- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCurrent report (foreign)

Filed: 5 Sep 23, 10:41am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2023

Commission File Number: 1-13368

POSCO HOLDINGS INC.

(Translation of registrant’s name into English)

POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 06194

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

POSCO HOLDINGS INC. is furnishing under cover of Form 6-K:

Exhibit 99.1: An English-language translated documents of POSCO HOLDINGS INC.’s Corporate Governance Report for the year 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| POSCO HOLDINGS INC. | ||||||

(Registrant)

| ||||||

| Date: September 5, 2023 | By | /s/ Han, Young-Ah | ||||

| (Signature) | ||||||

| Name: Han, Young-Ah | ||||||

| Title: Senior Vice President | ||||||

Corporate Governance Report

2022

May 31, 2023

POSCO HOLDINGS INC.

Pursuant to KOSPI Market Disclosure Regulation Article 24-2, POSCO HOLDINGS INC. provides this report in order to help investors to better understand the company’s corporate governance.

The corporate governance status in this report is composed based on December 31, 2022, and if there has been any changes occurred as of May 31, 2023 which was the submission date of this report to the Korea Exchange in Korean language, those are stated separately.

The status of corporate governance in this report is basically about the time period from January 1, 2022 to December 31, 2022. When the corporate governance report guidelines of the Korea Exchange provide different time period for some matters, we stated information within those time periods.

This is a courtesy English translation of the Corporate Governance Report that originally was disclosed in Korean.

| 3 | ||||

| 5 | ||||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 18 | ||||

| 33 | ||||

| 33 | ||||

| 45 | ||||

| 64 | ||||

(Core Principle 6) Evaluation of Outside Directors Activities | 71 | |||

| 73 | ||||

| 79 | ||||

| 85 | ||||

| 85 | ||||

| 93 | ||||

| 97 | ||||

• Attachment : Key Compliance Indicators of Corporate Governance | 98 | |||

2

| I | Overview |

| • | Name of Company : POSCO HOLDINGS INC. |

| • | People in charge of the report : |

| - | Main In-charge : Joo, Hyung-Kweon Leader, Investor Relations Team |

02-3457-1408 Email: silentj@posco-inc.com

02-3457-1408 Email: silentj@posco-inc.com

| - | Co In-charge : Jang, Soo-Young, Manager, Investor Relations Team |

02-3457-0747 Email: syjang0228@posco-inc.com

02-3457-0747 Email: syjang0228@posco-inc.com

| • | Record Date : December 31, 2022 |

| • | Company Overview |

| Largest Shareholder | National Pension Service | Shareholding Ratio of the Largest Shareholder 1) | 9.11% | |||

| Shareholding ratio of Minority Shareholders 2) | 67.12% | |||||

| Business Type | Non-Financial | Major Products | Holding Company | |||

| Enterprise Group under Monopoly Regulation and Fair Trade Act | Yes | Act on the Management of Public Institutions | Not Applicable | |||

| Name of Enterprise Group | POSCO | |||||

Summary of Financial Status (In hundred millions of KRW) | ||||||

| 2022 | 2021 | 2020 | ||||

| Consolidated Revenue | 847,502 | 763,323 | 577,928 | |||

Consolidated Operating Profit | 48,501 | 92,381 | 24,030 | |||

| Consolidated Profit from Continuing Operations | 35,605 | 71,959 | 17,882 | |||

| Consolidated Profit | 35,605 | 71,959 | 17,882 | |||

| Consolidated Total Assets | 984,068 | 914,716 | 790,870 | |||

| Separate Total Assets | 511,491 | 642,428 | 567,950 | |||

| 1) | As of December 31, 2022 |

| 2) | It is based on the total number of issued shares with voting rights (excluding treasury stock) as of December 31, 2022 and minority shareholders those with less 1% of the total number of issued shares. |

3

| Glossary | ||

| BoD, the BoD | The Board of Directors | |

| GMoS | General Meeting(s) of Shareholders | |

| The company, company, we, our, us | POSCO HOLDINGS as a separate business entity | |

4

| II | Current Status of Corporate Governance |

| 1. Corporate Governance Policy |

| • | The Principle and Policy of Corporate Governance |

POSCO HOLDINGS pursues advanced corporate governance that enhances shareholders’ value in the long-term and equally better interested parties’ rights. The management conducts responsible management with their expertise and reasonable decision-making and the BoD which consists of majority number of Outside Directors supervises and advises the management. This “Global Professional Management” is harmonized based on checks and balances and these principles, as proclaimed in Corporate Governance Charter are carried out within and outside POSCO HOLDINGS.

Detailed principles of corporate governance are reflected on internal regulations for corporate governance such as Articles of Incorporation, Operational Regulations of the Board of Directors, Corporate Governance Charter, etc., and also available on POSCO HOLDINGS’ website at http://www.posco-inc.com

POSCO HOLDINGS leadingly adopted Outside Directors Policy in 1997 and has continuously improved it for independence of BoD and to strengthen its roles.

Followed by vertical spin-off to the holding company in March 2022, POSCO HOLDINGS has been strengthening its Control Tower functions, including future business portfolio development and group business management functions.

The BoD consists of members with abundant experience and expertise from the fields of industry, academia, law, environment, accounting and public services in order to provide diversity and balanced-perspective for the management’s reasonable decision-making. In order to effectively supervise and intervene the management, the BoD consists of more than half of Outside Directors. In addition, the BoD is operated centered on outside directors, with the Chairmen of BoD and Special Committees are appointed from Outside Directors.

| • | Characteristics of Corporate Governance |

POSCO HOLDINGS’s BoD, as permanently established and the highest decision-making body, has the right to elect Representative Directors. Since 2006, the Chairman position of BoD has been separated from the position of the CEO and the Representative Director and has been appointed among Outside Directors by resolutions of BoD.

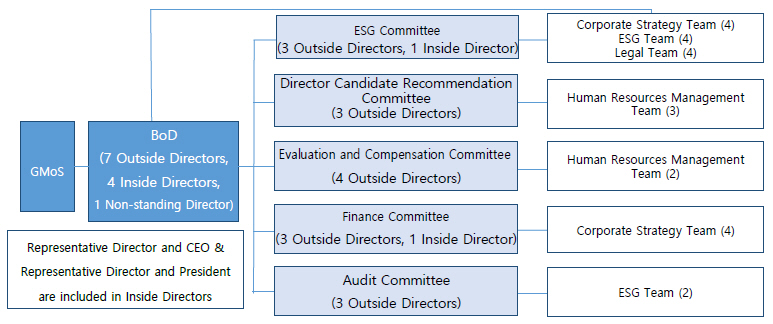

Outside Directors who have expertise and abundance of experience are recommended by Director Candidate Recommendation Committee or by shareholders’ suggestion then elected at the GMoS by shareholders’ votes. As of May 31, 2023, The BoD has total 12 Directors: 7 Outside Directors, 4 Inside Directors, and 1 Non-Standing Director.

The Articles of Incorporation was revised in accordance with the launch of the holding company in March 2022, and therefore, we currently operate five committees within the board of directors, including ESG Committee, Director Candidate Recommendation Committee, Evaluation and Compensation Committee, Finance Committee, and Audit Committee. Outside Directors are more than half of total number of Directors in each Special Committee. In addition, Director Candidate Recommendation Committee, Evaluation and Compensation Committee and Audit Committee consist of all Outside Directors in order to guarantee independent decision-making. Among Special Committees, Director Candidate Recommendation Committee and Audit Committee are mandatory for operation under the Commercial Act. However, the rest of 3 Special Committees were established voluntarily by the BoD for professionalism, independence and efficiency of the BoD. Finance Committee and Audit Committee are operated with experts who have experience in the fields of Industries, accounting/finance and public affairs and ESG Committee is operated with an environment expert.

5

The company held a total of 11 board meetings in 2022, and the attendance rate of the directors was 100%. The special committees held a total of 27 meetings, and the attendance rate of the committee members was 100%. In addition, all independent directors participated in major activities of the board such as Board Strategy Sessions, Independent Director Meetings, ESG Sessions, Leadership Sessions, Strategic/Performance Review Sessions, and site visits. The company’s independent directors are devoting sufficient time and effort to fulfill their duties and are doing their best to fulfill their authority and role as directors.

6

| 2. Shareholders |

(Core Principle 1) Rights of Shareholders

• Shareholders need to be given sufficient information in a timely manner to exercise rights and need to exercise rights with proper procedure. |

| (Sub-Principle 1-①) The company needs to provide sufficient information for the date, location and agendas of GMoS, long enough before the meeting date. |

A. History and Notice of GMoS

POSCO HOLDINGS has held 3 Ordinary GMoS and 1 Extraordinary GMoS from January 1, 2021 till May 31, 2023. Information regarding GMoS such as date, location, agendas, etc. were provided to shareholders through Korea Exchange(KRX) public disclosure both in Korean and English, Data Analysis, Retrieval and Transfer System(DART) website by Financial Supervisory Service, U.S. Securities and Exchange Commission(SEC) website, company website, mail notice for domestic shareholders, Depositary Notice and Proxy Card for foreign DR shareholders, and so on.

The history and details of GMoS from January 1, 2021 to May 31, 2023 are given in the following table.

| • | (Table 1-①-1) History and Details of GMoS from January 1, 2021 to May 31, 2023 |

Ordinary GMoS 2023 | Ordinary GMoS 2022 | Extraordinary GMoS 2022 | Ordinary GMoS 2021 | |||||||

| Resolution of Convocation | January 27, 2023 | January 28, 2022 | December 10, 2021 | January 28, 2021 | ||||||

| Notice of Convocation | February 20, 2023 | February 17, 2022 | January 5, 2022 | February 18, 2021 | ||||||

| GMoS Date | March 17, 2023 | March 18, 2022 | January 28, 2022 | March 12, 2021 | ||||||

Days between Notice of Convocation and GMoS Date | 24 days | 28 days | 22 days | 21 days | ||||||

Location/ Region | POSCO Center / Gangnam-gu, Seoul | POSCO Center / Gangnam-gu, Seoul | POSCO Center / Gangnam-gu, Seoul | POSCO Center / Gangnam-gu, Seoul | ||||||

| Notice to Shareholders | Mail notice, POSCO website, DART and KRX website | Mail notice, POSCO website, DART and KRX website | Mail notice, POSCO website, DART and KRX website | Mail notice, POSCO website, DART and KRX website | ||||||

Notice for foreign shareholders | U.S. SEC website, Depositary Notice and Proxy Card for DR holders, and KRX English public disclosure | U.S. SEC website, Depositary Notice and Proxy Card for DR holders, and KRX English public disclosure | U.S. SEC website, Depositary Notice and Proxy Card for DR holders, and KRX English public disclosure | U.S. SEC website, Depositary Notice and Proxy Card for DR holders, and KRX English public disclosure | ||||||

| Details | BoD | 12 out of 12 Directors attended | 11 out of 12 Directors attended | 12 out of 12 Directors attended | 12 out of 12 Directors attended | |||||

| Audit Committee Members | 3 out of 3 members attended | 3 out of 3 members attended | 3 out of 3 members attended | 3 out of 3 members attended | ||||||

Shareholders’ Remarks | 1) 1 shareholder remark 2) Message : Plans for POSCO Group’s LiB Business | 1) 2 shareholder remarks 2) Message : payout ratio, share cancellation | 1) 5 shareholder remarks 2) Message : vertical spin-off related issues, payout ratio, share cancellation | 1) 1 shareholder remark 2) Message : Plans for Lithium-ion battery materials business | ||||||

7

B. Providing Information regarding GMoS

POSCO HOLDINGS held 3 Ordinary GMoS and 1 Extraordinary GMoS from January 1, 2021 to May 31, 2023. Generally, we provide dates and locations of GMoS through BoD resolutions by 6 weeks before the meetings. After resolutions on the GMoS agendas by the BoD, we provided information through Korea Exchange(KRX), Data Analysis, Retrieval and Transfer System(DART) website by Financial Supervisory Service, U.S. Securities and Exchange Commission(SEC) website, and our website. In addition, until 2 weeks before the GMoS, we provided GMoS notice, related supplementary information, guide for voting rights exercise, ballot paper, return envelope, etc. to every shareholder by mail. In order to provide information better for our foreign shareholders, we have been conducting the Korea Exchange public disclosure in English since our GMoS in March 2021.

Although the company conducted Notice of Convocation 4 weeks before the date of GMoS March 2022 and met one of the Corporate Governance Key Compliance Indicator, we have not met the standard in 2023 by conducting the Notice of Convocation 3 weeks(24 days) before the date of GMoS. We will try our best to provide sufficient information to shareholders 4 weeks in advance regarding the GMoS in the future.

8

(Sub-Principle 1-②) The company needs to help shareholders to attend the GMoS and to express their opinions.

A. History of Shareholders’ Exercise of Voting Rights

(i) Date of GMoS and whether it has been held on Congested Dates for GMoS

From January 1, 2021 to May 31, 2023, the company has held 3 Ordinary GMoS, and participated in the Voluntary Compliance Program for GMoS Date Separation for all three years by setting GMoS dates on non-congested dates. The following are the details regarding the exercise of voting rights at the general meetings of shareholders held from January 1, 2021 to May 31, 2023.

| • | (Table 1-②-1) Dates of GMoS and Voting Types from January 1, 2021 to May 31, 2023 |

| GMoS 2023 | GMoS 2022 | GMoS 2021 | ||||

| Congested Dates for GMoS | March 24, 2023 March 30, 2023 March 31, 2023 | March 25, 2022 March 30, 2022 March 31, 2022 | March 26, 2021 March 30, 2021 March 31, 2021 | |||

| Date of GMoS | March 17, 2023 | March 18, 2022 | March 12, 2021 | |||

| Meeting on Non-Congested Date | Yes | Yes | Yes | |||

| Conduct of Voting via Mail | Yes | Yes | Yes | |||

| Conduct of Electronic Voting | Yes | Yes | Yes | |||

| Conduct of Proxy Solicitation | Yes | Yes | Yes |

(ii) GMoS Voting Results on Each Agenda

The company held 2 GMoS from January 1, 2022 to May 31, 2023 and the results on each agenda are as follows.

(ii) Introduction of ballot paper and electronic voting system and proxy solicitation

The company mails written ballot papers and envelops to all shareholders so that they can exercise their voting rights through written voting if they cannot attend GMoS. To promote participation by minority shareholders and protect their rights, POSCO HOLDINGS also operates the electronic voting system every year. We also recommend proxy solicitation, and we have uploaded the proxy solicitation form on the website to facilitate shareholders’ exercise of voting rights. Since March 2021, the company has broadcasted GMoS live under COVID-19 situation, and made efforts to ensure the participation of shareholders as much as possible by receiving shareholder inquiries in advance.

(iii) GMoS Voting Results on Each Agenda

9

| • | (Table 1-②-2) GMoS Voting Results on Each Agenda |

| Ordinary | The 54th GMoS | March 18, 2022 | ||||||||||||

| Agenda | Resolution Type | Description | Result | Number of Total Issued Shares with Voting Rights (①) | Exercised Shares from ① (A) 1) | For (B) (Ratio, %)2) | ||||||||

Against, Spoilt vote, etc. (C) (Ratio, %)3) | ||||||||||||||

| 1 | Ordinary | Approval of the 54th (January 1, 2021 ~ December 31, 2021) Financial Statements | Approved | 75,625,572 | 56,086,920 | 45,926,950 (81.9%) | ||||||||

10,159,970 (18.1%) | ||||||||||||||

| 2 | 2-1 | Ordinary | Election of Inside Director Chon, Jung-Son | Approved | 75,625,572 | 56,086,320 | 46,748,318 (83.4%) | |||||||

9,338,002 (16.6%) | ||||||||||||||

| 2-2 | Ordinary | Election of Inside Director Chung, Chang-Hwa | Approved | 75,625,572 | 56,086,320 | 39,236,266 (70.0%) | ||||||||

16,850,054 (30.0%) | ||||||||||||||

| 2-3 | Ordinary | Election of Inside Director Yoo, Byeong-Og | Approved | 75,625,572 | 56,086,920 | 39,430,679 (70.3%) | ||||||||

16,656,241 (29.7%) | ||||||||||||||

| 3 | Ordinary | Election of Non-Standing Director Kim, Hag-Dong | Approved | 75,625,572 | 56,086,920 | 37,899,741 (67.6%) | ||||||||

18,187,179 (32.4%) | ||||||||||||||

| 4 | 4-1 | Ordinary | Election of Outside Director Sohn, Sung Kyu | Approved | 75,625,572 | 56,086,920 | 53,302,928 (95.0%) | |||||||

2,783,992 (5.0%) | ||||||||||||||

| 4-2 | Ordinary | Election of Outside Director Yoo, Jin Nyong | Approved | 75,625,572 | 56,086,920 | 53,349,615 (95.1%) | ||||||||

2,737,305 (4.9%) | ||||||||||||||

| 4-3 | Ordinary | Election of Outside Director Pahk, Heui-Jae | Approved | 75,625,572 | 56,086,920 | 51,288,028 (91.4%) | ||||||||

4,798,892 (8.6%) | ||||||||||||||

| 5 | 5-1 | Ordinary | Election of Audit Committee Member from Outside Directors Sohn, Sung Kyu | Approved | 75,625,572 | 49,045,521 | 46,257,121 (94.3%) | |||||||

2,788,400 (5.7%) | ||||||||||||||

| 5-2 | Ordinary | Election of Audit Committee Member from Outside Directors Yoo, Jin Nyong | Approved | 75,625,572 | 49,045,521 | 46,319,713 (94.4%) | ||||||||

2,725,808 (5.6%) | ||||||||||||||

| 6 | Ordinary | Approval of the Ceiling Amount of Total Remuneration for Directors | Approved | 75,625,572 | 56,086,920 | 53,120,362 (94.7%) | ||||||||

2,966,558 (5.3%) | ||||||||||||||

| 1) | Number of shares for Audit Committee Member agenda excluded the number of shares that are limited for voting rights. |

| 2) | Ratio of approval shares (%) : (B/A) x 100 |

| 3) | Ratio of objection, spoilt vote and other shares = (C/A) x 100 |

10

| 정 기 | The 55th GMoS | March 17, 2023. | ||||||||||||

| Agenda | Resolution Type | Description | Result | Number of Total Issued Shares with Voting Rights (①) | Exercised Shares from ① (A) 1) | For (B) (Ratio, %)2) | ||||||||

Against, Spoilt vote, etc. (C) (Ratio, %)3) | ||||||||||||||

| 1 | Ordinary | Approval of the 55th (January 1, 2022 ~ December 31, 2022) Financial Statements | Approved | 75,849,177 | 54,021,693 | 46,974,931 (87.0%) | ||||||||

7,046,762 (13.0%) | ||||||||||||||

| 2 | 2-1 | Special | Partial Amendments of the Article of Incorporation : Change of the Location of the Head Office | Approved | 75,849,177 | 54,021,693 | 51,508,281 (95.3%) | |||||||

2,513,412 (4.7%) | ||||||||||||||

| 2-2 | Special | Partial Amendments of the Article of Incorporation : Removal of Exercise of Voting Rights in Writing | Approved | 75,849,177 | 54,021,693 | 39,204,818 (72.6%) | ||||||||

14,816,875 (27.4%) | ||||||||||||||

| 2-3 | Special | Partial Amendments of the Article of Incorporation : Change of the Record Date for Year-End Dividends | Approved | 75,849,177 | 54,021,693 | 52,625,369 (97.4%) | ||||||||

1,396,324 (2.6%) | ||||||||||||||

| 3 | 3-1 | Ordinary | Election of Inside Director Jeong, Ki-Seop | Approved | 75,849,177 | 54,021,693 | 43,618,751 (80.7%) | |||||||

10,402,942 (19.3%) | ||||||||||||||

| 3-2 | Ordinary | Election of Inside Director Yoo, Byeong-Og | Approved | 75,849,177 | 54,021,693 | 42,906,536 (79.4%) | ||||||||

11,115,157 (20.6%) | ||||||||||||||

| 3-3 | Ordinary | Election of Inside Director Kim, Ji-Yong | Approved | 75,849,177 | 54,021,693 | 43,449,303 (80.4%) | ||||||||

10,572,390 (19.6%) | ||||||||||||||

| 4 | Ordinary | Election of Non-Standing Director Kim, Hag-Dong | Approved | 75,849,177 | 54,021,693 | 38,381,607 (71.0%) | ||||||||

15,640,086 (29.0%) | ||||||||||||||

| 5 | Ordinary | Election of Outside Director Kim, Joon-Gi | Approved | 75,849,177 | 54,021,693 | 52,455,580 (97.1%) | ||||||||

1,566,113 (2.9%) | ||||||||||||||

| 6 | Ordinary | Approval of the Ceiling Amount of Total Remuneration for Directors | Approved | 75,849,177 | 54,021,693 | 51,540,266 (95.4%) | ||||||||

2,481,427 (4.6%) | ||||||||||||||

| 1) | Exercised shares(A) = Number of shares (B) + Number of shares (C) |

| 2) | Ratio of approval shares (%) : (B/A) x 100 |

| 3) | Ratio of objection, spoilt vote and other shares = (C/A) x 100 |

11

B. Company’s Effort for Shareholders’ Voting Rights Exercise

As described in A. History of Shareholders’ Exercise of Voting Rights, POSCO HOLDINGS provides voting via mail, electronic voting, and proxy solicitation in order to facilitate shareholders’ participation to GMoS. Especially for the GMoS held from 2020 under the COVID-19 situation, the company promoted non-contact exercise of voting rights such as voting via mail or electronic voting through company website. Additionally, we provided e-mail address and phone number for inquiries regarding GMoS through the CEO’s letter via mail with the notice of GMoS convocation, and actively responded to shareholders’ inquiries.

| • | (Picture 1-②-1) Promotion on the Company Website |

12

(Sub-Principle 1-③) Company needs to facilitate shareholders to suggest GMoS agendas conveniently and to facilitate them freely asking questions and requesting explanations about shareholders’ suggested agendas at the meeting.

A. Shareholder Proposal Right

(i) Guidance of shareholder proposal procedures

Regarding shareholder proposal standards and procedures for Outside Director candidate recommendation, the company prescribed in the Article 30 of the Articles of Incorporation that by exercising shareholder proposal right in accordance with relevant laws, shareholders may recommend Outside Director candidates to Director Candidate Recommendation Committee.

(ii) Standards and procedures of shareholder proposal

When the recommendation of an Outside Director candidate is received as shareholder proposal, the Investor Relations(IR) team checks whether it meets the shareholder proposal requirements. After that, the Director Candidate Recommendation Committee verifies the candidate’s eligibility and recommends to the GMoS as an Outside Director candidate.

(iii) History of shareholder proposals and implementation status

From January 1, 2021 to May 31, 2023, there was no shareholder proposal with regards to GMoS agenda or no public letter received from institutional investors as part of the Stewardship Code. Accordingly, implementation status related to shareholder proposal or public letter of institutional investors have been omitted. In the future, if there is any shareholder proposal related to agenda of the GMoS, the company will respect shareholders’ opinions so that they can freely ask questions and request explanations at the GMoS.

B. Support for Exercise of Shareholder Proposal Right

Though the company does not provide separate guidance regarding the shareholder proposal procedure as stipulated by law on the website, shareholders who possess the right to propose matters as prescribed by law are notified of the recommendation process for independent director candidates through electronic mail or other means to facilitate the recommendation of such candidates.

In order to enhance communication with shareholders and secure a diverse pool of independent director candidates, the “Shareholder Recommendation System” has been introduced since 2018, allowing shareholders to directly participate in the process of recommending candidates. Candidates recommended by shareholders undergo the same qualification review process as other candidates by the Advisory Committee for Independent Director Candidates.

About 3~4 months before Ordinary GMoS, a letter from the Chairman of Director Candidate Recommendation Committee is sent to shareholders who can exercise shareholder proposal rights under the Commercial Act, suggesting recommendation of one Outside Director candidate per one shareholder and the recommendation is received by e-mail or mail. For the Ordinary GMoS held in March 2023, the recommendation period was from November 10, 2022 to December 15, 2022.

For the Ordinary GMoS in March 2019, one candidate(law major, professorship, female) was proposed for Outside Director through the Shareholders’ Recommendation procedure and the Outside Director Candidate Recommendation Advisory Panel included the candidate as one of the potential candidates and proceeded discussion. It was concluded that the candidate did not meet the need of the company and was not recommended to the Director Candidate Recommendation and Management Committee. Subsequently, the related information was provided to the recommended organization.

13

(Sub-Principle 1-④) The company needs to prepare mid to long-term shareholder return policy and future plans, including dividends, and to guide them to shareholders.

A. Shareholder Return Policies

(i) Shareholder Return Policy and company’s future plan

In January 2020, the company announced its first mid-term dividend policy aimed at enhancing transparency and predictability regarding dividends. The policy set a target dividend payout ratio of approximately 30% from 2020 to 2022. Subsequently, with the expiration of the existing medium-term dividend policy, the company announced its medium-term shareholder return policy for the next three years (2023 to 2025) in April 2023. Under this policy, starting from 2023, the company plans to allocate 50-60% of the annual Free Cash Flow (parent only) as a funding source. The company aims to distribute a basic dividend of KRW 10,000 per share and utilize the remaining funds for additional returns to shareholders, thereby promoting shareholder value and stable dividend distribution.

In addition, by partially amending the Articles of Incorporation in 2016, the company introduced quarterly dividend system so that quarterly dividends can be paid in cash by resolution of the BoD and the quarterly dividends has been continued since the 2nd quarter of 2016.

In April 2020, the BoD resolved on a share repurchase trust contract in order for stable management of stock price and improvement of shareholders’ value. During the contract period, from April 13, 2020 to April 12, 2021, the company finished repurchasing shares worth KRW 1 trillion (4.49 million share, 5.1%) which is the contract amount. Additionally, in August 2022, the company conducted a share cancellation of 3% of the issued shares to further enhance shareholder returns and increase shareholder value.

Furthermore, at the 55th GMoS in March 2023, the company amended the Articles of Incorporation to change the year-end dividend record date to a date determined by the BoD. This amendment lays the foundation for introducing a shareholder-friendly dividend procedure, enabling shareholders to make investment decisions after the dividend amount is publicly disclosed.

(ii) Method of guidance on shareholder return policies, etc

When the company establish a new shareholder return policy and conduct a quarterly/final dividend resolution, treasury stock purchase, or treasury stock cancellation, we disclose the details without delay and inform our shareholders in detail through IR events and announcement on the company website. In addition, shareholders can conveniently check the company’s shareholder return policy and related information such as dividend policy, treasury stock status, and dividend inquiry on our IR website.

B. Information Provision of Shareholders Return Policies

In April 2020, the company website related to shareholder return policy was re-organized to provide information on the mid-term dividend policy, dividend details and amounts, and information on share repurchase in Korean and English. In addition, the POSCO HOLDINGS dividend information service has been established and operated as a separate website to enable online search of dividend details from the 3rd quarter dividend of 2020. Through the service, information related to shareholder return, such as the company’s investor relations materials, mid-term dividend policy, and share repurchase result is provided in an integrated manner.

(POSCO HOLDINGS dividend information service)

: https://dividend.posco.co.kr:4452/F52/F52B10/jsp/home/posF52BMain.jsp

14

| • | (Picture 1-④-1) Disclosure of Shareholders Return Policy |

15

(Sub-Principle 1-⑤) Shareholders right to receive proper level of dividends, etc. based on shareholder return policy and future plan, etc. needs to be respected.

A. Shareholder Return Status

(i) Shareholder Return Status for the past 3 years

During the mid-term dividend policy period (2020-2022), the company carried out the largest shareholder returns of KRW 3,384 billion including cash dividend of KRW 2,816 billion(dividend payout ratio of 24.8%) and retirement of treasury shares (3% of total issued shares which is KRW 568 billion in terms of book value). The total shareholder return rate including both cash dividends and retirement of treasury stock amounts to 29.8%.

The company has set shareholders return target of approximately 30% in order to improve predictability and transparency on dividends at the BoD in January 2020. And when calculating a dividend payout ratio, based on profit attributable to owners of the controlling company in consolidated basis, by adjusting one-off expenses without cash outflows the company reinforced linkage with business performance.

In 2020, based on KRW 1,816 billion, profit attributable to owners of the controlling company in consolidated basis is KRW 1,602 billion and one-off expenses without cash outflows is KRW 214 billion, the BoD discussed applying dividend payout ratio of 38.7% (adjusted dividend payout ratio of 34.2%). The annual dividend per share was resolved to KRW 8,000 and the total annual dividend of KRW 620 billion was paid.

In 2021, based on KRW 7,143 billion, profit attributable to owners of the controlling company in consolidated basis is KRW 6,617 billion and one-off expenses without cash outflows is KRW 526 billion, the BoD discussed applying dividend payout ratio of 19.4% (adjusted dividend payout ratio of 18.0%). The annual dividend per share was resolved to KRW 17,000 and the total annual dividend of KRW 1,286 billion was paid.

In 2022, based on KRW 3,493billion, profit attributable to owners of the controlling company in consolidated basis is KRW 3,144 billion and one-off expenses without cash outflows is KRW 349 billion, the BoD discussed applying dividend payout ratio of 28.9% (adjusted dividend payout ratio of 26.1%). The annual dividend per share was resolved to KRW 12,000 and the total annual dividend of KRW 910 billion was paid. In addition, to enhanced the shareholder value, the company has canceled 3% of the total issued shares (KRW 568 billion based on book value) at BoD held in August 2022.

The shareholder return status for the last 3 fiscal years is as follows.

| • | (Table 1-⑤-1) Shareholder Return Status in the Last 3 Fiscal Years (Shares, KRW, Billions of KRW, %) |

Fiscal Year | Month for Year-end Closing | Types of Shares | Share Dividend | Cash Dividend | ||||||||||||

Dividend per (KRW) | Total (Billions of | Dividend Ratio to Market Value | Dividend Payout Ratio | |||||||||||||

Consolidated Basis 1) | Separate Basis | |||||||||||||||

2022 | December | Common | — | 12,000 | 910 | 4.1% | 28.9% | — | ||||||||

| Class | — | — | — | — | ||||||||||||

2021 | December | Common | — | 17,000 | 1,286 | 6.0% | 19.4% | 24.8% | ||||||||

| Class | — | — | — | — | ||||||||||||

2020 | December | Common | — | 8,000 | 620 | 3.0% | 38.7% | 64.2% | ||||||||

| Class | — | — | — | — | ||||||||||||

| • | Dividend per Share : Sum of quarterly dividends/share and year-end dividend/share |

| • | Dividend Payout Ratio : |

| • | Consolidated base is calculated total dividend divided by profit attributable to owners of the controlling company. |

| • | Dividend Ratio to Market Value is calculated by dividing Dividend per Share to average closing share prices of the 1 week which is the time period prior to the two last trading days before the year-end record date. |

| 1) | The adjusted dividend payout ratio with the company’s mid-term dividend policy is different due to adjustment of one-off expenses without cash outflows. |

16

(ii) Quarterly Dividend Status

The company has introduced quarterly dividend system since 2016, and has been maintaining shareholder return through quarterly dividends throughout the year. The details of quarterly dividends for the last 3 fiscal years are as follows. The company has not paid stock dividends or differential dividends in the last 3 fiscal years.

| • | (Table 1-⑤-2) Quarterly Dividend Status in the Last 3 Fiscal Years |

(KRW, Billions of KRW)

| Fiscal Year | Quarter | Resolution Date of BoD | Dividend per Share | Total Dividend | ||||

2022 | 1st | May 13, 2022 | 4,000 | 303 | ||||

| 2nd | August 12, 2022 | 4,000 | 303 | |||||

| 3rd | November 4, 2022 | 2,000 | 152 | |||||

| 4th | January 27, 2023 | 2,000 | 152 | |||||

2021 | 1st | May 14, 2021 | 3,000 | 227 | ||||

| 2nd | August 13, 2021 | 4,000 | 303 | |||||

| 3rd | November 5, 2021 | 5,000 | 378 | |||||

| 4th | January 28, 2022 | 5,000 | 378 | |||||

2020 | 1st | May 8, 2020 | 1,500 | 120 | ||||

| 2nd | August 7, 2020 | 500 | 40 | |||||

| 3rd | November 6, 2020 | 1,500 | 118 | |||||

| 4th | January 28, 2021 | 4,500 | 343 |

B. Shareholder Right for Shareholder Return

The mid-term dividend policy was established at the BoD in January 2020 to enhance transparency and predictability related to dividends by reflecting the expectations and demands of shareholders. The company has set shareholder return target of approximately 30% of dividend payout ratio, and adjusted one-off expenses without cash outflows from profit attributable to owners of the controlling company so that dividends linked to business performance are paid out.

The company has recently established a new shareholder return policy for the next three years (2023-2025) in order to offer balanced shareholder returns through business growth and stable dividend. We have Established a shareholder return policy based on ‘free cash flow’ in consideration of the need for future growth investment. In order to achieve sustainable growth as a global eco-friendly future materials provider, we also have adopted base dividend to minimize the risk of v in shareholder returns due to the uncertainty of free cash flow. In addition, we have amended the Articles of Incorporation to adopt advanced dividend procedures of ‘determining dividends before the record date’. We will continue to make ongoing efforts to transparently communicate with shareholders and actively reflect their rights in relation to shareholder returns.

17

(Sub-Principle 2-①) The company needs to ensure that shareholders’ voting rights are not infringed and to provide company information to shareholders in timely, sufficient and equitable manners.

A. Stock Issuance Information

(i) Status of Issued Shares

According to the Articles of Incorporation, the total number of shares which the company is authorized to issue is 200,000,000 shares. As of May 31, 2023, 96,480,625 common shares were issued 11,909,395 of them were retire, resulting in total of 84,571,230 common shares remained.

| • | (Table 2-①-1) Share Issuance Status |

| 구 분 | Authorized Shares * | Issued Shares** | Remarks | |||

Common Shares | 200,000,000 | 84,571,230 | Canceled 11,909,395 treasury shares | |||

Class Shares | — | — | — |

| * | Authorized Shares : Total number of shares that is authorized to issue by the company under the Articles of Incorporation |

| ** | Issued Shares : Total issued shares as of May 31, 2023 deducted by the number of retired shares |

(ii) Voting rights among different classes of shares

So far, the company has not been applied to different classes of shares, and therefore, separate description related to the shares has been omitted.

B. Voting Rights on Issued Shares

The company does not have any different classes of shares, but issued only common shares. Shareholders exercise fair voting rights in accordance with the principle of 1 voting right per 1 share.

For reference, at the 54th GMoS in March 2022, the number of shares holding voting rights was 75,625,572 which excludes the company’s treasury stock, 11,561,263 shares. At the 55th GMoS in March 2023, the number of shares holding voting rights was 75,849,177 which excludes the company’s treasury stock, 8,722,053shares.

C. Communication with Shareholders

1) Investor Relations Activities

(i) IR activities

In January, April, July, and October of each year, we hold annual and quarterly earnings announcements in the form of conference calls presided by the CSO. After the announcement, the company regularly conducts non-deal roadshows (NDR) for institutional investors in Korea, Asia, the Americas, and Europe, and frequently participates in domestic and international conferences held by securities companies to have direct communication on investors’ interests and requests.

18

We also strives to strengthen market confidence in key business strategies by providing top management access to key shareholders, and CSO, the Head of IR team and others if necessary are directly involved in overseas NDRs to share the company’s performance and mid and long-term strategic direction with investors, and thereby strive to provide higher-level feedback on shareholder interests. Especially, since 2018, we have provided opportunities for direct communication between Outside Directors and shareholders to improve understanding of the company’s corporate governance and to strengthen communication with shareholders.

IR team’s email address is available on the company website and shareholders can send comments or questions to the IR team through the Contact Us page. The IR representative respond to shareholder inquiries received by e-mail after checking them. In addition, shareholders can reach IR team through IR telephone as well.

In addition, the company has established a section for IR meeting request on the website for investors who want to visit the company directly and holds frequent meetings, and provides diverse IR activities that reflect investors’ interests.

From February 2020 to December 2021, due to widespread of COVID-19 and social distancing policy as one of the counter-measures, it was difficult to hold face-to-face meetings. But with frequent conference calls, we are having active communication with domestic and foreign investors and working to expand our investors pool. In addition, we are actively communicating with investors through conferences and conference calls on ESG-related issues that have recently emerged.

In order to strengthen communication channels with our investors, we have started to provide online streaming service that is also available to our minority shareholders from 2022 1Q Earnings Release session. Furthermore, in March 2023, the POSCO HOLDINGS IR’ YouTube channel was launched to respond to the needs of individual investors and strengthen communication with the shareholders.

Video contents such as tech talk and market talk are produced by EV battery materials experts to introduce the overall EV battery material business. Also, virtual tour contents are provided in order to give detailed introduction of POSCO HOLDINGS’ new businesses in Korea and overseas. IR team answers the questions that come through company website(http://www.posco-inc.co.kr). We also try to strengthen communication with our minority shareholders by actively responding to their inquires over the phone.

| • | (Table 2-①-2) Major IR Events, Conference Calls, and Discussions with Shareholders |

from January 1, 2022 to March 31, 2023

| Date | Counterpart | Meeting Type | Subject | Remarks | ||||

| January 4~21, 2022 | Domestic and foreign institutional investors | NDR | NDR (Regarding transition to a holding company) | |||||

| January 28, 2022 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of FY2021 and Q&A session) | |||||

| February 8~10, 2022 | Domestic institutional investors, Analysts | NDR | NDR followed by Earnings release | |||||

| March 24, 2022 | Foreign institutional investors | Conference | Credit Suisse Conference (Earnings, markets, business issues, etc.) | |||||

| April 25, 2022 | Domestic institutional investors, Analysts | Conference call | Earnings release (Provisional business outcome of 1st quarter of FY2022 and Q&A session) |

19

| April 25~28, 2022 | Domestic institutional investors, Analysts | NDR | NDR followed by Earnings release | |||||

| May 31, 2022 | Foreign institutional investors | Conference | Morgan Stanley Conference (Earnings, markets, business issues, etc.) | |||||

| July 5, 2022 | Domestic and foreign institutional investors | IR | 2022 LiB Material Business Value Day (POSCO Group’s LiB Material Business, etc.) | |||||

| July 7, 2022 | Foreign institutional investors | NDR | CSO IR (POSCO Group’s LiB Material Business strategy and future plan) | |||||

| July 21, 2022 | Domestic and foreign institutional investors, | Conference call | Earnings release (Provisional business outcome of 2nd quarter of FY2022 and Q&A session | |||||

| July 26~28, 2022 | Domestic institutional investors | NDR | NDR followed by Earnings release | |||||

| August 18, 2022 | Domestic and foreign institutional investors | Conference | Samsung Securities Conference (Earnings, markets, business issues, etc.) | |||||

| August 19, 2022 | Foreign institutional investors | NDR | CEO IR Business strategy and plan as a leading provider of eco-friendly future materials | |||||

| October 3~7, 2022 | Foreign institutional investors | NDR | NDR (The United States) (Earnings, markets, business issues, etc.) | |||||

| October 24, 2022 | Domestic and foreign institutional investors | Conference call | Earnings release (Provisional business outcome of 3rd quarter of FY2022 and Q&A session | |||||

| October 25~27, 2022 | Domestic institutional investors | NDR | NDR followed by Earnings release | |||||

| November 16~18, 2022 | Domestic and foreign institutional investors | Conference | Morgan Stanley Conference (Earnings, markets, business issues, etc.) | |||||

| November 29~30, 2022 | Domestic institutional investors, Analysts | IR | 2022 Green Steel Value Day (Green Steel, materials for EV and etc.) | |||||

| January 1~December 31, 2022 | Domestic/Foreign institutional investors, Analysts | IR | Individual meetings and conference calls per request of shareholders and investors | 165 times in 2022 | ||||

| January 27, 2023 | Domestic and foreign institutional investors | Conference call | Earnings release (Provisional business outcome of FY2022 and Q&A session) | |||||

| January 30~February 2, 2023 | Domestic institutional investors | NDR | NDR followed by Earnings release | |||||

| March 22~23, 2023 | Foreign institutional investors | Conference | Credit Suisse Conference (Earnings, markets, business issues, etc.) | |||||

| April 27, 2023 | Domestic and foreign institutional investors, | Conference call | Earnings release (Provisional business outcome of 1st quarter of FY2023, Shareholder Return policy for 2023~2025 and Q&A session) | |||||

| April 28~May 4, 2023 | Domestic institutional investors | NDR | NDR followed by Earnings release | |||||

| May 16, 2023 | Domestic and foreign institutional investors | Conference | BofA Conference (Earnings, markets, business issues, etc.) | |||||

| May 18, 2023 | Foreign institutional investors | IR | Gwangyang LiB Business site tour POSCO HY Clean Metal, POSCO Pilbara Lithium Solution, POSCO Future M | |||||

| May 24, 2023 | Foreign institutional investors | IR | CSO/ Meeting with LiB materials business experts | |||||

| May 25~26, 2023 | Domestic and foreign institutional investors | Conference | Samsung Securities Conference (Earnings, markets, business issues, etc.) | |||||

| January 1~31 May, 2023 | Domestic and foreign institutional investors, | IR | Individual meetings and conference calls per request of shareholders and investors | 54 times |

20

(ii) IR team contact information

The company discloses e-mail address of the IR department on the company website, and shareholders can send opinions or questions to the IR department through the inquiry section. Inquiries to shareholders received by e-mail are reviewed and answered by the IR persons in charge.

In addition, it is accessible to an IR-only phone through the company’s representative phone posted on the company website, and we respond to shareholders’ inquiries.

In addition, the company information including IR materials are disclosed to all shareholders in a timely and fair manner at the Korea Exchange electronic disclosure system, KIND (http://kind.krx.co.kr), the Financial Supervisory Service electronic disclosure system DART (http://dart.fss.or.kr), and the company website, etc.

(iii) Information for Foreign Shareholders

The company operates an English website for foreign shareholders, and inquiries can be forwarded to the IR department by using the email address of the IR department or the Q&A section. Inquiries received are answered after checks by the IR persons in charge. In addition, the company has been participating in the Korea Exchange’s English disclosure strengthening campaign since 2020 and has strengthened disclosure of information to foreign investors by actively utilizing the English disclosure of the electronic disclosure system, KIND.

As the company listed American Depositary Receipts(ADR) on the New York Stock Exchange (NYSE), we submit English disclosures to the EDGAR system (https://www.sec.gov/edgar) of the U.S. Securities and Exchange Commission(SEC). In addition, the IR contact information is provided on Form 20-F submitted to the SEC, so that shareholders can submit inquiries.

| • | (Table 2-①-3) English Disclosure to KIND System from January 1, 2022 to May 31, 2023 |

21

Date of Disclosure | Disclosure Title | Contents | ||

| January 10, 2022 | Matters Related to Ad Hoc Public Disclosure Obligation (Fair Disclosure) | Guide to the shareholder-friendly policy to enhance shareholder value | ||

| January 13, 2022 | Interim Report on Business Performance (Fair Disclosure) | Provisional business performance for the year 2021 | ||

| January 13, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the year 2021 | ||

| January 17, 2022 | Organization of Investor Relations Event | Notice disclosure for IR event | ||

| March 4, 2022 | Relocation of Head Office | Notice of relocation of Head Office | ||

| March 14, 2022 | Submission of Audit Report | Submission of Audit Report | ||

| March 16, 2022 | Decision on Closure of Shareholder’s Registry(Including Record Date) for Dividends | Record date notice for quarterly dividend | ||

| March 18, 2022 | Outcome of Annual Shareholders’ Meeting | Result of Ordinary GMoS | ||

| March 18, 2022 | Notice on Change of CEO | Changes of representative directors | ||

| April 15, 2022 | Other Management Information(Voluntary Disclosure) | Receipt of examination result for report on the conversion of holding company | ||

| April 15, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 1st quarter of 2022 | ||

| April 15, 2022 | Organization of Investor Relations Event | Notice disclosure for IR event | ||

| April 25, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 1st quarter of 2022 | ||

| May 3, 2022 | Submission of Annual Report or Other Documents Submitted to Overseas Exchange, etc. | Form 20-F submitted to the SEC | ||

| May 13, 2022 | Decision on Cash Dividends and Dividends in Kind | Decision on quarterly cash dividend | ||

| May 13, 2022 | Adjustments of Conversion Price, Warrant Exercise Price or Exchange Price (Information Disclosure) | Adjustment of Exchange Price | ||

| July 5, 2022 | Organization of Investor Relations Event | Notice disclosure for IR event | ||

| July 5, 2022 | Inclusion of Subsidiary in Holding Company | Notice of Inclusion of Subsidiary in Holding Company | ||

| July 5, 2022 | Future Business or Management Plans (Fair Disclosure) | Explanation on POSCO Group’s LiB materials business | ||

| July 14, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 2nd quarter of 2022 | ||

| July 14, 2022 | Organization of Investor Relations Event | Notice disclosure for IR event | ||

| July 21, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 2nd quarter of 2022 | ||

| August 16, 2022 | Decision on Merger (Material Business Matters of Subsidiary Company) | Merger of POSCO Energy and POSCO International | ||

| August 16, 2022 | Occurrence of Causes for Corporate Dissolution | Occurrence of Causes for Corporate Dissolution (Subsidiary Company POSCO Energy) | ||

| August 16, 2022 | Decision on Cash Dividendsand Dividends in Kind | Decision on quarterly cash dividend | ||

| August 16, 2022 | Adjustments of Conversion Price, Warrant Exercise Price or Exchange Price (Information Disclosure) | Adjustment of Exchange Price | ||

| August 16, 2022 | Retirement of Stocks | Notice of retirement of treasury shares |

22

| August 16, 2022 | Other Management Information(Voluntary Disclosure) | 2Q 2022 Shareholders return, Merger of POSCO International and POSCO Energy | ||

| September 7, 2022 | Suspension of Production | Notice of Suspension of Production (Subsidiary Company POSCO) | ||

| September 14, 2022 | Resumption of Production(Voluntary Disclosure) | Notice of Resumption of Production (Subsidiary Company POSCO) | ||

| September 15, 2022 | Decision on Closure of Shareholder’s Registry(Including Record Date) for Dividends | Record date notice for quarterly dividend | ||

| September 16, 2022 | Other Management Information (Voluntary Disclosure)(Material Management matters of Subsidiary Company) | Update on production resume schedule of major mills in Pohang Steelworks and estimated impact on revenue (Subsidiary Company POSCO) | ||

| October 6, 2022 | Exclusion of Subsidiary from Holding Company | Notice of exclusion of Subsidiary in Holding Company | ||

| October 11, 2022 | Other Management Information (Voluntary Disclosure)(Material Management matters of Subsidiary Company) | Business plan of 2nd stage of POSCO Argentina’s lithium brine project (Subsidiary Company POSCO Argentina) | ||

| October 19, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 3rd quarter of 2022 | ||

| October 19, 2022 | Organization of Investor Relations Event | Notice disclosure for IR event | ||

| October 24, 2022 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 3rd quarter of 2022 | ||

| November 1, 2022 | Exclusion of Subsidiary from Holding Company | Notice of exclusion of Subsidiary in Holding Company | ||

| November 1, 2022 | Inclusion of Subsidiary in Holding Company | Notice of Inclusion of Subsidiary in Holding Company | ||

| November 4, 2022 | Material Business Matters Related to Investment Decisions | POSCO’s decision on acquisition of steel business related shares or investment certificates of POSCO HOLDINGS (Subsidiary Company POSCO) | ||

| November 4, 2022 | Decision on Cash Dividendsand Dividendsin Kind | Decision on quarterly cash dividend | ||

| December 21, 2022 | Exclusion of Subsidiary from Holding Company | Notice of exclusion of Subsidiary in Holding Company | ||

| December 21, 2022 | Inclusion of Subsidiary in Holding Company | Notice of Inclusion of Subsidiary in Holding Company | ||

| January 3, 2023 | Exclusion of Subsidiary from Holding Company | Notice of exclusion of Subsidiary in Holding Company | ||

| January 20, 2023 | Organization of Investor Relations Event | Notice disclosure for IR event | ||

| January 20, 2023 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 3rd quarter of 2022 |

23

| January 20, 2023 | Prior Notice on Disclosure of Final Earnings | Prior Notice on Disclosure of Final Earnings | ||

| January 27, 2023 | Decision on Calling Shareholders’ Meeting | Decision on Calling Shareholders’ Meeting | ||

| January 27, 2023 | Decision on Cash Dividendsand Dividendsin Kind | Decision on year-end cash dividend | ||

| January 27, 2023 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the year 2022 | ||

| January 27, 2023 | Changes of 30% or More in Sales or Profits/Losses (15% or More in the Case of Large-sized Corporations) | Changes of 15% or More in Sales or Profits/Losses | ||

| January 27, 2023 | Forecast for Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the year 2022 | ||

| March 15, 2023 | Submission of Audit Report | Submission of Audit Report | ||

| March 15, 2023 | Decision on Closure of Shareholder’s Registry(Including Record Date) for Dividends | Record date notice for quarterly dividend | ||

| March 17, 2023 | Outcome of Annual Shareholders’ Meeting | Result of Ordinary GMoS | ||

| March 17, 2023 | Adjustments of Conversion Price, Warrant Exercise Price or Exchange Price (Information Disclosure) | Adjustment of Exchange Price | ||

| March 17, 2023 | Notice on Change of CEO | Changes of representative directors | ||

| March 17, 2023 | Decision on Disposal of Treasury Stock | Notice of Decision on Disposal of Treasury Stock | ||

| April 4, 2023 | Inclusion of Subsidiary in Holding Company | Notice of Inclusion of Subsidiary in Holding Company | ||

| April 27, 2023 | Report on Business Performance according to Consolidated Financial Statements (Fair Disclosure) | (Consolidated basis) Provisional business performance for the 1st quarter of 2023 | ||

| April 27, 2023 | Matters Related to Ad Hoc Public Disclosure Obligation (Fair Disclosure) | Shareholder Return policy for 2023~2025 |

• The company listed American Depositary Receipts on the New York Stock Exchange and under the rules of the U.S. Securities and Exchange Commission, we submit English public disclosures such as Form 20-F, Form 6-K, Form SD, etc. |

(iv) Fair Disclosure

The company is actively utilizing the fair disclosure system to provide shareholders with sufficient information in a timely manner. In particular, fair disclosures and informative disclosures related to performance announcements are conducted on a regular basis in every quarter. The list of fair disclosures from January 1, 2022 to May 31, 2023 are as follows:

24

| • | (Table 2-①-4) List of Fair Disclosures |

| Date of Disclosure | Disclosure Title | Contents | ||

| January 12, 2022 | Provisional business performance | Provisional revenue, operating profit on separate basis | ||

| January 12, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| January 14, 2022 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| January 25, 2022 | Prior Notice on Disclosure of Final Earnings | Prior Notice on Disclosure of Earnings of FY2021 | ||

| January 28, 2022 | Outlook on business performance | Outlook on separate basis of revenue, crude steel production, product sales volume | ||

| January 28, 2022 | Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue | ||

| January 28, 2022 | Provisional business performance | Provisional revenue, operating profit on separate basis | ||

| January 28, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| February 3, 2022 | Outlook on business performance | Outlook on separate basis of revenue, crude steel production, product sales volume | ||

| February 3, 2022 | Outlook on business performance on consolidated basis | Outlook on consolidated basis of revenue | ||

| February 3, 2022 | Provisional business performance | Provisional revenue, operating profit on separate basis | ||

| February 3, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| April 14, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| April 14, 2022 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| April 25, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| July 5, 2022 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| July 5, 2022 | Future Business or Management Plans (Fair Disclosure) | Investment in LiB Business | ||

| July 14, 2022 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| July 14, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| July 21, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit, etc. on consolidated basis | ||

| July 21, 2022 | Outlook on business performance on consolidated basis | Outlook on business performance of 2022 on consolidated basis | ||

| October 19, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| October 19, 2022 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| October 24, 2022 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit, etc. on consolidated basis | ||

| January 20, 2023 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| January 20, 2023 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| January 27, 2023 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit, etc. on consolidated basis | ||

| January 27, 2023 | Changes of 30% or More in Sales or Profits/Losses (15% or More in the Case of Large-sized Corporations) | Main causes for changes in sales or profits/losses amount | ||

| January 27, 2023 | Outlook on business performance on consolidated basis | Outlook on business performance of FY 2022 | ||

| April 18, 2023 | Organization of Investor Relations Event | The purpose, methods, summary of IR event | ||

| April 18, 2023 | Provisional business performance on consolidated basis | Provisional revenue, operating profit on consolidated basis | ||

| April 27, 2023 | Provisional business performance on consolidated basis | Provisional revenue, operating profit, profit, etc. on consolidated basis | ||

| April 28, 2023 | Matters Related to Ad Hoc Public Disclosure Obligation (Fair Disclosure) | Shareholder Return policy for 2023~2025 |

25

(v) Unfaithful Disclosure Corporation

The company has not been designated as an unfaithful disclosure corporation from January 1, 2022 until May 31, 2023 and therefore, the table for the list of designation of unfaithful disclosure corporation and its details has been omitted.

D. Provision of Corporate Information to Shareholders

As referred on C. Communication with Shareholders, the company provides company information including IR materials on its website and public disclosure websites such as DART(http://dart.fss.or.kr), KIND(http://kind.krx.co.kr), etc. fairly to all shareholders in a timely manner. In addition, as the company listed American Depositary Receipts(ADR) on the New York Stock Exchange(NYSE), we submit English disclosures to the EDGAR system (https://www.sec.gov/edgar) of the U.S. Securities and Exchange Commission(SEC). The company runs website with English and provides English translations of IR materials, independent auditors’ quarterly, interim review reports and annual audit reports thereby, giving a fair access to the corporate information to all of its shareholders, whether domestic or foreign.

26

(Sub-Principle 2-②) The company needs to prepare and operate mechanism to protect shareholders from unfair internal transactions and self-transactions of other shareholders such as controlling shareholders.

A. Corporate Control System related to Internal Transactions and Self-Transaction

(i) Corporate Control System of Internal Transactions and Self-Transaction

In order to prevent internal transactions for the purpose of private profits by management or controlling shareholders, the company has prepared separate internal control related rules. First of all, the internal accounting management regulations are managed by the resolution of Audit Committee. And regarding transactions of funds, assets, and securities over certain amounts conducted by the company’s largest shareholder, including its related parties, and the company’s related parties are ruled to be resolved by the BoD.

The company established ESG committee to deliberate and decide on large-scale internal transactions of from KRW 5 billion to less than KRW 100 billion, and in the case of large-scale internal transactions of from KRW 100 billion or more, the Committee conducts prior deliberation and it needs approval from the BoD. Please refer to ‘VI.3. Board of Directors(BoD)” for the details of internal transactions decided or deliberated by the ESG Committee.

(ii) Comprehensive board approval for internal transactions with affiliated companies, managements or controlling shareholders.

In accordance with Article 542-9 of the Commercial Act, the company gets comprehensive approvals from the BoD in advance if expected transaction amounts with affiliated companies during the current fiscal year exceed 5% of the total assets or total sales of the previous year. There was no such comprehensive approval in 2022.

(iii) Transactions with major shareholders and related parties

In 2022, the Company did not provide credit grants to major shareholders, assets transfer or business transactions with major shareholders. The major transactions between the company and related parties (affiliated companies) are as follows.

<Reference : POSCO HODLINGS’ 2022 Business Report – X. Details of transactions with major shareholders, etc >

| (in millions of Won) | ||||||||||||||||||||||||||||

| Name of the Company | Sales and others(*1) | Purchase and others(*2) | ||||||||||||||||||||||||||

| Sales | Dividend | Others | Purchase of material | Purchase of fixed assets | Outsourced processing cost | Others | ||||||||||||||||||||||

Subsidiaries (*3) | ||||||||||||||||||||||||||||

POSCO | 87,165 | — | 2 | — | — | — | 10,446 | |||||||||||||||||||||

POSCO E&C (Former POSCO ENGINEERING & CONSTRUCTION CO.,LTD. | 7,502 | 16,555 | 7 | — | 80,306 | — | 13,086 | |||||||||||||||||||||

27

| (in millions of Won) | ||||||||||||||||||||||||||||

| Name of the Company | Sales and others(*1) | Purchase and others(*2) | ||||||||||||||||||||||||||

| Sales | Dividend | Others | Purchase of material | Purchase of fixed assets | Outsourced processing cost | Others | ||||||||||||||||||||||

POSCO STEELEON (Former POSCO COATED & COLOR STEEL Co., Ltd.) | 133,743 | — | 215 | — | — | 7,656 | 18 | |||||||||||||||||||||

POSCO DX (Former POSCO ICT) (*4) | 1,760 | 4,970 | 18 | — | 39,932 | 10,190 | 34,724 | |||||||||||||||||||||

eNtoB Corporation | 3 | 24 | — | 60,649 | 9,706 | 32 | 3,453 | |||||||||||||||||||||

POSCO Future M (Former POSCO CHEMICAL CO., LTD | 89,535 | 13,878 | 44 | 84,301 | 4,757 | 56,325 | 908 | |||||||||||||||||||||

POSCO Energy (*5) | 4,331 | — | — | 6,682 | — | — | 3,925 | |||||||||||||||||||||

POSCO Mobility Solutions | 176,534 | — | — | — | — | 8,802 | 28 | |||||||||||||||||||||

POSCO INTERNATIONAL Corporation | 2,102,356 | 62,093 | — | 244,230 | — | 768 | 1,049 | |||||||||||||||||||||

POSCO Thainox Public Company Limited | 49,359 | 22,867 | — | — | — | — | 1 | |||||||||||||||||||||

POSCO Canada Ltd. | — | — | — | 77,225 | — | — | — | |||||||||||||||||||||

Qingdao Pohang Stainless Steel Co., Ltd. | 32,584 | — | — | — | — | — | — | |||||||||||||||||||||

POSCO JAPAN Co., Ltd. | 28,790 | — | — | 835 | — | — | 16 | |||||||||||||||||||||

POSCO-VIETNAM Co., Ltd. | 44,840 | — | 513 | — | — | — | — | |||||||||||||||||||||

POSCO MEXICO S.A. DE C.V. | 102,776 | — | 562 | — | — | — | — | |||||||||||||||||||||

POSCO Maharashtra Steel Private Limited | 171,806 | — | 1,130 | — | — | — | 120 | |||||||||||||||||||||

POSCO(Suzhou) Automotive Processing Center Co., Ltd. | 42,320 | — | — | — | — | — | 15 | |||||||||||||||||||||

POSCO VST CO., LTD. | 28,475 | — | — | — | — | — | — | |||||||||||||||||||||

POSCO INTERNATIONAL SINGAPORE PTE LTD. | — | — | 179 | 379,823 | — | — | — | |||||||||||||||||||||

POSCO ASSAN TST STEEL INDUSTRY | 47,335 | — | 537 | — | — | — | 8 | |||||||||||||||||||||

Others | 203,869 | 2,452 | 6,574 | 61,457 | 18,844 | 53,139 | 223,222 | |||||||||||||||||||||

Sub Total | 3,355,083 | 122,839 | 9,781 | 915,202 | 153,545 | 136,912 | 291,019 | |||||||||||||||||||||

28

| (in millions of Won) | ||||||||||||||||||||||||||||

| Name of the Company | Sales and others(*1) | Purchase and others(*2) | ||||||||||||||||||||||||||

| Sales | Dividend | Others | Purchase of material | Purchase of fixed assets | Outsourced processing cost | Others | ||||||||||||||||||||||

Associates and joint ventures (*3) | ||||||||||||||||||||||||||||

SNNC | 3,242 | 5,348 | 8 | 148,239 | — | — | — | |||||||||||||||||||||

POSCO-SAMSUNG-Slovakia Processing Center | 25,614 | — | — | — | — | — | — | |||||||||||||||||||||

Roy Hill Holdings Pty Ltd | — | 186,813 | — | 210,455 | — | — | — | |||||||||||||||||||||

Others | 78,048 | 209,457 | 14,704 | 14,015 | — | — | 197 | |||||||||||||||||||||

Sub Total | 106,904 | 401,618 | 14,712 | 372,709 | — | — | 197 | |||||||||||||||||||||

Total | 3,461,987 | 524,457 | 24,493 | 1,287,911 | 153,545 | 136,912 | 291,216 | |||||||||||||||||||||

| (*1) | ‘Sales and others’ consist sales of steel products (before vertical spin-off), profits from trademark use, rental income and dividend income of subsidiaries, associates and joint ventures. |

| (*2) | ‘Purchases and others’ mainly consist of subsidiaries’ purchases of construction services and purchases of raw materials to manufacture steel products. |

| (*3) | As of December 31, 2021, the company provided guarantees to related parties |

| (*4) | Others (purchase) mainly consist of service fees related to maintenance and repair of ERP System. |

| (*5) | POSCO Energy was merged into POSCO International in January 2023. |

As of December 31, 2022, the details of receivables and payables between the company and the related parties (affiliated companies) are as follows.

| (in millions of Won) | ||||||||||||||||||||||||

| Name of the Company | Receivables | Payables | ||||||||||||||||||||||

| Trade accounts and notes receivable | Others | Total | Accounts payable | Others | Total | |||||||||||||||||||

Subsidiaries | ||||||||||||||||||||||||

POSCO | 75,343 | 6,600 | 81,943 | 5,678 | 14,663 | 20,341 | ||||||||||||||||||

POSCO E&C (Former POSCO ENGINEERING & CONSTRUCTION CO.,LTD. | 3,808 | 660 | 4,468 | — | — | — | ||||||||||||||||||

POSCO STEELEON (Former POSCO COATED & COLOR STEEL Co., Ltd.) | 818 | — | 818 | — | — | — | ||||||||||||||||||

29

| (in millions of Won) | ||||||||||||||||||||||||

| Name of the Company | Receivables | Payables | ||||||||||||||||||||||

| Trade accounts and notes receivable | Others | Total | Accounts payable | Others | Total | |||||||||||||||||||

POSCO DX (Former POSCO ICT) (*2) | 687 | — | 687 | 859 | 705 | 1,564 | ||||||||||||||||||

eNtoB Corporation | — | — | — | — | — | — | ||||||||||||||||||

POSCO Future M (Former POSCO CHEMICAL CO., LTD | 8,550 | — | 8,550 | — | 5,086 | 5,086 | ||||||||||||||||||

POSCO Energy (*5) | 3,400 | 462 | 3,862 | — | 1,593 | 1,593 | ||||||||||||||||||

POSCO Mobility Solutions | 489 | — | 489 | — | — | — | ||||||||||||||||||

POSCO INTERNATIONAL Corporation | 2,002 | — | 2,002 | — | 502 | 502 | ||||||||||||||||||

Qingdao Pohang Stainless Steel Co., Ltd. | — | — | — | 122 | — | 122 | ||||||||||||||||||

POSCO Maharashtra Steel Private Limited | — | 466 | 466 | 486 | — | 486 | ||||||||||||||||||

POSCO ASSAN TST STEEL INDUSTRY | — | 513 | 513 | 104 | — | 104 | ||||||||||||||||||

PT. KRAKATAU POSCO | — | 8,967 | 8,967 | 391 | — | 391 | ||||||||||||||||||

Others | 1,918 | 5,618 | 7,536 | 11,874 | 3,335 | 15,209 | ||||||||||||||||||

Sub Total | 97,015 | 23,286 | 120,301 | 19,514 | 25,884 | 45,398 | ||||||||||||||||||

Associates and joint ventures | ||||||||||||||||||||||||

SNNC | 94 | — | 94 | — | — | — | ||||||||||||||||||

Roy Hill Holdings Pty Ltd | 23,400 | — | 23,400 | — | — | — | ||||||||||||||||||

FQM Australia Holdings Pty Ltd(*1) | — | 202,562 | 202,562 | — | — | — | ||||||||||||||||||

Others | 190 | 761 | 951 | 74 | — | 74 | ||||||||||||||||||

Sub Total | 23,684 | 203,323 | 227,007 | 74 | — | 74 | ||||||||||||||||||

Total | 120,699 | 226,609 | 347,308 | 19,588 | 25,884 | 45,472 | ||||||||||||||||||

| (*1) | Other payable for FQM Australia Holdings Pty is full long-term loans. POSCO HOLDINGS lent 12,116 million in 2022. |

| (*2) | POSCO Energy was merged into POSCO International in January 2023. |

30

(Sub-Principle 2-③)

| • | The company must pursue means to protect the rights of shareholders as gathering opinions of minor shareholders and protect shareholders who are against the major change in businesses and governance structure of the company, including merger, business transfer agreement, spin-off, and all-inclusive exchange of shares, etc. |

A. Shareholder protection policy in the event of changes in corporate ownership structure or major business

POSCO declared the ‘POSCO Charter of Corporate Citizenship’ on July 25, 2019 and affirmed that under its management philosophy of ‘Corporate Citizenship : Building a Better Future Together’, will engage and communicate with all stakeholders including customers, employees and shareholders, and continually seek changes and innovation in pursuit of sustainability by ultimately creating greater value for the company. Accordingly, the company is implementing a shareholder protection policy that actively collects opinions of shareholders, including minor shareholders, through various communication channels such as homepage and representative phone. In addition, if a listed company decides at a general shareholders’ meeting to have a significant impact on shareholders’ interests, such as acquiring, merging, or transferring major business areas, shareholders who oppose the resolution can exercise their right to purchase shares at a predetermined price.

B. Change in governance structure or major business changes and shareholders protection during reporting fiscal year

Recently, on Dec 10, 2021, the company gathered BoD meeting to decide the vertical spin-off to transfer to a holding company structure. At the meeting, BoD approved the plan for the vertical spin-off, announcement for Special General Shareholders’ Meeting, and the date of the spin-off. Also on the same day of the BoD meeting, the company held a investor day to explain the plan to transfer into holding company structure to investors, including foreign, institutional, and minor shareholders.

Though the conference call was held towards major domestic and overseas institutional shareholders, the company uploaded the presentation material for the spin-off and Q&A of the investor day on the company website in order to help all the investors’ including minor investors understanding.

Prior to the Special Shareholders’ Meeting (Jan 28, 2022), to gain the approval for the vertical spin-off, the company held individual conference call led by the executive level to explain on the plan to both domestic and overseas investors (held 45 meetings, from Dec 13, 2021 to Jan 21, 2022) and heard the investors’ thoughts on the plan. Moreover, to actively engage with minor shareholders, the staff engaged personally on answering the inquiries raised on the company website and explained the agenda.

To prohibit the conflict of interest of existing shareholders and any harm in shareholders’ value by possible dual-listing after the spin-off, the company decided to keep the new company (steel) unlisted after the spin-off. To guarantee the decision, clauses related to listing as public or third-party offering were not included in the Articles of Incorporation of new company, POSCO, and included clauses stating that in case the new company desires to come public, it must win the recognition of the Shareholders’ Meeting of POSCO Holdings (“existing company”). This was ensure the shareholders that the company is certain to keep the steel business unlisted. Not only steel, but also new growth businesses will remain unlisted, in case of a spin-off. Such decisions enabled the company to solely keep the growth value of unlisted subsidiaries in line with the shareholders’ value of the holding company, a form of an advanced global governance structure. The company has publicly disclosed the policy through CEO letter (Jan 5, 2022) uploaded on the website.

31

The company also disclosed the progress of the mid-term strategy on 1Q 2022 earnings result material when announcing the vertical spin-off. By providing on-line streaming service of the earnings release conference call, the company levelled up the transparency of information to all shareholders.

This vertical spin-off is simple vertical spin-off that accord with the Article 530-2 or 530-12 of the Commercial Act, and therefore, appraisal right by a shareholder of dissident shareholders do not apply to the case.

If the major changes in business and corporate governance structure take place in the future, the company will actively utilize public filing, investor events, homepage disclosure, and letters, to help the investors, including the minor shareholders, to understand the decision and plans of the company. Moreover, we plan to actively listen to opinions of minor shareholders through diverse communication channels such as channels as company website, official IR email account and calls. The company will also try its best to protect the shareholders’ rights by maintaining the policy which is un-listing the newly spin-off companies.

32

| 3. Board of Directors(BoD) |

(Core Principle 3) Function of BoD

• BoD needs to determine the company’s business goals and strategies for the benefit of the company and shareholders, and to effectively supervise the management. |

(Sub-Principle 3-①) BoD needs to effectively perform business decision-makings and management supervision. |

A. Operation Policy of BoD

The BoD of the company decides important matters of the company, such as setting business goals and core business strategies for the benefit of the company and shareholders in accordance with relevant laws and the Operational Regulations of the Board of Directors. And the concrete roles of the BoD are specified in the Article 38 (1) of the Articles of Incorporation and the Operational Regulations of the Board of Directors.

The BoD may establish special committee pursuant to the Article 38 and 45 of the Articles of Incorporation and delegate authority to the committee after determining scope of authority and operation. Details of the operation of the special committee except for the audit committee are separately determined by the Operational Regulations of the Board of Directors.