- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCurrent report (foreign)

Filed: 29 Jun 20, 9:24am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE13a-16 OR15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2020

Commission File Number:1-13368

POSCO

(Translation of registrant’s name into English)

POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 06194

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F orForm 40-F.

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1): ☐

Note: RegulationS-T Rule 101(b)(1) only permits the submission in paper of a Form6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7): ☐

Note: RegulationS-T Rule 101(b)(7) only permits the submission in paper of a Form6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form6-K submission or other Commission filing on EDGAR.

POSCO is furnishing under cover of Form6-K:

| Exhibit 99.1: | An English-translated documents of POSCO FY2019 Corporate Governance Report | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| POSCO | ||||||

| (Registrant) | ||||||

| Date: June 29, 2020 | By | /s/ Lim, Seung Kyu | ||||

| (Signature) | ||||||

| Name: | Lim, Seung Kyu | |||||

| Title: | Executive Vice President | |||||

Exhibit 99.1

POSCO

Corporate Governance Report

FY2019

POSCO provides this report in accordance with KOSPI Market Disclosure Regulation Article24-2 in order to help investors to better understand the company’s corporate governance. The corporate governance status in this report is composed based on December 31, 2019, and if there has been any changes occurred until June 1, 2020 which is the submission date of this report, those are stated separately. The status of corporate governance in this report is basically about the time period from January 1, 2019 to December 31, 2019. When the corporate governance report guidelines of Korea Exchange provide different time period for some matters, we stated information within those time period.

I. | 3 | |||||||

II. | 4 | |||||||

1. | Corporate Governance | 4 | ||||||

2. | Shareholders | 5 | ||||||

| 5 | ||||||||

| 14 | ||||||||

3. | Board of Directors(BoD) | 22 | ||||||

| 22 | ||||||||

| 29 | ||||||||

| 45 | ||||||||

(Core Principle 6) Evaluation of Outside Directors Activities | 49 | |||||||

| 50 | ||||||||

| 55 | ||||||||

4. | Audit Organization | 61 | ||||||

| 61 | ||||||||

| 67 | ||||||||

5. | Other Highlights | 69 | ||||||

• | Attachment : Key Compliance Indicators of Corporate Governance | 71 | ||||||

2

| I | Overview |

| • | Name of Company : POSCO |

| • | People in charge of the report : |

| • | MainIn-charge : Ahn,Jae-Ung, Section Leader, Investor Relations Group |

| • | CoIn-charge : Jeong, Gyeoun, Junior Manager, Investor Relations Group |

| • | Record Date : December 31, 2019 |

| • | Company Overview |

| Largest Shareholder | National Pension Service | Shareholding Ratio of the Largest Shareholder 1) | 12.17% | |||

Shareholding ratio of Minority Shareholders | 65.57% | |||||

| Business Type | Non-Financial | Major Products | Slabs, Blooms, Billets, Rolled Steel Products, etc. | |||

| Business Group under Monopoly Regulation and Fair Trade Act | Yes | Act on the Management of Public Institutions | Not Applicable | |||

Name of Business Group |

POSCO | |||||

| Summary of Financial Status (In hundred millions of KRW) | ||||||

FY 2019 | FY 2018 | FY 2017 | ||||

Consolidated Revenue | 643,668 | 649,778 | 606,551 | |||

Consolidated Operating Profit | 38,689 | 55,426 | 46,218 | |||

Consolidated Profit from Continuing Operations | 19,826 | 18,921 | 29,735 | |||

Consolidated Profit | 19,826 | 18,921 | 29,735 | |||

Consolidated Total Assets | 790,587 | 782,483 | 790,250 | |||

Separate Total Assets | 557,108 | 541,260 | 536,923 | |||

| 1) | As of April 29, 2020 |

3

| Glossary | ||

| BoD, the BoD | The Board of Directors | |

| GMoS | General Meeting(s) of Shareholders | |

| The company, company, we, our, us | POSCO as a separate business entity | |

| II | Current Status of Corporate Governance |

| • | The Principle and Policy of Corporate Governance |

POSCO pursues advanced corporate governance that enhances shareholders’ value in the long term and equally better interested parties’ rights. The management conducts responsible management with their expertise and reasonable decision-making and the BoD which consists of majority number of Outside Directors supervise and advise the management. This “Global Professional Management” is harmonized based on checks and balances and these principles in Corporate Governance Charter are proclaimed and fulfilled by the company.

Detailed principles of corporate governance are provided with Articles of Incorporation, Board of Directors Regulations, Corporate Governance Charter, other related internal governance rules, and also available on POSCO homepage(http://www.posco.com).

POSCO leadingly adopted Outside Directors Policy in 1997 and has continuously improved it for independence of BoD and strengthen its roles. The BoD consists of members with abundant experience and expertise from backgrounds such as fields of industry, finance, academia, law, accounting and public services in order to provide diversity and balanced perspective for the management’s reasonable decision-making. In order to effectively supervise and intervene the management, the BoD consists of more than half of Outside Directors. In addition, the Chairman of the BoD and Special Committees are Outside Directors.

| • | Characteristics of Corporate Governance |

POSCO’s BoD, as permanently established and the highest decision-making body, has the right to elect the Representative Directors. Since 2006, the Chairman position of BoD has been separated from the position of the CEO and the Representative Director and appointed among Outside Directors by resolution of BoD.

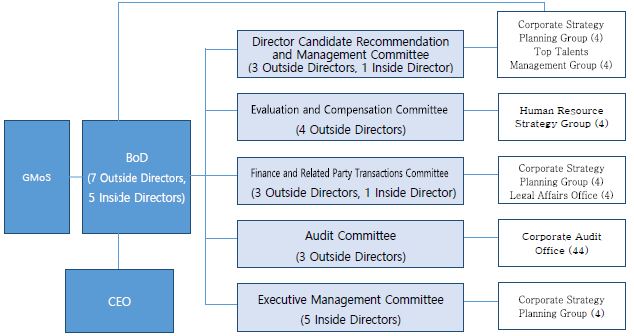

Outside Directors who have expertise and abundance of experience are recommended by Director Candidate Recommendation and Management Committee or by shareholders’ suggestion. As of June 1, 2020, POSCO BoD has total 12 Directors: 7 Outside Directors and 5 Inside Directors.

Under the BoD, there are 5 Special Committees: Director Candidate Recommendation and Management Committee, Evaluation and Compensation Committee, Finance and Related Party Translations Committee, Audit Committee, and Executive Management Committee. Except Executive Management Committee which review and deliberate steel related investments, Outside Directors are more than half of total number of Directors in each Special Committee. In addition, Evaluation and Compensation Committee and Audit Committee are consist of all Outside Directors in order to guarantee independent decision-making. Among Special Committees, Director Candidate Recommendation and Management Committee and Audit Committee are mandatory for installation under Commercial Act. However, the rest of 3 Special Committees were established voluntarily by the BoD in order for professionalism, independence and efficiency of the BoD. Finance and Related Party Translations Committee and Audit Committee include Directors who have expertise and experience in the fields of Industries, accounting and finance and are operated with minimum changes of members during their terms in consideration of specialty for the committees.

4

Moreover, in order to gather opinions on BoD agendas and other matters Outside Directors Meeting is held semi-annually and BoD Strategy Session is held twice in a year to collect opinions for the POSCO Group’s strategy, business plan, and so on. For detailed explanation of BoD, Special Committees, members and roles, please refer to “3. Board of Directors(BoD)”.

(Core Principle 1) Rights of Shareholders

| • | Shareholders need to be given sufficient information in a timely manner for exercise rights and need to exercise rights in proper procedure. |

(Sub-Principle 1-(1)) The company needs to provide sufficient information for the date, location and agendas of GMoS, long enough before the meeting date.

| 1) | History and Notice of GMoS |

POSCO has held 4 GMoS from 2018 till June 1, 2020 and 3 of them were Ordinary GMoS and 1 was Extraordinary GMoS . Information regarding GMoS such as date, location, agendas, etc. were provided to shareholders through Korea Exchange(KRX), Data Analysis, Retrieval and Transfer System(DART) website by Financial Supervisory Service, U.S. Securities and Exchange Commission(SEC) webpage, POSCO homepage, mail notice for domestic shareholders, Depository Notice and Proxy Card for foreign DR shareholders, and so on.

| • | (Table 1-(1)-1) History and Notice of GMoS |

The 52nd Term | The 51st Term | Extraordinary GMoS | The 50th Term | |||||||

| Resolution of Convocation | January 31, 2020 | January 30, 2019 | June 25, 2018 | January 24, 2018 | ||||||

| Notice of Convocation | February 27, 2020 | February 20, 2019 | June 25, 2018 | February 13, 2018 | ||||||

| GMoS Date | March 27, 2020 | March 15, 2019 | July 27, 2018 | March 9, 2018 | ||||||

| Days between Notice of Convocation and GMoS Date | 29 days before the meeting | 23 days before the meeting | 32 days before the meeting | 24 days before the meeting | ||||||

| Location/ Region | POSCO Center / Gangnam-gu, Seoul | POSCO Center / Gangnam-gu, Seoul | POSCO Center / Gangnam-gu, Seoul | POSCO Center / Gangnam-gu, Seoul | ||||||

| Notice to Shareholders | Mail notice, POSCO homepage, DART and KRX webpage | Mail notice, POSCO homepage, DART and KRX webpage | Mail notice, POSCO homepage, DART and KRX webpage | Mail notice, POSCO homepage, DART and KRX webpage | ||||||

| Notice for foreign shareholders | SEC webpage, Depository Notice and Proxy Card for foreign DR shareholders | SEC webpage, Depository Notice and Proxy Card for foreign DR shareholders | SEC webpage, Depository Notice and Proxy Card for foreign DR shareholders | SEC webpage, Depository Notice and Proxy Card for foreign DR shareholders | ||||||

5

| Details | BoD | 11 out of 12 Directors attended | 12 out of 12 Directors attended | 12 out of 12 Directors attended | 12 out of 12 Directors attended | |||||

Audit Committee Members |

2 out of 3 members attended |

3 out of 3 members attended |

3 out of 3 members attended |

3 out of 3 members attended | ||||||

| Shareholders’ Remarks |

1) 5 shareholders remarked 2) Messages : Impact of COVID19, shareholder return plan, consent remarks, other remarks |

1) 5 shareholders remarked 2) Messages : consent remarks, Inquiry regarding laborer director as Board member, other remarks |

1) 2 shareholders remarked 2) Messages : consent remarks, other remarks |

1) 10 shareholders remarked 2) Messages : Inquiry about rumor of company, Inquiry regarding changes in Articles of Incorporation to increase number of Directors, Inquiry regarding disposal of investing stocks, etc. | ||||||

| 2) | Providing Information regarding GMoS |

In general, POSCO provides date and location of GMoS through BoD resolution by 6 weeks before the meeting. By 3 weeks before the meeting, POSCO announced agendas of the GMoS after BoD resolution. Also, by 2 weeks before the meeting, POSCO provides agendas, related supplementary information and ways to vote to shareholders via mail.

For the 52nd term of Ordinary GMoS, POSCO provided date, location, agendas, etc. 4 weeks before the meeting through convocation announcement disclosure, and resultantly did meet one of the Corporate Governance Key Compliance Indicators. Additionally, in accordance with the amended Enforcement Decree of Commercial Act to strengthen information provision to shareholders, POSCO proactively disclosed its annual business report on DART a week before the GMoS.

(Sub-Principle 1-(2)) The company needs to help shareholders to attend the GMoS and to express their opinions.

| 1) | History of Shareholders’ Exercise of Voting Rights |

POSCO has held 3 Ordinary GMoS from 2018 until June 1, 2020. The company generally sets the meeting dates not among the designated congested dates. However, for the 52nd term of GMoS POSCO held the meeting in one of the congested dates. Generally, POSCO sets date and location of GMoS 6 weeks before the meeting through public disclosure after BoD resolution. However, in the time period when the company was considering to set the date, amendment of the Enforcement Decree of Commercial Act was in progress. To minimize uncertainties surrounding the meeting date, POSCO set the date later than previous years’ GMoS date and as a result held the GMoS in one of the expected congested dates.

According to the Articles of Incorporation, shareholders can vote with ballot paper. The company provides notification of convocation with ballot sheet via mail for every shareholders, thus shareholders who are not able to attend the meeting can vote via mail.

6

Furthermore, POSCO has adopted electronic voting system from the 51st GMoS in order to enhance convenience on voting by shareholders, and it has been continued to the 52nd meeting. The company conducts proxy solicitation every year.

| • | (Table 1-(2)-1) GMoS Date and Ways of Voting |

| The 52nd Term | The 51st Term | The 50th Term | ||||||||||

Congested Dates for GMoS | | March 13, 2020 March 20, 2020 March 26, 2020 March 27, 2020 |

| | March 22, 2019 March 27, 2019 March 28, 2019 March 29, 2019 |

| | March 23, 2018 March 29, 2018 March 30, 2018 |

| |||

Date of GMoS | 2020.3.27 | 2019.3.15 | 2018.3.9 | |||||||||

Meeting onNon-Congested Date | No | Yes | Yes | |||||||||

Conduct of Voting via Mail | Yes | Yes | Yes | |||||||||

Conduct of Electronic Voting | Yes | Yes | No | |||||||||

Conduct of Proxy Solicitation | Yes | Yes | Yes | |||||||||

POSCO held 2 Ordinary GMoS from January 1, 2019 to June 1, 2020.

In the 51st GMoS, total 57,112 thousand shares were voted. Among them, 17,681 thousand shares were voted through proxy solicitation, 33,731 thousand shares held by foreign shareholders were voted through standing proxy or depositary bank, 5,651 thousand shares were voted through the electronic voting system and 43 thousand shares were voted via mail. The rest of 6 thousand shares attended at the meeting in person.

In the 52nd GMoS, total 59,467 thousand shares were voted. Among them, 18,889 thousand shares were voted through proxy solicitation, 34,136 thousand shares held by foreign shareholders were voted through standing proxy or depositary bank, 6,369 thousand shares were voted through the electronic voting system and 69 thousand shares were voted via mail. The rest of 4 thousand shares attended at the meeting in person.

The approval and objection ratio and detailed vote results are given below.

| • | (Table 1-(2)-2) Voting Results on Each Agenda |

| The 51st GMoS | March 15, 2019 | |||||||||||||

Agenda | Resolution | Description | Result | Number of Outstanding Shares(1) 1) | (1)Counted Outstanding Shares(A) 2) | For (B) (Ratio, %)3) | ||||||||||

| Against, Spoilt vote, etc. (C) (Ratio, %)4) | ||||||||||||||||

1 | Ordinary | Approval of the 51st (FY2018) Financial Statements | Approved | 80,001,132 | 57,111,873 | | 49,395,553 (86.5 | %) | ||||||||

| | 7,716,320 (13.5 | %) | ||||||||||||||

2 | 2-1 | Special | Partial Amendments on the Articles of Incorporation (Article regarding the introduction of electronic voting system) | Approved | 80,001,132 | 57,111,873 | | 56,989,039 (99.8 | %) | |||||||

| | 122,834 (0.2 | %) | ||||||||||||||

| 2-2 | Special | Partial Amendments on the Articles of Incorporation (Article 51, Appointment of External Auditor) | Approved | 80,001,132 | 57,111,873 | | 56,978,452 (99.8 | %) | ||||||||

| | 133,421 (0.2 | %) | ||||||||||||||

| 2-3 | Special | Partial Amendments on the Articles of Incorporation (Article 23, Elimination of the qualification limit for proxy) | Approved | 80,001,132 | 57,111,873 | | 56,969,255 (99.8 | %) | ||||||||

| | 142,618 (0.2 | %) | ||||||||||||||

7

3 | 3-1 | Ordinary | Appointment of Inside Director Chang,In-Hwa | Approved | 80,001,132 | 57,111,873 | | 54,686,989 (95.8 | %) | |||||||

| | 2,424,984 (4.2 | %) | ||||||||||||||

| 3-2 | Ordinary | Appointment of Inside Director Chon,Jung-Son | Approved | 80,001,132 | 57,111,873 | | 48,564,238 (85.0 | %) | ||||||||

| | 8,547,635 (15.0 | %) | ||||||||||||||

| 3-3 | Ordinary | Appointment of Inside Director Kim,Hag-Dong | Approved | 80,001,132 | 57,111,873 | | 55,912,614 (97.9 | %) | ||||||||

| | 1,199,259 (2.1 | %) | ||||||||||||||

| 3-4 | Ordinary | Appointment of Inside Director Jeong, Tak | Approved | 80,001,132 | 57,111,873 | | 55,858,160 (97.8 | %) | ||||||||

| | 1,253,713 (2.2 | %) | ||||||||||||||

4 | 4-1 | Ordinary | Appointment of Outside Director Kim,Shin-Bae | Approved | 80,001,132 | 57,111,873 | | 56,701,734 (99.3 | %) | |||||||

| | 410,139 (0.7 | %) | ||||||||||||||

| 4-2 | Ordinary | Appointment of Outside Director Chung,Moon-Ki | Approved | 80,001,132 | 57,111,873 | | 52,760,555 (92.4 | %) | ||||||||

| | 4,351,318 (7.6 | %) | ||||||||||||||

| 4-3 | Ordinary | Appointment of Outside Director Pahk,Heui-Jae | Approved | 80,001,132 | 57,111,873 | | 56,922,730 (99.7 | %) | ||||||||

| | 189,143 (0.3 | %) | ||||||||||||||

5 | Ordinary | Appointment of Audit Committee Member Chung,Moon-Ki | Approved | 72,564,296 | 49,675,037 | | 45,269,266 (91.1 | %) | ||||||||

| | 4,405,771 (8.9 | %) | ||||||||||||||

6 | Ordinary | Ceiling of Directors’ Compensation | Approved | 80,001,132 | 57,111,873 | | 56,792,587 (99.4 | %) | ||||||||

| | 319,286 (0.6 | %) |

| 1) | Number of shares for Audit Committee Member agenda excluded the number of shares that are limited for voting rights. |

| 2) | Number of shares (A) : Number of shares (B) + Number of shares (C) |

| 3) | Ratio of approval shares (%) : (B/A) x 100 |

| 4) | Ratio of objection, spoilt vote and other Shares = (C/A) x 100 |

8

| The 52nd GMoS | March 27, 2020 | |||||||||||||

Agenda | Resolution | Description | Result | Number of Outstanding Shares(1) 1) | (1)Counted Outstanding Shares(A) 2) | For (B) (Ratio, %)3) | ||||||||||

| Against, Spoilt vote, etc. (C) (Ratio, %)4) | ||||||||||||||||

1 | Ordinary | Approval of the 52nd (FY2019) Financial Statements | Approved | 80,115,641 | 59,466,665 | | 55,009,722 (92.5 | %) | ||||||||

| | 4,456,943 (7.5 | %) | ||||||||||||||

2 | 2-1 | Ordinary | Appointment of Inside Director Chang,In-Hwa | Approved | 80,115,641 | 59,466,665 | | 56,365,868 (94.8 | %) | |||||||

| | 3,100,797 (5.2 | %) | ||||||||||||||

| 2-2 | Ordinary | Appointment of Inside Director Chon,Jung-Son | Approved | 80,115,641 | 59,466,665 | | 52,915,681 (89.0 | %) | ||||||||

| | 6,550,984 (11.0 | %) | ||||||||||||||

| 2-3 | Ordinary | Appointment of Inside Director Kim,Hag-Dong | Approved | 80,115,641 | 59,466,665 | | 57,578,408 (96.8 | %) | ||||||||

| | 1,888,257 (3.2 | %) | ||||||||||||||

| 2-4 | Ordinary | Appointment of Inside Director Jeong, Tak | Approved | 80,115,641 | 59,466,665 | | 57,591,028 (96.8 | %) | ||||||||

| | 1,875,637 (3.2 | %) | ||||||||||||||

3 | Ordinary | Appointment of Outside Director Chang,Seung-Wha | Approved | 80,115,641 | 59,466,665 | | 46,313,765 (77.9 | %) | ||||||||

| | 13,152,900 (22.1 | %) | ||||||||||||||

4 | Ordinary | Appointment of Audit Committee Member Pahk,Heui-Jae | Approved | 71,736,197 | 51,087,221 | | 49,027,361 (96.0 | %) | ||||||||

| | 2,059,860 (4.0 | %) | ||||||||||||||

5 | Ordinary | Ceiling of Directors’ Compensation | Approved | 80,115,641 | 59,466,665 | | 58,865,200 (99.0 | %) | ||||||||

| | 601,465 (1.0 | %) | ||||||||||||||

| 1) | Number of shares for Audit Committee Member agenda excluded the number of shares that are limited for voting rights. |

| 2) | Number of shares (A) : Number of shares (B) + Number of shares (C) |

| 3) | Ratio of approval shares (%) : (B/A) x 100 |

| 4) | Ratio of objection, spoilt vote and other Shares = (C/A) x 100 |

| 2) | Company’s Effort for Shareholders’ Voting Rights Exercise |

As described in 1) History of Shareholders’ Exercise of Voting Rights, POSCO provides voting via mail, electronic voting, and proxy solicitation in order to maximize shareholders’ participation. Especially, due to widespread ofCOVID-19, the company promotednon-contact exercise of voting rights such as voting via mail and electronic voting through company homepage and social networking services such as Facebook and Instagram. Due to the effort, the number exercised votes of domestic shares were increased by 1.9 million shares or by 2.8% to 74.2%.

9

(Sub-Principle 1-(3)) Company needs to facilitate shareholders to propose suggestions of GMoS conveniently and also facilitate them to freely ask questions and to request explanations regarding agendas proposed by shareholders at the meeting.

| 1) | History of Shareholders Proposal Right Exercise |

Although POSCO does not provide guidance on shareholders’ proposal procedure on the company website, apart from the shareholders’ right to propose by laws, we guide the recommendation of candidates for Outside Directors viae-mail so that shareholders can easily exercise their proposal rights.

Regarding proposals for shareholders recommending Outside Directors, Article 30 of the Articles of Incorporation, Recommendation of Candidate for Outside Directors, states that shareholders, by law, may recommend candidates for Outside Directors to the Director Candidate Recommendation and Management Committee.

When the recommendation of an Outside Director candidate is received as a shareholder proposal, the Investor Relations(IR) Group checks whether it meets the shareholder proposal requirements. After that, the Director Candidate Recommendation and Management Committee verifies the candidate’s eligibility. Subsequently, the committee recommends the candidate to the BoD. The BoD resolves the recommendation as for the agenda of GMoS.

From January 1, 2018 until June 1, 2020, there was 1 shareholders proposal. At the 50th GMoS, Dutch asset managers APG and Robeco recommended Professor Park,Kyung-Suh of Korea University as an Outside Director candidate as a shareholder proposal. In accordance with Articles of Incorporation and Article363-2 and Article542-6 of the Commercial Act, the candidate recommendation was verified by the Director Candidate Recommendation Committee (currently the Director Candidate Recommendation and Management Committee), and finally recommended as an Outside Director candidate. The BoD resolved and submitted as the agenda4-3, Appointment of Outside Director Park,Kyung-Suh, to the GMoS. However, on March 5, 2018, before the 50th GMoS was held, Professor Park,Kyung-Suh voluntarily resigned from the Outside Director candidate due to personal reasons, and the agenda was discarded at the GMoS.

| • | (Table 1-(3)-1) Shareholder Proposal |

Proposal Date | Proposed Shareholders | Proposal | Progress | Approval | Approval Rate (%) | Objection Rate (%) | ||||||

| January 25, 2018 | APG (Asset Manager), Robeco (Asset Manager) | To Recommend Professor Park,Kyung-Suh of Korea University as for the candidate of Outside Director | After verification of eligibility on Professor Park,Kyung-Suh the Director Candidate Recommendation Committee (currently the Director Candidate Recommendation and Management Committee) recommended him as an Outside Director candidate and it was resolved and submitted by the BoD as an agenda to the 50th GMoS. However, due to personal reasons, he voluntarily resigned from the Outside Director candidate on March 5, 2018, and the agenda was discarded at the GMoS. | Not Applicable | Not Applicable | Not Applicable |

10

From January 1, 2018 to June 1, 2020, there was no public letter from institutional investors in line with Stewardship Code. Therefore, the main contents of the public letter of institutional investors are not applicable, so the description is omitted.

| 2) | Support for Exercise of Shareholders Proposal Right |

Apart from shareholders proposal right under the law, the company guides candidates recommendation for Outside Directors throughe-mail so that shareholders can easily exercise the right. In order to strengthen communication with shareholders and secure various candidates for Outside Directors, from 2018, “Shareholders’ Recommendation” procedure was introduced in which shareholders participate directly in the process of finding candidates for Outside Directors. Like other candidates, the recommended candidates are screened by the Outside Director Candidate Recommendation Advisory Panel to determine whether or not to be included in the list of candidates.

About 3 months before Ordinary GMoS, a letter from the Chairman of Director Candidate Recommendation and Management Committee is sent to shareholders who can exercise shareholders proposal rights under the Commercial Act, suggesting recommendation of one Outside Director candidate per one shareholder and the recommendation is received bye-mail or mail. At the 52nd GMoS in 2020, the recommendation period was from December 18, 2019 to December 31, 2019.

Meanwhile, at the 51st GMoS in 2019, one candidate(professorship, law major, female) was proposed for Outside Director candidate through the “Shareholders’ Recommendation” procedure. The Outside Director Candidate Recommendation Advisory Panel included the candidate as one of the potential candidates and discussed eligibility. However, it was concluded that the candidate did not meet the need of the company as for Outside Director and was not recommended to the Director Candidate Recommendation and Management Committee. Subsequently, the related information was provided to the recommended organization.

(Sub-Principle 1-(4)) The company needs to prepare mid to long-term shareholder return policy, including dividends and future plans, and to guide them to shareholders.

| 1) | Shareholder Return Policies |

During the subjected period of this report, the company’s dividend policy was “maintaining stable long-term cash dividend levels including quarterly dividends” and related dividend policies and dividend details are disclosed on the company website. In accordance with the dividend policy, the company maintained a stable dividend level of KRW 8,000 to KRW 10,000 per share annually in spite of loss on consolidated basis in 2015.

11

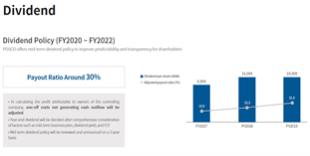

In January 2020, the company formulated amid-term dividend policy to improve predictability and transparency in terms of dividends. The company’smid-term dividend policy aims approximately 30% dividend payout ratio for the next three years from 2020 to 2022. The target dividend payout ratio is calculated as adjusted dividend payout ratio by addingone-off expenses without cash outflows on profit attributable to owners of the controlling company in consolidated basis. For theyear-end dividend,mid-term business plan, dividend yield, and cash flow, and other factors are comprehensively considered. The dividend policy is disclosed on the company website.

In April 2020, the BoD resolved aone-year share repurchase trust agreement to stabilize stock prices and increase shareholders value. The share repurchase trust contract period is from April 13, 2020 to April 12, 2021, and the total amount of trust is KRW 1 trillion. The information regarding share repurchase trust contract is also available on the company website.

About information related toyear-end dividend payments, the company notifies the dividend decision six weeks before Ordinary GMoS, and details of dividends and total amount of dividends are confirmed and announced to shareholders through public disclosure of the GMoS result on the date of approval. In addition, the company may provide quarterly dividends in cash through resolutions of the BoD according to the Articles of Incorporation and since the 2nd quarter of 2016 has been continuing quarterly dividend. On the day of the resolution of the BoD, it is publicly disclosed as quarterly dividend decision.

| 2) | Information Provision of Shareholders Return Policies |

Dividend policy and dividend details are provided to all shareholders in Korean and English through the company website. Reflecting the new dividend policy and share repurchase trust contract, the company expanded and reorganized the shareholder return policy page, and provides information onmid-term dividend policy, dividend details, and treasury stock information. Themid-term dividend policy was announced on January 31, 2020 through public disclosure and conference call of 2019 earnings release with institutional investors, analysts and press. The resolution of share repurchase trust contract was publicly disclosed on April 10, 2020.

| • | (Image 1-(4)-1) Shareholders Return Policy on the Company Webpage |

12

(Sub-Principle 1-(5)) Shareholders right to receive proper level of dividends, etc. needs to be respected based on shareholders return policies and future plans, etc.

| 1) | Shareholders Return Status |

In the last 3 fiscal years, the company has continued quarterly dividends andyear-end dividends, both in cash, in accordance with the dividend policy of “maintaining stable long-term cash dividend levels including quarterly dividends.” In the last 3 fiscal years, stock dividends, differential dividends, treasury stock purchases and retirement have not been implemented.

In 2017, quarterly dividends were paid KRW 1,500 per share in the 1st, 2nd, and 3rd quarter respectively, and KRW 3,500 per share was paid asyear-end dividends. Resultantly, we paid KRW 8,000 per share and total dividend of KRW 640 billion. In 2018, quarterly dividends were paid KRW 1,500 per share in the 1st and 2nd quarter respectively, KRW 2,000 per share in the 3rd Quarter and KRW 5,000 per share was paid asyear-end dividends. Resultantly, we paid KRW 10,000 per share and total dividend of KRW 800 billion. In 2019, quarterly dividends were paid KRW 2,000 per share in the 1st, 2nd, and 3rd quarter respectively, and KRW 4,000 per share was paid asyear-end dividends. Resultantly, we paid KRW 10,000 per share and total dividend of KRW 801 billion.

| • | (Table 1-(5)-1) Shareholders Return in the Last 3 Fiscal Years (Shares, KRW, Billions of KRW, %) |

Fiscal Year | Month for Year-end Closing | Types of Shares | Share Dividend | Cash Dividend | ||||||||||||||||||||||||

| Dividend per Share (KRW) | Total Dividend (Billions of KRW) | Dividend Ratio to Market Value | Dividend Payout Ratio | |||||||||||||||||||||||||

| Consolidated Base | Separate Base | |||||||||||||||||||||||||||

2019 | December | Common | — | 10,000 | 801 | 4.1 | % | 43.7 | % | 68.1 | % | |||||||||||||||||

| Class | — | — | — | — | ||||||||||||||||||||||||

2018 | December | Common | — | 10,000 | 800 | 4.1 | % | 47.3 | % | 74.6 | % | |||||||||||||||||

| Class | — | — | — | — | ||||||||||||||||||||||||

2017 | December | Common | — | 8,000 | 640 | 2.4 | % | 22.9 | % | 25.1 | % | |||||||||||||||||

| Class | — | — | — | — | ||||||||||||||||||||||||

ø Dividend per Share : Combined amount of quarterly dividend andyear-end dividend ø Dividend Payout Ratio : • Consolidated base is calculated total dividend divided by profit attributable to owners of the controlling company. • Separate base is calculated total dividend divided by separate profit. ø Dividend Ratio to Market Value is calculated by dividing Dividend per Share to average closing share price of the 1 week which is the time period before the two last trading days before theyear-end record date. |

| 2) | Respect Shareholders Rights for Shareholders Return |

As a result of continuous long-term stable cash dividends to improve shareholders value, we have maintained stable cash dividends of KRW 8,000 to 10,000 per share since 2004. In addition, quarterly dividend system has been adopted since 2016, and through quarterly dividends shareholders return are maintained continuously.

13

The company communicates transparently with shareholders regarding shareholders return and through detailed dividend policy and disclosure ofmid-term targets in order to increase market predictability. In the next 3 years, we plan to pay dividends with approximately 30% of dividend payout ratio in accordance with themid-term dividend policy announced by the BoD in January 2020. The target dividend payout ratio is calculated by adjusting dividend payout ratio by addingone-off expenses without cash outflows on profit attributable to owners of the controlling company in consolidated base. Foryear-end dividends,mid-term business plans, dividend yields, cash flows and other factors are comprehensively considered.

(Core Principle 2) Fair Treatment of Shareholders

| • | Shareholders need to be given fair voting rights according to the type and number of shares held and the company needs to make efforts to furnish a system that provides corporate information fairly to shareholders. |

(Sub-Principle 2-(1)) The company needs to ensure that shareholders’ voting rights are not infringed and provide company information to shareholders in timely, sufficient and equitable manners.

| 1) | Stock Issuance Information |

According to the Articles of Incorporation, the total number of shares which the company is authorized to issue is 200,000,000 shares. As of June 1, 2020, 96,480,625 common shares were issued and 9,293,790 of them were retired, resulting in a total of 87,186,835 common shares remained. As of June 1, 2020, our largest shareholder is National Pension Service with 10,612,872 of common shares (12.17%). So far, the company has no class shares and thus the separate description for class shares has been omitted.

| • | (Table 2-(1)-1) Shares Issuance Status |

| Authorized Shares * | Issued Shares** | Remarks | ||||||||

Common Shares | 200,000,000 | 87,186,835 | Retirement of 9,293,790 shares | |||||||

Class Shares | — | — | — | |||||||

| * | Authorized Shares : Total number of shares that is authorized to issue by the company under the Articles of Incorporation |

| ** | Issued Shares as of June 1, 2020 : Total issued shares deducted by the number of retired shares |

| 2) | Voting Rights on Issued Shares |

The company does not have any class shares, but issued only common shares. Shareholders exercise fair voting rights in accordance with the principle of 1 voting right per 1 share. As of March 31, 2020, the number of shares with voting rights are 80,115,641 which excludes company’s treasury stock of 7,071,194 shares.

| 3) | Communication with Shareholders |

In January, April, July, and October of each year, we hold annual and quarterly earnings announcements in the form of conference calls presided by the CFO. After the announcement of the results, the company regularly conductsnon-deal roadshows (NDR) for institutional investors in Korea, Asia, the Americas, and Europe, and frequently participates in domestic and international conferences held by securities companies to have direct communication on investors’ interests and requests.

14

CFO, the Head of the Finance Office and others if necessary are directly involved in overseas NDRs to share the company’s performance and mid and long-term strategic direction with investors, and thereby strive to provide higher-level feedback on shareholder interests. Especially, since 2018, we have provided opportunities for direct communication between Outside Directors and shareholders to improve understanding of the company’s corporate governance and to strengthen communication with shareholders.

The company discloses email address of the IR department on the company’s homepage, and also through the Contact Us page, shareholders can send comments or questions to the IR department. Inquiries received bye-mail are returned by the IR representative after internal checks. In addition,IR-only telephone connection is available through the company’s representative phone, which is provided on the company’s homepage, and answers to shareholders’ inquiries are made by phone.

In addition, the company has established a section for IR meeting request on the homepage for investors who want to visit the company directly. The meeting is held on average twice a day and diverse IR activities are conducted that reflect investors’ interests.

Since February 2020, due to widespread ofCOVID-19 and social distancing as one of the counter-measures, it is difficult to holdface-to-face meetings. But with frequent conference calls, we are having active communication with domestic and foreign investors and working to expand our investors pool.

| • | (Table 2-(1)-2) Major IR, Conference Calls, and Discussions with Shareholders |

Date | Subject | Meeting Type | Description | Remarks | ||||

| January 30, 2019 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of FY2018 and Q&A session) | |||||

| January 31, February 7 to 8, 2019 | Domestic institutional investors | NDR | Earnings release (Provisional business outcome of FY2018 and Q&A session) | |||||

| February 21 to 22, 2019 | Foreign institutional investors | Conference | JP Morgan Korea Conference (Earnings, markets, business issues, etc.) | |||||

| March 7, 2019 | Foreign institutional investors | Conference | Citi Korea Investor Conference (Earnings, markets, business issues, etc.) | |||||

| March 25 to 27, 2019 | Foreign institutional investors | Conference | Credit Suisse 22nd Asian Investment Conference (Earnings, markets, business issues, etc.) | Hong Kong | ||||

| March 28, 2019 | Steel analysts | IR | Seminar with Steel Analysts – raw material markets | |||||

| April 24, 2019 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of 1st quarter of FY2019 and Q&A session) | |||||

| April 26 to 30, 2019 | Domestic institutional investors | NDR | Earnings release (Provisional business outcome of 1st quarter of FY2019 and Q&A session) | |||||

| May 14 to 15, 2019 | Foreign institutional investors | Conference | BofAML Global Metals, Mining & Steel Conference 2019 (Earnings, markets, business issues, etc.) | Europe | ||||

| May 17, 2019 | Foreign institutional investors | NDR | Earnings, markets, business issues, etc. | Europe | ||||

| May 17, 2019 | Foreign institutional investors | Conference | Samsung Global Investors Conference (Earnings, markets, business issues, etc.) |

15

| May 21, 2019 | Domestic institutional investors | Conference | DAISHIN Securities Corporate Day (Earnings, markets, business issues, etc.) | |||||

| May 30, 2019 | Domestic institutional investors | Conference | Hanwha Investment & Securities Top Picks & Hidden Company Day (Earnings, markets, business issues, etc.) | |||||

| June 24, 2019 | Foreign institutional investors | Conference | UBS Korea Conference 2019 (Earnings, markets, business issues, etc.) | |||||

| July 8, 2019 | Domestic institutional investors | IR | 2019 POSCO Outside Directors IR (3 Outside Directors including the Chairman of BoD and CFO) | |||||

| July 23, 2019 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of 2nd quarter of FY2019 and Q&A session) | |||||

| July 24 to 25, 2019 | Domestic institutional investors | NDR | Earnings release (Provisional business outcome of 2nd quarter of FY2019 and Q&A session) | |||||

| July 26, 2019 | Domestic institutional investors, Analysts | IR | POSCO Group Corporate Day | |||||

| August 21, 2019 | Foreign institutional investors | NDR | NDR to Asian region by the Head of Finance Office | Singapore | ||||

| August 29, 2019 | Foreign institutional investors | Conference | BofAML Korea Conference 2019 (Earnings, markets, business issues, etc.) | |||||

| September 4, 2019 | Domestic institutional investors | Conference | 2019 KB Korea Conference (Earnings, markets, business issues, etc.) | |||||

| September 4 to 5, 2019 | Foreign institutional investors | Conference | Citi GEM Conference New York 2019 (Earnings, markets, business issues, etc.) | USA | ||||

| September 6, 9 to 10, 2019 | Foreign institutional investors | NDR | (Earnings, markets, business issues, etc.) | USA | ||||

| September 9 to 11, 2019 | Foreign institutional investors | Conference | CLSA 26th Investors’ Forum 2019 | Hong Kong | ||||

| October 24, 2019 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of 3rd quarter of FY2019 and Q&A session) | |||||

| October 25, 28 to 29, 2019 | Domestic institutional investors | NDR | Earnings release (Provisional business outcome of 3rd quarter of FY2019 and Q&A session) | |||||

| November 6 to 8, 2019 | Foreign institutional investors | IR | 2019 POSCO Outside Directors IR (3 Outside Directors including the Chairman of BoD and CFO) | |||||

| November 13 to 14, 2019 | Foreign institutional investors | Conference | Daiwa Investment Conference Hong Kong 2019 | Hong Kong | ||||

| November 15, 2019 | Foreign institutional investors | NDR | Earnings, markets, business issues, etc. | Singapore |

16

| November 21, 2019 | Domestic institutional investors, Analysts | IR | POSCO Group Corporate Day | |||||

| December 3 to 4, 2019 | Foreign institutional investors | Conference | UBS Global EmergingOne-on-One Conference 2019 | USA | ||||

| January 1 to December 31, 2019 | Domestic and foreign institutional investors, analysts | IR | Individual meetings and conference calls at the request of shareholders and investors (Earnings, markets, business issues, etc.) | 168 times in 2019 | ||||

| January 31, 2020 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of FY2019 and Q&A session) | |||||

| February 3 to 6, 2020 | Domestic institutional investors, Analysts | NDR | Earnings release (Provisional business outcome of FY2019 and Q&A session) | |||||

| April 24, 2020 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of 1st quarter of FY2020 and Q&A session) | |||||

| January 1 to May 31, 2020 | Domestic and foreign institutional investors, analysts | IR | Individual meetings and after the spread ofCOVID-19 conductednon-contact meetings (Earnings, markets, business issues, etc.) | 85 times |

The IR materials and information about the company that are mentioned above are provided to the company homepage as well as DART(http://dart.fss.or.kr) and KIND(http://kind.krx.co.kr) that are the webpages for public disclosure in order for fair disclosure to every shareholder. In addition, as the company listed American Depositary Receipts(ADR) on the New York Stock Exchange(NYSE), we are submitting English disclosures on the EDGAR system(https://www.sec.gov/edgar) of the U.S. Securities and Exchange Commission(SEC). The company runs a homepage with English as well and IR materials, independent auditors’ periodic reports such as quarterly, interim and annual reports are available in English in the homepage. Foreign shareholders can send inquiries viae-mail using the Q&A section on the English homepage, and the IR department replies to the inquiries. In addition, IR contact information is given on Form20-F that is submitted to the SEC, so that shareholders can submit inquiries.

| • | (Table 2-(1)-3) List of English Disclosure on the Korea Exchange(KRX) |

Date of Disclosure | Disclosure Title | Contents | ||

| June 17, 2019 | Details of Corporate Governance Report | English translated version of Corporate Governance Report | ||

| November 8, 2019 | Details of Sustainability Report, etc. (Voluntary Disclosure) | English translated version of Sustainability Report | ||

ø The company listed American Depositary Receipts on the New York Stock Exchange and under the rules of the U.S. Securities and Exchange Commission, we submit English public disclosures such as Form20-F, Form6-K, Form SD, etc. |

17

| • | (Table 2-(1)-4) List of Fair Disclosures |

Date of Disclosure | Disclosure Title | Contents | ||

| April 24, 2020 | [Amended] Outlook on business performance | Outlook on separate basis of revenue, capital expenditure, crude steel production | ||

| April 24, 2020 | [Amended] Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue, capital expenditure, etc. | ||

| April 24, 2020 | Provisional business performance | Provisional revenue, operating profit, profit on separate base | ||

| April 24, 2020 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit on consolidated base | ||

| January 31, 2020 | Occasional disclosure obligations | Fair disclosure ofmid-term dividend policy | ||

| January 31, 2020 | Outlook on business performance | Outlook on separate basis of revenue, capital expenditure, crude steel production | ||

| January 31, 2020 | Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue, capital expenditure, etc. | ||

| January 31, 2020 | Provisional business performance | Provisional revenue, operating profit, profit on separate base | ||

| January 31, 2020 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit on consolidated base | ||

| October 24, 2019 | [Amended] Outlook on business performance | Outlook on separate basis of revenue, capital expenditure, crude steel production | ||

| October 24, 2019 | [Amended] Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue, capital expenditure, etc. | ||

| October 24, 2019 | Provisional business performance | Provisional revenue, operating profit, profit on separate base | ||

| October 24, 2019 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit on consolidated base | ||

| July 23, 2019 | [Amended] Outlook on business performance | Outlook on separate basis of revenue, capital expenditure, crude steel production | ||

| July 23, 2019 | [Amended] Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue, capital expenditure, etc. | ||

| July 23, 2019 | Provisional business performance | Provisional revenue, operating profit, profit on separate base | ||

| July 23, 2019 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit on consolidated base | ||

| April 24, 2019 | Provisional business performance | Provisional revenue, operating profit, profit on separate base | ||

| April 24, 2019 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit on consolidated base | ||

| January 30, 2019 | Outlook on business performance | Outlook on separate basis of revenue, capital expenditure, crude steel production | ||

| January 30, 2019 | Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue, capital expenditure, etc. | ||

| January 30, 2019 | Provisional business performance | Provisional revenue, operating profit, profit on separate base | ||

| January 30, 2019 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit on consolidated base | ||

18

The company has not been designated as an unfaithful disclosure corporation from the subjected disclosure period until June 1, 2020 and therefore, the table for the list of designation of unfaithful disclosure corporation and its details has been omitted.

| 4) | Provision of Corporate Information to Shareholders |

As referred on 3) Communication with Shareholders, the company provides company information including IR materials on its homepage and public disclosure website such as DART(http://dart.fss.or.kr), KIND(http://kind.krx.co.kr), etc. to shareholders in a timely manner. In addition, as the company listed American Depositary Receipts(ADR) on the New York Stock Exchange(NYSE), we are submitting English disclosures to the EDGAR system (https://www.sec.gov/edgar) of the U.S. Securities and Exchange Commission(SEC). The company runs a homepage with English as well and IR materials, independent auditors’ periodic reports such as quarterly, interim and annual reports are translated in English and provided fairly to both domestic and foreign shareholders.

(Sub-Principle 2-(2)) The company needs to prepare and operate mechanism to protect shareholders from unfair internal transactions and self-transactions of other shareholders, such as controlling shareholders.

| 1) | Corporate Control System related to Internal Transactions and Self-Transaction |

In order to prevent internal transactions for the purpose of private profits by management or controlling shareholders, the company has prepared separate internal control related rules. First of all, the internal accounting management regulations are managed by the resolution of the Audit Committee. And regarding transactions of funds, assets, and securities over certain amounts conducted by the company’s largest shareholder, including its related parties, and related parties are ruled to be resolved by the BoD. The company established the Finance and Related Party Transactions Committee to deliberate and decide on large-scale internal transactions of more than KRW 5 billion and less than KRW 100 billion, and in the case of large-scale internal transactions of more than KRW 100 billion, the committee is subject to prior deliberation and approval of the BoD. Please refer to “3. Board of Directors(BoD)” for the details of the internal transactions decided or deliberated by the Finance and Related Party Transactions Committee.

In 2019, the company does not have credit grants to major shareholders, asset transfers or sales transactions with major shareholders, and the important transactions between the company and related parties are as follows.

19

(In millions of KRW) | ||||||||||||||||||||||||

Name of company | Sales and others (1) | Purchase and others (2) | ||||||||||||||||||||||

| Sales | Others | Materials purchase | Fixed assets purchase | Outsourced process cost | Others | |||||||||||||||||||

[Consolidated subsidiaries] (3) |

| |||||||||||||||||||||||

POSCO ENGINEERING & CONSTRUCTION., CO., LTD. | 6,688 | 11,137 | 4,725 | 416,734 | 57 | 24,174 | ||||||||||||||||||

POSCO COATED & COLOR STEEL Co., Ltd. | 468,070 | 2,014 | 95 | — | 20,298 | 724 | ||||||||||||||||||

POSCO ICT (4) | 2,924 | 4,994 | — | 344,977 | 34,638 | 181,128 | ||||||||||||||||||

eNtoB Corporation | 15 | 60 | 304,846 | 64,845 | 126 | 25,754 | ||||||||||||||||||

POSCO CHEMICAL CO., LTD. | 389,731 | 35,592 | 522,493 | 17,549 | 315,530 | 4,561 | ||||||||||||||||||

POSCO ENERGY CO., LTD. | 148,205 | 2,211 | 5,123 | 94 | — | 7,561 | ||||||||||||||||||

POSCO INTERNATIONAL Corporation | 6,025,938 | 46,661 | 541,002 | — | 49,506 | 7,149 | ||||||||||||||||||

POSCO Thainox Public Company Limited | 265,374 | 13,795 | 10,037 | — | — | 3 | ||||||||||||||||||

POSCO America Corporation | 300,598 | — | — | — | — | 2,994 | ||||||||||||||||||

POSCO Canada Ltd. | 1,067 | 1,833 | 306,552 | — | — | — | ||||||||||||||||||

POSCO Asia Co., Ltd. | 1,781,841 | 1,352 | 390,056 | 1,338 | 1,574 | 7,561 | ||||||||||||||||||

Qingdao Pohang Stainless Steel Co., Ltd. | 146,468 | — | — | — | — | 110 | ||||||||||||||||||

POSCO JAPAN Co., Ltd. | 1,509,631 | 36 | 38,631 | 6,269 | — | 5,835 | ||||||||||||||||||

POSCO-VIETNAM Co., Ltd. | 265,849 | 368 | — | — | — | 66 | ||||||||||||||||||

POSCO MEXICO S.A. DE C.V. | 303,924 | 159 | — | — | — | 809 | ||||||||||||||||||

POSCO Maharashtra Steel Private Limited | 644,652 | 311 | — | — | — | 800 | ||||||||||||||||||

POSCO(Suzhou) Automotive Processing Center Co., Ltd. | 121,633 | 27 | 2,189 | — | — | — | ||||||||||||||||||

POSCO VST CO., LTD. | 299,307 | — | — | — | — | 114 | ||||||||||||||||||

POSCO INTERNATIONAL SINGAPORE PTE LTD. | — | 154 | 694,600 | — | — | — | ||||||||||||||||||

Others | 964,532 | 20,679 | 134,296 | 34,444 | 246,184 | 169,849 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Sub-total | 13,646,447 | 141,383 | 2,954,645 | 886,250 | 667,913 | 439,192 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

[Associates and Joint Ventures] (3) |

| |||||||||||||||||||||||

POSCO PLANTEC Co., Ltd. | 1,364 | 86 | 2,882 | 306,927 | 15,089 | 30,317 | ||||||||||||||||||

SNNC | 5,527 | 4,100 | 588,276 | — | — | 9 | ||||||||||||||||||

POSCO-SAMSUNG Slovakia Processing Center | 65,688 | — | — | — | — | — | ||||||||||||||||||

Roy Hill Holdings Pty Ltd | — | — | 1,237,168 | — | — | — | ||||||||||||||||||

Others | 16,084 | 112,390 | 76,427 | — | — | 85,167 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Sub-total | 88,663 | 116,576 | 1,904,753 | 306,927 | 15,089 | 115,493 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 13,735,110 | 257,959 | 4,859,398 | 1,193,177 | 683,002 | 554,685 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| (1) | It consists of steel products revenue, etc. of consolidated subsidiaries, associates and joint ventures. |

| (2) | It consists of providing construction services for subsidiaries and purchasing raw materials for steel products production.. |

| (3) | As of the end of 2019, the company provides payment guarantees for special parties. |

| (4) | Most of the other purchases fromPOSCO-ICT consist of payments related to maintenance of the ERP system. |

20

The details of receivables and payables between the company and related parties at the end of 2019 are as follows.

(In millions of KRW) | ||||||||||||||||||||||||||||

Name of company | Receivables | Payables | ||||||||||||||||||||||||||

| Trade accounts and notes receivable | Others | Total | Trade accounts and notes payable | Accounts payable | Others | Total | ||||||||||||||||||||||

[Subsidiaries] |

| |||||||||||||||||||||||||||

POSCO ENGINEERING & CONSTRUCTION CO., LTD. | 5,702 | 65 | 5,767 | — | 78,512 | 385 | 78,897 | |||||||||||||||||||||

POSCO COATED & COLOR STEEL Co., Ltd. | 57,792 | — | 57,792 | — | 11 | 3,828 | 3,839 | |||||||||||||||||||||

POSCO ICT | 225 | 1 | 226 | 1,147 | 129,424 | 42,844 | 173,415 | |||||||||||||||||||||

eNtoB Corporation | — | — | — | 3,459 | 27,431 | — | 30,890 | |||||||||||||||||||||

POSCO CHEMICAL CO.,LTD | 35,102 | 3,578 | 38,680 | 17,839 | 52,710 | 19,369 | 89,918 | |||||||||||||||||||||

POSCO ENERGY CO.,LTD | 1,876 | 4 | 1,880 | — | 3,229 | 14,912 | 18,141 | |||||||||||||||||||||

POSCO INTERNATIONAL Corporation | 633,073 | — | 633,073 | 345 | 2,218 | 3,839 | 6,402 | |||||||||||||||||||||

POSCO Thainox Public Company Limited | 52,826 | 2 | 52,828 | 916 | — | — | 916 | |||||||||||||||||||||

POSCO America Corporation | 8,448 | — | 8,448 | — | — | — | — | |||||||||||||||||||||

POSCO Asia Co., Ltd. | 508,962 | 748 | 509,710 | 12,784 | 171 | — | 12,955 | |||||||||||||||||||||

Qingdao Pohang Stainless Steel Co., Ltd. | 29,842 | — | 29,842 | — | — | — | — | |||||||||||||||||||||

POSCO MEXICO S.A. DE C.V. | 90,351 | 702 | 91,053 | — | — | — | — | |||||||||||||||||||||

POSCO Maharashtra Steel Private Limited | 235,917 | 444 | 236,361 | — | — | — | — | |||||||||||||||||||||

Others (1) | 470,734 | 33,851 | 504,585 | 14,397 | 40,233 | 87,652 | 142,282 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Sub-total | 2,130,850 | 39,395 | 2,170,245 | 50,887 | 333,939 | 172,829 | 557,655 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

[Associates and Joint Ventures] |

| |||||||||||||||||||||||||||

POSCO PLANTEC Co., Ltd. | 84 | 10 | 94 | 471 | 49,511 | — | 49,982 | |||||||||||||||||||||

SNNC | 297 | 65 | 362 | 19,769 | — | — | 19,769 | |||||||||||||||||||||

Roy Hill Holdings Pty Ltd | — | — | — | 93,383 | — | — | 93,383 | |||||||||||||||||||||

Others | 942 | 706 | 1,648 | 3,447 | 586 | — | 4,033 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Sub-total | 1,323 | 781 | 2,104 | 117,070 | 50,097 | — | 167,167 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 2,132,173 | 40,176 | 2,172,349 | 167,957 | 384,036 | 172,829 | 724,822 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (1) | During 2018, the company made loans of KRW 2,950 million to Suncheon Eco Trans Co., Ltd., a subsidiary of the company. As of December 31, 2019, corresponding amounts of those loans were recorded as allowance for doubtful accounts. |

21

ø As of June 1 ,2020, POSCO DAEWOO Corporation changed name of the company to POSCO INTERNATIONAL Corporation and POSCO CHEMTECH changed name of the company to POSCO CHEMICAL CO., LTD. |

(Core Principle 3) Function of BoD

| • | The BoD needs to determine the company’s management goals and strategies for the benefit of the company and shareholders, and effectively supervise the management. |

(Sub-Principle 3-(1)) The BoD needs to effectively perform business decision-making functions and management supervision functions.

| 1) | Deliberation and Resolution by BoD and the Support System other than those Required by Laws |

The BoD of the company decides important matters of the company, such as setting management goals and core management strategies for the benefit of the company and shareholders in accordance with relevant laws and the Board of Directors Regulations. And each consideration matters of the BoD and Special Committees are specified in the Board of Directors Regulations. In addition, thorough preliminary reviews are made before the BoD makes resolution.

In addition to the BoD and Special Committees, strategic sessions are held in which Board members andnon-registered executive officers participate in order to effectively fulfill the roles of the BoD. There are also regular meetings centered on Outside Directors to collect opinions proactively on agendas of the BoD. If necessary, there are prior reports before meetings to improve understanding of agendas, and regular visitation of major business sites.

Currently, the specific roles of the BoD are determined in the Board of Directors Regulations and in the Article 38, Paragraph 1 of the Articles of Incorporation. The deliberations and resolutions of the BoD and Special Committees within the BoD are as follows.

22

< The deliberations and resolutions of the BoD and Special Committees >

Board of Directors

(BoD) | [Deliberation Agenda]

1. GMoS

(1) Convocation of GMoS

(2) Approval on statements of financial position, comprehensive income, changes in equity, cash flows and notes, statements of appropriation of retained earnings or statements of disposition of deficit and accompanying statements, consolidated financial statements in every settlement term

(3) Approval of annual report

(4) Amendments to the Articles of Incorporation

(5) Retirement of shares

(6) Remuneration, retirement benefits of Directors

(7) Other agendas to be submitted to GMoS

2. Business

(1) Establishment of business goals and core business strategies (mid and long-term business plans, annual operating objectives, business rationalization plans, etc.)

(2) Important CI establishment and modification (corporate philosophy, flag, badge, etc.)

(3) Group-level restructuring plans

(4) Yearly business plans

(5) Appointment of the Chairman of the BoD

(6) Recommendation of candidates for Inside Directors

(7) Appointment of the CEO and the Representative Director, appointment of Representative Directors among Inside Directors, and appointing Inside Directors

(8) Management succession and management training plans

(9) Management evaluation and compensation plans

(10) Composition and operation plans for Special Committees under the BoD

(11) Determination of expert assistance of Directors

(12) Matters concerning the composition and operation of CEO Candidate Recommendation Committee and the Succession Council

(13) Enact, amend or repeal of the following company regulations

A. Operational regulations of BoD and Audit Committee | |

3. Investment and Finance

(1) New external investments, capital increase or investment shares disposal of invested companies (KRW 100 billion or more, investment and capital increase includes borrowings and liabilities that the company takes)

(2) In-house investment plans (New establishment or expansion project of KRW 200 billion or more)

(3) Acquisition and disposal of tangible, intangible, fixed assets or important investment assets ( KRW 200 billion or more, based on book value per unit of invested assets)

(4) Deficit disposal

(5) Decision on disposal of retained earnings |

23

(6) Determination of new shares issuance

(7) Decision on forfeited andodd-lot shares

(8) Retirement of repurchased shares

(9) Decision to repurchase and dispose of treasury stock

(10) Transfer of reserve fund to equity

(11) Issuance of corporate bonds and important borrowings (long-term borrowings over KRW 100 billion) | ||

(12) Issuance of convertible bonds

(13) Issuance of bond with warrant

(14) Donation (Over KRW 1 billion)

4. Others

(1) When filing a lawsuit or arbitration of KRW 100 billion or more, responding to a court reconciliation or mediation, or taking other legal actions equivalent to this level.

(2) Transactions with the largest shareholder of the company (including its related parties) and related parties as determined by the Commercial Act

A. A single transaction size ofone-hundredth or more of total assets or revenue as of the end of the last business year

B. The total transaction amount during the business year including the transaction with specific persons or business entities becomes 5/100 or more of total assets or revenue as of the end of the recent business year (However, it is excluded when ordinary transactions, etc. that the total amount of the transactions are approved and the transactions amounts occurred within the approved ranges.)

(3) Transactions with related parties under the Monopoly Regulation and Fair Trade Act.

A. Provision or transaction of funds such as provisional payments or loans, etc. (KRW 100 billion or more)

B. Provision or transaction of shares or bonds of the company (KRW 100 billion or more)

C. Provision or transaction of assets such as real estates or intangible property rights (KRW 100 billion or more)

(4) Appointment of transfer agent

(5) Decision on administration fees treatment for shares of the company

(6) Establishment, transfer or closure of branches

(7) Approval of transactions between Directors and the company

(8) Compliance officers appointment or dismissal, enactment or amendment of compliance standards

(9) Other matters by laws or Articles of Incorporation, and matters submitted by Directors in relation to business execution

[Report Agenda]

1. Result of matters delegated to Special Committees

2. Important matters related to operation of subsidiaries

3. Report the results of the compliance officer’s compliance checks

4. Other important business execution matters

| ||

24

| Director Candidate Recommendation and Management Committee | 1. Qualification review of Outside Director candidates and recommendation to GMoS

2. Preliminary review and qualification review of Inside Director candidates

3. Preliminary deliberation on appointment of members of Special Committees

4. Pre-deliberation of appointment of Representative Directors other than the CEO and the Representative Director CEO

5. Operation of Outside Director Candidate Recommendation Advisory Panel | |

6. Other matters necessary for recommending candidates for Outside Directors

7. Agenda development and establishment of operating standards of the BoD and Special Committees

8. Revision or repeal of the Board of Directors Regulations

9. Pre-deliberation of the composition and operation of the Special Committees under the BoD

| ||

| Evaluation and Compensation Committee | 1. Establishment of management succession and management training plan

2. Establishment and execution of management evaluation and compensation plan

3. Pre-deliberation on remuneration and retirement allowance of Directors

| |

| Finance and Related Party Transactions Committee | 1. Developing policies for the company’s internal values and financial soundness

2. Prior deliberation in case of filing in, KRW 100 billion or more, litigation or arbitration, responding to reconciliation or mediation in the process of trial or taking any equivalent level of legal actions.

3. External Investments (Business units other than Steel)

(1) Pre-deliberation on new external investments, capital increase or investment shares disposal of invested companies (KRW 100 billion or more. Investment and capital increase includes borrowings and liabilities that the company takes) However, the internal transaction deliberations under paragraph 9 are excluded.

(2) Approval on new external investments, capital increase or investment shares disposal of invested

4. Deliberation and resolution of donation from over KRW 100 million to KRW 1 billion andpre-deliberation of donation over KRW 1 billion (Deliberation agendas under paragraph 9 are excluded)

5. Deliberation and resolution of bonds issuance or important borrowings (Including borrowings for refunding over KRW 100 billion)

6. Pre-deliberation of bonds issuance or important borrowings (New long-term borrowings over KRW 100 billion)

7. Deliberation and resolution on collateral provision ofnon-current assets

8. Deliberation and resolution on debt acquisition of invested company such as security and guarantee (Excludes when the debt is in relation to steel investment) Deliberations and resolutions of internal transactions under paragraph 9 are excluded.

9. Internal transactions under Monopoly Regulation and Fair Trade Act (The act of providing or trading funds, securities, or assets with related party as business counterpart or for related party)

A. Review of internal transaction-related problems and improvement measures

B. Pre-deliberation of internal transaction (Amount KRW 100 billion or more)

C. Deliberation and resolution of internal transaction (Amount from KRW 5 billion to less than KRW 100 billion)

10. Appointment of Fair Trade Compliance Manager

| |

25

| Audit Committee | 1. Setting the work scope of the committee

2. Matters that the BoD or Representative Directors delegated

3. Request for Extraordinary GMoS

4. Consulting of external experts

5. Audit of the legitimacy of management’s business execution

6. Review soundness and validity of the company’s financial activities and the appropriateness of | |

7. Review the validity of important accounting standards or changes in accounting estimates

8. Evaluation of the operation status of the internal accounting management system

9. Evaluation of the internal control system

10. Agreement on appointment or dismissal of internal audit department representative

11. Contract for appointment, remuneration andnon-audit services of independent auditors

12. Evaluation of independent auditors’ audit activities

13. Report internal audit department’s annual audit plan and results

14. Report on the evaluation results of the company’s ethical compliance

15. An independent auditor reports on important facts of the company’s Directors’ misconduct or in violation of laws or Articles of Incorporation

16. Report that independent auditors have violated the company’s accounting standards

17. Enactment, amendment or repeal of internal accounting management regulations

18. Other items deemed necessary by each committee member

| ||

| Executive Management Committee | 1. Business

(1) Position system, important matters related to human resource development and coordination

(2) Important matters about changing the work system and welfare

(3) New establishment plan for chair-professor

(4) Housing Policy Establishment (Housing fund support standard and plan for housing construction)

(5) Decision on closure of shareholders’ registry

2. Finance

(1) Preliminary review onin-house investment plan (New establishment or expansion investment of KRW 200 billion or more)

(2) Approval onin-house investment plan

A. New establishment or expansion investment from KRW 10 billion or more to less than KRW 200 billion.

B. Investment of KRW 10 billion or more other than new establishment or expansion (Amount of KRW 5 billion or more for investment in the ordinary course of business)

(3) Pre-deliberation on new external investments, capital increase or investment shares disposal of invested companies in Steel Business Unit (KRW 100 billion or more. Investment or capital increase amount includes borrowings and liabilities that the company takes)

(4) Approval on new external investments, capital increase or investment shares disposal of invested companies in Steel Business Unit (Amount of KRW 10 billion or more to less than KRW 100 billion. Investment or capital increase amount includes borrowings and liabilities that the company takes) | |

26

(5) Acquisition or disposal of tangible, intangible, fixed or important investment assets of from KRW 10 billion or more to less than KRW 200 billion (Based on book value per unit of investment assets)

(6) Technology application of over USD 1 million and technology sales contract approval

(7) Acquisition of debt such as guarantees for invested company’s collateral involving steel investments

3. Other matters that the Chairman deems necessary or deemed necessary by each committee member |

| 2) | Whether the BoD effectively performs business decision-making functions and business supervision functions |

Our management performs responsible business practice based on expertise and reasonable decision-making and the BoD, centered with independent Outside Directors, supervises and advises the management. The initial plans such as strategic direction of the group, business plans, etc. set out by the management, but after active discussions at the Board level, such as strategic sessions, meetings of Outside Directors, etc. the opinions of the Directors are actively reflected.

At the BoD strategic session in April, 2019, the business promotion strategy for the group’s new growth was established afterin-depth discussion and at the strategic session in November, the group’s mid and long-term strategic and business plan of 2020 waspre-reviewed and the Directors’ opinions were reflected.

In addition, at the Outside Directors’ meeting held twice in June and October, 2019, the Directors reviewed the progress of each business projects such as Samcheok power plant and discussed corporate governance matters such as the future roles of the CEO, etc.

(Sub-Principle 3-(2)) The BoD needs to prepare the Chief Executive Officer(CEO) succession policy (including appointment process as for contingency plan) and to improve continuously.

| 1) | The CEO Succession Policy |

In accordance with Article 29 of the Articles of Incorporation, the BoD decides candidates for the CEO and the CEO Candidate Recommendation Committee verifies eligibility of the candidates. After that, the BoD recommends a candidate to the GMoS. After appointment of the candidate as an Inside Director at the GMoS and the BoD appoints the Director as the Representative Director then the succession process of the CEO is completed.

In the process above, the succession council identifies and proposes candidates to the BoD that meet qualifications set by the BoD and for the purpose of selecting an independent and transparent CEO. Also, by conducting multi-faceted andin-depth qualification reviews of candidates, set by the BoD, from the CEO Candidate Recommendation Committee that is composed of all Outside Directors, the company operates management succession process with separation of roles and powers between organizations.

The current succession policy is applicable in contingent situations, and in 2018, even in the sudden succession process, there was a case that the succession of the CEO was successfully completed according to the established policy. In addition, the company appoints two or more Representative Directors, so it is possible to conduct internal or external business even when the CEO is not able to conduct the role.

In order to systematically train candidates for the top management, the company selects and manages key talents from executives and managerial level of employees in each major business areas. Selected personnel are trained by performing major tasks in the company and by completing training in major institutions to improve global business capabilities and leadership.

27

(Sub-Principle 3-(3)) The BoD needs to establish and operate internal control policies (risk management, compliance management, internal accounting management, disclosure information management, etc.) and continuously improve and supplement them.

| 1) | Operation of Internal Control Policy |

In order to check compliance with the compliance control standards, the company established and enforced the compliance control standards in accordance with the resolution by the BoD in May 2012, and since August 2017, it has been under the Articles of Incorporation and operated. We have appointed a compliance officer with legal qualifications who monitors the legality of company business activities in accordance with the compliance control standards, while faithfully supporting our organization and business through various compliance support activities such as autonomous department self-checks and managing major risk areas proactively, etc. The company discloses the appointment details and operation status of the compliance officer in the business report, and reports the results of the activities to the BoD.

The company proactively adopted internal accounting management system in 2001, the year that this was introduced for the first time in the Republic of Korea, and through self-assessment in every business year, has improved and supplemented it. Listed on the New York Stock Exchange in the United States, POSCO has been audited by independent auditors for the company’s consolidated internal accounting management system since the business year of 2006 under the Sarbanes-Oxley Act of 2002. In order for effective control, internal accounting management system is applied not only for POSCO but also for other major consolidated companies to strengthen management at the group level.