Searchable text section of graphics shown above

[GRAPHIC]

Falconbridge Limited

Corporate Profile

Goldman Sachs

Basic Materials Conference

May 24, 2006

[LOGO]

Forward-Looking Statements | | [LOGO] |

• Certain statements contained in this presentation are forward-looking statements (as defined in applicable securities legislation). Examples of such statements include, but are not limited to, statements concerning (i) our assessment of the outlook for metal markets in 2006, (ii) Inco’s offer to acquire all of the common shares of Falconbridge Limited and the benefits of such combination, (iii) Xstrata’s offer to acquire all of the common shares of Falconbridge Limited and the effects of such combination (iv) our future financial requirements, including to redeem the junior preference shares, and funding of those requirements, (v) our expectations with respect to our development projects, and (vi) our production forecast for 2006. Inherent in forward-looking statements are risks and uncertainties well beyond our ability to predict or control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this presentation. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about the timing, steps to be taken and completion of Inco’s offer to acquire all of our common shares, the ability to successfully compete against global metals and mining and exploration companies by creating through such a combination an enterprise of increased scale; strong demand for nickel, copper and other metals in emerging markets such as China; approximately $390 million per annum in pre-tax operating and other synergies and cost savings, and other benefits being realized based on the achievement of operational efficiencies from restructuring, integration and other initiatives relating to the combination of Falconbridge and Inco; the approvals or clearances required to be obtained by Inco and Falconbridge from regulatory and other agencies and bodies being obtained in a timely manner; divestitures required by regulatory agencies being acceptable and completed in a timely manner; there being limited costs, difficulties or delays related to the integration of the Falconbridge’s operations with those of Inco; the timely completion of the steps required to be taken for the eventual combination of the two companies; business and economic conditions generally; exchange rates, energy and other anticipated and unanticipated costs and pension contributions and expenses; the supply and demand for, deliveries of, and the level and volatility of prices of, nickel, copper, aluminum, zinc and other primary metals products and other metal products Inco and Falconbridge produce; the timing of the receipt of remaining regulatory and governmental approvals for the development projects and other operations; the continued availability of financing on appropriate terms for development projects; Falconbridge’s costs of production and production and productivity levels, as well as those of its competitors; market competition; mining, processing, exploration and research and development activities; the accuracy of ore/mineral reserve estimates; premiums realized over LME cash and other benchmark prices; tax benefits/charges; the resolution of environmental and other proceedings and the impact on the combined company of various environmental regulations and initiatives; assumptions concerning political and economic stability in countries or locations in which Falconbridge operates or otherwise and the ability to continue to pay quarterly cash dividends in such amounts as Falconbridge’s Board of Directors may determine in light of other uses for such funds and other factors.

• Inherent in those statements are known and unknown risks, uncertainties and other factors well beyond the Company’s ability to control or predict. Some of these known risks and uncertainties are outlined in filings by Falconbridge with applicable securities regulatory authorities, including in Falconbridge’s annual information form. Readers are encouraged to consult such filings. While Falconbridge anticipates that subsequent events and developments may cause Falconbridge’s views to change, the Company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. These factors are not intended to represent a complete list of the factors that could affect Falconbridge and the combination of Inco and Falconbridge.

Agenda

(ALL AMOUNTS ARE IN U.S. DOLLARS)

Falconbridge

Highlights

Producer Ranking In World* | | |

• Copper | | 4th |

• Nickel | | 4th |

• Zinc | | 5th |

• Aluminum | | 10% of U.S. primary production |

| | April/06 | | Q1/06 | | 2005 | | 2004 | |

Sales | | $ | 1.2 | B | $ | 2.9 | B | $ | 8.1 | B | $ | 6.8 | B |

EBITDA | | $ | 0.5 | B | $ | 0.9 | B | $ | 2.4 | B | $ | 1.9 | B |

Net Income | | $ | 238 | M | $ | 462 | M | $ | 872 | M | $ | 521 | M |

Assets (Book value) | | $ | 13.1 | B | $ | 12.9 | B | $ | 12.4 | B | $ | 9.6 | B |

Market Capitalization (As at May 17, 2006) $18.6 B

* Based on 2006 forecast refined metal production data (Source: Falconbridge, Brook Hunt)

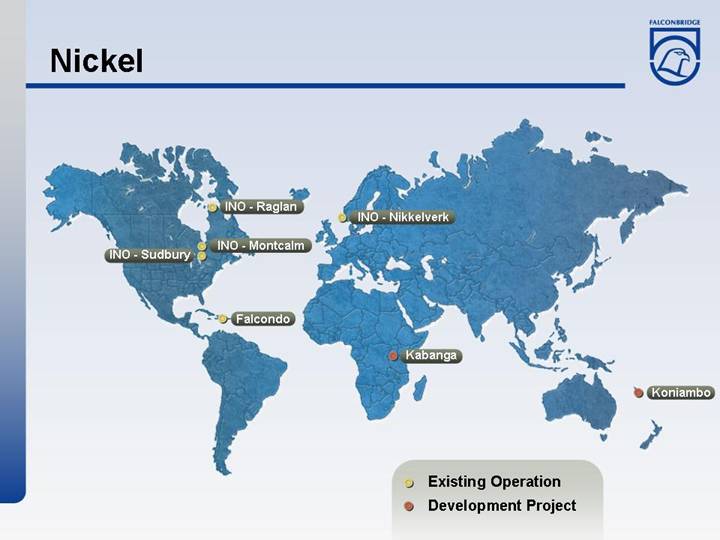

Operations around the World

Geographically diversified operating base

[GRAPHIC]

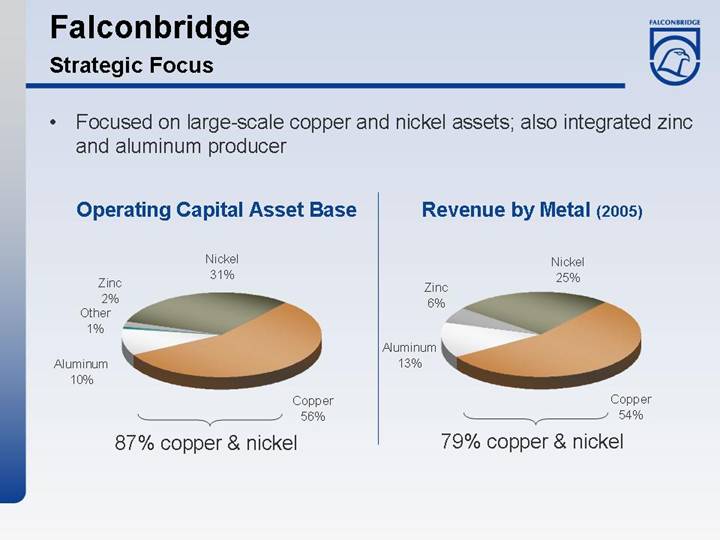

Falconbridge

Strategic Focus

• Focused on large-scale copper and nickel assets; also integrated zinc and aluminum producer

Operating Capital Asset Base | Revenue by Metal (2005) |

| |

[CHART] | [CHART] |

Production Outlook for 2006

Production (MT) | | Actual

2005 | | Forecast

2006 | |

| | | | | | | |

Copper | | | Mined | | 462,000 | | 475,000 | |

| Refined | | 544,000 | | 635,000 | |

| | | | | | | | |

Nickel | | | Mined | | 80,000 | | 82,000 | |

| Refined | | 114,000 | | 115,000 | |

| | | | | | | | |

Zinc | | | Mined | | 454,000 | | 460,000 | |

| Refined* | | 182,000 | | 210,000 | |

| | | | | | | | |

Aluminum | | | Primary | | 246,000 | | 250,000 | |

| Fabricated | | 178,000 | | 195,000 | |

* Includes 100% of Kidd Creek refinery production and 25% of the Noranda Income Fund CEZ Refinery production

Falconbridge – Subject of Two Takeover Offers

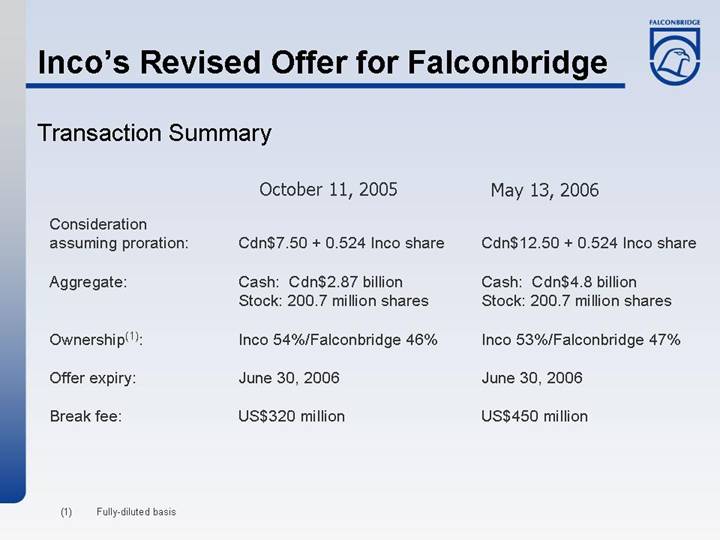

Inco’s Revised Offer for Falconbridge | | |

Transaction Summary

| | October 11, 2005 | | May 13, 2006 | |

| | | | | |

Consideration assuming proration: | | Cdn$7.50 + 0.524 Inco share | | Cdn$12.50 + 0.524 Inco share | |

| | | | | |

Aggregate: | | Cash: Cdn$2.87 billion

Stock: 200.7 million shares | | Cash: Cdn$4.8 billion

Stock: 200.7 million shares | |

| | | | | |

Ownership(1): | | Inco 54%/Falconbridge 46% | | Inco 53%/Falconbridge 47% | |

| | | | | |

Offer expiry: | | June 30, 2006 | | June 30, 2006 | |

| | | | | |

Break fee: | | US$320 million | | US$450 million | |

(1) Fully-diluted basis

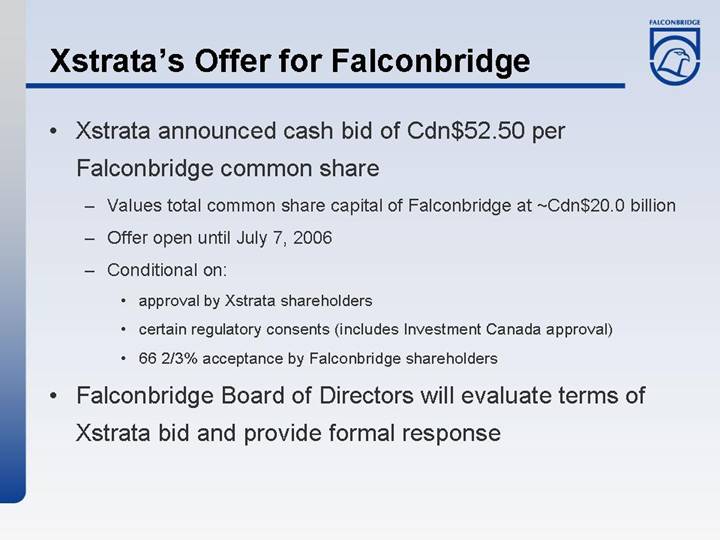

Xstrata’s Offer for Falconbridge

• Xstrata announced cash bid of Cdn$52.50 per Falconbridge common share

• Values total common share capital of Falconbridge at ~Cdn$20.0 billion

• Offer open until July 7, 2006

• Conditional on:

• approval by Xstrata shareholders

• certain regulatory consents (includes Investment Canada approval)

• 66 2/3% acceptance by Falconbridge shareholders

• Falconbridge Board of Directors will evaluate terms of Xstrata bid and provide formal response

Summary of Offers

Xstrata’s Offer For Falconbridge

• Cash bid of Cdn$52.50 per share

Inco’s Offer For Falconbridge

• Cdn$12.50 + 0.524 Inco share

• Falconbridge shareholders would participate in new company

• Maintain investment exposure to mining and metals industry

• Participate in growth and synergies

Why the Interest in Falconbridge?

Metal Markets | | |

Well Supported by Many Factors | | |

• Strong upward price momentum for all base metals supported by very solid fundamentals

• Many bullish drivers coinciding:

• Synchronized world economic growth

• Robust physical demand

• Production disruptions and shortfalls

• Critically low inventory levels

• Constraints on new supply

• Increasing interest from funds

Metal Markets Summary

• Very positive industry outlook

• Solid fundamentals

• Continued role of investment funds?

• Prices to remain volatile in short term

• Longer-term price outlook supportive of ongoing strong profitability

Operations Overview & Growth Opportunities

Copper

World-Class Assets

• World’s fourth-largest producer of refined copper

• Long-life, low-cost mines located primarily in South America

• Technologically advanced processing facilities, (Altonorte smelter in northern Chile, Horne and Kidd Creek in Canada)

• Technology produces high margins from treatment of complex feeds

• Integrated operations drive benefits

• Mitigate market volatility in treatment costs

• Create freight cost arbitrage

Falconbridge Total Mined Copper Output

[CHART]

Q1/06 net operating cash cost of $0.30/lb. versus $0.35/lb. in Q1/05

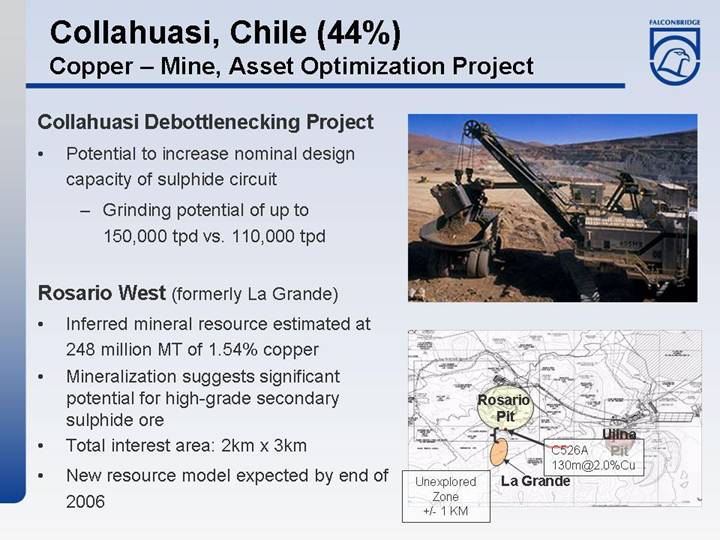

Collahuasi, Chile (44%)

Copper – Mine, Asset Optimization Project

Collahuasi Debottlenecking Project

• Potential to increase nominal design capacity of sulphide circuit

• Grinding potential of up to 150,000 tpd vs. 110,000 tpd

[GRAPHIC]

Rosario West (formerly La Grande)

• Inferred mineral resource estimated at 248 million MT of 1.54% copper

• Mineralization suggests significant potential for high-grade secondary sulphide ore

• Total interest area: 2km x 3km

• New resource model expected by end of 2006

[GRAPHIC]

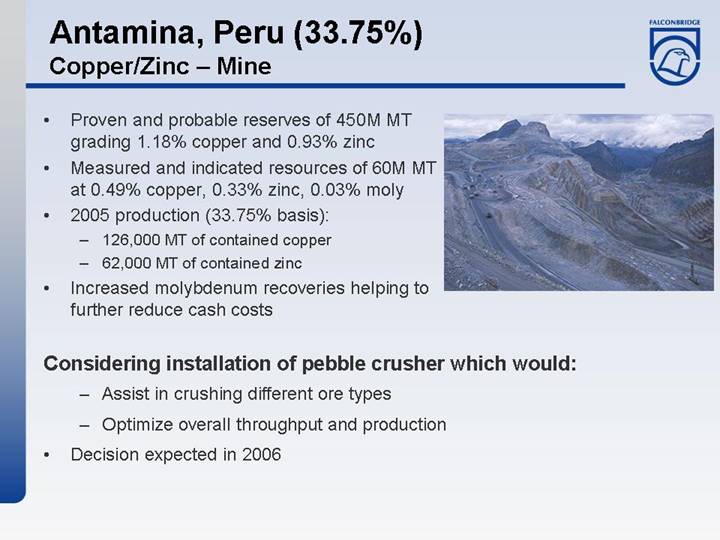

Antamina, Peru (33.75%)

Copper/Zinc – Mine

• Proven and probable reserves of 450M MT grading 1.18% copper and 0.93% zinc

• Measured and indicated resources of 60M MT at 0.49% copper, 0.33% zinc, 0.03% moly

• 2005 production (33.75% basis):

• 126,000 MT of contained copper

• 62,000 MT of contained zinc

• Increased molybdenum recoveries helping to further reduce cash costs

[GRAPHIC]

Considering installation of pebble crusher which would:

• Assist in crushing different ore types

• Optimize overall throughput and production

• Decision expected in 2006

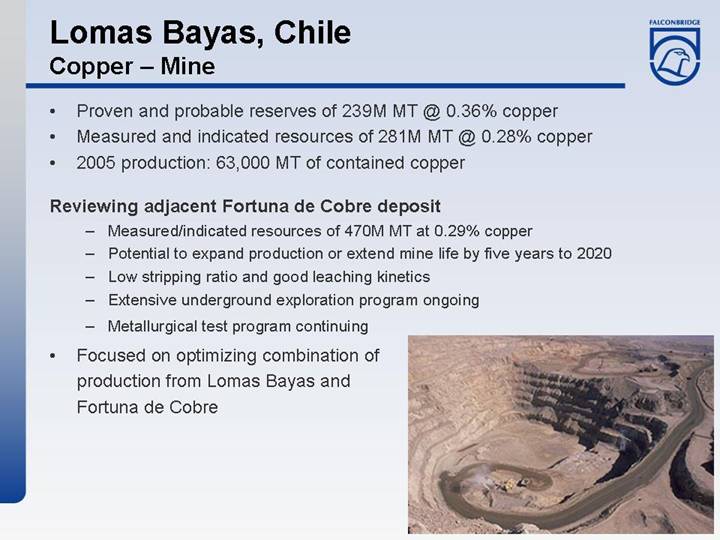

Lomas Bayas, Chile

Copper – Mine

• Proven and probable reserves of 239M MT @ 0.36% copper

• Measured and indicated resources of 281M MT @ 0.28% copper

• 2005 production: 63,000 MT of contained copper

Reviewing adjacent Fortuna de Cobre deposit

• Measured/indicated resources of 470M MT at 0.29% copper

• Potential to expand production or extend mine life by five years to 2020

• Low stripping ratio and good leaching kinetics

• Extensive underground exploration program ongoing

• Metallurgical test program continuing

• Focused on optimizing combination of production from Lomas Bayas and Fortuna de Cobre

[GRAPHIC]

Kidd Creek, Canada

Copper/Zinc – Mine

Kidd Mine D Project

• Mining operations transitioning to newly developed Mine D

• Improving operational stability and predictability as mine transition completed

• 2005 Production: 43,000 MT of contained copper, 120,000 MT of contained zinc

• Project completion expected by end of 2006

Kidd Mine Performance 2003 - 2007F

[CHART]

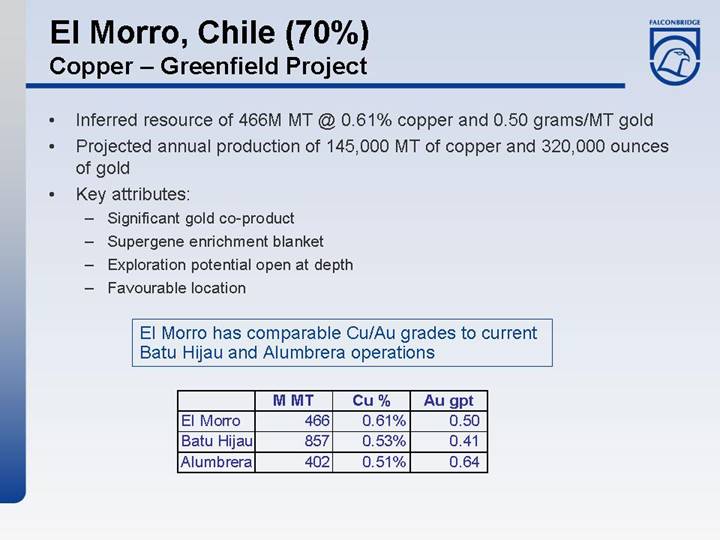

El Morro, Chile (70%)

Copper – Greenfield Project

• Inferred resource of 466M MT @ 0.61% copper and 0.50 grams/MT gold

• Projected annual production of 145,000 MT of copper and 320,000 ounces of gold

• Key attributes:

• Significant gold co-product

• Supergene enrichment blanket

• Exploration potential open at depth

• Favourable location

El Morro has comparable Cu/Au grades to current Batu Hijau and Alumbrera operations

| | M MT | | Cu % | | Au gpt | |

El Morro | | 466 | | 0.61 | % | 0.50 | |

Batu Hijau | | 857 | | 0.53 | % | 0.41 | |

Alumbrera | | 402 | | 0.51 | % | 0.64 | |

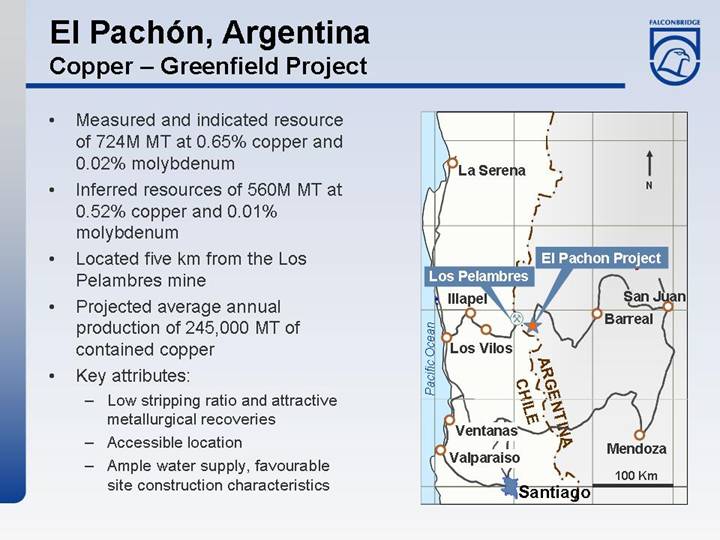

El Pachón, Argentina

Copper – Greenfield Project

• Measured and indicated resource of 724M MT at 0.65% copper and 0.02% molybdenum

• Inferred resources of 560M MT at 0.52% copper and 0.01% molybdenum

• Located five km from the Los Pelambres mine

• Projected average annual production of 245,000 MT of contained copper

• Key attributes:

• Low stripping ratio and attractive metallurgical recoveries

• Accessible location

• Ample water supply, favourable site construction characteristics

[GRAPHIC]

Copper

Substantial Growth Potential

(000s MT of contained copper)

[CHART]

(1) Collahuasi expansions includes debottlenecking project and a further expansion

(2) Other additions include Antamina, Kidd Creek Mine D and Nickel Rim South

* Share of production

Nickel

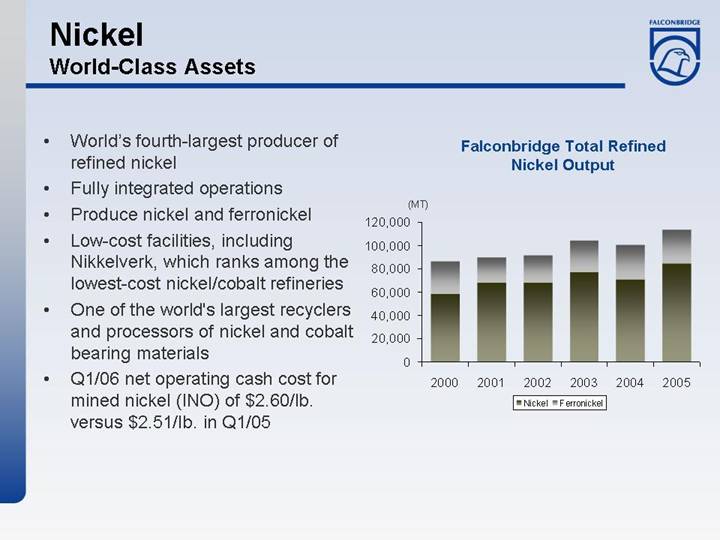

World-Class Assets

• World’s fourth-largest producer of refined nickel

• Fully integrated operations

• Produce nickel and ferronickel

• Low-cost facilities, including Nikkelverk, which ranks among the lowest-cost nickel/cobalt refineries

• One of the world’s largest recyclers and processors of nickel and cobalt bearing materials

• Q1/06 net operating cash cost for mined nickel (INO) of $2.60/lb. versus $2.51/lb. in Q1/05

Falconbridge Total Refined Nickel Output

[CHART]

Nickel Rim South, Canada

Nickel - Brownfield Project

• Resources of 13.4M MT of 1.8% nickel and 3.3% copper; significant PGMs

• Significantly improves resource base in Sudbury (20+ years)

• Project progressing on schedule and within budget

• Vent shaft sinking began in February 2005

• Main shaft sinking began in April 2005

• First ore production expected in late 2009

[GRAPHIC]

Raglan, Canada

Nickel – Throughput Optimization Project

Phase One – conversion of mill from autogenous to semi-autogenous grinding

• Completed in October 2005; on schedule and on budget

• Increased level of annual throughput to approximately one million MT of ore per year and increase mill’s ability to process harder ore

Phase Two – maximizing throughput capacity

• Involves expanding site infrastructure and ore production to allow for mining, milling and processing of 1.3 million tonnes of ore annually; resulting in 30,500 MT of annual contained nickel production

• Expected to be complete in early in 2008

[GRAPHIC]

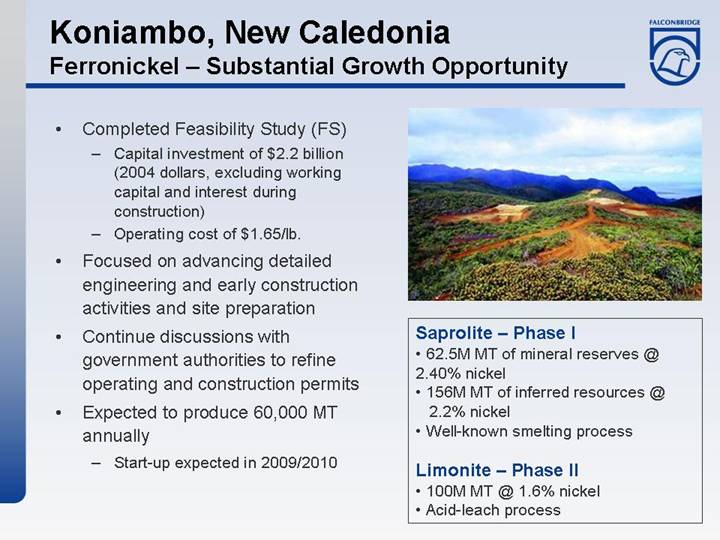

Koniambo, New Caledonia

Ferronickel – Substantial Growth Opportunity

• Completed Feasibility Study (FS)

• Capital investment of $2.2 billion (2004 dollars, excluding working capital and interest during construction)

• Operating cost of $1.65/lb.

• Focused on advancing detailed engineering and early construction activities and site preparation

• Continue discussions with government authorities to refine operating and construction permits

• Expected to produce 60,000 MT annually

• Start-up expected in 2009/2010

[GRAPHIC]

Saprolite – Phase I

• 62.5M MT of mineral reserves @ 2.40% nickel

• 156M MT of inferred resources @ 2.2% nickel

• Well-known smelting process

Limonite – Phase II

• 100M MT @ 1.6% nickel

• Acid-leach process

Kabanga, Tanzania

Nickel – Greenfield Project

• Agreement for joint venture with Barrick Gold

• Located in northwestern Tanzania ~ 400 km west of Bulyanhulu mine; Barrick has successfully operated there before

• Initial inferred resources estimate of 26M MT grading 2.6% nickel with potential for further growth

• Potential nickel production of 30,000 to 35,000 MT per year

• Completing a work plan over the next three years at a cost of $50 million

• Current work includes infill diamond drilling, geophysical surveys and metallurgical testing and engineering study work

[GRAPHIC]

Araguaia, Brazil

Nickel – Greenfield Project

• Promising new greenfield nickel discovery

• Discovered two greenfield nickel laterite deposits in State of Para in northern Brazil

• Deposit hosted in 90 km geological setting similar to that of other large deposits in Dominican Republic and in New Caledonia

• Deposit located on properties owned by Falconbridge or where it can acquire a 100% interest

• Company to pursue extensive exploration program

[GRAPHIC]

Impressive mineralization over thick intervals

Intercept

Examples | | Ni Grade

(%) | |

Serra do Tapa | | | |

52 metres | | 1.69 | |

61 metres | | 1.70 | |

Vale dos Sonhos | | | |

14 metres | | 1.92 | |

12 metres | | 1.58 | |

See press release dated Sept. 6, 2005

Nickel

Substantial Growth Potential

(000s MT of contained nickel)

[CHART]

* Share of production

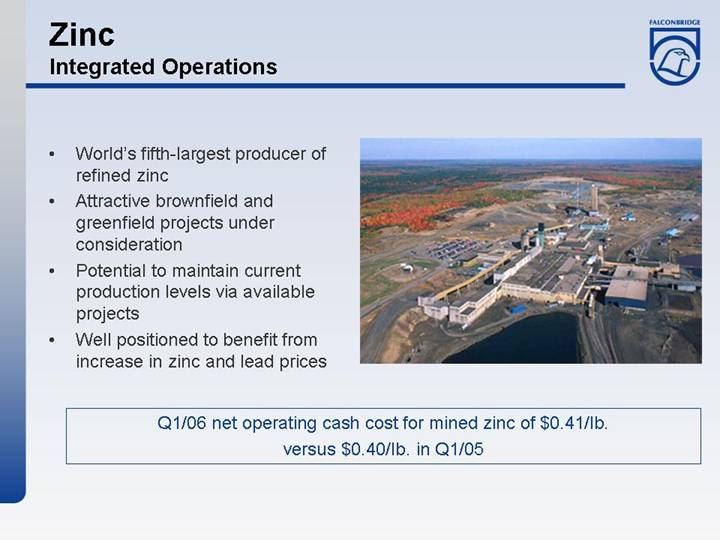

Zinc

Integrated Operations

• World’s fifth-largest producer of refined zinc

• Attractive brownfield and greenfield projects under consideration

• Potential to maintain current production levels via available projects

• Well positioned to benefit from increase in zinc and lead prices

[GRAPHIC]

Q1/06 net operating cash cost for mined zinc of $0.41/lb. versus $0.40/lb. in Q1/05

Lennard Shelf

Zinc - Mine

• Zinc mine located in Western Australia

• 50% Falconbridge, 50% Teck Cominco

• First concentrate production planned for early 2007

• Expected to produce 70,000-80,000 tonnes per year for three to four years (100% basis)

• Capex forecast is A$23 million, with additional A$5 million of pre-production costs (100% basis)

[GRAPHIC]

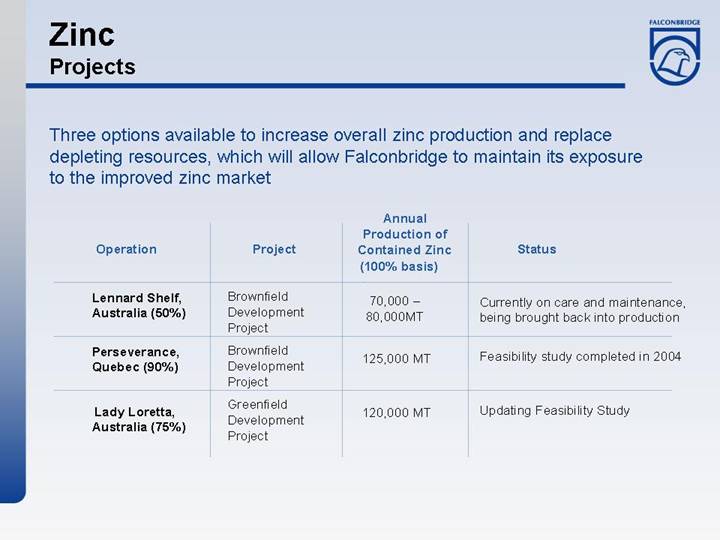

Zinc

Projects

Three options available to increase overall zinc production and replace depleting resources, which will allow Falconbridge to maintain its exposure to the improved zinc market

Operation | | Project | | Annual

Production of

Contained Zinc

(100% basis) | | Status | |

| | | | | | | |

Lennard Shelf, Australia (50%) | | Brownfield Development Project | | 70,000 – 80,000MT | | Currently on care and maintenance, being brought back into production | |

| | | | | | | |

Perseverance, Quebec (90%) | | Brownfield Development Project | | 125,000 MT | | Feasibility study completed in 2004 | |

| | | | | | | |

Lady Loretta, Australia (75%) | | Greenfield Development Project | | 120,000 MT | | Updating Feasibility Study | |

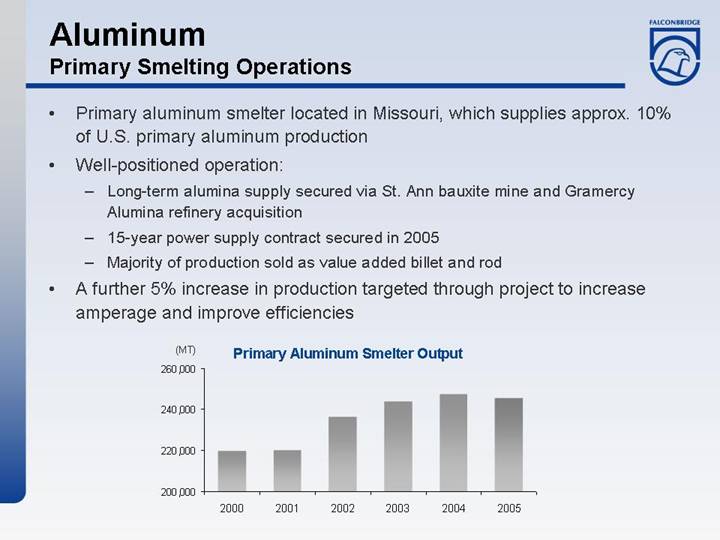

Aluminum

Primary Smelting Operations

• Primary aluminum smelter located in Missouri, which supplies approx. 10% of U.S. primary aluminum production

• Well-positioned operation:

• Long-term alumina supply secured via St. Ann bauxite mine and Gramercy Alumina refinery acquisition

• 15-year power supply contract secured in 2005

• Majority of production sold as value added billet and rod

• A further 5% increase in production targeted through project to increase amperage and improve efficiencies

Primary Aluminum Smelter Output

[CHART]

Aluminum

Fabricating Operations

• Third-largest foil producer in North America

• Large market share in fin stock, transformer sheet and light-gauge converter foil

• Record shipments in 2005 of 178,000 MT; Fab spreads increased by 10% in 2005

• Growing production volumes through reliability initiatives and elimination of bottlenecks

• New caster at Huntingdon increasing capacity by approx. 8.5%

• Shift in marketing strategy from filling orders to meet production capacity to selectively targeting market segments to maximize margins

Shipments (millions of lbs.)

[CHART]

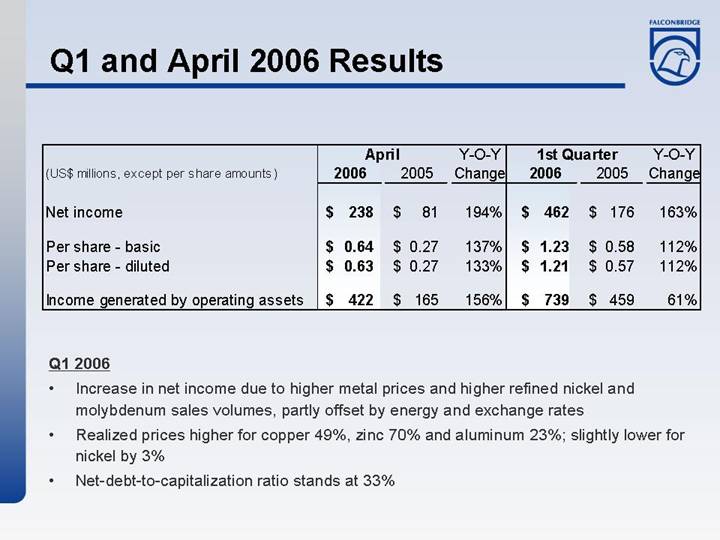

Q1 and April 2006 Results | |

| | April | | Y-O-Y | | 1st Quarter | | Y-O-Y | |

(US$ millions, except per share amounts) | | 2006 | | 2005 | | Change | | 2006 | | 2005 | | Change | |

| | | | | | | | | | | | | |

Net income | | $ | 238 | | $ | 81 | | 194 | % | $ | 462 | | $ | 176 | | 163 | % |

| | | | | | | | | | | | | |

Per share - basic | | $ | 0.64 | | $ | 0.27 | | 137 | % | $ | 1.23 | | $ | 0.58 | | 112 | % |

Per share - diluted | | $ | 0.63 | | $ | 0.27 | | 133 | % | $ | 1.21 | | $ | 0.57 | | 112 | % |

| | | | | | | | | | | | | |

Income generated by operating assets | | $ | 422 | | $ | 165 | | 156 | % | $ | 739 | | $ | 459 | | 61 | % |

Q1 2006

• Increase in net income due to higher metal prices and higher refined nickel and molybdenum sales volumes, partly offset by energy and exchange rates

• Realized prices higher for copper 49%, zinc 70% and aluminum 23%; slightly lower for nickel by 3%

• Net-debt-to-capitalization ratio stands at 33%

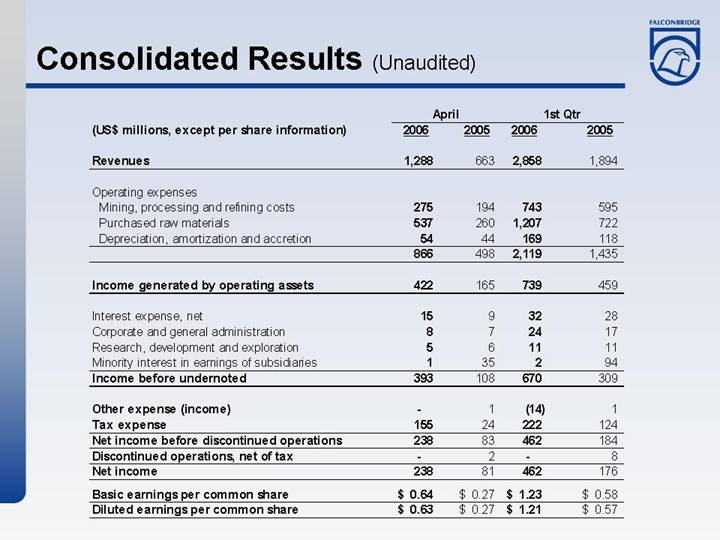

Consolidated Results (Unaudited)

| | April | | 1st Qtr | |

(US$ millions, except per share information) | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | |

Revenues | | 1,288 | | 663 | | 2,858 | | 1,894 | |

| | | | | | | | | |

Operating expenses | | | | | | | | | |

Mining, processing and refining costs | | 275 | | 194 | | 743 | | 595 | |

Purchased raw materials | | 537 | | 260 | | 1,207 | | 722 | |

Depreciation, amortization and accretion | | 54 | | 44 | | 169 | | 118 | |

| | 866 | | 498 | | 2,119 | | 1,435 | |

| | | | | | | | | |

Income generated by operating assets | | 422 | | 165 | | 739 | | 459 | |

| | | | | | | | | |

Interest expense, net | | 15 | | 9 | | 32 | | 28 | |

Corporate and general administration | | 8 | | 7 | | 24 | | 17 | |

Research, development and exploration | | 5 | | 6 | | 11 | | 11 | |

Minority interest in earnings of subsidiaries | | 1 | | 35 | | 2 | | 94 | |

Income before undernoted | | 393 | | 108 | | 670 | | 309 | |

| | | | | | | | | |

Other expense (income) | | — | | 1 | | (14 | ) | 1 | |

Tax expense | | 155 | | 24 | | 222 | | 124 | |

Net income before discontinued operations | | 238 | | 83 | | 462 | | 184 | |

Discontinued operations, net of tax | | — | | 2 | | — | | 8 | |

Net income | | 238 | | 81 | | 462 | | 176 | |

Basic earnings per common share | | $ | 0.64 | | $ | 0.27 | | $ | 1.23 | | $ | 0.58 | |

Diluted earnings per common share | | $ | 0.63 | | $ | 0.27 | | $ | 1.21 | | $ | 0.57 | |

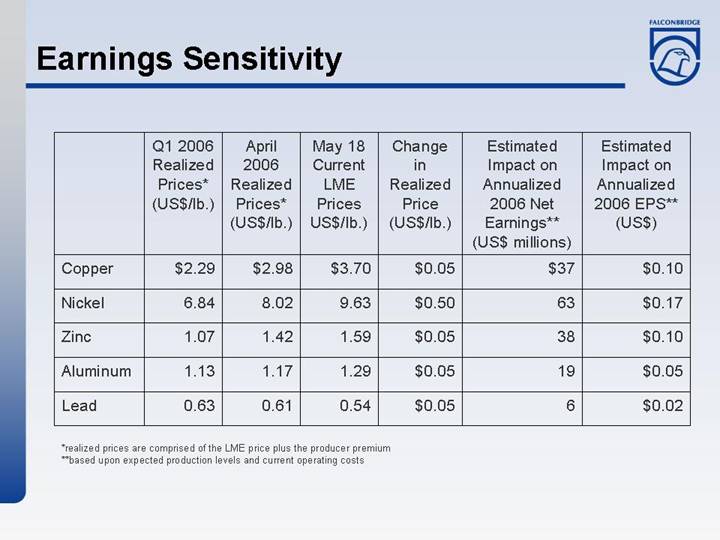

Earnings Sensitivity

| | Q1 2006

Realized

Prices* | | April

2006

Realized

Prices* | | May 18

Current

LME

Prices | | Change

in

Realized

Price | | Estimated

Impact on

Annualized

2006 Net

Earnings** | | Estimated

Impact on

Annualized

2006 EPS** | |

| | (US$/lb.) | | (US$/lb.) | | US$/lb.) | | (US$/lb.) | | (US$millions) | | (US$) | |

Copper | | $ | 2.29 | | $ | 2.98 | | $ | 3.70 | | $ | 0.05 | | $ | 37 | | $ | 0.10 | |

Nickel | | 6.84 | | 8.02 | | 9.63 | | $ | 0.50 | | 63 | | $ | 0.17 | |

Zinc | | 1.07 | | 1.42 | | 1.59 | | $ | 0.05 | | 38 | | $ | 0.10 | |

Aluminum | | 1.13 | | 1.17 | | 1.29 | | $ | 0.05 | | 19 | | $ | 0.05 | |

Lead | | 0.63 | | 0.61 | | 0.54 | | $ | 0.05 | | 6 | | $ | 0.02 | |

| | | | | | | | | | | | | | | | | | | |

*realized prices are comprised of the LME price plus the producer premium

**based upon expected production levels and current operating costs

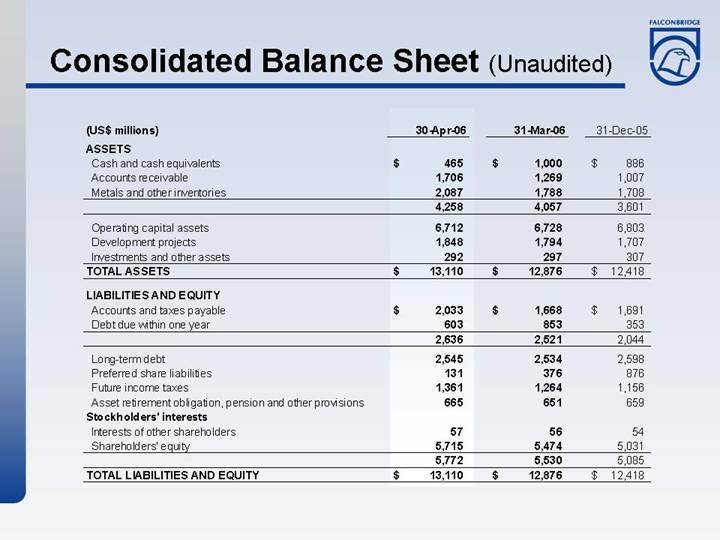

Consolidated Balance Sheet (Unaudited)

(US$ millions) | | 30-Apr-06 | | 31-Mar-06 | | 31-Dec-05 | |

ASSETS | | | | | | | |

Cash and cash equivalents | | $ | 465 | | $ | 1,000 | | $ | 886 | |

Accounts receivable | | 1,706 | | 1,269 | | 1,007 | |

Metals and other inventories | | 2,087 | | 1,788 | | 1,708 | |

| | 4,258 | | 4,057 | | 3,601 | |

| | | | | | | |

Operating capital assets | | 6,712 | | 6,728 | | 6,803 | |

Development projects | | 1,848 | | 1,794 | | 1,707 | |

Investments and other assets | | 292 | | 297 | | 307 | |

TOTAL ASSETS | | $ | 13,110 | | $ | 12,876 | | $ | 12,418 | |

| | | | | | | |

LIABILITIES AND EQUITY | | | | | | | |

Accounts and taxes payable | | $ | 2,033 | | $ | 1,668 | | $ | 1,691 | |

Debt due within one year | | 603 | | 853 | | 353 | |

| | 2,636 | | 2,521 | | 2,044 | |

| | | | | | | |

Long-term debt | | 2,545 | | 2,534 | | 2,598 | |

Preferred share liabilities | | 131 | | 376 | | 876 | |

Future income taxes | | 1,361 | | 1,264 | | 1,156 | |

Asset retirement obligation, pension and other provisions | | 665 | | 651 | | 659 | |

Stockholders’ interests | | | | | | | |

Interests of other shareholders | | 57 | | 56 | | 54 | |

Shareholders’ equity | | 5,715 | | 5,474 | | 5,031 | |

| | 5,772 | | 5,530 | | 5,085 | |

TOTAL LIABILITIES AND EQUITY | | $ | 13,110 | | $ | 12,876 | | $ | 12,418 | |

Capital Investments

(US$ millions) | | 2006F | | 2005 | |

Copper | Copper development projects | | | | | |

| (El Morro, El Pachon, Lomas Bayas) | | $ | 50 | | $ | 4 | |

| Kidd Creek Mine extension | | $ | 90 | | $ | 114 | |

| | | | | | |

Nickel | Koniambo | | $ | 180 | | $ | 96 | |

| Nickel Rim South | | $ | 85 | | $ | 74 | |

| Nickel development projects | | | | | |

| (Kabanga, Raglan) | | $ | 30 | | $ | 61 | |

| | | | | | |

Sustaining capital and other | | $ | 315 | | $ | 388 | |

Total Capital Investments | | $ | 750 | | $ | 737 | |

Inco-Falconbridge Transaction

Inco’s Offer to Acquire Falconbridge

Acquisition Highlights | | |

• Global leader in nickel and leading copper company

• Outstanding nickel and copper growth prospects

• Strong cash flow and financial strength to grow

• US$390 million in annual synergies identified

• Significantly accretive

• Reduced risk profile

• Enhanced share liquidity

• Potential re-rating in capital markets

Inco’s offer to acquire Falconbridge

World Leader in Nickel, Strong Position in Copper

[GRAPHIC]

• Leading nickel position

• Excellent copper position

• World-class operations

• Enviable reserves and growth prospects

• Solid, global marketing position

• At forefront of technological capability in our industry

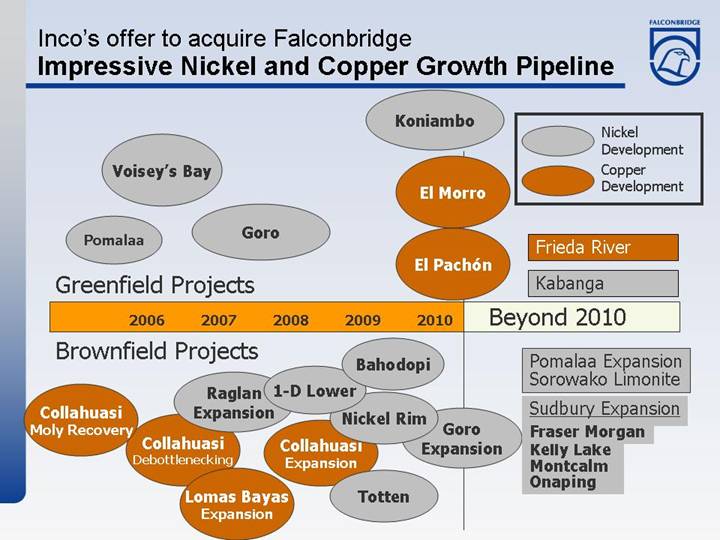

Inco’s offer to acquire Falconbridge

Impressive Nickel and Copper Growth Pipeline

[CHART]

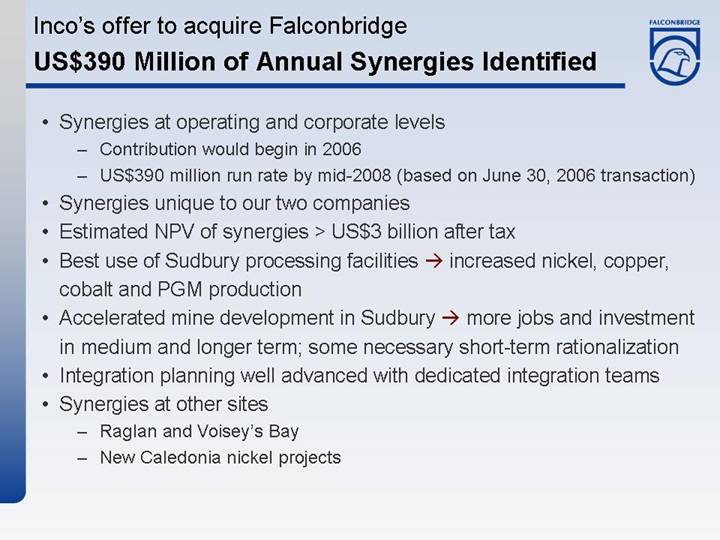

Inco’s offer to acquire Falconbridge

US$390 Million of Annual Synergies Identified

• Synergies at operating and corporate levels

• Contribution would begin in 2006

• US$390 million run rate by mid-2008 (based on June 30, 2006 transaction)

• Synergies unique to our two companies

• Estimated NPV of synergies > US$3 billion after tax

• Best use of Sudbury processing facilities à increased nickel, copper, cobalt and PGM production

• Accelerated mine development in Sudbury à more jobs and investment in medium and longer term; some necessary short-term rationalization

• Integration planning well advanced with dedicated integration teams

• Synergies at other sites

• Raglan and Voisey’s Bay

• New Caledonia nickel projects

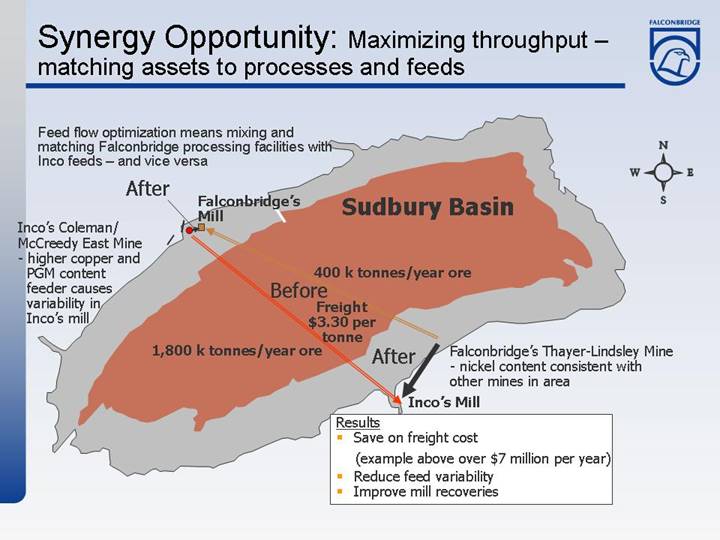

Synergy Opportunity: Maximizing throughput – matching assets to processes and feeds

[GRAPHIC]

Synergy Opportunity:

Feed flow optimization

[GRAPHIC]

• Reconfigure Clarabelle mill processing circuit to produce copper concentrate to feed Falconbridge’s Kidd Creek smelter

Benefits to new Inco:

• Increases nickel smelting capacity and nickel production while avoiding capital expenditures that would otherwise be required

• Reduces working capital

• Reduces freight charges

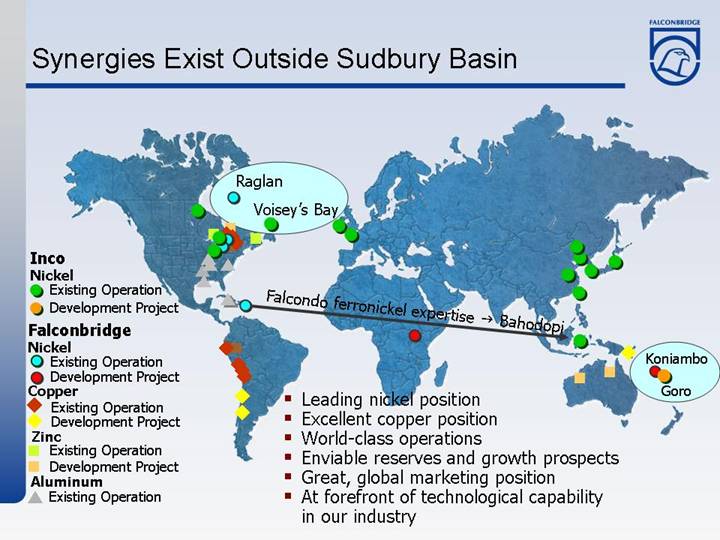

Synergies Exist Outside Sudbury Basin

[GRAPHIC]

• Leading nickel position

• Excellent copper position

• World-class operations

• Enviable reserves and growth prospects

• Great, global marketing position

• At forefront of technological capability in our industry

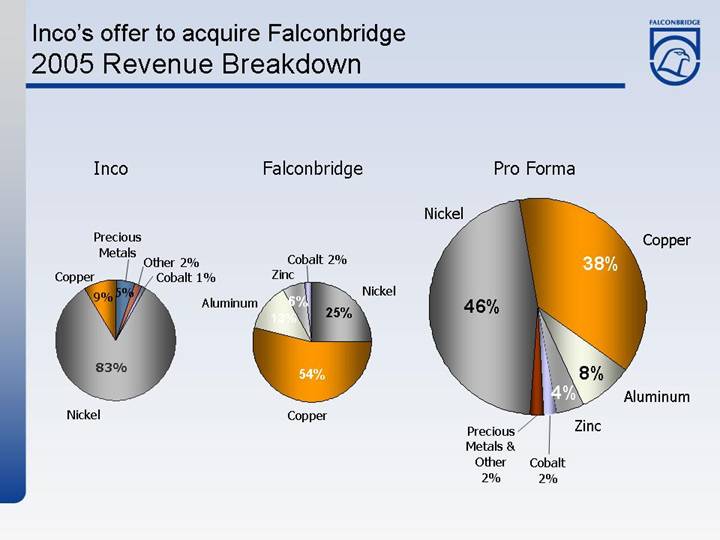

Inco’s offer to acquire Falconbridge

2005 Revenue Breakdown

Inco | Falconbridge | Pro Forma |

| | |

[CHART] | [CHART] | [CHART] |

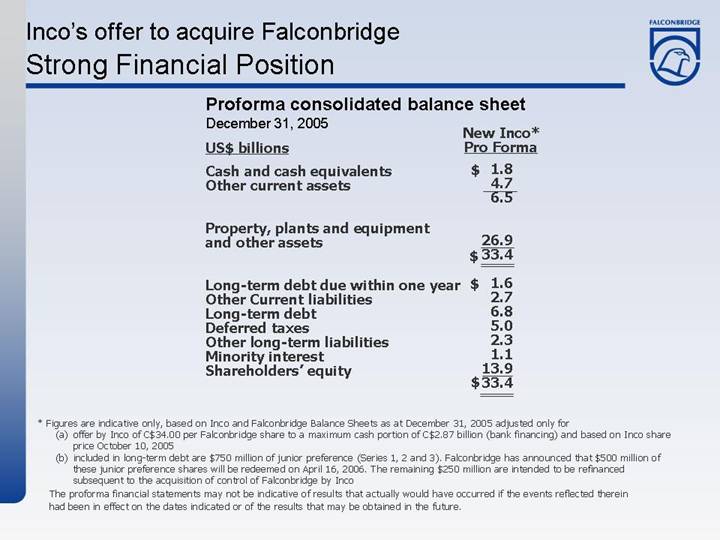

Inco’s offer to acquire Falconbridge

Strong Financial Position

Proforma consolidated balance sheet

December 31, 2005

US$ billions | | New Inco*

Pro Forma | |

| | | |

Cash and cash equivalents | | $ | 1.8 | |

Other current assets | | 4.7 | |

| | 6.5 | |

| | | |

Property, plants and equipment and other assets | | 26.9 | |

| | $ | 33.4 | |

Long-term debt due within one year | | $ | 1.6 | |

Other Current liabilities | | 2.7 | |

Long-term debt | | 6.8 | |

Deferred taxes | | 5.0 | |

Other long-term liabilities | | 2.3 | |

Minority interest | | 1.1 | |

Shareholders’ equity | | 13.9 | |

| | $ | 33.4 | |

* Figures are indicative only, based on Inco and Falconbridge Balance Sheets as at December 31, 2005 adjusted only for

(a) offer by Inco of C$34.00 per Falconbridge share to a maximum cash portion of C$2.87 billion (bank financing) and based on Inco share price October 10, 2005

(b) included in long-term debt are $750 million of junior preference (Series 1, 2 and 3). Falconbridge has announced that $500 million of these junior preference shares will be redeemed on April 16, 2006. The remaining $250 million are intended to be refinanced subsequent to the acquisition of control of Falconbridge by Inco

The proforma financial statements may not be indicative of results that actually would have occurred if the events reflected therein had been in effect on the dates indicated or of the results that may be obtained in the future.

Inco’s offer to acquire Falconbridge

Proforma Enterprise Value (1)

[CHART]

(1) “Enterprise value” means the market capitalization as of May 12, 2006 plus most recently publicly reported net debt

(2) Sum of standalone enterprise values based on May 12, 2006 closing prices and net debt (debt less cash) as of March 31, 2006. Indicative values only, as at May 12, 2006. Future values could change.

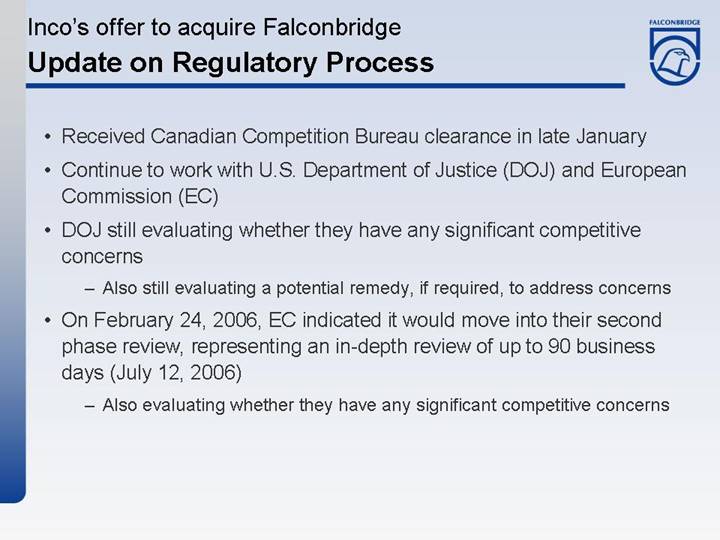

Inco’s offer to acquire Falconbridge

Update on Regulatory Process

• Received Canadian Competition Bureau clearance in late January

• Continue to work with U.S. Department of Justice (DOJ) and European Commission (EC)

• DOJ still evaluating whether they have any significant competitive concerns

• Also still evaluating a potential remedy, if required, to address concerns

• On February 24, 2006, EC indicated it would move into their second phase review, representing an in-depth review of up to 90 business days (July 12, 2006)

• Also evaluating whether they have any significant competitive concerns

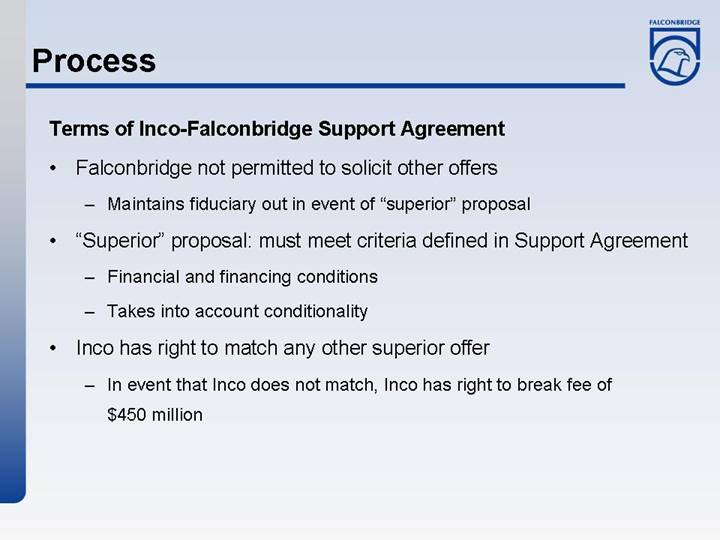

Process

Terms of Inco-Falconbridge Support Agreement

• Falconbridge not permitted to solicit other offers

• Maintains fiduciary out in event of “superior” proposal

• “Superior” proposal: must meet criteria defined in Support Agreement

• Financial and financing conditions

• Takes into account conditionality

• Inco has right to match any other superior offer

• In event that Inco does not match, Inco has right to break fee of $450 million

Falconbridge Today

In an Excellent Position | | |

• Falconbridge remains in an excellent position to add value for shareholders

• Strong industry fundamentals for all our metals

• Solid operating base with upside potential

• World-class greenfield and brownfield growth projects

• Impressive financial performance

Falconbridge Limited

Corporate Profile

Goldman Sachs

Basic Materials Conference

May 24, 2006

Important Legal Information | | |

• This communication is being made in respect of Inco Limited’s proposed combination with Falconbridge Limited. Inco has filed with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form F-8 (containing an offer to purchase and a share exchange take-over bid circular) and amendments thereto, and, if required, will file other documents with the SEC in connection with the proposed combination. Falconbridge has filed a Schedule 14D-9F with the SEC in connection with Inco’s offer and has filed and, if required, will file other documents regarding the proposed combination with the SEC.

• INVESTORS AND SECURITYHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

• Investors and security holders may obtain copies of the registration statement and Inco’s and Falconbridge’s SEC filings free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Inco may be obtained free of charge by contacting Inco’s media or investor relations departments. Documents filed with the SEC by Falconbridge may be obtained free of charge by contacting Falconbridge’s investor relations department.

• Filings made by Inco and Falconbridge with Canadian securities regulatory authorities, including filings made in connection with the offer, are available at www.sedar.com.