As filed with the Securities and Exchange Commission on July 13, 2018

1933 Act Registration No. 033-48940

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PRE-EFFECTIVE AMENDMENT NO.

POST-EFFECTIVE AMENDMENT NO. 129

FORWARD FUNDS

(Exact Name of Registrant as Specified in Charter)

345 California Street, Suite 1600

San Francisco, California 94104

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: 1-800-999-6809

John A. Blaisdell

Forward Funds

345 California Street, Suite 1600

San Francisco, California 94104

(Name and Address of Agent for Service)

Copies to:

Richard F. Kerr

K&L Gates LLP

One Lincoln Street

Boston, MA 02111-2950

(617) 261-3166

Approximate Date of Proposed Offering: As soon as practicable after this Registration Statement becomes effective.

Title of securities being registered: shares of beneficial interest, without par value, of the Registrant. No filing fee is due because Registrant is relying on section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on August 15, 2018 pursuant to Rule 488.

EXPLANATORY NOTE

This filing on Form N-14 is organized as follows:

Part A:

| 1. | Letter to Shareholders of Salient Tactical Real Estate Fund |

| 2. | Combined Information Statement of Salient Tactical Real Estate Fund and Prospectus of Salient International Real Estate Fund |

| 4. | Exhibit A - Form of Agreement and Plan of Reorganization |

| 5. | Exhibit B - Financial Highlights of Salient Tactical Real Estate Fund and Salient International Real Estate Fund |

Part B:

| 6. | Statement of Additional Information |

Dear Salient Tactical Real Estate Fund Shareholder:

We continually review our lineup of funds to confirm that we are delivering value to our shareholders. One element of this assessment is to refine our business with the expectation that successful business lines will be provided with more concentrated and focused support. Another part of this assessment is to assess whether funds have an opportunity to grow large enough to achieve economies of scale that can be passed on to shareholders in terms of lower fees. There can be no guarantee that these efforts will be successful. Due to the lack of scale in the Salient Tactical Real Estate Fund (the “Acquired Fund”), we recommended to the Board of Trustees, and they agreed, that the Acquired Fund should be merged into Salient International Real Estate Fund (the “Acquiring Fund” and, together with the Acquired Fund, each a “Fund” and collectively the “Funds”). No shareholder vote is required for the reorganization. We are not asking you for a proxy and you are requested not to send us a proxy.

Currently, Forward Management, LLC d/b/a Salient (“Salient Management”) serves as the investment advisor to each of the Funds and Joel S. Beam, as real estate team leader, has ultimate responsibility for each Fund’s investment. After the reorganization of the Acquired Fund into the Acquiring Fund (the “Reorganization”), Salient Management would continue to serve as the investment advisor to the Acquiring Fund and Mr. Beam would continue to be ultimately responsible for day-to-day portfolio management. Prior to the closing of the Reorganization, the Acquiring Fund will be renamed the “Salient Global Real Estate Fund,” and the Acquiring Fund’s expense ratio will be lowered by the implementation of a contractual waiver of 0.25% of the investment advisory fee payable to Salient Management and an additional expense limitation agreement. The Acquiring Fund’s investment objective, principal investment strategies and principal risks are substantially the same as those of the Acquired Fund and are explained in detail in the enclosed information statement.

The Reorganization Offers You Potential Advantages

Here are the most important advantages we see:

| | • | | Expected lower expenses. As fixed costs are spread across the larger asset base of the combined Funds, shareholder expenses are expected to decline. Moreover, the Acquiring Fund’s expense ratio will be lowered by the implementation of a contractual waiver of 0.25% of the investment advisory fee payable to Salient Management and an additional expense limitation agreement. |

| | • | | Similar investment strategy. Both Funds pursue current income and capital appreciation by investing primarily in securities of real estate companies. |

| | • | | Continuity of management. Both Funds are managed by the same experienced portfolio management team at Salient Management, led by Joel S. Beam, who has over 20 years of real estate investing experience. |

| | • | | Fund performance. Although past performance does not guarantee future results, for the one-year period ended December 31, 2017, the Acquiring Fund outperformed the Acquired Fund. |

The Reorganization is expected to have no negative tax impact on shareholders.

After consideration and for the reasons described in these materials, the Board of Trustees of the Acquired Fund has approved the Reorganization.

The enclosed combined information statement and prospectus contains important information about the Reorganization, which I strongly encourage you to read. The Reorganization is scheduled to take place at the close of business on or about August 15, 2018.

If you have questions, please call 800-900-4675 between 8:00 a.m. and 5:00 p.m. Eastern Time Monday through Friday. I thank you for your time on this matter.

|

| Sincerely |

|

/s/ John A. Blaisdell |

| John A. Blaisdell |

| President, Forward Funds |

INFORMATION STATEMENT of

Salient Tactical Real Estate Fund

(the “Acquired Fund”)

a series of Forward Funds

PROSPECTUS for

Salient International Real Estate Fund

(the “Acquiring Fund”)

a series of Forward Funds

The address of both the Acquired Fund and the Acquiring Fund is 345 California Street, Suite 1600, San Francisco, California 94104. The Acquired Fund and the Acquiring Fund are each a “Fund” and together referred to as the “Funds.”

* * * * * *

This combined information statement and prospectus (“information statement and prospectus”) contains information that shareholders of the Acquired Fund may wish to know about the reorganization of the Acquired Fund into the Acquiring Fund (the “Reorganization”). Please read it carefully and retain it for future reference. No shareholder vote is required for the reorganization. We are not asking you for a proxy and you are requested not to send us a proxy.

How the Reorganization Will Work

| | • | | The Acquired Fund will transfer all of its assets to the Acquiring Fund. The Acquiring Fund will assume all of the Acquired Fund’s liabilities as of the date of the closing of the Reorganization (the “Closing Date”). |

| | • | | The Acquiring Fund will be managed by the same portfolio manager as the Acquired Fund, using substantially the same investment strategies and portfolio management techniques and supported by the same real estate team. |

| | • | | The Acquiring Fund will issue to the Acquired Fund a number of full and fractional Class A, Class C, Investor Class, Institutional Class and Class I2 shares having an aggregate net asset value equal to the value of the assets of the Acquired Fund attributable to its Class A, Class C, Investor Class, Institutional Class and Class I2 shares, less the value of any liabilities attributable to such classes of shares. These shares will be distributed to the shareholders of the corresponding classes of the Acquired Fund in proportion to their holdings on the Closing Date. |

| | • | | No sales charge will be imposed on shares of the Acquiring Fund received by shareholders of the Acquired Fund. |

| | • | | Shareholders of the Acquired Fund will become shareholders of the Acquiring Fund, and the Acquired Fund will be terminated. |

| | • | | Prior to the closing of the Reorganization, the name of the Acquiring Fund will be changed to “Salient Global Real Estate Fund,” the Acquiring Fund’s expense ratio will be lowered by the implementation of a contractual waiver of 0.25% of the investment advisory fee payable to Salient Management and an additional expense limitation agreement, and the investment strategies of the Acquiring Fund will be modified to reflect those included in this information statement and prospectus. |

| | • | | For federal income tax purposes, the Reorganization is intended not to result in income, gain or loss being recognized by the Acquired Fund, the Acquiring Fund, or the shareholders of the Acquired Fund. |

Rationale for the Reorganization

The Reorganization is intended to consolidate the Acquired Fund with a similar fund advised by Forward Management, LLC d/b/a Salient (“Salient Management”). Each of the Funds pursues current income and capital appreciation by investing primarily in securities of real estate companies. Following the Reorganization, the combined fund will pursue a similar investment objective in a larger fund utilizing substantially similar investment policies, and subject to lower overall expenses.

Although past performance does not guarantee future results, the Acquiring Fund has outperformed the Acquired Fund for the one-year period ended December 31, 2017.

Immediately following the Reorganization of the Acquired Fund into the Acquiring Fund, as a result of a contractual waiver and limitation of expenses agreed to by Salient Management, the maximum net annual operating expenses of all classes of shares of the Acquiring Fund (excluding certain expenses) are expected to be lower than the current net annual operating expenses of the corresponding classes of the Acquired Fund for so long as the expense waiver and limitation agreement remains in effect. The advisory fee waiver and expense limitation agreement will be effective until April 30, 2019, and any termination of the advisory fee waiver and expense limitation agreement earlier than that date will require the approval of the Board of Trustees.

Salient Management believes that the Acquiring Fund will be better positioned in the market to increase asset size and achieve additional economies of scale than the Acquired Fund as currently constituted. As a result, the Acquiring Fund may benefit from the ability to achieve better net prices on securities trades and spread fixed expenses in a manner that may contribute to achieving a lower expense ratio in the long-term than the Acquired Fund could be expected to achieve as currently constituted.

Shares of the Acquiring Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank or other depository institution. These shares are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

Shares of the Acquiring Fund have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”). The SEC has not passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Where to Get More Information

| • | | The Class A and Class C shares prospectus, and Investor Class, Institutional Class, and Class I2 prospectus of the Acquired Fund and the Acquiring Fund dated May 1, 2018, as supplemented |

| • | | The annual shareholder report of the Acquired Fund and the Acquiring Fund dated December 31, 2017 |

| • | | The semiannual shareholder report of the Acquired Fund and the Acquiring Fund dated June 30, 2017 |

| • | | The statement of additional information (“SAI”) dated May 1, 2018, as supplemented, of the Acquired Fund and the Acquiring Fund |

These documents and additional information about the Funds are on file with the SEC.

| • | | Acquired Fund documents and additional information about that Fund are available at no charge by writing to that Fund or by calling, toll-free: (800) 999-6809. |

| • | | Acquiring Fund documents and additional information about that Fund are available at no charge by writing to that Fund or by calling, toll-free: (800) 999-6809. |

| • | | These documents are incorporated by reference into (and therefore legally part of) this information statement and prospectus. |

To ask questions about this information statement and prospectus, call our toll-free telephone number: 800-900-4675.

The date of this information statement and prospectus is July 13, 2018.

TABLE OF CONTENTS

INTRODUCTION

This information statement and prospectus is provided by the Board of Trustees of Forward Funds (the “Board”) to inform the Acquired Fund’s shareholders that the Board has approved an Agreement and Plan of Reorganization (the “Agreement”) providing for the reorganization of the Acquired Fund into the Acquiring Fund (the “Reorganization”). This information statement and prospectus is being mailed to the Acquired Fund’s shareholders on or about July 18, 2018.

This information statement and prospectus includes information that is specific to the Reorganization, including summary comparisons. You should read the entire information statement and prospectus carefully, including Exhibit A, which contains the form of Agreement, and the Acquired Fund’s annual and semiannual reports, because they contain details that are not in the summary, and retain these documents for future reference. No shareholder vote is required for the reorganization. We are not asking you for a proxy and you are requested not to send us a proxy.

DESCRIPTION OF THE REORGANIZATION

Agreement and Plan of Reorganization

The Board has approved the Agreement on behalf of the Acquired Fund and the Acquiring Fund. Under the Agreement, the Acquired Fund would transfer all of its assets to the Acquiring Fund in exchange for Class A, Class C, Investor Class, Institutional Class and Class I2 shares of the Acquiring Fund, and the Acquiring Fund would assume the Acquired Fund’s liabilities as of the Closing Date. These shares would be distributed to shareholders of the Acquired Fund in proportion to such shareholders’ holdings of the corresponding classes on the Closing Date.

SUMMARY COMPARISONS OF THE FUNDS

Comparison of the Funds’ Organization, Investment Objectives, Strategies and Policies

The chart below describes the similarities and differences between the Funds’ objectives and principal investment strategies. As shown below, as of the Closing Date, the Funds have substantially identical investment objectives and invest primarily in securities of real estate companies. However, as also shown below, there are differences in the principal investment strategies of the Funds, including:

| | • | | The Acquired Fund invests at least 80% of its net assets plus borrowings for investment purposes, if any, in securities of issuers engaged primarily in the real estate industry such as real estate investment trusts (“REITs”), master limited partnerships and other real estate firms. The Acquiring Fund invests at least 80%, and usually substantially all, of its net assets plus borrowings for investment purposes, if any, in common stocks and other equity securities issued by U.S. and non-U.S. real estate companies, including real estate investment trusts (“REITs”) and similar REIT-like entities in at least three different countries. |

| | • | | The Acquired Fund may invest in debt obligations of any credit quality (including securities commonly referred to as “junk bonds”) and other senior securities (e.g., convertible bonds and preferred stock) and may sell securities short to hedge against changes in the price of the Fund’s portfolio securities. The Acquiring Fund may invest in American Depositary Receipts and European Depositary Receipts, synthetic instruments such as rights and warrants, and investment grade debt securities. |

1

| | | | |

| | | Acquired Fund | | Acquiring Fund |

| Organization | | The Acquired Fund is a diversified series of Forward Funds, an open-end management investment company organized as a Delaware statutory trust. | | The Acquiring Fund will be a diversified series of Forward Funds, an open-end management investment company organized as a Delaware statutory trust, as of the Closing Date. |

| | |

| Net assets as of December 31, 2017 | | Approximately $39 million | | Approximately $22 million |

| | |

| Investment advisor | | Salient Management | | Salient Management |

| | |

| Portfolio Manager | | Joel S. Beam Managing Director and Senior Portfolio Manager; Managed the Fund since April 2006. | | Joel S. Beam Managing Director and Senior Portfolio Manager; Managed the Fund since April 2006. |

| | |

| Investment Objective | | The Fund seeks total return through a combination of high current income relative to equity investment alternatives, plus long-term growth of capital. | | The Fund seeks total return from both capital appreciation and current income. |

| | |

| Principal investment strategies | | Under normal conditions, the Fund invests at least 80% of its net assets plus borrowings for investment purposes, if any, in securities of issuers engaged primarily in the real estate industry such as REITs, master limited partnerships and other real estate firms. Its investments in these issuers may include equity securities of any market capitalization, debt obligations of any credit quality (including securities commonly referred to as “junk bonds”) and other senior securities (e.g., convertible bonds and preferred stock) and limited partnership interests. The Fund may invest in both U.S. and non-U.S. real estate securities as well as companies located in emerging and frontier market countries. Forward Management, LLC d/b/a Salient (the “Advisor”) uses a variety of strategies in managing the Fund’s investments. Typically, security selection is guided by the comparison of current market prices for securities relative to their estimated fair value in a process conducted by the Advisor. Fair value is estimated based on both a discounted cash flow approach and a net asset value approach. Both approaches are reconciled based on the relevance of each given business conditions and the issuing company’s prospects. The Advisor may engage in | | Under normal conditions, the Fund invests at least 80%, and usually substantially all, of its net assets plus borrowings for investment purposes, if any, in common stocks and other equity securities issued by U.S. and non-U.S. real estate companies, including real estate investment trusts (“REITs”) and similar REIT-like entities in at least three different countries. The Fund may invest in equity securities, debt securities, limited partnership interests, exchange-traded funds (“ETFs”), American Depositary Receipts and European Depositary Receipts, and its investments may include other securities, such as synthetic instruments. Synthetic instruments are investments that have economic characteristics similar to the Fund’s direct investments, and may include rights, warrants, futures, and options. The Fund may invest in securities of companies having any capitalization and investment grade debt securities. The Fund may also leverage its portfolio by borrowing money to purchase securities. Under normal market conditions, the Fund will invest significantly (at least 30%) in real estate companies organized or located outside the U.S. or doing a substantial amount of business outside the U.S. The Fund allocates its assets among various |

2

| | | | |

| | | Acquired Fund | | Acquiring Fund |

| | transactions designed to hedge against changes in the price of the Fund’s portfolio securities, such as purchasing put options, selling securities short or writing covered call options. The Fund’s short positions may equal up to 100% of the Fund’s net asset value. The Fund may also leverage its portfolio by borrowing money to purchase securities. The Fund may also purchase restricted securities or securities which are deemed to be not readily marketable. The Fund may write (sell) call options and purchase put options on individual stocks or broad-based stock indices, including exchange-traded funds (“ETFs”) that replicate such indices. The Fund may also enter into put option spreads, which consist of paired purchased and written options with different strike prices on the same stock or index. The Fund generally intends to use option strategies to seek to generate premium income, acquire a security at a specified price, or reduce the Fund’s exposure to market risk and volatility. | | regions and countries, including the United States (but in no less than three different countries). The Fund considers a company that derives at least 50% of its revenue from business outside the U.S. or has at least 50% of its assets outside the U.S. as doing a substantial amount of business outside the U.S. The non-U.S. companies in which the Fund invests may include those domiciled in emerging market countries. Typically, emerging markets are in countries that are in the process of industrialization, with lower gross national products per capita than more developed countries. The Fund is not limited in the extent to which it may invest in emerging market companies. Forward Management, LLC d/b/a Salient (“Salient Management” or the “Advisor”) allocates the Fund’s assets among securities of countries and in currency denominations that are expected to provide the best opportunities for meeting the Fund’s investment objective. In analyzing specific companies for possible investment, the Advisor utilizes fundamental real estate analysis and quantitative analysis to select investments for the Fund, including analyzing a company’s management and strategic focus, evaluating the location, physical attributes and cash flow generating capacity of a company’s properties and calculating relative return potential among other things. The Fund may write (sell) call options and purchase put options on individual stocks or broad-based stock indices, including ETFs that replicate such indices. The Fund may also enter into put option spreads, which consist of paired purchased and written options with different strike prices on the same stock or index. The Fund generally intends to use option strategies to seek to generate premium income, acquire a security at a specified price, or reduce the Fund’s exposure to market risk and volatility. |

3

Comparison of the Funds’ Classes of Shares

The following table details the expense structures of the Acquired Fund’s and the Acquiring Fund’s Class A, Class C, Investor Class, Institutional Class, and Class I2 shares.

Each of the Funds offers the same share classes on the same terms.

| | | | | | |

| | | Acquired Fund | | Acquiring Fund | | |

| Class A | | Class A shares of each Fund have the same characteristics and fee structures. • Class A shares are offered with front-end sales charges ranging from 1.50% to 5.75% of a Fund’s offering price, depending on the amount invested. • There is no front-end sales charge for investments of $1 million or more, but there is a contingent deferred sales charge (“CDSC”) of 1.00% on Class A shares that are redeemed within 18 months of purchase. • Class A shares are subject to distribution (“Rule 12b-1”) fees equal to an annual rate of 0.35% (However, Class A is currently only authorized to pay 0.25% in 12b-1 fees) of a Fund’s average daily net assets attributable to Class A shares, and shareholder service fees of up to 0.20%. • An investor can combine multiple purchases of Class A shares of Salient funds to take advantage of breakpoints in the sales charge schedule. • Class A shares may be offered without front-end sales charges or CDSCs to various individuals and institutions, including those listed in the Funds’ prospectuses. |

| |

| Class C | | Class C shares of each Fund have the same characteristics and fee structures. • Class C shares are offered without a front-end sales charge, but may be subject to a CDSC of 1.00% of the lesser of the current market value or the cost of the shares being redeemed, of the Class C shares held for less than one year of purchase. • Class C shares are subject to Rule 12b-1 fees equal to an annual rate of 0.75% of a Fund’s average daily net assets attributable to Class C shares, and shareholder service fees of up to 0.25%. • Class C shares’ CDSCs may be waived in certain cases, including those listed in the Funds’ prospectuses. |

| |

| Investor Class | | Investor Class shares of each Fund have the same characteristics and fee structures. • Investor Class shares are offered without front-end sales loads or CDSCs. • Investor Class shares are subject to Rule 12b-1 fees equal to an annual rate of 0.25% of a Fund’s average daily net assets attributable to Investor Class shares, and shareholder service fees of up to 0.15%. |

| |

| Institutional Class | | Institutional Class shares of each Fund have the same characteristics and fee structures. • Institutional Class shares are offered without front-end sales loads or CDSCs. • Institutional Class shares are not subject to any Rule 12b-1 fees, but are subject to shareholder service fees of up to 0.05%. |

| |

| Class I2 | | Class I2 shares of each Fund have the same characteristics and fee structures. • Class I2 shares are offered without front-end sales loads or CDSCs. • Class I2 shares are not subject to any Rule 12b-1 or shareholder service fees. |

4

Comparison of Buying, Selling and Exchanging Shares

| | | | | | |

| | | Acquired Fund | | Acquiring Fund | | |

| How to Buy Shares | | Class A and Class C shares: Initial purchases of Class A or Class C shares cannot be made directly from the Funds and must be made through a financial intermediary that has established an agreement with the Funds’ distributor. Investor Class, Institutional Class, and Class I2 shares: Shareholders can open an account and make an initial purchase of Investor Class or Institutional Class shares of the Funds directly from the Funds or through a financial intermediary that has established an agreement with the Funds’ distributor. |

| |

| Minimum Initial Investment | | Class A and Class C shares: $2,000 for accounts enrolled in eDelivery; $2,000 for Coverdell Education Savings accounts; $500 for Automatic Investment Plan accounts, and $2,500 for all other accounts, per Fund. Subsequent investments in Class A shares or Class C shares must be $100 or more. Financial intermediaries may charge their customers a transaction or service fee. The Fund may, in its sole discretion, waive or reduce any minimum investment requirements. Investments also may be made on a Monthly Automatic Investment Plan, which requires $500 to open an account followed by minimum subsequent investments of $100 thereafter. Investor Class shares: $2,000 for accounts enrolled in eDelivery; $2,000 for Coverdell Education Savings accounts; $500 for Automatic Investment Plan accounts; and $2,500 for all other accounts, per Fund. A Fund may, in its sole discretion, waive or reduce any minimum investment requirements. Investments also may be made on a Monthly Automatic Investment Plan, which requires $500 to open an account followed by minimum subsequent investments of $100 thereafter. Institutional Class shares: $100,000 per Fund, provided that the requirement does not apply to investors purchasing through asset allocation, wrap fee, and other similar fee-based advisory programs sponsored by financial intermediaries, such as brokerage firms, investment advisers, financial planners, third-party administrators, insurance companies, and any other institutions having a selling, administration or any similar agreement with the Funds’ distributor, and through group retirement plans. There are no minimum investment requirements for subsequent purchases to existing accounts. Financial intermediaries may charge their customers a transaction or service fee. The Fund may, in its sole discretion, waive or reduce any minimum investment requirements. Investments also may be made on a Monthly Automatic Investment Plan, and once the initial minimum purchase amount has been met, such automatic investment plan may be established with minimum subsequent investments of $100. |

| |

| | Class I2 shares: Class I2 shares are not currently available for purchase. |

| |

| Exchanging Shares | | Class A and Class C shares: Shareholders may exchange Class A or Class C shares of any Fund for the same class shares of any other Fund. Class A shares of a Fund initially purchased subject to a front-end sales load may generally be exchanged for Class A shares of another Fund without the payment of an additional front-end sales load. If a shareholder exchanges Class A shares of a Fund for Class A shares of another Fund that is subject to a higher front-end sales load, the shareholder will be charged the difference between the two sales loads. If the front-end sales load was waived for a shareholder’s initial purchase of Class A shares, the shareholder may be subject to the imposition of a front-end sales load upon exchanging into Class A shares of another Fund. If a shareholder purchased Class A shares subject to a sales load, the shareholder will not be reimbursed the sales load upon exchange of the shares to another Fund. If a shareholder’s Class A or Class C shares are subject to a CDSC, and the shareholder exchanges them for Class A or Class C shares |

5

| | | | | | |

| | | Acquired Fund | | Acquiring Fund | | |

| | subject to a CDSC, the shares will be subject to the higher applicable CDSC of the two classes and, for purposes of calculating CDSC rates, will be deemed to have been held since the date the shares being exchanged were initially purchased. Shareholders may also exchange Class A and Class C shares for Investor Class, Institutional Class or Class I2 shares of the same Fund. Class A and Class C shares subject to a CDSC will be charged the applicable CDSC upon exchange for Institutional Class or Investor Class shares. If a shareholder purchased Class A shares subject to a sales load, the shareholder will not be reimbursed the sales load upon exchange of the shares to another Class in the same Fund. A shareholder may exchange Class C shares for Class A shares, provided that the following conditions are met: the Class C shares must be fully aged and no longer eligible for a CDSC, and no sales charge may be applied to the Class A shares that are being acquired through an exchange from Class C shares. Shareholders should read the prospectus for any other class of shares into which they are considering exchanging. Investor Class, Institutional Class, and Class I2 shares: Shareholders may exchange Institutional Class or Investor Class shares of any Fund for the same class shares of any other Fund, or with a money market fund. Shareholders may also exchange shares of one class of a Fund for another class within the same Fund. Shareholders should read the prospectus for any other class of shares into which they are considering exchanging. |

| |

| Redeeming Shares | | Shareholders may redeem shares on any business day. Redemptions are priced at the NAV per share next determined after receipt of a redemption request in good order by the Funds’ distributor, the Funds, or their agent, and subject to any applicable CDSC. Requests received “in good order” must include: account name, account number, dollar or share amount of transaction, class, Fund(s), allocation of investment and signature of authorized signer. Redemption requests may be made by telephone, by mail, by systematic withdrawal, and for retirement accounts, by a completed and signed distribution form. |

| |

| Net Asset Value | | The price paid for a share of a Fund, and the price received upon selling or redeeming a share of a Fund, is based on the Fund’s NAV. The NAV per share for each Fund for purposes of pricing sales and redemptions is calculated by dividing the value of all securities and other assets belonging to the Fund, less the liabilities charged to the Fund, by the number of shares of the Fund that have already been issued. The NAV per share of a Fund (and each class of shares) is usually determined and its shares are priced as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern Time) on each Business Day. A “Business Day” is a day on which the NYSE is open for trading. The NAV per share of a Fund will fluctuate as the market value of the Fund’s investments changes. The NAV of different classes of shares of the same Fund will differ due to differing class expenses. A Fund’s assets are valued generally by using available market quotations or at fair value, as described below, as determined in good faith in accordance with procedures established by, and under direction of, the Board. |

Comparison of Expenses

Shareholders of the Funds pay various expenses, either directly or indirectly. Transaction expenses are charged directly to your account. Operating expenses are paid from the Fund’s assets and, therefore, are paid by shareholders indirectly. Future expenses for all share classes may be greater or less than those shown in the following tables.

As the tables below indicate, the maximum hypothetical pro forma net annual operating expenses (before waivers and reimbursements) of the Acquiring Fund’s Class A, Class C, Investor Class, Institutional Class and Class I2 shares after the Reorganization are expected to be lower than the net annual operating expenses of the

6

corresponding classes of the Acquired Fund. To the extent that the Acquiring Fund’s assets grow after the Closing Date, the total annual operating expenses of the Acquiring Fund’s Class A, Class C, Investor Class, Institutional Class and Class I2 shares (before waivers and reimbursements) could be lower than the current total annual operating expenses of the corresponding classes of the Acquired Fund.

At an annual rate of 1.00% of average daily net assets, the current management fee for the Acquiring Fund is the same as the management fee for the Acquired Fund. However, concurrent with the closing of the Reorganization, Salient Management will enter into a management fee waiver and expense limitation agreement with the Acquiring Fund which will reduce the management fee of the Acquiring Fund to 0.75% on all assets and cap the expense ratios of the Acquiring Fund until April 30, 2019. Accordingly, effective with the Reorganization, the maximum net annual operating expenses of the Acquiring Fund’s Class A (1.55%), Class C (2.10%), Investor Class (1.50%), Institutional Class (1.15%) and Class I2 (1.10%) shares will be lower than the current net annual operating expenses of the Acquired Fund’s Class A (2.66%), Class C (3.21%), Investor Class (2.61%), Institutional Class (2.26%), and Class I2 (2.21%) shares.

The Funds’ Expenses

The following expense tables briefly describe the fees and the expenses that shareholders of the Acquired Fund and the Acquiring Fund may pay if they buy and hold shares of each respective Fund, and are based on expenses paid by the Funds for the twelve-month period ended December 31, 2017 (the end of the Funds’ most recent fiscal year). The tables also show the pro forma expenses of the Acquiring Fund assuming the Reorganization with the Acquired Fund and implementation of the Acquiring Fund’s advisory fee waiver and expense limitation agreement had occurred at the beginning of the twelve-month period ended December 31, 2017 (i.e., on January 1, 2017). The Acquiring Fund’s actual expenses after the Reorganization may be greater or less than those shown.

| | | | | | | | | | | | | | |

| | | | | Acquired

Fund | | | Acquiring

Fund | | | Acquiring Fund

(Pro Forma,

Assuming

Reorganization

and Expense

Waivers) | |

Class A | | | | | | | | | | | | | | |

| Shareholder Fees | | Maximum Sales Charge (Load) on purchases (as a percentage of offering price) | | | 5.75% | | | | 5.75% | | | | 5.75% | |

| | Maximum Deferred Sales Charge for shares held less than 1 year (as a percentage of the lesser of original price or redemption proceeds) | | | None | | | | None | | | | None | |

| | | | |

| Annual Fund Operating Expenses | | Management Fee | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| | Distribution (12b-1) Fees | | | 0.25% | | | | 0.25% | | | | 0.25% | |

| | Other Expenses | | | 0.72% | | | | 1.19% | | | | 0.66% | |

| | Dividend and Interest Expense on Short Sales | | | 0.20% | | | | N/A | | | | N/A | |

| | Interest Expense on Borrowings | | | 0.49% | | | | N/A | | | | N/A | |

| | Total Other Expenses | | | 1.41% | | | | 1.19% | | | | 0.66% | |

| | Total Annual Fund Operating Expenses | | | 2.66% | | | | 2.44% | | | | 1.91% | |

| | Fee Waiver and/or Expense Reimbursement | | | N/A | | | | N/A | | | | -0.36% | |

| | Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 2.66% | | | | 2.44% | | | | 1.55% | |

7

| | | | | | | | | | | | | | |

| | | | | Acquired

Fund | | | Acquiring

Fund | | | Acquiring Fund

(Pro Forma,

Assuming

Reorganization

and Expense

Waivers) | |

Class C | | | | | | | | | | | | | | |

| Shareholder Fees | | Maximum Sales Charge (Load) on purchases (as a percentage of offering price) | | | None | | | | None | | | | None | |

| | Maximum Deferred Sales Charge for shares held less than 1 year (as a percentage of the lesser of original price or redemption proceeds) | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| Annual Fund Operating Expenses | | Management Fee | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| | Distribution (12b-1) Fees | | | 0.75% | | | | 0.75% | | | | 0.75% | |

| | Other Expenses | | | 0.77% | | | | 1.24% | | | | 0.71% | |

| | Dividend and Interest Expense on Short Sales | | | 0.20% | | | | N/A | | | | N/A | |

| | Interest Expense on Borrowings | | | 0.49% | | | | N/A | | | | N/A | |

| | Total Other Expenses | | | 1.46% | | | | 1.24% | | | | 0.71% | |

| | Total Annual Fund Operating Expenses | | | 3.21% | | | | 2.99% | | | | 2.46% | |

| | Fee Waiver and/or Expense Reimbursement | | | N/A | | | | N/A | | | | -0.36% | |

| | Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 3.21% | | | | 2.99% | | | | 2.10% | |

| | | | |

| | | | | Acquired

Fund | | | Acquiring

Fund | | | Acquiring Fund

(Pro Forma,

Assuming

Reorganization

and Expense

Waivers) | |

Investor Class | | | | | | | | | | | | | | |

| Annual Fund Operating Expenses | | Management Fee | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| | Distribution (12b-1) Fees | | | 0.25% | | | | 0.25% | | | | 0.25% | |

| | Other Expenses | | | 0.67% | | | | 1.14% | | | | 0.61% | |

| | Dividend and Interest Expense on Short Sales | | | 0.20% | | | | N/A | | | | N/A | |

| | Interest Expense on Borrowings | | | 0.49% | | | | N/A | | | | N/A | |

| | Total Other Expenses | | | 1.36% | | | | 1.14% | | | | 0.61% | |

| | Total Annual Fund Operating Expenses | | | 2.61% | | | | 2.39% | | | | 1.86% | |

| | Fee Waiver and/or Expense Reimbursement | | | N/A | | | | N/A | | | | -0.36% | |

| | Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 2.61% | | | | 2.39% | | | | 1.50% | |

8

| | | | | | | | | | | | | | |

| | | | | Acquired

Fund | | | Acquiring

Fund | | | Acquiring Fund

(Pro Forma,

Assuming

Reorganization

and Expense

Waivers) | |

Institutional Class | | | | | | | | | | | | | | |

| Annual Fund Operating Expenses | | Management Fee | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| | Distribution (12b-1) Fees | | | N/A | | | | N/A | | | | N/A | |

| | Other Expenses | | | 0.57% | | | | 1.04% | | | | 0.51% | |

| | Dividend and Interest Expense on Short Sales | | | 0.20% | | | | N/A | | | | N/A | |

| | Interest Expense on Borrowings | | | 0.49% | | | | N/A | | | | N/A | |

| | Total Other Expenses | | | 1.26% | | | | 1.04% | | | | 0.51% | |

| | Total Annual Fund Operating Expenses | | | 2.26% | | | | 2.04% | | | | 1.51% | |

| | Fee Waiver and/or Expense Reimbursement | | | N/A | | | | N/A | | | | -0.36% | |

| | Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 2.26% | | | | 2.04% | | | | 1.15% | |

| | | | |

| | | | | Acquired

Fund | | | Acquiring

Fund | | | Acquiring Fund

(Pro Forma,

Assuming

Reorganization

and Expense

Waivers) | |

Class I2 | | | | | | | | | | | | | | |

| Annual Fund Operating Expenses | | Management Fee | | | 1.00% | | | | 1.00% | | | | 1.00% | |

| | Distribution (12b-1) Fees | | | N/A | | | | N/A | | | | N/A | |

| | Other Expenses | | | 0.52%(1) | | | | 0.99%(2) | | | | 0.46%(2) | |

| | Dividend and Interest Expense on Short Sales | | | 0.20%(1) | | | | N/A | | | | N/A | |

| | Interest Expense on Borrowings | | | 0.49%(1) | | | | N/A | | | | N/A | |

| | Total Other Expenses | | | 1.21% | | | | 0.99% | | | | 0.46% | |

| | Total Annual Fund Operating Expenses | | | 2.21% | | | | 1.99% | | | | 1.46% | |

| | Fee Waiver and/or Expense Reimbursement | | | N/A | | | | N/A | | | | -0.36% | |

| | Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 2.21% | | | | 1.99% | | | | 1.10% | |

| (1) | Other Expenses, Dividend and Interest Expense on Short Sales, and Interest Expense on Borrowings for Class I2 shares are based on estimated amounts for the current fiscal year. |

| (2) | Other Expenses for Class I2 shares are based on estimated amounts for the current fiscal year. |

Expense Examples

The hypothetical examples below show what your expenses would be if you invested $10,000 over different time periods in the Acquired Fund and the Acquiring Fund, based on fees and expenses incurred by the Funds during the 12-month period ended December 31, 2017. The expense examples shown below assume that the investor sells shares at the end of the period. Pro forma expenses of the Acquiring Fund assuming the Reorganization with the Acquired Fund and implementation of the Acquiring Fund’s advisory fee waiver and expense limitation agreement had occurred at the beginning of the twelve-month period ended December 31, 2017 (i.e., on January 1, 2017), also are included. Each example assumes that you reinvested all distributions,

9

the average annual return was 5%, and Fund expenses did not change over the period. The pro forma examples are for comparison purposes only and are not a representation of the Acquired Fund’s or Acquiring Fund’s actual expenses or returns, either past or future.

| | | | | | | | | | | | | | | | | | |

| | | | | Acquired Fund | | | Acquiring Fund | | | Acquiring Fund

(Pro Forma, Assuming

Reorganization and

Expense Waivers) | |

Class A | | Year 1 | | $ | 829 | | | $ | 808 | | | $ | | | | $ | 724 | |

| | Year 3 | | $ | 1,354 | | | $ | 1,292 | | | $ | | | | $ | 1,108 | |

| | Year 5 | | $ | 1,903 | | | $ | 1,800 | | | $ | | | | $ | 1,515 | |

| | Year 10 | | $ | 3,392 | | | $ | 3,188 | | | $ | | | | $ | 2,649 | |

| | | | |

| | | | | Acquired Fund | | | Acquiring Fund | | | Acquiring Fund

(Pro Forma, Assuming

Reorganization and

Expense Waivers)

| |

Class C (Assuming Redemption) | | Year 1 | | $ | 424 | | | $ | 402 | | | $ | | | | $ | 313 | |

| | Year 3 | | $ | 989 | | | $ | 924 | | | $ | | | | $ | 732 | |

| | Year 5 | | $ | 1,677 | | | $ | 1,571 | | | $ | | | | $ | 1,277 | |

| | Year 10 | | $ | 3,508 | | | $ | 3,304 | | | $ | | | | $ | 2,765 | |

Class C (Assuming No Redemption) | | Year 1 | | $ | 324 | | | $ | 302 | | | $ | | | | $ | 213 | |

| | Year 3 | | $ | 989 | | | $ | 924 | | | $ | | | | $ | 732 | |

| | Year 5 | | $ | 1,677 | | | $ | 1,571 | | | $ | | | | $ | 1,277 | |

| | Year 10 | | $ | 3,508 | | | $ | 3,304 | | | $ | | | | $ | 2,765 | |

| | | | |

| | | | | Acquired Fund | | | Acquiring Fund | | | Acquiring Fund

(Pro Forma, Assuming

Reorganization and

Expense Waivers)

| |

Investor Class | | Year 1 | | $ | 264 | | | $ | 242 | | | $ | | | | $ | 153 | |

| | Year 3 | | $ | 811 | | | $ | 745 | | | $ | | | | $ | 550 | |

| | Year 5 | | $ | 1,384 | | | $ | 1,275 | | | $ | | | | $ | 972 | |

| | Year 10 | | $ | 2,940 | | | $ | 2,722 | | | $ | | | | $ | 2,148 | |

| | | | |

| | | | | Acquired Fund | | | Acquiring Fund | | | Acquiring Fund

(Pro Forma, Assuming

Reorganization and

Expense Waivers)

| |

Institutional Class | | Year 1 | | $ | 229 | | | $ | 207 | | | $ | | | | $ | 117 | |

| | Year 3 | | $ | 706 | | | $ | 639 | | | $ | | | | $ | 442 | |

| | Year 5 | | $ | 1,209 | | | $ | 1,098 | | | $ | | | | $ | 789 | |

| | Year 10 | | $ | 2,591 | | | $ | 2,366 | | | $ | | | | $ | 1,769 | |

| | | | |

| | | | | Acquired Fund | | | Acquiring Fund | | | Acquiring Fund

(Pro Forma, Assuming

Reorganization and

Expense Waivers)

| |

Class I2 | | Year 1 | | $ | 224 | | | $ | 202 | | | $ | | | | $ | 112 | |

| | Year 3 | | $ | 691 | | | $ | 624 | | | $ | | | | $ | 426 | |

| | Year 5 | | $ | 1,184 | | | $ | 1,072 | | | $ | | | | $ | 763 | |

| | Year 10 | | $ | 2,541 | | | $ | 2,314 | | | $ | | | | $ | 1,713 | |

Portfolio Turnover

Each Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the

10

Example tables above, affect each Fund’s performance. During the most recent fiscal year, the Acquired Fund’s portfolio turnover rate was 59% of the average value of its portfolio, and the Acquiring Fund’s portfolio turnover rate was 41% of the average value of its portfolio.

Exchanging Shares

As described above, generally, shareholders of either Fund may exchange their shares for shares of the same class of another fund offered by the fund complex. Following the Closing Date, holders of shares of the Acquiring Fund may exchange their shares for similar shares of other funds in the fund complex. The exchanged shares would be subject to the expenses of such other funds’ shares.

For information regarding exchanging shares of the Acquiring Fund, please contact your financial representative.

Comparison of Advisory and Distribution Arrangements

Other than the waivers and expense limitations that Salient Management will enter into with the Acquiring Fund concurrent with the closing of the Reorganization, the advisory agreements and distribution agreements of the Funds are identical.

| | | | |

| | | Acquired Fund | | Acquiring Fund |

Management Fee | | 1.00% on all assets. | | 1.00%* on all assets. |

| | |

Distribution (12b-1) Fees | | Class A - 0.35%** Class C - 0.75% Investor Class - 0.25% Institutional Class - None Class I2 - None | | Class A - 0.35%** Class C - 0.75% Investor Class - 0.25% Institutional Class - None Class I2 - None |

| | |

Shareholder Service Fees | | Class A - 0.20% Class C - 0.25% Investor Class - 0.15% Institutional Class - 0.05% Class I2 - None | | Class A - 0.20% Class C - 0.25% Investor Class - 0.15% Institutional Class - 0.05% Class I2 - None |

| * | Concurrent with the closing of the Reorganization, Salient Management will enter into a management fee waiver and expense limitation agreement with the Acquiring Fund which will reduce the management fee of the Acquiring Fund to 0.75% on all assets. |

| ** | Class A is currently only authorized to pay 0.25% in Distribution (12b-1) fees. |

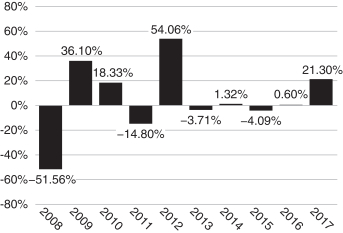

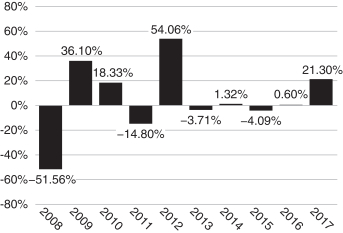

Fund Performance

Past performance records of the Funds through December 31, 2017, including: (1) calendar year total returns (without sales charges); and (2) average annual total returns, are set forth under “Acquired Fund Past Performance” beginning on page 21 of this information statement and prospectus.

Comparison of Investment Risks

The Funds are exposed to various risks that could cause shareholders to lose money on their investments in the Funds. The table below identifies the principal risks of each Fund. As shown below, as of the Closing Date, the Funds have substantially identical investment risks. However, as also shown below, there are differences in the principal investment risks of the Funds, including:

| | • | | The Acquired Fund is subject to the following risks that the Acquiring Fund is not subject to: Lower-Rated Debt Securities (“Junk Bonds”) Risk and Short Sale Risk. The Acquiring Fund is subject to the following risks that the Acquired Fund is not subject to: Depositary Receipts Risk, Exchange-Traded Funds (“ETFs”) Risk, and Portfolio Turnover Risk. |

11

| | | | | | | | |

Risks: | | Acquired Fund | | | Acquiring Fund | |

Borrowing Risk | | | X | | | | X | |

Concentration Risk | | | X | | | | X | |

Counterparty Risk | | | X | | | | X | |

Currency Risk | | | X | | | | X | |

Debt Instruments Risk | | | X | | | | X | |

Depositary Receipts Risk | | | | | | | X | |

Derivatives Risk | | | X | | | | X | |

Emerging Market and Frontier Market Securities Risk | | | X | | | | X | |

Equity Securities Risk | | | X | | | | X | |

Exchange-Traded Funds (“ETFs”) Risk | | | | | | | X | |

Foreign Securities Risk | | | X | | | | X | |

Hedging Risk | | | X | | | | X | |

Leverage Risk | | | X | | | | X | |

Liquidity Risk | | | X | | | | X | |

Lower-Rated Debt Securities (“Junk Bonds”) Risk | | | X | | | | | |

Manager Risk | | | X | | | | X | |

Market Events Risk | | | X | | | | X | |

Market Risk | | | X | | | | X | |

Mortgage-Related and Other Asset-Backed Securities Risk | | | X | | | | X | |

Overseas Exchanges Risk | | | X | | | | X | |

Portfolio Turnover Risk | | | | | | | X | |

Real Estate Securities and REITs Risk | | | X | | | | X | |

Restricted and Illiquid Securities Risk | | | X | | | | X | |

Short Sale Risk | | | X | | | | | |

Small and Medium Capitalization Stocks Risk | | | X | | | | X | |

Underlying Funds Risk | | | X | | | | X | |

The following summarizes the principal risks affecting each Fund.

Principal Risks Applicable to Both Funds

Below are descriptions of the main factors that may play a role in shaping the Fund’s overall risk profile. The following discussions relating to various principal risks associated with investing in the Fund are not, and are not intended to be, a complete enumeration or explanation of the risks involved in an investment in the Fund. Your investment may be subject to the risks described below if you invest in the Fund.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. The Fund’s principal risk factors are listed below. The Fund’s shares will go up and down in price, meaning that you could lose money by investing in the Fund. Many factors influence a mutual fund’s performance. An investment in the Fund is not intended to constitute a complete investment program and should not be viewed as such. Before investing, be sure to read the additional descriptions of these risks below.

As an overall matter, instability in the financial markets has led many governments, including the United States government, to take a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal, state and other governments, and their regulatory agencies or self-regulatory organizations, may take

12

actions that affect the regulation of the instruments in which the Fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation or regulation may also change the way in which the Fund itself is regulated. Such legislation or regulation could limit or preclude the Fund’s ability to achieve its investment objective.

All securities investing and trading activities risk the loss of capital. No assurance can be given that the Fund’s investment activities will be successful or that the Fund’s shareholders will not suffer losses.

Borrowing Risk

Borrowing for investment purposes creates leverage, which will exaggerate the effect of any increase or decrease in the market price of securities in the Fund’s portfolio on the Fund’s net asset value and, therefore, may increase the volatility of the Fund. Money borrowed will be subject to interest and other costs (that may include commitment fees and/or the cost of maintaining minimum average balances). These costs may exceed the gain on securities purchased with borrowed funds. Increased operating costs, including the financing cost associated with any leverage, may reduce the Fund’s total return. Unless the income and capital appreciation, if any, on securities acquired with borrowed funds exceed the cost of borrowing, the use of leverage will diminish the investment performance of the Fund.

Concentration Risk

The Fund concentrates its investments in issuers of one or more particular industries to the extent permitted by applicable regulatory guidance. There is a risk that those issuers (or industry sector) will perform poorly and negatively impact the Fund. Concentration risk results from maintaining exposure (long or short) to issuers conducting business in a specific industry. The risk of concentrating investments in a limited number of issuers in a particular industry is that the Fund will be more susceptible to the risks associated with that industry than a fund that does not concentrate its investments.

Counterparty Risk

In general, a derivative contract typically involves leverage, i.e., it provides exposure to potential gain or loss from a change in the level of the market price of a security, currency or commodity (or a basket or index) in a notional amount that exceeds the amount of cash or assets required to establish or maintain the derivative contract. Many of these derivative contracts will be privately negotiated in the over-the-counter market. These contracts also involve exposure to credit risk, since contract performance depends in part on the financial condition of the counterparty. If a privately negotiated over-the-counter contract calls for payments by the Fund, the Fund must be prepared to make such payments when due. In addition, if a counterparty’s creditworthiness declines, the Fund may not receive payments owed under the contract, or such payments may be delayed under such circumstances and the value of agreements with such counterparty can be expected to decline, potentially resulting in losses by the Fund.

Currency Risk

The risk that changes in currency exchange rates will negatively affect securities denominated in, and/or receiving revenues in, foreign currencies, including foreign exchange forward contracts and other currency-related futures contracts. The liquidity and trading value of foreign currencies could be affected by global economic factors, such as inflation, interest rate levels, and trade balances among countries, as well as the actions of sovereign governments. Adverse changes in currency exchange rates (relative to the U.S. dollar) may erode or reverse any potential gains from the Fund’s investments in securities denominated in a foreign currency or may widen existing losses. The Fund’s net currency positions may expose it to risks independent of its securities positions.

13

Debt Instruments Risk

Debt instruments are generally subject to credit risk and interest rate risk. Credit risk refers to the possibility that the issuer of a security will be unable to make interest payments and/or repay the principal on its debt. Interest rate risk refers to fluctuations in the value of a fixed-income security resulting from changes in the general level of interest rates. When the general level of interest rates goes up, the prices of most fixed-income securities go down. When the general level of interest rates goes down, the prices of most fixed-income securities go up. Derivatives related to debt instruments may be exposed to similar risks for individual securities, groups of securities or indices tracking multiple securities or markets. Both debt securities and debt-related derivative instruments may be exposed to one or more of the following risks:

| | • | | Credit Risk: Credit risk refers to the possibility that the issuer of the security will not be able to make principal and interest payments when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation. Securities rated by the rating agencies in the four highest categories (Standard & Poor’s Ratings Services (“S&P”) (AAA, AA, A and BBB), Fitch, Inc. (“Fitch”) (AAA, AA, A and BBB) or Moody’s Investors Service, Inc. (“Moody’s”) (Aaa, Aa, A and Baa) are considered investment grade, but they may also have some speculative characteristics, meaning that they carry more risk than higher rated securities and may have problems making principal and interest payments in difficult economic climates. Investment grade ratings do not guarantee that bonds will not lose value. |

| | • | | Extension Risk: Extension risk is the risk that, when interest rates rise, certain obligations will be paid off by the issuer (or obligor) more slowly than anticipated, causing the value of these securities to fall. Rising interest rates tend to extend the duration of securities, making them more sensitive to changes in interest rates. The value of longer-term securities generally changes more in response to changes in interest rates than shorter-term securities. As a result, in a period of rising interest rates, securities may exhibit additional volatility and may lose value. |

| | • | | Interest Rate Risk: The yields for certain securities are susceptible in the short-term to fluctuations in interest rates, and the prices of such securities may decline when interest rates rise. Interest rate risk in general is the risk that prices of fixed income securities generally increase when interest rates decline and decrease when interest rates increase. The Fund may decline in value or suffer losses if short term or long term interest rates rise sharply or otherwise change in a manner not anticipated by the Advisor. |

| | • | | Prepayment Risk: Prepayment risk is the risk that certain debt securities with high interest rates will be prepaid by the issuer before they mature. When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and an investor may have to invest the proceeds in securities with lower yields. In periods of falling interest rates, the rate of prepayments tends to increase (as does price fluctuation) as borrowers are motivated to pay off debt and refinance at new lower rates. During such periods, reinvestment of the prepayment proceeds by the management team will generally be at lower rates of return than the return on the assets that were prepaid. Prepayment reduces the yield to maturity and the average life of the security. |

Derivatives Risk

The market value of the derivative instruments in which the Fund may invest, including options, futures contracts, forward currency contracts, swap agreements and other similar instruments, may be more volatile than that of other instruments. A Fund’s use of derivative instruments involves risks different from, and possibly greater than, the risks associated with investing directly in securities and other more traditional investments, and certain derivatives may create a risk of loss greater than the amount invested. There can be no assurance given that each derivative position will perform as expected, or that a particular derivative position will be available when sought by the portfolio manager. A Fund’s use of derivative instruments to obtain short exposures may result in greater volatility because losses are potentially unlimited. In addition there can be no assurance given

14

that any derivatives strategy will succeed and the Fund may lose money as a result of its use of derivative instruments. Changes in regulation relating to a mutual fund’s use of derivatives and related instruments could potentially limit or impact the Fund’s ability to invest in derivatives, limit the Fund’s ability to employ certain strategies that use derivatives and adversely affect the value or performance of derivatives and the Fund.

Emerging Market and Frontier Market Risk

Emerging market and frontier market securities present greater investment risks than investing in the securities of companies in developed markets. These risks include a greater likelihood of economic, political or social instability, less liquid and more volatile stock markets, foreign exchange controls, a lack of government regulation and different legal systems, and immature economic structures.

Equity Securities Risk

The risks associated with investing in equity securities of companies include the financial and operational risks faced by individual companies, the risk that the stock markets, sectors and industries in which the Fund invests may experience periods of turbulence and instability, and the general risk that domestic and global economies may go through periods of decline and cyclical change.

Foreign Securities Risk

Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include:

| | • | | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| | • | | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| | • | | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

| | • | | The governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their capital markets or in certain industries. |

| | • | | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| | • | | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

Hedging Risk

The Fund’s hedging activities, although designed to help offset negative movements in the markets for the Fund’s investments, will not always be successful. Moreover, hedging can cause the Fund to lose money and can reduce the opportunity for gain.

Leverage Risk

If the Fund makes investments in futures contracts, forward currency contracts and other derivative instruments, the futures contracts and certain other derivatives provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If the Fund uses leverage through

15

activities such as borrowing, entering into short sales, purchasing securities on margin or on a “when issued” basis or purchasing derivative instruments in an effort to increase its returns, the Fund has the risk of magnified capital losses that occur when losses affect an asset base, enlarged by borrowings or the creation of liabilities, that exceeds the net assets of the Fund. The net asset value of the Fund when employing leverage will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest.

Liquidity Risk

Certain securities may trade less frequently than those of larger companies due to their smaller capitalizations. In the event certain securities experience limited trading volumes, the prices may display abrupt or erratic movements at times. Additionally, it may be more difficult for the Fund to buy and sell significant amounts of such securities without an unfavorable impact on prevailing market prices. As a result, these securities may be difficult to dispose of at a fair price at the times when the Advisor believes it is desirable to do so. The Fund’s investment in securities that are less actively traded or over time experience decreased trading volume may restrict its ability to take advantage of other market opportunities or to dispose of securities. This also may affect adversely the Fund’s ability to make dividend distributions. The Fund will not purchase or otherwise acquire any security if, as a result, more than 15% of its net assets would be invested in illiquid investments.

Manager Risk

If the Fund’s portfolio managers make poor investment decisions, it will negatively affect the Fund’s investment performance.

Market Events Risk

The U.S. Government and the Federal Reserve, as well as certain foreign governments and their central banks, have taken various steps designed to support and stabilize credit and financial markets since 2008. Reduction or withdrawal of this support, failure of efforts to stabilize the markets, or investor perception that such efforts are not succeeding could negatively affect financial markets generally, as well as have an adverse impact on the liquidity and value of certain securities. In addition, policy and legislative changes in the United States and in other countries are affecting many aspects of financial regulation. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted in the U.S., reflecting a significant revision of the U.S. financial regulatory framework. The Dodd-Frank Act addresses a variety of topics, including, among others, new rules for trading in derivatives; restrictions on banking entities from engaging in proprietary trading of certain instruments; the registration and additional regulation of private fund managers; and new federal requirements for residential mortgage loans. Fund investments may be impacted by the Dodd-Frank Act and any related or additional legislation or regulation in unforeseeable ways. The results of the recent U.S. presidential election appear to herald significant changes in certain policies, which may result in less stringent prudential regulation of certain players in the financial markets. While these policies are going through the political process, markets may react strongly to expectations, which could increase volatility, especially if a market’s expectations for changes in government policies are not borne out. The ultimate effect of these changes on the markets, and the practical implications for market participants, may not be fully known for some time.

Market Risk

Market risk is the risk that the markets on which the Fund’s investments trade will increase or decrease in value. Prices may fluctuate widely over short or extended periods in response to company, market or economic news. Markets also tend to move in cycles, with periods of rising and falling prices. If there is a general decline in the securities and other markets, your investment in the Fund may lose value, regardless of the individual results of the securities and other instruments in which the Fund invests.

16

Mortgage-Related and Other Asset-Backed Securities Risk

Rising interest rates tend to extend the duration of mortgage-related securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, the Fund may exhibit additional volatility (i.e., extension risk). In addition, when interest rates decline, borrowers may pay off their mortgages sooner than expected. This can reduce the returns of the Fund because the Fund will have to reinvest that money at the lower prevailing interest rates (i.e., prepayment risk). The Fund’s investments in asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets. Asset-backed securities present credit risks that are not presented by mortgage-backed securities because asset-backed securities generally do not have the benefit of a security interest in collateral that is comparable in quality to mortgage assets. If the issuer of an asset-backed security defaults on its payment obligations, there is the possibility that, in some cases, the Fund will be unable to possess and sell the underlying collateral and that the Fund’s recoveries on repossessed collateral may not be available to support payments on the security. In the event of a default, the Fund may suffer a loss if it cannot sell collateral quickly and receive the amount it is owed.

Overseas Exchanges Risk

The Fund may engage in transactions on a number of overseas stock exchanges, which may pose increased risk to the Fund and result in delays in obtaining accurate information on the value of securities. In addition, the Fund may engage in transactions in the stock markets of emerging market countries, which in general have stock markets that are less liquid, smaller and less regulated than many of the developed country stock markets.

Real Estate Securities and REITs Risk

The Fund is subject to risks related to investment in REITs, including fluctuations in the value of underlying properties, defaults by borrowers or tenants, lack of diversification, heavy cash flow dependency, self-liquidation, and potential failure to qualify for tax-free pass through of income and exemption from registration as an investment company. In addition, the Fund is subject to the risks associated with the direct ownership of real estate, including fluctuations in value due to general and local economic conditions, increases in property taxes and operating expenses, changes in zoning laws, casualty or condemnation losses, regulatory limitations on rents, changes in neighborhood values, changes in the appeal of properties to tenants, increases in interest rates and defaults by borrowers or tenants. The Fund is not eligible for a tax deduction based on dividends received from REITs that is available to individuals who invest directly in REITs.

Restricted and Illiquid Securities Risk

Certain securities generally trade in lower volume and may be less liquid than securities of large established companies. If a security is illiquid, the Fund may not be able to sell the security at a time when the Advisor might wish to sell, which means that the Fund could lose money. In addition, the security could have the effect of decreasing the overall level of the Fund’s liquidity. Certain restricted securities, i.e., securities subject to legal or contractual restrictions on resale, may be treated as liquid even though they may be less liquid than registered securities traded on established secondary markets.

Small and Medium Capitalization Stocks Risk

Investment in securities of smaller companies presents greater investment risks than investing in the securities of larger companies. These risks include greater price volatility, greater sensitivity to changing economic conditions, and less liquidity than the securities of larger, more mature companies.

17

Underlying Funds Risk

Because the Fund may be an “Underlying Fund” for one or more related “fund of funds” and, therefore, a significant percentage of the Fund’s outstanding shares may be held by a fund of funds, a change in asset allocation by the fund of funds could result in purchases and redemptions of a large number of shares of the Fund, causing significant changes to the Fund’s portfolio composition, potential increases in expenses to the Fund and purchase sand sales of securities in a short timeframe, each of which could negatively impact Fund performance.

Particular Risks of the Acquired Fund

Lower-Rated Debt Securities (“Junk Bonds”) Risk

Securities rated below investment grade and comparable unrated securities are often referred to as “junk bonds.” Junk bonds involve greater risks of default or downgrade and are more volatile than investment grade securities. In addition, issuers of junk bonds may be more susceptible than other issuers to economic downturns. Junk bonds are subject to the risk that the issuer may not be able to pay interest or dividends or ultimately repay principal upon maturity. Analysis of the creditworthiness of issuers of lower-rated debt securities may be more complex than for issuers of higher-rated securities, and the use of credit ratings to evaluate lower-rated securities can involve certain risks.

Short Sale Risk

The Fund may take a short position in a derivative instrument, such as a future, forward or swap. A short position on a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying instrument. The Fund may also from time to time sell securities short, which involves borrowing and selling a security and covering such borrowed security through a later purchase. A short sale creates the risk of an unlimited loss, in that the price of the underlying security could theoretically increase without limit, thus increasing the cost of buying those securities to cover the short position. There can be no assurance that the securities necessary to cover a short position will be available for purchase. The Fund must set aside “cover” for short sales to comply with applicable SEC provisions under the Investment Company Act of 1940, as amended (“1940 Act”).

Particular Risks of the Acquiring Fund

Depositary Receipts Risk

Investments in depositary receipts involve risks similar to those accompanying direct investments in foreign securities. In addition, there is risk involved in investing in unsponsored depositary receipts, as there may be less information available about the underlying issuer than there is about an issuer of sponsored depositary receipts and the prices of unsponsored depositary receipts may be more volatile than those of sponsored depositary receipts.

Exchange-Traded Funds (“ETFs”) Risk

Because the Fund invests in ETFs and in options on ETFs, the Fund is exposed to the risks associated with the securities and other investments held by such ETFs. The value of any investment in an ETF will fluctuate according to the performance of that ETF. In addition, the Fund will indirectly bear a proportionate share of expenses, including any management fees, paid by each ETF in which the Fund invests. Such expenses are in addition to the operating expenses of the Fund, which are borne directly by shareholders of the Fund. Further, individual shares of an ETF may be purchased and sold only on a national securities exchange through a

18

broker-dealer. The price of such shares is based on market price, and because ETF shares trade at market prices rather than net asset value (“NAV”), shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). The market price of an ETF’s shares, like the price of any exchange-traded security, includes a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the particular security. The bid-ask spread often increases significantly during times of market disruption, which means that, to the extent that the Fund invests directly in an ETF, the shares of that ETF may trade at a greater discount at a time when the Fund wishes to sell its shares. Many ETFs have obtained exemptive relief from the SEC permitting unaffiliated funds to invest in shares of the ETF beyond the limitations imposed by the 1940 Act, subject to certain conditions. The Fund may rely on these exemptive orders to invest in unaffiliated ETFs, and the risks described above may be greater than if the Fund limited its investment in an ETF in accordance with the limitations imposed by the 1940 Act.

Portfolio Turnover Risk

The Fund is generally expected to engage in frequent and active trading of portfolio securities to achieve its investment objective. A higher turnover rate (100% or more) will involve correspondingly greater transaction costs, which will be borne directly by the Fund, may have an adverse impact on performance, and may increase the potential for more taxable distributions being paid to shareholders, including short-term capital gains that are taxed at ordinary income rates. To the extent a Fund engages in short sales (which are not included in calculating the portfolio turnover rate), the transaction costs incurred by a Fund are likely to be greater than the transaction costs incurred by a mutual fund that does not take short positions and has a similar portfolio turnover rate.

AGREEMENT AND PLAN OF REORGANIZATION

Description of Reorganization

The Board has approved the Agreement, a form of which is attached to this information statement and prospectus as Exhibit A. Additional information about the Reorganization and the Agreement is set forth below under “Further Information on the Reorganization.” The Agreement provides for the Reorganization on the following terms: