| | |

| | 1900 K Street, NW Washington, DC 20006-1110 +1 202 261 3300 Main +1 202 261 3333 Fax www.dechert.com DOUGLAS P. DICK douglas.dick@dechert.com +1 202 261 3305 Direct +1 949 681 8647 Fax |

March 9, 2015

VIA EDGAR

Ms. Anu Dubey

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Forward Funds (the “Registrant”) |

Files Nos. 033-48940; 811-06722

Dear Ms. Dubey:

This letter responds to comments that you provided to William L. Horn of Dechert LLP in a telephonic discussion on February 26, 2015, with respect to your review of the preliminary proxy materials of the Registrant, as filed with the U.S. Securities and Exchange Commission (“SEC”) on February 20, 2015 (“Preliminary Proxy Materials”). We have reproduced your comments below, followed by the Registrant’s responses. Undefined capitalized terms used below have the same meaning as given in the Preliminary Proxy Materials.

Comment 1: With your response letter, please provide a form of proxy that meets the requirements of Rule 14a-4 of the Securities Exchange Act of 1934, as amended. Please confirm that an identical form of proxy will be included with the definitive proxy materials filed with the SEC.

Response: Comment accepted. Please find the requested forms of proxy supplied with this letter. The Registrant hereby confirms that identical forms of proxy will be included with the definitive proxy materials filed with the SEC.

Comment 2: With respect to the descriptions of proposals 1 through 3 in the Preliminary Proxy Materials, each description states that one of the factors considered by the Trustees when approving each of the advisory and sub-advisory agreements was “a comparison of fee rates, expense ratios, and investment performance to those of similar funds.” Pursuant to Item 22(c)(11)(i) of Schedule 14A, please describe these comparisons and how they assisted the Board in determining to recommend that the shareholders approve the advisory and sub-advisory agreements.

| | | | |

| | | | Anu Dubey March 9, 2015 Page 2 |

Response: The Registrant believes that the disclosure found in Exhibit E to the definitive proxy materials together with the current disclosure in each proposal is consistent with the requirements of Item 22(c)(11)(i) of Schedule 14A. A copy of Exhibit E is supplied with this letter, and Exhibit E will be included with the definitive proxy materials filed with the SEC.

* * *

Should you have any questions or comments, please contact the undersigned at 202.261.3305 or William L. Horn at 949.442.6005.

Sincerely,

/s/ Douglas P. Dick

Douglas P. Dick

| cc: | Judith M. Rosenberg, Chief Compliance Officer and Chief Legal Officer, Forward Funds |

Megan H. Koehler, ALPS Fund Services, Inc.

Attachment

FORWARD FUNDS

101 California Street, 16th Floor

San Francisco, California 94111

March 9, 2015

VIA EDGAR

Ms. Anu Dubey

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Forward Funds (the “Registrant”) |

Files Nos. 033-48940; 811-06722

Dear Ms. Dubey:

In connection with a response being made on behalf of Forward Funds to comments provided with respect to the preliminary proxy materials of the Registrant, as filed with the U.S. Securities and Exchange Commission (“SEC”) on February 20, 2015 (“Preliminary Proxy Materials”), it is hereby acknowledged that:

| • | | the Registrant is responsible for the adequacy and the accuracy of the disclosure contained in the filing; |

| • | | comments of the staff of the Securities and Exchange Commission (the “SEC Staff”) or changes to disclosure in response to SEC Staff comments with respect to the Preliminary Proxy Materials do not preclude the SEC from taking any action with respect to the filing made; and |

| • | | if, to Registrant’s knowledge, an inquiry or investigation is currently pending or threatened by the SEC and if the SEC subsequently, in order to protect its investigative position, so requests, the Registrant will not assert SEC Staff comments with respect to the inquiry or investigation as a defense in any proceeding initiated by the SEC under the federal securities laws of the United States. |

As indicated in the SEC’s June 24, 2004 release regarding the public release of comment letters and responses, you are requesting such acknowledgements from all companies whose filings are being reviewed and that this request and these acknowledgements should not be construed as suggesting that there is an inquiry or investigation or other matter involving the Registrant.

Sincerely,

/s/ Judith M. Rosenberg

Judith M. Rosenberg

Chief Compliance Officer and Chief Legal Officer

| | | | |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.PLEASE CAST YOUR PROXY VOTETODAY!

| | | | PROXY CARD

|

| |

“FUND NAME HERE”

101 California Street, 16th Floor

San Francisco, California 94111

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 6, 2015

The undersigned, revoking prior proxies, hereby appoints Robert S. Naka, Judith M. Rosenberg and Barbara H. Tolle, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Special Meeting of Shareholders of Forward Funds (the “Trust”), to be held at the offices of Forward Funds, 101 California Street, 16th Floor, San Francisco, CA 94111, on May 6, 2015, at 9:30 a.m. Pacific Time, or at any adjournment thereof, upon the Proposals described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

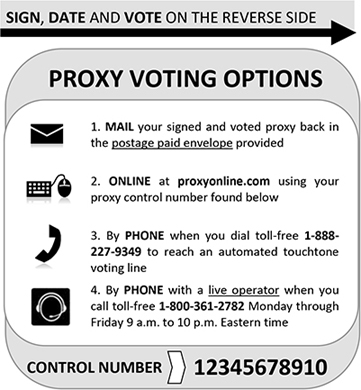

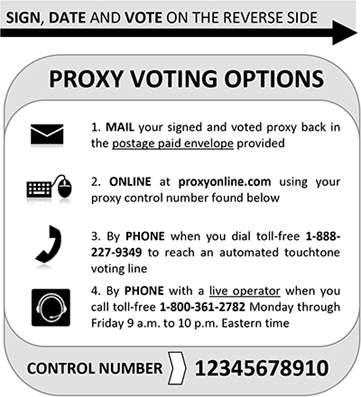

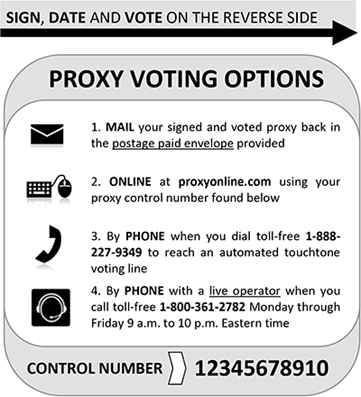

Do you have questions?If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free1-800-361-2782. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on May 6, 2015. The proxy statement for this meeting is available at:www.proxyonline.com/docs/forward.pdf

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | |

| “FUND NAME HERE” | | PROXY CARD |

| | | | | | |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt of this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. | | | | |

| | | SIGNATURE (AND TITLE IF APPLICABLE) | | DATE |

| | | |

| | | SIGNATURE (IF HELD JOINTLY) | | DATE |

This proxy is solicited on behalf of the Trust’s Board of Trustees, and the Proposals have been unanimously approved by the Board of Trustees and recommended for approval by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the proposal(s) if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Special Meeting.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example:•

| | | | | | | | | | |

| | | | | | FOR | | AGAINST | | ABSTAIN |

| | | | |

1. | | To approve a new investment advisory agreement between each Forward Fund (each, a “Fund”) and Forward Management, LLC, each Fund’s current investment advisor, as a result of the proposed transaction (the “Transaction”); | | O | | O | | O |

| | | | | |

| | | | | | | | | | |

| | | | | | | | FOR | | WITHHOLD |

| | | | |

4. | | To elect eight Trustees to serve until their successors are elected and qualified, provided that the election of the nominees 4c through 4h as the Trustees is contingent upon and will not be effective until the closing of the Transaction: | | | | | | |

| | | | | |

| | 4a. | | Julie Allecta | | | | O | | O |

| | | | | |

| | 4b. | | A. John Gambs | | | | O | | O |

| | | | | |

| | 4c. | | Karin B. Bonding | | | | O | | O |

| | | | | |

| | 4d. | | Jonathan P. Carroll | | | | O | | O |

| | | | | |

| | 4e. | | Dr. Bernard A. Harris | | | | O | | O |

| | | | | |

| | 4f. | | Richard C. Johnson | | | | O | | O |

| | | | | |

| | 4g. | | Scott E. Schwinger | | | | O | | O |

| | | | | |

| | 4h. | | John A. Blaisdell | | | | O | | O |

| |

5. | | To consider and act upon any other business as may properly come before the Special Meeting and any adjournment thereof. |

THANK YOU FOR VOTING

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | | | |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.PLEASE CAST YOUR PROXY VOTETODAY! | | | | PROXY CARD

|

| |

FORWARD EM CORPORATE DEBT FUND

101 California Street, 16th Floor

San Francisco, California 94111

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 6, 2015

The undersigned, revoking prior proxies, hereby appoints Robert S. Naka, Judith M. Rosenberg and Barbara H. Tolle, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Special Meeting of Shareholders of Forward Funds (the “Trust”), to be held at the offices of Forward Funds, 101 California Street, 16th Floor, San Francisco, CA 94111, on May 6, 2015, at 9:30 a.m. Pacific Time, or at any adjournment thereof, upon the Proposals described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

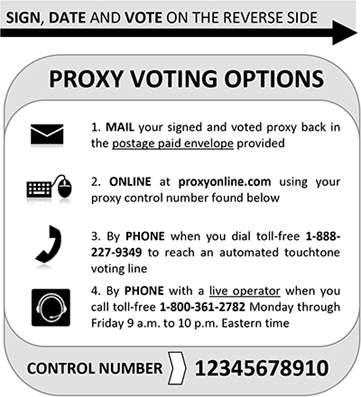

Do you have questions?If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free1-800-361-2782. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on May 6, 2015. The proxy statement for this meeting is available at:www.proxyonline.com/docs/forward.pdf

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | |

| FORWARD EM CORPORATE DEBT FUND | | PROXY CARD |

| | | | | | |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt of this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. | | | | |

| | | SIGNATURE (AND TITLE IF APPLICABLE) | | DATE |

| | | |

| | | SIGNATURE (IF HELD JOINTLY) | | DATE |

This proxy is solicited on behalf of the Trust’s Board of Trustees, and the Proposals have been unanimously approved by the Board of Trustees and recommended for approval by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the proposal(s) if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Special Meeting.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example:•

| | | | | | | | | | |

| | | | | | FOR | | AGAINST | | ABSTAIN |

| | | | |

1. | | To approve a new investment advisory agreement between each Forward Fund (each, a “Fund”) and Forward Management, LLC (“Forward Management”), each Fund’s current investment advisor, as a result of the proposed transaction (the “Transaction”); | | O | | O | | O |

3. | | To approve a new investment sub-advisory agreement between Forward Management and SW Asset Management, LLC, with respect to the Forward EM Corporate Debt Fund as a result of the Transaction; | | O | | O | | O |

| | | | | |

| | | | | | | | | | |

| | | | | | | | FOR | | WITHHOLD |

| | | | |

4. | | To elect eight Trustees to serve until their successors are elected and qualified, provided that the election of nominees 4c through 4h as Trustees is contingent upon and will not be effective until the closing of the Transaction: | | | | | | |

| | | | | |

| | 4a. | | Julie Allecta | | | | O | | O |

| | | | | |

| | 4b. | | A. John Gambs | | | | O | | O |

| | | | | |

| | 4c. | | Karin B. Bonding | | | | O | | O |

| | | | | |

| | 4d. | | Jonathan P. Carroll | | | | O | | O |

| | | | | |

| | 4e. | | Dr. Bernard A. Harris | | | | O | | O |

| | | | | |

| | 4f. | | Richard C. Johnson | | | | O | | O |

| | | | | |

| | 4g. | | Scott E. Schwinger | | | | O | | O |

| | | | | |

| | 4h. | | John A. Blaisdell | | | | O | | O |

| |

5. | | To consider and act upon any other business as may properly come before the Special Meeting and any adjournment thereof. |

THANK YOU FOR VOTING

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | | | |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.PLEASE CAST YOUR PROXY VOTETODAY! | | | | PROXY CARD

|

| |

FORWARD TACTICAL GROWTH FUND

101 California Street, 16th Floor

San Francisco, California 94111

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 6, 2015

The undersigned, revoking prior proxies, hereby appoints Robert S. Naka, Judith M. Rosenberg and Barbara H. Tolle, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Special Meeting of Shareholders of Forward Funds (the “Trust”), to be held at the offices of Forward Funds, 101 California Street, 16th Floor, San Francisco, CA 94111, on May 6, 2015, at 9:30 a.m. Pacific Time, or at any adjournment thereof, upon the Proposals described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

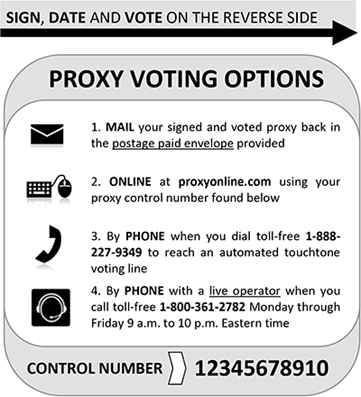

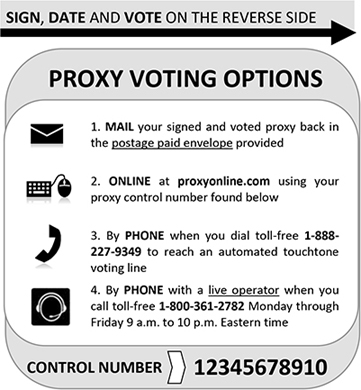

Do you have questions?If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free1-800-361-2782. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on May 6, 2015. The proxy statement for this meeting is available at:www.proxyonline.com/docs/forward.pdf

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | |

| FORWARD TACTICAL GROWTH FUND | | PROXY CARD |

| | | | | | |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt of this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. | | | | |

| | | SIGNATURE (AND TITLE IF APPLICABLE) | | DATE |

| | | |

| | | SIGNATURE (IF HELD JOINTLY) | | DATE |

This proxy is solicited on behalf of the Trust’s Board of Trustees, and the Proposals have been unanimously approved by the Board of Trustees and recommended for approval by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the proposal(s) if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Special Meeting.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example:•

| | | | | | | | | | |

| | | | | | FOR | | AGAINST | | ABSTAIN |

| | | | |

1. | | To approve a new investment advisory agreement between each Forward Fund (each, a “Fund”) and Forward Management, LLC (“Forward Management”), each Fund’s current investment advisor, as a result of the proposed transaction (the “Transaction”); | | O | | O | | O |

2. | | To approve a new investment sub-advisory agreement between Forward Management and Broadmark Asset Management, LLC, with respect to the Forward Tactical Growth Fund as a result of the Transaction; | | O | | O | | O |

| | | | | | | | FOR | | WITHHOLD |

| | | | |

4. | | To elect eight Trustees to serve until their successors are elected and qualified, provided that the election of nominees 4c through 4h as Trustees is contingent upon and will not be effective until the closing of the Transaction: | | | | | | |

| | | | | |

| | 4a. | | Julie Allecta | | | | O | | O |

| | | | | |

| | 4b. | | A. John Gambs | | | | O | | O |

| | | | | |

| | 4c. | | Karin B. Bonding | | | | O | | O |

| | | | | |

| | 4d. | | Jonathan P. Carroll | | | | O | | O |

| | | | | |

| | 4e. | | Dr. Bernard A. Harris | | | | O | | O |

| | | | | |

| | 4f. | | Richard C. Johnson | | | | O | | O |

| | | | | |

| | 4g. | | Scott E. Schwinger | | | | O | | O |

| | | | | |

| | 4h. | | John A. Blaisdell | | | | O | | O |

| |

5. | | To consider and act upon any other business as may properly come before the Special Meeting and any adjournment thereof. |

THANK YOU FOR VOTING

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

EXHIBIT E

APPROVAL OF EXISTING INVESTMENT ADVISORY AND SUB-ADVISORY AGREEMENTS

Factors Considered by the Board of Trustees in Approving the Existing Investment Advisory and Sub-Advisory Agreements

The Investment Company Act of 1940, as amended (the “Investment Company Act”), requires that the investment advisory and sub-advisory agreements of Forward Funds (the “Trust”) and its series trusts (each, a “Fund” and, collectively, the “Funds”) be approved initially, and following an initial two-year term, at least annually, by the Funds’ Board of Trustees (the “Board” or the “Trustees”), including a majority of the Trustees who are not “interested persons” (“Independent Trustees”) of the Funds, Forward Management, LLC (“Forward Management” or the “Advisor”) or any sub-advisor (each, a “Sub-Advisor” and, collectively, the “Sub-Advisors”) voting separately.

At an in-person meeting of the Board held on September 15-16, 2014, the Board considered and approved the continuation of the sub-advisory agreements among the Trust, Forward Management and each Sub-Advisor (each, a “Sub-Advisory Agreement” and, collectively, the “Sub-Advisory Agreements”). Subsequently, at an in-person meeting of the Board held on December 10, 2014, the Board considered and approved the continuation of the investment advisory agreement between Forward Management and the Trust (the “Advisory Agreement,” and together with the Sub-Advisory Agreements, the “Advisory Agreements”).

In evaluating the Advisory Agreements, the Board reviewed materials furnished by Forward Management and each Sub-Advisor, including information about their respective affiliates, personnel, and operations and also relied upon its knowledge of Forward Management and the Sub-Advisors resulting from its prior Board meetings, telephonic meetings and other prior communications. The Board noted that the materials were extensive, and included information relating to each Fund’s investment results; portfolio composition; advisory fee and sub-advisory fee expense comparisons; financial information regarding Forward Management and the Sub-Advisors; descriptions of the Advisor’s and Sub-Advisor’s compliance program; portfolio trading practices; information about the personnel providing investment management and administrative services to each Fund; and the nature of services provided under the Advisory Agreements. In addition, during the course of each year, the Board receives a wide variety of materials relating to the services provided by Forward Management and each Sub-Advisor. At each of its quarterly meetings, the Board reviews Fund performance and a significant amount of information relating to Fund operations, including the Trust’s compliance program, shareholder services, valuation, custody, distribution, and other information relating to the nature, extent, and quality of services provided by Forward Management and the Sub-Advisors to the Funds.

In their deliberations, the Independent Trustees had the opportunity to meet privately without representatives of Forward Management or any Sub-Advisor present and were represented throughout the process by legal counsel to the Independent Trustees and the Funds.

In considering the approval of each Fund’s Advisory Agreement and, where applicable, Sub-Advisory Agreement, the Board, including the Independent Trustees, evaluated a number of factors it considered relevant to its determination. The Board did not identify any single factor as all-important or controlling, and individual Trustees did not necessarily attribute the same weight or importance to each factor.

Among the factors considered by the Board in approving the Advisory Agreements were the following:

| | • | | the nature, extent, and quality of the services to be provided by Forward Management and each Sub-Advisor (as applicable); |

| | • | | the investment performance of each Fund in comparison to the Fund’s peer group as well as its respective benchmark indices over time; |

| | • | | the profitability of Forward Management and each Sub-Advisor with respect to each Fund; |

| | • | | the fees charged by Forward Management and each Sub-Advisor for their advisory services; |

| | • | | the fees and expense ratios of each Fund relative to the quality of services provided and the fees and expense ratios of similar investment companies; |

| | • | | the potential of Forward Management, each Sub-Advisor and the Funds to experience economies of scale as the Funds grow in size, and the extent to which each Fund’s advisory and sub-advisory fee level reflects any economies of scale for the benefit of Fund investors; and |

| | • | | the ancillary benefits to be received by Forward Management and each Sub-Advisor as a result of Forward Management’s and each Sub-Advisor’s relationships with the Funds. |

Nature, Extent and Quality of Services

Advisory Agreement

The Board considered the nature of the services to be provided under the Advisory Agreement. The Board considered the ability of Forward Management to provide an appropriate level of support and resources to the Funds and whether Forward Management has sufficiently qualified personnel. The Board noted the background and experience of Forward Management’s senior management and investment personnel. The Board also noted that, because the series of the Trust are Forward Management’s principal investment advisory clients, the expertise of, and amount of attention expected to be given to the Funds by Forward Management’s management team is substantial. The Board considered Forward Management’s ability to attract and retain qualified business professionals. The Board also determined that Forward Management has made a commitment to the recruitment and retention of high quality personnel, and maintains the financial and operational resources reasonably necessary to manage the Funds. The Board also favorably considered Forward Management’s entrepreneurial commitment to the management and success of the Funds, which entails a substantial financial and professional commitment.

The Board also considered Forward Management’s compliance operations with respect to the Trust, including the measures taken by Forward Management to assist the Trust in complying with Rule 38a-1 under the Investment Company Act. The Board noted that personnel at Forward Management represented that the firm had no significant compliance or administrative problems over the past year and that no material deficiencies were found by any independent audit or material compliance issues found by the Securities and Exchange Commission in its recent routine examination of Forward Management or the series of the Trust. The Board also considered the services provided by Forward Management as a “manager of managers” and noted that Forward Management has been active in monitoring the performance of the Sub-Advisors to the Funds, and has taken measures to attempt to remedy relative underperformance by a Fund when Forward Management and the Board believe it to be appropriate.

The Board concluded that it was satisfied with the nature, extent, and quality of the services provided by Forward Management under the Advisory Agreement.

Sub-Advisory Agreements

The Board considered the benefits to shareholders of continuing to retain each Sub-Advisor, particularly in light of the nature, extent, and quality of services to be provided by each Sub-Advisor. The Board considered that each Sub-Advisor had represented that it had no significant compliance or administrative problems over the past year and that no material deficiencies were found by any independent audit. The Board considered the quality of the management services provided to the Funds over both the short and long term and the organizational depth and stability of each Sub-Advisor, including the background and experience of each Sub-Advisor’s senior management and the expertise of and amount of attention expected to be given to the Funds by the respective portfolio management teams. The Board noted that it has received presentations from portfolio management personnel from each of the Sub-Advisors, and has discussed investment results with such personnel. The Board also considered each Sub-Advisor’s compliance operations with respect to the Funds, including the assessment of each Sub-Advisor’s compliance program by the Trust’s Chief Compliance Officer pursuant to Rule 38a-1 under the Investment Company Act. In conducting its review, the Board was aided by assessments of personnel at Forward Management and the various presentation materials (including presentations made by representatives of the Sub-Advisors to the

Board) during the course of the year. With respect to the Investment Grade Fixed-Income Fund, the Board noted that it had approved the removal of Pacific Investment Management Company LLC (“PIMCO”) as a Sub-Advisor to the Fund effective on or about December 1, 2014, and that it was approving the Sub-Advisory with PIMCO on behalf of the Investment Grade Fixed-Income Fund so that PIMCO could continue to serve as Sub-Advisor until that date.

The Board concluded that it was satisfied with the nature, extent, and quality of the services provided by each of the Sub-Advisors under the respective Sub-Advisory Agreement.

Investment Performance

Advisory Agreements

In considering information about the Funds’ historical performance, unless otherwise noted below, the Board was provided with information by Forward Management using data from Morningstar Inc. (“Morningstar”) and other sources about each Fund’s historical performance, noting whether there were periods of underperformance and outperformance relative to each Fund’s peer group as well as its respective benchmark indices over time. The Board was provided with a comparative analysis of the performance of each Fund relative to certain comparable funds and relevant market indices for certain periods, including annual performance information and cumulative performance information. In assessing the performance of Forward Management and the Sub-Advisors, as applicable, the Board also considered the length of time each Sub-Advisor had served as a Sub-Advisor to the respective Fund or Forward Management had served as the Advisor to the respective Fund. The Board also noted the need for Forward Management or each Sub-Advisor to adhere to its investment mandates, which could at times have an impact on a Fund’s performance.

The Board noted that, as a general matter, the Funds had periods of both underperformance and outperformance relative to the comparable funds within their respective Morningstar Category over time. Specifically, the Board noted:

| | • | | The Balanced Allocation Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-, three-, and five-year periods ended September 30, 2014; |

| | • | | The Commodity Long/Short Strategy Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one- and three-year periods ended September 30, 2014; |

| | • | | The Credit Analysis Long/Short Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one- and three-year periods ended June 30, 2014; however, it outperformed the comparable funds within its Morningstar Category for the five-year period ended June 30, 2014; |

| | • | | The Dynamic Income Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-year period ended September 30, 2014; |

| | • | | The EM Corporate Debt Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-year period ended June 30, 2014; however, it underperformed the comparable funds within its Morningstar Category during the three- and five-year periods ended June 30, 2014; |

| | • | | The Emerging Markets Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-, three-, and five-year periods ended September 30, 2014. It was noted that Forward Management took over the day-to-day management of this Fund in September 2012; |

| | • | | The Equity Long/Short Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-year period ended September 30, 2014; |

| | • | | The Frontier Strategy Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-, three-, and five-year periods ended September 30, 2014; |

| | • | | The Global Dividend Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-, three-, and five-year periods ended September 30, 2014; |

| | • | | The Global Infrastructure Fund outperformed in relation to the average performance of the comparable funds within its Morningstar category for the one-year period ended September 30, 2014; however, it underperformed the comparable funds within its Morningstar category for the three- and five-year periods ended September 30, 2014; |

| | • | | The Growth & Income Allocation Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one- and five-year periods ended September 30, 2014; however, it outperformed the comparable funds within its Morningstar category for the three-year period ended September 30, 2014; |

| | • | | The Growth Allocation Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one- and three-year periods ended September 30, 2014; however, it underperformed the comparable funds within its Morningstar category during the five-year period ended September 30, 2014; |

| | • | | The High Yield Bond Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the three-year period ended June 30, 2014; it performed in line with the comparable funds within its Morningstar Category during the one- and ten-year periods ended June 30, 2014; however, it underperformed the comparable funds within its Morningstar category during the five-year period ended June 30, 2014; |

| | • | | The Income & Growth Allocation Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-, three-, and five-year periods ended September 30, 2014; |

| | • | | The Income Builder Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-, three-, and five-year periods ended September 30, 2014; |

| | • | | The International Dividend Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-, and five-year periods ended September 30, 2014; however, it underperformed the comparable funds within its Morningstar Category during the three-year period ended September 30, 2014. It was noted that Forward Management took over the day-to-day management of this Fund in December 2008; |

| | • | | The International Real Estate Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-, and five-year periods ended September 30, 2014; however, it outperformed the comparable funds within its Morningstar Category for the three-year period ended September 30, 2014; |

| | • | | The International Small Companies Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-, three-, five-, and ten-year periods ended June 30, 2014; |

| | • | | The Investment Grade Fixed-Income Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-,three-, five-, and ten-year periods ended June 30, 2014; the Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-,three-, and five-year periods ended September 30, 2014. It was noted that Forward Management took over the day-to-day management of this Fund on December 1, 2014; |

| | • | | The Multi-Strategy Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one- and three-year periods ended September 30, 2014; however, it underperformed the comparable funds within its Morningstar Category for the five-year period ended September 30, 2014; |

| | • | | The Real Estate Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one- and five-year periods ended September 30, 2014; however, it outperformed the comparable funds within its Morningstar Category during the three-year period ended September 30, 2014. It was noted that Forward Management took over the day-to-day management of this Fund in March 2010; |

| | • | | The Real Estate Long/Short Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-year period ended September 30, 2014; however, it outperformed the comparable funds within its Morningstar Category during the three- and five-year periods ended September 30, 2014; |

| | • | | The Select EM Dividend Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-year period ended September 30, 2014; however, it outperformed the comparable funds within its Morningstar Category for the three-year period ended September 30, 2014; |

| | • | | The Select Income Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one-, three-, and five-year periods ended September 30, 2014; |

| | • | | The Select Opportunity Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-year period ended September 30, 2014; |

| | • | | The Small Cap Equity Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-year period ended September 30, 2014; however, it underperformed the comparable funds within its Morningstar Category during the three- and five-year periods ended September 30, 2014; |

| | • | | The Tactical Enhanced Fund underperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one- and three-year periods ended September 30, 2014. It was noted that Forward Management took over the day-to-day management of this Fund in November 2012; |

| | • | | The Tactical Growth Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category during the one-year period ended June 30, 2014; however, it underperformed the comparable funds within its Morningstar Category for the three-year period ended June 30, 2014; |

| | • | | The Total MarketPlus Fund outperformed in relation to the average performance of the comparable funds within its Morningstar Category for the one- and three-year periods ended September 30, 2014; however, it underperformed the comparable funds within its Morningstar Category for the five-year period ended September 30, 2014; |

| | • | | The U.S. Government Money Fund is subject to a fee waiver agreement pursuant to which Forward Management has agreed to waive or reimburse the Fund for certain fees and expenses in order to maintain the Fund’s current yield at or above 0.01%. |

The Board considered the various performance data presented, and considered that certain Funds underperforming their benchmark or peer group for a given period had outperformed such benchmarks or peer groups during other periods. The Board also recognized that certain asset classes or strategies may be out of favor from time to time, which can have an effect on performance. The Board also noted the difficulties of constructing appropriate benchmarks for certain Funds. The Board discussed the possible reasons for the underperformance of certain Funds with Forward Management and took note of Forward Management’s plans to continue to monitor and address performance. The Board also noted recent portfolio management and/or strategy changes implemented by Forward Management.

The Board determined to continue to monitor the performance of the Funds and concluded, after consideration of the performance and strategy for each of the Funds, that each Sub-Advisor should continue to serve under the respective Sub-Advisory Agreement subject to the supervision of the Board and Forward Management, and that Forward Management should continue to serve under the Advisory Agreement subject to the supervision of the Board.

Profitability and Reasonableness of Advisory Compensation

Advisory Agreement

The Board considered Forward Management’s profitability and methodology used to calculate profitability. The Board reviewed Forward Management’s audited financial statements, expense allocations and profitability analysis before marketing expenses, included in the 15(c) Materials. The Board also considered Forward Management’s presentation of these materials at the Board meeting held on September 16, 2014, as well as the Board’s discussion of Forward Management’s profitability with Mr. Reid in executive session of the Board meeting.

The Board considered the costs of services to be provided and profits to be realized by Forward Management from its relationship with the Funds, including the overall financial soundness of Forward Management. The Board considered financial information previously provided by Forward Management. The Board noted that Forward Management has been responsive to inquiries over time regarding the firm’s financial resources and ability to serve as the Advisor to the Funds, and that the Board has been satisfied with this information. The Board also considered information about the profitability of each Fund to Forward Management. The Board also considered that Forward Management has historically waived fees or reimbursed the various series of the Trust for certain operating expenses that exceeded stated expense limits, and that amounts waived or reimbursed by Forward Management have been substantial.

The Board also considered information regarding the investment management fees charged to the Funds by Forward Management and operating expense comparisons for each Fund compared with other comparable registered investment companies. The Board noted that the investment management fees to be paid to Forward Management with respect to each of the Funds were within the range of the gross investment management fees charged to the group of similar investment companies presented to the Board.

The Board noted that Forward Management’s business currently consists primarily of managing the series of the Trust, and that, except as noted below, Forward Management does not currently manage other investment accounts for clients using strategies similar to the Funds so it is not possible to meaningfully compare the fees charged to the Funds with fees charged to other non-investment company clients of Forward Management. With respect to the International Dividend Fund, Forward Management manages retail separate accounts where the lowest fee is 38 basis points. With respect to the Global Dividend Fund, Forward Management manages retail separate accounts where the lowest fee is 35 basis points. However, it was noted that the retail separate accounts that are similar to the International Dividend Fund and Global Dividend Fund invest in a more limited range of investments than the Funds. With respect to the Tactical Growth Fund, Forward Management manages retail separate accounts where the lowest fee is 50 basis points. The Board considered that there were differences between these accounts and the Funds, including differences in the management style, level of services provided, compliance responsibilities, and the frequency and amount of inflows and outflows. The Board noted that, with respect to certain Funds, the potential for additional meaningful comparisons will be revisited as Forward Management’s separate account business grows. The Board noted that, with respect to certain Funds, Forward Management is responsible for compensation of the Funds’ Sub-Advisors, whereas with respect to certain other Funds, the sub-advisory fees paid to the Sub-Advisors are paid directly by the Trust on behalf of each respective Fund and that overall expense ratios of certain of the Funds are currently limited by Forward Management pursuant to contractual expense limitation and/or reimbursement agreements.

The Board concluded that Forward Management’s profitability with respect to the Funds was not excessive and that the advisory fees charged to each Fund were reasonable in light of the services provided to each Fund.

Sub-Advisory Agreements

With respect to the fees paid to the Sub-Advisors, the Board considered information regarding the sub-advisory fees charged by the Sub-Advisors to their other clients (if applicable), and sub-advisory fees charged by other investment advisors to registered investment companies with similar investment objectives and strategies.

The Board considered the operating results and financial condition of each Sub-Advisor based on the financial information each Sub-Advisor had provided. The Trustees noted that it was difficult to accurately determine or evaluate the profitability of a particular Sub-Advisory Agreement because each of the Sub-Advisors managed assets other than the Funds or has multiple business lines and, further, that any such assessment would involve assumptions regarding each Sub-Advisor’s allocation policies, capital structure, cost of capital, business mix, and other factors.

Based on the prior information provided and the nature of the negotiation underlying each Sub-Advisory Agreement, the Board concluded that it was reasonable to infer that each Sub-Advisor’s profitability with respect to the relevant Funds was not excessive and that the sub-advisory fees charged to each Fund were reasonable in light of the services provided to each Fund.

Economies of Scale

Advisory Agreement

The Board considered the potential of Forward Management and the Funds to experience economies of scale as the Funds grow in size, but recognized that the current asset levels of certain of the Funds do not provide significant economies of scale. The Board noted that Forward Management has typically subsidized series of the Trust at smaller asset levels. The Board concluded that, considering the size and operating history of the Funds and the fee and financial information considered by the Board, the current fee structures reflected in the Advisory Agreement are appropriate. The Board also noted that it would have the opportunity to periodically re-examine whether the Funds had achieved economies of scale and the appropriateness of advisory fees payable to Forward Management in the future, and that fee reductions have been implemented from time to time with regard to certain of the Funds.

Sub-Advisory Agreements

The Board considered the potential of the Sub-Advisors and the Funds to experience economies of scale as the Funds grow in size, but recognized that the current asset levels of certain of the Funds do not provide significant economies of scale. The Board noted that Forward Management has typically subsidized series of the Trust at smaller asset levels. The Board concluded that, considering the size and operating history of the Funds and the fee and financial information considered by the Board, the current fee structures reflected in the Sub-Advisory Agreements are appropriate. The Board also noted that it would have the opportunity to periodically re-examine whether the Funds had achieved economies of scale and the appropriateness of sub-advisory fees payable to the Sub-Advisors in the future.

Any Additional Benefits and Other Considerations

Advisory Agreement

The Board considered ancillary benefits to be received by Forward Management as a result of Forward Management’s relationships with the Funds, including the fees paid by the Funds to ReFlow Management Co., LLC, a company that is affiliated with Forward Management, for the Funds’ participation in ReFlow, a program designed to provide an alternative liquidity source for mutual funds experiencing redemptions of their shares. The Board also considered Forward Management’s ownership interest in certain of the Sub-Advisors, noting the financial benefits that may be realized by Forward Management from its ownership arrangements with those Sub-Advisors. In addition, the Board also took into consideration the potential benefits that may be derived by Forward Management as a result of the establishment of Forward Securities, LLC, an affiliated broker-dealer that serves as distributor for the Funds. The Board also considered any benefits to be derived by Forward Management from soft dollar arrangements, and noted that the Board receives regular reports from Forward Management regarding its soft dollar policies and usage. The Board also noted that potential benefits to be derived by Forward Management from its relationship with the Funds include the potential for larger assets under management and reputational benefits, which are consistent with those benefits generally derived by investment advisors to mutual funds.

Sub-Advisory Agreements

The Board considered any benefits to be derived by the Sub-Advisors from their relationships with the Funds, such as soft dollar arrangements. In this connection, the Board has received regular reports from Forward Management and the Sub-Advisors regarding their soft dollar policies and usage. The Board considered ancillary benefits to be received by the Sub-Advisors as a result of the Sub-Advisors’ relationships with the Trust. The Board concluded that any potential benefits to be derived by a Sub-Advisor from its relationship with the Funds included the potential for larger assets under management and reputational benefits, which are consistent with those benefits generally derived by advisors or sub-advisors to mutual funds.

After discussion, the Board, including all of the Independent Trustees voting separately, determined that the terms of the Advisory Agreements were fair and reasonable and approved the continuation for a one-year period of the Advisory Agreements as being in the best interests of each series of the Trust and its shareholders.