UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

BB&T Funds

(Exact name of registrant as specified in charter)

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Address of principal executive offices) (Zip code)

E.G. Purcell, III, President

BB&T Funds

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: March 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Table of Contents

Letter from the President and the Investment Advisor

Dear Shareholders:

We are pleased to present this BB&T Funds semiannual report covering the six months between October 1, 2008 and March 31, 2009. The widening global recession led to substantial declines in equities for much of the period, though the market ticked up in March. High-quality bonds posted the strong gains, as investors favored the financial markets’ most stable and liquid securities.

Economic growth figures declined sharply. U.S. gross domestic product decreased at an annualized rate of 6.3% during the first half of this semiannual period. According to preliminary figures, GDP declined at an annualized 6.1% rate during the second half of the period. Lenders were extremely cautious about extending credit in the wake of the sub-prime mortgage crisis, and employers laid off hundreds of thousands of workers in reaction to the deepening recession.

Consumer spending fell during four of the six months under review, as individuals reacted to the struggling housing market, weak income growth, mounting job losses, the need to rebuild savings and tighter credit. The decline in consumer spending also reflected falling prices on goods and services, and particularly lower oil and gas prices. Spending did increase in January and

February, but it slumped again in the final month of the period. Business spending shrank as well, as corporations continued to react to the weak economy.

The Federal Reserve took aggressive action to stem the credit crisis and spur economic growth. It lowered its target short-term interest rate from 2.00% to a range between 0% and 0.25% in the first half of this semiannual period, and kept the rate at that historically low level through the second half of the period.

That environment led to a decline in the stock market. The S&P 500 peaked in early October, then fell nearly 42% through early March before making a small recovery during the final weeks of the period. All told, the index lost 31.95% during the six months under review. Large-cap stocks outperformed smaller shares, with the Russell 2000 index of small-cap stocks falling 38.16%.The decline in consumer spending particularly hurt restaurants, consumer products companies and retailers.

Among fixed-income securities, the soft economic outlook, poor housing market, weakening credit picture and widespread market fears sent investors fleeing to the safety of the highest-quality investments. Long- term Treasury bonds continued to outpace other bond sectors during the period under review. Meanwhile, investors’ pursuit of stability led them to favor high-

quality corporate issues over lower-quality corporate bonds. Credit and liquidity concerns weighed on municipal bonds’ performance. As a result, municipal bonds during much of the period offered higher yields than Treasury securities with comparable maturities. Despite the challenging environment, many of the BB&T Funds performed very well against their peers.

Thank you for your continued confidence in BB&T Funds. We will continue to monitor the evolving economic and market climate, and will manage the BB&T Funds accordingly. We look forward to serving your investment needs during the months and years ahead.

Sincerely,

E.G. Purcell, III

President

BB&T Funds

Jeffrey J. Schappe, CFA

Chief Investment Officer

BB&T Asset Management, Inc.

Past performance does not guarantee future results.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. BB&T Asset Management, Inc., a wholly owned subsidiary of BB&T Corporation, serves as investment advisor to the BB&T Funds and is paid a fee for its services. Shares of the BB&T Funds (each a “Fund” and collectively, the “Funds”) are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by BB&T AM Distributors, Inc. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. BB&T Asset Management, Inc. does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

Summary of Portfolio Holdings (Unaudited)

The BB&T Funds invested, as a percentage of net assets, in the following industry sectors, countries, states, funds or security types, as of March 31, 2009.

| | |

| Large Cap Fund | | Percentage

of net assets |

Consumer Discretionary | | 12.1% |

Consumer Staples | | 16.3% |

Energy | | 10.4% |

Exchange Traded Funds | | 14.7% |

Financials | | 18.0% |

Health Care | | 1.4% |

Industrials | | 19.2% |

Information Technology | | 2.9% |

Put Options Purchased | | 0.3% |

Cash and Cash Equivalents | | 5.6% |

| | |

| | 100.9% |

| | |

| |

| Mid Cap Value Fund | | Percentage

of net assets |

Consumer Discretionary | | 24.1% |

Financial Services | | 31.1% |

Health Care | | 16.8% |

Materials & Processing | | 3.8% |

Other Energy | | 1.4% |

Producer Durables | | 1.4% |

Technology | | 20.4% |

Cash and Cash Equivalents | | 3.9% |

| | |

| | 102.9% |

| | |

| |

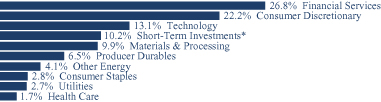

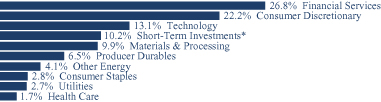

| Mid Cap Growth Fund | | Percentage

of net assets |

Consumer Discretionary | | 15.6% |

Consumer Staples | | 3.0% |

Energy | | 10.3% |

Financials | | 5.6% |

Health Care | | 15.1% |

Industrials | | 5.4% |

Information Technology | | 29.8% |

Materials | | 4.1% |

Telecommunication Services | | 4.0% |

Cash and Cash Equivalents | | 11.0% |

| | |

| | 103.9% |

| | |

| |

| Small Cap Fund | | Percentage

of net assets |

Consumer Discretionary | | 9.3% |

Consumer Staples | | 4.5% |

Energy | | 1.0% |

Exchange Traded Funds | | 7.8% |

Financials | | 6.9% |

Health Care | | 18.9% |

Industrials | | 13.6% |

Information Technology | | 22.4% |

Materials | | 2.6% |

Telecommunication Services | | 1.4% |

Utilities | | 2.6% |

Cash and Cash Equivalents | | 12.3% |

| | |

| | 103.3% |

| | |

| | |

| International Equity Fund | | Percentage

of net assets |

Australia | | 6.2% |

Austria | | 0.9% |

Belgium | | 0.3% |

Brazil | | 1.2% |

Canada | | 1.8% |

China | | 1.9% |

Czech Republic | | 1.4% |

Denmark | | 0.4% |

Finland | | 0.7% |

France | | 14.0% |

Germany | | 7.5% |

Greece | | 0.2% |

Hong Kong | | 0.8% |

Hungary | | 0.9% |

Ireland | | 2.1% |

Italy | | 3.7% |

Japan | | 13.1% |

Korea (South) | | 2.5% |

Netherlands | | 6.4% |

New Zealand | | 0.0% |

Norway | | 1.0% |

Poland | | 0.5% |

Portugal | | 0.1% |

Romania | | 0.2% |

Russia | | 0.5% |

Spain | | 2.3% |

Sweden | | 1.9% |

Switzerland | | 9.1% |

Taiwan | | 0.6% |

Ukraine | | 0.1% |

United Kingdom | | 12.6% |

United States | | 0.1% |

Cash and Cash Equivalents | | 6.9% |

| | |

| | 101.9% |

| | |

| |

| Special Opportunities Equity Fund | | Percentage

of net assets |

Consumer Discretionary | | 8.4% |

Consumer Staples | | 4.0% |

Energy | | 16.5% |

Financials | | 2.2% |

Health Care | | 20.3% |

Industrials | | 9.1% |

Information Technology | | 24.5% |

Materials | | 3.4% |

Cash and Cash Equivalents | | 12.3% |

| | |

| | 100.7% |

| | |

| |

| Equity Income Fund | | Percentage

of net assets |

Consumer Discretionary | | 3.6% |

Consumer Staples | | 16.5% |

Energy | | 22.6% |

Financials | | 9.8% |

Health Care | | 9.9% |

Industrials | | 12.5% |

Information Technology | | 14.6% |

Utilities | | 4.0% |

Cash and Cash Equivalents | | 8.4% |

| | |

| | 101.9% |

| | |

2

Summary of Portfolio Holdings (Unaudited)

| | |

Short U.S. Government Fund | | Percentage

of net assets |

Corporate Bonds | | 12.8% |

Fannie Mae | | 26.3% |

Freddie Mac | | 19.6% |

Ginnie Mae | | 5.9% |

Federal Farm Credit Bank | | 15.7% |

Federal Home Loan Bank | | 8.0% |

U.S. Treasury Notes | | 5.6% |

Cash and Cash Equivalents | | 13.5% |

| | |

| | 107.4% |

| | |

| |

| Intermediate U.S. Government Fund | | Percentage

of net assets |

Collateralized Mortgage Obligations | | 0.3% |

Corporate Bonds | | 11.1% |

Fannie Mae | | 39.5% |

Freddie Mac | | 17.2% |

Federal Home Loan Bank | | 3.6% |

Municipal Bonds | | 1.4% |

Private Export Funding Corp | | 6.8% |

U.S. Treasury Bills | | 6.6% |

U.S. Treasury Notes | | 5.3% |

Cash and Cash Equivalents | | 8.3% |

| | |

| | 100.1% |

| | |

| |

| Total Return Bond Fund | | Percentage

of net assets |

Asset Backed Securities | | 6.7% |

Collateralized Mortgage Obligations | | 0.9% |

Commercial Mortgage-Backed Securities | | 2.7% |

Corporate Bonds | | 28.0% |

Fannie Mae | | 26.0% |

Freddie Mac | | 27.6% |

Foreign Government Bonds | | 0.3% |

Ginnie Mae | | 1.9% |

Municipal Bonds | | 5.5% |

Supranational Bonds | | 1.4% |

U.S. Treasury Notes | | 0.2% |

Cash and Cash Equivalents | | 1.4% |

| | |

| | 102.6% |

| | |

| |

| Kentucky Intermediate Tax-Free Fund | | Percentage

of net assets |

Kentucky Municipal Bonds | | 94.9% |

Cash and Cash Equivalents | | 4.1% |

| | |

| | 99.0% |

| | |

| |

| Maryland Intermediate Tax-Free Fund | | Percentage

of net assets |

District of Columbia Municipal Bonds | | 4.0% |

Maryland Municipal Bonds | | 87.2% |

Cash and Cash Equivalents | | 7.4% |

| | |

| | 98.6% |

| | |

| |

| North Carolina Intermediate Tax-Free Fund | | Percentage

of net assets |

North Carolina Municipal Bonds | | 96.1% |

Puerto Rico Municipal Bonds | | 2.3% |

Cash and Cash Equivalents | | 1.9% |

| | |

| | 100.3% |

| | |

| | |

| South Carolina Intermediate Tax-Free Fund | | Percentage of net assets |

South Carolina Municipal Bonds | | 97.3% |

Cash and Cash Equivalents | | 1.6% |

| | |

| | 98.9% |

| | |

| |

| Virginia Intermediate Tax-Free Fund | | Percentage of net assets |

District of Columbia Municipal Bonds | | 1.6% |

Virginia Municipal Bonds | | 96.5% |

Cash and Cash Equivalents | | 2.7% |

| | |

| | 100.8% |

| | |

| |

| West Virginia Intermediate Tax-Free Fund | | Percentage

of net assets |

West Virginia Municipal Bonds | | 97.5% |

Cash and Cash Equivalents | | 1.4% |

| | |

| | 98.9% |

| | |

| |

| National Tax-Free Money Market Fund | | Percentage

of net assets |

Arizona | | 0.9% |

Colorado | | 3.0% |

Connecticut | | 0.7% |

District of Columbia | | 2.3% |

Florida | | 5.3% |

Georgia | | 4.0% |

Illinois | | 14.5% |

Maine | | 3.3% |

Massachusetts | | 1.5% |

Mississippi | | 1.6% |

Missouri | | 3.6% |

New Jersey | | 0.9% |

North Carolina | | 5.6% |

Ohio | | 27.8% |

Pennsylvania | | 0.5% |

Tennessee | | 1.4% |

Texas | | 7.9% |

Utah | | 1.1% |

Virginia | | 5.4% |

Washington | | 5.5% |

Wisconsin | | 6.3% |

Cash and Cash Equivalents | | 0.0% |

| | |

| | 103.1% |

| | |

| |

| Prime Money Market Fund | | Percentage

of net assets |

Asset Backed Securities | | 2.7% |

Certificates of Deposit | | 23.3% |

Commercial Paper | | 46.8% |

Corporate Bonds | | 1.3% |

Federal Home Loan Bank | | 4.4% |

Repurchase Agreement | | 8.8% |

Variable Rate Notes | | 13.0% |

| | |

| | 100.3% |

| | |

| |

| U.S. Treasury Money Market Fund | | Percentage

of net assets |

Repurchase Agreements | | 55.3% |

U.S. Treasury Bills | | 29.2% |

U.S. Treasury Notes | | 15.4% |

Cash and Cash Equivalents | | 0.1% |

| | |

| | 100.0% |

| | |

3

Summary of Portfolio Holdings (Unaudited)

| | |

| Capital Manager Conservative Growth Fund | | |

BB&T Equity Income Fund | | 4.2% |

BB&T International Equity Fund | | 9.8% |

BB&T Large Cap Fund | | 3.9% |

BB&T Mid Cap Growth Fund | | 3.9% |

BB&T Mid Cap Value Fund | | 6.2% |

BB&T Special Opportunities Equity Fund | | 2.2% |

BB&T Total Return Bond Fund | | 55.3% |

BB&T U.S. Treasury Money Market Fund | | 1.4% |

Exchange Traded Funds | | 12.9% |

| | |

| | 99.8% |

| | |

| |

| Capital Manager Moderate Growth Fund | | Percentage

of Net Assets |

BB&T Equity Income Fund | | 6.2% |

BB&T International Equity Fund | | 14.8% |

BB&T Large Cap Fund | | 5.6% |

BB&T Mid Cap Growth Fund | | 5.6% |

BB&T Mid Cap Value Fund | | 9.0% |

BB&T Special Opportunities Equity Fund | | 3.0% |

BB&T Total Return Bond Fund | | 34.6% |

BB&T U.S. Treasury Money Market Fund | | 2.4% |

Exchange Traded Funds | | 18.7% |

| | |

| | 99.9% |

| | |

| | |

| Capital Manager Growth Fund | | |

BB&T Equity Income Fund | | 7.5% |

BB&T International Equity Fund | | 18.5% |

BB&T Large Cap Fund | | 6.9% |

BB&T Mid Cap Growth Fund | | 6.9% |

BB&T Mid Cap Value Fund | | 11.0% |

BB&T Special Opportunities Equity Fund | | 3.8% |

BB&T Total Return Bond Fund | | 20.1% |

BB&T U.S. Treasury Money Market Fund | | 2.5% |

Exchange Traded Funds | | 22.9% |

| | |

| | 100.1% |

| | |

| |

| Capital Manager Equity Fund | | |

BB&T Equity Income Fund | | 9.5% |

BB&T International Equity Fund | | 23.8% |

BB&T Large Cap Fund | | 8.6% |

BB&T Mid Cap Growth Fund | | 8.6% |

BB&T Mid Cap Value Fund | | 13.9% |

BB&T Special Opportunities Equity Fund | | 4.8% |

BB&T U.S. Treasury Money Market Fund | | 2.3% |

Exchange Traded Funds | | 28.7% |

| | |

| | 100.2% |

| | |

4

Expense Example (Unaudited)

As a shareholder of the BB&T Funds (each a “Fund” and collectively, the “Funds”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and (2) ongoing costs, including management fees; distribution fees; and other Fund expenses.

These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds’ and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2008 through March 31, 2009.

Actual Example

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | |

| | | Beginning

Account Value

10/1/08 | | Ending

Account Value

3/31/09 | | Expenses Paid

During Period*

10/1/08 - 3/31/09 | | Annualized

Expense Ratio

During Period

10/1/08 - 3/31/09 |

Large Cap Fund | | | | | | | | |

Class A Shares | | $1,000.00 | | $ 698.60 | | $ 4.66 | | 1.10% |

Class B Shares | | 1,000.00 | | 695.70 | | 7.82 | | 1.85% |

Class C Shares | | 1,000.00 | | 695.50 | | 7.82 | | 1.85% |

Institutional Shares | | 1,000.00 | | 699.10 | | 3.60 | | 0.85% |

Mid Cap Value Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 702.00 | | 5.13 | | 1.21% |

Class B Shares | | 1,000.00 | | 697.90 | | 8.34 | | 1.97% |

Class C Shares | | 1,000.00 | | 696.00 | | 8.29 | | 1.96% |

Institutional Shares | | 1,000.00 | | 700.40 | | 4.11 | | 0.97% |

Mid Cap Growth Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 642.60 | | 5.00 | | 1.22% |

Class B Shares | | 1,000.00 | | 639.00 | | 8.01 | | 1.96% |

Class C Shares | | 1,000.00 | | 639.40 | | 7.93 | | 1.94% |

Institutional Shares | | 1,000.00 | | 642.50 | | 3.97 | | 0.97% |

Small Cap Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 636.10 | | 5.79 | | 1.42% |

Class B Shares | | 1,000.00 | | 633.50 | | 8.84 | | 2.17% |

Class C Shares | | 1,000.00 | | 632.80 | | 8.75 | | 2.15% |

Institutional Shares | | 1,000.00 | | 636.40 | | 4.77 | | 1.17% |

International Equity Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 667.90 | | 7.44 | | 1.79% |

Class B Shares | | 1,000.00 | | 665.30 | | 10.55 | | 2.54% |

Class C Shares | | 1,000.00 | | 666.10 | | 10.55 | | 2.54% |

Institutional Shares | | 1,000.00 | | 670.80 | | 6.37 | | 1.53% |

Special Opportunities Equity Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 764.70 | | 5.63 | | 1.28% |

Class B Shares | | 1,000.00 | | 761.60 | | 8.87 | | 2.02% |

Class C Shares | | 1,000.00 | | 761.80 | | 8.87 | | 2.02% |

Institutional Shares | | 1,000.00 | | 765.00 | | 4.53 | | 1.03% |

Equity Income Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 754.30 | | 5.16 | | 1.18% |

Class B Shares | | 1,000.00 | | 751.40 | | 8.43 | | 1.93% |

Class C Shares | | 1,000.00 | | 751.30 | | 8.43 | | 1.93% |

Institutional Shares | | 1,000.00 | | 754.80 | | 4.07 | | 0.93% |

Short U.S. Government Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 1,032.50 | | 5.07 | | 1.00% |

Institutional Shares | | 1,000.00 | | 1,033.80 | | 3.55 | | 0.70% |

Intermediate U.S. Government Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 1,065.30 | | 4.84 | | 0.94% |

Class B Shares | | 1,000.00 | | 1,061.50 | | 8.69 | | 1.69% |

Class C Shares | | 1,000.00 | | 1,061.40 | | 8.69 | | 1.69% |

Institutional Shares | | 1,000.00 | | 1,065.50 | | 3.55 | | 0.69% |

Total Return Bond Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 1,040.00 | | 4.83 | | 0.95% |

Class B Shares | | 1,000.00 | | 1,035.10 | | 8.57 | | 1.69% |

Class C Shares | | 1,000.00 | | 1,036.10 | | 8.58 | | 1.69% |

Institutional Shares | | 1,000.00 | | 1,040.30 | | 3.51 | | 0.69% |

Kentucky Intermediate Tax-Free Fund | | | | | | | | |

Class A Shares | | 1,000.00 | | 1,061.30 | | 4.57 | | 0.89% |

Institutional Shares | | 1,000.00 | | 1,062.60 | | 3.29 | | 0.64% |

5

Expense Example (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

10/1/08 | | | | | | Ending

Account Value

3/31/09 | | | | | | Expenses Paid

During Period*

10/1/08 - 3/31/09 | | | | | | Annualized

Expense Ratio

During Period

10/1/08 - 3/31/09 |

Maryland Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | $1,000.00 | | | | | | $1,069.30 | | | | | | $4.28 | | | | | | 0.83% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,070.50 | | | | | | 2.99 | | | | | | 0.58% |

North Carolina Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,055.50 | | | | | | 4.61 | | | | | | 0.90% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,056.80 | | | | | | 3.33 | | | | | | 0.65% |

South Carolina Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,060.90 | | | | | | 4.88 | | | | | | 0.95% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,061.50 | | | | | | 3.60 | | | | | | 0.70% |

Virginia Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,073.90 | | | | | | 4.71 | | | | | | 0.91% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,075.20 | | | | | | 3.41 | | | | | | 0.66% |

West Virginia Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,046.30 | | | | | | 4.64 | | | | | | 0.91% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,047.50 | | | | | | 3.37 | | | | | | 0.66% |

National Tax-Free Money Market Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,005.60 | | | | | | 3.35 | | | | | | 0.67% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,006.80 | | | | | | 2.10 | | | | | | 0.42% |

Prime Money Market Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,005.20 | | | | | | 5.15 | | | | | | 1.03% |

Class B Shares | | | | 1,000.00 | | | | | | 1,003.30 | | | | | | 6.99 | | | | | | 1.40% |

Class C Shares | | | | 1,000.00 | | | | | | 1,003.30 | | | | | | 6.89 | | | | | | 1.38% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,007.70 | | | | | | 2.65 | | | | | | 0.53% |

U.S. Treasury Money Market Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,000.20 | | | | | | 1.94 | | | | | | 0.39% |

Class B Shares | | | | 1,000.00 | | | | | | 1,000.20 | | | | | | 1.75 | | | | | | 0.35% |

Class C Shares | | | | 1,000.00 | | | | | | 1,000.30 | | | | | | 1.65 | | | | | | 0.33% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,000.30 | | | | | | 1.70 | | | | | | 0.34% |

Capital Manager Conservative Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 881.40 | | | | | | 2.25 | | | | | | 0.48% |

Class B Shares | | | | 1,000.00 | | | | | | 879.20 | | | | | | 5.81 | | | | | | 1.24% |

Class C Shares | | | | 1,000.00 | | | | | | 878.00 | | | | | | 5.81 | | | | | | 1.24% |

Institutional Shares | | | | 1,000.00 | | | | | | 883.50 | | | | | | 0.70 | | | | | | 0.15% |

Capital Manager Moderate Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 814.40 | | | | | | 1.85 | | | | | | 0.41% |

Class B Shares | | | | 1,000.00 | | | | | | 810.30 | | | | | | 5.24 | | | | | | 1.16% |

Class C Shares | | | | 1,000.00 | | | | | | 810.40 | | | | | | 5.24 | | | | | | 1.16% |

Institutional Shares | | | | 1,000.00 | | | | | | 815.10 | | | | | | 0.63 | | | | | | 0.14% |

Capital Manager Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 758.50 | | | | | | 1.84 | | | | | | 0.42% |

Class B Shares | | | | 1,000.00 | | | | | | 756.80 | | | | | | 5.12 | | | | | | 1.17% |

Class C Shares | | | | 1,000.00 | | | | | | 757.00 | | | | | | 5.13 | | | | | | 1.17% |

Institutional Shares | | | | 1,000.00 | | | | | | 760.80 | | | | | | 0.61 | | | | | | 0.14% |

Capital Manager Equity Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 682.50 | | | | | | 2.10 | | | | | | 0.50% |

Class B Shares | | | | 1,000.00 | | | | | | 679.00 | | | | | | 5.23 | | | | | | 1.25% |

Class C Shares | | | | 1,000.00 | | | | | | 680.30 | | | | | | 4.65 | | | | | | 1.11% |

Institutional Shares | | | | 1,000.00 | | | | | | 683.20 | | | | | | 0.71 | | | | | | 0.17% |

| * | Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half year period). |

6

Expense Example (Unaudited)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

10/1/08 | | | | | | Ending

Account Value

3/31/09 | | | | | | Expenses Paid

During Period

10/1/08 - 3/31/09 | | | | | | Annualized

Expense Ratio

During Period

10/1/08 - 3/31/09 |

Large Cap Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | $1,000.00 | | | | | | $1,019.45 | | | | | | $5.54 | | | | | | 1.10% |

Class B Shares | | | | 1,000.00 | | | | | | 1,015.71 | | | | | | 9.30 | | | | | | 1.85% |

Class C Shares | | | | 1,000.00 | | | | | | 1,015.71 | | | | | | 9.30 | | | | | | 1.85% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,020.69 | | | | | | 4.28 | | | | | | 0.85% |

Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,018.90 | | | | | | 6.09 | | | | | | 1.21% |

Class B Shares | | | | 1,000.00 | | | | | | 1,015.11 | | | | | | 9.90 | | | | | | 1.97% |

Class C Shares | | | | 1,000.00 | | | | | | 1,015.16 | | | | | | 9.85 | | | | | | 1.96% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,020.09 | | | | | | 4.89 | | | | | | 0.97% |

Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,018.85 | | | | | | 6.14 | | | | | | 1.22% |

Class B Shares | | | | 1,000.00 | | | | | | 1,015.16 | | | | | | 9.85 | | | | | | 1.96% |

Class C Shares | | | | 1,000.00 | | | | | | 1,015.26 | | | | | | 9.75 | | | | | | 1.94% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,020.09 | | | | | | 4.89 | | | | | | 0.97% |

Small Cap Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,017.85 | | | | | | 7.14 | | | | | | 1.42% |

Class B Shares | | | | 1,000.00 | | | | | | 1,014.11 | | | | | | 10.90 | | | | | | 2.17% |

Class C Shares | | | | 1,000.00 | | | | | | 1,014.21 | | | | | | 10.80 | | | | | | 2.15% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,019.10 | | | | | | 5.89 | | | | | | 1.17% |

International Equity Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,016.01 | | | | | | 9.00 | | | | | | 1.79% |

Class B Shares | | | | 1,000.00 | | | | | | 1,012.27 | | | | | | 12.74 | | | | | | 2.54% |

Class C Shares | | | | 1,000.00 | | | | | | 1,012.27 | | | | | | 12.74 | | | | | | 2.54% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,017.30 | | | | | | 7.70 | | | | | | 1.53% |

Special Opportunities Equity Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,018.55 | | | | | | 6.44 | | | | | | 1.28% |

Class B Shares | | | | 1,000.00 | | | | | | 1,014.86 | | | | | | 10.15 | | | | | | 2.02% |

Class C Shares | | | | 1,000.00 | | | | | | 1,014.86 | | | | | | 10.15 | | | | | | 2.02% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,019.80 | | | | | | 5.19 | | | | | | 1.03% |

Equity Income Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,019.05 | | | | | | 5.94 | | | | | | 1.18% |

Class B Shares | | | | 1,000.00 | | | | | | 1,015.31 | | | | | | 9.70 | | | | | | 1.93% |

Class C Shares | | | | 1,000.00 | | | | | | 1,015.31 | | | | | | 9.70 | | | | | | 1.93% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,020.29 | | | | | | 4.68 | | | | | | 0.93% |

Short U.S. Government Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,019.95 | | | | | | 5.04 | | | | | | 1.00% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.44 | | | | | | 3.53 | | | | | | 0.70% |

Intermediate U.S. Government Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.24 | | | | | | 4.73 | | | | | | 0.94% |

Class B Shares | | | | 1,000.00 | | | | | | 1,016.50 | | | | | | 8.50 | | | | | | 1.69% |

Class C Shares | | | | 1,000.00 | | | | | | 1,016.50 | | | | | | 8.50 | | | | | | 1.69% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.49 | | | | | | 3.48 | | | | | | 0.69% |

Total Return Bond Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.19 | | | | | | 4.78 | | | | | | 0.95% |

Class B Shares | | | | 1,000.00 | | | | | | 1,016.50 | | | | | | 8.50 | | | | | | 1.69% |

Class C Shares | | | | 1,000.00 | | | | | | 1,016.50 | | | | | | 8.50 | | | | | | 1.69% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.49 | | | | | | 3.48 | | | | | | 0.69% |

Kentucky Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.49 | | | | | | 4.48 | | | | | | 0.89% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.74 | | | | | | 3.23 | | | | | | 0.64% |

7

Expense Example (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

10/1/08 | | | | | | Ending

Account Value

3/31/09 | | | | | | Expenses Paid

During Period

10/1/08 - 3/31/09 | | | | | | Annualized

Expense Ratio

During Period

10/1/08 - 3/31/09 |

Maryland Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | $1,000.00 | | | | | | $1,020.79 | | | | | | $4.18 | | | | | | 0.83% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,022.04 | | | | | | 2.92 | | | | | | 0.58% |

North Carolina Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.44 | | | | | | 4.53 | | | | | | 0.90% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.69 | | | | | | 3.28 | | | | | | 0.65% |

South Carolina Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.19 | | | | | | 4.78 | | | | | | 0.95% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.44 | | | | | | 3.53 | | | | | | 0.70% |

Virginia Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.39 | | | | | | 4.58 | | | | | | 0.91% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.64 | | | | | | 3.33 | | | | | | 0.66% |

West Virginia Intermediate Tax-Free Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,020.39 | | | | | | 4.58 | | | | | | 0.91% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,021.64 | | | | | | 3.33 | | | | | | 0.66% |

National Tax-Free Money Market Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,021.59 | | | | | | 3.38 | | | | | | 0.67% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,022.84 | | | | | | 2.12 | | | | | | 0.42% |

Prime Money Market Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,019.80 | | | | | | 5.19 | | | | | | 1.03% |

Class B Shares | | | | 1,000.00 | | | | | | 1,017.95 | | | | | | 7.04 | | | | | | 1.40% |

Class C Shares | | | | 1,000.00 | | | | | | 1,018.05 | | | | | | 6.94 | | | | | | 1.38% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,022.29 | | | | | | 2.67 | | | | | | 0.53% |

U.S. Treasury Money Market Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,022.99 | | | | | | 1.97 | | | | | | 0.39% |

Class B Shares | | | | 1,000.00 | | | | | | 1,023.19 | | | | | | 1.77 | | | | | | 0.35% |

Class C Shares | | | | 1,000.00 | | | | | | 1,023.29 | | | | | | 1.66 | | | | | | 0.33% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,023.24 | | | | | | 1.72 | | | | | | 0.34% |

Capital Manager Conservative Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,022.54 | | | | | | 2.42 | | | | | | 0.48% |

Class B Shares | | | | 1,000.00 | | | | | | 1,018.75 | | | | | | 6.24 | | | | | | 1.24% |

Class C Shares | | | | 1,000.00 | | | | | | 1,018.75 | | | | | | 6.24 | | | | | | 1.24% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,024.18 | | | | | | 0.76 | | | | | | 0.15% |

Capital Manager Moderate Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,022.89 | | | | | | 2.07 | | | | | | 0.41% |

Class B Shares | | | | 1,000.00 | | | | | | 1,019.15 | | | | | | 5.84 | | | | | | 1.16% |

Class C Shares | | | | 1,000.00 | | | | | | 1,019.15 | | | | | | 5.84 | | | | | | 1.16% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,024.23 | | | | | | 0.71 | | | | | | 0.14% |

Capital Manager Growth Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,022.84 | | | | | | 2.12 | | | | | | 0.42% |

Class B Shares | | | | 1,000.00 | | | | | | 1,019.10 | | | | | | 5.89 | | | | | | 1.17% |

Class C Shares | | | | 1,000.00 | | | | | | 1,019.10 | | | | | | 5.89 | | | | | | 1.17% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,024.23 | | | | | | 0.71 | | | | | | 0.14% |

Capital Manager Equity Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A Shares | | | | 1,000.00 | | | | | | 1,022.44 | | | | | | 2.52 | | | | | | 0.50% |

Class B Shares | | | | 1,000.00 | | | | | | 1,018.70 | | | | | | 6.29 | | | | | | 1.25% |

Class C Shares | | | | 1,000.00 | | | | | | 1,019.40 | | | | | | 5.59 | | | | | | 1.11% |

Institutional Shares | | | | 1,000.00 | | | | | | 1,024.08 | | | | | | 0.86 | | | | | | 0.17% |

8

Schedule of Portfolio Investments

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS (92.1%) | | | | | |

| | | | Consumer Discretionary (12.1%) | | | | | |

| 502,099 | | | | Comcast Corp., Class A | | | | $ | 6,848,630 |

| 557,853 | | | | KB Home(h) | | | | | 7,352,503 |

| 32,376 | | | | McDonald’s Corp. | | | | | 1,766,758 |

| 122,257 | | | | Target Corp. | | | | | 4,204,418 |

| 84,069 | | | | Tiffany & Co.(h) | | | | | 1,812,528 |

| | | | | | | | | |

| | | | | | | | | 21,984,837 |

| | | | | | | | | |

| | | | Consumer Staples (16.3%) | | | | | |

| 142,187 | | | | Clorox Co. (The) | | | | | 7,319,787 |

| 82,771 | | | | Costco Wholesale Corp. | | | | | 3,833,953 |

| 148,216 | | | | Kraft Foods, Inc., Class A | | | | | 3,303,735 |

| 79,881 | | | | Kroger Co. (The) | | | | | 1,695,075 |

| 86,324 | | | | Procter & Gamble Co. (The) | | | | | 4,064,997 |

| 183,756 | | | | Wal-Mart Stores, Inc. | | | | | 9,573,687 |

| | | | | | | | | |

| | | | | | | | | 29,791,234 |

| | | | | | | | | |

| | | | Energy (10.4%) | | | | | |

| 126,290 | | | | ConocoPhillips | | | | | 4,945,516 |

| 28,610 | | | | EOG Resources, Inc. | | | | | 1,566,684 |

| 155,997 | | | | Exxon Mobil Corp. | | | | | 10,623,396 |

| 34,180 | | | | Occidental Petroleum Corp. | | | | | 1,902,117 |

| | | | | | | | | |

| | | | | | | | | 19,037,713 |

| | | | | | | | | |

| | | | Financials (14.7%) | | | | | |

| 3,382 | | | | Berkshire Hathaway, Inc. Class B(a) | | | | | 9,537,240 |

| 264,862 | | | | JPMorgan Chase & Co. | | | | | 7,040,032 |

| 89,863 | | | | Loews Corp. | | | | | 1,985,972 |

| 32,734 | | | | Northern Trust Corp. | | | | | 1,958,148 |

| 76,298 | | | | T. Rowe Price Group, Inc.(h) | | | | | 2,201,960 |

| 288,852 | | | | Wells Fargo & Co. | | | | | 4,113,253 |

| | | | | | | | | |

| | | | | | | | | 26,836,605 |

| | | | | | | | | |

| | | | Health Care (18.0%) | | | | | |

| 63,538 | | | | Eli Lilly & Co. | | | | | 2,122,805 |

| 183,201 | | | | Johnson & Johnson | | | | | 9,636,373 |

| 65,054 | | | | Medco Health Solutions, Inc.(a) | | | | | 2,689,332 |

| 212,862 | | | | Medtronic, Inc. | | | | | 6,273,043 |

| 305,737 | | | | Merck & Co., Inc. | | | | | 8,178,465 |

| 290,073 | | | | Pfizer, Inc. | | | | | 3,950,794 |

| | | | | | | | | |

| | | | | | | | | 32,850,812 |

| | | | | | | | | |

| | | | Industrials (1.4%) | | | | | |

| 285,649 | | | | Terex Corp.(a) | | | | | 2,642,253 |

| | | | | | | | | |

| | | | Information Technology (19.2%) | | | | | |

| 349,311 | | | | Cisco Systems, Inc.(a) | | | | | 5,857,946 |

| 315,285 | | | | eBay, Inc.(a) | | | | | 3,959,979 |

| 18,148 | | | | Google, Inc., Class A(a) | | | | | 6,316,593 |

| 370,294 | | | | Intel Corp. | | | | | 5,572,925 |

| 348,837 | | | | Microsoft Corp. | | | | | 6,408,136 |

| | | | | | | | | | |

| Shares | | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | |

| | | | Information Technology — (continued) | |

| 176,295 | | | | QUALCOMM, Inc. | | | | $ | 6,859,638 | |

| | | | | | | | | | |

| | | | | | | | | 34,975,217 | |

| | | | | | | | | | |

| | | | Total Common Stocks

(Cost $200,708,578) | | | | | 168,118,671 | |

| | | | | | | | | | |

| | |

| EXCHANGE TRADED FUNDS (2.9%) | | | | | | |

| 197,190 | | | | Industrial Select Sector SPDR Fund | | | | | 3,634,212 | |

| 17,909 | | | | SPDR Gold Trust(a) | | | | | 1,616,824 | |

| | | | | | | | | | |

| | | | Total Exchange Traded Funds

(Cost $5,228,897) | | | | | 5,251,036 | |

| | | | | | | | | | |

| | | | |

Contracts | | | | | | | | | |

| PUT OPTIONS PURCHASED (0.3%) | | | | | | |

| | | | Financials (0.3%) | | | | | | |

| 920 | | | | Wells Fargo & Co., Strike Price $20.00, Expiration Date 04/18/09 | | | | | 551,080 | |

| | | | | | | | | | |

| | | | Total Put Options Purchased (Cost $573,160) | | | | | 551,080 | |

| | | | | | | | | | |

Shares | | | | | | | | | |

| INVESTMENT COMPANY (4.5%) | | | | | | |

| 8,143,968 | | | | Federated Treasury Obligations Fund, Institutional Shares | | | | | 8,143,968 | |

| | | | | | | | | | |

| | | | Total Investment Company (Cost $8,143,968) | | | | | 8,143,968 | |

| | | | | | | | | | |

Principal

Amount | | | | | | | | | |

SECURITIES HELD AS COLLATERAL FOR

SECURITIES ON LOAN (1.1%) |

|

| $2,316,585 | | | | Pool of Various Securities(i) | | | | | 1,929,981 | |

| | | | | | | | | | |

| | | | Total Securities Held as Collateral for Securities on Loan (Cost $2,316,585) | | | | | 1,929,981 | |

| | | | | | | | | | |

Total Investments — 100.9% (Cost $216,971,188) | | | | | 183,994,736 | |

| Net Other Assets (Liabilities) — (0.9)% | | | | | (1,559,262 | ) |

| | | | | | | | | | |

NET ASSETS — 100.0% | | | | $ | 182,435,474 | |

| | | | | | | | | | |

See footnote legend to Schedules of Portfolio Investments.

See accompanying notes to the financial statements.

9

Schedule of Portfolio Investments

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS (99.0%) | | | | | |

| | | | Consumer Discretionary (24.1%) | | | | | |

| 666,750 | | | | Chico’s FAS, Inc.(a) | | | | $ | 3,580,447 |

| 401,650 | | | | EarthLink, Inc.(a) | | | | | 2,638,841 |

| 407,750 | | | | eBay, Inc.(a) | | | | | 5,121,340 |

| 80,250 | | | | Gannett Co., Inc.(h) | | | | | 176,550 |

| 114,650 | | | | International Speedway Corp., Class A | | | | | 2,529,179 |

| 980,800 | | | | Interpublic Group of Cos., Inc.(a) | | | | | 4,040,896 |

| 125,600 | | | | Kohl’s Corp.(a) | | | | | 5,315,392 |

| 81,200 | | | | Omnicom Group, Inc. | | | | | 1,900,080 |

| 104,150 | | | | R.H. Donnelley Corp.(a)(h) | | | | | 31,766 |

| 282,030 | | | | Select Comfort Corp.(a)(h) | | | | | 203,062 |

| 173,650 | | | | Universal Technical Institute, Inc.(a) | | | | | 2,083,800 |

| 258,900 | | | | Viacom, Inc., Class B(a) | | | | | 4,499,682 |

| | | | | | | | | |

| | | | | | | | | 32,121,035 |

| | | | | | | | | |

| | | | Financial Services (31.1%) | | | | | |

| 80,000 | | | | Alliance Data Systems Corp.(a)(h) | | | | | 2,956,000 |

| 176,600 | | | | Annaly Capital Management, Inc., REIT | | | | | 2,449,442 |

| 132,600 | | | | Assured Guaranty, Ltd.(h) | | | | | 897,702 |

| 187,302 | | | | Endurance Specialty Holdings, Ltd.(h) | | | | | 4,671,312 |

| 231,950 | | | | Fair Isaac Corp. | | | | | 3,263,537 |

| 276,905 | | | | Fidelity National Information Services, Inc. | | | | | 5,039,671 |

| 33,029 | | | | Jefferies Group, Inc. | | | | | 455,800 |

| 245,900 | | | | Leucadia National Corp.(a) | | | | | 3,661,451 |

| 204,950 | | | | Marshall & Ilsley Corp. | | | | | 1,153,868 |

| 56,843 | | | | Mercury General Corp. | | | | | 1,688,237 |

| 112,300 | | | | Piper Jaffray Cos.(a) | | | | | 2,896,217 |

| 114,890 | | | | StanCorp Financial Group, Inc. | | | | | 2,617,194 |

| 394,150 | | | | Synovus Financial Corp.(h) | | | | | 1,280,988 |

| 237,900 | | | | Waddell & Reed Financial, Inc., Class A | | | | | 4,298,853 |

| 186,300 | | | | Willis Group Holdings, Ltd. | | | | | 4,098,600 |

| | | | | | | | | |

| | | | | | | | | 41,428,872 |

| | | | | | | | | |

| | | | Health Care (16.8%) | | | | | |

| 101,500 | | | | Coventry Health Care, Inc.(a) | | | | | 1,313,410 |

| 163,054 | | | | Covidien, Ltd. | | | | | 5,419,915 |

| 87,810 | | | | Genzyme Corp.(a) | | | | | 5,215,036 |

| 272,242 | | | | IMS Health, Inc. | | | | | 3,394,858 |

| 413,050 | | | | King Pharmaceuticals, Inc.(a) | | | | | 2,920,263 |

| 53,900 | | | | Wellpoint, Inc.(a) | | | | | 2,046,583 |

| 58,450 | | | | Zimmer Holdings, Inc.(a) | | | | | 2,133,425 |

| | | | | | | | | |

| | | | | | | | | 22,443,490 |

| | | | | | | | | |

| | | | Materials & Processing (3.8%) | | | | | |

| 250,225 | | | | Valspar Corp. | | | | | 4,996,993 |

| | | | | | | | | |

| | | | | | | | | | |

| Shares | | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | |

| | | | Other Energy (1.4%) | | | | | | |

| 145,200 | | | | Forest Oil Corp.(a) | | | | $ | 1,909,380 | |

| | | | | | | | | | |

| | | | Producer Durables (1.4%) | | | | | | |

| 502,650 | | | | Axcelis Technologies, Inc.(a) | | | | | 191,007 | |

| 96,100 | | | | Lexmark International, Inc., Class A(a) | | | | | 1,621,207 | |

| | | | | | | | | | |

| | | | | | | | | 1,812,214 | |

| | | | | | | | | | |

| | | | Technology (20.4%) | | | | | | |

| 66,300 | | | | Affiliated Computer Services, Inc., Class A(a) | | | | | 3,175,107 | |

| 94,750 | | | | BMC Software, Inc.(a) | | | | | 3,126,750 | |

| 352,460 | | | | CA, Inc. | | | | | 6,206,821 | |

| 84,100 | | | | Computer Sciences Corp.(a) | | | | | 3,098,244 | |

| 96,050 | | | | General Dynamics Corp. | | | | | 3,994,719 | |

| 10,200 | | | | MicroStrategy, Inc., Class A(a) | | | | | 348,738 | |

| 134,600 | | | | Progress Software Corp.(a) | | | | | 2,336,656 | |

| 238,500 | | | | Synopsys, Inc.(a) | | | | | 4,944,105 | |

| | | | | | | | | | |

| | | | | | | | | 27,231,140 | |

| | | | | | | | | | |

| | | | Total Common Stocks (Cost $194,017,733) | | | | | 131,943,124 | |

| | | | | | | | | | |

INVESTMENT COMPANY (1.3%) | | | | | | |

1,754,301 | | | | Federated Treasury Obligations Fund, Institutional Shares | | | | | 1,754,301 | |

| | | | | | | | | | |

| | | | Total Investment Company (Cost $1,754,301) | | | | | 1,754,301 | |

| | | | | | | | | | |

| | | | |

Principal Amount | | | | | | | | | |

SECURITIES HELD AS COLLATERAL FOR

SECURITIES ON LOAN (2.6%) |

|

| $4,111,389 | | | | Pool of Various Securities(i) | | | | | 3,375,873 | |

| | | | | | | | | | |

| | | | Total Securities Held as Collateral for Securities on Loan (Cost $4,111,389) | | | | | 3,375,873 | |

| | | | | | | | | | |

Total Investments — 102.9% (Cost $199,883,423) | | | | | 137,073,298 | |

| Net Other Assets (Liabilities) — (2.9)% | | | | | (3,808,077 | ) |

| | | | | | | | | | |

NET ASSETS — 100.0% | | | | $ | 133,265,221 | |

| | | | | | | | | | |

See footnote legend to Schedules of Portfolio Investments.

See accompanying notes to the financial statements.

10

Schedule of Portfolio Investments

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS (92.9%) | | | |

| | | | Consumer Discretionary (15.6%) |

| 26,700 | | | | Amazon.com, Inc.(a) | | | | $ | 1,960,848 |

| 42,200 | | | | Best Buy Co., Inc. | | | | | 1,601,912 |

| 85,800 | | | | Burger King Holdings, Inc. | | | | | 1,969,110 |

| 147,525 | | | | Cheesecake Factory (The)(a) | | | | | 1,689,161 |

| 50,470 | | | | Darden Restaurants, Inc. | | | | | 1,729,102 |

| 21,975 | | | | DeVry, Inc. | | | | | 1,058,756 |

| 83,300 | | | | GameStop Corp., Class A(a) | | | | | 2,334,066 |

| 73,760 | | | | P.F. Chang’s China Bistro, Inc.(a)(h) | | | | | 1,687,629 |

| 55,270 | | | | Polo Ralph Lauren Corp. | | | | | 2,335,157 |

| | | | | | | | | |

| | | | | | | | | 16,365,741 |

| | | | | | | | | |

| | | | Consumer Staples (3.0%) | | | | | |

| 18,400 | | | | Chattem, Inc.(a)(h) | | | | | 1,031,320 |

| 124,315 | | | | Whole Foods Market, Inc.(h) | | | | | 2,088,492 |

| | | | | | | | | |

| | | | | | | | | 3,119,812 |

| | | | | | | | | |

| | | | Energy (10.3%) | | | | | |

| 95,480 | | | | Alpha Natural Resources, Inc.(a) | | | | | 1,694,770 |

| 32,250 | | | | Anadarko Petroleum Corp. | | | | | 1,254,202 |

| 26,975 | | | | Core Laboratories NV | | | | | 1,973,491 |

| 76,000 | | | | National Oilwell Varco, Inc.(a) | | | | | 2,181,960 |

| 57,700 | | | | Petroleo Brasileiro SA, ADR | | | | | 1,758,119 |

| 67,400 | | | | Southwestern Energy Co.(a) | | | | | 2,001,106 |

| | | | | | | | | |

| | | | | | | | | 10,863,648 |

| | | | | | | | | |

| | | | Financials (5.6%) | | | | | |

| 47,000 | | | | Assurant, Inc. | | | | | 1,023,660 |

| 8,870 | | | | CME Group, Inc. | | | | | 2,185,479 |

| 139,705 | | | | Fidelity National Financial, Inc., Class A | | | | | 2,725,645 |

| | | | | | | | | |

| | | | | | | | | 5,934,784 |

| | | | | | | | | |

| | | | Health Care (15.1%) | | | | | |

| 96,945 | | | | Alexion Pharmaceuticals, Inc.(a) | | | | | 3,650,948 |

| 35,500 | | | | Amedisys, Inc.(a)(h) | | | | | 975,895 |

| 23,625 | | | | Celgene Corp.(a) | | | | | 1,048,950 |

| 15,900 | | | | Cephalon, Inc.(a)(h) | | | | | 1,082,790 |

| 118,000 | | | | Mylan, Inc.(a) | | | | | 1,582,380 |

| 74,900 | | | | Myriad Genetics, Inc.(a) | | | | | 3,405,703 |

| 56,800 | | | | NuVasive, Inc.(a)(h) | | | | | 1,782,384 |

| 76,615 | | | | Watson Pharmaceuticals, Inc.(a) | | | | | 2,383,493 |

| | | | | | | | | |

| | | | | | | | | 15,912,543 |

| | | | | | | | | |

| | | | Industrials (5.4%) | | | | | |

| 28,900 | | | | Fluor Corp. | | | | | 998,495 |

| 170,770 | | | | Quanta Services, Inc.(a) | | | | | 3,663,016 |

| 22,350 | | | | Stericycle, Inc.(a) | | | | | 1,066,766 |

| | | | | | | | | |

| | | | | | | | | 5,728,277 |

| | | | | | | | | |

| | | | | | | | | | |

| Shares | | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | |

| | | | Information Technology (29.8%) | |

| 153,500 | | | | Activision Blizzard, Inc.(a) | | | | $ | 1,605,610 | |

| 191,955 | | | | Altera Corp. | | | | | 3,368,810 | |

| 21,455 | | | | Baidu, Inc., ADR(a)(h) | | | | | 3,788,953 | |

| 66,475 | | | | Equinix, Inc.(a)(h) | | | | | 3,732,571 | |

| 61,850 | | | | InterDigital, Inc.(a) | | | | | 1,596,967 | |

| 200,060 | | | | Macrovision Solutions Corp.(a) | | | | | 3,559,068 | |

| 334,265 | | | | Nuance Communications, Inc.(a) | | | | | 3,630,118 | |

| 121,955 | | | | Sina China Corp.(a) | | | | | 2,835,454 | |

| 114,180 | | | | Synaptics, Inc.(a)(h) | | | | | 3,055,457 | |

| 117,735 | | | | Varian Semiconductor Equipment Associates, Inc.(a) | | | | | 2,550,140 | |

| 85,715 | | | | Xilinx, Inc. | | | | | 1,642,299 | |

| | | | | | | | | | |

| | | | | | | | | 31,365,447 | |

| | | | | | | | | | |

| | | | Materials (4.1%) | |

| 69,100 | | | | Freeport-McMoRan Copper & Gold, Inc. | | | | | 2,633,401 | |

| 20,500 | | | | Monsanto Co. | | | | | 1,703,550 | |

| | | | | | | | | | |

| | | | | | | | | 4,336,951 | |

| | | | | | | | | | |

| | | | Telecommunication Services (4.0%) | |

| 47,160 | | | | Leap Wireless International, Inc.(a) | | | | | 1,644,469 | |

| 149,590 | | | | MetroPCS Communications, Inc.(a) | | | | | 2,554,997 | |

| | | | | | | | | | |

| | | | | | | | | 4,199,466 | |

| | | | | | | | | | |

| | | | Total Common Stocks (Cost $102,910,617) | | | | | 97,826,669 | |

| | | | | | | | | | |

INVESTMENT COMPANY (2.1%) | | | | | | |

2,184,875 | | | | Federated Treasury Obligations Fund, Institutional Shares | | | | | 2,184,875 | |

| | | | | | | | | | |

| | | | Total Investment Company (Cost $2,184,875) | | | | | 2,184,875 | |

| | | | | | | | | | |

| | | |

Principal

Amount | | | | | | | |

SECURITIES HELD AS COLLATERAL FOR

SECURITIES ON LOAN (8.9%) |

|

$9,907,489 | | | | Pool of Various Securities(i) | | | | | 9,419,116 | |

| | | | | | | | | | |

| | | | Total Securities Held as Collateral for Securities on Loan (Cost $9,907,489) | | | | | 9,419,116 | |

| | | | | | | | | | |

Total Investments — 103.9% (Cost $115,002,981) | | | | | 109,430,660 | |

| Net Other Assets (Liabilities) — (3.9)% | | | | | (4,143,557 | ) |

| | | | | | | | | | |

NET ASSETS — 100.0% | | | | $ | 105,287,103 | |

| | | | | | | | | | |

See footnote legend to Schedules of Portfolio Investments.

See accompanying notes to the financial statements.

11

Schedule of Portfolio Investments

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | | | Fair Value |

| COMMON STOCKS (83.2%) | | | |

| | | | Consumer Discretionary (9.3%) |

| 21,150 | | | | Buffalo Wild Wings, Inc.(a)(h) | | | | $ | 773,667 |

| 5,375 | | | | Capella Education Co.(a) | | | | | 284,875 |

| 19,400 | | | | CEC Entertainment, Inc.(a) | | | | | 502,072 |

| 21,950 | | | | Cheesecake Factory (The)(a) | | | | | 251,328 |

| 10,975 | | | | P.F. Chang’s China Bistro, Inc.(a) | | | | | 251,108 |

| 17,000 | | | | Polaris Industries, Inc.(h) | | | | | 364,480 |

| | | | | | | | | |

| | | | | | | | | 2,427,530 |

| | | | | | | | | |

| | | | Consumer Staples (4.5%) |

| 4,575 | | | | Chattem, Inc.(a)(h) | | | | | 256,429 |

| 16,200 | | | | Sanderson Farms, Inc. | | | | | 608,310 |

| 18,750 | | | | Whole Foods Market, Inc.(h) | | | | | 315,000 |

| | | | | | | | | |

| | | | | | | | | 1,179,739 |

| | | | | | | | | |

| | | | Energy (1.0%) | | | | | |

| 14,175 | | | | Alpha Natural Resources, Inc.(a) | | | | | 251,606 |

| | | | | | | | | |

| | | | Financials (6.9%) | | | | | |

| 11,650 | | | | Assurant, Inc. | | | | | 253,737 |

| 58,952 | | | | Dime Community Bancshares | | | | | 552,970 |

| 85,186 | | | | NewAlliance Bancshares, Inc. | | | | | 1,000,083 |

| | | | | | | | | |

| | | | | | | | | 1,806,790 |

| | | | | | | | | |

| | | | Health Care (18.9%) |

| 13,900 | | | | Alexion Pharmaceuticals, Inc.(a) | | | | | 523,474 |

| 8,650 | | | | Amedisys, Inc.(a)(h) | | | | | 237,788 |

| 46,150 | | | | American Medical Systems Holdings, Inc.(a) | | | | | 514,572 |

| 24,600 | | | | CardioNet, Inc.(a) | | | | | 690,276 |

| 63,500 | | | | Geron Corp.(a)(h) | | | | | 283,845 |

| 12,600 | | | | Haemonetics Corp.(a) | | | | | 694,008 |

| 18,850 | | | | Myriad Genetics, Inc.(a) | | | | | 857,110 |

| 8,650 | | | | NuVasive, Inc.(a)(h) | | | | | 271,437 |

| 29,000 | | | | SonoSite, Inc.(a) | | | | | 518,520 |

| 11,575 | | | | Watson Pharmaceuticals, Inc.(a) | | | | | 360,098 |

| | | | | | | | | |

| | | | | | | | | 4,951,128 |

| | | | | | | | | |

| | | | Industrials (13.6%) |

| 40,900 | | | | Celadon Group, Inc.(a) | | | | | 226,995 |

| 19,395 | | | | Curtiss-Wright Corp. | | | | | 544,030 |

| 40,200 | | | | GrafTech International, Ltd.(a) | | | | | 247,632 |

| 64,300 | | | | LaBarge, Inc.(a) | | | | | 538,191 |

| 17,000 | | | | Moog, Inc., Class A(a) | | | | | 388,790 |

| 34,000 | | | | Quanta Services, Inc.(a) | | | | | 729,300 |

| 22,530 | | | | RBC Bearings, Inc.(a) | | | | | 344,258 |

| 17,275 | | | | Regal-Beloit Corp. | | | | | 529,306 |

| | | | | | | | | |

| | | | | | | | | 3,548,502 |

| | | | | | | | | |

| | | | Information Technology (22.4%) |

| 13,800 | | | | Equinix, Inc.(a)(h) | | | | | 774,870 |

| 15,350 | | | | InterDigital, Inc.(a) | | | | | 396,337 |

| 18,045 | | | | Longtop Financial Technologies, Ltd. ADR(a) | | | | | 383,095 |

| 30,125 | | | | Macrovision Solutions Corp.(a) | | | | | 535,924 |

| 50,000 | | | | Nuance Communications, Inc.(a) | | | | | 543,000 |

| | | | | | | | | | |

| Shares | | | | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | |

| | | | Information Technology — (continued) | |

| 40,500 | | | | Perot Systems Corp., Class A(a) | | | | $ | 521,640 | |

| 32,100 | | | | Silicon Laboratories, Inc.(a) | | | | | 847,440 | |

| 20,000 | | | | Sina China Corp.(a) | | | | | 465,000 | |

| 17,100 | | | | Synaptics, Inc.(a)(h) | | | | | 457,596 | |

| 17,700 | | | | Varian Semiconductor Equipment Associates, Inc.(a) | | | | | 383,382 | |

| 20,500 | | | | VistaPrint, Ltd.(a)(h) | | | | | 563,545 | |

| | | | | | | | | | |

| | | | | | | | | 5,871,829 | |

| | | | | | | | | | |

| | | | Materials (2.6%) | | | | | | |

| 49,000 | | | | Calgon Carbon Corp.(a) | | | | | 694,330 | |

| | | | | | | | | | |

| | | | Telecommunication Services (1.4%) | |

| 10,550 | | | | Leap Wireless International, Inc.(a) | | | | | 367,879 | |

| | | | | | | | | | |

| | | | Utilities (2.6%) | | | | | | |

| 8,723 | | | | Laclede Group, Inc. (The) | | | | | 340,022 | |

| 15,056 | | | | UIL Holdings Corp. | | | | | 336,050 | |

| | | | | | | | | | |

| | | | | | | | | 676,072 | |

| | | | | | | | | | |

| | | | Total Common Stocks (Cost $24,223,253) | | | | | 21,775,405 | |

| | | | | | | | | | |

EXCHANGE TRADED FUNDS (7.8%) | |

6,300 | | | | Energy Select Sector SPDR Fund | | | | | 267,498 | |

| 44,734 | | | | iShares Russell 2000 Value Index Fund | | | | | 1,765,204 | |

| | | | | | | | | | |

| | | | Total Exchange Traded Funds (Cost $2,502,343) | | | | | 2,032,702 | |

| | | | | | | | | | |

INVESTMENT COMPANY (2.8%) | |

744,827 | | | | Federated Treasury Obligations Fund, Institutional Shares | | | | | 744,827 | |

| | | | | | | | | | |

| | | | Total Investment Company (Cost $744,827) | | | | | 744,827 | |

| | | | | | | | | | |

| | | |

Principal

Amount | | | | | | | |

SECURITIES HELD AS COLLATERAL FOR

SECURITIES ON LOAN (9.5%) |

|

$2,692,053 | | | | Pool of Various Securities(i) | | | | | 2,475,111 | |

| | | | | | | | | | |

| | | | Total Securities Held as Collateral for Securities on Loan (Cost $2,692,053) | | | | | 2,475,111 | |

| | | | | | | | | | |

Total Investments — 103.3% (Cost $30,162,476) | | | | | 27,028,045 | |

| Net Other Assets (Liabilities) — (3.3)% | | | | | (860,719 | ) |

| | | | | | | | | | |

NET ASSETS — 100.0% | | | | $ | 26,167,326 | |

| | | | | | | | | | |

See footnote legend to Schedules of Portfolio Investments.

See accompanying notes to the financial statements.

12

|

BB&T International Equity Fund |

Schedule of Portfolio Investments

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS (87.6%) |

| | | | Australia (6.2%) | | | | | |

| 72,917 | | | | BHP Billiton, Ltd. | | | | $ | 1,611,557 |

| 16,721 | | | | Foster’s Group, Ltd. | | | | | 58,805 |

| 153,412 | | | | Macquarie Airports | | | | | 193,669 |

| 35,726 | | | | Rio Tinto, Ltd. | | | | | 1,418,876 |

| 53,020 | | | | Telstra Corp, Ltd. | | | | | 118,354 |

| 11,651 | | | | Woodside Petroleum, Ltd. | | | | | 310,338 |

| 10,040 | | | | Woolworths, Ltd. | | | | | 174,261 |

| | | | | | | | | |

| | | | | | | | | 3,885,860 |

| | | | | | | | | |

| | | | Austria (0.9%) | | | | | |

| 4,315 | | | | Flughafen Wien AG | | | | | 126,047 |

| 11,829 | | | | OMV AG | | | | | 395,728 |

| 2,624 | | | | Telekom Austria AG | | | | | 39,724 |

| | | | | | | | | |

| | | | | | | | | 561,499 |

| | | | | | | | | |

| | | | Belgium (0.3%) | | | | | |

| 5,628 | | | | Anheuser-Busch InBev NV | | | | | 154,969 |

| | | | | | | | | |

| �� | | | Brazil (1.2%) | | | | | |

| 54,981 | | | | Companhai Vale do Rio Doce ADR | | | | | 731,247 |

| | | | | | | | | |

| | | | Canada (1.8%) | | | | | |

| 10,760 | | | | EnCana Corp. | | | | | 440,368 |

| 14,994 | | | | Petro-Canada | | | | | 402,797 |

| 1,866 | | | | Research In Motion, Ltd.(a) | | | | | 80,369 |

| 16,590 | | | | Talisman Energy, Inc. | | | | | 175,663 |

| | | | | | | | | |

| | | | | | | | | 1,099,197 |

| | | | | | | | | |

| | | | China (1.9%) | | | | | |

| 138,854 | | | | Beijing Capital International Airport Co., Ltd., Series H | | | | | 61,747 |

| 44,000 | | | | China Mobile, Ltd. | | | | | 383,280 |

| 504,000 | | | | China Petroleum & Chemical Corp., Series H | | | | | 322,963 |

| 88,000 | | | | China Telecom Corp., Ltd., Series H | | | | | 36,349 |

| 111,000 | | | | CNOOC, Ltd. | | | | | 111,539 |

| 374,000 | | | | PetroChina, Co., Ltd., Series H | | | | | 298,375 |

| | | | | | | | | |

| | | | | | | | | 1,214,253 |

| | | | | | | | | |

| | | | Czech Republic (1.4%) | | | | | |

| 8,642 | | | | Komercni Banka AS | | | | | 870,424 |

| | | | | | | | | |

| | | | Denmark (0.4%) | | | | | |

| 4,604 | | | | Novo Nordisk AS, Class B | | | | | 220,743 |

| | | | | | | | | |

| | | | Finland (0.7%) | | | | | |

| 1,504 | | | | Kone OYJ, Class B | | | | | 31,157 |

| 25,501 | | | | Nokia OYJ | | | | | 298,246 |

| 6,245 | | | | Orion OYJ, Class B | | | | | 90,371 |

| 6,436 | | | | Stora Enso OYJ, R Shares(a) | | | | | 22,798 |

| 3,220 | | | | UPM-Kymmene OYJ | | | | | 18,584 |

| | | | | | | | | |

| | | | | | | | | 461,156 |

| | | | | | | | | |

| | | | France (14.0%) | | | | | |

| 841 | | | | Accor SA | | | | | 29,270 |

| 3,906 | | | | Aeroports de Paris | | | | | 207,955 |

| 4,081 | | | | Air Liquide SA | | | | | 331,894 |

| 2,545 | | | | Alstom SA | | | | | 131,974 |

| 18,099 | | | | ArcelorMittal | | | | | 369,287 |

| 1,462 | | | | BNP Paribas | | | | | 60,317 |

| 1,949 | | | | Bouygues SA | | | | | 69,648 |

| 4,245 | | | | Carrefour SA | | | | | 165,598 |

| 2,543 | | | | Casino Guichard Perrachon SA | | | | | 165,467 |

| 2,511 | | | | Cie de Saint-Gobain | | | | | 70,356 |

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS — (continued) | | | | | |

| | | | France — (continued) |

| 903 | | | | Compagnie Generale des Etablissements Michelin, Class B | | | | $ | 33,469 |

| 5,214 | | | | Credit Agricole SA | | | | | 57,529 |

| 47,954 | | | | France Telecom SA | | | | | 1,093,217 |

| 18,078 | | | | GDF Suez | | | | | 619,979 |

| 24,727 | | | | Groupe Danone | | | | | 1,203,305 |

| 485 | | | | L’Oreal SA | | | | | 33,342 |

| 5,262 | | | | LVMH Moet Hennessy Louis Vuitton SA | | | | | 330,200 |

| 3,140 | | | | Pernod-Ricard SA | | | | | 174,991 |

| 1,007 | | | | PPR | | | | | 64,559 |

| 2,541 | | | | Publicis Groupe | | | | | 65,139 |

| 1,510 | | | | Renault SA | | | | | 31,049 |

| 6,353 | | | | Sanofi-Aventis SA | | | | | 356,539 |

| 2,446 | | | | Schneider Electric SA | | | | | 162,676 |

| 1,489 | | | | Societe Generale | | | | | 58,245 |

| 3,368 | | | | Suez Environnement SA(a) | | | | | 49,526 |

| 45,263 | | | | Total SA | | | | | 2,238,234 |

| 9,251 | | | | Vinci SA | | | | | 343,440 |

| 8,664 | | | | Vivendi | | | | | 229,154 |

| | | | | | | | | |

| | | | | | | | | 8,746,359 |

| | | | | | | | | |

| | | | Germany (7.5%) | | | | | |

| 2,023 | | | | Adidas AG | | | | | 67,142 |

| 12,386 | | | | BASF SE | | | | | 377,277 |

| 5,546 | | | | Bayer AG | | | | | 269,385 |

| 14,731 | | | | Bayerische Motoren Werke AG | | | | | 423,164 |

| 8,617 | | | | Daimler AG | | | | | 220,864 |

| 8,806 | | | | Deutsche Post AG | | | | | 95,003 |

| 20,686 | | | | Deutsche Telekom AG | | | | | 256,765 |

| 14,279 | | | | E.ON AG | | | | | 398,668 |

| 22,272 | | | | Fraport AG Frankfurt Airport Services Worldwide | | | | | 712,819 |

| 2,843 | | | | Fresenius SE | | | | | 108,006 |

| 867 | | | | Linde AG | | | | | 58,891 |

| 3,139 | | | | MAN AG | | | | | 136,213 |

| 1,220 | | | | Merck KGaA(a) | | | | | 107,520 |

| 495 | | | | Muenchener Rueckversicherungs AG | | | | | 60,406 |

| 4,022 | | | | RWE AG | | | | | 283,264 |

| 9,318 | | | | SAP AG | | | | | 328,267 |

| 12,802 | | | | Siemens AG | | | | | 734,771 |

| 729 | | | | Volkswagen AG, Preference shares | | | | | 41,862 |

| | | | | | | | | |

| | | | | | | | | 4,680,287 |

| | | | | | | | | |

| | | | Greece (0.2%) | | | | | |

| 6,454 | | | | Hellenic Telecommunications Organization SA | | | | | 96,743 |

| | | | | | | | | |

| | | | Hong Kong (0.8%) | | | | | |

| 77,564 | | | | China Merchants Holdings International Co., Ltd. | | | | | 178,538 |

| 7,900 | | | | Esprit Holdings, Ltd. | | | | | 40,309 |

| 199,056 | | | | GOME Electrical Appliances Holdings, Ltd.(f)(i) | | | | | 28,764 |

| 51,000 | | | | Hutchison Whampoa, Ltd. | | | | | 250,363 |

| 92,164 | | | | Shun Tak Holdings, Ltd. | | | | | 28,665 |

| | | | | | | | | |

| | | | | | | | | 526,639 |

| | | | | | | | | |

| | | | Hungary (0.9%) | | | | | |

| 68,312 | | | | OTP Bank Nyrt(a) | | | | | 575,557 |

| | | | | | | | | |

| | | | Ireland (1.7%) | | | | | |

| 47,767 | | | | CRH PLC | | | | | 1,039,531 |

| | | | | | | | | |

Continued

13

|

BB&T International Equity Fund |

Schedule of Portfolio Investments — (continued)

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS — (continued) | | | | | |

| | | | Italy (3.7%) | | | | | |

| 63,067 | | | | Enel SpA | | | | $ | 302,424 |

| 98,371 | | | | ENI SpA | | | | | 1,904,687 |

| 3,616 | | | | Snam Rete Gas SpA | | | | | 19,402 |

| 74,609 | | | | Telecom Italia SpA | | | | | 96,189 |

| | | | | | | | | |

| | | | | | | | | 2,322,702 |

| | | | | | | | | |

| | | | Japan (6.3%) | | | | | |

| 1,800 | | | | Aisin Seiki Co., Ltd. | | | | | 28,884 |

| 5,386 | | | | Canon, Inc. | | | | | 157,012 |

| 10 | | | | Central Japan Railway Co. | | | | | 56,388 |

| 1,400 | | | | Daikin Industries, Ltd. | | | | | 38,545 |

| 4,231 | | | | Denso Corp. | | | | | 85,531 |

| 2,100 | | | | East Japan Railway Co. | | | | | 109,482 |

| 1,700 | | | | Eisai Co., Ltd. | | | | | 50,039 |

| 3,425 | | | | Fanuc, Ltd. | | | | | 234,260 |

| 26 | | | | Fuji Media Holdings, Inc. | | | | | 29,224 |

| 14,706 | | | | Honda Motor Co., Ltd. | | | | | 350,088 |

| 41,000 | | | | Itochu Corp. | | | | | 202,295 |

| 12 | | | | KDDI Corp. | | | | | 56,510 |

| 4,900 | | | | Komatsu, Ltd. | | | | | 54,227 |

| 4,202 | | | | Kubota Corp. | | | | | 23,286 |

| 700 | | | | Kyocera Corp. | | | | | 46,724 |

| 29,700 | | | | Mitsubishi Corp. | | | | | 393,725 |

| 14,000 | | | | Mitsubishi Electric Corp. | | | | | 63,624 |

| 41,000 | | | | Mitsui & Co., Ltd. | | | | | 417,679 |

| 5,000 | | | | NGK Insulators, Ltd. | | | | | 78,203 |

| 2,800 | | | | Nidec Corp. | | | | | 126,041 |

| 766 | | | | Nintendo Co., Ltd. | | | | | 224,079 |

| 1,200 | | | | Nippon Telegraph & Telephone Corp. | | | | | 45,797 |

| 48 | | | | NTT DoCoMo, Inc. | | | | | 65,397 |

| 10,408 | | | | Panasonic Corp. | | | | | 114,892 |

| 3,000 | | | | Ricoh Co., Ltd. | | | | | 36,276 |

| 1,500 | | | | Shin-Etsu Chemical Co., Ltd. | | | | | 73,695 |

| 2,066 | | | | Sony Corp. | | | | | 42,734 |

| 7,300 | | | | Suzuki Motor Corp. | | | | | 122,783 |

| 1,800 | | | | Takeda Pharmaceutical Co., Ltd. | | | | | 62,450 |

| 17,054 | | | | Toyota Motor Corp. | | | | | 541,701 |

| | | | | | | | | |

| | | | | | | | | 3,931,571 |

| | | | | | | | | |

| | | | Korea (South) (2.5%) | | | | | |

| 1,044 | | | | Hyundai Heavy Industries Co., Ltd. | | | | | 149,472 |

| 4,141 | | | | Hyundai Motor Co. | | | | | 167,565 |

| 2,288 | | | | KT&G Corp. | | | | | 126,291 |

| 1,145 | | | | POSCO | | | | | 305,119 |

| 1,180 | | | | Samsung Electronics Co., Ltd. | | | | | 487,526 |

| 440 | | | | Shinsegae Co., Ltd. | | | | | 138,191 |

| 1,381 | | | | SK Telecom Co., Ltd. | | | | | 192,092 |

| | | | | | | | | |

| | | | | | | | | 1,566,256 |

| | | | | | | | | |

| | | | Netherlands (6.4%) | | | | | |

| 10,623 | | | | Heineken NV | | | | | 301,770 |

| 33,989 | | | | Koninklijke KPN NV | | | | | 453,790 |

| 22,603 | | | | Koninklijke Philips Electronics NV(h) | | | | | 334,574 |

| 13,817 | | | | Reed Elsevier NV | | | | | 147,854 |

| 87,082 | | | | Royal Dutch Shell PLC, Class A | | | | | 1,942,723 |

| 3,877 | | | | TNT NV | | | | | 66,453 |

| 37,871 | | | | Unilever NV | | | | | 746,104 |

| | | | | | | | | |

| | | | | | | | | 3,993,268 |

| | | | | | | | | |

| | | | New Zealand (0.0%) | | | | | |

| 18,688 | | | | Auckland International Airport, Ltd. | | | | | 18,232 |

| | | | | | | | | |

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS — (continued) |

| | | | Norway (1.0%) | | | | | |

| 36,558 | | | | StatoilHydro ASA | | | | $ | 639,791 |

| | | | | | | | | |

| | | | Poland (0.5%) | | | | | |

| 47,142 | | | | Powszechna Kasa Oszczednosci Bank Polski SA | | | | | 291,538 |

| | | | | | | | | |

| | | | Portugal (0.1%) | | | | | |

| 15,543 | | | | Energias de Portugal SA | | | | | 53,882 |

| | | | | | | | | |

| | | | Russia (0.5%) | | | | | |

| 3,762 | | | | Inter Rao Ues OAO, GDR(a)(e) | | | | | 9,781 |

| 1,251 | | | | Kuzbassenergo OJSC, GDR(a)(e) | | | | | 1,126 |

| 2,850 | | | | LUKOIL, ADR | | | | | 107,445 |

| 16,921 | | | | MMC Norilsk Nickel, OJSC, ADR | | | | | 103,218 |

| 17,316 | | | | OGK-1 OAO, GDR(a)(e) | | | | | 6,667 |

| 4,500 | | | | OGK-2 OAO, GDR(a)(e) | | | | | 3,708 |

| 5,247 | | | | OGK-6 OAO, GDR(a)(e) | | | | | 4,434 |

| 900,000 | | | | RAO Energy System of East OAO(a)(f) | | | | | 1,440 |

| 8,650 | | | | Severstal, GDR | | | | | 29,410 |

| 10,784 | | | | Sistema-Hals, GDR(a)(d) | | | | | 5,122 |

| 6,876 | | | | TGK-1, GDR(a)(e) | | | | | 3,438 |

| 288 | | | | TGK-14, GDR(a)(e) | | | | | 519 |

| 1,161 | | | | TGK-2, GDR(a)(e) | | | | | 1,045 |

| 2,853 | | | | TGK-4, GDR(a)(e) | | | | | 2,283 |

| 3,024 | | | | TGK-9 OAO, GDR(a)(e) | | | | | 1,814 |

| 3,006 | | | | Volga Territorial Generating Co., GDR(a)(e) | | | | | 2,567 |

| 3,096 | | | | Yenisei Territorial Generating Co., OJSC, GDR(a)(e) | | | | | 1,238 |

| | | | | | | | | |

| | | | | | | | | 285,255 |

| | | | | | | | | |

| | | | Spain (2.3%) | | | | | |

| 20,515 | | | | EDP Renovaveis SA(a) | | | | | 167,563 |

| 11,216 | | | | Iberdrola Renovables(a)(h) | | | | | 46,454 |

| 45,340 | | | | Iberdrola SA(h) | | | | | 318,106 |

| 9,712 | | | | Inditex SA(h) | | | | | 378,467 |

| 25,531 | | | | Telefonica SA | | | | | 509,123 |

| | | | | | | | | |

| | | | | | | | | 1,419,713 |

| | | | | | | | | |

| | | | Sweden (1.9%) | | | | | |

| 18,211 | | | | Atlas Copco AB, Class A(h) | | | | | 136,743 |

| 7,213 | | | | Getinge AB, Class B | | | | | 69,858 |

| 9,983 | | | | Hennes & Mauritz AB, Class B(h) | | | | | 374,264 |

| 52,158 | | | | Sandvik AB | | | | | 298,784 |

| 2,974 | | | | Skanska AB, Class B | | | | | 25,670 |

| 21,744 | | | | SKF AB, Class B | | | | | 188,216 |

| 8,893 | | | | Svenska Cellulosa AB, Class B | | | | | 67,495 |

| 10,104 | | | | TeliaSonera AB(h) | | | | | 48,597 |

| | | | | | | | | |

| | | | | | | | | 1,209,627 |

| | | | | | | | | |

| | | | Switzerland (9.1%) | | | | | |

| 36,118 | | | | ABB, Ltd.(a) | | | | | 503,729 |

| 1,857 | | | | Compagnie Financiere Richemont SA, Class A | | | | | 28,994 |

| 890 | | | | Flughafen Zuerich AG | | | | | 160,229 |

| 109 | | | | Givaudan SA(a) | | | | | 56,417 |

| 1,917 | | | | Holcim, Ltd. | | | | | 68,281 |

| 59,226 | | | | Nestle SA | | | | | 2,000,913 |

| 1,670 | | | | Nobel Biocare Holding AG(a) | | | | | 28,505 |

| 16,204 | | | | Novartis AG | | | | | 613,055 |

| 2,833 | | | | Roche Holding AG | | | | | 388,830 |

| 243 | | | | Swatch Group AG (The) | | | | | 29,308 |

| 511 | | | | Swisscom AG | | | | | 143,477 |

| 2,365 | | | | Syngenta AG | | | | | 475,395 |

Continued

14

|

BB&T International Equity Fund |

Schedule of Portfolio Investments — (continued)

March 31, 2009 (Unaudited)

| | | | | | | | | |

| Shares | | | | Fair Value |

| COMMON STOCKS — (continued) | | | | | |

| | | | Switzerland — (continued) | | | | | |

| 174,275 | | | | Xstrata PLC | | | | $ | 1,169,028 |

| | | | | | | | | |

| | | | | | | | | 5,666,161 |

| | | | | | | | | |

| | | | Taiwan (0.6%) | | | | | |

| 43,010 | | | | Taiwan Semiconductor Manufacturing Co., Ltd., ADR | | | | | 384,939 |

| | | | | | | | | |

| | | | Ukraine (0.1%) | | | | | |

| 933,947 | | | | Raiffeisen Bank Aval(a) | | | | | 9,050 |

| 2,656 | | | | Ukrnafta Oil Co.(a) | | | | | 28,375 |

| 1,101,903 | | | | Ukrsotsbank JSCB(a) | | | | | 10,953 |

| 33,222 | | | | UkrTelecom, GDR | | | | | 41,710 |

| | | | | | | | | |

| | | | | | | | | 90,088 |

| | | | | | | | | |

| | | | United Kingdom (12.6%) | | | | | |

| 13,544 | | | | Anglo American PLC | | | | | 230,635 |

| 56,647 | | | | BHP Billiton PLC | | | | | 1,117,393 |

| 150,867 | | | | BP PLC | | | | | 1,011,617 |

| 18,371 | | | | British American Tobacco PLC | | | | | 424,384 |

| 38,643 | | | | Cadbury PLC | | | | | 291,486 |

| 16,434 | | | | Diageo PLC | | | | | 183,515 |

| 12,290 | | | | GlaxoSmithKline PLC | | | | | 191,412 |

| 11,655 | | | | Imperial Tobacco Group PLC | | | | | 261,752 |

| 32,995 | | | | Marks & Spencer Group PLC | | | | | 139,885 |

| 16,979 | | | | National Grid PLC | | | | | 130,407 |

| 15,619 | | | | Pearson PLC | | | | | 157,069 |

| 30,106 | | | | Rio Tinto PLC | | | | | 1,010,899 |

| 19,872 | | | | Rolls-Royce Group PLC(a) | | | | | 83,708 |

| 10,171 | | | | Scottish & Southern Energy PLC | | | | | 161,617 |

| 13,436 | | | | Smith & Nephew PLC(h) | | | | | 83,631 |

| 175,569 | | | | Tesco PLC | | | | | 838,822 |

| 34,190 | | | | Tullow Oil PLC | | | | | 393,101 |

| 521,091 | | | | Vodafone Group PLC | | | | | 908,496 |

| 17,271 | | | | WM Morrison Supermarkets PLC | | | | | 63,232 |

| 36,250 | | | | WPP PLC | | | | | 203,862 |

| | | | | | | | | |

| | | | | | | | | 7,886,923 |

| | | | | | | | | |

| | | | United States (0.1%) | | | | | |

| 2,421 | | | | Dr Pepper Snapple Group, Inc.(a) | | | | | 40,937 |

| | | | | | | | | |

| | | | Total Common Stocks (Cost $66,388,429) | | | | | 54,665,347 |

| | | | | | | | | |

EXCHANGE TRADED FUNDS (6.8%) |

| | | | Japan (6.8%) | | | | | |

| 14,757 | | | | Nomura - Nikkei 225 | | | | | 1,243,354 |

| 368,570 | | | | Nomura TOPIX | | | | | 2,967,624 |

| | | | | | | | | |

| | | | Total Exchange Traded Funds (Cost $4,746,309) | | | | | 4,210,978 |

| | | | | | | | | |

RIGHTS/WARRANTS (0.6%) |

| | | | Ireland (0.4%) | | | | | |

| 12,341 | | | | CRH PLC, Rights, Expire 04/09/09 | | | | | 268,408 |

| | | | | | | | | |

| | | | | | | | | | |

| Shares | | | | Fair Value | |

| RIGHTS/WARRANTS — (continued) | | | | | | |

| | | | Romania (0.2%) | | | | | | |

| 41,596 | | | | BRD-Group Societe Generale, Warrants, Expire 06/30/17(a)(d) | | | | $ | 81,511 | |

| | | | | | | | | | |

| | | | Russia (0.0%) | | | | | | |

| 9 | | | | Unified Energy System Warrants, Expire 12/31/09(a)(e) | | | | | 12,575 | |