- PKX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

POSCO (PKX) 6-KCurrent report (foreign)

Filed: 19 Feb 25, 11:17am

Exhibit 99.1

POSCO HOLDINGS 2025 Ordinary General Meeting of Shareholders —Reference Material—

Contents Convocation Notice of 01 03 Ordinary General Meeting of Shareholders 02 2024 Financial & ESG Highlights 04 03 Amendments of the Articles of Incorporation 07 04 Composition of the Board 12 05 Inside Director Candidates 13 Outside Director Appointment Process, 06 16 Candicates and Board Skills Matrix 07 Director Remuneration 22

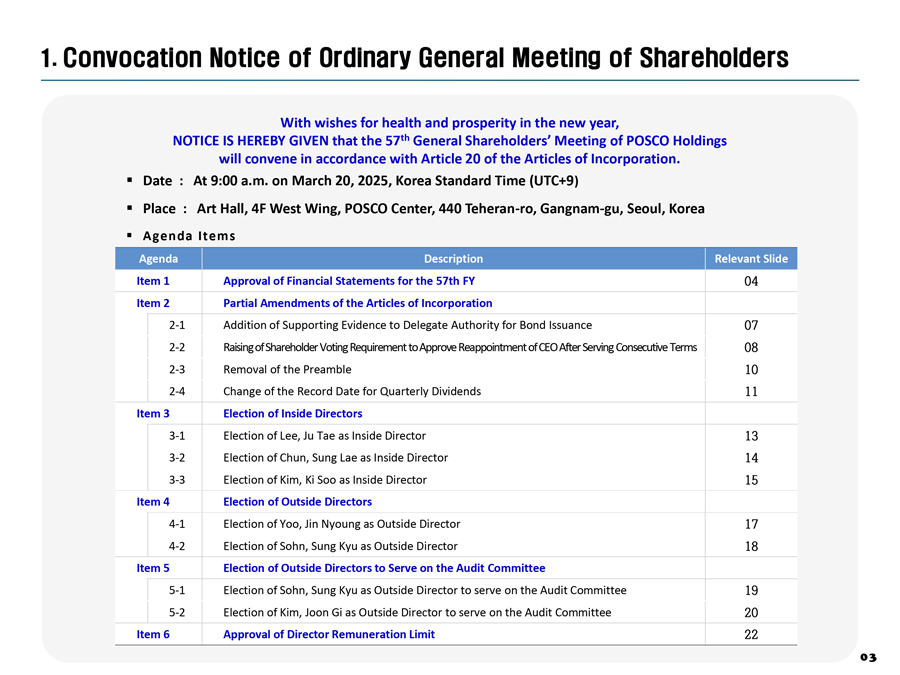

1. Convocation Notice of Ordinary General Meeting of Shareholders With wishes for health and prosperity in the new year, NOTICE IS HEREBY GIVEN that the 57th General Shareholders’ Meeting of POSCO Holdings will convene in accordance with Article 20 of the Articles of Incorporation. Date : At 9:00 a.m. on March 20, 2025, Korea Standard Time (UTC+9) Place : Art Hall, 4F West Wing, POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea Agenda Items Agenda Description Relevant Slide Item 1 Approval of Financial Statements for the 57th FY 04 Item 2 Partial Amendments of the Articles of Incorporation 2-1 Addition of Supporting Evidence to Delegate Authority for Bond Issuance 07 2-2 Raising of Shareholder Voting Requirement to Approve Reappointment of CEO After Serving Consecutive Terms 08 2-3 Removal of the Preamble 10 2-4 Change of the Record Date for Quarterly Dividends 11 Item 3 Election of Inside Directors 3-1 Election of Lee, Ju Tae as Inside Director 13 3-2 Election of Chun, Sung Lae as Inside Director 14 3-3 Election of Kim, Ki Soo as Inside Director 15 Item 4 Election of Outside Directors 4-1 Election of Yoo, Jin Nyoung as Outside Director 17 4-2 Election of Sohn, Sung Kyu as Outside Director 18 Item 5 Election of Outside Directors to Serve on the Audit Committee 5-1 Election of Sohn, Sung Kyu as Outside Director to serve on the Audit Committee 19 5-2 Election of Kim, Joon Gi as Outside Director to serve on the Audit Committee 20 Item 6 Approval of Director Remuneration Limit 22 03

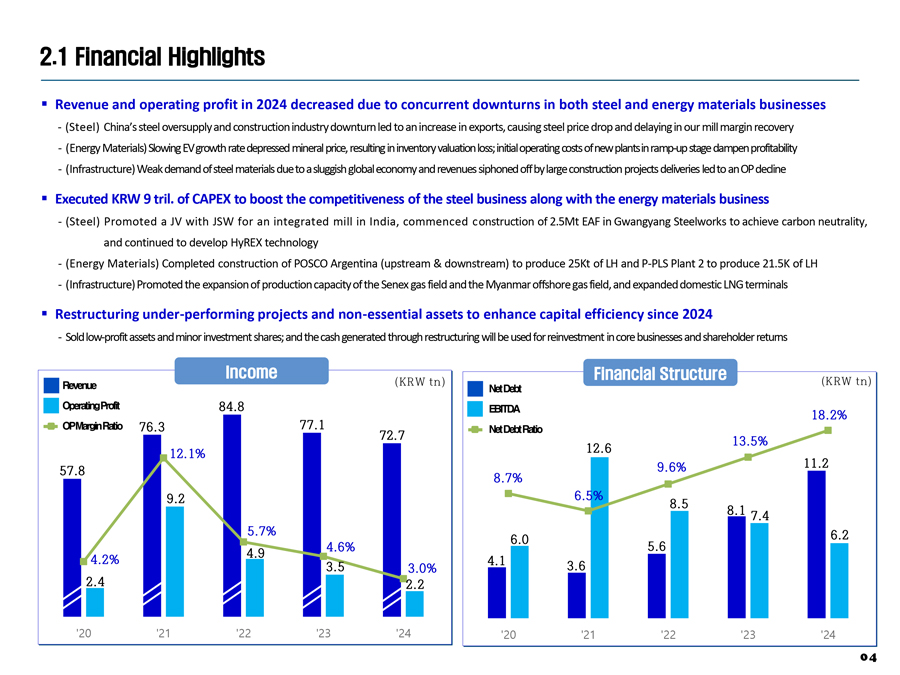

2.1 Financial Highlights Revenue and operating profit in 2024 decreased due to concurrent downturns in both steel and energy materials businesses—(Steel) China’s steel oversupply and construction industry downturn led to an increase in exports, causing steel price drop and delayingin our mill margin recovery —(Energy Materials) Slowing EVgrowth rate depressed mineral price, resulting in inventory valuation loss; initial operating costs ofnew plantsin ramp-up stage dampen profitability —(Infrastructure) Weak demand of steel materials due to a sluggish global economy and revenues siphoned off by large construction projects deliveries led to an OP decline Executed KRW 9 tril. of CAPEX to boost the competitiveness of the steel business along with the energy materials business —(Steel) Promoted a JV with JSW for an integrated mill in India, commenced construction of 2.5Mt EAF in Gwangyang Steelworks to achieve carbon neutrality, and continued to develop HyREX technology —(Energy Materials) Completed construction of POSCO Argentina (upstream & downstream) to produce 25Kt of LH and P-PLS Plant 2 to produce 21.5K of LH—(Infrastructure) Promoted the expansion of production capacity of the Senex gas field and the Myanmar offshore gas field, and expanded domestic LNG terminals Restructuring under-performing projects and non-essential assets to enhance capital efficiency since 2024 —Sold low-profit assets and minor investment shares; and the cash generated through restructuring will be used for reinvestment in core businesses and shareholder returns Income Financial Structure (KRW tn) (KRW tn) Revenue NetDebt OperatingProfit 84.8 EBITDA 18.2% OPMarginRatio 76.3 77.1 72.7 NetDebtRatio 13.5% 12.1% 12.6 57.8 9.6% 11.2 8.7% 9.2 6.5% 8.5 8.1 7.4 5.7% 6.0 6.2 4.9 4.6% 5.6 4.2% 3.5 3.0% 4.1 3.6 2.4 2.2 ’20 ‘21 ‘22 ‘23 ‘24 ‘20 ‘21 ‘22 ‘23 ‘24 04

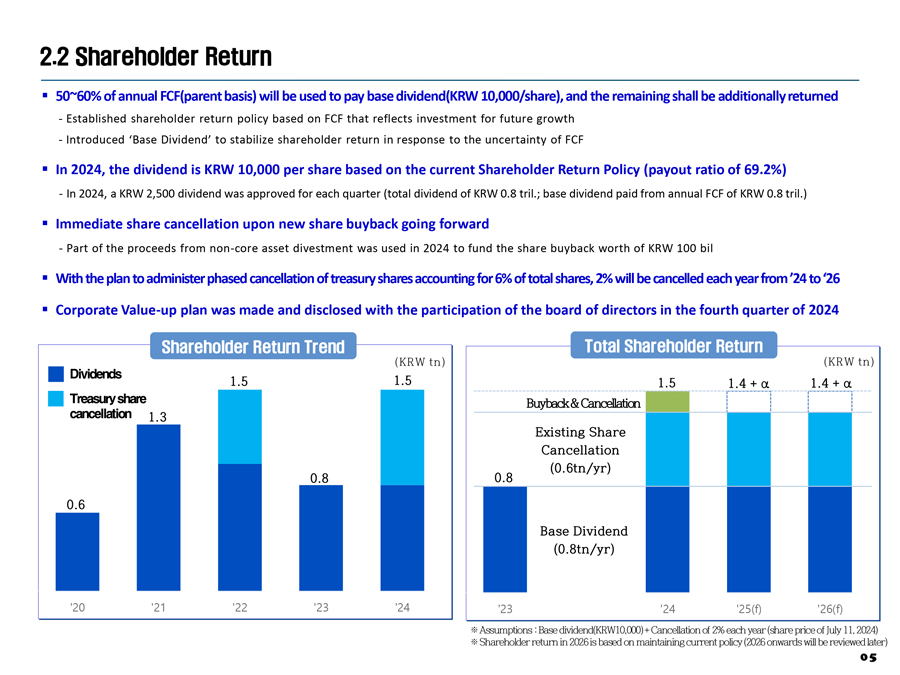

2.2 Shareholder Return 50~60% of annual FCF(parent basis) will be used to pay base dividend(KRW 10,000/share), and the remaining shall be additionally returned —Established shareholder return policy based on FCF that reflects investment for future growth —Introduced ‘Base Dividend’ to stabilize shareholder return in response to the uncertainty of FCF In 2024, the dividend is KRW 10,000 per share based on the current Shareholder Return Policy (payout ratio of 69.2%) —In 2024, a KRW 2,500 dividend was approved for each quarter (total dividend of KRW 0.8 tril.; base dividend paid from annual FCF of KRW 0.8 tril.) Immediate share cancellation upon new share buyback going forward —Part of the proceeds from non -core asset divestment was used in 2024 to fund the share buyback worth of KRW 100 bil With the plan to administer phased cancellation of treasury shares accounting for 6% of total shares, 2% will be cancelled each year from ’24 to ‘26 Corporate Value-up plan was made and disclosed with the participation of the board of directors in the fourth quarter of 2024 Shareholder Return Trend Total Shareholder Return (KRW tn) (KRW tn) Dividends 5ì¡° 5ì¡° 1.5 1.5 1.5 1.4 + α 1.4 + α Treasuryshare Buyback & Cancellation cancellation 1.3 Existing Share Cancellation 0.8 0.8 (0.6tn/yr) 0.6 Base Dividend (0.8tn/yr) ‘20 ‘21 ‘22 ‘23 ‘24 ‘23 ‘24 ‘25(f) ‘26(f) ? Assumptions : Base dividend(KRW10,000)+ Cancellation of 2% each year (share price of July 11, 2024) ? Shareholder return in 2026 is based on maintaining current policy (2026 onwards will be reviewed later) 05

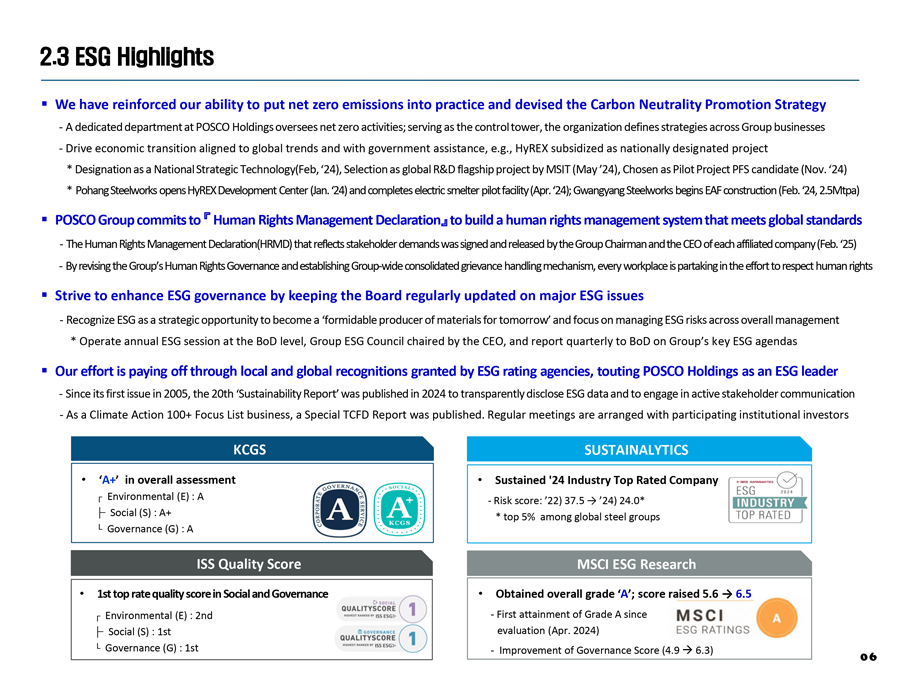

2.3 ESG Highlights We have reinforced our ability to put net zero emissions into practice and devised the Carbon Neutrality Promotion Strategy —A dedicated department at POSCO Holdings oversees net zero activities; serving as the control tower, the organization defines strategies across Group businesses —Drive economic transition aligned to global trends and with government assistance, e.g., HyREX subsidized as nationally designated project * Designation as a National Strategic Technology(Feb, ‘24), Selection as global R&D flagship project by MSIT (May ’24), Chosen as Pilot Project PFS candidate (Nov. ‘24) * Pohang Steelworks opens HyREX Development Center (Jan. ‘24) and completes electric smelter pilot facility (Apr. ‘24); Gwangyang Steelworks begins EAF construction (Feb. ‘24, 2.5Mtpa) POSCO Group commits to Human Rights Management Declaration to build a human rights management system that meets global standards—The Human Rights Management Declaration(HRMD) that reflects stakeholder demands was signed and released by the Group Chairmanand the CEO of each affiliated company (Feb. ‘25)—By revising the Group’s Human Rights Governance and establishing Group-wide consolidated grievance handling mechanism, every workplace is partaking in the effort to respect human rights Strive to enhance ESG governance by keeping the Board regularly updated on major ESG issues —Recognize ESG as a strategic opportunity to become a ‘formidable producer of materials for tomorrow’ and focus on managing ESG risks across overall management * Operate annual ESG session at the BoD level, Group ESG Council chaired by the CEO, and report quarterly to BoD on Group’s k ey ESG agendas Our effort is paying off through local and global recognitions granted by ESG rating agencies, touting POSCO Holdings as an ESG leader —Since its first issue in 2005, the 20th ‘Sustainability Report’ was published in 2024 to transparently disclose ESG data and to engage in active stakeholder communication—As a Climate Action 100+ Focus List business, a Special TCFD Report was published. Regular meetings are arranged with participating institutional investors KCGS SUSTAINALYTICS • ‘A+’ in overall assessment • Sustained ‘24 Industry Top Rated Company ┌ Environmental (E) : A —Risk score: ’22) 37.5 → ’24) 24.0* ├ Social (S) : A+ * top 5% among global steel groups â”” Governance (G) : A ISS Quality Score MSCI ESG Research • 1st top rate quality score in Social and Governance • Obtained overall grade ‘A’; score raised 5.6 → 6.5 ┌ Environmental (E) : 2nd —First attainment of Grade A since ├ Social (S) : 1st evaluation (Apr. 2024) â”” Governance (G) : 1st —Improvement of Governance Score (4.9 → 6.3) 06

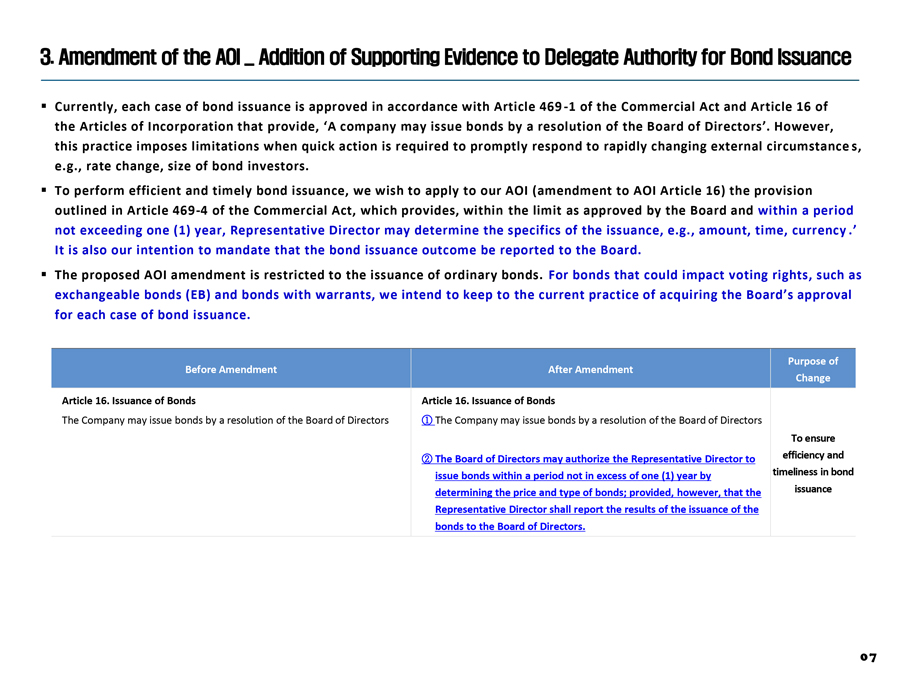

3. Amendment of the AOI _ Addition of Supporting Evidence to Delegate Authority for Bond Issuance Currently, each case of bond issuance is approved in accordance with Article 469 -1 of the Commercial Act and Article 16 of the Articles of Incorporation that provide, ‘A company may issue bonds by a resolution of the Board of Directors’. However, this practice imposes limitations when quick action is required to promptly respond to rapidly changing external circumstance s, e.g., rate change, size of bond investors. To perform efficient and timely bond issuance, we wish to apply to our AOI (amendment to AOI Article 16) the provision outlined in Article 469 -4 of the Commercial Act, which provides, within the limit as approved by the Board and within a period not exceeding one (1) year, Representative Director may determine the specifics of the issuance, e.g., amount, time, currency .’ It is also our intention to mandate that the bond issuance outcome be reported to the Board. The proposed AOI amendment is restricted to the issuance of ordinary bonds. For bonds that could impact voting rights, such as exchangeable bonds (EB) and bonds with warrants, we intend to keep to the current practice of acquiring the Board’s approval for each case of bond issuance. Purpose of Before Amendment After Amendment Change Article 16. Issuance of Bonds Article 16. Issuance of Bonds The Company may issue bonds by a resolution of the Board of Directors 1 The Company may issue bonds by a resolution of the Board of Directors To ensure 2 The Board of Directors may authorize the Representative Director to efficiency and issue bonds within a period not in excess of one (1) year by timeliness in bond determining the price and type of bonds; provided, however, that the issuance Representative Director shall report the results of the issuance of the bonds to the Board of Directors. 07

3. Amendment of the AOI _ Raising of Shareholder Voting Requirement to Approve Reappointment of CEO After Serving ConsecutiveTerms With the objective to raise the standard by which shareholders can assess the qualification of and approve a CEO seeking reappointment after serving consecutive terms, we wish to amend the votes and shares needed to reach a resolution. Absent any management control conflict at the company, the objective of this amendment is not intended to defend rights to management. We believe raising of approval standards serves the interest of shareholder value. When a CEO has completed a consecutive term and seeks reappointment for the CEO and Representative Director position, during appointment as Inside Director at the General Meeting of Shareholders, we seek to amend the rules governing resolution to raise the standards to the requirements defined for a ‘special resolution’ (Amendment of Article 29 of the Articles of Incorporation). Purpose of Before Amendment After Amendment Change Article 24. Quorum and Requisite for Resolutions Article 24. Quorum and Requisite for Resolutions 1 Except as otherwise provided in these Articles of Incorporation or by 1 (Same as left) applicable laws or regulations, all resolutions passed at a General Meeting of Shareholders shall be adopted by the affirmative vote of a majority of the voting shares of the shareholders present, which shall represent at least one-fourth (1/4) of the voting shares of the Company then issued and outstanding. 2 In the following cases, the resolutions of a General Meeting of Shareholders shall be adopted by the affirmative vote of at least two-thirds 2 (Same as left) (2/3) of the voting shares of the shareholders present and by the affirmative vote of at least one-third (1/3) of the voting shares of the total issued and outstanding shares: 1 ~ 6. (Same as left) To provide a 1. Amendment of the Articles of Incorporation; 2. Transfer of all or any important part of the business; consistent 3. Execution, amendment or rescission of a contractfor leasing the whole of the approval process business, for entrustment of management, or for sharing with another in the AOI person all profits and losses in relation to the business or of a similar contract; 4. Acquisition of all or part of business of any other company, which may have agreat influence upon the business ofthe Company; 5. Merger or consolidation of the Company (excluding a small scale merger or consolidation); 6. Matters required to be approved by the General Meeting of Shareholders, which have material effects on the company’s assets, as determined by the Board of Directors; and 7. Any other matter requiring a special resolution of a 7. Any other matter for which such vote is required by Korean laws and General Meeting of Shareholders under Korean laws and regulations. regulations or these Articles of Incorporation 08

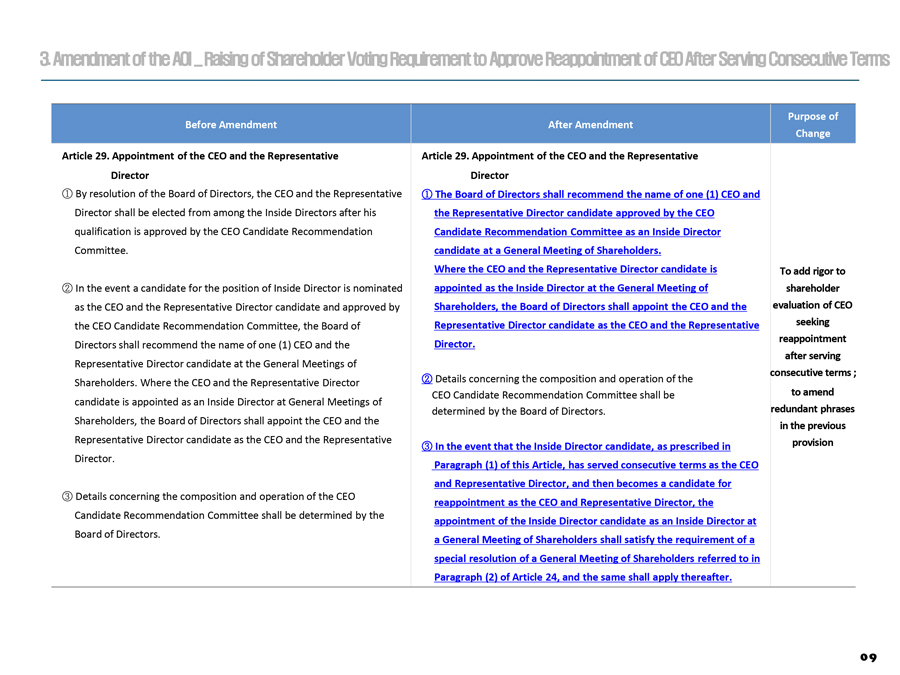

3. Amendment of the AOI _ Raising of Shareholder Voting Requirement to Approve Reappointment of CEO After Serving ConsecutiveTerms Purpose of Before Amendment After Amendment Change Article 29. Appointment of the CEO and the Representative Article 29. Appointment of the CEO and the Representative Director Director 1 By resolution of the Board of Directors, the CEO and the Representative 1 The Board of Directors shall recommend the name of one (1) CEO and Director shall be elected from among the Inside Directors after his the Representative Director candidate approved by the CEO qualification is approved by the CEO Candidate Recommendation Candidate Recommendation Committee as an Inside Director Committee. candidate at a General Meeting of Shareholders. Where the CEO and the Representative Director candidate is To add rigor to 2 In the event a candidate for the position of Inside Director is nominated appointed as the Inside Director at the General Meeting of shareholder as the CEO and the Representative Director candidate and approved by Shareholders, the Board of Directors shall appoint the CEO and the evaluation of CEO the CEO Candidate Recommendation Committee, the Board of Representative Director candidate as the CEO and the Representative seeking Directors shall recommend the name of one (1) CEO and the Director. reappointment after serving Representative Director candidate at the General Meetings of Shareholders. Where the CEO and the Representative Director 2 Details concerning the composition and operation of the consecutive terms ; CEO Candidate Recommendation Committee shall be to amend candidate is appointed as an Inside Director at General Meetings of determined by the Board of Directors. redundant phrases Shareholders, the Board of Directors shall appoint the CEO and the in the previous Representative Director candidate as the CEO and the Representative 3 In the event that the Inside Director candidate, as prescribed in provision Director. Paragraph (1) of this Article, has served consecutive terms as the CEO and Representative Director, and then becomes a candidate for 3 Details concerning the composition and operation of the CEO reappointment as the CEO and Representative Director, the Candidate Recommendation Committee shall be determined by the appointment of the Inside Director candidate as an Inside Director at Board of Directors. a General Meeting of Shareholders shall satisfy the requirement of a special resolution of a General Meeting of Shareholders referred to in Paragraph (2) of Article 24, and the same shall apply thereafter. 09

3. Amendment of the AOI _ Removal of the Preamble In March 2022, on the occasion of the launch of POSCO Holdings, with the goal to establish a shared spirit of corporate cultu re across the POSCO Group of companies, the full text of the Corporate Citizenship Charter was compiled into the Articles of Incorporation. In the past, philosophical slogans, such as ‘Steelmaking Patriotism’, ‘National Company’, ‘Corporate Citizen’, had been conceived to rally attention. In 2024, the corporate spirit and our entrepreneurial evolution, previously captured in short phrases, have been standardized into a larger frame of the ‘POSCO Spirit.’ Hence, we will remove the declarative Corporate Citizenship Charter from the Articles of Incorporation like other companies which do not have preamble in the AOI. Instead, we wish to rally support for the ‘POSCO Spirit’ that encapsulates into a systematized frame the corporate spirit and entrepreneurial advancement, which invariably evolve over time. Purpose of Before Amendment After Amendment Change Companies achieve lasting growth and sustainability by pursuing harmony (Deleted) within the society where businesses operate. As a member of the social community, companies who have benefited from resources provided by the society should look beyond profit, engage in addressing social issues and contribute to the prosperity of mankind and to making the world a better place. To rally support for the POSCO We believe that this is the right way to move forward. Spirit beyond Corporate Citizen POSCO Holdings Inc, under its management philosophy of ‘Corporate Citizenship: Building a Better Future Together’, will engage and communicate with all stakeholders including customers, employees and shareholders, and continually seek changes and innovation in pursuit of sustainability by ultimately creating greater value for the company. 10

3. Amendment of the AOI _ Change of the Record Date for Quarterly Dividends At the 55th GSM, we proposed an amendment to the AOI regarding the year -end dividend record date with the goal to ‘determine dividend amount before the record date,’ introducing a more shareholder -friendly dividend determination process. However, per quarterly dividend payout, relevant law amendments have been delayed, forcing previous rules that determine the last day of each month of March, June, and September as the record date, to remain in place. Owing to the revision of Capital Market Law Article 165 -12 that was enacted in December 2024, we are now able to apply the improved dividend determination process to quarterly payout standards. Therefore, ‘dividend determination prior to record date’ process is now applied to quarterly dividend process, enabling consistency across the quarterly and year -end dividend determination processes and balanced payout schedule. Purpose of Before Amendment After Amendment Change Article 56-2. Quarterly Dividends Article 56-2. Quarterly Dividends 1 The Company may pay quarterly dividends in cash by a resolution of 1 The Company may pay quarterly dividends in cash by a resolution to be the Board of Directors each fiscal year. In such case, the record date for adopted at the meeting of the Board of Directors to be held within the distribution of quarterly dividends shall be the last day of March, fourty five (45) days from the last day of March, June and September June or September. The dividends shall be paid within 20 days from the each fiscal year. The dividends shall be paid within one (1) month from To implement resolution above. the resolution above. shareholder— friendly dividend 2 Dividends referred to in Paragraph (1) shall be paid to the shareholders 2 The dividends referred to in Paragraph (1) of this Article shall be paid to determination or registered pledgees whose names appear in the shareholders’ the shareholders or registered pledgees whose names appear in the process register of the Company as of the record date for the distribution of shareholders’ register of the Company as of the record date quarterly dividends. determined by a resolution of the Board of Directors. Where the Company sets a record date, a public notice of the record date shall be given at least two (2) weeks in advance. 11

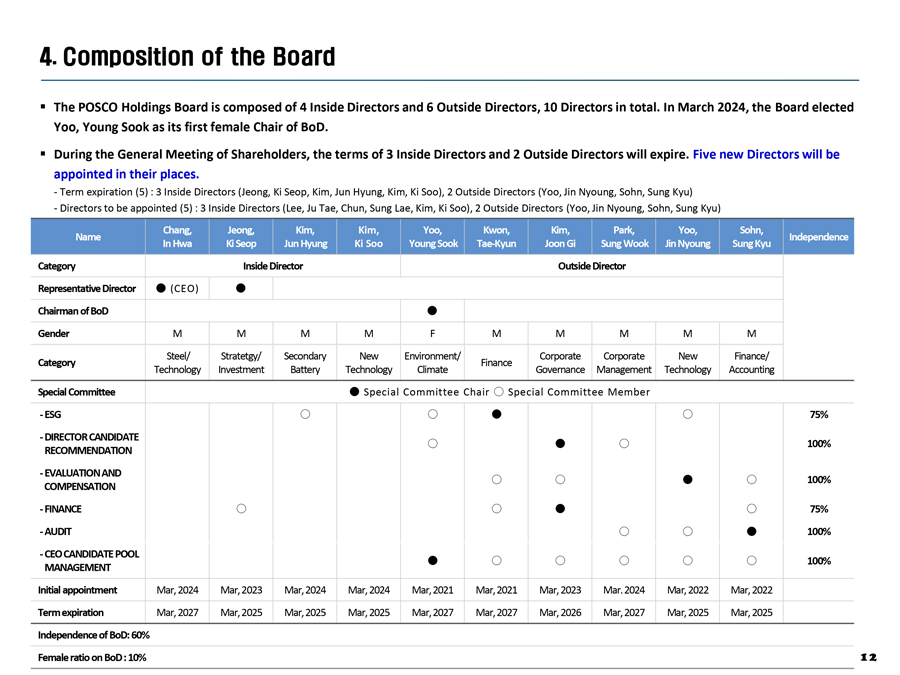

4. Composition of the Board The POSCO Holdings Board is composed of 4 Inside Directors and 6 Outside Directors, 10 Directors in total. In March 2024, the Board elected Yoo, Young Sook as its first female Chair of BoD. During the General Meeting of Shareholders, the terms of 3 Inside Directors and 2 Outside Directors will expire. Five new Directors will be appointed in their places. —Term expiration (5) : 3 Inside Directors (Jeong, Ki Seop, Kim, Jun Hyung, Kim, Ki Soo), 2 Outside Directors (Yoo, Jin Nyoung, Sohn, Sung Kyu) —Directors to be appointed (5) : 3 Inside Directors (Lee, Ju Tae, Chun, Sung Lae, Kim, Ki Soo), 2 Outside Directors (Yoo, Jin Nyoung, Sohn, Sung Kyu) Chang, Jeong, Kim, Kim, Yoo, Kwon, Kim, Park, Yoo, Sohn, Name Independence In Hwa Ki Seop Jun Hyung Ki Soo Young Sook Tae-Kyun Joon Gi Sung Wook Jin Nyoung Sung Kyu Category Inside Director Outside Director Representative Director • (CEO) • Chairman ofBoD • Gender M M M M F M M M M M Steel/ Stratetgy/ Secondary New Environment/ Corporate Corporate New Finance/ Category Finance Technology Investment Battery Technology Climate Governance Management Technology Accounting SpecialCommittee • Special Committee Chair Special Committee Member —ESG • 75% —DIRECTOR CANDIDATE • 100% RECOMMENDATION —EVALUATION AND • 100% COMPENSATION —FINANCE • 75% —AUDIT • 100% —CEO CANDIDATE POOL • 100% MANAGEMENT Initial appointment Mar, 2024 Mar, 2023 Mar, 2024 Mar, 2024 Mar, 2021 Mar, 2021 Mar, 2023 Mar. 2024 Mar, 2022 Mar, 2022 Term expiration Mar, 2027 Mar, 2025 Mar, 2025 Mar, 2025 Mar, 2027 Mar, 2027 Mar, 2026 Mar, 2027 Mar, 2025 Mar, 2025 Independenceof BoD: 60% Female ratio on BoD: 10% 12

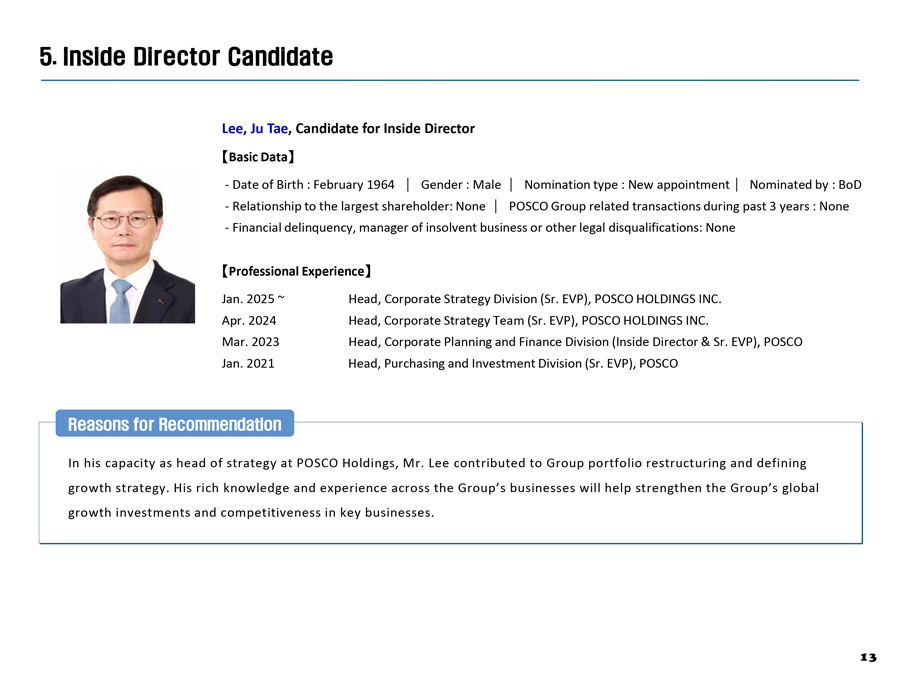

5. Inside Director Candidate Lee, Ju Tae, Candidate for Inside Director Basic Data —Date of Birth : February 1964 Gender : Male Nomination type : New appointment Nominated by : BoD—Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience Jan. 2025 ~ Head, Corporate Strategy Division (Sr. EVP), POSCO HOLDINGS INC. Apr. 2024 Head, Corporate Strategy Team (Sr. EVP), POSCO HOLDINGS INC. Mar. 2023 Head, Corporate Planning and Finance Division (Inside Director & Sr. EVP), POSCO Jan. 2021 Head, Purchasing and Investment Division (Sr. EVP), POSCO Reasons for Recommendation In his capacity as head of strategy at POSCO Holdings, Mr. Lee contributed to Group portfolio restructuring and defining growth strategy. His rich knowledge and experience across the Group’s businesses will help strengthen the Group’s global growth investments and competitiveness in key businesses. 13

5. Inside Director Candidate Chun, Sung Lae, Candidate for Inside Director Basic Data —Date of Birth : October 1963 Gender : Male Nomination type : New appointment Nominated by : BoD —Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience Jan. 2025 ~ Head, Business Synergy Division (Sr. EVP), POSCO HOLDINGS INC. Apr. 2024 Head, Carbon Neutral Team (Sr. EVP), POSCO HOLDINGS INC. Mar. 2022 Head, Steel Business Team (Sr. EVP), POSCO HOLDINGS INC. Jan. 2022 Representative President, POSCO-Maharashtra (Sr. EVP) Reasons for Recommendation As Head of the Carbon Neutral Team, Mr. Chun contributed to steel business portfolio restructuring. His broad experience and expertise in marketing, overseas investment, and business management will help strengthen synergies across the Group. 14

5. Inside Director Candidate Kim, Ki Soo, Candidate for Inside Director Basic Data —Date of Birth : April 1965 Gender : Male Nomination type : Re-appointment Nominated by : BoD —Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience Mar 2024 ~ Head, New Experience of Technology Hub; Group CTO (Inside Director & Sr. EVP), POSCO HOLDINGS INC. Jan 2024 Head, Technical Research Laboratories (Sr. EVP), POSCO Jan 2019 Head, Low-Carbon Process R&D Center (EVP), POSCO Feb 2017 Head, Engineering Solution Office (SVP), POSCO Reasons for Recommendation As Head of POSCO N.EX.T Hub and CTO, Mr. Kim helped to solidify the Group’s research organization and to secure opportunities to commercialize new technologies. By leveraging his expertise in steel research and broad experience in new technology development, e.g., AI-powered process automation, Mr. Kim will assist to build a holding company-led Corporate R&D system and to advance the Group’s technology development system. 15

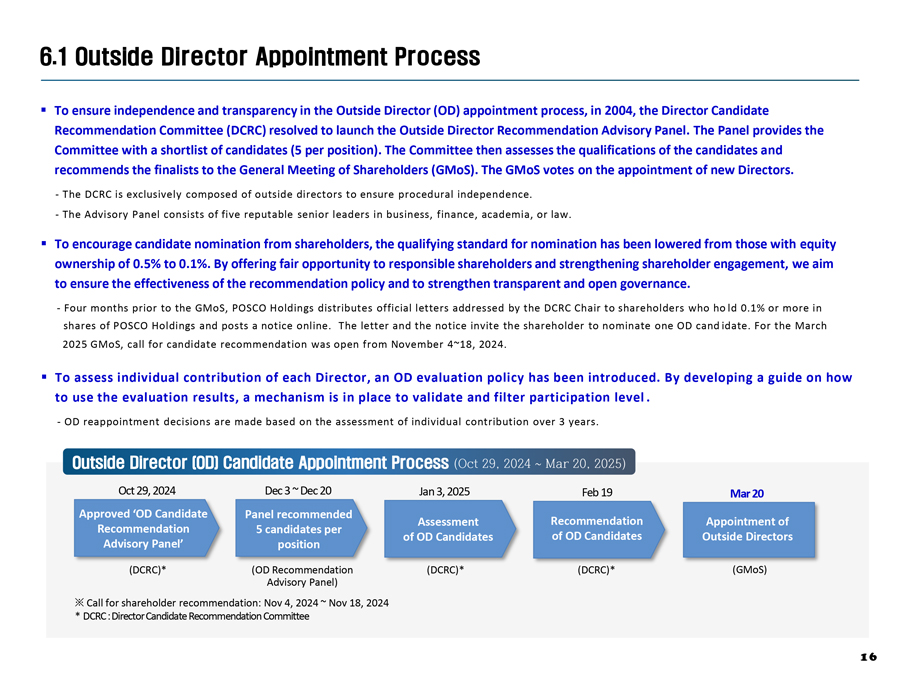

6.1 Outside Director Appointment Process To ensure independence and transparency in the Outside Director (OD) appointment process, in 2004, the Director Candidate Recommendation Committee (DCRC) resolved to launch the Outside Director Recommendation Advisory Panel. The Panel provides the Committee with a shortlist of candidates (5 per position). The Committee then assesses the qualifications of the candidates and recommends the finalists to the General Meeting of Shareholders (GMoS). The GMoS votes on the appointment of new Directors.—The DCRC is exclusively composed of outside directors to ensure procedural independence.—The Advisory Panel consists of five reputable senior leaders in business, finance, academia, or law. To encourage candidate nomination from shareholders, the qualifying standard for nomination has been lowered from those with equity ownership of 0.5% to 0.1%. By offering fair opportunity to responsible shareholders and strengthening shareholder engagement, we aim to ensure the effectiveness of the recommendation policy and to strengthen transparent and open governance.—Four months prior to the GMoS, POSCO Holdings distributes official letters addressed by the DCRC Chair to shareholders who ho ld 0.1% or more in shares of POSCO Holdings and posts a notice online. The letter and the notice invite the shareholder to nominate one OD cand idate. For the March 2025 GMoS, call for candidate recommendation was open from November 4~18, 2024. To assess individual contribution of each Director, an OD evaluation policy has been introduced. By developing a guide on how to use the evaluation results, a mechanism is in place to validate and filter participation level .—OD reappointment decisions are made based on the assessment of individual contribution over 3 years. Outside Director (OD) Candidate Appointment Process (Oct 29, 2024 ~ Mar 20, 2025) Oct 29, 2024 Dec 3 ~ Dec 20 Jan 3, 2025 Feb 19 Mar 20 Approved ‘OD Candidate Panel recommended Assessment Recommendation Appointment of Recommendation 5 candidates per of OD Candidates of OD Candidates Outside Directors Advisory Panel’ position (DCRC)* (OD Recommendation (DCRC)* (DCRC)* (GMoS) Advisory Panel) ? Call for shareholder recommendation: Nov 4, 2024 ~ Nov 18, 2024 * DCRC : Director Candidate Recommendation Committee 16

6.2 Outside Director Candidate Yoo, Jin Nyoung, Candidate for Outside Director Basic Data —Date of Birth : July 1957 Gender : Male Nomination type : Re-appointment—Nominated by : Director Candidate Recommendation Committee —Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience 2019 ~ CEO, Angel 6+ 1998 ~ 2004 VP, Head, Advanced Materials Lab, LG Chem 2017 ~ 2018 CTO and President, LG Chem 1997 VP, Head, Polymers Lab, LG Chem 2014 ~ 2016 President & Head, Research Park, LG Chem 1996 VP, Research Fellow, Polymers Lab, LG Chem 2005 ~ 2013 EVP & Head, Research Park, LG Chem 1981 ~ 1995 Researcher, Polymers Lab, LG Chem Reasons for Recommendation Mr. Yoo is an expert in rechargeable battery components and advanced materials technology development. In his current position as CEO of Angel 6+, he is engaged in various technology development activities. During his previous 3 -year term on the Board, he made significant contribution to Company policy, risk assessment, governance improvement and Board operation. As an Outside Director, Mr. Yoo is expected to continue to assist the operation and advancement of the Board, for which Mr. Yoo is nominated as a candidate to serve as an Outside Director. 17

6.2 Outside Director Candidate Sohn, Sung Kyu, Candidate for Outside Director Basic Data —Date of Birth : December 1959 Gender : Male Nomination type : Re-appointment—Nominated by : Director Candidate Recommendation Committee —Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience 2019 ~ Outside Director, Samsung Asset Management 2013 ~ 2015 Distinguished Professor, Samil 1993 ~ 2025 Professor, School of Business, Yonsei University 2008 ~ 2010 Non-standing member, Korea Accounting 2017 ~ 2022 Outside Director, Hyundai Construction Equipment Standards Board 2016 ~ 2017 President, Korean Accounting Association 2008 ~ 2010 Head, KOSPI Disclosure Committee Reasons for Recommendation Mr. Sohn is a professor of Business Administration at Yonsei University. He formerly served as Chair of the Korea Accounting Association, Professor Emeritus at Samil PWC, and a non-standing member of the Korea Accounting Standards Board. Drawing on his expert knowledge and experience in accounting, over the past 3 years, Mr. Sohn has made significant contribution to th e Company’s accounting and finance policy, risk assessment, and the operation of the Board. As an Outside Director, Mr. Sohn is expected to continue to assist the operation and advancement of the Board, for which Mr. Sohn is nominated as a candidate to serve as an Outside Director. 18

6.3 Outside Director Candidate to Serve on the Audit Committee Sohn, Sung Kyu, as Outside Director to serve on the Audit Committee Basic Data —Date of Birth : December 1959 Gender : Male Nomination type : Re-appointment—Nominated by : Director Candidate Recommendation Committee —Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience 2019 ~ Outside Director, Samsung Asset Management 2013 ~ 2015 Distinguished Professor, Samil 1993 ~ 2025 Professor, School of Business, Yonsei University 2008 ~ 2010 Non-standing member, Korea Accounting 2017 ~ 2022 Outside Director, Hyundai Construction Equipment Standards Board 2016 ~ 2017 President, Korean Accounting Association 2008 ~ 2010 Head, KOSPI Disclosure Committee Reasons for Recommendation Mr. Sohn is a professor of Business Administration at Yonsei University. He formerly served as Chair of the Korea Accounting Association, Professor Emeritus at Samil PWC, and a non-standing member of the Korea Accounting Standards Board. Drawing on his expert knowledge and experience in accounting, over the past 3 years, Mr. Sohn has made significant contribution to th e Company’s accounting and finance policy, risk assessment, and the operation of the Board. As an Outside Director to serve on the audit committee, Mr. Sohn is expected to continue to assist the effective operation of Audit committee. 19

6.3 Outside Director Candidate to Serve on the Audit Committee Kim, Joon Gi, as Outside Director to serve on the Audit Committee Basic Data —Date of Birth : May 1965 Gender : Male Nomination type : New appointment—Nominated by : Director Candidate Recommendation Committee —Relationship to the largest shareholder: None POSCO Group related transactions during past 3 years : None—Financial delinquency, manager of insolvent business or other legal disqualifications: None Professional Experience 2008 ~ Professor of Law, Yonsei University 2022 ~ 2024 President, The Korean Council for 2021 ~ ICC International Court of Arbitration Member International Arbitration(KOCIA) 2018 ~ International Arbitration Committee Member, KCAB 2003 ~ 2007 Executive Director, Hills Governance Center 2013 ~ Panel of Arbitrators, World Bank 1992 ~ 1995 Attorney, Foley & Lardner Reasons for Recommendation As a law professor and professional expert in international trade and commercial law and corporate governance enhancement, Mr. Kim has served as arbitrator at domestic and international dispute settlement bodies and as Executive Director at the Hills Governance Center. He is also active in various research projects in international dispute resolution, trade and governance. Mr. Kim’s academic record and expertise gained from his legal practice will help to ensure the Audit Committee runs effectively. 20

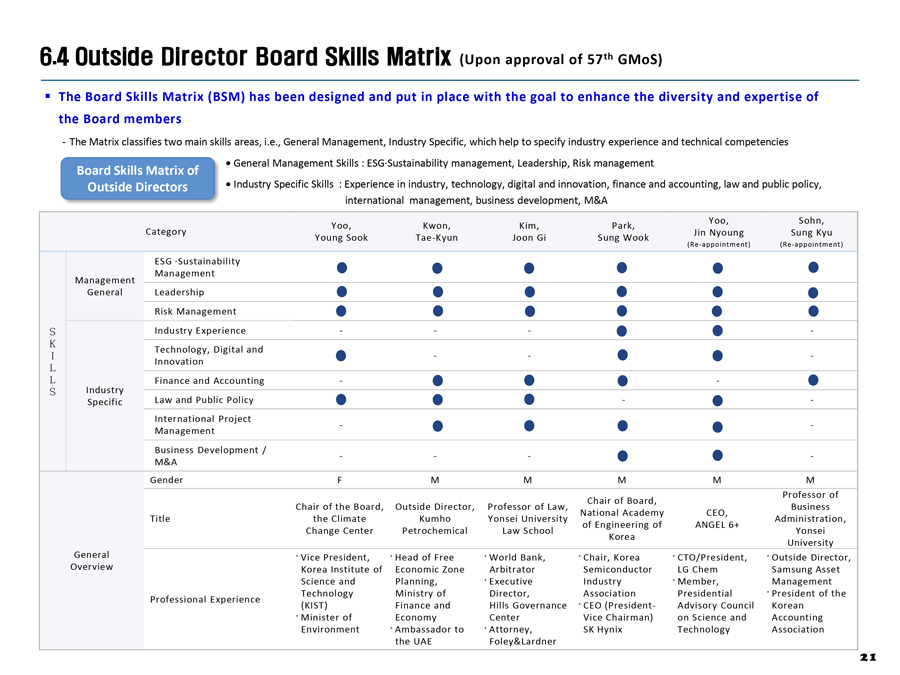

6.4 Outside Director Board Skills Matrix (Upon approval of 57 th GMoS) The Board Skills Matrix (BSM) has been designed and put in place with the goal to enhance the diversity and expertise of the Board members —The Matrix classifies two main skills areas, i.e., General Management, Industry Specific, which help to specify industry experience and technical competencies • General Management Skills : ESG·Sustainability management, Leadership, Risk management Board Skills Matrix of Outside Directors • Industry Specific Skills : Experience in industry, technology, digital and innovation, finance and accounting, law and public policy, international management, business development, M&A Yoo, Kwon, Kim, Park, Yoo, Sohn, Category Jin Nyoung Sung Kyu Young Sook Tae-Kyun Joon Gi Sung Wook (Re-appointment) (Re-appointment) ESG ·Sustainability — — — Management Management General Leadership — — — Risk Management — — — S Industry Experience — — — K Technology, Digital and I — — — L Innovation L Finance and Accounting — — — S Industry Specific Law and Public Policy — — — International Project — — — Management Business Development / — — — M&A Gender F M M M M M Professor of Chair of Board, Chair of the Board, Outside Director, Professor of Law, Business National Academy CEO, Title the Climate Kumho Yonsei University Administration, of Engineering of ANGEL 6+ Change Center Petrochemical Law School Yonsei Korea University General Vice President, Head of Free World Bank, Chair, Korea CTO/President, Outside Director, Overview Korea Institute of Economic Zone Arbitrator Semiconductor LG Chem Samsung Asset Science and Planning, Executive Industry Member, Management Technology Ministry of Director, Association Presidential President of the Professional Experience (KIST) Finance and Hills Governance CEO (President- Advisory Council Korean Minister of Economy Center Vice Chairman) on Science and Accounting Environment Ambassador to Attorney, SK Hynix Technology Association the UAE Foley&Lardner 21

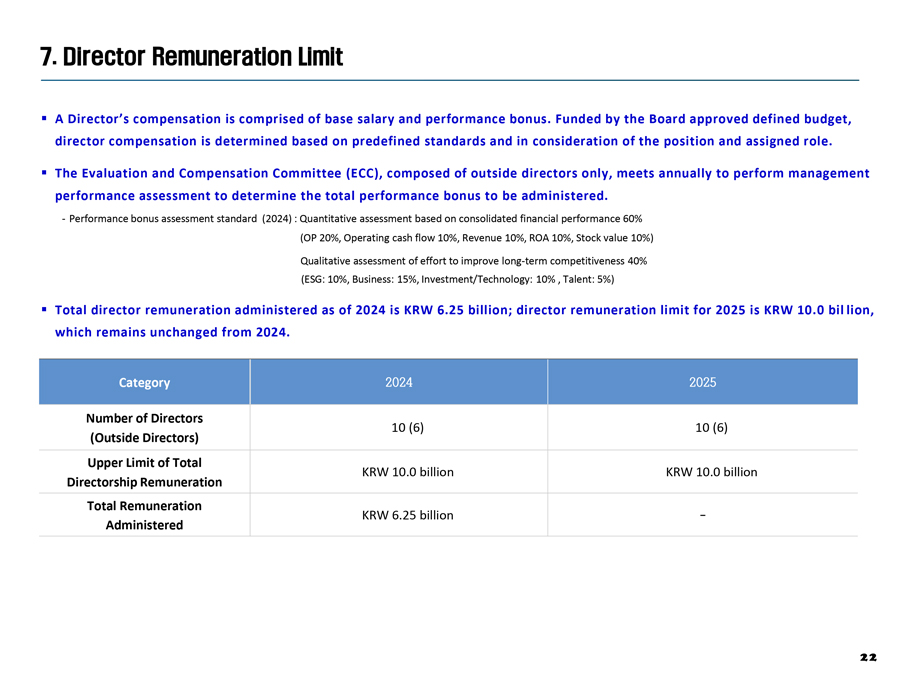

7. Director Remuneration Limit A Director’s compensation is comprised of base salary and performance bonus. Funded by the Board approved defined budget, director compensation is determined based on predefined standards and in consideration of the position and assigned role. The Evaluation and Compensation Committee (ECC), composed of outside directors only, meets annually to perform management performance assessment to determine the total performance bonus to be administered. —Performance bonus assessment standard (2024) : Quantitative assessment based on consolidated financial performance 60% (OP 20%, Operating cash flow 10%, Revenue 10%, ROA 10%, Stock value 10%) Qualitative assessment of effort to improve long-term competitiveness 40% (ESG: 10%, Business: 15%, Investment/Technology: 10% , Talent: 5%) Total director remuneration administered as of 2024 is KRW 6.25 billion; director remuneration limit for 2025 is KRW 10.0 bil lion, which remains unchanged from 2024. Category 2024 2025 Number of Directors (Outside Directors) 10 (6) 10 (6) Upper Limit of Total Directorship Remuneration KRW 10.0 billion KRW 10.0 billion Total Remuneration Administered KRW 6.25 billion—22