- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCurrent report (foreign)

Filed: 27 Mar 23, 8:23am

Exhibit 99.1

BUSINESS REPORT

(From January 1, 2022 to December 31, 2022)

THIS IS AN ENGLISH TRANSLATION OF THE BUSINESS REPORT ORIGINALLY PREPARED IN THE KOREAN LANGUAGE (IN SUCH FORM AS REQUIRED BY THE KOREAN FINANCIAL SERVICES COMMISSION). THIS ENGLISH TRANSLATION IS NOT OFFICIAL AND IS PROVIDED FOR INFORMATION PURPOSES ONLY.

UNLESS EXPRESSLY STATED OTHERWISE, ALL INFORMATION CONTAINED HEREIN IS PRESENTED ON BOTH CONSOLIDATED AND NON-CONSOLIDATED BASIS IN ACCORDANCE WITH THE KOREAN-INTERNATIONAL FINANCIAL REPORTING STANDARDS (K-IFRS) WHICH DIFFER IN CERTAIN RESPECTS FROM GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN CERTAIN OTHER COUNTRIES, INCLUDING THE UNITED STATES. WE HAVE MADE NO ATTEMPT TO IDENTIFY OR QUANTIFY THE IMPACT OF THESE DIFFERENCES.

BUSINESS REPORT

(From January 1, 2022 to December 31, 2022)

| To: | Korean Financial Services Commission and Korea Exchange |

/s/ Chon, Jung-Son

Chon, Jung-Son

President and Representative Director

POSCO HOLDINGS INC.

POSCO Center, 440, Teheran-ro, Gangnam-gu, Seoul, 06194 Korea

Telephone: +82-2-3457-0114

/s/ Han, Young-Ah

Han, Young-Ah

Senior Vice President

POSCO HOLDINGS INC.

POSCO Center, 440, Teheran-ro, Gangnam-gu, Seoul, 06194 Korea

Telephone: +82-2-3457-0114

2

I. Overview | 4 | |||

II. Business | 12 | |||

III. Financial Statements | 43 | |||

| 47 | ||||

| ø | Independent auditors’ reports on both Consolidated and Separate financial statements were filed to the SEC respectively on March 14, 2023. |

| • | Report for consolidated financial statements : |

File/Film Number 0001193125-23-069565

| • | Report for separate financial statements : |

File/Film Number 0001193125-23-069571

3

1. Scope of Business

A. POSCO HOLDINGS INC. (the “Company”, Former POSCO)1)

1) Change of the company name : POSCO (the “Company”) approved the vertical Spin-off plan at the Extraordinary General Meeting of Shareholders as proposed on January 28, 2022 and therefore, the name of the company has changed from ‘POSCO’ to ‘POSCO HODLINGS INC.’ as of March 2, 2022.

The Company’s business scope is as follows :

Before the vertical Spin-off (Beginning of 2022) | After the vertical Spin-off (As of the date of submission) | |

| (1) To manufacture, market, promote, sell and distribute iron, steel and rolled products; | (1) To engage in holding business of controlling the business of, and guiding, organizing and improving the management of, subsidiaries by acquiring and owning the shares or ownership interests in subsidiaries (including sub-subsidiaries and companies controlled by such sub-subsidiaries; collectively “subsidiaries”); | |

| (2) To engage in harbor loading and unloading, transportation and warehousing businesses; | ||

| (3) To engage in the management of professional athletic organizations; | ||

| (4) To engage in the supply of gas and power generation as well as in the distribution business thereof and in the resources development business; | (2) To engage in the management and licensing of intellectual property rights including brands and trademarks; | |

| (5) To engage in leasing of real estate and distribution businesses; | (3) To engage in the investment related to start-up assistance and new technology; | |

| (6) To engage in the supply of district heating business; | (4) To engage in market research, management advisory and consulting services; | |

| (7) To engage in marine transportation, processing and sales of minerals within or outside of Korea; | (5) To engage in technology research and commissioned services; | |

| (8) To engage in educational service and other services related to business; | (6) To engage in matters entrusted by subsidiaries to assist the subsidiaries’ businesses; | |

| (9) To engage in manufacture, process and sale of non-ferrous metal; | (7) To engage in the supply of gas such as hydrogen and resources development business; | |

| (10) To engage in technology license sales and engineering business; and | (8) To engage in leasing of real estate and distribution businesses; and | |

| (11) To engage in all other conducts, activities or businesses which are related, directly or indirectly, to the attainment and continuation of the foregoing purposes | (9) To engage in all other conducts, activities or businesses which are related, directly or indirectly, to the attainment and continuation of the foregoing purposes. | |

4

2. Business Organization

A. Highlights of the Company’s Business Organization

(1) Location of the Headquarters

Before the vertical Spin-off (Beginning of 2022) | After the vertical Spin-off (As of the date of submission) | |||

Name | POSCO | POSCO HOLDINGS INC. | ||

| Location of the Headquarters | 6261 Donghaean-ro (Goedong-dong), Nam-gu, Pohang-si, Gyeongsangbuk -do, Korea | POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 06194 |

(2) Steel Works and Offices

Before the vertical Spin-off (Beginning of 2022) | After the vertical Spin-off (As of the date of submission) | |||

Date | POSCO | POSCO HOLDINGS INC. | ||

March 2, 2022 | (a) Pohang Steel Works: 6262 Donghaean-ro (Dongchon-dong), Nam-gu, Pohang-si, Gyeongsangbuk-do, Korea

(b) Gwangyang Steel Works: 20-26 Pokposarang-gil (Geumho-dong), Gwangyang-si, Jeollanam-do, Korea

(c) Seoul Office: POSCO Center, 440 Teheran-ro (Daechi-dong), Gangnam-gu, Seoul, Korea

(d) Overseas Offices: In order to support international businesses, the Company operates five overseas offices as follows: United Arab Emirates(Dubai), Brazil(Rio de Janeiro), Argentina(Jujuy), European Union(Germany), and Australia(Perth). | POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 06194 |

5

(3) Major Changes in the Board of Directors

Date of Change | Type of General | Appointment | Expiration of Term | |||||

New | Re-appointment | |||||||

| March 9, 2018 | Ordinary | — | Representative Director Oh, In-Hwan | — | ||||

| — | Representative Director Chang, In-Hwa | — | ||||||

| — | Inside Director Yu, Seong | — | ||||||

Inside Director Chon, Jung-Son | — | — | ||||||

| — | — | Representative Director Choi, Jeong-Woo | ||||||

Outside Director Kim, Sung-Jin | — | — | ||||||

| — | Outside Director Bahk, Byong-Won | — | ||||||

| — | Outside Director Kim, Joo-Hyun | — | ||||||

| — | — | Outside Director Shin, Chae-Chol | ||||||

| July 27, 2018 | Extraordinary | Representative Director Choi, Jeong-Woo | — | — | ||||

| — | — | Representative Director Kwon, Oh-Joon | ||||||

| March 15, 2019 | Ordinary | — | Representative Director Chang, In-Hwa | — | ||||

| — | Inside Director Chon, Jung-Son | — | ||||||

Inside Director Kim, Hag-Dong | — | — | ||||||

Inside Director Jeong, Tak | — | — | ||||||

| — | — | Representative Director Oh, In-Hwan | ||||||

| — | — | Inside Director Yu, Seong | ||||||

Outside Director Pahk, Heui-Jae | — | — | ||||||

| — | Outside Director Kim, Shin-Bae | — | ||||||

| — | Outside Director Chung, Moon-Ki | — | ||||||

| — | — | Outside Director Lee, Myoung-Woo | ||||||

6

Date of Change | Type of General | Appointment | Expiration of Term | |||||

New | Re-appointment | |||||||

| March 27, 2020 | Ordinary | — | Representative Director Chang, In-Hwa | — | ||||

| — | Inside Director Chon, Jung-Son | — | ||||||

| — | Inside Director Kim, Hag-Dong | — | ||||||

| — | Inside Director Jeong, Tak | — | ||||||

| — | Outside Director Chang, Seung-Wha | — | ||||||

| March 12, 2021 | Ordinary | — | Representative Director Choi, Jeong- Woo | — | ||||

| — | Representative Director Kim, Hag-Dong | — | ||||||

| — | Representative Director Chon, Jung-Son | — | ||||||

| — | Inside Director Jeong, Tak | — | ||||||

| Inside Director Chung, Chang-Hwa | — | — | ||||||

| — | — | Inside Director Chang, In-Hwa | ||||||

| — | Outside Director Kim, Sung-Jin * | — | ||||||

Outside Director Yoo, Young-Sook | — | — | ||||||

Outside Director Kwon, Tae-Kyun | — | — | ||||||

| — | — | Outside Director Kim, Joo-Hyun | ||||||

| — | — | �� | Outside Director Bahk, Byong-Won | |||||

| March 18, 2022 | Ordinary | — | Representative Director Chon, Jung-Son | — | ||||

| — | Inside Director Chung, Chang-Hwa | — | ||||||

Inside Director Yoo, Byeong-Og | — | — | ||||||

| — | — | Representative Director Kim, Hag-Dong | ||||||

| — | — | Inside Director Jeong, Tak | ||||||

Non-standing Director Kim, Hag-Dong | — | — | ||||||

| — | Outside Director Pahk, Heui-Jae | |||||||

Outside Director Yoo, Jin-Nyong** | — | |||||||

Outside Director Sohn, Sung-Kyu** | — | |||||||

| — | Outside Director Kim, Shin-Bae | |||||||

| — | Outside Director Chung, Moon-Ki | |||||||

7

| * | The re-appointed Outside Director Kim, Sung-Jin was elected as an Outside Director to become an Audit Committee Member |

| ** | The Outside Director Yoo, Jin-Nyong and Sohn, Sung-Kyu were appointed as Audit Committee Member at the General Meeting of Shareholders held on March 18, 2022. |

(4) Changes of the Major Shareholders of POSCO HOLDINGS INC.

Since January 30, 2007, National Pension Service holds the largest number of common shares of POSCO HOLDINGS INC.

| (a) | From SK Telecom to National Pension Service |

| (b) | Date of Change: January 30, 2007 |

For further reference, please refer to the public disclosures of changes in common shares of the largest shareholder on Financial Supervisory Service website (http://dart.fss.or.kr)

B. POSCO HOLDINGS’ Merger, Acquisition and Handover of Businesses

| (1) | January 2019 : Small scale merger of POSCO Processing & Service Co., Ltd into POSCO |

| (2) | September 2019 : Handover of business right of LNG terminal to POSCO ENERGY |

| (3) | September 2019 : Small scale merger of By-Product Gas Generation Business from POSCO ENERGY into POSCO after spin-off |

| (4) | January 2022 : Handover of logistic related business to POSCO Terminal |

| (5) | March 2022 : Completion of Vertical Spin-off |

Classification | Company Name | Business Unit | ||

| Surviving Company | POSCO HOLDINGS INC. | Development of future business portfolios and management of group’s businesses | ||

| New Company | POSCO | Production and sale of steel | ||

8

3. Changes in Share Capital

There has been no changes in share capital in the last 5 years.

| (Unit : Share, KRW/Share, In millions of KRW) | ||||||||||||||

Type | Details | As of December 31, 2022 | As of December 31, 2021 | As of December 31, 2020 | ||||||||||

Common Stock | Total number of issued shares | 84,571,230 | 87,186,835 | 87,186,835 | ||||||||||

| Par value | 5,000 | 5,000 | 5,000 | |||||||||||

| Share capital | 482,403 | 482,403 | 482,403 | |||||||||||

Preferred Stock | Total number of issued shares | — | — | — | ||||||||||

| Par value | — | — | — | |||||||||||

| Share capital | — | — | — | |||||||||||

Others | Total number of issued shares | — | — | — | ||||||||||

| Par value | — | — | — | |||||||||||

| Share capital | — | — | — | |||||||||||

Sum | Share capital | 482,403 | 482,403 | 482,403 | ||||||||||

| ø | Due to the decision to cancel treasury shares by the resolution of the board of directors on August 12, 2022, the total number of shares issued by the company is decreased from 87,186,835 to 84,571,230, and there will be no change in capital. |

4. Other Information Regarding Shares

A. Total Number of Shares

| (As of December 31, 2022) | ||

Authorized Shares | Issued Shares | |

200,000,000 | 84,571,230 |

| ø | Currency of the Republic of Korea is Korean Won (“KRW”). |

| ø | Par Value: KRW 5,000 per share |

| ø | Due to the decision to cancel treasury shares by the resolution of the board of directors on August 12, 2022, the total number of shares issued by the company will decrease from 87,186,835 to 84,571,230 |

9

B. Treasury Stock Acquisition and Disposal

| (As of December 31, 2022) | ||||||||||||||||||||||||||

Method of Purchase | Type | Beginning Balance | Increased | Decreased | Cancelled | Ending Balance | remark | |||||||||||||||||||

Direct | Common Stock | 7,071,194 | — | 223,605 | 1,441,410- | 5,406,179 | 1 | ), 2) | ||||||||||||||||||

Trust Contract | 4,490,069 | — | — | 1,174,195 | 3,315,874 | |||||||||||||||||||||

Total | 11,561,263 | — | 223,605 | 2,615,605 | 8,722,053 | 3 | ) | |||||||||||||||||||

| 1) | The company has disposed of 223,605 treasury stocks (0.26% of total number of issued shares) to the employee stock ownership association on February 25, 2022. |

| 2) | In order to improve shareholder value, the company has cancelled 2,615,605 shares which accounts for 3.00% of the total number of issued shares on August 22, 2022. |

| 3) | Aforementioned number of treasury stocks includes 3,128,714 treasury stocks which are subject to the exchange of exchangeable bonds issued by the company on September 1, 2021. The treasury stock subject to this exchange is finalized at the time the exchange right is exercised and is currently deposited with the Korea Securities Depository. |

5. Voting Rights

| (As of December 31, 2022) | ||||||

Classification | Number of Common Shares | Remarks | ||||

(1) Number of Issued Shares | 84,571,230 | — | ||||

(2) Shares without Voting Rights | 8,722,053 | Treasury stock | ||||

(3) Shares with Voting Rights | 75,849,177 | — | ||||

| * | The above “(3) Shares with Voting Rights” is the number of shares based on holding voting rights as of December 31, 2022. |

6. Earnings and Dividends

| (In millions of KRW) | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

(Consolidated) Profit* | 3,144,087 | 6,617,239 | 1,602,148 | |||||||||

(Separate) Profit | -467,852 | 5,181,227 | 965,863 | |||||||||

Earnings per Share (Consolidated, KRW) | 41,456 | 87,330 | 20,165 | |||||||||

Cash Dividend Paid | 910,190 | 1,285,635 | 620,287 | |||||||||

Pay-out Ratio (Consolidated, %) | 28.9 | 19.4 | 38.7 | |||||||||

Dividend per Share (KRW) | 12,000 | 17,000 | 8,000 | |||||||||

Dividend Yield (%) | 4.1 | 6.0 | 3.0 | |||||||||

| * | (Consolidated) Profit : Profit attributable to owners of the controlling company |

| ** | Earnings per Share is based on consolidated financial statement prepared in K-IFRS |

| *** | The Company has paid quarterly dividend for 1Q, 2Q and 3Q of 2022, and year-end cash dividend will be approved |

10

<Cash Dividends includes quarterly dividends>

| • | 1Q, 2022 : Cash Dividend Paid : KRW 303,397 million Dividend per Share : KRW 4,000 |

| • | 2Q, 2022 : Cash Dividend Paid : KRW 303,397 million Dividend per Share : KRW 4,000 |

| • | 3Q, 2022 : Cash Dividend Paid : KRW 151,698 million Dividend per Share : KRW 2,000 |

7. Stock Prices and Trading Volumes

The stock prices and trading volumes of POSCO HOLDINGS INC. for the last 6 months are as follows.

A. The Korean Stock Market

| (KRW/share, In thousands of shares) | ||||||||||||||||||||||||||

| July 2022 | August 2022 | September 2022 | October 2022 | November 2022 | December 2022 | |||||||||||||||||||||

Common share | Highest Price | 242,000 | 259,500 | 253,000 | 255,000 | 299,500 | 301,000 | |||||||||||||||||||

Lowest Price | 223,000 | 233,000 | 211,000 | 222,500 | 254,500 | 276,500 | ||||||||||||||||||||

Average Price | 231,571 | 248,045 | 236,825 | 240,474 | 283,905 | 287,333 | ||||||||||||||||||||

Trading volume | Daily highest | 343 | 469 | 539 | 613 | 920 | 606 | |||||||||||||||||||

Daily lowest | 104 | 181 | 197 | 183 | 224 | 222 | ||||||||||||||||||||

| Monthly | 5,123 | 6,692 | 7,406 | 7,554 | 10,986 | 388 | ||||||||||||||||||||

B. New York Stock Exchange

| (USD/ADS*, In thousands of ADS*) | ||||||||||||||||||||||||||

| July 2022 | August 2022 | September 2022 | October 2022 | November 2022 | December 2022 | |||||||||||||||||||||

American Depositary Share (ADS) | Highest Price | 46.9 | 50.2 | 46.1 | 44.9 | 57.1 | 57.0 | |||||||||||||||||||

Lowest Price | 42.1 | 44.8 | 36.6 | 38.3 | 43.9 | 52.9 | ||||||||||||||||||||

Average Price | 44.4 | 47.0 | 42.3 | 41.7 | 52 | 55.0 | ||||||||||||||||||||

Trading volume | Daily highest | 250.8 | 601.7 | 483.1 | 710 | 526 | 249 | |||||||||||||||||||

Daily lowest | 119.9 | 76.2 | 192.0 | 227 | 66 | 102 | ||||||||||||||||||||

| Monthly | 3,535 | 4,873 | 6,892 | 6,536 | 5,635 | 3,865 | ||||||||||||||||||||

| * | ADS : One American Depositary Share representing one-fourth of a Common Share |

11

1. Overview

A. Classification of Business

We classify our business into four segments:

Steel, Green Infrastructure, Green Materials and Energy, and Others.

Green Infrastructure is subdivided into Construction, Trading, and Energy and others.

B. Summary of Financial Status of Segment

| (In millions of KRW) | ||||||||||||||||||||||||

Business Segment | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Sales | Operating Income (Loss) | Sales | Operating Income (Loss) | Sales | Operating Income (Loss) | |||||||||||||||||||

Steel | 44,546,966 | 3,413,915 | 41,093,405 | 8,123,117 | 28,892,877 | 1,372,852 | ||||||||||||||||||

Green Infrastructure (Construction) | 7,667,696 | 299,746 | 6,398,366 | 424,085 | 6,576,170 | 385,048 | ||||||||||||||||||

Green Infrastructure (Trading) | 25,955,458 | 793,454 | 25,065,608 | 488,884 | 19,345,222 | 394,954 | ||||||||||||||||||

Green Infrastructure (Energy and others) | 3,998,959 | 275,412 | 2,061,277 | 96,968 | 1,739,469 | 198,192 | ||||||||||||||||||

Green Materials and Energy | 2,451,785 | 107,216 | 1,241,957 | 69,510 | 771,575 | 22,818 | ||||||||||||||||||

Others | 129,340 | -39,690 | 471,732 | 35,525 | 467,484 | 29,171 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 84,750,204 | 4,850,053 | 76,332,345 | 9,238,089 | 57,792,796 | 2,403,035 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

2. Business Status of Segments

A. Steel

There are 77 consolidated companies in the steel segment, including POSCO and POSCO Steeleon, and overseas companies including PT.Krakatau POSCO in Indonesia, POSCO (Zhangjiagang) Stainless Steel Co., Ltd. in China and overseas processing centers.

12

∎ POSCO

(1) Summary of Business

POSCO produces steel materials such as hot rolled, cold rolled and stainless steel at Pohang Steelworks and Gwangyang Steelworks which is the largest steel mill in the world.

The steel industry is a key industry that has taken pivotal roles in the national economic development since the 1970s. Steel is used as a basic material in various manufacturing fields such as automobiles, shipbuilding, home appliances, and construction, and has a close connection with the front industry due to its characteristics.

Global crude steel production in 2022 fell 4.3% year-on-year to 1,832 million tons due to retrenchment of global capital flows affected by prolonged war between Russia and Ukraine and China’s slow economic growth.

Global Crude Steel Production

| (Millions of Tons, %) | ||||||||||||

| Crude Steel Production | 2020 | 2021 | 2022 | |||||||||

Global | 1,864 | 1,951 | 1,832 | |||||||||

Korea | 67 | 71 | 66 | |||||||||

(Ratio) | (3.6 | %) | (3.6 | %) | (3.6 | %) | ||||||

| ø | Source: World Steel Association (www.worldsteel.org) |

The steel industry is affected by the business cycle and the ups and downs of the demand industry.

Therefore, steel demand is not only related to trend of market economy, but also to situation of demand industries like shipbuilding, automobiles, home appliances, constructions and etc.

The steel industry is a capital and technology-intensive industry that requires enormous initial investments. Steel companies are focusing on reducing production costs and securing price competitiveness.

All iron ore and coking coal that are the main raw materials for steel manufacturing, are imported. In order to secure stable raw materials sourcing and consider company’s new growth strategy and ESG policy, POSCO maintains an appropriate ratio of investment in raw material development by acquiring or selling shares of overseas raw material companies.

POSCO aims to maintain its competitive edge in the domestic market by strengthening long-term partnerships with key and leading customers and responding to global protectionism based on comprehensive response systems such as marketing, R&D, technology services, and production. In addition, we are expanding steel processing centers to meet the needs of global front industries such as automobiles, shipbuilding, home appliances, and construction, while strengthening our global sales network by operating steel production bases Indonesia(upstream) and India(cold-rolling mills). Although the supply of some products was temporarily disrupted due to the flood damage in Pohang in 2022, production competitiveness is now restored due to demand response through Gwangyang Steelworks and sequential facility recovery.

13

The company plans to upgrade its customer and market structure by expanding its high value-added World Top Premium products, while responding to customers’ diverse needs by launching an eco-friendly product line Greenate and developing hydrogen-reduced steel HyREX technology in line with the global low-carbon trend.

In the steel industry, automobiles, shipbuilding, and construction are the main demand industries, and steel products are used as raw materials for these demand industries. In terms of sales, the proportion of domestic sale is 60% of total sales and export sales are around 40%, and by export region, the proportion of Southeast Asia, China, and Japan is high. POSCO maintains order based production and sales system, and to secure stable sales, the proportion of direct sales to customers in domestic sales is maintained at about 60%.

POSCO continues to strive to strengthen its competitiveness in the midst of rapidly changing business environments such as the transition to a low-carbon eco-friendly era, accelerating technological innovation, and strengthening ESG management. The company’s competitive advantages include followings:

First, POSCO is promoting great transformation from current steelmaking process to a low-carbon, eco-friendly process.

Second, POSCO will complete establishing ‘intelligent Smart mill’

Third, POSCO will upgrade portfolio for ‘premium product competitiveness’. In order to proactively respond to the increasing customer demand of eco-friendly products and expand the development of high-end products and Green transition solutions, POSCO launched three green steel brands that are : INNOVILT, e Autopos, and Greenable. In November 2022, Greenate which is a masterbrand representing POSCO’s “net-zero carbon 2050 was newly launched. Greenate is a brand that encompasses all departmental efforts and products for producing low-carbon, eco-friendly steel in the process of converting to eco-friendly secondary battery materials and hydrogen-reduced steel, as well as the three major eco-friendly steel brands represented by e Autopos, INNOVILT, and Greenable. POSCO Group plans to systematically communicate its efforts and achievements to achieve 2050 carbon neutrality internally and externally with Greenate.

Fourth, POSCO has been strengthening ESG oriented management. POSCO, As an unlisted company, has no obligation to establish special committee under the board of directors, but it has not only established an ESG committee to strengthen its external communication with interested parties but also established an audit committee to support ESG governance.

(2) Market Share

| (Millions of Tons, %) | ||||||||

Category | 2022 | |||||||

| Production | Market share | |||||||

Crude Steel Production | 65.9 | 100 | % | |||||

POSCO | 34.2 | 51.9 | % | |||||

Others | 31.7 | 48.1 | % | |||||

| ø | Source: World Steel Association (www.worldsteel.org) |

14

∎ POSCO STEELEON

POSCO Steeleon provides differentiated value through technology development and new market development with design/solution provision in both domestic and overseas surface treatment steel market. In addition, POSCO Steeleon is strengthening sales system of WTP (World Top Premium) products through joint marketing with POSCO. In line with POSCO Group’s strategy that strengthens the sales base for high-end steel materials for construction use, POSCO Steeleon is striving to strengthen its competitiveness in the high-end construction/exterior materials through research and development based on customers.

∎ POSCO M-TECH

(1) Summary of Business

POSCO M-TECH is a specialized supplier of steel products packaging and steel supplementary materials such as aluminum deoxidizers which is needed to remove oversaturated oxygen in steelmaking process. In case of steel products packaging, POSCO M-TECH continuously develops packaging machines and materials. The cost competitiveness of its steel packaging business has strengthened by reducing packaging materials and developing technology to improve packaging quality. The packaging facility business expanded its business area to external steel companies, and continued to resolve safety risks by upgrading packaging automation facility technology and developing new technologies.

(2) Business Areas

| Business Areas | Major Goods and Services | Major Customer | ||

| Steel raw material business | Aluminum deoxidizer pellets, mini pellets, ingots and etc. | POSCO | ||

| Steel product packaging business | Steel packaging service, maintenance of packaging facilities and etc. | |||

| Engineering business | Steel Packaging Engineering, Mechanical Equipment and etc. | |||

| Consignment operation business | Ferromanangan factory, Copper Plate Material factory and etc. |

(3) Market Share

| (Tons) | ||||||||||||||||||||||||

| Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Sales Volume | Market share | Sales Volume | Market share | Sales Volume | Market share | |||||||||||||||||||

POSCO M-TECH | 31.245 | 44.0 | % | 34,846 | 49.0 | % | 31,044 | 53.0 | % | |||||||||||||||

| ø | It is difficult to calculate exact market share of Aluminum deoxidizers as total production and sales volume of the domestic market are not counted. |

15

B. Green Infrastructure Business

There are 76 subsidiaries on consolidated basis including trading sector (36 subsidiaries including POSCO International), construction sector (26 subsidiaries including POSCO E&C) and energy sector (14 subsidiaries including POSCO Energy).

∎ POSCO INTERNATIONAL

(1) Market Share

| (Millions of US Dollars) | ||||||||||||

Category | 2022 | 2021 | Growth Rate | |||||||||

All Trading Companies in Korea | �� | 683,750 | 644,400 | 6.11 | % | |||||||

POSCO International Corp. | 10,019 | 8,732 | 14.74 | % | ||||||||

| ø | Source: Korea International Trade Association |

(2) Summary of Businesses

While focusing on trading which is its main business, POSCO International is engaged in resource development, production processing, and infrastructure development and operation.

POSCO International and its consolidated subsidiaries engage in three major businesses: trading, energy and investment(food resources, motor core for EV, mineral resource development and etc). In addition, POSCO International maintains a global network of over 80 subsidiaries and branches in major overseas regions.

In case of trading business, POSCO International has not only been securing stable supply line in steel business but also been actively developing and expanding new businesses such as secondary battery business, agro-commodities, LNG trading, and industrial materials based on the know-how accumulated over a long period of time in the traditional trading business and through its vast overseas networks. POSCO International is also carrying out agro-commodities trading and food resource development projects in order to secure sustainable future food resources. As a result, the company has diversified its sales outlets in Korea, China, Southeast Asia, and MENA, while expanding food import volume.

In terms of energy business, POSCO International conducts businesses such as natural gas and crude oil development, LNG infrastructure, natural resources and power generation infrastructure.

In the LNG trading area, POSCO International started LNG trading for time in Korea in 2017. In May 2022, POSCO International signed long-term LNG sales and Purchase Agreement. Under the deal, POSCO International has agreed to purchase approximately 0.4 million tonnes per annum (MTPA) of LNG from Cheniere for a term of 20 years. In addition, POSCO International plans to take the lead in developing the business within the entire LNG value chain in connection with the group’s gas business strategy.

In regard to investment business, POSCO International mainly focus on food resource business in which developing palm farm in Indonesia, Rice Processing Complex in Myanmar, grain export terminal in Uzbekistan , and other food value chain in North America. Together with POSCO Mobility Solution, POSCO International started engaging into motor core business for EV. It is expected to expand motor core production to 7 million by 2030. In addition, the company invests in mineral resource development in Australia and power generation infrastructure overseas. To be specific, POSCO International has been participating in the Ambatobi Nickel Mine Project, the world’s third-largest nickel mine in the mineral resource development project with a 6.1% stake since 2006. In addition, POSCO International is searching for new opportunities in four new growth businesses areas which include smart farm, green materials, green mobility and hydrogen.

16

∎ POSCO E&C

POSCO E&C engages in primarily 3 businesses: plant, civil engineering(infrastructure) and construction.

Plant business is the construction of integrated steel mills, EPC projects and industrial plants. Plant business used to focus on small investment of existing facilities but there will be more new investments in Electric furnace and hydrogen reduction process followed by global green trend. As nuclear power generation is getting attention again, the development of small nuclear power plants is expected to become active.

The civil engineering business is about constructing expressways, railroads and bridges. With the government’s Green New Deal policy, the infrastructure industry is expected to increase investment in eco-friendly facilities such as water treatment and waste treatment, and investment in roads and railways is expected to increase as well. It is expected that more favorable overseas construction market would be created for the domestic construction companies as demand of infrastructure development is increasing in Asia, Middle East, Americas as well as in Europe.

Housing demand is shrinking after a sharp rate hike, and number of unsold households are increasing around areas where supply has been concentrated. Recently, concerns have been growing that new orders will shrink as funding has been suspended due to the financial market crunch. In addition, disputes between contractors/union and construction companies are increasing due to worsening profitability due to rising construction costs. This trend is expected to continue for a considerable period of time, and only profitable businesses would be carried forward in the future. In terms of overseas market, domestic construction companies have entered Southeast Asia, where urbanization is actively underway, but for now, construction companies’ risk management is expected to be the top priority due to growing economic uncertainties around the world.

∎ POSCO ENERGY

(1) Market Share

| • | Power generation business : POSCO ENERGY’s power generation facility capacity is about 2.3% of the total power generation facilities in Korea |

* Source: Power Exchange as of the end of December, 2022

| • | Gas business : POSCO ENERGY’s LNG terminal capacity accounts for about 5.2% of domestic terminals. |

* Source: POSCO ENERGY’s Estimate Data as of the end of December, 2022

| • | Fuel cell business : POSCO ENERGY’s supply of fuel cell power generation facilities accounts for about 22.0% of all fuel cell facilities in Korea. |

* Source: POSCO ENERGY’s Estimate Data as of the end of December, 2022

* Statistics on the supply of renewable energy by the Korea Energy Management Corporation as of the end of 2021

17

(2) Summary of Businesses

POSCO ENERGY started its commercial operation in February, 1972 as the only privately-owned power plant in Korea. Since the early 1990’s, POSCO ENERGY continuously remodeled and built additional power plants meeting the increased demand for electricity in Korea. POSCO ENERGY acquired the LNG terminal business from POSCO in 2019, providing an opportunity to expand the LNG value chain. The LNG terminal business operates stable business structure through businesses such as tank rental, small scale LNG business, and ship trial run. POSCO ENERGY plans to secure stable profit base through the expansion of the LNG terminal in the future and grow into a general energy company focused on gas and power. Furthermore, POSCO ENERGY has been running businesses such as fuel cell facility installation, long-term O&M service provision, and fuel cell power plant operation after it has established fuel cell business division in 2007. POSCO Energy is strengthening its expertise and enhancing its management efficiency through Korea Fuel Cell Co., Ltd., which was established in November 2019.

∎ POSCO ICT

POSCO ICT has both IT and OT technologies and has secured competitiveness in its manufacturing-based business on the convergence of IT and OT technologies. When domestic ICT market size is estimated to be KRW 35 trillion, ICT is expected to take about 3.5% of domestic ICT market share (ICT market for local corporates only). POSCO ICT will continue to adopt POSCO Group’s capabilities in digital transformation, logistics automation, and industrial robot system engineering businesses to create new success stories for sustainable growth even in business environments lots of uncertainties. Based on POSCO Group’s One IT strategy, POSCO ICT is expecting to add value by developing IT infrastructure and strengthening the competitiveness of Smart Factory business.

The experiences operating POSCO’s Smart Factory based on big data, IoT and AI-based platform, led the company to have a strength in the area of continuous and automation process. With its experiences in POSCO’s smart factory construction, POSCO ICT is planning to support the mass production system of secondary battery materials such as lithium and nickel. In addition, POSCO ICT will expand the logistics automation business market with the successful completion of the logistics business in progress. While diversifying logistic business sectors POSCO ICT will actively participate new airport project and contribute to the groups’ advancement of the group’s logistic system.

18

C. Green Materials and Energy

∎ POSCO CHEMICAL

POSCO CHEMICAL operates mainly 3 businesses: refractory, quicklime & chemical and energy material.

Refractories maintain their chemical properties and strength even at high temperatures making them indispensable materials for industrial facilities including the furnaces in steelworks and petrochemical plants. In the refractory business, POSCO CHEMICAL produces and maintains refractories. In order to keep price competitiveness in the domestic market, the company has expanded its business to China. In the quicklime & chemical business, POSCO CHEMICAL is currently doing consignment operation of cokes plants where purify coke oven gas (COG) in Pohang and Gwangyang. With the chemical products generated in during the purification process, POSCO CHEMICAL operates cokes business. In addition, it produces quicklime and chemical products such as coal tar and light oil. In the energy material business, POSCO CHEMICAL provides cathode and anode materials which are the main components for secondary battery: cathode, anode, electrolyte and separation membrane. It is planned to expand its production of natural graphite anode materials from 61 thousand ton/year in 2021 to 106 thousand ton/year in 2025. Considering expanding artificial graphite production to 62 thousands ton/year by 2025, it is expected to have a production capacity of 168 thousands ton/year in total by 2025. Furthermore, cathode material production is expected to increase from 40 thousands ton/year in 2021 to 345 thousands ton/year in 2025.

Due to environment-friendly policy with less carbon emission worldwide, demands for Energy Storage System and Electric Vehicle are expected to grow continuously. POSCO CHEMICAL generates sales by supplying major materials for secondary batteries to electric vehicle battery companies such as LG Energy Solution, Samsung SDI, and SK On. POSCO CHEMICAL signed KRW 1.8trillion deal to supply anode for LG Chem’s EV battery and also signed a contract to supply high-nickel NCA cathode materials for electric vehicle batteries to Samsung SDI for 10 years for the next 10 years. The secondary battery market for electric vehicles is expected to grow due to China’s strong electric vehicle industry development policy, European CO2 emission regulations, and global OEMs’ proportion of electric vehicle. In 2021, POSCO CHEMICAL has focused on investing in large-scale expansion of energy materials for future growth under a difficult business environment. In the meantime, the company conducted various activities to improve profitability and sustainable management and therefore, achieved its highest sales volume of KRW 3,301.9 billion and operating profit of KRW 165.9 billion (consolidated basis) since its foundation.

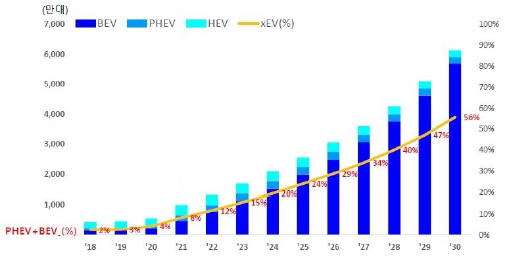

Global EV Market Outlook

(Ten thousand vehicles)

19

(SNE Research)

D. Others

In Others segment, there are 11 subsidiaries in total, including POSCO HOLDINGS. POSCO HOLDING is focusing on investment in new growth businesses and opportunities

3. Key Products

A. Sales of Key Products (2022)

| (In hundred millions of KRW, %) | ||||||||||||

Business Segment | Item / Business Sector | Specific Use | Total Sales | Ratio | ||||||||

| Steel | Hot-rolled Product (HR) | Steel pipe, Shipbuilding, etc. | 135,656 | 19.20 | % | |||||||

| Cold-rolled Product (CR) | Automobile , Home appliances, etc. | 218,585 | 30.90 | % | ||||||||

| Stainless Steel Products | Tableware, pipes, etc. | 134,761 | 19.10 | % | ||||||||

| Others | Plates, Wire rods, etc. | 217,494 | 30.80 | % | ||||||||

| Gross Sum | 706,496 | 100.00 | % | |||||||||

| Deduction of Internal Trade | -261,026 | |||||||||||

| Sub Total | 445,470 | |||||||||||

| Green Infrastructure | Trading | Steel, Metal | 369,371 | 56.00 | % | |||||||

| Chemical, Strategic Item, Energy | 48,749 | 7.40 | % | |||||||||

| Others | 77,777 | 11.80 | % | |||||||||

| Construction | Architecture (Domestic) | 35,061 | 5.30 | % | ||||||||

| Plant (Domestic) | 15,706 | 2.40 | % | |||||||||

| Civil Engineering (Domestic) | 9,321 | 1.40 | % | |||||||||

| Others (Domestic) | 1,823 | 0.30 | % | |||||||||

| Overseas Construction | 15,938 | 2.40 | % | |||||||||

| Owned Construction | 7,276 | 1.10 | % | |||||||||

| Others | 3,730 | 0.60 | % | |||||||||

| Energy and etc. | Electricity Sales, etc. | 74,256 | 11.30 | % | ||||||||

| Gross Sum | 659,008 | 100.00 | % | |||||||||

| Deduction of Internal Trade | -282,787 | |||||||||||

| Sub Total | 376,221 | |||||||||||

| Gross Sum | 33,888 | 100.00 | % | |||||||||

| Green Materials and Energy | Deduction of Internal Trade | -9,370 | ||||||||||

| Sub Total | 24,518 | |||||||||||

| Others | Gross Sum | 11,695 | 100.00 | % | ||||||||

| Deduction of Internal Trade | -10,402 | |||||||||||

| Sub Total | 1,293 | |||||||||||

| Total Sum | 847,502 | |||||||||||

| * | The steel segment above includes POSCO’s performance before the spin-off (January to February). |

20

B. Price Movement Trends of Key Products

| (In thousands of KRW/Tons, KRW/kWh) | ||||||||||||||

Business Segment | Products | 2022 | 2021 | 2020 | ||||||||||

Steel | Hot-rolled Product (HR) | 1,105 | 970 | 622 | ||||||||||

| Cold-rolled Product (CR) | 1,293 | 1,035 | 759 | |||||||||||

Green Infrastructure | Electric Power | 224 | 98 | 72 | ||||||||||

Green Materials and Energy | Refractory | 1,022 | 913 | 965 | ||||||||||

| Lime | 117 | 104 | 106 | |||||||||||

| ø | Above price movement trend of steel segment is based on the price between March 1 to December 31, 2022 (HR and CR price in 2022 is 1,108 and 1,282 thousand won) |

| ø | Trading and Others parts of Green Infrastructure are omitted due to its difficulties of measuring raw materials fluctuations. In the case of the secondary battery material business, detailed descriptions are not included due to risk of information leakage |

[Steel]

(1) Criteria for Calculation

(a) Subjects for Calculation: Unit sales prices of the standard hot-rolled product and cold-rolled product

(b) Calculation Method and Unit: The average price of each product based on its total sales including the freight costs during the given period.

(2) Factors of Price Changes

In 2022, the sales price of major steel products increased compared to 2021 due to concerns over steel supply disruptions caused by the Russian-Ukraine war. Though the price for distribution sector was adjusted a little, the impact was not significant as the sales to distribution sector is mainly spot-base contract.

21

[Green Infrastructure]

(1) Criteria for Calculation

(a) Subjects for Calculation: Price of electric power

(b) Calculation Method and Unit: Unit price per electric power ÷ Net power volume generated

(2) Factors of Price Changes

Power : Korea Gas Corporation cost, etc.

| • | The cost consists of introduction cost, supply cost, etc., and is affected by crude oil and exchange rates |

[Green materials and Energy]

(1) Criteria for Calculation

(a) Subjects for Calculation: Unit price of refractory and quicklime

(b) Calculation Method and Unit: The average price of each product based on its total sales including the freight costs during the given period.

(2) Factors of Price Changes

Price of refractories is affected by business condition of front industry and raw material cost. Quicklime price is mainly influenced by utility unit price and raw materials cost. The price fluctuation of quicklime is small. Prices of raw materials for energy materials fluctuates according to the supply and demand of international mineral resources

22

4. Major Raw Materials

A. Current Status of Major Raw Materials

| (In hundred millions of KRW) | ||||||||||||||||||

Business Segment | Type of | Item | Specific Use | Purchase Amount (Portion, %) | Portion (%) | Remarks | ||||||||||||

Steel | Raw Materials | Materials for Iron-making | Iron Ore for Blast Furnaces | 167,545 | 48.00 | % | Iron Ore, Coal | |||||||||||

| Sub-materials | Sub-materials for Iron-making, Steelmaking | 75,660 | 21.70 | % | Iron Material, Alloy Iron, Non-ferrous Metal, Limestone, etc. | |||||||||||||

| Stainless Steel Materials | Key Materials for STS Production | 105,767 | 30.30 | % | Nickel, Ferrochrome, STS Scrap Iron, etc. | |||||||||||||

Green Infrastructure | Construction | Raw Materials | Ready-mixed Concrete | Construction of Structure | 2,464 | 15.50 | % | — | ||||||||||

Steel Reinforcement | Strengthening Concrete | 3,133 | 19.80 | % | — | |||||||||||||

| Cable | Electricity Transfer | 183 | 1.20 | % | — | |||||||||||||

| Steel Pile | Foundation of Structure | 313 | 2.00 | % | — | |||||||||||||

| Others | Construction of Pipe and Structure etc. | 9,757 | 61.60 | % | — | |||||||||||||

| Trading | Raw Materials | Others | For other use | 4,234 | 100.00 | % | — | |||||||||||

| Energy | Raw Materials | LNG | Material for Power Generation | 23,493 | 56.60 | % | — | |||||||||||

| Others | For other use | 18,037 | 43.40 | % | — | |||||||||||||

Green Materials and Energy | Raw Materials | NCM and etc. | Production of cathode materials | 19,158 | 85.20 | % | — | |||||||||||

| Graphite and etc. | Production of anode materials | 1,379 | 6.10 | % | — | |||||||||||||

| Limestone and etc. | Production of Lime | 983 | 4.40 | % | — | |||||||||||||

| Others | Production of refractory | 957 | 4.30 | % | — | |||||||||||||

| * | The steel segment above includes POSCO’s performance before the spin-off (January to February). |

23

B. Price Movement Trends of Major Raw Materials

| (In thousands of KRW) | ||||||||||||||||

Business Segment | Category | 2022 | 2021 | 2020 | ||||||||||||

Steel | Iron Ore(per ton) | 143 | 169 | 120 | ||||||||||||

| Coal(per ton) | 472 | 257 | 147 | |||||||||||||

| Scrap Iron(per ton) | 605 | 563 | 348 | |||||||||||||

| Nickel(per ton) | 33,147 | 21,130 | 16,254 | |||||||||||||

Green Infrastructure | Construction | Ready-mixed Concrete (per m3) | 77 | 68 | 65 | |||||||||||

Steel Pile (per m) | 180 | 272 | 102 | |||||||||||||

Steel Reinforcement (per kg) | 1.0 | 1.0 | 0.7 | |||||||||||||

Cable (per m) | 0.9 | 1.2 | 1.0 | |||||||||||||

| Energy and etc. | LNG (per ton) | 1,594 | 702 | 484 | ||||||||||||

Green Materials and Energy | Refractory (per ton) | 479 | 320 | 294 | ||||||||||||

Limestone (per ton) | 22 | 19 | 19 | |||||||||||||

| ø | Trading and Others parts of Green Infrastructure are omitted due to its difficulties of measuring raw materials fluctuations. In the case of the secondary battery material business, detailed descriptions are not included due to risk of information leakage |

24

[Steel]

| ø | Price Movement Trend of Major Raw Materials |

| (1) Iron Ore | (In US Dollars/ Tons) | |||||||||||||||||||||||||||||||||||||||||||||||

| ‘22.4Q | ‘22.3Q | ‘22.2Q | ‘22.1Q | ‘21.4Q | ‘21.3Q | ‘21.2Q | ‘21.1Q | ‘20.4Q | ‘20.3Q | ‘20.2Q | ‘20.1Q | |||||||||||||||||||||||||||||||||||||

Trend of International Benchmark Price (Free On Board, “FOB”) | 90 | 94 | 126 | 132 | 96 | 148 | 188 | 158 | 126 | 110 | 88 | 83 | ||||||||||||||||||||||||||||||||||||

| (2) Coal | (In US Dollars/ Tons) | |||||||||||||||||||||||||||||||||||||||||||||||

| ‘22.4Q | ‘22.3Q | ‘22.2Q | ‘22.1Q | ‘21.4Q | ‘21.3Q | ‘21.2Q | ‘21.1Q | ‘20.4Q | ‘20.3Q | ‘20.2Q | ‘20.1Q | |||||||||||||||||||||||||||||||||||||

Trend of International Benchmark Price (FOB) | 278 | 250 | 446 | 488 | 369 | 264 | 137 | 127 | 109 | 115 | 118 | 155 | ||||||||||||||||||||||||||||||||||||

| (3) Scrap Iron | (In US Dollars/ Tons) | |||||||||||||||||||||||||||||||||||||||||||||||

| ‘22.4Q | ‘22.3Q | ‘22.2Q | ‘22.1Q | ‘21.4Q | ‘21.3Q | ‘21.2Q | ‘21.1Q | ‘20.4Q | ‘20.3Q | ‘20.2Q | ‘20.1Q | |||||||||||||||||||||||||||||||||||||

Trend of Purchase Price (Cost and Freight, “CFR”) | 387 | 394 | 531 | 562 | 527 | 500 | 497 | 443 | 361 | 289 | 254 | 274 | ||||||||||||||||||||||||||||||||||||

| (4) Nickel | (In US Dollars/lb, US Dollars/ Tons) | |||||||||||||||||||||||||||||||||||||||||||||||

| ‘22.4Q | ‘22.3Q | ‘22.2Q | ‘22.1Q | ‘21.4Q | ‘21.3Q | ‘21.2Q | ‘21.1Q | ‘20.4Q | ‘20.3Q | ‘20.2Q | ‘20.1Q | |||||||||||||||||||||||||||||||||||||

Trend of London Metal Exchange (“LME”) Cash Price | 11.48 | 10.01 | 13.13 | 11.98 | 8.99 | 8.68 | 7.87 | 7.97 | 7.23 | 6.45 | 5.54 | 5.77 | ||||||||||||||||||||||||||||||||||||

| 25,292 | 22,063 | 28,940 | 26,395 | 19,821 | 19,125 | 17,359 | 17,570 | 15,930 | 14,210 | 12,215 | 12,723 | |||||||||||||||||||||||||||||||||||||

| ø | LME : London Metal Exchange |

25

[Green Infrastructure]

(1) Criteria for Calculation

Business Sector | Products | Criteria for Calculation | Factors of Price Changes | |||

| Construction | Ready-mixed Concrete | Standard 25-210-15 | Raise of priced agreed in Seoul metropolitan area

| |||

| Steel Pile | SPIRAL,609.6,12T,STP275,KS F 4602,STEEL PILE | Changes in unit price due to decrease in raw material (coil) price

| ||||

| Steel Reinforcement | SD400 10mm | Price increase of the raw materials (scrap)

| ||||

| Cable | TFR-3, 0.6/1KV, 2.5SQ, 2C | Decrease the price of raw materials (electrolytic copper)

| ||||

| Energy and etc. | LNG | Average purchase price and LNG direct purchase price of Korea Gas Corporation | Cost of Korea Gas Corporation (cost consists of introduction cost, supply cost, etc. and is affected by crude oil, exchange rate, etc.) | |||

[Green Materials and Energy]

| (1) | Criteria for Calculation |

| • | Based on the receiving amount |

| (2) | Factors of Price Changes |

| • | Limestone : Raw material price fluctuation is not extreme and it varies slightly depending on the freight cost |

| • | Other (refractory raw materials) : Price fluctuations and compositional costs of raw materials in China |

26

5. Production and Facilities

A. Production Capacity

[Steel]

∎ POSCO

| (Thousands of Tons) | ||||||||||||||||

Business Area | Products | 2022 | 2021 | 2020 | ||||||||||||

Steel | Crude Steel | 40,680 | 40,680 | 40,680 | ||||||||||||

| * | The steel production above includes POSCO’s performance before the spin-off (January to February). |

∎ POSCO STEELEON

| (Thousands of Tons) | ||||||||||||||||

Business Area | Products | Plant | 2022 | 2021 | 2020 | |||||||||||

Steel | Galvanized / Color- coated Steel | Pohang | 960 | 960 | 960 | |||||||||||

| Myanmar | 70 | 70 | 70 | |||||||||||||

Total | 1,030 | 1,030 | 1,030 | |||||||||||||

∎ POSCO M-TECH

| (Tons) | ||||||||||||||

Business Area | Products | 2022 | 2021 | 2020 | ||||||||||

Raw materials for steel production | Ingot and etc. | 39,058 | 38,080 | 38,232 | ||||||||||

[Green Infrastructure]

∎ POSCO ENERGY

| (MW) | ||||||||||||||

Business Area | Products | 2022 | 2021 | 2020 | ||||||||||

Power Generation | Electric Power | 3,412 | 3,412 | 3,412 | ||||||||||

[Green Materials and Energy]

∎ POSCO CHEMICAL

Business Area | Products | Place of Business | 2022 | 2021 | 2020 | |||||||||||

Refractory | Brick and etc. | Pohang | 116,560 | 113,000 | 115,000 | |||||||||||

LIME | Quicklime | Pohang | 1,095,000 | 1,095,000 | 1,098,000 | |||||||||||

| Gwangyang | 1,095,000 | 1,095,000 | 1,098,000 | |||||||||||||

Total | 2,306,560 | 2,303,000 | 2,311,000 | |||||||||||||

In the case of the secondary battery material business, detailed descriptions are not included due to risk of information leakage

27

B. Production Result and Capacity Utilization Rate

[Steel]

| (1) Production | (Thousands of Tons) | |||||||||||||

Products | 2022 | 2021 | 2020 | |||||||||||

Crude Steel | 37,928 | 42,964 | 40,579 | |||||||||||

Products | Hot-Rolled Steel | 9,268 | 9,243 | 9,128 | ||||||||||

| Plate | 5,857 | 6,832 | 7,009 | |||||||||||

| Wire Rod | 1,988 | 2,688 | 2,666 | |||||||||||

Pickled-Oiled Steel | 2,847 | 2,880 | 2,432 | |||||||||||

Cold-Rolled Products | 7,623 | 7,898 | 6,795 | |||||||||||

| Coated Steel | 6,708 | 7,446 | 6,316 | |||||||||||

| Electrical Steel | 1,005 | 1,032 | 826 | |||||||||||

| Stainless Steel | 3,400 | 4,099 | 3,900 | |||||||||||

| Others | 3,261 | 3,106 | 4,691 | |||||||||||

| Total | 41,957 | 45,224 | 43,763 | |||||||||||

| ø | The amount of products is the aggregate amount of POSCO’s production and production of POSCOsubsidiaries, which may include interested parties’ transactions. |

| ø | POSCO’s production result includes production of POSCO HOLDINGS before the spin-off date (March 1, 2022), and production of POSCO after the spin-off date. |

| (2) Capacity Utilization Rate | (Thousands of Tons, %) | |||||||||||||

Company | Capacity | Production | Utilization Rate | |||||||||||

Crude Steel Production | POSCO | 40,680 | 34,219 | 84.10 | % | |||||||||

| PT.KRAKATAU POSCO | 1,100 | 989 | 100.20 | % | ||||||||||

| POSCO (Zhangjiagang) Stainless Steel Co., Ltd. | 550 | 397 | 89.90 | % | ||||||||||

| POSCO YAMATO VINA STEEL JOINT STOCK COMPANY | 2,319 | 2,323 | 72.10 | % | ||||||||||

| Total | 44,649 | 37,928 | 84.90 | % | ||||||||||

| ø | POSCO YAMATO VINA STEEL JOINT STOCK COMPANY had production capacity of crude steel 1,100 thousand tons/year: section steel 550 thousand tons/year and reinforcing bar 550 thousand tons/year. However, after the exit of the reinforcing bar business in November 2019, the current crude steel production capacity is 550 thousand tons/year. |

| ø | POSCO’s production result includes production of POSCO HOLDINGS before the spin-off date (March 1, 2022), and production of POSCO after the spin-off date. |

28

[Green Infrastructure]

∎ POSCO ENERGY

| (1) Production Result | (Gwh) | |||||||||||||

Business Area | Products | 2022 | 2021 | 2020 | ||||||||||

Power Generation | Electric Power | 11,189 | 13,493 | 13,998 | ||||||||||

| (2) Capacity Utilization Rate | (Hour, %) | |||||||||||||

Business Area | Products | 2022 Capacity | 2022 Production | Utilization Rate | ||||||||||

Power Generation | Incheon Power Plant | 8,760 | 4,664 | 53.2 | ||||||||||

[Green Materials and Energy]

∎ POSCO CHEMICAL

| (1) Production Result | (Tons) | |||||||||||||||

Business Area | Products | Place of Business | 2022 | 2021 | 2020 | |||||||||||

Refractory | Brick and etc. | Pohang | 81,094 | 83,884 | 80,587 | |||||||||||

LIME | Quicklime | Pohang | 1,043,109 | 1,151,419 | 1,101,589 | |||||||||||

| Gwangyang | 1,176,611 | 1,295,720 | 1,243,402 | |||||||||||||

Total | 2,300,814 | 2,531,023 | 2,425,578 | |||||||||||||

| ø | In the case of the secondary battery material business, detailed descriptions are not included due to risk of information leakage |

29

| (2) Capacity Utilization Rate (Current Business Year) | (Tons) | |||||||||||

Business Area | Capacity | Production | Utilization Rate | |||||||||

Refractory Factory | 116,560 | 81,094 | 70 | % | ||||||||

Quicklime Factory (Pohang) | 1,095,000 | 1,043,109 | 95 | % | ||||||||

Quicklime Factory (Gwangyang) | 1,095,000 | 1,176,611 | 107 | % | ||||||||

Total | 2,306,560 | 2,300,814 | — | |||||||||

C. Production Facilities

(1) The current status of production facilities

| [Land] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 1,856,469 | 63,813 | -106,010 | — | 1,814,272 | |||||||||||||||||

Green Infrastructure | Construction | 122,399 | 261,199 | -1,012 | — | 382,586 | ||||||||||||||||

| Trading | 176,007 | 25,127 | -15,639 | — | 185,495 | |||||||||||||||||

| Energy and etc. | 372,989 | 26,634 | -234 | — | 399,389 | |||||||||||||||||

Green Materials and Energy | 174,851 | 25,587 | — | — | 200,438 | |||||||||||||||||

Others | — | 120,987 | -2 | — | 120,985 | |||||||||||||||||

| [Buildings] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 3,245,693 | 123,687 | -43,251 | -244,582 | 3,081,547 | |||||||||||||||||

Green Infrastructure | Construction | 85,033 | 847 | -7,680 | -2,472 | 75,728 | ||||||||||||||||

| Trading | 460,474 | 51,399 | -1,907 | -23,101 | 486,865 | |||||||||||||||||

| Energy and etc. | 197,846 | 3,837 | -716 | -13,242 | 187,725 | |||||||||||||||||

Green Materials and Energy | 208,793 | 31,739 | -356 | -9,072 | 231,104 | |||||||||||||||||

Others | 6,611 | 167,253 | -25,828 | -36,111 | 111,925 | |||||||||||||||||

30

| [Structures] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 2,510,527 | 217,590 | -19,604 | -193,134 | 2,515,379 | |||||||||||||||||

Green Infrastructure | Construction | 24,430 | 5,741 | -1,394 | -1,889 | 26,888 | ||||||||||||||||

| Trading | 25,313 | 41,678 | -524 | -4,434 | 62,033 | |||||||||||||||||

| Energy and etc. | 554,835 | 4,101 | -695 | -26,668 | 531,573 | |||||||||||||||||

Green Materials and Energy | 16,690 | 5,544 | -70 | -1,299 | 20,865 | |||||||||||||||||

Others | — | 43,596 | -5,751 | -31,656 | 6,189 | |||||||||||||||||

| [Machinery and Equipment] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 14,286,899 | 2,552,976 | -592,939 | -2,016,663 | 14,230,273 | |||||||||||||||||

Green Infrastructure | Construction | 8,640 | 1,671 | -1,015 | -1,975 | 7,321 | ||||||||||||||||

| Trading | 373,354 | 60,648 | -9,326 | -32,114 | 392,562 | |||||||||||||||||

| Energy and etc. | 1,224,934 | 50,073 | -37,217 | -87,055 | 1,150,735 | |||||||||||||||||

Green Materials and Energy | 526,329 | 161,712 | -10,506 | -47,877 | 629,658 | |||||||||||||||||

Others | — | 422,413 | -107,193 | -302,939 | 12,281 | |||||||||||||||||

| [Vehicles] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 32,036 | 31,049 | -17,812 | -11,830 | 33,443 | |||||||||||||||||

Green Infrastructure | Construction | 2,297 | 6,067 | -2,855 | -910 | 4,599 | ||||||||||||||||

| Trading | 5,894 | 6,937 | -2,257 | -1,982 | 8,592 | |||||||||||||||||

| Energy and etc. | 1,014 | 801 | -595 | -357 | 863 | |||||||||||||||||

Green Materials and Energy | 4,786 | 2,628 | -583 | -2,211 | 4,620 | |||||||||||||||||

Others | 3 | 1,761 | -200 | -1,550 | 14 | |||||||||||||||||

31

| [Tools and Fixtures] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 45,388 | 50,186 | -20,840 | -18,960 | 55,774 | |||||||||||||||||

Green Infrastructure | Construction | 1,447 | 663 | -419 | -543 | 1,148 | ||||||||||||||||

| Trading | 21,496 | 18,575 | -3,051 | -11,526 | 25,494 | |||||||||||||||||

| Energy and etc. | 1,840 | 1,930 | -1,160 | -584 | 2,026 | |||||||||||||||||

Green Materials and Energy | 7,624 | 3,731 | -882 | -3,985 | 6,488 | |||||||||||||||||

Others | — | 5,406 | -3,452 | -1,923 | 31 | |||||||||||||||||

| [Equipment] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 111,762 | 63,094 | -36,056 | -37,057 | 101,743 | |||||||||||||||||

Green Infrastructure | Construction | 5,995 | 8,489 | -2,803 | -3,352 | 8,329 | ||||||||||||||||

| Trading | 22,143 | 20,499 | -6,344 | -8,507 | 27,791 | |||||||||||||||||

| Energy and etc. | 16,267 | 3,549 | -3,104 | -3,515 | 13,197 | |||||||||||||||||

Green Materials and Energy | 8,916 | 3,633 | -600 | -3,077 | 8,872 | |||||||||||||||||

Others | 1,079 | 26,825 | -8,650 | -5,841 | 13,413 | |||||||||||||||||

| [Financial Lease Assets] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 622,803 | 27,114 | -79,311 | -62,283 | 508,323 | |||||||||||||||||

Green Infrastructure | Construction | 66,477 | 174,063 | -149,326 | -41,043 | 50,171 | ||||||||||||||||

| Trading | 83,790 | 271,674 | -62,599 | -41,981 | 250,884 | |||||||||||||||||

| Energy and etc. | 35,466 | 10,289 | -3,650 | -7,699 | 34,406 | |||||||||||||||||

Green Materials and Energy | 59,071 | 60,268 | -59,013 | -5,618 | 54,708 | |||||||||||||||||

Others | 139 | 46,988 | -14,524 | -9,897 | 22,706 | |||||||||||||||||

32

| [Biological Assets] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | — | — | — | — | — | |||||||||||||||||

Green Infrastructure | Construction | — | — | — | — | — | ||||||||||||||||

| Trading | 154,682 | -3,271 | — | -9,691 | 141,720 | |||||||||||||||||

| Energy and etc. | — | — | — | — | — | |||||||||||||||||

Green Materials and Energy | — | — | — | — | — | |||||||||||||||||

Others | — | — | — | — | — | |||||||||||||||||

| [Assets under Construction] | (In millions of KRW) | |||||||||||||||||||||

Business Segment | Beginning Book Balance | Increased | Decreased | Depreciation | Ending Book Balance | |||||||||||||||||

Steel | 1,111,470 | 678,703 | -189 | -9,699 | 1,780,285 | |||||||||||||||||

Green Infrastructure | Construction | 2,166 | 19,125 | 1 | — | 21,292 | ||||||||||||||||

| Trading | 36,295 | 93,175 | -191 | — | 129,279 | |||||||||||||||||

| Energy and etc. | 32,332 | 56,360 | — | — | 88,692 | |||||||||||||||||

Green Materials and Energy | 642,904 | 845,038 | — | — | 1,487,942 | |||||||||||||||||

Others | — | 30,535 | — | — | 30,535 | |||||||||||||||||

33

(2) New Facility Establishment, Purchase, Etc.

(a) Investments under Construction

| [Steel] | (In hundred millions of KRW) | |||||||||||||||||

Company | Date | Project | Total Investment | Invested Amount | Amount to Be Invested | |||||||||||||

| POSCO | Expansion/ Establish ment | November 2021 ~ December 2025 | G) Increased production capacity of electrical steel for eco-friendly vehicles in Gwangyang | 8,900 | 1,366 | 7,534 | ||||||||||||

July 2019 ~ December 2025 | P) Establishment of #6 Coke plant | 13,420 | 6,881 | 6,539 | ||||||||||||||

Maintenance/ Improvement | October 2019 ~ June 2025 | G,P) The first phase of the sealing of raw material yards for both Pohang and Gwangyang Works | 19,264 | 3,039 | 16,225 | |||||||||||||

| August 2021 ~ October 2028 | P) Improvement of #2 Hot strip mill furnace | 3,078 | 78 | 3,000 | ||||||||||||||

| ø | P stands for Pohang Steel Works. |

| ø | G stands for Gwangyang Steel Works. |

| [Green Infrastructure] | (In hundred millions of KRW) | |||||||||||||||||||

Business Area | Company | Date | Project | Total Investment | Invested Amount | Amount to Be Invested | ||||||||||||||

Trading | POSCO MOBILITY SOLUTION | Expansion/ Establish ment | January 2022~March 2023 | Mechanical Equipment _Press/Molding/Assembling (Gwangyang) | 130 | 61 | 69 | |||||||||||||

| POSCO INTERNATIONAL TEXTILE LLC. | Expansion/ Establish ment | March 2022~ May 2023 | Fixed assets | 146 | 124 | 22 | ||||||||||||||

Construction | POSCO O&M | Expansion/ Establish ment | January 2022 ~ December | Other current investments | 195 | 195 | — | |||||||||||||

Energy and etc. | POSCO ICT | Expansion/ Establish ment | January 2022 ~ December | Other business and current investments | 118 | 96 | — | |||||||||||||

| January 2022 ~ December | Expansion of SM servers, etc | 145 | 85 | — | ||||||||||||||||

| POSCO Energy | Expansion/ Establish ment | January 2021- ~May 2024 | Gwangyang LNG #6 Tank | 1,437 | 603 | 834 | ||||||||||||||

| NEH | Expansion/ Establish ment | May 2022~December 2025 | Gwangyang LNG terminal | 8,668 | 213 | 8,455 | ||||||||||||||

| POSCO FLOW | Expansion/ Establish ment | November 2022~April 2024 | railway cargo pickup station at Taegeum Station | 320 | — | 320 | ||||||||||||||

34

| [Green Materials and Energy] | (In hundred millions of KRW) | |||||||||||||||||

Company | Date | Project | Total Investment | Invested Amount | Amount to Be Invested | |||||||||||||

POSCO CHEMICAL | Expansion/ Establish ment | November 2019~April 2023 | The 2nd stage of production line up expansion in #2 anode material factory | 2,711 | 2,226 | 485 | ||||||||||||

| February 2020~June 2025 | Establishment of new Artificial Graphite Anode material line | 3,458 | 1,459 | 1,999 | ||||||||||||||

| July 2020~January 2024 | The 3rd stage of cathode material factory in Gwangyang | 2,895 | 2,454 | 441 | ||||||||||||||

| October 2020~February 2023 | Facilities rationalization of refractory sintering plant in Pohang | 348 | 135 | 213 | ||||||||||||||

| November 2020~March 2023 | The 4th stage of cathode material factory in Gwangyang | 2,758 | 2,274 | 441 | ||||||||||||||

| December 2021~June 2024 | cathode material factory in Pohang | 3,303 | 989 | 2,314 | ||||||||||||||

| July 2022~May 2024 | #2 precursor factory in Gwangyang | 3,262 | 121 | 3,141 | ||||||||||||||

P&O Chemical | Expansion/ Establish ment | October 2021~December 2024 | New construction of pitch production plant | 963 | 272 | 691 | ||||||||||||

POSCO-Pilbara LITHIUM SOLUTION | Expansion/ Establish ment | April 2021~February 2024 | Construction of hard rock lithium commercialization plant | 9,188 | 2,083 | 7,105 | ||||||||||||

Zhejiang POSCO-HUAYOU New Energy Co., Ltd | Expansion/ Establish ment | December 2021~December 2024 | #2 new factory with capacity of 29 thousand tons | 2,971 | 915 | 2,056 | ||||||||||||

POSCO ARGENTINA | Expansion/ Establish ment | January 2022~April 2024 | Brine lithium commercialization plant stage 1 (25,000 tons of lithium hydroxide production) | 10,484 | 1,217 | 9,165 | ||||||||||||

| November 2022~June 2025 | 25,000 tons of lithium carbonate production | 12,090 | — | 12,090 | ||||||||||||||

| ø | Ongoing investments over KRW 10 billion as of December 31, 2022 are listed on the table. |

35

6. Product Sales

[Steel]

| (In hundred millions of KRW) | ||||||||||||||

Items | 2022 | 2021 | 2020 | |||||||||||

Domestic | Hot-Rolled Products | 68,784 | 70,117 | 39,663 | ||||||||||

Cold-Rolled Products | 55,997 | 54,864 | 37,870 | |||||||||||

| Stainless Steel | 42,481 | 35,722 | 23,746 | |||||||||||

| Others | 110,202 | 94,737 | 63,111 | |||||||||||

Overseas | Hot-Rolled Products | 66,871 | 55,180 | 37,368 | ||||||||||

Cold-Rolled Products | 162,588 | 144,421 | 101,808 | |||||||||||

| Stainless Steel | 92,279 | 86,712 | 72,140 | |||||||||||

| Others | 107,298 | 93,736 | 66,876 | |||||||||||

Total | Gross Sum | 706,496 | 635,489 | 442,583 | ||||||||||

| Internal Transaction | -261,026 | -224,555 | -153,654 | |||||||||||

| Total | 445,470 | 410,934 | 288,929 | |||||||||||

36

[Green Infrastructure]

| (In hundred millions of KRW) | ||||||||||||||||

Business Area | Items | 2022 | 2021 | 2020 | ||||||||||||

Trading | Domestic Trading | Merchandise | 65,401 | 63,137 | 33,565 | |||||||||||

| Product | 9,825 | 8,757 | 2,028 | |||||||||||||

| Others | 647 | 1,174 | 240 | |||||||||||||

| Overseas Trading | Merchandise | 137,635 | 137,741 | 75,922 | ||||||||||||

| Product | 1,058 | 1,223 | 528 | |||||||||||||

| Others | 10 | 207 | 1,192 | |||||||||||||

| Trades among the 3 countries | 281,321 | 209,444 | ||||||||||||||

Construction | Domestic Construction | Building | 35,061 | 35,633 | 42,761 | |||||||||||

| Plant | 15,706 | 13,272 | 12,887 | |||||||||||||

| Civil Engineering | 9,321 | 6,771 | 6,177 | |||||||||||||

| Others | 1,823 | 1,763 | — | |||||||||||||

| Overseas | 15,938 | 8,097 | 7,089 | |||||||||||||

| Own Construction | 11,006 | 8,589 | 7,185 | |||||||||||||

Energy and etc. | Electric Power Sales | 74,256 | 29,145 | 25,688 | ||||||||||||

Total | Gross Sum | 659,008 | 556,174 | 424,706 | ||||||||||||

| Deduction of Internal Transaction | -282,787 | -220,938 | -148,097 | |||||||||||||

| Total | 376,221 | 335,236 | 276,609 | |||||||||||||

[Green Materials and Energy]

| (In hundred millions of KRW) | ||||||||||||

Items | 2022 | 2021 | 2020 | |||||||||

Gross Sum | 33,888 | 20,892 | 16,137 | |||||||||

Deduction of Internal Transaction | -9,370 | -8,472 | -8,421 | |||||||||

Total | 24,518 | 12,420 | 7,716 | |||||||||

37

[Others]

| (In hundred millions of KRW) | ||||||||||||

Items | 2022.3Q | 2021 | 2020 | |||||||||

Gross Sum | 11,695 | 17,842 | 14,062 | |||||||||

Deduction of Internal Transaction | -10,402 | -13,109 | -9,388 | |||||||||

Total | 1,293 | 4,733 | 4,674 | |||||||||

| ø | Domestic and overseas categorized by the sales area. |

| ø | Sales of POSCO International’s foreign branches are included in ‘trade among the 3 countries’ under Green Infrastructure part |

| ø | POSCO’s production result includes production of POSCO HOLDINGS before the spin-off date (March 1, 2022), and production of POSCO after the spin-off date. |

7. Derivatives

POSCO use forward exchange contracts to hedge against the exchange rate risk for foreign currency loans. As of December 31, 2022, we assessed the fair value of our currency swap contracts to be USD 0.5 billion(expiring January, 2023), USD 0.5 billion (expiring August, 2023), USD 0.5 billion(expiring July, 2024) USD 0.44 billion(expiring January, 2025), EUR 0.5 billion(expiring January, 2024). The transaction gain of forward exchange contracts is KRW 87,951 million. Also, we recognized KRW 94,807 million of valuation gain on currency swap contracts.

38

8. Significant Contracts

[Steel]

∎ POSCO M-TECH

Contract | Contract Date | Remarks | ||

| Outsourcing of Products Packaging Contract with Pohang and Gwangyang Steelworks | November 26, 2021 | (1) Contract Counterparty: POSCO (2) Purpose: Service concerning packaging of steel products, supply of packaging materials, maintenance of packaging facilities, etc, Packaging work for Pohang and Gwangyang Steelworks (3) Contract period: July 1, 2021~June 30, 2022 (4) Transaction amount: KRW 174,209 million | ||

| Consign management of Ferromanganese Plant | December 30, 2021 | (1) Contract counterparty: POSCO (2) Purpose: Collective consignment of plant facilities and operations (3) Contract period: July 1, 2021~June 30, 2022 (4) Transaction amount: KRW 27,412 million | ||

| Consign management of copperplate factory | December 1, 2021 | (1) Contractual Counterparty: POSCO (2) Purpose: Collective consignment of plant facilities and operations (3) Contract period: November 1, 2021~October 31, 2022 (4) Transaction amount: KRW 740 million | ||

| Supply contract of aluminum deoxidizer | November 30, 2021 | (1) Contract Counterparty: POSCO (2) Purpose: Production and sale of sub-materials that remove supersaturated oxygen in steel making process (3) Contract period: January 1, 2022~June 30, 2022 (4) Transaction amount: KRW 55,500 million | ||

| Supply contract of aluminum deoxidizer | August 19, 2022 | (1) Contract Counterparty: POSCO (2) Purpose: Production and sale of sub-materials that remove supersaturated oxygen in steel making process (3) Contract period: July 1, 2022~December 31, 2022 (4) Transaction amount: KRW 42,937 million | ||

| ø | The above transaction amount is excluding VAT, and the transaction amount of the aluminum deoxidizer supply contract may vary depending on the total volume and aluminum market situation. |

∎ POSCO YAMATO VINA STEEL JOINT STOCK COMPANY

Contract | Date | Remarks | ||

| Joint stock contract with POSCO, YAMATO KOGYO CO., LTD. and SIAM YAMATO STEEL CO., LTD. to improve business structure | March 2020 | 1) Purpose: To improve business structure by collaborating with leading company in 2) Information: POSCO’s 100% share of POSCO SS VINA changes to 51% YAMATO KOGYO CO., LTD. takes 30% of shares and SIAM YAMATO STEEL CO., LTD. takes 19% of shares. 3) Signed date of the contract: March 18, 2020 4) Registration of joint stock company : April 28, 2020 |

39

[Green Infrastructure]

∎ POSCO INTERNATIONAL

Contract | Date | Remarks | ||

Investment on the 3rd stage development of A-1 / A-3 block in Myanmar gas field | September 2020 | 1) Investment amount: KRW 365,786,302,000 2) Development period: September 1, 2019 ~ December 31, 2024 3) Schedule : Installation Completion of low-pressure gas compression platform and 4) Other Information • Location: North-west offshore, Myanmar • This investment is the 3rd stage of development, which consists of 3 stages in Myanmar gas field development. The purpose of investment is to maintain current gas production level stably by installing low-pressure gas compression platform. • In the first quarter of 2021, the design and production of the equipment for this work was started, and it is planned to start operation in 2024. The “(2) Development period” above is the period including the basic design progress period, September 2019 to September 2020. • Participation rate of each company in gas production and offshore pipeline transportation business • POSCO International Corporation : 51.0% • ONGC VIDESH(Oil and Natural Gas Corporation Videsh Limited) : 17.0% • MOGE(Myanmar Oil and Gas Enterprise): 15.0% • GAIL (India) Limited : 8.5% • KOGAS(Korea Gas Corporation): 8.5% • Investment size of USD 315,170 thousand, applying the exchange rate of 1USD=1,160.60 KRW, which is the date of the BOD resolution. • Detailed information and future timeline on this resource development investment is subject to change. ø POSCO International disclosure date : September 22, 2020 (Decision on natural resources investment) | ||

| Decision to acquire shares of Senex Energy (Australia) | December 2021 | 1) Purpose : Production and Development of land gas field in eastern Australia 2) Method : Cash acquisition 3) Resolution date of Board of Directors : December 10, 2021 4) Acquisition amount : KRW 371,077,996,186 5) Number of shares acquired : 96,178,946Shares 6) Date of acquisition : April 1, 2022 7) equity structure (after acquisition of shares) : • POSCO International : 50.1% • Hancock Energy (Australia) : 49.9% ø POSCO International disclosure date : March 31, 2022 (Decision on Acquisition of Shares or Investment Certificates of Other Corporations) | ||

| Decision on Merger | August 2022 | 1) Purpose : The purpose of the merger is to consolidate the energy business within the group and complete the value chain of the LNG business, thereby strengthening competitiveness, improving management efficiency and laying the foundation for sustainable growth. 2) Method of Merger : POSCO Energy Co., Ltd. (“POSCO Energy”) will be merged with and into POSCO International Co., Ltd. (“POSCO International”). 3) Date of board resolution (decision Date) : August 12, 2022 4) Date of General Shareholders Meeting for merger approval : November 4, 2022 4) Merger ratio : POSCO International : POSCO Energy = 1 : 1.1626920 5) Record date of merger : January 1, 2023 6) Scheduled date of merger registration : January 2, 2023 ø POSCO International disclosure date : January 2, 2023 | ||

40

[Green Materials and Energy]

∎ POSCO ENERGY

Contract | Date | Remarks | ||

| Merger | May 2020 | 1) Contract counterpart : PSC Energy Global Co., Ltd. 2) Signed date : May 26, 2020 3) Date of merger : August 1, 2020 4) Merger ratio : 1.0000000 : 0.0000000 5) Information : POSCO ENERGY merges PSC Energy Global Co., Ltd., a wholly | ||

| Decision on Merger | August 2022 | 1) Contract counterpart : POSCO International Co., Ltd. 2) Signed date : August 12, 2022 3) Date of merger : January 1, 2023 4) Merger ratio : 1.0000000 : 1.1626920 5) Information : POSCO International Co., Ltd. Merges POSCO Energy Co., Ltd. ø POSCO Energy disclosure date : August, 12, 2022 (Important Notice : Decision of Merger) | ||

∎ POSCO ICT

Contract | Date | Remarks | ||

| Sales of shares of ChargEV | November 2021 | 1) Contract counterpart : GS Energy, ChargEA 2) Signed date : November 3, 2022 3) Date of Transfer : November 11, 2022 4) Transfer amount : KRW 15,958,116,470 5) Information : Sales of shares of ChargEV (13.88% of total shares which is 6,445 shares) that POSCO ICT used to own following the exercise of the right to claim for joint sale of ChargEA(claimant of the right). |

∎ POSCO FLOW

Contract | Date | Remarks | ||

| Transfer of all logistics tasks such as arranging logistics and performing related services | December 2021 | 1) Contract counterpart : POSCO (POSCO HOLDINGS INC.) 2) Signed date : December 22, 2021 3) Date of Transfer : January 1, 2022 4) Transfer amount : KRW 2,945 million 5) Information : Transfer of all logistics tasks such as arranging logistics and performing related services |

41

9. Research and Development

A. Research and Development (“R&D”) Organization

Business Segment | Company | Organization | ||

| Steel | POSCO | Steel Production & Technology Strategy Office | ||

| R&D Center | ||||

| Steel Product R&D Center | ||||

| Low-Carbon Process R&D Center | ||||

| Automotive Steel R&D Center | ||||

| Steel Solution R&D Center | ||||

| POSCO (Zhangjiagang) Stainless Steel Co., Ltd. | R&D Center | |||

| POSCO STEELEON | Production & Marketing Strategy Office | |||