UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 6718 |

| |

| Dreyfus Investment Grade Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 7/31 | |

Date of reporting period: | 01/31/11 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

|

| Dreyfus |

| Inflation Adjusted |

| Securities Fund |

SEMIANNUAL REPORT January 31, 2011

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Understanding Your Fund’s Expenses |

| 6 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 7 | Statement of Investments |

| 9 | Statement of Assets and Liabilities |

| 10 | Statement of Operations |

| 11 | Statement of Changes in Net Assets |

| 13 | Financial Highlights |

| 15 | Notes to Financial Statements |

| | FOR MORE INFORMATION |

| | Back Cover |

|

| Dreyfus |

| Inflation Adjusted |

| Securities Fund |

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this semiannual report for Dreyfus Inflation Adjusted Securities Fund, covering the six-month period from August 1, 2010, through January 31, 2011.

The past six months proved to be a volatile time for the financial markets, but most asset classes, including bonds, generally produced positive absolute returns for the reporting period. Investors’ concerns regarding a sovereign debt crisis in Europe and stubbornly high unemployment in the United States later gave way to optimism that massive economic stimulus programs, robust growth in the world’s emerging markets, a strong holiday retail season and rising corporate earnings signaled better economic times ahead. Consequently, returns were particularly strong in higher yielding fixed-income market sectors, including investment-grade and high yield corporate bonds. In contrast, traditionally defensive U.S. government securities weathered pronounced weakness during the fourth quarter, with long-term U.S. Treasury bonds posting modest declines, on average.

As the first quarter of 2011 unfolds, we are aware that short-term interest rates may rise from historically low levels if growth accelerates, while any new economic setbacks could spark heightened market volatility among corporate and mortgage-backed securities. Nonetheless, we continue to see value in the bond market, and a well-diversified bond portfolio can help temper volatility stemming from unexpected economic or market developments. Of course, your financial advisor may be in the best position to help you seize the opportunities and confront the challenges produced by the financial markets in the months ahead.

For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

February 15, 2011

2

DISCUSSION OF FUND PERFORMANCE

For the period of August 1, 2010, through January 31, 2011, as provided by Robert Bayston, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended January 31, 2011, Dreyfus Inflation Adjusted Securities Fund’s Institutional shares produced a total return of 1.40%, and the fund’s Investor shares returned 1.31%.1 In comparison, the fund’s benchmark, the Barclays Capital U.S.Treasury Inflation Protected Securities Index (the “Index”), produced a total return of 1.87% for the same period.2

AlthoughTreasury Inflation Protected Securities (“TIPS”) fared relatively well early in the reporting period, they later suffered a sell-off when new stimulative measures caused investors to increase their expectations for economic growth and eventual hikes in short-term interest rates. The fund produced lower returns than its benchmark, primarily due to its relatively long average duration and an emphasis on intermediate-term securities that were more severely affected than other maturity ranges by changing investor sentiment.

The Fund’s Investment Approach

The fund seeks returns that exceed the rate of inflation. To pursue its goal, the fund normally invests at least 80% of its assets in inflation-indexed securities, which are fixed-income securities designed to protect investors from a loss of value due to inflation by periodically adjusting their principal and/or coupon according to the rate of inflation.

The fund invests primarily in high-quality, U.S. dollar-denominated, inflation-indexed securities.To a limited extent, the fund may invest in foreign currency-denominated, inflation-protected securities and other fixed-income securities not adjusted for inflation, including U.S. government bonds and notes, corporate bonds, mortgage-related securities and asset-backed securities. The fund seeks to keep its average effective duration between two and 10 years, and the fund may invest in securities of any maturity without restriction.

DISCUSSION OF FUND PERFORMANCE (continued)

Changing Economic Expectations Sparked a Market Decline

The reporting period began in the midst of a “soft patch” in the U.S. economic recovery, which already had been weaker than historical averages in the wake of the 2007-2009 recession. Investors became increasingly concerned in the weeks prior to the reporting period about persistently high levels of unemployment, lack of meaningful improvement in housing markets and the potential effects of a sovereign debt crisis in Europe. As a result, they generally turned to traditional safe havens, including U.S.Treasury securities. Inflation expectations remained muted in the sluggish economy, and breakeven inflation rates for TIPS stood at relatively low levels, supporting prices.

After the Federal Reserve Board (the “Fed”) announced a second round of quantitative easing in September through the purchase of $600 million of U.S.Treasury securities, it became clearer that investors’ economic concerns were overblown. Although many market participants expected the Fed’s program to put upward pressure on Treasury prices, the opposite occurred. U.S. Treasury securities declined sharply through year-end as investors looked forward to a stronger U.S. economy and the eventual end of the Fed’s aggressively accommodative monetary policy. New tax cuts enacted in the weeks following the U.S. midterm elections also contributed to expectations of a more robust economic recovery.

Although yields on TIPS generally ended the reporting period close to where they began, breakeven inflation rates increased from approximately 1.50% in August 2010 to as high as 2.45% in January 2011.

Interest Rates Strategies Undermined Relative Performance

The fund proved to be too constructively positioned as these developments unfolded.We had focused on intermediate-term securities that we believed would be the primary targets of the Fed’s quantitative easing efforts, but short-term TIPS fared better, dampening the fund’s results compared to its benchmark. Likewise, we had adopted a relatively long average duration, which magnified the adverse effects of rising interest rates.

Nonetheless, it is worthwhile to note thatTIPS generally retained more of their value than nominal U.S.Treasury securities, enabling the fund to produce positive absolute returns for the reporting period overall.

4

Repositioned for Stronger Growth in the Near Term

As of the reporting period’s end, the consensus among investors appears to be that U.S. economic growth during the early months of 2011 will be between one and two percentage points greater than previously esti-mated.We agree that a more stimulative fiscal policy, combined with the Fed’s accommodative monetary policy, is likely to boost the economic growth rate over the near term. Therefore, we have shifted the fund’s duration posture toward a market-neutral position.We have maintained the fund’s focus on intermediate-term securities, where we believe values are particularly attractive.

However, we are less convinced that a more robust economic growth rate can be sustained over the longer term without additional stimulus from the Fed or U.S. government. Consequently, we are prepared to adopt a more constructive posture should economic and market conditions deteriorate, potentially delaying any increase in short-term interest rates and triggering a renewed “flight to quality” among investors.

February 15, 2011

| |

| | Bond funds are subject generally to interest rate, credit, liquidity and market risks, to varying |

| | degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors |

| | being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause |

| | price declines. |

| | Interest payments on inflation-protected bonds will vary as the bond’s principal value is |

| | periodically adjusted based on the rate of inflation. If the index measuring inflation falls, the |

| | interest payable on these securities will be reduced.Any increase in the principal amount of an |

| | inflation-protected bond (which follows a rise in the relevant inflation index), will be considered |

| | taxable ordinary income, even though investors do not receive their principal until maturity. |

| | During periods of rising interest rates and flat or declining inflation rates, inflation-protected bonds |

| | can underperform. Inflation-protected bonds issued by corporations generally do not guarantee |

| | repayment of principal. |

| | The fund may use derivative instruments, such as options, futures and options on futures, forward |

| | contracts, swaps (including credit default swaps on corporate bonds and asset-backed securities), |

| | options on swaps and other credit derivatives.A small investment in derivatives could have a |

| | potentially large impact on the fund’s performance.The use of derivatives involves risks different |

| | from, or possibly greater than, the risks associated with investing directly in the underlying assets. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| | redemption, fund shares may be worth more or less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | gain distributions.The Barclays Capital U.S.Treasury Inflation Protected Securities Index is a |

| | sub-index of the U.S.Treasury component of the Barclays Capital U.S. Government Index. |

| | Securities in the Barclays Capital U.S.Treasury Inflation Protected Securities Index are dollar- |

| | denominated, non-convertible, publicly issued, fixed-rate, investment-grade (Moody’s Baa3 or |

| | better) U.S.Treasury inflation notes, with at least one year to final maturity and at least $100 |

| | million par amount outstanding. Investors cannot invest directly in any index. |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Inflation Adjusted Securities Fund from August 1, 2010 to January 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended January 31, 2011

| | | | |

| | | Investor Shares | | Institutional Shares |

| Expenses paid per $1,000† | $ | 3.65 | $ | 1.93 |

| Ending value (after expenses) | $ | 1,013.10 | $ | 1,014.00 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended January 31, 2011

| | | | |

| | | Investor Shares | | Institutional Shares |

| Expenses paid per $1,000† | $ | 3.67 | $ | 1.94 |

| Ending value (after expenses) | $ | 1,021.58 | $ | 1,023.29 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .72% for Investor Shares and .38% for Institutional Shares, |

| multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

|

| STATEMENT OF INVESTMENTS |

| January 31, 2011 (Unaudited) |

| | | |

| | Principal | | |

| Bonds and Notes—99.5% | Amount ($) | | Value ($) |

| U.S. Treasury Inflation Protected Securities: | | | |

| 0.50%, 4/15/15 | 20,803,426 | a | 21,554,305 |

| 0.63%, 4/15/13 | 5,082,685 | a | 5,274,475 |

| 1.25%, 4/14/14 | 2,243,498 | a | 2,388,273 |

| 1.25%, 7/15/20 | 5,638,473 | a | 5,790,007 |

| 1.38%, 7/15/18 | 4,505,046 | a | 4,796,113 |

| 1.38%, 1/15/20 | 9,925,856 | a | 10,360,887 |

| 1.63%, 1/15/18 | 9,780,900 | a | 10,568,722 |

| 1.75%, 1/15/28 | 3,289,892 | a | 3,279,097 |

| 1.88%, 7/15/15 | 1,704,193 | a,b | 1,873,680 |

| 1.88%, 7/15/19 | 8,310,641 | a | 9,093,013 |

| 2.00%, 1/15/14 | 9,328,734 | a | 10,120,948 |

| 2.00%, 7/15/14 | 1,823,554 | a | 1,995,367 |

| 2.00%, 1/15/16 | 10,097,892 | a | 11,158,959 |

| 2.00%, 1/15/26 | 12,078,887 | a | 12,615,830 |

| 2.13%, 1/15/19 | 1,610,178 | a | 1,793,336 |

| 2.13%, 2/15/40 | 5,233,643 | a | 5,313,785 |

| 2.38%, 1/15/25 | 4,473,569 | a | 4,924,769 |

| 2.38%, 1/15/27 | 2,441,183 | a | 2,662,986 |

| 2.50%, 7/15/16 | 5,446,403 | a | 6,197,413 |

| 2.50%, 1/15/29 | 6,980,835 | a | 7,741,090 |

| 2.63%, 7/15/17 | 7,222,044 | a | 8,318,328 |

| 3.00%, 7/15/12 | 22,129,488 | a,b | 23,592,115 |

| 3.63%, 4/15/28 | 10,505,767 | a,b | 13,291,434 |

| 3.88%, 4/15/29 | 5,689,811 | a,b | 7,464,321 |

| Total Bonds and Notes | | | |

| (cost $187,799,169) | | | 192,169,253 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | |

| Other Investment—1.0% | Shares | Value ($) |

| Registered Investment Company; | | |

| Dreyfus Institutional Preferred | | |

| Plus Money Market Fund | | |

| (cost $1,847,000) | 1,847,000c | 1,847,000 |

| |

| Total Investments (cost $189,646,169) | 100.5% | 194,016,253 |

| Liabilities, Less Cash and Receivables | (.5%) | (927,700) |

| Net Assets | 100.0% | 193,088,553 |

| a | Principal amount for accrual purposes is periodically adjusted based on changes in the Consumer Price Index. |

| b | Security, or portion thereof, on loan.At January 31, 2011, the value of the fund’s securities on loan was $28,907,162 and the value of the collateral held by the fund was $29,548,708, consisting of U.S. Government and Agency securities. |

| c | Investment in affiliated money market mutual fund. |

| | | |

| Portfolio Summary (Unaudited)† | | |

| | Value (%) | | Value (%) |

| U.S. Government & Agencies | 99.5 | Money Market Investment | 1.0 |

| | | | 100.5 |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

8

|

| STATEMENT OF ASSETS AND LIABILITIES |

| January 31, 2011 (Unaudited) |

| | | |

| | Cost | Value |

| Assets ($): | | |

| Investments in securities—See Statement of Investments (including | |

| securities on loan, valued at $28,907,162)—Note 1(b): | | |

| Unaffiliated issuers | 187,799,169 | 192,169,253 |

| Affiliated issuers | 1,847,000 | 1,847,000 |

| Cash | | 471,986 |

| Receivable for investment securities sold | | 2,598,511 |

| Receivable for shares of Common Stock subscribed | | 708,879 |

| Dividends and interest receivable | | 408,369 |

| Prepaid expenses | | 17,330 |

| | | 198,221,328 |

| Liabilities ($): | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 64,787 |

| Payable for investment securities purchased | | 4,045,918 |

| Payable for shares of Common Stock redeemed | | 985,298 |

| Accrued expenses | | 36,772 |

| | | 5,132,775 |

| Net Assets ($) | | 193,088,553 |

| Composition of Net Assets ($): | | |

| Paid-in capital | | 188,765,500 |

| Accumulated undistributed investment income—net | | 77,373 |

| Accumulated net realized gain (loss) on investments | | (124,404)�� |

| Accumulated net unrealized appreciation | | |

| (depreciation) on investments | | 4,370,084 |

| Net Assets ($) | | 193,088,553 |

| |

| |

| Net Asset Value Per Share | | |

| | Investor Shares | Institutional Shares |

| Net Assets ($) | 42,597,642 | 150,490,911 |

| Shares Outstanding | 3,318,350 | 11,728,285 |

| Net Asset Value Per Share ($) | 12.84 | 12.83 |

| |

| See notes to financial statements. | | |

|

| STATEMENT OF OPERATIONS |

| Six Months Ended January 31, 2011 (Unaudited) |

| | |

| Investment Income ($): | |

| Income: | |

| Interest | 1,707,968 |

| Income from securities lending—Note 1(b) | 4,731 |

| Dividends; | |

| Affiliated issuers | 923 |

| Total Income | 1,713,622 |

| Expenses: | |

| Management fee—Note 3(a) | 258,956 |

| Shareholder servicing costs—Note 3(b) | 79,269 |

| Professional fees | 21,129 |

| Registration fees | 21,046 |

| Custodian fees—Note 3(b) | 8,825 |

| Prospectus and shareholders’ reports | 4,140 |

| Directors’ fees and expenses—Note 3(c) | 1,280 |

| Loan commitment fees—Note 2 | 190 |

| Miscellaneous | 9,539 |

| Total Expenses | 404,374 |

| Less—reduction in fees due to earnings credits—Note 3(b) | (44) |

| Net Expenses | 404,330 |

| Investment Income—Net | 1,309,292 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments | 1,401,383 |

| Net unrealized appreciation (depreciation) on investments | (896,996) |

| Net Realized and Unrealized Gain (Loss) on Investments | 504,387 |

| Net Increase in Net Assets Resulting from Operations | 1,813,679 |

| |

| See notes to financial statements. | |

10

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Six Months Ended | |

| | January 31, 2011 | Year Ended |

| | (Unaudited) | July 31, 2010 |

| Operations ($): | | |

| Investment income—net | 1,309,292 | 2,862,339 |

| Net realized gain (loss) on investments | 1,401,383 | 386,374 |

| Net unrealized appreciation | | |

| (depreciation) on investments | (896,996) | 5,314,427 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 1,813,679 | 8,563,140 |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Investor Shares | (423,124) | (807,812) |

| Institutional Shares | (1,508,222) | (1,354,777) |

| Net realized gain on investments: | | |

| Investor Shares | (98,397) | — |

| Institutional Shares | (321,249) | — |

| Total Dividends | (2,350,992) | (2,162,589) |

| Capital Stock Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Investor Shares | 6,646,813 | 18,229,270 |

| Institutional Shares | 56,538,723 | 91,849,994 |

| Dividends reinvested: | | |

| Investor Shares | 500,448 | 773,951 |

| Institutional Shares | 641,142 | 369,361 |

| Cost of shares redeemed: | | |

| Investor Shares | (7,446,445) | (19,606,339) |

| Institutional Shares | (11,964,899) | (14,440,863) |

| Increase (Decrease) in Net Assets | | |

| from Capital Stock Transactions | 44,915,782 | 77,175,374 |

| Total Increase (Decrease) in Net Assets | 44,378,469 | 83,575,925 |

| Net Assets ($): | | |

| Beginning of Period | 148,710,084 | 65,134,159 |

| End of Period | 193,088,553 | 148,710,084 |

| Undistributed investment income—net | 77,373 | 699,427 |

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | |

| | Six Months Ended | |

| | January 31, 2011 | Year Ended |

| | (Unaudited) | July 31, 2010 |

| Capital Share Transactions: | | |

| Investor Shares | | |

| Shares sold | 512,160 | 1,462,065 |

| Shares issued for dividends reinvested | 38,358 | 61,395 |

| Shares redeemed | (571,429) | (1,570,809) |

| Net Increase (Decrease) in Shares Outstanding | (20,911) | (47,349) |

| Institutional Shares | | |

| Shares sold | 4,341,666 | 7,325,995 |

| Shares issued for dividends reinvested | 49,388 | 29,209 |

| Shares redeemed | (917,275) | (1,153,413) |

| Net Increase (Decrease) in Shares Outstanding | 3,473,779 | 6,201,791 |

| |

| See notes to financial statements. | | |

12

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | | | |

| Six Months Ended | | | | | |

| January 31, 2011 | | Year Ended July 31, | |

| Investor Shares | (Unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 |

| Per Share Data ($): | | | | | | |

| Net asset value, | | | | | | |

| beginning of period | 12.83 | 11.98 | 12.30 | 11.67 | 11.69 | 12.34 |

| Investment Operations: | | | | | | |

| Investment income—neta | .08 | .33 | .08 | .79 | .21 | .26 |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | .09 | .76 | (.14) | .48 | .27 | (.06) |

| Total from Investment Operations | .17 | 1.09 | (.06) | 1.27 | .48 | .20 |

| Distributions: | | | | | | |

| Dividends from | | | | | | |

| investment income—net | (.13) | (.24) | (.16) | (.64) | (.50) | (.71) |

| Dividends from net realized | | | | | | |

| gain on investments | (.03) | — | (.10) | — | — | (.14) |

| Total Distributions | (.16) | (.24) | (.26) | (.64) | (.50) | (.85) |

| Net asset value, end of period | 12.84 | 12.83 | 11.98 | 12.30 | 11.67 | 11.69 |

| Total Return (%) | 1.31b | 9.23 | (.54) | 11.01 | 4.24 | 1.51 |

| Ratios/Supplemental Data (%): | | | | | | |

| Ratio of total expenses | | | | | | |

| to average net assets | .72c | .79 | .87 | 1.04 | 2.10 | 1.88 |

| Ratio of net expenses | | | | | | |

| to average net assets | .72c | .71 | .55 | .55 | .53 | .55 |

| Ratio of net investment income | | | | | | |

| to average net assets | 1.20c | 2.63 | .73 | 6.39 | 1.83 | 2.18 |

| Portfolio Turnover Rate | 56.81b | 61.50 | 77.13 | 90.18 | 18.17 | 60.82 |

| Net Assets, end of period | | | | | | |

| ($ x 1,000) | 42,598 | 42,846 | 40,557 | 26,830 | 2,538 | 3,269 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Not annualized. |

| c | Annualized. |

See notes to financial statements.

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | |

| Six Months Ended | | | | | |

| January 31, 2011 | | Year Ended July 31, | |

| Institutional Shares | (Unaudited) | 2010 | 2009 | 2008 | 2007 | 2006 |

| Per Share Data ($): | | | | | | |

| Net asset value, | | | | | | |

| beginning of period | 12.83 | 11.97 | 12.30 | 11.66 | 11.68 | 12.35 |

| Investment Operations: | | | | | | |

| Investment income—neta | .11 | .37 | .11 | .84 | .24 | .29 |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | .07 | .77 | (.15) | .48 | .26 | (.07) |

| Total from Investment Operations | .18 | 1.14 | (.04) | 1.32 | .50 | .22 |

| Distributions: | | | | | | |

| Dividends from | | | | | | |

| investment income—net | (.15) | (.28) | (.19) | (.68) | (.52) | (.75) |

| Dividends from net realized | | | | | | |

| gain on investments | (.03) | — | (.10) | — | — | (.14) |

| Total Distributions | (.18) | (.28) | (.29) | (.68) | (.52) | (.89) |

| Net asset value, end of period | 12.83 | 12.83 | 11.97 | 12.30 | 11.66 | 11.68 |

| Total Return (%) | 1.40b | 9.58 | (.30) | 11.29 | 4.47 | 1.82 |

| Ratios/Supplemental Data (%): | | | | | | |

| Ratio of total expenses | | | | | | |

| to average net assets | .38c | .44 | .55 | .77 | 1.83 | 1.63 |

| Ratio of net expenses | | | | | | |

| to average net assets | .38c | .42 | .30 | .30 | .28 | .30 |

| Ratio of net investment income | | | | | | |

| to average net assets | 1.62c | 2.97 | .98 | 6.68 | 2.08 | 2.43 |

| Portfolio Turnover Rate | 56.81b | 61.50 | 77.13 | 90.18 | 18.17 | 60.82 |

| Net Assets, end of period | | | | | | |

| ($ x 1,000) | 150,491 | 105,864 | 24,577 | 13,740 | 2,693 | 3,463 |

| |

| a | Based on average shares outstanding at each month end. |

| b | Not annualized. |

| c | Annualized. |

See notes to financial statements.

14

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

Dreyfus Inflation Adjusted Securities Fund (the “fund”) is a separate diversified series of Dreyfus Investment Grade Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering three series, including the fund.The fund’s investment objective is to seek returns that exceed the rate of inflation.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary ofThe Bank of NewYork Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares, which are sold to the public without a sales charge.The fund is authorized to issue 500 million shares of $.001 par value Common Stock in each of the following classes of shares: Investor and Institutional. Investor shares are subject to a shareholder services plan. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, the minimum initial investment and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”)

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities excluding short-term investments (other than U.S.Treasury Bills), are valued each business day by an independent pricing service (the “Service”) approved by the Board of Directors. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are valued as determined by the Service, based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. Restricted securities, as well as securities or other assets for which recent market quotations are not readily available, and are not valued by a pricing service approved by the Board of Directors, or are determined by the fund not to reflect accurately fair value, are valued at fair value as determined in good faith under the direction of the Board of Directors.The factors that may be considered when fair valuing a security include fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Short-term

16

investments, excluding U.S.Treasury Bills, are carried at amortized cost, which approximates value. Registered investment companies that are not traded on an exchange are valued at their net asset value.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

The following is a summary of the inputs used as of January 31, 2011 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Mutual Funds | 1,847,000 | — | — | 1,847,000 |

| U.S. Treasury | — | 192,169,253 | — | 192,169,253 |

In January 2010, FASB issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about FairValue Measurements”. The portions of ASU No. 2010-06 which require reporting entities to prepare new disclosures surrounding amounts and reasons for significant transfers in and out of Level 1 and Level 2 fair value measurements as well as inputs and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3 have been adopted by the fund. No significant transfers between Level 1 or Level 2 fair value measurements occurred at January 31, 2011. The remaining portion of ASU No. 2010-06 requires reporting entities to make new disclosures about information on purchases, sales, issuances and settlements on a gross basis in the reconciliation of activity in Level 3 fair value measurements. These new and revised disclosures are required to be implemented for fiscal years beginning after December 15, 2010. Management is currently evaluating the impact that the adoption of this remaining portion of ASU No. 2010-06 may have on the fund’s financial statement disclosures.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

18

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended January 31, 2011, The Bank of New York Mellon earned $2,548 from lending portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended January 31, 2011 were as follows:

| | | | | | | |

| Affiliated | | | | | | | |

| Investment | Value | | | | Value | | Net |

| Company | 7/31/2010 | ($) | Purchases ($) | Sales ($) | 1/31/2011 | ($) | Assets (%) |

| Dreyfus | | | | | | | |

| Institutional | | | | | | | |

| Preferred | | | | | | | |

| Plus Money | | | | | | | |

| Market Fund | 276,000 | | 35,017,000 | 33,446,000 | 1,847,000 | | 1.0 |

(d) Dividends to shareholders: It is the policy of the fund to declare dividends daily from investment income-net. Such dividends are paid monthly. Dividends from net realized capital gains, if any, are normally

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended January 31, 2011, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the three-year period ended July 31, 2010 remains subject to examination by the Internal Revenue Service and state taxing authorities.

The fund has an unused capital loss carryover of $419,083 available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to July 31, 2010. If not applied, $47,768 of the carryover expires in fiscal 2017 and $371,315 expires in fiscal 2018.

The tax character of distributions paid to shareholders during the fiscal year ended July 31, 2010 was as follows: ordinary income $2,162,589. The tax character of current year distributions will be determined at the end of the current fiscal year.

20

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended January 31, 2011, the fund did not borrow under the Facilities.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .30% of the value of the fund’s average daily net assets and is payable monthly.

(b) Under the Investor Shares Shareholder Services Plan, the fund pays the Distributor at an annual rate of .25% of the value of Investor Shares average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor determines the amounts to be paid to Service Agents. During the period ended January 31, 2011, Investor Shares were charged $54,185 pursuant to the Shareholder Services Plan.

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended January 31, 2011, the fund was charged $7,201 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended January 31, 2011, the fund was charged $682 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $44.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended January 31, 2011, the fund was charged $8,825 pursuant to the custody agreement.

During the period ended January 31, 2011, the fund was charged $3,456 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $48,051, shareholder services plan fees $8,977, custodian fees $3,200, chief compliance officer fees $2,304 and transfer agency per account fees $2,255.

22

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended January 31, 2011, amounted to $140,643,488 and $96,538,237, respectively.

The provisions of ASC Topic 815 “Derivatives and Hedging” require qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements.The fund held no derivatives during the period ended January 31, 2011.

At January 31, 2011, accumulated net unrealized appreciation on investments was $4,370,084, consisting of $5,014,483 gross unrealized appreciation and $644,399 gross unrealized depreciation.

At January 31, 2011, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

For More Information

Telephone 1-800-645-6561

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 E-mail Send your request to info@dreyfus.com Internet Information can be viewed online or downloaded at: http://www.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

|

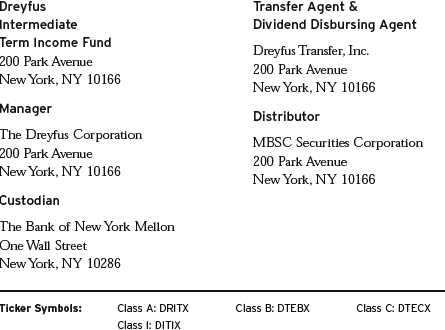

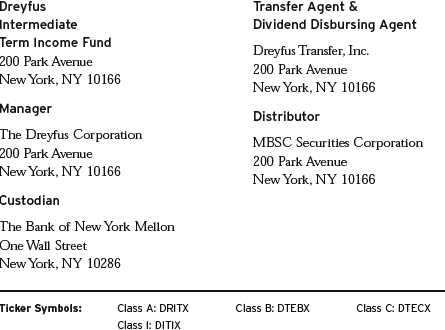

| Dreyfus |

| Intermediate |

| Term Income Fund |

SEMIANNUAL REPORT January 31, 2011

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Understanding Your Fund’s Expenses |

| 6 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 7 | Statement of Investments |

| 28 | Statement of Financial Futures |

| 28 | Statement of Options Written |

| 29 | Statement of Assets and Liabilities |

| 30 | Statement of Operations |

| 31 | Statement of Changes in Net Assets |

| 33 | Financial Highlights |

| 37 | Notes to Financial Statements |

| | FOR MORE INFORMATION |

| | Back Cover |

|

| Dreyfus |

| Intermediate |

| Term Income Fund |

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this semiannual report for Dreyfus Intermediate Term Income Fund, covering the six-month period from August 1, 2010, through January 31, 2011.

The past six months proved to be a volatile time for the financial markets, but most asset classes, including bonds, generally produced positive absolute returns for the reporting period. Investors’ concerns regarding a sovereign debt crisis in Europe and stubbornly high unemployment in the United States later gave way to optimism that massive economic stimulus programs, robust growth in the world’s emerging markets, a strong holiday retail season and rising corporate earnings signaled better economic times ahead. Consequently, returns were particularly strong in higher yielding fixed-income market sectors, including investment-grade and high yield corporate bonds. In contrast, traditionally defensive U.S. government securities weathered pronounced weakness during the fourth quarter, with long-term U.S. Treasury bonds posting modest declines, on average.

As the first quarter of 2011 unfolds, we are aware that short-term interest rates may rise from historically low levels if growth accelerates, while any new economic setbacks could spark heightened market volatility among corporate and mortgage-backed securities. Nonetheless, we continue to see value in the bond market, and a well-diversified bond portfolio can help temper volatility stemming from unexpected economic or market developments. Of course, your financial advisor may be in the best position to help you seize the opportunities and confront the challenges produced by the financial markets in the months ahead.

For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

February 15, 2011

2

DISCUSSION OF FUND PERFORMANCE

For the period of August 1, 2010, through January 31, 2011, as provided by David Horsfall, David Bowser, CFA, and Peter Vaream, Portfolio Managers

Fund and Market Performance Overview

For the six-month period ended January 31, 2011, Dreyfus Intermediate Term Income Fund’s Class A shares produced a total return of 1.57%, Class B shares returned 1.17%, Class C shares returned 1.19% and Class I shares returned 1.84%.1 In comparison, the fund’s benchmark, the Barclays Capital U.S. Aggregate Bond Index, achieved a total return of 0.20% for the same period.2

The reporting period generally proved to be a favorable time for higher yielding sectors of the bond market, but U.S. government securities declined as the economy continued to emerge from recession.The fund produced higher returns than its benchmark, primarily due to its emphasis on market sectors that fared well in a recovering economy.

The Fund’s Investment Approach

The fund seeks to maximize total return, consisting of capital appreciation and current income.To pursue its goal, the fund normally invests at least 80% of its assets in fixed-income securities of U.S. and foreign issuers rated at least investment grade or the unrated equivalent as determined by Dreyfus.These securities include: U.S. government bonds and notes, corporate bonds, municipal bonds, convertible securities, preferred stocks, inflation-indexed securities, asset-backed securities, mortgage-related securities and foreign bonds.Typically, the fund can be expected to have an average effective maturity ranging from five to 10 years, and an average effective duration ranging between three and eight years. For additional yield, the fund may invest up to 20% of its assets in fixed-income securities rated below investment grade.

Stimulative Policies Fueled Rallying Credit Markets

Although the reporting period began in the midst of recovery from a global recession, recent macroeconomic developments threatened to derail an already choppy rebound. High unemployment and troubled housing markets weighed on U.S. economic growth, and Europe was

DISCUSSION OF FUND PERFORMANCE (continued)

roiled by a sovereign debt crisis. As a result, investors at the start of the reporting period favored high-quality investments, such as U.S. government securities.

In response to the sluggish economy, the Federal Reserve Board (the “Fed”) maintained its target for the federal funds rate in a range between 0% and 0.25%, and it announced a new round of quantitative easing of monetary policy for the fall.The Fed’s announcement helped trigger a resurgence among high yield and investment-grade corporate-backed bonds. Meanwhile, it became clearer that earlier concerns regarding a potential double-dip recession were overblown, helping to support additional gains among corporate bonds, mortgage-backed securities and asset-backed securities. As investors grew more tolerant of credit risks, they shifted their attention away from traditional safe havens, and U.S. government securities gave back many of the gains achieved earlier in the year.

Constructive Posture Bolstered Relative Performance

By the start of the reporting period, we had boosted the fund’s holdings of U.S.Treasury securities, and we focused more intently on intermediate-term bonds in anticipation of steeper yield differences along the market’s maturity range.These strategies proved relatively effective during the “flight to quality” that prevailed over much of the summer of 2010.

As evidence mounted that the economic recovery would continue, we shifted to a more constructive investment posture. We reduced the fund’s holdings of U.S. government securities and increased its positions in high yield and investment-grade corporate bonds. High yield bonds from the energy, media, cable and paper-and-packaging industry groups fared particularly well, and investment-grade bonds issued by financial companies rebounded strongly from previously depressed levels. We also maintained a significant position in commercial mortgage-backed securities, which produced competitive levels of income and gained value in the recovering economy.

The fund’s interest rate strategies detracted mildly from the fund’s relative performance during the reporting period, as a slightly longer-than-average duration increased its sensitivity to market volatility. Our focus on bonds with maturities in the five- to seven-year maturity range helped offset a portion of weakness stemming from the fund’s duration posture.

4

We successfully employed Treasury futures and interest-rate options to help establish the fund’s duration and yield curve positions.

Finding Opportunities in a More Mature Recovery

While economic headwinds have lingered, we expect the U.S. economic recovery to persist as 2011 unfolds. Inflation has remained negligible, and we see little reason for the Fed to raise short-term interest rates anytime soon. Consequently, the appetite among domestic and overseas investors for competitive yields and higher levels of credit risk should remain robust.

However, in the wake of strong performance in many sectors of the U.S. bond market, we believe that fixed-income returns are likely to moderate over the months ahead. Indeed, selectivity within market sectors may be the key to generating above-average returns. In our judgment, our research-intensive investment process makes the fund particularly well suited to uncover potential opportunities in a more selective investment climate.

February 15, 2011

| |

| | Bond funds are subject generally to interest rate, credit, liquidity and market risks, to varying |

| | degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors |

| | being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause |

| | price declines. |

| | High yield bonds are subject to increased credit risk and are considered speculative in terms of the |

| | issuer’s perceived ability to continue making interest payments on a timely basis and to repay |

| | principal upon maturity. |

| | The fund may use derivative instruments, such as options, futures and options on futures, forward |

| | contracts, swaps (including credit default swaps on corporate bonds and asset-backed securities), |

| | options on swaps and other credit derivatives.A small investment in derivatives could have a |

| | potentially large impact on the fund’s performance.The use of derivatives involves risks different |

| | from, or possibly greater than, the risks associated with investing directly in the underlying assets. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | consideration the maximum initial sales charge in the case of Class A shares, or the applicable |

| | contingent deferred sales charges imposed on redemptions in the case of Class B and Class C |

| | shares. Had these charges been reflected, returns would have been lower. Past performance is no |

| | guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| | redemption, fund shares may be worth more or less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | gain distributions.The Barclays Capital U.S.Aggregate Bond Index is a widely accepted, |

| | unmanaged total return index of corporate, U.S. government and U.S. government agency debt |

| | instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1- |

| | 10 years. Investors cannot invest directly in any index. |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Intermediate Term Income Fund from August 1, 2010 to January 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended January 31, 2011

| | | | | | | | |

| | | Class A | | Class B | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 4.32 | $ | 8.27 | $ | 8.11 | $ | 2.65 |

| Ending value (after expenses) | $ | 1,015.70 | $ | 1,011.70 | $ | 1,011.90 | $ | 1,018.40 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended January 31, 2011

| | | | | | | | |

| | | Class A | | Class B | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 4.33 | $ | 8.29 | $ | 8.13 | $ | 2.65 |

| Ending value (after expenses) | $ | 1,020.92 | $ | 1,016.99 | $ | 1,017.14 | $ | 1,022.58 |

|

| † Expenses are equal to the fund’s annualized expense ratio of .85% for Class A, 1.63% for Class B, 1.60% for |

| Class C and .52% for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to |

| reflect the one-half year period). |

|

| STATEMENT OF INVESTMENTS |

| January 31, 2011 (Unaudited) |

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes—105.3% | Rate (%) | Date | Amount ($)d | Value ($) |

| Advertising—.3% | | | | | |

| Lamar Media, | | | | | |

| Gtd. Notes | 6.63 | 8/15/15 | 3,493,000 | | 3,593,424 |

| Aerospace & Defense—.5% | | | | | |

| BE Aerospace, | | | | | |

| Sr. Unscd. Notes | 6.88 | 10/1/20 | 1,680,000 | | 1,751,400 |

| Meccanica Holdings USA, | | | | | |

| Gtd. Notes | 6.25 | 7/15/19 | 4,220,000 | a | 4,372,346 |

| | | | | | 6,123,746 |

| Agriculture—.8% | | | | | |

| Altria Group, | | | | | |

| Gtd. Notes | 9.70 | 11/10/18 | 5,100,000 | | 6,623,819 |

| Altria Group, | | | | | |

| Gtd. Notes | 10.20 | 2/6/39 | 2,125,000 | | 2,893,196 |

| | | | | | 9,517,015 |

| Apparel—.1% | | | | | |

| HanesBrands, | | | | | |

| Gtd. Notes | 6.38 | 12/15/20 | 1,105,000 | a | 1,070,469 |

| Asset-Backed Ctfs./ | | | | | |

| Auto Receivables—3.9% | | | | | |

| Ally Auto Receivables Trust, | | | | | |

| Ser. 2010-1, Cl. B | 3.29 | 3/15/15 | 3,975,000 | a | 4,124,383 |

| Americredit Automobile Receivables | | | | | |

| Trust, Ser. 2010-3, Cl. C | 3.34 | 4/8/16 | 1,855,000 | | 1,876,960 |

| Americredit Automobile Receivables | | | | | |

| Trust, Ser. 2010-1, Cl. C | 5.19 | 8/17/15 | 1,395,000 | | 1,494,997 |

| Americredit Prime Automobile | | | | | |

| Receivable, Ser. 2007-1, Cl. B | 5.35 | 9/9/13 | 70,000 | | 71,743 |

| Americredit Prime Automobile | | | | | |

| Receivable, Ser. 2007-1, Cl. C | 5.43 | 2/10/14 | 70,000 | | 72,248 |

| Americredit Prime Automobile | | | | | |

| Receivable, Ser. 2007-1, Cl. E | 6.96 | 3/8/16 | 6,504,306 | a | 6,672,433 |

| Capital Auto Receivables Asset | | | | | |

| Trust, Ser. 2007-1, Cl. D | 6.57 | 9/16/13 | 1,708,000 | a | 1,806,204 |

| Carmax Auto Owner Trust, | | | | | |

| Ser. 2010-1, Cl. B | 3.75 | 12/15/15 | 980,000 | | 1,022,743 |

| Chrysler Financial Auto | | | | | |

| Securitization Trust, | | | | | |

| Ser. 2010-A, Cl. C | 2.00 | 1/8/14 | 5,820,000 | | 5,813,692 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Asset-Backed Ctfs./ | | | | | |

| Auto Receivables (continued) | | | | | |

| Chrysler Financial Lease Trust, | | | | | |

| Ser. 2010-A, Cl. C | 4.49 | 9/16/13 | 2,600,000 | a | 2,601,245 |

| Ford Credit Auto Owner Trust, | | | | | |

| Ser. 2007-A, Cl. D | 7.05 | 12/15/13 | 5,100,000 | a | 5,340,906 |

| Ford Credit Auto Owner Trust, | | | | | |

| Ser. 2006-B, Cl. D | 7.12 | 2/15/13 | 1,600,000 | a | 1,618,000 |

| Franklin Auto Trust, | | | | | |

| Ser. 2008-A, Cl. B | 6.10 | 5/20/16 | 2,970,000 | a | 3,100,586 |

| JPMorgan Auto Receivables Trust, | | | | | |

| Ser. 2008-A, Cl. D | 5.22 | 7/15/15 | 791,726 | a | 793,125 |

| JPMorgan Auto Receivables Trust, | | | | | |

| Ser. 2008-A, Cl. CFTS | 5.22 | 7/15/15 | 1,245,557 | a | 1,227,945 |

| Santander Drive Auto Receivables | | | | | |

| Trust, Ser. 2010-2, Cl. B | 2.24 | 12/15/14 | 1,402,000 | | 1,407,610 |

| Santander Drive Auto Receivables | | | | | |

| Trust, Ser. 2010-B, Cl. C | 3.02 | 10/17/16 | 3,660,000 | a | 3,670,835 |

| Wachovia Auto Loan Owner Trust, | | | | | |

| Ser. 2007-1, Cl. C | 5.45 | 10/22/12 | 1,876,000 | | 1,907,804 |

| Wachovia Auto Loan Owner Trust, | | | | | |

| Ser. 2007-1, Cl. D | 5.65 | 2/20/13 | 1,160,000 | | 1,168,269 |

| | | | | | 45,791,728 |

| Asset-Backed Ctfs./ | | | | | |

| Home Equity Loans—1.4% | | | | | |

| Ameriquest Mortgage Securities, | | | | | |

| Ser. 2003-11, Cl. AF6 | 5.14 | 1/25/34 | 673,149 | b | 681,946 |

| Bayview Financial Acquisition | | | | | |

| Trust, Ser. 2005-B, Cl. 1A6 | 5.21 | 4/28/39 | 3,311,806 | b | 3,161,139 |

| Carrington Mortgage Loan Trust, | | | | | |

| Ser. 2005-NC5, Cl. A2 | 0.58 | 10/25/35 | 2,176,532 | b | 2,071,717 |

| Citicorp Residential Mortgage | | | | | |

| Securities, Ser. 2006-1, Cl. A3 | 5.71 | 7/25/36 | 1,597,593 | b | 1,612,411 |

| Citigroup Mortgage Loan Trust, | | | | | |

| Ser. 2005-HE1, Cl. M1 | 0.69 | 5/25/35 | 589,489 | b | 588,007 |

| Citigroup Mortgage Loan Trust, | | | | | |

| Ser. 2005-WF1, Cl. A5 | 5.01 | 11/25/34 | 3,311,090 | b | 3,311,097 |

| CS First Boston Mortgage | | | | | |

| Securities, Ser. 2005-FIX1, Cl. A5 | 4.90 | 5/25/35 | 257,059 | b | 230,314 |

8

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Asset-Backed Ctfs./ | | | | | |

| Home Equity Loans (continued) | | | | | |

| First Franklin Mortgage Loan Asset | | | | | |

| Backed Certificates, | | | | | |

| Ser. 2005-FF2, Cl. M1 | 0.66 | 3/25/35 | 1,239,372 | b | 1,211,042 |

| Home Equity Asset Trust, | | | | | |

| Ser. 2005-2, Cl. M1 | 0.71 | 7/25/35 | 494,994 | b | 493,391 |

| JP Morgan Mortgage Acquisition, | | | | | |

| Ser. 2006-CH2, Cl. AV2 | 0.31 | 10/25/36 | 710,841 | b | 690,671 |

| Mastr Asset Backed Securities | | | | | |

| Trust, Ser. 2006-AM1, Cl. A2 | 0.39 | 1/25/36 | 220,202 | b | 218,158 |

| Morgan Stanley ABS Capital I, | | | | | |

| Ser. 2004-NC1, Cl. M2 | 2.59 | 12/27/33 | 1,084,915 | b | 910,538 |

| Residential Asset Securities, | | | | | |

| Ser. 2005-EMX4, Cl. A2 | 0.52 | 11/25/35 | 1,279,396 | b | 1,261,373 |

| | | | | | 16,441,804 |

| Asset-Backed Ctfs./ | | | | | |

| Manufactured Housing—.2% | | | | | |

| Origen Manufactured Housing, | | | | | |

| Ser. 2005-B, Cl. A2 | 5.25 | 12/15/18 | 304,940 | | 307,107 |

| Origen Manufactured Housing, | | | | | |

| Ser. 2005-B, Cl. M2 | 6.48 | 1/15/37 | 1,745,000 | | 1,777,629 |

| Vanderbilt Mortgage Finance, | | | | | |

| Ser. 1999-A, Cl. 1A6 | 6.75 | 3/7/29 | 80,000 | b | 80,951 |

| | | | | | 2,165,687 |

| Automobiles—.3% | | | | | |

| Lear, | | | | | |

| Gtd. Bonds | 7.88 | 3/15/18 | 2,235,000 | | 2,436,150 |

| Lear, | | | | | |

| Gtd. Notes | 8.13 | 3/15/20 | 1,090,000 | c | 1,207,175 |

| | | | | | 3,643,325 |

| Banks—6.3% | | | | | |

| Ally Financial, | | | | | |

| Gtd. Notes | 8.00 | 11/1/31 | 2,585,000 | | 2,933,975 |

| Bank of America, | | | | | |

| Sr. Unscd. Notes | 5.63 | 7/1/20 | 7,170,000 | | 7,387,065 |

| Citigroup, | | | | | |

| Sr. Unscd. Notes | 5.50 | 4/11/13 | 6,225,000 | | 6,670,934 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Banks (continued) | | | | | |

| Citigroup, | | | | | |

| Sr. Unscd. Notes | 6.13 | 5/15/18 | 6,210,000 | | 6,760,560 |

| Credit Suisse, | | | | | |

| Sub. Notes | 5.40 | 1/14/20 | 2,245,000 | | 2,276,455 |

| Discover Bank, | | | | | |

| Sub. Notes | 7.00 | 4/15/20 | 1,750,000 | | 1,919,438 |

| JPMorgan Chase & Co., | | | | | |

| Sr. Unscd. Notes | 6.00 | 1/15/18 | 4,135,000 | | 4,599,435 |

| Lloyds TSB Bank, | | | | | |

| Bank Gtd. Notes | 4.88 | 1/21/16 | 3,250,000 | | 3,256,331 |

| Manufacturers & Traders Trust, | | | | | |

| Sub. Notes | 5.59 | 12/28/20 | 475,000 | b | 453,045 |

| Morgan Stanley, | | | | | |

| Sr. Unscd. Notes | 5.30 | 3/1/13 | 1,680,000 | | 1,800,263 |

| Morgan Stanley, | | | | | |

| Sr. Unscd. Notes | 5.50 | 1/26/20 | 3,300,000 | | 3,299,063 |

| Morgan Stanley, | | | | | |

| Sr. Unscd. Notes | 5.55 | 4/27/17 | 5,050,000 | | 5,261,438 |

| Morgan Stanley, | | | | | |

| Sr. Unscd. Notes | 5.75 | 8/31/12 | 1,180,000 | | 1,260,998 |

| NB Capital Trust IV, | | | | | |

| Gtd. Cap. Secs. | 8.25 | 4/15/27 | 1,290,000 | | 1,330,313 |

| Royal Bank of Scotland, | | | | | |

| Bank Gtd. Notes | 6.13 | 1/11/21 | 4,650,000 | | 4,629,284 |

| UBS AG/Stamford, | | | | | |

| Sr. Unscd. Notes | 4.88 | 8/4/20 | 2,445,000 | | 2,465,391 |

| USB Capital IX, | | | | | |

| Gtd. Notes | 6.19 | 10/29/49 | 7,090,000 | b | 5,622,370 |

| Wells Fargo Capital XIII, | | | | | |

| Gtd. Secs. | 7.70 | 12/29/49 | 11,615,000 | b | 12,043,594 |

| | | | | | 73,969,952 |

| Building Materials—.3% | | | | | |

| Masco, | | | | | |

| Sr. Unscd. Bonds | 7.13 | 3/15/20 | 3,090,000 | | 3,230,694 |

| Chemicals—.3% | | | | | |

| Dow Chemical, | | | | | |

| Sr. Unscd. Notes | 2.50 | 2/15/16 | 190,000 | | 182,446 |

10

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Chemicals (continued) | | | | | |

| Dow Chemical, | | | | | |

| Sr. Unscd. Notes | 8.55 | 5/15/19 | 2,885,000 | | 3,606,850 |

| | | | | | 3,789,296 |

| Coal—.2% | | | | | |

| Consol Energy, | | | | | |

| Gtd. Notes | 8.00 | 4/1/17 | 1,585,000 | a | 1,727,650 |

| Consol Energy, | | | | | |

| Gtd. Notes | 8.25 | 4/1/20 | 1,070,000 | a | 1,174,325 |

| | | | | | 2,901,975 |

| Commercial & Professional | | | | | |

| Services—1.0% | | | | | |

| Aramark, | | | | | |

| Gtd. Notes | 8.50 | 2/1/15 | 5,908,000 | | 6,188,630 |

| Ceridian, | | | | | |

| Gtd. Notes | 11.25 | 11/15/15 | 2,510,000 | b | 2,610,400 |

| Iron Mountain, | | | | | |

| Sr. Sub. Notes | 8.38 | 8/15/21 | 3,125,000 | | 3,414,063 |

| | | | | | 12,213,093 |

| Commercial Mortgage | | | | | |

| Pass-Through Ctfs.—9.7% | | | | | |

| Banc of America Commercial | | | | | |

| Mortgage, Ser. 2004-6, Cl. A5 | 4.81 | 12/10/42 | 4,224,000 | | 4,484,697 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2003-T12, Cl. A3 | 4.24 | 8/13/39 | 132,288 | b | 134,781 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2004-PWR5, Cl. A2 | 4.25 | 7/11/42 | 413,500 | | 415,956 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2005-T18 Cl. A2 | 4.56 | 2/13/42 | 2,073,464 | b | 2,093,129 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2004-PWR5, Cl. A3 | 4.57 | 7/11/42 | 110,000 | | 111,210 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2007-T26, Cl. A4 | 5.47 | 1/12/45 | 5,055,000 | b | 5,439,141 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2006-PW13, Cl. A3 | 5.52 | 9/11/41 | 35,000 | | 36,697 |

| Bear Stearns Commercial Mortgage | | | | | |

| Securities, Ser. 2007-T28, Cl. A4 | 5.74 | 9/11/42 | 6,885,000 | b | 7,481,474 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Commercial Mortgage | | | | | |

| Pass-Through Ctfs. (continued) | | | | | |

| Commercial Mortgage Pass-Through | | | | | |

| Certificates, Ser. 2010-C1, Cl. B | 5.24 | 7/10/46 | 2,639,000 | a,b | 2,645,166 |

| Commercial Mortgage Pass-Through | | | | | |

| Certificates, Ser. 2010-C1, Cl. C | 5.78 | 7/10/46 | 1,730,000 | a,b | 1,774,289 |

| Commercial Mortgage Pass-Through | | | | | |

| Certificates, Ser. 2010-C1, Cl. D | 5.92 | 7/10/46 | 2,110,000 | a,b | 2,035,311 |

| Credit Suisse/Morgan Stanley | | | | | |

| Commercial Mortgage | | | | | |

| Certificate, Ser. 2006-HC1A, Cl. A1 | 0.45 | 5/15/23 | 4,933,899 | a,b | 4,833,323 |

| CS First Boston Mortgage | | | | | |

| Securities, Ser. 2004-C3, Cl. A3 | 4.30 | 7/15/36 | 368,272 | | 368,038 |

| CS First Boston Mortgage | | | | | |

| Securities, Ser. 2005-C4, Cl. AAB | 5.07 | 8/15/38 | 2,975,861 | b | 3,087,515 |

| CS First Boston Mortgage | | | | | |

| Securities, Ser. 2005-C5, Cl. A4 | 5.10 | 8/15/38 | 6,230,000 | b | 6,708,242 |

| Extended Stay America Trust, | | | | | |

| Ser. 2010-ESHA, Cl. B | 4.22 | 11/5/27 | 8,705,000 | a | 8,829,372 |

| GE Capital Commercial Mortgage, | | | | | |

| Ser. 2004-C2, Cl. A4 | 4.89 | 3/10/40 | 6,175,000 | | 6,549,577 |

| GMAC Commercial Mortgage | | | | | |

| Securities, Ser. 2004-C3, Cl. A3 | 4.21 | 12/10/41 | 761,623 | | 761,756 |

| Greenwich Capital Commercial | | | | | |

| Funding, Ser. 2004-GG1, Cl. A7 | 5.32 | 6/10/36 | 650,000 | b | 700,100 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. B | 1.98 | 3/6/20 | 1,630,000 | a,b | 1,601,418 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. E | 2.92 | 3/6/20 | 610,000 | a,b | 586,901 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. F | 3.11 | 3/6/20 | 5,680,000 | a,b | 5,453,337 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. G | 3.31 | 3/6/20 | 3,110,000 | a,b | 2,972,020 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. H | 3.95 | 3/6/20 | 25,000 | a,b | 23,803 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. K | 5.92 | 3/6/20 | 2,380,000 | a,b | 2,174,641 |

| GS Mortgage Securities Corporation | | | | | |

| II, Ser. 2007-EOP, Cl. L | 7.15 | 3/6/20 | 6,725,000 | a,b | 6,038,650 |

12

| | | | | |

| | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Commercial Mortgage | | | | | |

| Pass-Through Ctfs. (continued) | | | | | |

| JP Morgan Chase Commercial | | | | | |

| Mortgage Securities, | | | | | |

| Ser. 2010-C2, Cl. A1 | 2.75 | 11/15/43 | 986,809 | a | 979,564 |

| JP Morgan Chase Commercial | | | | | |

| Mortgage Securities, | | | | | |

| Ser. 2003-CB7, Cl. A3 | 4.45 | 1/12/38 | 224,974 | | 224,842 |

| JP Morgan Chase Commercial | | | | | |

| Mortgage Securities, | | | | | |

| Ser. 2005-LDP5, Cl. A2 | 5.20 | 12/15/44 | 1,250,000 | | 1,272,385 |

| JP Morgan Chase Commercial | | | | | |

| Mortgage Securities, | | | | | |

| Ser. 2010-CNTR, Cl. C | 5.51 | 8/5/32 | 3,635,000 | a | 3,582,594 |

| JP Morgan Chase Commercial | | | | | |

| Mortgage Securities, | | | | | |

| Ser. 2009-IWST, Cl. B | 7.15 | 12/5/27 | 1,200,000 | a | 1,351,400 |

| JP Morgan Chase Commercial | | | | | |

| Mortgage Securities, | | | | | |

| Ser. 2009-IWST, Cl. C | 7.45 | 12/5/27 | 5,455,000 | a,b | 6,177,840 |

| LB-UBS Commercial Mortgage Trust, | | | | | |

| Ser. 2005-C3, Cl. A5 | 4.74 | 7/15/30 | 2,280,000 | | 2,408,727 |

| Merrill Lynch Mortgage Trust, | | | | | |

| Ser. 2005-LC1, Cl. A2 | 5.20 | 1/12/44 | 1,080,286 | b | 1,079,610 |

| Merrill Lynch Mortgage Trust, | | | | | |

| Ser. 2005-CKI1, Cl. A2 | 5.22 | 11/12/37 | 122,571 | b | 123,548 |

| Merrill Lynch Mortgage Trust, | | | | | |

| Ser. 2005-CKI1, Cl. A6 | 5.24 | 11/12/37 | 4,035,000 | b | 4,341,131 |

| Merrill Lynch Mortgage Trust, | | | | | |

| Ser. 2002-MW1, Cl. A3 | 5.40 | 7/12/34 | 8,366 | | 8,362 |

| Morgan Stanley Capital I, | | | | | |

| Ser. 2005-HQ7, Cl. A4 | 5.20 | 11/14/42 | 2,235,000 | b | 2,395,216 |

| Morgan Stanley Capital I, | | | | | |

| Ser. 2006-IQ12, Cl. AAB | 5.33 | 12/15/43 | 100,000 | | 105,595 |

| Morgan Stanley Capital I, | | | | | |

| Ser. 2007-T27, Cl. A4 | 5.65 | 6/11/42 | 7,160,000 | b | 7,796,906 |

| Morgan Stanley | | | | | |

| Dean Witter Capital I, | | | | | |

| Ser. 2001-TOP3, Cl. A4 | 6.39 | 7/15/33 | 45,278 | | 45,782 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | | |

| | | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)d | Value ($) |

| Commercial Mortgage | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | |

| RBSCF Trust, | | | | | | |

| Ser. 2010-MB1, Cl. B | | 4.63 | 4/15/24 | 900,000 | a,b | 939,104 |

| TIAA Seasoned Commercial Mortgage | | | | | |

| Trust, Ser. 2007-C4, Cl. A3 | | 6.04 | 8/15/39 | 495,000 | b | 540,799 |

| Vornado, | | | | | | |

| Ser. 2010-VN0, Cl. C | | 5.28 | 9/13/28 | 2,070,000 | a | 2,053,933 |

| Wachovia Bank Commercial Mortgage | | | | | |

| Trust, Ser. 2005-C16, Cl. A2 | 4.38 | 10/15/41 | 931,244 | | 939,994 |

| | | | | | | 113,707,876 |

| Diversified Financial Services—6.8% | | | | | |

| American Express, | | | | | | |

| Sr. Unscd. Notes | | 7.25 | 5/20/14 | 5,255,000 | | 6,022,661 |

| Ameriprise Financial, | | | | | | |

| Jr. Sub. Notes | | 7.52 | 6/1/66 | 3,441,000 | b | 3,656,063 |

| Capital One Bank USA, | | | | | | |

| Sub. Notes | | 8.80 | 7/15/19 | 7,540,000 | | 9,373,660 |

| Capital One Capital VI, | | | | | | |

| Gtd. Secs. | | 8.88 | 5/15/40 | 2,240,000 | | 2,385,600 |

| Countrywide Home Loans, | | | | | | |

| Gtd. Notes, Ser. L | | 4.00 | 3/22/11 | 1,820,000 | | 1,828,900 |

| Discover Financial Services, | | | | | | |

| Sr. Unscd. Notes | | 10.25 | 7/15/19 | 5,402,000 | | 6,915,446 |

| ERAC USA Finance, | | | | | | |

| Gtd. Notes | | 6.38 | 10/15/17 | 5,325,000 | a | 5,928,274 |

| FCE Bank, | | | | | | |

| Sr. Unscd. Notes | EUR | 7.13 | 1/16/12 | 1,050,000 | | 1,493,387 |

| Ford Motor Credit, | | | | | | |

| Sr. Unscd. Notes | | 6.63 | 8/15/17 | 3,260,000 | | 3,497,931 |

| Ford Motor Credit, | | | | | | |

| Sr. Unscd. Notes | | 8.00 | 12/15/16 | 8,135,000 | | 9,238,236 |

| General Electric Capital, | | | | | | |

| Sr. Unscd. Notes | | 5.63 | 5/1/18 | 70,000 | | 75,996 |

| General Electric Capital, | | | | | | |