- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCurrent report (foreign)

Filed: 22 Jul 20, 6:09am

2Q 2020 Earnings Release July 21, 2020 Exhibit 99.1

Disclaimer This presentation was prepared and circulated to release the informations regarding the company’s business performance to shareholders and investors prior to the completion of auditing for the period of the second quarter of 2019. As figures in this presentation are based on unaudited financial statements, certain contents may be subject to modification in the course of auditing process. This presentation contains certain forward-looking statements relating to the business, financial performance and results of the company and/or the industry in which it operates. The forward-looking statements set forth herein concern future circumstances and results and other statements that not historical facts, and are solely opinions and forecasts which are uncertain and subject to risks. Therefore, the recipients of this presentation shall be aware of that the forward-looking statements set forth herein may not correspond to the actual business performance of the company due to changes and risks in business environments and conditions. The sole purpose of this presentation is to assist persons in deciding whether they wish to proceed with certain investments to the company. The company does not make any representation or warranty, expressly or impliedly, as to the accuracy and completeness of this presentation or of the information contained herein and shall not have any liability for the informations contained in this presentation.

2Q 2020 Business Performance Parent Performance Consolidated Performance Subsidiary Performance Key Business Activities 2020 Business Outlook Contents

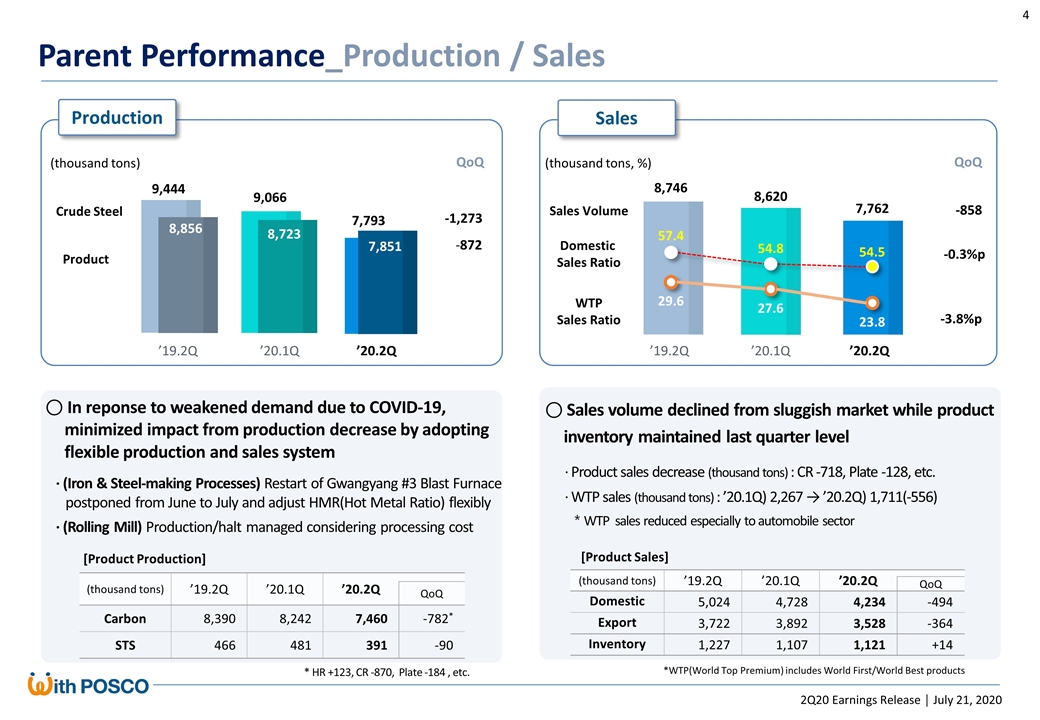

’19.2Q ’20.1Q ’20.2Q 8,746 8,620 57.4 54.8 7,762 54.5 (thousand tons) ’19.2Q ’20.1Q ’20.2Q QoQ Domestic 5,024 4,728 4,234 -494 Export 3,722 3,892 3,528 -364 Inventory 1,227 1,107 1,121 +14 29.6 27.6 23.8 -3.8%p *WTP(World Top Premium) includes World First/World Best products -858 -0.3%p ’19.2Q ’20.1Q ’20.2Q 9,444 8,856 -1,273 -872 (thousand tons) ’19.2Q ’20.1Q ’20.2Q QoQ Carbon 8,390 8,242 7,460 -782* STS 466 481 391 -90 * HR +123, CR -870, Plate -184 , etc. 4 9,066 8,723 7,793 7,851 Parent Performance_Production / Sales Production Sales QoQ QoQ Crude Steel Product Sales Volume Domestic Sales Ratio WTP Sales Ratio (thousand tons) (thousand tons, %) [Product Production] [Product Sales] ○ Sales volume declined from sluggish market while product inventory maintained last quarter level ○ In reponse to weakened demand due to COVID-19, minimized impact from production decrease by adopting flexible production and sales system · (Iron & Steel-making Processes) Restart of Gwangyang #3 Blast Furnace postponed from June to July and adjust HMR(Hot Metal Ratio) flexibly · (Rolling Mill) Production/halt managed considering processing cost · Product sales decrease (thousand tons) : CR -718, Plate -128, etc. · WTP sales (thousand tons) : ’20.1Q) 2,267 → ’20.2Q) 1,711(-556) *WTP sales reduced especially to automobile sector

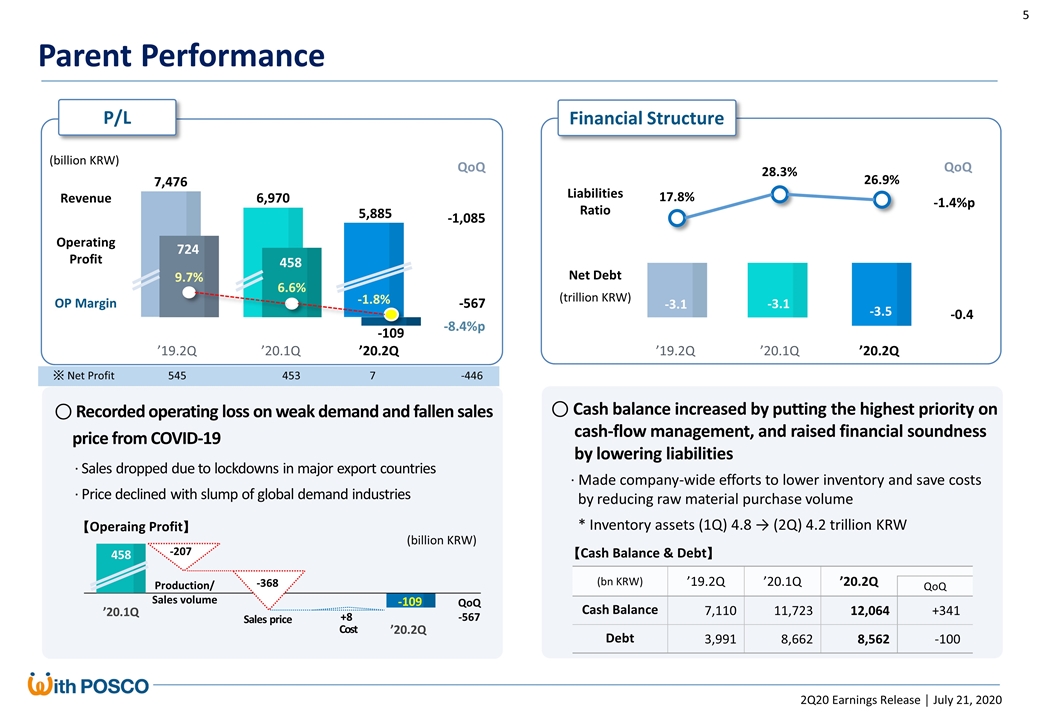

-3.1 -3.5 17.8% 28.3% 26.9% QoQ -567 Cost Production/ Sales volume -109 458 ’20.1Q ’20.2Q -567 -3.1 (bn KRW) ’19.2Q ’20.1Q ’20.2Q QoQ Cash Balance 7,110 11,723 12,064 +341 Debt 3,991 8,662 8,562 -100 【Operaing Profit】 -0.4 -8.4%p -1.4%p -1,085 ’19.2Q ’20.1Q ’20.2Q ’19.2Q ’20.1Q ’20.2Q 6,970 458 6.6% 5,885 -109 -1.8% -207 +8 -368 7,476 724 9.7% Sales price 5 Parent Performance P/L Financial Structure (billion KRW) Revenue Operating Profit OP Margin Liabilities Ratio QoQ QoQ (trillion KRW) Net Debt (billion KRW) 【Cash Balance & Debt】 · Sales dropped due to lockdowns in major export countries · Price declined with slump of global demand industries · Made company-wide efforts to lower inventory and save costs by reducing raw material purchase volume * Inventory assets (1Q) 4.8 → (2Q) 4.2 trillion KRW ○ Recorded operating loss on weak demand and fallen sales price from COVID-19 ○ Cash balance increased by putting the highest priority on cash-flow management, and raised financial soundness by lowering liabilities ※ Net Profit 545 453 7 -446

8.2 7.3 65.0% 73.5% 72.8% 9.2 (billion KRW) ’19.2Q ’20.1Q ’20.2Q QoQ Cash Balance 10,021 15,351 16,913 +1,562 Debt 19,199 23,503 24,238 +735 (billion KRW) ’19.2Q ’20.1Q ’20.2Q QoQ Steel 805 383 -197 -580 Overseas steel 38 -81 -93 -12 Global&Infra 299 375 304 -71 New Growth 15 14 1 -13 -0.9 -0.7%p ’19.2Q ’20.1Q ’20.2Q 6 · Overseas steel subsidiaries operating profit in ’20.2Q (million USD) PT.KP -28, PZSS 8, POSCO Maharashtra -13, PY VINA -9 -824 -537 -3.6%p ’19.2Q ’20.1Q ’20.2Q 16,321 1,069 6.5% 14,546 705 4.8% 13,722 168 1.2% Consolidated Performance P/L Financial Structure Liabilities Ratio (billion KRW) Revenue Operating Profit OP Margin QoQ QoQ (trillion KRW) Net Debt 【Aggregated Operating Profit】 【Cash Balance & Debt】 ○ Consolidated earnings decreased as steel business performance aggravated while robust earnings of companies in Global & Infra business sustained · Debt(bn KRW): P-Chemical +507 (Incl. Bonds for facility investment 210, U$ 100 million), P-Energy +333 (Incl. Long-term bond for refinancing 200) ○ Despite total debt growth from subsidiaries’ preemptive financing, net debt was lowered with cash increased by reducing working capital ※ Net Profit 681 435 105 -330

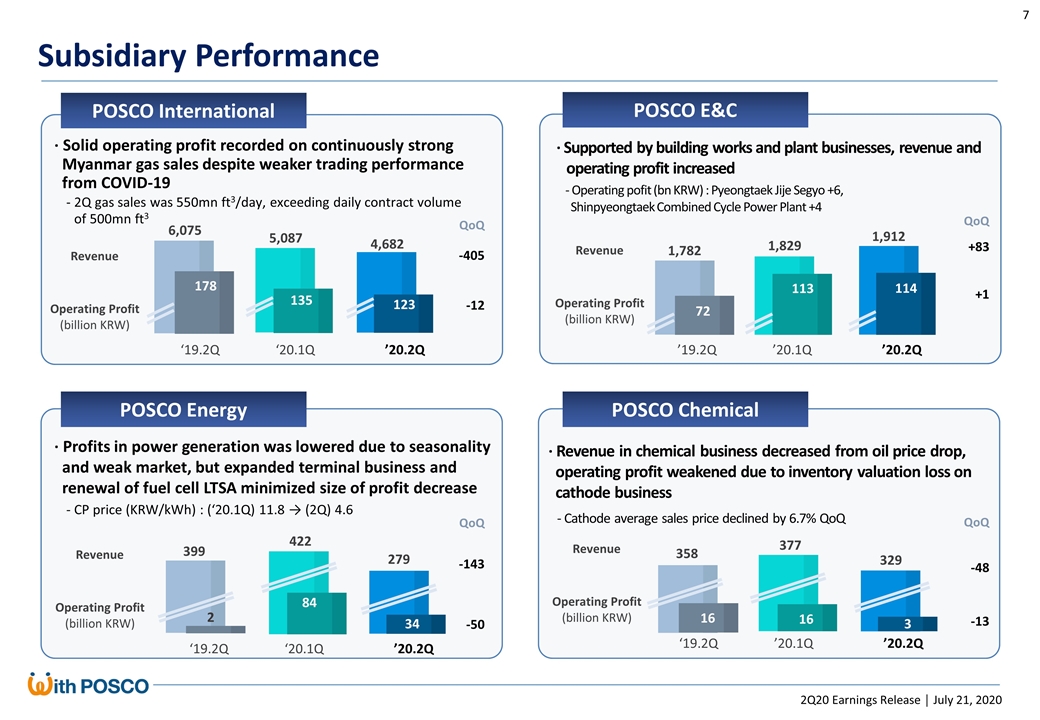

7 6,075 5,087 4,682 ‘19.2Q ‘20.1Q ’20.2Q 178 135 123 -405 -12 1,782 1,829 1,912 72 113 ’19.2Q ’20.1Q ’20.2Q 114 +83 +1 399 422 279 ‘19.2Q ‘20.1Q ’20.2Q 84 34 2 358 377 329 16 16 3 ‘19.2Q ’20.1Q ’20.2Q -143 -50 -48 -13 Subsidiary Performance POSCO E&C POSCO International POSCO Energy POSCO Chemical QoQ QoQ QoQ QoQ Revenue Operating Profit (billion KRW) Revenue Operating Profit (billion KRW) Revenue Operating Profit (billion KRW) Revenue Operating Profit (billion KRW) · Solid operating profit recorded on continuously strong Myanmar gas sales despite weaker trading performance from COVID-19 - 2Q gas sales was 550mn ft3/day, exceeding daily contract volume of 500mn ft3 · Supported by building works and plant businesses, revenue and operating profit increased · Profits in power generation was lowered due to seasonality and weak market, but expanded terminal business and renewal of fuel cell LTSA minimized size of profit decrease - CP price (KRW/kWh) : (‘20.1Q) 11.8 → (2Q) 4.6 · Revenue in chemical business decreased from oil price drop, operating profit weakened due to inventory valuation loss on cathode business - Cathode average sales price declined by 6.7% QoQ - Operating pofit (bn KRW) : Pyeongtaek Jije Segyo +6, Shinpyeongtaek Combined Cycle Power Plant +4

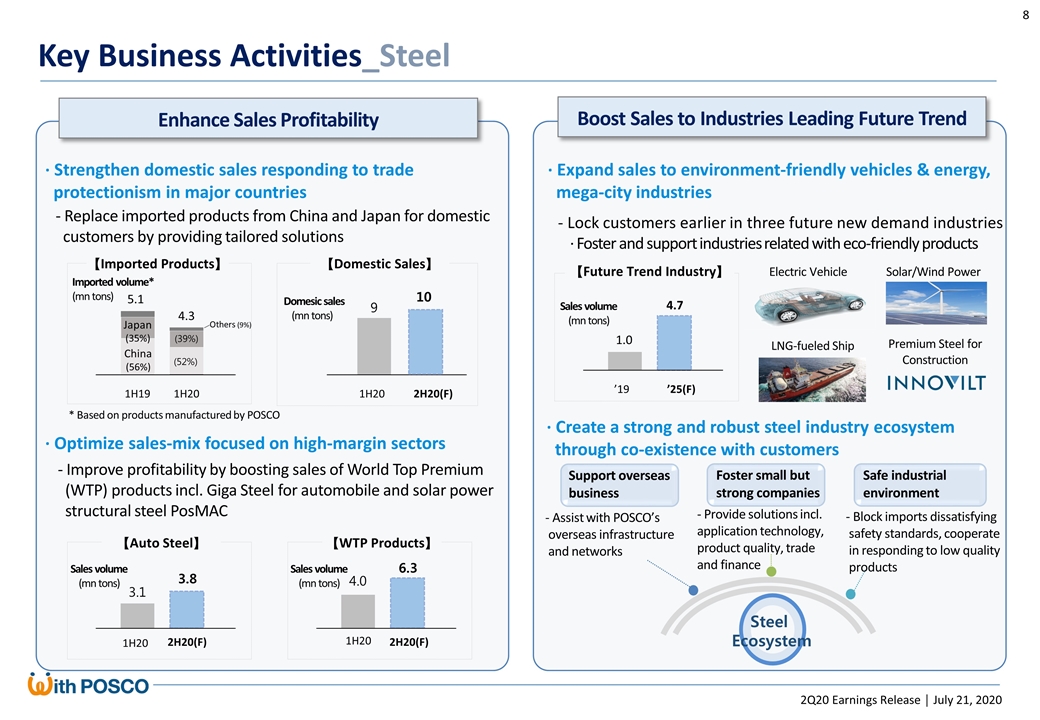

8 Key Business Activities_Steel - Replace imported products from China and Japan for domestic customers by providing tailored solutions Enhance Sales Profitability Boost Sales to Industries Leading Future Trend · Strengthen domestic sales responding to trade protectionism in major countries · Optimize sales-mix focused on high-margin sectors · Expand sales to environment-friendly vehicles & energy, mega-city industries - Improve profitability by boosting sales of World Top Premium (WTP) products incl. Giga Steel for automobile and solar power structural steel PosMAC 3.1 1H20 3.8 【Auto Steel】 Sales volume (mn tons) 4.0 6.3 【WTP Products】 1.0 ’19 4.7 ’25(F) 【Future Trend Industry】 - Lock customers earlier in three future new demand industries · Foster and support industries related with eco-friendly products · Create a strong and robust steel industry ecosystem through co-existence with customers Steel Ecosystem Support overseas business Foster small but strong companies Safe industrial environment - Assist with POSCO’s overseas infrastructure and networks - Provide solutions incl. application technology, product quality, trade and finance - Block imports dissatisfying safety standards, cooperate in responding to low quality products Solar/Wind Power Electric Vehicle LNG-fueled Ship Premium Steel for Construction 5.1 1H19 4.3 1H20 【Imported Products】 9 1H20 10 2H20(F) 【Domestic Sales】 * Based on products manufactured by POSCO Domesic sales (mn tons) Imported volume* (mn tons) China (56%) Japan (35%) (52%) (39%) Others (9%) Sales volume (mn tons) 2H20(F) 1H20 2H20(F) Sales volume (mn tons)

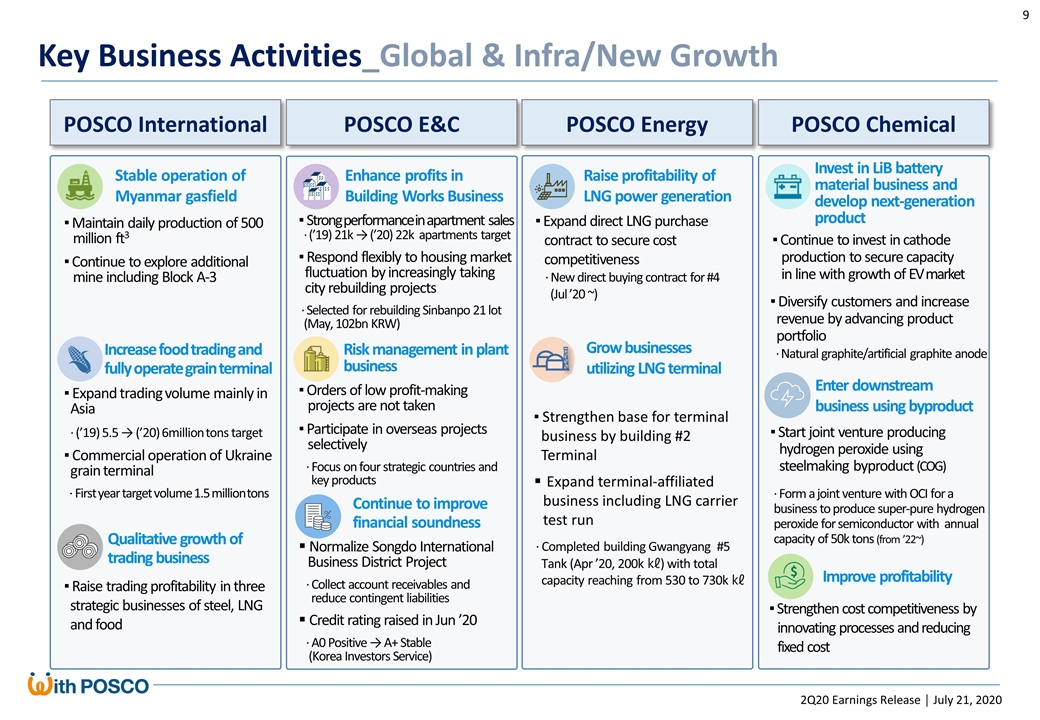

Stable operation of Myanmar gasfield Increase food trading and fully operate grain terminal Risk management in plant business Enhance profits in Building Works Business Continue to improve financial soundness Raise profitability of LNG power generation Grow businesses utilizing LNG terminal POSCO International POSCO E&C POSCO Energy POSCO Chemical ▪ Expand trading volume mainly in Asia · (’19) 5.5 → (’20) 6million tons target ▪ Commercial operation of Ukraine grain terminal · First year target volume 1.5 million tons ▪ Maintain daily production of 500 million ft3 ▪ Continue to explore additional mine including Block A-3 ▪ Orders of low profit-making projects are not taken ▪ Participate in overseas projects selectively · Focus on four strategic countries and key products Normalize Songdo International Business District Project · Collect account receivables and reduce contingent liabilities Credit rating raised in Jun ’20 · A0 Positive → A+ Stable (Korea Investors Service) ▪ Strong performance in apartment sales · (’19) 21k → (’20) 22k apartments target ▪ Respond flexibly to housing market fluctuation by increasingly taking city rebuilding projects · Selected for rebuilding Sinbanpo 21 lot (May, 102bn KRW) ▪ Expand direct LNG purchase contract to secure cost competitiveness · New direct buying contract for #4 (Jul ’20 ~) Improve profitability ▪ Strengthen cost competitiveness by innovating processes and reducing fixed cost Invest in LiB battery material business and develop next-generation product ▪ Continue to invest in cathode production to secure capacity in line with growth of EV market Enter downstream business using byproduct ▪ Start joint venture producing hydrogen peroxide using steelmaking byproduct (COG) 9 ▪ Diversify customers and increase revenue by advancing product portfolio · Natural graphite/artificial graphite anode · Form a joint venture with OCI for a business to produce super-pure hydrogen peroxide for semiconductor with annual capacity of 50k tons (from ’22~) Qualitative growth of trading business ▪ Raise trading profitability in three strategic businesses of steel, LNG and food · Completed building Gwangyang #5 Tank (Apr ’20, 200k ㎘) with total capacity reaching from 530 to 730k ㎘ Expand terminal-affiliated business including LNG carrier test run ▪ Strengthen base for terminal business by building #2 Terminal Key Business Activities_Global & Infra/New Growth

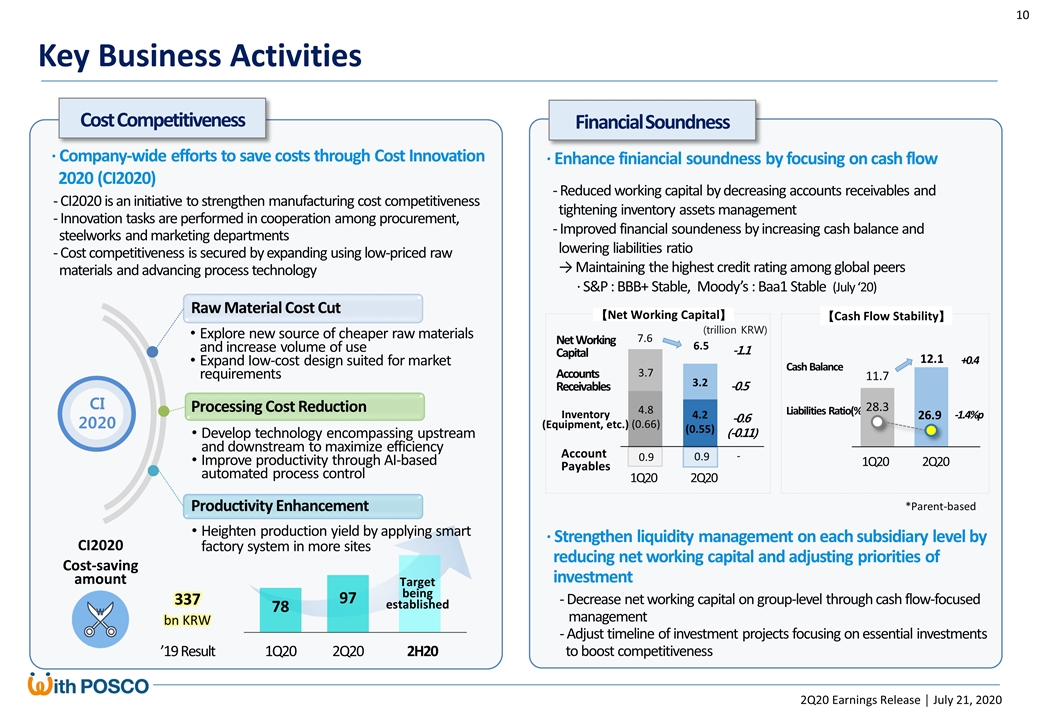

10 Key Business Activities Heighten production yield by applying smart factory system in more sites Develop technology encompassing upstream and downstream to maximize efficiency Improve productivity through AI-based automated process control - CI2020 is an initiative to strengthen manufacturing cost competitiveness - Innovation tasks are performed in cooperation among procurement, steelworks and marketing departments - Cost competitiveness is secured by expanding using low-priced raw materials and advancing process technology Cost Competitiveness CI2020 Cost-saving amount Financial Soundness CI 2020 Raw Material Cost Cut Productivity Enhancement 1Q20 2H20 · Company-wide efforts to save costs through Cost Innovation 2020 (CI2020) Cash Balance Liabilities Ratio(%) 11.7 12.1 +0.4 28.3 26.9 -1.4%p Net Working Capital Accounts Receivables 7.6 6.5 Inventory (Equipment, etc.) (trillion KRW) 3.7 3.2 4.8 (0.66) 4.2 (0.55) -1.1 -0.6 (-0.11) Account Payables 0.9 -0.5 - 0.9 *Parent-based 【Net Working Capital】 【Cash Flow Stability】 Processing Cost Reduction · Strengthen liquidity management on each subsidiary level by reducing net working capital and adjusting priorities of investment - Decrease net working capital on group-level through cash flow-focused management - Adjust timeline of investment projects focusing on essential investments to boost competitiveness - Reduced working capital by decreasing accounts receivables and tightening inventory assets management - Improved financial soundeness by increasing cash balance and lowering liabilities ratio → Maintaining the highest credit rating among global peers · S&P : BBB+ Stable, Moody’s : Baa1 Stable (July ‘20) 78 · Enhance finiancial soundness by focusing on cash flow ’19 Result 337 bn KRW 97 2Q20 Target being established 1Q20 2Q20 1Q20 2Q20 Explore new source of cheaper raw materials and increase volume of use Expand Iow-cost design suited for market requirements

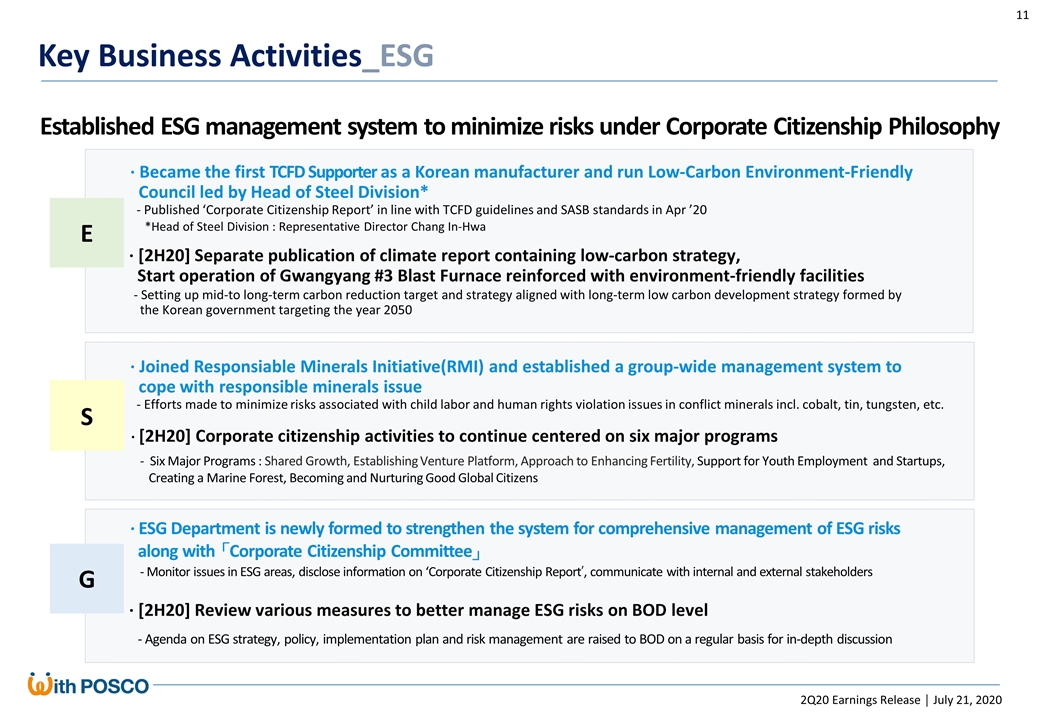

11 Established ESG management system to minimize risks under Corporate Citizenship Philosophy E · [2H20] Separate publication of climate report containing low-carbon strategy, Start operation of Gwangyang #3 Blast Furnace reinforced with environment-friendly facilities S G · [2H20] Corporate citizenship activities to continue centered on six major programs · [2H20] Review various measures to better manage ESG risks on BOD level · Became the first TCFD Supporter as a Korean manufacturer and run Low-Carbon Environment-Friendly Council led by Head of Steel Division* - Published ‘Corporate Citizenship Report’ in line with TCFD guidelines and SASB standards in Apr ’20 *Head of Steel Division : Representative Director Chang In-Hwa · Joined Responsiable Minerals Initiative(RMI) and established a group-wide management system to cope with responsible minerals issue - Efforts made to minimize risks associated with child labor and human rights violation issues in conflict minerals incl. cobalt, tin, tungsten, etc. · ESG Department is newly formed to strengthen the system for comprehensive management of ESG risks along with 「Corporate Citizenship Committee」 Key Business Activities_ESG - Six Major Programs : Shared Growth, Establishing Venture Platform, Approach to Enhancing Fertility, Support for Youth Employment and Startups, Creating a Marine Forest, Becoming and Nurturing Good Global Citizens - Monitor issues in ESG areas, disclose information on ‘Corporate Citizenship Report’, communicate with internal and external stakeholders - Agenda on ESG strategy, policy, implementation plan and risk management are raised to BOD on a regular basis for in-depth discussion - Setting up mid-to long-term carbon reduction target and strategy aligned with long-term low carbon development strategy formed by the Korean government targeting the year 2050

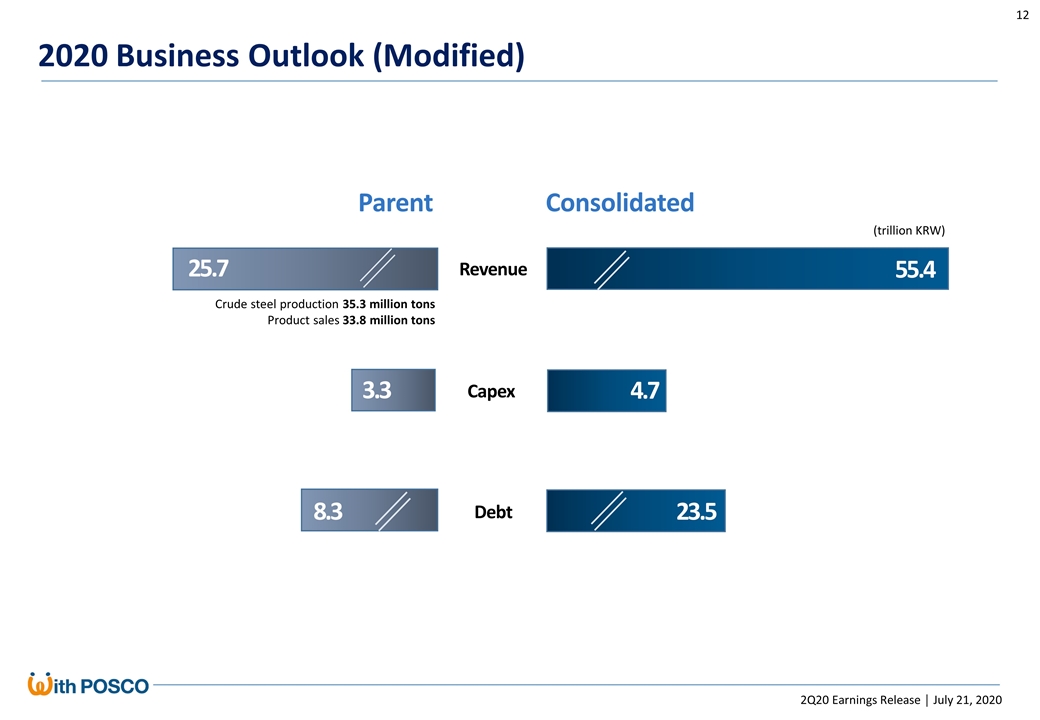

25.7 3.3 8.3 4.7 23.5 55.4 12 2020 Business Outlook (Modified) Parent Consolidated Revenue Capex Debt (trillion KRW) Crude steel production 35.3 million tons Product sales 33.8 million tons

※ Appendix Summarized Financial Statements Aggregated Earnings by Segment

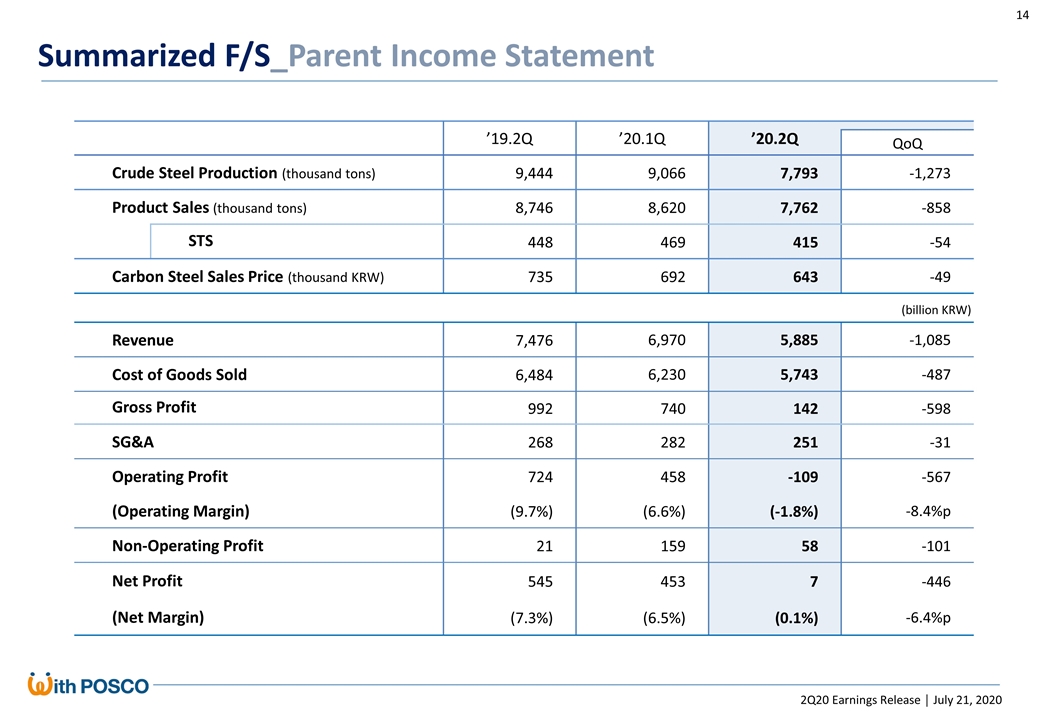

14 ’19.2Q ’20.1Q ’20.2Q QoQ Crude Steel Production (thousand tons) 9,444 9,066 7,793 -1,273 Product Sales (thousand tons) 8,746 8,620 7,762 -858 STS 448 469 415 -54 Carbon Steel Sales Price (thousand KRW) 735 692 643 -49 Revenue 7,476 6,970 5,885 -1,085 Cost of Goods Sold 6,484 6,230 5,743 -487 Gross Profit 992 740 142 -598 SG&A 268 282 251 -31 Operating Profit 724 458 -109 -567 (Operating Margin) (9.7%) (6.6%) (-1.8%) -8.4%p Non-Operating Profit 21 159 58 -101 Net Profit 545 453 7 -446 (Net Margin) (7.3%) (6.5%) (0.1%) -6.4%p Summarized F/S_Parent Income Statement (billion KRW)

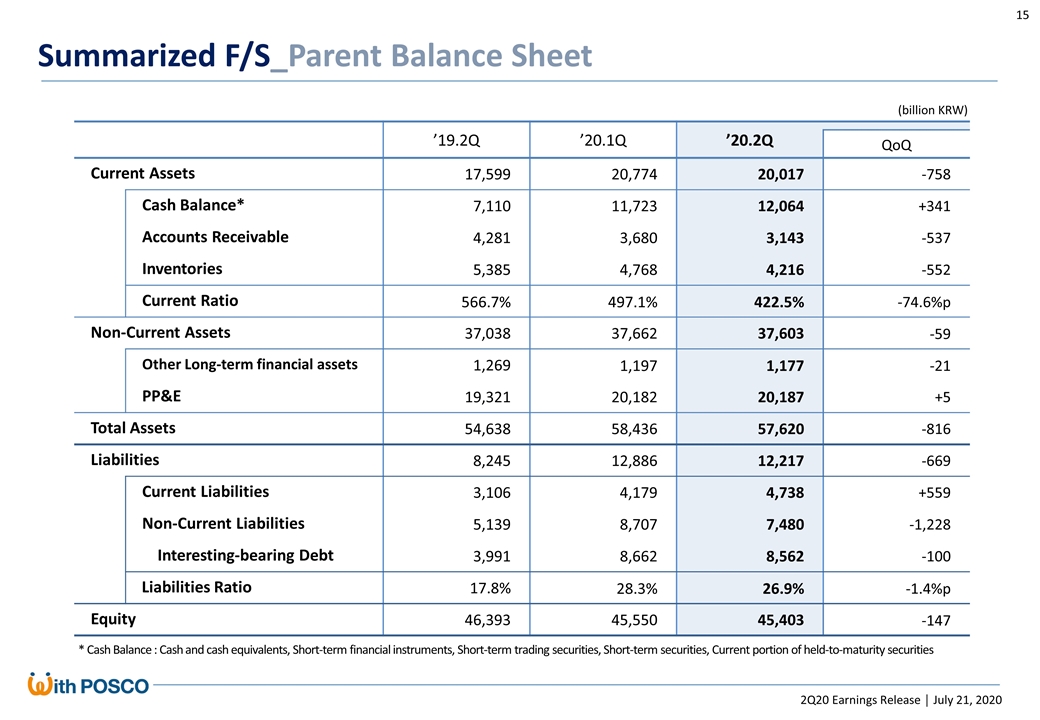

15 ’19.2Q ’20.1Q ’20.2Q QoQ Current Assets 17,599 20,774 20,017 -758 Cash Balance* 7,110 11,723 12,064 +341 Accounts Receivable 4,281 3,680 3,143 -537 Inventories 5,385 4,768 4,216 -552 Current Ratio 566.7% 497.1% 422.5% -74.6%p Non-Current Assets 37,038 37,662 37,603 -59 Other Long-term financial assets 1,269 1,197 1,177 -21 PP&E 19,321 20,182 20,187 +5 Total Assets 54,638 58,436 57,620 -816 Liabilities 8,245 12,886 12,217 -669 Current Liabilities 3,106 4,179 4,738 +559 Non-Current Liabilities 5,139 8,707 7,480 -1,228 Interesting-bearing Debt 3,991 8,662 8,562 -100 Liabilities Ratio 17.8% 28.3% 26.9% -1.4%p Equity 46,393 45,550 45,403 -147 Summarized F/S_Parent Balance Sheet * Cash Balance : Cash and cash equivalents, Short-term financial instruments, Short-term trading securities, Short-term securities, Current portion of held-to-maturity securities (billion KRW)

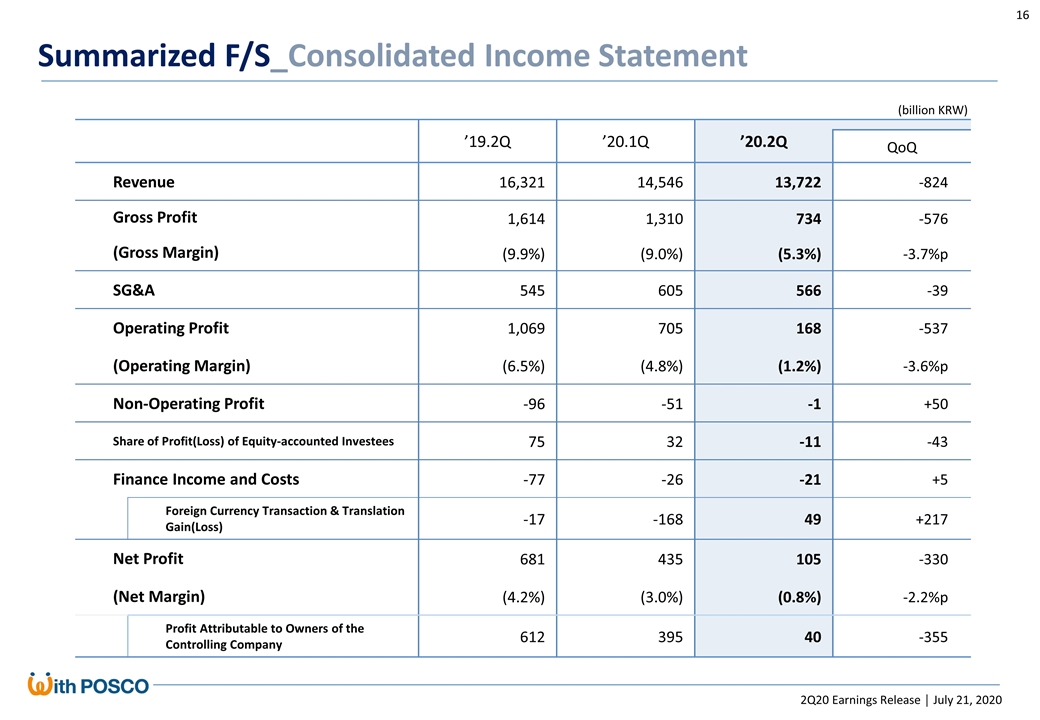

16 ’19.2Q ’20.1Q ’20.2Q QoQ Revenue 16,321 14,546 13,722 -824 Gross Profit 1,614 1,310 734 -576 (Gross Margin) (9.9%) (9.0%) (5.3%) -3.7%p SG&A 545 605 566 -39 Operating Profit 1,069 705 168 -537 (Operating Margin) (6.5%) (4.8%) (1.2%) -3.6%p Non-Operating Profit -96 -51 -1 +50 Share of Profit(Loss) of Equity-accounted Investees 75 32 -11 -43 Finance Income and Costs -77 -26 -21 +5 Foreign Currency Transaction & Translation Gain(Loss) -17 -168 49 +217 Net Profit 681 435 105 -330 (Net Margin) (4.2%) (3.0%) (0.8%) -2.2%p Profit Attributable to Owners of the Controlling Company 612 395 40 -355 (billion KRW) Summarized F/S_Consolidated Income Statement

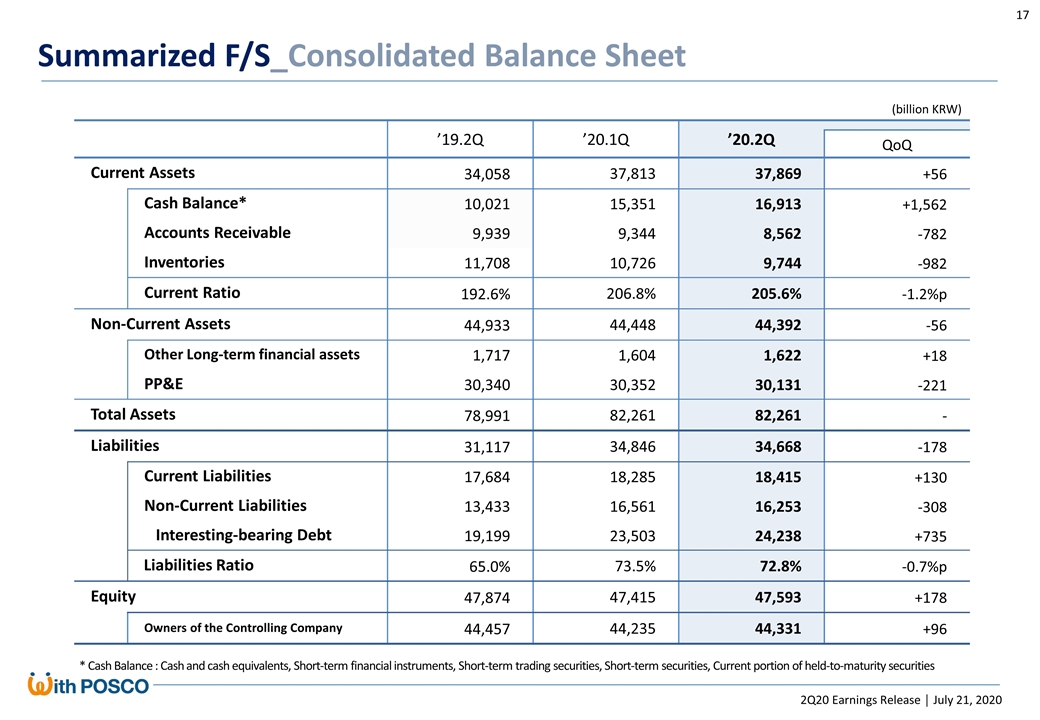

17 ’19.2Q ’20.1Q ’20.2Q QoQ Current Assets 34,058 37,813 37,869 +56 Cash Balance* 10,021 15,351 16,913 +1,562 Accounts Receivable 9,939 9,344 8,562 -782 Inventories 11,708 10,726 9,744 -982 Current Ratio 192.6% 206.8% 205.6% -1.2%p Non-Current Assets 44,933 44,448 44,392 -56 Other Long-term financial assets 1,717 1,604 1,622 +18 PP&E 30,340 30,352 30,131 -221 Total Assets 78,991 82,261 82,261 - Liabilities 31,117 34,846 34,668 -178 Current Liabilities 17,684 18,285 18,415 +130 Non-Current Liabilities 13,433 16,561 16,253 -308 Interesting-bearing Debt 19,199 23,503 24,238 +735 Liabilities Ratio 65.0% 73.5% 72.8% -0.7%p Equity 47,874 47,415 47,593 +178 Owners of the Controlling Company 44,457 44,235 44,331 +96 * Cash Balance : Cash and cash equivalents, Short-term financial instruments, Short-term trading securities, Short-term securities, Current portion of held-to-maturity securities Summarized F/S_Consolidated Balance Sheet (billion KRW)

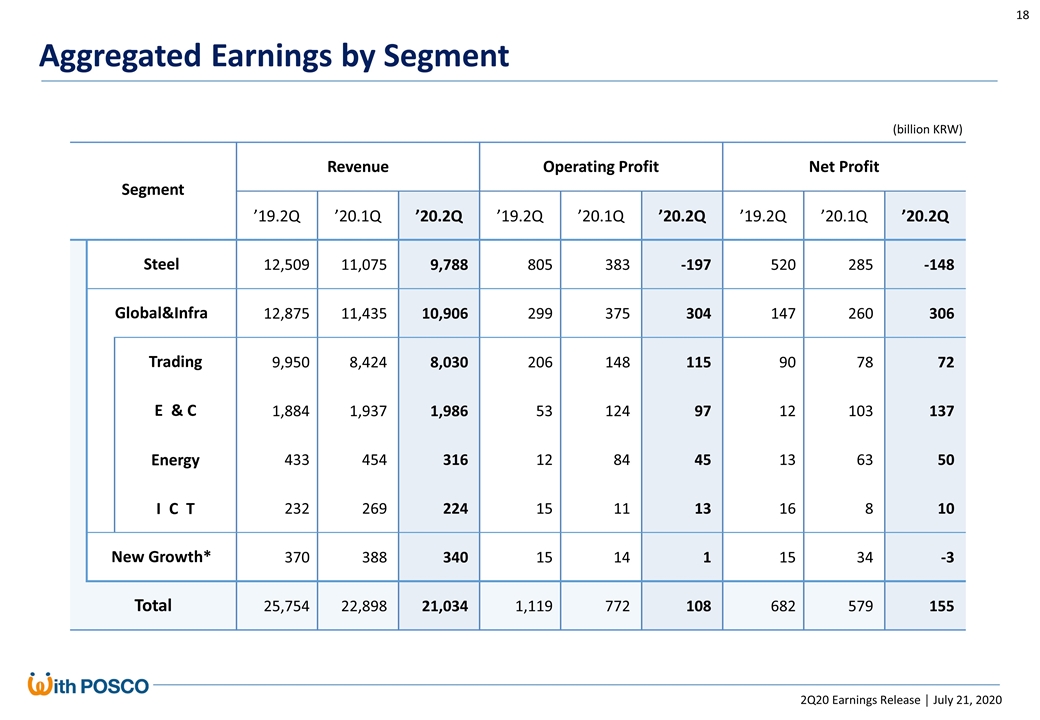

18 Segment Revenue Operating Profit Net Profit ’19.2Q ’20.1Q ’20.2Q ’19.2Q ’20.1Q ’20.2Q ’19.2Q ’20.1Q ’20.2Q Steel 12,509 11,075 9,788 805 383 -197 520 285 -148 Global&Infra 12,875 11,435 10,906 299 375 304 147 260 306 Trading 9,950 8,424 8,030 206 148 115 90 78 72 E & C 1,884 1,937 1,986 53 124 97 12 103 137 Energy 433 454 316 12 84 45 13 63 50 I C T 232 269 224 15 11 13 16 8 10 New Growth* 370 388 340 15 14 1 15 34 -3 Total 25,754 22,898 21,034 1,119 772 108 682 579 155 Aggregated Earnings by Segment (billion KRW)