will receive $3.85 per share in cash for each Online Resources share they own.

3. Specifically, the Transaction Agreement dated January 31, 2013 ACI will cause Acquisition Sub to commence a tender offer (the “Offer”) as promptly as practicable after January 30, 2013, for all of Online Resources’ outstanding shares of common at a purchase price of $3.85 per share in cash, without interest, less any applicable withholding taxes. The Offer is subject to the condition that there be validly tendered that number of Online Resources shares that constitutes a majority of all of the Online Resources outstanding shares and entitled to vote in the election of directors. Following the Offer, ACI will acquire any Online Resources shares not purchased in the Offer in a second-step merger (collectively the Offer and the Second-Step Merger are referred to herein as the “Proposed Buyout”).

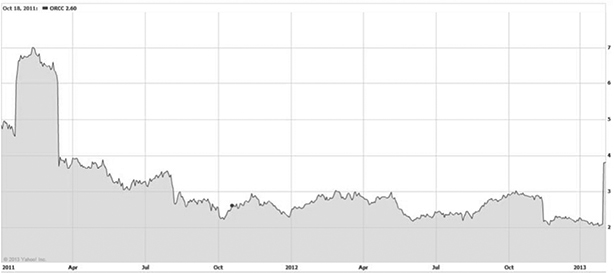

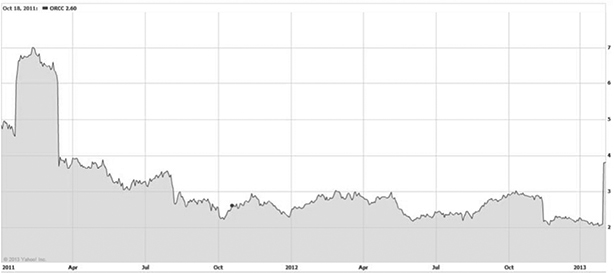

4. In early 2011, Online Resources reported that it had received unsolicited bids from multiple third parties and thereafter solicited bids from additional third parties. On March 15, 2011, Online Resources announced that it had “determined that the completion of a transaction on acceptable terms was unlikely at this time and that the best course of action to achieve the highest shareholder value is to continue to aggressively pursue our long-term strategic growth plan.” After trading consistently above $4 even before announcement of possible business combinations and consistently above $6 in anticipation of a possible combination, Online Resources stock collapsed and has never recovered.

5. Since March 2011, Online Resources has aggressively pursued its long-term strategic growth plan and has been reporting significant improvements in its financials and prospects. Indeed, Online Resources reports that it is in the middle of the investment heavy stage of its strategic growth plan, which should set the groundwork for greatly improved earnings and financial conditions.

2

6. ACI is well aware of Online Resources’ improving financial metrics. Knowing that the Company’s new strategic vision is in place and the Company’s performance is recovering, ACI recognized that it had an opportunity to cash in on Online Resources’ undervalued stock price by acquiring the Company before it felt the full effects of its improving financial condition resulting from the Company’s implementation of its strategic overhaul. As such, ACI, is in possession of non-public information regarding the performance of Online Resources and is taking advantage of its position to acquire the Company at a substantial discount to its true value.

7. Thus, the consideration being offered to Online Resources public stockholders in the Proposed Buyout is unfair and grossly inadequate because, among other things, the intrinsic value of Online Resources common stock is materially in excess of the amount offered given the Company’s recent financial performance together with its prospects for future growth and earnings.

8. The Individual Defendants’ (defined below) conduct constitutes a breach of their fiduciary duties owed to all public shareholders of Online Resources, and a violation of applicable legal standards governing the Defendants’ conduct. The Proposed Buyout is designed to preclude other potential bidders to emerge with superior offers while also precluding shareholders from voicing opposition, as the Transaction Agreement contains certain preclusive devices, including a substantial termination fee ($8,000,000) and a top-up option (“Top-Up Option”), which is coercive because it can be used to reach the 90% threshold to effectuate a short form merger, thus allowing the Company to pursue a merger without a shareholder vote.

3

9. In pursuing the unlawful plan to facilitate the acquisition of Online Resources by ACI for grossly inadequate consideration, through a flawed process, each of the Defendants (defined below) violated applicable law by directly breaching and/or aiding the other Defendants’ breaches of their fiduciary duties of loyalty, due care, independence, good faith and fair dealing.

10. For these reasons and as set forth in detail herein, Plaintiff seeks to enjoin Defendants from taking any steps to consummate the Offer or, in the event the Offer is consummated, recover damages resulting from the Individual Defendants’ violations of their fiduciary duties of loyalty, good faith and due care.

THE PARTIES

11. Plaintiff is, and at all relevant times was a stockholder of Defendant Online Resources since prior to the wrongs complained of herein.

12. Online Resources is a corporation organized and existing under the laws of Delaware, with its principal executive offices located at 4795 Meadow Wood Lane, Chantilly, Virginia. Online Resources develops and supplies our proprietary Digital Payment Framework to power ePayments choices between millions of consumers and financial institutions, creditors and billers.

13. Defendant John C. Dorman (“Dorman”) is and has been Chairman of the Board of Online Resources since 2010.

14. Defendant Joseph L. Cowan (“Cowan”) is and has been a director of Online Resources and President and Chief Executive Officer since 2010.

15. Defendant Edward D. Horowitz (“Horowitz”) is and has been a director of Online Resources since 2009.

4

16. Defendant Bruce A. Jaffe (“Jaffe”) is and has been a director of Online Resources since 2009.

17. Defendant Donald W. Layden, Jr. (“Layden”) is and has been a director of Online Resources since 2010.

18. Defendant Michael E. Leitner (“Leitner”) is and has been a director of Online Resources since 2007.

19. Defendant Ervin R. Shames (“Shames”) is and has been a director of Online Resources since 2000.

20. Defendant William H. Washecka (“Washecka”) is and has been a director of Online Resources since 2004.

21. Defendant Barry D. Wessler (“Wessler”) is and has been a director of Online Resources since 2000.

22. Defendants Dorman, Cowan, Horowitz, Jaffe, Layden, Leitner, Shames, Washecka and Wessler are collectively referred to hereinafter as the “Individual Defendants.”

23. Each of the Individual Defendants herein is sued individually, and as an aider and abettor, as well as in his or her capacity as an officer and/or director of the Company, and the liability of each arises from the fact that he or she has engaged in all or part of the unlawful acts, plans, schemes, or transactions complained of herein.

24. Defendant ACI is a corporation organized and existing under the laws of Delaware, with its principal executive offices located at 120 Broadway, Suite 3350, New York, New York. ACI develops, markets, installs and supports a broad line of software products and services primarily focused on facilitating electronic payments.

5

25. Defendant Acquisition Sub is a Delaware corporation and wholly owned subsidiary of ACI formed solely for the purpose of entering into the Transaction Agreement and consummating the Offer, and has not conducted any business operations other than those incident to its formation.

26. Collectively, the Individual Defendants, ACI, Online Resources and Acquisition Sub are referred to herein as the “Defendants.”

THE FIDUCIARY DUTIES OF THE INDIVIDUAL DEFENDANT

27. By reason of the Individual Defendants’ positions with the Company as officers and/or directors, said individuals are in a fiduciary relationship with Plaintiff and the other shareholders of Online Resources and owe Plaintiff and the other members of the Class (defined herein) the duties of good faith, fair dealing and loyalty.

28. By virtue of their positions as directors and/or officers of Online Resources, the Individual Defendants, at all relevant times, had the power to control and influence, and did control and influence and cause Online Resources to engage in the practices complained of herein.

29. Each of the Individual Defendants is required to act in good faith, in the best interests of the Company’s shareholders and with such care, including reasonable inquiry, as would be expected of an ordinarily prudent person. In a situation where the directors of a publicly traded company undertake a transaction that may result in a change in corporate control, the directors must take all steps reasonably required to maximize the value shareholders will receive rather than use a change of control to benefit themselves, and to disclose all material information concerning the proposed change of control to enable the shareholders to make an informed voting decision. To diligently comply with this duty, the directors of a corporation may not take any action that:

| | (a) | adversely affects the value provided to the corporation’s shareholders; |

6

| | (b) | contractually prohibits them from complying with or carrying out their fiduciary duties; |

| | (c) | discourages or inhibits alternative offers to purchase control of the corporation or its assets; |

| | (d) | will otherwise adversely affect their duty to search for and secure the best value reasonably available under the circumstances for the corporation’s shareholders; or |

| | (e) | will provide the directors and/or officers with preferential treatment at the expense of, or separate from, the public shareholders. |

30. Plaintiff alleges herein that the Individual Defendants, separately and together, in connection with the Proposed Buyout, violated duties owed to Plaintiff and the other shareholders of Online Resources, including their duties of loyalty, good faith and independence, insofar as they,inter alia, engaged in self-dealing and obtained for themselves personal benefits, including personal financial benefits, not shared equally by Plaintiff or the other shareholders of Online Resources common stock.

CLASS ACTION ALLEGATIONS

31. Plaintiff brings this action pursuant to the Court of Chancery Rule 23, on behalf of all holders of Online Resources common stock who are being and will be harmed by Defendants’ actions described below (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation or other entity related to or affiliated with any of the Defendants.

32. This action is properly maintainable as a class action.

7

33. The Class is so numerous that joinder of all members is impracticable. As of October 31, 2012, there were 32,889,083 shares of Online Resources common stock issued and outstanding. The actual number of public shareholders of Online Resources will be ascertained through discovery.

34. Questions of law and fact that are common to the Class, including, among others:

| | (a) | whether the Individual Defendants have fulfilled and are capable of fulfilling their fiduciary duties owed to Plaintiff and the Class; |

| | (b) | whether the Individual Defendants have engaged and continue to engage in a scheme to benefit themselves at the expense of Online Resources shareholders in violation of their fiduciary duties; |

| | (c) | whether the Individual Defendants are acting in furtherance of their own self-interest to the detriment of the Class; and |

| | (d) | whether Plaintiff and the other members of the Class will be irreparably damaged if Defendants are not enjoined from continuing the conduct described herein. |

35. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff has the same interests as the other members of the Class. Accordingly, Plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

36. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for Defendants, or adjudications with respect to individual members of the Class which would, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

8

37. Preliminary and final injunctive relief on behalf of the Class as a whole is entirely appropriate because Defendants have acted, or refused to act, on grounds generally applicable and causing injury to the Class.

SUBSTANTIVE ALLEGATIONS

38. Online Resources develops and supplies our proprietary Digital Payment Framework to power ePayments choices between millions of consumers and financial institutions, creditors and billers. The Company has two primary business lines: bill payment and transaction processing, and online banking and account presentation. The Company’s digital bill payment services directly link financial interactions between banks and billers, while our outsourced, web—and phone-based financial technology services enable clients to fulfill payment, banking and other financial services to their millions of end users. The Company’s Digital Payment Framework is built upon a foundation of security and innovation, and features a wide range of configurable services enabling the Company’s clients to take advantage of industry-leading agility, flexibility and breadth of solution.

39. On January 21, 2011, Online Resources announced that:

[the] Boards of Directors [are] evaluating unsolicited expressions of interest in potential business combinations that it has received from third parties. The Board is considering these alternatives against the long-term strategic growth plan that it recently approved in order to determine whether there is now an option that can deliver greater shareholder value. Under the strategic plan, the Company has enhanced its management team and is currently investing in technology, products and organizational structure to drive revenue growth and margin improvement.

9

40. Defendant Cowan, president and chief executive officer of Online Resources, stated, in part:

“Since I arrived as CEO in June, we have worked diligently to develop a long-term plan to put Online Resources back on the path to sustainable growth by investing in new ways to provide exceptional value to our customers.... We have a robust and unique set of core assets at Online Resources, and I believe that with the strong team we have in place, we can deliver against the objectives defined in the plan. However, because we have also been approached by other parties, the Company has an obligation to examine other potential value-creating alternatives that may now exist for our shareholders.”

41. On March 15, 2011, Online Resources reported its 4Q financial results and announced that it had abandoned pursuit of a business combination. The press release stated, in part that “[t]he Company’s Board of Directors announced that, after careful consideration, it has terminated its evaluation of potential business combinations and is not actively pursuing alternatives to the Company’s long-term strategic growth plan.” In addition, Defendant Cowan, stated:

“The Board of Directors determined that the completion of a transaction on acceptable terms was unlikely at this timeand that the best course of action to achieve the highest shareholder value is to continue to aggressively pursue our long-term strategic growth plan.... We have identified clear objectives to re-focus and maximize our technology, products and organizational structure to drive revenue and earnings growth. We are bullish about the opportunities that lie ahead for Online Resources.” (emphasis added)

42. After trading consistently above $4 even before announcement of possible business combinations and consistently above $6 in anticipation of a possible combination, Online Resources stock collapsed as evidenced in the chart below:

10

43. Since March 2011, Online Resources has aggressively pursued its long-term strategic growth plan and has been reporting significant improvements in its financials and prospects.

44. On March 14, 2012, Online Resources reported its 4Q and full-year results and confirmed that it was on track with its strategic growth plan. Defendant Cowan stated, in part:

“We made a great deal of progress on the long-term strategic growth plan we presented in March 2011.... We’ve focused the Company on becoming an innovative, best-of-breed solution provider in the payments market, opened a first-class development center in India and began the process of optimizing and consolidating the technology that we possess. All the while,we’ve met or exceeded the revenue and earnings direction we provided for 2011 at this time last year and for each of the 2011 quarters.”

“We had record sales in the fourth quarter, contributing to a record sales year. I’m very pleased with this as I believe it validates some of the early steps we’ve taken. With opportunity often comes challenge however, and this is no exception. In 2012, we expect to make additional investments, reprioritize planned investments and extend our investment period to ensure we can implement and service this new business.” (emphasis added)

45. On May 7, 2012, Online Resources reported its 1Q financial results and confirmed again progress in achieving its strategic growth plan. Defendant Cowan stated, in part:

11

“In the first quarter, revenue was in-line with our expectations, growing by 5% relative to the first quarter of last year,”.... “Earnings measures were higher than our expectations owing to some expense reversals that are not expected to recur in the future and the deferral of other expenses to later this year.”

“I’m pleased with the progress the Company is making on the long-term strategic growth plan. I believe the revenue and earnings growth we saw this past quarter are partially the result of the plan we set upon over a year ago. As such, I’m confident in the course we have set for the Company and the expectations we discussed two months ago.”

46. On November 8, 2012, Online Resources reported its 3Q financial results and confirmed continued progress in achieving its strategic growth plan. Defendant Cowan stated, in part:

“Revenue and earnings were better than expected in the third quarter,”.... “During the quarter we benefited from higher professional services revenue in our banking business that is non-recurring in nature. Excluding the higher professional services revenue, revenue and earnings would still have been at the high end of guidance.”

“As can be seen from the sequential decline in earnings in the third quarter, we have entered the major investment stage of our strategic growth plan,”.... “We anticipate that these investments will continue to grow in the fourth quarter of 2012. These investments in product management, marketing, sales and client services, operations and technology should allow us to drive increased revenue and earnings growth in late 2013 and beyond.”

47. Rather than permitting the Company’s shares to trade freely and allowing its public shareholders to reap the benefits of the Company’s long-term strategic growth plan, the Individual Defendants have acted for their personal benefit and the benefit of ACI as well as to the detriment of the Company’s public shareholders, by entering into the Transaction Agreement.

48. On January 31, 2013, ACI and Online Resources issued a joint press release announcing the Proposed Buyout which stated:

Naples, FLA—January 31, 2013—ACI Worldwide (NASDAQ: ACIW), a leading international provider of payment systems, andOnline Resources (NASDAQ: ORCC), a leading provider of online banking and full-service bill pay solutions, today announced that they have entered into a definitive transaction agreement. Under the terms of the agreement, ACI Worldwide will acquire Online Resources in an all cash transaction for $3.85 per share. The boards of directors of both companies have approved the transaction. [….]

12

The integration of ACI Worldwide and Online Resources will make available to financial institutions the preeminent online and mobile banking, bill payment and presentment solutions. ACI Worldwide is recognized as the leader in theU.S. Large Bank Market for 2012 and a Company to Watch in 2013 by Aite Group. The addition of Online Resources’ payment and presentment capabilities will benefit customers by giving them the choice and flexibility to address a broader set of needs from a single integrated source.

The acquisition would also broaden ACI Worldwide’s customer base with the addition of 1,000 banks, credit unions, billers, credit card issuers, and other credit and payment service providers.

“Built on our heritage of producing highly reliable and trusted solutions, ACI Worldwide’s mission is to deliver universal payment solutions that provide control, choice and flexibility to our customers while maintaining their peace of mind,” said Philip Heasley, President and CEO of ACI Worldwide. “Online Resources’ robust product set and talented employee base of online banking and payment experts is well-aligned with this focus and our desire to lead in a category undergoing accelerating change.”

“I believe the combination of the two companies will allow the Online Resources product suite to now achieve its full potential in the Banking and Biller Markets, provide even better services and functionality for our clients and customers, and create additional opportunity for our dedicated and hardworking employees,” said Joe L. Cowan, President and Chief Executive Officer of Online Resources. [....]

Terms of the Transaction

ACI Worldwide and Online Resources have entered into a definitive transaction agreement under which ACI Worldwide would acquire Online Resources for $3.85 per share in cash in a transaction valued at an enterprise value of approximately $263 million, which includes the redemption of Online Resources’ preferred stock. ACI Worldwide will commence a cash tender offer to purchase all outstanding shares of common stock of Online Resources no later than February 15, 2013.

Upon the successful closing of the tender offer, stockholders of Online Resources will receive $3.85 per share in cash for each share of Online Resources common stock validly tendered and not validly withdrawn in the offer, without interest and less any applicable withholding taxes. [....]

13

49. The $3.85 per share consideration being offered to Online Resources public stockholders in the Proposed Buyout is unfair and grossly inadequate because, among other things, the intrinsic value of Online Resources common stock is materially in excess of the amount offered given the Company’s recent financial performance together with its prospects for future growth and earnings.

50. Further, ACI will achieve significant synergies from the Proposed Buyout, enhancing the value to ACI and, in turn, the per share consideration Online Resources shareholders should receive. According to the press release announcing the Proposed Buyout, ACI anticipates “annual cost synergies of approximately $19.5 million.” It is unlikely that the $3.85 per share merger price ACI offers includes those material synergies.

| C. | The Preclusive Deal Protection Devices |

51. To the detriment of the Plaintiff and other members of the Class, the terms of the Transaction Agreement substantially favor ACI and are calculated to unreasonably dissuade potential suitors from making competing offers.

52. On January 31, 2013, the Company filed a Form 8-K with the United States Securities and Exchange Commission (“SEC”) wherein it disclosed the terms of the Transaction Agreement. As part of the Transaction Agreement, the Individual Defendants agreed to certain onerous and preclusive deal protection devices that operate conjunctively to make the Proposed Buyout afait accompli and ensure that no competing offers will emerge for the Company.

53. Defendants are attempting to circumvent the requirements of a shareholder vote through an irrevocable “Top-Up Option” which the Online Resources Board granted to ACI. The Top-Up Option is contained in Section 2.3 of the Transaction Agreement and states that in the event ACI falls short of obtaining the minimum number of shares in the Offer necessary to

14

effectuate a short form merger under § 253 of the Delaware General Corporations Law, ACI may purchase, at its option, the number of shares necessary for it to exceed the ninety percent threshold. The Top-Up Option therefore allows Online Resources to pursue a merge without ever having to conduct a shareholder vote.

54. ACI as part of the Proposed Buyout has entered into Shareholder Agreements with Tennenbaum Capital Partners, LLC (“Tennenbaum”), which collectively beneficially owned approximately 22.3% of all outstanding shares in Online Resources and Defendant Cowan, who beneficially owns approximately 1.4% of all the outstanding shares in Online Resources. By entering into these Shareholder Agreements, Tennebaum and Defendant Cowan have committed to tendering approximately 22.7% of all outstanding shares of Online Resources common stock in the Offer.

55. In addition to the Top-Up Option, Online Resources through the Individual Defendants agreed to onerous and preclusive deal protection devices. For example, the Transaction Agreement contains a strict “no shop” provision prohibiting the Board from taking any affirmative action to comply with their fiduciary duties to maximize shareholder value, including soliciting alternative acquisition proposals or business combinations. The Transaction Agreement also includes a strict “standstill” provision which prohibits, except under extremely limited circumstances, the Defendants from even engaging in discussions or negotiations relating to proposals regarding alternative business combinations. Further, in addition to the no-shop and standstill provisions, the Transaction Agreement includes a $8 million termination fee that will all but ensure that no competing offer will emerge.

15

56. Specifically, §5.8(a) of the Transaction Agreement includes a “no solicitation” provision barring the Board and any Company personnel from soliciting, initiating, facilitating or encouraging alternative proposals in an attempt to procure a price in excess of the amount offered by ACI. This section also demands that the Company terminate any and all prior or ongoing discussions with other potential suitors.

57. Similarly, §5.8(e) of the Transaction Agreement provides a matching rights provision whereby the Company must notify ACI of any unsolicited competing bidder’s offer within 24 hours after receipt. Then, if and only if, the Board determines that the competing offer constitutes a “Superior Proposal,” (as defined in the Merger Agreement) ACI is granted at least three (3) business days (the “Notice Period”) to amend the terms of the Transaction Agreement to make a counter-offer that the Company must consider in determining whether the competing bid still constitutes a “Superior Proposal.” Moreover, ACI will be able to match the unsolicited offer because it will be granted unfettered access to the details of the unsolicited offer, in its entirety, eliminating any leverage that the Company has in receiving the unsolicited offer. Accordingly, the Transaction Agreement unfairly assures that any “auction” will favor ACI and piggy-back upon the due diligence of the foreclosed alternative bidder.

58. To further ensure the success of the Proposed Buyout, the Board locked up the deal by agreeing to pay a termination fee of $8 million. The terms of the Transaction Agreement essentially requires that the alternative bidder agree to pay a naked premium for the right to provide Online Resources shareholders with a superior offer. Accordingly, the Transaction Agreement unfairly assures that any “auction” will favor ACI and piggy-back upon the due diligence efforts of the alternative bidder.

59. These provisions cumulatively discourage bidders from making a competing bid for the Company.

16

FIRST CAUSE OF ACTION

Claim for Breach of Fiduciary Duties Against the Individual Defendants

60. Plaintiff repeats and realleges each allegation set forth herein.

61. The Individual Defendants have violated fiduciary duties of care, loyalty and good faith owed to public shareholders of Online Resources.

62. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants, individually and acting as a part of a common plan, are attempting to unfairly deprive Plaintiff and other members of the Class of the true value of their investment in Online Resources.

63. As demonstrated by the allegations above, the Individual Defendants failed to exercise the care required, and breached their duties of loyalty, good faith and independence owed to the shareholders of Online Resources because, among other reasons, they failed to take steps to maximize the value of Online Resources to its public shareholders.

64. The Individual Defendants dominate and control the business and corporate affairs of Online Resources, and are in possession of private corporate information concerning Online Resources’ assets, business and future prospects. Thus, there exists an imbalance and disparity of knowledge and economic power between them and the public shareholders of Online Resources which makes it inherently unfair for them to benefit their own interests to the exclusion of maximizing shareholder value.

65. By reason of the foregoing acts, practices and course of conduct, the Individual Defendants have failed to exercise ordinary care and diligence in the exercise of their fiduciary obligations toward Plaintiff and the other members of the Class.

66. As a result of the actions of Defendants, Plaintiff and the Class will suffer irreparable injury in that they have not and will not receive their fair portion of the value of Online Resources’ assets and businesses and have been and will be prevented from obtaining a fair price for their common stock.

67. Unless the Individual Defendants are enjoined by the Court, they will continue to breach their fiduciary duties owed to Plaintiff and the members of the Class, all to the irreparable harm of the members of the Class.

68. Plaintiff and the members of the Class have no adequate remedy at law.

17

SECOND CAUSE OF ACTION

On Behalf of Plaintiff and the Class

Against ACI and Acquisition Sub for Aiding and Abetting the

Individual Defendants’ Breaches of Fiduciary Duty

69. Plaintiff repeats and realleges each allegation set forth herein.

70. ACI and Acquisition Sub (collectively “The Entities”) have acted and are acting with knowledge of, or with reckless disregard to, the fact that the Individual Defendants are in breach of their fiduciary duties to Online Resources’ public shareholders, and has participated in such breaches of fiduciary duties.

71. The Entities knowingly aided and abetted the Individual Defendants’ wrongdoing alleged herein. In so doing, the Entities rendered substantial assistance in order to effectuate the Individual Defendants’ plan to consummate the Offer in breach of their fiduciary duties.

72. Plaintiff has no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands injunctive relief in his favor and in favor of the Class and against Defendants as follows:

A. Declaring that this action is properly maintainable as a Class action and certifying Plaintiff as Class representative;

18

B. Enjoining Defendants, their agents, counsel, employees and all persons acting in concert with them from consummating the Offer, unless and until the Company adopts and implements a procedure or process to obtain a Transaction Agreement providing the best possible terms for shareholders;

C. Rescinding, to the extent already implemented, the Offer or any of the terms thereof, or granting Plaintiff and the Class rescissory damages;

D. Directing the Individual Defendants to account to Plaintiff and the Class for all damages suffered as a result of the Individual Defendants wrongdoing;

E. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and experts’ fees; and

F. Granting such other and further equitable relief as this Court may deem just and proper.

| | | | | | |

| DATED: February 5, 2013 | | | | FARUQI & FARUQI, LLP |

| | | |

| | | | By: | | /s/ Peter B. Andrews |

| | | | | | Peter B. Andrews (#4623) |

| | | | | | Craig J. Springer (#5529) |

| | | | | | 20 Montchanin Road, Suite 145 |

| | | | | | Wilmington, DE 19807 |

| | | | | | Tel: (302) 482-3182 Fax: (302) 482-3612 Counsel for Plaintiff |

19

Of Counsel:

FARUQI & FARUQI, LLP

Juan E. Monteverde

369 Lexington Ave., Tenth Floor

New York, NY 10017

Tel: (212) 983-9330

Fax: (212) 983-9331

ADEMI & O’REILLY, LLP

Guri Ademi

3620 East Layton Avenue

Cudahy, WI 53110

Tel: (414) 482-8000

Fax: (414) 482-8001

20