Searchable text section of graphics shown above

[LOGO]

Shaping the Future: Creating a Global Industry Leader

Forward-Looking Statements

These materials include "forward-looking statements" (as defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) including statements regarding, among other things, the benefits of the combination with Inco and the combined company’s plans, objectives, expectations and intentions.

All statements other than historical information are forward-looking statements.

These forward-looking statements are based on management’s current beliefs and expectations, speak only as of the date made, and are subject to a number of significant risks and uncertainties that cannot be predicted or quantified and are beyond our control.

Future developments and actual results could differ materially from those set forth in, contemplated by or underlying the forward-looking statements.

The following factors, among others, could cause actual results to differ from those described in the forward-looking statements in this document: (i) the ability to obtain governmental approvals of the combination on the proposed terms and schedule; (ii) the failure of Inco’s shareholders to approve the plan of arrangement; (iii) the failure of Phelps Dodge’s shareholders to authorize the issuance of Phelps Dodge common shares, the change of Phelps Dodge’s name to (Phelps Dodge Inco) and an increase in the size of Phelps Dodge’s board of directors as required under the combination agreement; (iv) the risks that the businesses of Phelps Dodge and Inco and/or Falconbridge will not be integrated successfully; (v) the risks that the cost savings, growth prospects and any other synergies from the combination may not be fully realized or may take longer to realize than expected; (vi) the risks that the cost savings, growth prospects and any other synergies from the combination may not be fully realized or may take longer to realize than expected; (vi) the combined company’s inability to refinance indebtedness incurred in connection with the combination on favorable terms or at all; (vii) the possibility that Phelps Dodge will combine with Inco only; (viii) the possible impairment of goodwill resulting from the combination and the resulting impact on the combined company’s assets and earnings; and (ix) additional factors that may affect future results of the combined company set forth in Phelps Dodge’s, Inco’s and Falconbridge’s filings with the Securities and Exchange Commission, which filings are available at the SEC’s Web site at (www.sec.gov).

Except as required by law, we are under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise.

Forward-Looking Statements for Falconbridge Shareholders

Certain statements contained in this News Release are forward-looking statements (as defined in applicable securities legislation). Examples of such statements include, but are not limited to, statements concerning Inco's offer to acquire all of the common shares of Falconbridge and the anticipated timing for completion of such offer and ancillary transactions upon the requisite regulatory approvals having been obtained. Inherent in forward-looking statements are risks and uncertainties well beyond our ability to predict or control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this News Release.

Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about all of the conditions to the Inco offer being met and the successful completion of a second step business combination transaction.

Inherent in those statements are known and unknown risks, uncertainties and other factors well beyond the Company's ability to control or predict. Some of these known risks and uncertainties are outlined in filings by Falconbridge with applicable securities regulatory authorities, including in Falconbridge's annual information form. Readers are encouraged to consult such filings. While Falconbridge anticipates that subsequent events and developments may cause Falconbridge's views to change, the Company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this News Release. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. These factors are not intended to represent a complete list of the factors that could affect Falconbridge and the combination of Inco and Falconbridge.

Falconbridge Limited is a leading copper and nickel company with investments in fully-integrated zinc and aluminum assets. Its primary focus is the identification and development of world-class copper and nickel mineral deposits. It employs 14,500 people at its operations and offices in 18 countries. Falconbridge's common shares are listed on the New York Stock Exchange (FAL) and the Toronto Stock Exchange (FAL). Falconbridge's website can be found at www.falconbridge.com.

Note: All dollar amounts are expressed in U.S. dollars unless otherwise noted.

Important Legal Information for Falconbridge Shareholders

Important Legal Information

This communication is being made in respect of Inco Limited’s proposed combination with Falconbridge Limited. Inco has filed with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form F-8 (containing an offer to purchase and a share exchange take-over bid circular) and amendments thereto, and, if required, will file other documents with the SEC in connection with the proposed combination. Falconbridge has filed a Schedule 14D-9F and an amendment thereto with the SEC in connection with Inco’s offer and has filed and, if required, will file other documents regarding the proposed combination with the SEC.

INVESTORS AND SECURITYHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors and security holders may obtain copies of the registration statement and Inco’s and Falconbridge’s SEC filings free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Inco may be obtained free of charge by contacting Inco’s media or investor relations departments. Documents filed with the SEC by Falconbridge may be obtained free of charge by contacting Falconbridge’s investor relations department.

Filings made by Inco and Falconbridge with Canadian securities regulatory authorities, including filings made in connection with the offer, are available at www.sedar.com.

Supplemental Data

These materials also include terms used to describe supplemental data.

Any such data or terms are not a substitute for any U.S. generally accepted accounting principle measure and should be evaluated within the context of our U.S. GAAP results.

Any such references may not be comparable to similarly titled measures reported by other companies.

As required by Regulation G, we have posted on our Web site – www.phelpsdodge.com – a full reconciliation of non-GAAP financial measures to U.S. GAAP financial measures.

Unless otherwise indicated, all information in this presentation relating to Phelps Dodge is on a post-FIN-46 basis (i.e., Candelaria and El Abra are fully consolidated with minority interests shown separately rather than a pro rata consolidation).

Note: In connection with the proposed combination, Phelps Dodge intends to file a preliminary proxy statement on Schedule 14A with the SEC. Investors are urged to read the proxy statement (including all amendments and supplements to it) when it is filed because it contains important information. Investors may obtain free copies of the proxy statement, as well as other filings containing information about Phelps Dodge, Inco and Falconbridge, without charge, at the SEC’s Web site (www.sec.gov). Copies of Phelps Dodge’s filings may also be obtained without charge from Phelps Dodge at Phelps Dodge’s Web site (www.phelpsdodge.com) or by directing a request to Phelps Dodge, One North Central Avenue, Phoenix, Arizona 85004-4415, Attention: Assistant General Counsel and Corporate Secretary, (602) 366-9100.

Webcast Details

Webcast:

www.phelpsdodgeinco.com

www.phelpsdodge.com

www.inco.com

www.falconbridge.com

Key Participants

• J. Steven Whisler

Chairman and Chief Executive Officer - Phelps Dodge

• Scott M. Hand

Chairman and Chief Executive Officer - Inco

• Derek G. Pannell

Chief Executive Officer - Falconbridge

• Timothy R. Snider

President and Chief Operating Officer - Phelps Dodge

• Ramiro G. Peru

Executive Vice President and Chief Financial Officer - Phelps Dodge

[LOGO]

Transaction Rationale

Creating a Global Industry Leader

• Preeminent North American-based miner

• Industry leader in safe production

• Pro forma enterprise value of US$56 billion (1)

• Diversity of commodities, markets and geographies

• Leading global market positions

#1 in nickel #2 in molybdenum

#2 in copper #3 in cobalt

• Quality assets with long-lived reserves

• Global scale with superior growth pipeline

• Proven operating capabilities, project management and industry-leading technology

• Significant synergies of approximately $900 million

• Combination of experienced and proven management teams

• Financial strength and capital access to invest in growth

• Clear potential for multiple expansion

(1) Pro forma enterprise value as of June 23, 2006

Agreed Transaction

Offer Price: | • C$80.13/share for Inco • C$62.11/share for Falconbridge |

| |

Premium (1): | • 22.8% for Inco • 11.9% for Falconbridge |

| |

Consideration Mix: | • C$17.50 + 0.672 Phelps Dodge shares for each Inco share |

| |

| • Approximately C$14 billion in cash (three-way) • Approximately 301 million shares (three-way) |

| |

Structure: | • Plan of Arrangement • Amended Support Agreement • Up to US$5.0 billion Share Repurchase Program • Inclusive of up to US$3.0 billion Convertible Subordinated Note purchase commitment |

| |

Key Conditions: | • Phelps Dodge and Inco shareholder votes • Not conditioned on Inco / Falconbridge merger completion • Regulatory approvals |

| |

Name: | • Phelps Dodge Inco Corporation |

Headquarters: | • Corporate, Copper Division: Phoenix, Arizona • Nickel Division: Toronto, Ontario |

Timing: | • Expected close: September 2006 |

(1) Premium to June 23, 2006, closing price

Creation of a Global Industry Leader

Enterprise Value

(US$ in billions)

“Super Majors”

BHP Billiton | Rio Tinto | Anglo | CVRD | Phelps Dodge Inco | Alcoa | Xstrata | Barrick | Newmont | Alcan | Norilsk |

123 | 80 | 68 | 59 | 56 | 33 | 30 | 28 | 23 | 22 | 18 |

Note: Stock prices as of June 23, 2006. Phelps Dodge Inco based on pro forma standalone enterprise values and does not include any impact of multiple re-rating or synergies. “Enterprise Value” means equity value plus net debt, preferred stock and minority interest less investments in unconsolidated affiliates.

Scale and Breadth of Core Operations

[MAP]

Phelps Dodge Today • 13,500 employees • Operations, projects and offices in 23 countries | Inco Today • 12,000 employees • Operations, projects and offices in 12 countries | Falconbridge Today • 14,500 employees • Operations, projects and offices in 18 countries | Phelps Dodge Inco • 40,000 employees • Operations, projects and offices in more than 40 countries |

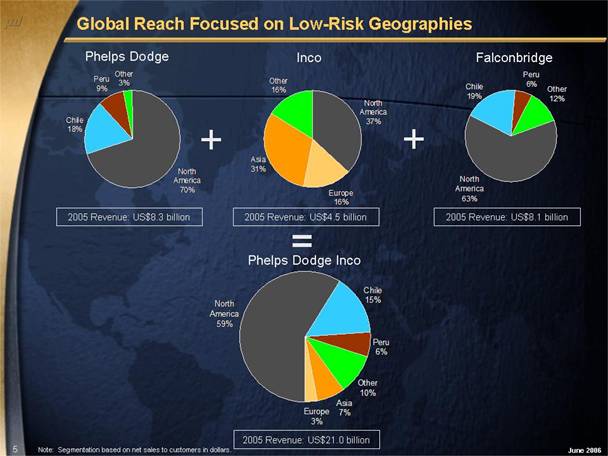

Global Reach Focused on Low-Risk Geographies

Phelps Dodge

North America | Chile | Peru | Other |

70% | 18% | 9% | 3% |

2005 Revenue: US$8.3 billion

Inco

North America | Europe | Asia | Other |

37% | 16% | 31% | 16% |

2005 Revenue: US$4.5 billion

Falconbridge

North America | Chile | Peru | Other |

63% | 19% | 6% | 12% |

2005 Revenue: US$8.1 billion

Phelps Dodge Inco

North America | Chile | Peru | Other | Asia | Europe |

59% | 15% | 6% | 10% | 7% | 3% |

2005 Revenue: US$21.0 billion

Note: Segmentation based on net sales to customers in dollars.

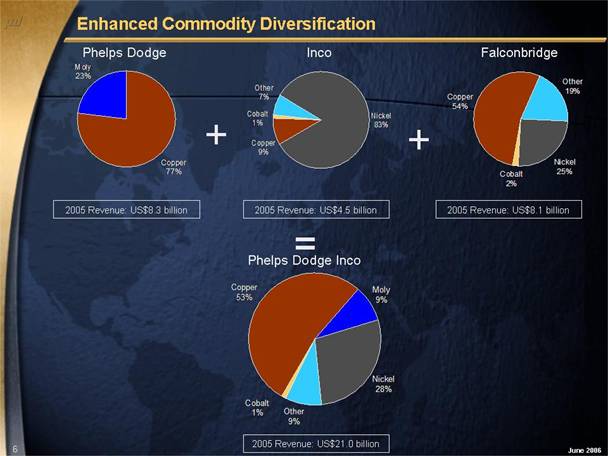

Enhanced Commodity Diversification

Phelps Dodge

2005 Revenue: US$8.3 billion

Inco

Copper | Cobalt | Other | Nickel |

9% | 1% | 7% | 83% |

2005 Revenue: US$4.5 billion

Falconbridge

Copper | Other | Nickel | Cobalt |

54% | 19% | 25% | 2% |

2005 Revenue: US$8.1 billion

Phelps Dodge Inco

Copper | Moly | Nickel | Other | Cobalt |

53% | 9% | 28% | 9% | 1% |

2005 Revenue: US$21.0 billion

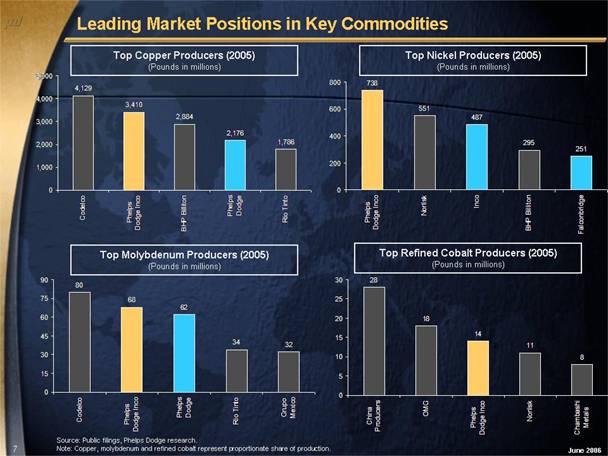

Leading Market Positions in Key Commodities

Top Copper Producers (2005)

(Pounds in millions)

4,129 | 3,410 | 2,884 | 2,176 | 1,786 |

Codelco | Phelps Dodge Inco | BHP Billiton | Phelps Dodge | Rio Tinto |

Top Nickel Producers (2005)

(Pounds in millions)

738 | 551 | 487 | 295 | 251 |

Phelps Dodge Inco | Norilsk | Inco | BHP Billiton | Falconbridge |

Top Molybdenum Producers (2005)

(Pounds in millions)

80 | 68 | 62 | 34 | 32 |

Codelco | Phelps Dodge Inco | Phelps Dodge | Rio Tinto | Grupo Mexico |

Top Refined Cobalt Producers (2005)

(Pounds in millions)

28 | 18 | 14 | 11 | 8 |

China Producers | OMG | Phelps Dodge Inco | Norilsk | Chambashi Metals |

Source: Public filings, Phelps Dodge research.

Note: Copper, molybdenum and refined cobalt represent proportionate share of production.

Commitment to Excellence

• Industry leader in safety - Zero and Beyond

• Committed to working with communities in which we do business

• Environmental responsibility a key part of doing business

• $400 million trust fund

• Accelerated reclamation and remediation

1987 | 1988 | 1989 | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 |

12.2 | 11.2 | 9.1 | 7.2 | 5.4 | 4.6 | 3.1 | 3.4 | 2.7 | 1.8 | 2.4 | 1.97 | 1.7 | 1.7 | 0.8 | 1.63 | 1.43 | 1.58 | 1.77 |

Phelps Dodge Total Recordable Injury Rate (TRIR)

U.S. Manufacturing Average = 5.9x

U.S. Mining Industry Average = 4.1x

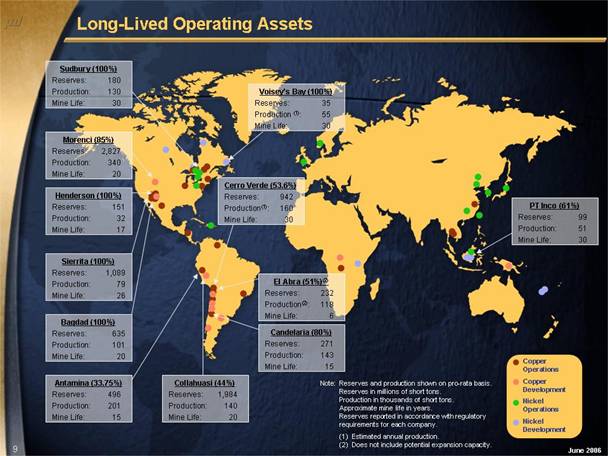

Long-Lived Operating Assets

Sudbury (100%)

Reserves: 180

Production: 130

Mine Life: 30

Morenci (85%)

Reserves: 2,827

Production: 340

Mine Life: 20

Antamina (33.75%)

Reserves: 496

Production: 201

Mine Life: 15

Collahuasi (44%)

Reserves: 1,984

Production: 140

Mine Life: 20

Candelaria (80%)

Reserves: 271

Production: 143

Mine Life: 15

El Abra (51%)(2)

Reserves: 232

Production(2): 118

Mine Life: 6

Voisey’s Bay (100%)

Reserves: 35

Production (1): 55

Mine Life: 30

PT Inco (61%)

Reserves: 99

Production: 51

Mine Life: 30

Bagdad (100%)

Reserves: 635

Production: 101

Mine Life: 20

Henderson (100%)

Reserves: 151

Production: 32

Mine Life: 17

Sierrita (100%)

Reserves: 1,089

Production: 79

Mine Life: 26

Cerro Verde (53.6%)

Reserves: 942

Production(1): 160

Mine Life: 30

Copper Operations Copper Development Nickel Operations Nickel Development

Note:

Reserves and production shown on pro-rata basis.

Reserves in millions of short tons.

Production in thousands of short tons.

Approximate mine life in years.

Reserves reported in accordance with regulatory requirements for each company.

(1) Estimated annual production.

(2) Does not include potential expansion capacity.

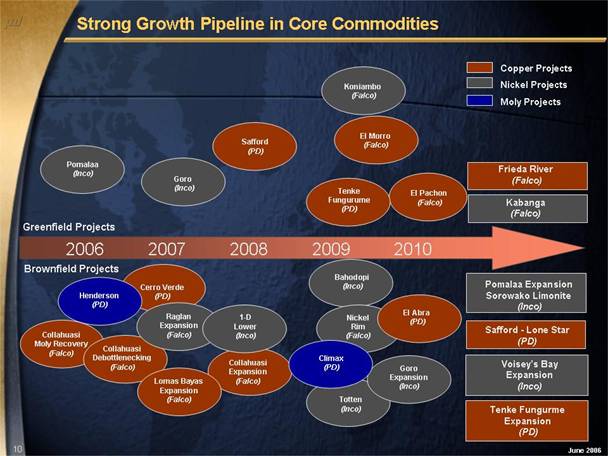

Strong Growth Pipeline in Core Commodities

Cerro Verde (PD) Goro (Inco) Koniambo (Falco) El Morro (Falco) El Pachon (Falco) Copper Projects Nickel Projects Moly Projects Pomalaa (Inco)

Greenfield Projects

2010 2009 2008 2007 2006

Brownfield Projects

Frieda River (Falco) Kabanga (Falco) Collahuasi Moly Recovery (Falco) Collahuasi Debottlenecking (Falco) Collahuasi Expansion (Falco) Raglan Expansion (Falco) 1-D Lower (Inco) Bahodopi (Inco) Nickel Rim (Falco) Goro Expansion (Inco) Lomas Bayas Expansion (Falco) Pomalaa Expansion Sorowako Limonite (Inco) Safford (PD) El Abra (PD) Climax (PD) Henderson (PD) Safford - Lone Star (PD) Tenke Fungurume (PD) Totten (Inco) Voisey’s Bay Expansion (Inco) Tenke Fungurme Expansion (PD)

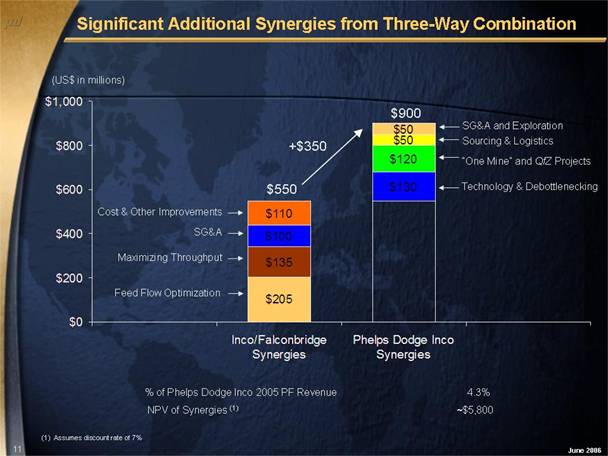

Significant Additional Synergies from Three-Way Combination

| Inco/Falconbridge Synergies | Phelps Dodge Inco Synergies |

Feed Flow Optimization | 205 | |

Maximizing Throughput | 135 | |

Cost & Other Improvements | 100 | |

SG&A | 110 | |

Efficiency savings (QFZ/One Mine Strategy) | | |

| | |

| | 550 |

Technology improvements/debottlenecking | | 130 |

Efficiencies (QFZ and Best Practices) | | 120 |

Sourcing & Logistics | | 50 |

| | |

SG&A and Exploration | | 50 |

$550 $900 +$350

% of Phelps Dodge Inco 2005 PF Revenue 4.3%

NPV of Synergies (1) ~$5,800

(1) Assumes discount rate of 7%

Synergy Opportunities

• Key drivers of cost savings

• Optimization of product flow

• Rationalization of purchasing and procurement

• Corporate office and governance

• Shared business services

• Focused exploration

• Application of best practices across portfolio

• Continuous improvement in capital efficiency

• Additional benefits expected in subsequent years

• North American “One Mine”

• Quest for Zero program

• Proven track record of delivering synergies / cost reduction

• $135 million in synergies announced in Cyprus Amax transaction

• Exceeded initial estimates by 35%

• Achieved one year ahead of schedule

Focus on Operational Excellence Has Delivered Superior Results to Shareholders

Leading S&P 500 Index Company

Market Capitalization

| | Market Cap. |

Rank | Company | ($ billions) |

57 | Caterpillar Inc. | $48.3 |

58 | Lowe's Cos. | 47.3 |

59 | WellPoint Inc. | 46.4 |

60 | Texas Instruments Inc. | 45.8 |

61 | Fannie Mae | 45.0 |

62 | Yahoo! Inc. | 44.4 |

63 | Walgreen Co. | 44.0 |

64 | Target Corp. | 42.8 |

65 | Washington Mutual Inc. | 42.7 |

66 | eBay Inc. | 42.3 |

| Phelps Dodge Inco (1) | 41.9 |

67 | Occidental Petroleum Corp. | 41.4 |

68 | McDonald's Corp. | 40.6 |

69 | Freddie Mac | 39.3 |

70 | E.I. DuPont de Nemours & Co. | 38.5 |

71 | Valero Energy Corp. | 38.2 |

72 | Exelon Corp. | 38.1 |

164 | Phelps Dodge | 16.1 |

Source: FactSet as of June 23, 2006.

(1) Pro forma market capitalization based on Phelps Dodge’s combination with Inco / Falconbridge.

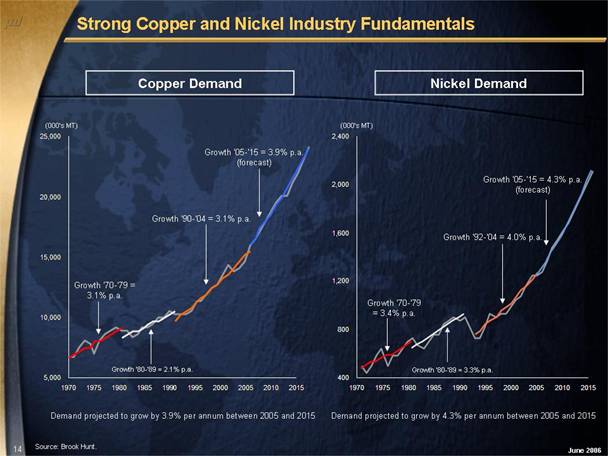

Strong Copper and Nickel Industry Fundamentals

Copper Demand Nickel Demand

[CHART]

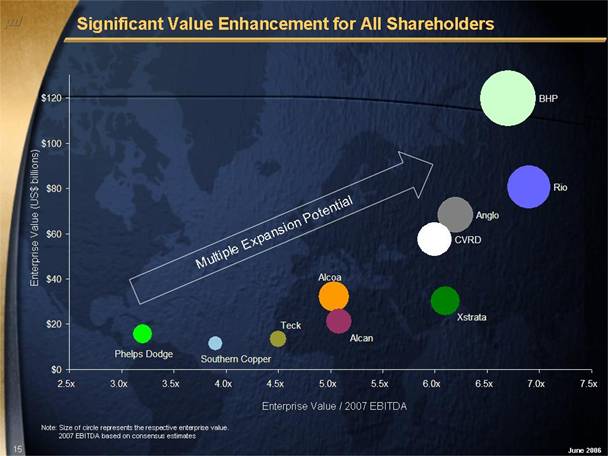

Significant Value Enhancement for All Shareholders

Multiple Expansion Potential

Enterprise Value (US$ billions)

Enterprise Value / 2007 EBITDA

Note: Size of circle represents the respective enterprise value.

2007 EBITDA based on consensus estimates

[CHART]

[LOGO]

Transaction Summary

June 2006

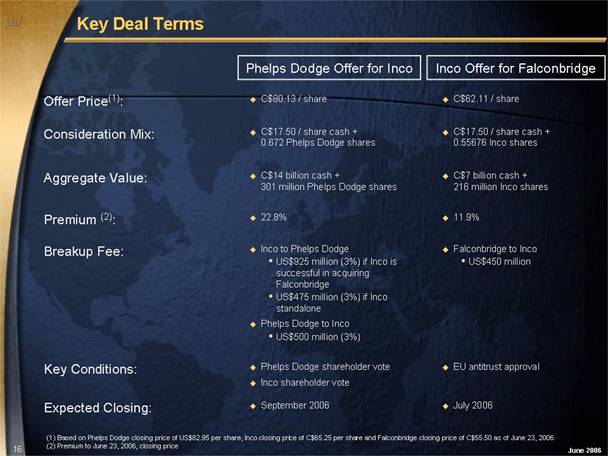

Key Deal Terms

| Phelps Dodge Offer for Inco | | Inco Offer for Falconbridge |

Offer Price(1): | • C$80.13 / share | | • C$62.11 / share |

Consideration Mix: | • C$17.50 / share cash +

0.672 Phelps Dodge shares | | • C$17.50 / share cash + 0.55676 Inco shares |

Aggregate Value: | • C$14 billion cash +

301 million Phelps Dodge shares | | • C$7 billion cash +

216 million Inco shares |

Premium (2): | • 22.8% | | • 11.9% |

Breakup Fee: | • Inco to Phelps Dodge • US$925 million (3%) if Inco is successful in acquiring Falconbridge • US$475 million (3%) if Inco standalone • Phelps Dodge to Inco • US$500 million (3%) | | • Falconbridge to Inco • US$450 million |

Key Conditions: | • Phelps Dodge shareholder vote • Inco shareholder vote | | • EU antitrust approval |

Expected Closing: | • September 2006 | | • July 2006 |

(1) Based on Phelps Dodge closing price of US$82.95 per share, Inco closing price of C$65.25 per share and Falconbridge closing price of C$55.50 as of June 23, 2006

(2) Premium to June 23, 2006, closing price

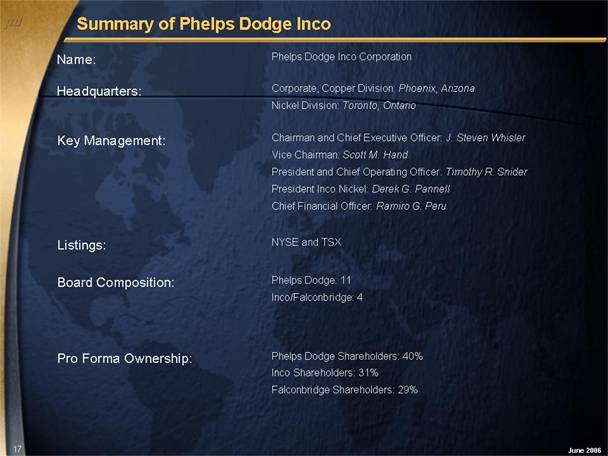

Summary of Phelps Dodge Inco

Name: | | Phelps Dodge Inco Corporation |

Headquarters: | | Corporate, Copper Division: Phoenix, Arizona Nickel Division: Toronto, Ontario |

Key Management: | | Chairman and Chief Executive Officer: J. Steven Whisler Vice Chairman: Scott M. Hand President and Chief Operating Officer: Timothy R. Snider President Inco Nickel: Derek G. Pannell Chief Financial Officer: Ramiro G. Peru |

Listings: | | NYSE and TSX |

Board Composition: | | Phelps Dodge: 11 Inco/Falconbridge: 4 |

Pro Forma Ownership: | | Phelps Dodge Shareholders: 40% Inco Shareholders: 31% Falconbridge Shareholders: 29% |

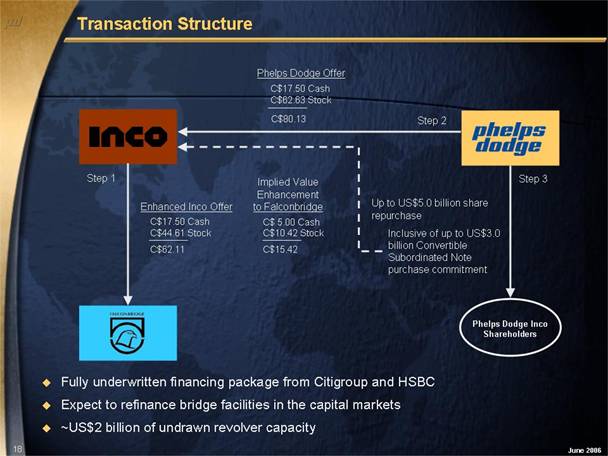

Transaction Structure

[CHART]

• Fully underwritten financing package from Citigroup and HSBC

• Expect to refinance bridge facilities in the capital markets

• ~US$2 billion of undrawn revolver capacity

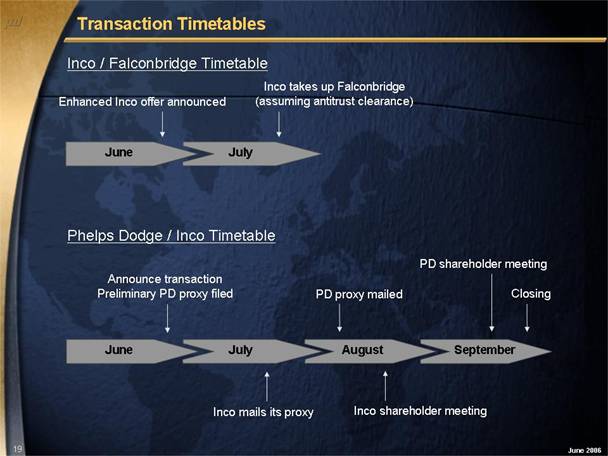

Transaction Timetables

Inco / Falconbridge Timetable

[CHART]

Phelps Dodge / Inco Timetable

[CHART]

[LOGO]

Financial Highlights

June 2006

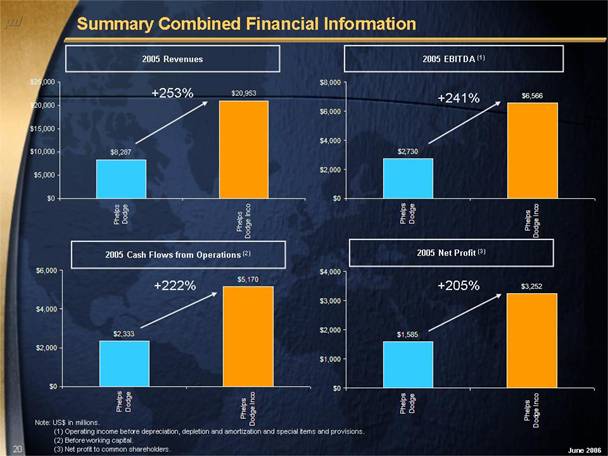

Summary Combined Financial Information

2005 Revenues | 2005 EBITDA (1) |

[CHART] | [CHART] |

| |

2005 Cash Flows from Operations (2) | 2005 Net Profit (3) |

[CHART] | [CHART] |

Note: US$ in millions.

(1) Operating income before depreciation, depletion and amortization and special items and provisions.

(2) Before working capital.

(3) Net profit to common shareholders.

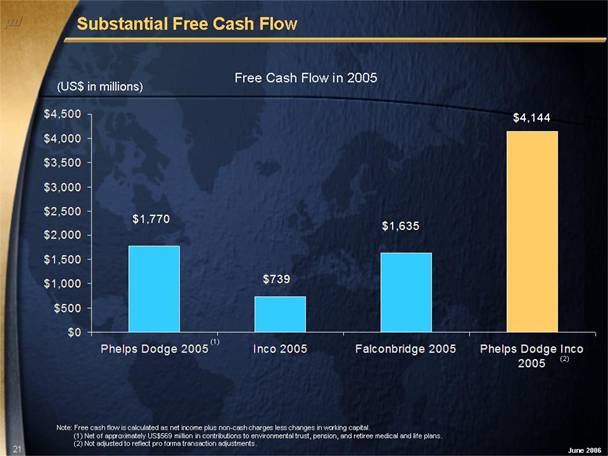

Substantial Free Cash Flow

(US$ in millions) Free Cash Flow in 2005

Phelps Dodge 2005(1) | Inco 2005 | Falconbridge 2005 | Phelps Dodge Inco 2005(2) |

$1770 | $739 | $1635 | $4144 |

Note: Free cash flow is calculated as net income plus non-cash charges less changes in working capital.

(1) Net of approximately US$569 million in contributions to environmental trust, pension, and retiree medical and life plans.

(2) Not adjusted to reflect pro forma transaction adjustments.

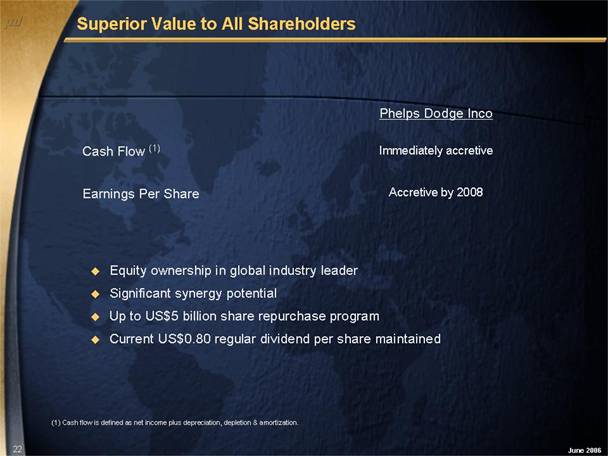

Superior Value to All Shareholders

| Phelps Dodge Inco |

| |

Cash Flow (1) | Immediately accretive |

| |

Earnings Per Share | Accretive by 2008 |

• Equity ownership in global industry leader

• Significant synergy potential

• Up to US$5 billion share repurchase program

• Current US$0.80 regular dividend per share maintained

(1) Cash flow is defined as net income plus depreciation, depletion & amortization.

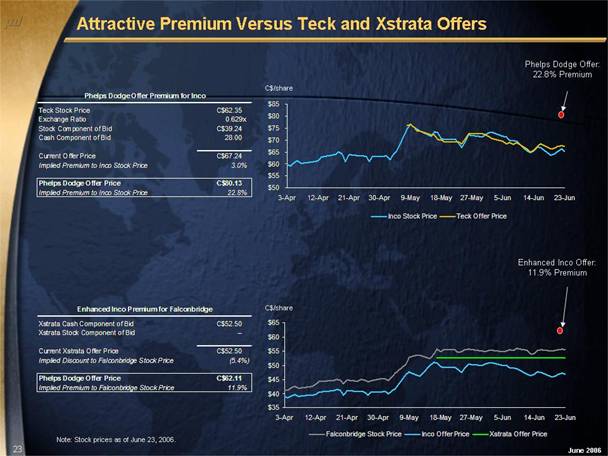

Attractive Premium Versus Teck and Xstrata Offers

[TABLE] [CHART]

[TABLE] [CHART]

Note: Stock prices as of June 23, 2006.

Three-Way Combination is Superior

• Superior asset quality and growth profile

• Greater synergies than any other combination

• Highly liquid stock and leading member of S&P 500

• Clear case for multiple expansion

• NYSE and TSX listings

• Approved by all three boards

• Enhanced premium to competing offers

• Ongoing equity participation in combined entity

• Significant presence and ongoing commitment to Canada

Creating a Global Industry Leader

[LOGO]

Shaping the Future: Creating a Global Industry Leader

June 2006