- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCurrent report (foreign)

Filed: 26 Oct 21, 6:15am

2021 3Q Earnings Release Oct 25, 2021 Exhibit 99.1

Disclaimer This presentation was prepared and circulated to release the informations regarding the company’s business performance to shareholders and investors prior to the completion of auditing for the period of the third quarter of 2021. As figures in this presentation are based on unaudited financial statements, certain contents may be subject to modification in the course of auditing process. This presentation contains certain forward-looking statements relating to the business, financial performance and results of the company and/or the industry in which it operates. The forward-looking statements set forth herein concern future circumstances and results and other statements that not historical facts, and are solely opinions and forecasts which are uncertain and subject to risks. Therefore, the recipients of this presentation shall be aware of that the forward-looking statements set forth herein may not correspond to the actual business performance of the company due to changes and risks in business environments and conditions. The sole purpose of this presentation is to assist persons in deciding whether they wish to proceed with certain investments to the company. The company does not make any representation or warranty, expressly or impliedly, as to the accuracy and completeness of this presentation or of the information contained herein and shall not have any liability for the informations contained in this presentation.

3Q 2021 Earnings Release Contents Business Performance (Parent/Consolidated) Financial Structure Subsidiary Performance Appendix 2021 Business Outlook

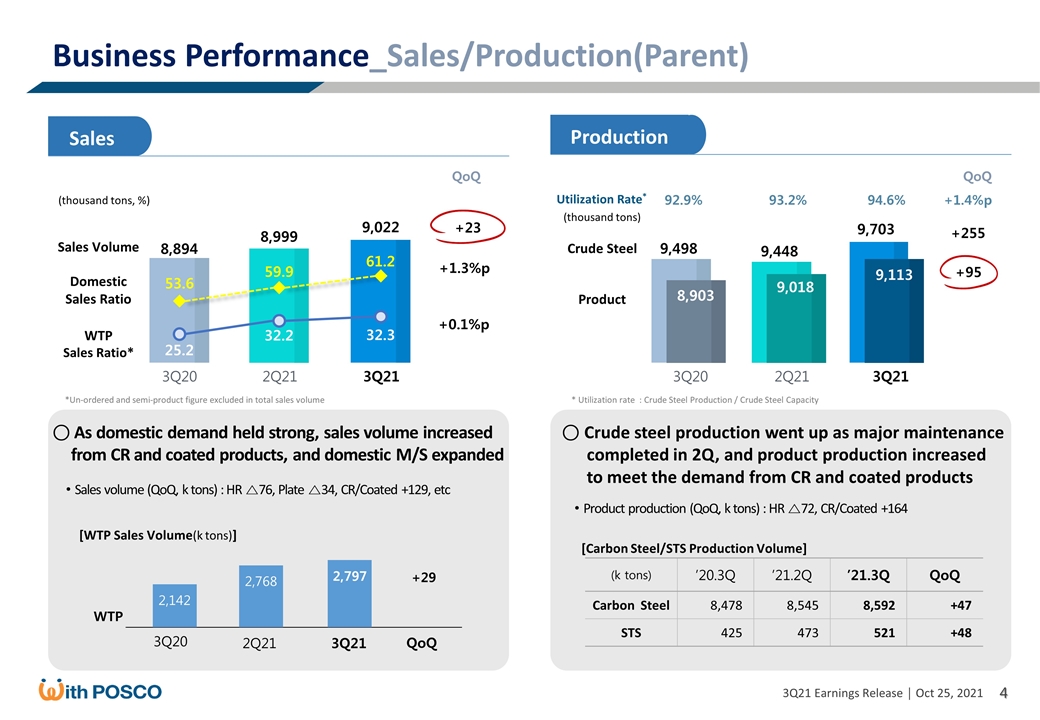

3Q20 2Q21 3Q21 9,498 8,903 +255 +95 QoQ 9,018 9,448 9,703 9,113 8,894 8,999 53.6 59.9 9,022 61.2 QoQ +23 +1.3%p 3Q20 2Q21 3Q21 ○ Crude steel production went up as major maintenance completed in 2Q, and product production increased to meet the demand from CR and coated products Sales volume (QoQ, k tons) : HR △76, Plate △34, CR/Coated +129, etc WTP 25.2 32.2 32.3 +0.1%p Product production (QoQ, k tons) : HR △72, CR/Coated +164 (k tons) ’20.3Q ’21.2Q ’21.3Q QoQ Carbon Steel 8,478 8,545 8,592 +47 STS 425 473 521 +48 3Q20 2,142 2Q21 2,768 4 +1.4%p 92.9% 93.2% 94.6% 3Q21 2,797 QoQ +29 ○ As domestic demand held strong, sales volume increased from CR and coated products, and domestic M/S expanded Business Performance_Sales/Production(Parent) Production Sales Sales Volume Domestic Sales Ratio (thousand tons, %) WTP Sales Ratio* *Un-ordered and semi-product figure excluded in total sales volume Crude Steel Product (thousand tons) Utilization Rate* * Utilization rate : Crude Steel Production / Crude Steel Capacity [WTP Sales Volume(k tons)] [Carbon Steel/STS Production Volume]

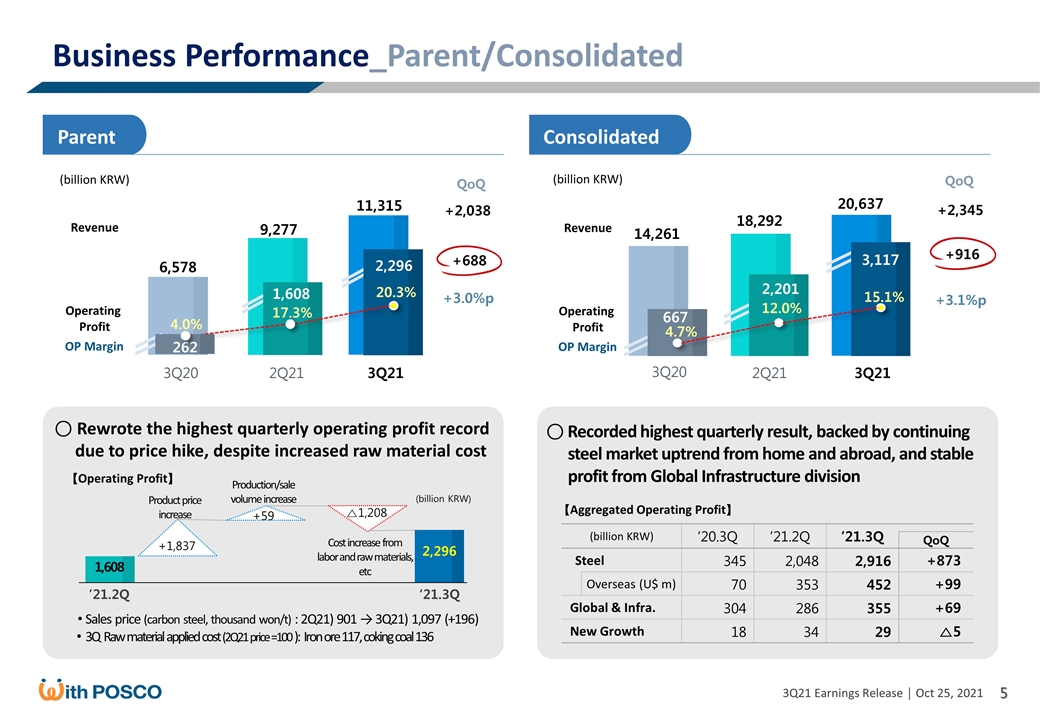

+2,038 +688 +3.0%p 3Q20 ○ Rewrote the highest quarterly operating profit record due to price hike, despite increased raw material cost 2Q21 9,277 3Q21 11,315 5 +2,345 +916 +3.1%p 14,261 18,292 20,637 3Q20 2Q21 3Q21 ○ Recorded highest quarterly result, backed by continuing steel market uptrend from home and abroad, and stable profit from Global Infrastructure division (billion KRW) ’20.3Q ’21.2Q ’21.3Q QoQ Steel 345 2,048 2,916 +873 Overseas (U$ m) 70 353 452 +99 Global & Infra. 304 286 355 +69 New Growth 18 34 29 △5 Product price increase 2,296 1,608 ’21.2Q +1,837 △1,208 Cost increase from labor and raw materials, etc ‘21.3Q 17.3% 1,608 6,578 20.3% 2,296 (billion KRW) +59 Production/sale volume increase 2,201 12.0% 3,117 15.1% 667 4.7% 4.0% 262 Business Performance_Parent/Consolidated Parent Consolidated (billion KRW) Revenue Operating Profit OP Margin (billion KRW) Revenue Operating Profit OP Margin QoQ QoQ 【Operating Profit】 【Aggregated Operating Profit】 Sales price (carbon steel, thousand won/t) : 2Q21) 901 → 3Q21) 1,097 (+196) 3Q Raw material applied cost (2Q21 price =100 ): Iron ore 117, coking coal 136

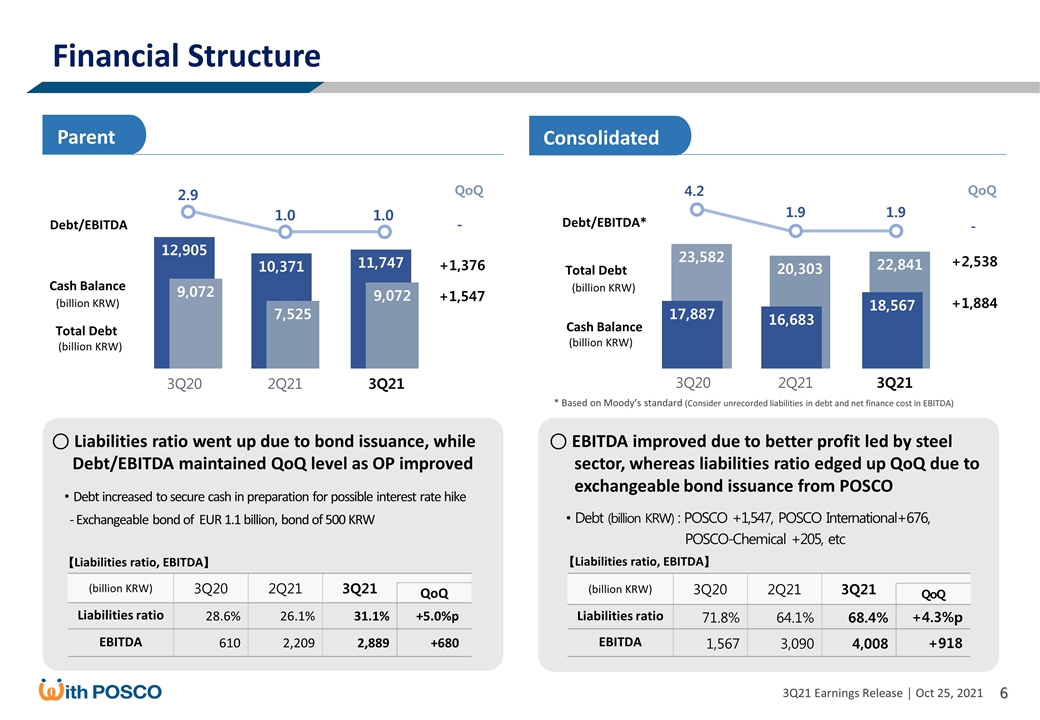

(billion KRW) 3Q20 2Q21 3Q21 QoQ Liabilities ratio 71.8% 64.1% 68.4% +4.3%p EBITDA 1,567 3,090 4,008 +918 ○ EBITDA improved due to better profit led by steel sector, whereas liabilities ratio edged up QoQ due to exchangeable bond issuance from POSCO (billion KRW) 3Q20 2Q21 3Q21 QoQ Liabilities ratio 28.6% 26.1% 31.1% +5.0%p EBITDA 610 2,209 2,889 +680 ○ Liabilities ratio went up due to bond issuance, while Debt/EBITDA maintained QoQ level as OP improved Debt increased to secure cash in preparation for possible interest rate hike - Exchangeable bond of EUR 1.1 billion, bond of 500 KRW +2,538 +1,376 +1,884 QoQ QoQ - - +1,547 2Q21 1.0 10,371 7,525 3Q21 1.0 11,747 9,072 3Q20 2.9 12,905 9,072 2Q21 1.9 20,303 16,683 3Q20 4.2 23,582 17,887 3Q21 1.9 22,841 18,567 6 Debt (billion KRW) : POSCO +1,547, POSCO International+676, POSCO-Chemical +205, etc Financial Structure Parent Consolidated Total Debt (billion KRW) Cash Balance (billion KRW) Debt/EBITDA Cash Balance (billion KRW) Total Debt (billion KRW) Debt/EBITDA* 【Liabilities ratio, EBITDA】 【Liabilities ratio, EBITDA】 * Based on Moody’s standard (Consider unrecorded liabilities in debt and net finance cost in EBITDA)

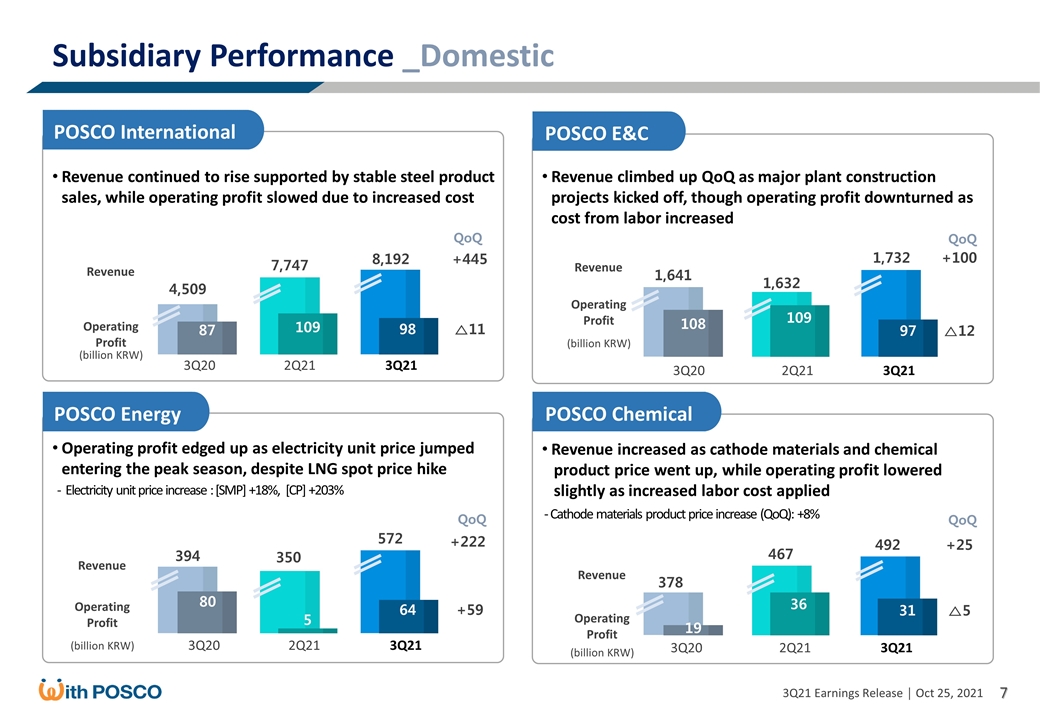

7 394 350 572 +222 +59 QoQ 80 5 64 Operating profit edged up as electricity unit price jumped entering the peak season, despite LNG spot price hike - Electricity unit price increase : [SMP] +18%, [CP] +203% 3Q20 2Q21 3Q21 Revenue continued to rise supported by stable steel product sales, while operating profit slowed due to increased cost +445 △11 QoQ 7,747 4,509 8,192 87 109 98 1,641 1,632 1,732 97 +100 △12 QoQ 108 109 Revenue climbed up QoQ as major plant construction projects kicked off, though operating profit downturned as cost from labor increased 378 467 492 Revenue increased as cathode materials and chemical product price went up, while operating profit lowered slightly as increased labor cost applied - Cathode materials product price increase (QoQ): +8% +25 △5 QoQ 19 36 31 Subsidiary Performance _Domestic POSCO E&C POSCO International POSCO E&C POSCO International POSCO Energy POSCO Chemical Revenue Operating Profit (billion KRW) Revenue Operating Profit (billion KRW) Revenue Operating Profit (billion KRW) Revenue Operating Profit (billion KRW) 3Q20 2Q21 3Q21 3Q20 2Q21 3Q21 3Q20 2Q21 3Q21

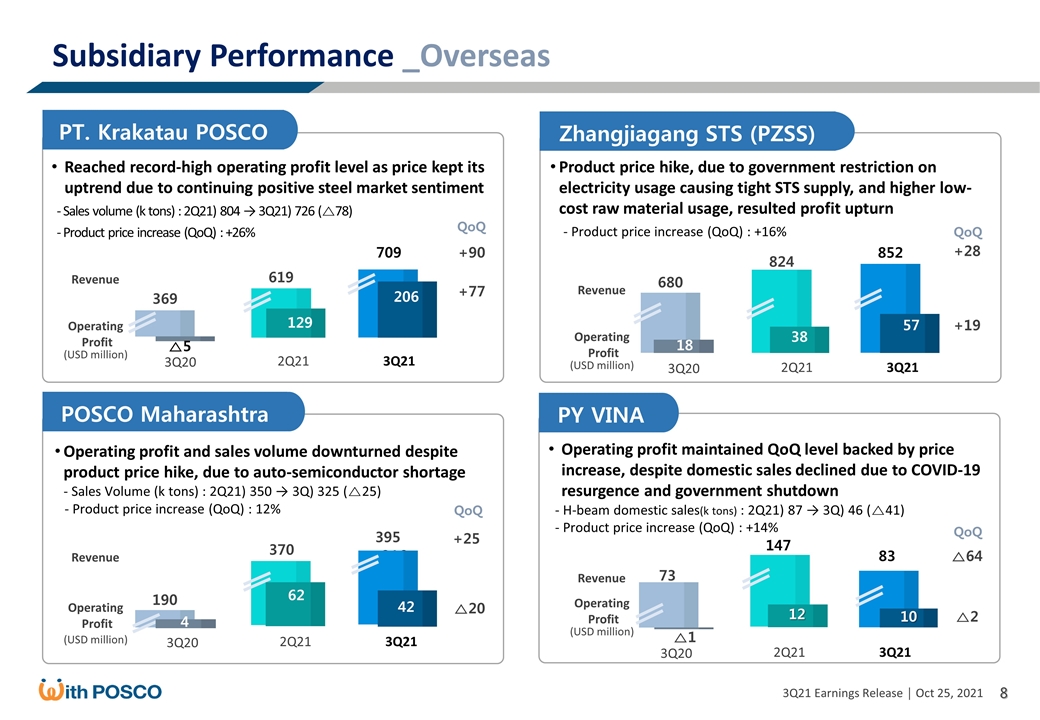

8 PT. Krakatau POSCO 709 369 619 Reached record-high operating profit level as price kept its uptrend due to continuing positive steel market sentiment - Sales volume (k tons) : 2Q21) 804 → 3Q21) 726 (△78) - Product price increase (QoQ) : +26% △5 POSCO Maharashtra +90 +77 QoQ 129 206 Operating profit maintained QoQ level backed by price increase, despite domestic sales declined due to COVID-19 resurgence and government shutdown - H-beam domestic sales(k tons) : 2Q21) 87 → 3Q) 46 (△41) - Product price increase (QoQ) : +14% PY VINA 73 △1 147 83 △64 △2 QoQ 12 10 824 852 680 Product price hike, due to government restriction on electricity usage causing tight STS supply, and higher low-cost raw material usage, resulted profit upturn - Product price increase (QoQ) : +16% +28 +19 QoQ 18 38 57 190 370 316 395 +25 △20 QoQ 62 42 Operating profit and sales volume downturned despite product price hike, due to auto-semiconductor shortage - Sales Volume (k tons) : 2Q21) 350 → 3Q) 325 (△25) - Product price increase (QoQ) : 12% 4 Subsidiary Performance _Overseas Zhangjiagang STS (PZSS) Revenue Operating Profit (USD million) Revenue Operating Profit (USD million) Revenue Operating Profit (USD million) Revenue Operating Profit (USD million) 3Q20 2Q21 3Q21 3Q20 2Q21 3Q21 3Q20 2Q21 3Q21 3Q20 2Q21 3Q21

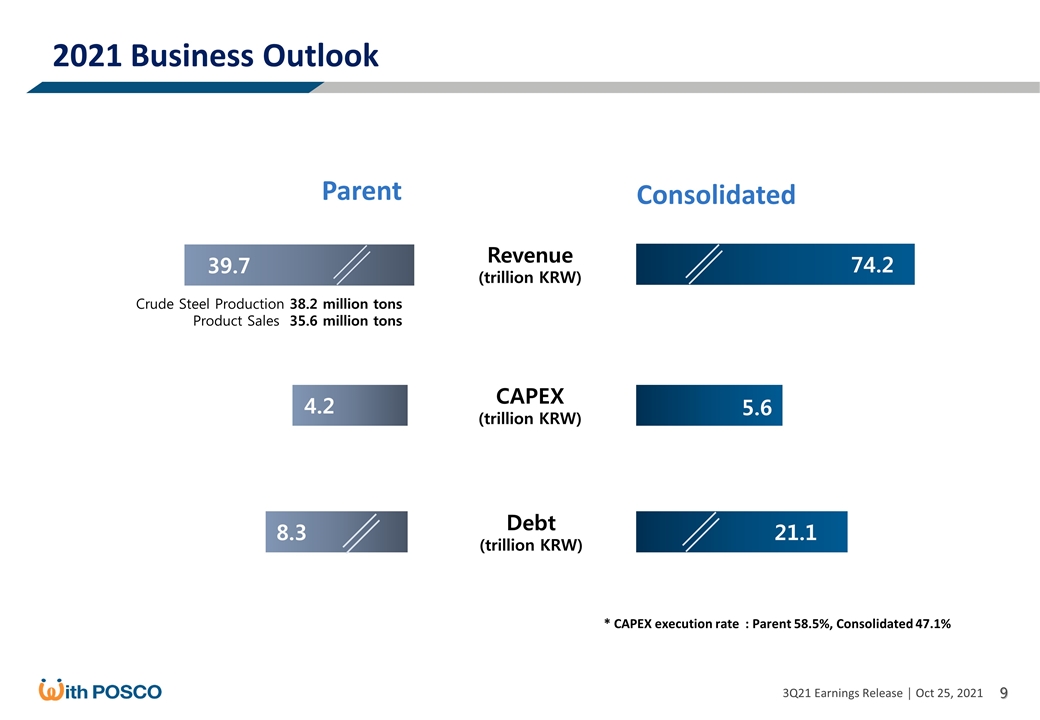

9 4.2 5.6 21.1 8.3 39.7 74.2 * CAPEX execution rate : Parent 58.5%, Consolidated 47.1% 2021 Business Outlook Parent Consolidated CAPEX (trillion KRW) Revenue (trillion KRW) Debt (trillion KRW) Crude Steel Production 38.2 million tons Product Sales 35.6 million tons

Summarized Financial Statements Appendix Summarized F/S_Parent (IS, BS) Summarized F/S_Consolidated (IS, BS)

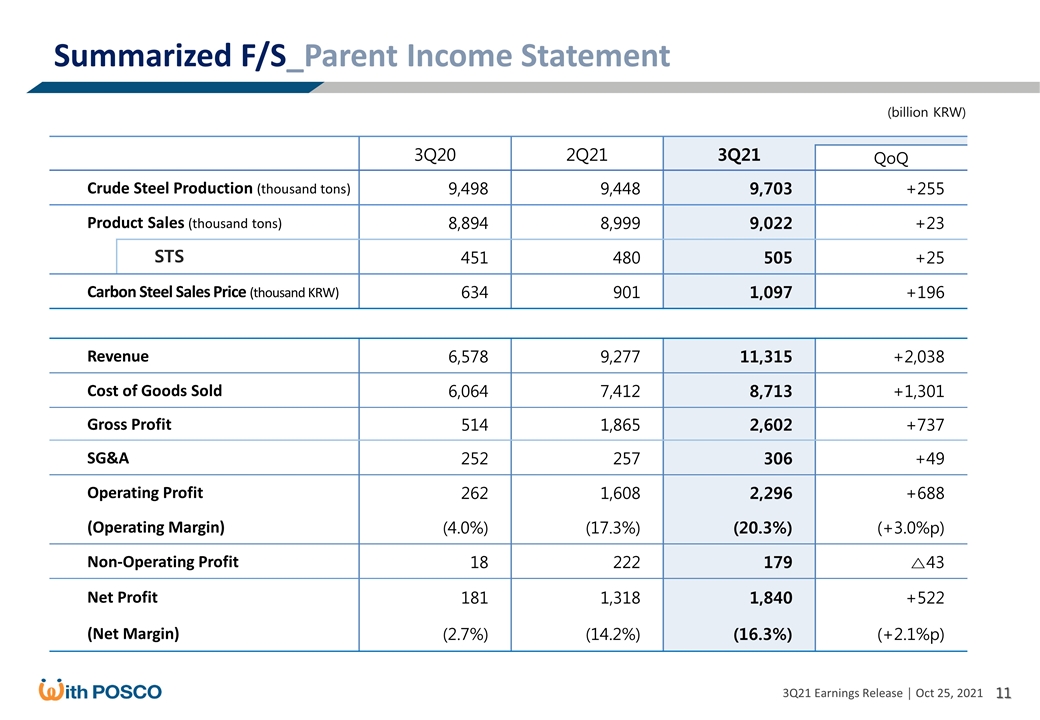

11 3Q20 2Q21 3Q21 QoQ Crude Steel Production (thousand tons) 9,498 9,448 9,703 +255 Product Sales (thousand tons) 8,894 8,999 9,022 +23 STS 451 480 505 +25 Carbon Steel Sales Price (thousand KRW) 634 901 1,097 +196 Revenue 6,578 9,277 11,315 +2,038 Cost of Goods Sold 6,064 7,412 8,713 +1,301 Gross Profit 514 1,865 2,602 +737 SG&A 252 257 306 +49 Operating Profit 262 1,608 2,296 +688 (Operating Margin) (4.0%) (17.3%) (20.3%) (+3.0%p) Non-Operating Profit 18 222 179 △43 Net Profit 181 1,318 1,840 +522 (Net Margin) (2.7%) (14.2%) (16.3%) (+2.1%p) Summarized F/S_Parent Income Statement (billion KRW)

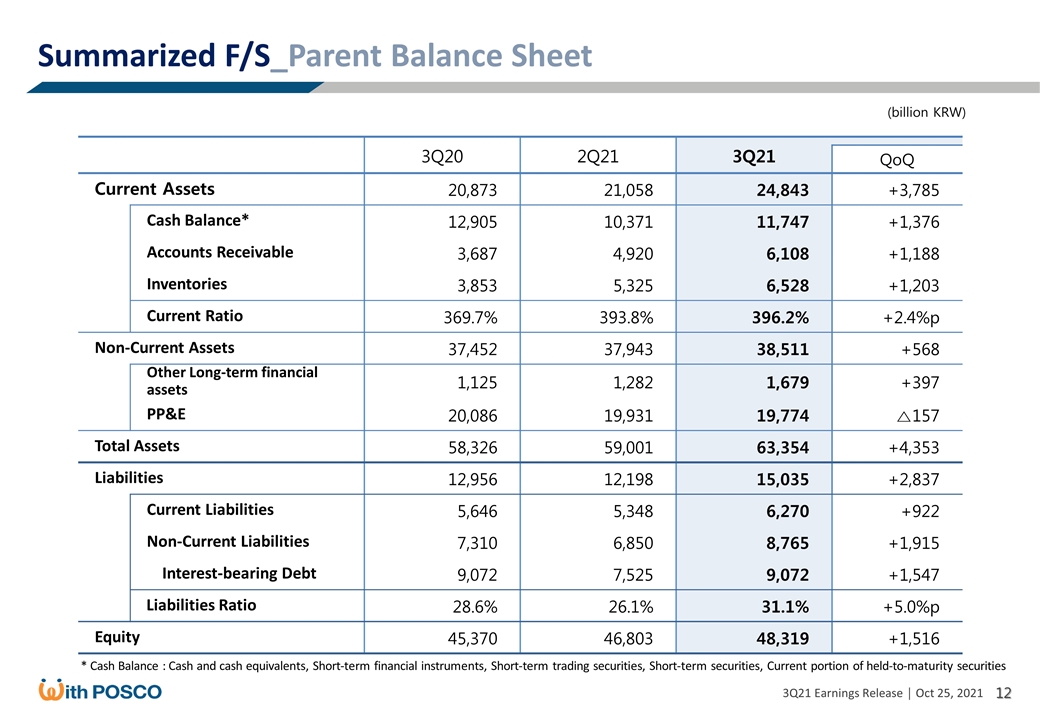

12 3Q20 2Q21 3Q21 QoQ Current Assets 20,873 21,058 24,843 +3,785 Cash Balance* 12,905 10,371 11,747 +1,376 Accounts Receivable 3,687 4,920 6,108 +1,188 Inventories 3,853 5,325 6,528 +1,203 Current Ratio 369.7% 393.8% 396.2% +2.4%p Non-Current Assets 37,452 37,943 38,511 +568 Other Long-term financial assets 1,125 1,282 1,679 +397 PP&E 20,086 19,931 19,774 △157 Total Assets 58,326 59,001 63,354 +4,353 Liabilities 12,956 12,198 15,035 +2,837 Current Liabilities 5,646 5,348 6,270 +922 Non-Current Liabilities 7,310 6,850 8,765 +1,915 Interest-bearing Debt 9,072 7,525 9,072 +1,547 Liabilities Ratio 28.6% 26.1% 31.1% +5.0%p Equity 45,370 46,803 48,319 +1,516 Summarized F/S_Parent Balance Sheet (billion KRW) * Cash Balance : Cash and cash equivalents, Short-term financial instruments, Short-term trading securities, Short-term securities, Current portion of held-to-maturity securities

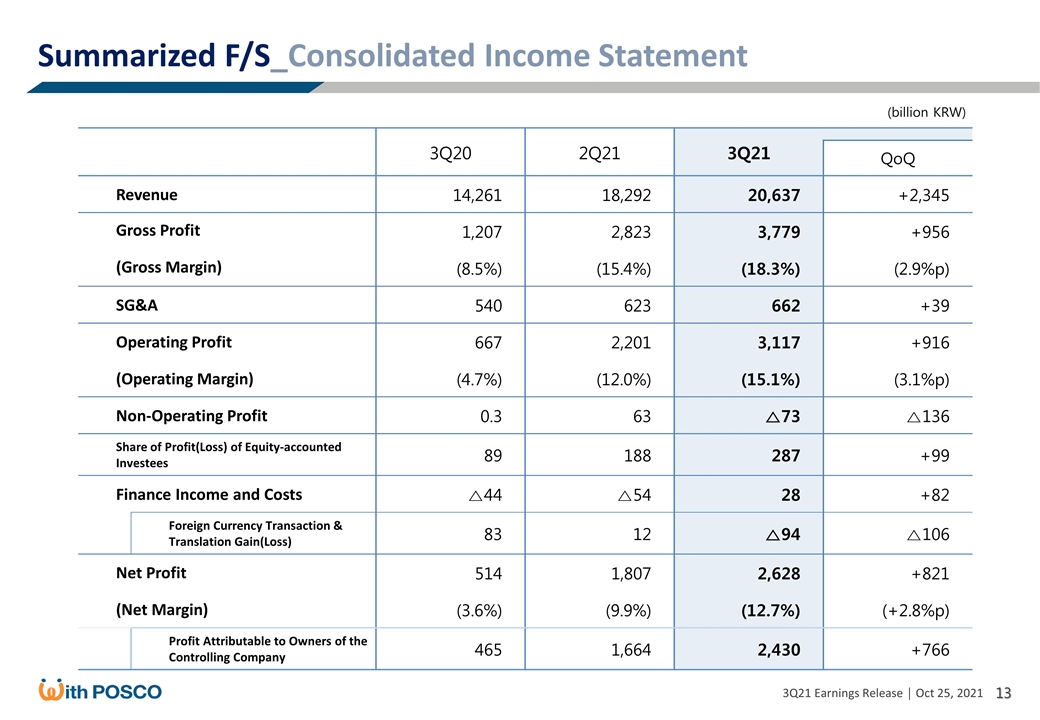

13 Summarized F/S_Consolidated Income Statement (billion KRW) 3Q20 2Q21 3Q21 QoQ Revenue 14,261 18,292 20,637 +2,345 Gross Profit 1,207 2,823 3,779 +956 (Gross Margin) (8.5%) (15.4%) (18.3%) (2.9%p) SG&A 540 623 662 +39 Operating Profit 667 2,201 3,117 +916 (Operating Margin) (4.7%) (12.0%) (15.1%) (3.1%p) Non-Operating Profit 0.3 63 △73 △136 Share of Profit(Loss) of Equity-accounted Investees 89 188 287 +99 Finance Income and Costs △44 △54 28 +82 Foreign Currency Transaction & Translation Gain(Loss) 83 12 △94 △106 Net Profit 514 1,807 2,628 +821 (Net Margin) (3.6%) (9.9%) (12.7%) (+2.8%p) Profit Attributable to Owners of the Controlling Company 465 1,664 2,430 +766

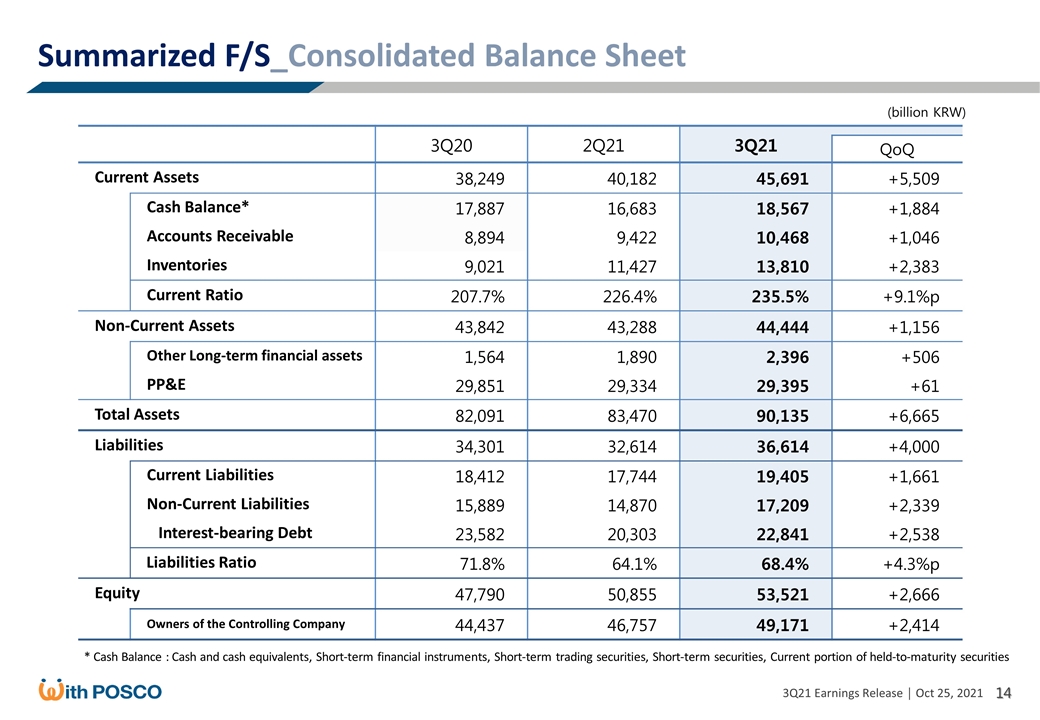

14 Summarized F/S_Consolidated Balance Sheet (billion KRW) 3Q20 2Q21 3Q21 QoQ Current Assets 38,249 40,182 45,691 +5,509 Cash Balance* 17,887 16,683 18,567 +1,884 Accounts Receivable 8,894 9,422 10,468 +1,046 Inventories 9,021 11,427 13,810 +2,383 Current Ratio 207.7% 226.4% 235.5% +9.1%p Non-Current Assets 43,842 43,288 44,444 +1,156 Other Long-term financial assets 1,564 1,890 2,396 +506 PP&E 29,851 29,334 29,395 +61 Total Assets 82,091 83,470 90,135 +6,665 Liabilities 34,301 32,614 36,614 +4,000 Current Liabilities 18,412 17,744 19,405 +1,661 Non-Current Liabilities 15,889 14,870 17,209 +2,339 Interest-bearing Debt 23,582 20,303 22,841 +2,538 Liabilities Ratio 71.8% 64.1% 68.4% +4.3%p Equity 47,790 50,855 53,521 +2,666 Owners of the Controlling Company 44,437 46,757 49,171 +2,414 * Cash Balance : Cash and cash equivalents, Short-term financial instruments, Short-term trading securities, Short-term securities, Current portion of held-to-maturity securities