UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-06718 |

| | |

| | BNY Mellon Investment Funds VII, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 07/31 | |

| Date of reporting period: | 07/31/23 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Short Term Income Fund

| |

ANNUAL REPORT July 31, 2023 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from August 1, 2022, through July 31, 2023, as provided by David Bowser, CFA, Scott Zaleski, CFA and Gautam Khanna, CFA, portfolio managers at Insight North America LLC (INA), an affiliate of BNY Mellon Investment Adviser, Inc.

Market and Fund Performance Overview

For the 12-month period ended July 31, 2023, BNY Mellon Short Term Income Fund’s (the “fund”) Class A shares produced a total return of .76%, Class D shares produced a total return of 1.15%, Class I shares produced a total return of 1.36% and Class Y shares produced a total return of 1.46%.1 In comparison, the fund’s benchmark, the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index (the “Index”), produced a total return of −.24% for the same period.2

Some sectors of the bond market remained under pressure during the reporting period from rising inflation and hawkish activity on the part of the U.S. Federal Reserve (the “Fed”) and other central banks. The fund outperformed the Index due to asset allocation, security selection and duration positioning.

The Fund’s Investment Approach

The fund seeks to maximize total return, consisting of capital appreciation and current income. To pursue its goal, the fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in fixed-income securities of U.S. or foreign issuers rated investment grade or the unrated equivalent, as determined by the sub-adviser. This may include U.S. government bonds and notes, corporate bonds, municipal bonds, convertible securities, preferred stocks, inflation-indexed securities, asset-backed securities, mortgage-related securities (including collateralized mortgage obligations), floating-rate loans (limited to up to 20% of the fund’s net assets) and other floating-rate securities and foreign bonds. Typically, the fund’s portfolio can be expected to have an average effective maturity and an average effective duration of three years or less.

For additional yield, the fund may invest up to 35% of its net assets in fixed-income securities rated below investment grade (“high yield” or “junk” bonds) to as low as Caa/CCC or the unrated equivalent as determined by the sub-adviser. The fund will focus on U.S. securities but may invest up to 30% of its total assets in fixed-income securities of foreign issuers including those securities denominated in foreign currencies and of issuers in emerging markets.

Inflation and Interest Rates Drive Bond Markets

Elevated inflationary pressures caused by rising commodity prices and a tight labor market generally drove bond yields higher during the first three months of the reporting period, causing bond prices to decline (bond yields and prices typically move in opposite directions). The level and persistence of inflationary pressures prompted the Fed to continue implementing the aggressive series of rate hikes it began in March 2022, raising rates by an additional 0.75% in September 2022, the central bank’s third consecutive 0.75% increase, with additional increases expected. The yield curve, which began the period with the two-year Treasury rate exceeding the 10-year Treasury rate, remained inverted throughout the period, a condition widely viewed as a precursor to a recession. Credit spreads widened amid

2

fears of a marked economic slowdown. (Credit spreads refer to the comparative yields of bonds of different credit quality but the same maturity.)

Although fears of a recession continued to pressure markets in late 2022 and early 2023, mounting evidence of easing inflation gave hope that the Fed might reduce the pace of further rate increases. Indeed, after an additional 0.75% rate hike in early November, the central bank reduced the pace of rate increases to 0.50% in December and 0.25% subsequently. While high rates led to difficulties in some areas of the economy—most notably in the banking sector, where a few prominent regional banks faced defaults—economic growth remained positive, supported by robust consumer spending and a strong labor market. As the prospects of a recession receded, credit spreads tightened on improved risk sentiment. For the period as a whole, short-term U.S. bond price performance proved mixed, with Treasury bonds and some corporate issues losing ground. However, spread product tended to outperform, particularly from October 2022 through the end of the period as hopes of less hawkish policies from the Fed outweighed lingering geopolitical uncertainties, and as asset flows into fixed-income securities increased.

Allocation, Selection and Duration Bolster Fund Performance

The fund was well positioned to benefit from the rally in spread product seen during most of the reporting period. Performance relative to the Index benefited from the combined effects of favorable asset allocation, security selection and duration positioning. From an allocation perspective, overweight exposure to spread product bolstered returns, led by holdings in high-yield corporates, investment-grade corporates and structured products, all of which outperformed Treasury bonds as spreads returned to levels not seen since the beginning of 2022. In terms of security selection, the fund’s holdings among high-yield credits, characterized by increased quality and relatively short yield-curve positioning, benefited from both yield and spread performance. Strong-performing holdings included subordinate debt positions in money center banks, including Bank of America, Citibank, Goldman Sachs and JPMorgan, along with senior notes in Credit Suisse and very short positions in select regional banks at the height of the industry’s troubles in early 2023. Other notably strong holdings included non-agency mortgage-backed securities, which performed well amid healthy consumer spending trends, and debt issued by casino operator Wynn Macau, which gained ground on China’s post-pandemic-lockdown recovery. Regarding duration, relatively underweight positions, primarily in the three-year and five-year portions of the yield curve, further contributed to relatively strong returns. Few positions detracted from relative performance, the most notable being the fund’s yield curve positioning during isolated portions of the period and lack of exposure to some outperforming banking names. In addition, a few of the fund’s bonds were called, and so failed to benefit from tightening spreads.

During the period, derivatives such as forwards and futures were used to hedge duration risk and credit volatility within the portfolio. These positions had little net impact on the fund’s relative performance, with slightly positive contributions from duration hedges and slightly negative effects from volatility hedges.

Remaining Cautiously Optimistic

While the economy has remained resilient in the face of the Fed’s aggressive efforts to combat inflation, cracks have begun to appear in some areas, including increasing consumer

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

delinquencies and tightening bank credit, with impacts on commercial real estate and commercial and industrial loans. We expect to see further effects if, as expected, the Fed maintains rates at or near current levels for an extended period of time. On the other hand, the labor market remains healthy, with the overall economy continuing to benefit from several recent federal programs designed to stimulate growth, including the CHIPS and Science Act, the $1 trillion bipartisan infrastructure bill and the Inflation Reduction Act of 2022. Accordingly, while we expect economic growth to modestly slow in the near term, we do not anticipate a steep recession.

In light of these countervailing forces, we continue to maintain the fund’s competitive yield advantage, while remaining cautious regarding the valuations of positions we add to the portfolio. From a sector perspective, we currently see the most attractive investments in banks, which appear reasonably valued; utilities, which offer a low-volatility way to add yield; pipelines, which are well positioned for the continued onshoring of U.S. manufacturing; gaming, which is likely to benefit from China’s continued recovery; and securitized products, which are also reasonably valued. In addition, we remain alert for emerging opportunities in terms of duration positioning, prepared to make tactical allocations along the yield curve depending on evolving conditions. At the same time, the fund continues to hold a Treasury position, a potential source of assets to take advantage of emerging opportunities in spread product.

August 15, 2023

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield and investment returns fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through December 1, 2023, at which time it may be extended, modified or terminated. Had these expenses not been absorbed, returns would have been lower.

2 Source: Lipper Inc. — The ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index tracks the performance of U.S. dollar-denominated, investment-grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities, including all securities with a remaining term to final maturity of less than five years. Investors cannot invest directly in any index.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

High yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity.

Investing internationally involves special risks, including changes in currency exchange rates, political, economic and social instability, a lack of comprehensive company information, differing auditing and legal standards, and less market liquidity. The fixed-income securities of issuers located in emerging markets can be more volatile and less liquid than those of issuers in more mature economies.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

4

FUND PERFORMANCE (Unaudited)

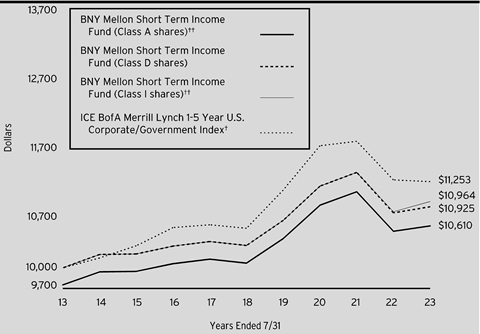

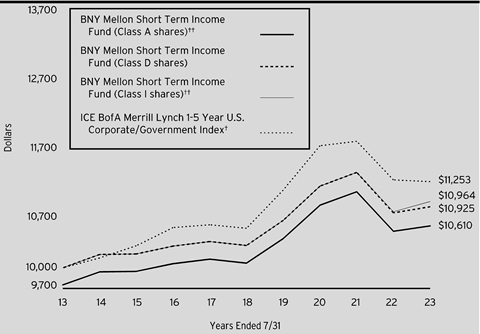

Comparison of change in value of a $10,000 investment in Class A shares, Class D shares and Class I shares of BNY Mellon Short Term Income Fund with a hypothetical investment of $10,000 in the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class A shares and Class I shares of the fund reflect the performance of the fund’s Class D shares for the period prior to 5/6/22 (the inception date for Class A shares and Class I shares).

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in Class A shares, Class D shares and Class I shares of BNY Mellon Short Term Income Fund on 7/31/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index tracks the performance of U.S. dollar-denominated investment-grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities, including all securities with a remaining term to final maturity less than five years. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Short Term Income Fund with a hypothetical investment of $1,000,000 in the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class D shares for the period prior to 5/6/22 (the inception date for Class Y shares).

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Short Term Income Fund on 7/31/13 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index tracks the performance of U.S. dollar-denominated investment-grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities, including all securities with a remaining term to final maturity less than five years. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | | | |

Average Annual Total Returns as of 7/31/2023 |

| Inception

Date | 1 Year | 5 Years | 10 Years |

Class A shares | | | | | | |

with maximum sales charge (2.50%) | 5/6/22 | -1.79%† | .54% | † | .59% | † |

without sales charge | 5/6/22 | .76%† | 1.06% | † | .85% | † |

Class D shares | 8/18/92 | 1.15% | 1.14% | | .89% | |

Class I shares | 5/6/22 | 1.36%† | 1.21% | † | .92% | † |

Class Y shares | 5/6/22 | 1.46%† | 1.21% | † | .92% | † |

ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index | | -.24% | 1.25% | | 1.19% | |

† The total return performance figures presented for Class A shares, Class I shares and Class Y shares of the fund reflect the performance of the fund’s Class D shares for the period prior to 5/6/22 (the inception date for Class A shares, Class I shares and Class Y shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Short Term Income Fund from February 1, 2023 to July 31, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended July 31, 2023 | |

| | | | | | |

| | Class A | Class D | Class I | Class Y | |

Expenses paid per $1,000† | $3.13 | $2.84 | $1.84 | $1.84 | |

Ending value (after expenses) | $1,004.00 | $1,007.90 | $1,008.90 | $1,008.90 | |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended July 31, 2023 | |

| | | | | | |

| | Class A | Class D | Class I | Class Y | |

Expenses paid per $1,000† | $3.16 | $2.86 | $1.86 | $1.86 | |

Ending value (after expenses) | $1,021.67 | $1,021.97 | $1,022.96 | $1,022.96 | |

† | Expenses are equal to the fund’s annualized expense ratio of .63% for Class A, .57% for Class D, .37% for Class I and .37% for Class Y, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

July 31, 2023

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% | | | | | |

Aerospace & Defense - .8% | | | | | |

Rolls-Royce PLC, Gtd. Notes | | 5.75 | | 10/15/2027 | | 220,000 | b | 217,019 | |

The Boeing Company, Sr. Unscd. Notes | | 2.20 | | 2/4/2026 | | 550,000 | | 507,785 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.75 | | 8/15/2028 | | 52,000 | b | 52,220 | |

| | 777,024 | |

Agriculture - .3% | | | | | |

Philip Morris International, Inc., Sr. Unscd. Notes | | 0.88 | | 5/1/2026 | | 350,000 | | 313,409 | |

Airlines - .1% | | | | | |

Air Canada, Sr. Scd. Notes | | 3.88 | | 8/15/2026 | | 128,000 | b | 118,899 | |

Asset-Backed Certificates - 8.7% | | | | | |

AMSR Trust, Ser. 2023-SFR2, Cl. A | | 3.95 | | 8/17/2040 | | 555,000 | b | 516,396 | |

Amur Equipment Finance Receivables XI LLC, Ser. 2022-2A, Cl. A2 | | 5.30 | | 6/21/2028 | | 88,423 | b | 87,670 | |

CF Hippolyta Issuer LLC, Ser. 2020-1, Cl. A1 | | 1.69 | | 7/15/2060 | | 346,289 | b | 312,230 | |

CF Hippolyta Issuer LLC, Ser. 2021-1A, Cl. A1 | | 1.53 | | 3/15/2061 | | 259,173 | b | 226,012 | |

CLI Funding VI LLC, Ser. 2020-1A, Cl. A | | 2.08 | | 9/18/2045 | | 131,073 | b | 114,238 | |

CLI Funding VI LLC, Ser. 2020-3A, Cl. A | | 2.07 | | 10/18/2045 | | 221,542 | b | 193,006 | |

CNH Capital Canada Receivables Trust, Ser. 2021-1A, Cl. A2 | CAD | 1.00 | | 11/16/2026 | | 218,023 | b | 158,989 | |

CyrusOne Data Centers Issuer I LLC, Ser. 2023-1A, Cl. B | | 5.45 | | 4/20/2048 | | 97,222 | b | 83,540 | |

DataBank Issuer, Ser. 2021-1A, Cl. A2 | | 2.06 | | 2/27/2051 | | 300,000 | b | 263,124 | |

DataBank Issuer, Ser. 2021-2A, CI. A2 | | 2.40 | | 10/25/2051 | | 350,000 | b | 303,258 | |

DataBank Issuer, Ser. 2023-1A, Cl. A2 | | 5.12 | | 2/25/2053 | | 270,000 | b | 249,029 | |

Dell Equipment Finance Trust, Ser. 2023-1, Cl. A3 | | 5.65 | | 9/22/2028 | | 310,000 | b | 310,888 | |

Domino's Pizza Master Issuer LLC, Ser. 2021-1A, Cl. A2I | | 2.66 | | 4/25/2051 | | 219,937 | b | 186,463 | |

Flexential Issuer, Ser. 2021-1A, Cl. A2 | | 3.25 | | 11/27/2051 | | 305,000 | b | 267,628 | |

Hilton Grand Vacations Trust, Ser. 2022-2A, CI. A | | 4.30 | | 1/25/2037 | | 82,013 | b | 78,539 | |

HPEFS Equipment Trust, Ser. 2021-2A, CI. C | | 0.88 | | 9/20/2028 | | 500,000 | b | 485,199 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Asset-Backed Certificates - 8.7% (continued) | | | | | |

Marlette Funding Trust, Ser. 2022-3A, Cl. A | | 5.18 | | 11/15/2032 | | 52,731 | b | 52,442 | |

MVW LLC, Ser. 2020-1A, Cl. A | | 1.74 | | 10/20/2037 | | 73,337 | b | 67,328 | |

New Economy Assets Phase 1 Sponsor LLC, Ser. 2021-1, Cl. A1 | | 1.91 | | 10/20/2061 | | 1,125,000 | b | 966,333 | |

Octane Receivables Trust, Ser. 2023-1A, Cl. B | | 5.96 | | 7/20/2029 | | 300,000 | b | 296,556 | |

OneMain Financial Issuance Trust, Ser. 2020-2A, Cl. A | | 1.75 | | 9/14/2035 | | 350,000 | b | 315,001 | |

Pagaya AI Debt Selection Trust, Ser. 2021-3, Cl. A | | 1.15 | | 5/15/2029 | | 54,674 | b | 54,289 | |

Purewest Funding LLC, Ser. 2021-1, Cl. A1 | | 4.09 | | 12/22/2036 | | 265,456 | b | 251,051 | |

Textainer Marine Containers VII Ltd., Ser. 2020-2A, CI. A | | 2.10 | | 9/20/2045 | | 420,403 | b | 370,051 | |

Textainer Marine Containers VII Ltd., Ser. 2021-1A, Cl. A | | 1.68 | | 2/20/2046 | | 282,333 | b | 239,645 | |

Tricon American Homes Trust, Ser. 2018-SFR1, Cl. A | | 3.53 | | 5/17/2037 | | 604,802 | b | 580,750 | |

Trinity Rail Leasing LLC, Ser. 2020-2A, Cl. A1 | | 1.83 | | 11/19/2050 | | 171,771 | b | 156,140 | |

TRP, Ser. 2021-2, Cl. A | | 2.15 | | 6/19/2051 | | 293,940 | b | 253,916 | |

TRP LLC, Ser. 2021-1, Cl. A | | 2.07 | | 6/19/2051 | | 286,891 | b | 247,171 | |

Upstart Securitization Trust, Ser. 2021-4, Cl. A | | 0.84 | | 9/20/2031 | | 80,732 | b | 79,571 | |

Vantage Data Centers Issuer LLC, Ser. 2021-1A, CI. A2 | | 2.17 | | 10/15/2046 | | 250,000 | b | 220,092 | |

Vantage Data Centers LLC, Ser. 2020-2A, CI. A2 | | 1.99 | | 9/15/2045 | | 414,000 | b | 349,352 | |

Verizon Master Trust, Ser. 2021-1, Cl. C | | 0.89 | | 5/20/2027 | | 500,000 | | 478,334 | |

Verizon Master Trust, Ser. 2022-5, CI. A1A | | 3.72 | | 7/20/2027 | | 142,000 | | 140,672 | |

| | 8,954,903 | |

Asset-Backed Certificates/Auto Receivables - 13.9% | | | | | |

AmeriCredit Automobile Receivables Trust, Ser. 2020-1, Cl. C | | 1.59 | | 10/20/2025 | | 285,298 | | 280,516 | |

AmeriCredit Automobile Receivables Trust, Ser. 2022-1, CI. A2 | | 2.05 | | 1/20/2026 | | 13,785 | | 13,727 | |

AmeriCredit Automobile Receivables Trust, Ser. 2022-2, Cl. B | | 4.81 | | 4/18/2028 | | 214,000 | | 209,407 | |

Avis Budget Rental Car Funding AESOP LLC, Ser. 2020-1A, Cl. A | | 2.33 | | 8/20/2026 | | 240,000 | b | 224,540 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Asset-Backed Certificates/Auto Receivables - 13.9% (continued) | | | | | |

Avis Budget Rental Car Funding AESOP LLC, Ser. 2023-3A, Cl. A | | 5.44 | | 2/22/2028 | | 385,000 | b | 379,418 | |

Bank of the West Auto Trust, Ser. 2019-1, Cl. B | | 2.76 | | 1/15/2025 | | 286,056 | b | 284,686 | |

BMW Canada Auto Trust, Ser. 2021-1A, Cl. A3 | CAD | 0.76 | | 12/20/2025 | | 400,000 | b | 298,311 | |

BMW Vehicle Lease Trust, Ser.2023-1, CI. A3 | | 5.16 | | 11/25/2025 | | 56,000 | | 55,694 | |

Capital One Prime Auto Receivables Trust, Ser. 2022-2, CI. A3 | | 3.66 | | 5/17/2027 | | 302,000 | | 293,149 | |

CarMax Auto Owner Trust, Ser. 2019-3, Cl. C | | 2.60 | | 6/16/2025 | | 315,000 | | 313,775 | |

CarMax Auto Owner Trust, Ser. 2019-4, Cl. B | | 2.32 | | 7/15/2025 | | 475,000 | | 469,073 | |

CarMax Auto Owner Trust, Ser. 2021-3, Cl. C | | 1.25 | | 5/17/2027 | | 500,000 | | 451,569 | |

Carvana Auto Receivables Trust, Ser. 2020-P1, Cl. A3 | | 0.44 | | 6/9/2025 | | 26,017 | | 25,967 | |

Carvana Auto Receivables Trust, Ser. 2020-P1, Cl. C | | 1.32 | | 11/9/2026 | | 425,000 | | 380,829 | |

Carvana Auto Receivables Trust, Ser. 2021-N2, Cl. C | | 1.07 | | 3/10/2028 | | 127,630 | | 117,833 | |

Carvana Auto Receivables Trust, Ser. 2021-P1, Cl. B | | 1.19 | | 1/11/2027 | | 230,000 | | 205,873 | |

Carvana Auto Receivables Trust, Ser. 2021-P4, Cl. B | | 1.98 | | 2/10/2028 | | 125,000 | | 108,344 | |

Carvana Auto Receivables Trust, Ser. 2022-P3, CI. C | | 5.54 | | 11/10/2028 | | 238,000 | | 229,998 | |

CPS Auto Receivables Trust, Ser. 2021-D, Cl. B | | 1.09 | | 10/15/2027 | | 475,487 | b | 469,350 | |

DT Auto Owner Trust, Ser. 2021-2A, Cl. B | | 0.81 | | 1/15/2027 | | 194,326 | b | 193,360 | |

Enterprise Fleet Financing LLC, Ser. 2022-3, CI. A2 | | 4.38 | | 7/20/2029 | | 90,352 | b | 88,581 | |

Exeter Automobile Receivables Trust, Ser. 2021-2A, Cl. C | | 0.98 | | 6/15/2026 | | 359,036 | | 351,858 | |

Exeter Automobile Receivables Trust, Ser. 2021-3A, Cl. B | | 0.69 | | 1/15/2026 | | 78,804 | | 78,430 | |

Exeter Automobile Receivables Trust, Ser. 2022-3A, Cl. B | | 4.86 | | 12/15/2026 | | 254,000 | | 251,554 | |

Ford Auto Securitization Trust, Ser. 2020-AA, Cl. B | CAD | 1.87 | | 6/15/2026 | | 450,000 | b | 321,796 | |

Ford Auto Securitization Trust II, Ser. 2022-AA, Cl. A3 | CAD | 5.40 | | 9/15/2028 | | 626,000 | b | 472,207 | |

Ford Credit Auto Owner Trust, Ser. 2020-2, Cl. B | | 1.49 | | 4/15/2033 | | 375,000 | b | 339,405 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Asset-Backed Certificates/Auto Receivables - 13.9% (continued) | | | | | |

Ford Credit Auto Owner Trust, Ser. 2022-C, CI. C | | 5.22 | | 3/15/2030 | | 325,000 | | 318,818 | |

GM Financial Automobile Leasing Trust, Ser. 2021-3, Cl. B | | 0.76 | | 7/21/2025 | | 500,000 | | 483,447 | |

GM Financial Consumer Automobile Receivables Trust, Ser. 2020-4, Cl. B | | 0.73 | | 3/16/2026 | | 300,000 | | 283,581 | |

GMF Canada Leasing Trust, Ser. 2021-1A, Cl. B | CAD | 1.26 | | 5/20/2026 | | 850,000 | b | 642,936 | |

Hertz Vehicle Financing LLC, Ser. 2021-1A, CI. A | | 1.21 | | 12/26/2025 | | 650,000 | b | 611,925 | |

Hyundai Auto Receivables Trust, Ser. 2022-C, CI. A4 | | 5.52 | | 10/16/2028 | | 333,000 | | 336,245 | |

MBarc Credit Canada, Inc., Ser. 2021-AA, Cl. A3 | CAD | 0.93 | | 2/17/2026 | | 323,767 | b | 243,081 | |

Nissan Auto Receivables Owner Trust, Ser. 2022-A, Cl. A2 | | 1.32 | | 11/15/2024 | | 47,378 | | 47,046 | |

OSCAR US Funding XIII LLC, Ser. 2021-2A, Cl. A4 | | 1.27 | | 9/11/2028 | | 600,000 | b | 553,627 | |

PenFed Auto Receivables Owner Trust, Ser. 2022-A, CI. C | | 4.83 | | 12/15/2028 | | 1,000,000 | b | 965,541 | |

Santander Consumer Auto Receivables Trust, Ser. 2020-BA, Cl. C | | 1.29 | | 4/15/2026 | | 210,000 | b | 205,601 | |

Santander Drive Auto Receivables Trust, Ser. 2021-4, CI. C | | 1.26 | | 2/16/2027 | | 260,000 | | 251,162 | |

Santander Drive Auto Receivables Trust, Ser. 2022-5, CI. C | | 4.74 | | 10/16/2028 | | 306,000 | | 298,347 | |

SFS Auto Receivables Securitization Trust, Ser.2023-1A, CI. A2A | | 5.89 | | 3/22/2027 | | 124,000 | b | 123,978 | |

SFS Auto Receivables Securitization Trust, Ser.2023-1A, CI. A3 | | 5.47 | | 10/20/2028 | | 205,000 | b | 204,499 | |

Tesla Auto Lease Trust, Ser. 2021-A, CI. C | | 1.18 | | 3/20/2025 | | 275,000 | b | 269,480 | |

Tesla Auto Lease Trust, Ser. 2021-A, Cl. A3 | | 0.56 | | 3/20/2025 | | 128,129 | b | 127,621 | |

Toyota Auto Receivables Owner Trust, Ser. 2020-D, Cl. A3 | | 0.35 | | 1/15/2025 | | 12,352 | | 12,242 | |

Toyota Auto Receivables Owner Trust, Ser. 2022-D, CI. A3 | | 5.30 | | 9/15/2027 | | 514,000 | | 513,742 | |

Volkswagen Auto Lease Trust, Ser. 2022-A, Cl. A3 | | 3.44 | | 7/21/2025 | | 100,000 | | 98,196 | |

Westlake Automobile Receivables Trust, Ser. 2021-1A, Cl. C | | 0.95 | | 3/16/2026 | | 510,000 | b | 500,264 | |

Westlake Automobile Receivables Trust, Ser. 2021-2A, CI. B | | 0.62 | | 7/15/2026 | | 218,331 | b | 215,969 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Asset-Backed Certificates/Auto Receivables - 13.9% (continued) | | | | | |

World Omni Auto Receivables Trust, Ser. 2023-A, Cl. A3 | | 4.83 | | 5/15/2028 | | 101,000 | | 99,887 | |

| | 14,316,485 | |

Automobiles & Components - 1.8% | | | | | |

Ford Motor Credit Co., LLC, Sr. Unscd. Notes | | 2.30 | | 2/10/2025 | | 290,000 | | 272,187 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 1.70 | | 8/18/2023 | | 300,000 | | 299,401 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 2.35 | | 2/26/2027 | | 400,000 | | 359,289 | |

Mercedes-Benz Finance North America LLC, Gtd. Notes | | 0.75 | | 3/1/2024 | | 650,000 | b | 629,881 | |

Stellantis Finance US, Inc., Gtd. Notes | | 1.71 | | 1/29/2027 | | 330,000 | b | 290,084 | |

| | 1,850,842 | |

Banks - 10.2% | | | | | |

Banco Santander Mexico SA, Sr. Unscd. Notes | | 5.38 | | 4/17/2025 | | 200,000 | b | 198,243 | |

Banco Santander SA, Sr. Unscd. Notes | | 1.85 | | 3/25/2026 | | 600,000 | | 541,375 | |

Banco Santander SA, Sr. Unscd. Notes | | 5.59 | | 8/8/2028 | | 400,000 | | 400,000 | |

Bank of America Corp., Jr. Sub. Notes, Ser. JJ | | 5.13 | | 6/20/2024 | | 192,000 | c | 188,759 | |

Bank of America Corp., Jr. Sub. Notes, Ser. X | | 6.25 | | 9/5/2024 | | 196,000 | c | 194,667 | |

Bank of America Corp., Sr. Unscd. Notes | | 0.98 | | 9/25/2025 | | 700,000 | | 661,564 | |

Barclays PLC, Sr. Unscd. Notes | | 3.93 | | 5/7/2025 | | 300,000 | | 294,699 | |

BNP Paribas SA, Sr. Unscd. Notes | | 2.22 | | 6/9/2026 | | 325,000 | b | 303,864 | |

Canadian Imperial Bank of Commerce, Sr. Unscd. Notes | | 3.30 | | 4/7/2025 | | 650,000 | | 626,132 | |

Citigroup, Inc., Jr. Sub. Bonds, Ser. W | | 4.00 | | 12/10/2025 | | 600,000 | c | 539,964 | |

Citizens Bank NA/ Providence RI, Sr. Unscd. Notes | | 6.06 | | 10/24/2025 | | 500,000 | | 484,280 | |

Credit Agricole SA, Sub. Notes | | 4.38 | | 3/17/2025 | | 600,000 | | 581,464 | |

Deutsche Bank AG, Sr. Unscd. Notes | | 7.15 | | 7/13/2027 | | 360,000 | | 367,346 | |

ING Groep NV, Sr. Unscd. Notes | | 3.55 | | 4/9/2024 | | 280,000 | | 275,673 | |

JPMorgan Chase & Co., Jr. Sub. Bonds, Ser. FF | | 5.00 | | 8/1/2024 | | 614,000 | c | 600,722 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 4.85 | | 7/25/2028 | | 445,000 | | 439,136 | |

Morgan Stanley, Sr. Unscd. Notes | | 5.12 | | 2/1/2029 | | 270,000 | | 267,372 | |

Morgan Stanley, Sr. Unscd. Notes | | 6.14 | | 10/16/2026 | | 300,000 | | 303,816 | |

Santander Holdings USA, Inc., Sr. Unscd. Notes | | 6.50 | | 3/9/2029 | | 139,000 | | 139,747 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Banks - 10.2% (continued) | | | | | |

Synovus Bank/Columbus GA, Sr. Unscd. Notes | | 5.63 | | 2/15/2028 | | 300,000 | | 280,060 | |

The Goldman Sachs Group, Inc., Jr. Sub. Notes, Ser. T | | 3.80 | | 5/10/2026 | | 350,000 | c | 289,600 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 0.93 | | 10/21/2024 | | 660,000 | | 651,952 | |

The PNC Financial Services Group, Inc., Sr. Unscd. Notes | | 5.67 | | 10/28/2025 | | 379,000 | | 377,249 | |

The Toronto-Dominion Bank, Sr. Unscd. Notes | | 5.53 | | 7/17/2026 | | 361,000 | | 362,737 | |

Truist Financial Corp., Sr. Unscd. Notes | | 1.27 | | 3/2/2027 | | 325,000 | | 289,874 | |

UBS Group AG, Sr. Unscd. Notes | | 2.59 | | 9/11/2025 | | 500,000 | b | 479,901 | |

UBS Group AG, Sr. Unscd. Notes | | 6.37 | | 7/15/2026 | | 350,000 | b | 350,511 | |

| | 10,490,707 | |

Beverage Products - .4% | | | | | |

Bacardi Ltd./Bacardi-Martini BV, Sr. Unscd. Notes | | 5.25 | | 1/15/2029 | | 380,000 | b | 377,090 | |

Chemicals - 1.0% | | | | | |

Celanese US Holdings LLC, Gtd. Notes | | 5.90 | | 7/5/2024 | | 300,000 | | 299,537 | |

Celanese US Holdings LLC, Gtd. Notes | | 6.17 | | 7/15/2027 | | 200,000 | | 201,612 | |

MEGlobal Canada ULC, Gtd. Notes | | 5.00 | | 5/18/2025 | | 300,000 | | 294,374 | |

SPCM SA, Sr. Unscd. Notes | | 3.13 | | 3/15/2027 | | 250,000 | b | 225,188 | |

The Sherwin-Williams Company, Sr. Unscd. Notes | | 4.05 | | 8/8/2024 | | 48,000 | | 47,201 | |

| | 1,067,912 | |

Collateralized Loan Obligations Debt - 7.1% | | | | | |

Antares Ltd. CLO, Ser. 2020-1A, Cl. A1R, (3 Month TSFR +1.72%) | | 7.07 | | 10/23/2033 | | 350,000 | b,d | 344,925 | |

Arbor Realty Commercial Real Estate Notes Ltd. CLO, Ser. 2021-FL4, Cl. A, (1 Month TSFR +1.46%) | | 6.69 | | 11/15/2036 | | 365,000 | b,d | 361,315 | |

Bain Capital Credit Ltd. CLO, Ser. 2020-3A, Cl. A1R, (3 Month TSFR +1.42%) | | 6.77 | | 10/23/2034 | | 360,000 | b,d | 357,863 | |

Ballyrock Ltd. CLO, Ser. 2020-2A, Cl. A1R, (3 Month TSFR +1.27%) | | 6.60 | | 10/20/2031 | | 275,000 | b,d | 273,916 | |

Carlyle US Ltd. CLO, Ser. 2017-1A, Cl. A1R, (3 Month TSFR +1.26%) | | 6.59 | | 4/20/2031 | | 497,731 | b,d | 495,380 | |

Cent 21 Ltd. CLO, Ser. 2014-21A, Cl. A1R3, (3 Month TSFR +1.23%) | | 6.59 | | 7/27/2030 | | 215,274 | b,d | 214,248 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Collateralized Loan Obligations Debt - 7.1% (continued) | | | | | |

Columbia Cent 30 Ltd. CLO, Ser. 2020-30A, Cl. A1, (3 Month TSFR +1.57%) | | 6.90 | | 1/20/2034 | | 330,000 | b,d | 326,885 | |

Dryden 41 Senior Loan Fund CLO, Ser. 2015-41A, Cl. AR, (3 Month TSFR +1.23%) | | 6.54 | | 4/15/2031 | | 268,448 | b,d | 267,231 | |

Dryden 83 Ltd. CLO, Ser. 2020-83A, Cl. B, (3 Month TSFR +1.86%) | | 7.17 | | 1/18/2032 | | 600,000 | b,d | 587,926 | |

Madison Park Funding XXVII Ltd. CLO, Ser. 2018-27A, Cl. A1A, (3 Month TSFR +1.29%) | | 6.62 | | 4/20/2030 | | 298,348 | b,d | 297,730 | |

Madison Park Funding XXX Ltd. CLO, Ser. 2018-30A, Cl. A, (3 Month TSFR +1.01%) | | 6.32 | | 4/15/2029 | | 354,356 | b,d | 352,211 | |

Magnetite XIX Ltd. CLO, Ser. 2017-19A, Cl. AR, (3 Month TSFR +1.31%) | | 6.62 | | 4/17/2034 | | 325,000 | b,d | 322,721 | |

Magnetite XVII Ltd. CLO, Ser. 2016-17A, Cl. AR, (3 Month TSFR +1.36%) | | 6.69 | | 7/20/2031 | | 325,000 | b,d | 324,033 | |

MF1 Ltd. CLO, Ser. 2021-FL7, CI. AS, (1 Month TSFR +1.56%) | | 6.79 | | 10/16/2036 | | 500,000 | b,d | 489,680 | |

MF1 Ltd. CLO, Ser. 2022-FL8, CI. AS, (1 Month SOFR +1.75%) | | 6.82 | | 2/19/2037 | | 375,000 | b,d | 367,720 | |

Neuberger Berman Loan Advisers 40 Ltd. CLO, Ser. 2021-40A, Cl. B, (3 Month TSFR +1.66%) | | 6.97 | | 4/16/2033 | | 400,000 | b,d | 392,325 | |

RIN IV Ltd. CLO, Ser. 2021-1A, CI. A, (3 Month TSFR +1.56%) | | 6.89 | | 4/20/2033 | | 250,000 | b,d | 245,495 | |

Symphony XV Ltd. CLO, Ser. 2014-15A, Cl. BR3, (3 Month TSFR +1.81%) | | 7.12 | | 1/17/2032 | | 550,000 | b,d | 539,928 | |

Symphony XXIV Ltd. CLO, Ser. 2020-24A, Cl. A, (3 Month TSFR +1.46%) | | 6.81 | | 1/23/2032 | | 300,000 | b,d | 298,792 | |

TPRK CLO, Ser. 2021-1A, CI. A1, (3 Month TSFR +1.26%) | | 6.57 | | 4/15/2034 | | 350,000 | b,d | 347,202 | |

Voya Ltd. CLO, Ser. 2019-1A, Cl. AR, (3 Month TSFR +1.32%) | | 6.63 | | 4/15/2031 | | 137,480 | b,d | 137,026 | |

| | 7,344,552 | |

Commercial & Professional Services - .6% | | | | | |

Adani Ports & Special Economic Zone Ltd., Sr. Unscd. Notes | | 3.38 | | 7/24/2024 | | 600,000 | b | 579,854 | |

Commercial Mortgage Pass-Through Certificates - 7.8% | | | | | |

American Homes 4 Rent Trust, Ser. 2014-SFR3, Cl. A | | 3.68 | | 12/17/2036 | | 272,658 | b | 263,741 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Commercial Mortgage Pass-Through Certificates - 7.8% (continued) | | | | | |

BSREP, Ser. 2021-DC, Cl. C, (1 Month TSFR +1.66%) | | 6.89 | | 8/15/2038 | | 500,000 | b,d | 434,706 | |

BXHPP Trust, Ser. 2021-FILM, Cl. B, (1 Month TSFR +1.01%) | | 6.24 | | 8/15/2036 | | 450,000 | b,d | 414,479 | |

CAMB Commercial Mortgage Trust, Ser. 2019-LIFE, Cl. A, (1 Month TSFR +1.18%) | | 6.41 | | 12/15/2037 | | 500,000 | b,d | 498,196 | |

CGDB Commercial Mortgage Trust, Ser. 2019-MOB, Cl. B, (1 Month TSFR +1.36%) | | 6.59 | | 11/15/2036 | | 675,000 | b,d | 660,321 | |

CHC Commercial Mortgage Trust, Ser. 2019-CHC, Cl. C, (1 Month TSFR +1.86%) | | 7.09 | | 6/15/2034 | | 302,149 | b,d | 296,294 | |

Citigroup Commercial Mortgage Trust, Ser. 2014-GC25, Cl. B | | 4.35 | | 10/10/2047 | | 270,000 | | 234,206 | |

CSAIL Commercial Mortgage Trust, Ser. 2015-C1, Cl. A3 | | 3.24 | | 4/15/2050 | | 465,181 | | 447,537 | |

GS Mortgage Securities Corp. Trust, Ser. 2019-70P, Cl. B, (1 Month TSFR +1.43%) | | 6.66 | | 10/15/2036 | | 560,000 | b,d | 524,423 | |

HPLY Trust, Ser. 2019-HIT, Cl. A, (1 Month TSFR +1.11%) | | 6.34 | | 11/15/2036 | | 379,013 | b,d | 375,872 | |

Imperial Fund Mortgage Trust, Ser. 2023-NQM1, Cl. A3 | | 7.16 | | 2/25/2068 | | 464,435 | b | 461,767 | |

JPMBB Commercial Mortgage Securities Trust, Ser. 2015-C30, Cl. A4 | | 3.55 | | 7/15/2048 | | 318,228 | | 302,126 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser. 2014-C17, Cl. A4 | | 3.44 | | 8/15/2047 | | 345,007 | | 338,503 | |

Natixis Commercial Mortgage Securities Trust, Ser. 2020-2PAC, Cl. A | | 2.97 | | 12/15/2038 | | 172,355 | b | 160,318 | |

New Residential Mortgage Loan Trust, Ser. 2022-NQM1, CI. A1 | | 2.28 | | 4/25/2061 | | 512,975 | b | 429,863 | |

OBX Trust, Ser. 2023-NQM2, Cl. A1 | | 6.32 | | 1/25/2062 | | 400,440 | b | 399,948 | |

Towd Point Mortgage Trust, Ser. 2023-1, CI. A1 | | 3.75 | | 1/25/2063 | | 103,477 | b | 95,106 | |

Tricon American Homes Trust, Ser. 2017-SFR2, Cl. A | | 2.93 | | 1/17/2036 | | 459,503 | b | 452,074 | |

Tricon American Homes Trust, Ser. 2019-SFR1, Cl. A | | 2.75 | | 3/17/2038 | | 321,848 | b | 298,670 | |

Verus Securitization Trust, Ser. 2019-INV2, CI. A1 | | 3.80 | | 7/25/2059 | | 136,816 | b | 132,621 | |

Wells Fargo Commercial Mortgage Trust, Ser. 2015-C27, Cl. A4 | | 3.19 | | 2/15/2048 | | 384,239 | | 366,949 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Commercial Mortgage Pass-Through Certificates - 7.8% (continued) | | | | | |

Wells Fargo Commercial Mortgage Trust, Ser. 2020-C56, CI. A2 | | 2.50 | | 6/15/2053 | | 300,000 | | 283,828 | |

Wells Fargo Commercial Mortgage Trust, Ser. 2021-SAVE, Cl. A, (1 Month TSFR +1.26%) | | 6.49 | | 2/15/2040 | | 164,210 | b,d | 154,911 | |

| | 8,026,459 | |

Consumer Discretionary - 1.9% | | | | | |

Caesars Entertainment, Inc., Sr. Scd. Notes | | 6.25 | | 7/1/2025 | | 500,000 | b | 497,728 | |

Caesars Entertainment, Inc., Sr. Scd. Notes | | 7.00 | | 2/15/2030 | | 99,000 | b | 100,085 | |

Caesars Entertainment, Inc., Sr. Unscd. Notes | | 8.13 | | 7/1/2027 | | 270,000 | b | 277,175 | |

Lennar Corp., Gtd. Notes | | 4.50 | | 4/30/2024 | | 600,000 | | 595,705 | |

Wynn Macau Ltd., Sr. Unscd. Notes | | 5.63 | | 8/26/2028 | | 600,000 | b | 533,308 | |

| | 2,004,001 | |

Diversified Financials - 3.3% | | | | | |

Aercap Ireland Capital DAC/AerCap Global Aviation Trust, Gtd. Notes | | 1.75 | | 1/30/2026 | | 700,000 | | 632,790 | |

Aercap Ireland Capital DAC/AerCap Global Aviation Trust, Gtd. Notes | | 2.45 | | 10/29/2026 | | 500,000 | | 450,011 | |

Air Lease Corp., Sr. Unscd. Notes | | 3.38 | | 7/1/2025 | | 625,000 | | 596,675 | |

Ally Financial, Inc., Sr. Unscd. Notes | | 4.75 | | 6/9/2027 | | 330,000 | e | 311,301 | |

Capital One Financial Corp., Sub. Notes | | 4.20 | | 10/29/2025 | | 650,000 | | 626,053 | |

Discover Financial Services, Sr. Unscd. Notes | | 3.75 | | 3/4/2025 | | 450,000 | | 433,935 | |

MDGH GMTN RSC Ltd., Gtd. Notes | | 2.50 | | 11/7/2024 | | 320,000 | | 307,800 | |

Nasdaq, Inc., Sr. Unscd. Notes | | 5.35 | | 6/28/2028 | | 85,000 | | 85,195 | |

| | 3,443,760 | |

Energy - 6.7% | | | | | |

Aker BP ASA, Sr. Unscd. Notes | | 3.00 | | 1/15/2025 | | 325,000 | b | 310,142 | |

BP Capital Markets PLC, Gtd. Notes | | 4.38 | | 6/22/2025 | | 345,000 | c | 333,063 | |

Cheniere Corpus Christi Holdings LLC, Sr. Scd. Notes | | 5.88 | | 3/31/2025 | | 585,000 | | 585,136 | |

CITGO Petroleum Corp., Sr. Scd. Notes | | 7.00 | | 6/15/2025 | | 250,000 | b | 247,256 | |

CVR Energy, Inc., Gtd. Bonds | | 5.25 | | 2/15/2025 | | 280,000 | b | 272,198 | |

Ecopetrol SA, Sr. Unscd. Notes | | 8.63 | | 1/19/2029 | | 107,000 | | 110,290 | |

Enbridge, Inc., Gtd. Notes | | 1.60 | | 10/4/2026 | | 500,000 | | 448,113 | |

Enbridge, Inc., Gtd. Notes | | 2.50 | | 1/15/2025 | | 300,000 | | 286,843 | |

Energean Israel Finance Ltd., Sr. Scd. Notes | | 4.50 | | 3/30/2024 | | 275,000 | b | 272,312 | |

Energy Transfer LP, Sr. Unscd. Notes | | 2.90 | | 5/15/2025 | | 500,000 | | 476,689 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Energy - 6.7% (continued) | | | | | |

Energy Transfer LP, Sr. Unscd. Notes | | 5.55 | | 2/15/2028 | | 266,000 | | 267,306 | |

Enterprise Products Operating LLC, Gtd. Notes | | 5.05 | | 1/10/2026 | | 136,000 | | 135,962 | |

EQT Corp., Sr. Unscd. Notes | | 3.13 | | 5/15/2026 | | 500,000 | b | 463,453 | |

Howard Midstream Energy Partners LLC, Sr. Unscd. Notes | | 6.75 | | 1/15/2027 | | 116,000 | b | 112,002 | |

Howard Midstream Energy Partners LLC, Sr. Unscd. Notes | | 8.88 | | 7/15/2028 | | 113,000 | b | 115,655 | |

Marathon Petroleum Corp., Sr. Unscd. Notes | | 3.63 | | 9/15/2024 | | 300,000 | | 293,111 | |

Parkland Corp., Gtd. Notes | | 4.50 | | 10/1/2029 | | 210,000 | b | 185,509 | |

Parkland Corp., Gtd. Notes | | 5.88 | | 7/15/2027 | | 875,000 | b | 852,235 | |

Petroleos Mexicanos, Gtd. Notes | | 4.25 | | 1/15/2025 | | 1,000,000 | e | 950,546 | |

Pioneer Natural Resources Co., Sr. Unscd. Notes | | 1.13 | | 1/15/2026 | | 150,000 | | 135,993 | |

| | 6,853,814 | |

Food Products - .2% | | | | | |

MARB BondCo PLC, Gtd. Bonds | | 3.95 | | 1/29/2031 | | 260,000 | b | 192,752 | |

Foreign Governmental - .5% | | | | | |

Hungary, Sr. Unscd. Notes | | 6.13 | | 5/22/2028 | | 200,000 | b | 203,904 | |

Romania, Sr. Unscd. Notes | | 6.63 | | 2/17/2028 | | 300,000 | b | 311,611 | |

| | 515,515 | |

Health Care - 2.0% | | | | | |

AbbVie, Inc., Sr. Unscd. Notes | | 3.80 | | 3/15/2025 | | 450,000 | | 438,576 | |

Elevance Health, Inc., Sr. Unscd. Notes | | 5.35 | | 10/15/2025 | | 155,000 | | 155,289 | |

HCA, Inc., Gtd. Notes | | 5.38 | | 2/1/2025 | | 300,000 | | 298,355 | |

Royalty Pharma PLC, Gtd. Notes | | 1.20 | | 9/2/2025 | | 325,000 | | 295,551 | |

Shire Acquisitions Investments Ireland DAC, Gtd. Notes | | 3.20 | | 9/23/2026 | | 300,000 | | 282,044 | |

Tenet Healthcare Corp., Sr. Scd. Notes | | 4.88 | | 1/1/2026 | | 300,000 | | 290,652 | |

Teva Pharmaceutical Finance Netherlands III BV, Gtd. Notes | | 3.15 | | 10/1/2026 | | 331,000 | | 299,756 | |

| | 2,060,223 | |

Industrial - .8% | | | | | |

General Electric Co., Jr. Sub. Debs., Ser. D, (3 Month LIBOR +3.33%) | | 8.88 | | 9/15/2023 | | 347,000 | c,d | 348,509 | |

Penske Truck Leasing Co. LP/ PTL Finance Corp., Sr. Unscd. Notes | | 6.05 | | 8/1/2028 | | 141,000 | b | 141,494 | |

TK Elevator US Newco, Inc., Sr. Scd. Notes | | 5.25 | | 7/15/2027 | | 400,000 | b | 374,475 | |

| | 864,478 | |

Insurance - 1.6% | | | | | |

Allianz SE, Jr. Sub. Bonds | | 3.20 | | 10/30/2027 | | 400,000 | b,c | 307,491 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Insurance - 1.6% (continued) | | | | | |

Berkshire Hathaway, Inc., Sr. Unscd. Notes | EUR | 0.87 | | 3/12/2025 | | 875,000 | | 904,688 | |

Jackson Financial, Inc., Sr. Unscd. Notes | | 1.13 | | 11/22/2023 | | 410,000 | | 404,003 | |

| | 1,616,182 | |

Materials - 2.3% | | | | | |

Ardagh Metal Packaging Finance USA LLC/ Ardagh Metal Packaging Finance PLC, Sr. Scd. Notes | | 6.00 | | 6/15/2027 | | 500,000 | b | 493,922 | |

Ball Corp., Gtd. Notes | | 5.25 | | 7/1/2025 | | 575,000 | | 570,479 | |

Berry Global, Inc., Sr. Scd. Notes | | 1.57 | | 1/15/2026 | | 175,000 | | 158,768 | |

Crown Americas LLC/Crown Americas Capital Corp. VI, Gtd. Notes | | 4.75 | | 2/1/2026 | | 190,000 | | 183,846 | |

Sealed Air Corp., Sr. Scd. Notes | | 1.57 | | 10/15/2026 | | 1,075,000 | b | 952,038 | |

| | 2,359,053 | |

Media - .0% | | | | | |

Univision Communications, Inc., Sr. Scd. Notes | | 8.00 | | 8/15/2028 | | 8,000 | b | 8,067 | |

Metals & Mining - ..3% | | | | | |

Anglo American Capital PLC, Gtd. Notes | | 3.63 | | 9/11/2024 | | 300,000 | b | 292,852 | |

Municipal Securities - .1% | | | | | |

Dallas Fort Worth International Airport, Revenue Bonds, Refunding, Ser. C | | 1.33 | | 11/1/2025 | | 75,000 | | 68,969 | |

Real Estate - 4.4% | | | | | |

Boston Properties LP, Sr. Unscd. Notes | | 3.80 | | 2/1/2024 | | 153,000 | | 150,056 | |

Brixmor Operating Partnership LP, Sr. Unscd. Notes | | 2.25 | | 4/1/2028 | | 355,000 | | 301,554 | |

Brixmor Operating Partnership LP, Sr. Unscd. Notes | | 3.85 | | 2/1/2025 | | 95,000 | | 91,439 | |

Equinix, Inc., Sr. Unscd. Notes | | 1.00 | | 9/15/2025 | | 430,000 | e | 391,564 | |

ERP Operating LP, Sr. Unscd. Notes | | 3.38 | | 6/1/2025 | | 650,000 | | 627,310 | |

Extra Space Storage LP, Gtd. Notes | | 5.70 | | 4/1/2028 | | 80,000 | | 80,504 | |

GLP Capital LP/GLP Financing II, Inc., Gtd. Notes | | 5.38 | | 4/15/2026 | | 710,000 | | 697,406 | |

Kimco Realty OP LLC, Gtd. Notes | | 3.85 | | 6/1/2025 | | 235,000 | | 223,699 | |

Realty Income Corp., Sr. Unscd. Notes | | 5.05 | | 1/13/2026 | | 112,000 | | 111,323 | |

SBA Tower Trust, Asset Backed Notes | | 1.84 | | 4/15/2027 | | 500,000 | b | 431,445 | |

SBA Tower Trust, Asset Backed Notes | | 1.88 | | 1/15/2026 | | 275,000 | b | 247,878 | |

19

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Real Estate - 4.4% (continued) | | | | | |

SBA Tower Trust, Asset Backed Notes | | 2.84 | | 1/15/2025 | | 650,000 | b | 619,399 | |

VICI Properties LP/ VICI Note Co., Inc., Gtd. Notes | | 3.50 | | 2/15/2025 | | 225,000 | b | 216,265 | |

WPC Eurobond BV, Gtd. Notes | EUR | 1.35 | | 4/15/2028 | | 300,000 | | 286,739 | |

| | 4,476,581 | |

Retailing - 1.1% | | | | | |

7-Eleven, Inc., Sr. Unscd. Notes | | 0.80 | | 2/10/2024 | | 500,000 | b | 486,563 | |

Autozone, Inc., Sr. Unscd. Notes | | 3.63 | | 4/15/2025 | | 300,000 | | 291,624 | |

CK Hutchison Europe Finance 18 Ltd., Gtd. Bonds | EUR | 1.25 | | 4/13/2025 | | 300,000 | | 313,768 | |

| | 1,091,955 | |

Semiconductors & Semiconductor Equipment - .3% | | | | | |

Intel Corp., Sr. Unscd. Notes | | 4.88 | | 2/10/2028 | | 104,000 | | 103,687 | |

TSMC Arizona Corp., Gtd. Notes | | 1.75 | | 10/25/2026 | | 240,000 | | 215,947 | |

| | 319,634 | |

Supranational Bank - .6% | | | | | |

The African Export-Import Bank, Sr. Unscd. Notes | | 4.13 | | 6/20/2024 | | 300,000 | | 294,399 | |

The African Export-Import Bank, Sr. Unscd. Notes | | 5.25 | | 10/11/2023 | | 350,000 | | 349,256 | |

| | 643,655 | |

Technology Hardware & Equipment - .3% | | | | | |

Hewlett Packard Enterprise Co., Sr. Unscd. Notes | | 1.45 | | 4/1/2024 | | 300,000 | | 291,131 | |

Kyndryl Holdings, Inc., Sr. Unscd. Notes | | 2.05 | | 10/15/2026 | | 76,000 | | 66,236 | |

| | 357,367 | |

Telecommunication Services - .8% | | | | | |

Millicom International Cellular SA, Sr. Unscd. Notes | | 5.13 | | 1/15/2028 | | 180,000 | b | 161,441 | |

T-Mobile USA, Inc., Gtd. Notes | | 2.25 | | 2/15/2026 | | 300,000 | | 277,484 | |

T-Mobile USA, Inc., Gtd. Notes | | 3.50 | | 4/15/2025 | | 300,000 | | 289,996 | |

T-Mobile USA, Inc., Gtd. Notes | | 4.95 | | 3/15/2028 | | 58,000 | | 57,317 | |

| | 786,238 | |

Transportation - .4% | | | | | |

Canadian Pacific Railway Co., Gtd. Notes | | 1.35 | | 12/2/2024 | | 385,000 | | 363,838 | |

U.S. Government Agencies Collateralized Mortgage Obligations - 1.6% | | | | | |

Federal Home Loan Mortgage Corp., REMIC, Ser. 3541, Cl. KB | | 4.00 | | 6/15/2024 | | 23,108 | f | 22,895 | |

Federal Home Loan Mortgage Corp., REMIC, Ser. 4091 Cl. KC | | 3.00 | | 8/15/2040 | | 55,575 | f | 53,285 | |

20

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

U.S. Government Agencies Collateralized Mortgage Obligations - 1.6% (continued) | | | | | |

Federal Home Loan Mortgage Corp., REMIC, Ser. 4838, Cl. VA | | 4.00 | | 3/15/2036 | | 356,010 | f | 343,124 | |

Federal Home Loan Mortgage Corp., REMIC, Ser. 5050, Cl. XA | | 1.00 | | 7/15/2039 | | 438,641 | f | 388,069 | |

Federal Home Loan Mortgage Corp. Seasoned Credit Risk Transfer Trust, Ser. 2020-3, Cl. TTU | | 2.50 | | 5/25/2060 | | 97,979 | f | 88,479 | |

Federal Home Loan Mortgage Corp. Seasoned Loans Structured Transaction Trust, Ser. 2018-2, Cl. A1 | | 3.50 | | 11/25/2028 | | 57,089 | f | 53,851 | |

Federal National Mortgage Association, REMIC, Ser. 2013-16, Cl. GP | | 3.00 | | 3/25/2033 | | 50,151 | f | 48,277 | |

Government National Mortgage Association, Ser. 2011-H23, Cl. HA | | 3.00 | | 12/20/2061 | | 5,263 | | 4,930 | |

Government National Mortgage Association, Ser. 2022-173, Cl. PQ | | 5.00 | | 6/20/2051 | | 681,512 | | 665,101 | |

| | 1,668,011 | |

U.S. Government Agencies Collateralized Municipal-Backed Securities - .0% | | | | | |

Federal Home Loan Mortgage Corp. Multifamily Structured Credit Risk, Ser. 2021-MN1, Cl. M1, (1 Month SOFR +2.00%) | | 7.07 | | 1/25/2051 | | 47,697 | b,d,f | 45,879 | |

U.S. Government Agencies Mortgage-Backed - .1% | | | | | |

Federal Home Loan Mortgage Corp.: | | | |

2.50%, 7/1/2029 | | | 84,709 | f | 80,403 | |

Government National Mortgage Association II: | | | |

7.00%, 12/20/2030-4/20/2031 | | | 1,787 | | 1,848 | |

7.50%, 11/20/2029-12/20/2030 | | | 1,611 | | 1,649 | |

| | 83,900 | |

U.S. Treasury Securities - 9.1% | | | | | |

U.S. Treasury Bonds | | 6.25 | | 8/15/2023 | | 415,000 | | 415,103 | |

U.S. Treasury Notes | | 0.63 | | 12/31/2027 | | 317,500 | | 271,611 | |

U.S. Treasury Notes | | 1.13 | | 2/28/2027 | | 3,550,000 | | 3,173,229 | |

U.S. Treasury Notes | | 2.88 | | 5/31/2025 | | 1,350,000 | | 1,300,641 | |

U.S. Treasury Notes | | 3.13 | | 8/31/2027 | | 1,530,000 | | 1,463,272 | |

U.S. Treasury Notes | | 3.63 | | 3/31/2028 | | 63,000 | | 61,453 | |

U.S. Treasury Notes | | 4.00 | | 6/30/2028 | | 1,354,000 | e | 1,343,210 | |

U.S. Treasury Notes | | 4.00 | | 2/29/2028 | | 40,000 | | 39,647 | |

U.S. Treasury Notes | | 4.13 | | 10/31/2027 | | 730,000 | | 725,495 | |

U.S. Treasury Notes | | 4.25 | | 10/15/2025 | | 550,000 | | 543,780 | |

| | 9,337,441 | |

21

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | a | Value ($) | |

Bonds and Notes - 96.5% (continued) | | | | | |

Utilities - 5.4% | | | | | |

American Electric Power Co., Inc., Jr. Sub. Notes | | 2.03 | | 3/15/2024 | | 170,000 | | 165,958 | |

Constellation Energy Generation LLC, Sr. Unscd. Notes | | 5.60 | | 3/1/2028 | | 375,000 | | 379,476 | |

Dominion Energy, Inc., Sr. Unscd. Notes | | 3.90 | | 10/1/2025 | | 575,000 | | 556,199 | |

DTE Energy Co., Sr. Unscd. Notes | | 4.22 | | 11/1/2024 | | 207,000 | | 203,095 | |

Duke Energy Corp., Sr. Unscd. Notes | | 2.65 | | 9/1/2026 | | 300,000 | | 278,158 | |

Electricite de France SA, Sr. Unscd. Notes | | 5.70 | | 5/23/2028 | | 200,000 | b | 201,495 | |

Enel Finance America LLC, Gtd. Notes | | 7.10 | | 10/14/2027 | | 200,000 | b | 210,218 | |

Entergy Corp., Sr. Unscd. Notes | | 0.90 | | 9/15/2025 | | 500,000 | | 453,084 | |

Evergy Missouri West, Inc., First Mortgage Bonds | | 5.15 | | 12/15/2027 | | 855,000 | b | 845,433 | |

NextEra Energy Capital Holdings, Inc., Gtd. Notes | | 4.26 | | 9/1/2024 | | 82,000 | | 80,797 | |

NextEra Energy Capital Holdings, Inc., Gtd. Notes | | 6.05 | | 3/1/2025 | | 62,000 | | 62,476 | |

NiSource, Inc., Sr. Unscd. Notes | | 5.25 | | 3/30/2028 | | 30,000 | | 30,071 | |

NRG Energy, Inc., Sr. Scd. Notes | | 2.00 | | 12/2/2025 | | 600,000 | b | 540,939 | |

Pacific Gas & Electric Co., First Mortgage Bonds | | 3.25 | | 2/16/2024 | | 600,000 | | 590,542 | |

The AES Corp., Sr. Unscd. Notes | | 1.38 | | 1/15/2026 | | 300,000 | | 271,321 | |

The AES Corp., Sr. Unscd. Notes | | 3.30 | | 7/15/2025 | | 300,000 | b | 285,553 | |

Xcel Energy, Inc., Sr. Unscd. Notes | | 1.75 | | 3/15/2027 | | 500,000 | | 443,772 | |

| | 5,598,587 | |

Total Bonds and Notes

(cost $103,661,028) | | 99,270,888 | |

| | Annualized

Yield (%) | | | | | | | |

Short-Term Investments - 1.9% | | | | | |

U.S. Government Securities | | | | | |

U.S. Treasury Bills

(cost $1,958,627) | | 5.35 | | 12/21/2023 | | 2,000,000 | g | 1,958,491 | |

| | 1-Day

Yield (%) | | | | Shares | | | |

Investment Companies - 4.0% | | | | | |

Registered Investment Companies - 4.0% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $4,103,714) | | 5.38 | | | | 4,103,714 | h | 4,103,714 | |

22

| | | | | | | | | | |

| |

Description | 1-Day

Yield (%) | | | | Shares | | Value ($) | |

Investment of Cash Collateral for Securities Loaned - 1.6% | | | | | |

Registered Investment Companies - 1.6% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $1,616,117) | | 5.38 | | | | 1,616,117 | h | 1,616,117 | |

Total Investments (cost $111,339,486) | | 104.0% | 106,949,210 | |

Liabilities, Less Cash and Receivables | | (4.0%) | (4,083,148) | |

Net Assets | | 100.0% | 102,866,062 | |

LIBOR—London Interbank Offered Rate

REMIC—Real Estate Mortgage Investment Conduit

SOFR—Secured Overnight Financing Rate

TSFR—Term Secured Overnight Financing Rate Reference Rates

CAD—Canadian Dollar

EUR—Euro

a Amount stated in U.S. Dollars unless otherwise noted above.

b Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At July 31, 2023, these securities were valued at $45,102,861 or 43.85% of net assets.

c Security is a perpetual bond with no specified maturity date. Maturity date shown is next reset date of the bond.

d Variable rate security—interest rate resets periodically and rate shown is the interest rate in effect at period end. Security description also includes the reference rate and spread if published and available.

e Security, or portion thereof, on loan. At July 31, 2023, the value of the fund’s securities on loan was $1,706,982 and the value of the collateral was $1,744,474, consisting of cash collateral of $1,616,117 and U.S. Government & Agency securities valued at $128,357. In addition, the value of collateral may include pending sales that are also on loan.

f The Federal Housing Finance Agency (“FHFA”) placed the Federal Home Loan Mortgage Corporation and Federal National Mortgage Association into conservatorship with FHFA as the conservator. As such, the FHFA oversees the continuing affairs of these companies.

g Security is a discount security. Income is recognized through the accretion of discount.

h Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

23

STATEMENT OF INVESTMENTS (continued)

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Asset Backed Securities | 22.6 |

Financial | 19.5 |

Government | 12.2 |

Mortgage Securities | 9.6 |

Collateralized Loan Obligations | 7.1 |

Energy | 6.7 |

Investment Companies | 5.6 |

Utilities | 5.4 |

Consumer, Cyclical | 4.9 |

Industrial | 4.2 |

Consumer, Non-cyclical | 3.4 |

Basic Materials | 1.3 |

Communications | .8 |

Technology | .7 |

| | 104.0 |

† Based on net assets.

See notes to financial statements.

24

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($) 7/31/2022 | Purchases ($)† | Sales ($) | Value ($) 7/31/2023 | Dividends/

Distributions ($) | |

Registered Investment Companies - 4.0% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 4.0% | 9,970,569 | 45,329,491 | (51,196,346) | 4,103,714 | 54,091 | |

Investment of Cash Collateral for Securities Loaned - 1.6%†† | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 1.6% | - | 12,847,986 | (11,231,869) | 1,616,117 | 3,714 | ††† |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares - .0% | 1,545,600 | 88,512,814 | (90,058,414) | - | 16,096 | ††† |

Total - 5.6% | 11,516,169 | 146,690,291 | (152,486,629) | 5,719,831 | 73,901 | |

† Includes reinvested dividends/distributions.

†† Effective July 3, 2023, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares.

††† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

25

STATEMENT OF INVESTMENTS (continued)

| | | | | | | |

Futures | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Long | | |

U.S. Treasury 2 Year Notes | 72 | 9/29/2023 | 14,848,828 | 14,618,250 | (230,578) | |

U.S. Treasury 5 Year Notes | 109 | 9/29/2023 | 11,867,671 | 11,643,414 | (224,257) | |

Futures Short | | |

Canadian 10 Year Bond | 3 | 9/20/2023 | 281,236a | 273,234 | 8,002 | |

Euro-Bobl | 2 | 9/7/2023 | 256,620a | 254,842 | 1,778 | |

Euro-Schatz | 11 | 9/7/2023 | 1,275,837a | 1,270,527 | 5,310 | |

U.S. Treasury 10 Year Notes | 4 | 9/20/2023 | 457,556 | 445,625 | 11,931 | |

Gross Unrealized Appreciation | | 27,021 | |

Gross Unrealized Depreciation | | (454,835) | |

a Notional amounts in foreign currency have been converted to USD using relevant foreign exchange rates.

See notes to financial statements.

| | | | | | |

Forward Foreign Currency Exchange Contracts | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Goldman Sachs & Co. LLC |

United States Dollar | 2,114,428 | Canadian Dollar | 2,788,000 | 8/25/2023 | (586) |

HSBC Securities (USA) Inc. |

United States Dollar | 1,609,206 | Euro | 1,428,000 | 8/25/2023 | 37,073 |

Gross Unrealized Appreciation | | | 37,073 |

Gross Unrealized Depreciation | | | (586) |

See notes to financial statements.

26

| | | | | | |

Centrally Cleared Credit Default Swaps | |

Reference

Obligation | Maturity

Date | Notional

Amount ($) | Market

Value ($) | Upfront

Payments/

Receipts ($) | Unrealized (Depreciation) ($) |

Purchased Contracts:1 | |

Markit iTraxx Europe Index Series 39, Paid Fixed Rate of 1.00% 3 Month | 6/20/2028 | 1,044,525 | (16,287) | (2,036) | (14,251) |

Markit CDX North America Investment Grade Index Series 40, Paid Fixed Rate of 1.00% 3 Month | 6/20/2028 | 5,000,000 | (86,256) | (37,656) | (48,600) |

Gross Unrealized Depreciation | (62,851) |

1 If the fund is a buyer of protection and a credit event occurs, as defined under the terms of the swap agreement, the fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the reference obligation or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the reference obligation.

See notes to financial statements.

27

STATEMENT OF ASSETS AND LIABILITIES

July 31, 2023

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $1,706,982)—Note 1(c): | | | |

Unaffiliated issuers | 105,619,655 | | 101,229,379 | |

Affiliated issuers | | 5,719,831 | | 5,719,831 | |

Cash denominated in foreign currency | | | 61,097 | | 60,512 | |

Dividends, interest and securities lending income receivable | | 598,167 | |

Receivable for shares of Common Stock subscribed | | 558,736 | |

Cash collateral held by broker—Note 4 | | 432,618 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | 37,073 | |

Receivable for futures variation margin—Note 4 | | 10,454 | |

Tax reclaim receivable—Note 1(b) | | 1,225 | |

Receivable for swap variation margin—Note 4 | | 583 | |

Prepaid expenses | | | | | 35,992 | |

| | | | | 108,684,570 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(b) | | 48,365 | |

Cash overdraft due to Custodian | | | | | 965,971 | |

Payable for investment securities purchased | | 2,821,596 | |

Liability for securities on loan—Note 1(c) | | 1,616,117 | |

Payable for shares of Common Stock redeemed | | 244,590 | |

Directors’ fees and expenses payable | | 1,923 | |

Unrealized depreciation on forward foreign

currency exchange contracts—Note 4 | | 586 | |

Other accrued expenses | | | | | 119,360 | |

| | | | | 5,818,508 | |

Net Assets ($) | | | 102,866,062 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 121,946,600 | |

Total distributable earnings (loss) | | | | | (19,080,538) | |

Net Assets ($) | | | 102,866,062 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class D | Class I | Class Y | |

Net Assets ($) | 334,242 | 96,110,855 | 6,372,018 | 48,947 | |

Shares Outstanding | 35,408 | 10,146,540 | 672,065 | 5,165 | |

Net Asset Value Per Share ($) | 9.44 | 9.47 | 9.48 | 9.48 | |

| | | | | |

See notes to financial statements. | | | | | |

28

STATEMENT OF OPERATIONS

Year Ended July 31, 2023

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest (net of $507 foreign taxes withheld at source) | | | 3,604,110 | |

Dividends from affiliated issuers | | | 54,091 | |

Income from securities lending—Note 1(c) | | | 19,810 | |

Total Income | | | 3,678,011 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 326,875 | |

Shareholder servicing costs—Note 3(b) | | | 305,915 | |

Professional fees | | | 117,305 | |

Registration fees | | | 86,708 | |

Pricing fees | | | 58,906 | |

Chief Compliance Officer fees—Note 3(b) | | | 22,122 | |

Prospectus and shareholders’ reports | | | 16,790 | |

Custodian fees—Note 3(b) | | | 9,695 | |

Directors’ fees and expenses—Note 3(c) | | | 5,587 | |

Loan commitment fees—Note 2 | | | 2,302 | |

Miscellaneous | | | 21,254 | |

Total Expenses | | | 973,459 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (322,990) | |

Less—reduction in fees due to earnings credits—Note 3(b) | | | (20,143) | |

Net Expenses | | | 630,326 | |

Net Investment Income | | | 3,047,685 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | (1,724,719) | |

Net realized gain (loss) on futures | (558,535) | |

Net realized gain (loss) on options transactions | (92,141) | |

Net realized gain (loss) on forward foreign currency exchange contracts | (31,040) | |

Net realized gain (loss) on swap agreements | 23,207 | |

Net Realized Gain (Loss) | | | (2,383,228) | |

Net change in unrealized appreciation (depreciation) on investments

and foreign currency transactions | 891,786 | |

Net change in unrealized appreciation (depreciation) on futures | (495,888) | |

Net change in unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | 78,094 | |

Net change in unrealized appreciation (depreciation) on swap agreements | (62,851) | |

Net Change in Unrealized Appreciation (Depreciation) | | | 411,141 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (1,972,087) | |

Net Increase in Net Assets Resulting from Operations | | 1,075,598 | |

| | | | | | |

See notes to financial statements. | | | | | |

29

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended July 31, |

| | | | 2023 | | 2022a | |

Operations ($): | | | | | | | | |

Net investment income | | | 3,047,685 | | | | 1,755,045 | |

Net realized gain (loss) on investments | | (2,383,228) | | | | (1,031,101) | |

Net change in unrealized appreciation

(depreciation) on investments | | 411,141 | | | | (7,338,916) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 1,075,598 | | | | (6,614,972) | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (18,047) | | | | (4,277) | |

Class D | | | (3,093,566) | | | | (2,113,684) | |

Class I | | | (193,281) | | | | (17,145) | |

Class Y | | | (1,580) | | | | (195) | |

Total Distributions | | | (3,306,474) | | | | (2,135,301) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 226,776 | | | | 1,651,246 | |

Class D | | | 11,841,130 | | | | 18,550,198 | |

Class I | | | 1,950,379 | | | | 6,563,996 | |

Class Y | | | - | | | | 50,000 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 16,585 | | | | 4,109 | |

Class D | | | 2,698,909 | | | | 1,930,166 | |

Class I | | | 191,698 | | | | 16,943 | |

Class P | | | - | | | | 1,989 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (1,532,058) | | | | (549) | |

Class D | | | (23,212,858) | | | | (36,259,329) | |

Class I | | | (1,622,033) | | | | (619,284) | |

Class P | | | - | | | | (316,713) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (9,441,472) | | | | (8,427,228) | |

Total Increase (Decrease) in Net Assets | (11,672,348) | | | | (17,177,501) | |

Net Assets ($): | |

Beginning of Period | | | 114,538,410 | | | | 131,715,911 | |

End of Period | | | 102,866,062 | | | | 114,538,410 | |

30

| | | | | | | | | | |

| | | | Year Ended July 31, |

| | | | 2023 | | 2022a | |

Capital Share Transactions (Shares): | |

Class A | | | | | | | | |

Shares sold | | | 24,093 | | | | 171,244 | |

Shares issued for distributions reinvested | | | 1,758 | | | | 427 | |

Shares redeemed | | | (162,057) | | | | (57) | |

Net Increase (Decrease) in Shares Outstanding | (136,206) | | | | 171,614 | |

Class Db | | | | | | | | |

Shares sold | | | 1,251,085 | | | | 1,848,040 | |

Shares issued for distributions reinvested | | | 285,186 | | | | 192,838 | |

Shares redeemed | | | (2,466,779) | | | | (3,654,073) | |

Net Increase (Decrease) in Shares Outstanding | (930,508) | | | | (1,613,195) | |

Class Ib | | | | | | | | |

Shares sold | | | 205,274 | | | | 681,490 | |

Shares issued for distributions reinvested | | | 20,231 | | | | 1,763 | |

Shares redeemed | | | (171,970) | | | | (64,723) | |

Net Increase (Decrease) in Shares Outstanding | 53,535 | | | | 618,530 | |

Class Y | | | | | | | | |

Shares sold | | | - | | | | 5,165 | |

Net Increase (Decrease) in Shares Outstanding | - | | | | 5,165 | |

Class Pb | | | | | | | | |

Shares issued for distributions reinvested | | | - | | | | 194 | |

Shares redeemed | | | - | | | | (31,088) | |

Net Increase (Decrease) in Shares Outstanding | - | | | | (30,894) | |

| | | | | | | | | |

a | On May 6, 2022, the fund commenced offering Class A, Class I and Class Y shares and Class P shares converted into Class D shares, Class P shares of the fund were terminated as a separate class of shares. | |

b | During the period ended July 31, 2022, 7,803 Class D shares representing $74,906 were exchanged for 7,795 Class I shares and 1,932 Class P shares representing $18,730 were exchanged for 1,937 Class D shares. | |

See notes to financial statements. | | | | | | | | |

31

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | |

| | | |

| | | |

Class A Shares | | | Year Ended July 31, |

| | | | | 2023 | 2022a |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | | | 9.64 | 9.67 |

Investment Operations: | | | | | | |

Net investment income (loss)b | | | | | .24 | (.00)c |

Net realized and unrealized

gain (loss) on investments | | | | | (.16) | .00c |

Total from Investment Operations | | | | | .08 | .00c |

Distributions: | | | | | | |

Dividends from

net investment income | | | | | (.28) | (.03) |

Net asset value, end of period | | | | | 9.44 | 9.64 |

Total Return (%)d | | | | | .76 | .13e |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | | | | | .94 | 1.17f |

Ratio of net expenses to

average net assets | | | | | .65 | .65f |

Ratio of net investment income

(loss) to average net assets | | | | | 2.73 | .(20)f |

Portfolio Turnover Rate | | | | | 46.00 | 43.43 |

Net Assets, end of period ($ x 1,000) | | | | | 334 | 1,655 |

a From May 6, 2022 (commencement of initial offering) to July 31, 2022.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Exclusive of sales charge.

e Not annualized.

f Annualized.

See notes to financial statements.

32

| | | | | | | | | |

| | | |

| | | |

Class D Shares | | Year Ended July 31, |

| | 2023 | 2022a | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 9.65 | 10.35 | 10.38 | 10.16 | 10.10 |

Investment Operations: | | | | | | |

Net investment incomeb | | .26 | .14 | .16 | .22 | .25 |

Net realized and unrealized

gain (loss) on investments | | (.15) | (.67) | .02 | .25 | .10 |

Total from Investment Operations | | .11 | (.53) | .18 | .47 | .35 |

Distributions: | | | | | | |

Dividends from

net investment income | | (.29) | (.16) | (.19) | (.25) | (.21) |

Dividends from net realized

gain on investments | | - | (.01) | (.02) | - | (.08) |

Total Distributions | | (.29) | (.17) | (.21) | (.25) | (.29) |

Net asset value, end of period | | 9.47 | 9.65 | 10.35 | 10.38 | 10.16 |

Total Return (%) | | 1.15 | (5.15) | 1.78 | 4.66 | 3.53 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | | .91 | 1.27 | 1.19 | 1.16 | 1.07 |

Ratio of net expenses to

average net assets | | .59 | .64 | .65 | .65 | .65 |

Ratio of net investment income

to average net assets | | 2.79 | 1.43 | 1.53 | 2.18 | 2.48 |

Portfolio Turnover Rate | | 46.00 | 43.43 | 127.20c | 98.18c | 143.61 |

Net Assets,

end of period ($ x 1,000) | | 96,111 | 106,861 | 131,395 | 129,876 | 137,065 |

a Effective May 6, 2022, Class P shares converted into Class D shares, terminate Class P shares as a separate class of shares.

b Based on average shares outstanding.

c The portfolio turnover rate excluding mortgage dollar roll transactions for the period ended July 31, 2021 and 2020 were 112.23% and 84.31%, respectively.

See notes to financial statements.

33

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | |

| | | |

| | | |

Class I Shares | | | Year Ended July 31, |

| | | | | 2023 | 2022a |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | | | 9.66 | 9.67 |

Investment Operations: | | | | | | |