- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCorporate Governance Report

Filed: 18 Jun 19, 7:59am

Exhibit 99.1

2018 POSCO

Corporate Governance Report

POSCO provides this report for investors to better understand the company’s corporate governance system in accordance with the stock market’s disclosure regulations 24-2 in Korea. Information contained in the report is based as of December 31, 2018. A separate remark was made on any modifications as of the June 3rd, 2019. Activities related with corporate governance described in the report are the results during the period from January 1, 2018 to June 3rd, 2019, unless stated otherwise.

I. Corporate Governance

1. Corporate Governance Principles and Policy

POSCO is making utmost efforts to firmly establish corporate governance that is a basis of transparent and rational business management, thereby raising shareholders’ value and protecting their rights. To realize this, POSCO constituted ‘Corporate Governance Charter’ stating on the vision and principles of company’s corporate governance. Based on this, the company has set and advanced the management system run by a professional CEO with independent Board of Directors. Basic principles of corporate governance are reflected in the internal rules including the Articles of Incorporation and the Operational Regulations of the BOD and are disclosed on the company website(http://www.posco.com). Information on the Board’s activities is publicly released on the annual report and quarterly/semi-annual reports filed to DART(http://dart.fss.or.kr) on a regular basis.

POSCO was the first to adopt the Outside Director system in 1997. Since it has continuously improved corporate governance systems to strengthen independence of the Board. POSCO BOD consists of directors who have profound knowledge and expertise in a variety of fields including industry, finance, academics, law, accounting and public sector to support the management’s most reasonable decision-making while not pursuing any specific stakeholder’s interest. The number of Outside Director on the Board is maintained at higher than 50% for check and balance. Moreover, the Board chairman and the chairs of Special Committees except for Executive Management Committee are appointed among Outside Directors. All these measures are to guarantee a balanced corporate governance system between the management and the Board.

2. Characteristics of Governance Structure

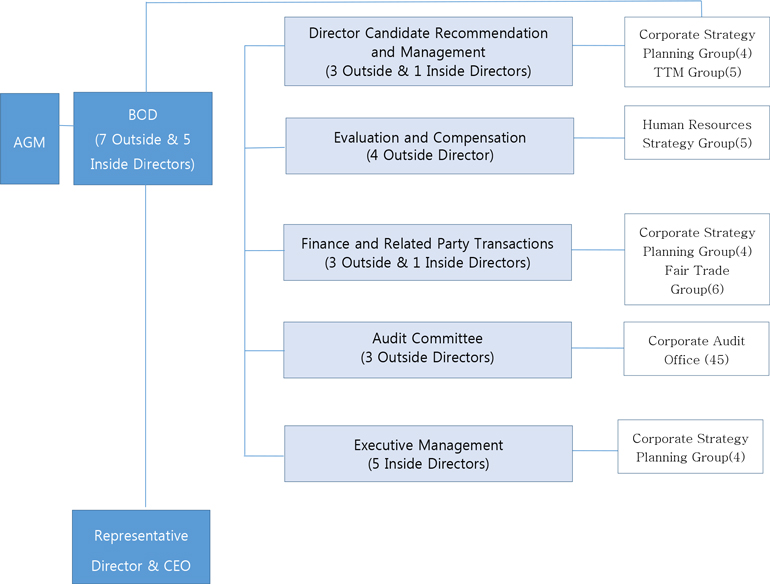

POSCO’s Board of Directors is the highest standing decision-making body that holds the power to appoint the representative directors and is operated led by Outside Directors. Outside Directors are recommended among candidates who have deep knowledge and experience in various fields by the Director Candidate Recommendation and Management Committee or shareholders’ proposal and appointed by the resolution of the General Meeting of Shareholders. As of June 3, 2019, the present Board is run by 7 Outside Directors and 5 Inside Directors, making a total of 12 members.

Under the Board of Directors, there are 5 Special Committees - Director Candidate Recommendation and Management Committee, Evaluation and Compensation Committee, Finance and Related Party Transactions Committee, Audit Committee, and Executive Management Committee. Except for the Executive Management Committee that reviews and deliberates steel investments, each of the committee is participated by a majority of Outside Directors. Members of the Evaluation and Compensation Committee and Audit Committee are all Outside Directors to ensure independent decision-making of the Special Committees. Among the committees, Director Candidate Recommendation and Management Committee and Audit Committee are required to be established by the Commercial Act, and the rest 3 committees were formed by the Board based on its autonomous decision in pursuit of professional, independent and efficient Board management. Finance and Related Party Transactions Committee and Audit Committee have at least 1 director who has expertise in industrial, accounting, and financial circles. Also, change of such members is refrained during their term considering the professional capabilities in those fields.

The organization and functions of the BOD and the Special Committees are described in detail in Section III. Board of Directors.

2

<Summary of Governance Structure>

Committee | Members (No. of Outside | Chairman | Main Responsibilities | |||

| Board of Directors | 7/12 | Shin-Bae Kim (Outside Director) | AGM agenda, Management, Investment and Finance | |||

| Director Candidate Recommendation and Management Committee | 3/4 | Byong-Won Bahk (Outside Director) | Recommendation for, and evaluation on qualifications of candidates for Outside Director | |||

| Evaluation and Compensation Committee | 4/4 | Seung-Wha Chang (Outside Director) | Executives evaluation, Compensation plan | |||

| Finance and Related Party Transactions Committee | 3/4 | Joo-Hyun Kim (Outside Director) | External investment, Borrowings | |||

| Audit Committee | 3/3 | Moon-Ki Chung (Outside Director) | Internal Audit | |||

| Executive Management Committee | 0/5 | Jeong-Woo Choi (Inside Director) | Internal investment | |||

| * | As of June 3rd, 2019 |

3

II. Shareholders

1. Shareholders’ Rights

(1) Annual General Meeting of Shareholders

POSCO discloses the date and venue of an Annual General Meeting of Shareholders(AGM) on DART(http://dart.fss.or.kr) immediately after the resolution of the BOD usually 6 weeks before the meeting. Meeting agenda is announced on DART(http://dart.fss.or.kr) and the company website after the BOD resolution normally 3 weeks before the meeting.

Information regarding the AGM is sent out to all shareholders in writing 2 weeks before the meeting. The AGM are held avoiding concentrated period of other companies’ AGM. Beginning from 2018, POSCO also participates AGM Dispersion Compliance Program.

Details of the AGM for the last 3 years are as follows

<Details of AGM For The Last 3 Years>

| 51th | Extraordinary | 50th | 49th | |||||||

| Notice Date | 2019.01.30 2019.02.20 | 2018.06.25 | 2018.01.24 2018.02.13 | 2017.01.25 2017.02.17 | ||||||

| Means of Notice | Written notice by mail, Disclosure on website, Dart(http://dart.fss.or.kr) | Written notice by mail, Disclosure on website, Dart(http://dart.fss.or.kr) | Written notice by mail, Disclosure on website, Dart(http://dart.fss.or.kr) | Written notice by mail, Disclosure on website, Dart(http://dart.fss.or.kr) | ||||||

| Means of Notice to Foreign Shareholders | Disclosure on SEC, Written notice sent to DR Holders | Disclosure on SEC, Holders | Disclosure on SEC, DR Holders | Disclosure on SEC, Written notice sent to DR Holders | ||||||

| Meeting Date | 2019.03.15 9 A.M. | 2018.07.27 9 A.M. | 2018.03.09 9 A.M. | 2017.03.10 10 A.M. | ||||||

| Venue | ART Hall, 4th Floor, West Wing, POSCO Center | |||||||||

| Details | Attendance | All 12 Members Of The Board Of Directors Attended | All 12 Members Of The Board Of Directors Attended | All 12 Members Of The Board Of Directors Attended | All 12 Members Of The Board Of Directors Attended | |||||

| Shareholders’ Remarks | 5 Shareholders made 1 seconding the agendas, | 2 Shareholders made seconding the agendas, 1 | 10 Shareholders made remarks (10 individuals) : 3 asking for an explanation on the recent rumors on the failed investment, 2 asking more information about the agendas, 1 asking for the detailed information on the sales of investment stocks, 1 seconding the agendas, 3 commenting on other matters | 4 Shareholders made remarks (1 institution and 3 individuals) : 1 seconding the agendas, 1 asking for an explanation on the rumor about the links between former government and CEO, 1 asking for a business plan after reunification of South and North Korea, and 1 asking about the voting procedure | ||||||

4

(2) Resolution of AGM and Voting

Shareholders can exercise voting rights in writing in accordance with the Articles of Incorporation. All shareholders receive the notification of AGM with an explanation on agenda items. Shareholders who are unable to participate in the meeting can vote on each agenda item in writing. Beginning from the 51st AGM, an Electronic Voting System is adopted and practiced.

In the 50th AGM, 61,067 thousand shares were present at the meeting. Among them, 23,966 thousand shares were voted by proxy, 37,045 thousand shares held by foreign shareholders were voted through standing proxy or depositary bank and 49 thousand shares were voted in writing. The rest 7 thousand shares attended the meeting in person.

In the 51st AGM, 57,112 thousand shares were present at the meeting. Among them, 17,681 thousand shares were voted by proxy, 33,731 thousand shares held by foreign shareholders were voted through standing proxy or depositary bank, 5,651 thousand shares were voted through the electronic voting system and 43 thousand shares were voted in writing. The rest 6 thousand shares attended the meeting in person.

From January 1, 2018 to June 3, 2019, three AGM were held and the details of them are as follows.

<Voting Results of Each Agenda>

| 50th AGM | 2018.03.09 | |||

| Item | Resolution | Agenda | Result | Number of Outstanding Shares(①) *1 | ①Counted Outstanding Shares(A) *2 | For (B) (Ratio, %)*3 | ||||||||

Against, Forfeit, etc (C) (Ratio, %)*4 | ||||||||||||||

| 1 | Ordinary | Approval of the 50th Fiscal Year Financial Statements | Approved | 79,999,604 | 61,067,460 | 54,541,671 (89.3%) | ||||||||

6,525,789 (10.7%) | ||||||||||||||

| 2 | 2-1 | Special | Partial Amendments on the Articles of (Article 2 Purpose) | Approved | 79,999,604 | 61,067,460 | 61,011,265 (99.9%) | |||||||

56,195 (0.1%) | ||||||||||||||

| 2-2 | Special | Partial Amendments on the Articles of (Article 27 Number of Directors) | Approved | 79,999,604 | 61,067,460 | 60,976,762 (99.9%) | ||||||||

90,698 (0.1%) | ||||||||||||||

| 2-3 | Special | Partial Amendments on the Articles of (Article of Special Committee Article | Approved | 79,999,604 | 61,067,460 | 60,277,037 (98.7%) | ||||||||

790,423 (1.3%) | ||||||||||||||

| 3 | 3-1 | Ordinary | Appointment of Inside DirectorIn-Hwan, Oh | Approved | 79,999,604 | 61,067,460 | 60,621,584 (99.3%) | |||||||

445,876 (0.7%) | ||||||||||||||

| 3-2 | Ordinary | Appointment of Inside DirectorIn-Wha, Chang | Approved | 79,999,604 | 61,067,460 | 60,621,753 (99.3%) | ||||||||

445,707 (0.7%) | ||||||||||||||

| 3-3 | Ordinary | Appointment of Inside Director Seong, Yu | Approved | 79,999,604 | 61,067,460 | 60,621,274 (99.3%) | ||||||||

446,186 (0.7%) | ||||||||||||||

| 3-4 | Ordinary | Appointment of Inside DirectorJung-Son, Chon | Approved | 79,999,604 | 61,067,460 | 60,619,093 (99.3%) | ||||||||

448,367 (0.7%) | ||||||||||||||

5

| 4 | 4-1 | Ordinary | Appointment of Outside Director Sung Jin, Kim | Approved | 79,999,604 | 61,067,460 | 60,704,497 (99.4%) | |||||||

362,963 (0.6%) | ||||||||||||||

| 4-2 | Ordinary | Appointment of Outside Director Joo Hyun, Kim | Approved | 79,999,604 | 61,067,460 | 56,427,838 (92.4%) | ||||||||

4,639,622 (7.6%) | ||||||||||||||

| 4-3 | Ordinary | Appointment of Outside Director Kyung Suh, Park | Discarded | 79,999,604 | — | — — | ||||||||

| 4-4 | Ordinary | Appointment of Outside Director Byong Won, Bahk | Approved | 79,999,604 | 61,067,460 | 60,013,959 (98.3%) | ||||||||

1,053,501 (1.7%) | ||||||||||||||

| 5 | Ordinary | Appointment of Audit Committee Member Byong Won, Bahk | Approved | 72,243,983 | 53,311,839 | 52,893,305 (99.2%) | ||||||||

418,534 (0.8%) | ||||||||||||||

| 6 | Ordinary | Bound for Director’s Compensation | Approved | 79,999,604 | 61,067,460 | 60,807,655 (99.6%) | ||||||||

259,805 (0.4%) | ||||||||||||||

| *1 | Number of Outstanding Shares for Audit Committee Member agenda excluded the number of shares that are without voting rights. |

| *2 | Number of Shares (A) : Number of Shares (B) + Number of Shares (C) |

| *3 | Ratio of Approval Shares (%) : (B/A) x 100 |

| *4 | Ratio of Objection, Forfeit and others Shares = (C/A) x 100 |

| Extraordinary General Meeting of Shareholders | 2018.07.27 | |||

| Item | Resolution | Agenda | Result | Number of Outstanding Shares(①) *1 | ①Counted Outstanding Shares(A) *2 | For (B) (Ratio, %)*3 | ||||||

Against, (Ratio, %)*4 | ||||||||||||

| 1 | Ordinary | Appointment of Inside Director Jeong Woo, Choi (Representative Director and CEO Nominee) | Approved | 80,000,872 | 58,573,565 | 56,658,795 (96.7%) | ||||||

1,914,770 (3.3%) |

| *1 | Number of Outstanding Shares for Audit Committee Member agenda excluded the number of shares that are without voting rights. |

| *2 | Number of Shares (A) : Number of Shares (B) + Number of Shares (C) |

| *3 | Ratio of Approval Shares (%) : (B/A) x 100 |

| *4 | Ratio of Objection, Forfeit and others Shares = (C/A) x 100 |

6

| 51th AGM | 2019.03.15 |

| Item | Resolution | Agenda | Result | Number of Outstanding Shares(①) *1 | ①Counted Outstanding Shares(A) *2 | For (B) (Ratio, %)*3 | ||||||||

| Against, Forfeit, etc (C) (Ratio, %)*4 | ||||||||||||||

| 1 | Ordinary | Approval of the 51st Fiscal Year Financial Statements | Approved | 80,001,132 | 57,111,873 | 49,395,553 (86.5%) | ||||||||

| 7,716,320 (13.5%) | ||||||||||||||

| 2 | 2-1 | Special | Partial Amendments on the Articles of Incorporation (Article regarding the introduction of electronic voting system) | Approved | 80,001,132 | 57,111,873 | 56,989,039 (99.8%) | |||||||

122,834 (0.2%) | ||||||||||||||

| 2-2 | Special | Partial Amendments on the Articles of Incorporation (Appointment of 51st External Auditor) | Approved | 80,001,132 | 57,111,873 | 56,978,452 (99.8%) | ||||||||

133,421 (0.2%) | ||||||||||||||

| 2-3 | Special | Partial Amendments on the Articles of Incorporation (Article 23 elimination of the limit for the qualification of proxy) | Approved | 80,001,132 | 57,111,873 | 56,969,255 (99.8%) | ||||||||

142,618 (0.2%) | ||||||||||||||

| 3 | 3-1 | Ordinary | Appointment of Inside DirectorIn-Wha, Chang | Approved | 80,001,132 | 57,111,873 | 54,686,989 (95.8%) | |||||||

2,424,984 (4.2%) | ||||||||||||||

| 3-2 | Ordinary | Appointment of Inside Director Jung Son, Chon | Approved | 80,001,132 | 57,111,873 | 48,564,238 (85.0%) | ||||||||

8,547,635 (15.0%) | ||||||||||||||

| 3-3 | Ordinary | Appointment of Inside Director Hag Dong, Kim | Approved | 80,001,132 | 57,111,873 | 55,912,614 (97.9%) | ||||||||

1,199,259 (2.1%) | ||||||||||||||

| 3-4 | Ordinary | Appointment of Inside Director Tak, Jeong | Approved | 80,001,132 | 57,111,873 | 55,858,160 (97.8%) | ||||||||

1,253,713 (2.2%) | ||||||||||||||

| 4 | 4-1 | Ordinary | Appointment of Outside Director Shin Bae, Kim | Approved | 80,001,132 | 57,111,873 | 56,701,734 (99.3%) | |||||||

410,139 (0.7%) | ||||||||||||||

| 4-2 | Ordinary | Appointment of Outside Director Moon Ki, Chung | Approved | 80,001,132 | 57,111,873 | 52,760,555 (92.4%) | ||||||||

4,351,318 (7.6%) | ||||||||||||||

| 4-3 | Ordinary | Appointment of Outside Director Heui Jae, Pahk | Approved | 80,001,132 | 57,111,873 | 56,922,730 (99.7%) | ||||||||

189,143 (0.3%) | ||||||||||||||

| 5 | Ordinary | Appointment of Audit Committee Member Moon Ki, Chung | Approved | 72,564,296 | 49,675,037 | 45,269,266 (91.1%) | ||||||||

| 4,405,771 (8.9%) | ||||||||||||||

| 6 | Ordinary | Bound for Director’s Compensation | Approved | 80,001,132 | 57,111,873 | 56,792,587 (99.4%) | ||||||||

| 319,286 (0.6%) | ||||||||||||||

| *1 | Number of Outstanding Shares for Audit Committee Member agenda excluded the number of shares that are without voting rights. |

| *2 | Number of Shares (A) : Number of Shares (B) + Number of Shares (C) |

| *3 | Ratio of Approval Shares (%) : (B/A) x 100 |

| *4 | Ratio of Objection, Forfeit and others Shares = (C/A) x 100 |

7

(3) Shareholder’s Proposal Rights

Shareholders can exercise shareholder proposal rights. In accordance with the Articles of Incorporation, shareholders can propose a candidate of Outside Director to Director Candidate Recommendation and Management Committee. After the proposal is recognized, the Committee examines candidate’s eligibility for the position, put on a final list as a candidate, and then submit as an agenda to AGM. In the 50th AGM, APG and Robeco recommendedMr. Kyung-Suh Park, Professor of Korea University, as an Outside Director candidate through the shareholder proposal. In Director Candidate Recommendation and Management Committee, the qualifications of the proposed candidate were evaluated and he was designated as one of the final candidates for Outside Directors. The Board raised an agenda item to appoint Mr. Park as an Outside Director in accordance with Article363-2 and542-6 of the Commercial Act. However, Mr. Park expressed his will to withdraw candidacy for his personal reasons in March 5, 2018, and the agenda item was discarded in the AGM.

Director Candidate Recommendation and Management Committee also sent shareholders letters to ask for candidate recommendations. The intention was to expand the candidate group of the CEO and Outside Directors for the 2018 Extraordinary General Meeting of Shareholders and the 51st AGM.

<Shareholder’s Proposal Result>

| Proposal Date | Subject | Main Topic | Status | Result | For(%) | Against(%) | ||||||

| 2018.1.25 | APG (Institutional Investor) Robeco (Institutional Investor) | Recommendation of Korea University Professor Kyung Suh, Park for Outside Director nominee | Director Candidate Recommendation and Management evaluated Mr. Park as a nominee and recommended him. The agenda was raised at the 50th AGM. But Mr.Park withdrew his candidacy for his personal reason; therefore, the agenda was discarded. | N/A | N/A | N/A |

(4) Dividend

POSCO can pay out dividends by cash, shares, or any other form of property based on the Articles of Incorporation. In the case of stock dividends, the company may issue different types of shares to the shareholders by resolution of the AGM.

As part of the efforts to raise shareholders’ value, POSCO modified the Articles of Incorporation in the 48th AGM to permit quarterly cash dividend as of the end of March, June and September through the BOD resolution. As a result, POSCO has been paying out quarterly dividend since the 2nd quarter of 2016.

8

POSCO’s dividend policy is to maintain a long term stable cash dividend. The policy has been sustained even in 2015 when the company recorded a net loss. The history of dividend payment for the last 3 years is as follows.

<Dividend Payout for Last 3 Years>

(Shares, KRW, %)

Fiscal Year | Closing Month | Share Type | Stock Dividend | Cash Dividend | ||||||||||||||

Face Value | Dividend per Share | Total Dividend (Million dollars) | Dividend Ratio | Payout Ratio | ||||||||||||||

| Consolidated | Separate | |||||||||||||||||

2018 | 12 | Common Stock | — | 5,000 | 10,000 | 800 | 4.1% | 47.3% | 74.6% | |||||||||

2017 | 12 | Common Stock | — | 5,000 | 8,000 | 640 | 2.4% | 22.9% | 25.1% | |||||||||

2016 | 12 | Common Stock | — | 5,000 | 8,000 | 640 | 3.1% | 46.9% | 35.9% | |||||||||

| ø | Dividend per share is the sum of quarterly, semi-annual, and annual dividends. |

| ø | Consolidated Payout Ratio = (Total Dividend/Profit for the period attributable to owners of the controlling company) |

| ø | Separate Payout Ratio = (Total Dividend/Separate profit) |

| ø | Dividend Yield Ratio = (Dividend per share/Stock price as of the dividend payment date x 100) |

2. Fair Treatment of Shareholders

(1) Issuance of Stocks

As stated in the Articles of Incorporation, POSCO can issue up to 200,000,000 shares. Until now, 96,480,625 common stocks have been issued and 9,293,790 shares have been retired. As of March 31, 2019, the outstanding number of common shares issued is 87,186,835. Excluding 7,071,194 treasury shares, the number of shares in the market reaches 80,115,641. The largest shareholder is National Pension Service holding 9,410,674(10.79%) shares.

(2) IR Activities

POSCO holds quarterly earnings release conference call in January, April, July and October led by CFO. After the earnings result announcement, POSCO regularly conducts NDR(Non-Deal Roadshow) to meet with institutional investors in Korea, Asia, U.S. and Europe. Also, it participates in Investor Conferences hosted by Korean and foreign securities companies at least 5 times a year to listen to comments and answer questions of investors.

Especially from 2017, POSCO’s CFO and Head of Finance Dept. attended overseas NDR to share business performance and management strategy with investors and to provide feedback to their interest from the high-level point of view. Especially from 2018, outside directors have made opportunities in holding direct talks with shareholders to help better understand POSCO’s corporate governance. For institutional investors who would like to visit the company for an investor meeting, the Investor Relations team runs a system to reserve meetings on the company website. Through the system, 2 meetings on average are held on a daily basis. Moreover, the IR team carries out various IR activities such as site tour at steelworks and seminars on the steel market for investors and steel analysts.

(3) Disclosure of Company Information

POSCO’s company information including IR materials is publicly open to all shareholders on company website in both Korean and English and disclosure systems such as DART(http://dart.fss.or.kr) and KIND(http://kind.krx.co.kr).

9

Also, POSCO is listed on the NYSE in ADR, thereby submitting disclosure materials in English through EDGAR system(https://www.sec.gov/edgar). All materials prepared for investors such as quarterly earnings result, CEO Forum presentation and annual, semi-annual and quarterly audit reports are uploaded on the company website.

<List of Main IR Activities, Conference Call, Talks with Shareholders>

| Date | Target | Type | Main Topic | Note | ||||

2018.1.24 | Domestic Institutional Investor Analysts | Conference Call | Company Presentation (2017 Earnings and Q&A) | |||||

2018.1.25-26 | Domestic Institutional Investor | NDR | Company Presentation (2017 Earnings and Q&A) | |||||

2018.2.23 | Foreign Institutional Investors | Conference | JP Morgan Korea Conference (Earnings, Market Condition, Management Status, etc) | |||||

2018.3.9 | Foreign Institutional Investors | Conference | Citi Korea Investor Conference (Earnings, Market Condition, Management Status, etc) | |||||

2018.3.20-22 | Domestic Institutional Investor | Conference | MiraeAssetDaewoo 2018First Half year Corp Day (Earnings, Market Condition, Management Status, etc) | Listed POSCO Affiliates present | ||||

2018.3.19-21 | Foreign Institutional Investors | Conference | Credit Suisse 21th Asian Investment Conference (Earnings, Market Condition, Management Status, etc) | |||||

2018.4.24 | Domestic Institutional Investor Analysts | Conference Call | Company Presentation (2018 1st quarter Earnings and Q&A) | |||||

2018.4.26 | National Pension Service | NDR | Company Presentation (2018 1st quarter Earnings and Q&A) | |||||

2018.5.3 | Domestic Institutional Investor | IR | POSCO Group day (2018 1st quarter Earnings and Q&A) | POSCO AffiliatesCo-Host | ||||

2018.5.14-18 | Foreign Institutional Investors | NDR | Finance Depart. Head NDR (Earnings, Market Condition, Management Status, etc) | Asia | ||||

2018.5.28-31 | Foreign Institutional Investors | Conference | NHIS Korea Corporate Day (Earnings, Market Condition, Management Status, etc) | |||||

2018.6.25-26 | Domestic Institutional Investor | Conference | UBS Korea Conference 2018 (Earnings, Market Condition, Management Status, etc) | Listed POSCO Affiliates present | ||||

2018.7.23 | Domestic Institutional Investor Analysts | Conference Call | Company Presentation (2018 2nd quarter Earnings and Q&A) | |||||

2018.7.30 | National Pension Service | NDR | Company Presentation (2018 2nd quarter Earnings and Q&A) | |||||

2018.8.29-30 | Foreign Institutional Investors | Conference | HSBC Korea Corporate Day (Earnings, Market Condition, Management Status, etc)) | |||||

2018.9.10-14 | Foreign Institutional Investors | Conference | CLSA 25th Investors’ Forum 2018 (Earnings, Market Condition, Management Status, etc) | Finance Depart. Head present | ||||

2018.9.18-19 | Foreign Institutional Investors | Conference | BofAML Korea Conference (Earnings, Market Condition, Management Status, etc) |

10

2018.10.23 | Domestic Institutional Investor Analysts | Conference Call | Company Presentation (2018 3rd quarter Earnings and Q&A) | |||||

2018.10.24-26 | Domestic Institutional Investor | NDR | Company Presentation (2018 3rd quarter Earnings and Q&A) | |||||

2018.10.29-31 | Foreign Institutional Investors | NDR | Finance Department Head 2nd half NDR (2018 3rd quarter Earnings and Q&A) | Asia | ||||

2018.11.6-8 | Foreign Institutional Investors | Conference | HSBC 10th Annual Asia Investor Forum (2018 3rd quarter Earnings and Q&A) | |||||

2018.11.23 | Domestic/Foreign Institutional Investors | IR | Outside Director IR - Talks with Shareholders (Corporate Governance : Outside Directors 6/7participated) | The first talk with CFO present | ||||

2018.12.4-5 | Foreign Institutional Investors | Conference | BofAML 2018 Asia Pacific Resources Conference (Earnings, Market Condition, Management Status, etc) | |||||

2018.12.5-6 | Foreign Institutional Investors | Conference | Nomura Investment Forum 2018 (Earnings, Market Condition, Management Status, etc) | Finance Depart. Head present | ||||

2018.12.13 | Steel Analysts | IR | Site tour and study on Gwangyang Works Steel Production Process | Site Visit | ||||

2018.1.1-12.31 | Domestic/Foreign Institutional Investors | IR | One on one meeting or conference call with shareholder, investor | 242 times in 2018 | ||||

2019.1.30 | Domestic Institutional Investor Analysts | Conference Call | Company Presentation (2018 Annual Earnings and Q&A) | |||||

2019.1.31,2.7-8 | Domestic Institutional Investor | NDR | Company Presentation (2018 Annual Earnings and Q&A) | |||||

2019.2.21-22 | Foreign Institutional Investors | Conference | JP Morgan Korea Conference (Earnings, Market Condition, Management Status, etc) | |||||

2019.3.7 | Foreign Institutional Investors | Conference | Citi Korea Investor Conference (Earnings, Market Condition, Management Status, etc) | |||||

2019.3.25-27 | Foreign Institutional Investors | Conference | Credit Suisse 22th Asian Investment Conference (Earnings, Market Condition, Management Status, etc) | Hong Kong | ||||

2019.3.28 | Steel Analysts | IR | Steel Analyst Seminar – Raw Material Market Condition | |||||

2019.4.24 | Domestic Institutional Investor/Analysts | Conference Call | Company Presentation (2019 1st quarter Earnings and Q&A) | |||||

2019.4.26-30 | Domestic Institutional Investor | NDR | Company Presentation (2019 1st quarter Earnings and Q&A) | |||||

2019.5.14-15 | Foreign Institutional Investors | Conference | BofAML Global Metals, Mining & Steel Conference 2019 (Earnings, Market Condition, Management Status, etc) | Europe | ||||

2019.5.17 | Foreign Institutional Investors | NDR | Earnings, Market Condition, Management Status, etc | Europe | ||||

2019.5.17 | Foreign Institutional Investors | Conference | Samsung Global Investors Conference (Earnings, Market Condition, Management Status, etc) |

11

2019.5.21 | Domestic Institutional Investor | Conference | Daeshin Securities Corporate Day (Earnings, Market Condition, Management Status, etc) | |||||

2019.5.30 | Domestic Institutional Investor | Confernece | Hanhwa Investment&Securities Top Picks & Hidden Company Day (Earnings, Market Condition, Management Status, etc) | |||||

2019.1.1-5.31 | Domestic/foreign Institutional Investor | IR | One on one meeting or conference call with shareholder, investor (Earnings, Market Condition, Management Status, etc) | 65 times as of 2019 present |

(4) Internal Control System

POSCO has established regulations regarding internal management control to prevent internal transactions from the management or the controlling shareholders for the purpose of their own interest. The company manages internal accounting management regulations by the BOD resolution. As for the matters that exceed a certain amount among the transactions consisting of capital, assets, and securities with the company’s major shareholder (including its affiliates) and the affiliates, they are subject to resolution by the Board. POSCO established the Finance and Related Party Transactions Committee to deliberate and vote on large scale internal transactions amounting from KRW 3 to 10 billion. When exceeding KRW 10 billion, the Committee carries outpre-deliberation before the approval of the Board. Internal transactions deliberated or resolved by Finance and Related Party Transactions Committee can be referred to III. Board of Directors.

POSCO did not have any transaction such as asset transfer, credit offering and any other business with the company’s major shareholders in 2018. The transactions between POSCO and its affiliates are as follows.

<Transactions between POSCO and its affiliates>

*quoted from 2018 POSCO Annual Report disclosed in DART system

| In millions of KRW | ||||||||||||

| Companies | Sales and etc. (*1) | Purchase and others (*2) | ||||||||||

| Sales | Others | Purchase of Materials | Purchase of Fixed Asset | Outsourced processing cost | Others | |||||||

[subsidiaries](*3) | ||||||||||||

POSCO E&C | 7,827 | 97 | — | 322,924 | 47 | 36,428 | ||||||

POSCO C&C | 476,105 | 2,725 | — | — | 9,211 | 1,434 | ||||||

POSCO ICT(*4) | 2,624 | 7,479 | — | 341,472 | 34,376 | 196,252 | ||||||

eNtoB | 12 | 60 | 377,198 | 27,508 | 390 | 31,455 | ||||||

POSCO CHEMTECH | 417,957 | 35,762 | 531,452 | 21,730 | 319,868 | 2,802 | ||||||

POSCO ENERGY | 206,638 | 1,445 | — | — | — | — | ||||||

POSCO DAEWOO | 5,835,226 | 42,888 | 690,345 | — | 57,624 | 4,318�� | ||||||

POSCO Thainox Public | 299,450 | 5,335 | 10,115 | — | — | 71 | ||||||

POSCO America Corporation | 336,366 | — | — | — | — | 2,486 | ||||||

12

POSCO Canada Ltd. | — | 2,155 | 300,982 | — | — | — | ||||||

POSCO Asia Co., Ltd. | 1,857,665 | 253 | 536,280 | 650 | 2,449 | 6,524 | ||||||

Qingdao Pohang Stainless Steel Co., Ltd. | 188,252 | 7 | — | — | — | 34 | ||||||

POSCO JAPAN Co., Ltd. | 1,353,313 | 6 | 25,773 | 4,204 | — | 5,411 | ||||||

POSCO-VIETNAM Co., Ltd. | 273,573 | 156 | — | — | — | 8 | ||||||

POSCO MEXICO S.A. DE C.V. | 299,276 | 17 | — | — | — | 35 | ||||||

POSCO Maharashtra Steel | 563,618 | 584 | — | — | — | 156 | ||||||

POSCO(Suzhou) Automotive Processing Center Co., Ltd. | 196,095 | — | 2,616 | — | — | 5 | ||||||

Others(*5) | 1,158,122 | 44,098 | 456,804 | 31,787 | 264,060 | 140,869 | ||||||

Subtotal | 13,472,119 | 143,067 | 2,931,565 | 750,275 | 688,025 | 428,288 | ||||||

[Related Companies and Joint Enterprises](*3) | ||||||||||||

POSCO Plantec | 10,904 | 240 | 3,166 | 215,023 | 24,192 | 10,257 | ||||||

SNNC | 5,105 | 4,108 | 558,425 | — | — | 80 | ||||||

POSCO-SAMSUNG-Slovakia Processing Center | 61,981 | — | — | — | — | — | ||||||

Roy Hill Holdings Pty Ltd | — | — | 810,196 | — | — | — | ||||||

Others | 14,199 | 54,747 | 64,335 | — | — | 6 | ||||||

Subtotal | 92,189 | 59,095 | 1,436,122 | 215,023 | 24,192 | 10,343 | ||||||

Total | 13,564,308 | 202,162 | 4,367,687 | 965,298 | 712,217 | 438,631 | ||||||

| (*1) | Sales and others mainly consist of sales of steel products from subsidiaries, associates and joint ventures. |

| (*2) | Purchases and others are mainly consist of subsidiaries’ purchases of construction services and purchases of raw materials to manufacture steel products. |

| (*3) | As of December 31, 2018, the Company provided guarantees to related parties |

| (*4) | Others (purchase) mainly consist of service fees related to maintenance and repair of ERP System |

| (*5) | During the year ended December 31, 2018, the Company made loans of |

| In millions of KRW | ||||||||||||||||||||||||||||

| Companies | Receivables | Payables | ||||||||||||||||||||||||||

| Trade accounts and notes Receivable | Others | Total | Trade Payable | Accounts Payable | Others | Total | ||||||||||||||||||||||

[Subsidiaries] |

| |||||||||||||||||||||||||||

POSCO E&C | 57 | 5,181 | 5,238 | — | 52,775 | 438 | 53,213 | |||||||||||||||||||||

POSCO C&C | 55,598 | 317 | 55,915 | — | 25 | 1,194 | 1,219 | |||||||||||||||||||||

POSCO ICT | — | 229 | 229 | 1,572 | 112,960 | 8,717 | 123,249 | |||||||||||||||||||||

eNtoB | — | — | — | 10,860 | 22,072 | 11 | 32,943 | |||||||||||||||||||||

POSCO CHEMTECH | 40,258 | 3,883 | 44,141 | 19,911 | 58,725 | 19,012 | 97,648 | |||||||||||||||||||||

POSCO ENERGY | 22,163 | 1,700 | 23,863 | — | — | 1,425 | 1,425 | |||||||||||||||||||||

POSCO DAEWOO | 437,554 | 1,056 | 438,610 | 161 | 1,881 | 5,304 | 7,346 | |||||||||||||||||||||

POSCO Thainox Public Company Limited | 71,189 | — | 71,189 | 467 | 71 | — | 538 | |||||||||||||||||||||

13

POSCO America | 14,338 | — | 14,338 | — | 221 | — | 221 | |||||||||||||||||||||

POSCO Asia Co., Ltd. | 480,205 | 1,047 | 481,252 | 7,839 | — | — | 7,839 | |||||||||||||||||||||

Qingdao Pohang | 52,037 | — | 52,037 | — | — | — | — | |||||||||||||||||||||

POSCO MEXICO S.A. DE C.V. | 101,179 | 218 | 101,397 | — | — | — | — | |||||||||||||||||||||

POSCO Maharashtra Steel Private Limited | 390,413 | 1,428 | 391,841 | — | — | — | — | |||||||||||||||||||||

Others | 379,950 | 54,407 | 434,357 | 33,183 | 36,591 | 85,745 | 155,519 | |||||||||||||||||||||

Subtotal | 2,044,941 | 69,466 | 2,114,407 | 73,993 | 285,321 | 121,846 | 481,160 | |||||||||||||||||||||

[Related Companies and Joint Enterprises] |

| |||||||||||||||||||||||||||

POSCO PLANTEC | 249 | 10 | 259 | 3,275 | 34,803 | — | 38,078 | |||||||||||||||||||||

SNNC | 541 | 61 | 602 | 22,188 | — | — | 22,188 | |||||||||||||||||||||

Roy Hill Holdings Pty Ltd | — | — | — | 22,997 | — | — | 22,997 | |||||||||||||||||||||

Others | 918 | 910 | 1,828 | 217 | 76 | — | 293 | |||||||||||||||||||||

Subtotal | 1,708 | 981 | 2,689 | 48,677 | 34,879 | — | 83,556 | |||||||||||||||||||||

Total | 2,046,649 | 70,447 | 2,117,096 | 122,670 | 320,200 | 121,846 | 564,716 | |||||||||||||||||||||

ø As of June 3rd, 2019, the name of some companies are changed: POSCO Daewoo Corporation to POSCO International Corporation, POSCO Chemtech to POSCO Chemical Co., LTD.

14

III. Board of Directors

1. Role and Function

(1) Responsibilities of the BOD

For the benefit of both company and its shareholders, the Board of Directors determines imporant matters of the company by establishing management goals and key strategies and overseeing the management’s activities for transparency. A strategic session participated by executives andnon-executive key staffs is also held to reflect Outside Directors’ opinions more actively on POSCO group’s strategic direction and the management plan. POSCO holds regular meetings centered with the Outside Directors to gather opinions in advance regarding the agenda of the Board of Directors.

In the strategic session held in November 2018, the followings were discussed: ‘With POSCO’ management reform, direction of the reform, 100 major tasks and affiliates’ medium term strategy and core businesses (POSCO International, E&C, Chemical, ICT). In April 2019, the session established the strategy of promoting POSCO affiliates’ new businesses. In November 2018, the Outside Directors held the meeting to review ways of improving corporate governance and promoting Outside Director IR activity. In 2019, the Outside Directors have a plan to hold meetings in June and October.

<BOD and the roles of Special Committees>

BOD Responsibilities | [Submission] 1. General Meeting of Shareholders (1) Convening of the General Meeting of Shareholders (2) Approval of Balance sheet, income statement, statement of equity changes, statement of cash flow, statement of appropriation of retained earnings or statement of disposition of deficit, auxiliary statements and consolidated financial statements in every settlement term (3) Approval of annual report (4) Amendments to the Articles of Incorporation (5) Cancellation of shares (6) Remuneration, retirement benefits of directors (7) Other issues requiring the resolutions of the General Meeting of Shareholders 2. Management (1) Creation of business plan and core business strategies (mid and long-term business policy and annual operating objectives, and business rationalization plans, etc.) (2) Creation of important CI and modification and amendments (corporate vision, flag, badge, etc.) (3) Restructuring plans on a group level (4) Business plans and budget for each fiscal year (5) Nomination of the Chairman of the Board (6) Recommendation of candidates of Inside Directors (7) Nomination of the Representative Directors and the Chief Executive Officer among Inside Directors and Assignment of responsibilities of office to Inside Directors (8) Approval of management succession and development plan (9) Approval of executive evaluation and compensation plan (10) Organization and method of operations of the Special Committees under the control of the BOD (11) Decision of Support from Expert to Director (12) Organization and Operations of the Chief Executive Officer Recommendation Committee (13) Following Establishment, Amendment and Repeal of Operational Regulations A. Operational regulations for the BOD and Audit Committee B. Internal accounting management regulations 3. Investment & finance (1) New external investments, capital increase and disposal of acquired equities of subsidiary company exceeding 10% of equity. (2) Investments within the company (investment project for new establishment and increase more than KRW 100 billion) |

15

(3) Acquisition or disposal of tangible intangible assets and important investment assets (more than 10% of equity based on the book value per unit of asset) (4) Deficits disposal (exceeding KRW 10 billion) (5) Appropriation of retained earnings (6) Issuance of new shares (7) Dealing with forfeited stock or odd lot (8) Cancellation of Share by Gains (9) Acquisition or disposal of treasury stocks (10) Injection of reserve funds into equity capital (11) Issuance of corporate bonds and important borrowings (new long-term borrowings exceeding KRW 100 billion) (12) Issuance of convertible bonds (13) Issuance of bonds with warrant (14) Donations (exceeding KRW 1 billion) 4. Others (1) Filing and Settling a lawsuit worth exceeding KRW 10 billion and Settling a lawsuit without limitation of the amount of money(excluding the case with conclusive evidence that guarantee it will not cost exceeding KRW 10 billion) (2) Transaction with majority shareholder and a subsidiary as prescribed in Securities Transaction Act A. Transactions of which size is more than 1/100 of the total sales or asset volume of the most recent business year B. Transaction which brings total transaction amount with a subsidiary during the current business year exceeding more than 5/100 of total sales or asset volume of the most recent business year. (excluding transactions executed within the total amount approved as ordinary transaction arising from business, etc.) (3) Transaction with a company in the same group as described in Monopoly Regulation and Fair Trade Act A. Transactions extending funds such as advances or loans, etc. (More than KRW 10 billion ) B. Transactions offering or trading market securities such as stock or corporate bond (More than KRW 10 billion) C. Transactions offering or trading assets such as real estate or incorporeal asset (More than KRW10 billion) (4) Appointment of transfer agent (5) Matters concerning administrative fees related to the shares of the company (6) Establishment, relocation, or closure of branches (7) Business between Directors and the company (8) Appointment and dismissal of compliance officer, creation and amendment of compliance criteria (9) Other matters that is prescribed in the mandatory provisions of applicable laws, regulations or Articles of Incorporation or that, a Director deems, needs a resolution from the BOD

[Report] 1. Result of matters delegated to Special Committees 2. Important matters regarding the operation of invested companies 3. Result in examining compliance oflaw-abiding control standard 4. Others relating to the important management matters | ||

Director Candidate Recommendation and Management | 1. Recommendation for, and evaluation on qualification of, candidates for Outside Director 2. Evaluation on qualification of, andpre-deliberation on candidates for Inside Director 3. Pre-deliberation on appointment of members of special committees 4. Pre-deliberation on nomination of the representative directors except for the Chief Executive Officer among Inside Directors 5. Operation of Outside Director Candidates Advisory Group 6. Other matters necessary for recommendation of Outside Directors 7. Developing issues to be discussed in the BOD and the Special Committees 8. Pre-deliberation on amendment or repeal of the Operational Regulations for the BOD 9. Pre-deliberation on composition and operation procedures of the BOD or the Special Committees | |

| Evaluation and Compensation | 1. Establishing management succession and development plans 2. Establishing executives evaluation and compensation plan and taking necessary measures to execute such plans 3. Pre-deliberation on remuneration and retirement allowance of directors |

16

Finance and Related Party Transactions | 1. Establishing strategy for internal values, and financial well-being 2. Pre-deliberation on filing and settling a lawsuit worth over KRW 10 billion and settling a lawsuit without limitation of the amount of money(excluding the case with conclusive evidence that guarantee it will not cost exceeding KRW 10 billion ) 3. Issues of external investment(Non-steel) A. Pre-deliberation on new external investments, capital increase and disposition of acquired equities exceeding 10% of equity (excluding items for deliberation on internal transaction in No.9) B. Making resolutions on new external investments, capital increase and disposition of acquired equities exceeding KRW 5 billion and less than 10% of equity (excluding items for deliberation and voting in No.9) 4. Pre-deliberation on donations exceeding KRW 1 billion and resolutions on donations between exceeding KRW 100 million and less than KRW 1 billion (excluding items for deliberation on internal transaction in No.9) 5. Resolutions on issuance of corporate bonds and important borrowings (including the conversion issue exceeding KRW 100 billion) 6. Pre-deliberation on issuance of corporate bonds and important borrowings (new long-term borrowings exceeding KRW 100 billion) 7. Resolutions on offering fixed assets as security 8. Resolutions on providing subsidiaries or affiliates with the company’s security or guarantee (excluding items for deliberation and voting in No.9) 9. Internal transactions in accordance with the Monopoly Regulation and Fair Trade Act(Internal transactions mean transactions of capital, securities and assets with a person who has special relations with the company) A. Review of issues and improvement measures related to internal transactions B. Preliminary deliberation of internal transactions (more than KRW 10 billion in transaction amount) C. Resolutions on internal transactions (between KRW 3 billion and KRW 10 billion in transaction amount) 10. Appointment of Director for voluntary compliance of Fair Trade | |

| Audit | 1. Set up the committee’s work plan 2. Matters delegated by the Board(representative director) 3. Request for holding a provisional shareholders’ meeting 4. Consulting of external experts 5. Audit on legitimacy of the management’s work 6. Review on soundness and validity of the company’s financial activity and legitimacy of financial reporting 7. Review on accounting standards of materiality and revision of accounting estimation result 8. Evaluate on the operation of internal accounting management system 9. Evaluate on the internal control system 10. Propose a motion on appointment of the head of internal audit department 11. Preapprove appointment, compensation andnon-audit service contract of external auditor 12. Evaluate on auditing activities of external auditor 13. Report annual auditing plan and result of internal audit department 14. Report evaluation result on compliance with the Code of Conduct of employees 15. Report of external auditor on irregularities or any violations of the laws and the Articles of Incorporation by a director 16. Report of external auditor on the company’s violation of accounting standards 17. Other matters considered by each member to be resolved | |

| Executive Management | 1. Management (1) Important matters in the class of employee’s positions, Human Resources development and adjustment (2) Important changes in terms of working condition and welfare (3) Plans to newly establish endowed chair-professor (4) Housing policy making (standards to support housing loans, basic plans to build housing) (5) Closing the list of shareholders 2. Finance (1) Pre-deliberation on internal investments |

17

- Investment for new establishment and increase project more than KRW 100 billion (2) Approval of Internal Investment Plans - Project investments of more than KRW 100 billion excluding Investment for new establishment and increase projects - Investment project between exceeding KRW 10 billion and KRW 100 billion and less - Investment for new establishment and increase project less than KRW 10 billion - Maintenance investment of exceeding KRW 10 billion - Ordinary investment of exceeding KRW 5 billion (3) Pre-deliberation on new external investments, capital increase, and disposition of acquired equities of exceeding 10% of equity in steel sector (excluding deliberation items for the Insider Trading Committee) (4) Approval of new external investment, capital increase, and disposition of acquired equities exceeding KRW 5 billion and less than 10% of equity in steel sector (5) Acquisition or disposal of tangible intangible assets and important investment assets exceeding KRW 5 billion and less than 10% of equity (Based on the book value per unit of asset) (6) Approval of deficits disposal between exceeding KRW 500 million and less than KRW 10 billion (7) Approval of technology adoption and technology sales contract exceeding USD 1 million 3. Other matters submitted by the Chair of the committee or each individual member |

(2) Succession of the Chief Executive Officer

The CEO selection process follows the regulations stated in Article 29 of the Articles of Incorporation. The CEO Candidate Recommendation Committee evaluates qualifications of candidates. Then, the BOD recommends the final candidate to the AGM. In the meeting, the candidate is appointed as Inside Director and the Board appoints him as a Representative Director, which ends the succession procedure of the Representative Director (CEO).

Roles and rights are segregated between the Succession Council and CEO Candidate Recommendation Committee to secure independent and transparent selection process of the Representative Director (CEO). The Succession Council explores candidates that are qualified to meet the requirements set by the BOD and proposes them to the BOD. The CEO Candidate Recommendation Committee goes throughin-depth evaluation on the candidates from multifaceted perspectives.

In order to systematically have top management candidates for the list of CEO candidates, POSCO have selected and managed core talents in each key business field. The selected are given major tasks and trained from major institutions to improve their capabilities for the global setting and their leadership skills.

(3) Internal Control Policy

According to the Operational Regulations of the BOD, the appointment of Compliance Officer, creation and amendment of the compliance code of conduct and the internal accounting management regulations are bound to be submitted for resolution of the BOD. The officer monitors if the management and employees comply with rules and regulations and fulfill their roles and report the monitoring results to the Board.

Based on NEW COSO FrameWork (*COSO : Committee of Sponsoring Organizations of the Treadway Commission) which was revised in 2014 through consulting by external professionals, the internal control evaluation system examines the risks through documentation of all the work processes that affect the financial statements. POSCO examines the system in which all the internal control sections of each work process are supposed to satisfy the control purpose, uncover and prevent distortion through inquiries and evidences.

POSCO has practiced the compliance code of conduct since the approval of the BOD for its establishment in May 2012. After August 2017, the BOD has been reported with activities for the compliance code of conduct such as making checklists to help voluntary examination for every team and managing major risks in advance such as FCPA, Industrial Safety and Health Act.

18

2. Organization of the Board of Directors and Appointment of Directors

(1) Organization of the Board of Directors

As of June 3, 2019, POSCO’s BOD is composed of 7 Outside Directors and 5 Inside Directors. The percentage of Outside Directors to Inside Director number is 58%. The Chairman of the BOD is appointed among Outside Directors. The Chairman of BOD has been separated from CEO since 2006 and has been selected among Outside Directors by resolution of the BOD. In March 2019,Shin-Bae, Kim was appointed as the Chairman of the BOD.

The BOD, Special Committees under BOD, and Supporting groups’ organization structures and compositions are as follows.

<BOD Organization Structure>

19

<Composition of the BOD>

Inside/ Outside | Name | Expertise | Appointment Date | Termination of office | Title/Committee | |||||

| Inside | Jeong-Woo Choi | Management (Planning/ Finance) | ‘16.3.11 | ‘21. AGM | CEO and Representative Director, Chair of Executive Management Committee | |||||

| Inside | In-Wha Chang | Management (Production/Research) | ‘17.3.10 | ‘20. AGM | President and Representative Director (Head of Steel Business Unit) Finance and Related Party Transaction Committee, Executive Management Committee | |||||

| Inside | Jung-Son Chon | Management (Planning) | ‘18.3.9 | ‘20. AGM | Head of Corporate Strategy&Planning Division(Senior Executive Vice President) Director Candidate Recommendation and Management Committee, Executive Management Committee | |||||

| Inside | Hag-Dong Kim | Management (Production) | ‘19.3.15 | ‘20. AGM | Head of Production Division(Senior Executive Vice President) Executive Management Committee | |||||

| Inside | Tak Jeong | Management (Marketing) | ‘19.3.15 | ‘20.AGM | Head of Production Division(Senior Executive Vice President) Executive Management Committee | |||||

| Outside | Shin-Bae Kim | Industry (Management) | ‘17.3.10 | ‘22. AGM | Chair of Board of Directors Evaluation and Compensation Committee | |||||

| Outside | Joo-Hyun Kim | Academia (Business/Economics) | ‘15.3.13 | ‘21. AGM | Chair of Finance and Related Party Transactions Committee, Director Candidate Recommendation and Management Committee | |||||

| Outside | Byong-Won Bahk | Finance (economics/finance) | ‘15.3.13 | ‘21. AGM | Chair of Director Candidate Recommendation and Management Committee, Audit Committee | |||||

| Outside | Moon-Ki Chung | Accounting (CPA) | ‘17.3.10 | ‘22. AGM | Chair of Audit Committee, Evaluation and Compensation Committee | |||||

| Outside | Seung-Wha, Chang | Law (Previously Judge) | ‘17.3.10 | ‘20. AGM | Chair of Evaluation and Compensation Committee Audit Committee, | |||||

| Outside | Sung-Jin Kim | Industry (small andmedium-sized business) | ‘18.3.9 | ‘21. AGM | Evaluation and Compensation Committee, Finance and Related Party Transactions Committee, | |||||

| Outside | Hee-Jae Pahk | Industry (new business/venture) | ‘19.3.15 | ‘22.AGM | Director Candidate Recommendation and Management Committee Finance and Related Party Transactions Committee, |

20

<Composition of Special Committees under BOD>

| Committee | Title | Inside/ Outside | Name | |||

| Director Candidate Recommendation and Management Committee | Chairman | Outside | Byong-Won Bahk | |||

| Member | Outside | Joo-Hyun Kim | ||||

| Member | Outside | Hee-Jae Pahk | ||||

| Member | Inside | Jung-Son Chon | ||||

| Evaluation and Compensation Committee | Chairman | Outside | Seung-Wha, Chang | |||

| Member | Outside | Shin-Bae Kim | ||||

| Member | Outside | Moon-Ki Chung | ||||

| Member | Outside | Sung-Jin Kim | ||||

| Finance and Related Party Transactions Committee | Chairman | Outside | Joo-Hyun Kim | |||

| Member | Outside | Sung-Jin Kim | ||||

| Member | Outside | Hee-Jae Pahk | ||||

| Member | Inside | In-Wha Chang | ||||

| Audit Committee | Chairman | Outside | Moon-Ki Chung | |||

| Member | Outside | Byong-Won Bahk | ||||

| Member | Outside | Seung-Wha, Chang | ||||

| Executive Management Committee | Chairman | Inside | Jeong-Woo, Choi | |||

| Member | Inside | In-Wha Chang | ||||

| Member | Inside | Jung-Son Chon | ||||

| Member | Inside | Hag-Dong Kim | ||||

| Member | Inside | Tak Jeong |

(2) Qualifications and Appointment of Directors

Not only considering the qualifications required by the Commercial Act, Director Candidate Recommendation and Management Committee limits the qualifications for the Directors to those who have expertise and experience in the relevant fields. Those who may be accountable for undermining corporate values or shareholders’ rights cannot be appointed as Directors.

All Directors are appointed by the General Meeting of Shareholders. Director candidates are recommended by the BOD for Inside Directors and the Director Candidate Recommendation and Management Committee for Outside Directors. Shareholders can recommend a Director candidate by exercising the rights of shareholder proposal based on the laws. The company does not exclude cumulative voting and announces meeting agendas usually 3 weeks before the General Meeting of Shareholders for the shareholders to examine the agendas.

POSCO states the recommendation procedure of Outside Director candidates in the Articles of Incorporation for the purpose of fair and transparent appointment of Outside Directors. The procedure is as follows.

For the proposal of Outside Director candidate, the Outside Director Candidates Advisory Group is run by the resolution of the Director Candidate Recommendation and Management Committee. The Advisory Group searches for candidates who are qualified based on the laws and highly knowledgeable in the fields of industry such as finance, academic, law, accounting and public sectors. It proposes Outside Director candidates of 3 times the number to be elected to the Director Candidate Recommendation and Management Committee. The Director Candidate Recommendation and Management Committee determines the final candidates after qualification analysis and proposes them to the AGM. Then, these Outside Directors are appointed by the shareholders’ voting. Current POSCO’s Outside Directors were appointed through the same procedure stated above. All Outside Directors have no special interest associated with the company, management and major shareholders.

21

POSCO established the Director Candidate Recommendation and Management Committee to recommend Outside Director candidates. The Committee is in charge ofpre-deliberation of selecting Special Committee Members and the Representative Director among Inside Directors except for the CEO. POSCO also runs the Outside Director Candidates Advisory Group for Outside Directors, developing agendas for the BOD, andpre-deliberating amendment and abolition of the Operational Regulations, composition and operation of Special Committees under the BOD. For transparency in the process of selecting Outside Director candidates, the advisory needs advisors who represent diverse groups and have high understandings in corporate governance. The Director Candidate Recommendation and Management Committee is guaranteed with independence as it is composed of three Outside Directors among four Committee Members.

Under the Commercial Act382-3 and542-8-2 and the company’s Articles of Incorporation 30 and 31, Director Candidate Recommendation and Management Committee evaluates qualifications of each Director and recommends as an agenda to AGM.

POSCO discloses candidates’ major biography and relevant information in advance to be examined by its shareholders.

<Information provided about Director Candidates at the General Meetings of Shareholders>

| Date of Disclosure | Date of GM | Nominees | Information | Note | ||||||

Inside/ Outside | Name | |||||||||

| 2018.2.13 | 2018.3.9 | Inside | In-Hwan Oh | 1. Candidate’s biography and field of expertise 2. Candidate’s term of office and whether newly-appointed orre-appointed 3. Transaction list of three years with the company 4. Relationship with major shareholders | Re-appointed | |||||

| In-Wha Chang | Re-appointed | |||||||||

| Seong Yu | Re-appointed | |||||||||

| Jung-Son Chon | Newly-appointed | |||||||||

| Outside | Sung-Jin Ki | 1. Candidate’s biography and field of expertise 2. Candidate’s term of office and whether newly-appointed orre-appointed 3. Status of nominee’s roles and positions other than POSCO’s 4. The summary of activities done during the term in Special Committees in case ofre-appointment 5. Transaction list of three years with the company 6. Relationship with major shareholders | Newly-appointed | |||||||

| Joo-Hyun Kim | Re-appointed | |||||||||

| Kyung-Seo Park | Newly-appointed, Proposal of shareholders (APG, ROBECO) | |||||||||

| Byong-Won Bahk | Re-appointed | |||||||||

| Byong-Won Bahk | 1. Appointment of Director in Audit Committee 2. Activity done in the committee | — | ||||||||

| 2018.3.5 | 2018.3.9 | Outside | Kyung-Seo Park | 1. Agenda(4-3) discarded due to the resignation as a nominee for Outside Director | Amending disclosure regarding resignation | |||||

22

2018.6.26 | 2018.7.27 | Inside | Jeong-Woo Choi | 1. Candidate’s biography and field of expertise CEO 2. Transaction list of three years with the company 3. Relationship with major shareholders | Disclosure of calling for the Extraordinary General Meeting of Shareholders | |||||

2019.2.20 | 2019.3.15 | Inside | In-Wha Chang | 1. Candidate’s biography and field of expertise 2. Candidate’s term of office and whether newly-appointed orre-appointed 5. Transaction list of three years with the company 6. Relationship with major shareholders | Re-appointed | |||||

| Jung-Son Chon | Re-appointed | |||||||||

| Hag-Dong Kim | Newly-appointed | |||||||||

| Tak Jeong | Newly-appointed | |||||||||

| Outside | Shin-Bae Kim | 1. Candidate’s biography and field of expertise 2. Candidate’s term of office and whether 3. Status of candidate’s roles and positions other than POSCO’s 4. The summary of activities done during the term in Special Committees in case ofre-appointment 5. Transaction list of three years with the company 6. Relationship with major shareholders | Re-appointed | |||||||

| Moon-Ki Chung | Re-appointed | |||||||||

Hee-Jae Pahk | Newly-appointed | |||||||||

| Moon-Ki Chung | 1. Appointment of Director in Audit Committee 2. Activity done in the committee | — |

In order to reinforce shareholder’s voting rights, POSCO adopted thevoting-by-mail system in 2004 for those who are not be able to attend the AGM. POSCO helps them vote in writing and send the details of Agenda by mail for understanding. In 2019, POSCO adopted an electronic voting system to even improve the convenience of acting shareholders’ voting rights.

As of June 3, 2019, POSCO has 78 executive members: 12 Board members (5 Inside / 7 Outside) and 66non-Board members. POSCO has put great efforts in appointing executives to reinforce the company’s values and shareholder’s rights. The ethical aspect is also highly valued in the executive selection process and a code of ethics was established in 2003. The code of ethics rules to pursue increasing shareholders’ values and discloses investment information fairly. It also rules to reprimand the employees who violate the code of ethics. Especially for a misconduct such as a bribe, an embezzlement, information fabrication, and violation of sexual ethics, no mercy should be applied. All the employees are required to sign on the code of ethics every January.

POSCO has never had a case of appointing executives who had a history with an embezzlement, a bribe or any other violation of laws. The company also dismisses those executives who go through investigations for critical business issues.

3. Operation of the Board of Directors

According to the Operational Regulations of the BOD, POSCO’s Board has two types of meeting - regular and provisional one. Regular meetings held at predetermined date convene in January, February, March, May, August, November and December, and provisional meetings are held when there is an urgent agenda. The Board meeting convenes by the Chairman’s call, and each director can request for a meeting when it is necessary. If there is a case when a director is unable to attend a meeting, he can participate in the meeting and the resolution through a remote communication tool and his attendance is counted.

23

Meeting minutes are recorded and stored. In the minutes, there are agenda items, development of the issue, meeting result, and the list of directors who oppose to the issue and the reasons which the attending directors sign and seal. The attendance rate and the agenda are disclosed on the quarterly, semi-annual and annual business report through DART(http://dart.fss.or.kr).

<List of the Board of Directors Activities>

| Round | Ordinary/ Extraordinary | Date of Convene | Date of Notice | Attendance | Agenda | Approved | ||||||||

| Type | Detail | |||||||||||||

| 1 | Ordinary | ‘18. 1.24 | ‘18. 1.18 | 12/12 | Resolution | Approval of the financial statements for the 50th fiscal year and the convocation schedule for the 50th General Meeting of Shareholders | Approved | |||||||

| Resolution | Partial Amendments to Articles of Incorporation | Approved | ||||||||||||

| Resolution | Silo lease contract with POSCO-TERMINAL Co., Ltd | Approved | ||||||||||||

| Report | The management result for the fiscal year of 2017 | Reported | ||||||||||||

| Report | Report on the operation of the internal accounting management regulations for the fiscal year of 2017 | Reported | ||||||||||||

| 2 | Ordinary | ‘18. 2.13 | ‘18. 2.8 | 12/12 | Resolution | Agenda for the 50th General Meeting of Shareholders | Approved | |||||||

| Resolution | Recommendation of candidates for the Inside Director position (Excluding the candidate for the Chief Executive Officer) | Approved | ||||||||||||

| Report | Assessment of the operation of the internal accounting management regulations for the fiscal year of 2017 | Reported | ||||||||||||

| 3 | Ordinary | ‘18. 3. 9 | ‘18. 3. 6 | 12/12 | Resolution | Appointment of the Chairman of the Board of Directors | Approved | |||||||

| Resolution | Appointment of the Special Committee Members | Approved | ||||||||||||

| Resolution | Designation of Representative Directors and presenting positions to Inside Directors | Approved | ||||||||||||

| Resolution | Commemoration business plan for POSCO’s 50th anniversary | Approved | ||||||||||||

| 4 | Ordinary | ‘18. 4.18 | ‘18. 4.17 | 12/12 | Resolution | Settlement and operation of Succession Council (plan) | Approved | |||||||

| 5 | Ordinary | ‘18. 5.11 | ‘18. 5. 8 | 12/12 | Resolution | Declaration of the first quarter dividend for the fiscal year of 2018 | Approved | |||||||

| Resolution | Plan for financing in FY2018 | Approved | ||||||||||||

| Resolution | Record Date for Extraordinary General Meeting of Shareholders | Approved | ||||||||||||

| Resolution | FY2018 Transaction Plans with affiliates | Amended and Approved | ||||||||||||

| Resolution | Capital Increase in POSCO ES MATERIALS | Approved | ||||||||||||

| Report | The management result of the first quarter of 2018 and business plan for 2018 | Reported | ||||||||||||

| Report | Report on the operation of Overseas Subsidiaries | Reported | ||||||||||||

| Report | Assessment of the operations of Board of Directors for 2017 | Reported | ||||||||||||

24

| 6 | Extraordinary | ‘18. 6.22 | ‘18. 6.21 | 11*/12 | Resolution | Finalizing candidates for CEO and operation of the CEO Candidate Recommendation Committee | Approved | |||||||

| 7 | Extraordinary | ‘18. 6.23 | ‘18. 6.21 | 12/12 | Resolution | Recommendation of candidates for the Inside Director position (Candidate for the Chief Executive Officer) | Approved | |||||||

| Resolution | Convocation and preparation of agenda for the extraordinary general meeting of shareholders in FY2018 | Approved | ||||||||||||

| 8 | Ordinary | ‘18. 7.27 | ‘18. 7.23 | 12/12 | Resolution | Appointment of the Chief Executive Officer and Representative Director | Approved | |||||||

| Resolution | Declaration of the second quarter dividend for the fiscal year of 2018 | Approved | ||||||||||||

| Report | . The management result of the 1st half of 2018 and business plan for 2018 | Reported | ||||||||||||

| 9 | Ordinary | ‘18. 8.22 | ‘18. 8.17 | 12/12 | Resolution | Capital increase for Project PUMA | Approved | |||||||

| Resolution | Capital increase for POSCO-China to acquire shares of POSCO center in Beijing | Approved | ||||||||||||

| Resolution | Establishment of coal silos in Pohang Works | Approved | ||||||||||||

| Resolution | Plan of merger and acquisition of POSCO P&S | Approved | ||||||||||||

| Resolution | Filing an administrative litigation regarding 2013 tax investigation results | Approved | ||||||||||||

| Resolution | Filing a suit against the former major shareholders of STEEL FLOWER CO., LTD for receiving stock trading payment based on the put back option | Approved | ||||||||||||

| 10 | Ordinary | ‘18.11. 3 | ‘18.10.29 | 12/12 | Resolution | Declaration of the third quarter dividend for the fiscal year of 2018 | Approved | |||||||

| Resolution | Enter into a lease contract of Limestone Calcinations Facility between POSCO and POSCO Chemtech | Approved | ||||||||||||

| Resolution | Resolution on the merger approval of POSCO P&S | Approved | ||||||||||||

| Resolution | Donation made for Corporate Partnership program | Approved | ||||||||||||

| Resolution | Donation made for recovery of earthquake damages in Indonesia | Approved | ||||||||||||

| Report | Result of reviewing legal compliance | Reported | ||||||||||||

| Report | The management result of the third quarter of 2018 and business plan for 2018 | Reported |

25

| 11 | Ordinary | ‘18.12. 7 | ‘18.12.5 | 12/12 | Resolution | Medium term business strategy and 2019 business plan | Approved | |||||||

| Resolution | Plan for merge between POSCO Chemtech and POSCO ESM | Approved | ||||||||||||

| Resolution | Payment of provisional payments due to the lawsuit of repayment of debt for Suncheon Eco Trans | Approved | ||||||||||||

| Resolution | Halt of SNG business | Hold** | ||||||||||||

| Resolution | Amendment of the Operational Regulation of the Audit Committee | Approved | ||||||||||||

| Resolution | Donation in the fund used for unprivileged | Approved | ||||||||||||

| Resolution | Donating in POSCO 1% Nanum foundation fund | Approved | ||||||||||||

| Report | Composition of Corporate Citizenship Committee and operation plan | Reported | ||||||||||||

| 12 | Extraordinary | ‘18.12.19 | ‘18.12.18 | 12/12 | Resolution | Halt of SNG business | Approved | |||||||

| 1 | Ordinary | ‘19. 1.30 | ‘19. 1.25 | 12/12 | Resolution | Approval of the financial statements for the 51th fiscal year and the convocation schedule for the 51th General Meeting of Shareholders | Approved | |||||||

| Resolution | Announcement of closing POSCO P&S merge | Approved | ||||||||||||

| Resolution | Appointment of Compliance Officer | Approved | ||||||||||||

| Resolution | Contribution of donation to Indonesia for the recovery of damage caused by Tsunami | Approved | ||||||||||||

| Report | The management result for the fiscal year of 2018 | Reported | ||||||||||||

| Report | Report on the operation of the internal accounting management regulations for the fiscal year of 2018 | Reported | ||||||||||||

| 2 | Ordinary | ‘19. 2.20 | ‘19. 2.14 | 12/12 | Resolution | Agenda for the 51th General Meeting of Shareholders and execution of electronic voting system | Approved | |||||||

| Resolution | Recommendation of candidates for the Inside Director position (Excluding the candidate for the Chief Executive Officer) | Approved | ||||||||||||

| 3 | Ordinary | ‘19. 3.15 | ‘19. 3.12 | 12/12 | Resolution | Appointment of the Chairman of the Board of Directors | Approved | |||||||

| Resolution | Appointment of the Special Committee Members | Approved | ||||||||||||

| Resolution | Designation of Representative Directors and presenting positions to Inside Directors | Approved | ||||||||||||

| 4 | Extraordinary | ‘19. 4.12 | ‘19. 4.10 | 12/12 | Resolution | Business restructuring plan for LNG terminaland by-product power plant | Approved | |||||||

| Resolution | Contribution of donation for the recovery of damage caused by forest fire in Gangwon Province | Approved | ||||||||||||

| 5 | Ordinary | ‘19. 5.10 | ‘19. 5.7 | 12/12 | Resolution | Declaration of the first quarter dividend for the fiscal year of 2019 | Approved | |||||||

| Resolution | Plan for financing for the fiscal year of 2019 | Approved | ||||||||||||

| Resolution | Increase of capital and extension of the payment guarantee period for Brazil CSP | Approved | ||||||||||||

| Resolution | FY2019 Transaction Plans with affiliates | Approved | ||||||||||||

| Report | The management result of the first quarter of 2019 | Reported | ||||||||||||

| Report | The performance and assessment of Board of Directors for 2018 | Reported | ||||||||||||

| Report | Standard for selecting domain and the possible list of domains for new business | Reported | ||||||||||||

| Report | Establishment of venture platform for exploring new business | Reported | ||||||||||||

| Report | The result of publicizing 50th anniversary commemorative project and its future plan | Reported |

| * | Oh-Joon, Kwon absent |

| ** | After supplementing, extraordinary meeting would take place in December 19, 2018 |

26

<Attendance Status for Each Director>

(2018.3.9~2018.7.26)

| Inside/Outside | Round | 1st | 2nd | |||

| Date | 2018. 1.24 | 2018. 2.13 | ||||

| Inside | Oh-Joon Kwon | Attended | Attended | |||

| In-Hwan Oh | Attended | Attended | ||||

| Jeong-Woo Choi | Attended | Attended | ||||

| In-Wha Chang | Attended | Attended | ||||

| Seong Yu | Attended | Attended | ||||

| Outside | Byong-Won Bahk | Attended | Attended | |||

| Chae-Chol Shin | Attended | Attended | ||||

| Myoung-Woo Lee | Attended | Attended | ||||

| Joo-Hyun Kim | Attended | Attended | ||||

| Shin-Bae Kim | Attended | Attended | ||||

| Moon-Ki Chung | Attended | Attended | ||||

| Seung-Wha, Chang | Attended | Attended |

(2018.3.9~2018.7.26)

| Inside/Outside | Round | 3rd | 4th | 5th | 6th | 7th | ||||||

| Date | 2018. 3. 9 | 2018. 4.18 | 2018. 5.11 | 2018. 6.22 | 2018. 6.23 | |||||||

| Inside | Oh-Joon Kwon | Attended | Attended | Attended | Attended | Attended | ||||||

| In-Hwan Oh | Attended | Attended | Attended | Attended | Attended | |||||||

| In-Wha Chang | Attended | Attended | Attended | Attended | Attended | |||||||

| Seong Yu | Attended | Attended | Attended | Attended | Attended | |||||||

| Jung-Son Chon | Attended | Attended | Attended | Attended | Attended | |||||||

| Outside | Joo-Hyun Kim | Attended | Attended | Attended | Attended | Attended | ||||||

| Myoung-Woo Lee | Attended | Attended | Attended | Attended | Attended | |||||||

| Byong-Won Bahk | Attended | Attended | Attended | Attended | Attended | |||||||

| Shin-Bae Kim | Attended | Attended | Attended | Attended | Attended | |||||||

| Moon-Ki Chung | Attended | Attended | Attended | Attended | Attended | |||||||

| Seung-Wha, Chang | Attended | Attended | Attended | Attended | Attended | |||||||

| Sung-Jin Kim | Attended | Attended | Attended | Attended | Attended |

27

(2018.7.27~2019.3.14)

Inside/ Outside | Round | 8th | 9th | 10th | 11th | 12th | 1st | 2nd | ||||||||

| Date | 2018. 7.27 | 2018. 8.22 | 2018.11.3 | 2018.12.7 | 2018.12.19 | 2019.1.30 | 2019.2.20 | |||||||||

| Inside | Jeong-Woo Choi | Attended | Attended | Attended | Attended | Attended | Attended | Attended | ||||||||

| In-Hwan Oh | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

| In-Wha Chang | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

| Seong Yu | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

Jung-Son Chon | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

| Outside | Joo-Hyun Kim | Attended | Attended | Attended | Attended | Attended | Attended | Attended | ||||||||

| Myoung-Woo Lee | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

| Byong-Won Bahk | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

| Shin-Bae Kim | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

Moon-Ki Chung | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

Seung-Wha, Chang | Attended | Attended | Attended | Attended | Attended | Attended | Attended | |||||||||

| Sung-Jin Kim | Attended | Attended | Attended | Attended | Attended | Attended | Attended |

(2019.3.15~2019.5.31)

| Inside/Outside | Round | 3rd | 4th | 5th | ||||

| Date | 2019. 3.15 | 2019. 4.12 | 2019. 5.10 | |||||

| Inside | Jeong-Woo Choi | Attended | Attended | Attended | ||||

| In-Wha Chang | Attended | Attended | Attended | |||||

| Jung-Son Chon | Attended | Attended | Attended | |||||

| Hag-Dong Kim | Attended | Attended | Attended | |||||

| Tak Jeong | Attended | Attended | Attended | |||||

| Outside | Shin-Bae Kim | Attended | Attended | Attended | ||||

| Byong-Won Bahk | Attended | Attended | Attended | |||||

| Joo-Hyun Kim | Attended | Attended | Attended | |||||

| Moon-Ki Chung | Attended | Attended | Attended | |||||

| Seung-Wha, Chang | Attended | Attended | Attended | |||||

| Sung-Jin Kim | Attended | Attended | Attended | |||||

| Hee-Jae Pahk | Attended | Attended | Attended |

4. Special Committees of BOD

(1) Establishment of the BOD’s Special Committees

Under the Board of Directors, there are 5 Special Committees - Director Candidate Recommendation and Management Committee, Evaluation and Compensation Committee, Finance and Related Party Transactions Committee, Audit Committee, and Executive Management Committee. Except for the Executive Management Committee that reviews and deliberates steel investments, each of the committee is participated by a majority of Outside Directors. Members of the Evaluation and Compensation Committee and Audit Committee are all Outside Directors to ensure independent decision-making of the Special Committees.

Among the committees, Director Candidate Recommendation and Management Committee and Audit Committee are required to be established by the Commercial Act, and the rest 3 committees were formed by the Board based on its autonomous decision in pursuit of professional, independent and efficient Board management. The meeting details for each Special Committee are as follows. The details of the organization, operation and responsibilities of committees are governed by the Articles of Incorporation and the Operational Regulations

28

Director Candidate Recommendation Committee

<Activities Details>

(2018.1.1~2018.12.31)

| Round | Date | Attendance | Agenda | Approved | ||||||

| Type | Detail | |||||||||

| 1st | ‘18. 3. 9 | 4/4 | Resolution | Appointment of the Chairman of Director Candidate Recommendation Committee | Approved | |||||

| Pre-deliberation | Appointment of Representative Directors | Pre-deliberated | ||||||||

| 2nd | ‘18.12. 4 | 4/4 | Resolution | Plan for Outside Director Candidates Advisory Group | Approved | |||||

| Resolution | Amendment of internal rules for Outside Director Candidates Advisory Group | Approved | ||||||||

(2019.1.1~2019.5.31)

| Round | Date | Attendance | Agenda | Approved | ||||||

| Type | Detail | |||||||||

| 1st | ‘19. 2.13 / 2.20 | 4/4 | Resolution | Qualification Assessment and Recommendation of Outside Director Candidates | Approved | |||||

| ‘19. 2.20 | Pre-deliberation | Qualification Assessment of Inside Director Candidates | Pre-deliberated | |||||||